Exhibit 99.2

1 | Copyright © 2023 Azure Power | www.azurepower.com Investor Update November 2023 India’s first private grid connected MW solar plant India’s first solar green bond issuance India’s largest owned and operated single site solar project

Delphine Voeltzel Non - Executive Director Over 14 years of professional experience in the infrastructure sector across Europe and Asia and is leading OMERS Infrastructure’s investment efforts in Asia Presently, serving as MD at OMERS Infrastructure . Philippe Wind Non - Executive Director Operating partner in the Infrastructure group at CDPQ. Over 30 years of experience in the areas of utility, renewable, deal making, management, operations, construction, engineering, consulting, regulatory, private equity, or project finance areas .. Previously, worked as CEO at Actis Singapore and Suez/Engie Group in the infra/utility sector . Jamie Garcia Nieto Non - Executive Director Managing Director, Infrastructure, Mexico at CDPQ since 2020. Over 30 years of experience in international finance and management consulting . Previously held position as Chief Investment Officer at a family office and worked at The Boston Consulting Group (BCG), a management consulting firm . M.S Unnikrishnan Board Chairman & Non - Executive Director CDPQ Representative, over 30 years of experience in the energy and environmental sector . Asia Innovator of the Year by CNBC Asia, one of the best CEOs in India by Grant Thorton, and India Innovator of the Year by CNBC India Ex. MD and CEO of Thermax Ltd. Sunil Gupta Chief Executive Officer Leadership experience in the renewable sector and strong track record of building renewable energy businesses . Years of experience as renewable energy banking specialist . 2 nd largest Canadian pension fund (Rated AAA) . Increased stake in Azure Power to c . 53 . 4 % through multiple rounds & open marketpurchase Acquired 19 . 4 % stake from IFC and IFC GIF . IFC (investor since 2010 ) . Stake increased to 21 . 4 % post rights issue in 2022 Supriya Sen Independent Director banking, private equity, capital markets and multilateral funding and investment as well as significant involvement in sustainability initiatives globally and in India . Over 25 years experience in corporate Over 30 years of experience in Richard Payette Independent Director Over four decades of experience in organizational transformation, international market development, finance, audit, governance, and risk management Currently serving as director of EDC and CPAB. Muhammad Khalid Peyrye Independent Director Heads the Corporate Secretarial and Administrative cluster of AAA Global Services Previously was a Money Laundering and Compliance officer for a leading financial services company. JEAN - FRANÇOIS BOISVENU Independent Director and commercial laws, and expertise in international banking transactions, lending and debt capital markets transactions & financial institutions regulation . Partner at Eversheds Sutherland (Mauritius), heading the banking and finance practice since 2017 . GOWTAMSINGH DABEE Independent Director Over 25 years experience professional accountant in as a public practice and industry in Mauritius, Africa, and Middle East. Partner of GD Riches Accountants and is an auditor, accountant, and insolvency practitioner in Mauritius . Experienced Board backed by Long Term Marquee Shareholders Recent Updates : Mr. Deepak Malhotra and Mr. Cyril Cabanes – nominees of CDPQ Infrastructures have resigned and Jamie Garcia Nieto and Philippe Wind have taken their place as nominee directors of CDPQ Infrastructures Sujata Sircar Group CFO Over 32 years of 2 | Copyright © 2023 Azure Power | www.azurepower.com experience in different industries, incl. Energy, Automation, City Gas Distribution, Textiles, Chemicals and FMCG with over 20 years as CFO.

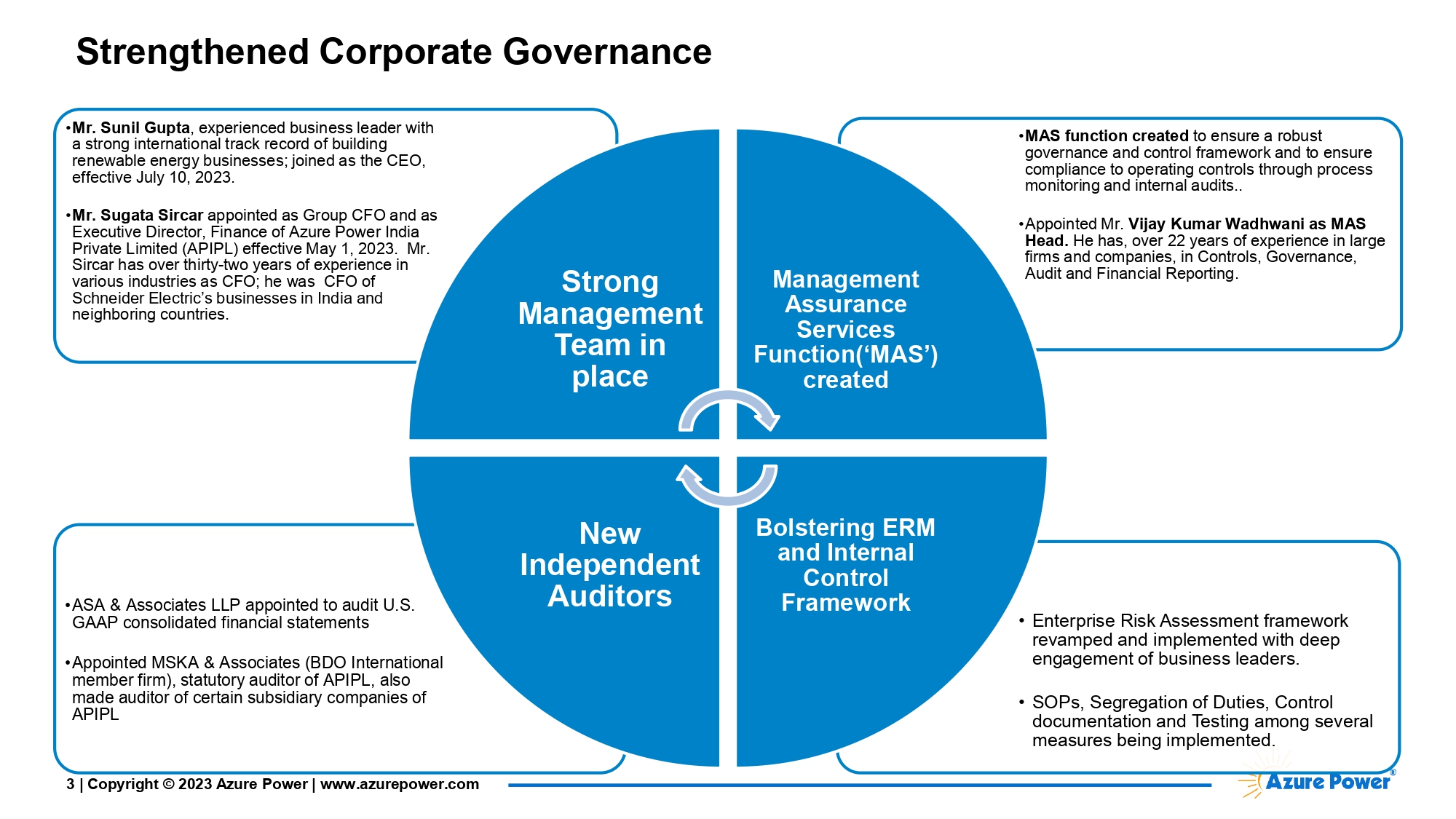

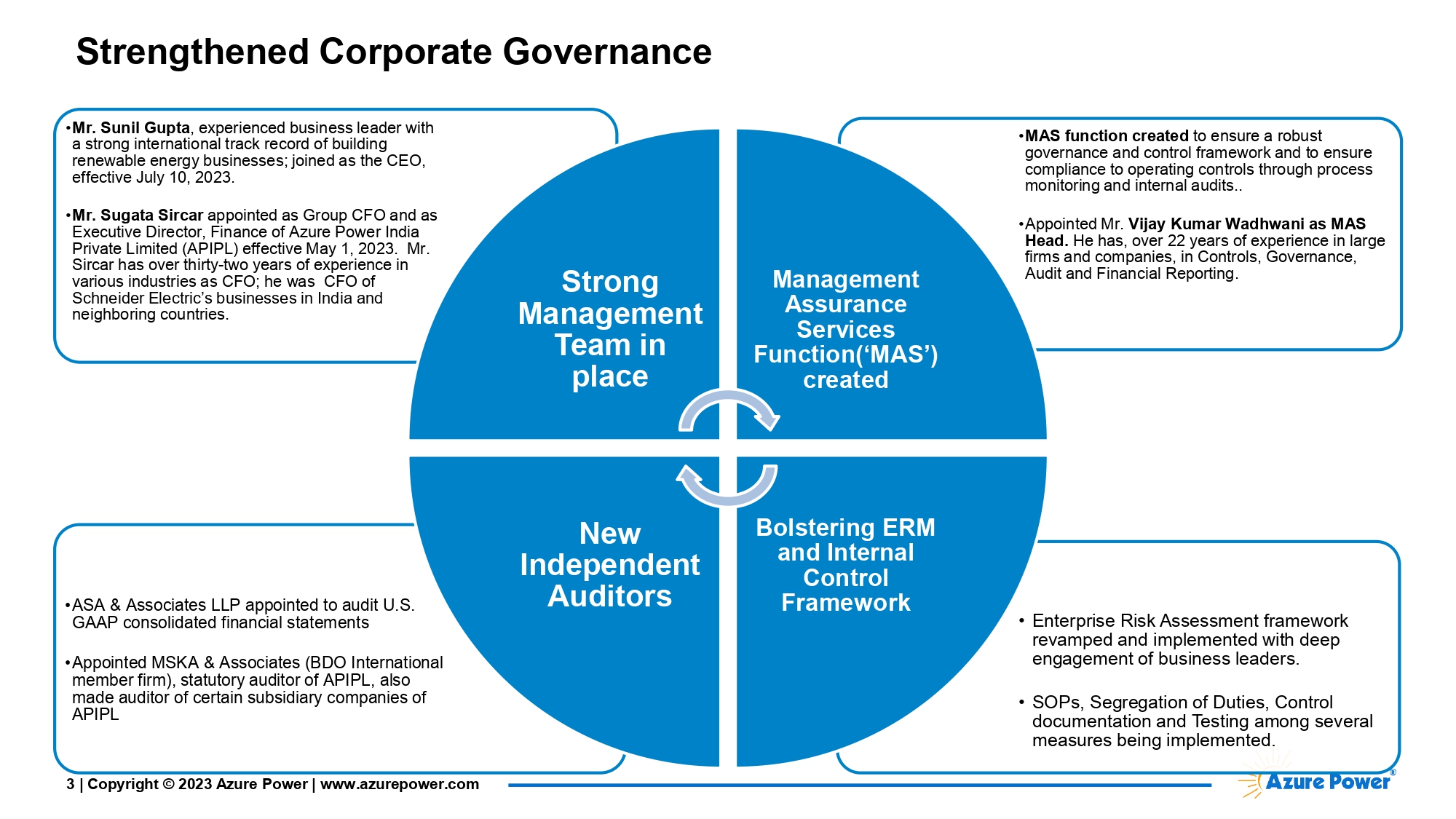

• Enterprise Risk Assessment framework revamped and implemented with deep engagement of business leaders. • SOPs, Segregation of Duties, Control documentation and Testing among several measures being implemented. • ASA & Associates LLP appointed to audit U.S. GAAP consolidated financial statements • Appointed MSKA & Associates (BDO International member firm), statutory auditor of APIPL, also made auditor of certain subsidiary companies of APIPL • MAS function created to ensure a robust governance and control framework and to ensure compliance to operating controls through process monitoring and internal audits.. • Appointed Mr. Vijay Kumar Wadhwani as MAS Head. He has, over 22 years of experience in large firms and companies, in Controls, Governance, Audit and Financial Reporting. • Mr. Sunil Gupta , experienced business leader with a strong international track record of building renewable energy businesses; joined as the CEO, effective July 10, 2023. • Mr. Sugata Sircar appointed as Group CFO and as Executive Director, Finance of Azure Power India Private Limited (APIPL) effective May 1, 2023. Mr. Sircar has over thirty - two years of experience in various industries as CFO; he was CFO of Schneider Electric’s businesses in India and neighboring countries. Strong Management Team in place Management Assurance Services Function(‘MAS’) created Bolstering ERM and Internal Control Framework New Independent Auditors Strengthened Corporate Governance 3 | Copyright © 2023 Azure Power | www.azurepower.com

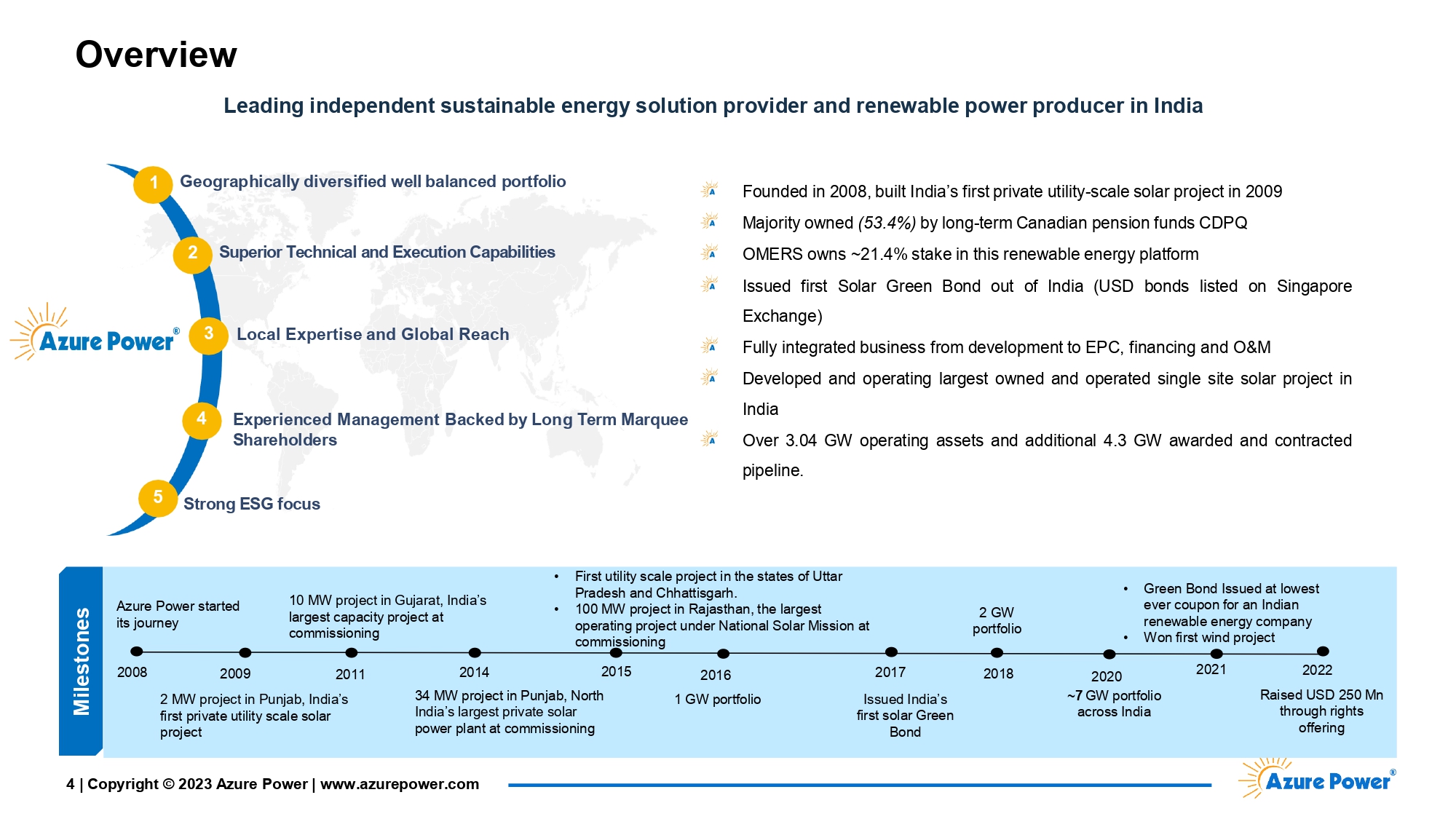

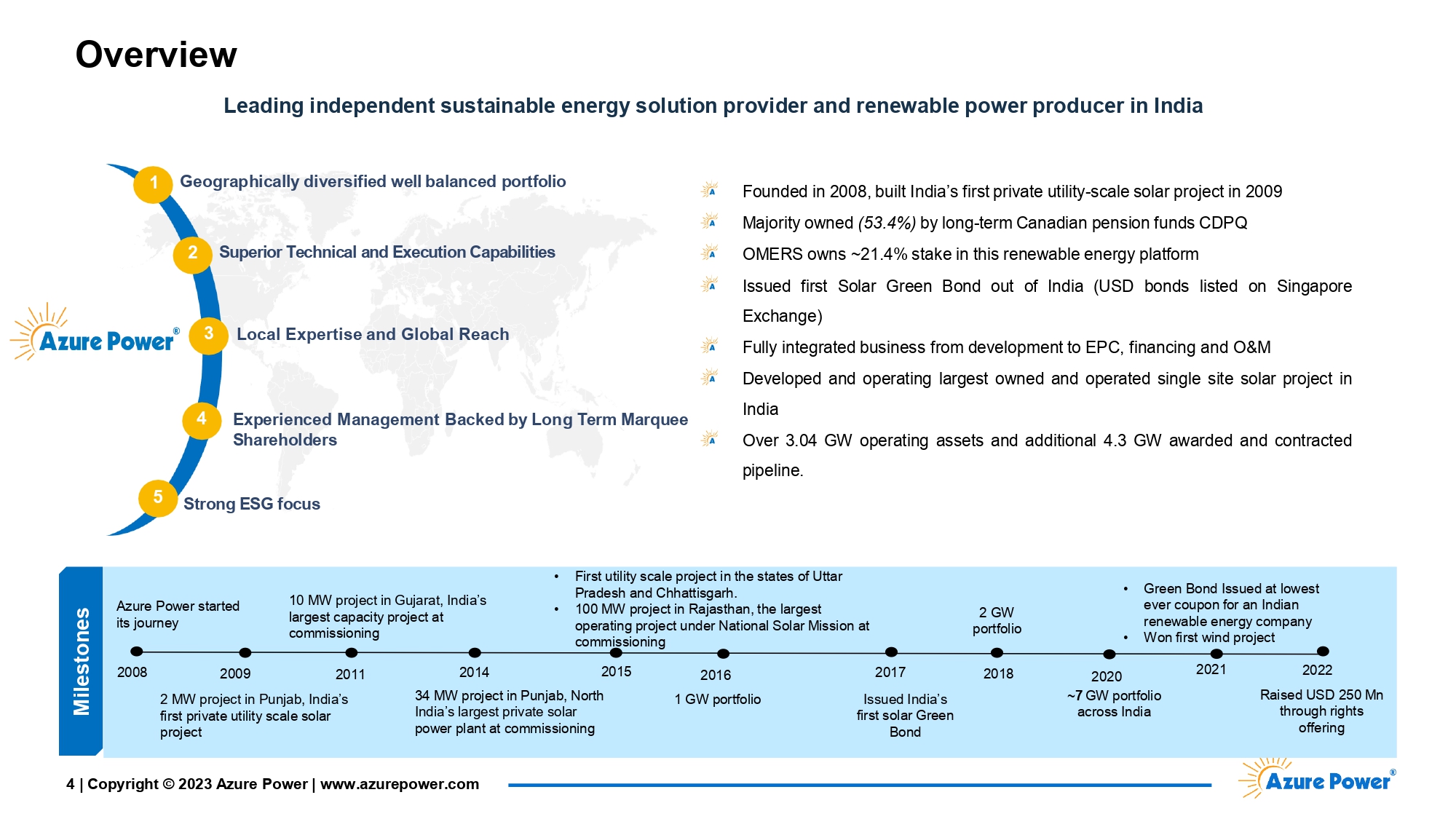

Leading independent sustainable energy solution provider and renewable power producer in India Geographically diversified well balanced portfolio Superior Technical and Execution Capabilities Local Expertise and Global Reach Strong ESG focus 1 2 3 4 Experienced Management Backed by Long Term Marquee Shareholders 5 Founded in 2008, built India’s first private utility - scale solar project in 2009 Majority owned (53.4%) by long - term Canadian pension funds CDPQ OMERS owns ~21.4% stake in this renewable energy platform Issued first Solar Green Bond out of India (USD bonds listed on Singapore Exchange) Fully integrated business from development to EPC, financing and O&M Developed and operating largest owned and operated single site solar project in India Over 3.04 GW operating assets and additional 4.3 GW awarded and contracted pipeline. Milestones 2 GW portfolio • First utility scale project in the states of Uttar Pradesh and Chhattisgarh. • 100 MW project in Rajasthan, the largest operating project under National Solar Mission at commissioning 10 MW project in Gujarat, India’s largest capacity project at commissioning Azure Power started its journey 2020 ~ 7 GW portfolio across India 2018 2017 Issued India’s first solar Green Bond 2016 1 GW portfolio 2014 2015 34 MW project in Punjab, North India’s largest private solar power plant at commissioning 2009 2011 2 MW project in Punjab, India’s first private utility scale solar project 2008 • Green Bond Issued at lowest ever coupon for an Indian renewable energy company • Won first wind project 2021 2022 Raised USD 250 Mn through rights offering 4 | Copyright © 2023 Azure Power | www.azurepower.com Overview

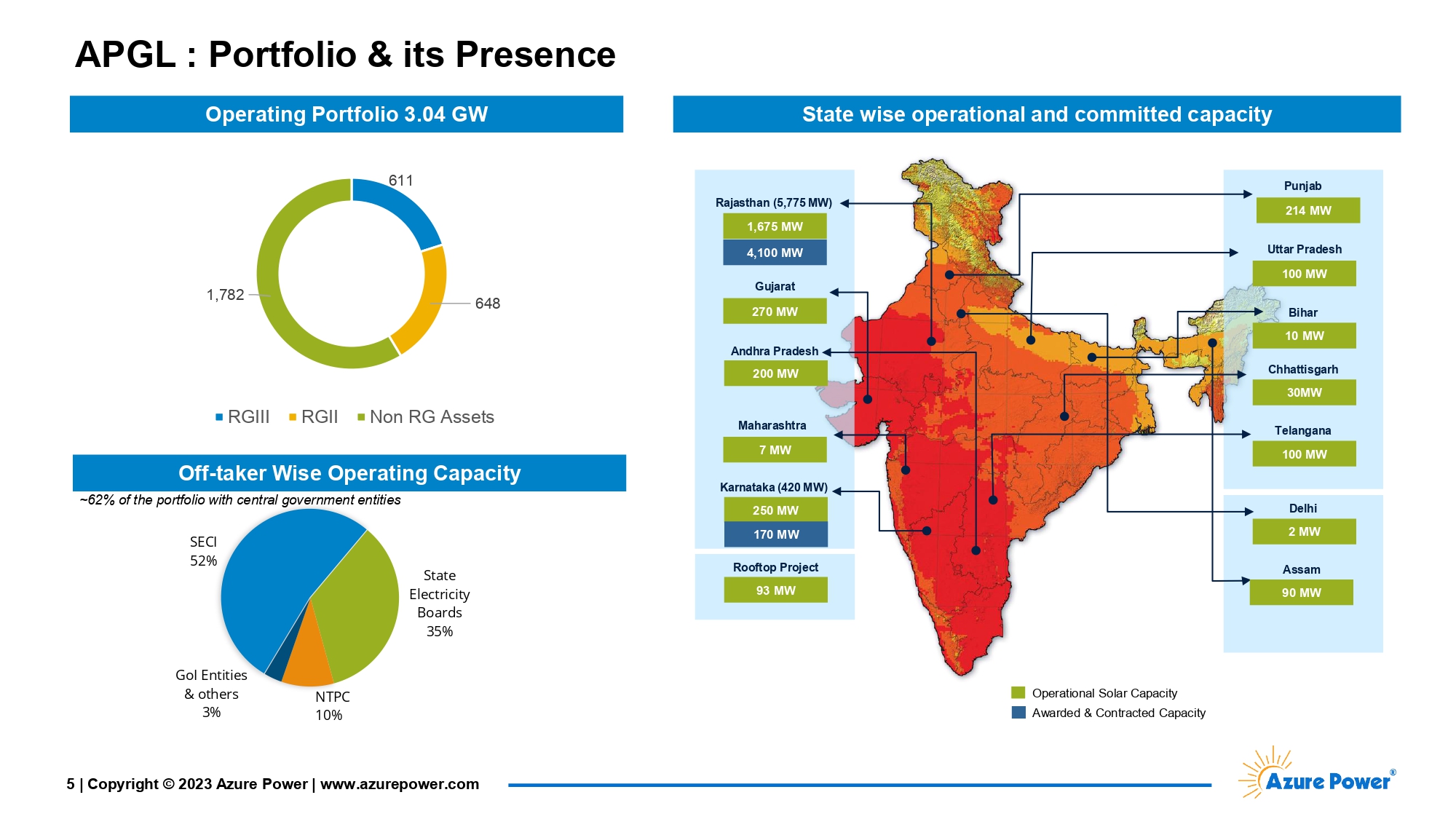

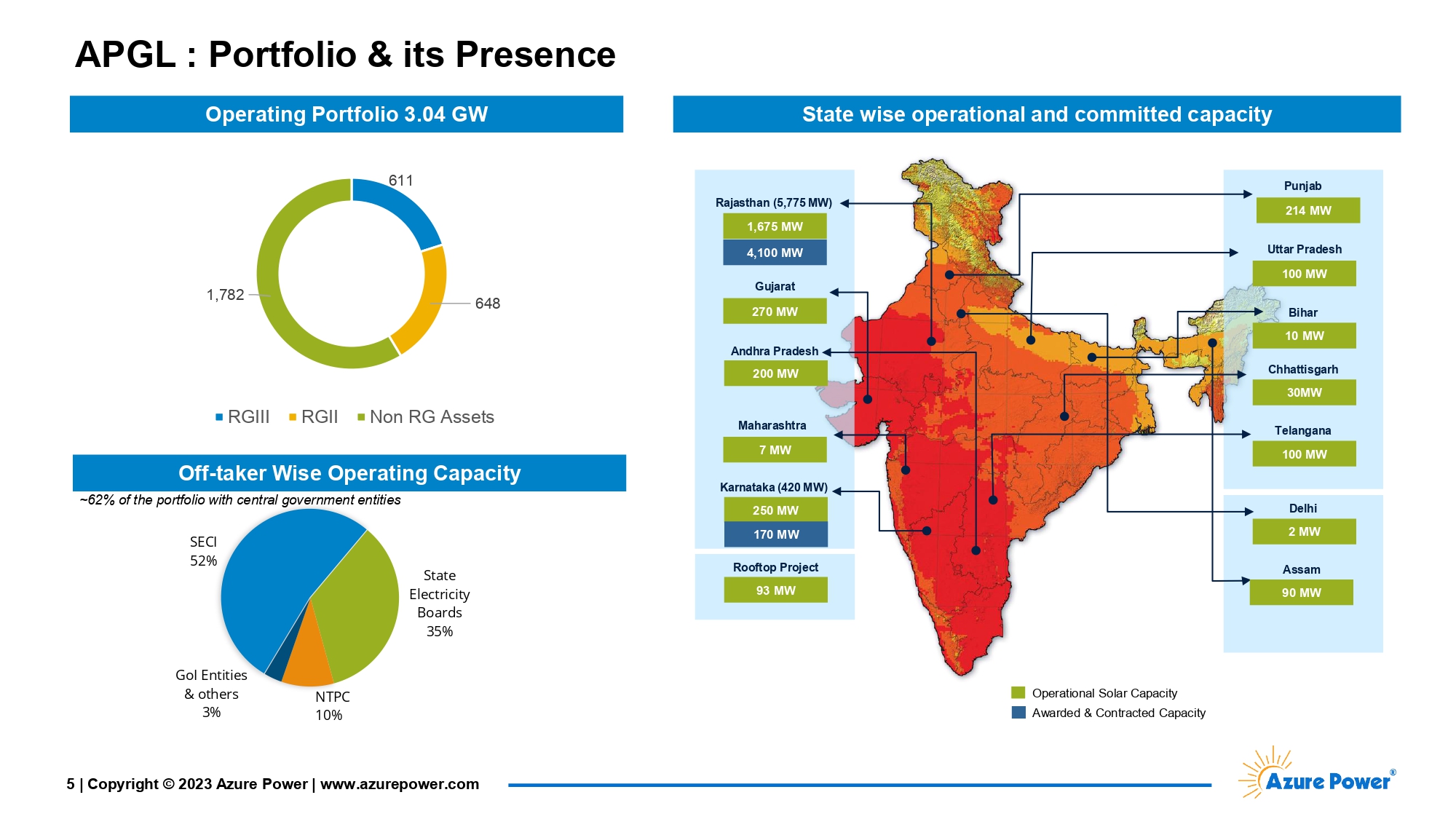

Punjab 214 MW Uttar Pradesh 100 MW Bihar 10 MW Chhattisgarh 30MW Telangana 100 MW Rajasthan (5,775 MW) 1,675 MW Gujarat 270 MW Andhra Pradesh 200 MW Maharashtra 7 MW Karnataka (420 MW) 250 MW 4,100 MW Delhi 2 MW Assam Rooftop Project 93 MW Operational Solar Capacity Awarded & Contracted Capacity 90 MW 170 MW Operating Portfolio 3.04 GW State wise operational and committed capacity SECI 52% State Electricity Boards 35% NTPC 10% GoI Entities & others 3% ~62% of the portfolio with central government entities Off - taker Wise Operating Capacity APGL : Portfolio & its Presence 611 648 1,782 RGIII RGII Non RG Assets 5 | Copyright © 2023 Azure Power | www.azurepower.com

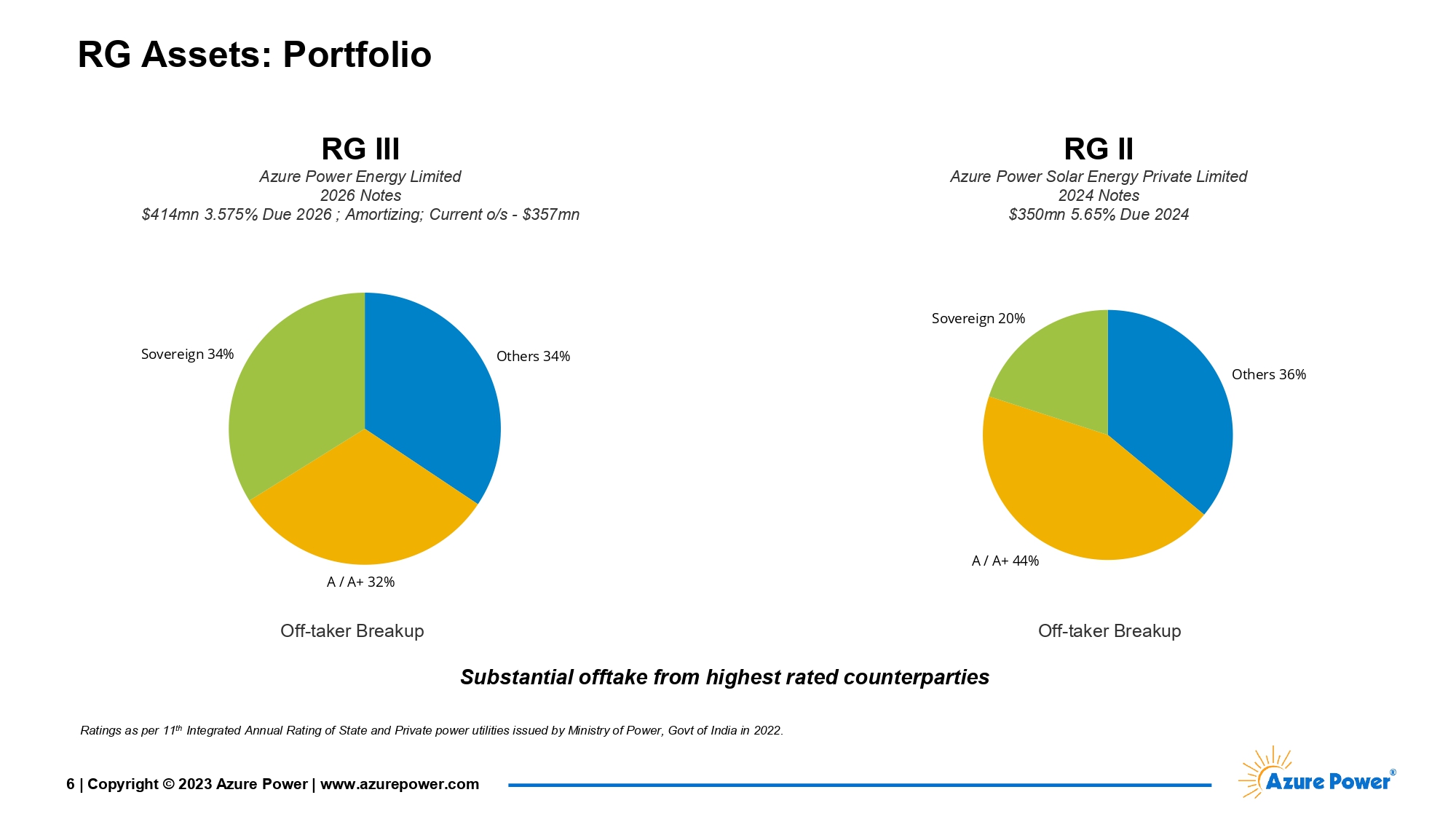

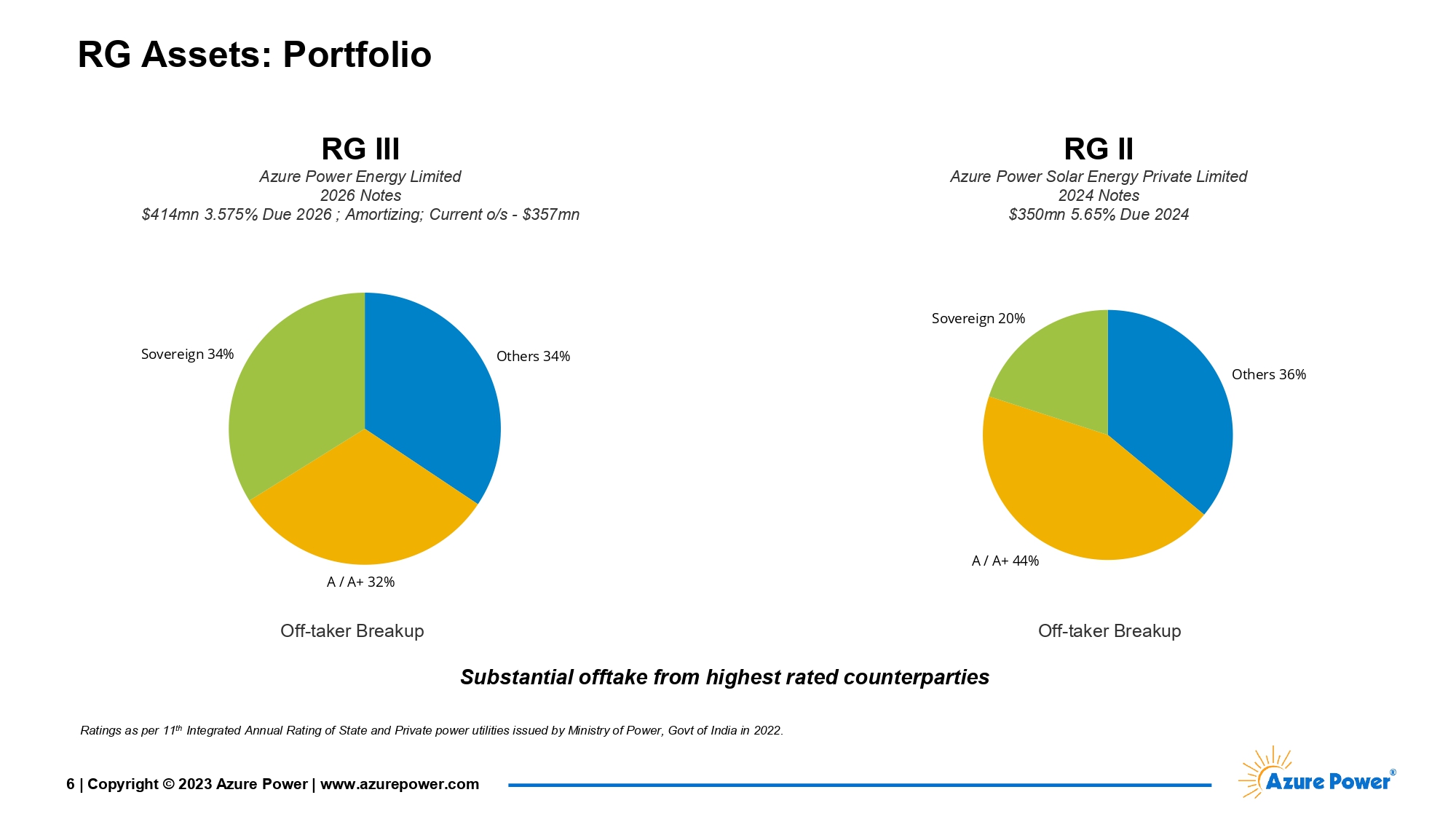

Others 36% A / A+ 44% Sovereign 20% RG Assets: Portfolio Ratings as per 11 th Integrated Annual Rating of State and Private power utilities issued by Ministry of Power, Govt of India in 2022. Others 34% 6 | Copyright © 2023 Azure Power | www.azurepower.com A / A+ 32% Sovereign 34% Substantial offtake from highest rated counterparties RG III Azure Power Energy Limited 2026 Notes $414mn 3.575% Due 2026 ; Amortizing; Current o/s - $357mn RG II Azure Power Solar Energy Private Limited 2024 Notes $350mn 5.65% Due 2024 Off - taker Breakup Off - taker Breakup

Established Operational Performance PLF performance Electricity Generation (mn KwH) 2,000 1,800 1,600 1,356 1,367 1,400 1,200 1,010 995 1,000 800 600 400 200 - RGIII RGII FY23 FY22 24.1% 18.6% 23.9% 18.9% 0.00% 5.00% 10.00% 15.00% 20.00% 25.00% 30.00% RGII RGIII FY22 FY23 Note: FY23 PLF performance includes the Rooftop PLF performance 7 | Copyright © 2023 Azure Power | www.azurepower.com

29,954 6,000 30000 5,000 28,490 29000 4,000 28000 3,000 26,291 27000 2,000 26000 1,000 25000 - 24000 30,373 31000 RGIII RGII FY22 FY23 * Increase in FY23 is due to conversion of foreign currency debt at forex rate as on March 31, 2023. All foreign currency debt are hedged. | Includes Current & Non Current Borrowings of the RG Bonds Healthy Financial Profile Revenue INR mn Cash & Bank INR mn Total Debt* INR mn Note: FY23 - Management Unaudited Numbers ; FY22 - RGIII and RGII audited numbers 1,586 2,380 2,668 3,248 0 500 1000 1500 2000 2500 3000 3500 RGIII RGII FY22 FY23 6,229 4,967 6,137 4,465 0 1000 2000 3000 4000 5000 6000 7000 RGIII RGII FY22 FY23 7,000 FY22 RGIII RGII FY22 - EBITDA INR mn RG II RG III 5,872 3.22 6.16 Average Tariff (INR) 4,131 23.9% 18.9% PLF (AC) FY 2023 19.6 17.1 Average Remaining PPA Tenure (Yrs.) 8 | Copyright © 2023 Azure Power | www.azurepower.com

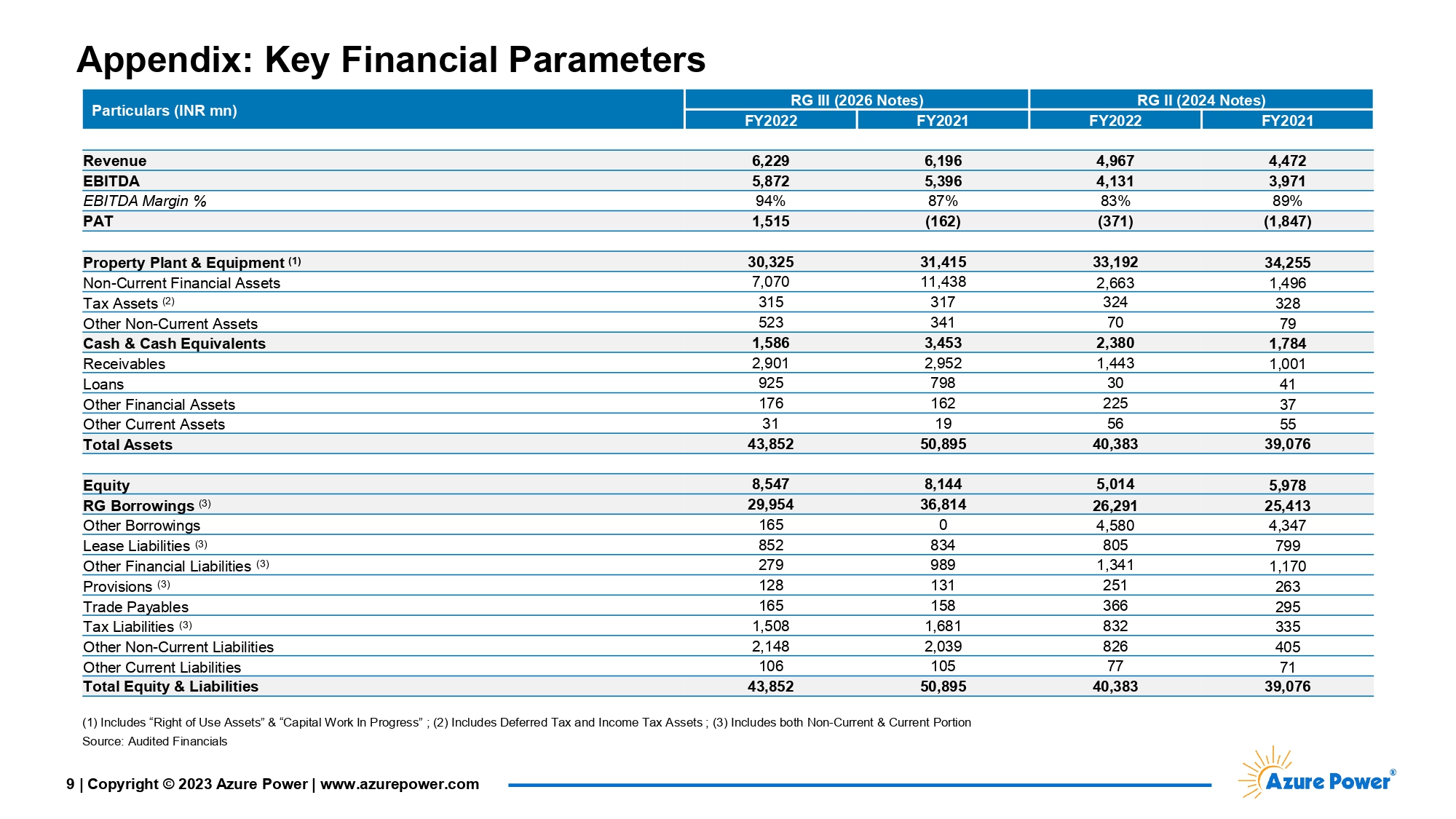

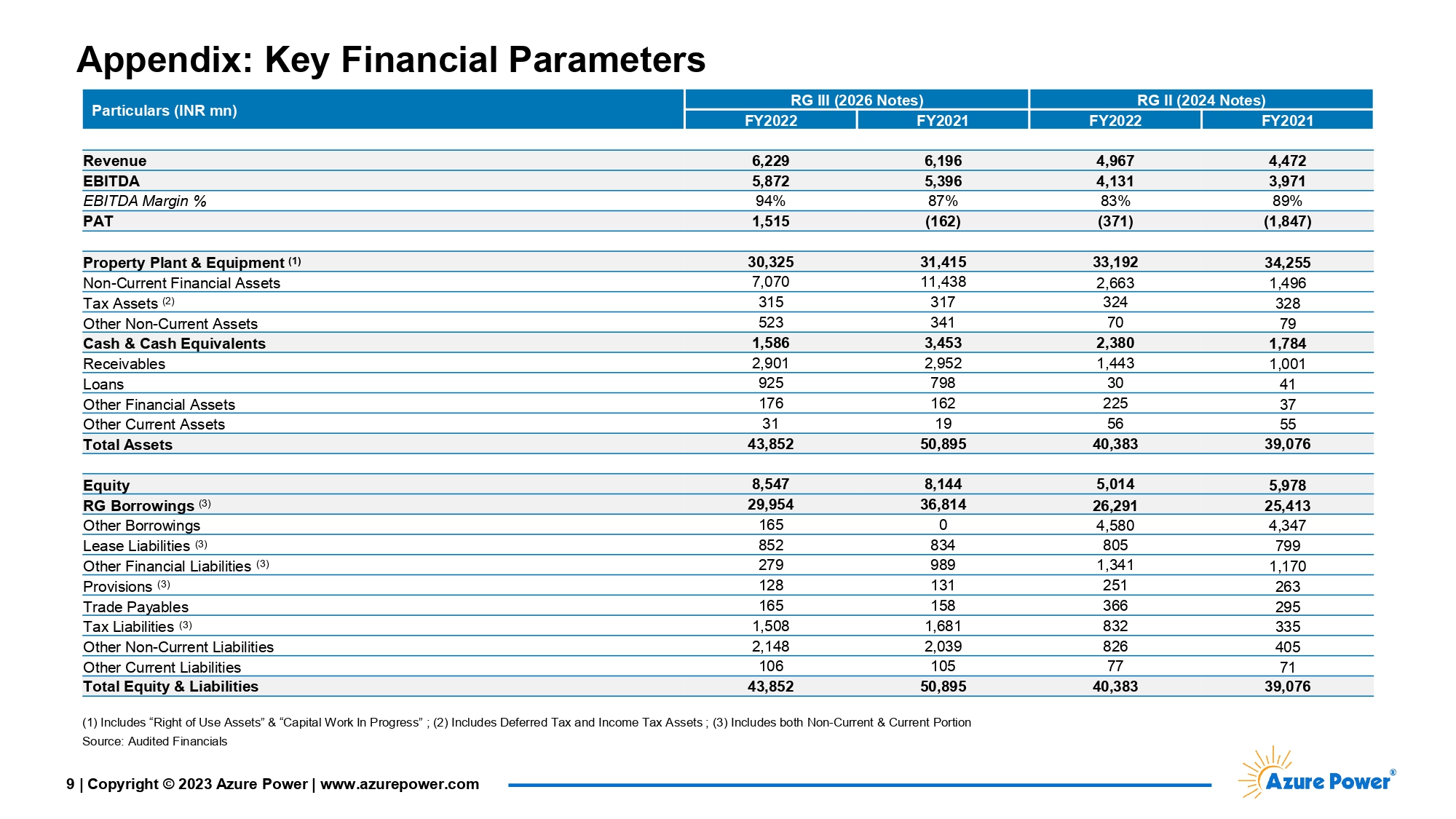

Appendix: Key Financial Parameters (1) Includes “Right of Use Assets” & “Capital Work In Progress” ; (2) Includes Deferred Tax and Income Tax Assets ; (3) Includes both Non - Current & Current Portion Source: Audited Financials RG II (2024 Notes) RG III (2026 Notes) Particulars (INR mn) FY2021 FY2022 FY2021 FY2022 4,472 4,967 6,196 6,229 Revenue 3,971 4,131 5,396 5,872 EBITDA 89% 83% 87% 94% EBITDA Margin % (1,847) (371) (162) 1,515 PAT 34,255 33,192 31,415 30,325 Property Plant & Equipment (1) 1,496 2,663 11,438 7,070 Non - Current Financial Assets 328 324 317 315 Tax Assets (2) 79 70 341 523 Other Non - Current Assets 1,784 2,380 3,453 1,586 Cash & Cash Equivalents 1,001 1,443 2,952 2,901 Receivables 41 30 798 925 Loans 37 225 162 176 Other Financial Assets 55 56 19 31 Other Current Assets 39,076 40,383 50,895 43,852 Total Assets 5,978 5,014 8,144 8,547 Equity 25,413 26,291 36,814 29,954 RG Borrowings (3) 4,347 4,580 0 165 Other Borrowings 799 805 834 852 Lease Liabilities (3) 1,170 1,341 989 279 Other Financial Liabilities (3) 263 251 131 128 Provisions (3) 295 366 158 165 Trade Payables 335 832 1,681 1,508 Tax Liabilities (3) 405 826 2,039 2,148 Other Non - Current Liabilities 71 77 105 106 Other Current Liabilities 39,076 40,383 50,895 43,852 Total Equity & Liabilities 9 | Copyright © 2023 Azure Power | www.azurepower.com

Disclaimer 10 | Copyright © 2023 Azure Power | www.azurepower.com Forward - Looking Statements This information contains forward - looking statements within the meaning of Section 21E of the US Securities Exchange Act of 1934, as amended, and the US Private Securities Litigation Reform Act of 1995, including statements regarding the Company's future financial and operating guidance, operational and financial results. The risks and uncertainties that could cause the Company's results to differ materially from those expressed or implied by such forward - looking statements include: the availability of financing/refinancing on acceptable terms; changes in the commercial and retail prices of traditional utility generated electricity; changes in tariffs at which long term PPAs are entered into; cancellation of PPAs; changes in policies and regulations including net metering and interconnection limits or caps; ongoing and potential litigation and/or regulatory investigations; failure and delays in making regulatory filings (including in India, Mauritius and United States); the availability of rebates, tax credits and other incentives; curtailment; the availability of solar panels and other raw materials; its limited operating history, particularly as a new public company; its ability to attract and retain its relationships with third parties, including its solar partners; its ability to meet the covenants in its debt facilities; meteorological conditions and such other risks identified in the registration statements and reports that the Company files with the US Securities and Exchange Commission from time to time. All forward - looking statements in this press release are based on information available to the Company as of the date hereof, and the Company assumes no obligation to update these forward - looking statements. Certain information provided in this release is unaudited and provisional and thus subject to completion of the Company’s FY 2022 - 23 financial year - end audit. Investors are advised, therefore, that this information may be subject to change

To Be The Number One Provider Of Sustainable Energy Solutions For A Carbon Neutral World Excellence | Honesty | Social Responsibility | Entrepreneurship