June 30, 2016

VIA EDGAR

Securities and Exchange Commission

Division of Corporation Finance

100 F. Street, N.E.

Washington, D.C. 20549

| | Re: | Azure Power Global Limited |

| | | Amendment No. 4 to Registration Statement on Form F-1 |

| | | Response dated June 23, 2016 |

Ladies and Gentlemen:

This letter on behalf of Azure Power Global Limited (the “Company”) is in response to the comments from the staff (the “Staff”) of the U.S. Securities and Exchange Commission (the “Commission”) in the Staff’s letter dated June 28, 2016 regarding the above-referenced Amendment No. 4 to the Registration Statement on Form F-1 (File No. 333-208584) filed with the Commission on June 15, 2016 (the “Registration Statement”) and the above-referenced Response filed with the Commission on June 23, 2016 (the “Response”). For your convenience, each of the Staff’s comments has been set forth below in bold italics, and our response to that comment immediately follows. The Company has also revised the Registration Statement in response to the Staff’s comments and is filing its Amendment No. 5 to the Registration Statement on Form F-1 on EDGAR (the “Amended F-1”) that reflects these revisions and updates and clarifies certain other information.

The Company has attached as Exhibit A to this letter (“Exhibit A”) versions of the prospectus cover, “Offering Summary,” “Summary—Corporate Structure,” “Capitalization” and “Principal and Selling Stockholders” sections of the Amended F-1 that reflect (i) the Preliminary Price Range as defined in the Response, (ii) a 26-for-1 stock split and (iii) an

Securities and Exchange Commission

Division of Corporation Finance

June 30, 2016

Page 2

assumed offering size of 7,500,000 equity shares (before giving effect to the underwriters’ option to purchase additional shares).

Capitalized terms used but not defined herein shall have the meanings ascribed thereto in the Amended F-1. Page references in the text of this response letter correspond to page numbers in the Amended F-1.

Response to Staff Comments

Capitalization, page 54

| | 1. | We note your disclosure on page 11 of your letter filed June 23, 2016 that 24,412,584 equity shares will be outstanding prior to the offering. However, your disclosures in the Capitalization table on page 55 of the letter, as well as the proposed disclosure on page 141, indicate that there were 23,802,624 pro forma shares issued and outstanding prior to the offering. Please tell us the reason for the difference between these figures and revise and/or clarify your disclosures accordingly. If the difference relates to the assumed exercise of stock options, as noted on pages 6 and 7, tell us why shares issuable upon stock option exercise should be included in the pre- and post-offering share totals on page 11. |

The Company acknowledges the Staff’s comment and has revised the disclosure in Exhibit A to address the Staff’s comment. The difference relates to the assumed exercise of outstanding stock options. Immediately prior to the offering, there will be 23,786,983 equity shares of the Company issued and outstanding, excluding shares issuable upon exercise of outstanding stock options. The Company has revised the disclosure in “Summary—Corporate Structure” to clarify that the number of equity shares outstanding prior to the offering excludes the equity shares issuable upon exercise of outstanding stock options under the Company’s 2015 Employee Stock Option Plan.

| | 2. | We note your proposed disclosure on pages 6 and 54 of your letter filed June 23, 2016 that, on a pro forma basis, you will issue 3,934,179 equity shares to the non-founder investors upon conversion of the compulsorily convertible preferred stock and compulsorily convertible debentures. We also note your disclosure that you will complete a 26 for 1 stock split immediately prior to the completion of this offering and that at March 31, 2016 you had 109,880 pre-split equity shares issued and outstanding. Based on the conversion ratio and the proposed stock split ratio, it appears that more than 3,934,179 equity shares will be issued upon the conversion of all convertible securities. Please revise your disclosure to quantify the number of equity shares to be issued upon conversion of all convertible securities, including your mezzanine-classified CCPS, liability-classified CCPS, and CCDs. With reference to the stock split ratio and the conversion provisions and conversion ratios applicable to your convertible securities disclosed in footnotes 10 and 14 of your financial statements, please provide us with your calculations of the converted equity shares attributable to each CCPS series and each CCD issuance. |

Securities and Exchange Commission

Division of Corporation Finance

June 30, 2016

Page 3

The Company acknowledges the Staff’s comment and has revised the disclosure in Exhibit A to address the Staff’s comment. The Company will issue 20,930,127 equity shares to the non-founder investors upon conversion of the compulsorily convertible preferred stock and compulsorily convertible debentures, assuming the effectiveness of a 26-for-1 stock split and an initial public offering price of US$20.00 per equity share, which is the midpoint of the Preliminary Price Range. Below are the conversion ratios, post-conversion share numbers and post-stock split share numbers for each CCPS series and each CCD issuance.

| | | | | | | | | | | | | | | | | | | | |

| Series | | Conversion

Ratio | | | No of shares

(post-CCPS

conversion) | | | Incremental

Shares Due

to Anti-Dilution

at CCD

Conversion | | | No of

shares

(post-all

conversion) | | | No of shares

(post-stock

split) | |

CCPS - Series A | | | 1-1 | | | | 38,770 | | | | | | | | 38,770 | | | | 1,008,020 | |

CCPS - Series B | | | 1-1 | | | | 181,046 | | | | | | | | 181,046 | | | | 4,707,196 | |

CCPS - Series C | | | 1-0.3424 | | | | 78,711 | | | | | | | | 78,711 | | | | 2,046,484 | |

CCPS - Series D | | | 1-1 | | | | 84,348 | | | | | | | | 84,348 | | | | 2,193,048 | |

CCPS - Series E | | | | | | | | | | | | | | | 24,386 | | | | 634,032 | |

CCPS - Series F | | | 1-1 | | | | 138,133 | | | | 21,090 | | | | 159,223 | | | | 4,139,809 | |

CCPS - Series G | | | | | | | | | | | | | | | 18,471 | | | | 480,248 | |

CCPS - Series H | | | 1-1 | | | | 133,285 | | | | 25,504 | | | | 158,789 | | | | 4,128,510 | |

CCDs 5% - DEG | | | | | | | | | | | | | | | 37,088 | | | | 964,299 | |

CCDs 10% - IFC | | | | | | | | | | | | | | | 13,349 | | | | 347,072 | |

CCDs 0% - IFC II | | | | | | | | | | | | | | | 3,993 | | | | 103,828 | |

CCDs 5% - IFC III | | | | | | | | | | | | | | | 6,830 | | | | 177,581 | |

| | | | Total | | | | | | | | | | | | 805,005 | | | | 20,930,127 | |

Securities and Exchange Commission

Division of Corporation Finance

June 30, 2016

Page 4

Income Tax Expense, page 82

| | 3. | Please revise your disclosure to indicate that your effective tax rate decreased, as opposed to increased, from fiscal 2015 to 2016 and to explain in sufficient detail the reasons for the decline in your effective tax rate. |

The Company acknowledges the Staff’s comment and has revised the disclosure on page 82 to address the Staff’s comment. The decrease in the Company’s effective tax rate from fiscal year 2015 to 2016 resulted from lower taxable profits generated by AZI, which provided certain engineering, procurement and construction services to its Indian subsidiaries, in fiscal year 2016.

Investing Activities, page 88

| | 4. | You disclose that your cash outflow during the year ended March 31, 2015 was primarily due to Rs. 8,426.0 of property, plant and equipment purchases offset, in part, by Rs. 927.9 million of proceeds from the sale of available for sale investments and the redemption of Rs. 624.5 million of investments in term deposits. However, we note from your statements of cash flows that you had net inflows of Rs. 13.9 million related to the purchase and sale of available for sale investments and that you purchased, rather than redeemed, Rs. 624.5 million of term deposits. Please revise your explanation of the changes in your cash used in investing activities for the year ended March 31, 2015 or tell us why you believe no revision is required. |

The Company acknowledges the Staff’s comment and has revised the disclosure on page 88 to address the Staff’s comment. It is correct that the Company purchased, rather than redeemed, Rs. 624.5 million of term deposits. The Company has revised the disclosure to state that the cash outflow during the year ended March 31, 2015 was primarily due to the Rs. 8,246.0 million incurred to purchase property, plant and equipment and the purchase of term deposits for Rs. 624.5 million, offset in part by a net sale of Rs. 13.9 million of available-for-sale non-current investments.

Industry, page 93

| | 5. | Please disclose the basis for the recently included assertions about your industry. Please also provide independent supplemental materials, with appropriate markings and page references in your response. The following are examples only of some of your recently included industry assertions: |

| | • | | “According to World Energy Outlook 2015, India requires 134GW of new capacity by 2020.” (Page 93). |

| | • | | “[t]he government hopes to improve the financial and operational efficiency improvements of such power procurers through initiatives such as interest rate reduction, debt takeover by states and reduced transmission losses.” (Page 94). |

| | • | | “The central government has announced plans to invest a total of approximately US$300 billion in power infrastructure from 2012 to 2017.” (Page 95). |

Securities and Exchange Commission

Division of Corporation Finance

June 30, 2016

Page 5

| | • | | “India received approximately US$39 billion in foreign direct investment in 2015 ….” (Page 96). |

| | • | | “India is expected to be the fourth largest country by solar capacity additions in 2016.” (Page 98). |

The Company has enclosed with the Staff’s courtesy copy of this letter, as supplemental material, copies of the assertions about our industry recently included in our Registration Statement, clearly marked to highlight the portion or section of those statements that contains the relevant information and cross-referenced to the appropriate location in the Registration Statement.

Principal and Selling Shareholders, page 141

| | 6. | Although the number of shares held by “All Directors and Officers as a Group” presented in your letter dated June 23, 2016 is 3,274,882 shares, the sum of the shares shown for these individuals totals 3,130,608 shares. Please either revise your table or tell us and disclose the reasons for the difference. |

The Company acknowledges the Staff’s comment and has revised the table on page 142 of Exhibit A to address the Staff’s comment. The difference was due to the inclusion of shares held by employees not listed as directors or officers. The Company has revised the table to only include the number of shares held by the directors and officers.

Related party Transactions, page 144

| | 7. | Disclose the amount you paid in rent on your guest home in fiscal 2016 |

The Company acknowledges the Staff’s comment and has revised the disclosure on page 144 to address the Staff’s comment.

Consolidated Financial Statements for the Years Ended March 31, 2016 and 2015 Note 11. Income Taxes, page F-31

| | 8. | The balance sheet amounts presented for deferred tax assets and deferred tax liabilities as of March 31, 2016 do not agree with the amounts presented in Note 11 on either a gross or a net basis. Please revise as appropriate or explain to us you believe no revision is necessary. |

The Company acknowledges the Staff’s comment and has revised the disclosure on page F-31 to address the Staff’s comment.

We hope that the foregoing has been responsive to the Staff’s comments. Please contact the undersigned at (650) 470-4522 should you require further information.

Very truly yours,

/s/ Thomas J. Ivey

Thomas J. Ivey, Esq.

| cc: | Azure Power Global Limited |

Inderpreet Wadhwa

Sandeep Chopra

Kirk A. Davenport II, Esq

Wesley C. Holmes, Esq

Ernst & Young Associates LLP

Kapil Jain

Exhibit A

The information in this prospectus is not complete and may be changed. Neither we nor the selling shareholder may sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

Subject to Completion, dated June 30, 2016

PROSPECTUS

7,500,000 Equity Shares

Azure Power Global Limited

This is the initial public offering of the equity shares of Azure Power Global Limited. We are offering 6,535,441 equity shares and the selling shareholder identified in this prospectus is offering 964,559 equity shares. We will not receive any of the proceeds from the sale of the shares by the selling shareholder. No public market currently exists for our equity shares.

We have applied to list our equity shares on the New York Stock Exchange under the symbol “AZRE.”

We anticipate that the initial public offering price will be between US$18.00 and US$22.00 per equity share.

We are an “emerging growth company” as that term is used in the Jumpstart Our Business Startups Act of 2012 and, as such, have elected to comply with certain reduced public company reporting requirements.

Investing in our equity shares involves risks. See “Risk Factors” beginning on page18of this prospectus.

| | | | | | | | |

| | | Per Share | | | Total | |

Price to the public | | US$ | | | | US$ | | |

Underwriting discounts and commissions(1) | | US$ | | | | US$ | | |

Proceeds to us (before expenses) | | US$ | | | | US$ | | |

Proceeds to the selling shareholder (before expenses) | | US$ | | | | US$ | | |

| (1) | We refer you to “Underwriting” beginning on page 169 of this prospectus for additional information regarding total underwriter compensation. |

We have granted the underwriters the option to purchase 1,125,000 additional equity shares on the same terms and conditions set forth above if the underwriters sell more than 7,500,000 equity shares in this offering.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed on the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The underwriters expect to deliver the equity shares on or about , 2016.

Barclays

Prospectus dated , 2016

| | • | | our operating results may fluctuate from quarter to quarter, which could make our future performance difficult to predict and could cause our operating results for a particular period to fall below expectations, resulting in a severe decline in the price of our equity shares; |

| | • | | our substantial indebtedness could adversely affect our business, financial condition, results of operations and cash flows; |

| | • | | our growth prospects and future profitability depend to a significant extent on global liquidity and the availability of additional funding options with acceptable terms; |

| | • | | if we fail to comply with financial and other covenants under our loan agreements, our financial condition, results of operations, cash flows and business prospects may be materially and adversely affected; and |

| | • | | if we fail to maintain an effective system of internal control over financial reporting, we may be unable to accurately report our financial results and investor confidence in our company and the value of our equity shares may be adversely affected. |

See “Risk Factors” and “Forward-Looking Statements” for a more detailed discussion of these and other risks and uncertainties that we may face.

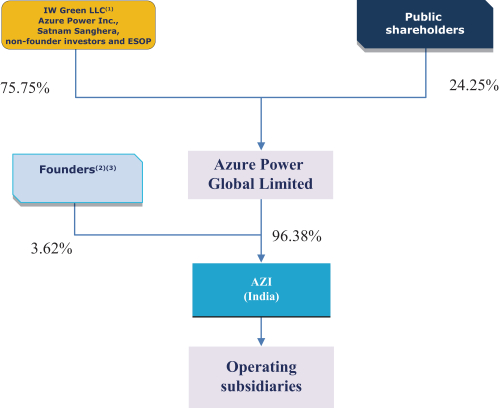

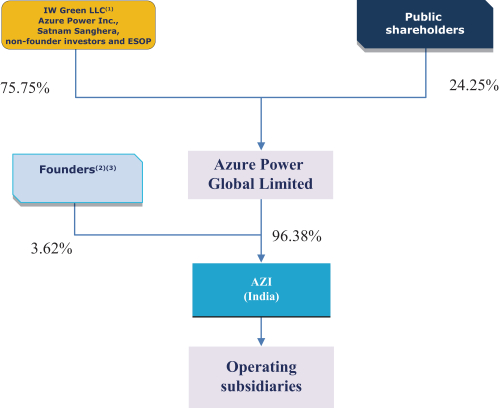

Corporate Structure

Azure Power Global Limited is a company incorporated in Mauritius and is the holding company of AZI. All of our operations at present and following the completion of this offering will be conducted through AZI and its subsidiaries. For details of the current shareholders of Azure Power Global Limited, see “Principal and Selling Shareholders.”

On July 25, 2015, Azure Power Global Limited purchased from the non-founder investors in AZI (i.e., International Finance Corporation, Helion Venture Partners II, LLC, Helion Venture Partners India II, LLC, FC VI India Venture (Mauritius) Ltd., DEG — Deutsche Investitions — Und Entwicklungsgesellschaft mbH and Société de Promotion et de Participation Pour la Coopération Économique) the equity shares and convertible securities held by them in AZI and issued an equivalent number of equity shares and convertible securities of Azure Power Global Limited to such non-founder investors on equivalent terms. Immediately prior to the consummation of this offering and the listing of the equity shares pursuant to the offering, the convertible securities of Azure Power Global Limited issued to the non-founder investors will be converted into equity shares of Azure Power Global Limited in an amount that depends, among other factors, on the initial public offering price in the offering. Assuming the effectiveness of a 26-for-1 stock split of our equity shares and an initial public offering price of US$20.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, a total of 20,930,127 equity shares of Azure Power Global Limited will be issued to the non-founder investors upon the conversion of such convertible securities and there will be a total of 30,322,424 equity shares of Azure Power Global Limited issued and outstanding as of the consummation of this offering. A US$1.00 decrease or increase in the assumed initial public offering price of US$20.00 would increase or decrease the total number of equity shares of Azure Power Global Limited issued and outstanding as of the consummation of this offering by 155,485 shares or 140,677 shares, respectively. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Corporate Structure” for a more detailed discussion.

Assuming an initial public offering price of US$20.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, IW Green LLC (in which Mr. Inderpreet S. Wadhwa is the sole member), Azure Power Inc. and Mr. Satnam Sanghera, collectively referred to as the APGL Founders, and the non-founder investors will own 75.75% of the equity

6

shares in Azure Power Global Limited and 24.25% will be owned by the public investors. The percentage of Azure Power Global Limited that is owned by such shareholders will vary if the initial public offering price changes. For example, a US$1.00 decrease in the assumed initial public offering price would increase the aggregate percentage of Azure Power Global Limited that is owned by the APGL Founders and the non-founder investors to 75.87% and would decrease the percentage of Azure Power Global Limited that is owned by the public investors to 24.13%, while a US$1.00 increase in the assumed initial public offering price would decrease the aggregate percentage of Azure Power Global Limited that is owned by the APGL Founders and the non-founder investors to 75.64% and would increase the percentage of Azure Power Global Limited that is owned by the public investors to 24.36%.

Azure Power Global Limited intends to utilize substantially all of the net proceeds of this offering (other than approximately US$5 million to be retained by Azure Power Global Limited to fund its future operating expenses, including rent, professional fees and other corporate overhead expenses) to purchase 1.26 million equity shares to be issued by AZI at a price of US$92.08 per equity share, assuming that the initial public offering is priced at US$20.00 per equity share of Azure Power Global Limited, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus. Following the completion of this offering and the purchase of additional equity shares of AZI by Azure Power Global Limited, Azure Power Global Limited will own 96.38% of the equity shares of AZI. The percentage ownership of Azure Power Global Limited will vary if the offering size or the initial public offering price changes. For example, a US$1.00 decrease in the assumed equity share price would decrease Azure Power Global Limited’s ownership of AZI by 0.10%. Alternatively, a decrease of US$10 million in the net offering proceeds would decrease Azure Power Global Limited’s ownership of AZI by 0.14%. The remaining 3.62% of the equity shares of AZI will be held by Mr. Inderpreet S. Wadhwa, Mr. Harkanwal S. Wadhwa, Azure Power Inc. and Mr. Satnam Sanghera, collectively referred to as the AZI Founders. Furthermore, the amount for which the AZI Founders sell their shares in AZI (including any sale to Azure Power Global Limited) above the face value of such shares is to be distributed among the founders and non-founders pro rata based on their as converted shareholding in Azure Power Global Limited. Azure Power Global Limited has an option to purchase such equity shares from the AZI Founders. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Corporate Structure” for a more detailed discussion of the option and the lock-in agreement. For details of the intended use of proceeds by AZI upon investment by Azure Power Global Limited into AZI, see “Use of Proceeds.”

The AZI employee stock option plan has been terminated and all options granted pursuant to such plan have been cancelled. Employees who were granted options under the AZI employee stock option plan have been granted options to purchase equity shares of Azure Power Global Limited pursuant to the 2015 Employee Stock Option Plan. Immediately upon the completion of this offering, the 2015 Employee Stock Option Plan will be terminated and replaced by the 2016 Equity Incentive Plan. Options issued pursuant to the 2015 Employee Stock Option Plan will be cancelled and replaced with options to be issued pursuant to the 2016 Equity Incentive Plan. Upon the closing of the offering, and without assuming any stock-split, there will be 25,930 equity shares issuable upon exercise of outstanding stock options at a weighted average exercise price of Rs. 3,307 (US$50.00) per share under our employee stock option plan. The number of equity shares outstanding discussed above excludes 25,930 equity shares issuable upon exercise of outstanding stock options under our 2015 Employer Stock Option Plan.

7

The diagram below illustrates our corporate structure upon the completion of this offering assuming an offering price of US$20.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, and subsequent subscription of shares of AZI from the proceeds of this offering as described above.

| (1) | The sole member of IW Green LLC is Mr. Inderpreet S. Wadhwa. |

| (2) | Refers to Mr. Inderpreet S. Wadhwa and Mr. Harkanwal Singh Wadhwa. |

| (3) | Azure Power Global Limited has an option to purchase the equity shares from the Founders. See “Management Discussion and Analysis of Financial Condition and Results of Operations—Corporate Structure”. |

Corporate Information

We are a public company limited by shares incorporated in Mauritius on January 30, 2015. Our registered office is located at c/o AAA Global Services Ltd., 1st Floor, The Exchange 18 Cybercity, Ebene, Mauritius. Our principal executive offices are located at 8 Local Shopping Complex, Pushp Vihar, Madangir, New Delhi 110062, India, and our telephone number at this location is (91-11) 49409800. Our principal website address is www.azurepower.com. The information contained on our website does not form part of this prospectus. Our agent for service of process in the United States is CT Corporation System, located at 111 Eighth Avenue, 13th Floor, New York, NY 10011.

Dividends

As we are a holding company, we will have to rely on dividends paid to us by our subsidiaries (in particular, our subsidiary in India, AZI) for our cash requirements, including funds to pay dividends and other cash

8

THE OFFERING

Equity shares offered by us | 6,535,441 equity shares (7,660,441 equity shares if the underwriters exercise in full their option to purchase additional equity shares). |

Equity shares offered by the selling shareholder | 964,559 equity shares. |

Option to purchase additional equity shares | We have granted the underwriters an option, which is exercisable within 30 days from the date of this prospectus, to purchase up to additional equity shares from us at the public offering price less the underwriting discount. |

Equity shares to be outstanding before this offering | 23,786,983 equity shares. |

Equity shares to be outstanding immediately after this offering | 30,322,424 equity shares (31,447,424 equity shares if the underwriters exercise in full their option to purchase additional equity shares). |

Use of Proceeds | We anticipate that we will receive net proceeds from this offering of approximately US$120.6 million, or approximately US$141.6 million if the underwriters exercise their option to purchase additional equity shares in full. These estimates are based upon an assumed initial public offering price of US$20.00 per equity share, the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus, after deducting the estimated underwriting discounts, commissions and estimated aggregate offering expenses payable by us. |

| | We intend to use US$116.0 million to fund the purchase by Azure Power Global Limited of equity shares to be issued by AZI, which will occur contemporaneously with the completion of this offering. Net proceeds to be received by AZI as a result of such purchase are intended to be used for project development, working capital needs and other general corporate purposes. We intend to retain US$5.0 million to fund future operating expenses of Azure Power Global Limited. To the extent the underwriters exercise their option to purchase additional equity shares, the net proceeds from the sale of the additional equity shares will be used to purchase additional equity shares of AZI. See “Use of Proceeds.” |

| | We will not receive any of the proceeds from the sale of equity shares by the selling shareholder. |

Directed Share Program | At our request, the underwriters have reserved % of the equity shares offered by this prospectus for sale, at the initial public offering price, to our directors, officers, employees, business associates and related persons. If these persons purchase equity shares, this will reduce the number of shares available for sale to the public. |

11

Risk Factors | See “Risk Factors” and other information included in this prospectus for a discussion of factors you should carefully consider before deciding to invest in the equity shares. |

Dividend Policy | We currently intend to retain our earnings, if any, to finance the development and growth of our business and operations as well as expand our business and do not currently anticipate paying dividends on our equity shares in the near future. See “Dividends and Dividend Policy.” |

Listing | We have applied to list our equity shares on the New York Stock Exchange. |

Proposed Trading Symbol | “AZRE.” |

Certain Assumptions

The number of our equity shares to be outstanding after this offering, the combined voting power that identified shareholders will hold after this offering and the economic interest in our business that identified shareholders will hold after this offering are based on the following assumptions:

| | • | | the conversion of compulsorily convertible preferred shares and compulsorily convertible debentures into equity shares; |

| | • | | the effectiveness of a 26-for-1 stock split; and |

| | • | | our and the selling shareholder’s sale of equity shares in this offering. |

The number of our equity shares to be outstanding after this offering, the combined voting power that identified shareholders will hold after this offering and the economic interest in our business that identified shareholders will hold after this offering excludes the following:

| | • | | equity shares which may be issued upon the exercise of the underwriters’ option to purchase additional shares of our equity shares; and |

| | • | | 25,930 equity shares issuable upon exercise of outstanding stock options at a weighted-average exercise price of Rs. 3,307 (US$50.00) per share under our 2015 Employee Stock Option Plan. |

Except as otherwise indicated, all information in this prospectus assumes that the underwriters do not exercise their option to purchase additional equity shares.

12

CAPITALIZATION

The following table sets forth our capitalization on a consolidated basis as of March 31, 2016 on:

| | • | | an actual basis, which excludes equity shares issuable upon exercise of outstanding stock options at a weighted average price of Rs. 3,307 (US$50.00) per share under our 2015 Employee Stock Option Plan and reflects the effectiveness of a 26-for-1 stock split of our equity shares; |

| | • | | a pro forma basis to reflect the conversion of compulsorily convertible preferred shares and compulsorily convertible debentures into an aggregate of 20,930,127 equity shares based on an initial public offering price of US$20.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus; and |

| | • | | a pro forma as adjusted basis to further reflect the following transactions that will occur substantially contemporaneously with the completion of this offering: |

| | • | | our sale of 6,535,441 equity shares by us in this offering and our receipt of the estimated net proceeds from such issuance and sale in this offering, each based on an assumed initial public offering price of US$20.00 per equity share, the midpoint of the price range set forth on the cover page of this prospectus, after deducting underwriting discounts and commissions and estimated offering expenses payable by us, as if such transactions had occurred on March 31, 2016; and |

| | • | | the share subscription by Azure Power Global Limited of additional shares of AZI with substantially all of the net proceeds to Azure Power Global Limited of US$120.6 million of this offering (other than approximately US$5.0 million to be retained by Azure Power Global Limited to fund its future operating expenses). |

54

You should read this table in conjunction with the information under “Use of Proceeds,” “Selected Consolidated Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements and the related notes thereto included elsewhere in this prospectus.

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of March 31, 2016 | |

| | | Actual | | | Actual | | | Pro Forma(1) | | | Pro Forma(1) | | | Pro

Forma

Adjusted(1) | | | Pro

Forma

Adjusted(1) | |

| | | Rs. | | | U.S.$ | | | Rs. | | | U.S.$ | | | Rs. | | | U.S.$ | |

| | | | | | (in thousands, except per share data) | |

Cash and cash equivalents | | | 3,090,386 | | | | 46,647 | | | | 3,090,386 | | | | 46,647 | | | | 11,080,764 | | | | 167,257 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total debt | | | 24,526,824 | | | | 370,214 | | | | 20,926,124 | | | | 315,866 | | | | 20,926,124 | | | | 315,866 | |

Compulsory convertible preferred shares, Rs. 10 (US$ 0.16) par value (805,462 shares issued and outstanding, actual; 0 shares issued and outstanding, pro forma; and 0 shares issued and outstanding, pro forma as adjusted) | | | 9,733,272 | | | | 146,918 | | | | — | | | | — | | | | — | | | | — | |

Stockholder’s equity | | | | | | | | | | | | | | | | | | | | | | | | |

Equity shares Rs. 10 (US$ 0.16) par value (109,880 shares issued and outstanding, actual; 23,786,983 shares issued and outstanding, pro forma; and 30,322,424 shares issued and outstanding, pro forma as adjusted | | | 68 | | | | 1 | | | | 15,759 | | | | 238 | | | | 20,089 | | | | 303 | |

Additional paid in capital | | | (2,958,166 | ) | | | (44,652 | ) | | | 10,360,115 | | | | 156,379 | | | | 18,137,432 | | | | 273,773 | |

Accumulated deficit | | | (4,508,156 | ) | | | (68,048 | ) | | | (4,508,156 | ) | | | (68,048 | ) | | | (4,508,156 | ) | | | (68,048 | ) |

Accumulated other comprehensive income | | | 28,807 | | | | 435 | | | | 28,807 | | | | 435 | | | | 28,807 | | | | 435 | |

Non-controlling interest | | | (330 | ) | | | (5 | ) | | | (330 | ) | | | (5 | ) | | | (330 | ) | | | (5 | ) |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total shareholders’ (deficit) equity | | | (7,437,777 | ) | | | (112,269 | ) | | | 5,896,195 | | | | 88,999 | | | | 13,677,842 | | | | 206,458 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

Total Capitalization | | | 26,822,319 | | | | 404,863 | | | | 26,822,319 | | | | 404,864 | | | | 34,603,966 | | | | 522,323 | |

| | | | | | | | | | | | | | | | | | | | | | | | |

| (1) | Each US$1.00 increase or decrease in the assumed initial public offering price of US$20.00 per share, the mid-point of the price range on the cover page of this prospectus, would increase or decrease, respectively, the amount of cash, additional paid-in capital and total capitalization by approximately US$7,012,239, assuming the number of shares we offer, as stated on the cover page of this prospectus, remains the same, after deducting the estimated underwriting discounts and commission and estimated offering expenses payable by us. |

55

PRINCIPAL AND SELLING SHAREHOLDERS

The following table sets forth information regarding thepro forma beneficial ownership of our equity shares as of the date of this prospectus by:

| | • | | each of our directors and senior management; |

| | • | | each person known by us to own more than 5% of our equity shares; and |

| | • | | the selling shareholder. |

We have determined beneficial ownership in accordance with the rules of the SEC. The number of equity shares beneficially owned before the offering set forth below assumes the conversion of outstanding compulsorily convertible preferred shares and compulsorily convertible debentures into an aggregate of equity shares (assuming an initial public offering price of US$20.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus) and the effectiveness of a 26-for-1 stock split of our equity shares, both of which will take place immediately prior to the consummation of this offering. Except as indicated in the footnotes below, we believe, based on the information furnished to us, that the persons named in the following table have sole voting and investment power with respect to all equity shares that they beneficially own, subject to applicable community property laws.

The percentage ownership of each listed person before this offering is based upon 23,786,983 equity shares outstanding prior to this offering, including an aggregate of 20,930,127 equity shares to be issued upon the conversion of compulsorily convertible preferred shares and compulsorily convertible debentures immediately prior to the consummation of this offering, based on an initial public offering price of US$20.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus. The percentage ownership of each listed person after the offering is based upon 30,322,424 equity shares outstanding immediately after the closing of this offering, including the equity shares identified in the immediately preceding sentence plus the equity shares to be sold by us and by the Selling Shareholder in this offering.

In computing the number of equity shares beneficially owned by a person and the percentage ownership of that person, we deemed outstanding equity shares subject to options held by that person that are currently exercisable or exercisable within 60 days after the date of this prospectus. We did not deem these shares outstanding, however, for the purpose of computing the percentage ownership of any other person.

The underwriters have an option for a period of 30 days from the date of this prospectus to purchase up to an additional 1,125,000 equity shares from us at the initial public offering price less the underwriting discounts and commissions.

None of our shareholders will have different voting rights from other shareholders after the completion of this offering. We are not aware of any arrangement that may, at a subsequent date, result in a change of control of our company.

141

Unless otherwise indicated, the principal address of each of the shareholders below is c/o Azure Power India Private Limited, 8 Local Shopping Complex, Pushp Vihar, Madangir, New Delhi 110062, India.

| | | | | | | | | | | | | | | | | | | | |

| | | Shares Beneficially Owned

Before Offering | | | | | | Shares Beneficially Owned

After Offering

(Assuming No

Exercise of The

Over-Allotment

Option) | |

Name | | Number | | | % | | | Shares Offered

Hereby | | | Number | | | % | |

5% or Greater Shareholders: | | | | | | | | | | | | | | | | | | | | |

IW Green LLC(1) | | | 2,677,922 | | | | 11.3 | % | | | | | | | 2,677,922 | | | | 8.8 | % |

International Finance Corporation(2) | | | 3,945,903 | | | | 16.6 | % | | | | | | | 3,945,903 | | | | 13.0 | % |

Helion Venture Partners II, LLC(3) | | | 5,097,695 | | | | 21.4 | % | | | | | | | 5,097,695 | | | | 16.8 | % |

Helion Venture Partners India II, LLC(4) | | | 437,060 | | | | 1.8 | % | | | | | | | 437,060 | | | | 1.4 | % |

FC VI India Ventures (Mauritius) Ltd.(5) | | | 5,931,216 | | | | 24.9 | % | | | | | | | 5,931,216 | | | | 19.6 | % |

IFC GIF Investment Company I(6) | | | 3,440,430 | | | | 14.5 | % | | | | | | | 3,440,430 | | | | 11.3 | % |

| | | | | |

Directors and Officers: | | | | | | | | | | | | | | | | | | | | |

Inderpreet Singh Wadhwa(7) | | | 2,847,728 | | | | 11.9 | % | | | | | | | 2,847,728 | | | | 9.4 | % |

Harkanwal Singh Wadhwa | | | 67,990 | | | | * | | | | | | | | 67,990 | | | | * | |

Preet Sandhu | | | 82,940 | | | | * | | | | | | | | 82,940 | | | | * | |

Surendra Kumar Gupta | | | 58,812 | | | | * | | | | | | | | 58,812 | | | | * | |

Sandeep Chopra | | | 27,404 | | | | * | | | | | | | | 27,404 | | | | * | |

Mohor Sen | | | — | | | | * | | | | | | | | — | | | | * | |

Glen Minyard(8) | | | 40,144 | | | | * | | | | | | | | 40,144 | | | | * | |

Robert Kelly | | | 18,590 | | | | * | | | | | | | | 18,590 | | | | * | |

William B. Elmore(9) | | | — | | | | * | | | | | | | | — | | | | * | |

Sanjeev Aggarwal(10) | | | — | | | | * | | | | | | | | — | | | | * | |

Barney S. Rush(11) | | | — | | | | * | | | | | | | | — | | | | * | |

Arno Harris(12) | | | — | | | | * | | | | | | | | — | | | | * | |

Eric Ng Yim On(13) | | | — | | | | * | | | | | | | | — | | | | * | |

Muhammad Khalid Peyrye(14) | | | — | | | | * | | | | | | | | — | | | | * | |

All Directors and Officers as a Group (13 persons) | | | 3,143,608 | | | | 13.0 | % | | | | | | | 3,143,608 | | | | 10.4 | % |

| | | | | |

Selling Shareholder: | | | | | | | | | | | | | | | | | | | | |

DEG—Deutsche Investitions—Und Entwicklungsgesellschaft mbH(15) | | | 964,559 | | | | 4.1 | % | | | 964,559 | | | | — | | | | * | |

| * | Less than 1% of the outstanding equity shares. |

| (1) | The sole member of IW Green LLC is Mr. Inderpreet S. Wadhwa. IW Green LLC was known as IW Green Inc. prior to its conversion to IW Green LLC in October 2015. |

| (2) | International Finance Corporation is an international organization established by Articles of Agreement among its member countries. Its principal address is 2121 Pennsylvania Avenue, NW, Washington, District of Columbia 20433, United States. |

| (3) | Helion Investment Management, LLC holds the voting power in Helion Venture Partners II, LLC. SA Holdings Global Ltd and Gupta Goyal Trust are the beneficial owners of Helion Investment Management, LLC. Mr. Sanjeev Aggarwal is the beneficial owner of SA Holdings Global Ltd and Mr. Ashish Gupta and Ms. Nita Goyal are the beneficial owners of Gupta Goyal Trust. Each of the beneficial owners disclaims beneficial ownership in the shares held by the aforementioned entities except to the extent of his or her pecuniary interest therein. The principal address of Helion Venture Partners II, LLC is Les Cascades Building, Edith Cavell Street, Port Louis, Mauritius. |

| (4) | Helion Investment Management, LLC holds the voting power in Helion Venture Partners India II, LLC. SA Holdings Global Ltd and Gupta Goyal Trust are the beneficial owners of Helion Investment Management, LLC. Mr. Sanjeev Aggarwal is the beneficial owner of SA Holdings Global Ltd and |

142

| | Mr. Ashish Gupta and Ms. Nita Goyal are the beneficial owners of Gupta Goyal Trust. Each of the beneficial owners disclaims beneficial ownership in the shares held by the aforementioned entities except to the extent of his or her pecuniary interest therein. The principal address of Helion Venture Partners India II, LLC is Les Cascades Building, Edith Cavill Street, Port Louis, Mauritius. |

| (5) | FC VI India Holding (Mauritius) Ltd. is the beneficial owner of all equity interests of FC India Venture (Mauritius) Ltd. and exercises sole voting and investment power over the shares owned by FC India Venture (Mauritius) Ltd. Foundation Capital VI, L.P. and Foundation Capital VI Principals Fund, LLC are the beneficial owners of FC VI India Holding (Mauritius) Ltd. The general partner of Foundation Capital VI, L.P. and Foundation Capital VI Principals Fund, LLC is Foundation Capital Management Co. VI, LLC. The managing members of Foundation Capital Management Co. VI, LLC are Mr. William B. Elmore, Mr. Paul Koontz, Mr. Michael Schuh, Mr. Paul Holland, Mr. Richard Redelfs, Mr. Steve Vassallo, Mr. Charles Moldow and Mr. Warren Weiss. Each of the managing members of Foundation Capital Management Co. VI, LLC disclaims beneficial ownership in the shares held by the aforementioned entities except to the extent of his or her pecuniary interest therein. The address of Foundation Capital Management Co. VI, LLC is 250 Middlefield Road, Menlo Park, CA 94025. |

| (6) | IFC Global Infrastructure (GP) LLC and IFC Global Infrastructure (Alternate GP) LLP are beneficial owners of all equity interests of IFC GIF Investment Company I. The principal address of IFC GIF Investment Company I is c/o Cim Fund Services Ltd., 33 Edith Cavell Street, Port Louis, Mauritius. |

| (7) | Includes the equity shares held by IW Green LLC. Mr. Inderpreet Wadhwa is the beneficial owner of all equity interests of IW Green LLC. |

| (8) | Mr. Minyard’s business address is 20700 Timber Ct., Willits, CA 95490, United States. |

| (9) | Shares held by FC VI India Ventures (Mauritius) Ltd. do not include any equity shares directly held by Mr. Elmore. Mr. Elmore, a general partner of Foundation Capital, may be deemed to indirectly beneficially own such shares through the interest held by funds managed by Foundation Capital. Mr. Elmore’s business address is c/o Foundation Capital, 250 Middlefield Road, Menlo Park, CA 94025, United States. |

| (10) | Does not include any equity shares of Mr. Aggarwal, a managing director of Helion Venture Partners, who may be deemed to beneficially own through interests held by funds managed by Helion Venture Partners. Mr. Aggarwal’s business address is Helion Advisors Private Limited, Tower B, 10th Floor, Vatika Towers, Sector 54, Gurgaon, 122 002, India. |

| (11) | Mr. Rush’s business address is 6917 Maple Avenue, Chevy Chase, Maryland 20815. |

| (12) | Mr. Harris’ business address is 135 Main Street, Suite 1320, San Francisco, California 94105. |

| (13) | Mr. Ng’s business address is c/o AAA Global Services Ltd., 1st Floor, The Exchange 18 Cybercity, Ebene, Mauritius. |

| (14) | Mr. Peyrye’s business address is c/o AAA Global Services Ltd., 1st Floor, The Exchange 18 Cybercity, Ebene, Mauritius. |

| (15) | DEG-Deutsche Investitions- und Entwicklungsgesellschaft mbH, or DEG, is owned by KfW. KfW is the beneficial owner of all the equity interests of DEG. The Federal Republic of Germany is the beneficial owner of KfW and exercises sole voting and investment power over the shares owned by KfW. The Federal Republic of Germany disclaims beneficial ownership in the shares held by KfW except to the extent of its pecuniary interests therein. DEG’s principal address is Kämmergasse 22, 50676 Kôln, Germany. |

In addition, after the consummation of this offering and subscription of shares described under “Prospectus Summary — Corporate Structure,” Mr. Inderpreet Singh Wadhwa, Mr. Harkanwal Singh Wadhwa, Azure Power Inc. and Mr. Satnam Sanghera will collectively own 3.62% of the equity shares of AZI, assuming an offer price of US$20.00 per equity share, which is the midpoint of the estimated range of the initial public offering price as set forth on the cover page of this prospectus.

143