UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-23108

Amplify ETF Trust

(Exact name of registrant as specified in charter)

310 South Hale Street

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

Christian Magoon

Amplify ETF Trust

310 South Hale Street

Wheaton, IL 60187

(Name and address of agent for service)

With copies to:

Morrison C. Warren, Esq.

Chapman and Cutler LLP

111 West Monroe Street

Chicago, IL 60603

(855)-267-3837

Registrant's telephone number, including area code

Date of fiscal year end: October 31

Date of reporting period: October 31, 2021

Item 1. Reports to Stockholders.

AMPLIFY ETF TRUST

Amplify High Income ETF YYY

Amplify Online Retail ETF IBUY

Amplify CWP Enhanced Dividend Income ETF DIVO

Amplify Transformational Data Sharing ETF BLOK

Amplify Lithium & Battery Technology ETF BATT

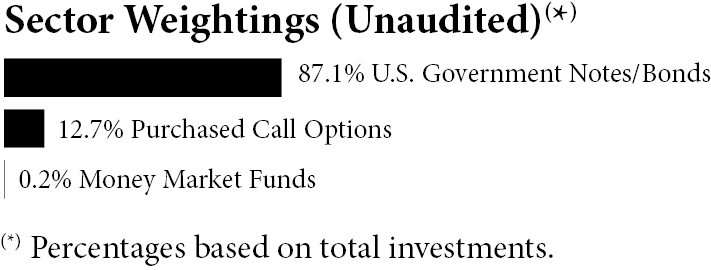

Amplify BlackSwan Growth & Treasury Core ETF SWAN

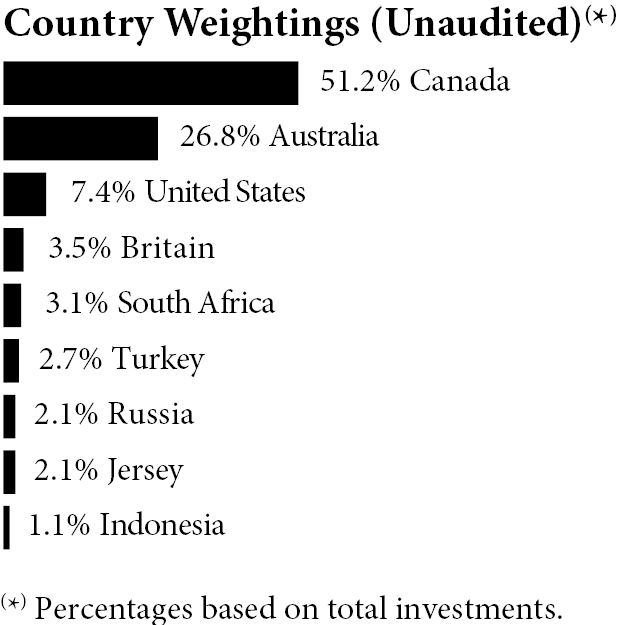

Amplify International Online Retail ETF XBUY

Amplify Seymour Cannabis ETF CNBS

Amplify Pure Junior Gold Miners ETF JGLD

Amplify BlackSwan ISWN ETF ISWN

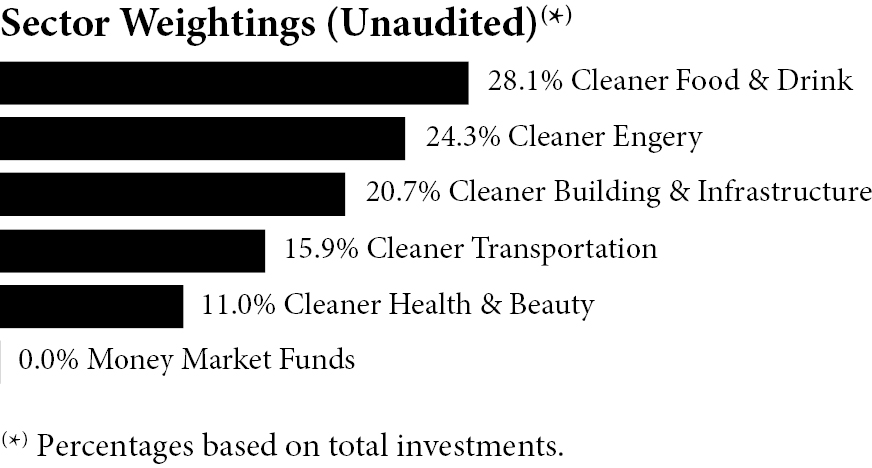

Amplify Cleaner Living ETF DTOX

Amplify Thematic All-Stars ETF MVPS

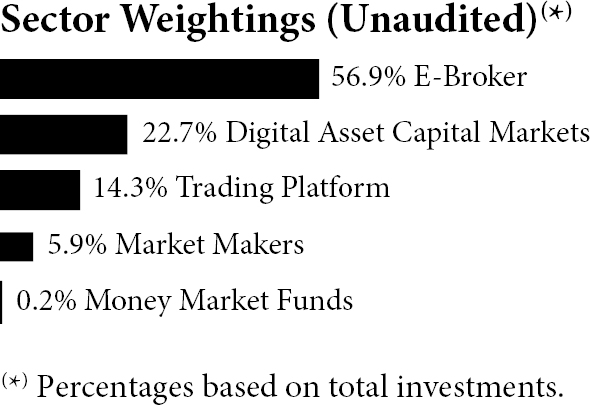

Amplify Digital & Online Trading ETF BIDS

ANNUAL REPORT

October 31, 2021

Beginning on January 1, 2022, as permitted by regulations adopted by the U.S. Securities and Exchange Commission, paper copies of the Amplify Seymour Cannabis ETF shareholder reports will no longer be sent by mail, unless you specifically request paper copies of the Amplify Seymour Cannabis ETF’s reports from your financial intermediary, such as a broker-dealer or bank. Instead, the reports will be made available on a website, and you will be notified by mail each time a report is posted and provided with a website link to access the report.

If you already elected to receive shareholder reports electronically, you will not be affected by this change and you need not take any action. Please contact your financial intermediary to elect to receive shareholder reports and other Fund communications electronically.

You may elect to receive all future reports in paper free of charge. Please contact your financial intermediary to inform them that you wish to continue receiving paper copies of shareholder reports and for details about whether your election to receive reports in paper will apply to all funds held with your financial intermediary.

Amplify ETF Trust

Table of Contents

Amplify ETF Trust (the “Trust”) files its complete schedule of fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Part F of Form N-PORT within sixty days after the end of the period. The Trust’s Part F of Form N-PORT is available on the Commission’s website at www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Amplify Investments LLC (the “Adviser”) uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-855-267-3837 and (ii) on the Commission’s website at www.sec.gov.

1

Amplify ETF Trust

Market Performance (Unaudited)

October 31, 2021

Equity investors experienced healthy returns across the board through the end of October of 2021. Despite risks of new COVID outbreaks, the potential for increased US taxes and inflation rising, broad-based US stock indexes surged. The Dow Jones Industrial Average, the S&P 500 and the Nasdaq 100 had positive returns ranging between 18-24% through the end of October. In addition, market capitalization and style indexes including the S&P Mid Cap Growth, S&P Mid Cap Value, S&P Small Cap Growth and S&P Small Cap Value all returned double digit positive returns. Besides healthy returns, the behavior of equity markets in 2021 was also quite calm with virtually no material corrections in the year. The first ten months of 2021 were a refreshing break for investors after a volatile 2020.

The S&P 500 delivered 24% year-to-date as of the end of October, which placed it in the middle of the various sector returns making up this well-known index. Reviewing the eleven sectors that comprise the S&P 500 index shows a variety of significant performance differences. In fact, three of the eleven S&P 500 sectors gained more than 30% year-to-date as of October 31. Leading the pack with just over a 57% gain was the Energy sector. Energy stocks continued to see their products in increased demand as the economy worldwide ramped up from the COVID slowdown of 2020. The energy sector declined 33% in 2020 amidst the worldwide economic slowdown, so 2021’s performance is a welcome sign for energy stock investors. Coming in a distant second and third place were the Financials sector with a 38% gain and the Real Estate sector with a 33% move upward. Both sectors were on the rebound in 2021 after experiencing slightly negative returns in 2020. After the top three sector winners, there were a mix of sectors that hovered around the 20% gain mark. Communication Services gained 25% and Technology and Consumer Discretionary followed closely with a 24% and 22% gain respectively. Returning 46% in 2020, the Technology sector has been on quite a roll the last 22 months. Healthcare, Industrials and Materials sectors returned between 18-19%, just underperforming the S&P 500. Utilities and Consumer Staples took the two bottom sector return positions with just single digit returns of 9% and 8% respectively. It’s notable there were no negative sectors returns in 2021 after 2020 saw three of eleven sectors in the red.

Looking forward to 2022, US investors will be watching the Federal Reserve’s tone, pace of interest rate increases, inflation data and geopolitical tensions with nations including China, Iran, and Russia. US equity markets have been abnormally rosy since the 2020 COVID lows, and it would not be surprising to see equity market volatility increase in 2022.

Past performance does not guarantee future results.

Investing involves risk; Principal loss is possible.

Fund holdings are subject to change and should not be considered a recommendation to buy or sell any security. Please see the Schedule of Investments for a complete list of Fund holdings.

S&P 500 Index: The S&P 500 is a market value weighted index and one of the common benchmarks for the U.S. stock market. Investors cannot invest directly in an index.

2

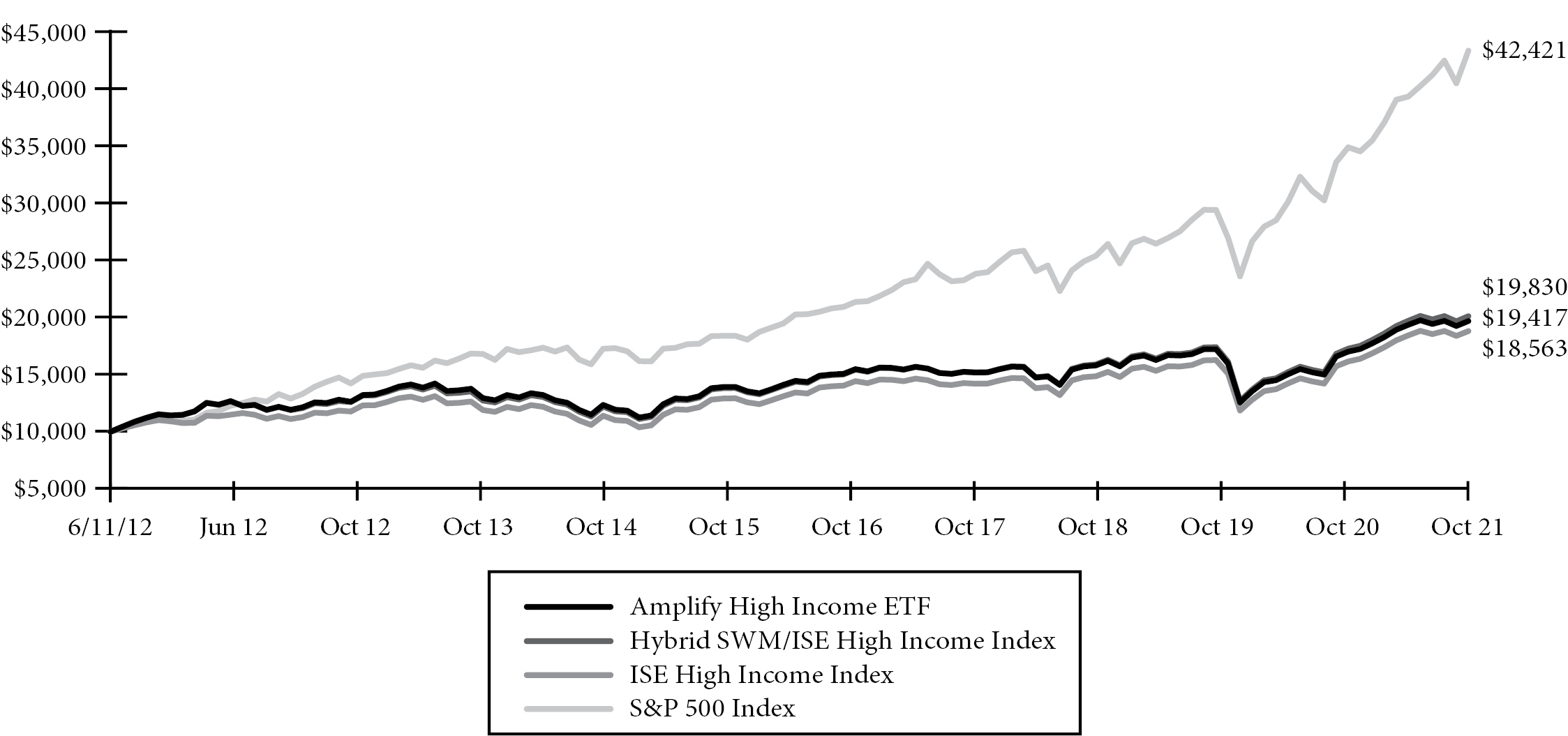

Amplify ETF Trust

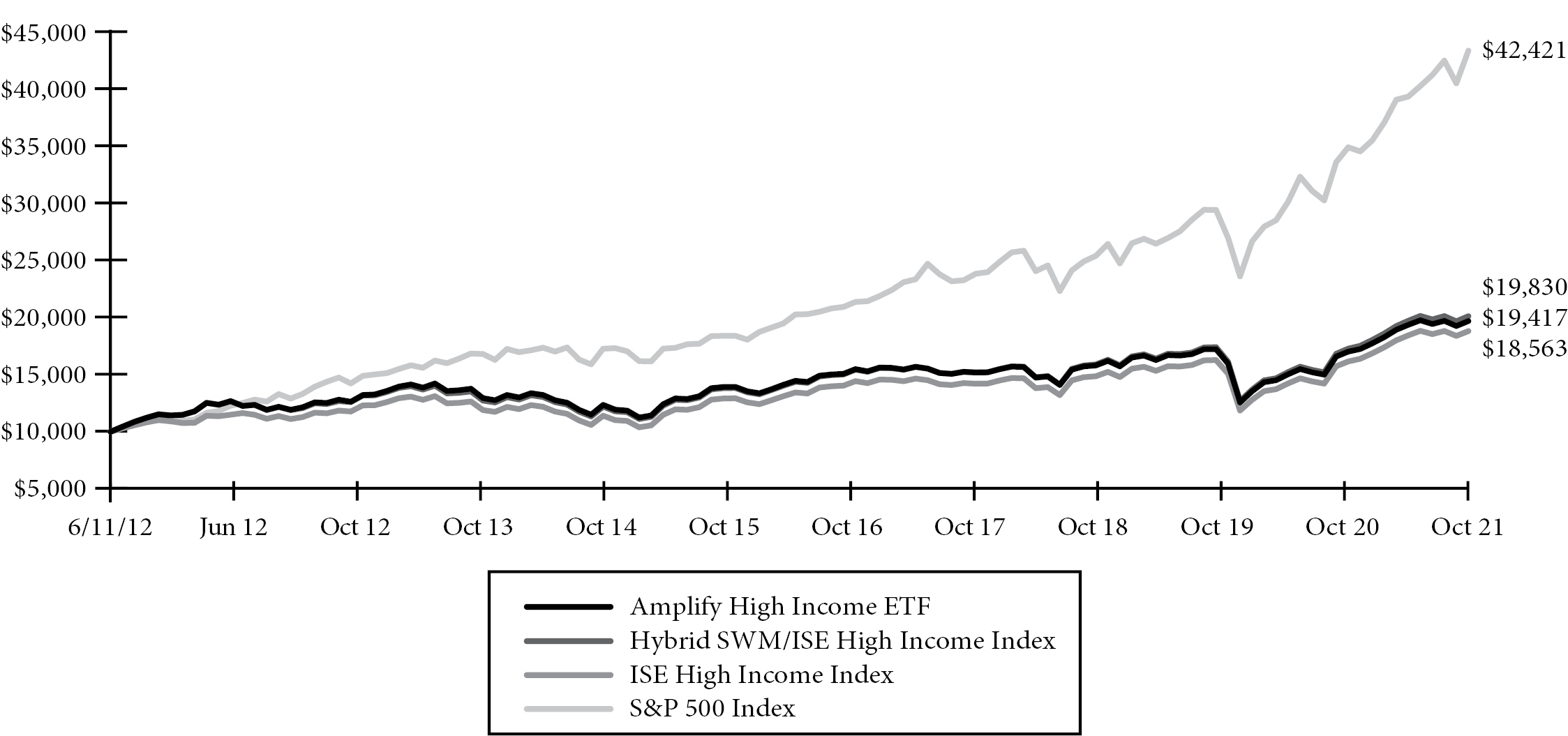

Amplify High Income ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | ANNUALIZED RETURNS |

| | | One Year | | Three Year | | Five Year | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price |

Amplify High Income ETF | | 30.71% | | 30.94% | | 9.96% | | 9.99% | | 7.63% | | 7.59% | | 7.32% | | 7.34% |

Hybrid SWM/ISE High Income Index(b) | | 31.70% | | 31.70% | | 10.64% | | 10.64% | | 8.23% | | 8.23% | | 7.56% | | 7.56% |

ISE High Income Index | | 31.70% | | 31.70% | | 10.64% | | 10.64% | | 8.23% | | 8.23% | | 6.81%(c) | | 6.81%(c) |

S&P 500 Index | | 42.91% | | 42.91% | | 21.48% | | 21.48% | | 18.93% | | 18.93% | | 16.64% | | 16.64% |

The Fund is the successor to the investment performance of the YieldShares High Income Fund (the “Predecessor High Income Fund”) as a result of the reorganization of the Predecessor High Income Fund into the Fund on October 7, 2019. Accordingly, the performance information shown in the chart and table above for periods prior to October 7, 2019 is that of the Predecessor High Income Fund’s Shares for the Fund. The Predecessor High Income Fund was managed by the same portfolio managers as the Fund and had substantially the same investment objectives, policies, and strategies as the Fund.

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Prior to June 20, 2013, the Fund sought to provide investment results that, before fees and expenses, corresponded generally to the price and yield performance of the SWM Index. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

3

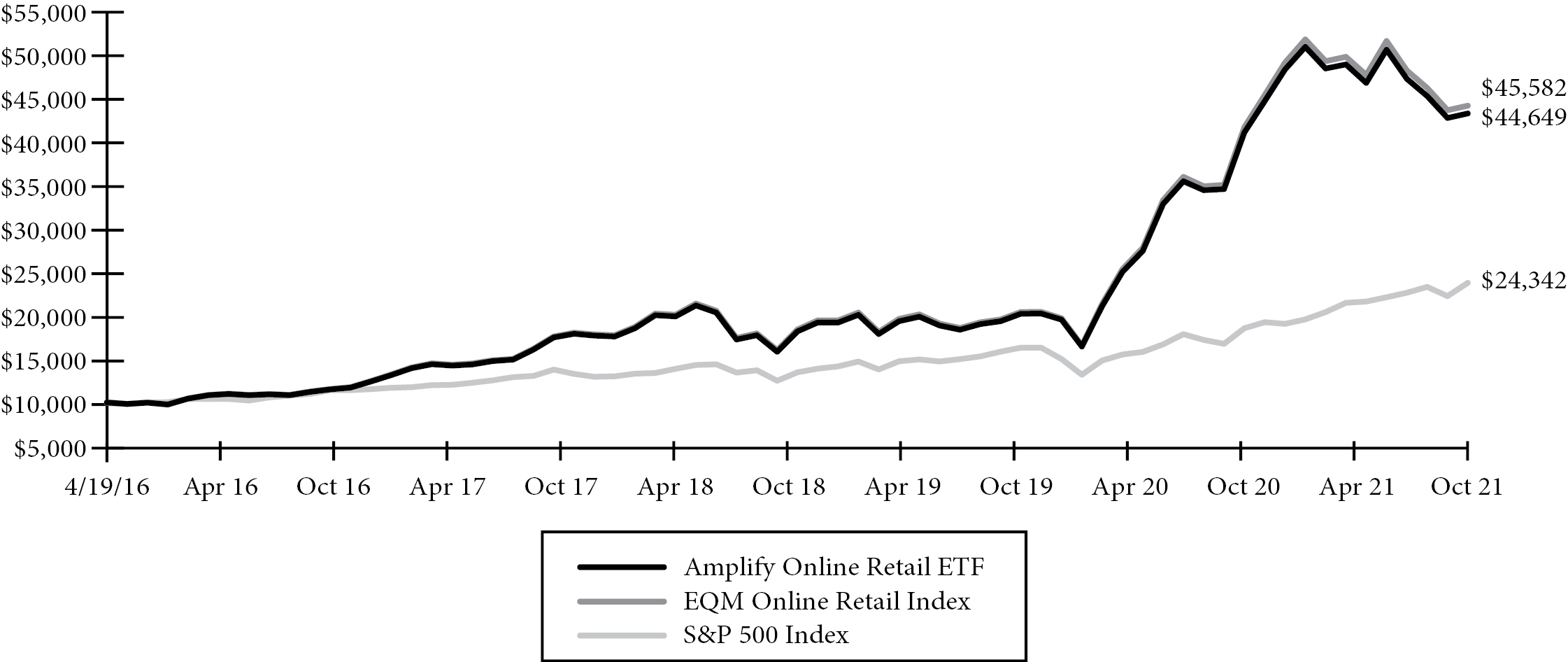

Amplify ETF Trust

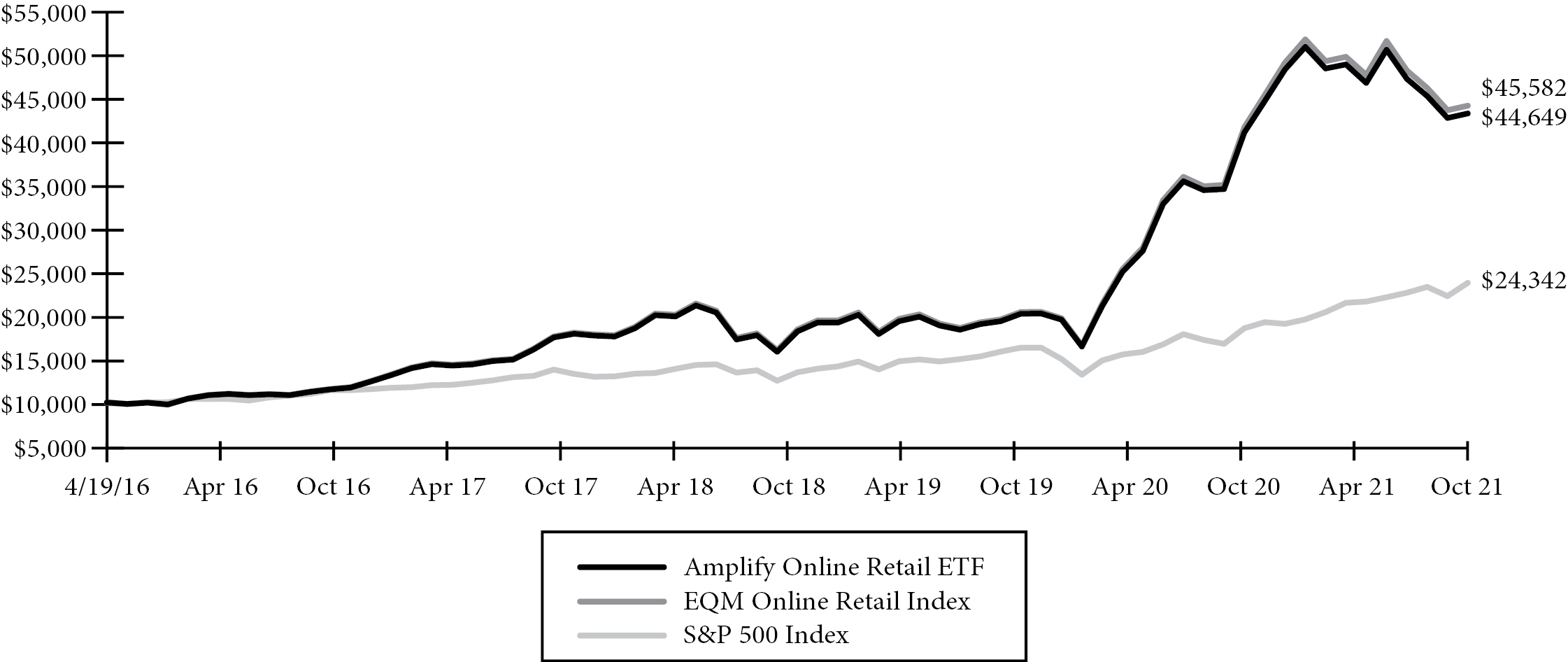

Amplify Online Retail ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | ANNUALIZED RETURNS |

| | | One Year | | Three Year | | Five Year | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price |

Amplify Online Retail ETF | | 25.49% | | 25.32% | | 36.53% | | 36.59% | | 32.65% | | 32.54% | | 31.04% | | 31.02% |

EQM Online Retail Index | | 26.34% | | 26.34% | | 36.97% | | 36.97% | | 33.11% | | 33.11% | | 31.53% | | 31.53% |

S&P 500 Index | | 42.91% | | 42.91% | | 21.48% | | 21.48% | | 18.93% | | 18.93% | | 17.44% | | 17.44% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

4

Amplify ETF Trust

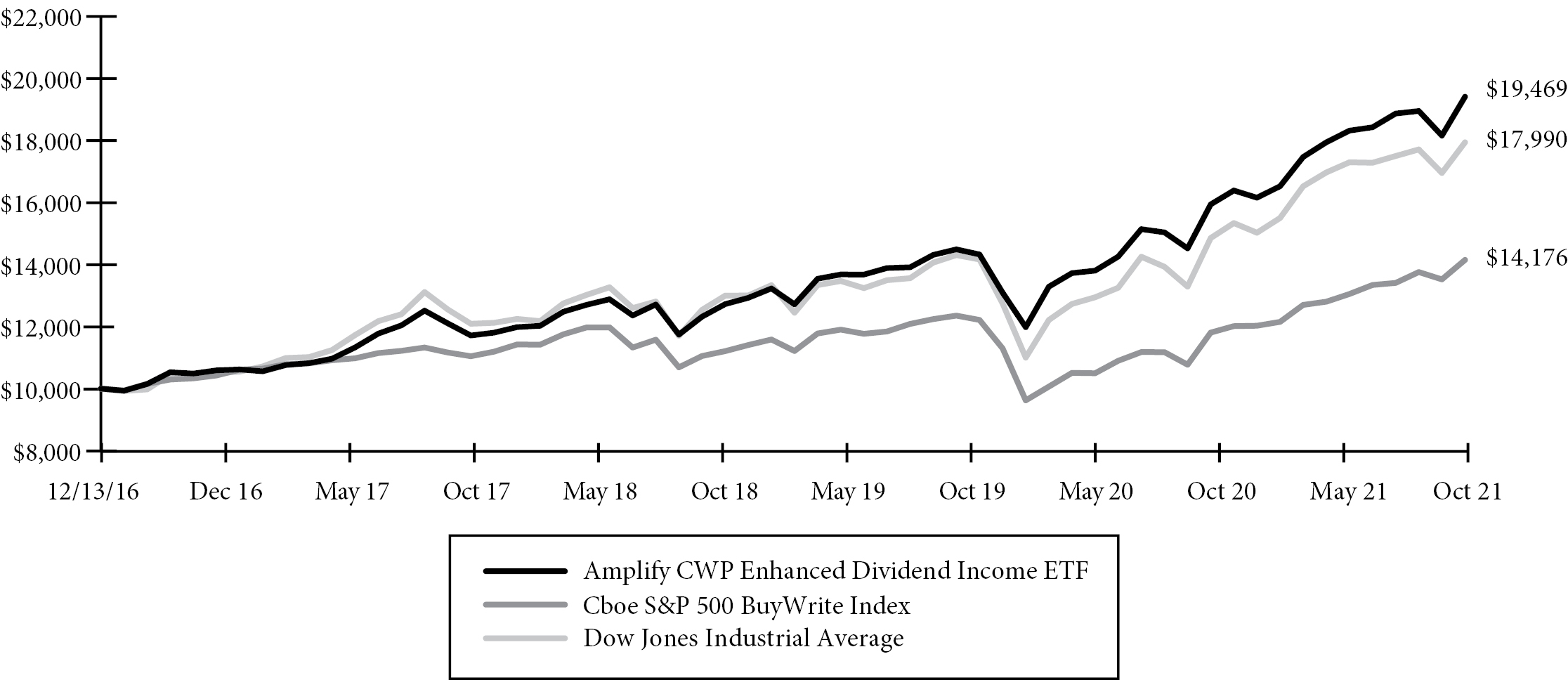

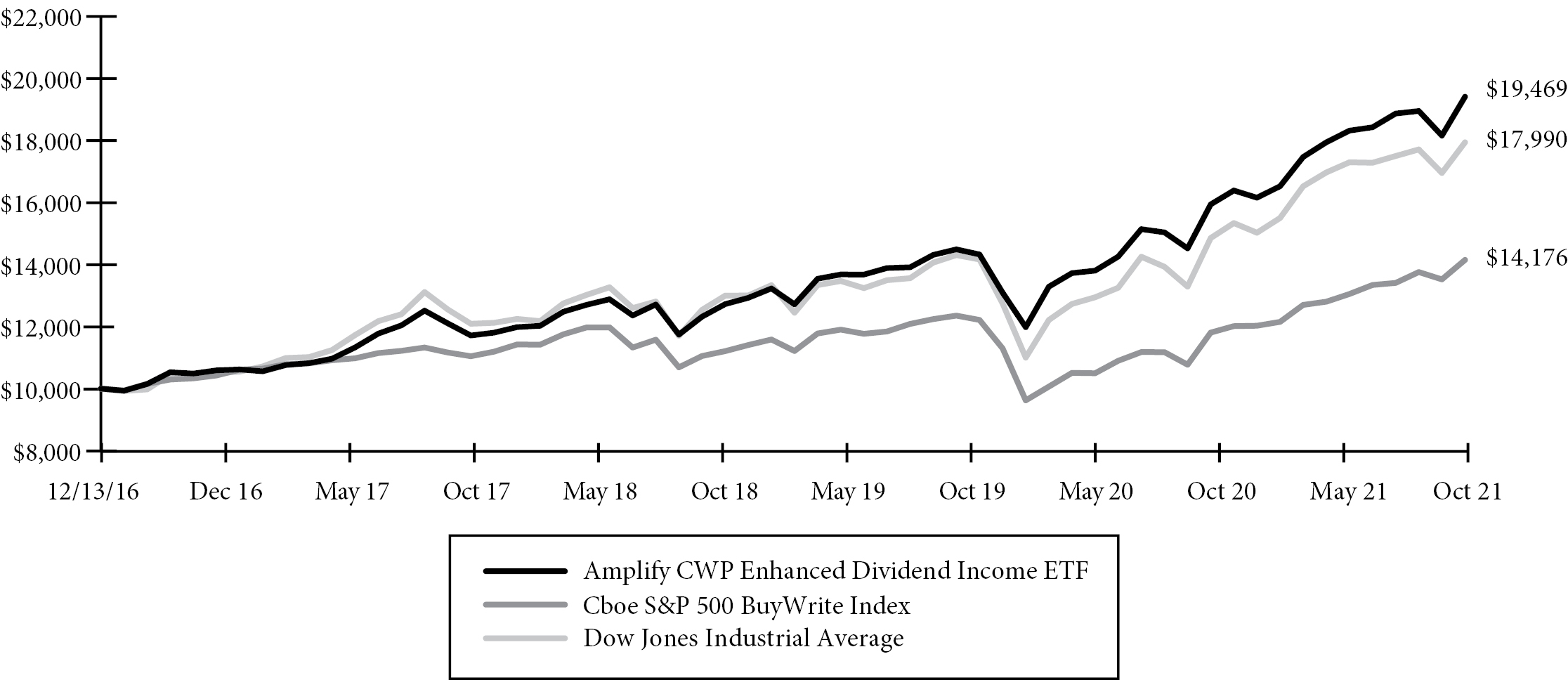

Amplify CWP Enhanced Dividend Income ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | ANNUALIZED RETURNS |

| | | One Year | | Three Year | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price |

Amplify CWP Enhanced Dividend Income ETF | | 33.81% | | 33.59% | | 16.31% | | 16.30% | | 14.62% | | 14.63% |

Cboe S&P 500 BuyWrite Index | | 31.54% | | 31.54% | | 7.75% | | 7.75% | | 7.41% | | 7.41% |

Dow Jones Industrial Average | | 35.16% | | 35.16% | | 12.56% | | 12.56% | | 12.78% | | 12.78% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

5

Amplify ETF Trust

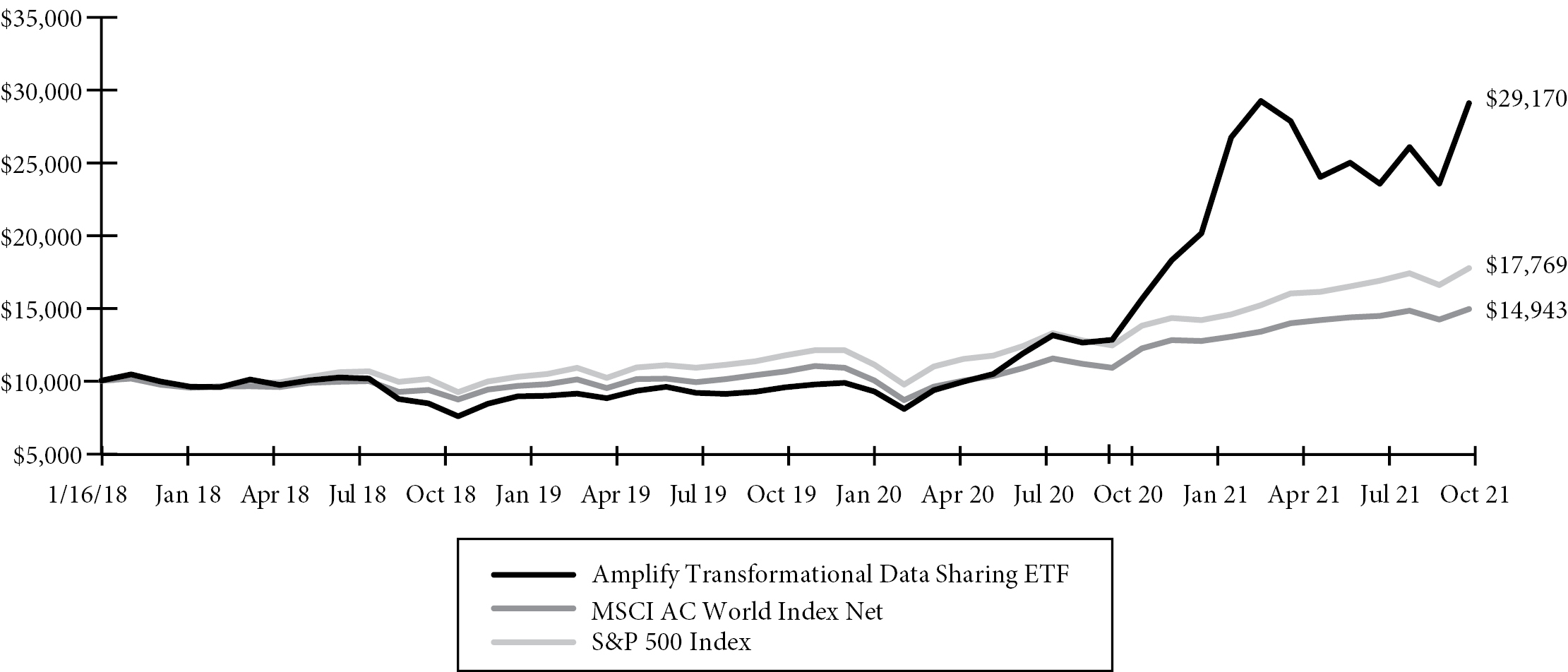

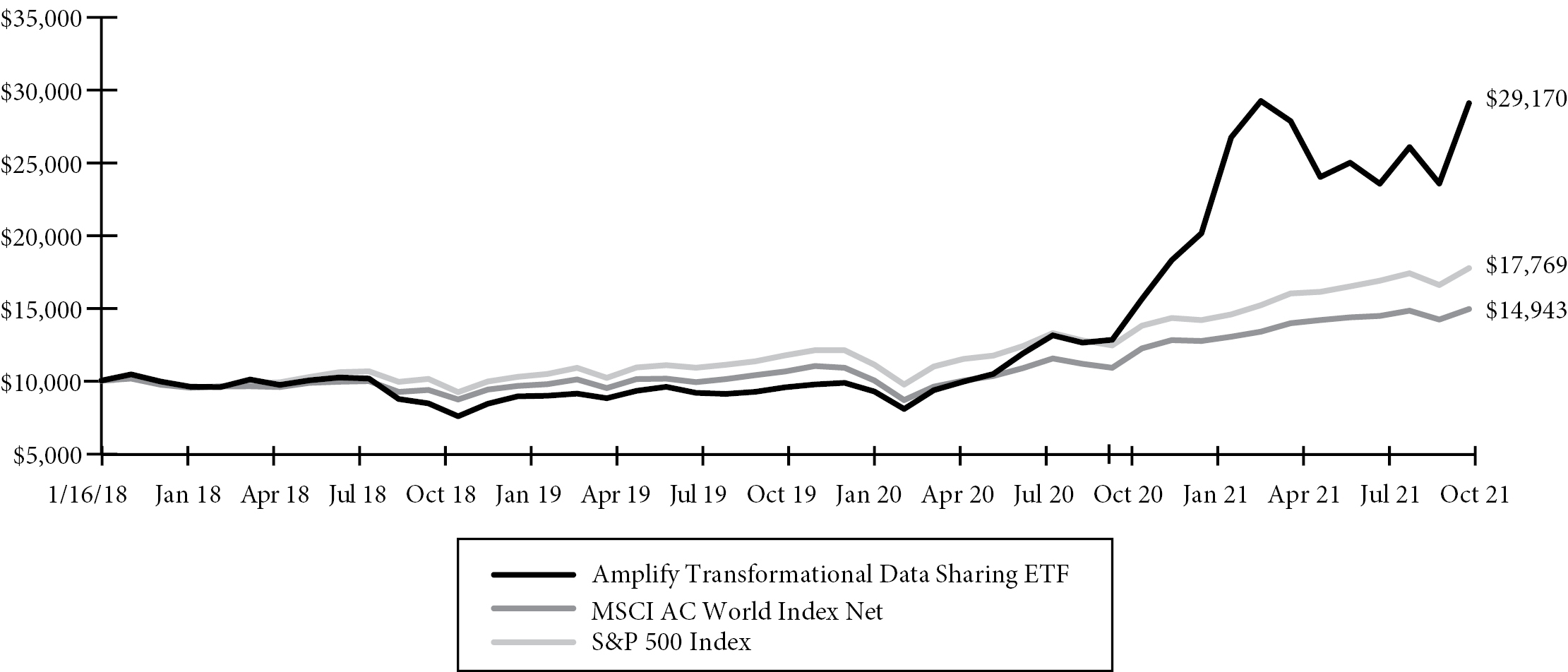

Amplify Transformational Data Sharing ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | ANNUALIZED RETURNS |

| | | One Year | | Three Year | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price |

Amplify Transformational Data Sharing ETF | | 127.54% | | 127.14% | | 49.52% | | 49.58% | | 32.65% | | 32.68% |

MSCI AC World Index Net | | 37.28% | | 37.28% | | 17.47% | | 17.47% | | 11.18% | | 11.18% |

S&P 500 Index | | 42.91% | | 42.91% | | 21.48% | | 21.48% | | 16.38% | | 16.38% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

6

Amplify ETF Trust

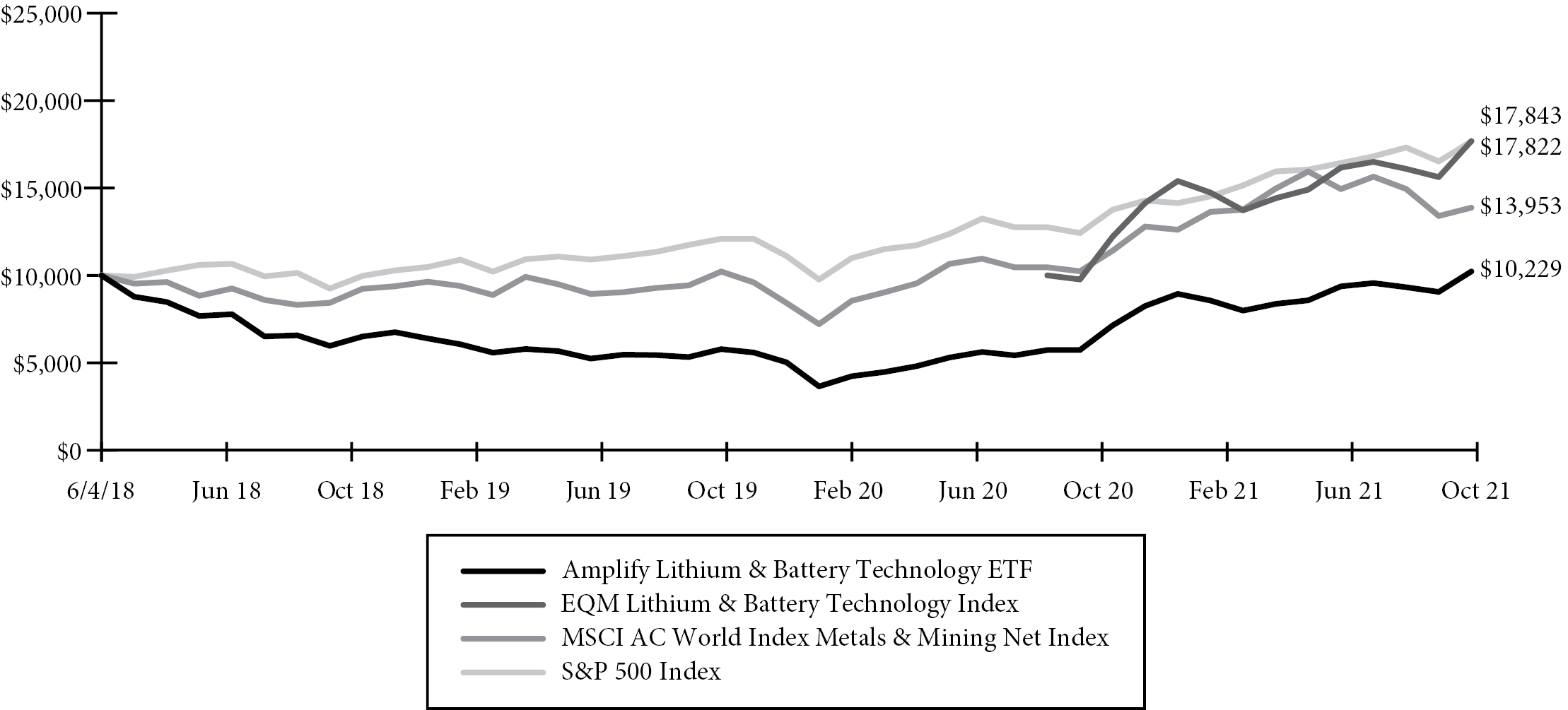

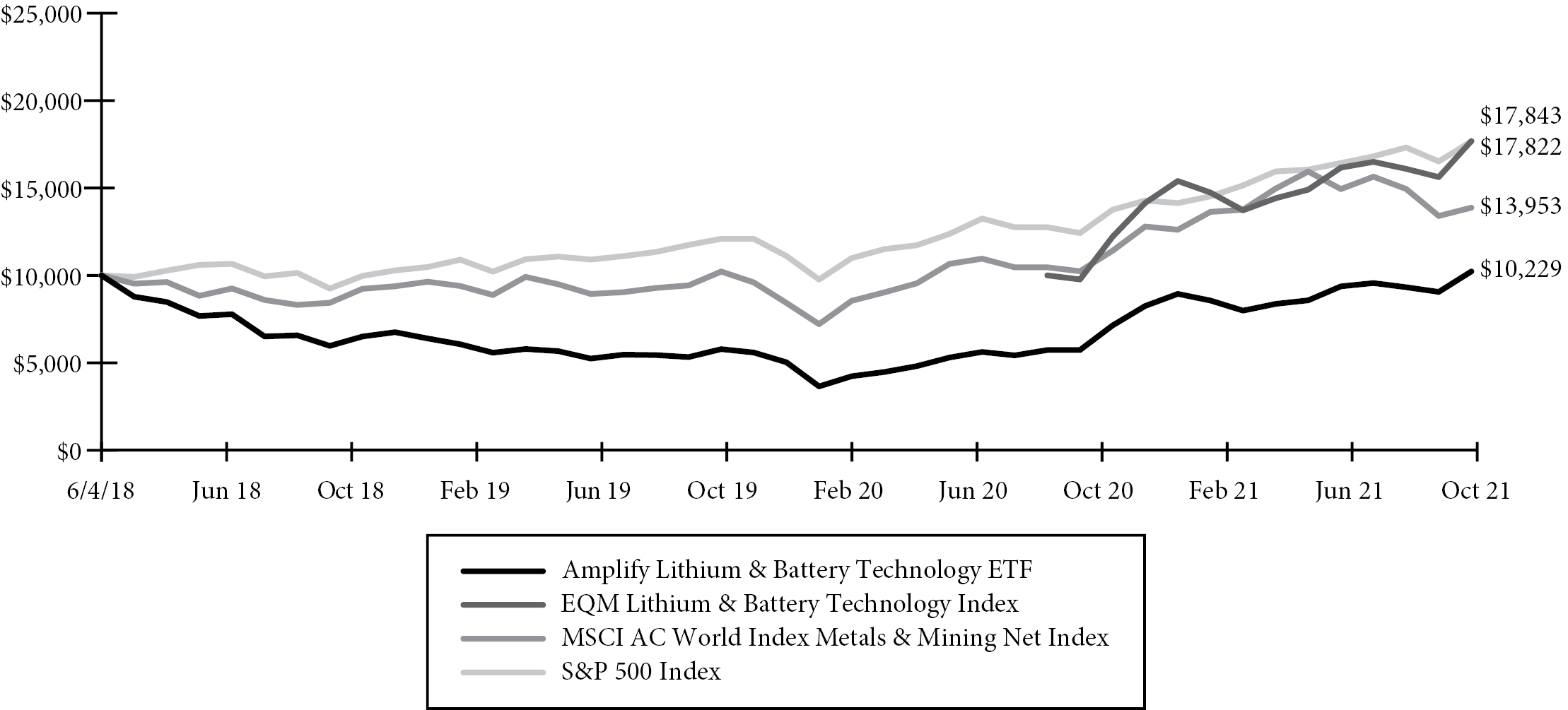

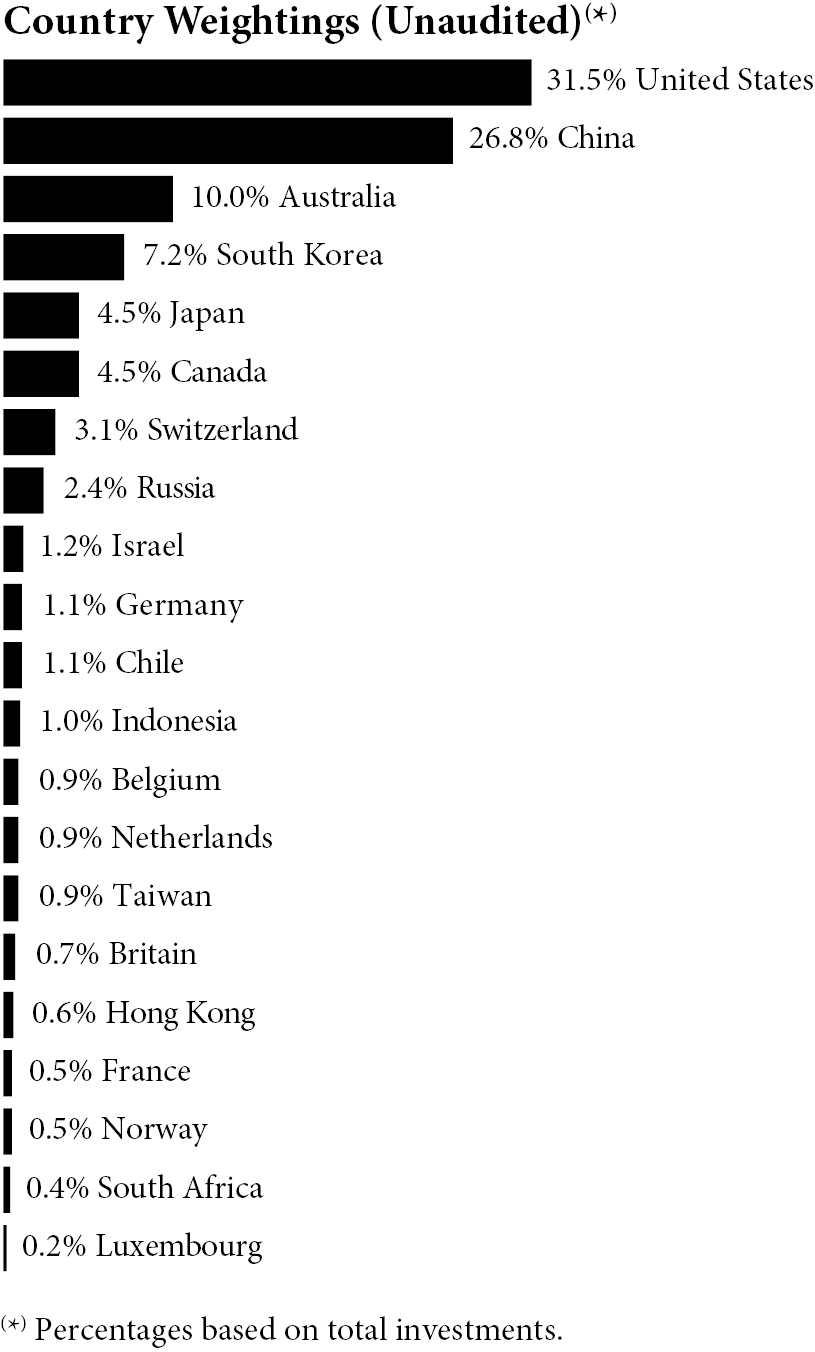

Amplify Lithium & Battery Technology ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | ANNUALIZED RETURNS |

| | | One Year | | Three Year | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price |

Amplify Lithium & Battery Technology ETF | | 81.32% | | 81.13% | | 16.70% | | 16.76% | | 0.67% | | 0.75% |

EQM Lithium & Battery Technology Index(b) | | 82.78% | | 82.78% | | N/A | | N/A | | 73.89%(c) | | 73.89%(c) |

MSCI AC World Index Metals & Mining Net Index | | 36.22% | | 36.22% | | 17.67% | | 17.67% | | 10.27% | | 10.27% |

S&P 500 Index | | 42.91% | | 42.91% | | 21.48% | | 21.48% | | 18.48% | | 18.48% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

7

Amplify ETF Trust

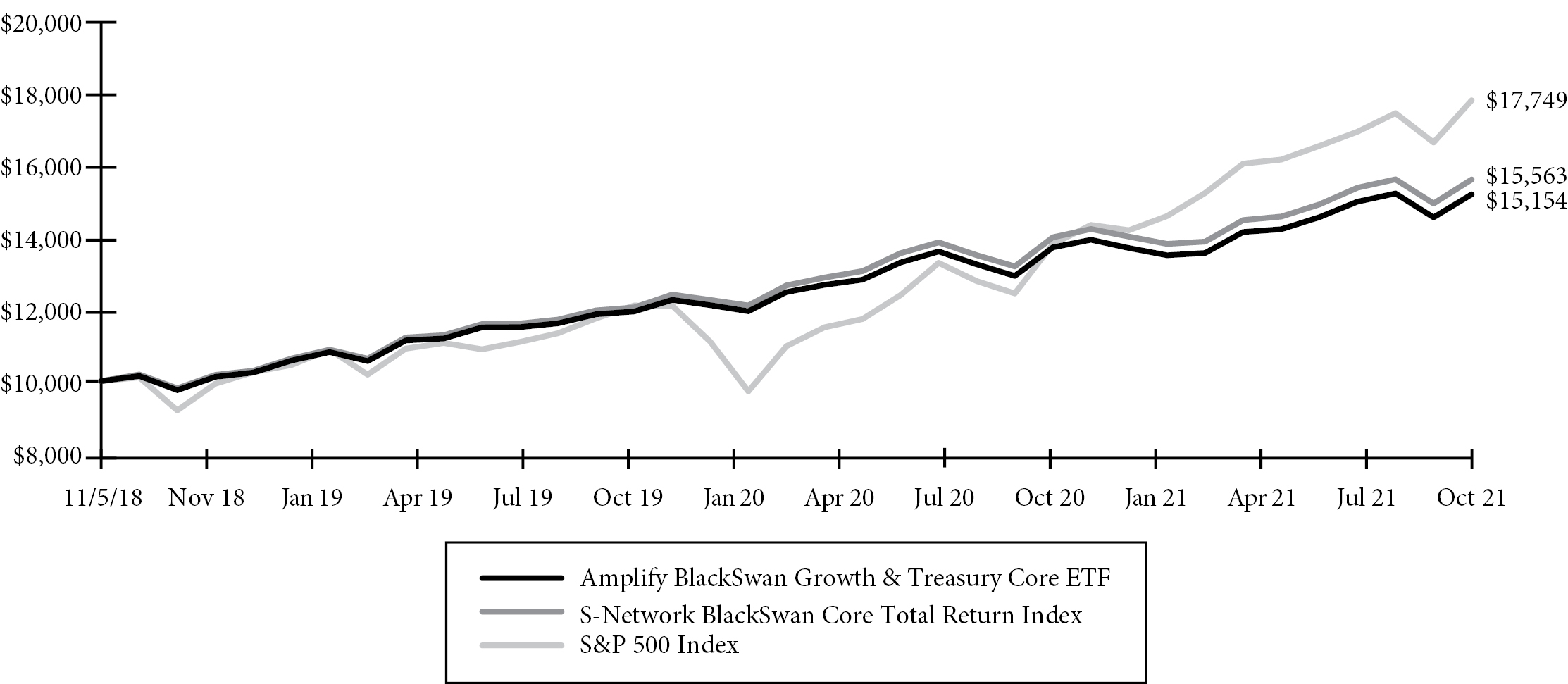

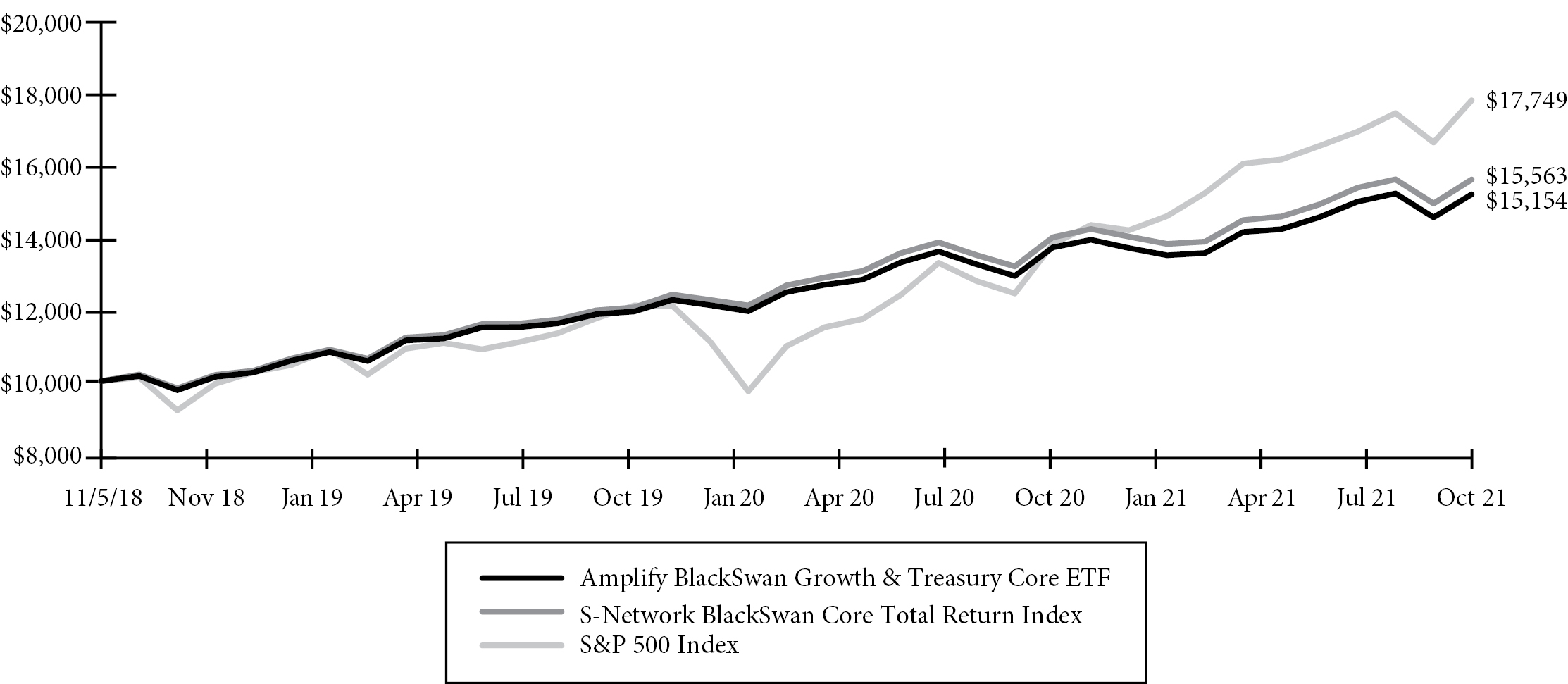

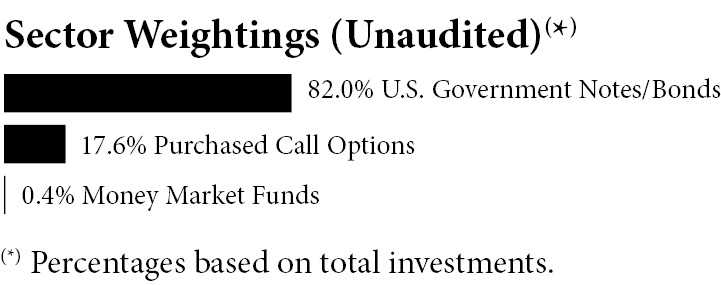

Amplify BlackSwan Growth & Treasury Core ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | ANNUALIZED RETURNS |

| | | One Year | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price |

Amplify BlackSwan Growth & Treasury Core ETF | | 17.44% | | 17.64% | | 14.93% | | 14.92% |

S-Network BlackSwan Core Total Return Index | | 18.20% | | 18.20% | | 15.96% | | 15.96% |

S&P 500 Index | | 42.91% | | 42.91% | | 21.18% | | 21.18% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

8

Amplify ETF Trust

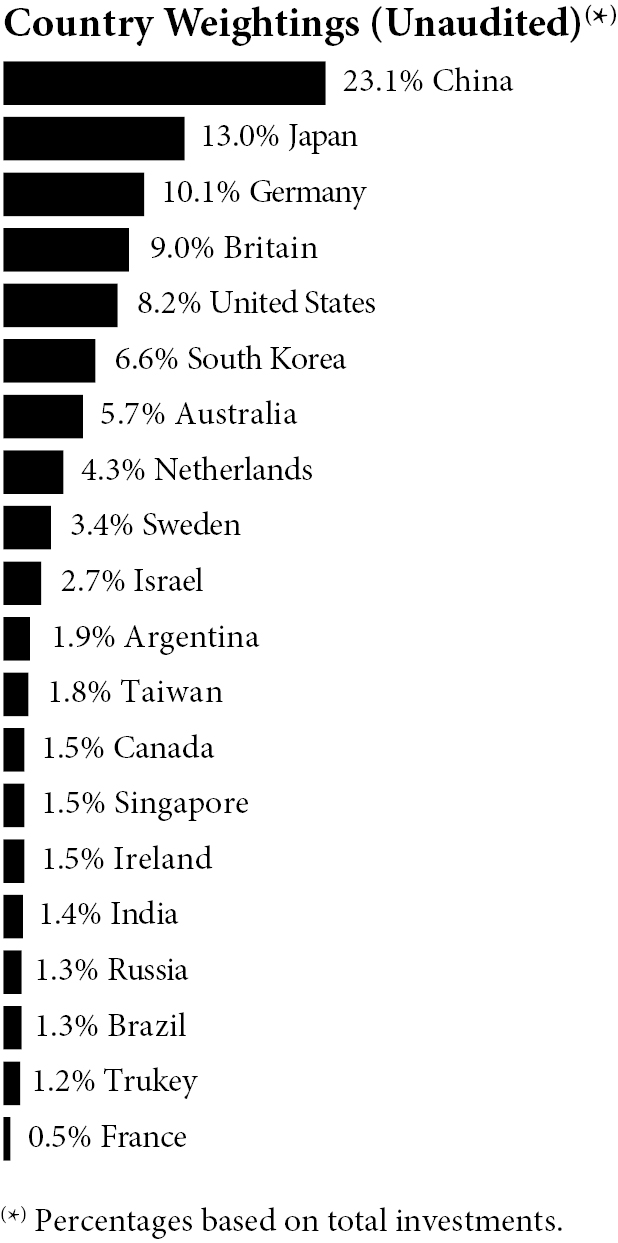

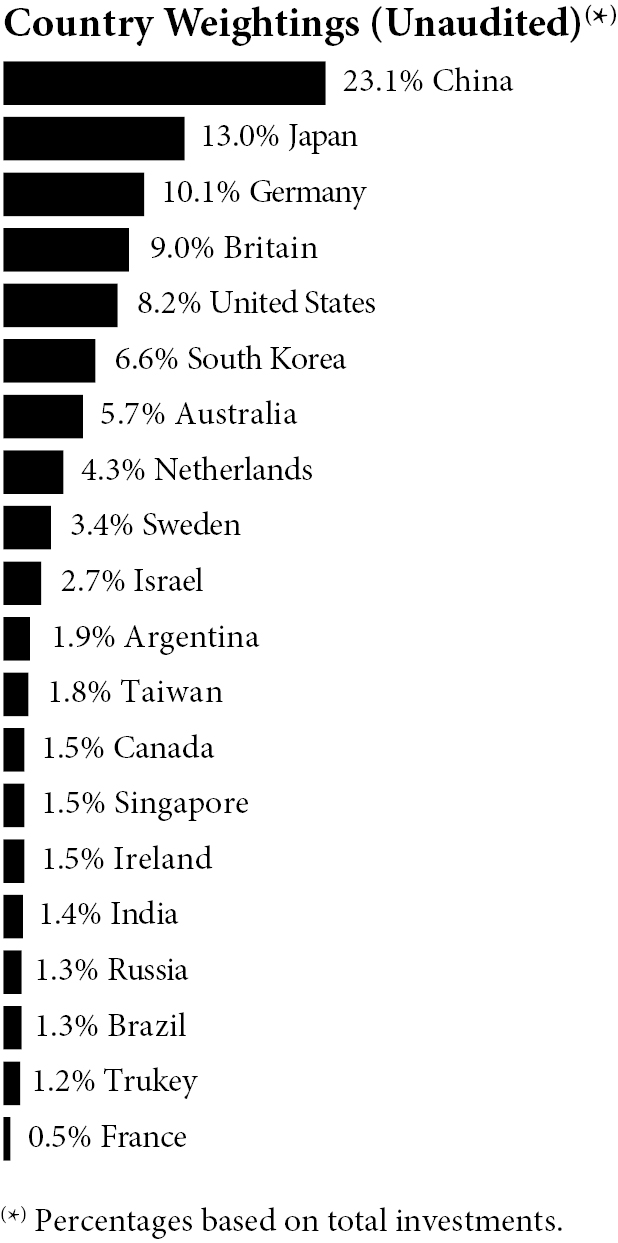

Amplify International Online Retail ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | ANNUALIZED RETURNS |

| | | One Year | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price |

Amplify International Online Retail ETF | | 4.68% | | 4.60% | | 22.35% | | 22.39% |

EQM International Ecommerce Index | | 4.99% | | 4.99% | | 23.17% | | 23.17% |

S&P 500 Index | | 42.91% | | 42.91% | | 24.59% | | 24.59% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

9

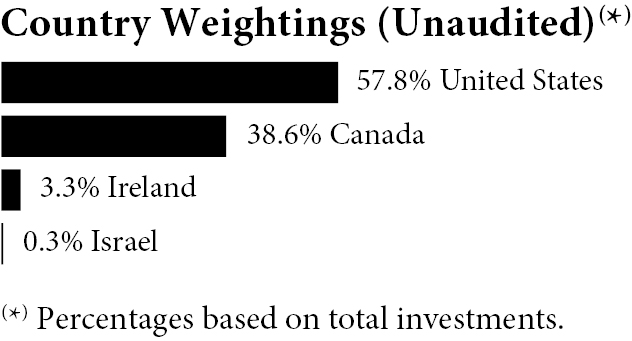

Amplify ETF Trust

Amplify Seymour Cannabis ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | ANNUALIZED RETURNS |

| | | One Year | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price | | Net Asset

Value | | Market

Price |

Amplify Seymour Cannabis ETF | | 47.93% | | 46.81% | | -13.89% | | -13.92% |

S&P 500 Index | | 42.91% | | 42.91% | | 23.06% | | 23.06% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

10

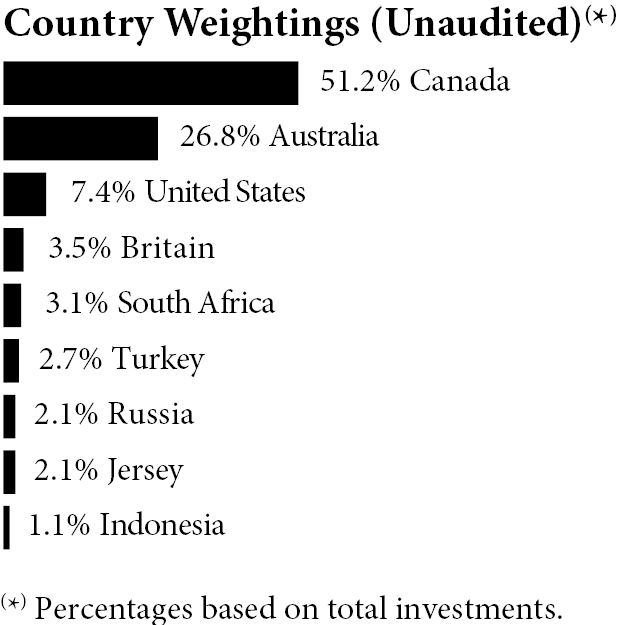

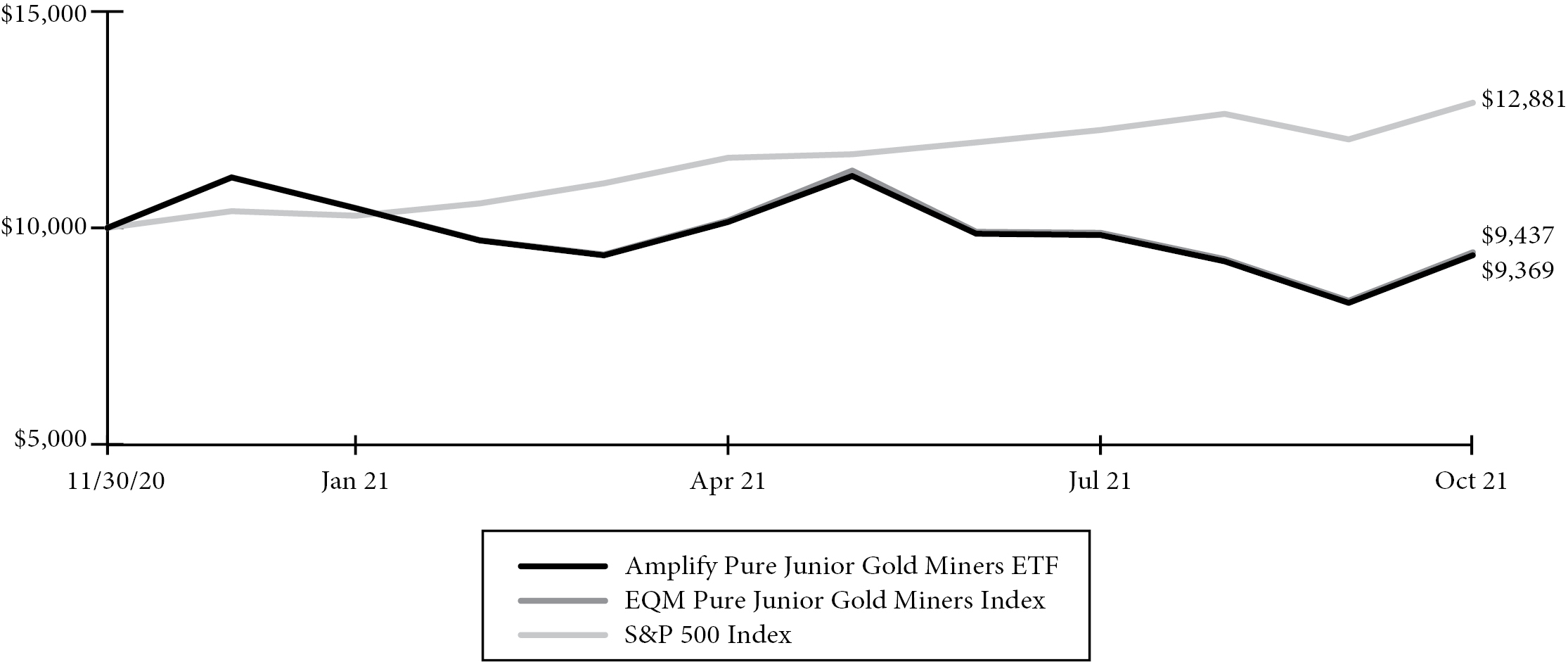

Amplify ETF Trust

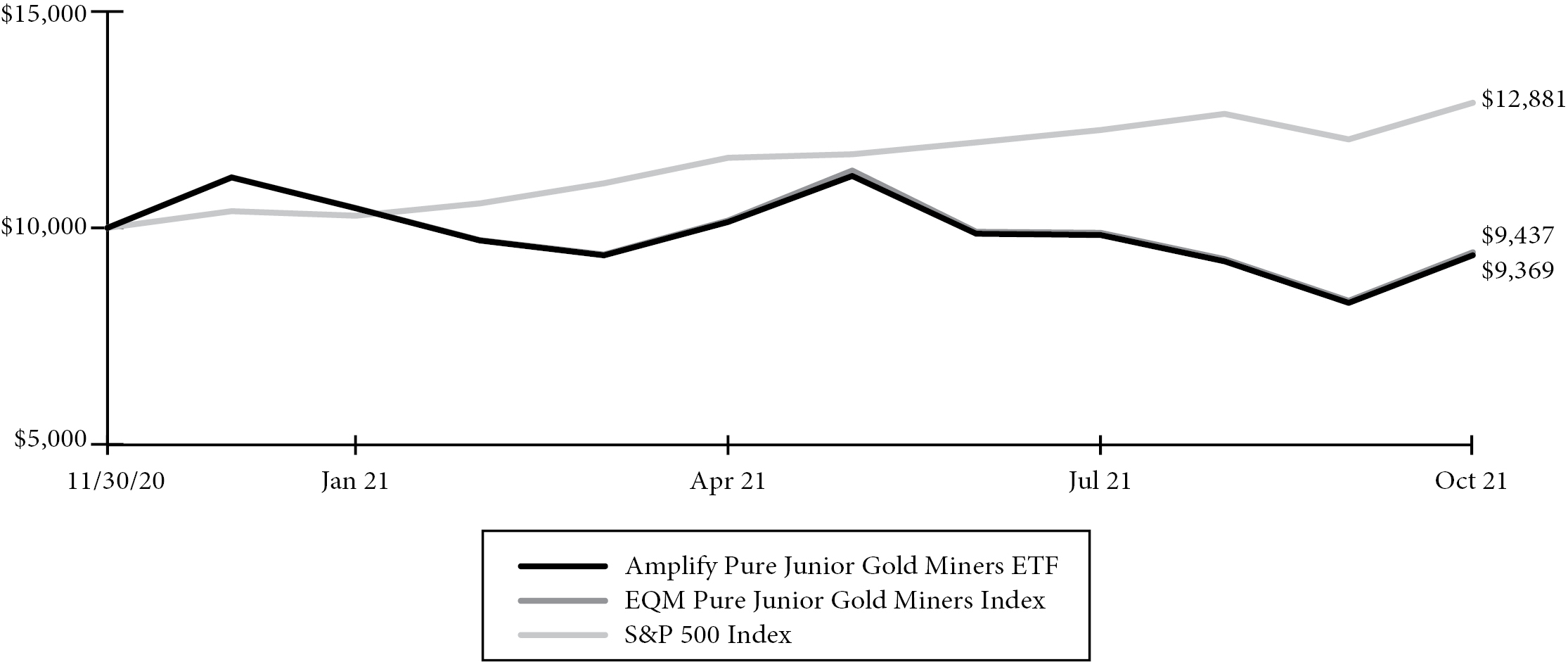

Amplify Pure Junior Gold Miners ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | TOTAL RETURN FOR THE PERIOD

ENDED OCTOBER 31, 2021 |

| | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price |

Amplify Pure Junior Gold Miners ETF | | -6.31% | | -6.08% |

EQM Pure Junior Gold Miners Index | | -5.63% | | -5.63% |

S&P 500 Index | | 28.81% | | 28.81% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

11

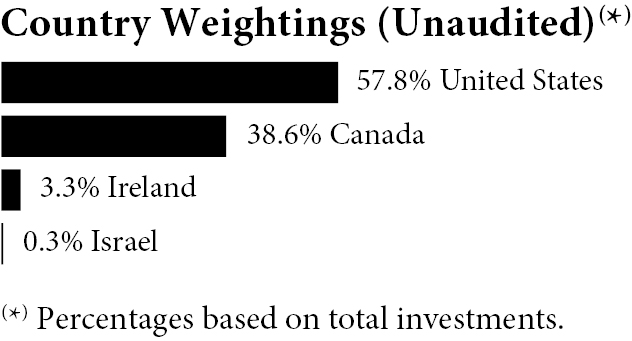

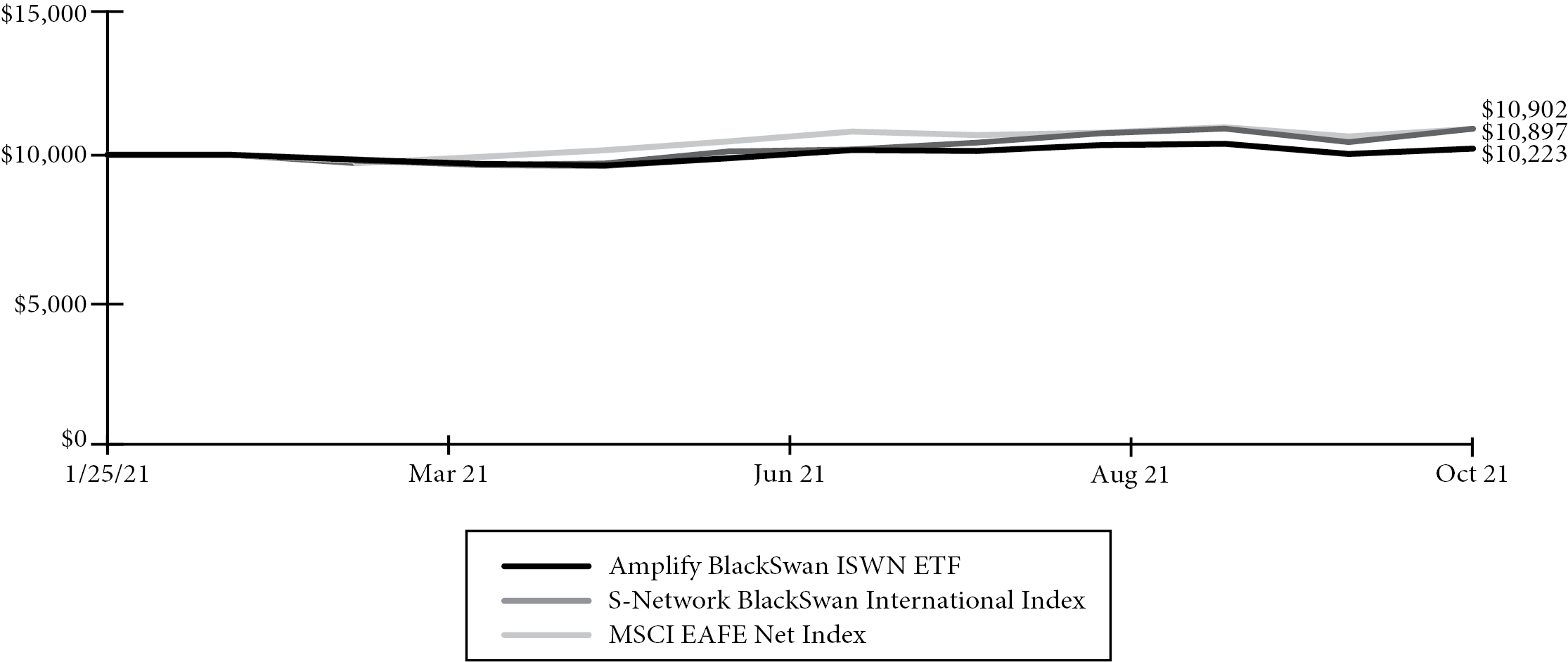

Amplify ETF Trust

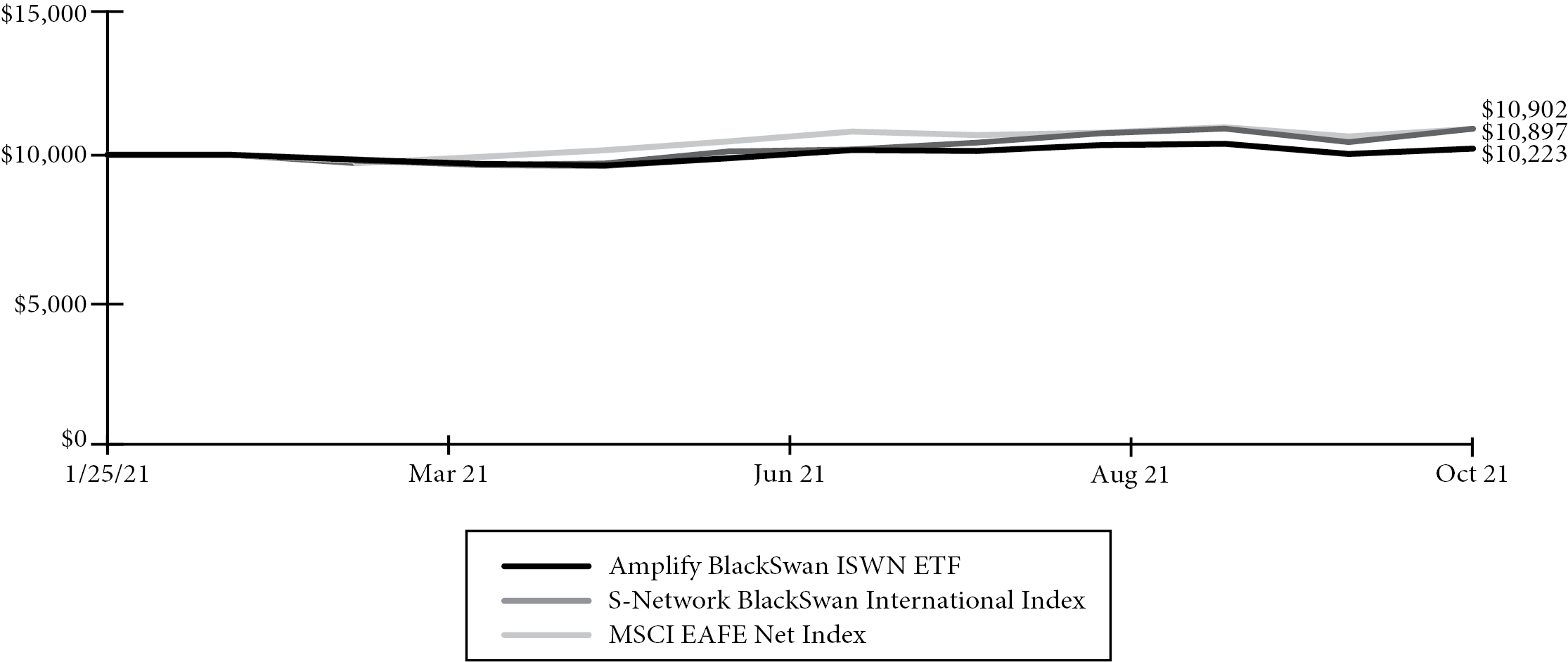

Amplify BlackSwan ISWN ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2021 |

| | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price |

Amplify BlackSwan ISWN ETF | | 2.23% | | 2.12% |

S-Network BlackSwan International Index | | 2.57% | | 2.57% |

MSCI EAFE Net Index | | 8.97% | | 8.97% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

12

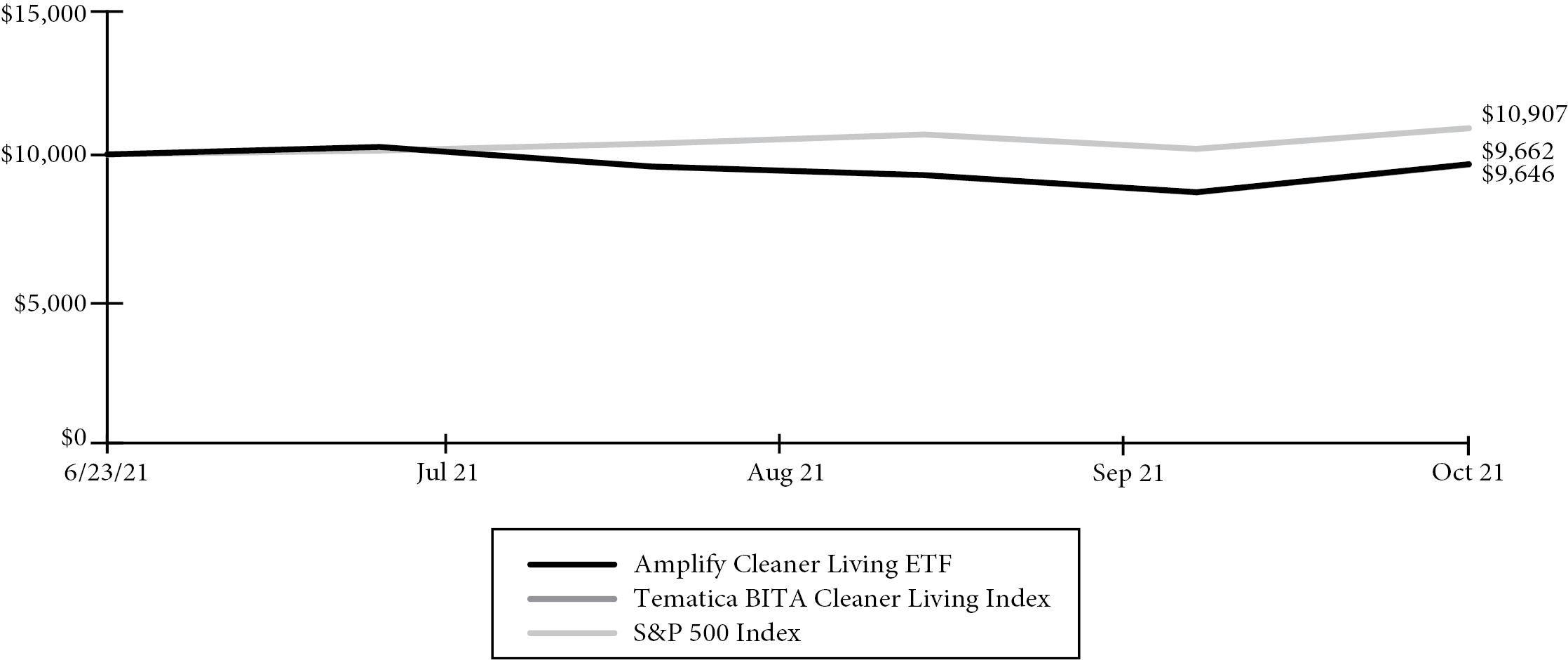

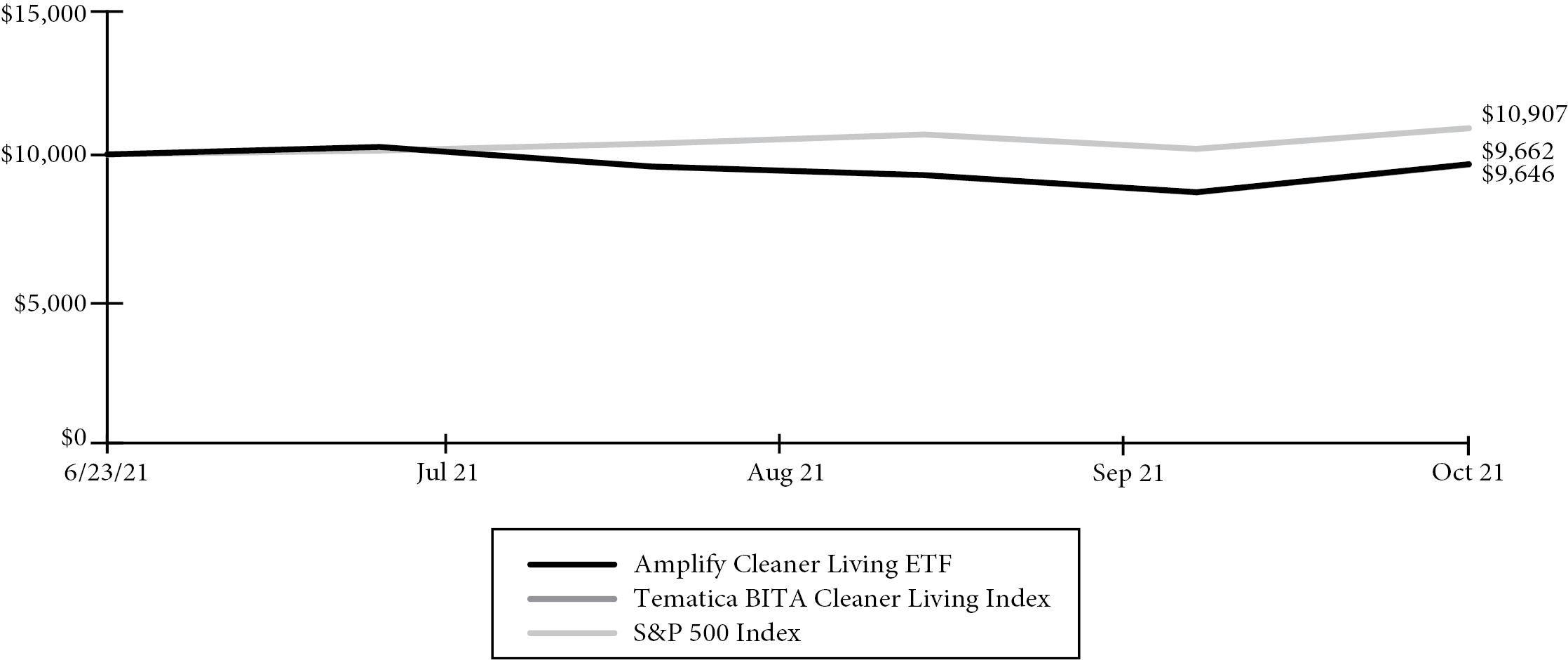

Amplify ETF Trust

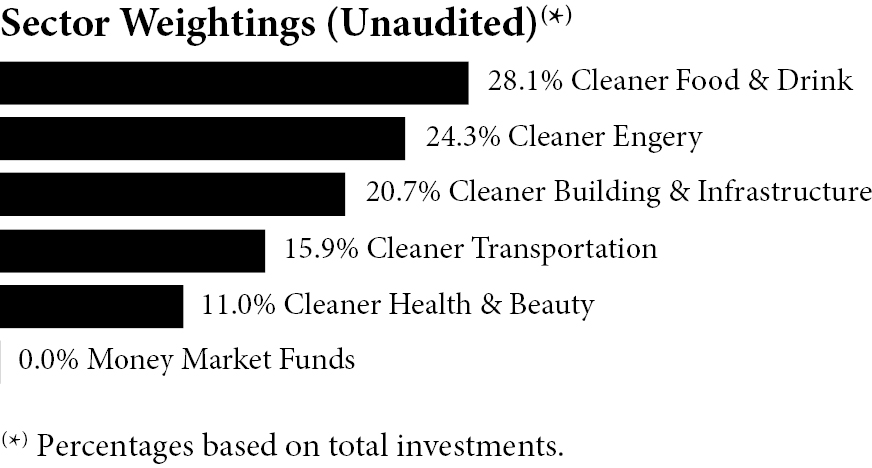

Amplify Cleaner Living ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2021 |

| | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price |

Amplify Cleaner Living ETF | | -3.54% | | -3.25% |

Tematica BITA Cleaner Living Index | | -3.38% | | -3.38% |

S&P 500 Index | | 9.07% | | 9.07% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

13

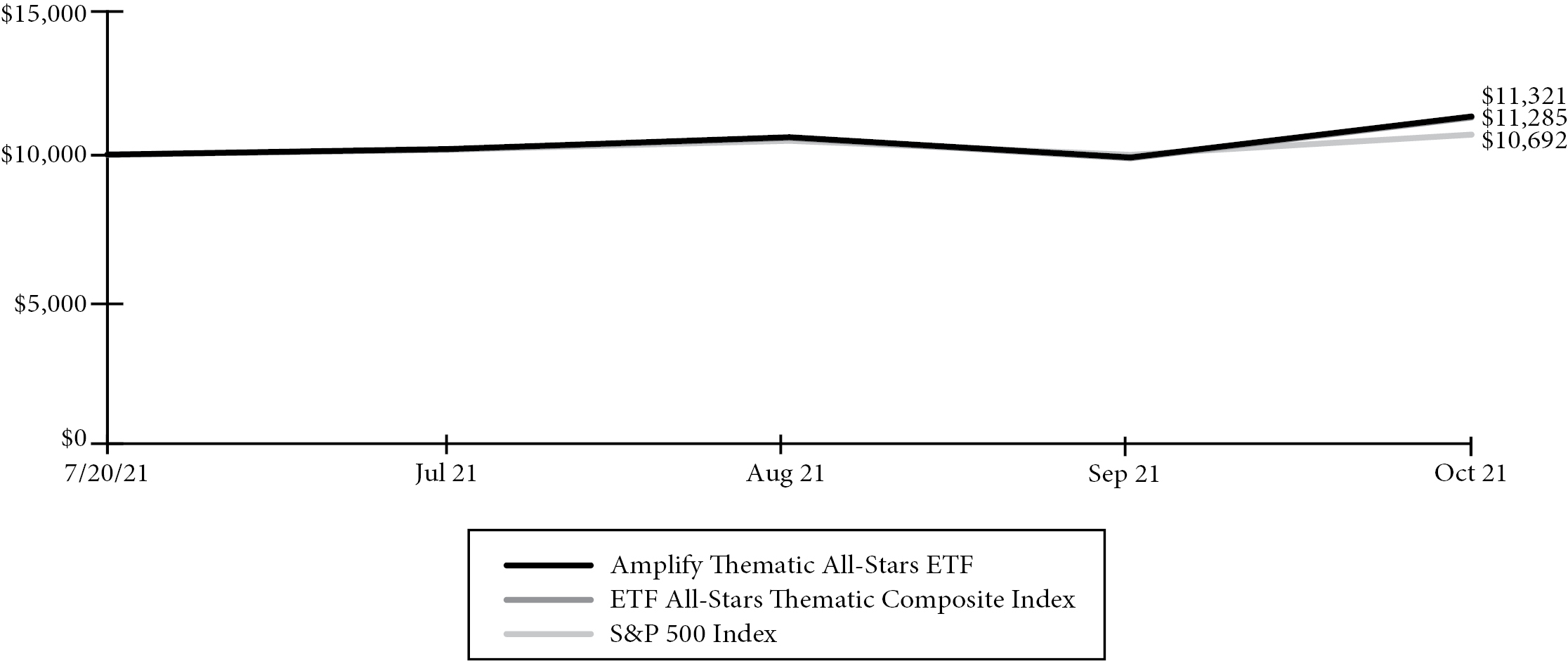

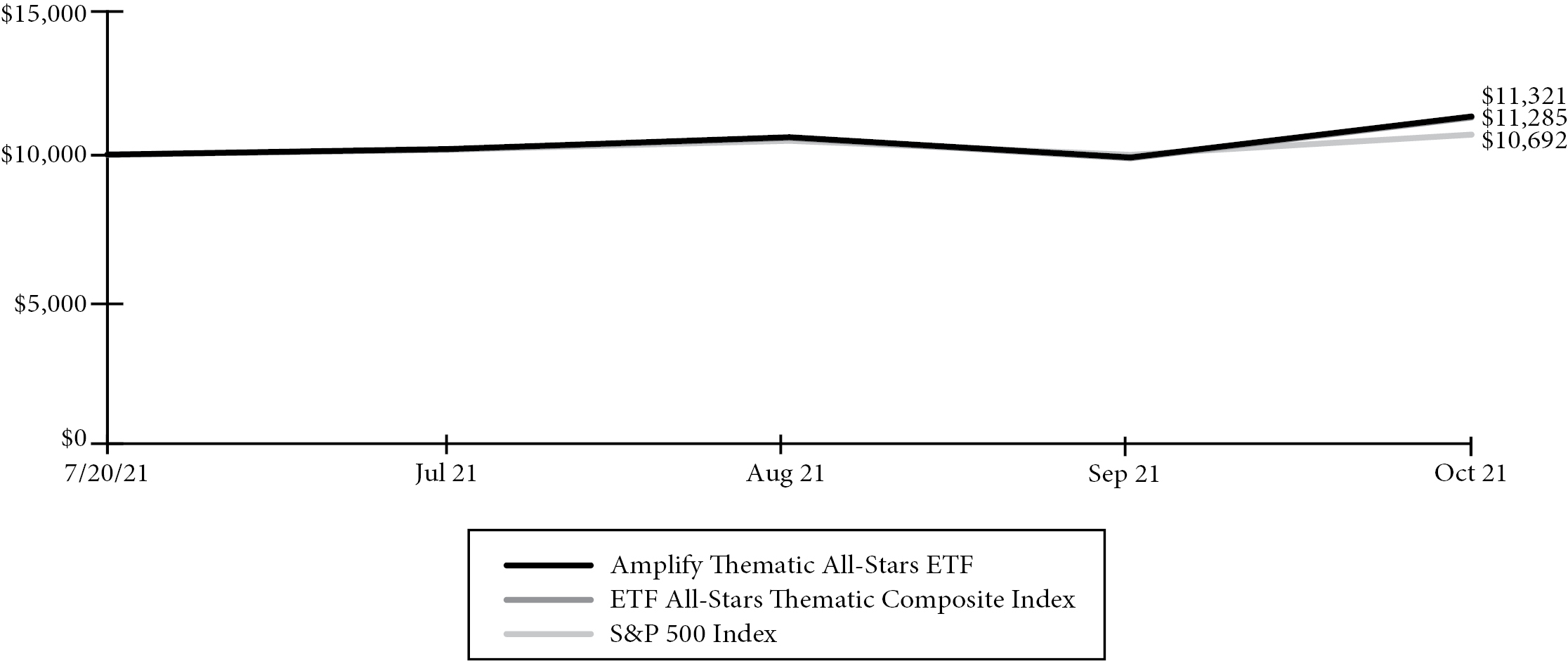

Amplify ETF Trust

Amplify Thematic All-Stars ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2021 |

| | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price |

Amplify Thematic All-Stars ETF | | 12.85% | | 13.16% |

ETF All-Stars Thematic Composite Index | | 13.21% | | 13.21% |

S&P 500 Index | | 6.92% | | 6.92% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

14

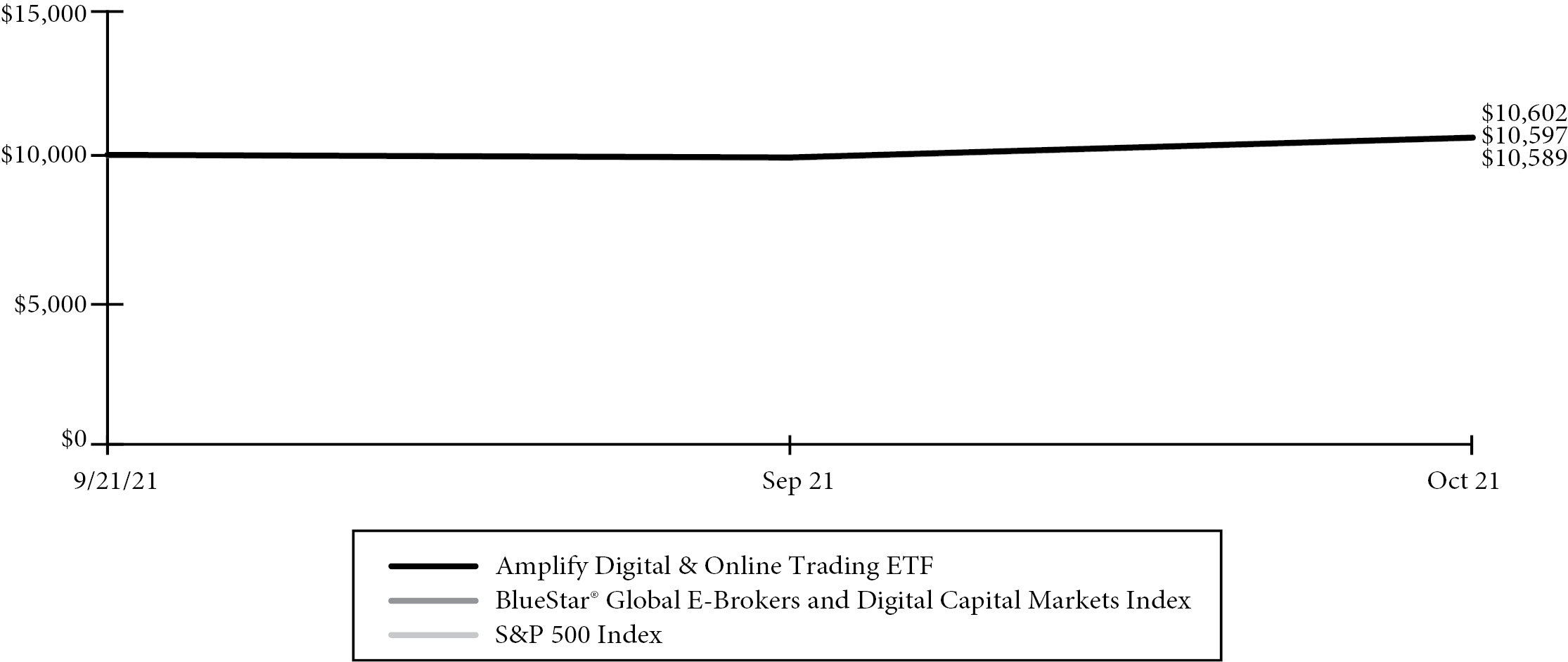

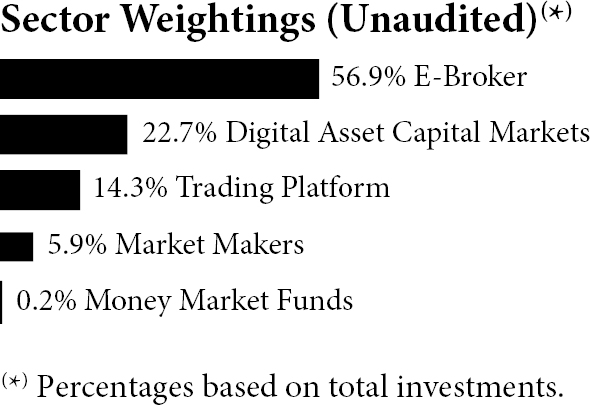

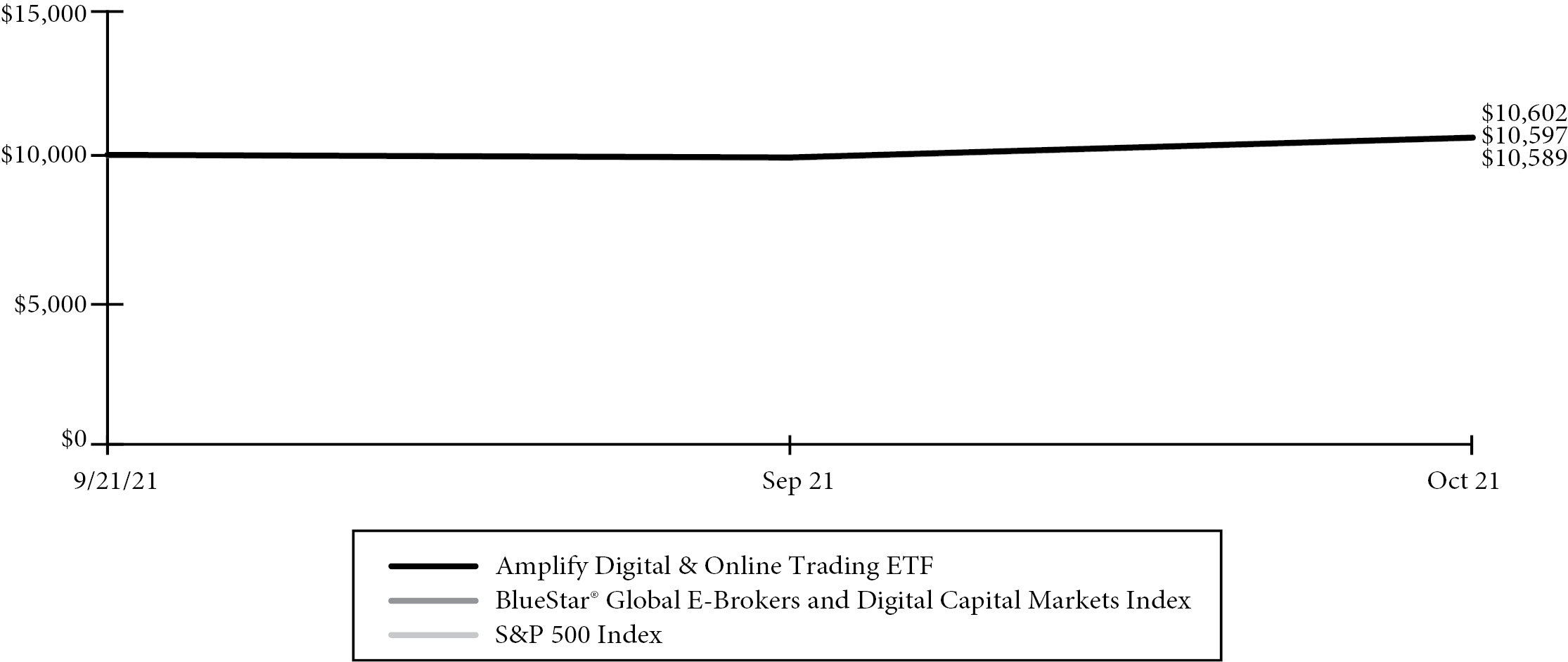

Amplify ETF Trust

Amplify Digital & Online Trading ETF

Fund Performance

October 31, 2021 (Unaudited)

Growth of a $10,000 Investment

(at Net Asset Value)

| | TOTAL RETURN FOR THE PERIOD ENDED OCTOBER 31, 2021 |

| | | Inception to Date(a) |

| | | Net Asset

Value | | Market

Price |

Amplify Digital & Online Trading ETF | | 5.97% | | 6.17% |

BlueStar® Global E-Brokers and Digital Capital Markets Index | | 6.02% | | 6.02% |

S&P 500 Index | | 5.89% | | 5.89% |

The performance data quoted herein represents past performance and the return and value of an investment in the Fund will fluctuate so that shares, when redeemed or sold in the market, may be worth more or less than their original cost. Past performance is no guarantee of future performance and should not be considered as a representation of the future results of the Fund. The Fund’s performance assumes the reinvestment of all dividends and all capital gains. Index returns assume reinvestment of dividends and, unlike a Fund’s returns, do not reflect any fees or expenses. If such fees and expenses were included in the index returns, the performance would have been lower. Please note that one cannot invest directly in an unmanaged index.

There are no assurances that the Fund will meet its stated objectives.

The Fund’s holdings and allocations are subject to change and should not be considered recommendations to buy individual securities.

Returns shown do not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption of Fund shares.

15

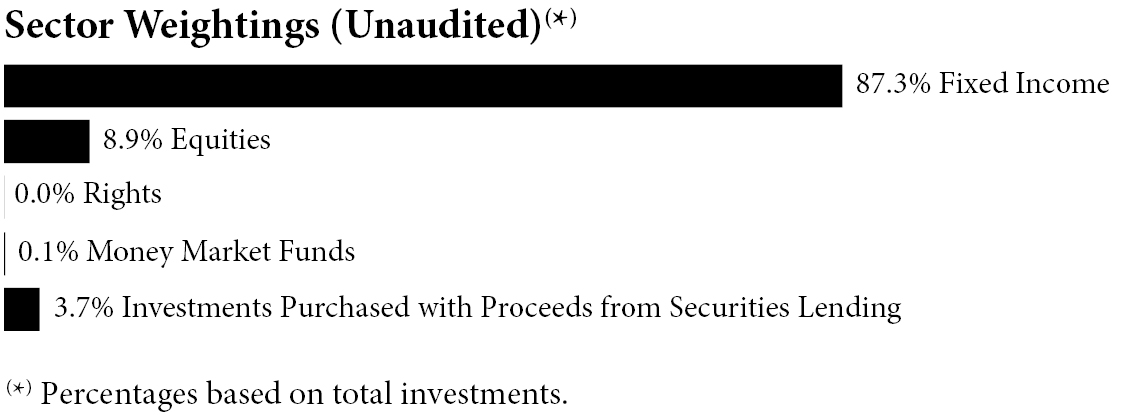

Amplify ETF Trust

Amplify High Income ETF

Schedule of Investments

October 31, 2021

Description | | Shares | | Value |

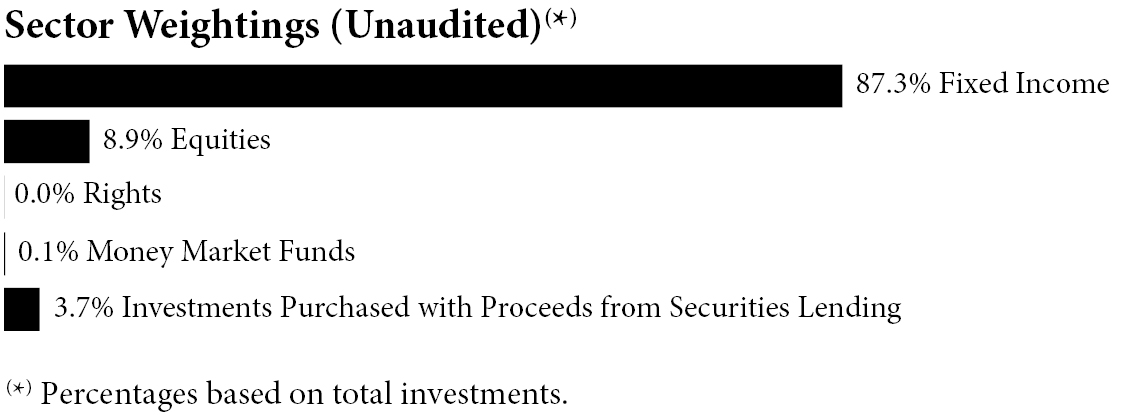

INVESTMENT COMPANIES — 99.7% | | | | | |

Equity — 9.3% | | | | | |

Aberdeen Total Dynamic

Dividend Fund | | 1,237,101 | | $ | 12,432,865 |

BlackRock Enhanced Equity

Dividend Trust | | 669,182 | | | 6,905,958 |

BlackRock Enhanced Global Dividend Trust(a) | | 287,642 | | | 3,500,603 |

John Hancock Tax-Advantaged Dividend Income Fund | | 172,217 | | | 4,224,483 |

Liberty All-Star Equity Fund(a) | | 1,723,776 | | | 14,531,432 |

| | | | | | 41,595,341 |

Fixed Income — 90.4% | | | | | |

AllianceBernstein Global High Income Fund, Inc. | | 1,043,268 | | | 12,978,254 |

BlackRock Corporate High Yield Fund, Inc. | | 705,748 | | | 8,588,953 |

BlackRock Credit Allocation Income Trust | | 869,615 | | | 13,244,236 |

BlackRock Debt Strategies Fund, Inc. | | 173,390 | | | 2,035,599 |

BlackRock Taxable Municipal

Bond Trust | | 182,562 | | | 4,772,171 |

Blackstone Strategic Credit Fund | | 921,529 | | | 12,855,330 |

Calamos Global Dynamic

Income Fund | | 297,623 | | | 3,092,303 |

DoubleLine Income Solutions Fund | | 737,425 | | | 13,022,925 |

DoubleLine Yield Opportunities Fund | | 665,199 | | | 12,931,469 |

Eaton Vance Floating-Rate Income

Trust(a) | | 676,784 | | | 10,144,992 |

Eaton Vance Limited Duration Income Fund | | 1,001,721 | | | 13,222,717 |

Eaton Vance Senior Floating - Rate Trust(a) | | 808,551 | | | 12,047,410 |

First Trust High Income Long/Short Fund | | 759,159 | | | 12,184,502 |

First Trust High Yield Opportunities 2027 Term Fund | | 644,369 | | | 13,493,087 |

First Trust Intermediate Duration Preferred & Income Fund(a) | | 134,374 | | | 3,423,850 |

Flaherty & Crumrine Preferred and Income Securities Fund, Inc. | | 115,102 | | | 2,587,493 |

Description | | Shares | | Value |

Highland Income Fund | | 970,242 | | $ | 11,051,056 |

NexPoint Strategic Opportunities Fund | | 520,844 | | | 7,911,620 |

Nuveen AMT-Free Quality Municipal Income Fund | | 451,679 | | | 6,856,487 |

Nuveen Core Plus Impact Fund(a) | | 674,781 | | | 12,490,196 |

Nuveen Credit Strategies Income Fund | | 917,136 | | | 6,043,926 |

Nuveen Floating Rate Income Fund | | 1,302,338 | | | 13,335,941 |

Nuveen Municipal Credit Opportunities Fund | | 382,066 | | | 5,746,273 |

Nuveen Preferred & Income Opportunities Fund | | 516,669 | | | 5,156,357 |

Nuveen Preferred & Income Securities Fund | | 783,150 | | | 7,784,511 |

Nuveen Quality Municipal

Income Fund | | 334,947 | | | 5,235,222 |

Oxford Lane Capital Corp. | | 2,080,916 | | | 16,647,328 |

PGIM Global High Yield Fund, Inc. | | 811,915 | | | 12,730,827 |

PGIM High Yield Bond Fund, Inc.(a) | | 790,650 | | | 13,037,818 |

PIMCO Corporate & Income Opportunity Fund | | 782,533 | | | 14,187,323 |

PIMCO Dynamic Credit and Mortgage Income Fund | | 663,575 | | | 14,266,863 |

PIMCO Dynamic Income Fund | | 516,683 | | | 13,841,938 |

PIMCO Dynamic Income Opportunities Fund | | 443,555 | | | 9,217,073 |

PIMCO High Income Fund | | 1,388,671 | | | 8,915,268 |

PIMCO Income Strategy Fund II | | 1,010,018 | | | 10,191,082 |

Templeton Global Income Fund | | 2,337,933 | | | 12,765,114 |

Virtus AllianzGI Convertible & Income Fund | | 2,162,960 | | | 13,605,018 |

Wells Fargo Income Opportunities

Fund | | 1,476,453 | | | 13,214,254 |

Western Asset Emerging Markets Debt Fund, Inc. | | 815,698 | | | 11,142,435 |

Western Asset High Income Opportunity Fund, Inc. | | 1,883,211 | | | 9,830,361 |

| | | | | | 405,829,582 |

Total Investment Companies

(Cost $432,854,808) | | | | | 447,424,923 |

| | | | | | |

RIGHTS — 0.0%(b) | | | | | |

Liberty All-Star Equity Fund(a)(c) | | 1,671,456 | | | 61,510 |

Total Rights

(Cost $0) | | | | | 61,510 |

| | | | | | |

MONEY MARKET FUNDS — 0.1% | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class — 0.03%(d) | | 479,599 | | | 479,599 |

Total Money Market Funds

(Cost $479,599) | | | | | 479,599 |

The accompanying notes are an integral part of the financial statements.

16

Amplify ETF Trust

Amplify High Income ETF

Schedule of Investments

October 31, 2021 (Continued)

Description | | Shares | | Value |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 3.8% | | | | | |

First American Government Obligations Fund - Class X — 0.03%(d) | | 17,004,950 | | $ | 17,004,950 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $17,004,950) | | | | | 17,004,950 |

| | | | | | |

Total Investments — 103.6% | | | | | |

(Cost $450,339,357) | | | | $ | 464,970,982 |

Percentages are based on Net Assets of $448,970,862.

The accompanying notes are an integral part of the financial statements.

17

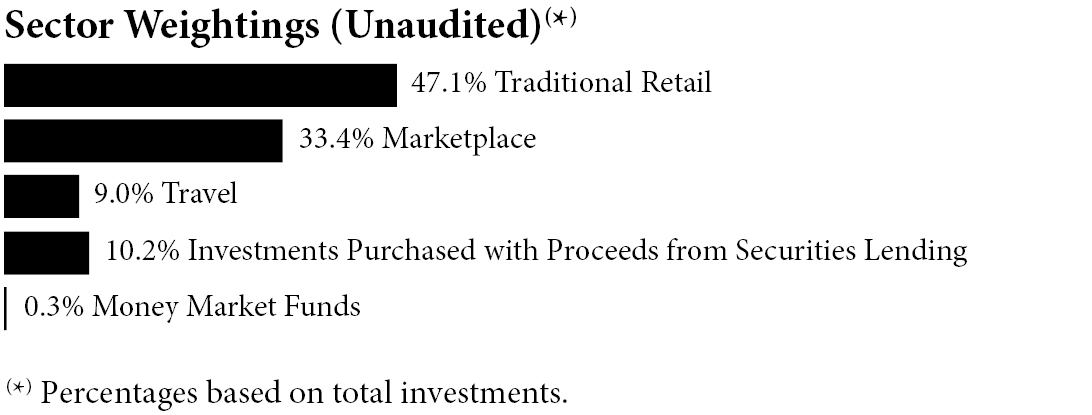

Amplify ETF Trust

Amplify Online Retail ETF

Schedule of Investments

October 31, 2021

Description | | Shares | | Value |

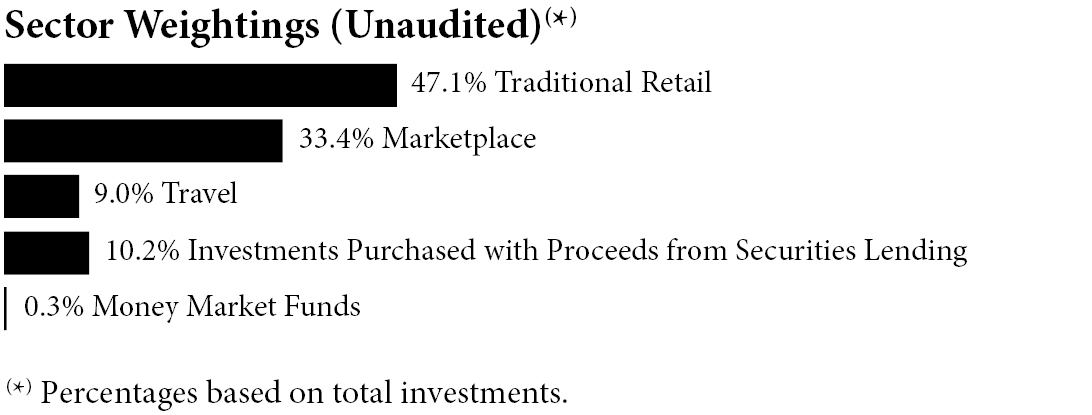

COMMON STOCKS — 99.7% | | | | | |

Marketplace — 37.2% | | | | | |

Alibaba Group Holding Ltd. - ADR(a) | | 35,159 | | $ | 5,799,125 |

BigCommerce Holdings, Inc.(a) | | 370,291 | | | 17,111,147 |

ContextLogic, Inc. - Class A(a)(b) | | 1,761,419 | | | 8,983,237 |

Copart, Inc.(a) | | 138,924 | | | 21,573,508 |

Coupang, Inc.(a) | | 202,167 | | | 6,016,490 |

Dada Nexus Ltd. - ADR(a) | | 335,218 | | | 6,808,278 |

Delivery Hero SE (a)(c) | | 57,897 | | | 7,198,223 |

DoorDash, Inc. - Class A(a) | | 122,242 | | | 23,812,742 |

Etsy, Inc.(a) | | 105,726 | | | 26,504,451 |

Fiverr International Ltd. - ADR(a) | | 43,405 | | | 7,394,042 |

Groupon, Inc. (a)(b) | | 372,929 | | | 7,913,553 |

Jumia Technologies AG - ADR(a)(b) | | 283,483 | | | 4,952,448 |

Just Eat Takeaway.com NV(a)(c) | | 281,394 | | | 20,207,150 |

KE Holdings, Inc. - ADR(a) | | 147,296 | | | 2,683,733 |

Liquidity Services, Inc.(a) | | 634,218 | | | 14,003,533 |

Lyft, Inc. - Class A(a) | | 347,322 | | | 15,931,660 |

MercadoLibre, Inc.(a) | | 5,569 | | | 8,247,800 |

Ozon Holdings PLC - ADR(a)(b) | | 131,914 | | | 5,936,130 |

PayPal Holdings, Inc.(a) | | 70,017 | | | 16,285,254 |

Pinduoduo, Inc. - ADR(a) | | 62,240 | | | 5,534,381 |

Poshmark, Inc. - Class A(a)(b) | | 471,418 | | | 11,469,600 |

Rakuten Group, Inc. | | 617,800 | | | 6,775,609 |

Shopify, Inc. - Class A - ADR(a) | | 6,793 | | | 9,963,497 |

The RealReal, Inc.(a) | | 1,192,550 | | | 15,538,927 |

ThredUp, Inc. - Class A(a)(b) | | 949,052 | | | 20,537,485 |

Uber Technologies, Inc.(a) | | 363,654 | | | 15,935,318 |

Upwork, Inc.(a) | | 431,219 | | | 20,319,039 |

| | | | | | 333,436,360 |

Traditional Retail — 52.5% | | | | | |

1-800-Flowers.com, Inc. - Class A(a) | | 522,082 | | | 16,769,274 |

Amazon.com, Inc.(a) | | 5,350 | | | 18,042,500 |

AO World PLC(a) | | 2,056,845 | | | 4,118,194 |

ASKUL Corp. | | 444,000 | | | 6,022,584 |

ASOS PLC(a) | | 105,331 | | | 3,577,823 |

CarParts.com, Inc.(a) | | 1,133,004 | | | 17,255,651 |

Carvana Co.(a) | | 72,599 | | | 22,010,565 |

Description | | Shares | | Value |

Casper Sleep, Inc.(a)(b) | | 1,811,371 | | $ | 6,593,390 |

Chegg, Inc.(a) | | 222,939 | | | 13,251,494 |

Chewy, Inc. - Class A(a)(b) | | 254,528 | | | 19,293,222 |

Cimpress PLC - ADR(a) | | 70,659 | | | 6,311,262 |

eBay, Inc. | | 284,866 | | | 21,854,919 |

Farfetch Ltd. - Class A - ADR(a) | | 175,776 | | | 6,892,177 |

HelloFresh SE(a) | | 90,492 | | | 7,322,629 |

IAC/InterActiveCorp(a) | | 110,607 | | | 16,853,189 |

iQIYI, Inc. - ADR(a)(b) | | 573,581 | | | 4,749,251 |

JD.com, Inc. - ADR(a) | | 108,067 | | | 8,459,485 |

Lands’ End, Inc.(a) | | 769,151 | | | 20,213,288 |

MYT Netherlands Parent BV - ADR(a)(b) | | 261,998 | | | 6,916,747 |

Netflix, Inc.(a) | | 34,956 | | | 24,130,476 |

Ocado Group PLC(a) | | 262,997 | | | 6,489,443 |

Overstock.com, Inc.(a) | | 242,400 | | | 23,083,752 |

Peloton Interactive, Inc. - Class A(a) | | 178,549 | | | 16,326,521 |

PetMed Express, Inc.(b) | | 611,504 | | | 17,385,059 |

Purple Innovation, Inc.(a) | | 552,705 | | | 10,667,206 |

Qurate Retail, Inc. - Class A | | 1,306,382 | | | 13,638,628 |

Revolve Group, Inc.(a) | | 365,190 | | | 27,403,858 |

Shutterstock, Inc. | | 197,523 | | | 23,929,911 |

Spotify Technology SA - ADR(a) | | 32,940 | | | 9,532,836 |

Stitch Fix, Inc. - Class A(a) | | 400,470 | | | 13,856,262 |

THG PLC(a) | | 844,686 | | | 2,503,887 |

Vipshop Holdings Ltd. - ADR(a) | | 291,789 | | | 3,256,365 |

Vroom, Inc.(a)(b) | | 443,754 | | | 8,489,014 |

Wayfair, Inc. - Class A(a)(b) | | 57,486 | | | 14,319,763 |

Zalando SE(a)(c) | | 72,129 | | | 6,802,247 |

zooplus AG(a) | | 27,099 | | | 14,986,604 |

ZOZO, Inc. | | 228,000 | | | 7,291,599 |

| | | | | | 470,601,075 |

Travel — 10.0% | | | | | |

Airbnb, Inc. - Class A(a) | | 122,132 | | | 20,843,047 |

Booking Holdings, Inc.(a) | | 7,559 | | | 18,298,676 |

Expedia Group, Inc.(a) | | 100,377 | | | 16,502,983 |

MakeMyTrip Ltd. - ADR(a) | | 299,019 | | | 9,469,932 |

On the Beach Group PLC(a)(c) | | 1,413,910 | | | 5,775,997 |

Trip.com Group Ltd. - ADR(a) | | 196,347 | | | 5,607,670 |

TripAdvisor, Inc.(a) | | 408,923 | | | 13,482,191 |

| | | | | | 89,980,496 |

Total Common Stocks

(Cost $863,942,199) | | | | | 894,017,931 |

| | | | | | |

MONEY MARKET FUNDS — 0.3% | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class — 0.03%(d) | | 3,105,588 | | | 3,105,588 |

Total Money Market Funds

(Cost $3,105,588) | | | | | 3,105,588 |

The accompanying notes are an integral part of the financial statements.

18

Amplify ETF Trust

Amplify Online Retail ETF

Schedule of Investments

October 31, 2021 (Continued)

Description | | Shares | | Value |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 11.3% | | | | | |

First American Government Obligations Fund - Class X — 0.03%(d) | | 101,273,216 | | $ | 101,273,216 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $101,273,216) | | | | | 101,273,216 |

| | | | | | |

Total Investments — 111.3% | | | | | |

(Cost $968,321,003) | | | | $ | 998,396,735 |

Percentages are based on Net Assets of $896,681,584.

ADR - American Depositary Receipt

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

19

Amplify ETF Trust

Amplify CWP Enhanced Dividend Income ETF

Schedule of Investments

October 31, 2021

Description | | Shares | | Value |

COMMON STOCKS — 77.3% | | | | | |

Consumer Discretionary — 13.5% | | | | | |

McDonald’s Corp. | | 160,743 | | $ | 39,470,444 |

NIKE, Inc. - Class B | | 147,811 | | | 24,727,302 |

The Home Depot, Inc. | | 106,341 | | | 39,531,203 |

| | | | | | 103,728,949 |

Consumer Staples — 6.1% | | | | | |

The Procter & Gamble Co. | | 157,792 | | | 22,562,678 |

Walmart, Inc. | | 164,028 | | | 24,509,064 |

| | | | | | 47,071,742 |

Energy — 7.1% | | | | | |

Chevron Corp.(a) | | 376,276 | | | 43,079,839 |

Marathon Petroleum Corp. | | 169,961 | | | 11,205,529 |

| | | | | | 54,285,368 |

Financials — 12.7% | | | | | |

Intercontinental Exchange, Inc. | | 185,550 | | | 25,691,253 |

JPMorgan Chase & Co. | | 201,888 | | | 34,298,752 |

The Goldman Sachs Group, Inc. | | 90,293 | | | 37,322,612 |

| | | | | | 97,312,617 |

Health Care — 9.1% | | | | | |

Johnson & Johnson | | 134,064 | | | 21,836,344 |

UnitedHealth Group, Inc. | | 105,018 | | | 48,357,639 |

| | | | | | 70,193,983 |

Industrials — 9.7% | | | | | |

3M Co. | | 82,600 | | | 14,758,968 |

CSX Corp. | | 671,220 | | | 24,278,027 |

Honeywell International, Inc. | | 161,192 | | | 35,239,795 |

| | | | | | 74,276,790 |

Information Technology — 16.2% | | | | | |

Apple, Inc.(a) | | 279,855 | | | 41,922,279 |

Microsoft Corp. | | 144,020 | | | 47,759,913 |

Visa, Inc. - Class A(a) | | 161,816 | | | 34,267,774 |

| | | | | | 123,949,966 |

Description | | Shares | | Value |

Utilities — 2.9% | | | | | |

Duke Energy Corp. | | 214,936 | | $ | 21,925,621 |

Total Common Stocks

(Cost $524,037,380) | | | | | 592,745,036 |

| | | | | | |

EXCHANGE TRADED FUNDS — 9.4% | | | | | |

SPDR Dow Jones Industrial Average ETF Trust | | 97,832 | | | 35,046,358 |

SPDR S&P 500 ETF Trust | | 80,540 | | | 36,987,995 |

Total Exchange Traded Funds

(Cost $71,407,466) | | | | | 72,034,353 |

| | | | | | |

Total Investments — 86.7% | | | | | |

(Cost $595,444,846) | | | | $ | 664,779,389 |

Percentages are based on Net Assets of $766,353,441.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

20

Amplify ETF Trust

Amplify CWP Enhanced Dividend Income ETF

Schedule of Options Written

October 31, 2021

| | Contracts | | Notional

Amount | | Value |

Call Options Written(a) — 0.00%(b) | | | | | | | | | | |

Apple, Inc., Expires 11/19/2021, Strike Price $165.00 | | 2,500 | | $ | (37,450,000 | ) | | $ | (43,750 | ) |

Chevron Corp., Expires 11/19/2021, Strike Price $120.00 | | 3,000 | | | (34,347,000 | ) | | | (112,500 | ) |

Visa, Inc., Expires 11/19/2021, Strike Price $225.00 | | 200 | | | (4,235,400 | ) | | | (17,100 | ) |

Total Call Options Written | | | | | | | | | | |

(Premiums Received $258,764) | | | | | | | | $ | (173,350 | ) |

The accompanying notes are an integral part of the financial statements.

21

Amplify ETF Trust

Amplify Transformational Data Sharing ETF

Schedule of Investments

October 31, 2021

Description | | Shares | | Value |

COMMON STOCKS — 87.2% | | | | | |

Banks — 4.6% | | | | | |

Silvergate Capital Corp.(a) | | 442,385 | | $ | 69,286,339 |

| | | | | | |

Diversified Financials — 22.7% | | | | | |

CME Group, Inc. | | 227,113 | | | 50,089,772 |

Coinbase Global, Inc. - Class A(a) | | 236,270 | | | 75,469,363 |

EQONEX Ltd.(a)(b) | | 1,885,859 | | | 12,918,134 |

Galaxy Digital Holdings Ltd.(a)(b) | | 2,849,814 | | | 77,094,193 |

Mogo, Inc.(a)(b) | | 4,385,716 | | | 24,077,581 |

Nocturne Acquisition Corp.(a)(e) | | 380,000 | | | 3,936,800 |

Power & Digital Infrastructure Acquisition Corp. - Class A(a)(e) | | 477,768 | | | 5,972,100 |

Robinhood Markets, Inc. - Class A(a)(b) | | 392,831 | | | 13,737,300 |

SBI Holdings, Inc./Japan | | 1,930,997 | | | 49,844,204 |

Vontobel Holding AG | | 122,234 | | | 11,307,580 |

WisdomTree Investments, Inc. | | 2,240,749 | | | 14,318,386 |

| | | | | | 338,765,413 |

Media & Entertainment — 3.4% | | | | | |

Tencent Holdings Ltd. | | 113,125 | | | 6,993,526 |

Twitter, Inc.(a) | | 273,283 | | | 14,631,572 |

Z Holdings Corp. | | 4,655,090 | | | 28,835,214 |

| | | | | | 50,460,312 |

Retailing — 3.4% | | | | | |

Overstock.com, Inc.(a) | | 470,386 | | | 44,794,859 |

Rakuten Group, Inc. | | 577,747 | | | 6,336,334 |

| | | | | | 51,131,193 |

Semiconductors & Semiconductor Equipment — 6.4% | | | | | |

Advanced Micro Devices, Inc.(a) | | 158,363 | | | 19,039,983 |

NVIDIA Corp. | | 252,204 | | | 64,480,997 |

Taiwan Semiconductor Manufacturing Co. Ltd. - ADR | | 111,798 | | | 12,711,433 |

| | | | | | 96,232,413 |

Description | | Shares | | Value |

Software & Services — 44.4% | | | | | | |

Accenture PLC - Class A | | | 77,846 | | $ | 27,930,366 |

Argo Blockchain PLC(a) | | | 22,856,985 | | | 38,162,750 |

Bakkt Holdings, Inc.(a)(b) | | | 852,609 | | | 36,252,935 |

BIGG Digital Assets, Inc.(a)(b) | | | 6,317,198 | | | 8,013,899 |

Bitfarms Ltd./Canada(a)(b) | | | 7,784,367 | | | 39,311,808 |

Cleanspark, Inc.(a)(b) | | | 910,847 | | | 18,453,760 |

Digital Garage, Inc. | | | 862,376 | | | 40,101,714 |

GMO internet, Inc. | | | 1,556,967 | | | 42,825,984 |

Hive Blockchain Technologies Ltd.(a)(b) | | | 15,442,272 | | | 54,527,092 |

Hut 8 Mining Corp.(a)(b) | | | 5,366,622 | | | 72,069,536 |

International Business Machines Corp. | | | 200,944 | | | 25,138,094 |

Marathon Digital Holdings, Inc.(a)(b) | | | 595,300 | | | 31,098,472 |

Oracle Corp. | | | 295,743 | | | 28,373,583 |

PayPal Holdings, Inc.(a) | | | 234,178 | | | 54,467,461 |

Riot Blockchain, Inc.(a)(b) | | | 1,425,652 | | | 38,806,247 |

Square, Inc. - Class A(a) | | | 220,315 | | | 56,070,168 |

Stronghold Digital

Mining, Inc. - Class A(a) | | | 336,715 | | | 9,246,194 |

Voyager Digital Ltd.(a)(b) | | | 2,846,322 | | | 43,375,592 |

| | | | | | | 664,225,655 |

Technology Hardware &

Equipment — 1.7% | | | | | | |

Canaan, Inc. - ADR(a)(b) | | | 2,437,609 | | | 20,890,309 |

Samsung Electronics Co. Ltd. | | | 81,612 | | | 4,874,860 |

| | | | | | | 25,765,169 |

Telecommunication Services — 0.6% | | | | | | |

SoftBank Group Corp. | | | 158,346 | | | 8,563,674 |

Total Common Stocks

(Cost $1,107,702,164) | | | | | | 1,304,430,168 |

| | | | Par Value | | | |

CONVERTIBLE BONDS — 1.8% | | | | | | |

Core Scientific, Inc. 4.000% Cash and 6.000% PIK, 04/19/2025(c)(f)(g) | | $ | 26,678,603 | | | 26,678,603 |

Total Convertible Bonds

(Cost $26,668,740) | | | | | | 26,678,603 |

| | | | | | | |

| | | Shares | | |

EXCHANGE TRADED FUNDS — 4.3% | | | | | | |

3iQ CoinShares Bitcoin ETF(a) | | | 2,050,874 | | | 21,431,633 |

Bitcoin ETF(a) | | | 916,554 | | | 21,804,820 |

Purpose Bitcoin ETF(a)(b) | | | 1,823,306 | | | 21,515,011 |

Total Exchange Traded Funds

(Cost $49,153,041) | | | | | | 64,751,464 |

The accompanying notes are an integral part of the financial statements.

22

Amplify ETF Trust

Amplify Transformational Data Sharing ETF

Schedule of Investments

October 31, 2021 (Continued)

Description | | Shares | | Value |

MONEY MARKET FUNDS — 6.1% | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class — 0.03%(d) | | 91,164,274 | | $ | 91,164,274 |

Total Money Market Funds

(Cost $91,164,274) | | | | | 91,164,274 |

| | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 14.3% | | | | | |

First American Government Obligations Fund - Class X — 0.03%(d) | | 213,507,916 | | | 213,507,916 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $213,507,916) | | | | | 213,507,916 |

| | | | | | |

Total Investments — 113.7% | | | | | |

(Cost $1,488,196,135) | | | | $ | 1,700,532,425 |

Percentages are based on Net Assets of $1,495,050,269.

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

23

Amplify ETF Trust

Amplify Lithium & Battery Technology ETF

Schedule of Investments

October 31, 2021

Description | | Shares | | Value |

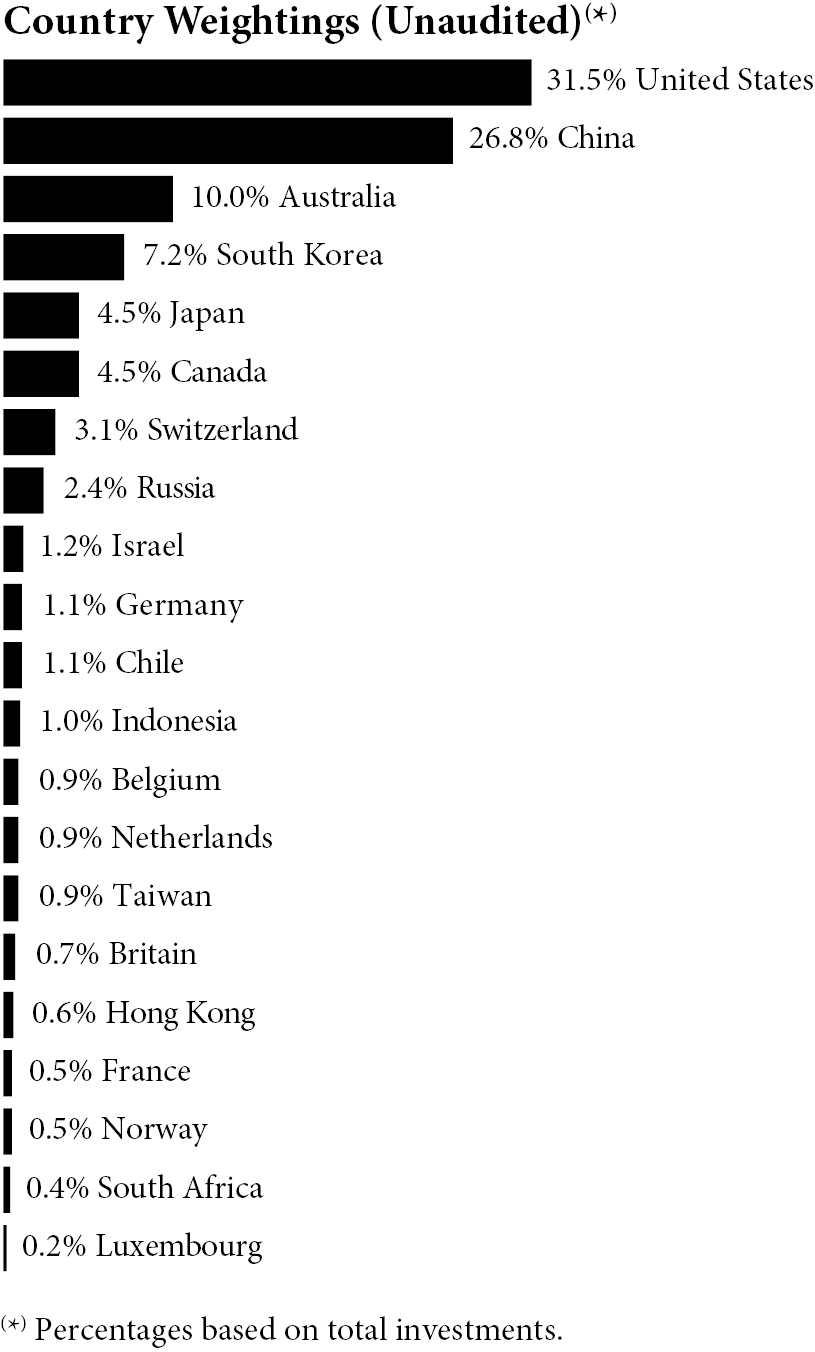

COMMON STOCKS — 99.6% | | | | | |

Consumer Discretionary — 26.4% | | | | | |

Arrival SA(a)(b) | | 30,196 | | $ | 499,140 |

BYD Co. Ltd. - Class H | | 335,102 | | | 12,774,405 |

EVgo, Inc.(a)(b) | | 149,297 | | | 1,391,448 |

Fisker, Inc.(a)(b) | | 5,200 | | | 83,460 |

Li Auto, Inc. - ADR(b) | | 98,034 | | | 3,198,850 |

Lucid Group, Inc.(a)(b) | | 146,579 | | | 5,421,957 |

NIO, Inc. - ADR(b) | | 169,135 | | | 6,665,610 |

Panasonic Corp. | | 365,528 | | | 4,465,872 |

QuantumScape Corp.(a)(b) | | 24,313 | | | 703,618 |

Tesla, Inc.(b) | | 20,442 | | | 22,772,388 |

XPeng, Inc. - ADR(b) | | 79,759 | | | 3,719,162 |

Yadea Group Holdings Ltd.(c) | | 78,830 | | | 135,765 |

| | | | | | 61,831,675 |

Industrials — 19.9% | | | | | |

Akasol AG(a)(b)(c) | | 8,532 | | | 1,248,658 |

Blink Charging Co.(a)(b) | | 38,961 | | | 1,238,960 |

ChargePoint Holdings, Inc.(b) | | 84,745 | | | 2,099,981 |

Description | | Shares | | Value |

Contemporary Amperex Technology Co. Ltd. | | 171,507 | | $ | 17,131,671 |

Ecopro BM Co. Ltd.(b) | | 6,814 | | | 2,390,192 |

EnerSys | | 15,923 | | | 1,274,477 |

Eos Energy Enterprises, Inc.(a)(b) | | 82,117 | | | 866,334 |

Eve Energy Co. Ltd. | | 245,173 | | | 4,346,550 |

FREYR Battery SA(a)(b) | | 120,878 | | | 1,224,494 |

FuelCell Energy, Inc.(a)(b) | | 216,452 | | | 1,729,452 |

GS Yuasa Corp. | | 54,228 | | | 1,177,101 |

Hyliion Holdings Corp.(a)(b) | | 134,273 | | | 1,086,269 |

Nikola Corp.(a)(b) | | 143,028 | | | 1,687,730 |

Plug Power, Inc.(b) | | 103,259 | | | 3,951,722 |

PROTERRA, Inc.(b) | | 125,101 | | | 1,402,382 |

Romeo Power, Inc.(b) | | 186,336 | | | 808,698 |

The Lion Electric Co.(a)(b) | | 98,723 | | | 1,406,803 |

Varta AG(a) | | 10,521 | | | 1,617,586 |

| | | | | | 46,689,060 |

Information Technology — 10.7% | | | | | |

Dynapack International Technology Corp. | | 322,814 | | | 1,114,413 |

Iljin Materials Co. Ltd. | | 21,319 | | | 1,833,520 |

L&F Co. Ltd. | | 15,760 | | | 2,482,920 |

NAURA Technology Group Co. Ltd. | | 66,084 | | | 3,833,807 |

NEC Corp. | | 52,612 | | | 2,686,570 |

Samsung SDI Co. Ltd. | | 9,077 | | | 5,701,526 |

Simplo Technology Co. Ltd. | | 105,639 | | | 1,135,842 |

SolarEdge Technologies, Inc.(b) | | 8,859 | | | 3,142,110 |

Wuxi Lead Intelligent Equipment Co. Ltd. | | 237,192 | | | 3,011,185 |

| | | | | | 24,941,893 |

Materials — 42.1% | | | | | |

African Rainbow Minerals Ltd. | | 75,168 | | | 1,001,567 |

Albemarle Corp. | | 17,578 | | | 4,402,762 |

AMG Advanced Metallurgical

Group NV | | 38,288 | | | 1,130,427 |

Aneka Tambang Tbk | | 8,415,027 | | | 1,389,883 |

BHP Group Ltd. - ADR(a) | | 209,146 | | | 11,469,567 |

China Molybdenum Co. Ltd. - Class H | | 4,319,132 | | | 2,681,243 |

Eramet SA(b) | | 16,649 | | | 1,391,506 |

First Quantum Minerals Ltd. | | 123,960 | | | 2,934,735 |

Ganfeng Lithium Co. Ltd. - Class H(c) | | 229,948 | | | 4,311,987 |

Glencore PLC | | 1,633,518 | | | 8,165,354 |

IGO Ltd. | | 236,694 | | | 1,716,425 |

ioneer Ltd.(b) | | 3,637,048 | | | 1,874,132 |

Jinchuan Group International Resources Co. Ltd. | | 9,467,554 | | | 1,521,039 |

Johnson Matthey PLC | | 47,806 | | | 1,788,063 |

Largo Resources Ltd.(b) | | 78,392 | | | 978,000 |

LG Chem Ltd. | | 8,831 | | | 6,317,843 |

The accompanying notes are an integral part of the financial statements.

24

Amplify ETF Trust

Amplify Lithium & Battery Technology ETF

Schedule of Investments

October 31, 2021 (Continued)

Description | | Shares | | Value |

Lithium Americas Corp.(b) | | 91,309 | | $ | 2,648,669 |

Livent Corp.(b) | | 70,028 | | | 1,976,190 |

Lundin Mining Corp. | | 202,537 | | | 1,762,543 |

Mineral Resources Ltd. | | 45,275 | | | 1,314,298 |

MMC Norilsk Nickel PJSC - ADR | | 199,095 | | | 6,229,683 |

Orocobre Ltd.(b) | | 389,494 | | | 2,607,663 |

Piedmont Lithium, Inc.(b) | | 20,828 | | | 1,298,417 |

Pilbara Minerals Ltd.(b) | | 1,030,750 | | | 1,705,834 |

Showa Denko KK | | 58,116 | | | 1,458,828 |

Sociedad Quimica y Minera de Chile SA - ADR | | 51,548 | | | 2,829,470 |

South32 Ltd. | | 989,484 | | | 2,657,282 |

Standard Lithium Ltd.(b) | | 168,018 | | | 1,907,444 |

Sumitomo Metal Mining Co. Ltd. | | 59,785 | | | 2,320,062 |

Umicore SA | | 43,409 | | | 2,487,970 |

Vale Indonesia Tbk PT | | 3,849,881 | | | 1,317,941 |

Vulcan Energy Resources Ltd.(b) | | 142,642 | | | 1,342,349 |

Western Areas Ltd.(b) | | 618,346 | | | 1,469,871 |

Yunnan Energy New Material Co. Ltd. | | 118,211 | | | 5,389,164 |

Zhejiang Huayou Cobalt Co. Ltd. | | 161,379 | | | 2,800,484 |

| | | | | | 98,598,695 |

Utilities — 0.5% | | | | | |

Fastned BV(a)(b) | | 19,024 | | | 1,139,175 |

Total Common Stocks

(Cost $206,193,000) | | | | | 233,200,498 |

| | | | | | |

MONEY MARKET FUNDS — 0.1% | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class — 0.03%(d) | | 316,257 | | | 316,257 |

Total Money Market Funds

(Cost $316,257) | | | | | 316,257 |

| | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 11.9% | | | | | |

First American Government Obligations Fund - Class X — 0.03%(d) | | 27,769,985 | | | 27,769,985 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $27,769,985) | | | | | 27,769,985 |

| | | | | | |

Total Investments — 111.6% | | | | | |

(Cost $234,279,242) | | | | $ | 261,286,740 |

Percentages are based on Net Assets of $234,137,185.

ADR - American Depositary Receipt

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

25

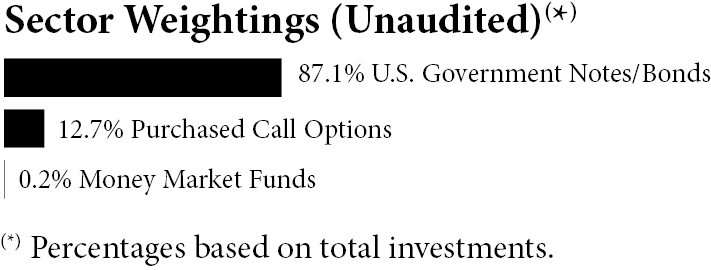

Amplify ETF Trust

Amplify BlackSwan Growth & Treasury Core ETF

Schedule of Investments

October 31, 2021

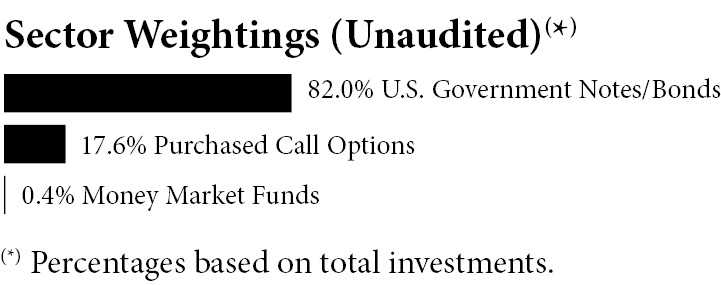

Description | | | | Par Value | | Value |

U.S. GOVERNMENT NOTES/BONDS — 81.9% | | | | | | | | |

0.125%, 04/30/2023 | | | | $ | 42,246,000 | | $ | 42,108,205 |

0.375%, 04/15/2024 | | | | | 136,686,000 | | | 135,775,649 |

0.750%, 04/30/2026 | | | | | 137,361,000 | | | 135,069,861 |

1.250%, 04/30/2028 | | | | | 137,241,000 | | | 135,903,437 |

1.125%, 02/15/2031 | | | | | 142,645,000 | | | 137,697,002 |

1.875%, 02/15/2051 | | | | | 162,794,000 | | | 159,970,542 |

Total U.S. Government Notes/Bonds

(Cost $743,870,643) | | | | | | | | 746,524,696 |

| | Contracts | | Notional

Amount | | |

PURCHASED CALL OPTIONS(a) — 17.5% | | | | | | | |

SPDR S&P 500 ETF Trust, Expires 12/17/2021, Strike Price $324.00 | | 7,124 | | $ | 327,169,700 | | 96,697,614 |

SPDR S&P 500 ETF Trust, Expires 6/17/2022, Strike Price $375.00 | | 6,887 | | | 316,285,475 | | 62,991,946 |

Total Purchased Call Options

(Cost $89,816,615) | | | | | | | 159,689,560 |

| | Shares | | | | |

MONEY MARKET FUNDS — 0.4% | | | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.03%(b) | | 3,677,816 | | | | | 3,677,816 |

Total Money Market Funds

(Cost $3,677,816) | | | | | | | 3,677,816 |

Total Investments — 99.8%

(Cost $837,365,074) | | | | | | $ | 909,892,072 |

Percentages are based on Net Assets of $911,466,600.

The accompanying notes are an integral part of the financial statements.

26

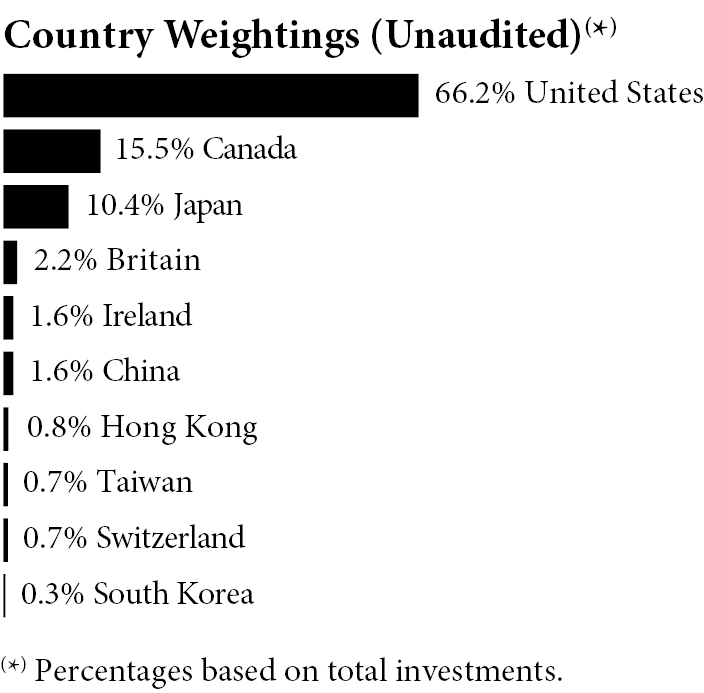

Amplify ETF Trust

Amplify International Online Retail ETF

Schedule of Investments

October 31, 2021

Description | | Shares | | Value |

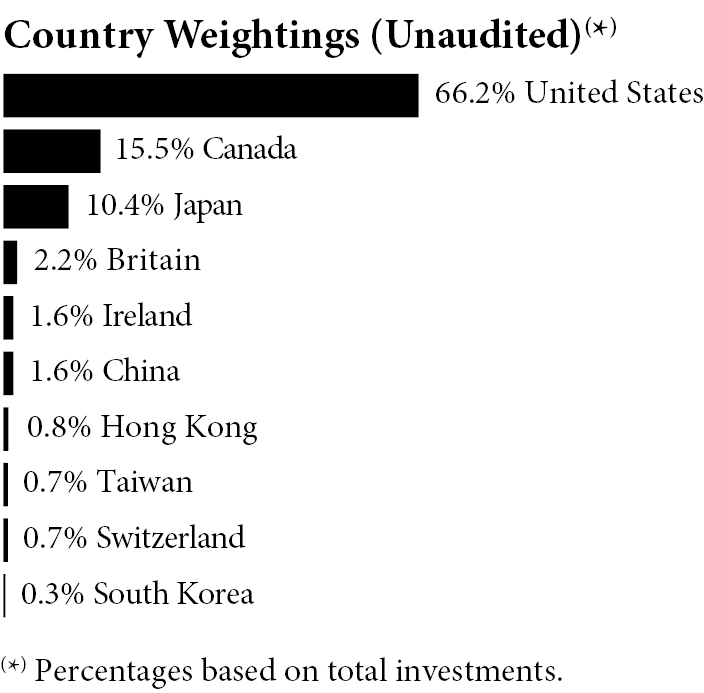

COMMON STOCKS — 99.9% | | | | | |

Marketplace — 43.0% | | | | | |

Alibaba Group Holding Ltd. - ADR(a) | | 897 | | $ | 147,951 |

Americanas SA(a) | | 28,500 | | | 150,160 |

Baozun, Inc. - ADR(a) | | 7,492 | | | 129,612 |

Coupang, Inc.(a) | | 5,932 | | | 176,536 |

Dada Nexus Ltd. - ADR(a) | | 7,049 | | | 143,165 |

Deliveroo PLC(a)(b) | | 44,898 | | | 166,353 |

Delivery Hero SE(a)(b) | | 1,301 | | | 161,925 |

Demae-Can Co. Ltd.(a) | | 10,900 | | | 130,007 |

DiDi Global, Inc. - ADR(a)(c) | | 17,749 | | | 143,234 |

DingDong Cayman Ltd. - ADR(a)(c) | | 6,011 | | | 168,488 |

Fiverr International Ltd.(a) | | 938 | | | 159,788 |

Global-e Online Ltd. - ADR(a)(c) | | 2,714 | | | 157,032 |

Jumia Technologies AG - ADR(a)(c) | | 8,950 | | | 156,356 |

Just Eat Takeaway.com NV(a)(b) | | 2,302 | | | 165,487 |

KE Holdings, Inc. - ADR(a) | | 7,473 | | | 136,158 |

Kogan.com Ltd. | | 23,430 | | | 174,927 |

Koreacenter Co. Ltd.(a) | | 29,071 | | | 174,394 |

Meituan - Class B(a)(b) | | 4,400 | | | 152,492 |

MercadoLibre, Inc.(a) | | 110 | | | 162,912 |

Mercari, Inc.(a) | | 2,700 | | | 145,626 |

Description | | Shares | | Value |

Missfresh Ltd. - ADR(a) | | 36,250 | | $ | 143,187 |

Ozon Holdings PLC - ADR(a) | | 3,385 | | | 152,325 |

Pinduoduo, Inc. - ADR(a) | | 1,507 | | | 134,002 |

Prosus NV | | 2,034 | | | 179,386 |

Rakuten Group, Inc. | | 17,200 | | | 188,555 |

Sea Ltd. - ADR(a) | | 515 | | | 176,939 |

Shopify, Inc. - Class A - ADR(a) | | 121 | | | 177,474 |

Tencent Holdings Ltd. | | 2,400 | | | 148,399 |

Uxin Ltd. - ADR(a) | | 52,918 | | | 127,003 |

Yixin Group Ltd.(a)(b) | | 750,500 | | | 140,857 |

| | | | | | 4,670,730 |

Traditional Retail — 48.7% | | | | | |

About You Holding SE(a) | | 3,261 | | | 75,476 |

AO World PLC(a) | | 37,174 | | | 74,549 |

ASKUL Corp. | | 11,300 | | | 153,210 |

ASOS PLC(a) | | 4,490 | | | 152,758 |

BHG Group AB(a) | | 12,009 | | | 138,218 |

boohoo Group PLC(a) | | 66,481 | | | 165,626 |

Boozt AB(a)(b) | | 9,940 | | | 167,470 |

China Literature Ltd.(a)(b) | | 19,600 | | | 136,436 |

Cimpress PLC(a) | | 1,973 | | | 176,228 |

Cogobuy Group(a)(b) | | 172,000 | | | 63,458 |

Danawa Co. Ltd.(a) | | 3,356 | | | 80,414 |

D-MARKET Elektronik Hizmetler

ve Ticaret AS - ADR(a) | | 29,761 | | | 135,413 |

Dustin Group AB(b) | | 8,191 | | | 100,236 |

Farfetch Ltd. - Class A(a) | | 4,447 | | | 174,367 |

HelloFresh SE(a) | | 1,763 | | | 142,816 |

Home24 SE(a) | | 5,462 | | | 71,363 |

iQIYI, Inc. - ADR(a) | | 16,496 | | | 136,587 |

Istyle, Inc.(a) | | 19,800 | | | 68,590 |

JD.com, Inc. - ADR(a) | | 1,845 | | | 144,427 |

Kitanotatsujin Corp. | | 19,900 | | | 72,253 |

LightInTheBox Holding

Co. Ltd. - ADR(a)(c) | | 36,957 | | | 55,435 |

MonotaRO Co. Ltd. | | 7,400 | | | 167,437 |

MYT Netherlands Parent BV - ADR(a) | | 6,236 | | | 164,630 |

Newegg Commerce, Inc.(a)(c) | | 10,638 | | | 125,528 |

Ocado Group PLC(a) | | 7,838 | | | 193,713 |

Oisix ra daichi, Inc.(a) | | 4,100 | | | 171,155 |

Onion Global Ltd. - ADR(a) | | 5,167 | | | 28,935 |

PChome Online, Inc. | | 40,000 | | | 208,569 |

Redbubble Ltd.(a) | | 50,449 | | | 157,253 |

Shop Apotheke Europe NV(a)(b) | | 1,085 | | | 164,485 |

So-Young International, Inc. - ADR(a) | | 12,743 | | | 50,335 |

SRP Groupe SA(a)(b) | | 26,294 | | | 64,204 |

Syuppin Co. Ltd. | | 7,200 | | | 79,372 |

Temple & Webster Group Ltd.(a) | | 18,499 | | | 176,045 |

The accompanying notes are an integral part of the financial statements.

27

Amplify ETF Trust

Amplify International Online Retail ETF

Schedule of Investments

October 31, 2021 (Continued)

Description | | Shares | | Value |

THG PLC(a) | | 27,658 | | $ | 82,118 |

Vipshop Holdings Ltd. - ADR(a) | | 12,832 | | | 143,205 |

YES24 Co. Ltd. | | 20,306 | | | 169,948 |

Zalando SE(a)(b) | | 1,951 | | | 184,190 |

Zero to Seven, Inc.(a) | | 19,665 | | | 176,700 |

zooplus AG(a) | | 290 | | | 160,552 |

ZOZO, Inc. | | 4,500 | | | 143,850 |

| | | | | | 5,297,554 |

Travel — 8.2% | | | | | |

Airtrip Corp. | | 4,500 | | | 152,138 |

Despegar.com Corp.(a) | | 6,010 | | | 66,831 |

MakeMyTrip Ltd.(a) | | 5,342 | | | 169,181 |

On the Beach Group PLC(a)(b) | | 14,478 | | | 59,239 |

Open Door, Inc.(a) | | 3,200 | | | 70,637 |

Trip.com Group Ltd. - ADR(a) | | 4,557 | | | 130,148 |

Trivago NV - ADR(a)(c) | | 28,873 | | | 76,225 |

Webjet Ltd.(a) | | 36,081 | | | 171,275 |

| | | | | | 895,674 |

Total Common Stocks

(Cost $13,209,877) | | | | | 10,863,958 |

| | | | | | |

MONEY MARKET FUNDS — 0.1% | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class — 0.03%(d) | | 9,667 | | | 9,667 |

Total Money Market Funds

(Cost $9,667) | | | | | 9,667 |

| | | | | | |

INVESTMENTS PURCHASED WITH PROCEEDS FROM SECURITIES LENDING — 8.8% | | | | | |

First American Government Obligations Fund - Class X — 0.03%(d) | | 959,654 | | | 959,654 |

Total Investments Purchased with Proceeds from Securities Lending

(Cost $959,654) | | | | | 959,654 |

| | | | | | |

Total Investments — 108.8% | | | | | |

(Cost $14,179,198) | | | | $ | 11,833,279 |

Percentages are based on Net Assets of $10,871,844.

ADR - American Depositary Receipt

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The accompanying notes are an integral part of the financial statements.

28

Amplify ETF Trust

Amplify Seymour Cannabis ETF

Schedule of Investments

October 31, 2021

Description | | Shares | | Value |

COMMON STOCKS — 68.3% | | | | | |

Consumer Discretionary — 4.3% | | | | | |

Greenlane Holdings, Inc. - Class A(a) | | 929,306 | | $ | 1,589,113 |

GrowGeneration Corp.(a) | | 134,826 | | | 2,842,132 |

| | | | | | 4,431,245 |

Consumer Staples — 5.8% | | | | | |

Neptune Wellness Solutions,

Inc. - ADR(a) | | 1,623,160 | | | 826,838 |

Village Farms International,

Inc. - ADR(a) | | 685,041 | | | 5,185,760 |

| | | | | | 6,012,598 |

Financials — 16.7% | | | | | |

AFC Gamma, Inc.(b)(c) | | 252,255 | | | 5,917,902 |

RIV Capital, Inc.(a)(d) | | 2,707,210 | | | 3,499,948 |

WM Technology, Inc.(a) | | 644,667 | | | 7,890,724 |

| | | | | | 17,308,574 |

Health Care — 32.9% | | | | | |

Aleafia Health, Inc.(a) | | 74,732 | | | 15,096 |

Arena Pharmaceuticals, Inc.(a)(b) | | 4,791 | | | 274,956 |

Auxly Cannabis Group, Inc.(a) | | 2,895,389 | | | 502,997 |

Canopy Growth Corp. - ADR(a) | | 467,875 | | | 5,909,261 |

Cara Therapeutics, Inc.(a) | | 192,351 | | | 3,237,267 |

cbdMD, Inc.(a) | | 507,635 | | | 898,514 |

Charlotte’s Web Holdings, Inc.(a) | | 1,161,176 | | | 1,895,261 |

Clever Leaves Holdings, Inc. - ADR(a)(b) | | 225,896 | | | 1,508,985 |

Cronos Group, Inc. - ADR(a) | | 487,478 | | | 2,530,011 |

IM Cannabis Corp.(a) | | 89,250 | | | 243,750 |

Jazz Pharmaceuticals Plc - ADR(a)(b) | | 21,348 | | | 2,840,181 |

MediPharm Labs Corp.(a) | | 3,247,526 | | | 656,013 |

Organigram Holdings, Inc. - ADR(a) | | 626,553 | | | 1,384,682 |

PerkinElmer, Inc. | | 81 | | | 14,328 |

The Valens Co., Inc.(a) | | 1,810,942 | | | 2,721,681 |

Tilray, Inc.(a) | | 809,890 | | | 8,341,867 |

Zynerba Pharmaceuticals, Inc.(a) | | 255,474 | | | 978,466 |

| | | | | | 33,953,316 |

Industrials — 3.8% | | | | | |

Akerna Corp.(a) | | 245,766 | | | 656,195 |

Hydrofarm Holdings Group, Inc.(a)(b) | | 100,677 | | | 3,319,321 |

| | | | | | 3,975,516 |

Description | | Shares | | Value |

Real Estate — 4.8% | | | | | |

Innovative Industrial

Properties, Inc.(b)(c) | | 18,652 | | $ | 4,907,155 |

Total Common Stocks

(Cost $113,901,907) | | | | | 70,588,404 |

| | | | | | |

MONEY MARKET FUNDS — 14.6% | | | | | |

Dreyfus Government Cash

Management — 0.030%(a)(e) | | 15,100,000 | | | 15,100,000 |

Total Money Market Funds

(Cost $15,100,000) | | | | | 15,100,000 |

| | | | | | |

Total Investments — 82.9%

(Cost $129,001,907) | | | | $ | 85,688,404 |

Percentages are based on Net Assets of $103,360,817.

ADR - American Depositary Receipt

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or ratings group indexes, and/or they may be defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

29

Amplify ETF Trust

Amplify Seymour Cannabis ETF

Schedule of Total Return Swaps

October 31, 2021

Reference Entity(a) | | Counterparty | | Long/Short | | Expiration

Date | | Financing

Rate(b) | | Payment

Frequency | | Notional

Amount | | Value/Unrealized

Appreciation

(Depreciation) |

Ayr Wellness, Inc. | | Cowen Financial Products, LLC | | Long | | 05/03/2022 | | 1.57% | | Monthly | | $ | 3,737,758 | | $ | (124,388 | ) |

Columbia Care, Inc. | | Cowen Financial Products, LLC | | Long | | 05/03/2022 | | 1.57% | | Monthly | | | 1,018,632 | | | (153,459 | ) |

Cresco Labs, Inc. | | Cowen Financial Products, LLC | | Long | | 05/03/2022 | | 1.57% | | Monthly | | | 5,686,902 | | | (184,798 | ) |

Curaleaf Holdings, Inc. | | Cowen Financial Products, LLC | | Long | | 05/03/2022 | | 1.57% | | Monthly | | | 6,514,755 | | | (551,912 | ) |

Green Thumb Industries, Inc. | | Cowen Financial Products, LLC | | Long | | 05/03/2022 | | 1.57% | | Monthly | | | 6,418,685 | | | (1,022,584 | ) |

Trulieve Cannabis Corp. | | Cowen Financial Products, LLC | | Long | | 05/03/2022 | | 1.57% | | Monthly | | | 5,361,210 | | | (225,569 | ) |

Verano Holdings Corp. | | Cowen Financial Products, LLC | | Long | | 05/03/2022 | | 1.57% | | Monthly | | | 2,300,625 | | | 78,496 | |

| | | | | | | | | | | | | | | | $ | (2,184,214 | ) |

The accompanying notes are an integral part of the financial statements.

30

Amplify ETF Trust

Amplify Pure Junior Gold Miners ETF

Schedule of Investments

October 31, 2021

Description | | Shares | | Value |

COMMON STOCKS — 99.8% | | | | | |

Materials — 99.8% | | | | | |

Alamos Gold, Inc. | | 6,013 | | $ | 44,532 |

Alkane Resources Ltd.(a) | | 64,760 | | | 43,534 |

Archi Indonesia Tbk PT(a) | | 607,950 | | | 26,176 |

Argonaut Gold, Inc.(a) | | 20,309 | | | 51,446 |

B2Gold Corp. | | 13,159 | | | 54,248 |

Caledonia Mining Corp. PLC | | 2,108 | | | 26,118 |

Calibre Mining Corp.(a) | | 20,172 | | | 24,085 |

Centamin PLC | | 37,898 | | | 48,707 |

Centerra Gold, Inc. | | 6,057 | | | 45,346 |

Coeur Mining, Inc.(a) | | 8,666 | | | 54,856 |

Dacian Gold Ltd.(a) | | 282,777 | | | 48,851 |

DRDGOLD Ltd. - ADR | | 5,198 | | | 46,886 |

Dundee Precious Metals, Inc. | | 6,694 | | | 43,959 |

Eldorado Gold Corp.(a) | | 5,249 | | | 46,877 |

Equinox Gold Corp.(a) | | 6,048 | | | 44,791 |

Evolution Mining Ltd. | | 18,620 | | | 50,767 |

Gold Road Resources Ltd. | | 44,797 | | | 46,601 |

Golden Star Resources Ltd.(a) | | 17,296 | | | 54,482 |

Gran Colombia Gold Corp. | | 10,769 | | | 44,047 |

Great Bear Resources Ltd.(a) | | 2,786 | | | 38,996 |

Great Panther Mining Ltd.(a) | | 97,506 | | | 43,127 |

Greatland Gold PLC(a) | | 130,629 | | | 31,067 |

i-80 Gold Corp.(a) | | 14,100 | | | 34,012 |

IAMGOLD Corp.(a) | | 17,954 | | | 49,391 |

Jaguar Mining, Inc. | | 7,471 | | | 25,917 |

K92 Mining, Inc.(a) | | 8,887 | | | 51,764 |

Karora Resources, Inc.(a) | | 9,745 | | | 34,749 |

Koza Altin Isletmeleri AS(a) | | 5,678 | | | 63,363 |

Lundin Gold, Inc.(a) | | 5,523 | | | 50,483 |

McEwen Mining, Inc.(a) | | 41,628 | | | 45,791 |

Novagold Resources, Inc.(a) | | 4,272 | | | 31,156 |

OceanaGold Corp.(a) | | 25,205 | | | 46,972 |

Description | | Shares | | Value |

Osisko Gold Royalties Ltd. | | 3,811 | | $ | 48,054 |

Osisko Mining, Inc.(a) | | 17,195 | | | 37,038 |

Pan African Resources PLC | | 209,515 | | | 49,742 |

Perseus Mining Ltd.(a) | | 40,759 | | | 48,370 |

Petropavlovsk PLC(a) | | 151,818 | | | 49,612 |

Pretium Resources, Inc.(a) | | 4,261 | | | 51,460 |

Ramelius Resources Ltd. | | 40,170 | | | 47,973 |

Red 5 Ltd.(a) | | 87,242 | | | 17,037 |

Regis Resources Ltd. | | 28,893 | | | 43,403 |

Resolute Mining Ltd.(a) | | 138,544 | | | 43,705 |

Royal Gold, Inc. | | 625 | | | 61,887 |

Sabina Gold & Silver Corp.(a) | | 18,973 | | | 21,582 |

Seabridge Gold, Inc.(a) | | 2,246 | | | 41,416 |

Silver Lake Resources Ltd.(a) | | 39,762 | | | 50,622 |

SSR Mining, Inc. | | 3,159 | | | 49,747 |

St Barbara Ltd. | | 41,298 | | | 45,443 |

Torex Gold Resources, Inc.(a) | | 4,142 | | | 48,085 |

Wesdome Gold Mines Ltd.(a) | | 5,675 | | | 50,956 |

West African Resources Ltd.(a) | | 47,798 | | | 46,671 |

Westgold Resources Ltd. | | 32,338 | | | 47,364 |

Yamana Gold, Inc. | | 11,305 | | | 44,324 |

| | | | | | 2,337,588 |

Total Common Stocks

(Cost $2,619,623) | | | | | 2,337,588 |

| | | | | | |

MONEY MARKET FUNDS — 0.2% | | | | | |

Invesco Government & Agency Portfolio - Institutional

Class — 0.03%(b) | | 5,135 | | | 5,135 |

Total Money Market Funds

(Cost $5,135) | | | | | 5,135 |

| | | | | | |

Total Investments — 100.0% | | | | | |

(Cost $2,624,758) | | | | $ | 2,342,723 |

Percentages are based on Net Assets of $2,342,344.

ADR - American Depositary Receipt

For Fund compliance purposes, the Fund’s industry classifications refer to any one or more of the industry sub-classifications used by one or more widely recognized market indexes or rating group indexes, and/or they may be defined by Fund management. This definition may not apply for purposes of this report, which may combine sub-classifications for reporting ease. Industries are shown as a percentage of net assets.

The Global Industry Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services LLC (“S&P”). GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by U.S. Bank Global Fund Services.

The accompanying notes are an integral part of the financial statements.

31

Amplify ETF Trust

Amplify BlackSwan ISWN ETF

Schedule of Investments

October 31, 2021

Description | | | | Par Value | | Value |

U.S. GOVERNMENT NOTES/BONDS — 86.9% | | | | | | | | |

0.125%, 04/30/2023 | | | | $ | 2,112,000 | | $ | 2,105,111 |

0.375%, 04/15/2024 | | | | | 6,880,000 | | | 6,834,178 |

0.750%, 04/30/2026 | | | | | 6,902,000 | | | 6,786,877 |

1.250%, 04/30/2028 | | | | | 6,889,000 | | | 6,821,859 |

1.125%, 02/15/2031 | | | | | 7,215,000 | | | 6,964,730 |

1.875%, 02/15/2051 | | | | | 8,306,000 | | | 8,161,943 |

Total U.S. Government Notes/Bonds

(Cost $37,532,145) | | | | | | | | 37,674,698 |

| | Contracts | | Notional

Amount | | |

PURCHASED CALL OPTIONS(a) — 12.7% | | | | | | | |

iShares MSCI EAFE ETF, Expires 12/17/2021, Strike Price $63.00 | | 1,917 | | $ | 15,429,933 | | 3,393,090 |

iShares MSCI EAFE ETF, Expires 6/17/2022, Strike Price $72.00 | | 2,088 | | | 16,806,312 | | 2,114,100 |

Total Purchased Call Options

(Cost $5,112,671) | | | | | | | 5,507,190 |

| | Shares | | | | |

MONEY MARKET FUNDS — 0.2% | | | | | | | |

Invesco Government & Agency Portfolio - Institutional Class — 0.03%(b) | | 98,010 | | | | | 98,010 |

Total Money Market Funds

(Cost $98,010) | | | | | | | 98,010 |

| | | | | | | | |

Total Investments — 99.8% | | | | | | | |

(Cost $42,742,826) | | | | | | $ | 43,279,898 |

Percentages are based on Net Assets of $43,353,422.

The accompanying notes are an integral part of the financial statements.

32

Amplify ETF Trust

Amplify Cleaner Living ETF

Schedule of Investments

October 31, 2021

Description | | Shares | | Value |

COMMON STOCKS — 100.0% | | | | | |

Cleaner Building &

Infrastructure — 20.7% | | | | | |

Array Technologies, Inc.(a) | | 1,030 | | $ | 21,991 |

Ballard Power Systems, Inc.(a) | | 914 | | | 16,565 |

Beam Global(a) | | 478 | | | 15,057 |

Blink Charging Co.(a) | | 422 | | | 13,420 |

Bloom Energy Corp. - Class A(a) | | 650 | | | 20,319 |

Daqo New Energy Corp. - ADR(a) | | 242 | | | 18,825 |

Enphase Energy, Inc.(a) | | 112 | | | 25,943 |

FuelCell Energy, Inc.(a) | | 1,572 | | | 12,560 |

Hannon Armstrong Sustainable Infrastructure Capital, Inc.(b) | | 308 | | | 18,603 |

JinkoSolar Holding Co. Ltd. - ADR(a) | | 360 | | | 21,535 |

Schnitzer Steel Industries, Inc. | | 298 | | | 16,032 |

SolarEdge Technologies, Inc.(a) | | 68 | | | 24,118 |

TPI Composites, Inc.(a) | | 376 | | | 12,645 |

Trex Co., Inc.(a) | | 166 | | | 17,662 |

| | | | | | 255,275 |