| | | FREE WRITING PROSPECTUS |

| | | FILED PURSUANT TO RULE 433 |

| | | REGISTRATION FILE NO.: 333-195164-05 |

| | | |

Free Writing Prospectus

Structural and Collateral Term Sheet

$1,047,828,035

(Approximate Aggregate Cut-off Date Balance of Mortgage Pool)

$927,327,000

(Approximate Aggregate Principal Balance of Offered Certificates)

Wells Fargo Commercial Mortgage Trust 2015-C27

as Issuing Entity

Wells Fargo Commercial Mortgage Securities, Inc.

as Depositor

Wells Fargo Bank, National Association

Rialto Mortgage Finance, LLC

Principal Commercial Capital

Liberty Island Group I LLC

C-III Commercial Mortgage LLC

Basis Real Estate Capital II, LLC

as Sponsors and Mortgage Loan Sellers

Commercial Mortgage Pass-Through Certificates

Series 2015-C27

February 24, 2015

| | WELLS FARGO SECURITIES | |

| | | |

| | Lead Manager and Sole Bookrunner | |

| | | |

| | Barclays Co-Manager | |

STATEMENT REGARDING THIS FREE WRITING PROSPECTUS

The depositor has filed a registration statement (including a prospectus) with the Securities and Exchange Commission (‘‘SEC’’) (SEC File No. 333-195164) for the offering to which this communication relates. Before you invest, you should read the prospectus in the registration statement and other documents the depositor has filed with the SEC for more complete information about the depositor, the issuing entity and this offering. You may get these documents for free by visiting EDGAR on the SEC Web site at www.sec.gov. Alternatively, the depositor, any underwriter, or any dealer participating in the offering will arrange to send you the prospectus after filing if you request it by calling toll free 1-800-745-2063 (8 a.m. – 5 p.m. EST) or by emailing wfs.cmbs@wellsfargo.com.

Nothing in this document constitutes an offer of securities for sale in any jurisdiction where the offer or sale is not permitted. The information contained herein is preliminary as of the date hereof, supersedes any such information previously delivered to you and will be superseded by any such information subsequently delivered and ultimately by the final prospectus relating to the securities. These materials are subject to change, completion, supplement or amendment from time to time.

STATEMENT REGARDING ASSUMPTIONS AS TO SECURITIES, PRICING ESTIMATES AND OTHER INFORMATION

The attached information contains certain tables and other statistical analyses (the “Computational Materials”) which have been prepared in reliance upon information furnished by the Mortgage Loan Sellers. Numerous assumptions were used in preparing the Computational Materials, which may or may not be reflected herein. As such, no assurance can be given as to the Computational Materials’ accuracy, appropriateness or completeness in any particular context; or as to whether the Computational Materials and/or the assumptions upon which they are based reflect present market conditions or future market performance. The Computational Materials should not be construed as either projections or predictions or as legal, tax, financial or accounting advice. You should consult your own counsel, accountant and other advisors as to the legal, tax, business, financial and related aspects of a purchase of these securities. Any weighted average lives, yields and principal payment periods shown in the Computational Materials are based on prepayment and/or loss assumptions, and changes in such prepayment and/or loss assumptions may dramatically affect such weighted average lives, yields and principal payment periods. In addition, it is possible that prepayments or losses on the underlying assets will occur at rates higher or lower than the rates shown in the attached Computational Materials. The specific characteristics of the securities may differ from those shown in the Computational Materials due to differences between the final underlying assets and the preliminary underlying assets used in preparing the Computational Materials. The principal amount and designation of any security described in the Computational Materials are subject to change prior to issuance. None of Wells Fargo Securities, LLC or Barclays Capital Inc., or any of their respective affiliates, make any representation or warranty as to the actual rate or timing of payments or losses on any of the underlying assets or the payments or yield on the securities. The information in this presentation is based upon management forecasts and reflects prevailing conditions and management’s views as of this date, all of which are subject to change. In preparing this presentation, we have relied upon and assumed, without independent verification, the accuracy and completeness of all information available from public sources or which was provided to us by or on behalf of the Mortgage Loan Sellers or which was otherwise reviewed by us.

This free writing prospectus contains certain forward-looking statements. If and when included in this free writing prospectus, the words “expects“, “intends“, “anticipates“, “estimates“ and analogous expressions and all statements that are not historical facts, including statements about our beliefs or expectations, are intended to identify forward-looking statements. Any forward-looking statements are made subject to risks and uncertainties which could cause actual results to differ materially from those stated. Those risks and uncertainties include, among other things, declines in general economic and business conditions, increased competition, changes in demographics, changes in political and social conditions, regulatory initiatives and changes in customer preferences, many of which are beyond our control and the control of any other person or entity related to this offering. The forward-looking statements made in this free writing prospectus are made as of the date stated on the cover. We have no obligation to update or revise any forward-looking statement.

Wells Fargo Securities is the trade name for the capital markets and investment banking services of Wells Fargo & Company and its subsidiaries, including but not limited to Wells Fargo Securities, LLC, a member of NYSE, FINRA, NFA and SIPC, Wells Fargo Institutional Securities, LLC, a member of FINRA and SIPC, Wells Fargo Prime Services, LLC, a member of FINRA, NFA and SIPC, and Wells Fargo Bank, N.A. Wells Fargo Securities, LLC carries and provides clearing services for Wells Fargo Institutional Securities, LLC customer accounts. Wells Fargo Securities, LLC, Wells Fargo Institutional Securities, LLC, and Wells Fargo Prime Services, LLC are distinct entities from affiliated banks and thrifts.

IMPORTANT NOTICE REGARDING THE OFFERED CERTIFICATES

The Offered Certificates referred to in these materials and the asset pool backing them are subject to modification or revision (including the possibility that one or more classes of certificates may be split, combined or eliminated at any time prior to issuance or availability of a final prospectus) and are offered on a “when, as and if issued” basis. Prospective investors should understand that, when considering the purchase of the Offered Certificates, a contract of sale will come into being no sooner than the date on which the relevant class of certificates has been priced and the underwriters have confirmed the allocation of certificates to be made to investors; any “indications of interest” expressed by any prospective investor, and any “soft circles” generated by the underwriters, will not create binding contractual obligations for such prospective investors, on the one hand, or the underwriters, the depositor or any of their respective agents or affiliates, on the other hand.

As a result of the foregoing, a prospective investor may commit to purchase certificates that have characteristics that may change, and each prospective investor is advised that all or a portion of the certificates referred to in these materials may be issued without all or certain of the characteristics described in these materials. The underwriters’ obligation to sell certificates to any prospective investor is conditioned on the certificates and the transaction having the characteristics described in these materials. If the underwriters determine that a condition is not satisfied in any material respect, such prospective investor will be notified, and neither the depositor nor the underwriters will have any obligation to such prospective investor to deliver any portion of the Offered Certificates which such prospective investor has committed to purchase, and there will be no liability between the underwriters, the depositor or any of their respective agents or affiliates, on the one hand, and such prospective investor, on the other hand, as a consequence of the non-delivery.

Each prospective investor has requested that the underwriters provide to such prospective investor information in connection with such prospective investor’s consideration of the purchase of the certificates described in these materials. These materials are being provided to each prospective investor for informative purposes only in response to such prospective investor’s specific request. The underwriters described in these materials may from time to time perform investment banking services for, or solicit investment banking business from, any company named in these materials. The underwriters and/or their affiliates or respective employees may from time to time have a long or short position in any security or contract discussed in these materials.

The information contained herein supersedes any previous such information delivered to any prospective investor and will be superseded by information delivered to such prospective investor prior to the time of sale.

IMPORTANT NOTICE RELATING TO AUTOMATICALLY-GENERATED EMAIL DISCLAIMERS

Any legends, disclaimers or other notices that may appear at the bottom of any email communication to which this free writing prospectus is attached relating to (1) these materials not constituting an offer (or a solicitation of an offer), (2) no representation that these materials are accurate or complete and may not be updated or (3) these materials possibly being confidential, are not applicable to these materials and should be disregarded. Such legends, disclaimers or other notices have been automatically generated as a result of these materials having been sent via Bloomberg or another system.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2015-C27 | Certificate Structure |

I. Certificate Structure

| | | | | | | | | | | | | | | | | | | |

| | | | Expected Ratings (DBRS/KBRA/Moody’s)(1) | | Approximate Initial

Certificate Principal

Balance or Notional

Amount(2) | | Approx.

Initial Credit

Support(3) | | Pass-Through

Rate

Description | | Weighted

Average

Life

(Years)(4) |

| Expected Principal

Window(4) | | Certificate

Principal to

Value Ratio(5) | | Certificate

Principal

U/W NOI

Debt Yield(6) |

| | | | Offered Certificates | | | | | | | | | | | | | | | |

| | A-1 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $50,293,000 | | | 30.000% | | (7) | | 2.99 | | 04/15 - 02/20 | | 47.1% | | 14.9% |

| | A-2 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $7,934,000 | | | 30.000% | | (7) | | 4.93 | | 02/20 - 02/20 | | 47.1% | | 14.9% |

| | A-3 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $36,418,000 | | | 30.000% | | (7) | | 6.92 | | 01/22 - 02/22 | | 47.1% | | 14.9% |

| | A-4 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $240,000,000 | | | 30.000% | | (7) | | 9.78 | | 12/24 - 01/25 | | 47.1% | | 14.9% |

| | A-5 | | AAA(sf)/AAA(sf)/Aaa(sf) | | $309,207,000 | | | 30.000% | | (7) | | 9.92 | | 01/25 - 02/25 | | 47.1% | | 14.9% |

| | A-SB | | AAA(sf)/AAA(sf)/Aaa(sf) | | $89,627,000 | | | 30.000% | | (7) | | 7.40 | | 02/20 - 12/24 | | 47.1% | | 14.9% |

| | A-S(8) | | AAA(sf)/AAA(sf)/Aa2(sf) | | $79,897,000 | | | 22.375% | | (7) | | 9.98 | | 02/25 - 03/25 | | 52.2% | | 13.5% |

| | X-A | | AAA(sf)/AAA(sf)/NR | | $813,376,000(9) | | | N/A | | Variable(10) | | N/A | | N/A | | N/A | | N/A |

| | X-B | | AAA(sf)/AAA(sf)/NR | | $158,484,000(11) | | | N/A | | Variable(12) | | N/A | | N/A | | N/A | | N/A |

| | B(8) | | AA(sf)/AA(sf)/A1(sf) | | $45,842,000 | | | 18.000% | | (7) | | 10.01 | | 03/25 - 03/25 | | 55.2% | | 12.8% |

| | C(8) | | A(low)(sf)/A-(sf)/NR | | $68,109,000 | | | 11.500% | | (7) | | 10.01 | | 03/25 - 03/25 | | 59.6% | | 11.8% |

| | PEX(8) | | A(low)(sf)/A-(sf)/NR | | $193,848,000 | | | 11.500% | | (7) | | 9.99 | | 02/25 - 03/25 | | 59.6% | | 11.8% |

| | | | | | | | | | | | | | | | | | | |

| | | | Non-Offered Certificates | | | | | | | | | | | | | | | |

| | X-E | | AAA(sf)/BB-(sf)/NR | | $26,196,000(13) | | | N/A | | Variable(14) | | N/A | | N/A | | N/A | | N/A |

| | X-F | | AAA(sf)/B-(sf)/NR | | $17,027,000(15) | | | N/A | | Variable(16) | | N/A | | N/A | | N/A | | N/A |

| | X-G | | AAA(sf)/NR/NR | | $32,745,035(17) | | | N/A | | Variable(18) | | N/A | | N/A | | N/A | | N/A |

| | D | | BBB(low)(sf)/BBB-(sf)/NR | | $44,533,000 | | | 7.250% | | (7) | | 10.01 | | 03/25 - 03/25 | | 62.4% | | 11.3% |

| | E | | BB(low)(sf)/BB-(sf)/NR | | $26,196,000 | | | 4.750% | | (7) | | 10.01 | | 03/25 - 03/25 | | 64.1% | | 11.0% |

| | F | | B(low)(sf)/B-(sf)/NR | | $17,027,000 | | | 3.125% | | (7) | | 10.01 | | 03/25 - 03/25 | | 65.2% | | 10.8% |

| | G | | NR/NR/NR | | $32,745,035 | | | 0.000% | | (7) | | 10.01 | | 03/25 - 03/25 | | 67.3% | | 10.5% |

| Notes: |

| (1) | The expected ratings presented are those of DBRS, Inc. (“DBRS”), Kroll Bond Rating Agency, Inc. (“KBRA”) and Moody’s Investors Service, Inc. (“Moody’s”) which the depositor hired to rate the offered certificates. One or more other nationally recognized statistical rating organizations that were not hired by the depositor may use information they receive pursuant to Rule 17g-5 under the Securities Exchange Act of 1934, as amended (the “Exchange Act“) or otherwise, to rate or provide market reports and/or published commentary related to the offered certificates. We cannot assure you as to what ratings a non-hired nationally recognized statistical rating organization would assign or that its reports will not express differing, possibly negative, views of the mortgage loans and/or the offered certificates. The ratings of each class of offered certificates address the likelihood of the timely distribution of interest and, except in the case of the Class X-A and Class X-B certificates, the ultimate distribution of principal due on those classes on or before the Rated Final Distribution Date. See “Risk Factors—Risks Related to the Offered Certificates—Ratings of the Certificates Have Substantial Limitations” and “Ratings” in the free writing prospectus, dated February 24, 2015 (the “Free Writing Prospectus”). DBRS, KBRA and Moody’s have informed us that the “sf“ designation in their ratings represents an identifier for structured finance product ratings. |

| | |

| (2) | The principal balances and notional amounts set forth in the table are approximate. The actual initial principal balances and notional amounts may be larger or smaller depending on the aggregate cut-off date principal balance of the mortgage loans definitively included in the pool of mortgage loans, which aggregate cut-off date principal balance may be as much as 5% larger or smaller than the amount presented in the Free Writing Prospectus. |

| | |

| (3) | The approximate initial credit support with respect to the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates represents the approximate credit enhancement for the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates in the aggregate. The percentage indicated under the column “Approx. Initial Credit Support” with respect to the Class C Certificates and the Class PEX Certificates represents the approximate credit support for the Class C regular interest, which will have an initial outstanding principal balance on the closing date of $68,109,000. |

| | |

| (4) | Weighted Average Lives and Expected Principal Windows are calculated based on an assumed prepayment rate of 0% CPR and the “Structuring Assumptions“ described on Annex B to the Free Writing Prospectus. |

| | |

| (5) | The Certificate Principal to Value Ratio for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and other than the Exchangeable Certificates) is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Certificate Principal to Value Ratios for each of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates are calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average Cut-off Date LTV Ratio for the mortgage loans and (b) a fraction, the numerator of which is the total initial aggregate Certificate Balances of such Classes of Certificates and the denominator of which is the total initial Certificate Balance of all of the Principal Balance Certificates. The Certificate Principal to Value Ratio of the Class PEX Certificates is equal to the Certificate Principal to Value Ratio of the Class C Certificates. In any event, however, excess mortgaged property value associated with a mortgage loan will not be available to offset losses on any other mortgage loan. |

| | |

| (6) | The Certificate Principal U/W NOI Debt Yield for each Class of Certificates (other than the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and other than the Exchangeable Certificates) is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total initial Certificate Balance for such Class of Certificates and all Classes of Principal Balance Certificates senior to such Class of Certificates. The Certificate Principal U/W NOI Debt Yield for each of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates is calculated in the aggregate for those Classes as if they were a single Class and is calculated as the product of (a) the weighted average UW NOI Debt Yield for the mortgage loans and (b) a fraction, the numerator of which is the total initial Certificate Balance of all of the Classes of Principal Balance Certificates and the denominator of which is the total aggregate initial Certificate Balances for such Classes of Certificates. The Certificate Principal U/W NOI Debt Yield of the Class PEX Certificates is equal to the Certificate Principal U/W NOI Debt Yield for the Class C Certificates. In any event, however, cash flow from each mortgaged property supports only the related mortgage loan and will not be available to support any other mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2015-C27 | Certificate Structure |

| (7) | The pass-through rates for the Class A-1, A-2, A-3, A-4, A-5, A-SB, A-S, B, C, D, E, F and G Certificates in each case will be one of the following: (i) a fixed rate per annum, (ii) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, (iii) a variable rate per annum equal to the lesser of (a) a fixed rate and (b) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date or (iv) a variable rate per annum equal to the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date minus a specified percentage. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. The Class PEX Certificates will not have a pass-through rate, but will be entitled to receive the sum of the interest distributable on the Class PEX Components. The pass-through rate for the Class A-S Certificates, the Class A-S regular interest and the Class PEX Component A-S will, at all times, be the same. The pass-through rate for the Class B Certificates, the Class B regular interest and the Class PEX Component B will, at all times, be the same. The pass-through rate for the Class C Certificates, the Class C regular interest and the Class PEX Component C will, at all times, be the same. |

| | |

| (8) | The Class A-S, B, C and PEX Certificates are “Exchangeable Certificates”. On the closing date, the upper-tier REMIC of the issuing entity will issue the Class A-S, B and C regular interests (each a “regular interest”) which will have outstanding principal balances on the closing date of $79,897,000 $45,842,000 and $68,109,000, respectively. The regular interests will be held in a grantor trust for the benefit of the holders of the Class A-S, B, C and PEX Certificates. The Class A-S, B, C and PEX Certificates will, at all times, represent undivided beneficial ownership interests in a grantor trust that will hold those regular interests. Each class of the Class A-S, B and C Certificates will, at all times, represent an undivided beneficial ownership interest in a percentage of the outstanding certificate principal balance of the regular interest with the same alphabetical class designation. The Class PEX Certificates will, at all times, represent an undivided beneficial ownership interest in the remaining percentages of the outstanding certificate principal balances of the Class A-S, B and C regular interests and which portions of those regular interests are referred to in this Term Sheet as the Class PEX Component A-S, Class PEX Component B and Class PEX Component C (collectively, the “Class PEX Components”). Following any exchange of Class A-S, B and C Certificates for Class PEX Certificates or any exchange of Class PEX Certificates for Class A-S, B and C Certificates as described in the Free Writing Prospectus, the percentage interest of the outstanding certificate principal balances of the Class A-S, B and C regular interest that is represented by the Class A-S, B, C and PEX Certificates will be increased or decreased accordingly. The initial certificate principal balance of each of the Class A-S, B and C Certificates shown in the table represents the maximum certificate principal balance of such class without giving effect to any exchange. The initial certificate principal balance of the Class PEX Certificates is equal to the aggregate of the initial certificate principal balance of the Class A-S, B and C Certificates and represents the maximum certificate principal balance of the Class PEX Certificates that could be issued in an exchange. The certificate principal balances of the Class A-S, B and C Certificates to be issued on the closing date will be reduced, in required proportions, by an amount equal to the certificate principal balance of the Class PEX Certificates issued on the closing date. Distributions and allocations of payments and losses with respect to the Exchangeable Certificates are described in this Term Sheet under “Allocations and Distributions on the Class A-S, B, C and PEX Certificates” and under “Description of the Offered Certificates—Distributions” in the Free Writing Prospectus. The maximum certificate principal balance of the Class PEX Certificates is set forth in the table but is not included in the certificate principal balance of the certificates set forth on the cover page of this Term Sheet or on the top of the cover page of the Free Writing Prospectus. |

| | |

| (9) | The Class X-A Certificates are notional amount certificates. The Notional Amount of the Class X-A Certificates will be equal to the aggregate principal balance of the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and the Class A-S regular interest outstanding from time to time (without regard to any exchange of Class A-S, B and C Certificates for Class PEX Certificates). The Class X-A Certificates will not be entitled to distributions of principal. |

| | |

| (10) | The pass-through rate for the Class X-A Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class A-1, A-2, A-3, A-4, A-5 and A-SB Certificates and the Class A-S regular interest for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (11) | The Class X-B Certificates are notional amount certificates. The Notional Amount of the Class X-B Certificates will be equal to the aggregate principal balance of the Class B and C regular interests and the Class D Certificates outstanding from time to time. The Class X-B Certificates will not be entitled to distributions of principal. |

| | |

| (12) | The pass-through rate for the Class X-B Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the weighted average of the pass-through rates on the Class B and C regular interests and the Class D Certificates for the related distribution date, weighted on the basis of their respective aggregate principal balances outstanding immediately prior to that distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (13) | The Class X-E Certificates are notional amount certificates. The Notional Amount of the Class X-E Certificates will be equal to the principal balance of the Class E Certificates outstanding from time to time. The Class X-E Certificates will not be entitled to distributions of principal. |

| | |

| (14) | The pass-through rate for the Class X-E Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class E Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (15) | The Class X-F Certificates are notional amount certificates. The Notional Amount of the Class X-F Certificates will be equal to the principal balance of the Class F Certificates outstanding from time to time. The Class X-F Certificates will not be entitled to distributions of principal. |

| | |

| (16) | The pass-through rate for the Class X-F Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class F Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

| | |

| (17) | The Class X-G Certificates are notional amount certificates. The Notional Amount of the Class X-G Certificates will be equal to the principal balance of the Class G Certificates outstanding from time to time. The Class X-G Certificates will not be entitled to distributions of principal. |

| | |

| (18) | The pass-through rate for the Class X-G Certificates for any distribution date will be a per annum rate equal to the excess, if any, of (a) the weighted average of the net mortgage interest rates on the mortgage loans for the related distribution date, over (b) the pass-through rate on the Class G Certificates for the related distribution date. For purposes of the calculation of the weighted average of the net mortgage interest rates on the mortgage loans for each distribution date, the mortgage interest rates will be adjusted as necessary to a 30/360 basis. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Issue Characteristics |

II. Transaction Highlights

Mortgage Loan Sellers:

| | | | | | | | | | | | | |

| | | | Number of Mortgaged Properties | | Aggregate Cut-off Date Balance | | % of Cut-off Date Pool Balance |

| Wells Fargo Bank, National Association | | 29 | | | 40 | | | $387,422,468 | | | 37.0 | % |

| Rialto Mortgage Finance, LLC | | 20 | | | 34 | | | 292,101,933 | | | 27.9 | |

Principal Commercial Capital(1) | | 9 | | | 9 | | | 153,204,518 | | | 14.6 | |

| Liberty Island Group I LLC | | 12 | | | 12 | | | 118,064,001 | | | 11.3 | |

| C-III Commercial Mortgage LLC | | 23 | | | 26 | | | 84,535,116 | | | 8.1 | |

| Basis Real Estate Capital II, LLC | | 2 | | | 3 | | | 12,500,000 | | | 1.2 | |

| | 95 | | | 124 | | | $1,047,828,035 | | | 100.0 | % |

| (1) | Principal Commercial Capital is the lending platform jointly formed by Macquarie US Trading LLC and Principal Real Estate Investors, LLC to originate and securitize commercial mortgage loans. The mortgage loans to be sold by Macquarie US Trading LLC d/b/a Principal Commercial Capital were initially originated by Macquarie Investments US Inc. d/b/a Principal Commercial Capital, which will transfer such mortgage loans to Macquarie US Trading LLC d/b/a Principal Commercial Capital on or prior to the Closing Date. |

Loan Pool:

| Cut-off Date Balance: | $1,047,828,035 | |

| Number of Mortgage Loans: | 95 | |

| Average Cut-off Date Balance per Mortgage Loan: | $11,029,769 | |

| Number of Mortgaged Properties: | 124 | |

Average Cut-off Date Balance per Mortgaged Property(1): | $8,450,226 | |

| Weighted Average Mortgage Interest Rate: | 4.321% | |

| Ten Largest Mortgage Loans as % of Cut-off Date Pool Balance: | 37.0% | |

| Weighted Average Original Term to Maturity (months): | 118 | |

| Weighted Average Remaining Term to Maturity (months): | 117 | |

Weighted Average Original Amortization Term (months)(2): | 355 | |

Weighted Average Remaining Amortization Term (months)(2): | 355 | |

| Weighted Average Seasoning (months): | 1 | |

| (1) | Information regarding mortgage loans secured by multiple properties is based on an allocation according to relative appraised values or the allocated loan amounts or property-specific release prices set forth in the related loan documents or such other allocation as the related mortgage loan seller deemed appropriate. |

| (2) | Excludes any mortgage loan that does not amortize. |

Credit Statistics:

Weighted Average U/W Net Cash Flow DSCR(1): | 1.67x | |

Weighted Average U/W Net Operating Income Debt Yield(1): | 10.5% | |

Weighted Average Cut-off Date Loan-to-Value Ratio(1): | 67.3% | |

Weighted Average Balloon Loan-to-Value Ratio(1): | 57.8% | |

% of Mortgage Loans with Additional Subordinate Debt(2): | 3.6% | |

% of Mortgage Loans with Single Tenants(3): | 6.4% | |

| (1) | With respect to the Westfield Palm Desert mortgage loan, the Depot Park mortgage loan and the Boca Hamptons Plaza Portfolio mortgage loan, each of which is part of a pari passu loan combination, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 and Annex B to the Free Writing Prospectus. |

| (2) | The percentage figure expressed as “% of Mortgage Loans with Additional Subordinate Debt” is determined as a percentage of cut-off date principal balance and does not take into account future subordinate debt (whether or not secured by the mortgaged property), if any, that may be permitted under the terms of any mortgage loan or the Pooling and Servicing Agreement. See “Description of the Mortgage Pool—Subordinate and/or Other Financing” in the Free Writing Prospectus. |

| (3) | Excludes mortgage loans that are secured by multiple single tenant properties and includes mortgage loans secured by multiple single tenant properties where each property is occupied by the same tenant or tenants that are affiliates of one another. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Issue Characteristics |

Loan Structural Features:

Amortization: Based on the Cut-off Date Pool Balance, 90.9% of the mortgage pool (92 mortgage loans) has scheduled amortization, as follows:

31.0% (43 mortgage loans) requires amortization during the entire loan term; and

59.8% (49 mortgage loans) provides for an interest-only period followed by an amortization period.

Interest-Only: Based on the Cut-off Date Pool Balance, 9.1% of the mortgage pool (three mortgage loans) provides for interest-only payments during the entire loan term. The Weighted Average Cut-off Date Loan-to-Value Ratio and Weighted Average U/W Net Cash Flow DSCR for those mortgage loans are 58.6% and 2.54x, respectively.

Hard Lockboxes: Based on the Cut-off Date Pool Balance, 31.1% of the mortgage pool (16 mortgage loans) has hard lockboxes in place.

Reserves: The mortgage loans require amounts to be escrowed monthly as follows (excluding any mortgage loans with springing provisions):

| Real Estate Taxes: | 84.8% of the pool | |

| Insurance: | 47.0% of the pool | |

| Capital Replacements: | 86.4% of the pool | |

| TI/LC: | 75.2% of the pool(1) | |

(1) The percentage of Cut-off Date Balance for mortgage loans with TI/LC reserves is based on the aggregate principal balance allocable to loans that include retail, office, industrial and mixed use properties. | |

Call Protection/Defeasance: Based on the Cut-off Date Pool Balance, the mortgage pool had the following call protection and defeasance features:

70.6% of the mortgage pool (67 mortgage loans) features a lockout period, then defeasance only until an open period;

20.9% of the mortgage pool (25 mortgage loans) features a lockout period, then the greater of a prepayment premium or yield maintenance until an open period;

8.4% of the mortgage pool (three mortgage loans) features a lockout period, then defeasance or the greater of a prepayment premium or yield maintenance until an open period;

Please refer to Annex A-1 to the Free Writing Prospectus for further information regarding individual loan call protection.

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Issue Characteristics |

III. Issue Characteristics

| | Securities Offered: | | $927,327,000 approximate monthly pay, multi-class, commercial mortgage REMIC pass-through certificates consisting of twelve classes (Classes A-1, A-2, A-3, A-4, A-5, A-SB, A-S, B, C, PEX, X-A and X-B), which are offered pursuant to a registration statement filed with the SEC. |

| | | | |

| | Mortgage Loan Sellers: | | Wells Fargo Bank, National Association (“WFB“); Rialto Mortgage Finance, LLC (“RMF“); Principal Commercial Capital (“PCC“); Liberty Island Group I LLC (“LIG I“); C-III Commercial Mortgage LLC (“C-III“); and Basis Real Estate Capital II, LLC (“Basis“). |

| | | | |

| | Sole Lead Bookrunning Manager: | | Wells Fargo Securities, LLC |

| | | | |

| | Co-Manager: | | Barclays Capital Inc. |

| | | | |

| | Rating Agencies: | | DBRS, Inc., Kroll Bond Rating Agency, Inc. and Moody’s Investors Service, Inc. |

| | | | |

| | Master Servicer: | | Wells Fargo Bank, National Association |

| | | | |

| | Special Servicer: | | Rialto Capital Advisors, LLC |

| | | | |

| | Additional Primary Servicers: | | Prudential Asset Resources, Inc. and Principal Global Investors, LLC |

| | | | |

| | Certificate Administrator: | | Wells Fargo Bank, National Association |

| | | | |

| | Trustee: | | Wilmington Trust, National Association |

| | | | |

| | Trust Advisor: | | Trimont Real Estate Advisors, Inc. |

| | | | |

| | Initial Majority Subordinate Certificateholder: | | Rialto CMBS V, LLC or another affiliate of Rialto Capital Advisors, LLC |

| | | | |

| | Cut-off Date: | | The Cut-off Date with respect to each mortgage loan is the due date for the monthly debt service payment that is due in March 2015 (or, in the case of any mortgage loan that has its first due date in April 2015, the date that would have been its due date in March 2015 under the terms of that mortgage loan if a monthly debt service payment were scheduled to be due in that month). |

| | | | |

| | Expected Closing Date: | | On or about March 12, 2015. |

| | | | |

| | Determination Dates: | | The 11th day of each month (or if that day is not a business day, the next succeeding business day), commencing in April 2015. |

| | | | |

| | Distribution Dates: | | The fourth business day following the Determination Date in each month, commencing in April 2015. |

| | | | |

| | Rated Final Distribution Date: | | The Distribution Date in February 2048. |

| | | | |

| | Interest Accrual Period: | | With respect to any Distribution Date, the calendar month immediately preceding the month in which such Distribution Date occurs. |

| | | | |

| | Day Count: | | The Offered Certificates will accrue interest on a 30/360 basis. |

| | | | |

| | Minimum Denominations: | | $10,000 for each Class of Offered Certificates (other than the Class X-A and X-B Certificates) and $1,000,000 for the Class X-A and X-B Certificates. Investments may also be made in any whole dollar denomination in excess of the applicable minimum denomination. |

| | | | |

| | Clean-up Call: | | 1% |

| | | | |

| | Delivery: | | DTC, Euroclear and Clearstream Banking |

| | | | |

| | ERISA/SMMEA Status: | | Each Class of Offered Certificates is expected to be eligible for exemptive relief under ERISA. No Class of Offered Certificates will be SMMEA eligible. |

| | | | |

| | Risk Factors: | | THE CERTIFICATES INVOLVE CERTAIN RISKS AND MAY NOT BE SUITABLE FOR ALL INVESTORS. SEE THE “RISK FACTORS” SECTION OF THE FREE WRITING PROSPECTUS. |

| | | | |

| | Bond Analytics Information: | | The Certificate Administrator will be authorized to make distribution date settlements, CREFC® reports and certain supplemental reports (other than confidential information) available to certain financial modeling and data provision services, including Bloomberg, L.P., Trepp, LLC, Intex Solutions, Inc., Markit Group Limited, Interactive Data Corp., BlackRock Financial Management, Inc and CMBS.com, Inc. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Characteristics of the Mortgage Pool |

IV. Characteristics of the Mortgage Pool(1)

A. Ten Largest Mortgage Loans

Mortgage Loan Seller | | Mortgage Loan Name | | City | | State | | Number of

Mortgage Loans

/ Mortgaged

Properties | | Mortgage Loan

Cut-off Date Balance ($) | | % of Cut-

off Date

Pool

Balance

(%) | | Property Type | | Number of

SF or

Rooms | | Cut-off Date

Balance Per

SF or Room

($) | | Cut-off

Date LTV

Ratio (%) | | Balloon LTV

Ratio (%) | | U/W NCF

DSCR (x) | | U/W NOI

Debt Yield

(%) |

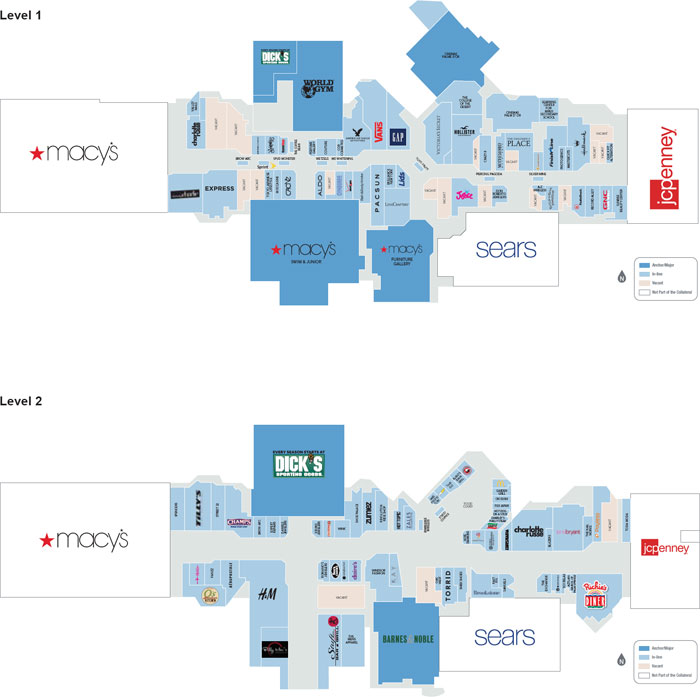

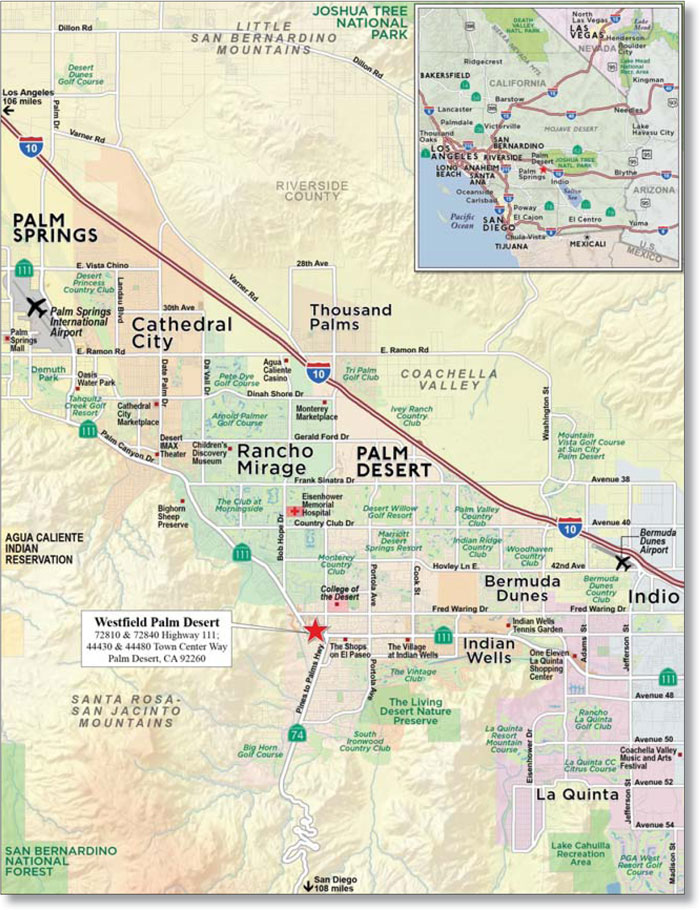

| RMF | | Westfield Palm Desert | | Palm Desert | | CA | | 1 / 1 | | $62,500,000 | | | 6.0 | % | | Retail | | 572,724 | | $218 | | 59.0 | % | | 59.0 | % | | 2.61x | | 10.8 | % |

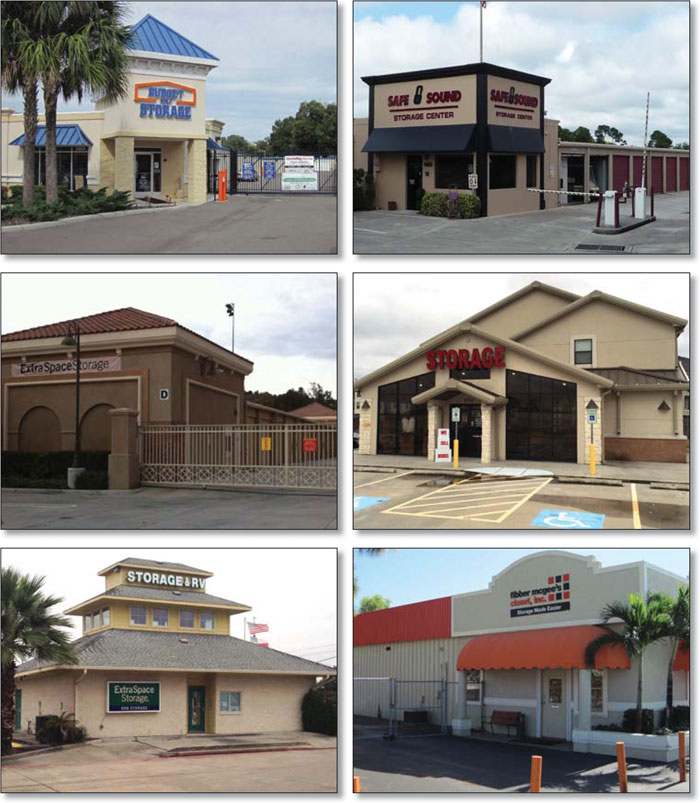

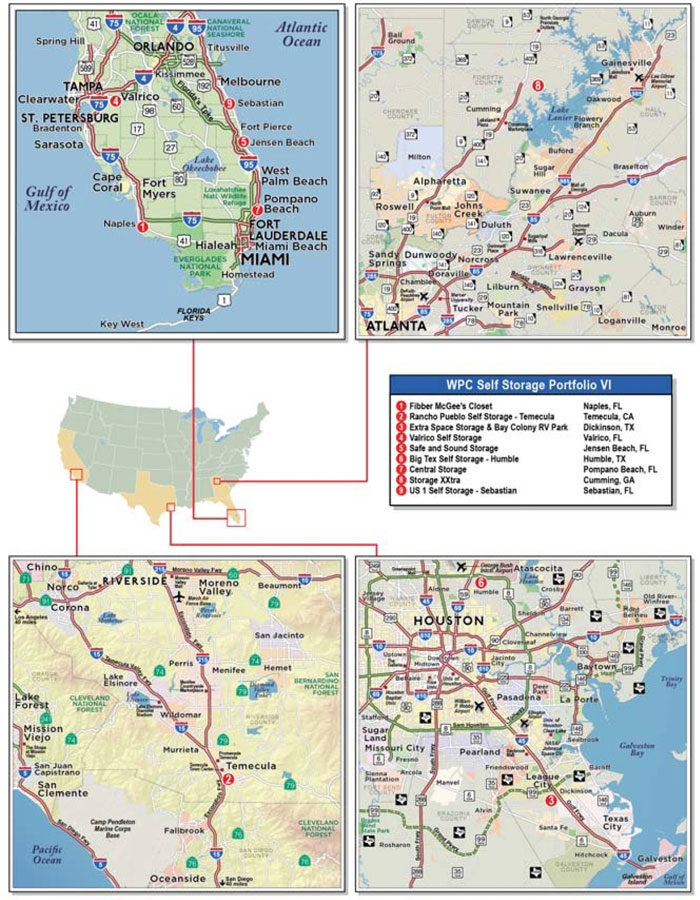

| WFB | | WP Carey Self Storage Portfolio VI | | Various | | Various | | 1 / 9 | | 48,139,000 | | | 4.6 | | | Self Storage | | 750,194 | | 64 | | 64.4 | | | 58.7 | | | 1.44 | | 8.7 | |

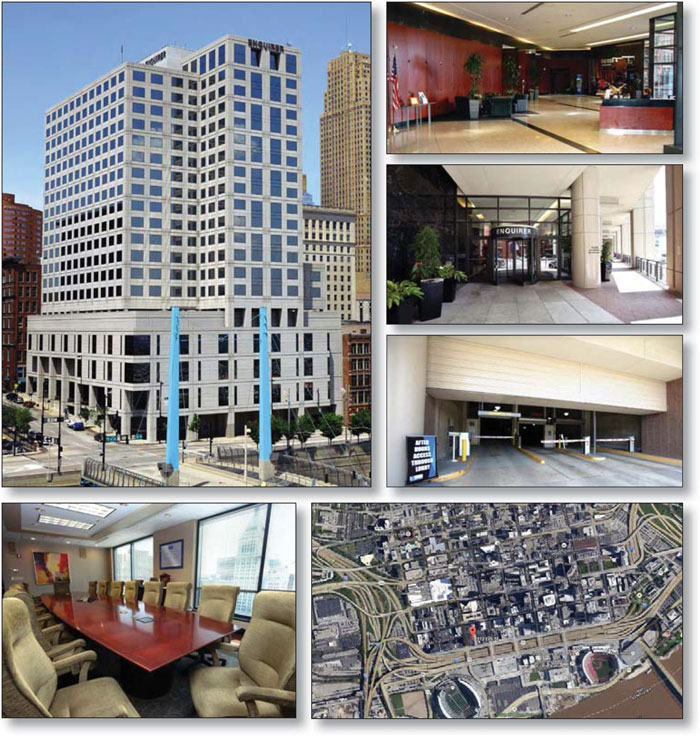

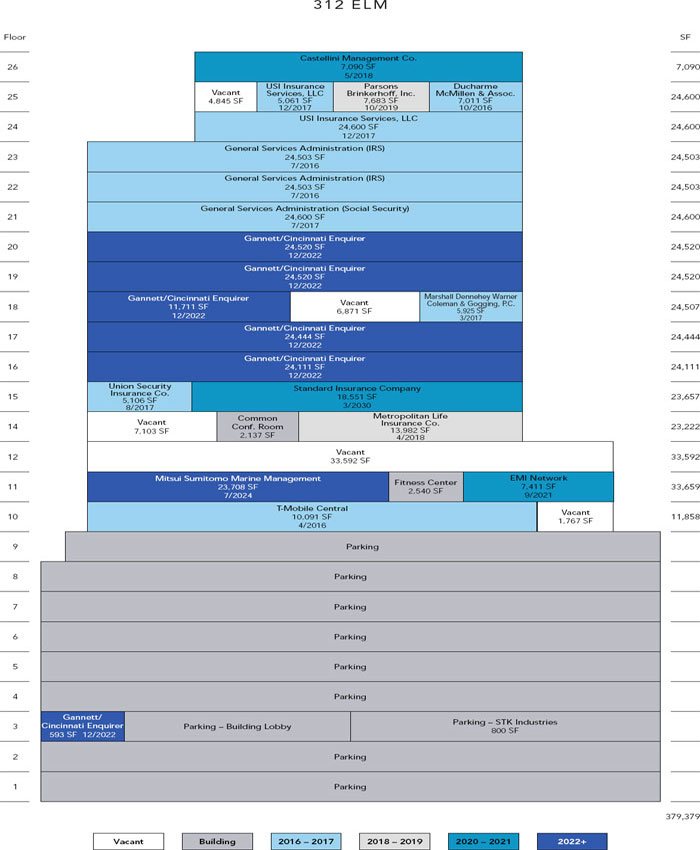

| PCC | | 312 Elm | | Cincinnati | | OH | | 1 / 1 | | 46,121,000 | | | 4.4 | | | Office | | 379,379 | | 122 | | 68.8 | | | 60.0 | | | 1.80 | | 12.0 | |

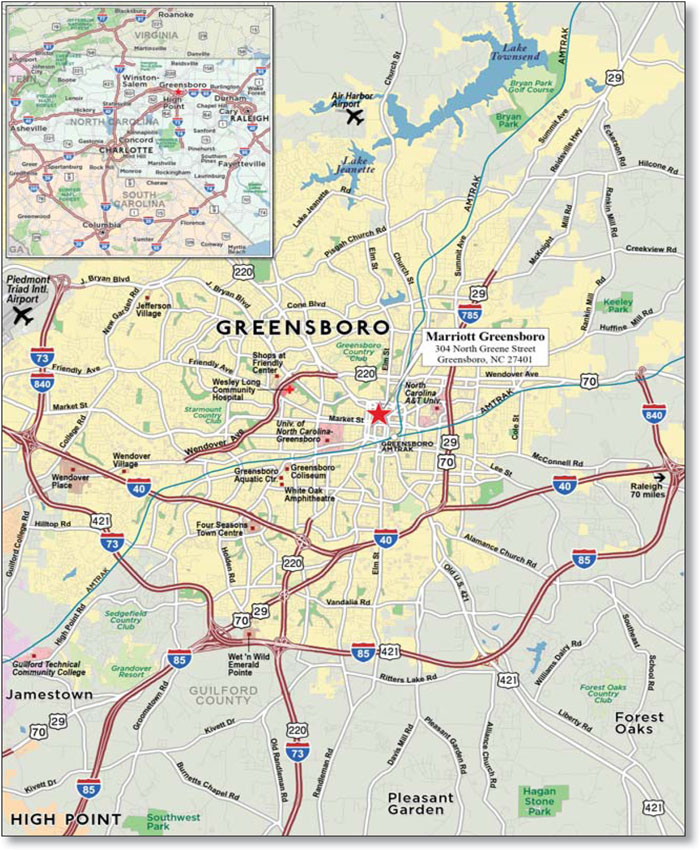

| RMF | | Marriott Greensboro | | Greensboro | | NC | | 1 / 1 | | 43,833,356 | | | 4.2 | | | Hospitality | | 281 | | 155,991 | | 68.7 | | | 56.2 | | | 1.66 | | 11.5 | |

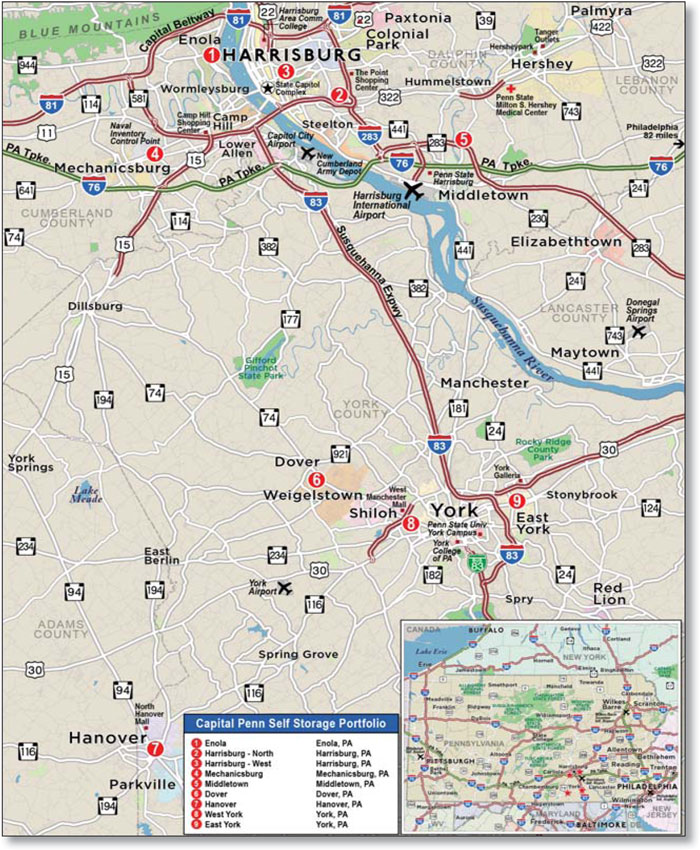

| RMF | | Capital Penn Self Storage Portfolio | | Various | | PA | | 1 / 9 | | 37,606,397 | | | 3.6 | | | Self Storage | | 592,854 | | 63 | | 69.5 | | | 61.0 | | | 1.72 | | 10.8 | |

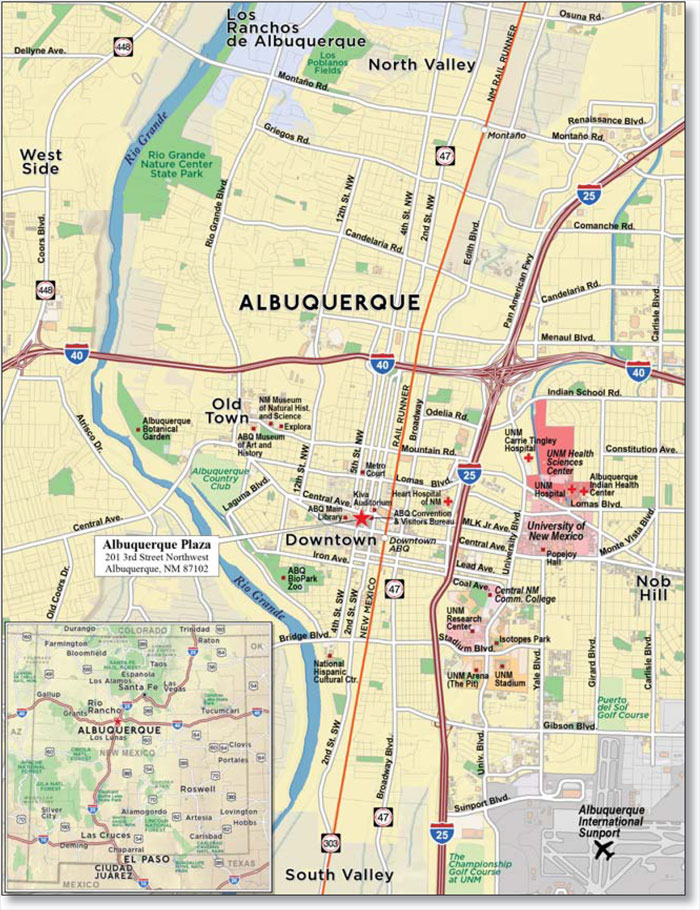

| WFB | | Albuquerque Plaza | | Albuquerque | | NM | | 1 / 1 | | 34,925,241 | | | 3.3 | | | Office | | 358,196 | | 98 | | 61.3 | | | 44.4 | | | 1.65 | | 11.9 | |

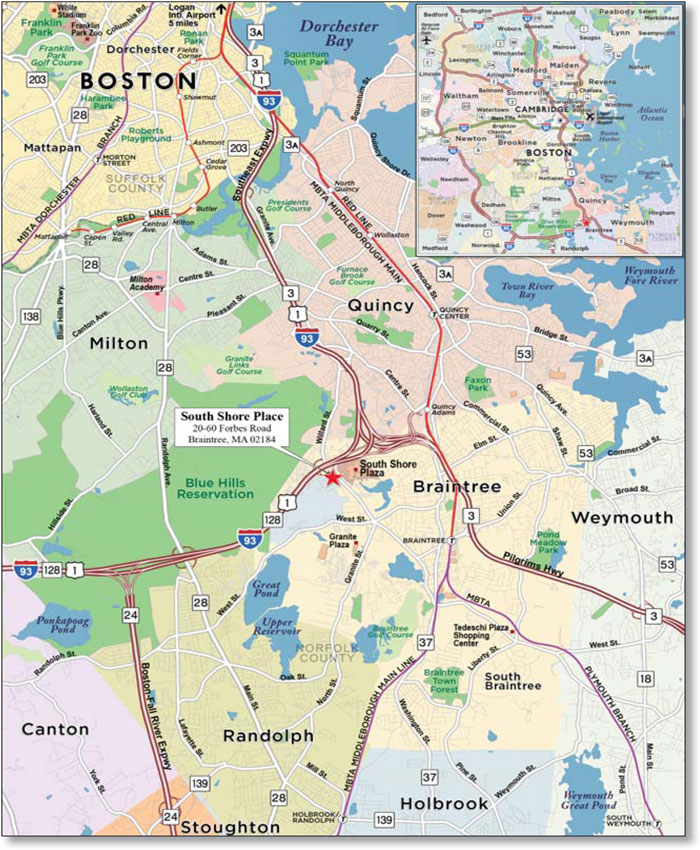

| WFB | | South Shore Place | | Braintree | | MA | | 1 / 1 | | 29,600,000 | | | 2.8 | | | Retail | | 45,407 | | 652 | | 71.2 | | | 58.4 | | | 1.30 | | 7.9 | |

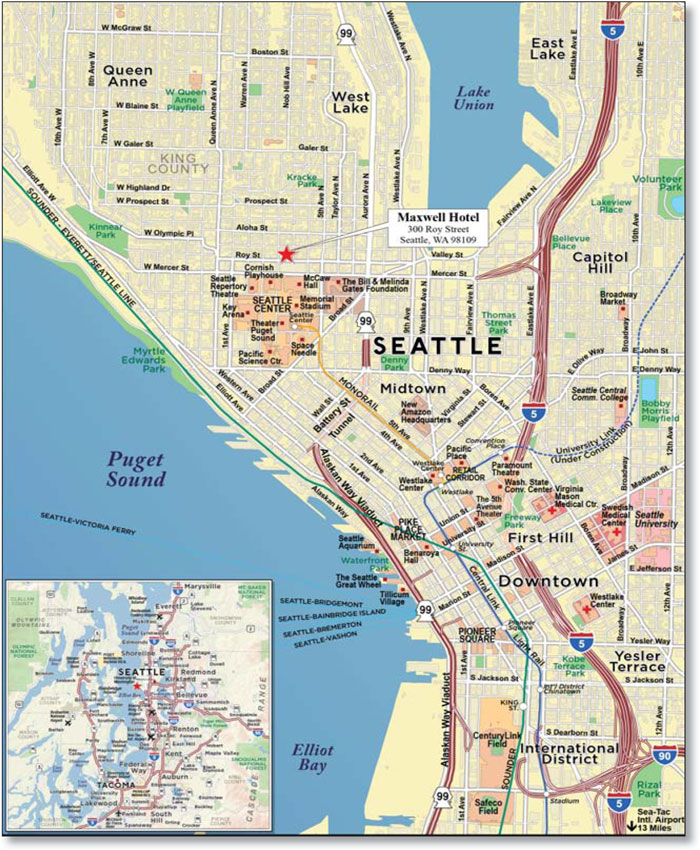

| LIG I | | Maxwell Hotel | | Seattle | | WA | | 1 / 1 | | 29,550,000 | | | 2.8 | | | Hospitality | | 139 | | 212,590 | | 67.0 | | | 58.5 | | | 1.75 | | 11.4 | |

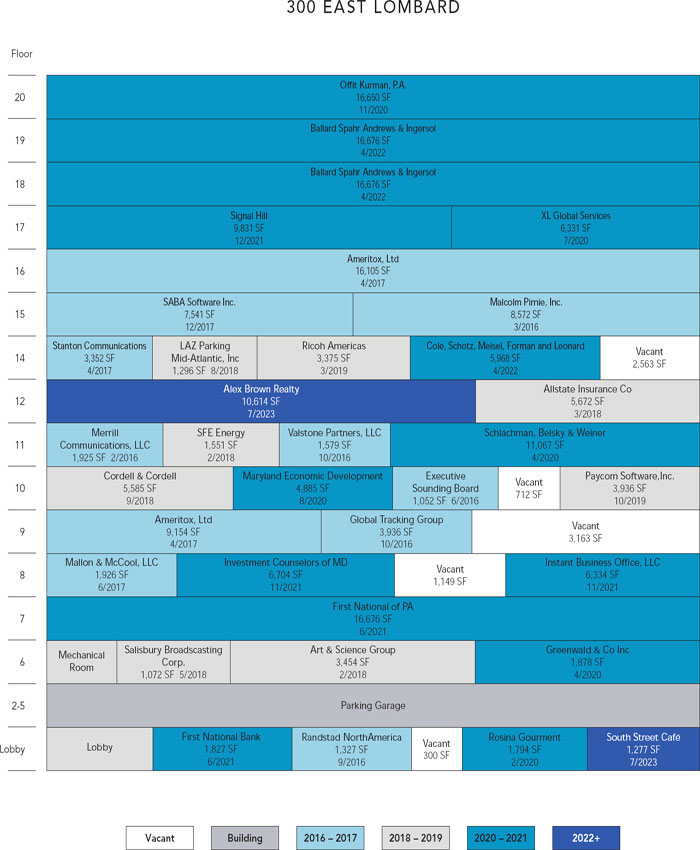

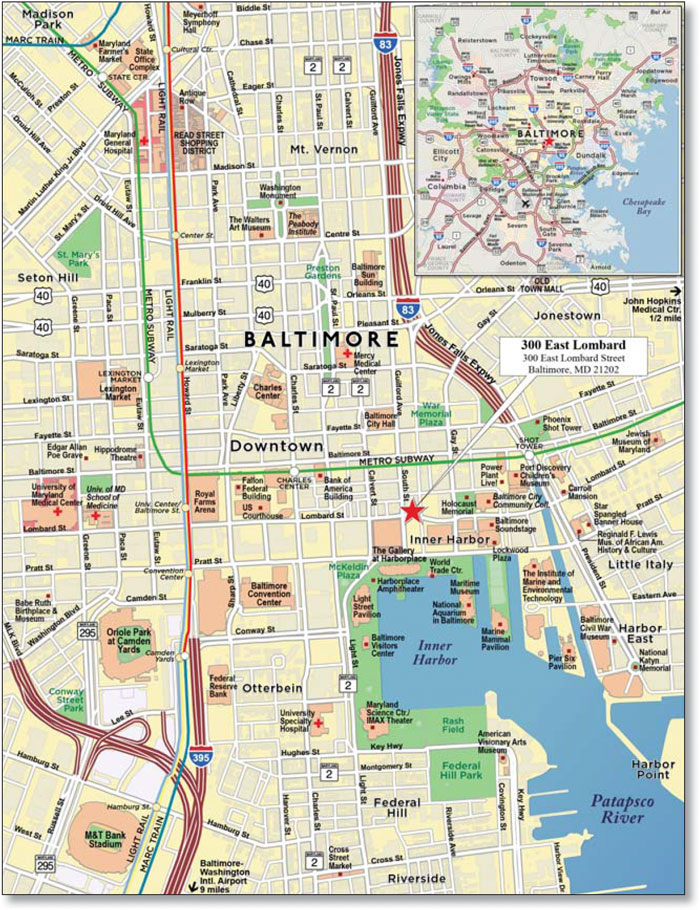

| WFB | | 300 East Lombard | | Baltimore | | MD | | 1 / 1 | | 28,692,492 | | | 2.7 | | | Office | | 225,485 | | 127 | | 74.5 | | | 59.4 | | | 1.38 | | 8.9 | |

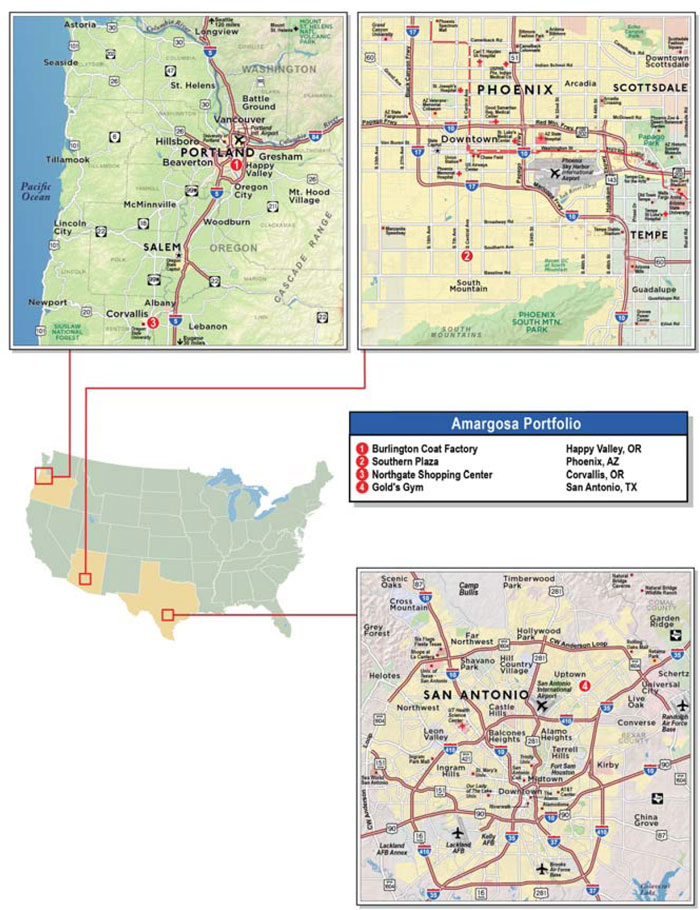

| WFB | | Amargosa Portfolio | | Various | | Various | | 1 / 4 | | 26,600,000 | | | 2.5 | | | Retail | | 225,906 | | 118 | | 71.5 | | | 60.6 | | | 1.52 | | 9.7 | |

| Top Three Total/Weighted Average | | | | 3 / 11 | | $156,760,000 | | | 15.0 | % | | | | | | | | 63.5 | % | | 59.2 | % | | 2.01x | | 10.5 | % |

| Top Five Total/Weighted Average | | | | 5 / 21 | | $238,199,753 | | | 22.7 | % | | | | | | | | 65.4 | % | | 58.9 | % | | 1.90x | | 10.7 | % |

| Top Ten Total/Weighted Average | | | | 10 / 29 | | $387,567,486 | | | 37.0 | % | | | | | | | | 66.7 | % | | 57.7 | % | | 1.76x | | 10.5 | % |

| Non-Top Ten Total/Weighted Average | | | | 85 / 95 | | $660,260,549 | | | 63.0 | % | | | | | | | | 67.6 | % | | 57.8 | % | | 1.62x | | 10.5 | % |

| (1) | With respect to the Westfield Palm Desert mortgage loan, the Depot Park mortgage loan and the Boca Hamptons Plaza Portfolio mortgage loan, each of which is part of a pari passu loan combination, Cut-off Date Balance per square foot, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). With respect to each Mortgage Loan, debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property), if any, that is allowed under the terms of any mortgage loan. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Characteristics of the Mortgage Pool |

B. Summary of Pari Passu Split Loan Structures

| Property Name | | Mortgage Loan

Seller | | Related Notes in

Loan Group

(Original Balance) | | Holder of Note | | Whether Note is

Lead Servicing

for the Entire

Loan

Combination | | Current Master Servicer Under Related

Securitization Servicing Agreement | | Current Special Servicer Under Related

Securitization Servicing Agreement | |

| Westfield Palm Desert | | RMF | | $62,500,000 | | | MSBAM 2015-C21(1) | | Yes | | KeyBank National Association | | LNR Partners, LLC | |

| | RMF | | $62,500,000 | | | WFCM 2015-C27 | | No | | Wells Fargo Bank, National Association | | Rialto Capital Advisors, LLC | |

| Depot Park | | LIG I | | $24,000,000 | | | WFCM 2014-LC18 | | Yes | | Wells Fargo Bank, National Association | | Rialto Capital Advisors, LLC | |

| | LIG I | | $21,600,000 | | | WFCM 2015-C27 | | No | | Wells Fargo Bank, National Association | | Rialto Capital Advisors, LLC | |

| Boca Hamptons Plaza Portfolio | | RMF | | $18,000,000 | | | WFCM 2015-C27 | | No | | Wells Fargo Bank, National Association | | Rialto Capital Advisors, LLC | |

| | RMF | | $8,000,000 | | | CGCMT 2015-GC27 | | Yes | | Wells Fargo Bank, National Association | | Midland Loan Services | |

| (1) | The MSBAM 2015-C21 transaction is scheduled to close on February 26, 2015. |

C. Mortgage Loans with Additional Secured and Mezzanine Financing

| Loan No. | | Mortgage Loan Seller | | Mortgage Loan Name | | Mortgage Loan Cut-off Date Balance ($) | | % of Cut-off

Date Balance

(%) | | Sub Debt Cut-off

Date Balance ($) | | Mezzanine

Debt Cut-off

Date Balance

($) | | Total Debt

Interest

Rate (%)(1) | | Mortgage

Loan U/W

NCF DSCR

(x) | | Total Debt

U/W NCF

DSCR (x) | | Mortgage

Loan Cut-

off Date

U/W NOI

Debt Yield

(%) | | Total Debt

Cut-off Date

U/W NOI

Debt Yield

(%) | | Mortgage

Loan Cut-off

Date LTV

Ratio (%) | | Total Debt

Cut-off

Date LTV

Ratio (%) |

| 5 | | RMF | | Capital Penn Self Storage Portfolio | | $37,606,397 | | 3.6% | | $0 | | $4,179,047 | | 5.354% | | | 1.72x | | 1.37x | | 10.8% | | 9.7% | | 69.5% | | 77.2% |

| Total/Weighted Average | | $37,606,397 | | 3.6% | | $0 | | $4,179,047 | | 5.354% | | | 1.72x | | 1.37x | | 10.8% | | 9.7% | | 69.5% | | 77.2% |

| (1) | Total Debt Interest Rate for any specified mortgage loan reflects the weighted average of the interest rates on the respective components of the total debt. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Characteristics of the Mortgage Pool |

D. Previous Securitization History(1)

| Loan No. | | Mortgage Loan Seller | | Mortgage Loan or Mortgaged Property Name | | City | | State | | Property Type | | Mortgage Loan

or Mortgaged

Property Cut-

off Date

Balance ($) | | % of Cut-

off Date

Pool

Balance

(%) | | Previous

Securitization |

| 3 | | PCC | | 312 Elm | | Cincinnati | | OH | | Office | | $46,121,000 | | 4.4 | % | | WFRBS 2011-C3 |

| 4 | | RMF | | Marriott Greensboro | | Greensboro | | NC | | Hospitality | | 43,833,356 | | 4.2 | | | GECMC 2005-C4 |

| 5 | | RMF | | Capital Penn Self Storage Portfolio | | Various | | PA | | Self Storage | | 37,606,397 | | 3.6 | | | LBUBS 2006-C3 |

| 5.01 | | RMF | | Capital Self Storage - Mechanicsburg | | Mechanicsburg | | PA | | Self Storage | | 6,989,109 | | 0.7 | | | LBUBS 2006-C3 |

| 5.02 | | RMF | | Capital Self Storage - Enola | | Enola | | PA | | Self Storage | | 4,867,415 | | 0.5 | | | LBUBS 2006-C3 |

| 5.06 | | RMF | | Capital Self Storage - Harrisburg North | | Harrisburg | | PA | | Self Storage | | 3,993,776 | | 0.4 | | | MSC 2005-HQ7 |

| 5.07 | | RMF | | Capital Self Storage - Hanover | | Hanover | | PA | | Self Storage | | 3,244,943 | | 0.3 | | | LBUBS 2006-C3 |

| 5.08 | | RMF | | Capital Self Storage - Dover | | Dover | | PA | | Self Storage | | 3,145,099 | | 0.3 | | | LBUBS 2006-C3 |

| 6 | | WFB | | Albuquerque Plaza | | Albuquerque | | NM | | Office | | 34,925,241 | | 3.3 | | | GSMS 2005-GG4 |

| 13 | | LIG I | | Depot Park | | Sacramento | | CA | | Industrial | | 21,600,000 | | 2.1 | | | BSCMS 2005-T20 |

| 17 | | PCC | | 312 Plum | | Cincinnati | | OH | | Office | | 18,379,000 | | 1.8 | | | WFRBS 2011-C3 |

| 18 | | RMF | | Maple Leaf Apartments | | University Park | | IL | | Multifamily | | 18,150,000 | | 1.7 | | | BACM 2006-3 |

| 19.01 | | RMF | | Boca Hamptons Plaza | | Boca Raton | | FL | | Mixed Use | | 13,153,846 | | 1.3 | | | JPMCC 2005-CB11 |

| 19.03 | | RMF | | One Industrial Plaza | | South Valley Stream | | NY | | Industrial | | 2,284,615 | | 0.2 | | | JPMCC 2005-CB11 |

| 20 | | PCC | | Palms Plaza | | Boca Raton | | FL | | Retail | | 17,500,000 | | 1.7 | | | WBCMT 2005-C20 |

| 22 | | PCC | | Plaza Mayor Shopping Center | | Torrance | | CA | | Retail | | 15,952,821 | | 1.5 | | | CSFB 2005-C2 |

| 24 | | RMF | | Long Island Retail Portfolio | | Various | | NY | | Various | | 15,500,000 | | 1.5 | | | GECMC 2005-C1 |

| 28 | | WFB | | Casa Bandera Apartments | | Las Cruces | | NM | | Multifamily | | 13,100,000 | | 1.3 | | | WBCMT 2005-C16 |

| 31 | | WFB | | Breckenridge Apartments | | Phoenix | | AZ | | Multifamily | | 10,500,000 | | 1.0 | | | COMM 2012-CR1 |

| 39 | | WFB | | Crestline Manufactured Home Community | | Colorado Springs | | CO | | Manufactured Housing Community | | 8,385,756 | | 0.8 | | | BSC 2005-PWR8 |

| 46 | | CIIICM | | Planet Self Storage - Southampton | | Boston | | MA | | Self Storage | | 6,250,000 | | 0.6 | | | BSCMS 2006-T22 |

| 48 | | RMF | | Village Crossing | | Whitpain Township | | PA | | Mixed Use | | 5,784,260 | | 0.6 | | | GSMS 2005-GG4 |

| 51 | | RMF | | Chesapeake Mills | | Columbus | | OH | | Multifamily | | 5,478,902 | | 0.5 | | | LBUBS 2004-C6 |

| 52 | | WFB | | Comfort Suites Chesapeake | | Chesapeake | | VA | | Hospitality | | 5,438,782 | | 0.5 | | | MSC 2007-T27 |

| 53 | | RMF | | Country Club Apartments | | Shreveport | | LA | | Multifamily | | 5,331,419 | | 0.5 | | | BACM 2005-1 |

| 55 | | CIIICM | | Planet Self Storage - Newington | | Newington | | CT | | Self Storage | | 5,225,000 | | 0.5 | | | MSC 2007-IQ15 |

| 63 | | CIIICM | | Planet Self Storage - Washington | | Washington Township | | NJ | | Self Storage | | 4,450,000 | | 0.4 | | | BSCMS 2006-PW11 |

| 65 | | LIG I | | Arctic Gardens | | Anchorage | | AK | | Multifamily | | 4,000,000 | | 0.4 | | | BSCMS 2005-PWR8 |

| 68 | | CIIICM | | Planet Self Storage - Quakertown | | Quakertown | | PA | | Self Storage | | 3,850,000 | | 0.4 | | | BSCMS 2005-PW10 |

| 70 | | WFB | | Eureka Village | | Denton | | TX | | Multifamily | | 3,793,831 | | 0.4 | | | JPMCC 2005-LDP4 |

| 74 | | CIIICM | | Southland Plaza | | Adrian | | MI | | Retail | | 3,344,812 | | 0.3 | | | CSFB 2005-C1 |

| 76 | | CIIICM | | Planet Self Storage - South Boston | | Boston | | MA | | Self Storage | | 3,200,000 | | 0.3 | | | BSCMS 2005-PW10 |

| 77 | | CIIICM | | Planet Self Storage - Brookfield | | Brookfield | | CT | | Self Storage | | 3,150,000 | | 0.3 | | | BSCMS 2005-PW10 |

| 80 | | WFB | | Jamul Shopping Village | | Jamul | | CA | | Retail | | 2,993,572 | | 0.3 | | | MSC 2005-HQ6 |

| 83 | | LIG I | | Coulter Forum | | Amarillo | | TX | | Retail | | 2,885,000 | | 0.3 | | | MSC 2006-HQ9 |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Characteristics of the Mortgage Pool |

| 84 | | CIIICM | | Out O‘Space Storage | | Cantonment | | FL | | Self Storage | | 2,450,000 | | 0.2 | | | BACM 2006-5 |

| 87 | | CIIICM | | Lambertson Lakes | | Thornton | | CO | | Retail | | 2,100,000 | | 0.2 | | | CSFB 2005-C2 |

| 94 | | CIIICM | | Cookson MHP | | Brookshire | | TX | | Manufactured Housing Community | | 1,500,000 | | 0.1 | | | CSFB 2005-C1 |

| | | Total | | | | | | | | | | $410,457,953 | | 39.2 | % | | |

| (1) | The table above represents the most recent securitization with respect to the mortgaged property securing the related mortgage loan, based on information provided by the related borrower or obtained through searches of a third-party database. While the above mortgage loans may have been securitized multiple times in prior transactions, mortgage loans are only listed in the above chart if the mortgage loan in this securitization paid off a mortgage loan in another securitization. The information has not otherwise been confirmed by the mortgage loan sellers. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Characteristics of the Mortgage Pool |

E. Mortgage Loans with Scheduled Balloon Payments and Related Classes

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A-2(1) |

| Loan No. | | Mortgage

Loan

Seller | | Mortgage Loan Name | | State | | Property Type | | Mortgage Loan Cut-off Date Balance ($) | | % of Cut-

off Date

Pool

Balance

(%) | | Mortgage Loan

Balance at

Maturity ($) | | % of Class A-

2 Certificate

Principal

Balance

(%)(2) | | SF | | Loan per SF ($) | | U/W NCF DSCR (x) | | U/W NOI

Debt Yield

(%) | | Cut-off

Date LTV

Ratio (%) | | Balloon

LTV Ratio

(%) | | Rem. IO

Period

(mos.) | | Rem.

Term to

Maturity

(mos.) |

| 45 | | Basis | | FedEx Portfolio Oxford, AL & El Dorado, AR | | Various | | Industrial | | $7,000,000 | | | 0.7 | % | | $6,658,891 | | | 83.9 | % | | 96,112 | | $73 | | 1.36x | | 8.8 | % | | 70.7 | % | | 67.3 | % | | 23 | | 59 |

| Total/Weighted Average | | | | | | $7,000,000 | | | 0.7 | % | | $6,658,891 | | | 83.9 | % | | | | | | 1.36x | | 8.8 | % | | 70.7 | % | | 67.3 | % | | 23 | | 59 |

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-2 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions“ described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates, including the Class A-2 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

| (2) | Reflects the percentage equal to the Mortgage Loan Balance at Maturity divided by the initial Class A-2 Certificate Principal Balance. |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Class A-3(1) |

| Loan No. | | Mortgage

Loan

Seller | | Mortgage Loan Name | | State | | Property Type | | Mortgage Loan Cut-off Date Balance ($) | | % of Cut-

off Date

Pool

Balance

(%) | | Mortgage Loan

Balance at

Maturity ($) | | % of Class A-

3 Certificate

Principal

Balance

(%)(2) | | SF | | Loan per SF ($) | | U/W NCF

DSCR (x) | | U/W NOI

Debt Yield

(%) | | Cut-off

Date LTV

Ratio (%) | | Balloon

LTV Ratio

(%) | | Rem. IO

Period

(mos.) | | Rem.

Term to

Maturity

(mos.) |

| 5 | | RMF | | Capital Penn Self Storage Portfolio | | PA | | Self Storage | | $37,606,397 | | | 3.6 | % | | $33,014,110 | | | 90.7 | % | | 592,854 | | $63 | | 1.72x | | 10.8 | % | | 69.5 | % | | 61.0 | % | | 0 | | 83 |

| 71 | | WFB | | Watson & Taylor Self Storage | | TX | | Self Storage | | 3,646,000 | | | 0.3 | | | 3,404,056 | | | 9.3 | | | 56,275 | | $65 | | 1.33 | | 8.3 | | | 67.5 | | | 63.0 | | | 34 | | 82 |

| Total/Weighted Average | | | | | | $41,252,397 | | | 3.9 | % | | $36,418,166 | | | 100.0 | % | | | | | | 1.69x | | 10.6 | % | | 69.3 | % | | 61.2 | % | | 3 | | 83 |

| (1) | The table above presents the mortgage loan(s) whose balloon payments would be applied to pay down the principal balance of the Class A-3 Certificates, assuming a 0% CPR and applying the “Structuring Assumptions” described in the Free Writing Prospectus, including the assumptions that (i) none of the mortgage loans in the pool experience prepayments prior to maturity, defaults or losses; (ii) there are no extensions of maturity dates of any mortgage loans in the pool; and (iii) each mortgage loan in the pool is paid in full on its stated maturity date. Each Class of Certificates, including the Class A-3 Certificates, evidences undivided ownership interests in the entire pool of mortgage loans. Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

| (2) | Reflects the percentage equal to the Mortgage Loan Balance at Maturity divided by the initial Class A-3 Certificate Principal Balance. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

(THIS PAGE INTENTIONALLY LEFT BLANK)

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Characteristics of the Mortgage Pool |

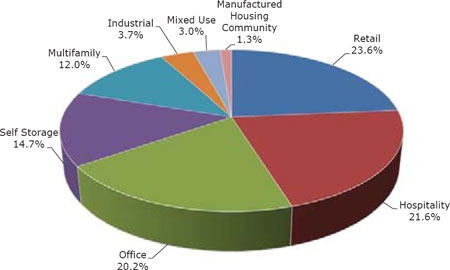

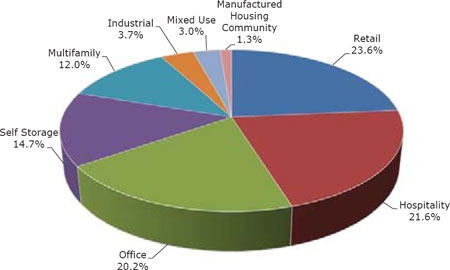

F. Property Type Distribution(1)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Property Type | | Number of Mortgaged Properties | | Aggregate Cut-off Date Balance ($) | | % of

Cut-off

Date

Balance

(%) | | Weighted

Average

Cut-off

Date LTV

Ratio (%) | | Weighted

Average

Balloon LTV

Ratio (%) | | Weighted

Average

U/W NCF

DSCR (x) | | Weighted

Average

U/W NOI

Debt

Yield

(%) | | Weighted

Average

U/W NCF

Debt

Yield

(%) | | Weighted

Average

Mortgage

Rate (%) |

| Retail | | 25 | | $247,391,262 | | 23.6 | % | | 66.1 | % | | 58.2 | % | | 1.78x | | | 9.7 | % | | 9.1 | % | | 4.182 | % |

| Anchored | | 9 | | 78,653,026 | | 7.5 | | | 70.1 | | | 59.6 | | | 1.47 | | | 9.4 | | | 8.7 | | | 4.291 | |

| Regional Mall | | 1 | | 62,500,000 | | 6.0 | | | 59.0 | | | 59.0 | | | 2.61 | | | 10.8 | | | 10.2 | | | 3.853 | |

| Shadow Anchored | | 3 | | 41,263,400 | | 3.9 | | | 70.6 | | | 57.9 | | | 1.32 | | | 8.3 | | | 7.8 | | | 4.291 | |

| Single Tenant | | 5 | | 40,486,264 | | 3.9 | | | 61.8 | | | 54.0 | | | 1.68 | | | 9.5 | | | 9.1 | | | 4.205 | |

| Unanchored | | 7 | | 24,488,572 | | 2.3 | | | 70.6 | | | 59.2 | | | 1.60 | | | 10.6 | | | 9.8 | | | 4.448 | |

| Hospitality | | 15 | | 225,902,753 | | 21.6 | | | 66.7 | | | 56.2 | | | 1.77 | | | 12.0 | | | 10.8 | | | 4.468 | |

| Limited Service | | 12 | | 133,044,397 | | 12.7 | | | 65.6 | | | 55.4 | | | 1.82 | | | 12.3 | | | 11.1 | | | 4.422 | |

| Full Service | | 3 | | 92,858,356 | | 8.9 | | | 68.2 | | | 57.4 | | | 1.69 | | | 11.5 | | | 10.3 | | | 4.534 | |

| Office | | 12 | | 211,198,396 | | 20.2 | | | 67.9 | | | 56.7 | | | 1.58 | | | 10.7 | | | 9.5 | | | 4.244 | |

| CBD | | 5 | | 147,890,733 | | 14.1 | | | 68.4 | | | 56.7 | | | 1.61 | | | 11.0 | | | 9.7 | | | 4.197 | |

| Suburban | | 6 | | 49,307,663 | | 4.7 | | | 66.6 | | | 56.5 | | | 1.52 | | | 10.2 | | | 9.2 | | | 4.435 | |

| Single Tenant | | 1 | | 14,000,000 | | 1.3 | | | 67.7 | | | 57.1 | | | 1.56 | | | 9.9 | | | 9.0 | | | 4.070 | |

| Self Storage | | 35 | | 154,250,129 | | 14.7 | | | 67.4 | | | 58.8 | | | 1.56 | | | 9.5 | | | 9.3 | | | 4.318 | |

| Self Storage | | 35 | | 154,250,129 | | 14.7 | | | 67.4 | | | 58.8 | | | 1.56 | | | 9.5 | | | 9.3 | | | 4.318 | |

| Multifamily | | 20 | | 126,063,730 | | 12.0 | | | 70.4 | | | 59.5 | | | 1.49 | | | 9.8 | | | 9.0 | | | 4.388 | |

| Garden | | 18 | | 103,963,730 | | 9.9 | | | 70.7 | | | 59.8 | | | 1.49 | | | 10.0 | | | 9.0 | | | 4.444 | |

| Student Housing | | 1 | | 13,100,000 | | 1.3 | | | 69.3 | | | 58.6 | | | 1.53 | | | 9.5 | | | 8.9 | | | 4.150 | |

| High Rise | | 1 | | 9,000,000 | | 0.9 | | | 68.7 | | | 58.0 | | | 1.48 | | | 8.8 | | | 8.6 | | | 4.080 | |

| Industrial | | 7 | | 38,446,154 | | 3.7 | | | 64.5 | | | 61.7 | | | 2.02 | | | 11.4 | | | 10.0 | | | 4.445 | |

| Warehouse | | 2 | | 24,161,538 | | 2.3 | | | 60.9 | | | 60.0 | | | 2.37 | | | 12.5 | | | 10.7 | | | 4.371 | |

| Industrial | | 2 | | 7,000,000 | | 0.7 | | | 70.7 | | | 67.3 | | | 1.36 | | | 8.8 | | | 8.3 | | | 4.500 | |

| Light Industrial | | 2 | | 5,000,000 | | 0.5 | | | 71.4 | | | 62.7 | | | 1.55 | | | 11.2 | | | 9.6 | | | 4.600 | |

| Flex | | 1 | | 2,284,615 | | 0.2 | | | 68.2 | | | 60.0 | | | 1.40 | | | 9.5 | | | 8.7 | | | 4.720 | |

| Mixed Use | | 6 | | 31,297,137 | | 3.0 | | | 68.1 | | | 57.9 | | | 1.44 | | | 9.6 | | | 8.8 | | | 4.542 | |

| Retail/Office | | 4 | | 24,778,639 | | 2.4 | | | 69.0 | | | 58.4 | | | 1.44 | | | 9.7 | | | 8.8 | | | 4.578 | |

| Office/Retail | | 2 | | 6,518,498 | | 0.6 | | | 64.4 | | | 56.3 | | | 1.43 | | | 9.5 | | | 8.6 | | | 4.406 | |

| Manufactured Housing Community | | 4 | | 13,278,474 | | 1.3 | | | 66.5 | | | 52.7 | | | 1.64 | | | 10.0 | | | 9.8 | | | 4.177 | |

| Manufactured Housing Community | | 4 | | 13,278,474 | | 1.3 | | | 66.5 | | | 52.7 | | | 1.64 | | | 10.0 | | | 9.8 | | | 4.177 | |

| Total/Weighted Average | | 124 | | $1,047,828,035 | | 100.0 | % | | 67.3 | % | | 57.8 | % | | 1.67 | x | | 10.5 | % | | 9.6 | % | | 4.321 | % |

| (1) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to the Westfield Palm Desert mortgage loan, the Depot Park mortgage loan and the Boca Hamptons Plaza Portfolio mortgage loan, each of which is part of a pari passu loan combination, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property) that is allowed under the terms of any mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

Wells Fargo Commercial Mortgage Trust 2015-C27 | Characteristics of the Mortgage Pool |

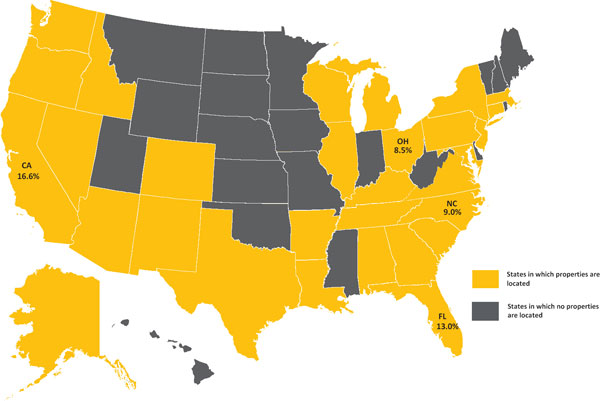

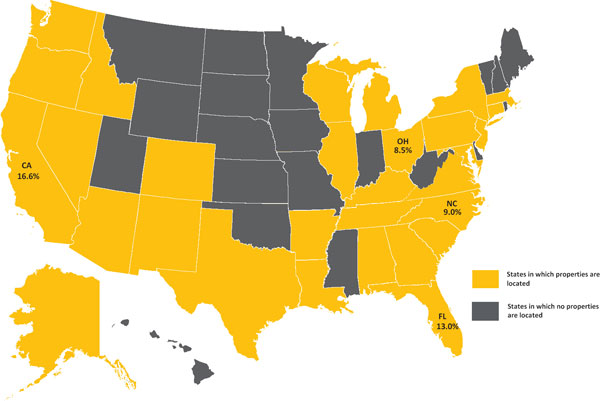

G. Geographic Distribution(1)(2)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

Location(3) | | Number of Mortgaged Properties | | Aggregate Cut- off Date

Balance ($) | | % of Cut-

off Date

Balance

(%) | | Weighted

Average

Cut-off

Date LTV

Ratio (%) | | Weighted

Average

Balloon

LTV Ratio

(%) | | Weighted

Average

U/W NCF

DSCR (x) | Weighted

Average

U/W NOI

Debt Yield

(%) | | Weighted

Average

U/W NCF

Debt Yield

(%) | | Weighted

Average

Mortgage

Rate (%) |

| California | | 10 | | $174,288,088 | | | 16.6 | % | | 61.0 | % | | 56.1 | % | | 2.06 | x | | 10.4 | % | | 9.6 | % | | 4.097 | % |

| Southern | | 7 | | 126,688,088 | | | 12.1 | | | 60.5 | | | 56.2 | | | 2.11 | | | 10.1 | | | 9.6 | | | 4.051 | |

| Northern | | 3 | | 47,600,000 | | | 4.5 | | | 62.2 | | | 55.9 | | | 1.94 | | | 11.1 | | | 9.9 | | | 4.218 | |

| Florida | | 17 | | 136,444,441 | | | 13.0 | | | 66.2 | | | 58.3 | | | 1.65 | | | 10.7 | | | 9.9 | | | 4.385 | |

| North Carolina | | 4 | | 94,166,356 | | | 9.0 | | | 68.1 | | | 58.2 | | | 1.63 | | | 11.0 | | | 9.9 | | | 4.490 | |

| Ohio | | 7 | | 88,545,642 | | | 8.5 | | | 69.8 | | | 59.6 | | | 1.71 | | | 11.7 | | | 10.2 | | | 4.356 | |

Other(4) | | 86 | | 554,383,508 | | | 52.9 | | | 69.0 | | | 57.8 | | | 1.55 | | | 10.1 | | | 9.4 | | | 4.342 | |

| Total/Weighted Average | | 124 | | $1,047,828,035 | | | 100.0 | % | | 67.3 | % | | 57.8 | % | | 1.67 | x | | 10.5 | % | | 9.6 | % | | 4.321 | % |

| (1) | The Mortgaged Properties are located in 30 states. |

| (2) | Because this table presents information relating to the mortgaged properties and not the mortgage loans, the information for mortgage loans secured by more than one mortgaged property is based on allocated amounts (allocating the mortgage loan principal balance to each of those properties according to the relative appraised values of the mortgaged properties or the allocated loan amounts or property-specific release prices set forth in the related mortgage loan documents or such other allocation as the related mortgage loan seller deemed appropriate). With respect to the Westfield Palm Desert mortgage loan, the Depot Park mortgage loan and the Boca Hamptons Plaza Portfolio mortgage loan, each of which is part of a pari passu loan combination, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

| (3) | For purposes of determining whether a mortgaged property is in Northern California or Southern California, Northern California includes areas with zip codes above 93600 and Southern California includes areas with zip codes of 93600 and below. |

| (4) | Includes 26 other states. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2015-C27 | Characteristics of the Mortgage Pool |

H. Characteristics of the Mortgage Pool(1)

| CUT-OFF DATE BALANCE | |

Range of Cut-off Date Balances ($) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| 1,092,718 - 2,000,000 | 7 | $12,071,545 | 1.2 | % |

| 2,000,001 - 3,000,000 | 11 | 28,942,563 | 2.8 | |

| 3,000,001 - 4,000,000 | 13 | 47,023,467 | 4.5 | |

| 4,000,001 - 5,000,000 | 8 | 37,910,390 | 3.6 | |

| 5,000,001 - 6,000,000 | 10 | 54,831,030 | 5.2 | |

| 6,000,001 - 7,000,000 | 2 | 13,250,000 | 1.3 | |

| 7,000,001 - 8,000,000 | 3 | 22,477,172 | 2.1 | |

| 8,000,001 - 9,000,000 | 5 | 42,725,006 | 4.1 | |

| 9,000,001 - 10,000,000 | 5 | 48,607,555 | 4.6 | |

| 10,000,001 - 15,000,000 | 7 | 90,184,000 | 8.6 | |

| 15,000,001 - 20,000,000 | 10 | 174,508,821 | 16.7 | |

| 20,000,001 - 30,000,000 | 8 | 202,171,492 | 19.3 | |

| 30,000,001 - 50,000,000 | 5 | 210,624,994 | 20.1 | |

| 50,000,001 - 62,500,000 | 1 | 62,500,000 | 6.0 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

| Average: | $11,029,769 | | | |

| UNDERWRITTEN NOI DEBT SERVICE COVERAGE RATIO | |

Range of U/W NOI DSCRs (x) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| 1.34 - 1.40 | 6 | $59,391,031 | 5.7 | % |

| 1.41 - 1.50 | 15 | 126,568,281 | 12.1 | |

| 1.51 - 1.60 | 15 | 142,040,666 | 13.6 | |

| 1.61 - 1.70 | 16 | 136,162,248 | 13.0 | |

| 1.71 - 1.80 | 15 | 131,579,484 | 12.6 | |

| 1.81 - 1.90 | 10 | 126,900,707 | 12.1 | |

| 1.91 - 2.00 | 6 | 81,389,572 | 7.8 | |

| 2.01 - 2.25 | 9 | 154,405,000 | 14.7 | |

| 2.26 - 2.50 | 1 | 5,291,046 | 0.5 | |

| 2.51 - 2.91 | 2 | 84,100,000 | 8.0 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

| Weighted Average: | 1.82x | | | |

| UNDERWRITTEN NCF DEBT SERVICE COVERAGE RATIO | |

Range of U/W NCF DSCRs (x) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| 1.26 - 1.30 | 4 | $54,884,240 | 5.2 | % |

| 1.31 - 1.40 | 16 | 135,235,049 | 12.9 | |

| 1.41 - 1.50 | 20 | 162,263,818 | 15.5 | |

| 1.51 - 1.60 | 21 | 177,812,606 | 17.0 | |

| 1.61 - 1.70 | 16 | 183,694,308 | 17.5 | |

| 1.71 - 1.80 | 7 | 151,648,397 | 14.5 | |

| 1.81 - 1.90 | 3 | 47,122,572 | 4.5 | |

| 1.91 - 2.25 | 5 | 45,776,000 | 4.4 | |

| 2.26 - 2.50 | 2 | 26,891,046 | 2.6 | |

| 2.51 - 2.61 | 1 | 62,500,000 | 6.0 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

| Weighted Average: | 1.67x | | | |

| LOAN PURPOSE | |

| Loan Purpose | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| Refinance | 66 | $605,531,450 | 57.8 | % |

| Acquisition | 29 | 442,296,585 | 42.2 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

| MORTGAGE RATE | |

Range of Mortgage Rates (%) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| 3.840 - 4.000 | 3 | $76,176,802 | 7.3 | % |

| 4.001 - 4.250 | 36 | 396,353,516 | 37.8 | |

| 4.251 - 4.500 | 28 | 350,447,671 | 33.4 | |

| 4.501 - 4.750 | 21 | 192,471,478 | 18.4 | |

| 4.751 - 5.000 | 6 | 27,047,149 | 2.6 | |

| 5.001 - 5.220 | 1 | 5,331,419 | 0.5 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

| Weighted Average: | 4.321% | | | |

| UNDERWRITTEN NOI DEBT YIELD | |

Range of U/W NOI Debt Yields (%) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| 7.8 - 8.0 | 2 | $45,552,821 | 4.3 | % |

| 8.1 - 9.0 | 18 | 168,877,164 | 16.1 | |

| 9.1 - 10.0 | 29 | 236,487,554 | 22.6 | |

| 10.1 - 11.0 | 18 | 218,281,453 | 20.8 | |

| 11.1 - 12.0 | 16 | 255,050,643 | 24.3 | |

| 12.1 - 13.0 | 7 | 84,261,354 | 8.0 | |

| 13.1 - 13.5 | 5 | 39,317,046 | 3.8 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

| Weighted Average: | 10.5% | | | |

| UNDERWRITTEN NCF DEBT YIELD | |

Range of U/W NCF Debt Yields (%) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| 7.4 - 8.0 | 6 | $101,218,313 | 9.7 | % |

| 8.1 - 9.0 | 36 | 293,381,367 | 28.0 | |

| 9.1 - 10.0 | 28 | 226,191,727 | 21.6 | |

| 10.1 - 11.0 | 14 | 329,404,292 | 31.4 | |

| 11.1 - 12.0 | 6 | 71,100,718 | 6.8 | |

| 12.1 - 13.0 | 2 | 17,440,572 | 1.7 | |

| 13.1 - 13.4 | 3 | 9,091,046 | 0.9 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

| Weighted Average: | 9.6% | | | |

(1) | With respect to the Westfield Palm Desert mortgage loan, the Depot Park mortgage loan and the Boca Hamptons Plaza Portfolio mortgage loan, each of which is part of a pari passu loan combination, loan-to-value ratio, debt service coverage ratio and debt yield calculations include the related pari passu companion loan(s) (unless otherwise stated). Debt service coverage ratio, debt yield and loan-to-value ratio information takes no account of subordinate debt (whether or not secured by the related mortgaged property), if any, that is allowed under the terms of any mortgage loan. See Annex A-1 to the Free Writing Prospectus. |

THE INFORMATION IN THIS STRUCTURAL AND COLLATERAL TERM SHEET IS NOT COMPLETE AND MAY BE AMENDED PRIOR TO THE TIME OF SALE. THIS TERM SHEET IS NOT AN OFFER TO SELL THESE SECURITIES AND IT IS NOT A SOLICITATION OF AN OFFER TO BUY THESE SECURITIES IN ANY JURISDICTION WHERE THE OFFER OR SALE IS NOT PERMITTED.

| Wells Fargo Commercial Mortgage Trust 2015-C27 | Characteristics of the Mortgage Pool |

| ORIGINAL TERM TO MATURITY | |

Range of Original Terms to Maturity (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| 60 | 1 | $7,000,000 | 0.7 | % |

| 61 - 84 | 2 | 41,252,397 | 3.9 | |

| 85 - 120 | 92 | 999,575,638 | 95.4 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

| Weighted Average: | 118 months | | | |

| REMAINING TERM TO MATURITY | |

Range of Remaining Terms to Maturity (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| 59 - 60 | 1 | $7,000,000 | 0.7 | % |

| 61 - 84 | 2 | 41,252,397 | 3.9 | |

| 85 - 120 | 92 | 999,575,638 | 95.4 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

| Weighted Average: | 117 months | | | |

ORIGINAL AMORTIZATION TERM(2) | |

Range of Original Amortization Terms (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| Interest-Only | 3 | $95,850,000 | 9.1 | % |

| 264 - 300 | 8 | 69,550,313 | 6.6 | |

| 301 - 360 | 84 | 882,427,722 | 84.2 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

Weighted Average(3): | 355 months | | | |

| (2) | The original amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

| (3) | Excludes the non-amortizing mortgage loans. |

REMAINING AMORTIZATION TERM(4) | |

Range of Remaining Amortization Terms (months) | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date Balance |

| Interest-Only | 3 | $95,850,000 | 9.1 | % |

| 264 - 300 | 8 | 69,550,313 | 6.6 | |

| 301 - 360 | 84 | 882,427,722 | 84.2 | |

| Total: | 95 | $1,047,828,035 | 100.0 | % |

Weighted Average(5): | 355 months | | | |

| (4) | The remaining amortization term shown for any mortgage loan that is interest-only for part of its term does not include the number of months in its interest-only period and reflects only the number of months as of the commencement of amortization remaining from the end of such interest-only period. |

| (5) | Excludes the non-amortizing mortgage loans. |

| LOCKBOXES | |

| Type of Lockbox | Number of Mortgage Loans | Aggregate Cut- off Date Balance | % of Cut-off

Date

Balance |

| Springing (Without Established Account) | 60 | $632,314,577 | 60.3 | % |

| Hard/Springing Cash Management | 14 | 284,304,691 | 27.1 | |

| None | 19 | 89,283,526 | 8.5 | |