Report of the Audit Committee

The following is the report of the Audit Committee of the Corporation with respect to the Corporation’s audited financial statements for the year ended December 31, 2020

The Audit Committee oversees the Corporation's accounting and financial reporting processes and the audits of the Corporation's financial statements. Management is responsible for the preparation, presentation, and integrity of the Corporation's financial statements, the Corporation's accounting and financial and reporting principles, and internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. The Audit Committee reviewed the audited financial statements in the Corporation's Annual Report on Form 10-K for the year ended December 31, 2020 (the “Form 10-K”) with management and discussed the quality of the accounting principles, the reasonableness of significant judgments, and the clarity of disclosures in the financial statements.

The Audit Committee has considered and discussed the above described December 31, 2020 audited financial statements with management and with E&Y. The Audit Committee has also discussed with E&Y the matters required to be discussed by the statement on Auditing Standards No. 16, as amended (AICPA, Professional Standards Vol. 1. AU Section 380), as adopted by the Public Company Accounting Oversight Board (“PCAOB”) in Rule 3200T, The Auditor’s Communication with Those Charged with Governance. The Audit Committee reviewed with E&Y, who is responsible for expressing an opinion on the conformity of those audited financial statements with generally accepted accounting principles, their judgment as to the quality, not just the acceptability, of the Corporation’s accounting principles and such other matters as are required to be discussed with the Audit Committee under generally accepted auditing standards. Finally, the Audit Committee reviewed the written disclosures and letters from E&Y required by PCAOB Rule 3526, Communication with Audit Committees Concerning Independence, as currently in effect, and has considered whether the provision of other non-audit services by E&Y to the Corporation are compatible with maintaining E&Y’s independence, and has discussed with E&Y its independence from the Corporation.

The Audit Committee discussed with E&Y the overall scope and plans for the audit. The Audit Committee met with E&Y to discuss the results of their audit, and the overall quality of the Corporation’s financial reporting.

Based upon the reports and discussions described in this report, and subject to the limitations on the role and responsibilities of the Audit Committee referred to in the Proxy Statement and in the Audit Committee Charter, the Audit Committee recommended to the Board (and the Board has approved) that the Corporation’s audited financial statements be included in the Form 10-K and filed with the SEC.

Stockholders are reminded, however, that the members of the Audit Committee are not professionally engaged in the practice of auditing or accounting. Members of the Audit Committee rely, without independent verification, on the information provided to them and on the representations made by management and E&Y. Accordingly, the Audit Committee’s oversight does not provide an independent basis to determine that management has maintained appropriate accounting and financial reporting principles or appropriate internal controls and procedures designed to assure compliance with accounting standards and applicable laws and regulations. Furthermore, the Audit Committee’s considerations and discussions, referred to above, do not assure that the audit of the Corporation’s financial statements has been carried out in accordance with the standards of the PCAOB, that the financial statements are presented in conformity with accounting principles generally accepted in the U.S. or that the Corporation's independent registered public accounting firm is, in fact, “independent.”

George G. Strong Jr., Chairman of the Audit Committee

Kathleen Briscoe, Audit Committee Member

Michael S. Segal, Audit Committee Member

Steven F. Strandberg, Audit Committee Member

Required Vote

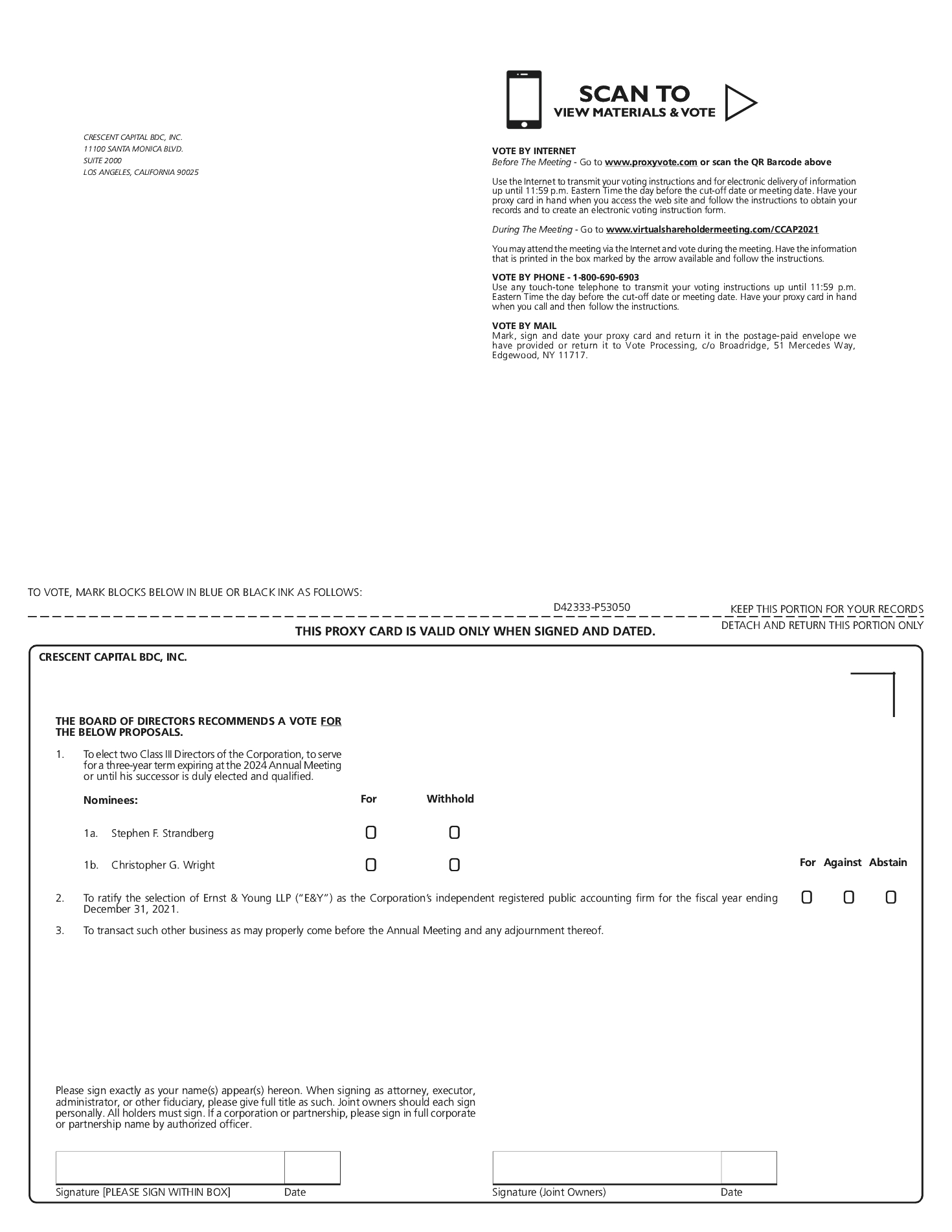

The ratification of the selection of the Corporation’s independent registered public accounting firm requires the affirmative vote of the holders of a majority of the votes cast by stockholders present at the Annual Meeting.

THE BOARD, INCLUDING EACH OF THE INDEPENDENT DIRECTORS, UNANIMOUSLY RECOMMENDS THAT STOCKHOLDERS VOTE “FOR” THE RATIFICATION OF THE SELECTION OF E&Y AS THE CORPORATION’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM.

OTHER MATTERS TO COME BEFORE THE ANNUAL MEETING