Third Quarter Fiscal 2019 Supplemental Financial Information August 6, 2019 Exhibit 99.2

Key Headlines * See non-GAAP reconciliations in the Appendix. Reaffirming Adjusted Diluted EPS from continuing operations, Adjusted EBITDA and Adjusted Free Cash Flow* Reported Net sales increased 64.8% to $647.2 million due to the impact of acquisitions and organic revenue growth of 3.6%* Adjusting Net sales outlook for fiscal 2019 to $2.48 to $2.50 billion as strength in the battery business is offset by softness in the auto care business Increasing synergy target by approximately $25 million to $100 million which will be realized in our results in our first 3 years of ownership.

Third Quarter Fiscal Year 2019 Results

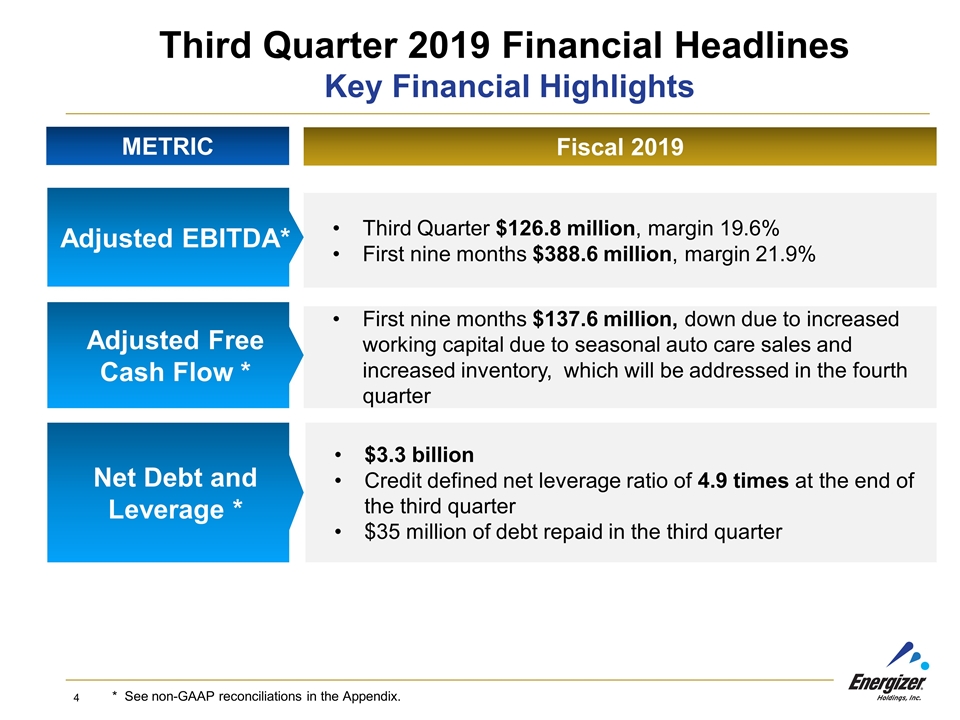

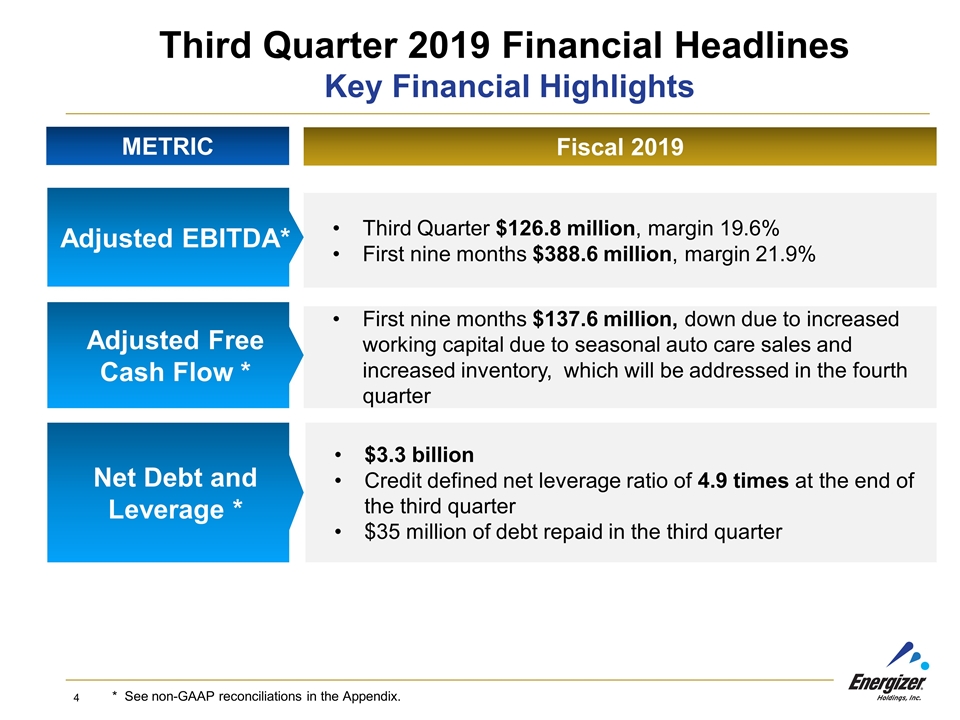

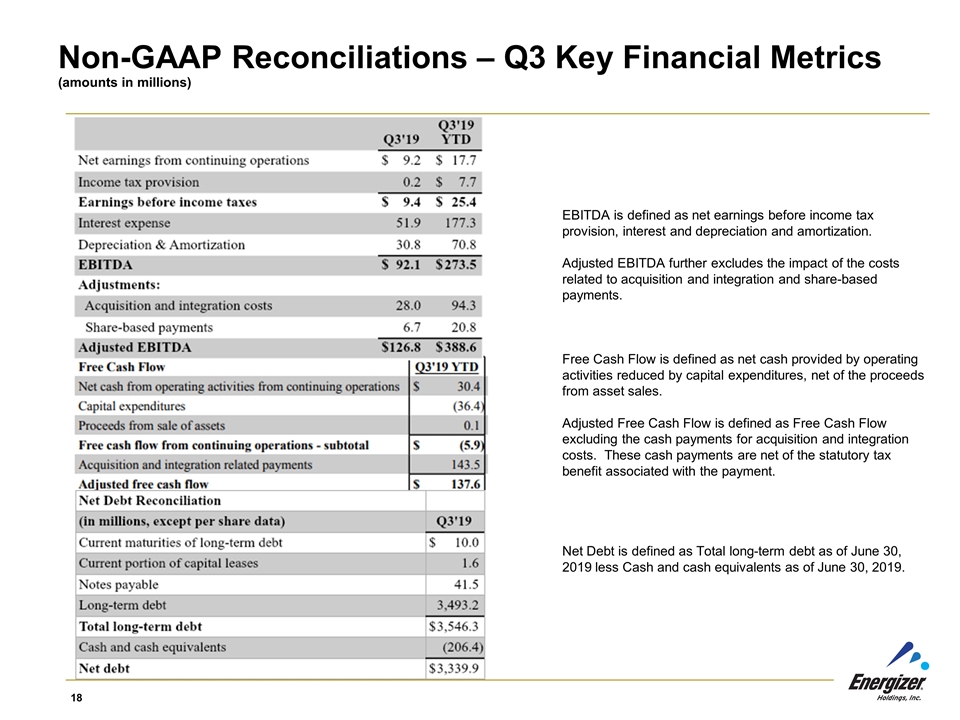

Third Quarter $126.8 million, margin 19.6% First nine months $388.6 million, margin 21.9% First nine months $137.6 million, down due to increased working capital due to seasonal auto care sales and increased inventory, which will be addressed in the fourth quarter $3.3 billion Credit defined net leverage ratio of 4.9 times at the end of the third quarter $35 million of debt repaid in the third quarter Third Quarter 2019 Financial Headlines Key Financial Highlights METRIC Fiscal 2019 Adjusted EBITDA* Adjusted Free Cash Flow * Net Debt and Leverage * * See non-GAAP reconciliations in the Appendix.

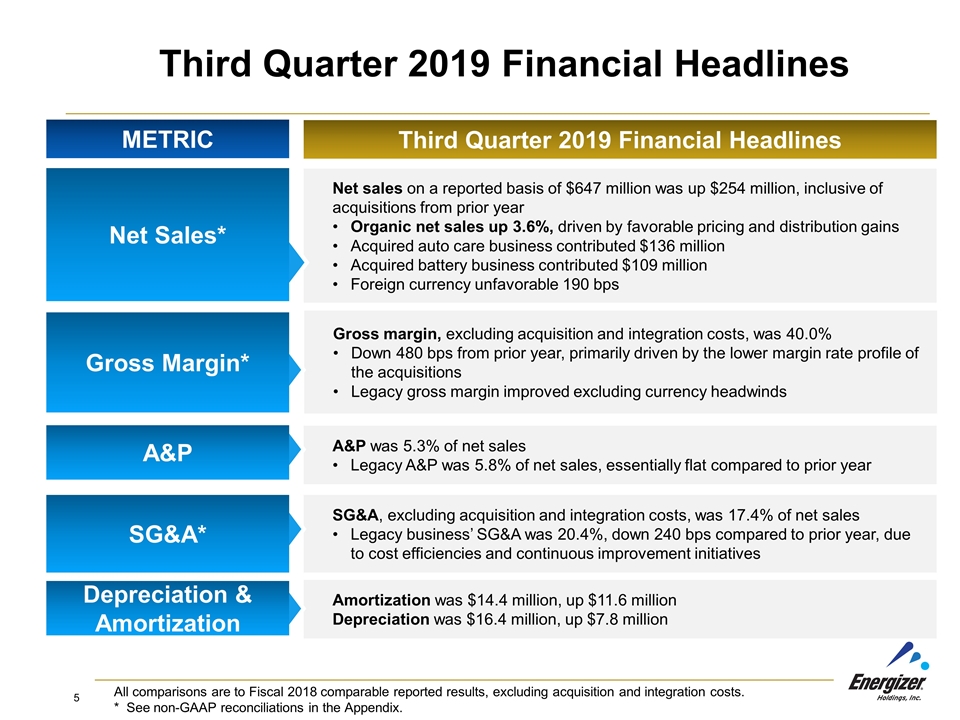

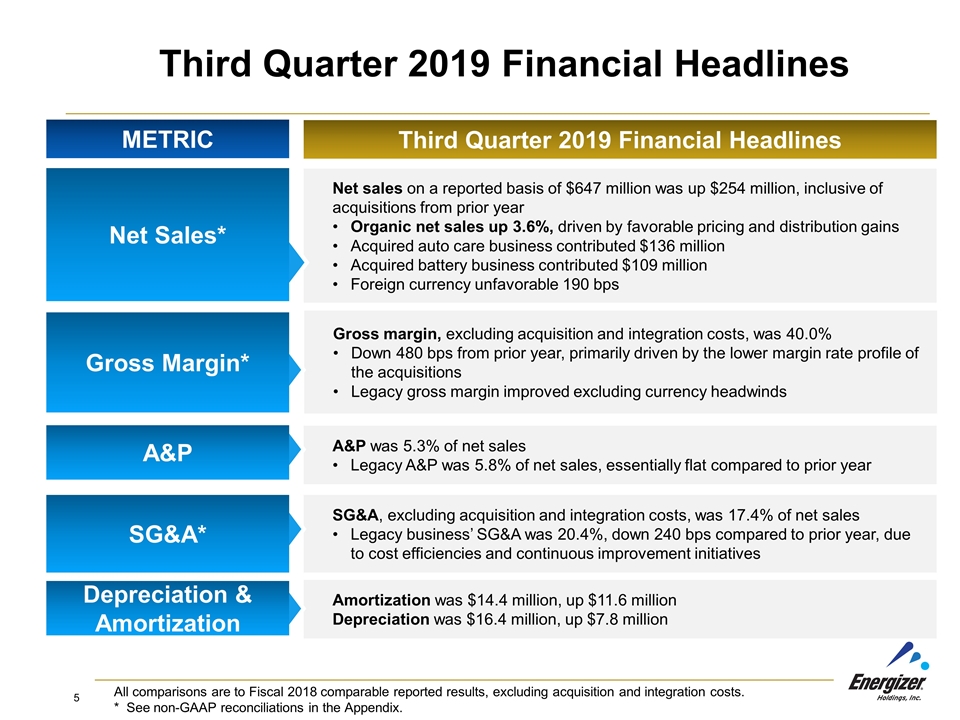

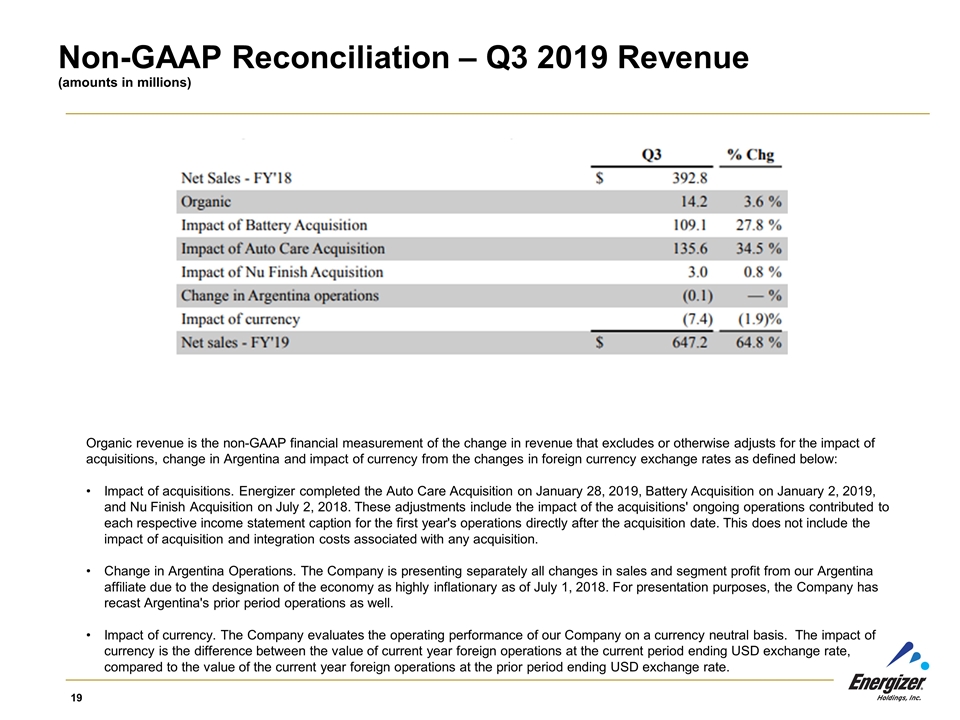

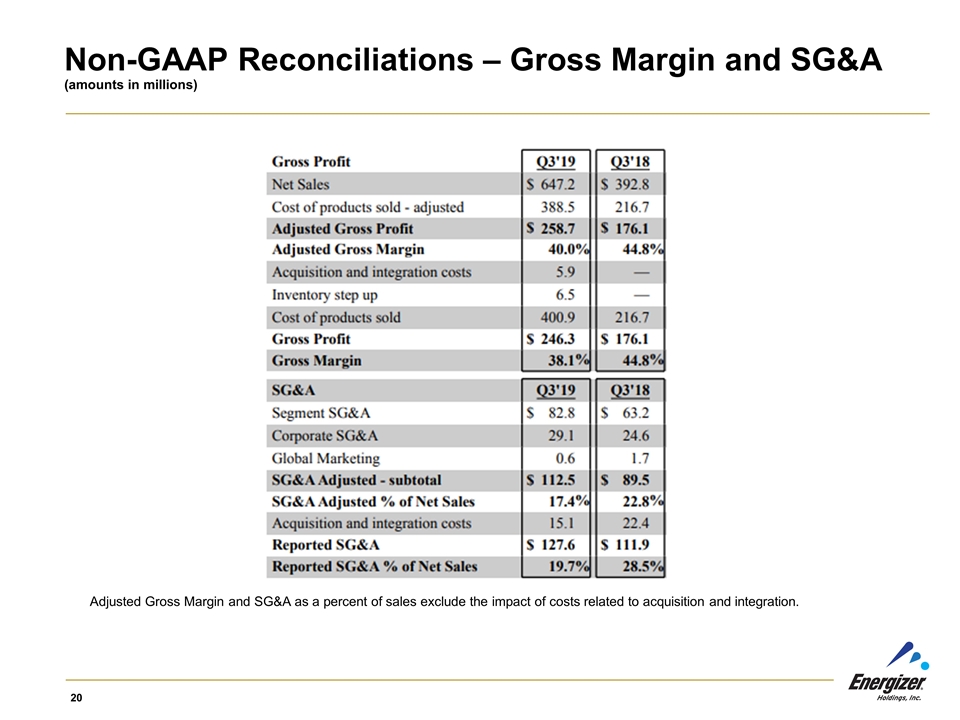

Gross margin, excluding acquisition and integration costs, was 40.0% Down 480 bps from prior year, primarily driven by the lower margin rate profile of the acquisitions Legacy gross margin improved excluding currency headwinds A&P was 5.3% of net sales Legacy A&P was 5.8% of net sales, essentially flat compared to prior year SG&A, excluding acquisition and integration costs, was 17.4% of net sales Legacy business’ SG&A was 20.4%, down 240 bps compared to prior year, due to cost efficiencies and continuous improvement initiatives Amortization was $14.4 million, up $11.6 million Depreciation was $16.4 million, up $7.8 million Third Quarter 2019 Financial Headlines Net sales on a reported basis of $647 million was up $254 million, inclusive of acquisitions from prior year Organic net sales up 3.6%, driven by favorable pricing and distribution gains Acquired auto care business contributed $136 million Acquired battery business contributed $109 million Foreign currency unfavorable 190 bps Net Sales* Gross Margin* A&P Depreciation & Amortization METRIC Third Quarter 2019 Financial Headlines SG&A* All comparisons are to Fiscal 2018 comparable reported results, excluding acquisition and integration costs. * See non-GAAP reconciliations in the Appendix.

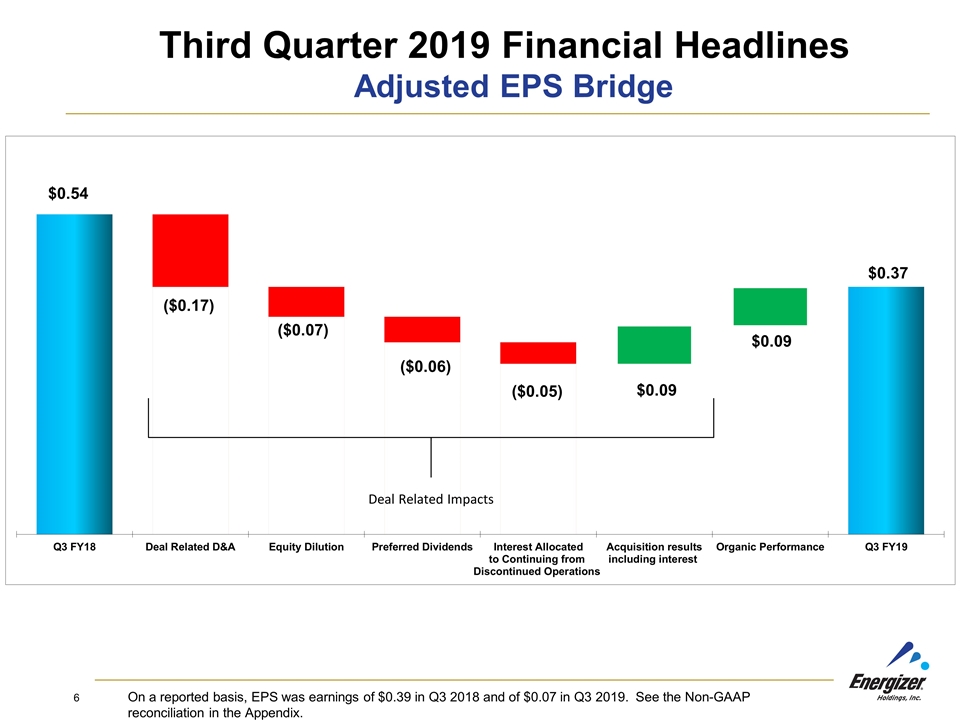

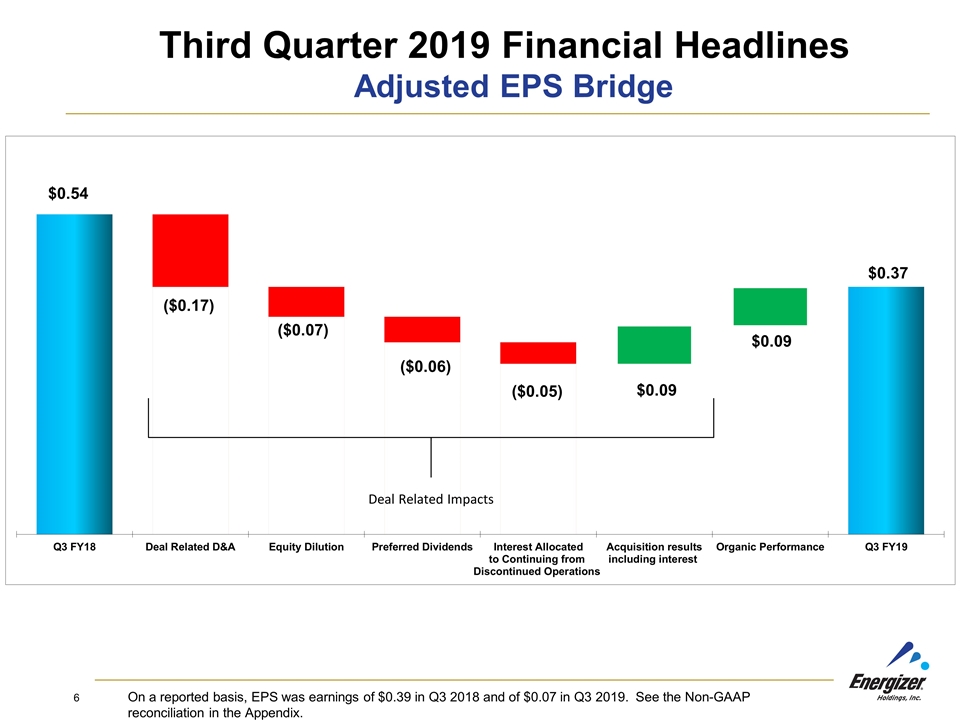

On a reported basis, EPS was earnings of $0.39 in Q3 2018 and of $0.07 in Q3 2019. See the Non-GAAP reconciliation in the Appendix. Adjusted EPS Bridge Third Quarter 2019 Financial Headlines Deal Related Impacts

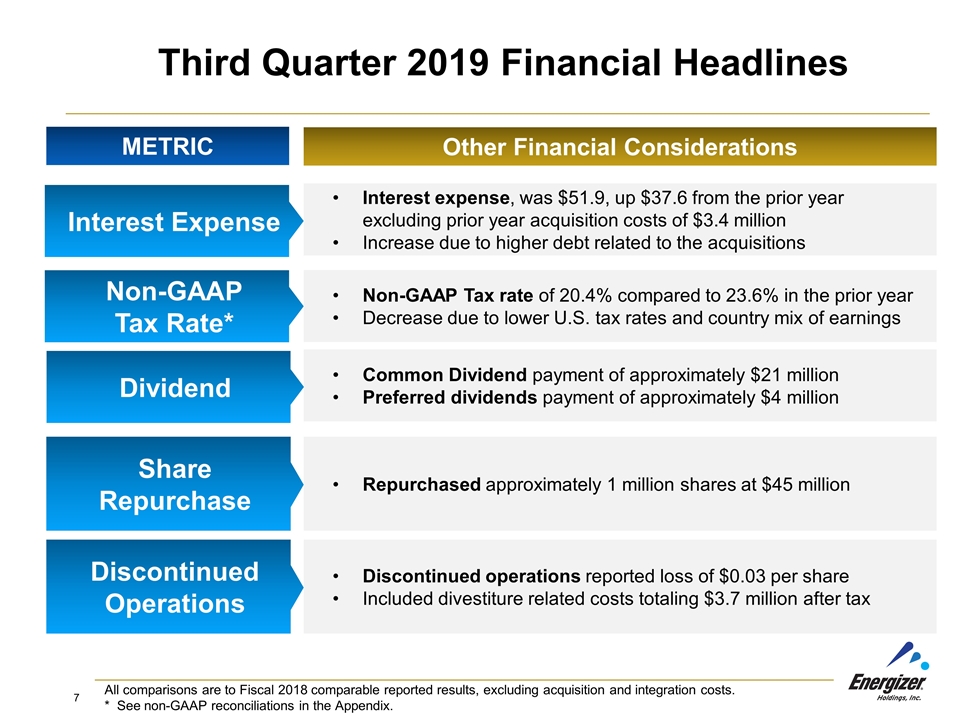

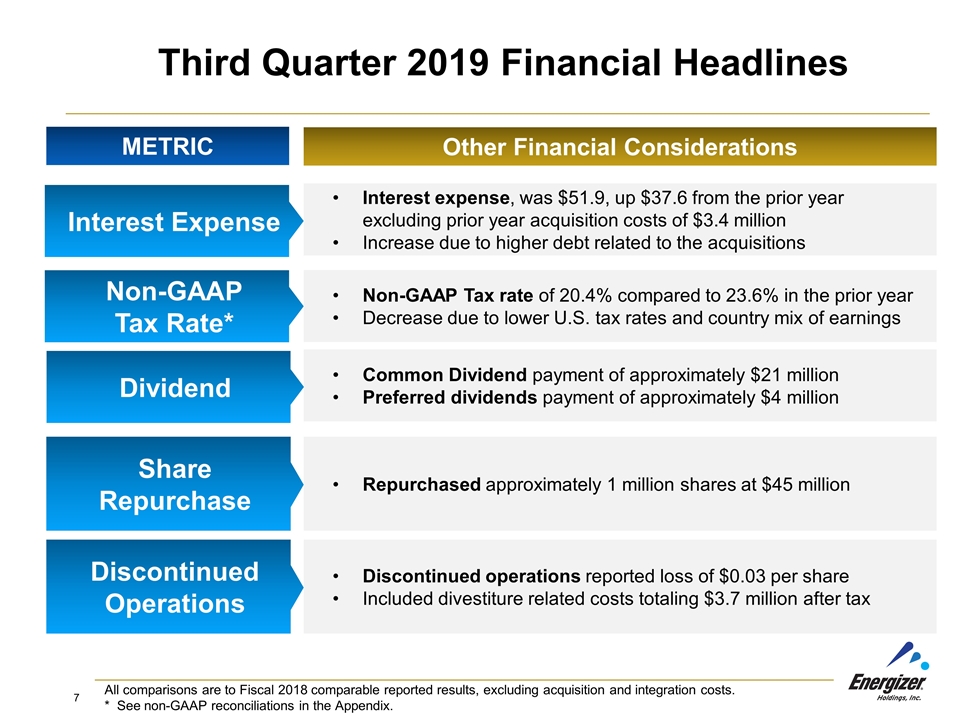

Interest expense, was $51.9, up $37.6 from the prior year excluding prior year acquisition costs of $3.4 million Increase due to higher debt related to the acquisitions Interest Expense Non-GAAP Tax rate of 20.4% compared to 23.6% in the prior year Decrease due to lower U.S. tax rates and country mix of earnings Non-GAAP Tax Rate* Common Dividend payment of approximately $21 million Preferred dividends payment of approximately $4 million Repurchased approximately 1 million shares at $45 million Share Repurchase Dividend Third Quarter 2019 Financial Headlines METRIC Other Financial Considerations All comparisons are to Fiscal 2018 comparable reported results, excluding acquisition and integration costs. * See non-GAAP reconciliations in the Appendix. Discontinued operations reported loss of $0.03 per share Included divestiture related costs totaling $3.7 million after tax Discontinued Operations

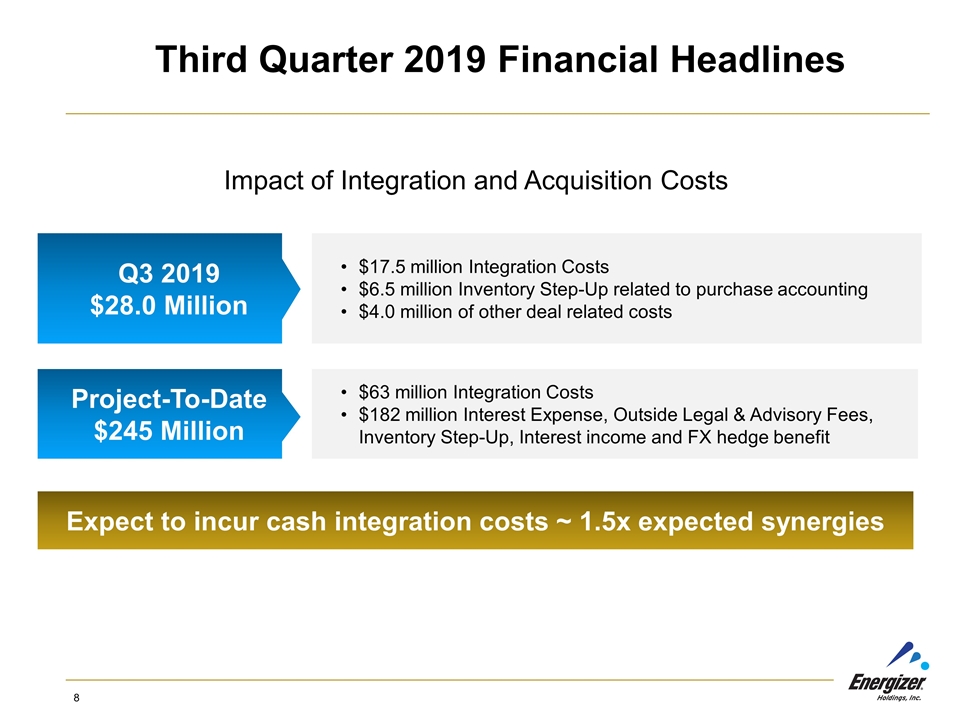

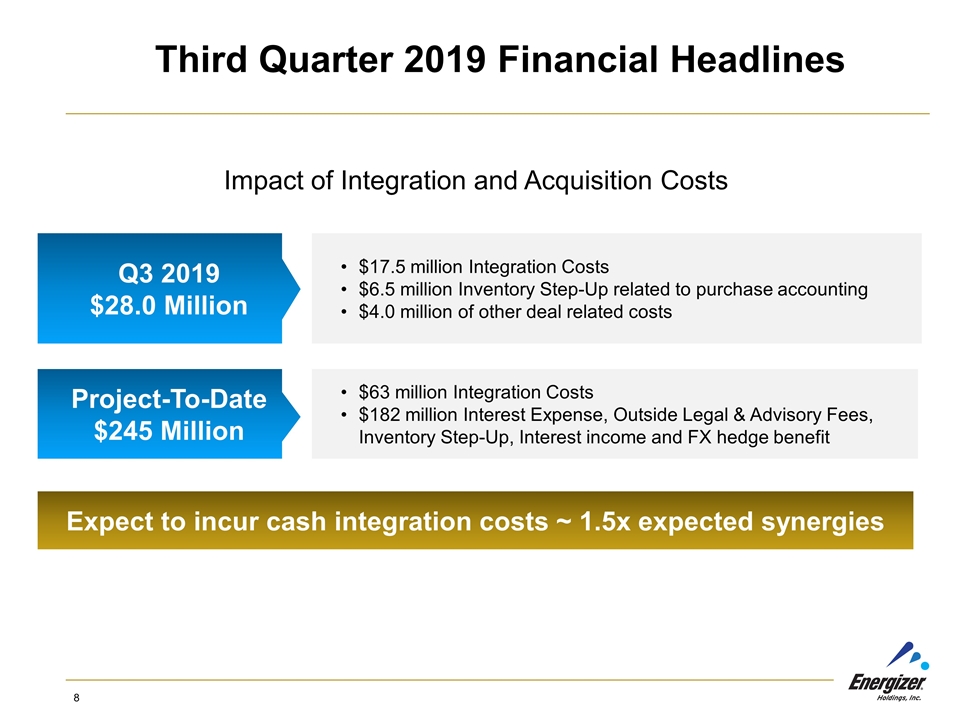

$17.5 million Integration Costs $6.5 million Inventory Step-Up related to purchase accounting $4.0 million of other deal related costs Q3 2019 $28.0 Million $63 million Integration Costs $182 million Interest Expense, Outside Legal & Advisory Fees, Inventory Step-Up, Interest income and FX hedge benefit Project-To-Date $245 Million Expect to incur cash integration costs ~ 1.5x expected synergies Third Quarter 2019 Financial Headlines Impact of Integration and Acquisition Costs

Fiscal Year 2019 Outlook

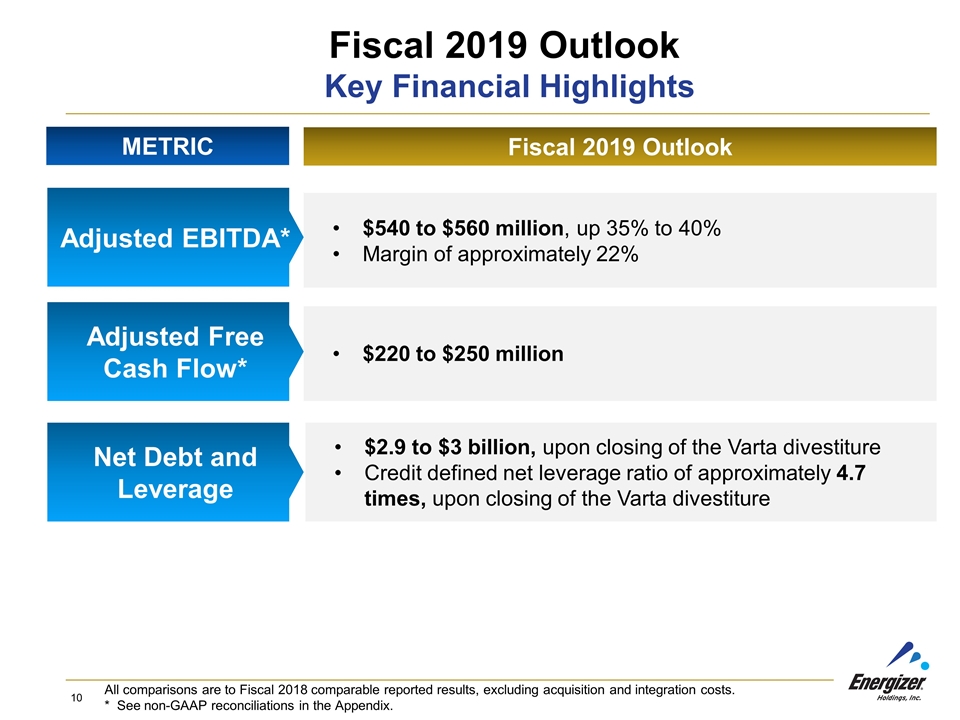

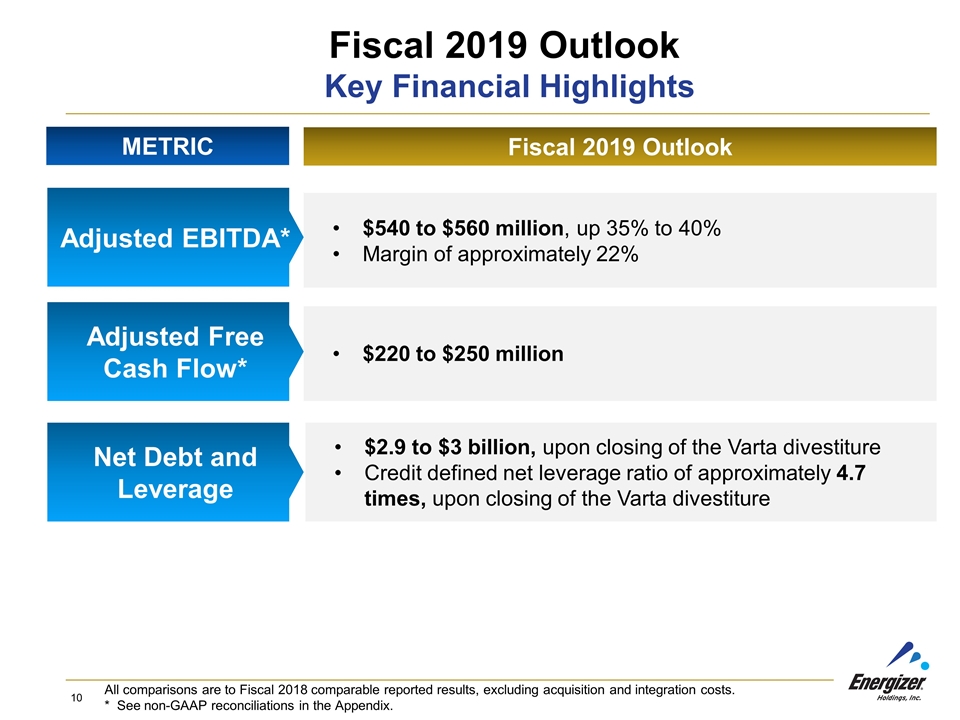

$540 to $560 million, up 35% to 40% Margin of approximately 22% $220 to $250 million $2.9 to $3 billion, upon closing of the Varta divestiture Credit defined net leverage ratio of approximately 4.7 times, upon closing of the Varta divestiture Fiscal 2019 Outlook Key Financial Highlights METRIC Fiscal 2019 Outlook Adjusted EBITDA* Adjusted Free Cash Flow* Net Debt and Leverage All comparisons are to Fiscal 2018 comparable reported results, excluding acquisition and integration costs. * See non-GAAP reconciliations in the Appendix.

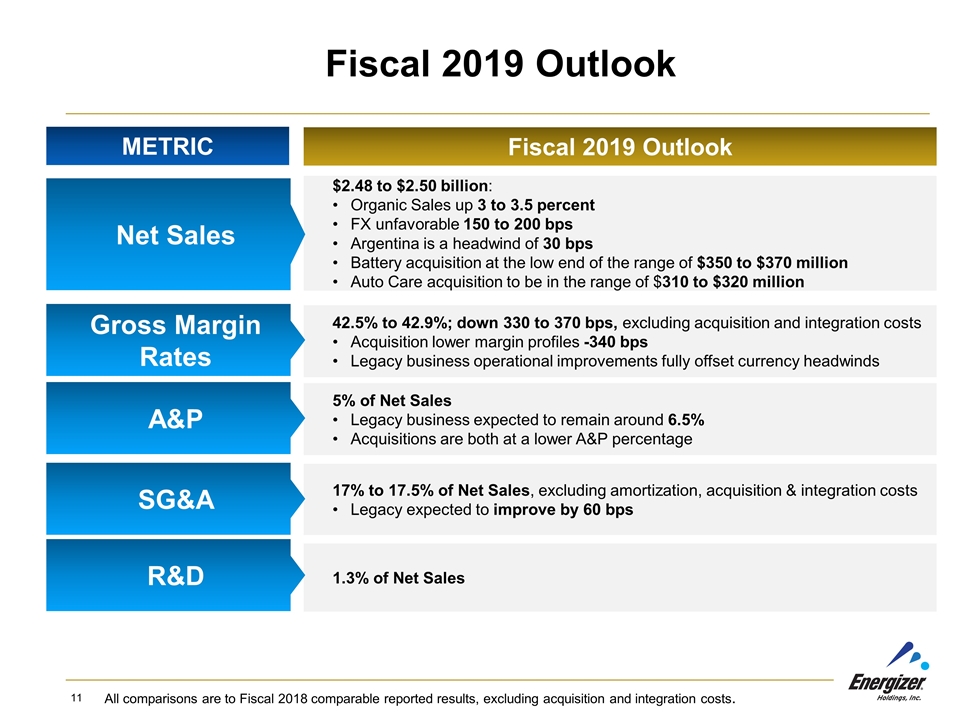

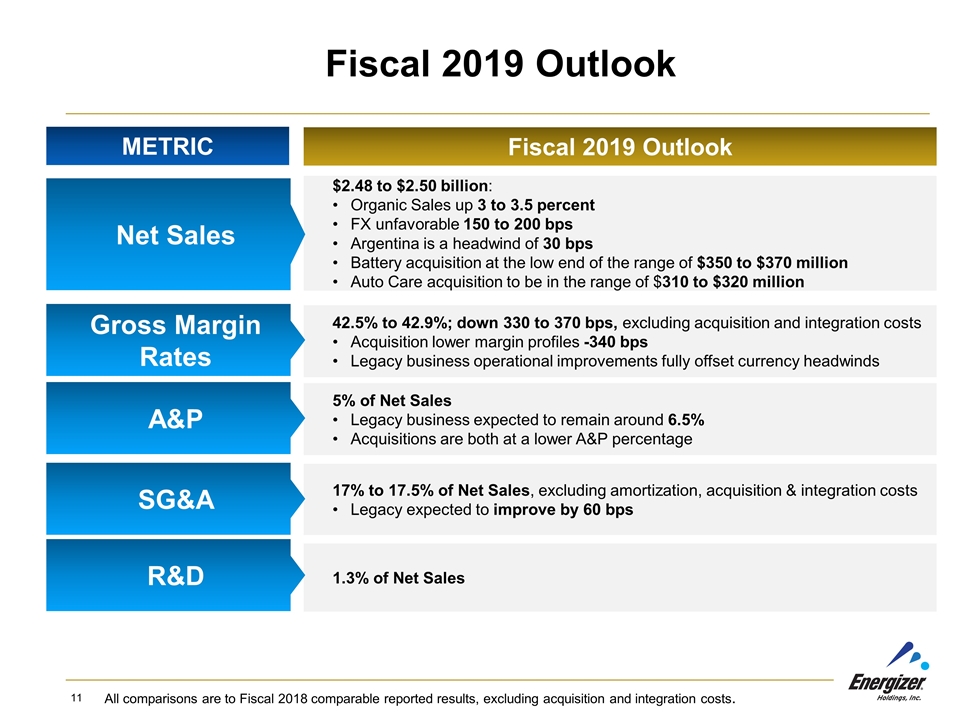

42.5% to 42.9%; down 330 to 370 bps, excluding acquisition and integration costs Acquisition lower margin profiles -340 bps Legacy business operational improvements fully offset currency headwinds 5% of Net Sales Legacy business expected to remain around 6.5% Acquisitions are both at a lower A&P percentage 17% to 17.5% of Net Sales, excluding amortization, acquisition & integration costs Legacy expected to improve by 60 bps $2.48 to $2.50 billion: Organic Sales up 3 to 3.5 percent FX unfavorable 150 to 200 bps Argentina is a headwind of 30 bps Battery acquisition at the low end of the range of $350 to $370 million Auto Care acquisition to be in the range of $310 to $320 million 1.3% of Net Sales Fiscal 2019 Outlook METRIC Fiscal 2019 Outlook Net Sales Gross Margin Rates A&P SG&A R&D All comparisons are to Fiscal 2018 comparable reported results, excluding acquisition and integration costs.

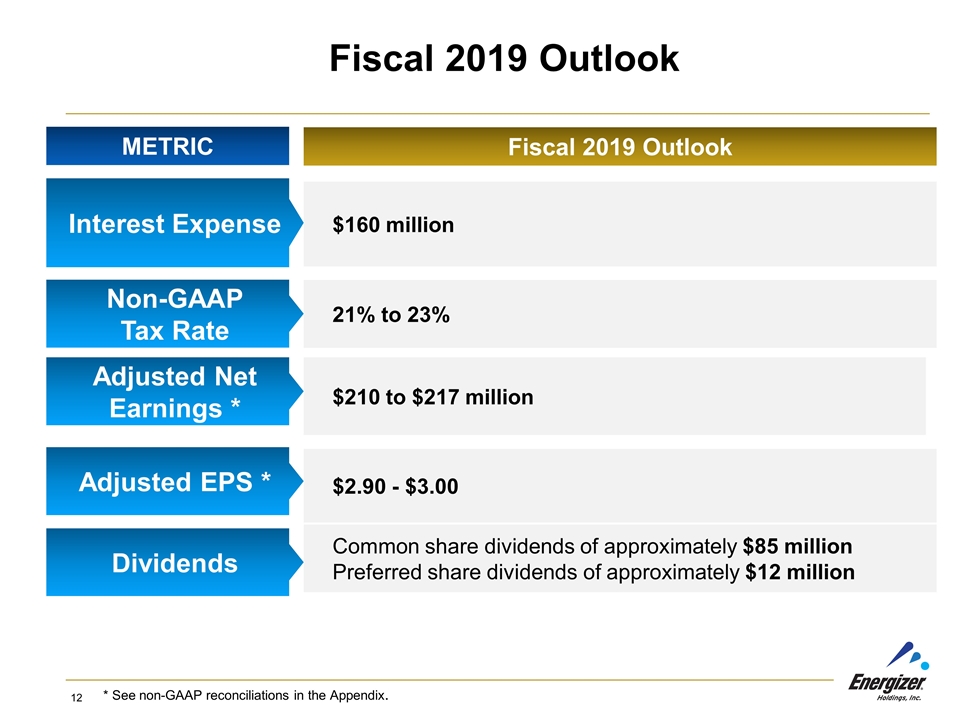

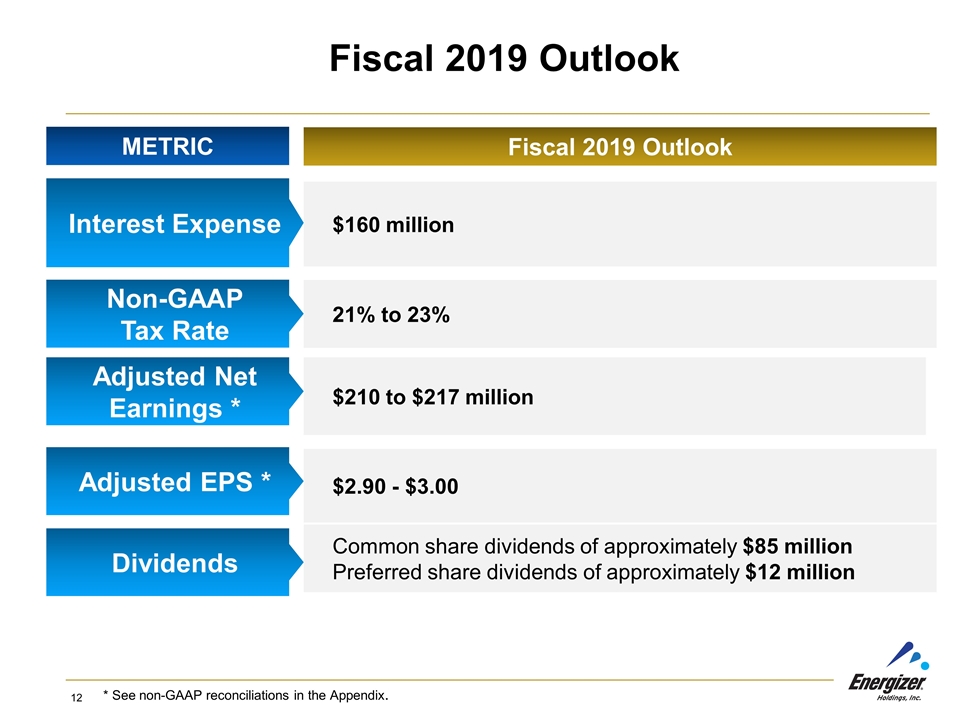

$210 to $217 million $160 million 21% to 23% $2.90 - $3.00 Common share dividends of approximately $85 million Preferred share dividends of approximately $12 million Fiscal 2019 Outlook METRIC Fiscal 2019 Outlook Dividends Adjusted EPS * Adjusted Net Earnings * Non-GAAP Tax Rate Interest Expense * See non-GAAP reconciliations in the Appendix.

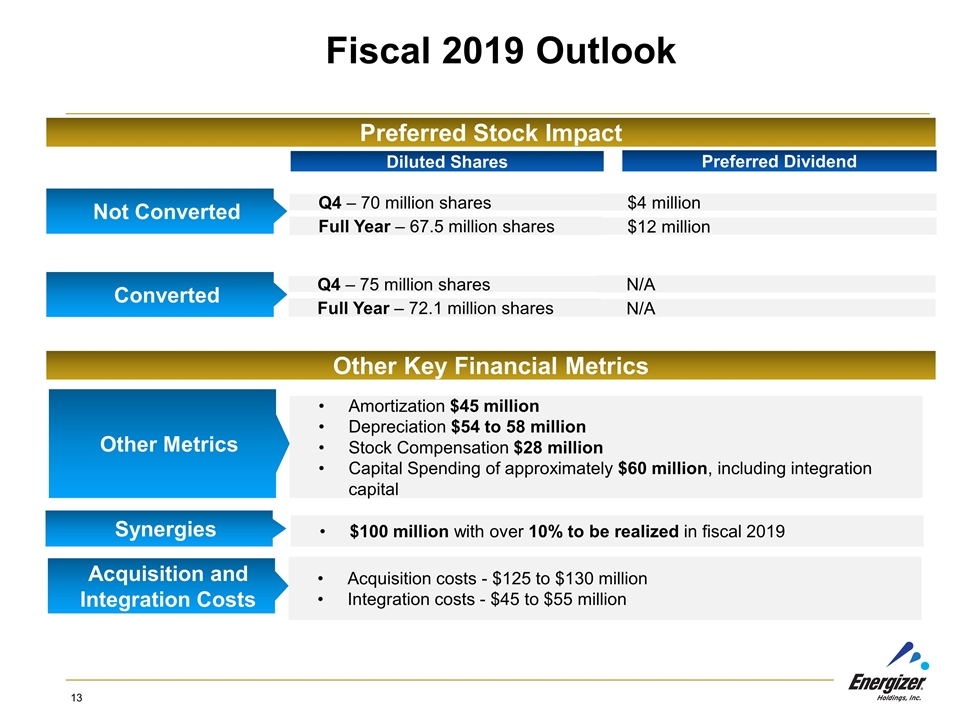

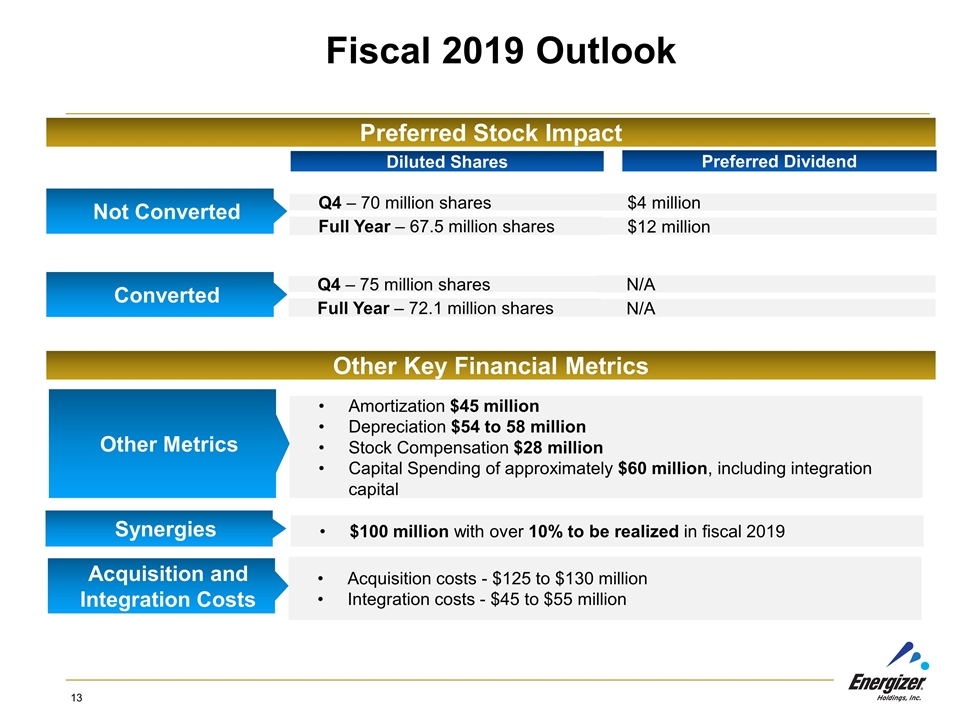

Acquisition costs - $125 to $130 million Integration costs - $45 to $55 million Preferred Stock Impact Other Key Financial Metrics Amortization $45 million Depreciation $54 to 58 million Stock Compensation $28 million Capital Spending of approximately $60 million, including integration capital $100 million with over 10% to be realized in fiscal 2019 Fiscal 2019 Outlook Not Converted Preferred Dividend Diluted Shares Q4 – 70 million shares $4 million Full Year – 67.5 million shares $12 million Converted Q4 – 75 million shares N/A Full Year – 72.1 million shares N/A Other Metrics Synergies Acquisition and Integration Costs

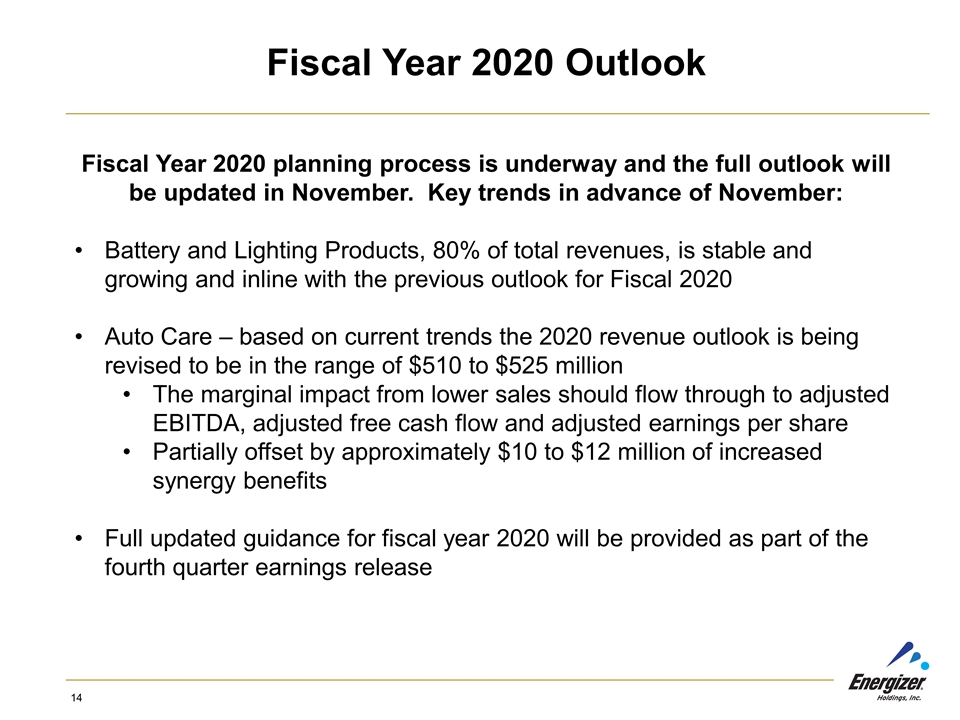

Fiscal Year 2020 Outlook PRESENTATION NAME DATE Fiscal Year 2020 planning process is underway and the full outlook will be updated in November. Key trends in advance of November: Battery and Lighting Products, 80% of total revenues, is stable and growing and inline with the previous outlook for Fiscal 2020 Auto Care – based on current trends the 2020 revenue outlook is being revised to be in the range of $510 to $525 million The marginal impact from lower sales should flow through to adjusted EBITDA, adjusted free cash flow and adjusted earnings per share Partially offset by approximately $10 to $12 million of increased synergy benefits Full updated guidance for fiscal year 2020 will be provided as part of the fourth quarter earnings release

Energizer Holdings, Inc. (the “Company”) and its management may make certain statements that constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. These statements can be identified by the fact that they do not relate strictly to historical or current facts. Forward-looking statements often use words such as “anticipates,” “targets,” “expects,” “hopes,” “estimates,” “intends,” “plans,” “goals,” “believes,” “continue” and other similar expressions or future or conditional verbs such as “will,” “may,” “might,” “should,” “would” and “could.” Forward-looking statements represent the Company’s current expectations, plans or forecasts of its future results, revenues, expenses, capital measures, strategy, and future business and economic conditions more generally, and other future matters. These statements are not guarantees of future results or performance and involve certain known and unknown risks, uncertainties and assumptions that are difficult to predict and are often beyond the Company’s control. Actual outcomes and results may differ materially from those expressed in, or Factors that could cause actual results or events to differ materially from those anticipated include, without limitation, the matters implied by, any of these forward-looking statements. You should not place undue reliance on any forward-looking statement and should consider the following uncertainties and risks, as well as the risks and uncertainties more fully discussed under Item 1A. Risk Factors of the Company’s 2018 Annual Report on Form 10-K and in any of the Company’s subsequent Securities and Exchange Commission filings: (1) market and economic conditions; (2) market trends in the categories in which we compete; (3) our ability to integrate businesses; to realize the projected results of acquisitions of the Acquired Businesses (defined below) (the “Acquisitions”), including our ability to promptly and effectively integrate the global battery, portable lighting and power business (the “Acquired Battery Business”) and the global auto care business (the “Acquired Auto Care Business” or “GAC”, and together with the Acquired Battery Business, the “Acquired Businesses”) acquired from Spectrum Brands Holdings, Inc. (“Spectrum”); and to obtain expected cost savings, synergies and other anticipated benefits of the Acquisitions within the expected timeframe, or at all; (4) the impact of the acquisitions of the Acquired Businesses on the business operations of ours and the Acquired Businesses; (5) our ability to close the divestiture of the Europe-based Varta® consumer battery, chargers, portable power and portable lighting business which serves the Europe, the Middle East and Africa markets (the “Varta Divestment Business”); (6) the success of new products and the ability to continually develop and market new products; (7) our ability to attract, retain and improve distribution with key customers; (8) our ability to continue planned advertising and other promotional spending; (9) our ability to timely execute strategic initiatives, including restructurings, and international go-to-market changes in a manner that will positively impact our financial condition and results of operations and does not disrupt our business operations; (10) the impact of strategic initiatives, including restructurings, on our relationships with employees, customers and vendors; (11) our ability to maintain and improve market share in the categories in which we operate despite heightened competitive pressure; (12) our ability to improve operations and realize cost savings; (13) the impact of foreign currency exchange rates and currency controls, as well as offsetting hedges; (14) the impact of the United Kingdom’s announced intention to exit the European Union; (15) uncertainty from the expected discontinuance of LIBOR and the transition to any other interest rate benchmark; (16) the impact of raw materials and other commodity costs; (17) the impact of legislative changes or regulatory determinations or changes by federal, state and local, and foreign authorities, including customs and tariff determinations, as well as the impact of potential changes to tax laws, policies and regulations; (18) costs and reputational damage associated with cyber-attacks or information security breaches or other events; (19) the impact of advertising and product liability claims and other litigation; and (20) compliance with debt covenants and maintenance of credit ratings as well as the impact of interest and principal repayment of our existing and any future debt. Forward-looking statements speak only as of the date they are made, and the Company undertakes no obligation to update any forward-looking statement to reflect the impact of circumstances or events that arise after the date the forward-looking statement was made. Forward-Looking Statements PRESENTATION NAME DATE

Important Presentation Information The information contained herein is preliminary and based on Company data available at the time of the earnings presentation. It speaks only as of the particular date or dates included in the accompanying slides. The Company does not undertake an obligation to, and disclaims any duty to, update any of the information provided. The Company reports its financial results in accordance with accounting principles generally accepted in the U.S. ("GAAP"). However, management believes that certain non-GAAP financial measures provide users with additional meaningful comparisons to the corresponding historical or future period. These non-GAAP financial measures exclude items that are not reflective of the Company's on-going operating performance, such as acquisition and integration costs and related items, gain on sale of real estate, settlement loss on the Canadian pension plan termination, and the one-time impact of the new U.S. tax legislation. In addition, these measures help investors to analyze year over year comparability when excluding currency fluctuations, acquisition activity as well as other company initiatives that are not on-going. We believe these non-GAAP financial measures are an enhancement to assist investors in understanding our business and in performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. In addition, these non-GAAP measures may not be the same as similar measures used by other companies due to possible differences in method and in the items being adjusted. References to specific quarters and years pertain to our fiscal years, and references to the legacy and/or base business relate to the Energizer business prior to the completion of the Battery and Auto Care Acquisitions. PRESENTATION NAME DATE

Appendix

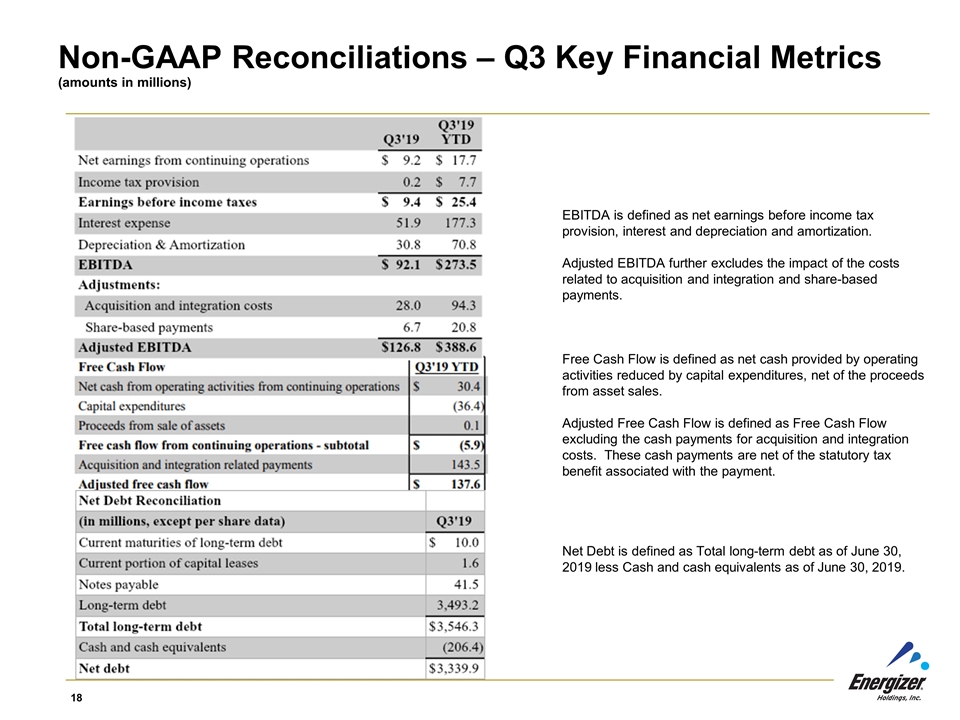

Non-GAAP Reconciliations – Q3 Key Financial Metrics (amounts in millions) PRESENTATION NAME DATE EBITDA is defined as net earnings before income tax provision, interest and depreciation and amortization. Adjusted EBITDA further excludes the impact of the costs related to acquisition and integration and share-based payments. Free Cash Flow is defined as net cash provided by operating activities reduced by capital expenditures, net of the proceeds from asset sales. Adjusted Free Cash Flow is defined as Free Cash Flow excluding the cash payments for acquisition and integration costs. These cash payments are net of the statutory tax benefit associated with the payment. Net Debt is defined as Total long-term debt as of June 30, 2019 less Cash and cash equivalents as of June 30, 2019.

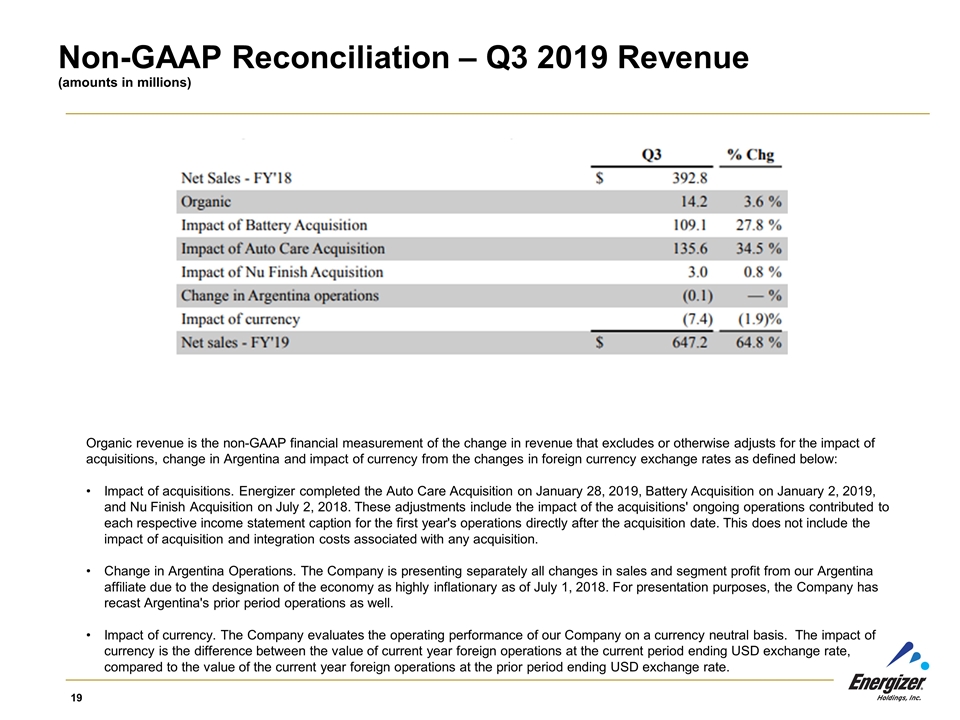

Non-GAAP Reconciliation – Q3 2019 Revenue (amounts in millions) PRESENTATION NAME DATE Organic revenue is the non-GAAP financial measurement of the change in revenue that excludes or otherwise adjusts for the impact of acquisitions, change in Argentina and impact of currency from the changes in foreign currency exchange rates as defined below: Impact of acquisitions. Energizer completed the Auto Care Acquisition on January 28, 2019, Battery Acquisition on January 2, 2019, and Nu Finish Acquisition on July 2, 2018. These adjustments include the impact of the acquisitions' ongoing operations contributed to each respective income statement caption for the first year's operations directly after the acquisition date. This does not include the impact of acquisition and integration costs associated with any acquisition. Change in Argentina Operations. The Company is presenting separately all changes in sales and segment profit from our Argentina affiliate due to the designation of the economy as highly inflationary as of July 1, 2018. For presentation purposes, the Company has recast Argentina's prior period operations as well. Impact of currency. The Company evaluates the operating performance of our Company on a currency neutral basis. The impact of currency is the difference between the value of current year foreign operations at the current period ending USD exchange rate, compared to the value of the current year foreign operations at the prior period ending USD exchange rate.

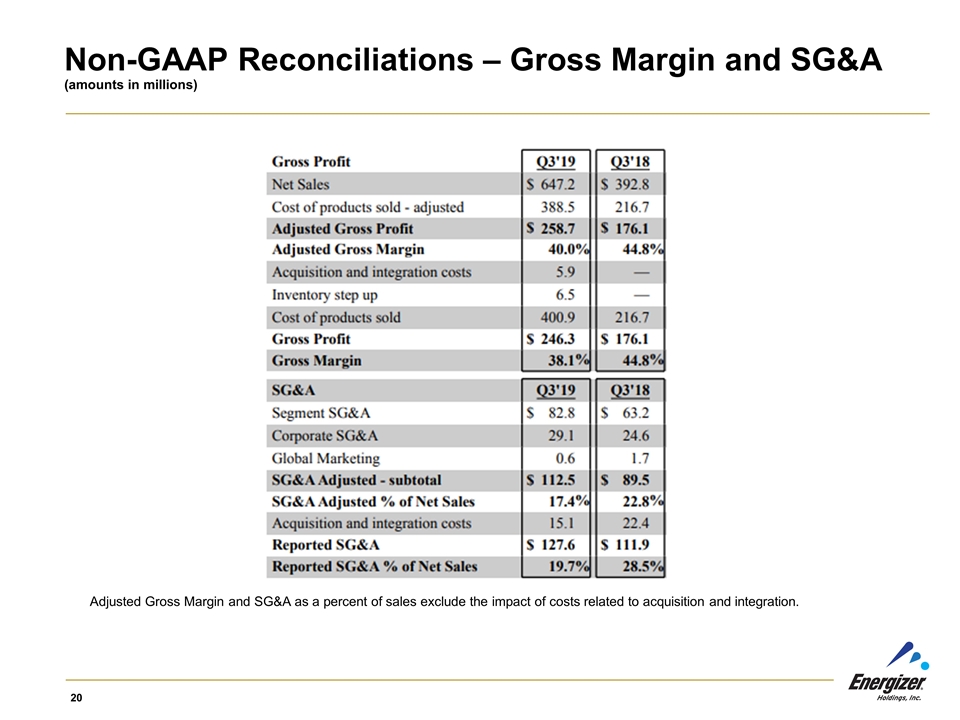

Non-GAAP Reconciliations – Gross Margin and SG&A (amounts in millions) Adjusted Gross Margin and SG&A as a percent of sales exclude the impact of costs related to acquisition and integration.

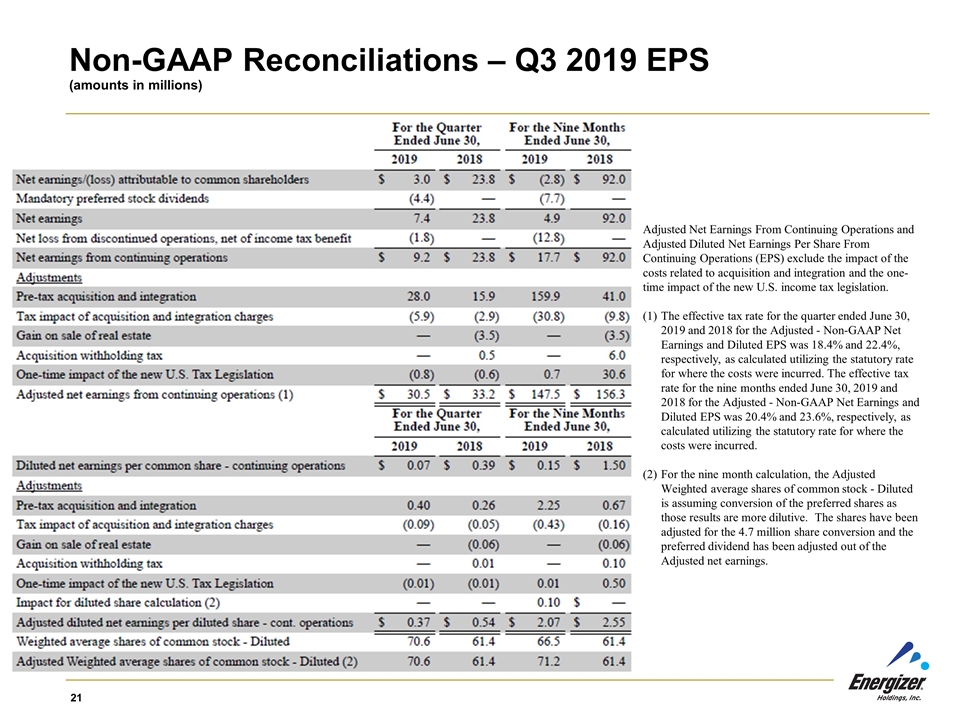

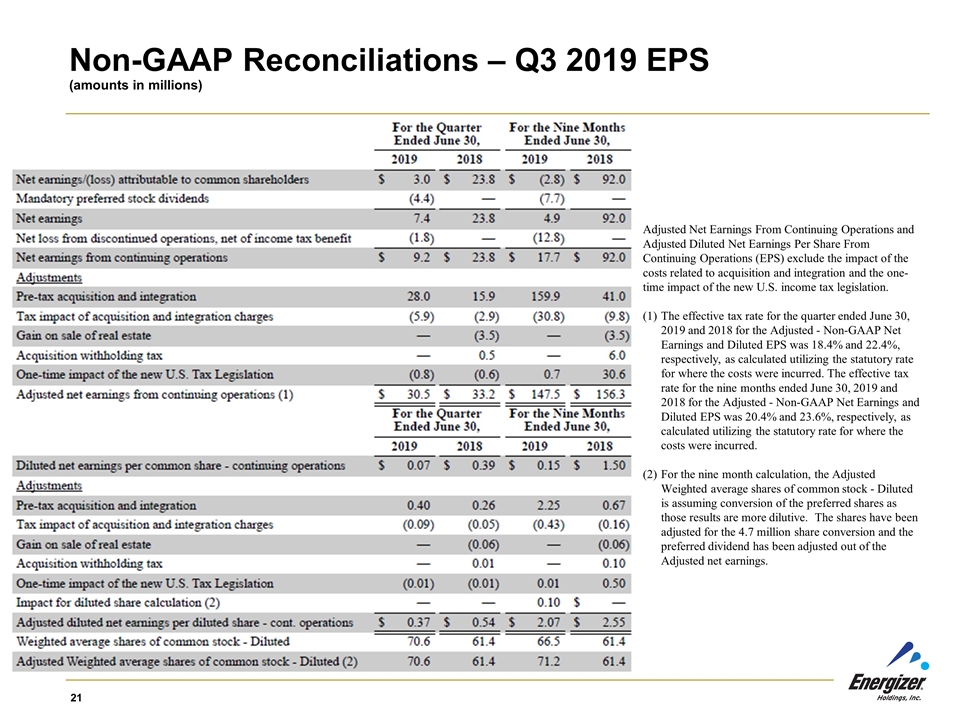

Non-GAAP Reconciliations – Q3 2019 EPS (amounts in millions) Adjusted Net Earnings From Continuing Operations and Adjusted Diluted Net Earnings Per Share From Continuing Operations (EPS) exclude the impact of the costs related to acquisition and integration and the one-time impact of the new U.S. income tax legislation. The effective tax rate for the quarter ended June 30, 2019 and 2018 for the Adjusted - Non-GAAP Net Earnings and Diluted EPS was 18.4% and 22.4%, respectively, as calculated utilizing the statutory rate for where the costs were incurred. The effective tax rate for the nine months ended June 30, 2019 and 2018 for the Adjusted - Non-GAAP Net Earnings and Diluted EPS was 20.4% and 23.6%, respectively, as calculated utilizing the statutory rate for where the costs were incurred. For the nine month calculation, the Adjusted Weighted average shares of common stock - Diluted is assuming conversion of the preferred shares as those results are more dilutive. The shares have been adjusted for the 4.7 million share conversion and the preferred dividend has been adjusted out of the Adjusted net earnings.

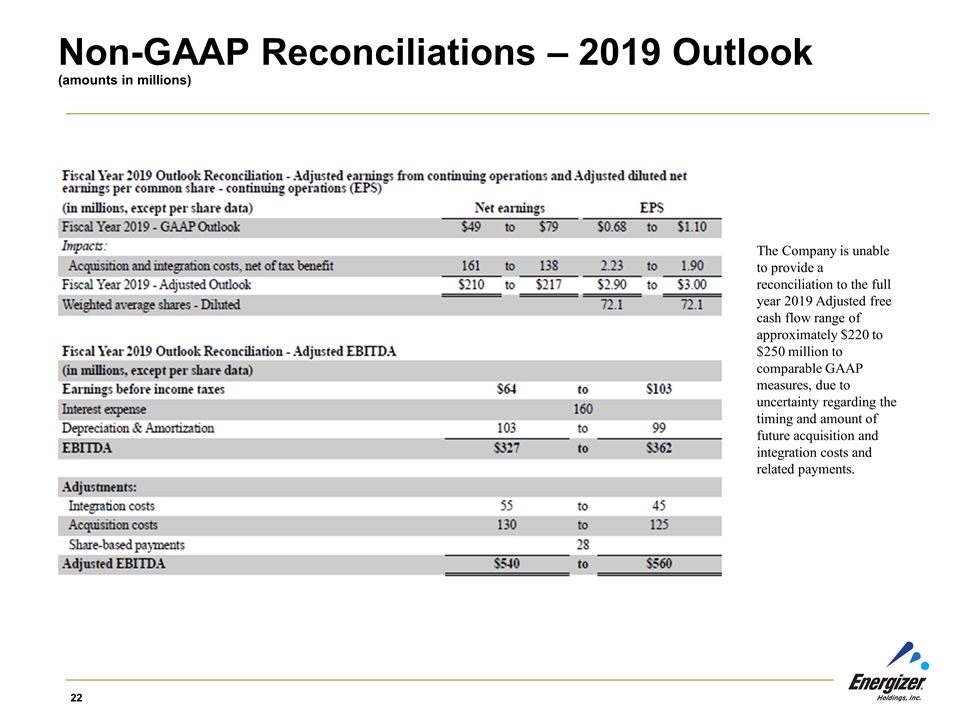

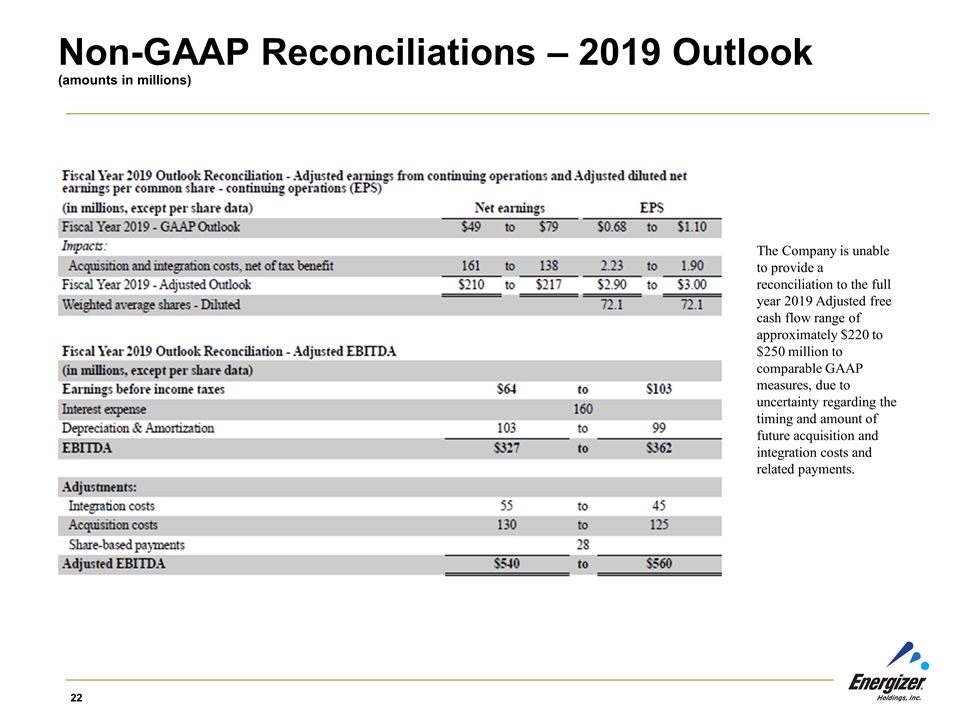

The Company is unable to provide a reconciliation to the full year 2019 Adjusted free cash flow range of approximately $220 to $250 million to comparable GAAP measures, due to uncertainty regarding the timing and amount of future acquisition and integration costs and related payments. Non-GAAP Reconciliations – 2019 Outlook (amounts in millions)