SEMI-ANNUAL REPORT

April 30, 2017

Amplify ETF Trust

Table of Contents

| SCHEDULES OF INVESTMENTS | 2 |

| STATEMENTS OF ASSETS AND LIABILITIES | 6 |

| STATEMENTS OF OPERATIONS | 7 |

| STATEMENTS OF CHANGES IN NET ASSETS | 8 |

| FINANCIAL HIGHLIGHTS | 11 |

| NOTES TO THE FINANCIAL STATEMENTS | 14 |

| BOARD CONSIDERATIONS REGARDING APPROVAL OF INVESTMENT MANAGEMENT AGREEMENT AND SUB-ADVISORY AGREEMENT | 26 |

| DISCLOSURE OF FUND EXPENSES | 28 |

| SUPPLEMENTAL INFORMATION | 30 |

| PRIVACY POLICY | 31 |

Amplify ETF Trust (the “Trust”) files its complete schedule of fund holdings with the Securities and Exchange Commission (the “Commission”) for the first and third quarters of each fiscal year on Form N-Q within sixty days after the end of the period. The Trust’s Form N-Qs are available on the Commission’s website at www.sec.gov, and may be reviewed and copied at the Commission’s Public Reference Room in Washington, DC. Information on the operation of the Public Reference Room may be obtained by calling 1-800-SEC-0330.

A description of the policies and procedures that Amplify Investments, LLC (the “Adviser”) uses to determine how to vote proxies relating to portfolio securities, as well as information relating to how a fund voted proxies relating to portfolio securities during the most recent 12-month period ended June 30, is available (i) without charge, upon request, by calling 1-855-267-3837 and (ii) on the Commission’s website at www.sec.gov.

1

Amplify ETF Trust

Amplify Online Retail ETF

Schedule of Investments

April 30, 2017 (Unaudited)

| Description | | Shares | | | Fair

Value | |

| COMMON STOCKS — 99.8% | | | | | | |

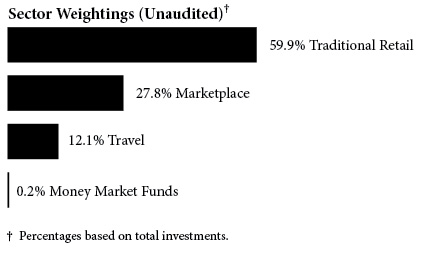

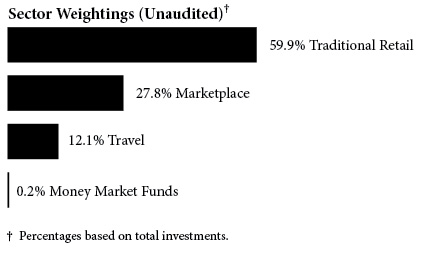

| Marketplace — 27.8% | | | | | | |

Alibaba Group Holding Ltd. - ADR (a) | | | 1,782 | | | $ | 205,821 | |

Copart, Inc. (a) | | | 15,162 | | | | 468,506 | |

Etsy, Inc. (a) | | | 35,563 | | | | 382,658 | |

GrubHub, Inc. (a) | | | 10,452 | | | | 449,227 | |

InterActiveCorp (a) | | | 6,179 | | | | 512,919 | |

Just Eat PLC (a) | | | 24,293 | | | | 181,549 | |

| MercadoLibre, Inc. | | | 995 | | | | 227,765 | |

PayPal Holdings, Inc. (a) | | | 9,801 | | | | 467,704 | |

| Rakuten, Inc. | | | 15,700 | | | | 160,697 | |

RetailMeNot, Inc. (a) | | | 45,435 | | | | 527,046 | |

Shopify, Inc. (a) | | | 4,242 | | | | 322,180 | |

| | | | | | | | 3,906,072 | |

| Traditional Retail — 59.9% | | | | | | | | |

1-800-Flowers.com, Inc. (a) | | | 40,439 | | | | 434,719 | |

Amazon.com, Inc. (a) | | | 523 | | | | 483,770 | |

| ASKUL Corp. | | | 4,400 | | | | 128,083 | |

ASOS PLC (a) | | | 2,631 | | | | 198,327 | |

Cimpress NV (a) | | | 1,974 | | | | 162,026 | |

Ebay, Inc. (a) | | | 14,294 | | | | 477,563 | |

FTD Companies, Inc. (a) | | | 19,441 | | | | 388,820 | |

| HSN, Inc. | | | 11,137 | | | | 410,955 | |

JD.com, Inc. - ADR (a) | | | 6,852 | | | | 240,300 | |

Jumei International Holding Ltd. - ADR (a) | | | 34,205 | | | | 113,219 | |

Lands' End, Inc. (a) | | | 22,909 | | | | 540,652 | |

Netflix, Inc. (a) | | | 3,308 | | | | 503,478 | |

| Nutrisystem, Inc. | | | 12,143 | | | | 649,043 | |

Overstock.com, Inc. (a) | | | 25,115 | | | | 435,745 | |

| PetMed Express, Inc. | | | 20,543 | | | | 474,543 | |

Liberty Interactive Corp (a) | | | 19,967 | | | | 422,901 | |

Shutterfly, Inc. (a) | | | 8,156 | | | | 423,296 | |

Stamps.com, Inc. (a) | | | 3,890 | | | | 412,923 | |

| Start Today Co Ltd. | | | 10,200 | | | | 217,771 | |

Vipshop Holdings Ltd. - ADR (a) | | | 13,330 | | | | 184,887 | |

Wayfair, Inc. (a) | | | 11,889 | | | | 543,446 | |

Yoox Net-A-Porter Group SpA (a) | | | 6,287 | | | | 167,102 | |

Zalando SE (a)(b) | | | 4,208 | | | | 185,574 | |

zooplus AG (a) | | | 1,229 | | | | 229,797 | |

| | | | | | | | 8,428,940 | |

| Travel — 12.1% | | | | | | | | |

Ctrip.com International Ltd. - ADR (a) | | | 4,071 | | | | 205,626 | |

| Expedia, Inc. | | | 3,245 | | | | 433,921 | |

MakeMyTrip Ltd. (a) | | | 6,463 | | | | 248,179 | |

Priceline Group, Inc. (a) | | | 256 | | | | 472,786 | |

TripAdvisor, Inc. (a) | | | 7,681 | | | | 345,722 | |

| | | | | | | | 1,706,234 | |

Total Common Stocks (Cost $12,511,756) | | | | | | | 14,041,246 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 0.2% | | | | | | | | |

STIT - Government & Agency Porfolio - Class I - 0.68% (c) | | | 32,116 | | | | 32,116 | |

Total Money Market Funds (Cost $32,116) | | | | | | | 32,116 | |

| | | | | | | | | |

Total Investments — 100.0% (Cost $12,543,872) | | | | | | $ | 14,073,362 | |

Percentages are based on Net Assets of $14,073,498.

ADR - American Depositary Receipt

(a) | Non-income producing security. |

(b) | Restricted securities as defined in Rule 144(a) under the Securities Act of 1933. Such securities are treated as liquid securities, according to the Funds’ liquidity guidelines. The value of those securities total $185,574 or 1.3% of net assets. |

(c) | Seven-day yield as of April 30, 2017. |

The accompanying notes are an integral part of the financial statements.

2

Amplify ETF Trust

Amplify YieldShares Prime 5 Dividend ETF

Schedule of Investments

April 30, 2017 (Unaudited)

| Description | | Shares | | | Fair

Value | |

| EXCHANGE TRADED FUNDS — 99.8% | | | | | | |

| First Trust Morningstar Dividend Leaders Index | | | 9,033 | | | $ | 257,441 | |

| Schwab U.S. Large-Cap Value ETF | | | 5,387 | | | | 267,626 | |

| Schwab U.S. Dividend Equity ETF | | | 6,893 | | | | 308,048 | |

| Vanguard High Dividend Yield ETF | | | 3,566 | | | | 276,686 | |

| WisdomTree LargeCap Dividend Fund | | | 3,165 | | | | 262,948 | |

Total Exchange Traded Funds (Cost $1,315,514) | | | | | | | 1,372,749 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 0.2% | | | | | | | | |

STIT - Government & Agency Porfolio - Class I - 0.68% (a) | | | 2,640 | | | | 2,640 | |

Total Money Market Funds (Cost $2,640) | | | | | | | 2,640 | |

| | | | | | | | | |

Total Investments — 100.0% (Cost $1,318,154) | | | | | | $ | 1,375,389 | |

Percentages are based on Net Assets of $1,374,853.

(a) | Seven-day yield as of April 30, 2017. |

The accompanying notes are an integral part of the financial statements.

3

Amplify ETF Trust

Amplify YieldShares CWP Dividend & Option Income ETF

Schedule of Investments

April 30, 2017 (Unaudited)

| Description | | Shares | | | Fair

Value | |

| COMMON STOCKS — 91.6% | | | | | | |

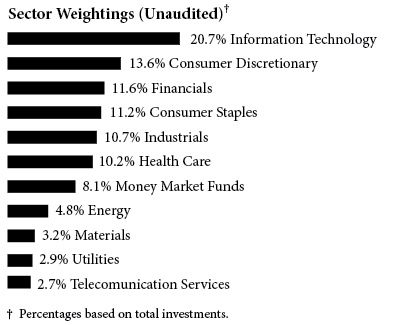

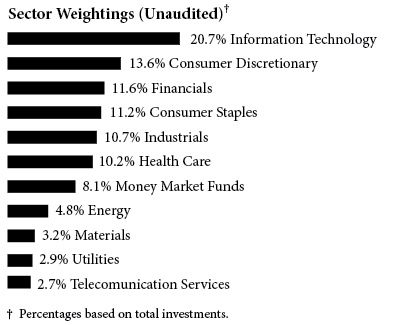

| Consumer Discretionary — 13.6% | | | | | | |

| Home Depot, Inc. | | | 2,760 | | | $ | 430,836 | |

| NIKE, Inc. | | | 4,080 | | | | 226,073 | |

| Walt Disney Co. | | | 3,600 | | | | 416,160 | |

| | | | | | | | 1,073,069 | |

| Consumer Staples — 11.2% | | | | | | | | |

| Coca-Cola Co. | | | 5,700 | | | | 245,955 | |

| Kraft Heinz Co. | | | 4,440 | | | | 401,332 | |

| Procter & Gamble Co. | | | 2,700 | | | | 235,791 | |

| | | | | | | | 883,078 | |

| Energy — 4.8% | | | | | | | | |

| Chevron Corp. | | | 3,570 | | | | 380,919 | |

| | | | | | | | | |

| Financials — 11.6% | | | | | | | | |

| Goldman Sachs Group, Inc. | | | 998 | | | | 223,352 | |

| JPMorgan Chase & Co. | | | 4,320 | | | | 375,840 | |

| The Travelers Companies, Inc. | | | 2,600 | | | | 316,316 | |

| | | | | | | | 915,508 | |

| Health Care — 10.2% | | | | | | | | |

| Merck & Co., Inc. | | | 6,245 | | | | 389,251 | |

| UnitedHealth Group, Inc. | | | 2,400 | | | | 419,712 | |

| | | | | | | | 808,963 | |

| Industrials — 10.7% | | | | | | | | |

| 3M Co. | | | 2,100 | | | | 411,243 | |

| Boeing Co. | | | 2,359 | | | | 436,014 | |

| | | | | | | | 847,257 | |

| Information Technology — 20.7% | | | | | | | | |

| Apple, Inc. | | | 1,140 | | | | 163,761 | |

| Cisco Systems, Inc. | | | 8,348 | | | | 284,416 | |

| Intel Corp. | | | 6,550 | | | | 236,782 | |

| International Business Machines Corp. | | | 1,330 | | | | 213,186 | |

| Microsoft Corp. | | | 3,637 | | | | 248,989 | |

| Texas Instruments, Inc. | | | 3,120 | | | | 247,042 | |

| Visa, Inc. | | | 2,648 | | | | 241,551 | |

| | | | | | | | 1,635,727 | |

| Materials — 3.2% | | | | | | | | |

| EI du Pont de Nemours & Co. | | | 3,199 | | | | 255,120 | |

| | | | | | | | | |

| Telecommunication Services — 2.7% | | | | | | | | |

| AT&T, Inc. | | | 5,460 | | | | 216,380 | |

| | | | | | | | | |

| Utilities — 2.9% | | | | | | | | |

| Southern Co. | | | 4,620 | | | | 230,076 | |

Total Common Stocks (Cost $7,089,301) | | | | | | | 7,246,097 | |

| | | | | | | | | |

| MONEY MARKET FUNDS — 8.1% | | | | | | | | |

STIT - Government & Agency Porfolio - Class I - 0.68% (a) | | | 638,246 | | | | 638,246 | |

Total Money Market Funds (Cost $638,246) | | | | | | | 638,246 | |

| | | | | | | | | |

Total Investments — 99.7% (Cost $7,727,547) | | | | | | $ | 7,884,343 | |

Percentages are based on Net Assets of $7,905,820.

(a) | Seven-day yield as of April 30, 2017. |

The Global Classification Standard (GICS®) was developed by and/or is the exclusive property of MSCI, Inc. and Standard & Poor’s Financial Services, LLC (“S&P”).

GICS® is a service mark of MSCI, Inc. and S&P and has been licensed for use by the Fund’s Administrator, U.S. Bancorp Fund Services, LLC.

The accompanying notes are an integral part of the financial statements.

4

Amplify ETF Trust

Amplify YieldShares CWP Dividend & Option Income ETF

Schedule of Options Written

April 30, 2017 (Unaudited)

| Description | | Contracts | | | Fair

Value | |

| Call Options Written — (0.05)% | | | | | | |

Cisco Systems, Inc.

Expires 5/19/2017, Strike Price $35.50 | | | 42 | | | $ | (693 | ) |

Home Depot, Inc.

Expires 5/19/2017, Strike Price $162.50 | | | 27 | | | | (2,511 | ) |

JPMorgan Chase & Co.

Expires 5/19/2017, Strike Price $93.00 | | | 21 | | | | (95 | ) |

Texas Instruments, Inc.

Expires 5/19/2017, Strike Price $83.00 | | | 31 | | | | (341 | ) |

Visa, Inc.

Expires 5/19/2017, Strike Price $95.00 | | | 26 | | | | (312 | ) |

Total Call Options Written (Premiums Received $4,233) | | | | | | $ | (3,952 | ) |

The accompanying notes are an integral part of the financial statements.

5

Amplify ETF Trust

Statements of Assets and Liabilities

April 30, 2017 (Unaudited)

| | | Amplify Online

Retail ETF | | | Amplify

YieldShares Prime 5 Dividend ETF | | | Amplify

YieldShares CWP Dividend & Option Income ETF | |

| Assets: | | | | | | | | | |

| Investments at Cost | | $ | 12,543,872 | | | $ | 1,318,154 | | | $ | 7,727,547 | |

| Investments at Fair Value | | $ | 14,073,362 | | | $ | 1,375,389 | | | $ | 7,884,343 | |

| Cash | | | — | | | | — | | | | 460 | |

| Receivable for Investments Sold | | | — | | | | — | | | | 575,875 | |

| Dividends and Interest Receivable | | | 1,047 | | | | 4 | | | | 9,476 | |

| Due from Affiliate | | | 5,163 | | | | — | | | | — | |

| Total Assets | | | 14,079,572 | | | | 1,375,393 | | | | 8,470,154 | |

| | | | | | | | | | | | | |

| Liabilities: | | | | | | | | | | | | |

| Options Written, at Value (Premiums Received $4,233) | | | — | | | | — | | | | 3,952 | |

| Payable for Investments Purchased | | | — | | | | — | | | | 554,274 | |

| Advisory Fees Payable | | | 6,074 | | | | 540 | | | | 6,108 | |

| Total Liabilities | | | 6,074 | | | | 540 | | | | 564,334 | |

| | | | | | | | | | | | | |

| Net Assets | | $ | 14,073,498 | | | $ | 1,374,853 | | | $ | 7,905,820 | |

| | | | | | | | | | | | | |

| Net Assets Consist of: | | | | | | | | | | | | |

| Paid-in Capital ($0.01 par value) | | $ | 4,500 | | | $ | 500 | | | $ | 3,000 | |

| Additional Paid-in Capital | | | 12,532,375 | | | | 1,126,685 | | | | 7,690,275 | |

| Undistributed (Accumulated) Net Investment Income (Loss) | | | (16,327 | ) | | | 8,128 | | | | (18,697 | ) |

| Accumulated Net Realized Gain (Loss) on Investments | | | 23,465 | | | | 182,305 | | | | 74,165 | |

| Net Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Investments | | | 1,529,485 | | | | 57,235 | | | | 156,796 | |

| Options Written | | | — | | | | — | | | | 281 | |

| Net Assets | | $ | 14,073,498 | | | $ | 1,374,853 | | | $ | 7,905,820 | |

| | | | | | | | | | | | | |

| Outstanding Shares of Beneficial Interest (unlimited authorized - $0.01 par value) | | | 450,000 | | | | 50,000 | | | | 300,000 | |

| Net Asset Value, Offering and Redemption Price per Share | | $ | 31.27 | | | $ | 27.50 | | | $ | 26.35 | |

The accompanying notes are an integral part of the financial statements.

6

Amplify ETF Trust

Statements of Operations

For the Period Ended April 30, 2017 (Unaudited)

| | | Amplify Online

Retail ETF | | | Amplify

YieldShares Prime 5 Dividend ETF | | | Amplify

YieldShares CWP Dividend & Option Income ETF1 | |

| Investment Income: | | | | | | | | | |

| Dividend Income (Net of Foreign Withholding Tax of $115, $0 and $0, respectively) | | $ | 13,216 | | | $ | 36,525 | | | $ | 39,793 | |

| Interest Income | | | 49 | | | | 20 | | | | 627 | |

| Total Investment Income | | | 13,265 | | | | 36,545 | | | | 40,420 | |

| | | | | | | | | | | | | |

| Expenses: | | | | | | | | | | | | |

| Advisory Fees | | | 24,759 | | | | 5,682 | | | | 17,334 | |

| Total Expenses | | | 24,759 | | | | 5,682 | | | | 17,334 | |

| Advisory Fees Waived | | | — | | | | (1,263 | ) | | | — | |

| Net Expenses | | | 24,759 | | | | 4,419 | | | | 17,334 | |

| | | | | | | | | | | | | |

| Net Investment Income (Loss) | | | (11,494 | ) | | | 32,126 | | | | 23,086 | |

| | | | | | | | | | | | | |

| Realized and Unrealized Gain (Loss): | | | | | | | | | | | | |

| Net Realized Gain (Loss) on: | | | | | | | | | | | | |

| Payment from Affiliate | | | 5,163 | | | | — | | | | — | |

| Investments | | | 25,818 | | | | 201,188 | | | | 67,871 | |

| Foreign Currency | | | (5,253 | ) | | | — | | | | — | |

| Options Written | | | — | | | | — | | | | 6,294 | |

| Net Change in Unrealized Appreciation (Depreciation) on: | | | | | | | | | | | | |

| Investments | | | 1,306,804 | | | | 57,802 | | | | 156,796 | |

| Options Written | | | — | | | | — | | | | 281 | |

| Net Realized and Unrealized Gain (Loss) | | | 1,332,532 | | | | 258,990 | | | | 231,242 | |

| | | | | | | | | | | | | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | $ | 1,321,038 | | | $ | 291,116 | | | $ | 254,328 | |

1 | Fund commenced operations on December 14, 2016. The information presented is for the period from December 14, 2016 to April 30, 2017. |

The accompanying notes are an integral part of the financial statements.

7

Amplify ETF Trust

Statements of Changes in Net Assets

| | | Amplify Online Retail ETF | |

| | | Six Months Ended April 30, 2017 (Unaudited) | | | Period Ended October 31, 20161 | |

| Operations: | | | | | | |

| Net Investment Income (Loss) | | $ | (11,494 | ) | | $ | (4,705 | ) |

| Net Realized Gain (Loss) on Investments and Foreign Currency | | | 25,728 | | | | (2,391 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency | | | 1,306,804 | | | | 222,681 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | 1,321,038 | | | | 215,585 | |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Subscriptions | | | 8,675,850 | | | | 3,861,025 | |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | | 8,675,850 | | | | 3,861,025 | |

| | | | | | | | | |

| Total Increase (Decrease) in Net Assets | | | 9,996,888 | | | | 4,076,610 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 4,076,610 | | | | — | |

| End of Period | | $ | 14,073,498 | | | $ | 4,076,610 | |

| Undistributed (Accumulated) Net Investment Income (Loss) | | $ | (16,327 | ) | | $ | (4,833 | ) |

| | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Subscriptions | | | 300,000 | | | | 150,000 | |

| Net Increase (Decrease) in Shares Outstanding from Share Transactions | | | 300,000 | | | | 150,000 | |

1 | The Fund commenced operations on April 20, 2016. The information presented is for the period from April 20, 2016 to October 31, 2016. |

The accompanying notes are an integral part of the financial statements.

8

Amplify ETF Trust

Statements of Changes in Net Assets

| | | Amplify YieldShares

Prime 5 Dividend ETF | |

| | | Six Months Ended April 30, 2017 (Unaudited) | | | Period Ended October 31, 20161 | |

| Operations: | | | | | | |

| Net Investment Income (Loss) | | $ | 32,126 | | | $ | 5,576 | |

| Net Realized Gain (Loss) on Investments and Foreign Currency | | | 201,188 | | | | (18,883 | ) |

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Foreign Currency | | | 57,802 | | | | (567 | ) |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | 291,116 | | | | (13,874 | ) |

| | | | | | | | | |

| Distributions to Shareholders: | | | | | | | | |

| From Net Investment Income | | | (29,574 | ) | | | — | |

| Total Distributions | | | (29,574 | ) | | | — | |

| | | | | | | | | |

| Capital Share Transactions: | | | | | | | | |

| Redemptions | | | (1,372,815 | ) | | | 2,500,000 | |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | | (1,372,815 | ) | | | 2,500,000 | |

| | | | | | | | | |

Total Increase (Decrease) in Net Assets | | | (1,111,273 | ) | | | 2,486,126 | |

| | | | | | | | | |

| Net Assets: | | | | | | | | |

| Beginning of Period | | | 2,486,126 | | | | — | |

| End of Period | | $ | 1,374,853 | | | $ | 2,486,126 | |

| Undistributed (Accumulated) Net Investment Income (Loss) | | $ | 8,128 | | | $ | 5,576 | |

| | | | | | | | | |

| Share Transactions: | | | | | | | | |

| Subscriptions | | | — | | | | 100,000 | |

| Redemptions | | | (50,000 | ) | | | — | |

| Net Increase (Decrease) in Shares Outstanding from Share Transactions | | | (50,000 | ) | | | 100,000 | |

1 | The Fund commenced operations on September 21, 2016. The information presented is for the period from September 21, 2016 to October 31, 2016. |

The accompanying notes are an integral part of the financial statements.

9

Amplify ETF Trust

Statement of Changes in Net Assets

| | | Amplify

YieldShares CWP Dividend & Option Income ETF | |

| | | Period Ended April 30, 2017 (Unaudited)1 | |

| Operations: | | | |

| Net Investment Income (Loss) | | $ | 23,086 | |

| Net Realized Gain (Loss) on Investments and Options Written | | | 74,165 | |

| Net Change in Unrealized Appreciation (Depreciation) on Investments and Options Written | | | 157,077 | |

| Net Increase (Decrease) in Net Assets Resulting from Operations | | | 254,328 | |

| | | | | |

| Distributions to Shareholders: | | | | |

| From Net Investment Income | | | (41,783 | ) |

| Total Distributions | | | (41,783 | ) |

| | | | | |

| Capital Share Transactions: | | | | |

| Subscriptions | | | 7,693,275 | |

| Increase (Decrease) in Net Assets from Capital Share Transactions | | | 7,693,275 | |

| | | | | |

Total Increase (Decrease) in Net Assets | | | 7,905,820 | |

| | | | | |

| Net Assets: | | | | |

| Beginning of Period | | | — | |

| End of Period | | $ | 7,905,820 | |

| Undistributed (Accumulated) Net Investment Income (Loss) | | $ | (18,697 | ) |

| | | | | |

| Share Transactions: | | | | |

| Subscriptions | | | 300,000 | |

| Net Increase (Decrease) in Shares Outstanding from Share Transactions | | | 300,000 | |

1 | The Fund commenced operations on December 14, 2016. The information presented is for the period from December 14, 2016 to April 30, 2017. |

The accompanying notes are an integral part of the financial statements.

10

Amplify ETF Trust

Amplify Online Retail ETF

Financial Highlights

| | | Six Months Ended

April 30, 2017 (Unaudited) | | | Period Ended

October 31, 20161 | |

| Net Asset Value, Beginning of Period | | $ | 27.18 | | | $ | 25.00 | |

| Income (Loss) from Investment Operations: | | | | | | | | |

Net Investment Income (Loss) 2 | | | (0.04 | ) | | | (0.05 | ) |

| Net Realized and Unrealized Gain (Loss) | | | 4.13 | 3 | | | 2.23 | |

| Total from Investment Operations | | | 4.09 | | | | 2.18 | |

| | | | | | | | | |

| Net Asset Value, End of Period | | $ | 31.27 | | | $ | 27.18 | |

| | | | | | | | | |

Total Return on Net Asset Value 4 | | | 15.08 | %5,6 | | | 8.71 | %5 |

| | | | | | | | | |

| Supplemental Data: | | | | | | | | |

| Net Assets, End of Period (000's) | | $ | 14,073 | | | $ | 4,077 | |

| Ratio of Expenses to Average Net Assets | | | 0.65 | %7 | | | 0.65 | %7 |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | | -0.30 | %7 | | | -0.34 | %7 |

Portfolio Turnover 8 | | | 7 | %5 | | | 8 | %5 |

1 | The Fund commenced operations on April 20, 2016. The information presented is for the period from April 20, 2016 to October 31, 2016. |

2 | Calculated based on average shares outstanding during the period. |

3 | Includes a $0.02 gain derived from a payment from affiliate. See Note 4. |

4 | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

6 | Before payment from affiliate for the loss resulting from a trade error, the total return for the period would have been 15.00%. See Note 4. |

8 | Excludes the impact of in-kind transactions. |

The accompanying notes are an integral part of the financial statements.

11

Amplify ETF Trust

Amplify YieldShares Prime 5 Dividend ETF

Financial Highlights

| | | Six Months Ended

April 30, 2017 (Unaudited) | | | Period Ended

October 31, 20161 | |

| Net Asset Value, Beginning of Period | | $ | 24.86 | | | $ | 25.00 | |

| Income (Loss) from Investment Operations: | | | | | | | | |

Net Investment Income (Loss) 2 | | | 0.34 | | | | 0.06 | |

| Net Realized and Unrealized Gain (Loss) | | | 2.60 | | | | (0.20 | ) |

| Total from Investment Operations | | | 2.94 | | | | (0.14 | ) |

| | | | | | | | | |

| Distributions to Shareholders | | | | | | | | |

| Net Investment Income | | | (0.30 | ) | | | — | |

| Total from Distributions | | | (0.30 | ) | | | — | |

| | | | | | | | | |

| Net Asset Value, End of Period | | $ | 27.50 | | | $ | 24.86 | |

| | | | | | | | | |

Total Return on Net Asset Value 3 | | | 11.82 | %4 | | | -0.55 | %4 |

| | | | | | | | | |

| Supplemental Data: | | | | | | | | |

| Net Assets, End of Period (000's) | | $ | 1,375 | | | $ | 2,486 | |

| Ratio of Expenses to Average Net Assets (Before Advisory Fees Waived) | | | 0.45 | %5,6 | | | 0.45 | %5,6 |

| Ratio of Expenses to Average Net Assets (After Advisory Fees Waived) | | | 0.35 | %5,6 | | | 0.35 | %5,6 |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | | 2.54 | %5,6 | | | 2.03 | %5,6 |

Portfolio Turnover 7 | | | 65 | %4 | | | 59 | %4 |

1 | The Fund commenced operations on September 21, 2016. The information presented is for the period from September 21, 2016 to October 31, 2016. |

2 | Calculated based on average shares outstanding during the period. |

3 | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

6 | These ratios exclude the impact of expenses of the underlying security holdings as represented in the Schedule of Investments. Recognition of net investment income by the Fund is affected by the timing of the declaration of dividends by the underlying exchange-traded funds in which the Fund Invests. |

7 | Excludes the impact of in-kind transactions. |

The accompanying notes are an integral part of the financial statements.

12

Amplify ETF Trust

Amplify YieldShares CWP Dividend & Option Income ETF

Financial Highlights

| | | Period Ended

April 30, 2017 (Unaudited)1 | |

| Net Asset Value, Beginning of Period | | $ | 25.00 | |

| Income (Loss) from Investment Operations: | | | | |

Net Investment Income (Loss) 2 | | | 0.12 | |

| Net Realized and Unrealized Gain (Loss) | | | 1.37 | |

| Total from Investment Operations | | | 1.49 | |

| | | | | |

| Distributions to Shareholders | | | | |

| Net Investment Income | | | (0.14 | ) |

| Total from Distributions | | | (0.14 | ) |

| | | | | |

| Net Asset Value, End of Period | | $ | 26.35 | |

| | | | | |

Total Return on Net Asset Value 3 | | | 5.95 | %4 |

| | | | | |

| Supplemental Data: | | | | |

| Net Assets, End of Period (000's) | | $ | 7,906 | |

| Ratio of Expenses to Average Net Assets | | | 0.95 | %5 |

| Ratio of Net Investment Income (Loss) to Average Net Assets | | | 1.27 | %5 |

Portfolio Turnover 6 | | | 58 | %4 |

1 | The Fund commenced operations on December 14, 2016. The information presented is for the period from December 14, 2016 to April 30, 2017. |

2 | Calculated based on average shares outstanding during the period. |

3 | Total Return on Net Asset Value is based on the change in net asset value (“NAV”) of a share during the period and assumes reinvestment of dividends and distributions at NAV. Total Return on Net Asset Value is for the period indicated and has not been annualized. The return shown does not reflect the deduction of taxes that a shareholder would pay on fund distributions or redemption of fund shares. |

6 | Excludes the impact of in-kind transactions. |

The accompanying notes are an integral part of the financial statements.

13

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited)

Amplify ETF Trust (the “Trust”) was organized as a Massachusetts business trust on January 6, 2015, and is authorized to issue an unlimited number of shares in one or more series of funds. The Trust is an open-end management investment company, registered under the Investment Company Act of 1940, as amended (the “1940 Act”). The Trust consists of three non-diversified funds, Amplify Online Retail ETF, Amplify YieldShares Prime 5 Dividend ETF, and Amplify YieldShares CWP Dividend & Option Income ETF (the “Funds”). Each Fund represents a beneficial interest in a separate portfolio of securities and other assets, with their own investment objectives and policies.

The investment objective of Amplify Online Retail ETF is to seek investment results that generally correspond (before fees and expenses) to the price and yield of the EQM Online Retail Index. Amplify Online Retail ETF commenced operations on April 20, 2016. The investment objective of Amplify YieldShares Prime 5 Dividend ETF is to seek investment results that generally correspond (before fees and expenses) to the price and yield of the Prime 5 US Dividend ETF Index. Amplify YieldShares Prime 5 Dividend ETF commenced operations on September 21, 2016. The investment objective of Amplify YieldShares CWP Dividend & Option Income ETF is to seek to provide current income as capital appreciation. Amplify YieldShares CWP Dividend & Option Income ETF commenced operations on December 14, 2016.

Amplify Online Retail ETF intends to list and principally trade its shares on The NASDAQ Stock Market® LLC (“NASDAQ”) and Amplify YieldShares Prime 5 Dividend ETF and Amplify YieldShares CWP Dividend and Option Income ETF intend to list and principally trade their shares on the BATS Exchange, Inc. (each an “Exchange” and collectively, the “Exchanges”). Shares of the Funds trade on the Exchanges at market prices that may be below, at, or above the Funds’ net asset value (“NAV”). The Funds will issue and redeem shares on a continuous basis at NAV only in large blocks of shares, typically 50,000 shares, called “Creation Units.” Creation Units will be issued and redeemed principally in-kind for securities included in a specified universe. Once created, shares generally will trade in the secondary market at market prices that change throughout the day in amounts less than a Creation Unit. Except when aggregated in Creation Units, shares are not redeemable securities of a Fund. Shares of a Fund may only be purchased or redeemed by certain financial institutions (“Authorized Participants”). An Authorized Participant is either (i) a broker-dealer or other participant in the clearing process through the Continuous Net Settlement System of the National Securities Clearing Corporation or (ii) a DTC participant and, in each case, must have executed a Participant Agreement with Quasar Distributors, LLC (“the Distributor”). Most retail investors will not qualify as Authorized Participants or have the resources to buy and sell whole Creation Units. Therefore, they will be unable to purchase or redeem the shares directly from the Funds. Rather, most retail investors will purchase shares in the secondary market with the assistance of a broker and will be subject to customary brokerage commissions or fees.

Each Fund currently offers one class of shares, which has no front end sales load, no deferred sales charge, and no redemption fee. A purchase (i.e. creation) transaction fee of $500 is imposed for the transfer and other transaction costs associated with the purchase of Creation Units for each Fund. The Funds may issue an unlimited number of shares of beneficial interest, with par value of $0.01 per share. All shares of the Funds have equal rights and privileges.

| 2. | SIGNIFICANT ACCOUNTING POLICIES |

The Funds are investment companies and accordingly follow the investment company accounting and reporting guidance of the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification Topic 946 Financial Services – Investment Companies.

The following is a summary of significant accounting policies consistently followed by the Funds in the preparation of their financial statements. These policies are in conformity with accounting principles generally accepted in the United States of America (“U.S. GAAP”).

SECURITY VALUATION

In accordance with the authoritative guidance on fair value measurements and disclosure under U.S. GAAP, the Funds disclose fair value of their investments in a hierarchy that prioritizes the inputs to valuation techniques used to measure fair value. The objective of a fair value measurement is to determine the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction

14

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

between market participants at the measurement date (an exit price). Accordingly, the fair value hierarchy gives the highest priority to quoted prices (unadjusted) in active markets for identical assets or liabilities (Level 1) and the lowest priority to unobservable inputs (Level 3). The following describes the levels of the fair value hierarchy:

Level 1 – Unadjusted quoted prices in active markets for identical, unrestricted assets or liabilities that the Funds have the ability to access at the measurement date;

Level 2 – Quoted prices which are not active, or inputs that are observable (either directly or indirectly) for substantially the full term of the asset or liability; and

Level 3 – Prices, inputs or exotic modeling techniques which are both significant to the fair value measurement and unobservable (supported by little or no market activity)

The valuation techniques used by the Funds to measure fair value for the period ended April 30, 2017 maximized the use of observable inputs and minimized the use of unobservable inputs.

For the period ended April 30, 2017, there have been no significant changes to the Funds’ fair valuation methodologies. It is the Funds’ policy to recognize transfers into or out of all levels at the end of the reporting period.

Common stocks, preferred stock and other equity securities listed on any national or foreign exchange (excluding NASDAQ) and the London Stock Exchange Alternative Investment Market (“AIM”) will be valued at the last price on the exchange on which they are principally traded or, for NASDAQ and AIM securities, the official closing price. Securities traded on more than one securities exchange are valued at the last sale price or official closing price, as applicable, at the close of the exchange representing the principal market for such securities.

Securities traded in the over-the-counter market are valued at the mean of the bid and the asked price, if available, and otherwise at their closing bid price.

If no quotation is available from either a pricing service, or one or more brokers or if the pricing committee has reason to question the reliability or accuracy of a quotation supplied, securities are valued at fair value as determined in good faith by the pricing committee, pursuant to procedures established under the general supervision and responsibility of the Fund’s Board of Trustees (the “Board”).

The following is a summary of the fair valuations according to the inputs used to value the Funds’ investments as of April 30, 20171:

| Category | | Amplify Online

Retail ETF | | | Amplify YieldShares Prime 5 Dividend ETF | | | Amplify YieldShares CWP Dividend & Option Income ETF | |

| Investments in Securities | | | | | | | | | |

| Assets | | | | | | | | | |

| Level 1 | | | | | | | | | |

| Common Stocks | | $ | 14,041,246 | | | $ | — | | | $ | 7,246,097 | |

| Exchange Traded Funds | | | — | | | | 1,372,749 | | | | — | |

| Money Market Funds | | | 32,116 | | | | 2,640 | | | | 638,246 | |

| Total Level 1 | | | 14,073,362 | | | | 1,375,389 | | | | 7,884,343 | |

| Level 2 | | | — | | | | — | | | | | |

| Total Level 2 | | | — | | | | — | | | | — | |

| Level 3 | | | — | | | | — | | | | — | |

| Total Level 3 | | | — | | | | — | | | | — | |

| Total | | $ | 14,073,362 | | | $ | 1,375,389 | | | $ | 7,884,343 | |

15

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

| Category | | Amplify

Online

Retail ETF | | | Amplify YieldShares Prime 5 Dividend ETF | | | Amplify YieldShares CWP Dividend & Option Income ETF | |

| Other Financial Instruments** | | | | | | | | | |

| Liabilities | | | | | | | | | |

| Level 1 | | | | | | | | | |

| Options Written | | $ | — | | | $ | — | | | $ | 3,952 | |

| Total Level 1 | | | — | | | | — | | | | 3,952 | |

| Level 2 | | | — | | | | — | | | | — | |

| Total Level 2 | | | — | | | | — | | | | — | |

| Level 3 | | | — | | | | — | | | | — | |

| Total Level 3 | | | — | | | | — | | | | — | |

| Total | | $ | — | | | $ | — | | | $ | 3,952 | |

See the Schedules of Investments for further disaggregation of investment categories.

1 | There were no transfers into or out of any Levels nor any Level 3 investments held during the period ended April 30, 2017. |

| ** | Other Financial Instruments are derivative instruments not reflected in the Schedule of Investments. Such as options written, which are reflected at value. |

OPTION WRITING

The Amplify YieldShares CWP Dividend & Option Income ETF will employ an option strategy in which it will write U.S. exchange-traded covered call options on Equity Securities in the Portfolio in order to seek additional income (in the form of premiums on the options) and selective repurchase of such options. A call option written (sold) by the Fund will give the holder (buyer) the right to buy a certain equity security at a predetermined strike price from the Fund. A premium is the income received by an investor who sells or writes an option contract to another party. CWP seeks to lower risk and enhance total return by tactically selling short-term call options on some, or all, of the Equity Securities in the Portfolio. Specifically, CWP seeks to provide gross income of approximately 2-3% from dividend income and 2-4% from option premium, plus the potential for capital appreciation. Unlike a systematic covered call program, CWP is not obligated to continuously cover each individual equity position. When one of the underlying stocks demonstrates strength or an increase in implied volatility, CWP identifies that opportunity and sells call options tactically, rather than keeping all positions covered and limiting potential upside.

When the Fund writes an option, an amount equal to the premium received by the Fund is recorded as a liability and is subsequently adjusted to the current fair value of the option written. Premiums received from writing options that expire unexercised are treated by the Fund on the expiration date as realized gains from options written. The difference between the premium and the amount paid on effecting a closing purchase transaction, including brokerage commissions, is also treated as a realized gain, or, if the premium is less than the amount paid for the closing purchase transaction, as a realized loss. If a call option is exercised, the premium is added to the proceeds from the sale of the underlying security in determining whether the Fund has realized a gain or loss. The Fund, as a writer of an option, bears the market risk of an unfavorable change in the price of the security underlying the written option.

16

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

The value of Derivative Instruments on the Statement of Assets and Liabilities for Amplify YieldShares CWP Dividend & Option Income ETF as of April 30, 2017 is as follows:

Statement of Assets and Liabilities - Values of Derivative Instruments as of April 30, 2017

| | Liability Derivatives | |

| Derivatives not accounted for as hedging instruments | Location | | Value | |

| Equity Contracts - Options | Options written, at value | | $ | 3,952 | |

The effect of Derivative Instruments on the Statement of Operations for the period ended April 30, 2017

Amount of Realized Gain on

Derivatives Recognized in Income | | Change in Unrealized Appreciation on Recognized in Income | |

Derivatives not accounted for as hedging instruments | | Options Written | | Derivatives not accounted for as hedging instruments | | Options Written | |

| Equity Contracts | | $ | 6,294 | | Equity Contracts | | $ | 281 | |

The average monthly value of options written during the period ended April 30, 2017 was $(2,586).

See Note 5 for additional disclosure related to transactions in options written during the period.

COVERED CALL RISK

Covered call risk is the risk that the Fund will forgo, during the option’s life, the opportunity to profit from increases in the market value of the security covering the call option above the sum of the premium and the strike price of the call, but has retained the risk of loss should the price of the underlying security decline. In addition, as the Fund writes covered calls over more of its portfolio, its ability to benefit from capital appreciation becomes more limited. The writer of an option has no control over the time when it may be required to fulfill its obligation as a writer of the option. Once an option writer has received an exercise notice, it cannot effect a closing purchase transaction in order to terminate its obligation under the option and must deliver the underlying security at the exercise price.

OFFSETTING ASSETS AND LIABILITIES

The Amplify YieldShares CWP Dividend & Option Income ETF is subject to various Master Netting Arrangements, which govern the terms of certain transactions with select counterparties. The Master Netting Arrangements allow the Fund to close out and net its total exposure to a counterparty in the event of a default with respect to all the transactions governed under a single agreement with a counterparty. The Master Netting Arrangements also specify collateral posting arrangements at pre-arranged exposure levels. Under the Master Netting Arrangements, collateral is routinely transferred if the total net exposure to certain transactions (net of existing collateral already in place) governed under the relevant Master Netting Arrangement with a counterparty in a given account exceeds a specified threshold depending on the counterparty and type of Master Netting Arrangement.

17

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

The following is a summary of the Assets and Liabilities subject to offsetting in the Amplify YieldShares CWP Dividend & Option Income ETF as of April 30, 2017:

| Liabilities | | | | | | | | | | | Gross Amounts not offset in the Statement of Assets and Liabilities | | | | |

| Description / Counterparty | | Gross Amounts of Recognized Liabilities | | | Gross Amounts Offset in the Statement of Assets and Liabilities | | | Net Amounts Presented in the Statement of Assets and Liabilities | | | Financial Instruments | | | Collateral Pledged | | | Net Amount | |

| Options Written | | | | | | | | | | | | | | | | | | |

| Instinent Clearing Services, Inc. | | $ | 3,952 | | | $ | — | | | $ | 3,952 | | | $ | — | | | $ | 3,952 | | | $ | — | |

In some instances, the collateral amounts disclosed in the tables were adjusted due to the requirement to limit the collateral amounts to avoid the effect of overcollateralization. Actual collateral received/pledged may be more than the amounts disclosed herein.

SHARE VALUATION

The NAV per share of the Funds is calculated by dividing the sum of the value of the securities held by the Funds, plus cash and other assets, minus all liabilities (including estimated accrued expenses) by the total number of shares outstanding for each Fund, rounded to the nearest cent. The Funds’ shares will not be priced on the days on which the New York Stock Exchange (“NYSE”) is closed for trading. The offering and redemption price per share for the Funds is equal to the Funds’ NAV.

USE OF ESTIMATES

The preparation of financial statements in conformity with U.S. GAAP requires management to make estimates and assumptions that affect the reported assets and liabilities and disclosure of contingent assets and liabilities at the date of the financial statement, as well as the reported amounts of revenues and expenses during the period. Actual results could differ from those estimates.

FEDERAL INCOME TAXES

The Funds intend to meet the requirements of Subchapter M of the Internal Revenue Code applicable to regulated investment companies and will distribute substantially all taxable income and capital gains to shareholders. Therefore, no federal income or excise tax provision has been made.

As of and during the period ended October 31, 2016, the Funds did not have any tax positions that did not meet the “more-likely-than-not” threshold of being sustained by the applicable tax authority. As of and during the period ended October 31, 2016, the Funds did not have liabilities for any unrecognized tax benefits. The Funds recognize interest and penalties, if any, related to unrecognized tax benefits on uncertain tax positions as income tax expense in the Statements of Operations. During the period ended October 31, 2016, The Funds did not incur any interest or penalties.

FOREIGN CURRENCY TRANSLATION

The books and records of the Funds are maintained in U.S. dollars. Investment securities and other assets and liabilities denominated in a foreign currency are translated into U.S. dollars on the date of valuation. Purchases and sales of investment securities, income and expenses are translated into U.S. dollars at the relevant rates of exchange prevailing on the respective dates of such transactions. The Funds do not isolate that portion of realized or unrealized gains and losses resulting from changes in the foreign exchange rate from fluctuations arising from changes in the market prices of the securities. These gains and losses are included in net realized and unrealized gains (loss) on investments on the Statement of Operations. Net realized and unrealized gains and losses on foreign currency transactions

18

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

represent net foreign exchange gains or losses from foreign currency exchange contracts, disposition of foreign currencies, currency gains or losses realized between trade and settlement dates on securities transactions and the difference between the amount of the investment income and foreign withholding taxes recorded on the Funds’ books and the U.S. dollar equivalent amounts actually received or paid.

SECURITY TRANSACTIONS AND INVESTMENT INCOME

Security transactions are accounted for on trade date. Costs used in determining realized gains and losses on the sale of investment securities are based on specific identification. Dividend income is recorded on the ex-dividend date. Interest income is recognized on the accrual basis. Withholding taxes on foreign dividends have been provided for in accordance with the Funds’ understanding of the applicable country’s tax rules and rates.

DIVIDENDS AND DISTRIBUTIONS TO SHAREHOLDERS

Dividends from net investment income, if any, will be declared and paid at least annually by the Funds. The Funds distributes their net realized capital gains, if any, to shareholders annually. All distributions are recorded on the ex-dividend date.

The amount and character of income and capital gain distributions to be paid, if any, are determined in accordance with income tax regulations, which may differ from U.S. GAAP. As a result, net investment income (loss) and net realized gain (loss) on investments and foreign currency for a reporting period may differ significantly from distributions during such period. These book/tax differences may be temporary or permanent. To the extent these differences are permanent in nature, they are charged or credited to undistributed (accumulated) net investment income (loss), accumulated net realized gain (loss) on investments or paid-in capital, as appropriate, in the period that the differences arise.

GUARANTEES AND INDEMNIFICATIONS

In the normal course of business, the Funds enter into contracts with service providers that contain general indemnification clauses. The Funds’ maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Funds that have not yet occurred. However, based on experience, the Funds expect risk of loss to be remote.

ORGANIZATIONAL AND OFFERING COSTS

All organizational costs incurred to establish the Funds were paid by Amplify Investments, LLC (the “Adviser”) and are not subject to reimbursement.

Amplify Investments, LLC (the “Adviser”) serves as investment adviser to the Funds. Pursuant to an Investment Management Agreement (the “Management Agreement”) between the Trust, on behalf of the Funds, and the Adviser, the Adviser provides investment advice to the Funds and oversees the day-to-day operations of the Funds, subject to the direction and control of the Board and the officers of the Trust. Under the Management Agreement, the Funds will pay the following investment advisory fees to the Adviser as compensation for the services rendered, facilities furnished, and expenses paid by it, including the cost of transfer agency, custody, fund administration, legal, audit and other service and license fees, but excluding interest, taxes, brokerage commissions, and other expenses connected with the execution of portfolio transactions, distribution and service fees payable pursuant to a Rule 12b-1 Plan, if any, and extraordinary expenses.

| Fund | Annual Rate of Average Daily Net Assets |

| Amplify Online Retail ETF | 0.65% |

| Amplify YieldShares Prime 5 Dividend ETF | 0.35% |

| Amplify YieldShares CWP Dividend & Option Income ETF | 0.95% |

19

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

Pursuant to a contractual agreement between the Trust, on behalf of Amplify YieldShares Prime 5 Dividend ETF and the Adviser, the management fees paid to the Adviser will be reduced by 0.10%. For the period ended April 30, 2017, the Adviser’s management fee was reduced by $1,263. This contractual agreement will continue until September 17, 2017. The Adviser is not eligible to recoup these amounts.

Penserra Capital Management, LLC serves as the Sub-Adviser (the “Sub-Adviser”) to the Funds. The Sub-Adviser has responsibility for selecting and continuously monitoring the Fund’s investments. The Adviser has overall responsibility for overseeing the investment of the Funds’ assets, managing the Funds’ business affairs and providing certain clerical, bookkeeping and other administrative services for the Trust. Sub-Advisory fees earned by Penserra Capital Management, LLC are paid for by the Adviser. For the period ended April 30, 2017, the Funds paid Penserra Securities, LLC, an affiliate of the Sub-Adviser, $124 for brokerage commissions.

U.S. Bancorp Fund Services, LLC (“USBFS” or the “Administrator”) acts as the Funds’ Administrator and, in that capacity, performs various administrative and accounting services for the Funds. The Administrator prepares various federal and state regulatory filings, reports and returns for the Funds, including regulatory compliance monitoring and financial reporting; prepares reports and materials to be supplied to the Board; monitors the activities of the Funds’ custodian, transfer agent and accountant. USBFS also serves as the transfer agent and fund accountant to the Funds.

U.S. Bank N.A., an affiliate of USBFS, serves as the Funds’ custodian.

The Distributor acts as the Funds’ principal underwriter in a continuous public offering of the Funds’ shares. The Distributor is an affiliate of the Administrator.

Certain officers and two Trustees of the Trust are also officers or employees of the Adviser or its affiliates. They receive no fees for serving as officers or Trustees of the Trust.

| 4. | INVESTMENT TRANSACTIONS |

For the period ended April 30, 2017, the purchases and sales of investments in securities, excluding in-kind transactions and short-term securities were:

| Fund | | Purchases | | | Sales and Maturities | |

| Amplify Online Retail ETF | | $ | 597,935 | | | $ | 594,694 | |

| Amplify YieldShares Prime 5 Dividend ETF | | | 1,608,103 | | | | 1,605,037 | |

| Amplify YieldShares CWP Dividend & Option Income ETF | | | 2,976,396 | | | | 3,047,343 | |

For the period ended April 30, 2017, in-kind transactions associated with creations and redemptions were:

| Fund | | Purchases | | | Sales | |

| Amplify Online Retail ETF | | $ | 8,634,153 | | | $ | — | |

| Amplify YieldShares Prime 5 Dividend ETF | | | — | | | | 1,366,976 | |

| Amplify YieldShares CWP Dividend & Option Income ETF | | | 7,156,641 | | | | — | |

There were no purchases or sales of long-term U.S. Government securities by the Funds.

During the period ended April 30, 2017, Amplify Online Retail ETF had a trade error where a foreign exchange transaction was placed using the incorrect currency. This resulted in a loss to the Fund of $5,163, which affiliates subsequently reimbursed to the Fund.

20

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

5. OPTION CONTRACTS WRITTEN

The premium amount and number of options contracts written during the period ended April 30, 2017 were as follows:

| Fund | | Amount of

Premiums | | | Number of

Contracts | |

| Amplify YieldShares CWP Dividend & Option Income ETF | |

Outstanding at 12/14/16 1 | | $ | — | | | | — | |

| Options written | | | 62,232 | | | | 964 | |

| Options exercised | | | (26,923 | ) | | | (180 | ) |

| Options expired | | | (6,672 | ) | | | (318 | ) |

| Options closed | | | (24,404 | ) | | | (319 | ) |

| Outstanding at 04/30/17 | | $ | 4,233 | | | | 147 | |

1 | The Fund commenced operations on December 14, 2016. |

See Note 2 for additional disclosure related to transactions in options written during the period.

There were no distributions during the period ended October 31, 2016.

The cost basis of investments for federal income tax purposes as of October 31, 2016 was as follows:

| | | Amplify Online

Retail ETF | | | Amplify

YieldShares Prime 5 Dividend ETF | |

| | | | | | | |

| Tax Cost of Investments | | $ | 3,856,165 | | | $ | 2,486,934 | |

| Gross Tax Unrealized Appreciation | | | 391,327 | | | | 1,392 | |

| Gross Tax Unrealized Depreciation | | | (169,381 | ) | | | (1,959 | ) |

| Net Tax Unrealized Appreciation (Depreciation) | | | 221,946 | | | | (567 | ) |

| | | | | | | | | |

| Undistributed Ordinary Income | | | — | | | | 5,576 | |

| Total Distributable Earnings | | | — | | | | 5,576 | |

| | | | | | | | | |

| Other Accumulated Gains (losses) | | | (6,361 | ) | | | (18,883 | ) |

| Total Accumulated Earnings (losses) | | $ | 215,585 | | | $ | (13,874 | ) |

The difference between book and tax-basis cost is attributable to the deferral on wash sales.

21

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

As of October 31, 2016, the components of Accumulated Losses on a tax basis were as follows:

| | | Amplify Online

Retail ETF | | | Amplify

YieldShares Prime 5 Dividend ETF | |

| | | | | | | |

| Short-Term Capital Loss Carryforward | | $ | 1,528 | | | $ | 18,883 | |

| Late-Year Ordinary Losses | | | 4,833 | | | | — | |

The Funds may elect to defer to the first day of the next taxable year all or part of any late-year ordinary losses or post-October capital losses. There is no expiration date on capital loss carryforwards.

Additionally, U.S. GAAP require that certain components of net assets relating to permanent differences be reclassified between financial and tax reporting. These reclassifications have no effect on net assets or NAV per share. The permanent differences primarily relate to distributions from foreign currency gain/loss. For the period ended October 31, 2016, the following table shows the reclassifications made:

| | | Amplify Online

Retail ETF | | | Amplify

YieldShares Prime 5 Dividend ETF | |

| | | | | | | |

| Undistributed (Accumulated) Net Investment Income (Loss) | | $ | (128 | ) | | $ | — | |

| Accumulated Net Realized Gain (Loss) | | | 128 | | | | — | |

| Paid-In Capital | | | — | | | | — | |

Amplify YieldShares CWP Dividend & Option Income ETF was launched prior to October 31, 2016, therefore there is not any federal income tax information.

ACTIVE MARKET RISK

Although the Funds intend to principally trade the shares on the Exchange, there can be no assurance that an active trading market for the shares will develop or be maintained. Shares may trade on the Exchange at market prices that may be below, at or above the Funds’ NAV.

ADR AND GDR RISK

ADRs and GDRs may be subject to certain of the risks associated with direct investments in the securities of foreign companies, such as currency, political, economic and market risks, because their values depend on the performance of the non-dollar denominated underlying foreign securities. Certain countries may limit the ability to convert ADRs into the underlying foreign securities and vice versa, which may cause the securities of the foreign company to trade at a discount or premium to the market price of the related ADR. ADRs may be purchased through “sponsored” or “unsponsored” facilities. A depositary may establish an unsponsored facility without participation by the issuer of the deposited security. Unsponsored receipts may involve higher expenses and may be less liquid. GDRs can involve currency risk since, unlike ADRs, they may not be U.S. dollar-denominated. Because the Funds’ NAV is determined in U.S. dollars, the NAV of the Funds could decline if the currency of the non-U.S. market in which the Funds invest depreciates against the U.S. dollar, even if the value of the Funds’ holdings, measured in the foreign currency, increases.

22

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

BORROWING AND LEVERAGE RISK

When the Funds borrows money, they must pay interest and other fees, which will reduce the Funds’ returns if such costs exceed the returns on the portfolio securities purchased or retained with such borrowings. Any such borrowings are intended to be temporary. However, under certain market conditions, including periods of low demand or decreased liquidity, such borrowings might be outstanding for longer periods of time. As prescribed by the 1940 Act, the Funds will be required to maintain specified asset coverage of at least 300% with respect to any bank borrowing immediately following such borrowing. The Funds may be required to dispose of assets on unfavorable terms if market fluctuations or other factors reduce the Funds’ asset coverage to less than the prescribed amount.

CONSUMER DISCRETIONARY COMPANIES RISK

These companies manufacture products and provide discretionary services directly to the consumer, and the success of these companies is tied closely to the performance of the overall domestic and international economy, interest rates, competition and consumer confidence. Success depends heavily on disposable household income and consumer spending. Changes in demographics and consumer tastes can also affect the demand for, and success of, consumer discretionary products in the marketplace.

CYBER SECURITY RISK

As the use of Internet technology has become more prevalent in the course of business, the Funds have become more susceptible to potential operational risks through breaches in cyber security. A breach in cyber security refers to both intentional and unintentional events that may cause the Funds to lose proprietary information, suffer data corruption or lose operational capacity. Such events could cause the Funds to incur regulatory penalties, reputational damage, additional compliance costs associated with corrective measures and/or financial loss. Cyber security breaches may involve unauthorized access to the Funds’ digital information systems through “hacking” or malicious software coding, but may also result from outside attacks such as denial-of-service attacks through efforts to make network services unavailable to intended users. In addition, cyber security breaches of the Funds’ third party service providers, such as its administrator, transfer agent, custodian, or sub-advisor, as applicable, or issuers in which the Funds invest, can also subject the Funds to many of the same risks associated with direct cyber security breaches. The Funds have established risk management systems designed to reduce the risks associated with cyber security. However, there is no guarantee that such efforts will succeed, especially because the Funds do not directly control the cyber security systems of issuers or third party service providers.

EQUITIES SECURITIES RISK

The value of shares of the Funds will fluctuate with changes in the value of these equity securities. Equity securities prices fluctuate for several reasons, including changes in investors’ perceptions of the financial condition of an issuer or the general condition of the relevant stock market, such as the current market volatility, or when political or economic events affecting the issuers occur.

FLUCUATION OF NAV RISK

The NAV of the Funds’ shares will generally fluctuate with changes in the market value of the Funds’ holdings. The market prices of shares will generally fluctuate in accordance with changes in NAV as well as the relative supply of and demand for shares on the Exchange.

FOREIGN INVESTMENT RISK

Securities issued by foreign companies present risks beyond those of securities of U.S. issuers. Risks of investing in the securities of foreign companies include: different accounting standards; expropriation, nationalization or other adverse political or economic developments; currency devaluation, blockages or transfer restrictions; changes in foreign currency exchange rates; taxes; restrictions on foreign investments and exchange of securities; and less government supervision and regulation of issuers in foreign countries. Prices of foreign securities also may be more volatile.

23

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

INDEX RISK

The Funds are not actively managed. The Funds invest in securities included in or representative of its Index regardless of their investment merit. Unlike many investment companies, the Funds do not utilize an investing strategy that seeks returns in excess of the Index. Therefore, it would not necessarily buy or sell a security unless that security is added or removed, respectively, from the Index, even if that security generally is underperforming.

INDUSTRY CONCENTRATION RISK

In following its methodology, the Index from time to time may be concentrated to a significant degree in securities of issuers located in a single industry or sector. To the extent that the Index concentrates in the securities of issuers in a particular industry or sector, the Funds will also concentrate its investments to approximately the same extent. By concentrating its investments in an industry or sector, the Funds may face more risks than if it were diversified broadly over numerous industries or sectors.

INFORMATION TECHNOLOGY COMPANIES RISK

Information technology companies are generally subject to rapidly changing technologies, short product life cycles, fierce competition, aggressive pricing and reduced profit margins, the loss of patent, copyright and trademark protections, cyclical market patterns, evolving industry standards, and frequent new product introductions. Information technology companies may be smaller and less experienced companies, with limited product lines, markets or financial resources and fewer experienced management or marketing personnel. Information technology company stocks, especially those which are internet related, have experienced extreme price and volume fluctuations that are often unrelated to their operating performance.

INTERNET COMPANIES RISK

Internet companies are subject to rapid changes in technology, worldwide competition, rapid obsolescence of products and services, loss of patent protections, cyclical market patterns, evolving industry standards, frequent new product introductions and the considerable risk of owning small capitalization companies that have recently begun operations. In addition, the stocks of many internet companies have exceptionally high price-to-earnings ratios with little or no earnings histories. Many internet companies have experienced extreme price and volume fluctuations that often have been unrelated to their operating performance.

MARKET CAPITALIZATION RISK

The Index may comprise large, mid and small capitalization stocks. The Index and therefore the Funds will comprise large, mid and small capitalization stocks to the same extent. As a result, the Funds may be exposed to additional risk associated with mid and small capitalization companies. Increased exposure to mid and/or small capitalization companies may cause the Funds to be more vulnerable to adverse general market or economic developments because such securities may be less liquid and subject to greater price volatility than those of larger, more established companies. Such companies may have limited product lines, markets or financial resources, and they may be dependent on a limited management group. In addition, they may be more vulnerable to adverse general market or economic developments.

MARKET RISK

Market risk is the risk that a particular security owned by the Funds or shares of the Funds in general may fall in value. Securities are subject to market fluctuations caused by such factors as economic, political, regulatory or market developments, changes in interest rates and perceived trends in securities prices. Overall security values could decline generally or could underperform other investments.

24

Amplify ETF Trust

Notes to the Financial Statements

April 30, 2017 (Unaudited) (Continued)

NEW FUND RISK

The Funds currently have fewer assets than larger funds, and like other relatively new funds, large inflows and outflows may impact the Funds’ market exposure for limited periods of time. This impact may be positive or negative, depending on the direction of market movement during the period affected. Also, during the initial invest-up period, the Funds may depart from its principal investment strategies and invest a larger amount or all of its assets in cash equivalents, or it may hold cash.

NON-CORRELATION RISK

The Funds’ return may not match the return of the Index for a number of reasons. Although the Funds currently intend to seek to fully replicate the Index, the Funds may use a representative sampling approach, which may cause the Funds not to be as well-correlated with the return of the Index as would be the case if the Funds purchased all of the securities in the Index in the proportions represented in the Index. In addition, the performance of the Funds and the Index may vary due to asset valuation differences and differences between the Funds’ portfolio and the Index resulting from legal restrictions, cost or liquidity constraints.

NON-DIVERSIFICATION RISK

Because the Funds are non-diversified and can invest a greater portion of its assets in securities of individual issuers than a diversified fund, changes in the market value of a single investment could cause greater fluctuations in share price than would occur in a diversified fund. This may increase the Funds’ volatility and cause the performance of a relatively small number of issuers to have a greater impact on the Funds’ performance.

ONLINE RETAIL RISK

Companies that operate in the online marketplace, retail and travel segments are subject to fluctuating consumer demand. Unlike traditional brick and mortar retailers, online marketplaces and retailers must assume shipping costs or pass such costs to consumers. Consumer access to price information for the same or similar products may cause companies that operate in the online marketplace, retail and travel segments to reduce profit margins in order to compete. Profit margins in the travel industry are particularly sensitive to seasonal demand, fuel costs and consumer perception of various risks associated with travel to various destinations. Due to the nature of their business models, companies that operate in the online marketplace, retail and travel segments may also be subject to heightened cybersecurity risk, including the risk of theft or damage to vital hardware, software and information systems. The loss or public dissemination of sensitive customer information or other proprietary data may negatively affect the financial performance of such companies to a greater extent than traditional brick and mortar retailers. As a result of such companies being web-based and the fact that they process, store, and transmit large amounts of data, including personal information, for their customers, failure to prevent or mitigate data loss or other security breaches, including breaches of vendors’ technology and systems, could expose companies that operate in the online marketplace, retail and travel segments or their customers to a risk of loss or misuse of such information, adversely affect their operating results, result in litigation or potential liability, and otherwise harm their businesses.

The Funds have evaluated the need for additional disclosures and/or adjustments resulting from subsequent events through the date the financial statements were issued. The evaluation did not result in any subsequent events that necessitated disclosures and/or adjustments other than below.

On June 1, 2017, the Adviser launched the Amplify YieldShares Oil-Hedged MLP Income ETF.

| 9. | NEW ACCOUNTING PRONOUNCEMENTS |

In October 2016, the U.S. Securities and Exchange Commission adopted new rules and amended existing rules (together, “final rules”) intended to modernize the reporting and disclosure of information by registered investment companies. In part, the final rules amend Regulation S-X and require standardized, enhanced disclosure about derivatives in investment company financial statements, as well as other amendments. The compliance date for the amendments to Regulation S-X is August 1, 2017. Management is currently evaluating the impact that the adoption of the amendments to Regulation S-X will have on the financial statements and related disclosures.

25

Amplify ETF Trust

Board Considerations Regarding Approval of Investment Management Agreement

and Sub-Advisory Agreement

April 30, 2017 (Unaudited)

Pursuant to Section 15(c) of the Investment Company Act of 1940 (the “1940 Act”), at a meeting held on June 22, 2016, the Board of Trustees (the “Board”) of Amplify ETF Trust (the “Trust”) considered the approval of the following agreements (collectively, the “Agreements”): 1) an Investment Management Agreement between Amplify Investments LLC (the “Adviser”) and the Trust, on behalf of the Amplify YieldShares CWP Dividend & Option Income ETF (the “Fund”) and 2) an Investment Sub-Advisory Agreement between the Adviser and Penserra Capital Management LLC (“Penserra”), and 3) an Investment Sub-Advisory Agreement between the Adviser and Capital Wealth Planning, LLC (Penserra and Capital Wealth Planning, LLC referred to together as the “Sub-Advisers”) on behalf of the Fund.

After their initial two-year terms, the Agreements must be approved: (i) by the vote of the Trustees or by a vote of the shareholders of the Fund; and (ii) by the vote of a majority of the Trustees who are not parties to the Agreements or “interested persons” of any party thereto, as defined in the 1940 Act (the “Independent Trustees”), cast in person at a meeting called for the purpose of voting on such approval. Each year after the initial two-year term, the Board will call and hold a meeting to decide whether to renew the Agreements for an additional one-year term. In preparation for such meetings, the Board requests and reviews a wide variety of information from the Adviser and the Sub-Advisers.

Prior to the meeting held on June 22, 2016, the Board, including the Independent Trustees, reviewed written materials from the Adviser and the Sub-Advisers regarding, among other things: (i) the nature, extent and quality of the services to be provided to fund shareholders by the Adviser and the Sub-Advisers; (ii) the Adviser and the Sub-Advisers’ costs and profits expected to be realized in providing their services, including any fall-out benefits expected to be enjoyed by the Adviser and the Sub-Advisers; and (iii) the existence, or anticipated existence, of economies of scale.

Prior to and at the meeting held on June 22, 2016, representatives from the Adviser and the Sub-Advisers, along with other service providers of the Fund, presented additional oral and written information to help the Board evaluate the Adviser and the Sub-Advisers’ fees and other aspects of the Agreements. Among other things, representatives from the Adviser and the Sub-Advisers provided overviews of their advisory businesses, including investment personnel and investment processes. The representatives also discussed the rationale for launching the Fund, the Fund’s fees and fee structures of comparable investment companies. The Board then discussed the written materials that it received before the meeting and the Adviser and Sub-Advisers’ oral presentations and any other information that the Board received at the meeting, and deliberated on the approval of the Agreements in light of this information. In its deliberations, the Board did not identify any single piece of information discussed below that was all-important, controlling or determinative of its decision.

Nature, Extent and Quality of Services. In evaluating the nature, extent and quality of the Adviser’s services, the Trustees considered information concerning the functions to be performed by the Adviser and the Sub-Advisers and the personnel and resources of the Adviser and Sub-Advisers, including the investment management team that will be responsible for the day-to-day management of the Fund and the portfolio manager responsible for investing the portfolio of the Fund. The Trustees considered statements by the Adviser and Sub-Advisers regarding its respective financial condition, that each was financially stable and could support its performance of the services under its Agreement. The Trustees also considered the services to be provided by the Adviser in its oversight of the Fund’s service providers.

Based on their review, the Trustees concluded that the nature, extent and quality of the services to be provided by the Adviser and Sub-Advisers to the Fund under the respective Agreement were expected to be appropriate and reasonable.

Fees, Expenses and Profitability. The Trustees discussed the information provided by the Adviser on the Fund’s proposed investment management fee of 0.95%, as compared to information provided by the Adviser on other similar products. The Trustees also considered that the Adviser and Sub-Advisers did not manage any similar accounts. The Trustees noted that the proposed annual investment management fee to be charged to the Fund was a unitary fee, and that the Adviser has agreed to pay all other expenses of the Fund, including fees payable to the Sub-Advisers, except brokerage commissions and other expenses connected with the execution of portfolio transactions, taxes, interest, distribution and service fees payable pursuant to a 12b-1 Plan, if any, and extraordinary expenses. The Board concluded that the unitary investment management fee to be charged to the Fund is reasonable and appropriate in light of the services expected to be provided by the Adviser and Sub-Advisers. In conjunction with their review of the unitary investment management fee, the Trustees considered information provided by the Adviser on its costs to be incurred in connection with the proposed Agreement and

26

Amplify ETF Trust

Board Considerations Regarding Approval of Investment Management Agreement

and Sub-Advisory Agreement

April 30, 2017 (Unaudited) (Continued)

its estimated profitability, and noted the Adviser’s statement that it would not likely be profitable in its first year of operating the Fund and that any profitability would not be excessive. The Trustees concluded that the estimated profits to be realized by the Adviser with respect to the Fund appeared to be reasonable.

Economies of Scale and Whether the Fee Level Reflects These Economies of Scale. The Trustees considered the information provided by the Adviser as to the extent to which economies of scale may be realized as the Fund grows and whether the fee level reflects economies of scale for the benefit of shareholders. The Trustees noted that any reduction in fixed costs associated with the management of the Fund would be enjoyed by the Adviser and Sub-Advisers, but that a unitary fee provides a level of certainty in expenses for the Fund. The Trustees considered whether the proposed advisory fee rate for the Fund is reasonable in relation to the projected asset size of the Fund. The Trustees noted the Adviser’s views on its expectations for growth, noting that, initially, the Adviser did not anticipate any material economies of scale. The Trustees concluded that the flat investment management fee was reasonable and appropriate.

The Trustees noted that the Adviser and Sub-Advisers had not identified any further benefits that it would derive from its relationship with the Fund, and had noted that it will not, initially, have any soft dollar arrangements.

Based on all of the information considered and the conclusions reached, the Board, including the Independent Trustees, determined to approve the Agreement for the Fund.

27

Amplify ETF Trust

Disclosure of Fund Expenses

April 30, 2017 (Unaudited)

All Exchange Traded Funds (“ETF”) have operating expenses. As a shareholder of an ETF, your investment is affected by these ongoing costs, which include (among others) costs for ETF management, administrative services, brokerage fees and shareholder reports like this one. It is important for you to understand the impact of these costs on your investment returns.