Filed pursuant to Rule 425 of the Securities Act of 1933

and deemed filed pursuant to Rule 14a-2

of the Securities Exchange Act of 1934

Filer: Grupo Villar Mir, S.A.U.

Subject Company: Globe Specialty Metals, Inc.

Subject Company File No.: 001-34420

Globe Specialty Metals and Grupo FerroAtlántica GSM Today and Our Transformational Next Step Globe Specialty Metals Grupo FerroAtlántica

Disclaimer and Forward Looking Statements Cautionary Statement Regarding Forward-Looking Statements Certain statements in this communication regarding the proposed transaction among Globe, Grupo Villar Mir, FerroAtlántica and VeloNewco, the expected timetable for completing the transaction, benefits and synergies of the transaction, future opportunities for the combined company and products and any other statements regarding Globe’s, Grupo Villar Mir’s, FerroAtlántica’s and VeloNewco’s future expectations, beliefs, plans, objectives, financial conditions, assumptions or future events or performance that are not historical facts are “forward-looking” statements made within the meaning of Section 21E of the Securities Exchange Act of 1934. These statements are often, but not always, made through the use of words or phrases such as “believe,” “anticipate,” “could,” “may,” “would,” “should,” “intend,” “plan,” “potential,” “predict(s),” “will,” “expect(s),” “estimate(s),” “project(s),” “positioned,” “strategy,” “outlook” and similar expressions. All such forward-looking statements involve estimates and assumptions that are subject to risks, uncertainties and other factors that could cause actual results to differ materially from the results expressed in the statements. Among the key factors that could cause actual results to differ materially from those projected in the forward-looking statements are the following: Globe, Grupo Villar Mir, FerroAtlántica and VeloNewco’s ability to consummate the transaction; the conditions to the completion of the transaction, including the receipt of stockholder approval; regulatory approvals required for the transaction may not be obtained on the terms expected or on the anticipated schedule; Globe, Grupo Villar Mir, FerroAtlántica and VeloNewco’s ability to meet expectations regarding the timing, completion and other aspects of the transaction; the possibility that the parties may be unable to successfully integrate Globe’s and FerroAtlántica’s operations; such integration may be more difficult, time-consuming or costly than expected; operating costs, customer loss and business disruption (including, without limitation, difficulties in maintaining relationships with employees, customers, clients or suppliers) may be greater than expected following the transaction; the retention of certain key employees may be difficult; the intense competition and expected increased competition in the future; the ability to adapt services to changes in technology or the marketplace; the ability to maintain and grow relationships with customers and clients; the historic cyclicality of the metals industry and the attendant swings in market price and demand; increases in energy costs and the effect on costs of production; disruptions in the supply of power; availability of raw materials or transportation; cost of raw material inputs and the ability to pass along those costs to customers; costs associated with labor disputes and stoppages; the ability to generate sufficient cash to service indebtedness; integration and development of prior and future acquisitions; VeloNewco’s ability to effectively implement strategic initiatives and actions taken to increase sales growth; VeloNewco’s ability to compete successfully; availability and cost of maintaining adequate levels of insurance; the ability to protect trade secrets or maintain their trademarks and other intellectual property; equipment failures, delays in deliveries or catastrophic loss at any of Globe’s, FerroAtlántica’s or VeloNewco’s manufacturing facilities; changes in laws protecting U.S. and Canadian companies from unfair foreign competition or the measures currently in place or expected to be imposed under those laws; compliance with, potential liability under, and risks related to environmental, health and safety laws and regulations (and changes in such laws and regulations, including their enforcement or interpretation); risks from international operations, such as foreign exchange, tariff, tax, inflation, increased costs, political risks and their ability to expand in certain international markets; risks associated with the metals manufacturing and smelting activity; ability to manage price and operational risks including industrial accidents and natural disasters; ability to acquire or renew permits and approvals; potential loss due to immediate cancellations of service contracts; risks associated with potential unionization of employees or work stoppages that could adversely affect the parties’ operations; changes in general economic, business and political conditions, including changes in the financial markets; and exchange rate fluctuation. Additional information concerning these and other factors can be found in Globe’s filings with the Securities and Exchange Commission (“SEC”), including Globe’s most recent Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q and Current Reports on Form 8-K. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as of the date hereof and Globe, FerroAtlántica or VeloNewco undertakes no obligation to update or revise publicly any forward-looking statements, whether as a result of new information, future events or otherwise. Additional Information and Where to Find It This communication may be deemed to be solicitation material in respect of the proposed transaction among Globe, Grupo Villar Mir, FerroAtlántica and VeloNewco. In connection with the proposed transaction, Globe and VeloNewco intend to file relevant materials with the SEC, including VeloNewco’s registration statement on Form F-4 that will include a proxy statement of Globe that also constitutes a prospectus of VeloNewco. Investors and security holders are urged to read all relevant documents filed with the SEC, including the proxy statement/prospectus, because they will contain important information about the proposed transaction. Investors and security holders are able to obtain the documents (once available) free of charge at the SEC’s website, http://www.sec.gov, or for free from Globe by contacting the Corporate Secretary, Globe Specialty Metals, 600 Brickell Avenue, Suite 1500, Miami, FL 33131, telephone: 786-509-6900 (for documents filed with the SEC by Globe) or from Grupo Villar Mir by contacting Investor Relations, Torre Espacio, Paseo de la Castellana, 259 D 49a, 28046 Madrid, Spain, +34 91 556 7347 (for documents filed with the SEC by FerroAtlantica or VeloNewco. Such documents are not currently available. Participants in Solicitation Globe, Grupo Villar Mir, FerroAtlántica and VeloNewco and their directors and executive officers and certain employees may be deemed to be participants in the solicitation of proxies from the holders of Globe common stock with respect to the proposed transaction. Information about Globe’s directors and executive officers is set forth in the proxy statement for Globe’s 2014 Annual Meeting of Stockholders, which was filed with the SEC on October 27, 2014. To the extent holdings of Globe securities have changed since the amounts contained in the proxy statement for Globe’s 2014 Annual Meeting of Stockholders, such changes have been or will be reflected on Statements of Change in Ownership on Form 4 filed with the SEC. Investors may obtain additional information regarding the interest of such participants by reading the proxy statement/prospectus regarding the acquisition (once available). These documents (when available) may be obtained free of charge from the SEC’s website http://www.sec.gov, or from Globe and Grupo Villar Mir using the contact information above. Non-Solicitation This communication shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended.

I. GSM: Today (Pre-Merger)

GSM’s Core Business Principles Grow through value enhancing acquisitions with well-defined investment criteria Maintain our industry leading cost structure to ensure profitability through cycles Ensure a well-defined business model and strategic purpose that is easily communicated to investors Focus on profitability through asset concentration in products with attractive, fast growing end markets Maintain a strong, flexible balance sheet - designed for growth Focus on maximizing shareholder returns through revenue and earnings growth, dividend growth and timely share repurchases

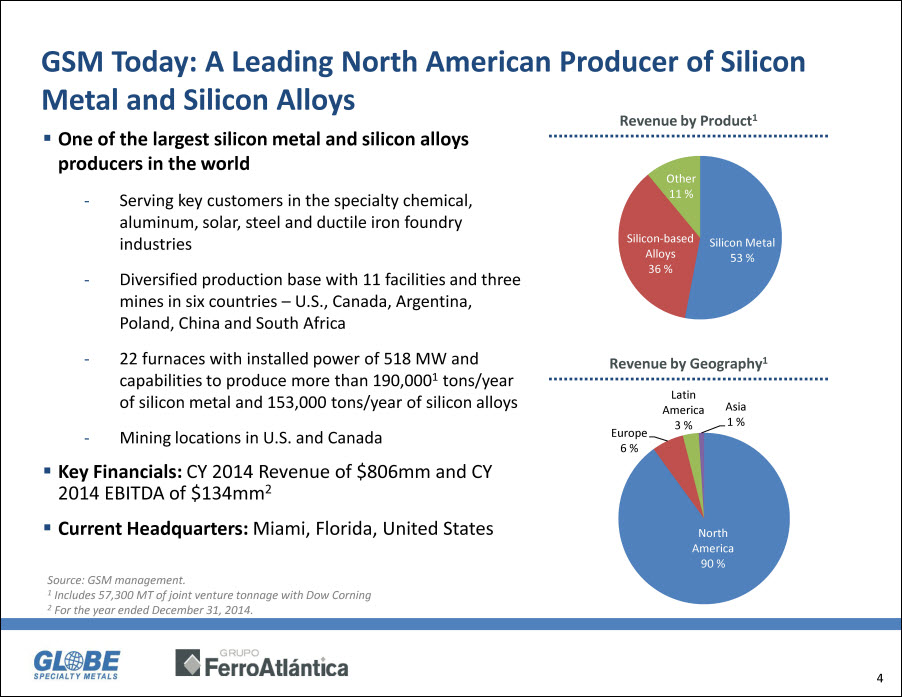

GSM Today: A Leading North American Producer of Silicon Metal and Silicon Alloys One of the largest silicon metal and silicon alloys producers in the world Serving key customers in the specialty chemical, aluminum, solar, steel and ductile iron foundry industries Diversified production base with 11 facilities and three mines in six countries - U.S., Canada, Argentina, Poland, China and South Africa 22 furnaces with installed power of 518 MW and capabilities to produce more than 190,0001 tons/year of silicon metal and 153,000 tons/year of silicon alloys Mining locations in U.S. and Canada Key Financials: CY 2014 Revenue of $806mm and CY 2014 EBITDA of $134mm2 Current Headquarters: Miami, Florida, United States Revenue by Product1 Silicon Metal 53 % Silicon-based Alloys 36 % Other 11 % Revenue by Geography1 North America 90 % Europe 6 % Latin America 3 % Asia 1 % Source: GSM management. 1 Includes 57,300 MT of joint venture tonnage with Dow Corning 2 For the year ended December 31, 2014.

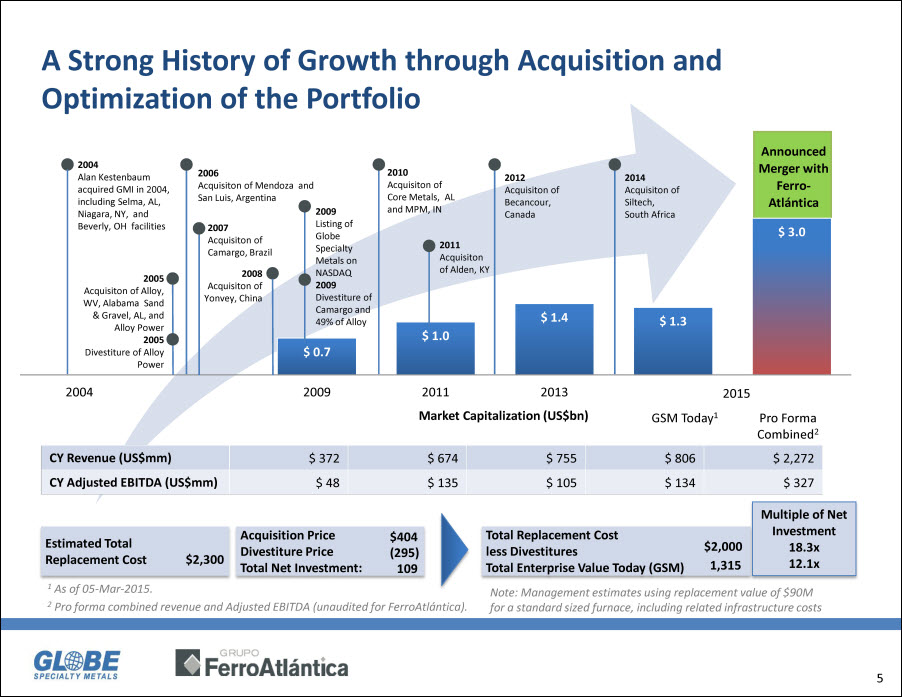

A Strong History of Growth through Acquisition and Optimization of the Portfolio Announced Merger with Ferro-Atlántica $ 3.0 2004 Alan Kestenbaum acquired GMI in 2004, including Selma, AL, Niagara, NY, and Beverly, OH facilities 2005 Acquisiton of Alloy, WV, Alabama Sand & Gravel, AL, and Alloy Power 2005 Divestiture of Alloy Power 2006 Acquisiton of Mendoza and San Luis, Argentina 2007 Acquisiton of Camargo, Brazil 2008 Acquisiton of Yonvey, China 2009 Listing of Globe Specialty Metals on NASDAQ 2009 Divestiture of Camargo and 49% of Alloy $ 0.7 2010 Acquisiton of Core Metals, AL and MPM, IN 2011 Acquisiton of Alden, KY $ 1.0 2012 Acquisiton of Becancour, Canada $ 1.4 2014 Acquisiton of Siltech, South Africa $ 1.3 2004 2009 2011 2013 2015 Market Capitalization (US$bn) GSM Today1 Pro Forma Combined2 CY Revenue (US$mm) $ 372 $ 674 $ 755 $ 806 $ 2,272 CY Adjusted EBITDA (US$mm) $ 48 $ 135 $ 105 $ 134 $ 327 Estimated Total Replacement Cost $2,300 Acquisition Price $404 Divestiture Price (295) Total Net Investment: 109 1 As of 05-Mar-2015. 2 Pro forma combined revenue and Adjusted EBITDA (unaudited for FerroAtlántica). Total Replacement Cost less Divestitures $2,000 Total Enterprise Value Today (GSM) 1,315 Multiple of Net Investment 18.3x 12.1x Note: Management estimates using replacement value of $90M for a standard sized furnace, including related infrastructure costs

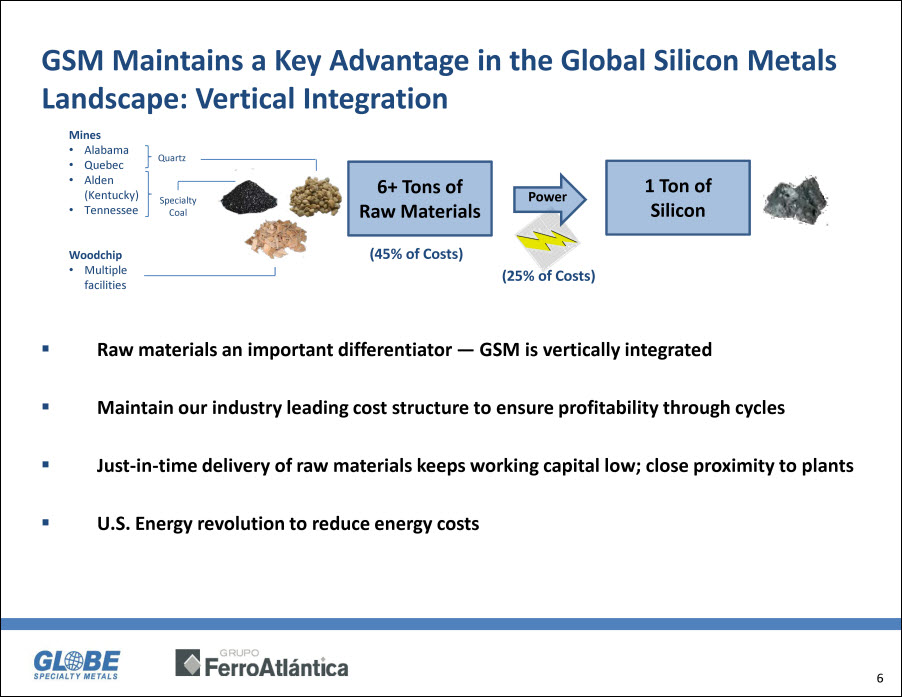

GSM Maintains a Key Advantage in the Global Silicon Metals Landscape: Vertical Integration Mines Alabama Quebec Quartz Alden (Kentucky) Tennessee Specialty Coal Woodchip Multiple facilities 6+ Tons of Raw Materials (45% of Costs) Power (25% of Costs) 1 Ton of Silicon Raw materials an important differentiator — GSM is vertically integrated Maintain our industry leading cost structure to ensure profitability through cycles Just-in-time delivery of raw materials keeps working capital low; close proximity to plants U.S. Energy revolution to reduce energy costs

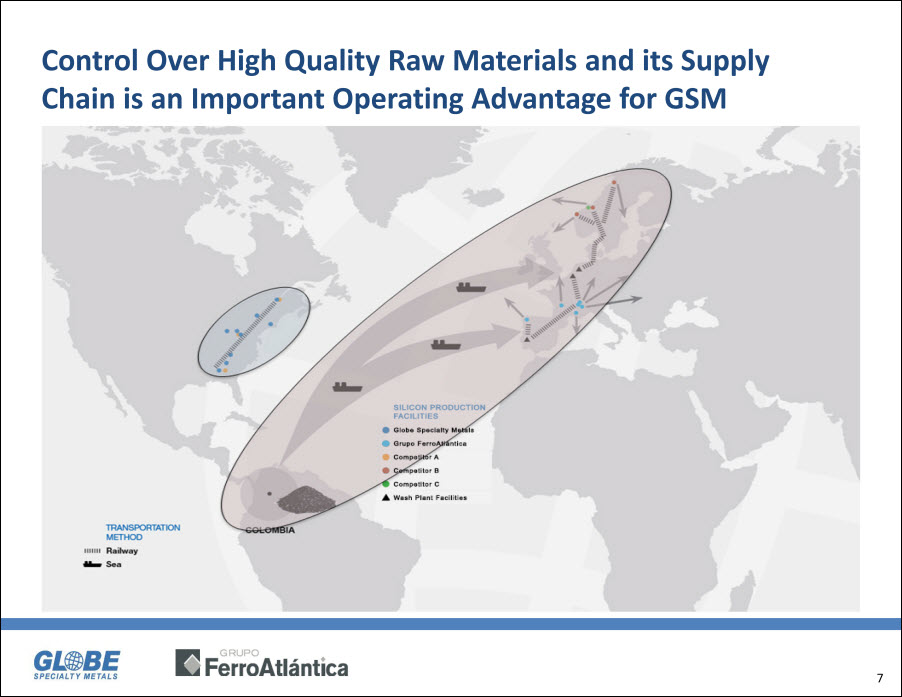

Control Over High Quality Raw Materials and its Supply Chain is an Important Operating Advantage for GSM Transportation Method Railway Sea Silicon Production Facilities Globe Specialty Metals Grupo FerroAtlantica Competitor A Competitor B Competitor C Wash Plant Facilities Colombia

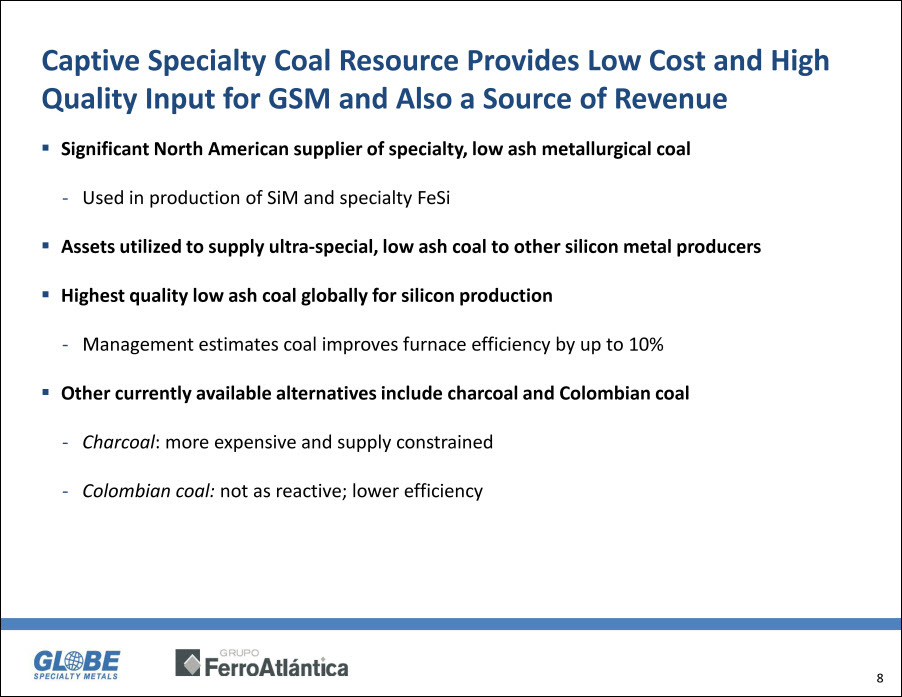

Captive Specialty Coal Resource Provides Low Cost and High Quality Input for GSM and Also a Source of Revenue Significant North American supplier of specialty, low ash metallurgical coal Used in production of SiM and specialty FeSi Assets utilized to supply ultra-special, low ash coal to other silicon metal producers Highest quality low ash coal globally for silicon production Management estimates coal improves furnace efficiency by up to 10% Other currently available alternatives include charcoal and Colombian coal Charcoal: more expensive and supply constrained Colombian coal: not as reactive; lower efficiency

GSM’s Industry Leading Cost Structure Provides Significant Operating Leverage to Price Stable operating costs with some of the most efficient operations globally 1¢/lb ($22/t) change in silicon and silicon alloys market prices results in ~$5.3 million EBITDA1 impact EBITDA ($ million) 0 100 200 300 400 500 Incremental EBITDA Total Operating Costs Silicon Metal $1.25 $1.35 $1.45 $1.55 $1.65 $1.75 $1.85 $1.95 Silicon-Based Alloys $1.00 $1.10 $1.20 $1.30 $1.40 $1.50 $1.60 $1.70 1. Incremental EBITDA at full capacity.

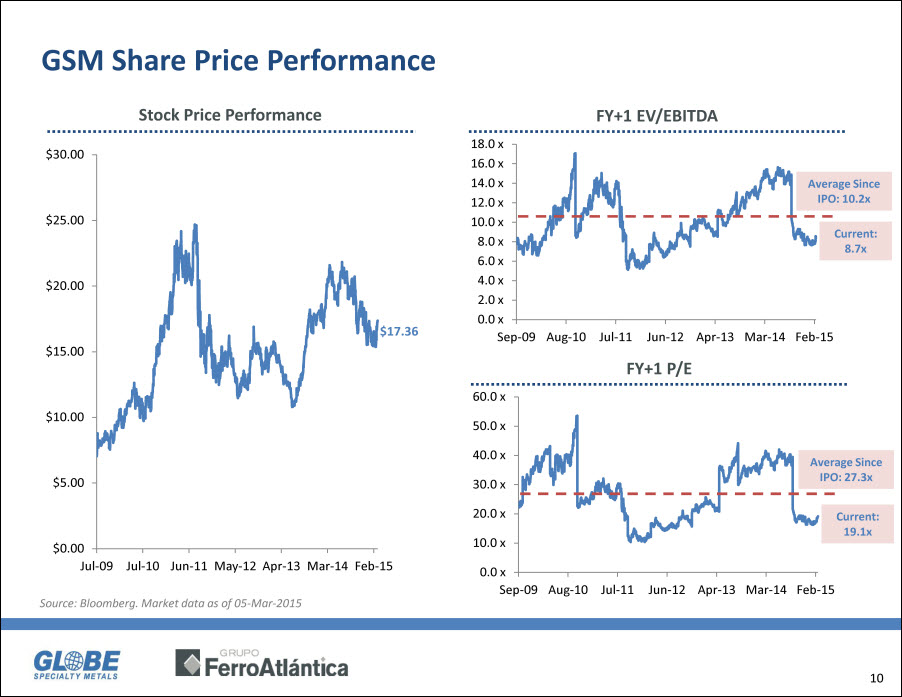

GSM Share Price Performance Stock Price Performance $0.00 $5.00 $10.00 $15.00 $20.00 $25.00 $30.00 Jul-09 Jul-10 Jun-11 May-12 Apr-13 Mar-14 Feb-15 $17.36 FY+1 EV/EBITDA 0.0 x 2.0 x 4.0 x 6.0 x 8.0 x 10.0 x 12.0 x 14.0 x 16.0 x 18.0 x Sep-09 Aug-10 Jul-11 Jun-12 Apr-13 Mar-14 Feb-15 Average Since IPO: 10.2x Current: 8.7x FY+1 P/E 0.0 x 10.0 x 20.0 x 30.0 x 40.0 x 50.0 x 60.0 x Sep-09 Aug-10 Jul-11 Jun-12 Apr-13 Mar-14 Feb-15 Average Since IPO: 27.3x Current: 19.1x Source: Bloomberg. Market data as of 05-Mar-2015

II. Merger with FerroAtlantica - The Transformational Next Step

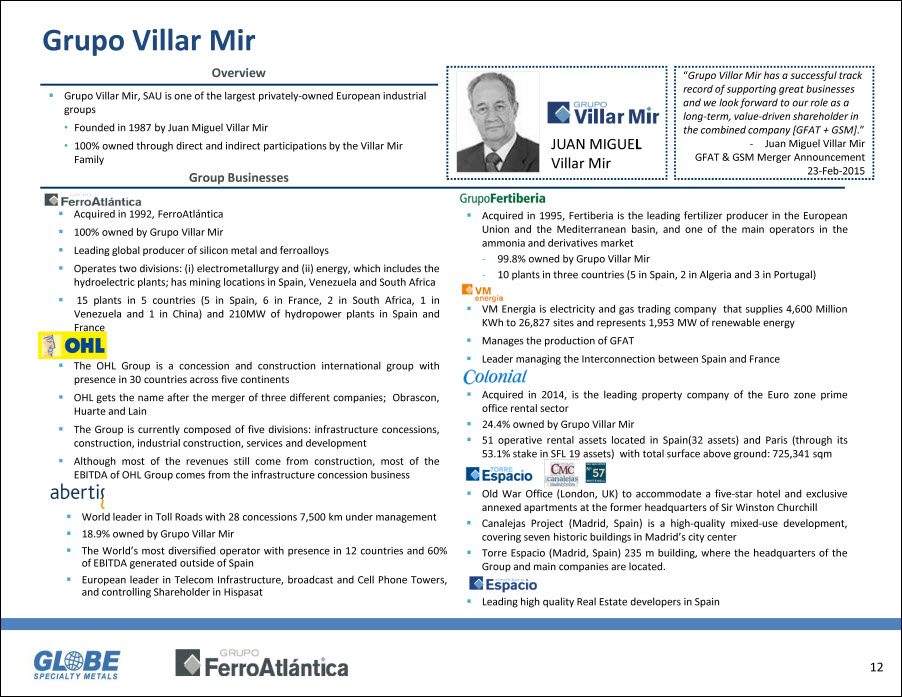

Grupo Villar Mir Overview Grupo Villar Mir, SAU is one of the largest privately-owned European industrial groups Founded in 1987 by Juan Miguel Villar Mir100% owned through direct and indirect participations by the Villar Mir Family JUAN MIGUEL Villar Mir “Grupo Villar Mir has a successful track record of supporting great businesses and we look forward to our role as a long-term, value-driven shareholder in the combined company [GFAT + GSM].” - Juan Miguel Villar Mir GFAT & GSM Merger Announcement 23-Feb-2015 Group Businesses FerroAtlántica Acquired in 1992, FerroAtlántica 100% owned by Grupo Villar Mir Leading global producer of silicon metal and ferroalloys Operates two divisions: (i) electrometallurgy and (ii) energy, which includes the hydroelectric plants; has mining locations in Spain, Venezuela and South Africa 15 plants in 5 countries (5 in Spain, 6 in France, 2 in South Africa, 1 in Venezuela and 1 in China) and 210MW of hydropower plants in Spain and France OHL The OHL Group is a concession and construction international group with presence in 30 countries across five continents OHL gets the name after the merger of three different companies; Obrascon, Huarte and Lain The Group is currently composed of five divisions: infrastructure concessions, construction, industrial construction, services and development Although most of the revenues still come from construction, most of the EBITDA of OHL Group comes from the infrastructure concession business abertis World leader in Toll Roads with 28 concessions 7,500 km under management 18.9% owned by Grupo Villar Mir The World’s most diversified operator with presence in 12 countries and 60% of EBITDA generated outside of Spain European leader in Telecom Infrastructure, broadcast and Cell Phone Towers, and controlling Shareholder in Hispasat GrupoFertiberia Acquired in 1995, Fertiberia is the leading fertilizer producer in the European Union and the Mediterranean basin, and one of the main operators in the ammonia and derivatives market ‐99.8% owned by Grupo Villar Mir ‐10 plants in three countries (5 in Spain, 2 in Algeria and 3 in Portugal) VM Energia VM Energia is electricity and gas trading company that supplies 4,600 Million KWh to 26,827 sites and represents 1,953 MW of renewable energy Manages the production of GFAT Leader managing the Interconnection between Spain and France Colonial Acquired in 2014, is the leading property company of the Euro zone prime office rental sector 24.4% owned by Grupo Villar Mir 51 operative rental assets located in Spain(32 assets) and Paris (through its 53.1% stake in SFL 19 assets) with total surface above ground: 725,341 sqm Torre Espacia CMC canalejas Madrid Centro Old War Office No. 57 Whitehall Old War Office (London, UK) to accommodate a five-star hotel and exclusive annexed apartments at the former headquarters of Sir Winston Churchill Canalejas Project (Madrid, Spain) is a high-quality mixed-use development, covering seven historic buildings in Madrid’s city center Torre Espacio (Madrid, Spain) 235 m building, where the headquarters of the Group and main companies are located. Espacio inmobiliaria Leading high quality Real Estate developers in Spain

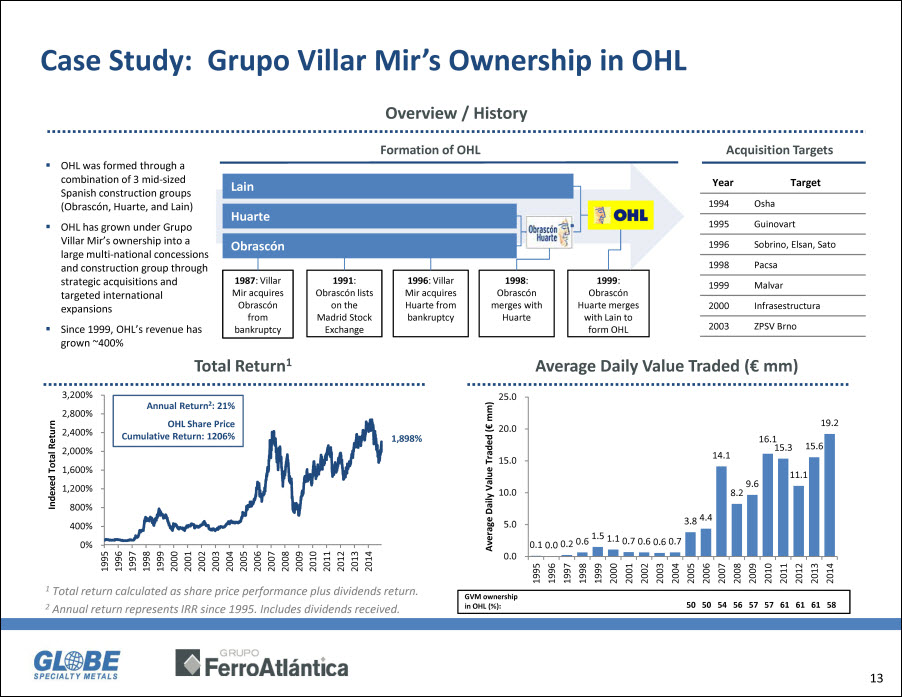

Case Study: Grupo Villar Mir’s Ownership in OHL Overview / History OHL was formed through a combination of 3 mid-sized Spanish construction groups (Obrascón, Huarte, and Lain) OHL has grown under Grupo Villar Mir’s ownership into a large multi-national concessions and construction group through strategic acquisitions and targeted international expansions Since 1999, OHL’s revenue has grown ~400% Formation of OHL Lain Huarte Obrascón 1987: Villar Mir acquires Obrascón from bankruptcy 1991: Obrascón lists on the Madrid Stock Exchange 1996: Villar Mir acquires Huarte from bankruptcy 1998: Obrascón merges with Huarte 1999: Obrascón Huarte merges with Lain to form OHL Acquisition Targets Year Target 1994 Osha 1995 Guinovart 1996 Sobrino, Elsan, Sato 1998 Pacsa 1999 Malvar 2000 Infrasestructura 2003 ZPSV Brno Total Return1 Annual Return2: 21% OHL Share Price Cumulative Return: 1206% Indexed Total Return 0% 400% 800% 1,200% 1,600% 2,000% 2,400% 2,800% 3,200% 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 1,898% Average Daily Value Traded (€ mm) 0.0 5.0 10.0 15.0 20.0 25.0 1995 0.1 1996 0.0 1997 0.2 1998 0.6 1999 1.5 2000 1.1 2001 0.7 2002 0.6 2003 0.6 2004 0.7 2005 3.8 2006 4.4 2007 14.1 2008 8.2 2009 9.6 2010 16.1 2011 15.3 2012 11.1 2013 15.6 2014 19.2 Average Daily Value Traded (€ mm) GVM ownership in OHL (%): 50 50 54 56 57 57 61 61 61 58 1 Total return calculated as share price performance plus dividends return. 2 Annual return represents IRR since 1995. Includes dividends received.

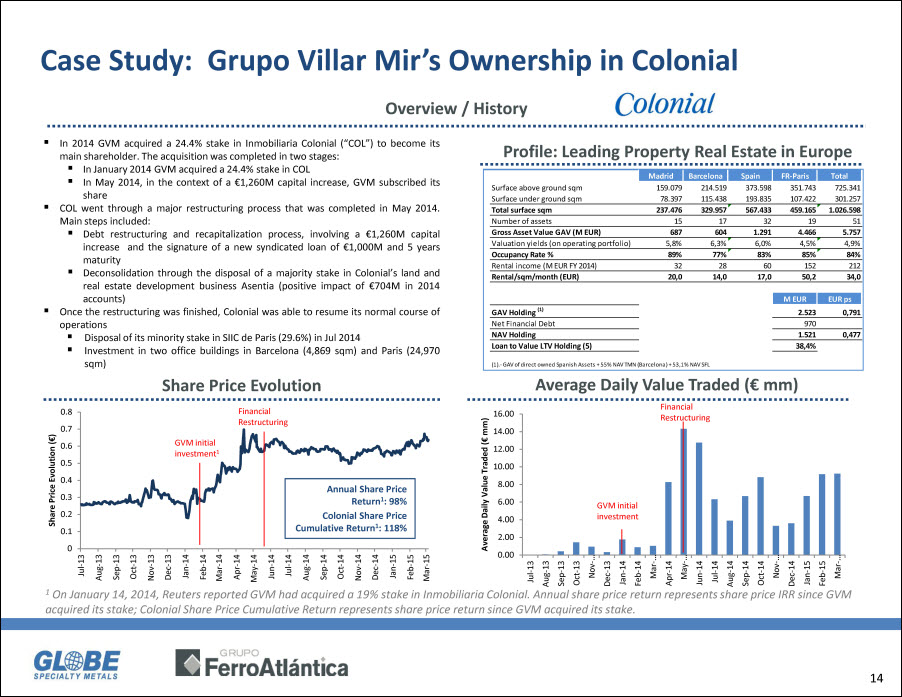

Case Study: Grupo Villar Mir’s Ownership in Colonial Overview / History In 2014 GVM acquired a 24.4% stake in Inmobiliaria Colonial (“COL”) to become its main shareholder. The acquisition was completed in two stages: In January 2014 GVM acquired a 24.4% stake in COL In May 2014, in the context of a €1,260M capital increase, GVM subscribed its share COL went through a major restructuring process that was completed in May 2014. Main steps included: Debt restructuring and recapitalization process, involving a €1,260M capital increase and the signature of a new syndicated loan of €1,000M and 5 years maturity Deconsolidation through the disposal of a majority stake in Colonial’s land and real estate development business Asentia (positive impact of €704M in 2014 accounts) Once the restructuring was finished, Colonial was able to resume its normal course of operations Disposal of its minority stake in SIIC de Paris (29.6%) in Jul 2014 Investment in two office buildings in Barcelona (4,869 sqm) and Paris (24,970 sqm) Profile: Leading Property Real Estate in Europe Madrid Barcelona Spain FR-Paris Total Surface above ground sqm 159.079 214.519 373.598 351.743 725.341 Surface under ground sqm 78.397 115.438 193.835 107.422 301.257 Total surface sqm 237.476 329.957 567.433 459.165 1.026.598 Number of assets 15 17 32 19 51 Gross Asset Value GAV (M EUR) 687 604 1.291 4.466 5.757 Valuation yields (on operating portfolio) 5,8% 6,3% 6,0% 4,5% 4,9% Occupancy Rate % 89% 77% 83% 85% 84% Rental income (M EUR FY 2014) 32 28 60 152 212 Rental/sqm/month (EUR) 20,0 14,0 17,0 50,2 34,0 M EUR EUR ps GAV Holding (1) 2.523 0,791 Net Financial Debt 970 NAV Holding 1.521 0,477 Loan to Value LTV Holding (5) 38,4% (1).- GAV of direct owned Spanish Assets + 55% NAV TMN (Barcelona) + 53,1% NAV SFL Share Price Evolution Share Price Evolution (€) 0 0.1 0.2 0.3 0.4 0.5 0.6 0.7 0.8 Jul-13 Aug-13 Sep-13 Oct-13 Nov-13 Dec-13 Jan-14 Feb-14 Mar-14 Apr-14 May-14 Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-14 Dec-14 Jan-15 Feb-15 Mar-15 GVM initial investment1 Financial Restructuring Annual Share Price Return1: 98% Colonial Share Price Cumulative Return1: 118% Average Daily Value Traded (€ mm) Average Daily Value Traded (€ mm) 0.00 2.00 4.00 6.00 8.00 10.00 12.00 14.00 16.00 Jul-13 Aug-13 Sep-13 Oct-13 Nov-… Dec-13 Jan-14 Feb-14 Mar-… Apr-14 May-… Jun-14 Jul-14 Aug-14 Sep-14 Oct-14 Nov-… Dec-14 Jan-15 Feb-15 Mar-… GVM initial investment Financial Restructuring 1 On January 14, 2014, Reuters reported GVM had acquired a 19% stake in Inmobiliaria Colonial. Annual share price return represents share price IRR since GVM acquired its stake; Colonial Share Price Cumulative Return represents share price return since GVM acquired its stake.

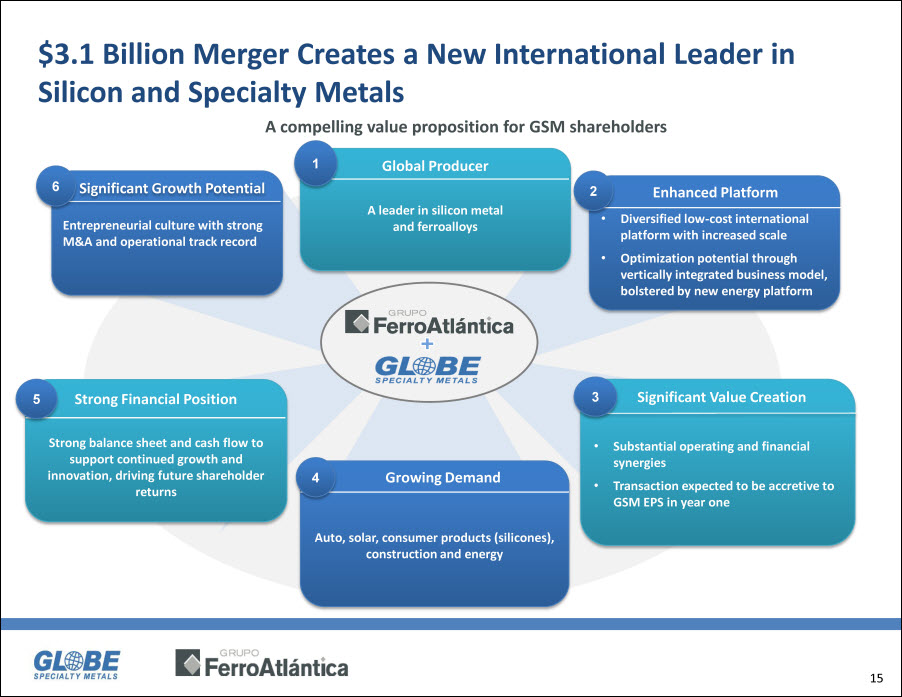

$3.1 Billion Merger Creates a New International Leader in Silicon and Specialty Metals A compelling value proposition for GSM shareholders 6 Significant Growth Potential Entrepreneurial culture with strong M&A and operational track record 1 Global Producer A leader in silicon metal and ferroalloys 2 Enhanced Platform Diversified low-cost international platform with increased scale Optimization potential through vertically integrated business model, bolstered by new energy platform 5 Strong Financial Position Strong balance sheet and cash flow to support continued growth and innovation, driving future shareholder returns 4 Growing Demand Auto, solar, consumer products (silicones), construction and energy 3 Significant Value Creation Substantial operating and financial synergies Transaction expected to be accretive to GSM EPS in year one

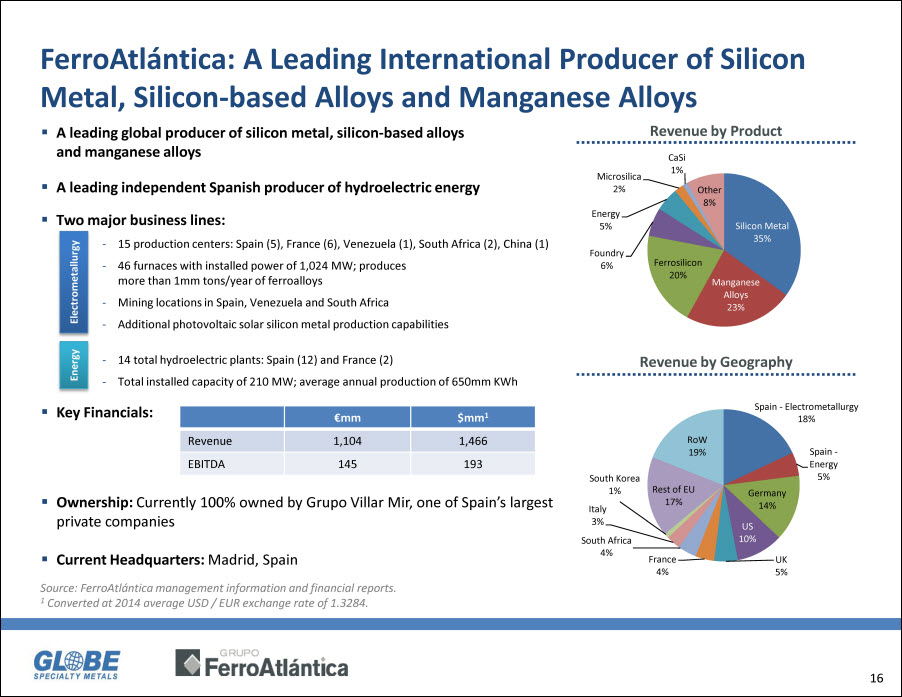

FerroAtlántica: A Leading International Producer of Silicon Metal, Silicon-based Alloys and Manganese Alloys A leading global producer of silicon metal, silicon-based alloys and manganese alloys A leading independent Spanish producer of hydroelectric energy Two major business lines: Electrometallurgy ‐15 production centers: Spain (5), France (6), Venezuela (1), South Africa (2), China (1) ‐46 furnaces with installed power of 1,024 MW; produces more than 1mm tons/year of ferroalloys ‐Mining locations in Spain, Venezuela and South Africa ‐Additional photovoltaic solar silicon metal production capabilities Energy ‐14 total hydroelectric plants: Spain (12) and France (2) ‐Total installed capacity of 210 MW; average annual production of 650mm KWh Key Financials: €mm $mm1 Revenue 1,104 1,466 EBITDA 145 193 Ownership: Currently 100% owned by Grupo Villar Mir, one of Spain’s largest private companies Current Headquarters: Madrid, Spain Source: FerroAtlántica management information and financial reports. 1 Converted at 2014 average USD / EUR exchange rate of 1.3284. Revenue by Product CaSi 1% Other 8% Silicon Metal 35% Manganese Alloys 23% Ferrosilicon 20% Foundry 6% Energy 5% Microsilica 2% Revenue by Geography Spain - Electrometallurgy 18% Spain - Energy 5% Germany 14% US 10% UK 5% France 4% South Africa 4% Italy 3% South Korea 1% Rest of EU 17% RoW 19%

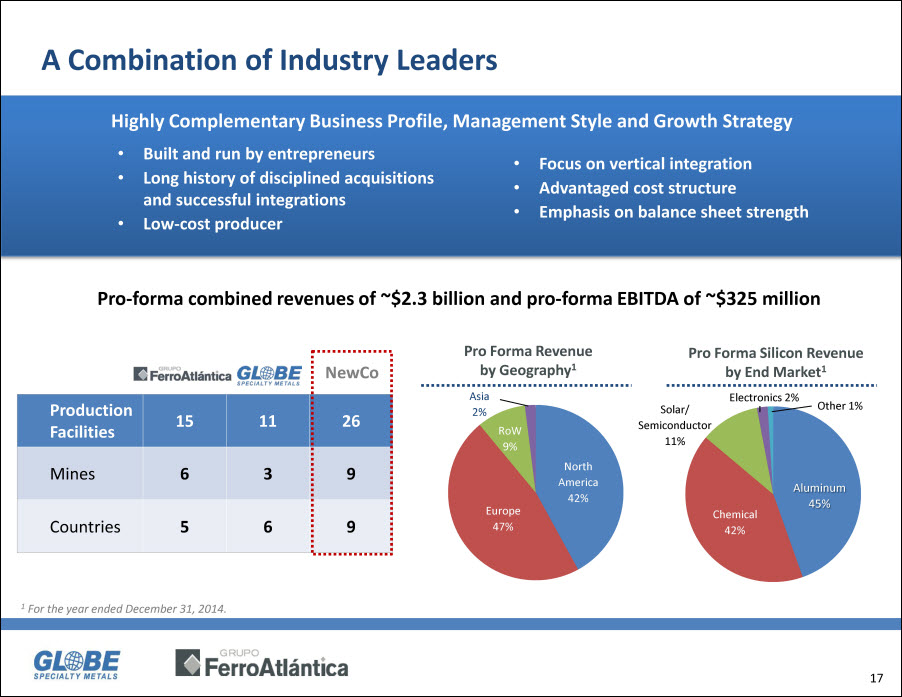

A Combination of Industry Leaders Highly Complementary Business Profile, Management Style and Growth Strategy Built and run by entrepreneurs Long history of disciplined acquisitions and successful integrations Low-cost producer Focus on vertical integration Advantaged cost structure Emphasis on balance sheet strength Pro-forma combined revenues of ~$2.3 billion and pro-forma EBITDA of ~$325 million Grupo FerroAtlántica Globe Specialty Metals NewCo Production Facilities 15 11 26 Mines 6 3 9 Countries 5 6 9 Pro Forma Revenue by Geography1 Asia 2% RoW 9% North America 42% Europe 47% Pro Forma Silicon Revenue by End Market1 Electronics 2% Other 1% Aluminum 45% Chemical 42% Chemical 42% Solar/ Semiconductor 11% 1 For the year ended December 31, 2014.

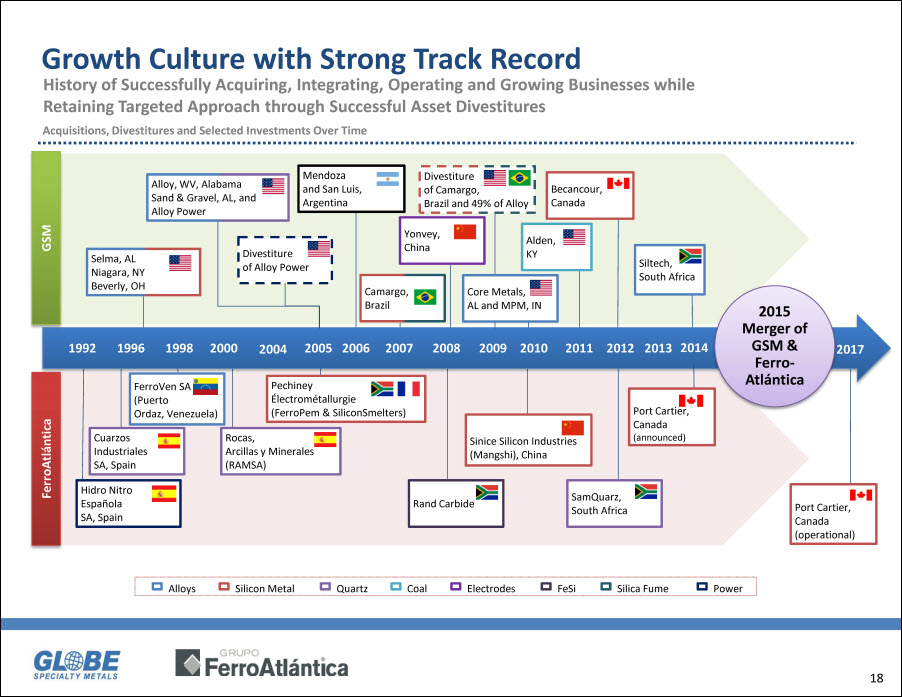

Growth Culture with Strong Track Record History of Successfully Acquiring, Integrating, Operating and Growing Businesses while Retaining Targeted Approach through Successful Asset Divestitures Acquisitions, Divestitures and Selected Investments Over Time GSM Selma, AL Niagara, NY Beverly, OH Alloy, WV, Alabama Sand & Gravel, AL, and Alloy Power Divestiture of Alloy Power Mendoza and San Luis, Argentina Camargo, Brazil Yonvey, China Divestiture of Camargo, Brazil and 49% of Alloy Core Metals, AL and MPM, IN Alden, KY Becancour, Canada Siltech, South Africa 1992 1996 1998 2000 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 Merger of GSM & Ferro-Atlántica 2017 FerroAtlántica Hidro Nitro Española SA, Spain Cuarzos Industriales SA, Spain FerroVen SA (Puerto Ordaz, Venezuela) Rocas, Arcillas y Minerales (RAMSA) Pechiney Électrométallurgie (FerroPem & SiliconSmelters) Rand Carbide Sinice Silicon Industries (Mangshi), China SamQuarz, South Africa Port Cartier, Canada (announced) Port Cartier, Canada (operational) Alloys Silicon Metal Quartz Coal Electrodes FeSi Silica Fume Power

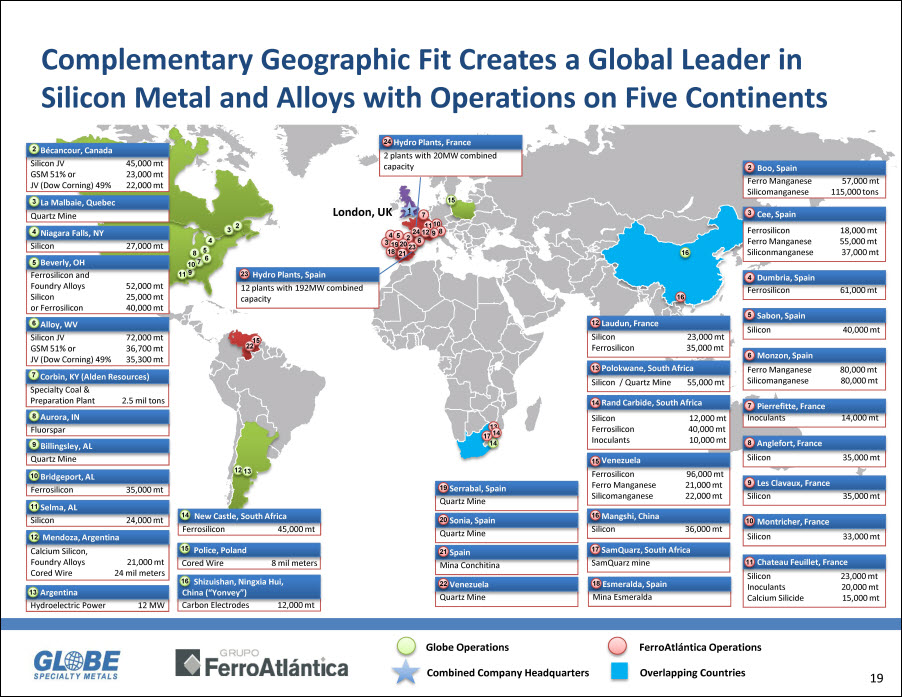

Complementary Geographic Fit Creates a Global Leader in Silicon Metal and Alloys with Operations on Five Continents 2 Bécancour, Canada Silicon JV 45,000 mt GSM 51% or 23,000 mt JV (Dow Corning) 49% 22,000 mt 3 La Malbaie, Quebec Quartz Mine 4 Niagara Falls, NY Silicon 27,000 mt 5 Beverly, OH Ferrosilicon and Foundry Alloys 52,000 mt Silicon 25,000 mt or Ferrosilicon 40,000 mt 6 Alloy, WV Silicon JV 72,000 mt GSM 51% or 36,700 mt JV (Dow Corning) 49% 35,300 mt 7 Corbin, KY (Alden Resources) Specialty Coal & Preparation Plant 2.5 mil tons 8 Aurora, IN Fluorspar 9 Billingsley, AL Quartz Mine 10 Bridgeport, AL Ferrosilicon 35,000 mt 11 Selma, AL Silicon 24,000 mt 12 Mendoza, Argentina Calcium Silicon, Foundry Alloys 21,000 mt Cored Wire 24 mil meters 13 Argentina Hydroelectric Power 12 MW 14 New Castle, South Africa Ferrosilicon 45,000 mt 15Police, Poland Cored Wire 8 mil meters 16Shizuishan, Ningxia Hui, China (“Yonvey”) Carbon Electrodes 12,000 mt 23Hydro Plants, Spain 12 plants with 192MW combined capacity 24 Hydro Plants, France 2 plants with 20MW combined capacity London, UK 2 Boo, Spain Ferro Manganese 57,000 mt Silicomanganese 115,000 tons 3 Cee, Spain Ferrosilicon 18,000 mt Ferro Manganese 55,000 mt Siliconmanganese 37,000 mt 4 Dumbria, Spain Ferrosilicon 61,000 mt 5 Sabon, Spain Silicon 40,000 mt 6 Monzon, Spain Ferro Manganese 80,000 mt Silicomanganese 80,000 mt 7 Pierrefitte, France Inoculants 14,000 mt 8 Anglefort, France Silicon 35,000 mt 9 Les Clavaux, France Silicon 35,000 mt 10Montricher, France Silicon 33,000 mt 11 Chateau Feuillet, France Silicon 23,000 mt Inoculants 20,000 mt Calcium Silicide 15,000 mt 12 Laudun, France Silicon 23,000 mt Ferrosilicon 35,000 mt 13 Polokwane, South Africa Silicon / Quartz Mine 55,000 mt 14 Rand Carbide, South Africa Silicon 12,000 mt Ferrosilicon 40,000 mt Inoculants 10,000 mt 15 Venezuela Ferrosilicon 96,000 mt Ferro Manganese 21,000 mt Silicomanganese 22,000 mt 16 Mangshi, China Silicon 36,000 mt 17 SamQuarz, South Africa SamQuarz mine 18 Esmeralda, Spain Mina Esmeralda 19 Serrabal, Spain Quartz Mine 20 Sonia, Spain Quartz Mine 21 Spain Mina Conchitina 22 Venezuela Quartz Mine Globe Operations FerroAtlántica Operations Combined Company Headquarters Overlapping Countries

Platform Diversification Through the Energy Division Hydro Power Generation – Long Term Revenue Visibility and Stability Key Characteristics Largest independent hydroelectric power producer in Spain and France, with an installed capacity totaling c.210MW 19MW of new hydro power currently under construction in Spain –Production will commence during 1Q 2016 Power Plants FerroAtlántica (148 MW installed) Plant Location Capacity 1 Castrelo A Coruña (Castrelo) 28.7 2 Puente Olveira A Coruña (Castrelo) 2.7 3 Carantoña A Coruña (Pasarela) 5.0 4 Santa Eugenia I A Coruña (Ezaro) 49.1 5 Fervenza A Coruña (A Reboira) 3.6 6 Santa Eugenia II A Coruña (Ezaro) 49.1 7 Novo Pindo A Coruña (Ezaro) 9.8 Hidro Nitro (44 MW installed) Plant Location Capacity 8 Barasona Huesca (Graus) 22.1 9 El Ciego Huesca (Estada) 2.7 10 Arias I Huesca (Somontano de Barbastro) 6.4 11 Arias II Huesca (Somontano de Barbastro) 6.4 12 Ariéstolas Huesca (Somontano de Barbastro) 6.1 FerroPem (20 MW installed) Plant Location Capacity 13 St.Béron St.Béron 13.7 14 Villalongue Pierrefite 6.0

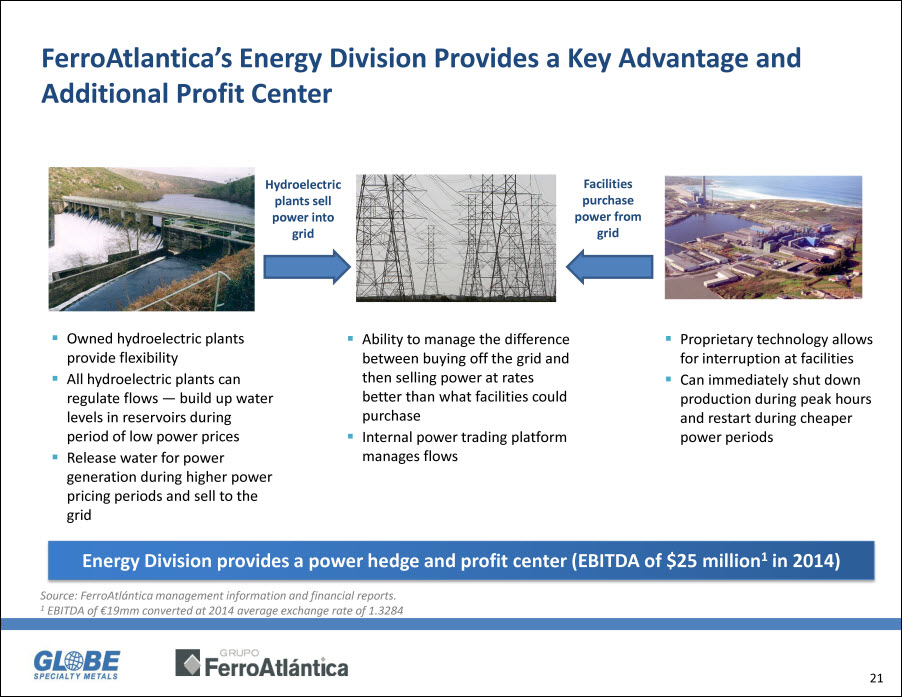

FerroAtlantica’s Energy Division Provides a Key Advantage and Additional Profit Center Hydroelectric plants sell power into grid Facilities purchase power from grid Owned hydroelectric plants provide flexibility All hydroelectric plants can regulate flows — build up water levels in reservoirs during period of low power prices Release water for power generation during higher power pricing periods and sell to the grid Ability to manage the difference between buying off the grid and then selling power at rates better than what facilities could purchase Internal power trading platform manages flows Proprietary technology allows for interruption at facilities Can immediately shut down production during peak hours and restart during cheaper power periods Energy Division provides a power hedge and profit center (EBITDA of $25 million1 in 2014) Source: FerroAtlántica management information and financial reports. 1 EBITDA of €19mm converted at 2014 average exchange rate of 1.3284

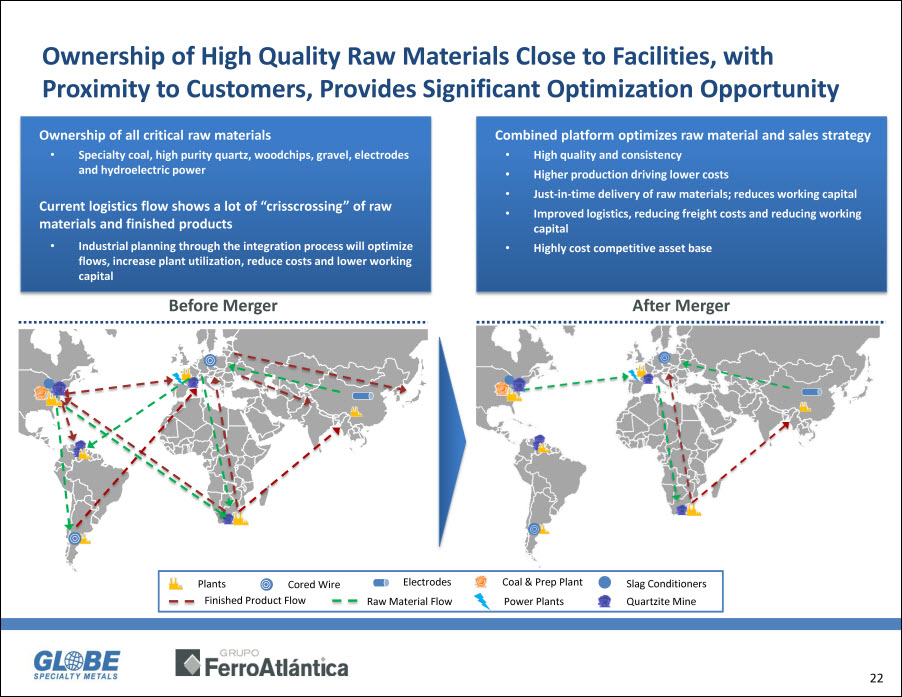

Ownership of High Quality Raw Materials Close to Facilities, with Proximity to Customers, Provides Significant Optimization Opportunity Ownership of all critical raw materials Specialty coal, high purity quartz, woodchips, gravel, electrodes and hydroelectric power Current logistics flow shows a lot of “crisscrossing” of raw materials and finished products Industrial planning through the integration process will optimize flows, increase plant utilization, reduce costs and lower working capital Combined platform optimizes raw material and sales strategy High quality and consistency Higher production driving lower costs Just-in-time delivery of raw materials; reduces working capital Improved logistics, reducing freight costs and reducing working capital Highly cost competitive asset base Before Merger After Merger Plants Cored Wire Electrodes Coal & Prep Plant Slag Conditioners Finished Product Flow Raw Material Flow Power Plants Quartzite Mine

Various Strategic Benefits for Combined Group Key Strategic Benefits Products SiM FeSi SiMn FeMn MgFeSi CaSi Innoculants Fume Energy Globe Specialty Metals Grupo FerroAtlántica Customers Optimization of product flows enables faster delivery times and improved customer service Improved ability to serve international customers with combined global platform Diversified customers across various end markets Cost Position & Raw Materials Combination of two low-cost producers drives profitability through cycle Scale enhances access to, and procurement of, key raw materials Broader currency exposure flattens cost volatility Operational Expertise Combination of best-in-class engineering and operational expertise will drive synergies Sharing of technological and operational “know-how” and best practices Increased efficiencies and lower cost of production across combined assets Research and development; silicon applications for solar end market

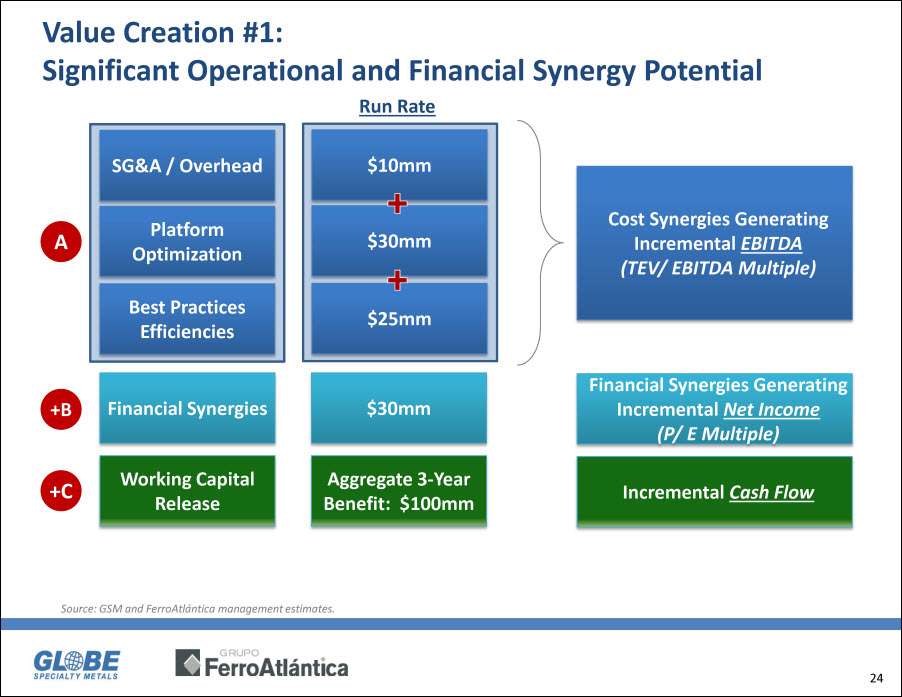

Value Creation #1: Significant Operational and Financial Synergy Potential Run Rate A SG&A / Overhead $10mm + Platform Optimization $30mm + Best Practices Efficiencies $25mm Cost Synergies Generating Incremental EBITDA (TEV/ EBITDA Multiple) +B Financial Synergies $30mm Financial Synergies Generating Incremental Net Income (P/ E Multiple) +C Working Capital Release Aggregate 3-Year Benefit: $100mm Incremental Cash Flow Source: GSM and FerroAtlántica management estimates.

Value Creation #2: Significant Operating Leverage to Price and Costs Overview of Currency Exposure Prices $ $ / € Costs $ € Historical USD / EUR Foreign Exchange Rate 1.00 1.20 1.40 1.60 Mar-14 May-14 Jul-14 Sep-14 Nov-14 Jan-15 Mar-15 1.09 Pro Forma Leverage to Prices 1¢/lb ($22/t) change in product market prices results in ~$21mm EBITDA1 impact EBITDA ($mm) $0 $200 $400 $600 $800 $1,000 First Year Synergies: $55mm LTM EBITDA: $325mm FerroAtlántica Globe $0 $0.025 $0.050 $0.075 $0.100 $0.125 $0.150 $0.175 $0.200 $0.225 $0.250 Change in Product Market Prices ($/lb) Note: Represents change in product market prices across all products produced by Pro Forma company. 1. Incremental EBITDA based on 2014 production.

Value Creation #3: Well Positioned for Continued Growth Global platform and strong balance sheet provides significant dry powder to pursue bolt-on acquisitions to our existing business and build-up the platform Unique opportunity in the energy sector to acquire strong assets at attractive valuations — can provide (on a base case) a natural hedge to our power costs, but also offers potential to expand the energy profit center Continued distress in the broader markets provide opportunities to acquire strategic mining and processing assets — good time to position ourselves for follow-on accretive acquisition opportunities Positions the combined company to opportunistically grow the downstream platform further (e.g. silicones, solar, etc.)

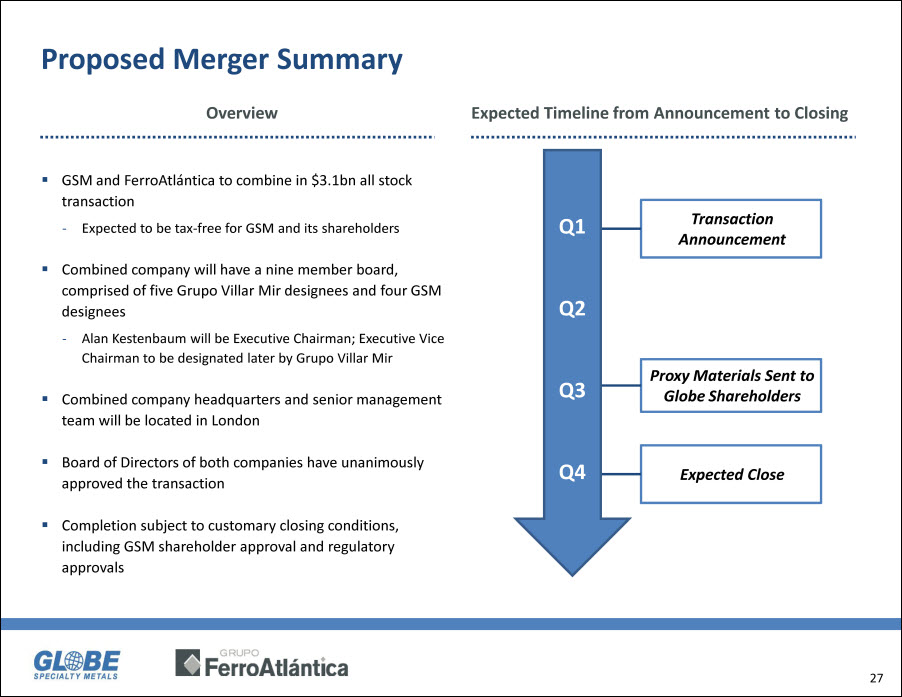

Proposed Merger Summary Overview GSM and FerroAtlántica to combine in $3.1bn all stock transaction -Expected to be tax-free for GSM and its shareholders Combined company will have a nine member board, comprised of five Grupo Villar Mir designees and four GSM designees -Alan Kestenbaum will be Executive Chairman; Executive Vice Chairman to be designated later by Grupo Villar Mir Combined company headquarters and senior management team will be located in London Board of Directors of both companies have unanimously approved the transaction Completion subject to customary closing conditions, including GSM shareholder approval and regulatory approvals Expected Timeline from Announcement to Closing Q1 Transaction Announcement Q2 Q3 Proxy Materials Sent to Globe Shareholders Q4 Expected Close

Compelling Value Proposition for GSM Shareholders Global Producer Positions combined company as a leading international producer of silicon metal with c.$2.3bn in revenues and pro forma leverage of 1.1x1 Enhanced Platform Enhanced product offering and diversified production base with broader geographic reach Significant Value Creation Optimized vertical integration with high quality raw materials to generate substantial operating and financial synergies Transaction expected to be accretive to GSM earnings per share from year one post completion Growth Potential Strategically positioned to benefit from fast-growing end markets, and financial structure to deliver further growth Strong Financials Improved cash generation — supports shareholder friendly policies 1 Based on LTM EBITDA, and year 1 synergies. Refer to Appendix for greater detail

Appendix

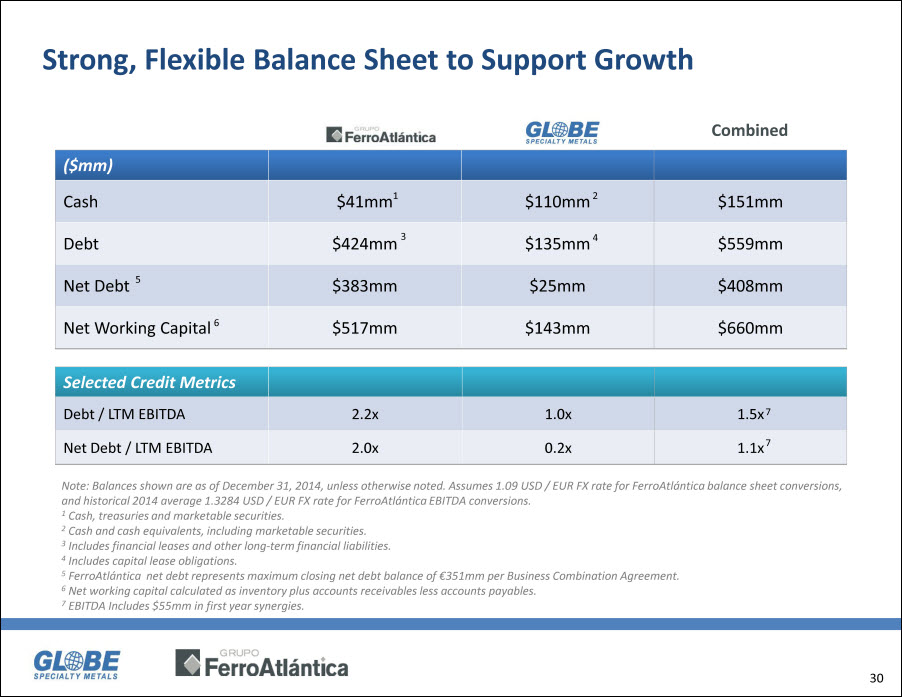

Strong, Flexible Balance Sheet to Support Growth Grupo FerroAtlántica Globe Specialty Metals Combined ($mm) Cash $41mm $110mm $151mm Debt $424mm $135mm $559mm Net Debt $383mm $25mm $408mm Net Working Capital $517mm $143mm $660mm Selected Credit Metrics Debt / LTM EBITDA 2.2x 1.0x 1.5x Net Debt / LTM EBITDA 2.0x 0.2x 1.1x Note: Balances shown are as of December 31, 2014, unless otherwise noted. Assumes 1.09 USD / EUR FX rate for FerroAtlántica balance sheet conversions, and historical 2014 average 1.3284 USD / EUR FX rate for FerroAtlántica EBITDA conversions. 1 Cash, treasuries and marketable securities. 2 Cash and cash equivalents, including marketable securities. 3 Includes financial leases and other long-term financial liabilities. 4 Includes capital lease obligations. 5 FerroAtlántica net debt represents maximum closing net debt balance of €351mm per Business Combination Agreement. 6 Net working capital calculated as inventory plus accounts receivables less accounts payables. 7 EBITDA Includes $55mm in first year synergies.

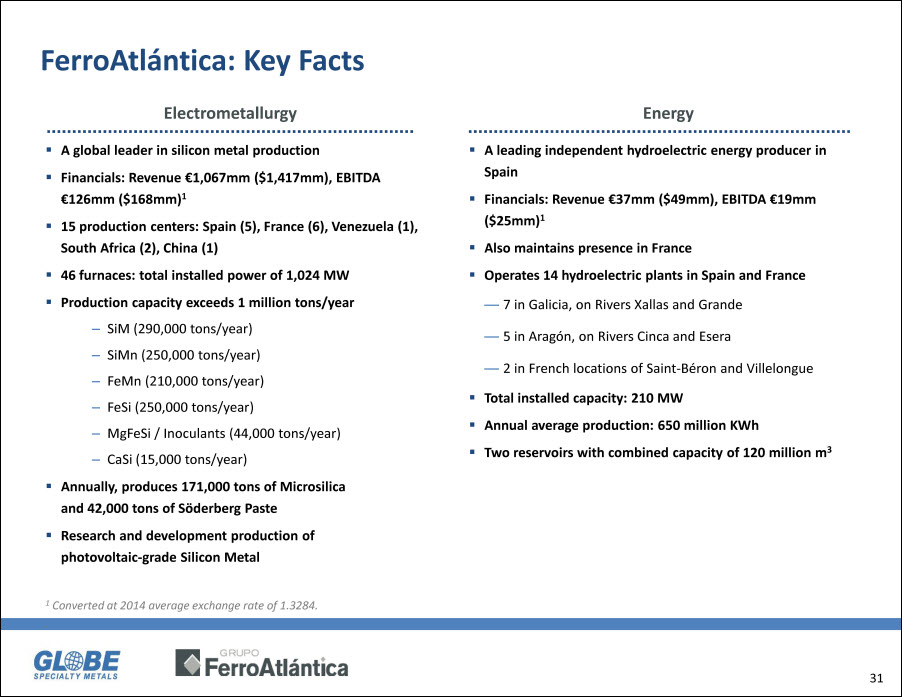

FerroAtlántica: Key Facts Electrometallurgy A global leader in silicon metal production Financials: Revenue €1,067mm ($1,417mm), EBITDA €126mm ($168mm)1 15 production centers: Spain (5), France (6), Venezuela (1), South Africa (2), China (1) 46 furnaces: total installed power of 1,024 MW Production capacity exceeds 1 million tons/year – SiM (290,000 tons/year) – SiMn (250,000 tons/year) – FeMn (210,000 tons/year) – FeSi (250,000 tons/year) – MgFeSi / Inoculants (44,000 tons/year) – CaSi (15,000 tons/year) Annually, produces 171,000 tons of Microsilica and 42,000 tons of Söderberg Paste Research and development production of photovoltaic-grade Silicon Metal Energy A leading independent hydroelectric energy producer in Spain Financials: Revenue €37mm ($49mm), EBITDA €19mm ($25mm)1 Also maintains presence in France Operates 14 hydroelectric plants in Spain and France — 7 in Galicia, on Rivers Xallas and Grande — 5 in Aragón, on Rivers Cinca and Esera — 2 in French locations of Saint-Béron and Villelongue Total installed capacity: 210 MW Annual average production: 650 million KWh Two reservoirs with combined capacity of 120 million m3 1 Converted at 2014 average exchange rate of 1.3284.

Favorable Trends Driving Growth in Silicon Metals and Silicon-based Alloys Products Key End Uses Key Trends Silicon Metal Aluminum Chemicals Polysilicon (photovoltaic solar) Electronics Industry trends positive in aluminum: focus on light weighting, increasing demand (particularly transports) Strong growth in solar industry as renewable energy develops Improvement in world economies and increased discretionary income leading to stronger demand for chemical consumer products Ferrosilicon Stainless steel, carbon steel, other steel alloys Stainless steel industry in the emerging economies continues to drive strong demand for ferroalloys Manganese Alloys Steel, steel alloys Automotives Long term urbanization trends create substantial growth potential for steel and steel alloys Growth in automotive demand from higher earning potential and improved vehicle access in emerging markets Foundry Alloys Construction Automotive Improving economic conditions leading to increase in construction and infrastructure build-out

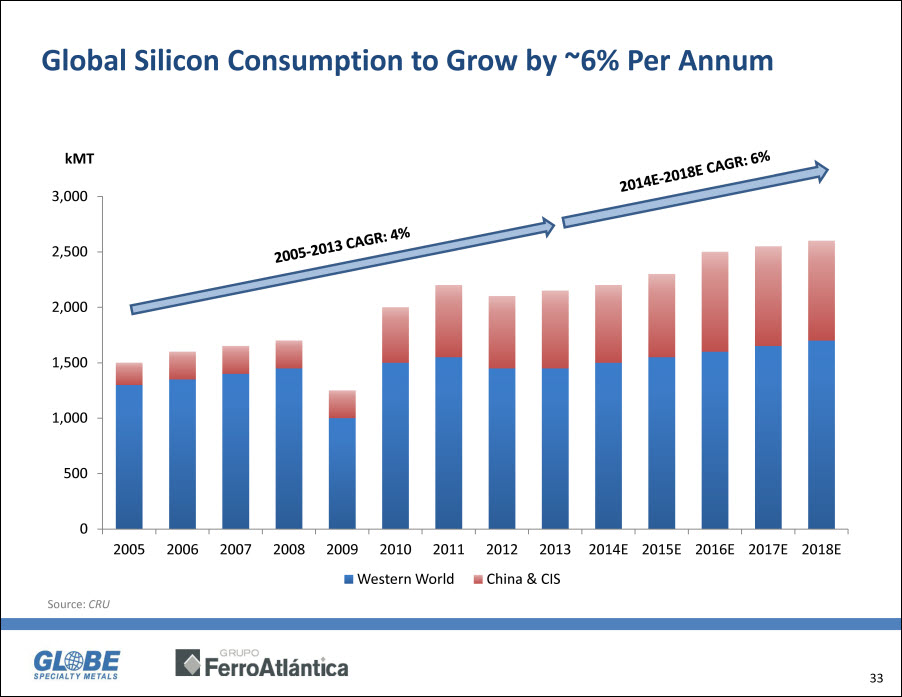

Global Silicon Consumption to Grow by ~6% Per Annum kMT 0 500 1,000 1,500 2,000 2,500 3,000 2005-2013 CAGR: 4% 2014E-2018E CAGR: 6% 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014E 2015E 2016E 2017E 2018E Western World China & CIS Source: CRU

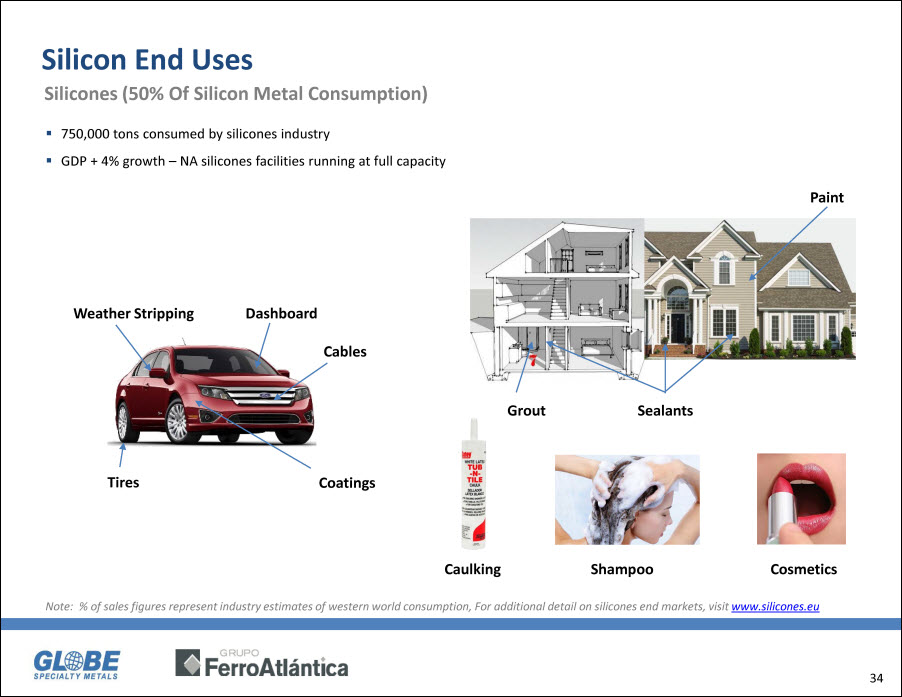

Silicon End Uses Silicones (50% Of Silicon Metal Consumption) 750,000 tons consumed by silicones industry GDP + 4% growth – NA silicones facilities running at full capacity Weather Stripping Dashboard Cables Coatings Tires Grout Sealants Paint Caulking Shampoo Cosmetics Note: % of sales figures represent industry estimates of western world consumption, For additional detail on silicones end markets, visit www.silicones.eu

Silicon End Uses Aluminum (40% of Silicon Metal Consumption) Silicon metal required in aluminum as a strengthener and alloying agent to improve castability and minimize shrinking and cracking Significant growth expected in silicon-intensive aluminum wheels to meet EPA regulations for the trucking industry (aluminum wheels average 7.5% silicon content by weight) Aluminum provides a lighter weight alternative to steel Aluminum demand has increased at a 5%+ CAGR for the past 20 years Global Primary Aluminum Demand (000s tons) 0 5,000 10,000 15,000 20,000 25,000 30,000 35,000 40,000 45,000 50,000 55,000 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014E 2015E Source: Bloomberg and Street research North American Light Vehicle Aluminum Content as a Percent of Curb Weight 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 2.0% 2.1% 3.9% 4.5% 7.1% 6.4% 6.9% 7.8% 8.8% 10.4% 13.0% 77 Pounds 343 Pounds ~500 Pounds Approx. 10kg of silicon metal per car 1970 1975 1980 1985 1990 1995 2000 2005 2010 2015E 2020E Source: Ducker Worldwide Note: Based on 3,600 lbs of curb weight

Silicon End Uses Solar (10% of Silicon Metal Consumption) Continued decreases in solar wafer and module prices stimulating demand and taking market share away from thin film makers (e.g. Solyndra) Global solar related silicon demand to double, exceeding 700,000 tons by 2016 Projections have been consistently beaten by actual growth Global Solar Demand 2008 Projections vs. 2012 Projections MW 0 10,000 20,000 30,000 40,000 50,000 60,000 70,000 Silicon Tons 0 100,000 200,000 300,000 400,000 500,000 600,000 700,000 800,000 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 2008 Estimates (Photon) Actual MW Actual Silicon (tons) 2012 Estimates MW 2012 Estimates Silicon (Tons) Silicon Polysilicon Wafer Solar Cell Solar Panel Solar Installation Source: Credit Suisse, CRU, Photon Consulting, GTM Research, EPIA, HIS, GSM Analysis, and WSJ

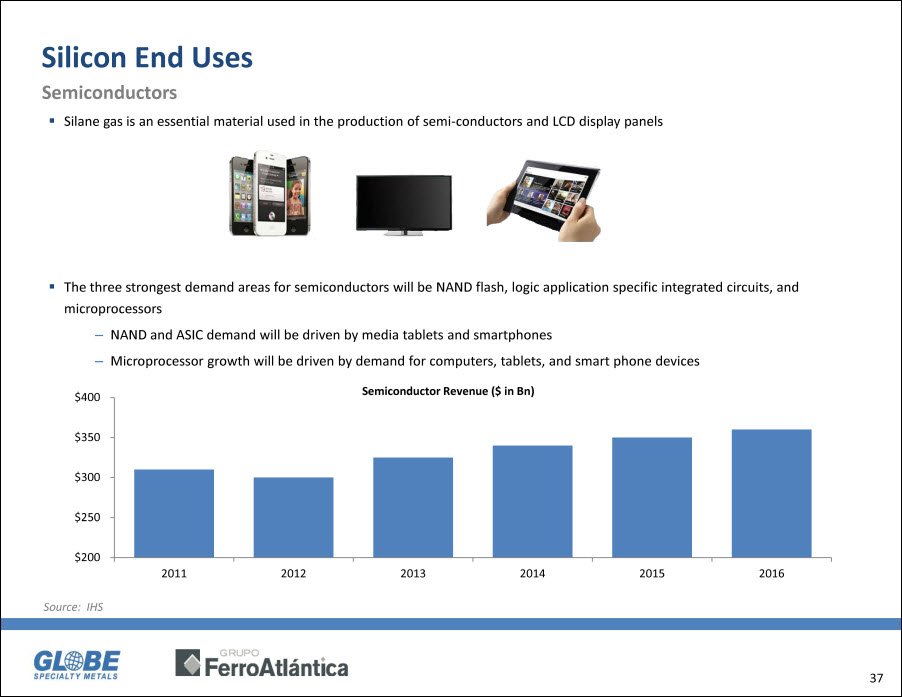

Silicon End Uses Semiconductors Silane gas is an essential material used in the production of semi-conductors and LCD display panels The three strongest demand areas for semiconductors will be NAND flash, logic application specific integrated circuits, and microprocessors –NAND and ASIC demand will be driven by media tablets and smartphones –Microprocessor growth will be driven by demand for computers, tablets, and smart phone devices Semiconductor Revenue ($ in Bn) $200 $250 $300 $350 $400 2011 2012 2013 2014 2015 2016 Source: IHS

Silicon End Uses New Applications & Products Example: Silicon Anode Lithium-ion Battery Greater energy storage capabilities Allows for smaller sizes batteries for electronic devices and electric cars Energy storage for renewable energy sources

Silicon Alloys End Uses Steel (Electrical Steel) Technical expertise Just-in-time delivery Steel Ferrosilicon (FeSi) Calcium Silicon (CaSi) Used in the manufacture of high grade steel Produces lump, powder and cored wire forms Commodity Used in production of carbon steels, stainless steels and other steel alloys Specialty High grade specifications Requires technical know-how Product/Market: electrical steel and motor laminates (auto)

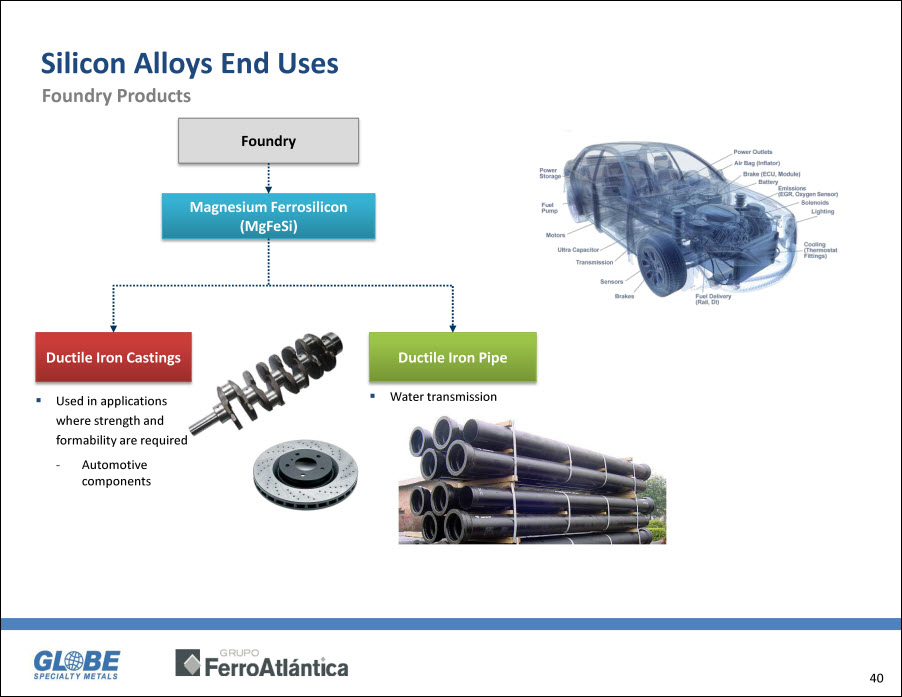

Silicon Alloys End Uses Foundry Products Foundry Magnesium Ferrosilicon (MgFeSi) Ductile Iron Castings Used in applications where strength and formability are required -Automotive components Ductile Iron Pipe Water transmission

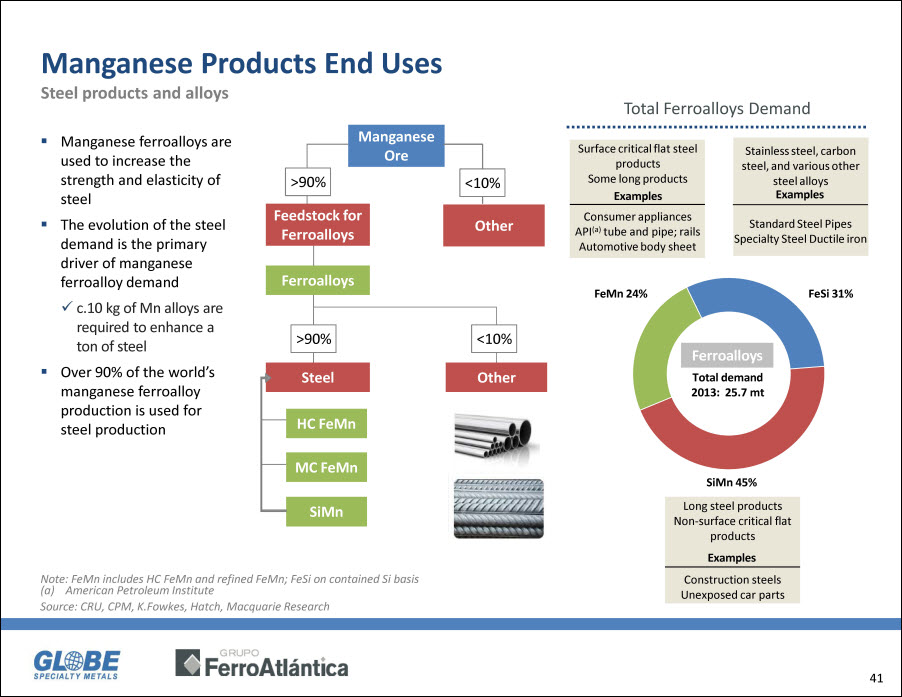

Manganese Products End Uses Steel products and alloys Manganese ferroalloys are used to increase the strength and elasticity of steel The evolution of the steel demand is the primary driver of manganese ferroalloy demand c.10 kg of Mn alloys are required to enhance a ton of steel Over 90% of the world’s manganese ferroalloy production is used for steel production Manganese Ore >90% Feedstock for Ferroalloys <10% Other Ferroalloys >90% Steel <10% Other HC FeMn MC FeMn SiMn Total Ferroalloys Demand Surface critical flat steel products Some long products Examples Consumer appliances API(a) tube and pipe; rails Automotive body sheet Stainless steel, carbon steel, and various other steel alloys Examples Standard Steel Pipes Specialty Steel Ductile iron FeMn 24% FeSi 31% Ferroalloys Total demand 2013: 25.7 mt SiMn 45% Long steel products Non-surface critical flat products Examples Construction steels Unexposed car parts Note: FeMn includes HC FeMn and refined FeMn; Fe Si on contained Si basis (a) American Petroleum Institute Source; CRU, CPM, K. Eowkes, Hatch, Macquarie Research

Silica Fume End Markets Construction, Oil & Gas, Refractory Collected in bag houses – sold to concrete, oil well and refractory end markets Key benefits of silica fume: - Physical strength of concrete up to 20,000 psi - Very low permeability to water and chloride intrusion of cement - Extremely high electrical resistivity (up to 100x greater than ordinary concrete) - Increased resistance to chemical attack from acids, nitrates and sulfates New applications have significantly added to demand and increases in price GSM’s Silica Fume Used in: Key Component in Hydraulic Fracturing Process Oil Wells Refractory Infrastructure/public works (Panama Canal Expansion) Contruction (One World Trade Center)