Investor Briefing January 2020 Exhibit 99.1

Disclaimer Forward-Looking Statements This information contains forward-looking statements within the meaning of Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995, including statements regarding our future financial and operating guidance, operational and financial results such as estimates of nominal contracted payments remaining and portfolio run rate, and the assumptions related to the calculation of the foregoing metrics. The risks and uncertainties that could cause our results to differ materially from those expressed or implied by such forward-looking statements include: the availability of additional financing on acceptable terms; changes in the commercial and retail prices of traditional utility generated electricity; changes in tariffs at which long term PPAs are entered into; changes in policies and regulations including net metering and interconnection limits or caps; the availability of rebates, tax credits and other incentives; the availability of solar panels and other raw materials; our limited operating history, particularly as a new public company; our ability to attract and retain our relationships with third parties, including our solar partners; our ability to meet the covenants in debt facilities; meteorological conditions and such other risks identified in the registration statements and reports that we have file with the U.S. Securities and Exchange Commission, or SEC, from time to time. All forward-looking statements in this press release are based on information available to us as of the date hereof, and we assume no obligation to update these forward-looking statements.

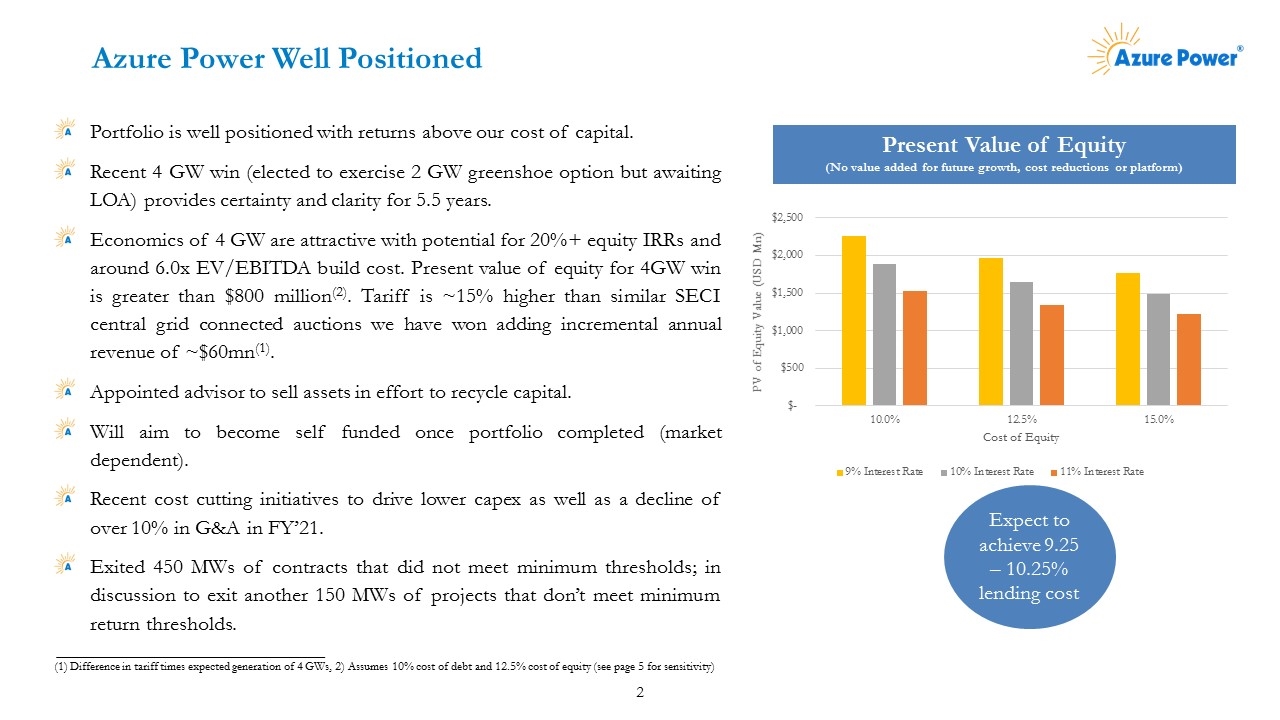

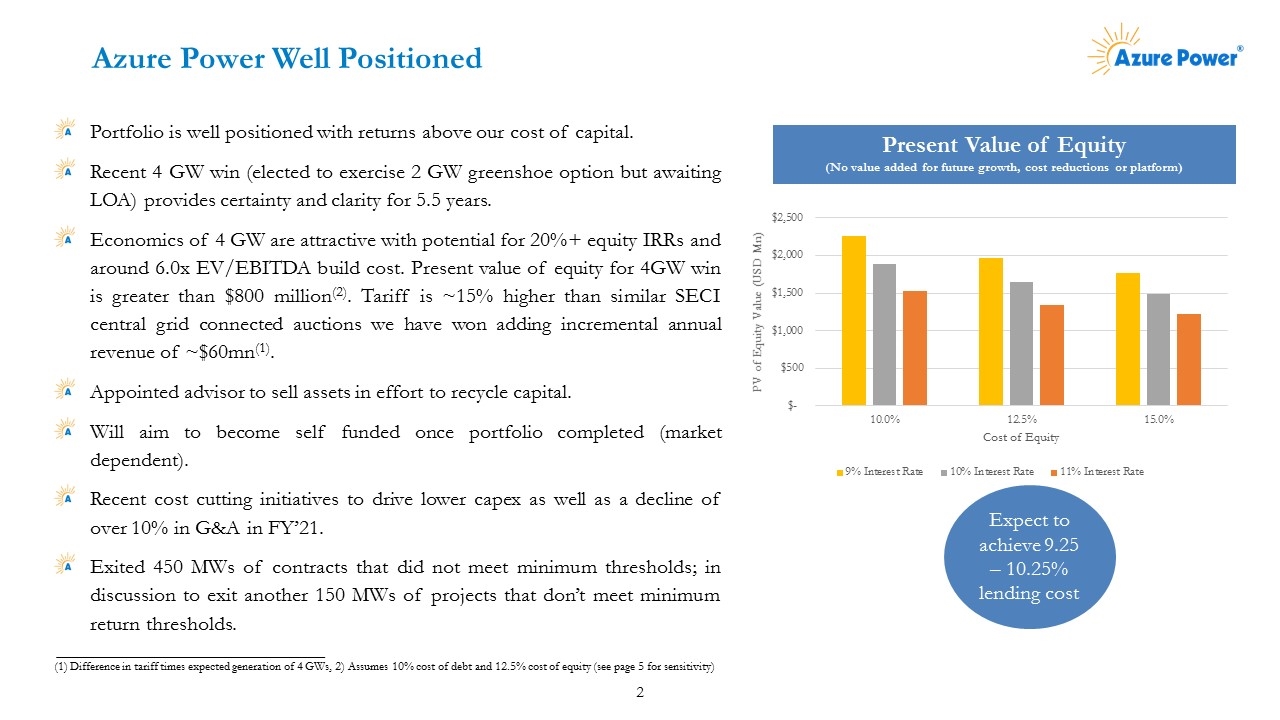

Azure Power Well Positioned Present Value of Equity (No value added for future growth, cost reductions or platform) Portfolio is well positioned with returns above our cost of capital. Recent 4 GW win (elected to exercise 2 GW greenshoe option but awaiting LOA) provides certainty and clarity for 5.5 years. Economics of 4 GW are attractive with potential for 20%+ equity IRRs and around 6.0x EV/EBITDA build cost. Present value of equity for 4GW win is greater than $800 million(2). Tariff is ~15% higher than similar SECI central grid connected auctions we have won adding incremental annual revenue of ~$60mn(1). Appointed advisor to sell assets in effort to recycle capital. Will aim to become self funded once portfolio completed (market dependent). Recent cost cutting initiatives to drive lower capex as well as a decline of over 10% in G&A in FY’21. Exited 450 MWs of contracts that did not meet minimum thresholds; in discussion to exit another 150 MWs of projects that don’t meet minimum return thresholds. Expect to achieve 9.25 – 10.25% lending cost (1) Difference in tariff times expected generation of 4 GWs, 2) Assumes 10% cost of debt and 12.5% cost of equity (see page 5 for sensitivity)

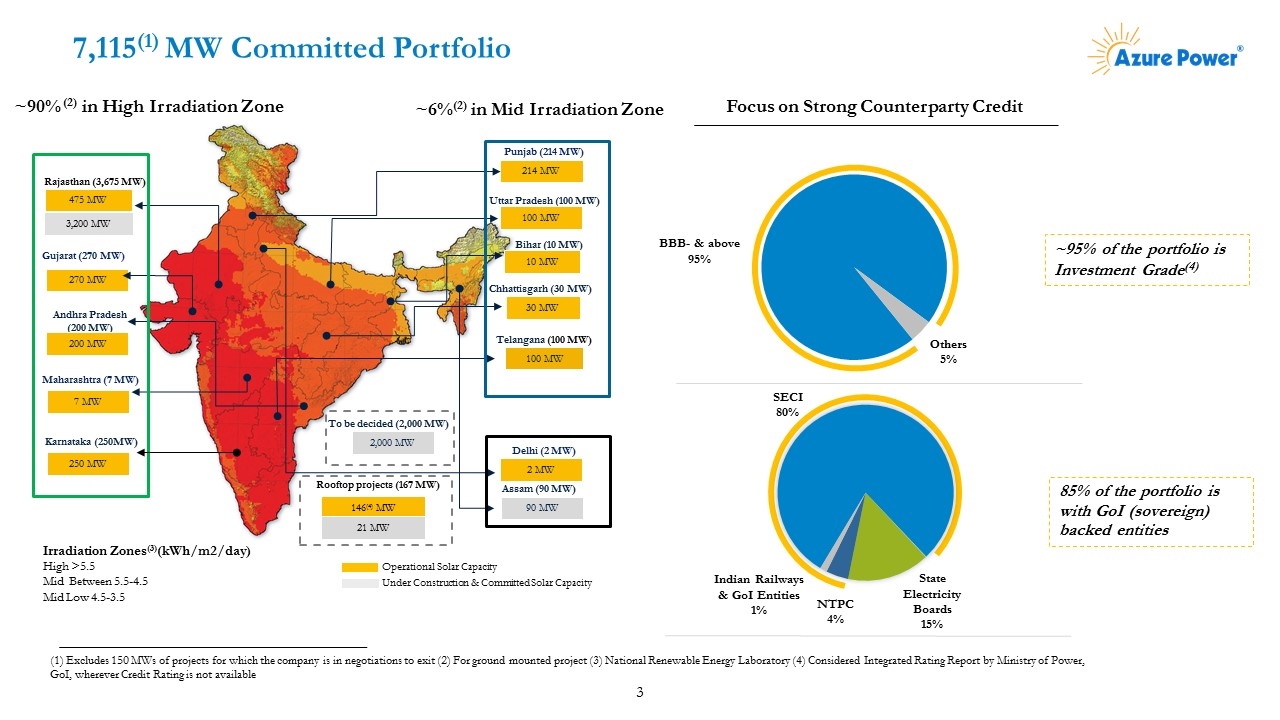

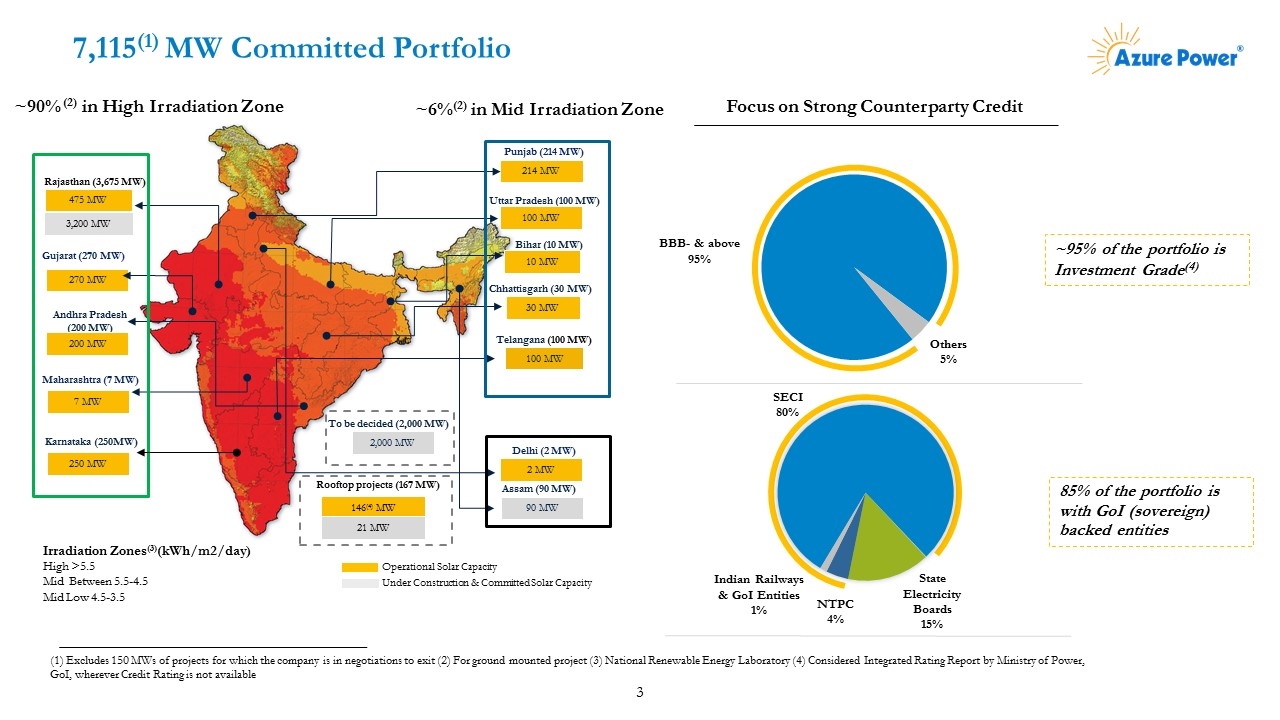

7,115(1) MW Committed Portfolio Operational Solar Capacity Under Construction & Committed Solar Capacity Gujarat (270 MW) 270 MW Rajasthan (3,675 MW) 475 MW Karnataka (250MW) 250 MW Andhra Pradesh (200 MW) 200 MW Chhattisgarh (30 MW) 30 MW Bihar (10 MW) Uttar Pradesh (100 MW) Punjab (214 MW) 214 MW Delhi (2 MW) 2 MW Maharashtra (7 MW) 7 MW Telangana (100 MW) 100 MW 100 MW 10 MW Rooftop projects (167 MW) 146(4) MW 21 MW 3,200 MW Assam (90 MW) 90 MW ~90% (2) in High Irradiation Zone Irradiation Zones(3)(kWh/m2/day) High >5.5 Mid Between 5.5-4.5 Mid Low 4.5-3.5 ~6%(2) in Mid Irradiation Zone (1) Excludes 150 MWs of projects for which the company is in negotiations to exit (2) For ground mounted project (3) National Renewable Energy Laboratory (4) Considered Integrated Rating Report by Ministry of Power, GoI, wherever Credit Rating is not available ~95% of the portfolio is Investment Grade(4) BBB- & above 95% 7 85% of the portfolio is with GoI (sovereign) backed entities Focus on Strong Counterparty Credit 1% State Electricity Boards 15% To be decided (2,000 MW) 2,000 MW

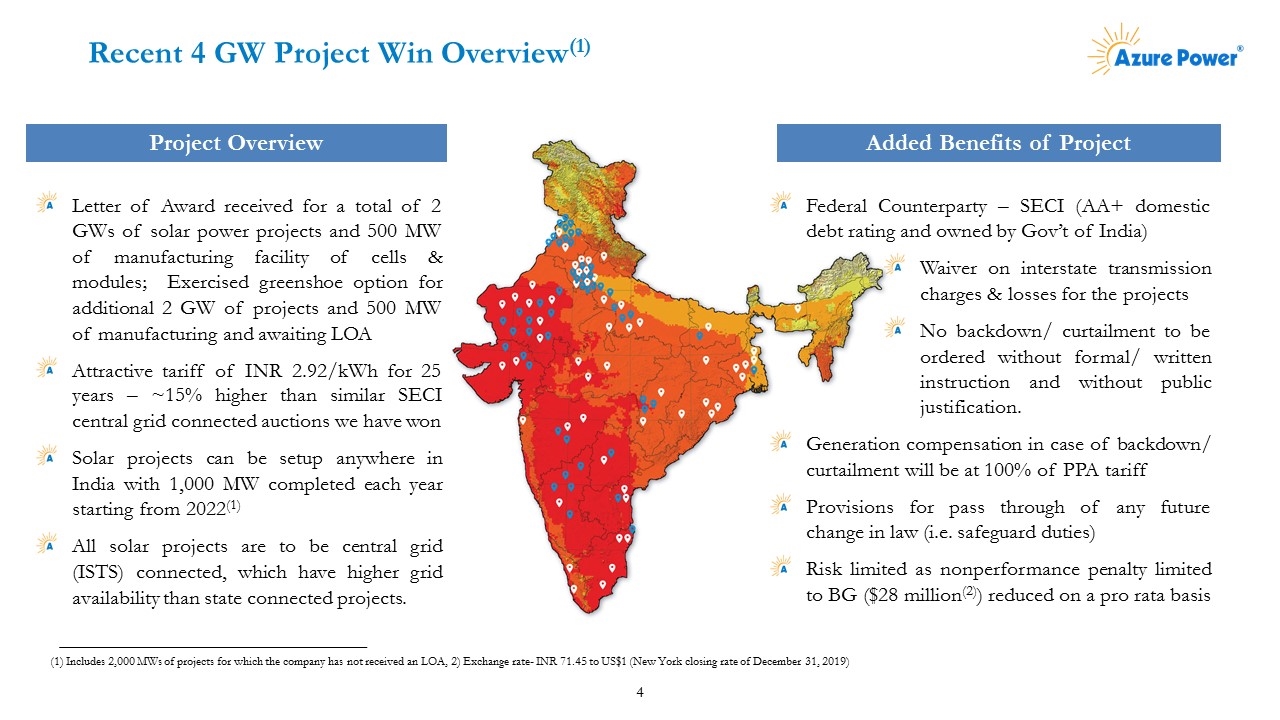

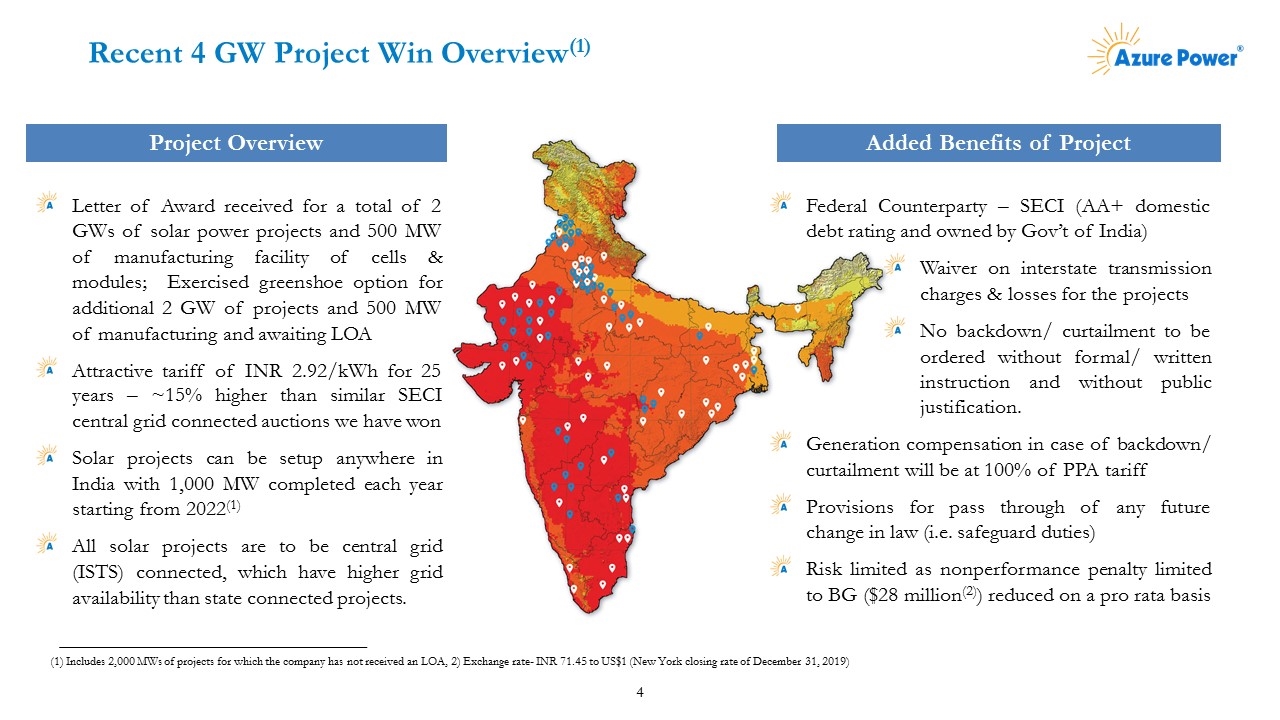

Recent 4 GW Project Win Overview(1) Letter of Award received for a total of 2 GWs of solar power projects and 500 MW of manufacturing facility of cells & modules; Exercised greenshoe option for additional 2 GW of projects and 500 MW of manufacturing and awaiting LOA Attractive tariff of INR 2.92/kWh for 25 years – ~15% higher than similar SECI central grid connected auctions we have won Solar projects can be setup anywhere in India with 1,000 MW completed each year starting from 2022(1) All solar projects are to be central grid (ISTS) connected, which have higher grid availability than state connected projects. Federal Counterparty – SECI (AA+ domestic debt rating and owned by Gov’t of India) Waiver on interstate transmission charges & losses for the projects No backdown/ curtailment to be ordered without formal/ written instruction and without public justification. Generation compensation in case of backdown/ curtailment will be at 100% of PPA tariff Provisions for pass through of any future change in law (i.e. safeguard duties) Risk limited as nonperformance penalty limited to BG ($28 million(2)) reduced on a pro rata basis Project Overview Added Benefits of Project (1) Includes 2,000 MWs of projects for which the company has not received an LOA, 2) Exchange rate- INR 71.45 to US$1 (New York closing rate of December 31, 2019)

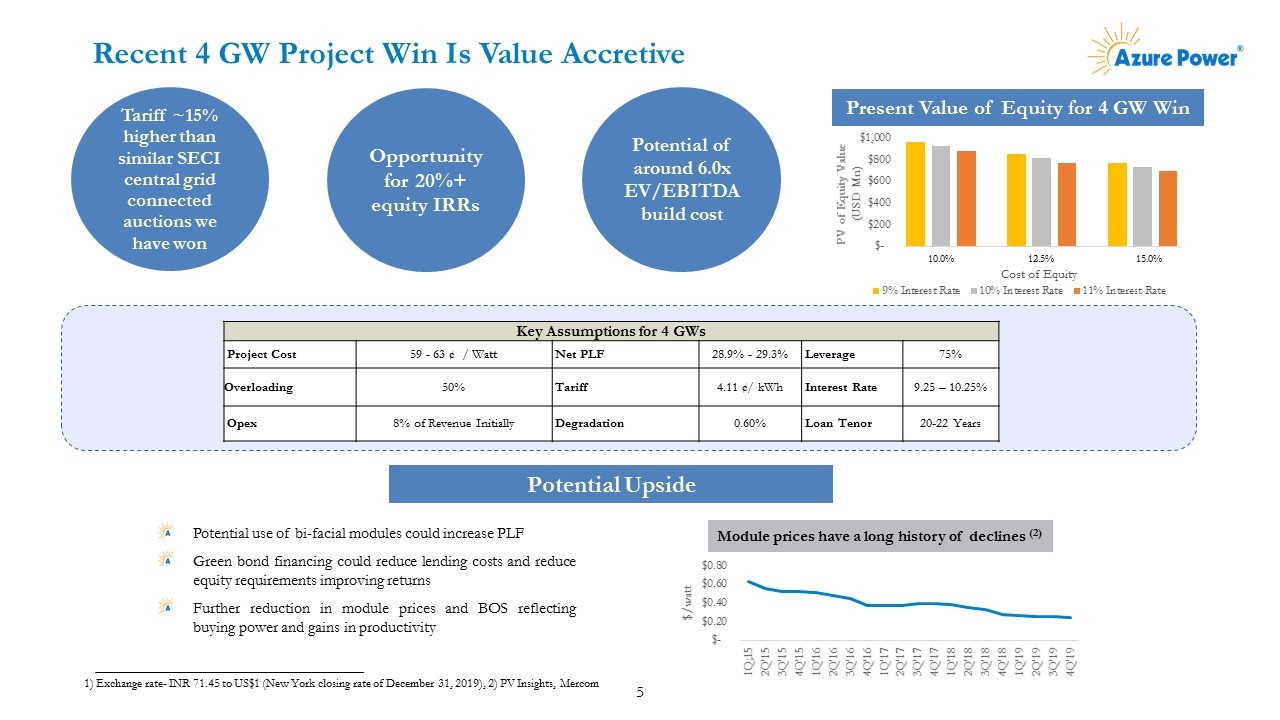

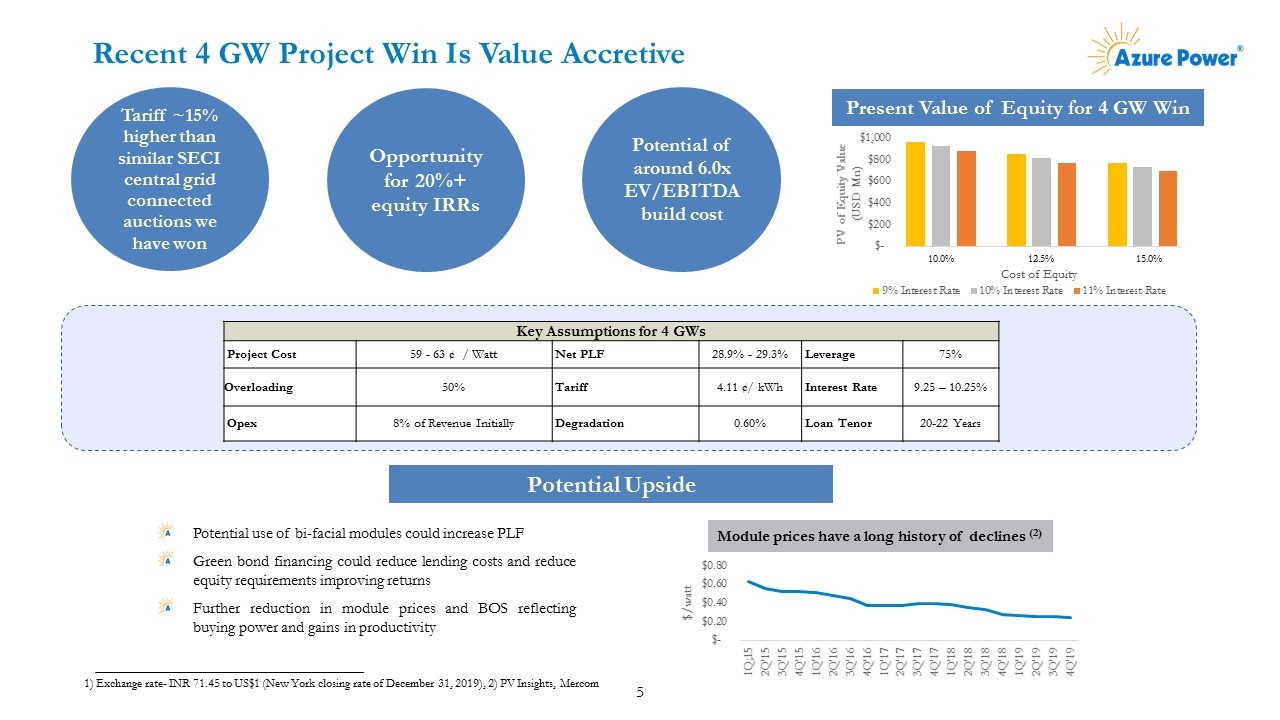

Key Assumptions for 4 GWs Project Cost 59 - 63 ¢ / Watt Net PLF 28.9% - 29.3% Leverage 75% Overloading 50% Tariff 4.11 ¢/ kWh Interest Rate 9.25 – 10.25% Opex 8% of Revenue Initially Degradation 0.60% Loan Tenor 20-22 Years Recent 4 GW Project Win Is Value Accretive 1) Exchange rate- INR 71.45 to US$1 (New York closing rate of December 31, 2019), 2) PV Insights, Mercom Potential Upside Opportunity for 20%+ equity IRRs Potential of around 6.0x EV/EBITDA build cost Module prices have a long history of declines (2) Potential use of bi-facial modules could increase PLF Green bond financing could reduce lending costs and reduce equity requirements improving returns Further reduction in module prices and BOS reflecting buying power and gains in productivity Tariff ~15% higher than similar SECI central grid connected auctions we have won Present Value of Equity for 4 GW Win

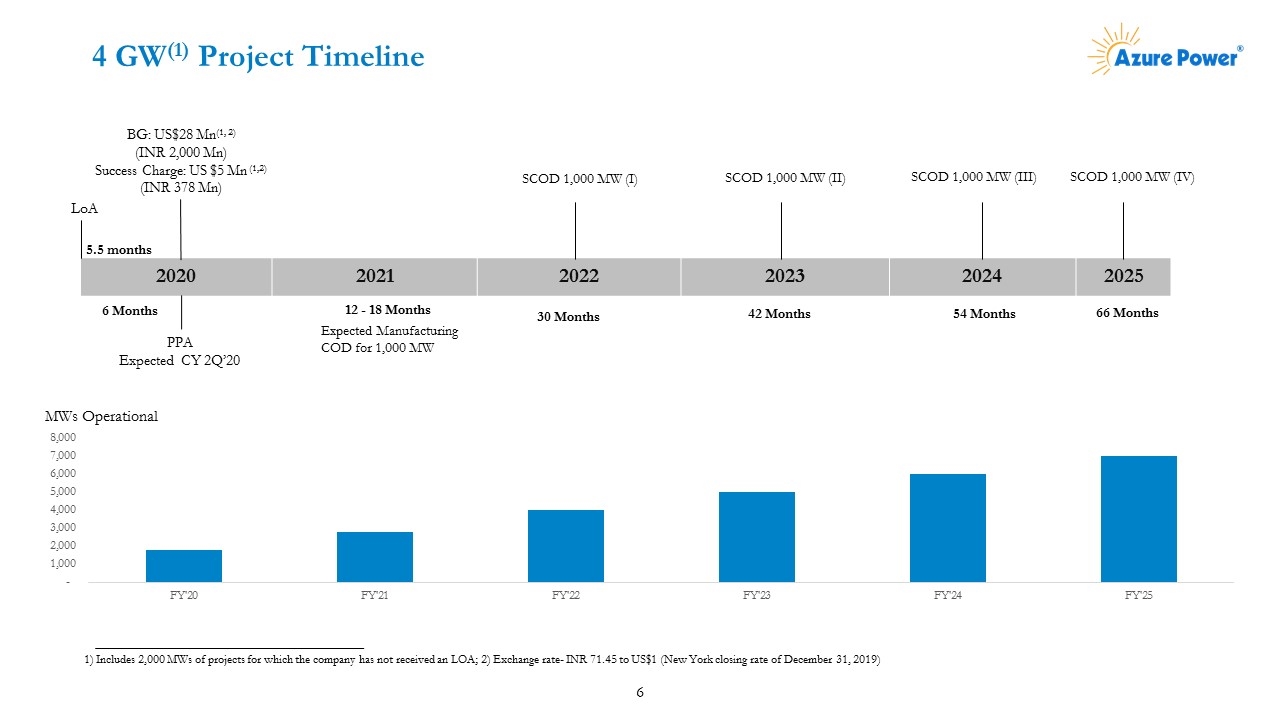

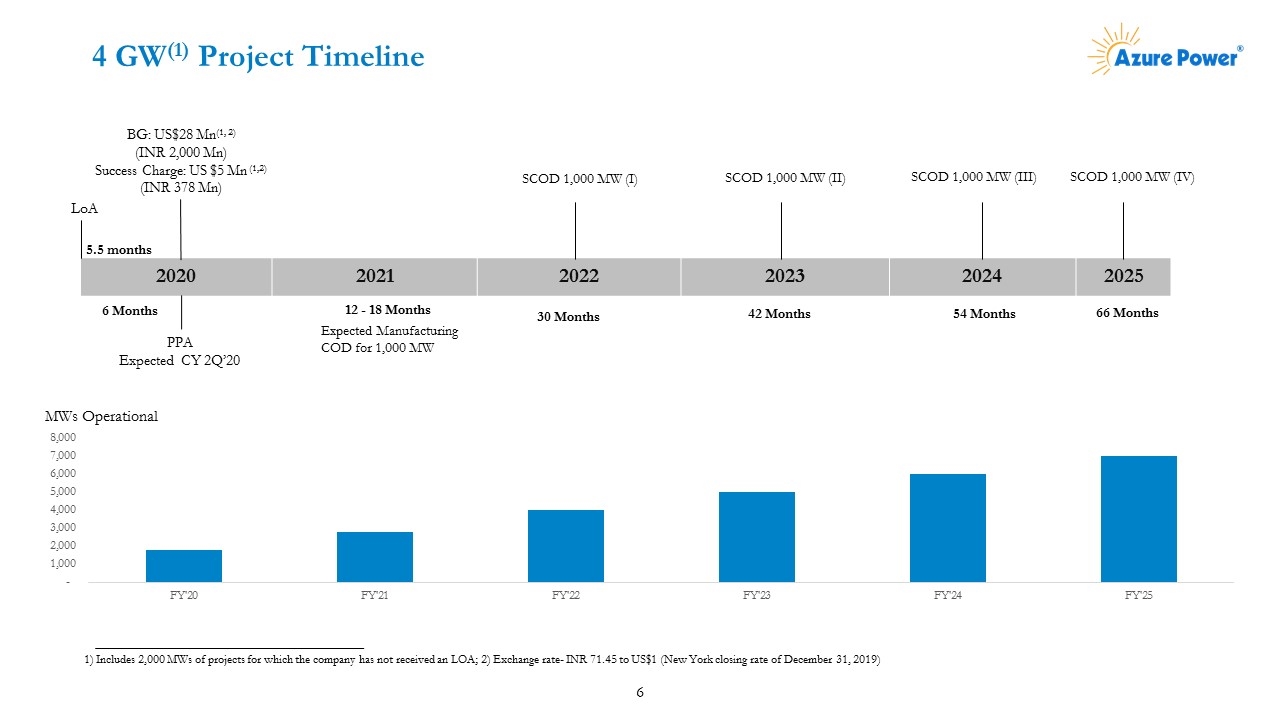

4 GW(1) Project Timeline 2020 2021 2022 2023 2024 2025 LoA 6 Months 5.5 months Expected Manufacturing COD for 1,000 MW 42 Months BG: US$28 Mn(1, 2) (INR 2,000 Mn) Success Charge: US $5 Mn (1,2) (INR 378 Mn) 30 Months 66 Months SCOD 1,000 MW (I) SCOD 1,000 MW (II) SCOD 1,000 MW (III) 54 Months PPA Expected CY 2Q’20 SCOD 1,000 MW (IV) MWs Operational 1) Includes 2,000 MWs of projects for which the company has not received an LOA; 2) Exchange rate- INR 71.45 to US$1 (New York closing rate of December 31, 2019) 12 - 18 Months

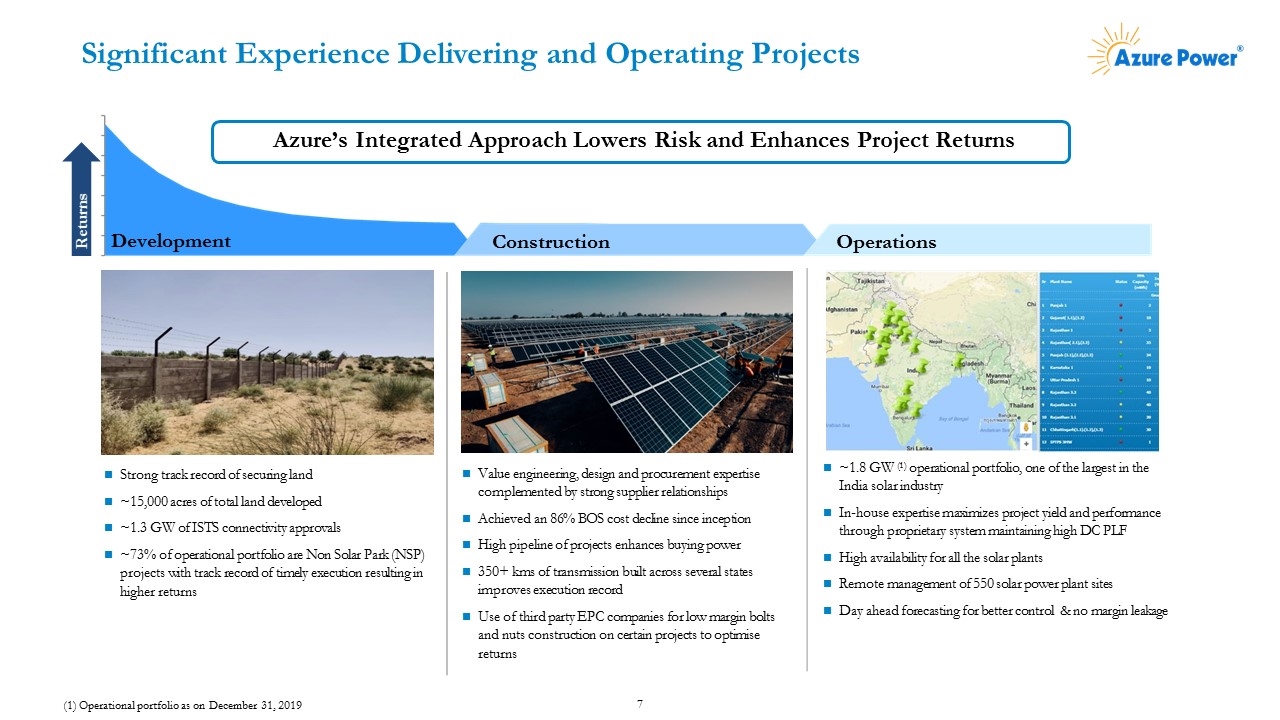

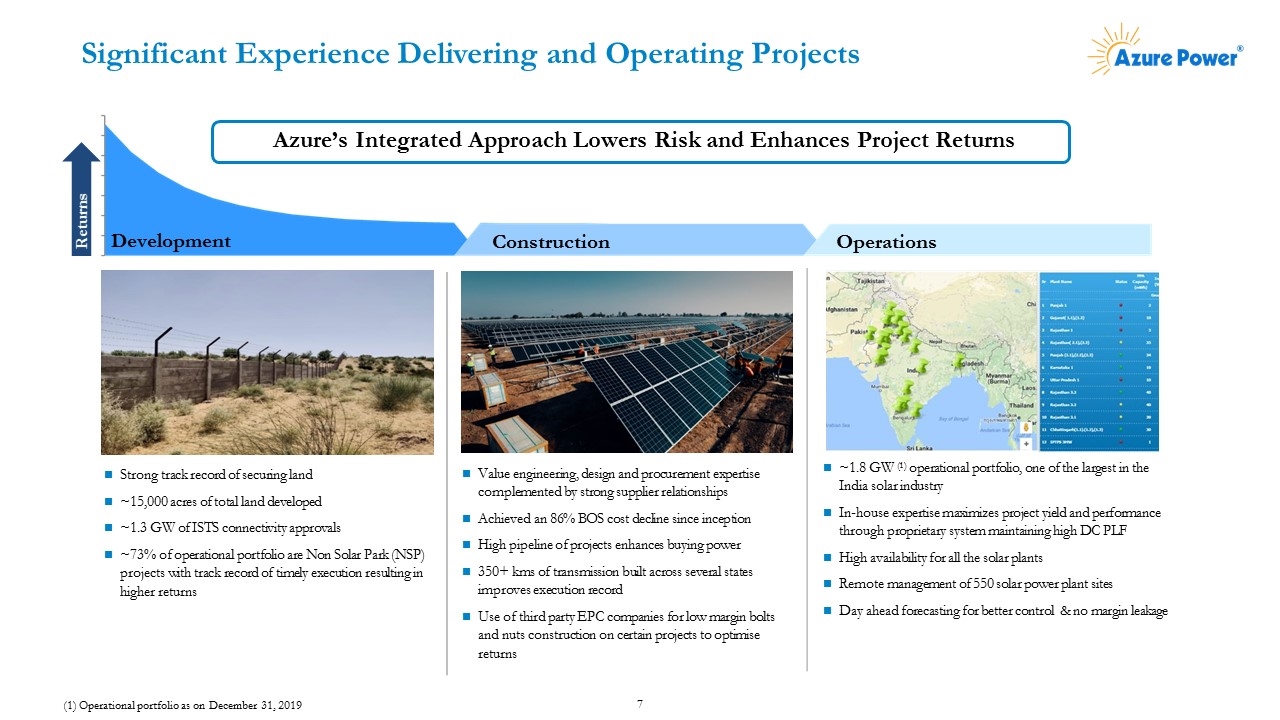

Strong track record of securing land ~15,000 acres of total land developed ~1.3 GW of ISTS connectivity approvals ~73% of operational portfolio are Non Solar Park (NSP) projects with track record of timely execution resulting in higher returns Value engineering, design and procurement expertise complemented by strong supplier relationships Achieved an 86% BOS cost decline since inception High pipeline of projects enhances buying power 350+ kms of transmission built across several states improves execution record Use of third party EPC companies for low margin bolts and nuts construction on certain projects to optimise returns ~1.8 GW (1) operational portfolio, one of the largest in the India solar industry In-house expertise maximizes project yield and performance through proprietary system maintaining high DC PLF High availability for all the solar plants Remote management of 550 solar power plant sites Day ahead forecasting for better control & no margin leakage Development Construction Operations Returns (1) Operational portfolio as on December 31, 2019 Significant Experience Delivering and Operating Projects Azure’s Integrated Approach Lowers Risk and Enhances Project Returns

Solar Cell and Module Manufacturing We are NOT entering into manufacturing Partnered with Waaree Energies for 500 MWs and closed discussions with another manufacturer for other 500 MWs Manufacturing partners have equity readily available and current construction plans Total equity investment in manufacturing totaling less than 1% of total cap ex Purchase obligation from facility only if price competitive, quality meets SECI/international standards and subject to lender approval Waaree is one of the largest solar manufacturers in India with 2 GW/year of capacity, over $200 million(1) of revenue and has an investment grade domestic debt rating by ICRA Waaree Manufacturing Facility 1) Exchange rate- INR 71.45 to US$1 (New York closing rate of December 31, 2019)

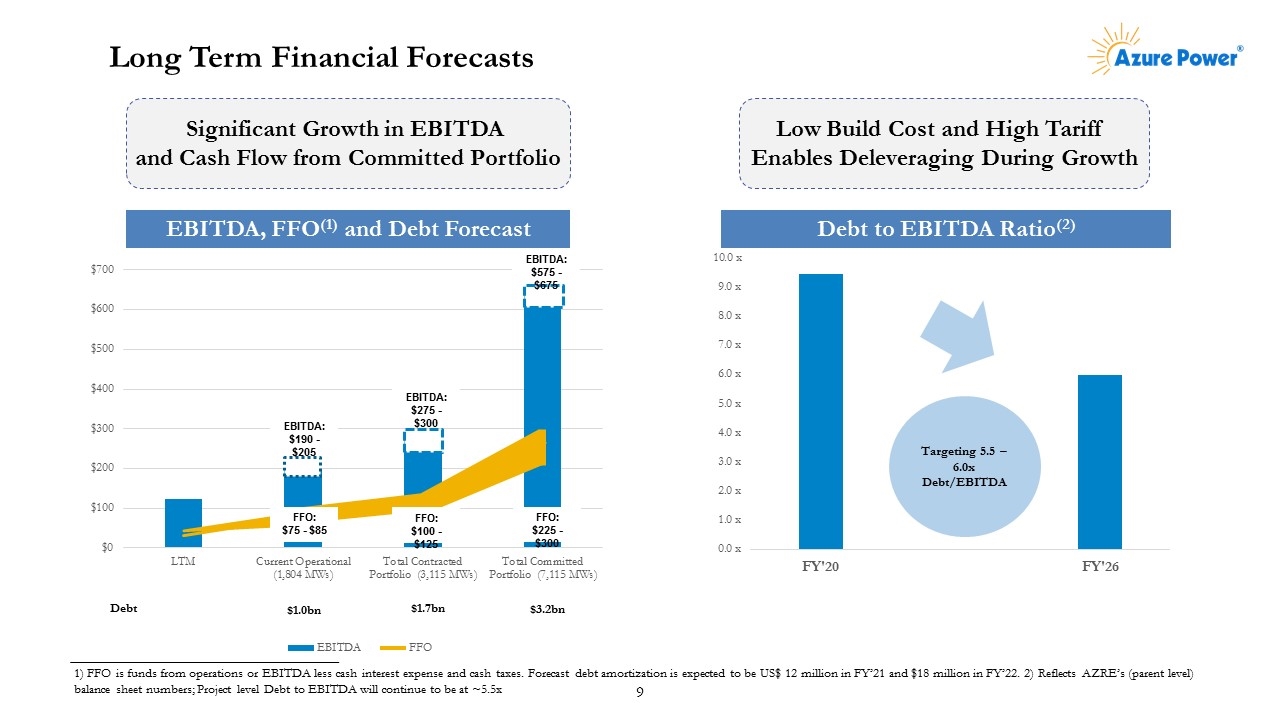

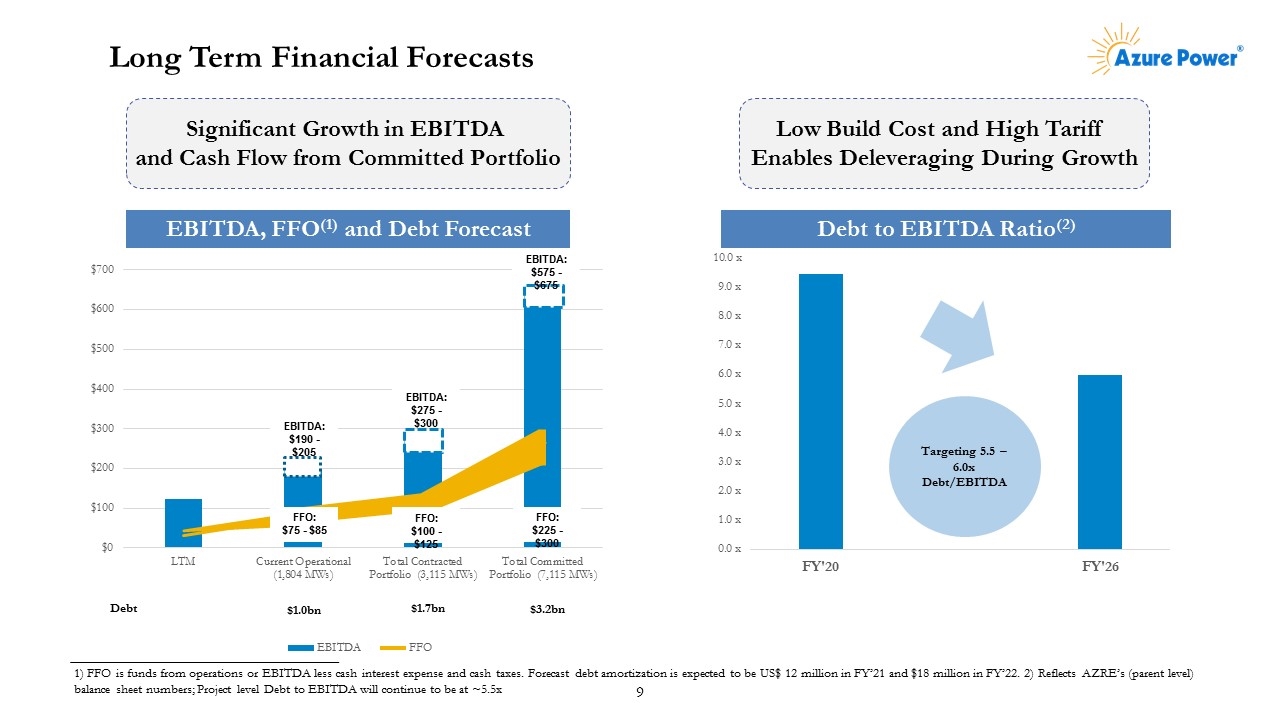

Long Term Financial Forecasts EBITDA, FFO(1) and Debt Forecast Debt to EBITDA Ratio(2) Targeting 5.5 – 6.0x Debt/EBITDA Low Build Cost and High Tariff Enables Deleveraging During Growth Significant Growth in EBITDA and Cash Flow from Committed Portfolio EBITDA: $190 - $205 EBITDA: $275 - $300 EBITDA: $575 - $675 FFO: $75 - $85 FFO: $100 - $125 FFO: $225 - $300 1) FFO is funds from operations or EBITDA less cash interest expense and cash taxes. Forecast debt amortization is expected to be US$ 12 million in FY’21 and $18 million in FY’22. 2) Reflects AZRE’s (parent level) balance sheet numbers; Project level Debt to EBITDA will continue to be at ~5.5x

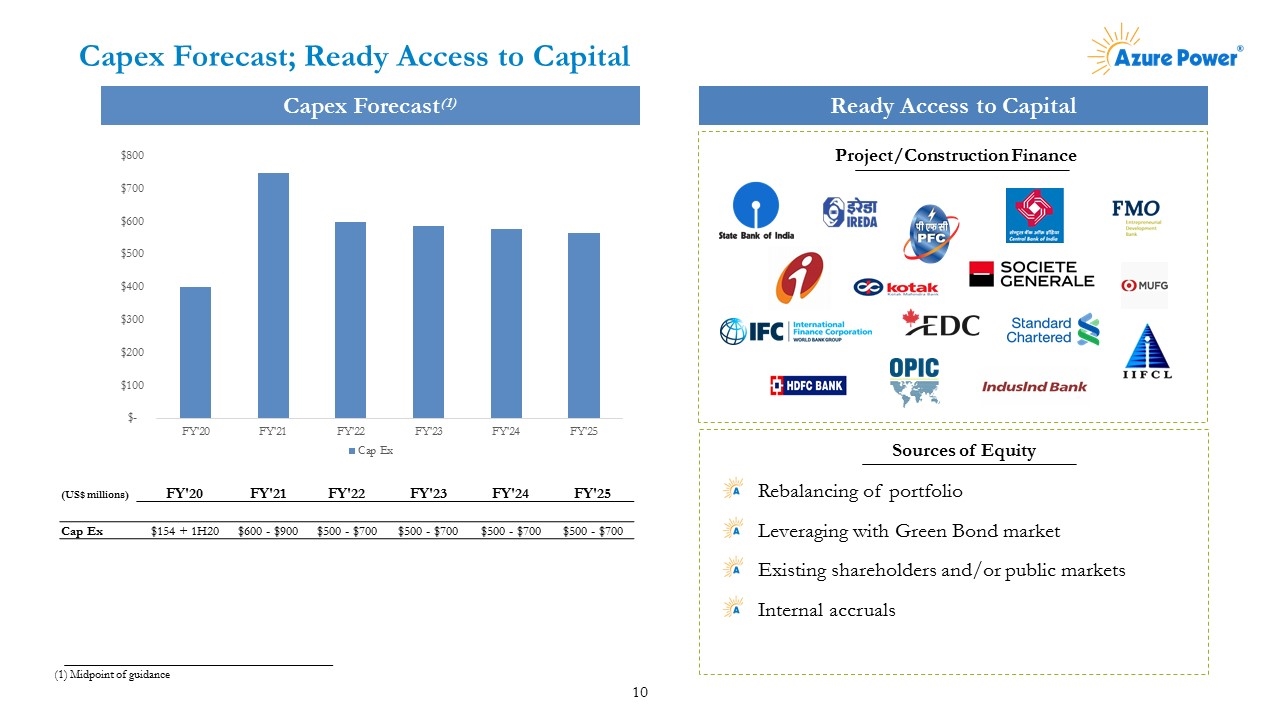

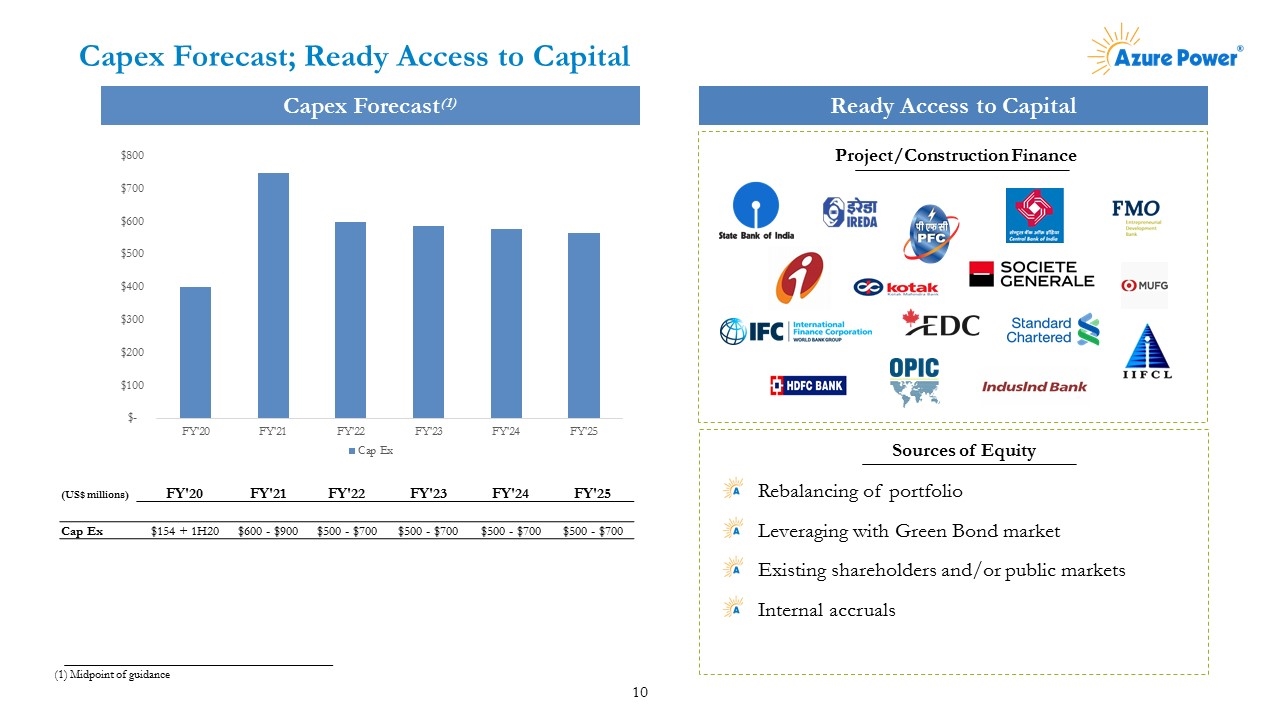

Capex Forecast; Ready Access to Capital Sources of Equity Rebalancing of portfolio Leveraging with Green Bond market Existing shareholders and/or public markets Internal accruals Project/Construction Finance Capex Forecast(1) (1) Midpoint of guidance Ready Access to Capital (US$ millions) FY'20 FY'21 FY'22 FY'23 FY'24 FY'25 Cap Ex $154 + 1H20 $600 - $900 $500 - $700 $500 - $700 $500 - $700 $500 - $700

Access to Debt and Pursuing Lowest Cost of Capital – Debt Costs Creating Value by Lowering Debt Cost Azure Portfolio Average Interest Rate PV of Equity Uplift From 100 bp Lower Borrowing Cost Raised over $2.4 bn of debt since inception Low build cost and high tariff makes projects more financeable High appetite with both domestic as well as foreign banks / financial institutions / development institutions for our projects Deeper market for potential investment grade issuance We are pursuing strategies to lower cost of debt Green bonds have lowered borrowing cost 50 – 70bp. We expect Investment Grade rating on future Restricted Group asset if we were to issue International lenders (recent 5 year borrowing at 9.2%) As solar becomes a mainstream source of electricity and has a strong cash profile as the lowest cost of power, domestic lenders continue to lower rates and increase lending size to solar developers Nascent domestic fixed rate product emerging

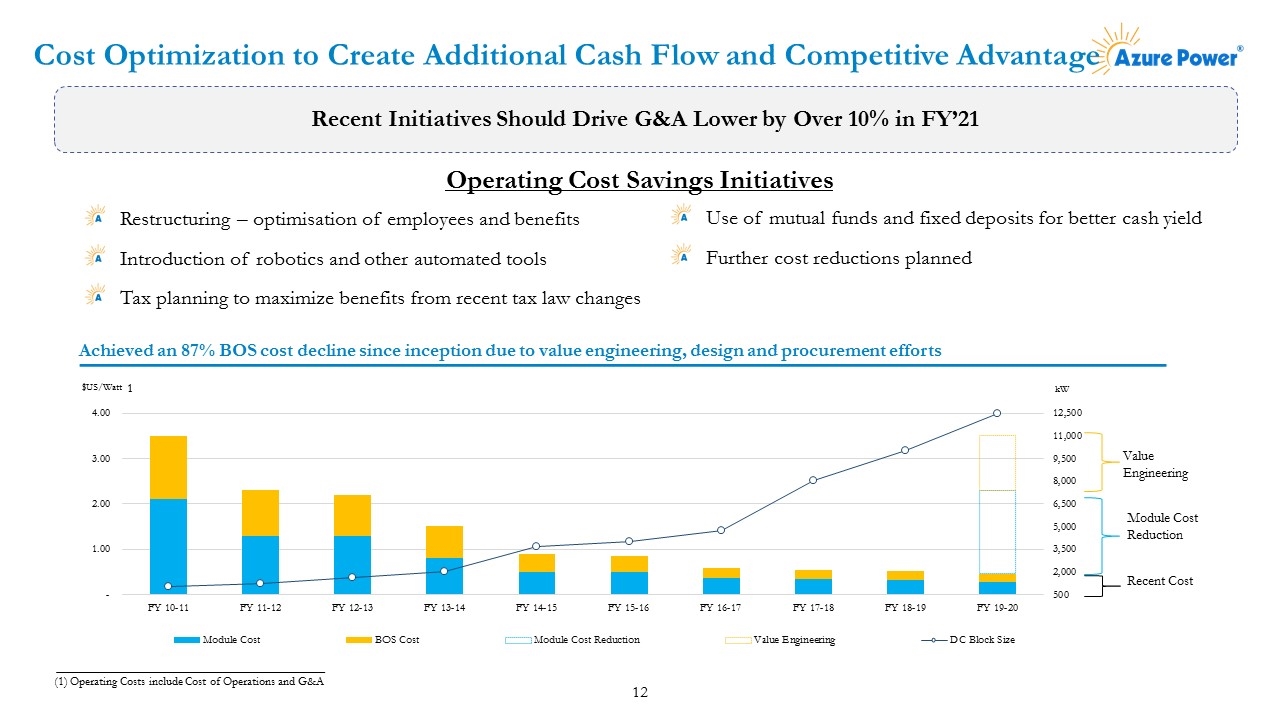

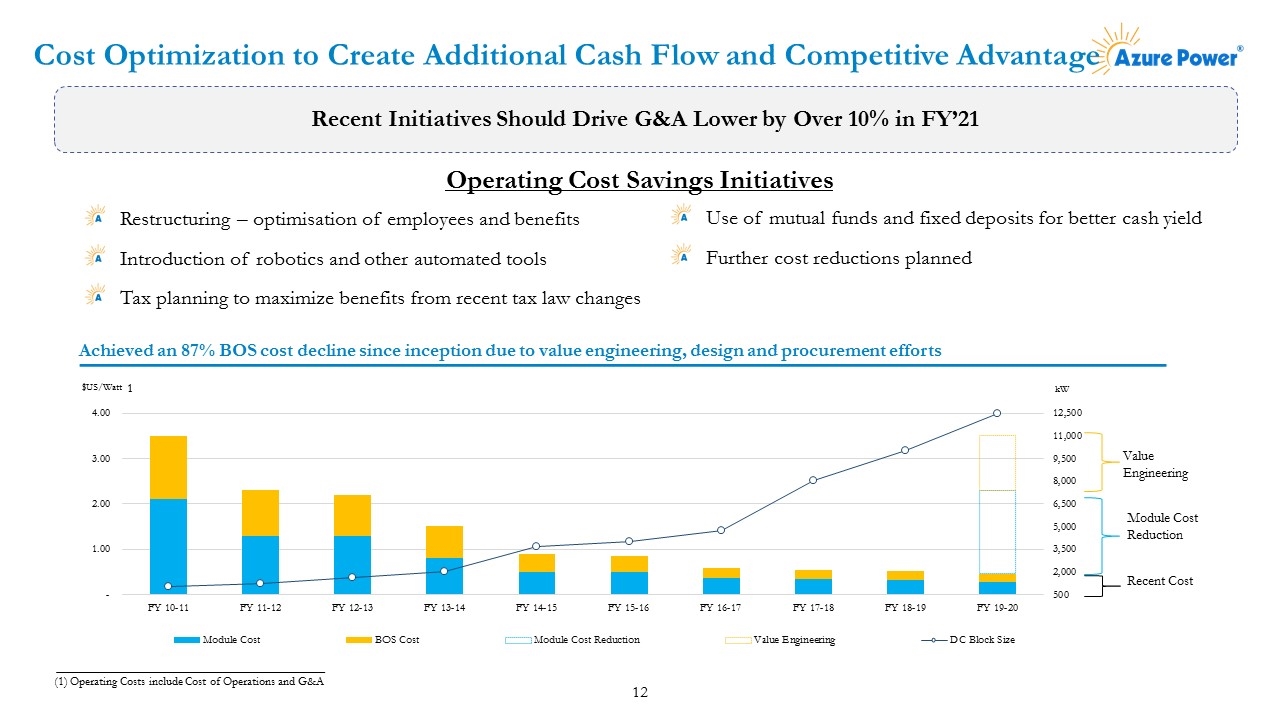

Cost Optimization to Create Additional Cash Flow and Competitive Advantage Restructuring – optimisation of employees and benefits Introduction of robotics and other automated tools Tax planning to maximize benefits from recent tax law changes Recent Initiatives Should Drive G&A Lower by Over 10% in FY’21 (1) Operating Costs include Cost of Operations and G&A Value Engineering Module Cost Reduction Recent Cost Achieved an 87% BOS cost decline since inception due to value engineering, design and procurement efforts 1 Use of mutual funds and fixed deposits for better cash yield Further cost reductions planned Operating Cost Savings Initiatives

Self Funded Post Completion of Portfolio Once 7 GWs completed, we believe internal cash flow generation will self fund future growth without issuing more equity (market dependent) Potential uses of free cash flow including growth, dividends and/or share buybacks We will grow ONLY if returns are above our cost of capital Self Funded Post Completion of Portfolio

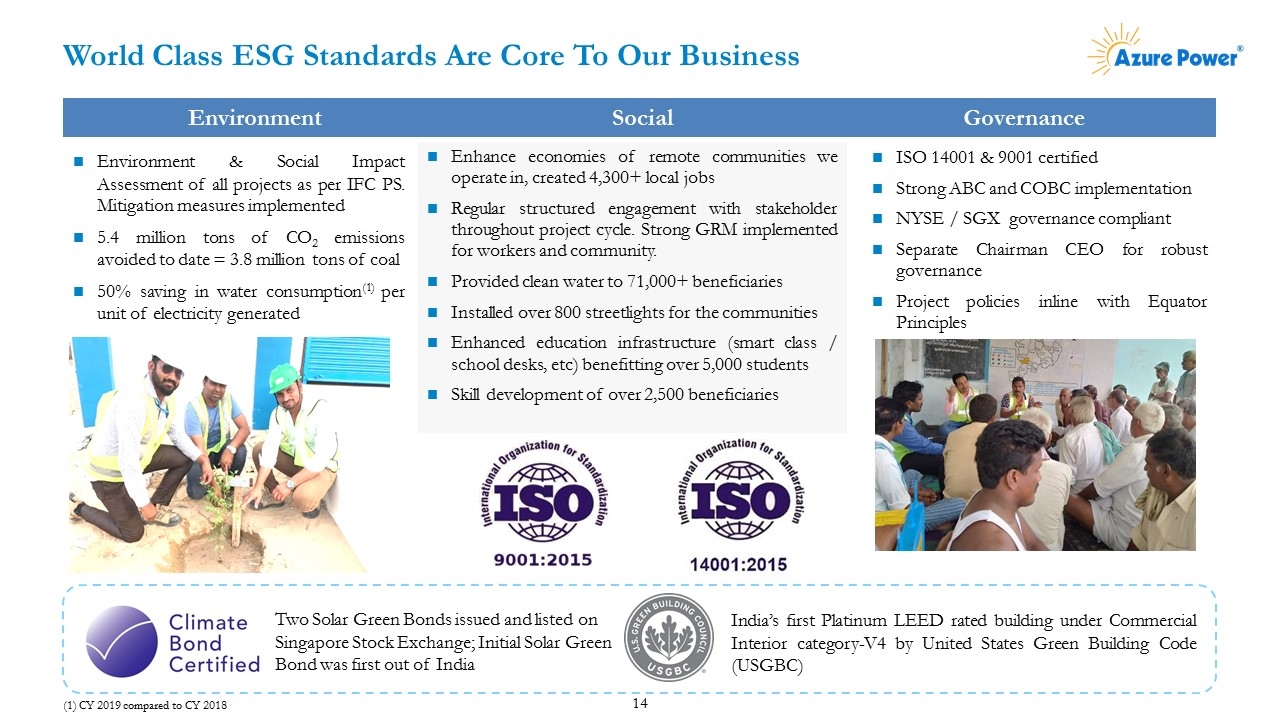

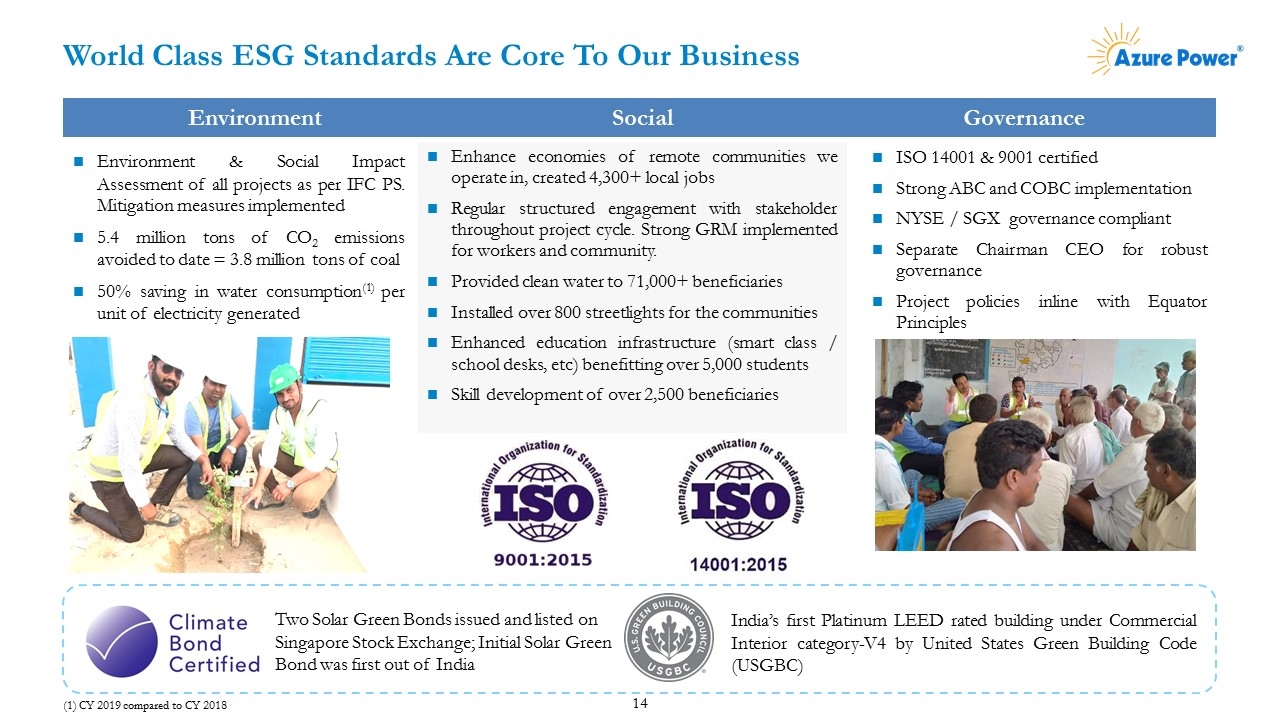

World Class ESG Standards Are Core To Our Business Two Solar Green Bonds issued and listed on Singapore Stock Exchange; Initial Solar Green Bond was first out of India India’s first Platinum LEED rated building under Commercial Interior category-V4 by United States Green Building Code (USGBC) Environment Social Governance Enhance economies of remote communities we operate in, created 4,300+ local jobs Regular structured engagement with stakeholder throughout project cycle. Strong GRM implemented for workers and community. Provided clean water to 71,000+ beneficiaries Installed over 800 streetlights for the communities Enhanced education infrastructure (smart class / school desks, etc) benefitting over 5,000 students Skill development of over 2,500 beneficiaries ISO 14001 & 9001 certified Strong ABC and COBC implementation NYSE / SGX governance compliant Separate Chairman CEO for robust governance Project policies inline with Equator Principles Environment & Social Impact Assessment of all projects as per IFC PS. Mitigation measures implemented 5.4 million tons of CO2 emissions avoided to date = 3.8 million tons of coal 50% saving in water consumption(1) per unit of electricity generated (1) CY 2019 compared to CY 2018

Appendix

Use of Non-GAAP Financial Measures Adjusted EBITDA is a non-GAAP financial measure. The Company presents Adjusted EBITDA as a supplemental measure of its performance. This measurement is not recognized in accordance with GAAP and should not be viewed as an alternative to GAAP measures of performance. The presentation of Adjusted EBITDA should not be construed as an inference that the Company’s future results will be unaffected by unusual or non-recurring items. The Company defines Adjusted EBITDA as net (loss) income plus (a) income tax expense, (b) interest expense, net, (c) depreciation and amortization, and (d) loss (income) on foreign currency exchange. The Company believes Adjusted EBITDA is useful to investors in evaluating our operating performance because: Securities analysts and other interested parties use such calculations as a measure of financial performance and debt service capabilities; and it is used by our management for internal reporting and planning purposes, including aspects of its consolidated operating budget and capital expenditures. Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation or as a substitute for analysis of the Company’s results as reported under GAAP. Some of these limitations include: it does not reflect its cash expenditures or future requirements for capital expenditures or contractual commitments or foreign exchange gain/loss; it does not reflect changes in, or cash requirements for, working capital; it does not reflect significant interest expense or the cash requirements necessary to service interest or principal payments on its outstanding debt; it does not reflect payments made or future requirements for income taxes; and although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced or paid in the future and Adjusted EBITDA does not reflect cash requirements for such replacements or payments. investors are encouraged to evaluate each adjustment and the reasons the Company considers it appropriate for supplemental analysis. For more information, please see the table captioned “Reconciliations of Non-GAAP Measures to Comparable GAAP Measures” in this presentation.

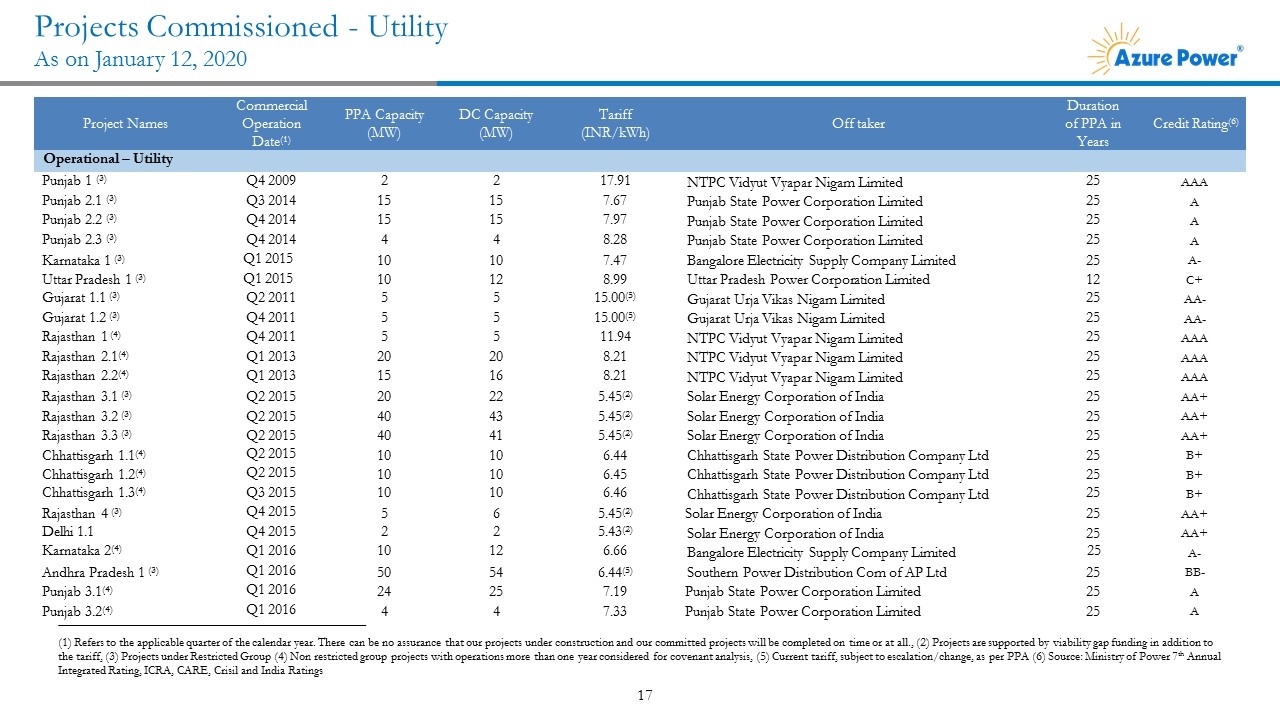

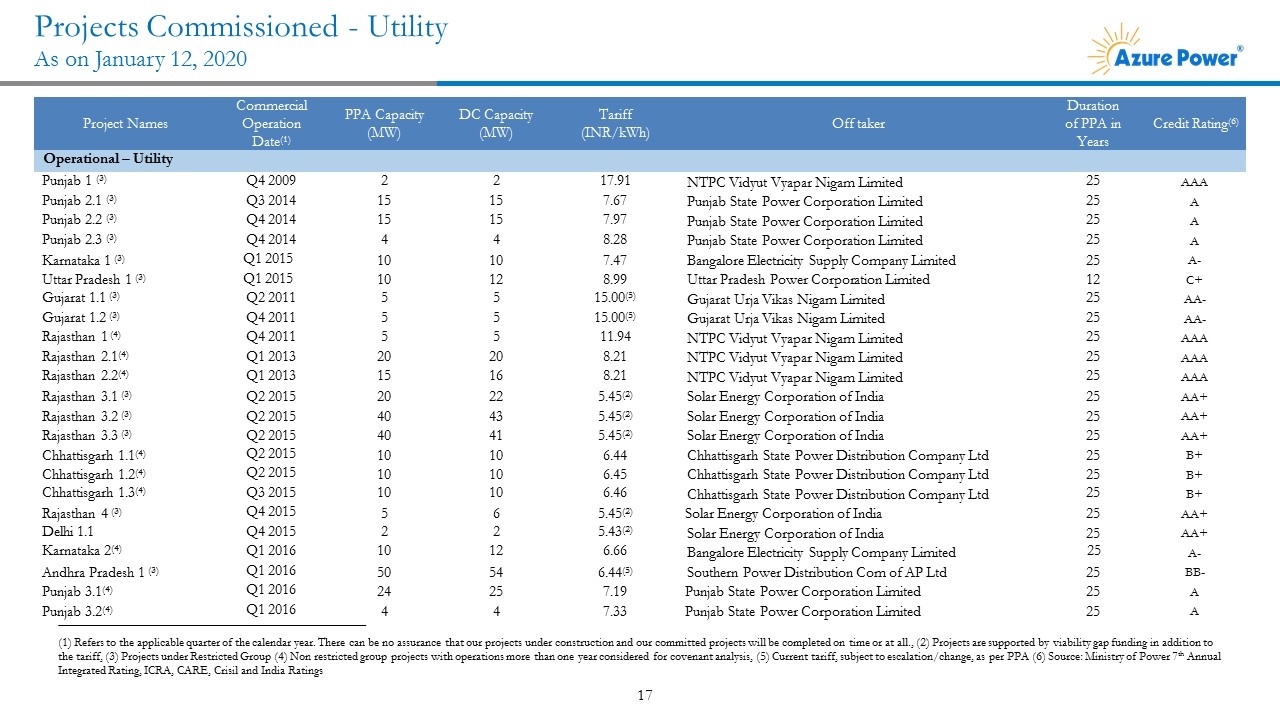

Projects Commissioned - Utility As on January 12, 2020 Project Names Commercial Operation Date(1) PPA Capacity (MW) DC Capacity (MW) Tariff (INR/kWh) Off taker Duration of PPA in Years Credit Rating(6) Operational – Utility Punjab 1 (3) Q4 2009 2 2 17.91 NTPC Vidyut Vyapar Nigam Limited 25 AAA Punjab 2.1 (3) Q3 2014 15 15 7.67 Punjab State Power Corporation Limited 25 A Punjab 2.2 (3) Q4 2014 15 15 7.97 Punjab State Power Corporation Limited 25 A Punjab 2.3 (3) Q4 2014 4 4 8.28 Punjab State Power Corporation Limited 25 A Karnataka 1 (3) Q1 2015 10 10 7.47 Bangalore Electricity Supply Company Limited 25 A- Uttar Pradesh 1 (3) Q1 2015 10 12 8.99 Uttar Pradesh Power Corporation Limited 12 C+ Gujarat 1.1 (3) Q2 2011 5 5 15.00(5) Gujarat Urja Vikas Nigam Limited 25 AA- Gujarat 1.2 (3) Q4 2011 5 5 15.00(5) Gujarat Urja Vikas Nigam Limited 25 AA- Rajasthan 1 (4) Q4 2011 5 5 11.94 NTPC Vidyut Vyapar Nigam Limited 25 AAA Rajasthan 2.1(4) Q1 2013 20 20 8.21 NTPC Vidyut Vyapar Nigam Limited 25 AAA Rajasthan 2.2(4) Q1 2013 15 16 8.21 NTPC Vidyut Vyapar Nigam Limited 25 AAA Rajasthan 3.1 (3) Q2 2015 20 22 5.45(2) Solar Energy Corporation of India 25 AA+ Rajasthan 3.2 (3) Q2 2015 40 43 5.45(2) Solar Energy Corporation of India 25 AA+ Rajasthan 3.3 (3) Q2 2015 40 41 5.45(2) Solar Energy Corporation of India 25 AA+ Chhattisgarh 1.1(4) Q2 2015 10 10 6.44 Chhattisgarh State Power Distribution Company Ltd 25 B+ Chhattisgarh 1.2(4) Q2 2015 10 10 6.45 Chhattisgarh State Power Distribution Company Ltd 25 B+ Chhattisgarh 1.3(4) Q3 2015 10 10 6.46 Chhattisgarh State Power Distribution Company Ltd 25 B+ Rajasthan 4 (3) Q4 2015 5 6 5.45(2) Solar Energy Corporation of India 25 AA+ Delhi 1.1 Q4 2015 2 2 5.43(2) Solar Energy Corporation of India 25 AA+ Karnataka 2(4) Q1 2016 10 12 6.66 Bangalore Electricity Supply Company Limited 25 A- Andhra Pradesh 1 (3) Q1 2016 50 54 6.44(5) Southern Power Distribution Com of AP Ltd 25 BB- Punjab 3.1(4) Q1 2016 24 25 7.19 Punjab State Power Corporation Limited 25 A Punjab 3.2(4) Q1 2016 4 4 7.33 Punjab State Power Corporation Limited 25 A (1) Refers to the applicable quarter of the calendar year. There can be no assurance that our projects under construction and our committed projects will be completed on time or at all., (2) Projects are supported by viability gap funding in addition to the tariff, (3) Projects under Restricted Group (4) Non restricted group projects with operations more than one year considered for covenant analysis, (5) Current tariff, subject to escalation/change, as per PPA (6) Source: Ministry of Power 7th Annual Integrated Rating, ICRA, CARE, Crisil and India Ratings

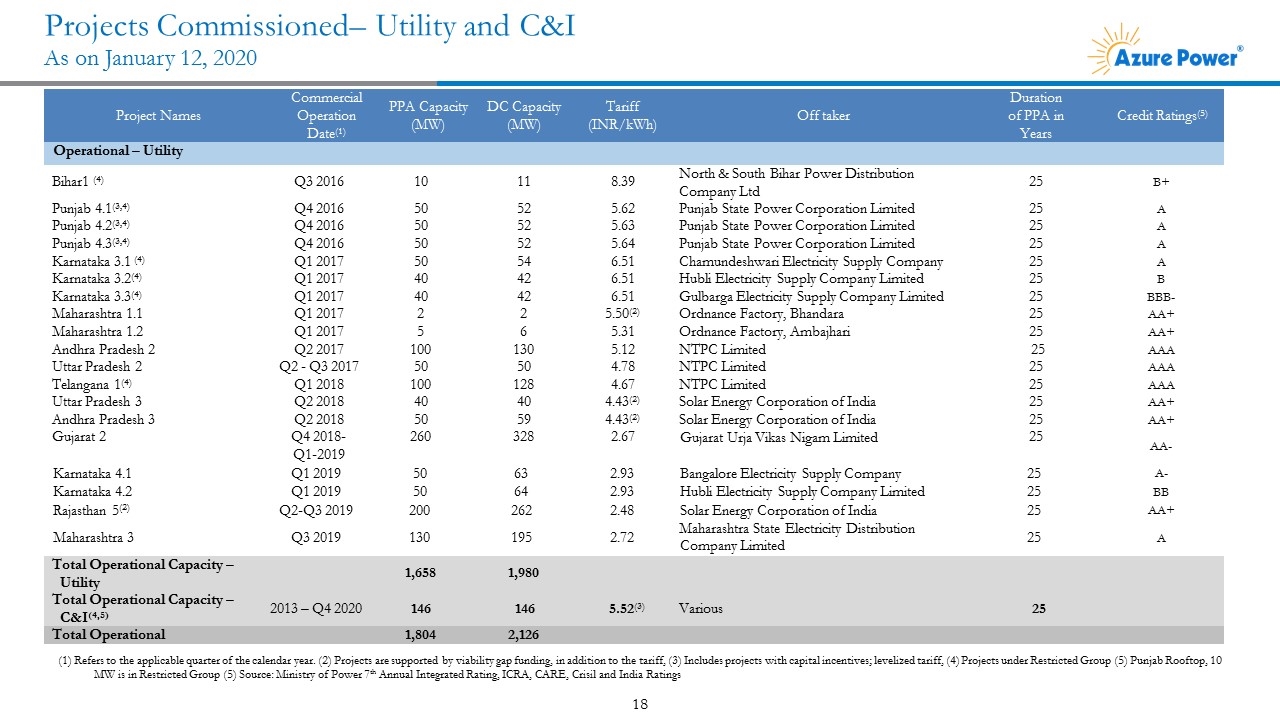

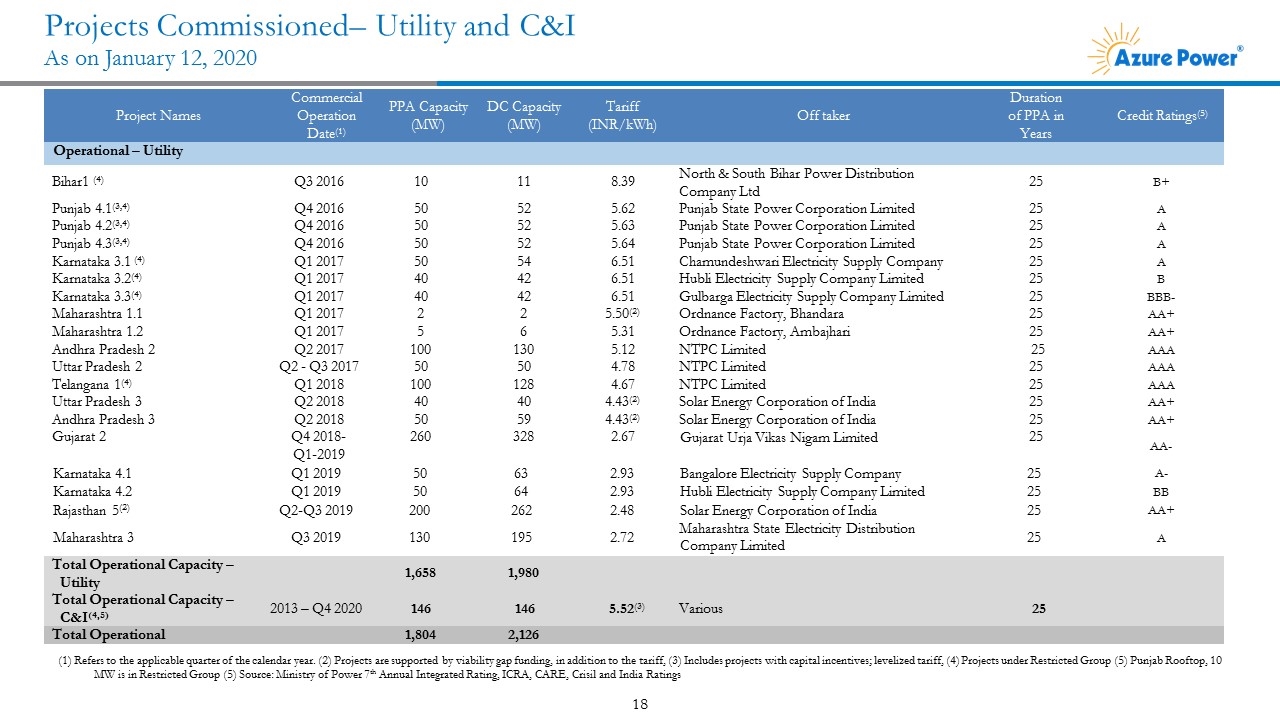

Projects Commissioned– Utility and C&I As on January 12, 2020 Project Names Commercial Operation Date(1) PPA Capacity (MW) DC Capacity (MW) Tariff (INR/kWh) Off taker Duration of PPA in Years Credit Ratings(5) Operational – Utility Bihar1 (4) Q3 2016 10 10 11 8.39 North & South Bihar Power Distribution Company Ltd 25 B+ Punjab 4.1(3,4) Q4 2016 50 50 52 5.62 Punjab State Power Corporation Limited 25 A Punjab 4.2(3,4) Q4 2016 50 50 52 5.63 Punjab State Power Corporation Limited 25 A Punjab 4.3(3,4) Q4 2016 50 50 52 5.64 Punjab State Power Corporation Limited 25 A Karnataka 3.1 (4) Q1 2017 50 50 54 6.51 Chamundeshwari Electricity Supply Company 25 A Karnataka 3.2(4) Q1 2017 40 40 42 6.51 Hubli Electricity Supply Company Limited 25 B Karnataka 3.3(4) Q1 2017 40 40 42 6.51 Gulbarga Electricity Supply Company Limited 25 BBB- Maharashtra 1.1 Q1 2017 2 2 2 5.50(2) Ordnance Factory, Bhandara 25 AA+ Maharashtra 1.2 Q1 2017 5 5 6 5.31 Ordnance Factory, Ambajhari 25 AA+ Andhra Pradesh 2 Q2 2017 100 100 130 5.12 NTPC Limited 25 AAA Uttar Pradesh 2 Q2 - Q3 2017 50 50 50 4.78 NTPC Limited 25 AAA Telangana 1(4) Q1 2018 100 100 128 4.67 NTPC Limited 25 AAA Uttar Pradesh 3 Q2 2018 40 40 40 4.43(2) Solar Energy Corporation of India 25 AA+ Andhra Pradesh 3 Q2 2018 50 50 59 4.43(2) Solar Energy Corporation of India 25 AA+ Gujarat 2 Q4 2018- Q1-2019 260 260 328 2.67 Gujarat Urja Vikas Nigam Limited 25 AA- Karnataka 4.1 Q1 2019 50 50 63 2.93 Bangalore Electricity Supply Company 25 A- Karnataka 4.2 Q1 2019 50 50 64 2.93 Hubli Electricity Supply Company Limited 25 BB Rajasthan 5(2) Q2-Q3 2019 200 200 262 2.48 Solar Energy Corporation of India 25 AA+ Maharashtra 3 Q3 2019 130 130 195 2.72 Maharashtra State Electricity Distribution Company Limited 25 A Total Operational Capacity – Utility 1,658 1,658 1,980 Total Operational Capacity – C&I(4,5) 2013 – Q4 2020 146 140 146 5.52(3) Various 25 Total Operational 1,804 1,798 2,126 (1) Refers to the applicable quarter of the calendar year. (2) Projects are supported by viability gap funding, in addition to the tariff, (3) Includes projects with capital incentives; levelized tariff, (4) Projects under Restricted Group (5) Punjab Rooftop, 10 MW is in Restricted Group (5) Source: Ministry of Power 7th Annual Integrated Rating, ICRA, CARE, Crisil and India Ratings

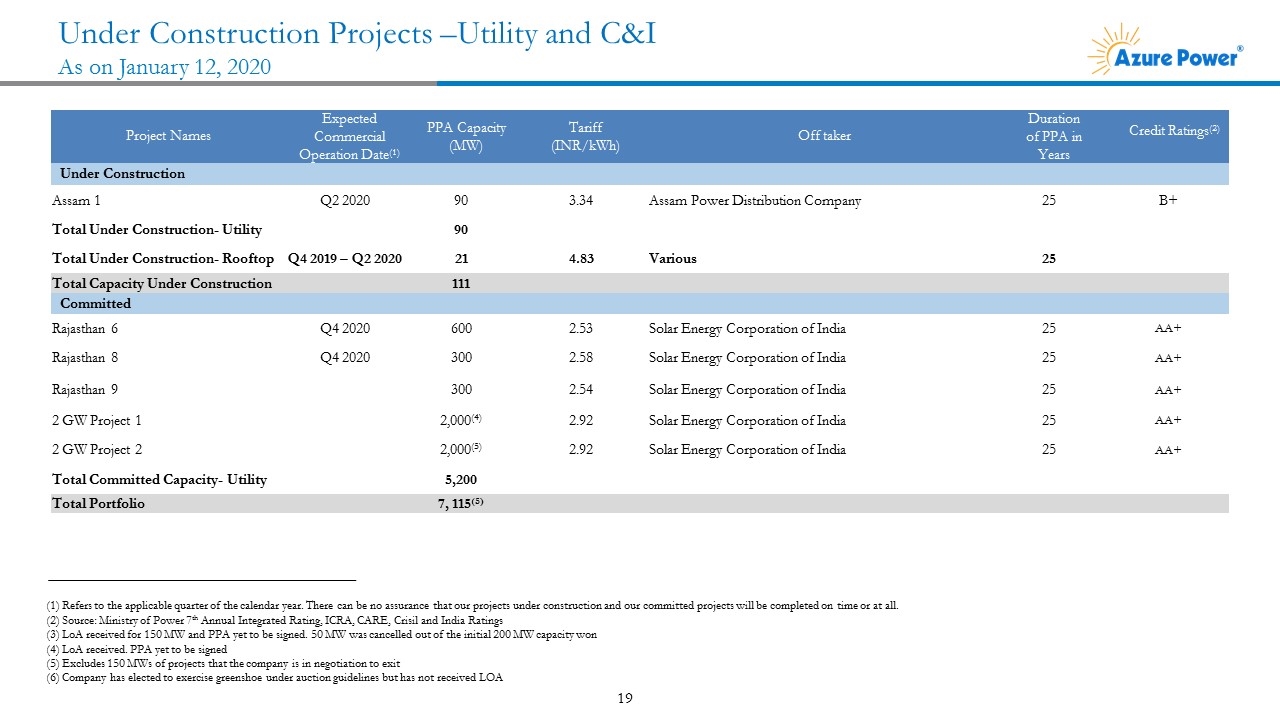

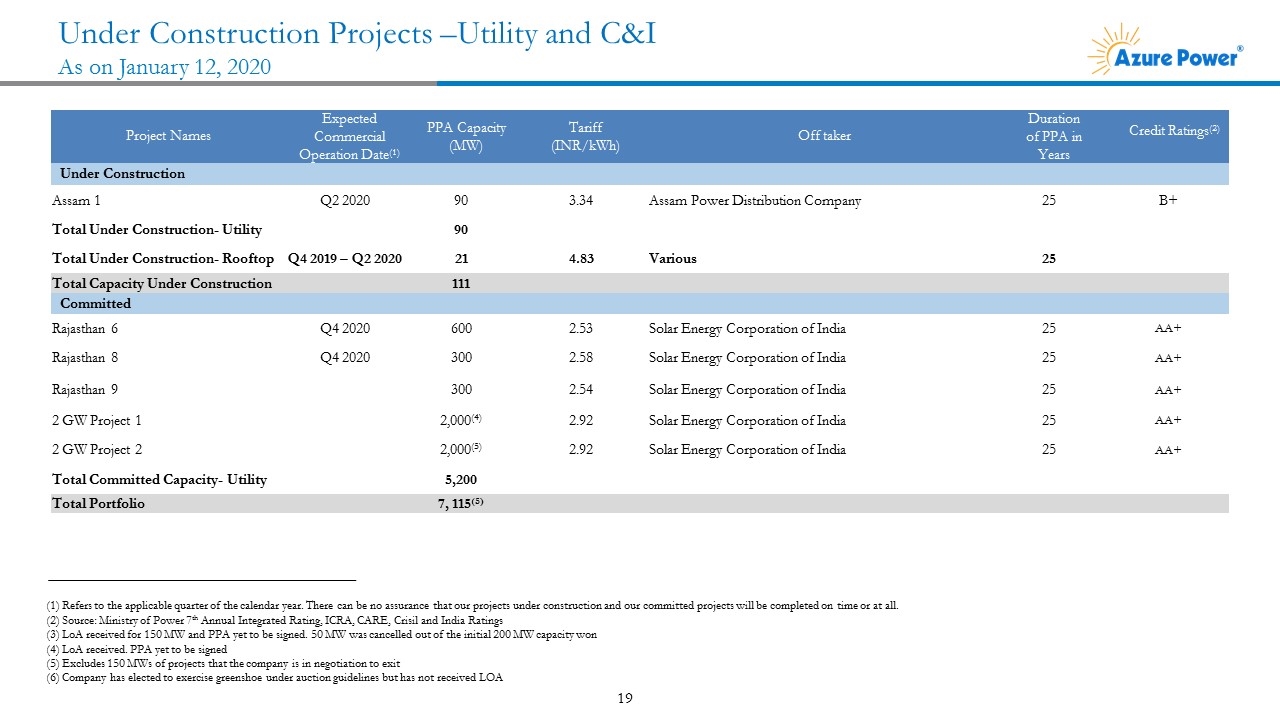

Under Construction Projects –Utility and C&I As on January 12, 2020 (1) Refers to the applicable quarter of the calendar year. There can be no assurance that our projects under construction and our committed projects will be completed on time or at all. (2) Source: Ministry of Power 7th Annual Integrated Rating, ICRA, CARE, Crisil and India Ratings (3) LoA received for 150 MW and PPA yet to be signed. 50 MW was cancelled out of the initial 200 MW capacity won (4) LoA received. PPA yet to be signed (5) Excludes 150 MWs of projects that the company is in negotiation to exit (6) Company has elected to exercise greenshoe under auction guidelines but has not received LOA Project Names Expected Commercial Operation Date(1) PPA Capacity (MW) Tariff (INR/kWh) Off taker Duration of PPA in Years Credit Ratings(2) Under Construction Assam 1 Q2 2020 90 3.34 Assam Power Distribution Company 25 B+ Total Under Construction- Utility 90 Total Under Construction- Rooftop Q4 2019 – Q2 2020 21 4.83 Various 25 Total Capacity Under Construction 111 Committed Rajasthan 6 Q4 2020 600 2.53 Solar Energy Corporation of India 25 AA+ Rajasthan 8 Q4 2020 300 2.58 Solar Energy Corporation of India 25 AA+ Rajasthan 9 300 2.54 Solar Energy Corporation of India 25 AA+ 2 GW Project 1 2,000(4) 2.92 Solar Energy Corporation of India 25 AA+ 2 GW Project 2 2,000(5) 2.92 Solar Energy Corporation of India 25 AA+ Total Committed Capacity- Utility 5,200 Total Portfolio 7, 115(5)

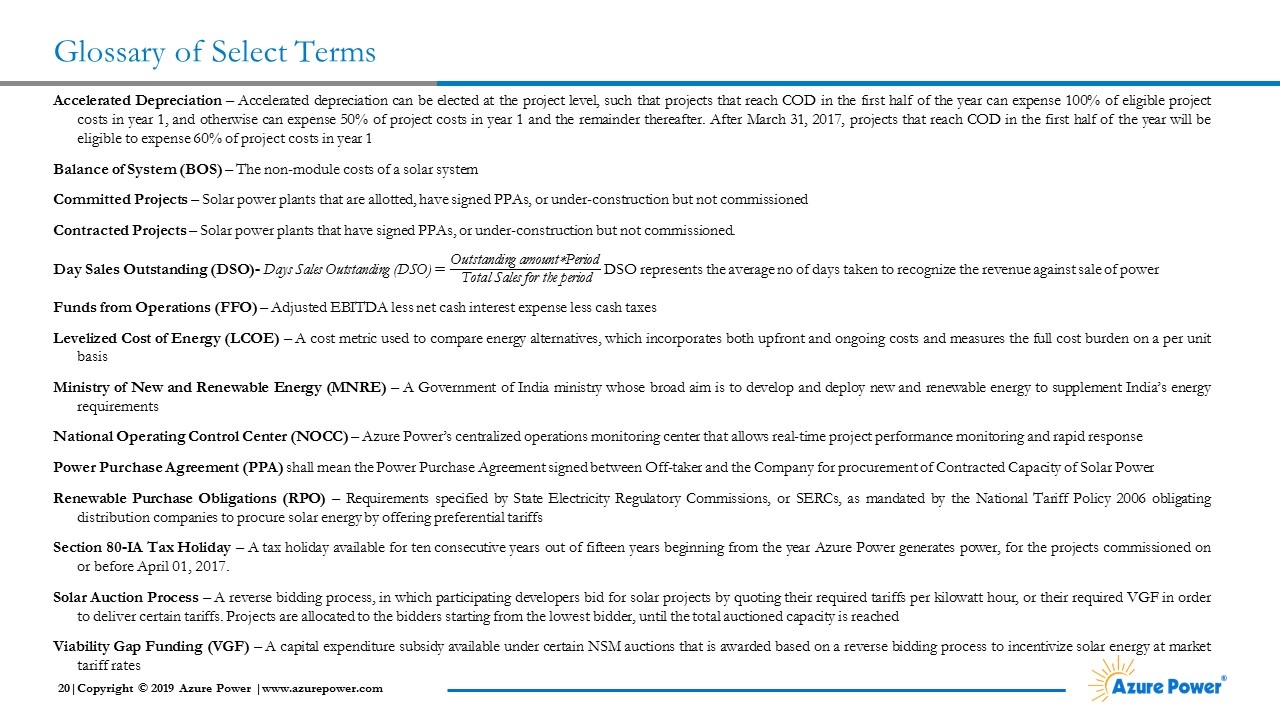

Glossary of Select Terms Accelerated Depreciation – Accelerated depreciation can be elected at the project level, such that projects that reach COD in the first half of the year can expense 100% of eligible project costs in year 1, and otherwise can expense 50% of project costs in year 1 and the remainder thereafter. After March 31, 2017, projects that reach COD in the first half of the year will be eligible to expense 60% of project costs in year 1 Balance of System (BOS) – The non-module costs of a solar system Committed Projects – Solar power plants that are allotted, have signed PPAs, or under-construction but not commissioned Contracted Projects – Solar power plants that have signed PPAs, or under-construction but not commissioned. Day Sales Outstanding (DSO)- DSO represents the average no of days taken to recognize the revenue against sale of power Funds from Operations (FFO) – Adjusted EBITDA less net cash interest expense less cash taxes Levelized Cost of Energy (LCOE) – A cost metric used to compare energy alternatives, which incorporates both upfront and ongoing costs and measures the full cost burden on a per unit basis Ministry of New and Renewable Energy (MNRE) – A Government of India ministry whose broad aim is to develop and deploy new and renewable energy to supplement India’s energy requirements National Operating Control Center (NOCC) – Azure Power’s centralized operations monitoring center that allows real-time project performance monitoring and rapid response Power Purchase Agreement (PPA) shall mean the Power Purchase Agreement signed between Off-taker and the Company for procurement of Contracted Capacity of Solar Power Renewable Purchase Obligations (RPO) – Requirements specified by State Electricity Regulatory Commissions, or SERCs, as mandated by the National Tariff Policy 2006 obligating distribution companies to procure solar energy by offering preferential tariffs Section 80-IA Tax Holiday – A tax holiday available for ten consecutive years out of fifteen years beginning from the year Azure Power generates power, for the projects commissioned on or before April 01, 2017. Solar Auction Process – A reverse bidding process, in which participating developers bid for solar projects by quoting their required tariffs per kilowatt hour, or their required VGF in order to deliver certain tariffs. Projects are allocated to the bidders starting from the lowest bidder, until the total auctioned capacity is reached Viability Gap Funding (VGF) – A capital expenditure subsidy available under certain NSM auctions that is awarded based on a reverse bidding process to incentivize solar energy at market tariff rates

Affordable Solar Power for Generations Excellence | Honesty | Social Responsibility | Entrepreneurship