As filed with the Securities and Exchange Commission on April 17, 2015

File No.

U.S. SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 10

GENERAL FORM FOR REGISTRATION OF SECURITIES

PURSUANT TO SECTION 12(b) OR 12(g) OF THE SECURITIES EXCHANGE ACT OF 1934

Audax Credit BDC Inc.

(Exact name of registrant as specified in charter)

Delaware | 47-3039124 |

| (State or other jurisdiction of incorporation or registration) | (I.R.S. Employer Identification No.) |

| | |

101 Huntington Avenue, Boston, Massachusetts | 02199 |

| (Address of principal executive offices) | (Zip Code) |

| | |

(617) 859-1500 |

| |

| (Registrant’s telephone number, including area code) |

with copies to: |

Kevin Magid Michael McGonigle Audax Management Company (NY), LLC 101 Huntington Avenue Boston, MA 02199 (617) 859-1500 | | Thomas Friedmann William Bielefeld

Dechert LLP 1900 K Street, NW

Washington, DC 20006

(202) 261-3300 |

Securities to be registered pursuant to Section 12(b) of the Act:

None

Securities to be registered pursuant to Section 12(g) of the Act:

Common Stock, par value $.001 per share

(Title of class)

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, or a smaller reporting company. See definitions of “large accelerated filer,” “accelerated filer” and “smaller reporting company” in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer | £ | Accelerated filer | £ |

| | | | |

| Non-accelerated filer | þ (do not check if a smaller reporting company) | Smaller reporting company | £ |

TABLE OF CONTENTS

Explanatory Note

Audax Credit BDC Inc. is filing this registration statement on Form 10 (the “Registration Statement”) with the Securities and Exchange Commission (the “SEC”) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), on a voluntary basis in order to permit it to file an election to be regulated as a business development company (a “BDC”) under the Investment Company Act of 1940, as amended (the “1940 Act”), and to provide current public information to the investment community and comply with applicable requirements for the possible future quotation or listing of its securities on a national securities exchange or other public trading market.

In this Registration Statement, except where the context suggests otherwise, the terms “we,” “us,” “our,” and the “Company” refer to Audax Credit BDC Inc. We refer to Audax Management Company (NY), LLC, our investment adviser, as our “Adviser,” and Audax Management Company, LLC, our administrator, as our “Administrator.” The term “stockholders” refers to holders of our common stock, $.001 par value per share (the “Common Stock”). The term “Shares” refers to the shares of Common Stock.

Once this Registration Statement has been deemed effective, we will be subject to the requirements of Section 13(a) of the Exchange Act, including the rules and regulations promulgated under the Exchange Act, which will require us, among other things, to file annual reports on Form 10-K, quarterly reports on Form 10-Q, and current reports on Form 8-K. We will also be required to comply with all other obligations of the Exchange Act applicable to issuers filing registration statements pursuant to Section 12(g) of the Exchange Act.

Shortly after the effectiveness of this Registration Statement, we intend to file an election to be regulated as a BDC under the 1940 Act. Upon filing of such election, we will become subject to the 1940 Act requirements applicable to BDCs.

Forward-Looking Statements

This Registration Statement contains forward-looking statements that involve substantial risks and uncertainties. Such statements involve known and unknown risks, uncertainties and other factors and undue reliance should not be placed thereon. These forward-looking statements are not historical facts, but rather are based on current expectations, estimates and projections about our company, our current and prospective portfolio investments, our industry, our beliefs and our assumptions. Words such as “anticipates,” “expects,” “intends,” “plans,” “will,” “may,” “continue,” “believes,” “seeks,” “estimates,” “would,” “could,” “should,” “targets,” “projects,” and variations of these words and similar expressions are intended to identify forward-looking statements. These statements are not guarantees of future performance and are subject to risks, uncertainties and other factors, some of which are beyond our control and difficult to predict and could cause actual results to differ materially from those expressed or forecasted in the forward-looking statements, including:

| · | our future operating results; |

| · | our business prospects and the prospects of our portfolio companies; |

| · | changes in the general economy; |

| · | risk associated with possible disruptions in our operations or the economy generally; |

| · | the effect of investments that we expect to make; |

| · | our contractual arrangements and relationships with third parties; |

| · | actual and potential conflicts of interest with our Adviser and its affiliates; |

| · | the dependence of our future success on the general economy and its effect on the industries in which we invest; |

| · | the ability of our portfolio companies to achieve their objectives; |

| · | the use of borrowed money to finance a portion of our investments; |

| · | the adequacy of our financing sources and working capital; |

| · | the timing of cash flows, if any, from the operations of our portfolio companies; |

| · | the ability of our Adviser to locate suitable investments for us and to monitor and administer our investments; |

| · | the ability of our Adviser and its affiliates to attract and retain highly talented professionals; |

| · | our ability to qualify and maintain our qualification as a BDC and as a regulated investment company (“RIC”); and |

| · | the risks, uncertainties and other factors we identify under “Item 1A. Risk Factors” and elsewhere in this Registration Statement. |

Although we believe that the assumptions on which these forward-looking statements are based are reasonable, any of those assumptions could prove to be inaccurate, and as a result, the forward-looking statements based on those assumptions also could be inaccurate. In light of these and other uncertainties, the inclusion of a projection or forward-looking statement in this Registration Statement should not be regarded as a representation by us that our plans and objectives will be achieved. These risks and uncertainties include those described or identified in the section entitled “Item 1A. Risk Factors” and elsewhere in this Registration Statement. You should not place undue reliance on these forward-looking statements, which apply only as of the date of this Registration Statement. Moreover, we assume no duty and do not undertake to update the forward-looking statements. The forward-looking statements and projections contained in this Registration Statement are excluded from the safe harbor protection provided by Section 21E of the Exchange Act.

We will be an externally managed specialty finance company that is a non-diversified, closed-end management investment company and we intend to file an election to be regulated as a BDC under the 1940 Act. Our investment objective is to generate current income and, to a lesser extent, long-term capital appreciation. We intend to meet our investment objective by investing primarily in senior secured debt of privately owned U.S. middle-market companies. For purposes of this Registration Statement, we define “middle-market companies” to be companies that, in general, generate less than $500 million in annual revenue or less than $75 million of annual earnings before interest, taxes, depreciation and amortization, or EBITDA, and we define “broadly syndicated loans” to be, in general, loans to companies generating substantially more than $50 million of annual EBITDA.

Although we have no present intention of doing so, we may decide to incur indebtedness, for the purpose of funding investments and for general corporate purposes, which we refer to as “leverage.” If we do incur leverage, however, we anticipate that it will be used in limited circumstances and on a short-term basis for purposes such as funding distributions. As a BDC, we will be limited in our use of leverage under the 1940 Act. Specifically, as a BDC we will only be allowed to borrow amounts such that our asset coverage, as defined in the 1940 Act, is at least 200% after such borrowing. In determining whether to use leverage, we expect to analyze the maturity, covenants and interest rate structure of the proposed borrowings, as well as the risks of such borrowings within the context of our investment outlook and the impact of leverage on our investment portfolio. The amount of any leverage that we will employ as a BDC will be subject to oversight by our Board of Directors.

Investment Strategy

We intend to focus our investment strategy primarily on sourcing investments in privately owned U.S. middle-market companies as we seek to construct a portfolio that generates attractive, reliable risk-adjusted returns. We plan to seek such returnsby taking advantage of perceived premium pricing and attractive loan structures available in middle-market debt instruments.

Key Elements of Investment Strategy

We intend to implement the following investment strategy:

| · | invest primarily in first lien senior secured loans and selectively in second lien loans to U.S. middle-market companies to take advantage of what we perceive to be higher pricing, more attractive structures and lower volatility than other fixed income investments, including larger, broadly syndicated loans; |

| · | utilize our Adviser’s investment team’s experience in middle-market debt investing; the senior team members average 30 years of middle-market debt investing through all phases of the credit cycle; |

| · | benefit from the broad deal sourcing capabilities and due diligence insights of the platform developed by our Adviser and its affiliates (together, “Audax Group”), as well as Audax Group’s primary research model and expertise in investing at each level of the capital structure of portfolio companies; |

| · | perform thorough credit analyses on investment opportunities with a focus on principal preservation and downside protection; |

| · | build a diversified portfolio of investments by company and industry; and |

| · | rigorously monitor company and portfolio performance. |

The Company intends to lend directly to borrowers, and to structure its investments to include fixed repayment schedules and extensive contractual rights and remedies. We do not expect to invest in structured products and investments and intend to focus on cash-pay instruments that pay interest on a monthly or quarterly basis, typically with maturities of between five and seven years. Such first lien senior secured loans typically do not include equity co-investments, warrants, or payment-in-kind, or “PIK”, payment terms. However, to the extent we invest in securities ranking more junior in a borrower’s capital structure, which we do not expect to be a focus of our portfolio, such investments may include some or all of these attributes.

We will typically require a pledge of all of the tangible and intangible assets of borrowers as collateral to secure our loans. As a result, we and other lenders in such first lien senior secured loans, will have a first priority secured claim on all tangible and intangible assets of such borrowers, including the proceeds of any sale of assets, should the borrower default on its obligations under such first lien senior secured loans. Such claim would rank senior in the capital structure of our borrowers ahead of all junior, subordinated and/or unsecured creditors.

We anticipate that our loans will be priced primarily on a floating rate basis, with interest rates calculated on the basis of a fixed interest rate spread over a specified base rate. While the London Interbank Offered Rate, or LIBOR, is the most commonly used base rate, we may also offer the prime rate as an option for borrowers. Our loan pricing will be influenced by several factors, including the industry of the borrower, the leverage of our loan and of the borrower’s overall capital structure, the equity contribution of the sponsor, if any, in the borrower’s capital, and general market conditions. We also anticipate including in our loan terms a yield enhancement device commonly referred to as a “LIBOR Floor.” This feature, which first appeared in the debt markets in 2008, sets a minimum rate to be used as the LIBOR or prime rate component of the loan’s interest rate calculation. As of the date of this Registration Statement, LIBOR floors in new loan agreements ranged from 1.00% to 1.25% per annum, as compared to the one-month and three-month LIBOR of 0.15% and 0.23%, respectively, on such date.

An additional component of return on the loans we expect to purchase is an upfront or closing fee. This yield enhancement could also come in the form of a discount to the purchase price when we purchase loans in the secondary market. When in discount form, this component is a form of deferred income that we will realize over time or upon final repayment of the loan. Such original issue discount, or “OID”, or closing fees serve to enhance the return on our investments. As of the date of this Registration Statement, market rates for fees or OID can enhance the rate of return on a loan over its stated interest rate by 0.5% to 2.0% per annum.

We believe our proven deal sourcing capabilities, combined with our focus on prudent lending practices, will enable us to identify investments with the potential for attractive current returns and downside protection. Our focus on the middle-market should create opportunities for us to invest in companies with more conservative capital structures and higher historic recovery rates than those generally found in larger, broadly syndicated transactions.

Middle-Market Senior Loan Opportunities

Several factors drive the appeal of middle-market senior loan investment opportunities:

Borrowers are proven companies with limited access to capital. The U.S. middle-market companies in which we intend to invest are seasoned companies with attractive credit profiles, including a demonstrated history of positive earnings and free cash flow. For these borrowers, however, their relatively smaller size often means they have difficulty accessing the high yield bond market or other public capital markets.

Attractive annualized returns.Because U.S. middle-market companies typically have fewer options to raise capital, we believe we can earn higher yields on loans to such companies as compared to loans to larger companies in the broadly syndicated loan market. Accordingly, we expect our middle-market loans to offer higher interest rate spreads, lower leverage levels, and higher historic recovery rates than broadly syndicated loans.

More favorable terms than broadly syndicated loans. We also believe that the same market dynamics will enable us to negotiate more conservative loan structures, including stronger collateral packages and financial covenants and lower leverage, than comparable broadly syndicated loans.

Floating rate instruments.Middle-market loans are typically priced at a spread above LIBOR, with minimal interest rate duration. We believe floating rate instruments will provide our stockholders with a level of protection against any increase in the general level of interest rates. In addition, LIBOR “floors” (a minimum base interest rate) offer protection in a continuing low interest rate environment.

Low correlation with public fixed income and equities. Based on the historical performance of middle-market loan indices, we expect that our portfolio will have a relatively low correlation with the returns of public fixed income and public equities indexes.

Favorable position in capital structure with downside protection. First lien senior loans of the type we intend to make have a favorable position at the top of the borrower’s capital structure. In addition, such loans are typically secured by a first priority lien on the assets of the borrowers. These factors should increase our recovery in the event of a loan default.

We believe the returns we can generate from current yield, fees, and/or OID on senior secured loans in the current credit market environment are attractive on a risk-adjusted basis and a historical basis. We also believe the changing dynamics of the lending environment over the past several years have made lending to U.S. middle-market companies an increasingly attractive investment opportunity. A multi-year trend of consolidation in the U.S. banking sector has resulted in fewer traditional lenders focused on lending to middle-market companies. As the banking industry has consolidated, banks have grown larger, and we believe the remaining banks have focused their lending activities on larger, broadly syndicated transactions to achieve the revenue and operating requirements required by their scale.

Compounding the challenge of bank consolidation for U.S. middle-market borrowers, several large independent specialty finance lenders have been acquired or have exited the business. Furthermore, we believe that banks have come to depend more on the activities of private equity groups to generate leveraged loan activity. As the number and size of private equity funds has grown, the size of leveraged buyout transactions and related financing arrangements have increased commensurately. This has contributed, in turn, to pressure on banks to seek ever-larger transactions to generate fees and increase demand for other banking services. In our view, the consolidation of available lenders and the period of dislocation in the credit markets following the 2008 downturn has resulted in higher yields and more conservative capital structures for middle-market companies, resulting in attractive lending opportunities for investors in middle-market loans.

We believe the focus of many senior loan investment strategies and of high yield managers with bank loan allocations is to acquire easily accessible broadly syndicated loans. Below we outline the key distinctions between middle-market loans and broadly syndicated loans.

Middle-market loans generally earn a premium over broadly syndicated loans. From January 1997 through September 2014, the loan spread premium of middle-market loans over broadly syndicated loans ranged between seven basis points and 211 basis points. Over that same period, the average spread of middle-market loans was 74 basis points higher than the average spread of broadly syndicated loans. As of September 30, 2014, the interest rate spread gap was near historically wide levels, with middle-market loans earning on average 194 basis points more than broadly syndicated loans during the twelve months ending September 30, 2014.

Middle-market loans generally benefit from lower leverage. Over the period from 1999 through the end of 2014, the difference in the ratio of Total Debt to EBITDA for middle-market and broadly syndicated loans generally ranged between 0.1x and 0.9x. On average, the Total Debt to EBITDA ratio for middle-market loans was 0.6x lower than broadly syndicated loans during that 15-year period.

Middle-market loans have had higher recovery rates than broadly syndicated loans and bonds. Between 1987 and 2009, defaulted middle-market loans had an average recovery rate of 86%, compared to 81% for broadly syndicated loans and 64% for senior secured bonds. The largest portion of the high yield debt market, senior subordinated notes, had a 29% recovery rate during the same period. We believe these higher recovery rates resulted from more conservative capital structures and loan documentation used for middle-market loans, including strict financial covenants that provide early warning signals of financial problems to middle-market lenders, enabling such lenders to take preemptive action to protect their investments.

Competition

Our primary competitors in providing financing to middle-market companies include public and private funds, other BDCs, commercial and investment banks, commercial finance companies and, to the extent they provide an alternative form of financing, private equity, mezzanine and hedge funds, as well as issuers of collateral loan obligations, or CLOs, and other structured loan funds. Many of our potential competitors are substantially larger and have considerably greater financial, technical and marketing resources than we do. For example, some competitors may have a lower cost of funds and access to funding sources that will not be available to us. Our competitors may have incurred, or may in the future incur, leverage to finance their debt investments at levels or on terms more favorable than those available to us. In addition, some of our competitors may have higher risk tolerances or different risk assessments than we do, which could allow them to consider a wider variety of investments and establish more relationships than us. Furthermore, many of our potential competitors are not subject to the regulatory restrictions that the 1940 Act and the Internal Revenue Code of 1986, as amended (the “Code”), will impose on us. We cannot assure you that the competitive pressures we will face will not have a material adverse effect on our business, financial condition and results of operations. Also, as a result of this competition, we may not be able to take advantage of attractive investment opportunities from time to time, and we can offer no assurance that we will be able to identify and make investments that are consistent with our investment objective.

Among other factors, the returns on investments available in the marketplace are a function of the supply of investment opportunities and the amount of capital investing in such opportunities. Strong competition for investments could result in fewer investment opportunities for us, as certain of our competitors are establishing investment vehicles that target the same or similar investments that we intend to purchase. Moreover, identifying attractive investment opportunities is difficult and involves a high degree of uncertainty.

Audax Management Company (NY), LLC

Pursuant to an investment advisory agreement (the “Investment Advisory Agreement”), we will be externally managed by our Adviser, which is registered as a registered investment adviser under the Investment Advisers Act of 1940, as amended (the “Advisers Act”). Our Adviser will be responsible for sourcing potential investments, conducting research and due diligence on prospective investments and equity sponsors, analyzing investment opportunities, structuring our investments and monitoring our investments and portfolio companies on an ongoing basis.

In its investment process, our Adviser utilizes a business model in which credit analysis is the priority throughout all processes, including deal sourcing, underwriting, and portfolio management. We intend to utilize our Adviser’s seasoned team and operating platform to identify compelling investment opportunities for us. We will then evaluate these opportunities through an investment approach that emphasizes strong fundamental credit analysis and rigorous portfolio monitoring. We intend to be disciplined in selecting investments and to focus on opportunities that we perceive offer favorable risk/reward characteristics.

Our Adviser will seek to diversify our portfolio by company type, asset type, investment size and industry.

The principals of our Adviser responsible for its senior debt advisory activities have worked together at Audax Group and previously at General Electric Capital Corporation (“GE Capital”) for more than 18 years, during which time they have focused on investing in senior debt issued by private middle-market companies and have invested in excess of $9.7 billion through multiple cycles. We anticipate that we will benefit from our Adviser’s experience in originating investments for us and, to the extent permitted by the 1940 Act and any exemptive relief that the Adviser may seek from the SEC, co-investment opportunities.

From its inception in 2007 through the end of December 31, 2014, the senior debt business of our Adviser (“Audax Senior Debt”) invested $4.3 billion of capital primarily in senior secured debt investments with selective investments in mezzanine debt and equity.

Potential Competitive Strengths

Experienced Team and Extensive Sourcing Network.We believe that the Audax Senior Debt has a competitive advantage over its middle-market investing peers given the breadth of the Audax Group platform. As part of Audax Group, Audax Senior Debt benefits from the industry-specific knowledge, extensive middle-market business relationships and established deal sourcing capabilities across the firm. In the aggregate, Audax Senior Debt, as well as the mezzanine debt and private equity businesses of Audax Group, together hold investments in over 140 middle-market companies across a wide variety of industries as of December 31, 2014.

Specifically, we believe Audax Senior Debt and the Audax Group platform provide advantages in sourcing transactions, accessing proprietary due diligence (subject to applicable confidentiality obligations), and leveraging the lengthy investing experience of the senior members of the Audax Group investment team.

| · | Sourcing—Audax Group’s mezzanine and private equity teams often get an early look at prospective middle-market merger and acquisition (“M&A”) transactions in the early stages of a sale process. Given this early insight into middle-market sale transactions, our Adviser can often evaluate investment opportunities before many of its competitors. Since most of these M&A transactions have a senior debt component, we believe the Adviser’s investment team often becomes aware of senior debt lending opportunities well before other firms. |

| · | Due diligence—As of December 31, 2014, Audax Group has over 140 portfolio companies across three investment businesses. Audax Senior Debt typically has direct, proprietary access to the relevant management teams, which can provide industry insights and primary research capabilities. This helps the Adviser make more informed investment decisions. |

| · | Investing experience—As of December 31, 2014, the Co-CEOs and 24 Managing Directors of Audax Group’s debt and equity investing businesses had an average of 21 years of experience and have successfully invested through numerous economic cycles. |

The Adviser’s sourcing processes and robust deal flow have enabled Audax Senior Debt to be selective and apply rigorous credit analysis on the investment opportunities it reviews. From Audax Senior Debt’s inception in December 2007 through December 31, 2014, the Audax Group platform has sourced 2,732 senior debt investment opportunities, conducted due diligence on 460 of those transactions, and ultimately invested $4.3 billion in 310 investments (11% of opportunities sourced).

Audax Senior Debt has invested in loans with lower leverage and higher spreads. Audax Senior Debt has been able to exploit opportunities in the market for middle-market senior loans by sourcing and underwriting investments with lower leverage and higher spreads than other middle-market transactions. From inception in 2007 through December 31, 2014, investment vehicles managed by Audax Senior Debt invested in new issue loans that had an average first lien debt multiple of 3.72x and an average spread of 514 basis points, both of which we believe compare favorably to broadly syndicated and other middle-market loans that have come to market during the same period.

Audax Group Platform.In addition to a large, seasoned team of investment professionals, our Adviser and its affiliates employ specialized professionals with expertise in transaction sourcing, capital markets, legal issues, and tax planning. We believe the Audax Group platform’s size, collective knowledge base, and shared experience provide a competitive advantage in the middle-market.

Investment Process

We believe our Adviser has a disciplined and repeatable process for executing, monitoring, structuring and exiting investments. We believe the primary driver of stable, consistent returns in a senior loan portfolio is the preservation of invested capital. To accomplish this objective, our Adviser utilizes a business model where credit analysis is the priority throughout all stages of the investment process, including deal sourcing, underwriting, and portfolio management. We evaluate each investment opportunity by analyzing each borrower’s industry dynamics, quality and sustainability of earnings, management team, and capital structure.

Our Adviser focuses on credit evaluation throughout the investment process.

Initial Screening Process.Once a potential transaction is sourced, it undergoes an initial screen to determine the suitability of the investment. This assessment includes a review of the borrower’s industry and its relative position within that industry, as well as transaction-specific items such as the proposed capital structure, deal size, and expected pricing. If the results of this initial screen are positive, the next step is to proceed with detailed transaction due diligence analysis.

Transaction Underwriting.When analyzing a possible transaction, our Adviser identifies and evaluates numerous investment criteria. While these criteria are likely to be different for each investment, in general the analysis includes an in-depth review of the borrower’s industry and the underlying dynamics within that industry. The Adviser reviews numerous borrower-specific criteria such as the quality and depth of the management team, products, and end markets. Our Adviser undertakes an extensive financial analysis, including a review of historical results and projected performance. The Adviser’s investment team also scrutinizes the specific characteristics of each investment, including transaction structure, investment collateral, overall transaction economics, and the maturity of the contemplated facilities.

Portfolio Management. The Adviser reviews investment performance on a regular basis to evaluate whether each investment is delivering the expected results. For each investment, portfolio monitoring processes measure the borrower’s current and projected financial performance versus historical performance, with emphasis on financial results since the funding of the investment. As part of the Adviser’s financial performance evaluation, it monitors, among other items, the borrower’s historical, current and projected covenant compliance. Additionally, the Adviser maintains communication with other lenders, borrowers, and sponsors, and manages any requested amendments or waivers.

Industry Dynamics. The Adviser evaluates criteria such as market size, participants, and barriers to entry, as well as the competitive position of the potential borrower. We plan to invest in established businesses with leading market positions that the Adviser believes are defensible against potential new entrants and that demonstrate strong potential for organic growth. Attributes of targeted investments may include low-cost manufacturing, product expertise, proprietary technology or distribution capability, and strong customer relationships.

Quality and Sustainability of Earnings. We intend to focus on investment opportunities that have demonstrated stability in their revenues and EBITDA. We plan to make investments that demonstrate a historical as well as projected ability to generate cash flow sufficient to service the contemplated leverage. Targeted investments typically possess multiple sources of cash flow that are not dependent upon a single product, customer, geography, regulation, or technology.

Company Management. We expect to invest in companies where senior management teams have demonstrated operating experience. Borrowers’ management teams are expected to play a key role in growing their businesses, to have a firm grasp on the competitive dynamics and business trends affecting their industries, to have demonstrated an ability to manage costs, and to have a well-defined vision and strategy for their company’s future success.

Capital Structure. Appropriate capitalization is a critical factor in a company’s ability to weather economic, industry, or company-specific downturns. Therefore, we will seek to invest in transactions that are prudently leveraged relative to a company’s current and projected cash flow generating capability and underlying asset and enterprise value. Our Adviser’s due diligence focuses on industry dynamics and a company’s future cash needs. Key metrics that the Adviser generally reviews when analyzing capitalization include:

| · | leverage ratios with respect to senior debt and total debt; |

| · | interest expense coverage ratios, which measure the ability of the company to pay interest on its debt obligations; and |

| · | fixed charge coverage ratios, which measure the ability of the company to service annual financial obligations, including interest expense, loan principal payments, and capital expenditures. |

Investment Committee

The purpose of the Adviser’s investment committee (the “Investment Committee”) is to evaluate and approve all investments by our Adviser. The Investment Committee includes Michael McGonigle, Kevin Magid, Geoffrey Rehnert and Marc Wolpow. The Investment Committee review process is intended to bring the diverse experience and perspectives of the committee members to the analysis and consideration of every investment. We believe this process provides consistency and coherence to our Adviser’s investment philosophy and policies. The Investment Committee also determines appropriate investment sizing and mandates ongoing monitoring requirements.

In addition to reviewing investments, the Investment Committee meetings serve as a forum to discuss credit views and outlooks. Potential transactions and deal flow are also reviewed on a regular basis. Members of the Investment Committee are encouraged to share information and views on credits with the committee early in their analysis. This process improves the quality of the analysis and assists the deal team members to work more efficiently.

Investment Committee Compensation

The compensation of the members of the Investment Committee paid by the Adviser includes an annual base salary, in certain cases an annual bonus based on an assessment of short-term and long-term performance, and a portion of the Incentive Fee, if any, to be paid to our Adviser determined on the same basis as the annual bonus. In addition, certain of our Investment Committee members have equity interests in our Adviser and Administrator, and may receive distributions of profits in respect of those interests.

Operating and Regulatory Structure

We intend to elect to be treated as a BDC under the 1940 Act. As a BDC, we will generally be prohibited from acquiring assets other than qualifying assets, unless, after giving effect to any acquisition, at least 70% of our total assets are qualifying assets. Qualifying assets generally include securities of eligible portfolio companies, cash, cash equivalents, U.S. government securities and high-quality debt instruments maturing in one year or less from the time of investment. Under the rules of the 1940 Act, “eligible portfolio companies” include (i) private U.S. operating companies, (ii) public U.S. operating companies whose securities are not listed on a national securities exchange (e.g., the New York Stock Exchange) or registered under the Exchange Act and (iii) public U.S. operating companies having a market capitalization of less than $250 million. Public U.S. operating companies whose securities are quoted on the over-the-counter bulletin board and through OTC Markets Group Inc. are not listed on a national securities exchange and therefore are eligible portfolio companies.

We intend to elect to be treated, and intend to qualify annually, as a RIC under Subchapter M of the Code, commencing with our taxable year ending on December 31, 2015. As a RIC, we generally will not have to pay corporate-level U.S. federal income taxes on any investment company taxable income (as defined below) or net capital gains that we distribute to our stockholders as dividends if we meet certain source of income, distribution and asset diversification requirements. We intend to timely distribute to our stockholders substantially all of our annual taxable income for each year, except that we may retain certain net capital gains for reinvestment and, depending upon the level of taxable income earned in a year, we may choose to carry forward taxable income for distribution in the following year and pay any applicable U.S. federal excise tax.

Risk Management

Broad Diversification.We intend to diversify our transactions by company, asset type, investment size, industry and geography within the U.S. Once we have fully invested the proceeds from any offering of our Shares, we expect that each individual investment will not exceed approximately five percent of our total assets and that the size of our individual investments will vary proportionately with the size of our capital base. Furthermore, we must meet certain diversification tests in order to qualify as a RIC for U.S. federal income tax purposes. See “Item 1. Business — Material U.S. Federal Income Tax Considerations.”

Rigorous Due Diligence.As noted above, our Adviser’s systematic underwriting process involves exhaustive in-house due diligence, applicable third-party consulting reports and multiple stages of investment approval, with a goal of risk mitigation during and after transaction execution.

Administrator

We will enter into an administration agreement (the “Administration Agreement”) with Audax Management Company, LLC, who will serve as our Administrator and provide us with office space, office services and equipment. The responsibilities of our Administrator will include overseeing our financial records, preparing reports to our investors and, as applicable, reports filed with the SEC. Our Administrator will also generally monitor the payment of our expenses and the performance of administrative and professional services rendered to us by others. Our Administrator will be reimbursed for certain administrative expenses it incurs on our behalf. The Adviser is a wholly-owned subsidiary of our Administrator.

Investment Advisory Agreement

Pursuant to the Investment Advisory Agreement with our Adviser, we will pay our Adviser a fee for investment advisory and management services consisting of two components — a base management fee and an Incentive Fee. Our Adviser may, from time-to-time, grant waivers on our obligations, including waivers of the base management fee and/or Incentive Fee, under the Investment Advisory Agreement.

Base Management Fee

The base management fee will be calculated at an annual rate of 1% of the value of our gross assets.

Incentive Fee

The Incentive Fee has two parts, as follows: one is calculated and payable quarterly in arrears based on our pre-incentive fee net investment income for the immediately preceding calendar quarter. For this purpose, pre-incentive fee net investment income means interest income, dividend income and any other income (including any other fees (other than fees for providing managerial assistance), such as commitment, origination, structuring, diligence and consulting fees or other fees that we receive from portfolio companies) accrued during the calendar quarter, minus our operating expenses accrued for the quarter (including the base management fee, expenses payable under the Administration Agreement, and any interest expense on any credit facilities or outstanding debt and dividends paid on any issued and outstanding preferred stock, but excluding the Incentive Fee).

Incentive Fee on Pre-Incentive Fee Net Investment Income

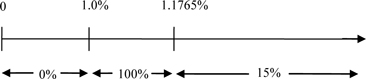

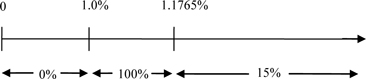

Pre-incentive fee net investment income is determined in accordance with United States Generally Accepted Accounting Principles (“GAAP”) (without any adjustments), including, in the case of investments with a deferred interest feature (such as OID, debt instruments with PIK, interest and zero coupon securities), accrued income that we have not yet received in cash. Pre-incentive fee net investment income does not include any realized capital gains, computed net of all realized capital losses or unrealized capital appreciation or depreciation. Pre-incentive fee net investment income, expressed as a rate of return on the value of our net assets at the end of the immediately preceding calendar quarter, is compared to a hurdle of 1.0% per quarter (4.0% annualized). Our net investment income used to calculate this part of the Incentive Fee is also included in the amount of our gross assets used to calculate the 1% annual base management fee. We will pay our Adviser an Incentive Fee with respect to our pre-incentive fee net investment income in each calendar quarter as follows:

| · | no amount will be paid on the income-portion of the Incentive Fee in any calendar quarter in which our pre-incentive fee net investment income does not exceed the hurdle of 1.0% (4.0% annualized); |

| · | 100.0% of our Pre-incentive fee net investment income with respect to that portion of such Pre-incentive fee net investment income, if any, that exceeds the hurdle rate but is less than 1.1765 % in any calendar quarter. We refer to this portion of our Pre-incentive fee net investment income (which exceeds the hurdle rate but is less than 1.1765%) as the “catch-up” provision. The catch-up is meant to provide our Adviser with 15.0% of the Pre-incentive fee net investment income as if a hurdle rate did not apply if this net investment income exceeds 1.1765% in any calendar quarter; and |

| · | 15.0% of the amount of our pre-incentive fee net investment income, if any, that exceeds 1.0% in any calendar quarter (4.0% annualized) will be payable to our Adviser. |

The following is a graphical representation of the calculation of the income-related portion of the Incentive Fee:

Pre-incentive Fee Net Investment Income

(expressed as a percentage of the value of net assets)

Percentage of pre-incentive fee net investment income allocated to our Adviser

These calculations are pro-rated for any period of less than three months and adjusted for any share issuances or repurchases during the relevant quarter. You should be aware that a rise in the general level of interest rates can be expected to lead to higher interest rates applicable to our debt investments. Accordingly, an increase in interest rates would make it easier for us to meet or exceed the hurdle rate and may result in a substantial increase of the amount of Incentive Fees payable to our Adviser with respect to pre-incentive fee net investment income.

Incentive Fee on Capital Gains

The second part of the Incentive Fee is determined and payable in arrears as of the end of each calendar year (or upon termination of the Investment Advisory Agreement, as of the termination date), and equals 15% of our realized capital gains, if any, on a cumulative basis from the effectiveness of this Registration Statement through the end of each calendar year, computed net of all realized capital losses and unrealized capital depreciation on a cumulative basis, less the aggregate amount of any previously paid capital gain Incentive Fees with respect to each of the investments in our portfolio. However, the Incentive Fee determined as of December 31, 2015 will be calculated for a period of shorter than 12 calendar months to take into account any realized capital gains computed net of all realized capital losses and unrealized capital depreciation from the effectiveness of this Registration Statement.

The sum of the incentive fee on Pre-incentive fee net investment income and incentive fee on capital gains is the “Incentive Fee.”

Examples of Quarterly Incentive Fee Calculation

Example 1: Income Related Portion of Incentive Fee (*):

Alternative 1

Assumptions

Investment income (including interest, dividends, fees, etc.) = 1.0%

Hurdle rate(1) = 1.0%

Management fee(2) =.25%

Other expenses (legal, accounting, custodian, transfer agent, etc.)(3) = 0.15%

Pre-incentive fee net investment income

(investment income – (management fee + other expenses)) = 0.60%

Pre-incentive net investment income does not exceed hurdle rate, therefore there is no incentive fee.

Alternative 2

Assumptions

Investment income (including interest, dividends, fees, etc.) = 1.5%

Hurdle rate(1) = 1.0%

Management fee(2) = .25%

Other expenses (legal, accounting, custodian, transfer agent, etc.)(3) = 0.15%

Pre-incentive fee net investment income

(investment income – (management fee + other expenses)) = 1.1%, which exceeds the hurdle rate

Incentive fee = 15% × pre-incentive fee net investment income, subject to the “catch-up”(4)

= 100% x (1.10%- 1.0%)

= 0.10%

Alternative 3

Assumptions

Investment income (including interest, dividends, fees, etc.) = 2.0%

Hurdle rate(1)= 1.0%

Management fee(2)= .25%

Other expenses (legal, accounting, custodian, transfer agent, etc.)(3) = 0.15%

Pre-incentive fee net investment income

(investment income – (management fee + other expenses)) = 1.60%

Incentive fee = 15% × pre-incentive fee net investment income, subject to “catch-up”(4)

= 100% × “catch-up” + (15% × (pre-incentive fee net investment income –1.1765%))

Catch-up = 1.1765% – 1.0% = 0.1765%

Incentive fee = (100% × 0.1765%) + (15% × (1.60% –1.1765%))

= 0.1765% + (15% × 0.4235%)

= 0.1765% + 0.063525%

= 0.24%

__________________________

| (*) | The hypothetical amount of pre-incentive fee net investment income shown is based on a percentage of total net assets. |

| (1) | Represents 4.0% annualized hurdle rate. |

| (2) | Represents 1% annualized management fee. |

| (3) | Excludes organizational and offering expenses. |

(4) The “catch-up” provision is intended to provide our Adviser with an Incentive Fee of approximately 15.0% on all of our pre-incentive fee net investment income as if a hurdle rate did not apply when our net investment income exceeds 1.1765% in any calendar quarter.

Example 2: Capital Gains Portion of Incentive Fee:

Alternative 1

Assumptions

| · | Year 1: $20 million investment made in Company A (“Investment A”), and $30 million investment made in Company B (“Investment B”) |

| · | Year 2: Investment A sold for $50 million and fair market value (“FMV”) of Investment B determined to be $32 million |

| · | Year 3: FMV of Investment B determined to be $25 million |

| · | Year 4: Investment B sold for $31 million |

The capital gains portion of the Incentive Fee, if any, would be:

| · | Year 2: $4.5 million capital gains incentive fee |

$30 million realized capital gains on sale of Investment A multiplied by 15%

$3.75 million cumulative fee (15% multiplied by $25 million ($30 million cumulative capital gains less $5 million cumulative capital depreciation)) less $4.5 million (previous capital gains fee paid in Year 2)

| · | Year 4: $150,000 capital gains incentive fee |

$4.65 million cumulative fee ($31 million cumulative realized capital gains multiplied by 15%) less $4.5 million (previous capital gains fee paid in Year 2)

Alternative 2

Assumptions

| · | Year 1: $20 million investment made in Company A (“Investment A”), $30 million investment made in Company B (“Investment B”) and $25 million investment made in Company C (“Investment C”) |

| · | Year 2: Investment A sold for $50 million, FMV of Investment B determined to be $25 million and FMV of Investment C determined to be $25 million |

| · | Year 3: FMV of Investment B determined to be $27 million and Investment C sold for $30 million |

| · | Year 4: FMV of Investment B determined to be $35 million |

| · | Year 5: Investment B sold for $20 million |

The capital gains portion of the Incentive Fee, if any, would be:

| · | Year 2: $3.75 million capital gains incentive fee |

15% multiplied by $25 million ($30 million realized capital gains on sale of Investment A less $5 million unrealized capital depreciation on Investment B)

| · | Year 3: $1,050,000 capital gains incentive fee |

$4.8 million cumulative fee (15% multiplied by $32 million ($35 million cumulative realized capital gains less $3 million unrealized capital depreciation)) less $3.75 million (previous capital gains fee paid in Year 2)

$3.75 million cumulative fee (15% multiplied by $25 million ($35 million cumulative realized capital gains less $10 million realized capital losses)) less $4.8 million (previous cumulative capital gains fee paid in Year 2 and Year 3)

Valuation Procedures

We will conduct the valuation of our assets, pursuant to which our net asset value will be determined, at all times consistent with the GAAP and the 1940 Act. Our Board of Directors, with the assistance of our Audit Committee, will determine the fair value of our assets, for assets with a public market, daily, and for assets with no readily available public market, on at least a quarterly basis, in accordance with the terms of Topic 820 of the Financial Accounting Standards Board’s Accounting Standards Codification, as amended,Fair Value Measurement andDisclosures(“ASC 820”). Our valuation procedures are set forth in more detail below.

ASC 820 defines fair value as “the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants at the measurement date.” Fair value is a market-based measurement, not an entity-specific measurement. For some assets and liabilities, observable market transactions or market information might be available. For other assets and liabilities, observable market transactions and market information might not be available. However, the objective of a fair value measurement in both cases is the same – to estimate the price when an orderly transaction to sell the asset or transfer the liability would take place between market participants at the measurement date under current market conditions (that is, an exit price at the measurement date from the perspective of a market participant that holds the asset or owes the liability).

ASC 820 establishes a hierarchal disclosure framework which ranks the observability of inputs used in measuring financial instruments at fair value. The observability of inputs is impacted by a number of factors, including the type of financial instruments and their specific characteristics. Financial instruments with readily available quoted prices, or for which fair value can be measured from quoted prices in active markets, generally will have a higher degree of market price observability and a lesser degree of judgment applied in determining fair value.

The three-level hierarchy for fair value measurement is defined as follows:

Level 1— inputs to the valuation methodology are quoted prices available in active markets for identical financial instruments as of the measurement date. The types of financial instruments in this category include unrestricted securities, including equities and derivatives, listed in active markets. We will not adjust the quoted price for these instruments, even in situations where we hold a large position and a sale could reasonably impact the quoted price.

Level 2— inputs to the valuation methodology are quoted prices in markets that are not active or for which all significant inputs are either directly or indirectly observable as of the measurement date. The types of financial instruments in this category include less liquid and restricted securities listed in active markets, securities traded in markets that are not active, government and agency securities, and certain over-the-counter derivatives where the fair value is based on observable inputs.

Level 3— inputs to the valuation methodology are unobservable and significant to the overall fair value measurement, and include situations where there is little, if any, market activity for the investment. The inputs into the determination of fair value require significant management judgment or estimation. The types of financial instruments in this category include investments in privately held entities, non-investment grade residual interests in securitizations, collateralized loan obligations, and certain over-the-counter derivatives where the fair value is based on unobservable inputs.

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, the determination of which category within the fair value hierarchy is appropriate for any given financial instrument is based on the lowest level of input that is significant to the fair value measurement. Assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment and considers factors specific to the financial instrument.

Pursuant to the framework set forth above, we will value securities traded in active markets on the measurement date by multiplying the exchange closing price of such traded securities/instruments by the quantity of shares or amount of the instrument held. We may also obtain quotes with respect to certain of our investments from pricing services, brokers or dealers’ quotes, or counterparty marks in order to value liquid assets that are not traded in active markets. Pricing services aggregate, evaluate and report pricing from a variety of sources including observed trades of identical or similar securities, broker or dealer quotes, model-based valuations and internal fundamental analysis and research. When doing so, we will determine whether the quote obtained is sufficient according to GAAP to determine the fair value of the security. If determined adequate, we will use the quote obtained.

Securities that are illiquid or for which the pricing source does not provide a valuation or methodology or provides a valuation or methodology that, in the judgment of the Adviser or our Board of Directors, does not represent fair value, will each be valued as of the measurement date using all techniques appropriate under the circumstances and for which sufficient data is available. These valuation techniques may vary by investment but include comparable public market valuations, comparable precedent transaction valuations and discounted cash flow analyses. The process used to determine the applicable value will be as follows: (i) each portfolio company or investment is initially valued by the investment professionals responsible for the portfolio investment using a standardized template designed to approximate fair market value based on observable market inputs and updated credit statistics and unobservable inputs; (ii) preliminary valuation conclusions are documented and discussed with our senior management and members of our Adviser’s valuation team; (iii) our Audit Committee will review the assessments of the Adviser and provide our Board of Directors with recommendations with respect to the fair value of each investment in our portfolio; and (iv) our Board of Directors will discuss the valuation recommendations of our Audit Committee and determine the fair value of each investment in our portfolio in good faith based on the input of the Adviser.

Our Audit Committee’s recommendation of fair value will generally be based on its assessment of the following factors, as relevant:

| · | the nature and realizable value of any collateral; |

| · | call features, put features and other relevant terms of debt; |

| · | the portfolio company’s ability to make payments; |

| · | the portfolio company’s actual and expected earnings and discounted cash flow; |

| · | prevailing interest rates for like securities and expected volatility in future interest rates; |

| · | the markets in which the issuer does business and recent economic and/or market events; and |

| · | comparisons to publicly traded securities. |

Investment performance data utilized will be the most recently available as of the measurement date which in many cases may reflect up to a one quarter lag in information.

Securities for which market quotations are not readily available or for which a pricing source is not sufficient may include the following:

| · | private placements and restricted securities that do not have an active trading market; |

| · | securities whose trading has been suspended or for which market quotes are no longer available; |

| · | debt securities that have recently gone into default and for which there is no current market; |

| · | securities whose prices are stale; and |

| · | securities affected by significant events. |

The Board of Directors will be ultimately responsible for the determination, in good faith, of the fair value of our portfolio investments.

Determination of fair value involves subjective judgments and estimates. Accordingly, the notes to our financial statements will express the uncertainty with respect to the possible effect of such valuations, and any change in such valuations, on our financial statements.

Advisory and Administrative Services

We do not currently have any employees. Our day-to-day investment operations will be managed by our Adviser, and our Administrator provides services necessary to conduct our business. Messrs. Magid and McGonigle, Managing Directors, have oversight responsibility for Audax Senior Debt. Mr. McGonigle joined Audax Group in 2007 and manages the day-to-day activities of Audax Senior Debt. He has over 25 years of experience in sourcing, underwriting, and managing the type of loans and other securities purchased by Audax Senior Debt. Mr. McGonigle leads a team of eight seasoned debt investment professionals. In addition, the Audax Senior Debt team is or will be supported by experienced finance, accounting, legal, operations and investor relations professionals as a part of the Audax Group platform and the Administrator’s proposed services to the Company. Our Adviser may hire additional investment professionals subsequent to the effectiveness of this Registration Statement.

Material U.S. Federal Income Tax Considerations

The following discussion is a general summary of the material U.S. federal income tax considerations applicable to us and to an investment in our shares of Common Stock. This summary does not purport to be a complete description of the income tax considerations applicable to such an investment. For example, we have not described tax consequences that may be relevant to certain types of holders subject to special treatment under U.S. federal income tax laws, including stockholders subject to the alternative minimum tax, tax-exempt organizations, insurance companies, dealers in securities, a trader in securities that elects to use a market-to-market method of accounting for its securities holdings, pension plans and trusts, financial institutions, U.S. expatriates, U.S. persons with a functional currency other than the U.S. dollar, “controlled foreign corporations,” “passive foreign investment companies,” or corporations that accumulate earnings to avoid U.S. federal income tax. This summary assumes that investors hold our Common Stock as capital assets (within the meaning of the Code). The discussion is based upon the Code, U.S. Department of the Treasury (“Treasury”) regulations, and administrative and judicial interpretations, each as of the date of this Registration Statement and all of which are subject to change, possibly retroactively, which could affect the continuing validity of this discussion. This summary does not discuss any aspects of U.S. estate or gift tax or foreign, state or local tax. It does not discuss the special treatment under U.S. federal income tax laws that could result if we invested in tax-exempt securities or certain other investment assets.

For purposes of this discussion, a “U.S. stockholder” generally is a beneficial owner of shares of our Common Stock who is for U.S. federal income tax purposes:

| · | an individual who is a citizen or resident of the United States; |

| · | a corporation or other entity treated as a corporation, for U.S. federal income tax purposes, created or organized in or under the laws of the United States, any state thereof, or the District of Columbia; |

| · | a trust if a court within the United States can exercise primary supervision over its administration and one or more U.S. persons have the authority to control all of its substantial decisions (or a trust that has made a valid election to be treated as a U.S. person); or |

| · | an estate, the income of which is subject to U.S. federal income taxation regardless of its source. |

For purposes of this discussion, a “Non-U.S. stockholder” generally is a beneficial owner of shares of our Common Stock who is not a U.S. stockholder.

If a partnership (including an entity treated as a partnership for U.S. federal income tax purposes) holds shares of our Common Stock, the tax treatment of a partner in the partnership will generally depend upon the status of the partner and the activities of the partnership. A prospective stockholder that is a partner of a partnership holding shares of our Common Stock should consult its tax advisers with respect to the partnership’s purchase, ownership and disposition of shares of our Common Stock.

Tax matters are complicated and the tax consequences to an investor of an investment in our shares of Common Stock will depend on the facts of its particular situation. Moreover, prospective investors should recognize that the present U.S. federal tax treatment of an investment in shares of our Common Stock may be modified by legislative, judicial or administrative action at any time, and that any such action may have retroactive effect, and such modifications could adversely the tax consequences of investing in our Common Stock. We encourage investors to consult their tax advisers regarding the specific consequences of such an investment, including tax reporting requirements, the applicability of U.S. federal, state, local and foreign tax laws, eligibility for the benefits of any applicable tax treaty and the effect of any possible changes in the tax laws.

Election to be Taxed as a RIC

We intend to elect to be treated as a RIC under Subchapter M of the Code. As a RIC, we generally will not have to pay corporate-level U.S. federal income taxes on any income that we distribute to our stockholders as dividends. To qualify as a RIC, we must, among other things, meet certain source-of-income and asset diversification requirements (as described below). In addition, we must distribute to our stockholders, for each taxable year, at least 90% of our “investment company taxable income,” which is generally our net ordinary taxable income plus the excess of realized net short-term capital gains over realized net long-term capital losses (the “Annual Distribution Requirement”).

Taxation as a Regulated Investment Company

If we:

| · | satisfy the Annual Distribution Requirement, |

then we will not be subject to U.S. federal income tax on the portion of our taxable income we distribute (or are deemed to distribute) to stockholders. We will be subject to U.S. federal income tax at regular corporate rates on any income or capital gains not distributed (or deemed distributed) to our stockholders.

We will be subject to a 4% nondeductible U.S. federal excise tax if we fail to distribute in a timely manner in respect of each calendar year an amount at least equal to the sum of (1) 98% of our net ordinary income (taking into account certain deferrals and elections) for the calendar year, (2) 98.2% of our capital gain net income (adjusted for certain net ordinary losses) for the one-year period ending October 31 in that calendar year and (3) any income recognized, but not distributed, in the preceding year (the “Excise Tax Avoidance Requirement”). For this purpose, however, any net ordinary income or capital gain net income retained by us that is subject to corporate income tax for the tax year ending in that calendar year will be considered to have been distributed by year end (or earlier if estimated taxes are paid). We currently intend to make sufficient distributions each taxable year to satisfy the Excise Tax Avoidance Requirement.

In order to qualify as a RIC for U.S. federal income tax purposes, we must, among other things:

| · | continue to qualify as a BDC under the 1940 Act at all times during each taxable year; |

| · | derive in each taxable year at least 90% of our gross income from dividends, interest, payments with respect to loans of certain securities, gains from the sale of stock or other securities or foreign currencies, net income from certain “qualified publicly traded partnerships,” or other income derived with respect to our business of investing in such stock or securities or foreign currencies (the “90% Income Test”); and |

| · | diversify our holdings so that at the end of each quarter of the taxable year: |

| o | at least 50% of the value of our assets consists of cash, cash equivalents, U.S. government securities, securities of other RICs, and other securities if such other securities of any one issuer do not represent more than 5% of the value of our assets or more than 10% of the outstanding voting securities of the issuer; and |

| o | no more than 25% of the value of our assets is invested in the securities, other than U.S. government securities or securities of other RICs, of one issuer, of two or more issuers that are controlled, as determined under applicable Code rules, by us and that are engaged in the same or similar or related trades or businesses, or of certain “qualified publicly traded partnerships” (the “Diversification Tests”). |

Some of the income that we might otherwise earn, such as fees for providing managerial assistance, certain fees earned with respect to our investments, income recognized in a work-out or restructuring of a portfolio investment, or income recognized from an equity investment in an operating partnership, may not satisfy the 90% Income Test. To manage the risk that such income might disqualify us as a RIC for failure to satisfy the 90% Income Test, one or more subsidiary entities treated as U.S. corporations for U.S. federal income tax purposes may be employed to earn such income and (if applicable) hold the related asset. Such subsidiary entities will be required to pay U.S. federal income tax on their earnings, which ultimately will reduce the yield to our stockholders on such fees and income.

We may in the future decide to pay a portion of our dividends in our stock. Distributions payable in stock or cash at the election of shareholders will be treated as a dividends so long as certain requirements are satisfied. If the total distribution to shareholders electing to receive cash would exceed the total amount of cash to be distributed, each shareholder electing to receive the distribution in cash would receive a proportionate share of the cash to be distributed. Taxable stockholders receiving such distributions will be required to include the full amount of the distribution (including the portion payable in stock) as ordinary income (or as long-term capital gain to the extent such distribution is properly designated as a capital gain dividend) to the extent of our current and accumulated earnings and profits for U.S. federal income tax purposes. As a result, a U.S. stockholder may be required to pay tax with respect to such distributions in excess of any cash received. If a U.S. stockholder sells the stock it receives as a distribution in order to pay this tax, the sales proceeds may be less than the amount included in income with respect to the distribution.

We may be required to recognize taxable income in circumstances in which we do not currently receive cash in respect of such income. For example, if we hold debt obligations that are treated under applicable tax rules as having OID (which may arise if we receive warrants in connection with the origination of a loan or possibly in other circumstances), we must include in income each year a portion of the OID that accrues over the life of the obligation, regardless of whether cash in respect of such income is received by us in the same taxable year. We may also have to include in income other amounts that we have not yet received in cash, such as contractual PIK interest (which represents contractual interest added to the loan balance and due at the end of the loan term) and deferred loan origination fees that are paid after origination of the loan or are paid in non-cash compensation such as warrants or stock. Because any OID or other amounts accrued will be included in our investment company taxable income for the year of accrual, we may be required to make a distribution to our stockholders in order to satisfy the Annual Distribution Requirement, even though we will not have received any corresponding cash amount.

We are authorized to borrow funds and to sell assets in order to satisfy distribution requirements. However, under the 1940 Act (and possibly certain debt covenants), we are not permitted to make distributions to our stockholders while our debt obligations and other senior securities are outstanding unless certain “asset coverage” tests are met. See “Item 1. Business – Regulation as a Business Development Company – Senior Securities.” Moreover, our ability to dispose of assets to meet our distribution requirements may be limited by (1) the illiquid nature of our portfolio and/or (2) other requirements relating to our qualification as a RIC, including the Diversification Tests. If we dispose of assets in order to meet the Annual Distribution Requirement or the Excise Tax Avoidance Requirement, we may make such dispositions at times that, from an investment standpoint, are not advantageous. If we are prohibited from making distributions or are unable to raise additional debt or equity capital or sell assets to make distributions, we may not be able to make sufficient distributions to satisfy the Annual Distribution Requirement, and therefore would not be able to maintain our qualification as a RIC.

A portfolio company in which we invest may face financial difficulties that require us to work-out, modify or otherwise restructure our investment in the portfolio company. Any such transaction could, depending upon the specific terms of the transaction, result in unusable capital losses and future non-cash income. Any such transaction could also result in our receiving assets that give rise to non-qualifying income for purposes of the 90% Income Test or otherwise would not count toward satisfying the Diversification Tests.

Some of the income that we might otherwise earn, such as fees for providing managerial assistance, certain fees earned with respect to our investments, income recognized in a work-out or restructuring of a portfolio investment, or income recognized from an equity investment in an operating partnership, may not satisfy the 90% Income Test. To manage the risk that such income might disqualify us as a RIC for failure to satisfy the 90% Income Test, one or more subsidiary entities treated as U.S. corporations for U.S. federal income tax purposes may be employed to earn such income and (if applicable) hold the related asset. Such subsidiary entities will be required to pay U.S. federal income tax on their earnings, which ultimately will reduce the yield to our stockholders on such fees and income.

A RIC is limited in its ability to claim expenses as deductions in excess of its investment company taxable income. If our expenses in a given taxable year exceed gross taxable income, we would have a net operating loss for that taxable year. However, a RIC is not permitted to carry forward net operating losses to subsequent taxable years. In addition, expenses can be used only to offset investment company taxable income, not net capital gain. Due to these limits on the deductibility of expenses, we may for U.S. federal income tax purposes have aggregate taxable income for several taxable years that we distribute and that is taxable to our stockholders even if such income is greater than the aggregate net income we actually earned during those taxable years. Such distributions may be made from our cash assets or by premature sale, exchange, or other disposition of our investments, if necessary. We may realize gains or losses from such sales, exchanges, or other disposition of our investments. In the event we realize net capital gains from such transactions, you may receive a larger capital gain distribution than you would have received in the absence of such transactions.

Investment income received from sources within foreign countries, or capital gains earned by investing in securities of foreign issuers, may be subject to foreign income taxes withheld at the source. In this regard, withholding tax rates in countries with which the United States does not have a tax treaty are often as high as 35% or more. The United States has entered into tax treaties with many foreign countries that may entitle us to a reduced rate of tax or exemption from tax on this related income and gains. The effective rate of foreign tax cannot be determined at this time since the amount of our assets to be invested within various countries is not now known. We do not anticipate being eligible for the special election that allows a RIC to treat foreign income taxes paid by such RIC as paid by its stockholders.

If we acquire stock in certain foreign corporations that receive at least 75% of their annual gross income from passive sources (such as interest, dividends, rents, royalties or capital gain) or hold at least 50% of their total assets in investments producing such passive income (“passive foreign investment companies” or “PFICs”), we could be subject to federal income tax and additional interest charges on “excess distributions” received from such companies or gain from the sale of stock in such companies, even if all income or gain actually received by us is timely distributed to our stockholders. We would not be able to pass through to our stockholders any credit or deduction for such a tax. Certain elections may, if available, ameliorate these adverse tax consequences, but any such election may require us to recognize taxable income or gain without the concurrent receipt of cash, and such income will nevertheless be subject to the Annual Distribution Requirement as well as will be taken into account for purposes of determining whether we satisfy the Excise Tax Avoidance Requirement.

Our functional currency, for U.S. federal tax purposes, will be the U.S. dollar. Under Section 988 of the Code, gains and losses realized by us attributable to fluctuations in exchange rates between the time we accrue income, expenses, or other liabilities denominated in a foreign currency and the time we actually collect such income or pay such expenses or liabilities generally will be characterized as ordinary gains and losses. Similarly, gains and losses realized by us upon the sale, exchange, or other disposition of debt instruments denominated in a foreign currency, foreign currency forward contracts, and other financial transactions denominated in a foreign currency, to the extent attributable to fluctuations in exchange rates between their acquisition and disposition dates, generally will be characterized as ordinary gains and losses. In each case, such gains and losses may affect the amount, timing and character of distributions to our stockholders. Any such transactions that are not directly related to our investment in securities (possibly including speculative currency positions or currency derivatives not used for hedging purposes) could, under future Treasury regulations, produce income not among the types of “qualifying income” for purposes of the 90% Income Test.

Certain of our investment practices may be subject to special and complex U.S. federal income tax provisions that may, among other things: (i) disallow, suspend or otherwise limit the allowance of certain losses or deductions; (ii) convert lower taxed long-term capital gain into higher taxed short-term capital gain or ordinary income; (iii) convert an ordinary loss or a deduction into a capital loss (the deductibility of which is more limited); (iv) cause us to recognize income or gain without a corresponding receipt of cash; (v) adversely affect the time as to when a purchase or sale of securities is deemed to occur; (vi) adversely alter the characterization of certain complex financial transactions; and (vii) produce income that will not be qualifying income for purposes of the 90% Income Test. We will monitor our transactions and we may make certain tax elections in order to mitigate the potential adverse effect of these provisions.

Gain or loss realized by us from the sale or exchange of warrants acquired by us as well as any loss attributable to the lapse of such warrants generally will be treated as capital gain or loss. The treatment of such gain or loss as long-term or short-term capital gain or loss will depend on how long we held a particular warrant. Upon the exercise of a warrant acquired by us, our tax basis in the stock purchased under the warrant will equal the sum of the amount paid for the warrant plus the strike price paid on the exercise of the warrant.