- ENR Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

8-K Filing

Energizer (ENR) 8-KChairman of the Board

Filed: 2 Jun 15, 12:00am

Exhibit 99.1

|

The New Energizer

PAT MULCAHY

Chairman of the Board

|

Presentation of Information; Forward-Looking Statements

Unless the context otherwise requires, references in this presentation to “Energizer,” “New Energizer,” “we,” “our,” and “the Company” refer to Energizer SpinCo, Inc., a Missouri corporation, and its subsidiaries. Unless the context otherwise requires, references in this presentation to “Parent” refer to Energizer Holdings, Inc., a Missouri corporation, and its consolidated subsidiaries, including the Household Products business prior to completion of the separation. Unless the context otherwise requires, references in this presentation to New Energizer’s historical assets, liabilities, products, businesses or activities generally refer to the historical assets, liabilities, products, businesses or activities of the Household Products business of Parent as the business was conducted as part of Parent prior to the completion of the separation.

The following presentation contains forward looking statements. Forward-looking statements are not based on historical facts but instead reflect our expectations concerning future results or events, including our expectations for the separation, new product launches and strategic initiatives, including restructurings, and our outlook for future financial, operational or other potential or expected results. These statements are not guarantees of performance and are inherently subject to known and unknown risks and assumptions that are difficult to predict and could cause our actual results, performance or achievements to differ materially from those expressed in or indicated by those statements.

In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of any such forward-looking statements. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and uncertainties include those detailed from time to time in our Registration Statement on Form 10 as well as Parent’s publicly filed documents, including its annual report on Form 10-K for the year ended September 30, 2014 and the Form 10-Q for the quarter ended March 31, 2015. The forward-looking statements included in this presentation are only made as of the date of this document and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances.

Market and Industry Data

Unless indicated otherwise, the information concerning our industry contained in this presentation is based on our general knowledge of and expectations concerning the industry. Our market position, market share and industry market size are based on estimates using our internal data and estimates, based on data from various industry analyses, our internal research and adjustments and assumptions that we believe to be reasonable. We have not independently verified data from industry analyses and cannot guarantee their accuracy or completeness. In addition, we believe that data regarding the industry, market size and our market position and market share within such industry provide general guidance but are inherently imprecise. Further, our estimates and assumptions involve risks and uncertainties and are subject to change based on various factors. These and other factors could cause results to differ materially from those expressed in the estimates and assumptions.

Non-GAAP Financial Measures

While the Company reports financial results in accordance with accounting principles generally accepted in the U.S. (“GAAP”), this presentation include non-GAAP measures. These non-GAAP measures, include EBITDA, adjusted EBITDA and ratios derived therefrom, free cash flow and ratios derived therefrom, as well as non-GAAP comparatives such as operating results, organic sales, gross margin and other comparison changes that exclude such items as the impact of changes in foreign currency rates on a period over period basis versus the U.S. dollar, separation related costs and costs associated with restructuring activities. We believe these non-GAAP measures provide a meaningful comparison to the corresponding historical or future period and assist investors in performing their analysis and provide investors with visibility into the underlying financial performance of the Company’s business. The Company believes that these non-GAAP measures are presented in such a way as to allow investors to more clearly understand the nature and amount of the adjustments to arrive at the non-GAAP measure. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. Further, these non-GAAP measures may differ from similarly titled measures presented by other companies. A reconciliation of these non-GAAP measures to the nearest comparable GAAP measure is available at the end of this presentation.

2 |

|

|

Energizer Holdings, Inc. has a strong legacy of shareholder value creation

Since spin off from Ralston Purina in March 2000, Energizer Holdings, Inc. has:

Distributed $317 million to shareholders via quarterly dividends

Repurchased $2.8 billion in stock opportunistically

(57 million shares at an average price of $49/share)

Achieved a more than six-fold increase in stock price

ENR STOCK PRICE (per share)

$141.58

$21.25

April 3, 2000

April 15, 2015

3 |

|

|

We expect the separation to drive long-term value for our shareholders

Focus on Distinct Commercial Opportunities

Creation of Independent

Equity Currencies

Management Focus and Separate

Capital Structures

Allocation of Financial Resources

Targeted

Investment Opportunity

Unlocking Full Shareholder Value

4 |

|

|

We have a strong Board of Directors with the right blend of continuity, fresh perspective and independence

Six current Energizer Holdings, Inc. members

Pat Mulcahy

Chairman of the Board

Bill Armstrong

Jim Johnson

John Klein

Pat McGinnis

John Roberts

Three new independent members that bring fresh perspectives on global operations, consumer goods and Board oversight

Pat Moore Cynthia Brinkley Kevin Hunt

Management representative

Alan Hoskins, CEO

5 |

|

|

We have a seasoned executive team with a wealth of diverse experience to guide the new company

Alan Hoskins, CEO

33 years at Energizer

CEO of the battery business since 2011

Previously led North America and Asia-Pacific divisions

Global sales, marketing and operational experience

Mark LaVigne, COO

15 years as advisor to Energizer

Currently the General Counsel of Energizer Holdings

Leading separation effort

Will lead commercial & legal teams

Brian Hamm, CFO

7 |

| years at Energizer; 17 years in consumer products industry |

Currently the Controller and Chief Accounting Officer

Led the enterprise-wide restructuring effort and working capital improvement initiative

6 |

|

|

Our agenda for today

Alan Hoskins

New Energizer’s Value Proposition

Energizer’s Brands and Global Leadership Position

Enhancing Value Across Our Chosen Categories and Channels

Mark LaVigne

Driving Momentum Across Our Operations and Organization

Brian Hamm

Delivering Total Shareholder Return

7 |

|

|

The New Energizer

ALAN HOSKINS

Chief Executive Officer

8 |

|

|

Our agenda for today

Who We Are

New Energizer’s Value Proposition

Our Brands and Global Leadership Position

Why We’ll Win

Lead with Innovation

Operate with Excellence

Drive Productivity Gains

How We’ll Deliver Long-Term Value

Focused on Free Cash Flow

Committed to Returning Cash to Shareholders

Dedicated to Enhancing Value for the Long Term

9

|

We are an innovative, brand-driven Household Products company

Revenue ~ U.S. Value Share

2014 5,200

33% 15%

$1.8Billion customers served,

in a consolidated in a highly fragmented

reaching

balanced between U.S. and global markets battery industry lighting products industry

BILLIONS of Free Cash Flow

iconic, of the largest

consumers globally Latest Three Fiscal Years

battery

globally

Cost Savings manufacturers ~

recognized

2 |

| > 1in the world |

brands Through $750

$210 Million

March 2015

Million No. of

manufacturing We sell in Energizer facilities today, and # # strategically Eveready globally located in North 7 batteries 1or 2 America, Africa 140 are ranked

(in 32 out of 34 measured markets) & Asia global markets

Source: U.S. battery share from Nielsen Global Track 52-weeks ending March 2015. U.S. lighting share from Nielson xAOC, 52-weeks ending 4-18-15.

Combined value share rank data from Nielsen Global Track, 52-weeks ending March 2015 including all Energizer and Eveready branded batteries excluded private label. 10

See appendix for free cash flow reconciliation.

10

|

Talented and deep management team ready to execute

Alan Hoskins

CEO

Sue Drath

Chief Human Resource Officer

23 years in human resources

Brian Hamm

Chief Financial Officer

17 years in consumer products, previously Chief Accounting Officer

Mark LaVigne

Chief Operating Officer

15 years as a strategic advisor or legal counsel to ENR, will lead Commercial and Legal teams

Greg Kinder

Chief Supply Chain Officer

30 years in global procurement, supply chain and operations

Michelle Atkinson

Chief Consumer Officer

25 years in marketing, previously Chief Marketing Officer

Jennifer Beatty

Vice President, Investor Relations

15 years in investor relations

Kelly Boss

General Counsel

25 years of legal experience

Brandon Davis

Chief Business Officer, Americas

18 years in commercial operations for North

& Latin America and Australia

Patrick Hedouin

Chief Business Officer, International

25 years leading global commercial teams in Europe/Asia

*Blue indicates in attendance today

11

|

New Energizer has a compelling value proposition

Driving results for our shareholders, customers and consumers

Powerful dual brand portfolio Global scale and leadership position Deep Board and management team expertise Track record of cost savings and productivity gains Top-tier free cash flow performer among household peers Focused on maximizing cash flow & returning cash to shareholders

12

|

Our business is built on two iconic brands

Billions of consumers around the world prefer the Energizer and Eveready brands and purchase them to meet their power and lighting needs After 26 years, the Energizer Bunny keeps going and going, generating millions of impressions each year

Source: Nielsen through April 2015.

13

|

Consumers prefer branded products in our categories

Reinforces the need to invest behind our brands to drive category value

U.S. HOUSEHOLD BATTERY CATEGORY

(share in US $)

Premium Brands (incl. Performance) Price Brands Private Label

Batteries

account for about

3B

$

in US retail sales(1) annually, with premium brands driving the vast majority of those sales

Batteries

account for about

6B

$

(1) |

|

in global retail sales

70% 72%

30% 28% 12% 13%

18% 15%

2009 Today

Source: U.S.: Nielsen US xAOC HOUSEHOLD BATTERIES 52-weeks ending 4-18-15 ; Global, Nielsen Global Track, 52-weeks ending March 2015.

Premium Brands = Energizer and Duracell; Price Brands = Eveready, Panasonic, Rayovac.

(1) |

| Only accounts for 34 measured markets and not 100% retailer coverage in those markets. |

14

|

Our broad portfolio of products is uniquely positioned

ESTABLISHED BROAD PRODUCT PORTFOLIO

ENR SALES BY PRODUCT SEGMENT

(percent of net sales in 2014)

16%

17% 50%

Premium 17% Performance

Value/Price

Specialty & Lights

Brand & product portfolio competes across all consumer segments

Premium

• |

| Premium Alkaline |

• |

| Lithium |

Performance • Performance Alkaline

• |

| Rechargeable |

Value • Value Alkaline

• Carbon Zinc Specialty • Specialty Batteries Lights • Lighting Products

15

|

Energizer products provide an un-matched consumer experience across its battery and lighting portfolio

#2

in Portable Lights

#1

in Rechargeable

#1in Lithium

in the growing # segment of 1specialty batteries

World’s

st

1in Recycled

#2

in Premium

Source: Nielsen Global Track 52-weeks ending March 2015 and Nielson xAOC, 52-weeks ending 4-18-15.

16

|

Eveready provides a portfolio of quality products families can trust at an affordable price

#2

in Value Alkaline

Powerful second brand in portfolio that appeals to consumers across many segments

#1

in Carbon Zinc

Source: Nielsen Global Track, 52-weeks ending March 2015.

17

|

Energizer and Eveready brands are #1 or #2 globally

Dual brand portfolio strengthens our market position

VALUE SHARE IN SELECTED COUNTRIES

Our products are sold in more than

140

markets around the world

CAN USA MEX COL ARG

GB ITA FRA EGP GRE

SING KOR HK MAL

AUS NZ

Source: Combined value share data from Nielsen Global Track, 52-weeks ending March 2015 including all Energizer and Eveready branded batteries excluded private label.

18

|

Our revenues are balanced across markets

NORTH AMERICA vs. INTERNATIONAL

(percent of net sales in 2014)

51% 49%

North America International

DEVELOPED vs. DEVELOPING

(percent of net sales in 2014)

75%

25%

Developed Developing

TOP 10 vs. ALL MARKETS

(percent of net sales in 2014)

28% 72%

Top 10 All Other

Source: Form 10 and internal data.

19

|

Category volume trends have recently stabilized

As the number of devices and replacement frequency has flattened

VOLUME TRENDS ARE DRIVEN BY THESE EXTERNAL FACTORS

Demographics Devices Disasters

20

|

Category volumes and value trends are improving in latest 12 week data

GLOBAL HOUSEHOLD BATTERY

CATEGORY VOLUME

(percent change)

1.7% -1.4% Latest 52 weeks Latest 12 weeks

GLOBAL HOUSEHOLD BATTERY CATEGORY VALUE

(percent change)

1.5%

-1.8%

Latest 52 weeks Latest 12 weeks

Source: Nielsen Global Track through March 2015.

21

|

There are more than 1 billion devices in U.S. consumer homes

Large installed base that requires regular battery replenishment

Toys, Games 18% Remote Controls 13% Flashlights 7% Smoke Alarms, Clocks 5%

Digital Cameras 4%

Top 20 Devices

Wireless Mouse 3% Account for about

Health** 3% 55%

Radio 2% of battery consumption

U.S. households report using 5+ billion batteries per year

Average U.S. household owns ~3X more primary battery devices than battery-on-board devices

As device trends stabilize globally, so will the number of batteries used annually per household

*Source: 2014 TNS US Device Study, **Health = hearing aids and electronic toothbrushes.

*2Battery Consumption represents Total # Batteries Required per device divided by Total # Batteries Required by all devices Base: All household battery-powered devices.

22

|

New devices that use primary batteries are emerging

Further opportunities for our categories

EMERGING DEVICE CATEGORIES

23

|

Our agenda for today

Who We Are

Why We’ll Win

How We’ll Deliver

Long-Term Value

New Energizer’s Value Proposition

Our Brands and Global Leadership Position

Lead with Innovation Operate with Excellence Drive Productivity Gains

Focused on Free Cash Flow

Committed to Returning Cash to Shareholders Dedicated to Enhancing Value for the Long Term

24

|

We’re a global household products company with a unified direction …

Mission Strategic Priorities

Connect our

brands, our Lead Operate Drive

people and the with with Productivity

products we

offer to the world Innovation Excellence Gains

better than anyone else

Focus on maximizing cash flows, and Objective deliver long-term value to our shareholders, customers and consumers

25

|

… and financial objectives aligned with our business strategies

Topline

Grow ahead of the category

Margins

Maintain or Improve

SG&A

% of Sales

Maintain or Improve

EBITDA

Low single digit growth

Working Capital

11% to 13%

of sales

Free Cash Flow

10% to 12%

of sales

How we manage our business will tie

to our corporate strategy and financial objectives

26

|

Energizer has a clear strategy to drive value creation

WHERE WE’LL PLAY

Customers Markets

Categories

HOW WE’LL WIN

1 |

| Achieve leading distribution |

2 |

| Drive top-tier consumer preference and conversion |

3 |

| Relentlessly focus on cost savings and productivity gains |

4 |

| Operate with excellence |

5 |

| Build a team for long-term success |

27

|

We’re a global household products company with a unified direction

Mission

Connect our brands, our people and the products we offer to the world better than anyone else

Lead

with Innovation

Strategic Priorities

Operate Drive

with Productivity Excellence Gains

Objective

Focus on maximizing cash flows, and deliver long-term value to our shareholders, customers and consumers

28

|

Our mandate for winning in power and light

Giving consumers a better overall performance

BATTERIES

LIGHTS

Long

AND RESPONSIBILITY

Lasting

RELIABILITY

QUALITY

Bright AND LONG LASTING QUALITY

DURABLE

USER FRIENDLY

29

|

Through consumer insights, we identify needs and bring innovative solutions to our categories better than anyone

Max

Long Lasting AND In Device Leakage Protection

EcoAdvanced

Our Longest Lasting AND World’s 1st Battery Made With Recycled Batteries

Lithium

The world’s longest-lasting

AA and AAA batteries in high-tech devices AND

20-year shelf life

Light Fusion

Bringing bright AND Advanced optics technology to re-disperse light for vibrant, uniform experience

World’s 1st batteries made with: Our product portfolio is differentiated, delivering

Zero Mercury “long lasting” … “AND” … with more to come

30

|

We’ve extended our powerful brands through strategic licensing partnerships to broader categories

Lighting Batteries Connecting Charging

Solar Bulbs Automotive Automotive Cables Household Batteries Chargers/Inverters

Photo Accessories

& Batteries Gaming Chargers USB Chargers

Gas-Powered Generators

Powerbanks

31

|

Investing in innovation maximizes category value

Drives our topline performance and improves our brand equity

GLOBAL ADVERTISING & PROMOTION SPEND

(as percent of sales)

6.6% 6.3%

5.3%

2012 2013 2014

ENR GLOBAL VALUE SHARE

+1.2

+0.5

Last 52 weeks Last 12 weeks

ENR U.S.

VALUE SHARE

+1.6

+1.3

Last 52 weeks Last 12 weeks

Innovation and investments are improving our brand equity

Source: Form 10 data, Nielsen US xAOC TOTAL BATTERIES 52-weeks ending 5-9-15 ; Global, Nielsen Global Track, 52-weeks ending March 2015.

32

|

We’re a global household products company with a unified direction

Mission Strategic Priorities

Connect our

brands, our Lead Operate Drive

people and the with with Productivity

products we

offer to the world Innovation Excellence Gains

better than anyone else

Focus on maximizing cash flows, and Objective deliver long-term value to our shareholders, customers and consumers

33

|

We create value for our channel partners

PROFITABLE LARGE-SCALE

HIGH BASKET HOUSEHOLD BUILDER PENET RAT ION

Battery category is one of the largest and most profitable at retailers.

Batteries can be found in more than 80% of all U.S. households. Batteries provide healthy margins and are a basket builder for retailers.

Source: Nielsen xAOC Strategic Planner 52 weeks ending 5-16-15 and 12-31-14.

34

|

Source: Form 10 and internal data.

We have a large and diversified channel/customer base

Our products are delivered across retail trade channels

BROAD, DIVERSE DISTRIBUTION

Sporting DIY

Goods Military

Traditional Online Trade

Food/ Hobby/ Drug/

Craft Energizer Mass

Con- Club venience

Office Dollar Home Auto Center

ENR GLOBAL SALES BY CUSTOMER

(percent of net sales in 2014)

76%

24%

Top 5

All Other

No single customer accounts for >10% of sales

Top 5 customers are <25% of sales

No customers in the top 10 are exclusive

35

|

We will continue to invest and deliver best-in-class category execution

Our products are sold in multiple locations throughout the store

Best-in-class category execution

CUSTOMER ENGAGEMENT

EXECUTION

VISIBILITY

SHOPPER BASED CATEGORY SOLUTIONS FUNDAMENTALS

36

|

We’re a global household products company with a unified direction

Mission

Connect our brands, our people and the products we offer to the world better than anyone else

Lead

with Innovation

Strategic Priorities

Operate

with

Excellence

Drive

Productivity Gains

Focus on maximizing cash flows, and Objective deliver long-term value to our shareholders, customers and consumers

37

|

We’ve significantly reduced our working capital needs, improving cash flow

WORKING CAPITAL

(as percent of sales, average trailing four quarters)

2011 22.9%

2012 20.0%

Freed up

2013 15.8%

~ $ 185

2014 12.7%

million in cash flow from 2011-2014

Reduced working capital requirements by 10.2 percentage points since 2011 Led by significant improvements in DSO and DPO

Source: internal data.

38

|

Our efforts to date have led to significant cost savings

Household Products’ cumulative restructuring savings

~ $185 million >$210 million

through FY2014 through 3/31/15

Source: internal data.

39

|

These restructuring efforts have helped enhance our healthy margins

HOUSEHOLD PRODUCTS GROSS MARGIN

(as percent of sales)

+430 46.2%

basis points

41.9% + 200 bps

+ 90 bps

2011 2012 2013 2014

Adjusted manufacturing footprint to reduce duplication Streamlined global supply chain Created center-led purchasing function Rationalized and streamlined product portfolio and centralized marketing

Will continue to evaluate and implement opportunities to optimize our cost structure and enhance margins

Source: Form 10 data.

40

|

Global areas of focus to drive productivity gains

1 |

| Trade investment |

2 |

| Working capital management |

Global Areas

of Focus 3 SG&A optimization

4 |

| Procurement |

5 |

| Integrated supply chain |

41

|

Our agenda for today

• |

| New Energizer’s Value Proposition |

Who We Are

• |

| Our Brands and Global Leadership Position |

• |

| Lead with Innovation Why We’ll Win Operate with Excellence |

• |

| Drive Productivity Gains |

• |

| Focused on Free Cash Flow |

How We’ll Deliver

• |

| Committed to Returning Cash to Shareholders |

Long-Term Value

• |

| Dedicated to Enhancing Value for the Long Term |

42

|

Our efforts to date have made us a leading cash flow generator

HOUSEHOLD PRODUCTS FREE CASH FLOW

(as percent of sales, prior fiscal three-year average)

Peer 1 14.0

EHP* 12.6 Peer 2 10.4

Peer 3 9.8 Peer 4 7.4 Peer 5 7.2 Peer 6 6.3 Peer 7 6.2 Peer 8 5.2

Healthy gross margins

Successful reductions in working capital Low capital expenditure requirements Strong free cash flow

Source: ENR and peer SEC filings.

Note: Peers comprised of the follow ing household products companies (in alpha order): CHD, CLX, HELE, NWL, SMG, SPB, TUP, WD40.

43

|

We will be prudent stewards of capital

Disciplined approach to capital allocation

Deliver VALUE

Selective,

Reinvest in Return of

Disciplined our business capital

M&A

Maximize Free Cash Flow

Relentless focus on delivering value to shareholders, customers and consumers

Pillars to our success

Our foundation

44

|

Our key takeaways

Execute our game plan

Build for long-term success

Deliver long-term value to shareholders, customers and consumers

Lead with innovation Operate with excellence

Drive productivity gains

First fiscal year is a year of transition Remain focused on maximizing cash flow

Reinvest in the business Return cash to shareholders

Evaluate strategic opportunities for growth

45

|

Why we’re excited to be a part of the new Energizer

46

|

The New Energizer

MARK LAVIGNE

Chief Operating Officer

47

|

We’re building upon our rich legacy to craft the next chapter as a standalone company

Proactive in improving the way we operate and how we perform

Leverage the separation as a catalyst to better prepare our business to win

Provide clear focus and solid foundation to achieve our goals

48

|

We’re focused on profitable share growth by winning in key markets and with key customers

SEGMENT NET SALES

(% of FY14 net sales) 1.8

$

Billion

19%

49%

23%

9%

North America Latin America Europe, Middle East, Asia-Pacific (LATAM) Africa (EMEA)

Half of our sales are generated outside North America Focused on our core global markets, customers and categories to drive profitable share growth

Markets where we have scale

Customers that create win-win partnerships

Source: Form 10 data.

49

|

We’re also re-aligning the new organization to best serve our markets based on size and scale

FY14 SEGMENT PROFIT MARGIN

NORTH AMERICA 29%

ASIA-PACIFIC 28%

EMEA 15%

LATAM 16%

DRIVERS

• |

| Scale |

• |

| Premium brands |

• |

| Modern Trade |

• |

| Dual brands |

• |

| Significant share |

• |

| Private label penetration |

• |

| Complexity |

• |

| Carbon zinc |

• |

| High inflation |

Source: Form 10 data.

50

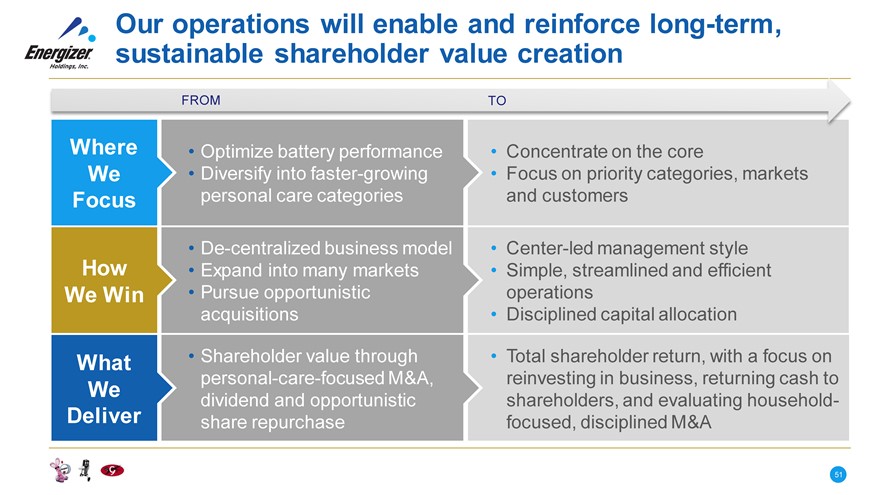

Our operations will enable and reinforce long-term, sustainable shareholder value creation

FROM TO

Where • Optimize battery performance • Concentrate on the core

We • Diversify into faster-growing • Focus on priority categories, markets

Focus personal care categories and customers

• De-centralized business model • Center-led management style

How • Expand into many markets • Simple, streamlined and efficient

We Win • Pursue opportunistic operations

acquisitions • Disciplined capital allocation

What • Shareholder value through • Total shareholder return, with a focus on

personal-care-focused M&A, reinvesting in business, returning cash to

We dividend and opportunistic shareholders, and evaluating household-

Deliver share repurchase focused, disciplined M&A

51

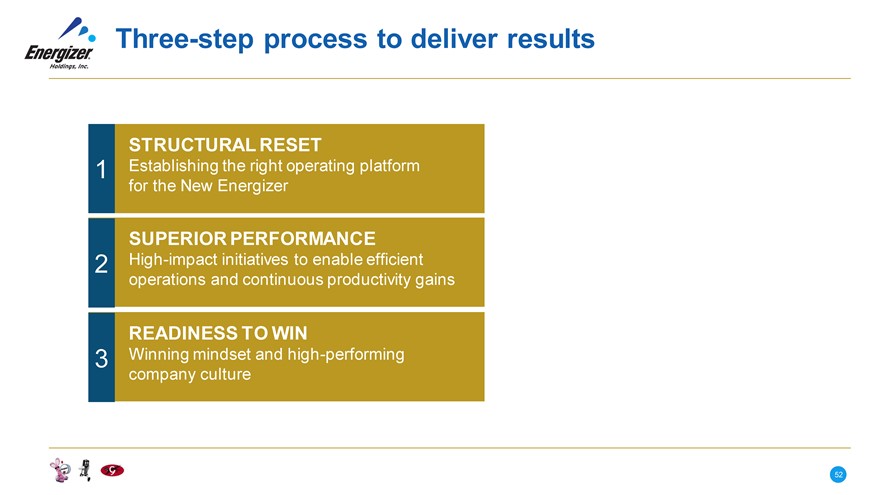

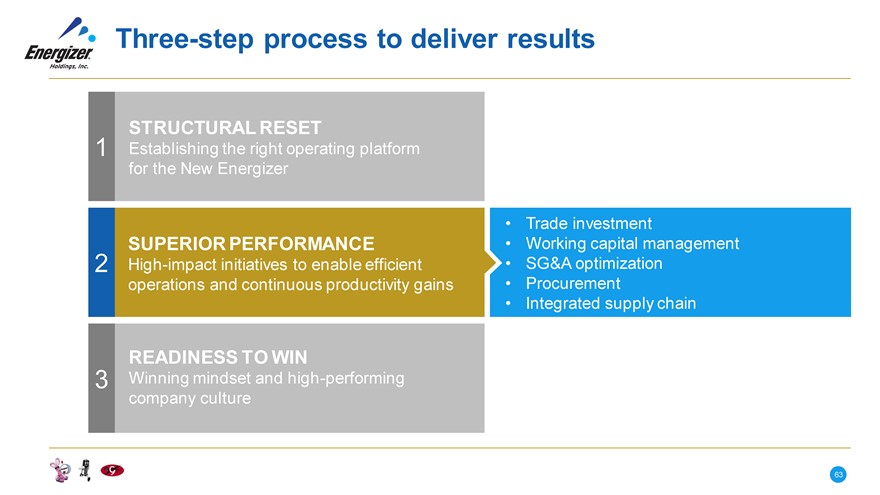

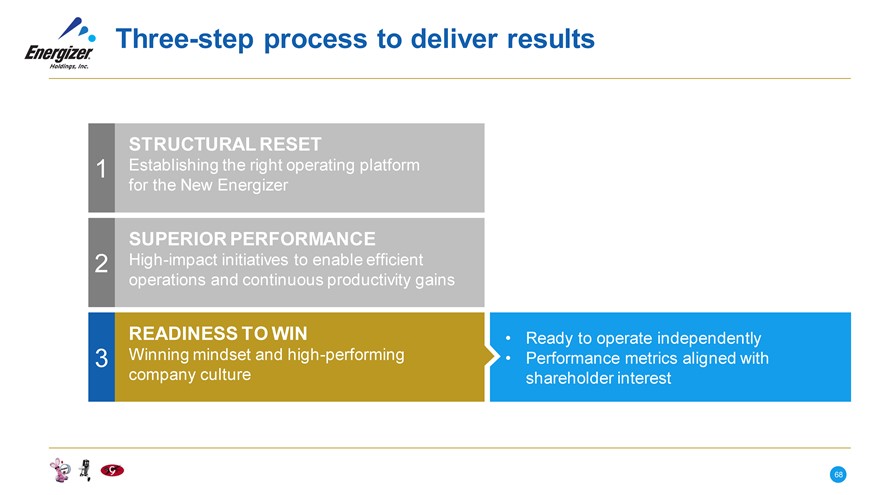

Three-step process to deliver results

STRUCTURAL RESET

1 Establishing the right operating platform for the New Energizer

SUPERIOR PERFORMANCE

2 High-impact initiatives to enable efficient operations and continuous productivity gains

READINESS TO WIN

3 Winning mindset and high-performing company culture

52

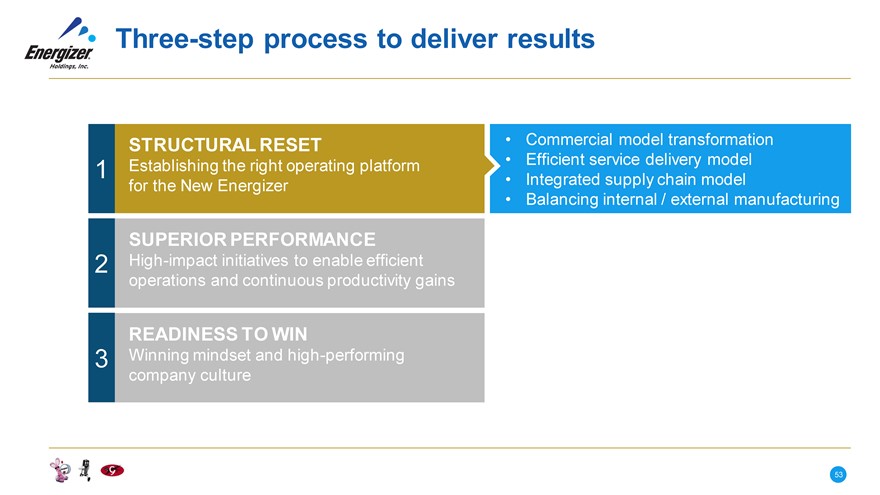

Three-step process to deliver results

STRUCTURAL RESET • Commercial model transformation

1 Establishing the right operating platform • Efficient service delivery model

for the New Energizer • Integrated supply chain model

• Balancing internal / external manufacturing

SUPERIOR PERFORMANCE

2 High-impact initiatives to enable efficient

operations and continuous productivity gains

READINESS TO WIN

3 Winning mindset and high -performing

company culture

53

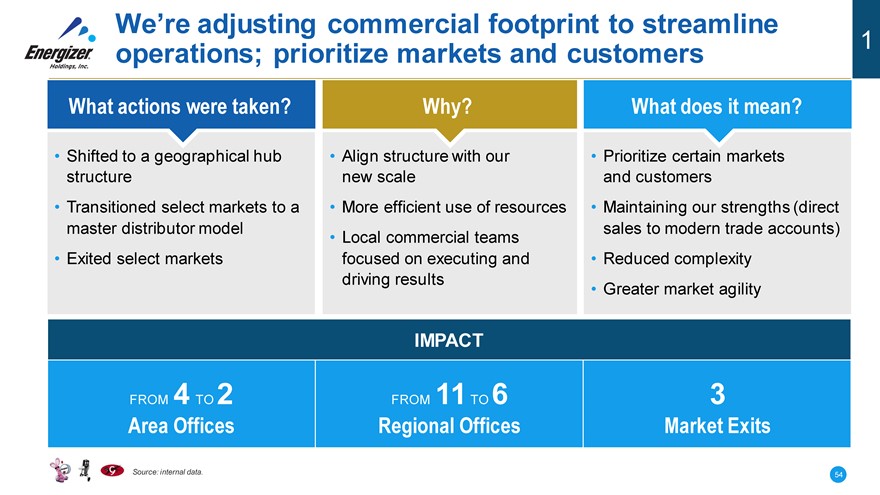

We’re adjusting commercial footprint to streamline operations; prioritize markets and customers

1

What actions were taken Why What does it mean

• Shifted to a geographical hub • Align structure with our • Prioritize certain markets

structure new scale and customers

• Transitioned select markets to a • More efficient use of resources • Maintaining our strengths (direct

master distributor model sales to modern trade accounts)

• Local commercial teams

• Exited select markets focused on executing and • Reduced complexity

driving results • Greater market agility

IMPACT

FROM 4 TO 2 FROM 11 TO 6 3

Area Offices Regional Offices Market Exits

Source: internal data.

54

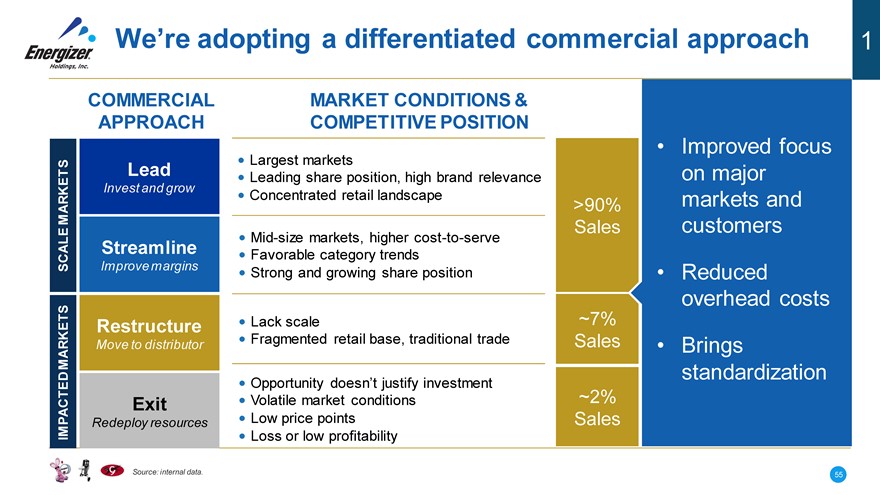

We’re adopting a differentiated commercial approach 1

COMMERCIAL MARKET CONDITIONS &

APPROACH COMPETITIVE POSITION

• Improved focus

• Largest markets

Lead • Leading share position, high brand relevance on major

Invest and grow • Concentrated retail landscape markets and

MARKETS >90%

• Mid-size markets, higher cost-to-serve Sales customers

Streamline • Favorable category trends

SCALE Improve margins • Strong and growing share position • Reduced

overhead costs

Restructure • Lack scale ~7%

MARKETS Move to distributor • Fragmented retail base, traditional trade Sales • Brings

• Opportunity doesn’t justify investment standardization

Exit • Volatile market conditions ~2%

IMPACTED Redeploy resources • Low price points Sales

• Loss or low profitability

Source: internal data.

55

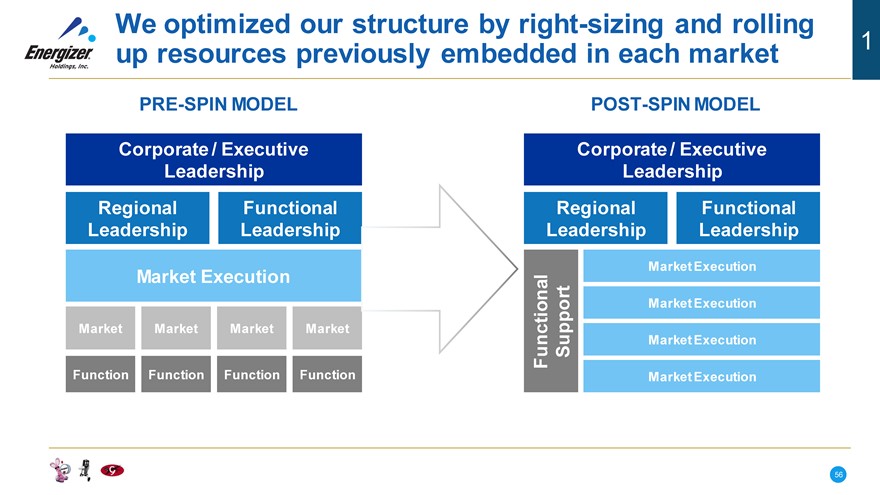

We optimized our structure by right-sizing and rolling

1

up resources previously embedded in each market

PRE-SPIN MODEL

Corporate / Executive

Leadership

Regional Functional

Leadership Leadership

Market Execution

Market Market Market Market

Function Function Function Function

POST-SPIN MODEL

Corporate / Executive

Leadership

Regional

Functional

Leadership

Leadership

Market Execution

Market Execution

Functional Support

Market Execution

Market Execution

56

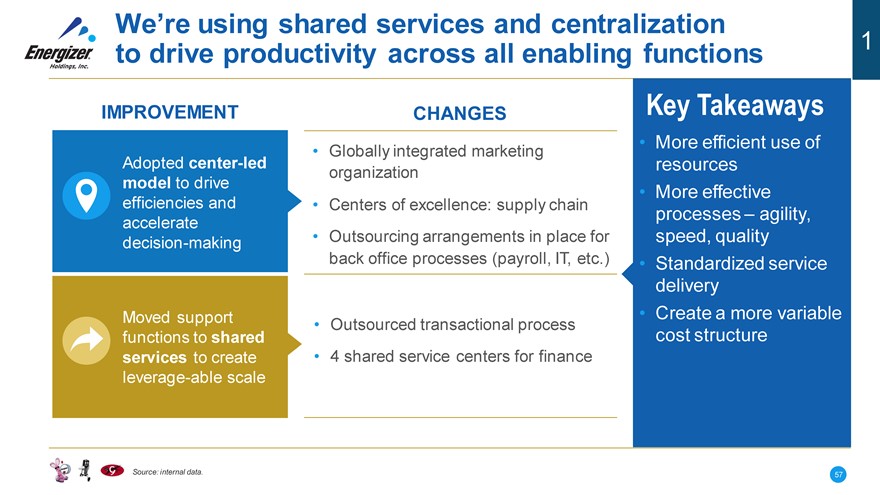

We’re using shared services and centralization

to drive productivity across all enabling functions 1

IMPROVEMENT

Adopted center-led model to drive efficiencies and accelerate decision-making

Moved support functions to shared services to create leverage-able scale

CHANGES

• Globally integrated marketing organization

• Centers of excellence: supply chain

• Outsourcing arrangements in place for back office processes (payroll, IT, etc.)

• Outsourced transactional process

• 4 shared service centers for finance

Key Takeaways

• More efficient use of

resources

• More effective

processes – agility,

speed, quality

• Standardized service

delivery

• Create a more variable

cost structure

Source: internal data.

57

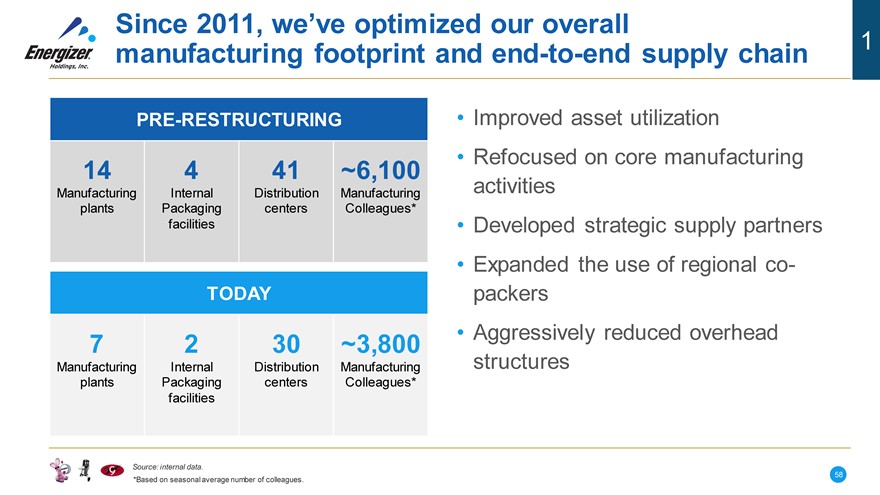

Since 2011, we’ve optimized our overall

1

manufacturing footprint and end-to-end supply chain

PRE-RESTRUCTURING

14 4 41 ~6,100

Manufacturing Internal Distribution Manufacturing plants Packaging centers Colleagues* facilities

TODAY

7 2 30 ~3,800

Manufacturing Internal Distribution Manufacturing plants Packaging centers Colleagues* facilities

Improved asset utilization

Refocused on core manufacturing activities

Developed strategic supply partners

Expanded the use of regional co- packers

Aggressively reduced overhead structures

Source: internal data.

*Based on seasonal average number of colleagues.

58

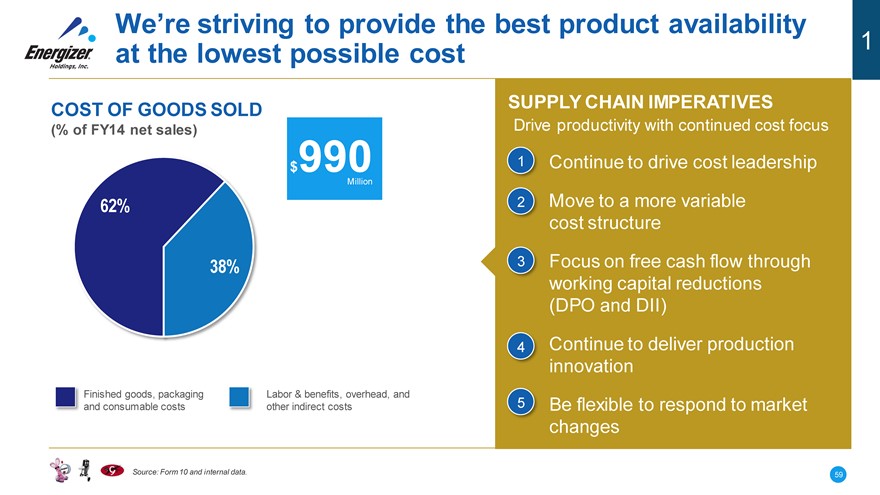

We’re striving to provide the best product availability

1

at the lowest possible cost

COST OF GOODS SOLD

(% of FY14 net sales)

$990

Million

62%

38%

Finished goods, packaging Labor & benefits, overhead, and

and consumable costs other indirect costs

SUPPLY CHAIN IMPERATIVES

Drive productivity with continued cost focus

1 Continue to drive cost leadership

2 Move to a more variable cost structure

3 Focus on free cash flow through working capital reductions (DPO and DII)

4 Continue to deliver production innovation

5 Be flexible to respond to market changes

Source: Form 10 and internal data.

59

We have a global manufacturing footprint that offers

1

scale, drives lower cost and offers flexibility

Westlake, OH

Bennington, VT St. Louis, MO

Shenzhen, China (2) Asheboro, NC

Egypt

Singapore

Indonesia

Global Headquarters

R&D

Manufacturing

60

Post separation, we’ll operate under a center-led integrated supply chain model

1

CHIEF SUPPLY CHAIN OFFICER

Global Sales & Procurement Manufacturing Supply Chain

Operations Planning

Centers of Excellence / Business Services

Empowered & Disciplined Flexible & Operating with

Accountable Standardized Processes Systems / Responsive Excellence

These functions previously have been under separate owners,

but are now under one leader with unified goals

61

We’re evolving our manufacturing strategy to balance

1

internal capabilities with targeted outsourcing

KEY TAKEWAYS

1 Significant progress made since 2011

2 Continue to proactively optimize our structure to align with business needs

3 Maintain good balance through a mix of internal and sourced manufacturing

62

Three-step process to deliver results

STRUCTURAL RESET

1 Establishing the right operating platform for the New Energizer

• Trade investment

SUPERIOR PERFORMANCE • Working capital management

2 High-impact initiatives to enable efficient • SG&A optimization operations and continuous productivity gains • Procurement

• Integrated supply chain

READINESS TO WIN

3 Winning mindset and high-performing company culture

63

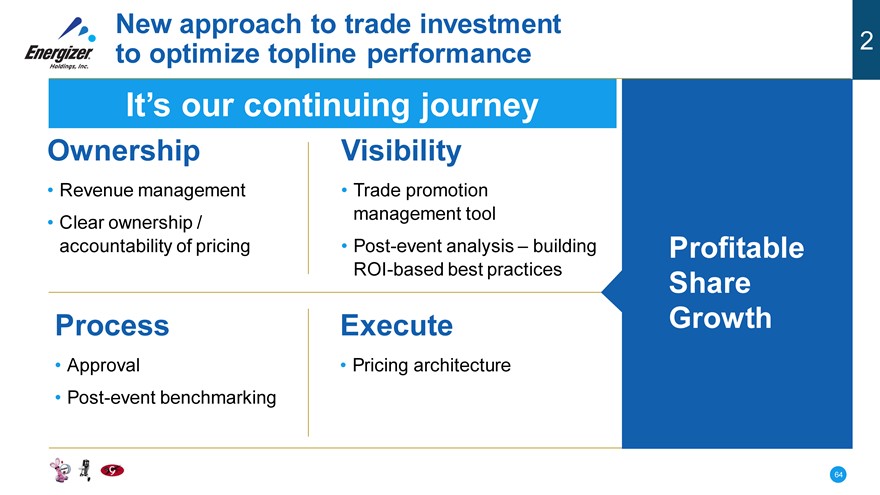

New approach to trade investment

2

to optimize topline performance

It’s our continuing journey

Ownership Visibility

• Revenue management • Trade promotion

• Clear ownership / management tool

accountability of pricing • Post-event analysis – building Profitable

ROI-based best practices Share

Process Execute Growth

• Approval • Pricing architecture

• Post-event benchmarking

64

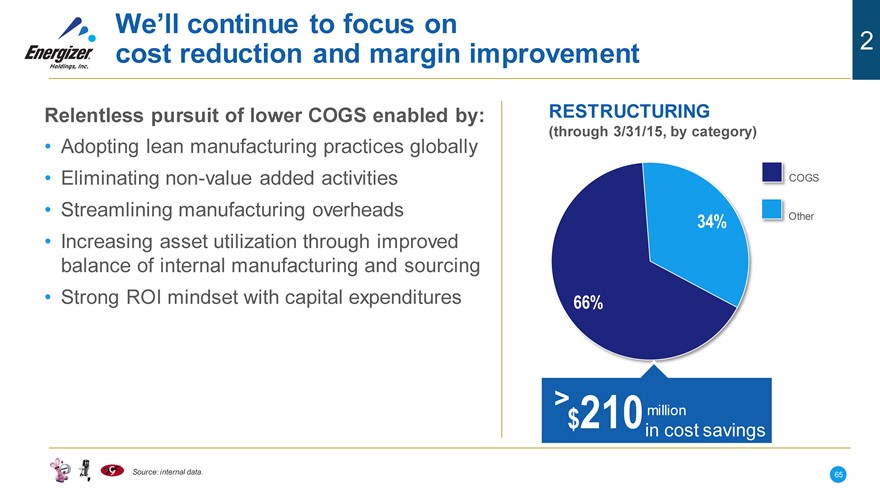

We’ll continue to focus on

2

cost reduction and margin improvement

Relentless pursuit of lower COGS enabled by:

• Adopting lean manufacturing practices globally

• Eliminating non-value added activities

• Streamlining manufacturing overheads

• Increasing asset utilization through improved balance of internal manufacturing and sourcing

• Strong ROI mindset with capital expenditures

RESTRUCTURING

(through 3/31/15, by category)

COGS

34% Other

66%

> $210 million

in cost savings

Source: internal data.

65

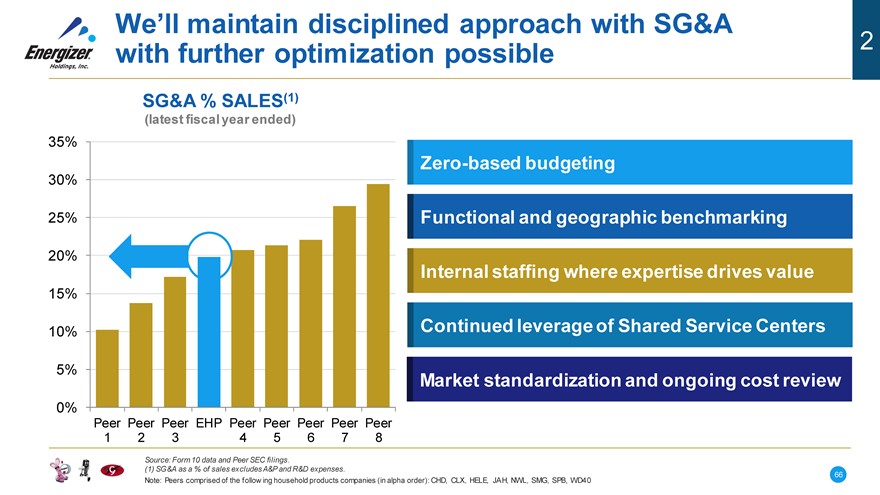

We’ll maintain disciplined approach with SG&A

2

with further optimization possible

SG&A % SALES(1)

(latest fiscal year ended)

35%

30%

25%

20%

15%

10%

5%

0%

Peer Peer Peer EHP Peer Peer Peer Peer Peer

1 2 3 4 5 6 7 8

Zero-based budgeting

Functional and geographic benchmarking Internal staffing where expertise drives value Continued leverage of Shared Service Centers Market standardization and ongoing cost review

Source: Form 10 data and Peer SEC filings.

(1) SG&A as a % of sales excludes A&P and R&D expenses.

Note: Peers comprised of the follow ing household products companies (in alpha order): CHD, CLX, HELE, JAH, NWL, SMG, SPB, WD40

66

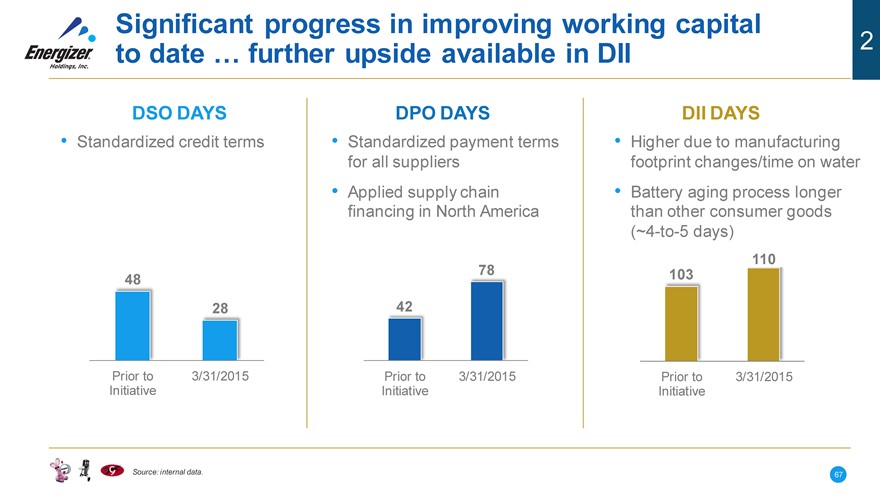

Significant progress in improving working capital

2

to date … further upside available in DII

DSO DAYS DPO DAYS DII DAYS

• Standardized credit terms • Standardized payment terms • Higher due to manufacturing

for all suppliers footprint changes/time on water

• Applied supply chain • Battery aging process longer

financing in North America than other consumer goods

(~4-to-5 days)

110

48 78 103

28 42

Prior to 3/31/2015 Prior to 3/31/2015 Prior to 3/31/2015

Initiative Initiative Initiative

Source: internal data.

67

Three-step process to deliver results

STRUCTURAL RESET

1 Establishing the right operating platform

for the New Energizer

SUPERIOR PERFORMANCE

2 High-impact initiatives to enable efficient

operations and continuous productivity gains

READINESS TO WIN • Ready to operate independently

3 Winning mindset and high -performing • Performance metrics aligned with

company culture shareholder interest

68

We are ready to operate independently 3

Clarity of purpose and objectives • Focused goal of maximizing free cash flow

• Management committed to driving value

• Enhanced operating model

Business realigned for success given • Lower complexity and efficiency gains

reduced scale resulting from spin • Right-sized SG&A

• Increase agility in decision-making

Business structured to enhance • Leaner, more efficient structure in place through

restructuring and go-to-market initiatives

shareholder value • Aligned compensation with shareholder interests

69

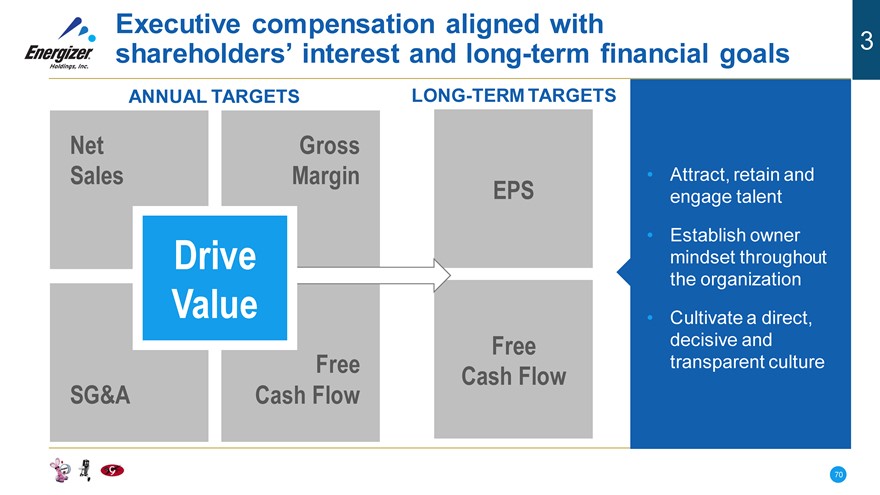

Executive compensation aligned with

3

shareholders’ interest and long-term financial goals

ANNUAL TARGETS LONG-TERM TARGETS

Net Gross

Sales Margin • Attract, retain and

EPS engage talent

• Establish owner

Drive mindset throughout

the organization

Value • Cultivate a direct,

Free decisive and

Free transparent culture

Cash Flow

SG&A Cash Flow

70

|

Key takeaways

Many accomplishments Leveraged the separation as a catalyst to in the past year better prepare our business to win

Have been and Constantly improving the way we operate

will continue to be proactive and our business performance

We will attain our goals Our focus is clear and the foundation is in place

71

|

The New Energizer

BRIAN HAMM

Chief Financial Officer

|

The creation of a new Energizer

Tax-free spin to shareholders; begin trading independently on July 1 1-for-1 ratio: receive 1 new ENR share for every 1 parent co share held Retain Energizer Holdings, Inc. name and ENR ticker symbol

“When-issued” trading expected to begin in mid-June

New Energizer to ring opening bell at NYSE on July 2

73

|

Our agenda for today

Track record of delivering cost savings Transition period as we separate Driving value as a standalone company Our capital structure and allocation strategies

74

|

Our agenda for today

Track record of delivering cost savings Transition period as we separate Driving value as a standalone company Our capital structure and allocation strategies

75

|

Our track record of delivering cost savings provides a strong foundation

RESTRUCTURING WORKING CAPITAL FREE CASH FLOW

(through 3/31/15, by category) (from FY11-FY14, by driver) (from FY12-FY14)

~ ~

> $210M of cost savings $185M cash flow improvement $750M cumulative free cash flow

16% 15.5%

48%

11.8%

18% 49% 10.4%

66%

COGS SG&A Other DPO DII DSO

FY12 FY13 FY14

Led to 430 basis points of Led to 10.2 percentage point ENR delivers top-tier free cash

gross margin improvement reduction in working capital flow among household peers

Source: Form 10 and internal data. See appendix for free cash flow reconciliation.

76

|

We’re aiming to offset our share of spin-related dis-synergies

Parent Co. dis-synergies of $65 - $85 million.

New Energizer expected to incur roughly one half of total.

Aiming to offset dis-synergies in 3-to-4 quarters post spin via these focus areas:

COMMERCIAL SHARED SERVICE CENTERS OUTSOURCING NON-CORE

ADMIN. ACTIVITIES

Goals ? Standardize ? Standardize

? Cost savings ? Create scale ? Standardize

? Cost savings ? Cost savings

? 50% reduction ? From 27 accounting teams ? Accounts payable

in area offices to 4 shared service centers ? T&E

Actions ? 45% reduction ? Payroll processing

in regional

offices ? IT help desk and application support

Source: internal data.

77

|

Additional cost saving opportunities will further enhance our cash flow

Trade Investment Integrated

? Revenue management team Supply Chain Our goal is to

SG&A

? Installing trade promotion ? Internal manufacturing deliver

management solution vs. sourcing Optimization

? Disciplined pricing ? Capacity utilization ? Process continuous

architecture ? Cost reduction standardization improvement in

? Go-to-market productivity,

changes reduce costs &

? Shared service

Center-Led Working Capital - centers maximize

Procurement Days in Inventory ? Outsourcing

? Create leverage-able scale Reduction ? Zero-based free cash

? Drive further cost ? SKU optimization budgeting

improvements ? Forecasting accuracy ? Benchmarking flow

? Optimize DPO ? Global supply

governance structure

78

|

Our agenda for today

Track record of delivering cost savings Transition period as we separate Driving value as a standalone company Our capital structure and allocation strategies

79

|

We’re committed to providing relevant data in the interim, and expect normalized reporting starting with Q4/FY15

August 2015 November 2015

FISCAL THIRD QUARTER FISCAL FOURTH QUARTER

2015 RESULTS / FULL YEAR 2015 RESULTS

• Earnings release focused on • Fourth quarter will include

net sales, segment profit, actual standalone results

brand investments and fourth - Additional costs expected

quarter outlook during “stabilization period”

• 10Q will contain carve-out • FY16 outlook to be provided

financials as part of our Q415 earnings

release and call

80

|

Topline adjustments anticipated

ADJUSTED ANNUALIZED NET SALES BASE

NORMAL VARIABILITY DUE TO

$1.8B

• Storms

• Timing of holiday shipments

• Distribution gains and losses

($95-$100M) ~$1.6B

($21M) • New product launches

($45-50M)

INCREMENTAL ADJUSTMENTS

FOR

• Currency

• Venezuela deconsolidation

• Go-to-market changes

LTM Net Sales Currency Venezuela Go-To-Market Adj. Base

3/31/15 Changes

Source: company estimates.

Market changes reflect decision to move to distributors in certain markets or exit altogether.

81

|

EBITDA base will also be reset

ADJUSTED ANNUALIZED EBITDA* BASE

$392M

+$0-$5M $310-$325M

($55-$60M)

($9M) ($10-$15M)

LTM EBITDA Currency Venezuela Corporate Go- To- Market Adj. Base

3/31/15 Costs Changes

Gross margin negatively impacted 300-400 basis points due to currency, Venezuela and go-to- market changes

Does not include additional temporary dis-synergy costs expected to be offset 3-4 quarters post-spin

Source: company estimates.

Market changes reflect decision to move to distributors in certain markets or exit altogether.

*Exclusive of unusual items, non-GAAP reconciliation in appendix.

82

|

Capital expenditures for standalone household products to remain relatively modest

DIVISIONAL CAPITAL SPENDING CAPITAL SPENDING OUTLOOK

($ in millions, excludes corporate and IT) (percent of total, includes corporate and IT)

$38 20% $35- $45

$32 Million

$28 65%

15%

$18

Maintenance Efficiency Product

FY’12 FY’13 FY’14 LTM (3/31/15) (including IT) Improvements Development

Source: Form 10 and company estimates.

83

|

Our agenda for today

Track record of delivering cost savings Transition period as we separate Driving value as a standalone company Our capital structure and allocation policies

84

|

We’re executing on our financial goals

EBITDA / Free Cash Flow

• Expand gross margins

• Proactively reduce SG&A costs

• Improve cash conversion cycle

Margin Expansion / reduce working capital

Revenue • Grow share profitably • Efficiently spend capital

• Leverage center-led

• Bring innovation procurement organization

• Optimize trade • Proactively reduce cost

investment spending to manufacture

• Enhance product mix and

trade-up strategies

• Grow share profitably

85

|

We’re confident in our ability to achieve long-term financial targets

METRIC LONG-TERM TARGET

Revenue Revenue growth rate at or above category

EBITDA Consistent low single digit growth

Tax Rate Corporate rate now in the range of 31% to 33%

Capital Expenditures In the range of $35 million to $45 million

Free Cash Flow Generate free cash flow between 10% to 12% of sales

(% of Sales)

Dividends Meaningful and competitive dividend, subject to

Board approval

86

|

Our agenda for today

Track record of delivering cost savings Transition period as we separate Driving value as a standalone company Our capital structure and allocation strategies

87

|

Our strong balance sheet supports growth and return of capital

Summary Capitalization

($M Pro-Forma)

Cash (minimum) $300

Total Debt $1,020 Availability under $230 $250M Revolver

$300 million (minimum) in offshore cash

Revolver capacity provides incremental financial flexibility

Annual cash flow generation should support anticipated future cash needs of the business

$1,000M in cash proceeds from ENR debt raise will fund payment to the parent prior to spin

88

|

Flexible capital structure ensures low borrowing costs with no near-term maturities

DEBT MATURITY LADDER

(notional amounts)

$600M

Unsecured Notes

$400M

Term Loan

B

$250M

Revolver

2020

2022

2025(1)

• Availability under revolver

to provide liquidity

• Covenant-lite Term Loan B

• Unsecured notes provide

attractive fixed rate

financing for 10 years

• Strong BB / Ba2

credit rating

• Weighted average

borrowing costs under 5%

(1) Bonds callable in 2020.

89

|

We will pursue a prudent capital allocation policy to drive long-term shareholder value

Reinvest in Dividend and

Selective / the Business Opportunistic Disciplined Share

(Including Productivity M&A Improvements) Repurchases

90

|

We’re taking the right steps to reinvest in the business to drive long-term shareholder value

Support Drive Further Invest in Systems/

Revenue Cost Savings Processes/People

? R&D and A&P spend to ? Reduce manufacturing ? Trade promotion

support innovation costs management tool

? Maintain and grow ? Simplify and create ? SAP in key markets

healthy margins shared service centers ? Training and

to drive efficiency

? Grow share profitably development

? Relentless pursuit of

cost savings to fund re-

investment opportunities

91

|

Meaningful return of capital to shareholders remains a top priority for new Energizer

DIVIDEND PAYOUT DIVIDEND SHARE REPURCHASE

~45% • $1/share annually

~75% • Intend to

• Represents a material opportunistically

increase from parent repurchase shares

51% ~27%

• Focus on maximizing Historically created

cash flow in order to shareholder value by

fund dividend (subject to opportunistically

Board approval, with the buying back stock

expectation to regularly

7.5 million share

review the dividend level authorization (subject

% U.S. % of Adj. with the Board) to Board approval)

Cash Flows Net Income

Parent ENR (FY14) New ENR Proj.

Source: Company estimates.

92

|

When evaluating M&A, we’ll be selective and disciplined in our approach

Prior Parent Criteria New ENR Criteria

• Fast moving consumable goods • Household products or adjacent

categories where we can compete and

• Household/personal care preferred generate superior returns

• Strong brands • Differentiated business models, due to

• #1 or #2 market share brand, technology or distribution

• Global or ability to go global • Complementary products to leverage our

existing global footprint

• Ability to maintain/build margins

• Strong cash flow characteristics … stable

margins, limited capital requirements

• Ability to derive synergies through scale,

operations or enhanced distribution

93

|

Key takeaways for New Energizer

Strong and • Cash and revolver provide adequate liquidity

Flexible

• Strong credit rating

Balance

Sheet • Long-dated maturity profile

Attractive • Track record of taking out costs

Cash Flow • Additional productivity improvement initiatives launched Generation • Top-tier free cash flow performer

Prudent • Reinvest in the business to drive long-term value

Capital • Meaningful and competitive dividend

Allocation • Opportunistic share repurchase program Policy • Selective, disciplined M&A

94

|

Q&A

ALAN HOSKINS MARK LAVIGNE BRIAN HAMM

|

Appendix

96

|

Company Contacts

BRIAN HAMM

Energizer’s Chief Financial Officer

Briank.Hamm@energizer.com

JENNIFER BEATTY, CFA

Energizer’s Vice President –

Investor Relations

Jennifer.Beatty@energizer.com (314) 985-1849

97

|

LTM 3/31/15 % Chg 2014 % Chg 2013 % Chg 2012

Net Sales North America

Net sales - prior year $934.8 $1,041.9 $1,103.4 $1,133.3

Organic ($59.3) -6.3% ($127.2) -12.2% ($61.0) -5.6% ($27.9)

Impact of currency ($5.9) -0.6% ($5.5) -0.5% ($0.5) 0.0% ($2.0)

Net sales - current year $869.6 -7.0% $909.2 -12.7% $1,041.9 -5.6% $1,103.4

Latin America

Net sales - prior year $171.5 $182.0 $183.1 $181.8

Organic $2.2 1.3% $1.0 0.6% $5.7 3.1% $4.7

Venezuela ($4.1) -2.4% ($2.6) -1.4% $1.7 0.9% $4.8

Impact of currency ($17.9) -10.4% ($18.3) -10.1% ($8.5) -4.6% ($8.2)

Net sales - current year $151.7 -11.5% $162.1 -10.9% $182.0 -0.6% $183.1

EMEA

Net sales - prior year $420.5 $423.3 $431.6 $472.9

Organic $5.0 1.2% ($5.6) -1.3% ($2.9) -0.6% ($21.2)

Impact of currency ($27.0) -6.4% $1.4 0.3% ($5.4) -1.3% ($20.1)

Net sales - current year $398.5 -5.2% $419.1 -1.0% $423.3 -1.9% $431.6

Asia Pacific

Net sales - prior year $345.9 $365.0 $369.6 $407.9

Organic $1.3 0.4% ($2.5) -0.7% ($3.0) -0.8% ($30.9)

Impact of currency ($10.4) -3.0% ($12.5) -3.4% ($1.6) -0.4% ($7.4)

Net sales - current year $336.8 -2.6% $350.0 -4.1% $365.0 -1.2% $369.6

Total Net Sales

Net sales - prior year $1,872.7 $2,012.2 $2,087.7 $2,195.9

Organic ($50.8) -2.7% ($134.3) -6.7% ($61.2) -2.9% ($75.3)

Venezuela ($4.1) -0.2% ($2.6) -0.1% $1.7 0.1% $4.8

Impact of currency ($61.2) -3.3% ($34.9) -1.7% ($16.0) -0.8% ($37.7)

Net sales - current year $1,756.6 -6.2% $1,840.4 -8.5% $2,012.2 -3.6% $2,087.7

98

|

2014 % Chg 2013 % Chg 2012

North America

Segment Profit Segment Profit - prior year $307.1 $302.9 $288.2

Operations ($39.2) -12.8% $4.5 1.5% $16.1

Impact of currency ($4.0) -1.3% ($0.3) -0.1% ($1.4)

Segment Profit - current year $263.9 -14.1% $307.1 1.4% $302.9

% of Sales 29.0% 29.5% 27.5%

Latin America

Segment Profit - prior year $32.9 $32.3 $27.6

Operations $4.9 14.9% $6.7 20.7% $6.7

Venezuela $0.1 0.3% ($0.5) -1.5% $2.4

Impact of currency ($11.5) -35.0% ($5.6) -17.3% ($4.4)

Segment Profit - current year $26.4 -19.8% $32.9 1.9% $32.3

% of Sales 16.3% 18.1% 17.6%

EMEA

Segment Profit - prior year $49.9 $50.4 $52.3

Operations $11.5 23.0% $3.7 7.3% $9.1

Impact of currency $0.0 0.0% ($4.2) -8.3% ($11.0)

Segment Profit - current year $61.4 23.0% $49.9 -1.0% $50.4

% of Sales 14.7% 11.8% 11.7%

Asia Pacific

Segment Profit - prior year $98.2 $85.9 $112.2

Operations $7.7 7.9% $13.9 16.2% ($20.7)

Impact of currency ($8.8) -9.0% ($1.6) -1.9% ($5.6)

Segment Profit - current year $97.1 -1.1% $98.2 14.3% $85.9

% of Sales 27.7% 26.9% 23.2%

Total Segment Profit

Segment Profit - prior year $488.1 $471.5 $480.3

Operations ($15.1) -3.1% $28.8 6.1% $11.2

Venezuela $0.1 0.0% ($0.5) -0.1% $2.4

Impact of currency ($24.3) -5.0% ($11.7) -2.5% ($22.4)

Segment Profit - current year $448.8 -8.1% $488.1 3.5% $471.5

% of Sales 24.4% 24.3% 22.6%

99

|

EBITDA and Adjusted EBITDA Reconciliation

LTM 3/31/15 2014 2013 2012

Net Income $75.3 $157.3 $114.9 $187.0

Income Taxes $51.1 $57.9 $47.1 $70.6

EARNINGS BEFORE TAXES $126.4 $215.2 $162.0 $257.6

Interest $50.4 $52.7 $68.1 $68.9

Depreciation & Amortization $46.6 $42.2 $55.9 $56.8

EBITDA (a) $223.4 $310.1 $286.0 $383.3

Adjustments:

Restructuring $1.1 $50.4 $132.6 ($0.3)

Spin costs $90.7 $21.3 $0.0 $0.0

Venezuela Deconsolidation $65.2 $0.0 $0.0 $0.0

Share-based payments $11.7 $13.2 $16.0 $20.7

ADJUSTED EBITDA (a) $392.1 $395.0 $434.6 $403.7

(a) EBITDA is defined as earnings before interest, taxes, depreciation and amortization. Adjusted EBITDA is defined as EBITDA, adjusted to exclude restructuring-related charges, spin-related charges, the Venezuela deconsolidation charge, extraordinary gains and share-based payment costs that we believe are not representative of our core business. These items are identified above in the reconciliation of EBITDA and Adjusted EBITDA to net loss, the most directly comparable GAAP measure. Our definition of EBITDA and Adjusted EBITDA may be different from the calculation used by other companies; therefore, they may not be comparable to other companies.

100

|

Free Cash Flow Reconciliation

3 Year 3 Year

2014 2013 2012 Total Average

Revenue $1,840.4 $2,012.2 $2,087.7 $1,980.1

Operating Cash Flow $219.9 $329.5 $285.3 $278.2

Capital Expenditures ($28.4) ($17.8) ($38.1) ($28.1)

Free Cash Flow (a) $191.5 $311.7 $247.2 $750.4 $250.1

% of Sales 10.4% 15.5% 11.8% 12.6%

(a) Free cash flow is defined as net cash provided by operating activities net of capital expeditures, i .e .

additions to property, plant and equipment.

101