| | |

Capital Allocation Acquisitions On October 1, 2020, the Company completed the acquisition of Garland Insulating, one of the largest locally owned and operated insulation installation companies in Texas. Garland generated approximately $60 million in revenue for the trailing twelve months ended June 30, 2020. Year-to-date, the Company has announced three acquisitions, which combined, are expected to generate approximately $79 million in annual revenue. | | “Acquisitions continue to be our number one capital allocation priority. Garland Insulating, which has a great reputation, strong customer base and outstanding leadership, is a good example of the type of quality companies we have in our pipeline.” Jerry Volas, CEO, TopBuild |

Share Repurchases

In the third quarter of 2020, the Company repurchased 57,810 shares at an average price of $155.63 per share. These shares were purchased as part of the Company’s $200 million share repurchase authorization announced on February 26, 2019. As of September 30, 2020, $46 million of the $200 million authorization remained.

Additional Information

Quarterly supplemental materials, including a presentation that will be referenced on today’s conference call, are available on the “Investors” section of the Company’s website at www.topbuild.com.

Conference Call

A conference call to discuss third quarter 2020 financial results is scheduled for today, Tuesday, November 3, at 9:00 a.m. Eastern Time. The call may be accessed by dialing (877) 407-9037. The conference call will be webcast simultaneously on the “Investors” section of the Company’s website at www.topbuild.com.

About TopBuild

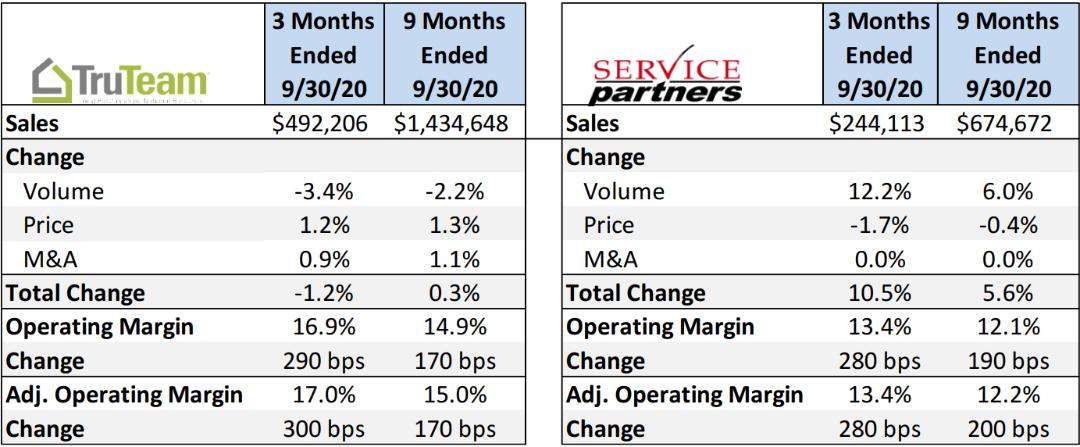

TopBuild Corp., a Fortune 1000 Company headquartered in Daytona Beach, Florida, is a leading installer and distributor of insulation and building material products to the U.S. construction industry. We provide insulation and building material services nationwide through TruTeam®, which has close to 200 branches, and through Service Partners® which distributes insulation and building material products from over 75 branches. We leverage our national footprint to gain economies of scale while capitalizing on our local market presence to forge strong relationships with our customers. To learn more about TopBuild please visit our website at www.topbuild.com.

Use of Non-GAAP Financial Measures

Adjusted EBITDA, incremental EBITDA margin, adjusted EBITDA margin, the “adjusted” financial measures presented above, and figures presented on a “same branch basis” are not calculated in accordance with U.S. generally accepted accounting principles (“GAAP”). The Company believes that these non-GAAP financial measures, which are used in managing the business, may provide users of this financial information with additional meaningful comparisons between current results and results in prior periods. We define same branch sales as sales from branches in operation for at least 12 full calendar months. Such non-GAAP financial measures are reconciled to their closest GAAP financial measures in tables contained in this press release. Non-GAAP financial measures should be viewed in addition to, and not as an alternative for, the Company’s reported results under GAAP. Additional information may be found in the Company’s filings with the Securities and Exchange Commission which are available on TopBuild’s website under “Investors” at www.topbuild.com.