+ Fiscal 2023 Q3 Earnings August 8, 2023 Exhibit 99.2

This document contains both historical and forward-looking statements. Forward-looking statements are not based on historical facts but instead reflect our expectations, estimates or projections concerning future results or events, including, without limitation, the future sales, gross margins, costs, earnings, cash flows, tax rates and performance of the Company. These statements generally can be identified by the use of forward-looking words or phrases such as "believe," "expect," "expectation," "anticipate," "may," "could," "will," "intend," "belief," "estimate," "plan," "target," "predict," "likely," "should," "forecast," "outlook," or other similar words or phrases. These statements are not guarantees of performance and are inherently subject to known and unknown risks, uncertainties and assumptions that are difficult to predict and could cause our actual results to differ materially from those indicated by those statements. We cannot assure you that any of our expectations, estimates or projections will be achieved. The forward-looking statements included in this document are only made as of the date of this document and we disclaim any obligation to publicly update any forward-looking statement to reflect subsequent events or circumstances. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Numerous factors could cause our actual results and events to differ materially from those expressed or implied by forward-looking statements, including, without limitation: Global economic and financial market conditions, including the conditions resulting from the COVID-19 pandemic, and actions taken by our customers, suppliers, other business partners and governments in markets in which we compete might materially and negatively impact us. Competition in our product categories might hinder our ability to execute our business strategy, achieve profitability, or maintain relationships with existing customers. Changes in the retail environment and consumer preferences could adversely affect our business, financial condition and results of operations. We must successfully manage the demand, supply, and operational challenges brought about by the COVID- 19 pandemic and any other disease outbreak, including epidemics, pandemics, or similar widespread public health concerns. Loss or impairment of the reputation of our Company or our leading brands or failure of our marketing plans could have an adverse effect on our business. Loss of any of our principal customers could significantly decrease our sales and profitability. Our ability to meet our growth targets depends on successful product, marketing and operations innovation and successful responses to competitive innovation and changing consumer habits. We are subject to risks related to our international operations, including currency fluctuations, which could adversely affect our results of operations. If we fail to protect our intellectual property rights, competitors may manufacture and market similar products, which could adversely affect our market share and results of operations. Changes in production costs, including raw material prices and transportation costs, from inflation or otherwise, have adversely affected, and in the future could erode, our profit margins and negatively impact operating results. Our reliance on certain significant suppliers subjects us to numerous risks, including possible interruptions in supply, which could adversely affect our business. Our business is vulnerable to the availability of raw materials, our ability to forecast customer demand and our ability to manage production capacity. The manufacturing facilities, supply channels or other business operations of the Company and our suppliers may be subject to disruption from events beyond our control. The Company's future results may be affected by its operational execution, including scenarios where the Company generates fewer productivity improvements than estimated. If our goodwill and indefinite-lived intangible assets become impaired, we will be required to record impairment charges, which may be significant. A failure of a key information technology system could adversely impact our ability to conduct business. We rely significantly on information technology and any inadequacy, interruption, theft or loss of data, malicious attack, integration failure, failure to maintain the security, confidentiality or privacy of sensitive data residing on our systems or other security failure of that technology could harm our ability to effectively operate our business and damage the reputation of our brands. We have significant debt obligations that could adversely affect our business and our ability to meet our obligations. If we pursue strategic acquisitions, divestitures or joint ventures, we might experience operating difficulties, dilution, and other consequences that may harm our business, financial condition, and operating results, and we may not be able to successfully consummate favorable transactions or successfully integrate acquired businesses. Our business involves the potential for product liability claims, labeling claims, commercial claims and other legal claims against us, which could affect our results of operations and financial condition and result in product recalls or withdrawals. Our business is subject to increasing government regulations in both the U.S. and abroad that could impose material costs. Increased focus by governmental and non-governmental organizations, customers, consumers and shareholders on environmental, social and governance (ESG) issues, including those related to sustainability and climate change, may have an adverse effect on our business, financial condition and results of operations and damage our reputation. We are subject to environmental laws and regulations that may expose us to significant liabilities and have a material adverse effect on our results of operations and financial condition. In addition, other risks and uncertainties not presently known to us or that we consider immaterial could affect the accuracy of any such forward-looking statements. The list of factors above is illustrative, but by no means exhaustive. All forward-looking statements should be evaluated with the understanding of their inherent uncertainty. Additional risks and uncertainties include those detailed from time to time in our publicly filed documents, including those described under the heading “Risk Factors” in our Form 10-K filed with the Securities and Exchange Commission on November 15, 2022. Forward-Looking Statements

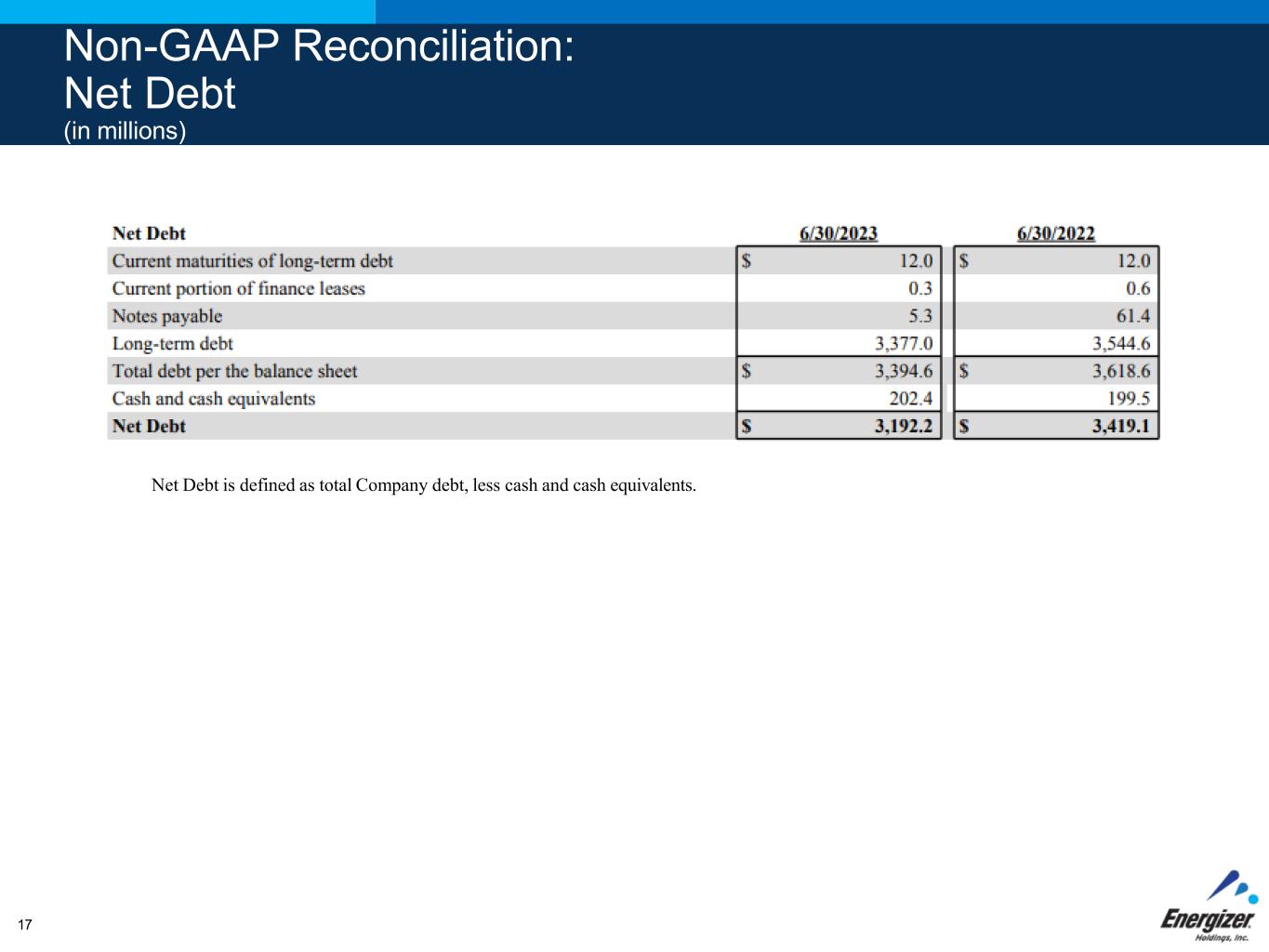

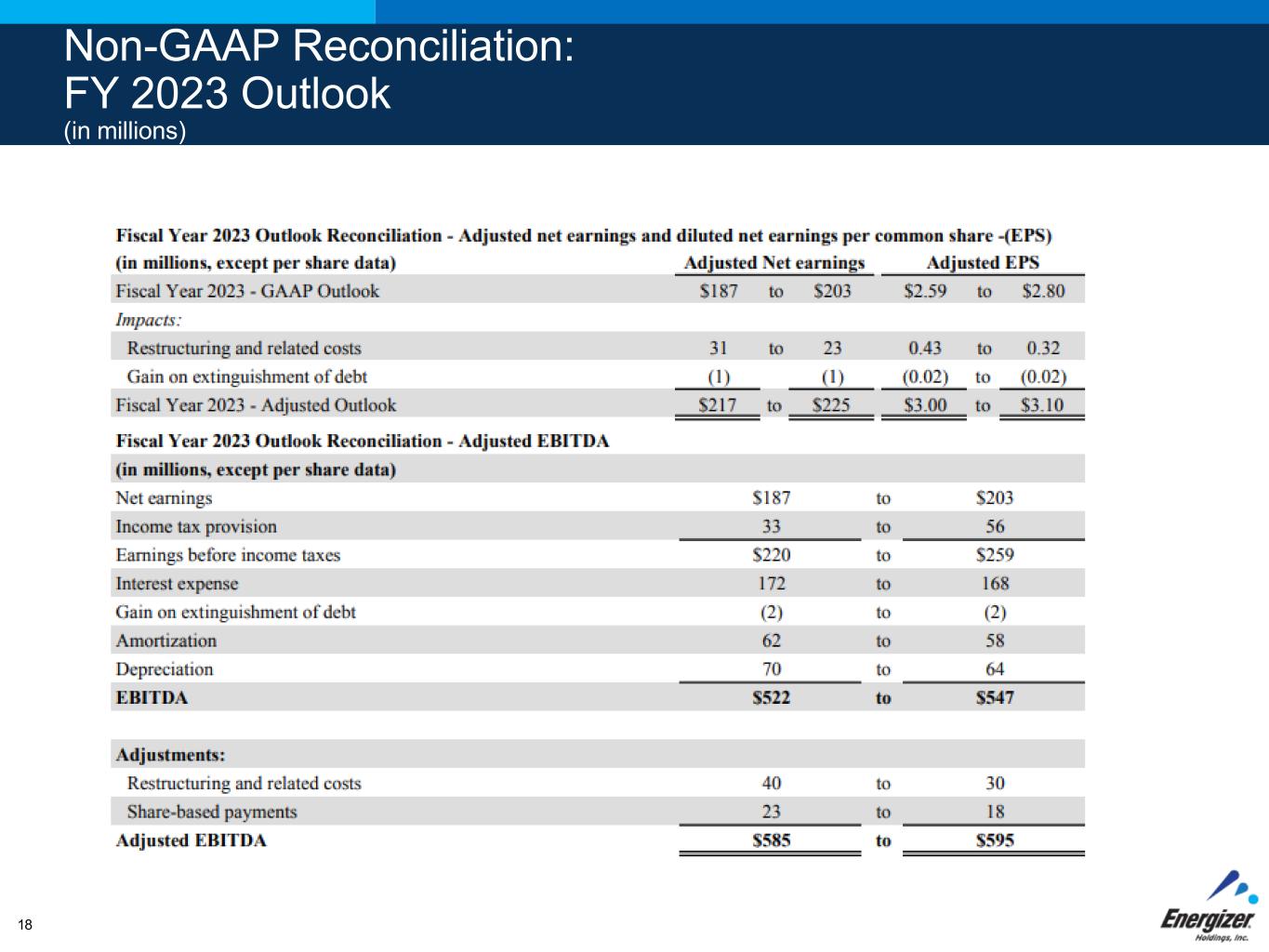

Non-GAAP Financial Measures The Company reports its financial results in accordance with accounting principles generally accepted in the U.S. ("GAAP"). However, management believes that certain non- GAAP financial measures provide users with additional meaningful comparisons to the corresponding historical or future period, and are used for management incentive compensation. These non-GAAP financial measures exclude items that are not reflective of the Company's on-going operating performance, such as restructuring and related costs, acquisition and integration costs, an acquisition earn out, the loss/(gain) on extinguishment of debt, the costs of the May 2022 flooding of our Brazilian manufacturing facility, the gain on finance lease termination, and the costs of exiting the Russian market. In addition, these measures help investors to analyze year over year comparability when excluding currency fluctuations as well as other Company initiatives that are not on-going. We believe these non-GAAP financial measures are an enhancement to assist investors in understanding our business and in performing analysis consistent with financial models developed by research analysts. Investors should consider non-GAAP measures in addition to, not as a substitute for, or superior to, the comparable GAAP measures. In addition, these non-GAAP measures may not be the same as similar measures used by other companies due to possible differences in methods and in the items being adjusted. We provide the following non-GAAP measures and calculations, as well as the corresponding reconciliation to the closest GAAP measure in the following supplemental schedules: • Adjusted Net Earnings and Adjusted Diluted Net Earnings Per Common Share (EPS). These measures exclude the impact of the costs related to acquisition and integration, restructuring and related costs, an acquisition earn out, the loss/(gain) on extinguishment of debt, the costs of the flooding of our Brazilian manufacturing facility, the gain on finance lease termination and the costs of exiting the Russian market. • Non-GAAP Tax Rate. This is the tax rate when excluding the pre-tax impact of acquisition and integration costs, restructuring and related costs, an acquisition earn out, the loss/(gain) on extinguishment of debt, the costs of the flooding of our Brazilian manufacturing facility, the gain on finance lease termination, and the costs of exiting the Russian market, as well as the related tax impact for these items, calculated utilizing the statutory rate for where the impact was incurred. • Organic. This is the non-GAAP financial measurement of the change in revenue or segment profit that excludes or otherwise adjusts for the change in Russia and Argentina operations and impact of currency from the changes in foreign currency exchange rates as defined below: • Change in Russia Operations. The Company exited the Russian market in the second quarter of fiscal 2022 due to the increased global and economic and political uncertainty resulting from the ongoing conflict between Russia and Ukraine. This adjusts for the change in Russian sales and segment profit from the prior year post exit. • Change in Argentina Operations. The Company is presenting separately all changes in sales and segment profit from our Argentina affiliate due to the designation of the economy as highly inflationary as of July 1, 2018. • Impact of Currency. The Company evaluates the operating performance of our Company on a currency neutral basis. The Impact of Currency is the change in foreign currency exchange rates year-over-year on reported results, which is calculated by comparing the value of current year foreign operations at the current period USD exchange rate versus the value of current year foreign operations at the prior period USD exchange rate. The impact of currency also includes gains/(losses) of currency hedging programs, and it excludes hyper-inflationary markets. • Adjusted Comparisons. Detail for adjusted gross profit and adjusted gross margin are also supplemental non-GAAP measure disclosures. These measures exclude the impact of costs related to acquisition and integration, restructuring and related costs, an acquisition earn out, the costs of the flooding of our Brazilian manufacturing facility, the gain on finance lease termination, and the costs of exiting the Russian market. • EBITDA and Adjusted EBITDA. EBITDA is defined as net earnings before income tax provision, interest, the loss/(gain) on extinguishment of debt, and depreciation and amortization. Adjusted EBITDA further excludes the impact of the costs related to restructuring, exiting the Russian market, gains on finance lease termination, the costs of the flooding of our manufacturing facility in Brazil, impairment of goodwill and other intangible assets, and share based payments. • Free Cash Flow. Free Cash Flow is defined as net cash provided by operating activities reduced by capital expenditures, net of the proceeds from asset sales. • Net Debt. Net Debt is defined as total Company debt, less cash and cash equivalents. • Currency-neutral. Currency-neutral excludes the Impact of Currency as defined above on key measures. Hyper inflationary markets are excluded from this calculation.

+ Financial Results Third Quarter 2023

METRIC Third Quarter 2023 Free Cash Flow* Adjusted Gross Margin* Third Quarter $126.8 million(3), or margin of 18.1% of net sales • Unfavorable currency had a negative impact of $3.4 million Adjusted Gross margin was 38.8%(1), down 160 bps • Up sequentially 90 bps from Q2 2023 All comparisons are to Fiscal 2022 comparable reported results. * See non-GAAP reconciliations in the Appendix. Adjusted EBITDA* Third quarter free cash flow of $69.4 million(2), or 10% of net sales • Within range of our long-term algorithm of 10% to 12% Key Metrics – Third Quarter Net Sales* Third quarter Net sales on a reported basis of $699.4 million, down 3.9% • Organic net sales down 2.7% (1) GAAP gross margin of 37.9% (2) Operating cash flow of $296.3 million (3) GAAP net earnings of $31.8 million Net Debt* Third quarter debt paydown of $44 million • Total debt paydown in FY’23 of $200 million 5

Q3 FY23 Organic Net Sales Decline of 2.7% Organic Decline -2.7% 6

FOR INTERNAL USE ONLY – DO NOT DISTRIBUTE Positive Battery Volumes Recovery -20.0% -15.0% -10.0% -5.0% 0.0% 5.0% 10.0% 15.0% 20.0% Total U.S. MULC + Amazon Volume Sales % Chg YA Dollar Sales % Chg YA Sources: Circana (IRI) Total US MULC 5/23/2021 – 7/16/2023; Profitero Amazon May 2021-July 2023 Battery volume recovery has lagged our expectations year to date but is continuing to recover with convergence in the latest 4 weeks at positive value and volume. 7

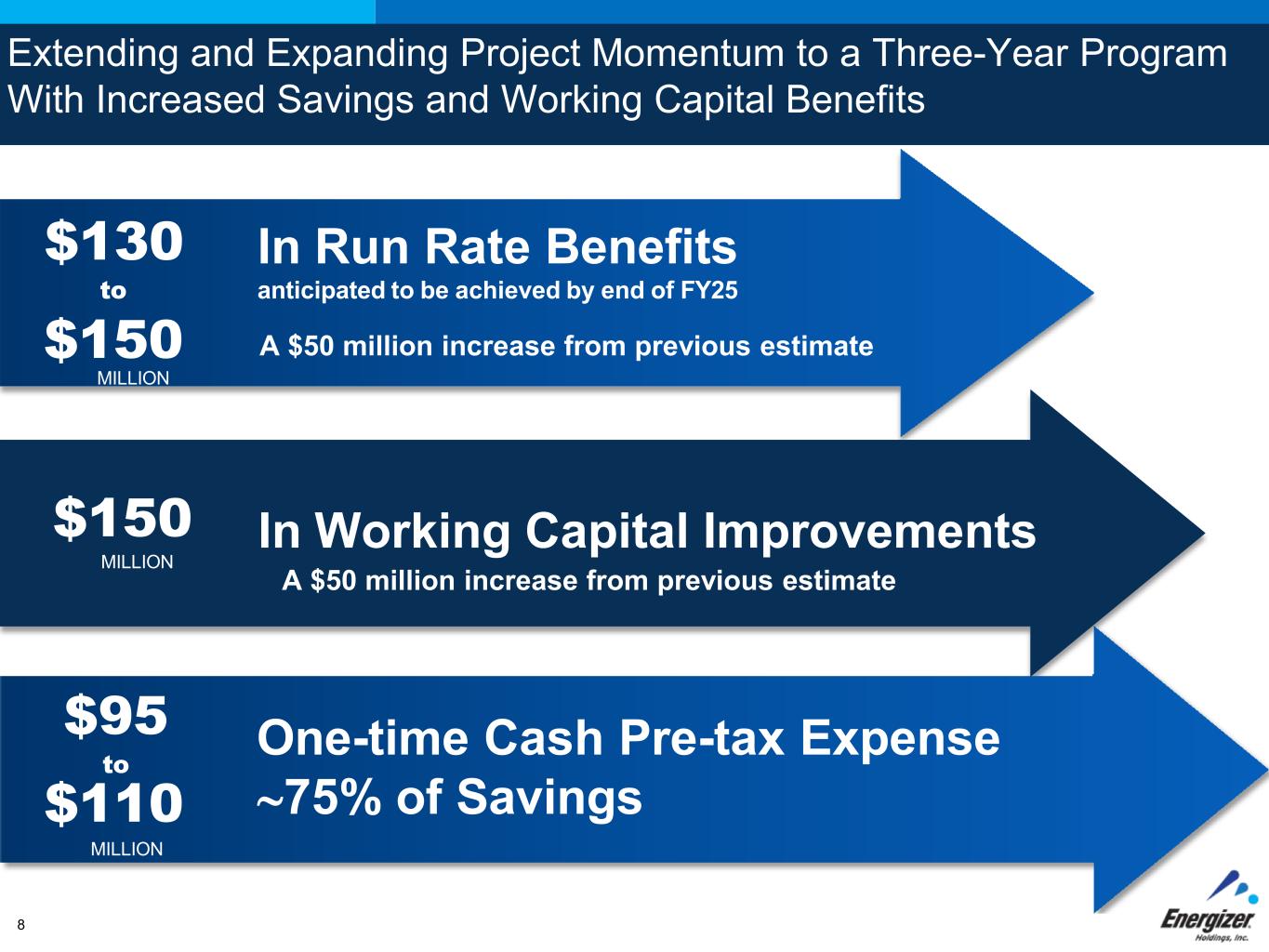

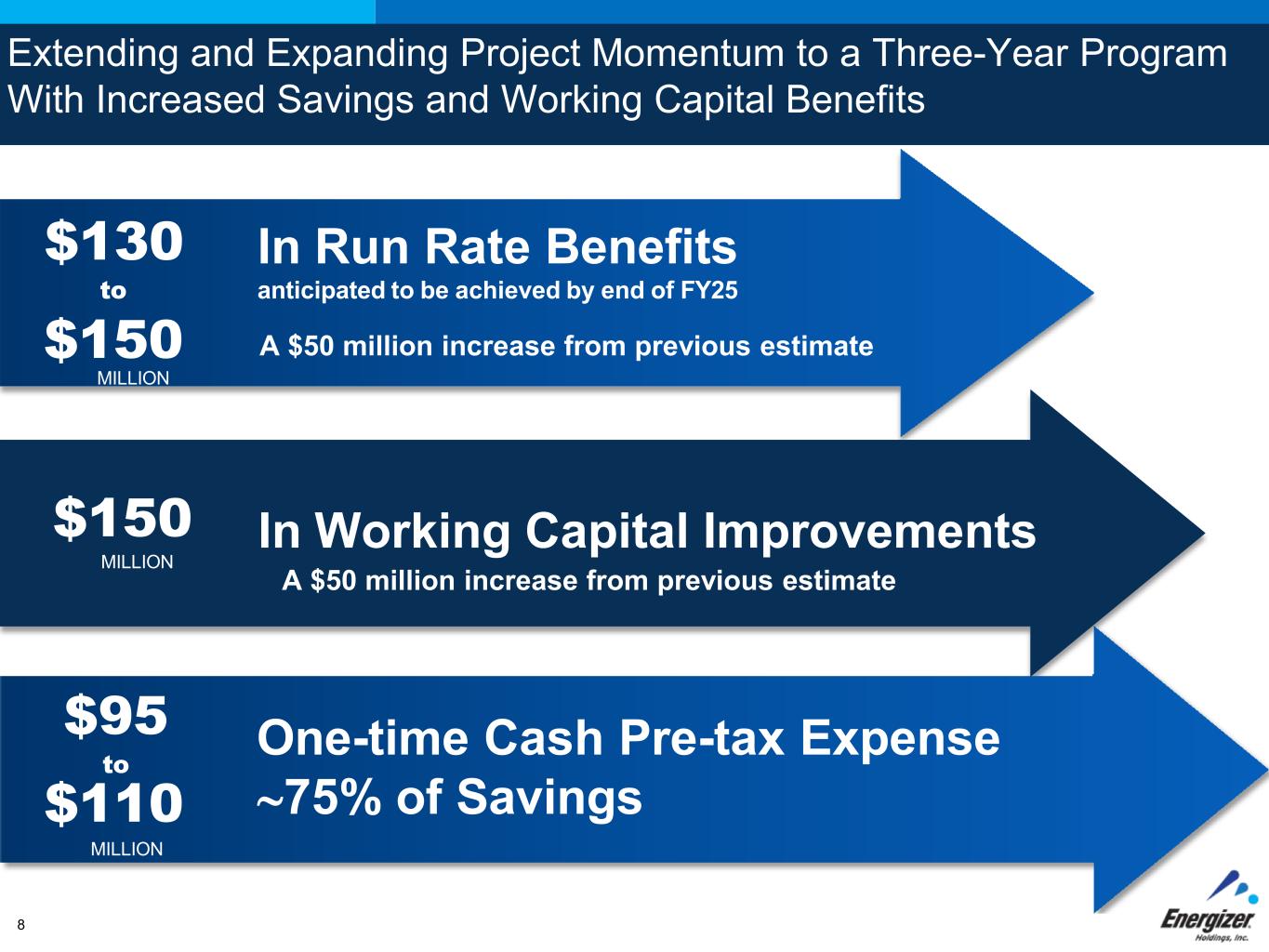

Extending and Expanding Project Momentum to a Three-Year Program With Increased Savings and Working Capital Benefits $130 to $150 MILLION In Run Rate Benefits anticipated to be achieved by end of FY25 A $50 million increase from previous estimate $150 MILLION In Working Capital Improvements One-time Cash Pre-tax Expense ∼75% of Savings $95 to $110 MILLION A $50 million increase from previous estimate 8

Strong Cash Flow and Debt Paydown Over the Past Four Quarters Q3 FY 2022 (Ended June 2022) Q3 FY 2023 (Ended June 2023) Last 12 Months LTM FCF % * LTM FCF % * Net Leverage Net Leverage 6.1x(2) (0.9%) 5.7x 12.1% ($ in millions) (1) Total Debt reduction on the senior notes, term loan and revolver was $263 million over the past 4 quarters which included retiring some notes at a cash discount. (2) Expected to reduce leverage by over half a turn by the end of Fiscal 2023 * See non-GAAP reconciliations in the Appendix. 9

+ Updated Outlook Fiscal 2023

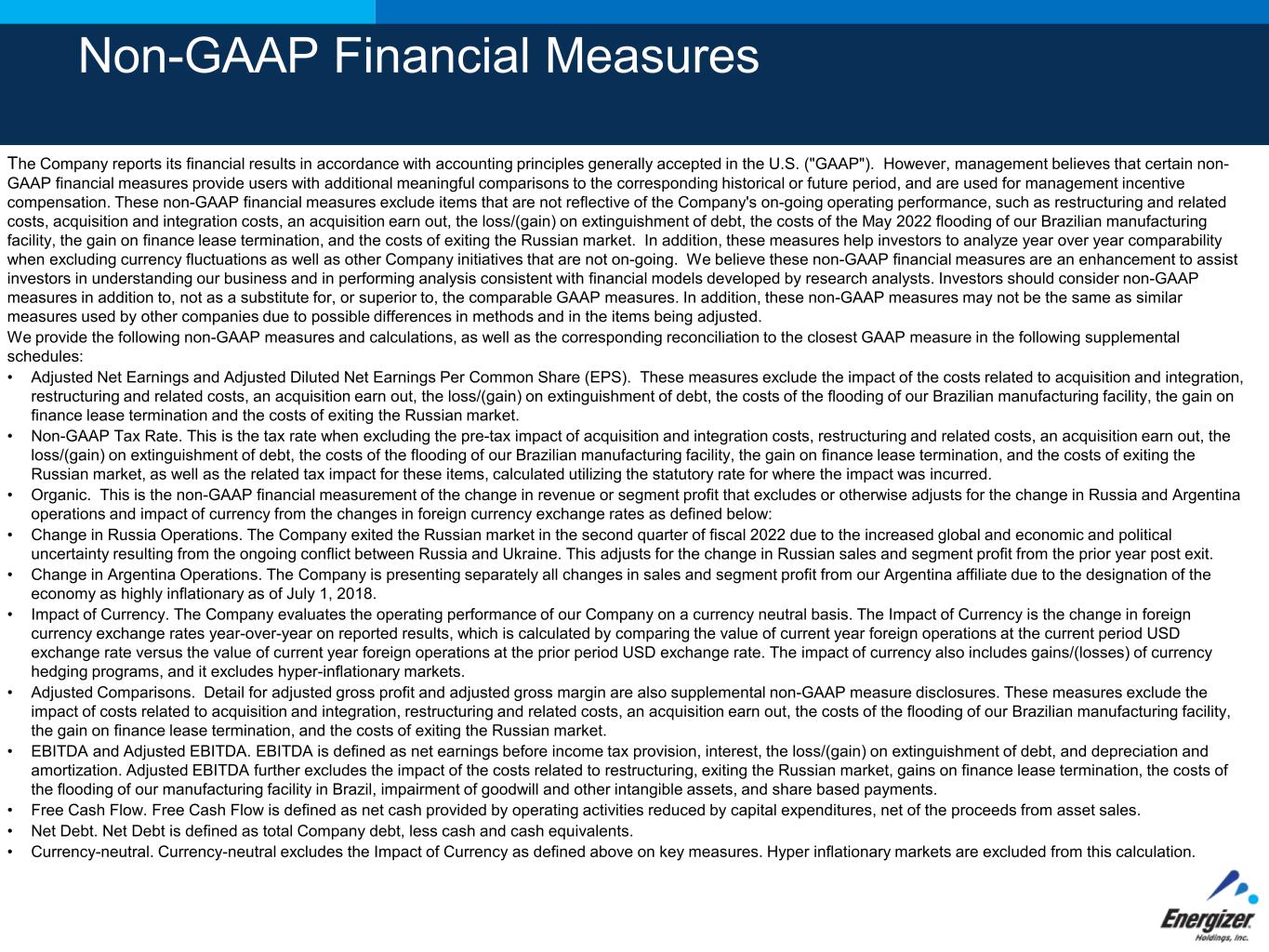

Key Metrics - Fiscal 2023 Outlook METRIC Fiscal 2023 Outlook All comparisons are to Fiscal 2022 comparable reported results. * See non-GAAP reconciliations in the Appendix. Low Single Digit Decline • Fourth quarter expected to be roughly flat to prior year Organic Net Sales $585 to $595 million • Fourth quarter $173 and $183Adjusted EBITDA* 150 – 200 Basis Point Improvement • Fourth quarter 350 to 400 bps improvement to prior year Adjusted Gross Margin $3.00 to $3.10 • Fourth quarter $1.10 to $1.20Adjusted EPS* $130 - $150 Million in Savings by the end of FY2025 • FY2023 savings of approximately $45 to 50 millionProject Momentum 11

Appendix Materials 12

Non-GAAP Reconciliation: Consolidated Net Sales (in millions) Organic revenues is the non-GAAP financial measurement of the change in revenue or segment profit that excludes or otherwise adjusts for the change in Argentina operations and impact of currency from the changes in foreign currency exchange rates as defined below: • Change in Argentina Operations. The Company is presenting separately all changes in sales and segment profit from our Argentina affiliate due to the designation of the economy as highly inflationary as of July 1, 2018. • Impact of currency. The Company evaluates the operating performance of our Company on a currency neutral basis. The impact of currency is the difference between the value of current year foreign operations at the current period ending USD exchange rate, compared to the value of the current year foreign operations at the prior period ending USD exchange rate, as well as the impact of hedging on the currency fluctuation. 13

Non-GAAP Reconciliation: Adjusted Gross Margin (in millions) Adjusted gross margin as a percent of sales excludes any charges related to restructuring programs, the costs of exiting the Russian market, the costs of the flooding of our manufacturing facility in Brazil and acquisition and integration costs. 14

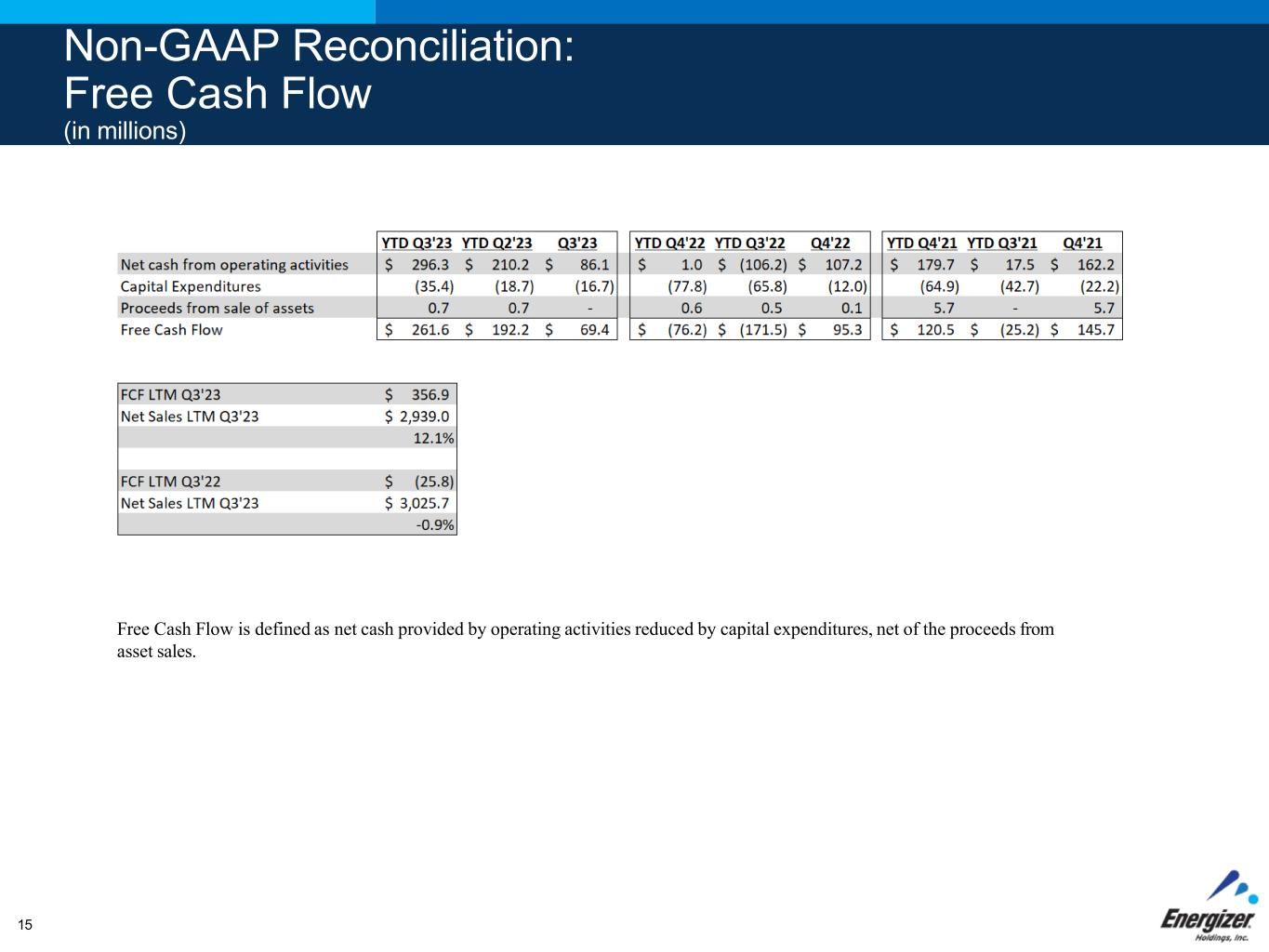

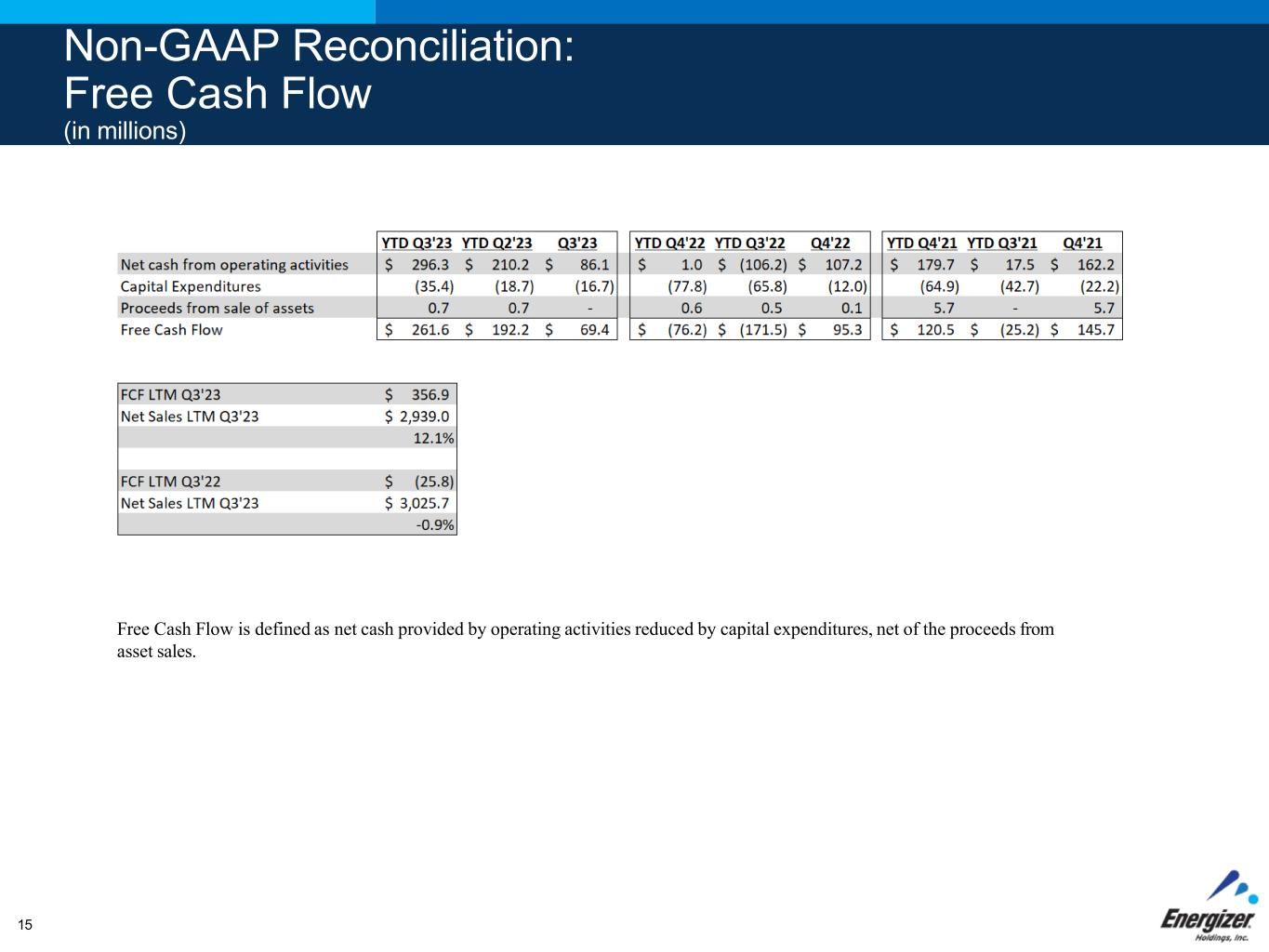

Non-GAAP Reconciliation: Free Cash Flow (in millions) Free Cash Flow is defined as net cash provided by operating activities reduced by capital expenditures, net of the proceeds from asset sales. 15

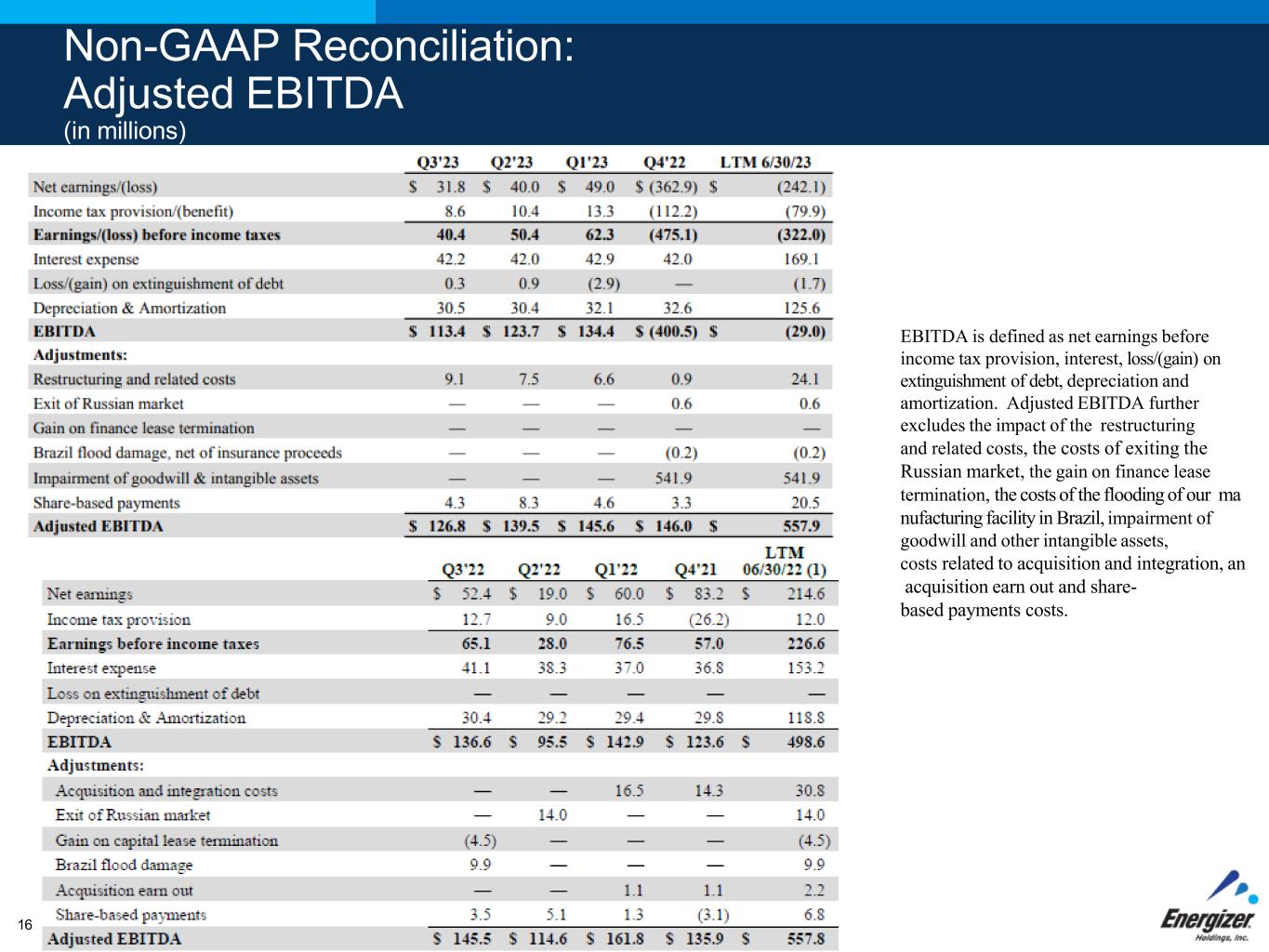

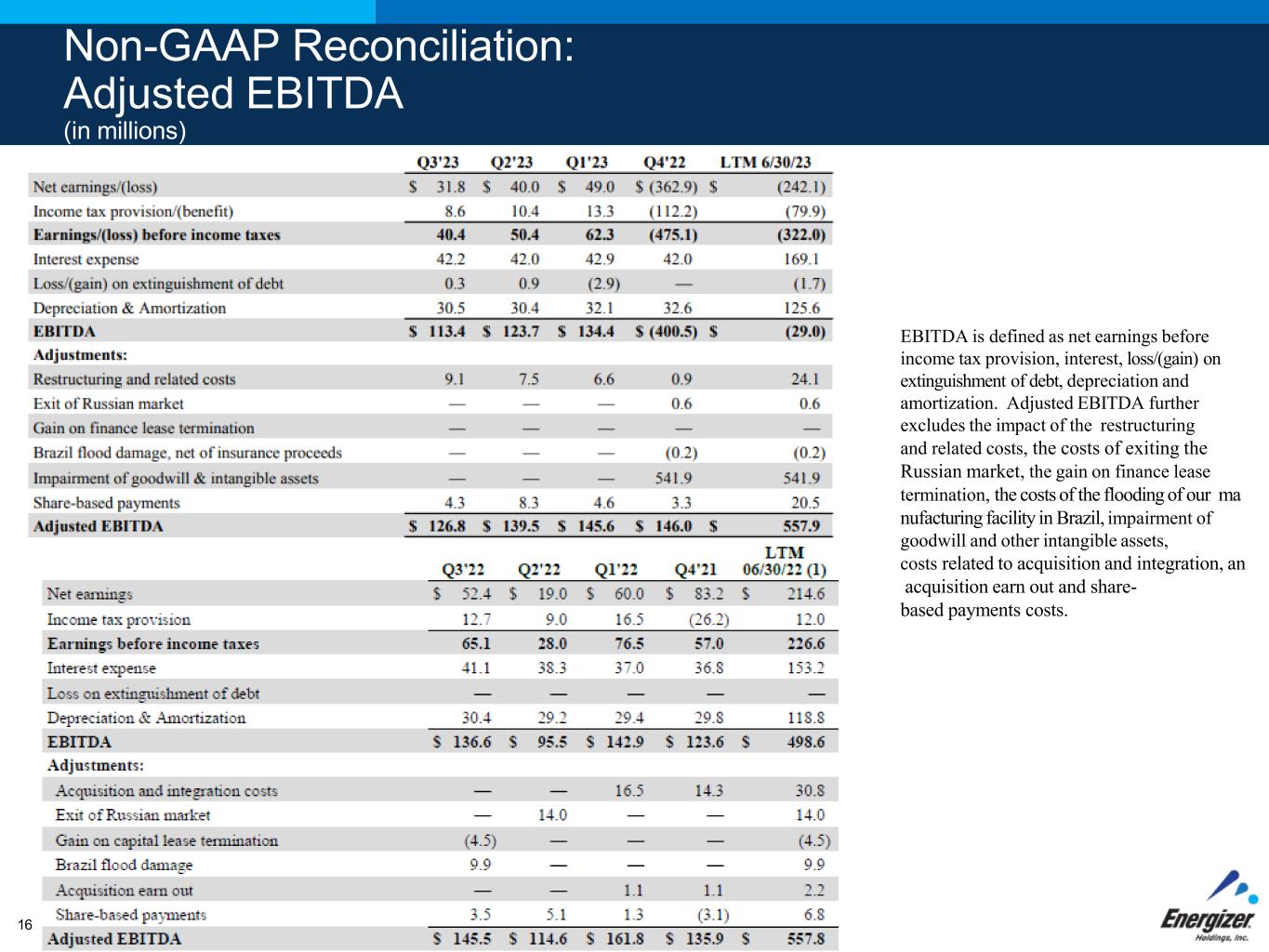

Non-GAAP Reconciliation: Adjusted EBITDA (in millions) EBITDA is defined as net earnings before income tax provision, interest, loss/(gain) on extinguishment of debt, depreciation and amortization. Adjusted EBITDA further excludes the impact of the restructuring and related costs, the costs of exiting the Russian market, the gain on finance lease termination, the costs of the flooding of our ma nufacturing facility in Brazil, impairment of goodwill and other intangible assets, costs related to acquisition and integration, an acquisition earn out and share- based payments costs. 16

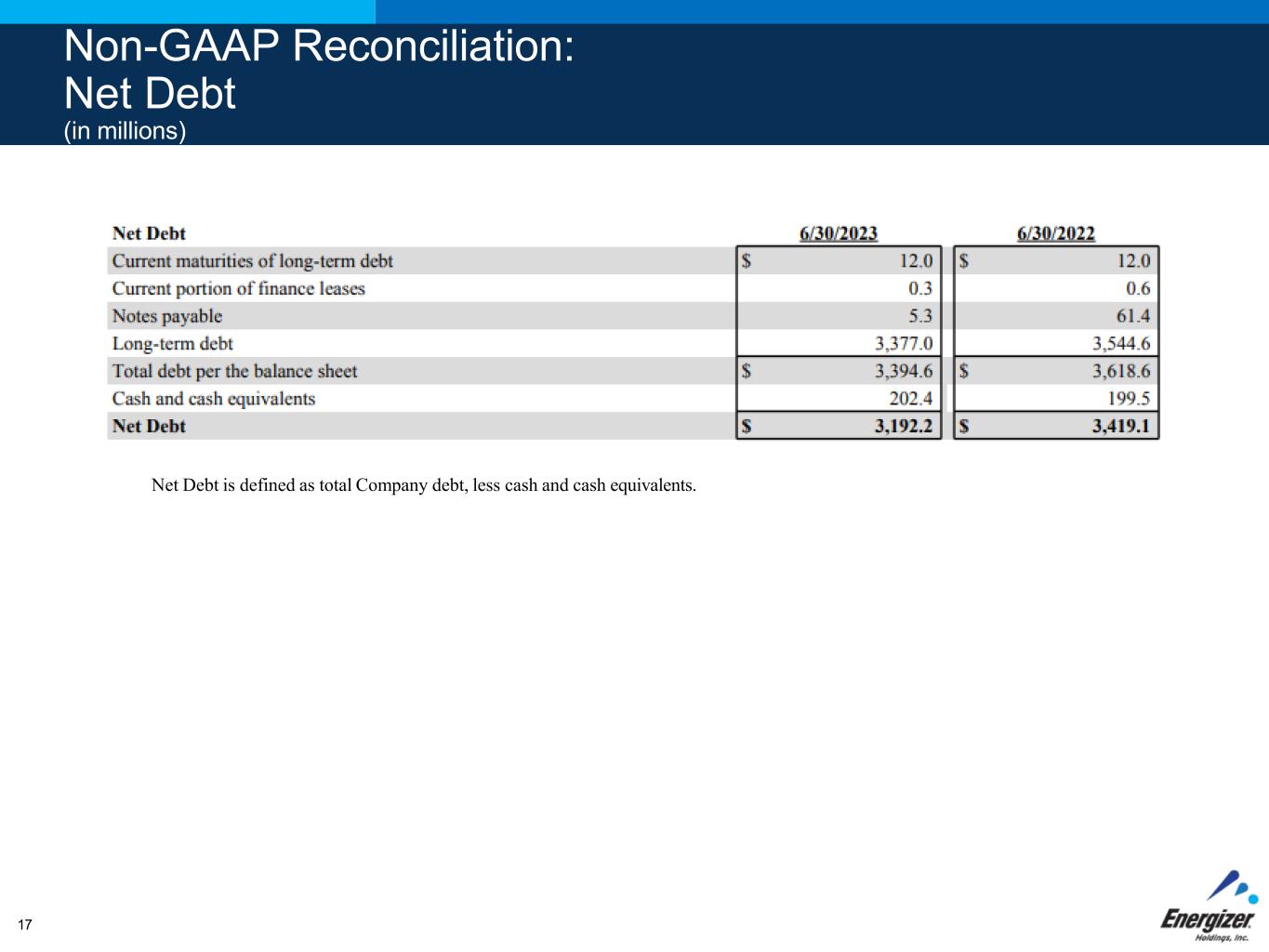

Non-GAAP Reconciliation: Net Debt (in millions) Net Debt is defined as total Company debt, less cash and cash equivalents. 17

Non-GAAP Reconciliation: FY 2023 Outlook (in millions) 18