“Our robust M&A pipeline will be further enhanced within the sizable and highly fragmented industrial and commercial markets,” Buck noted. “It also cements our position as the leading specialty distributor of all types of insulation and further strengthens our relationships with the major insulation manufacturers.”

Steve Margolius, President and Chief Executive Officer of DI added, “We are very pleased to announce this transaction and look forward to joining the TopBuild team. This will be a tremendous outcome for our customers and associates as the combined organization will now have exposure to all end-market insulation segments. Both companies have similar corporate cultures and shared values and are guided by a commitment to people, safety, integrity, and operational excellence.”

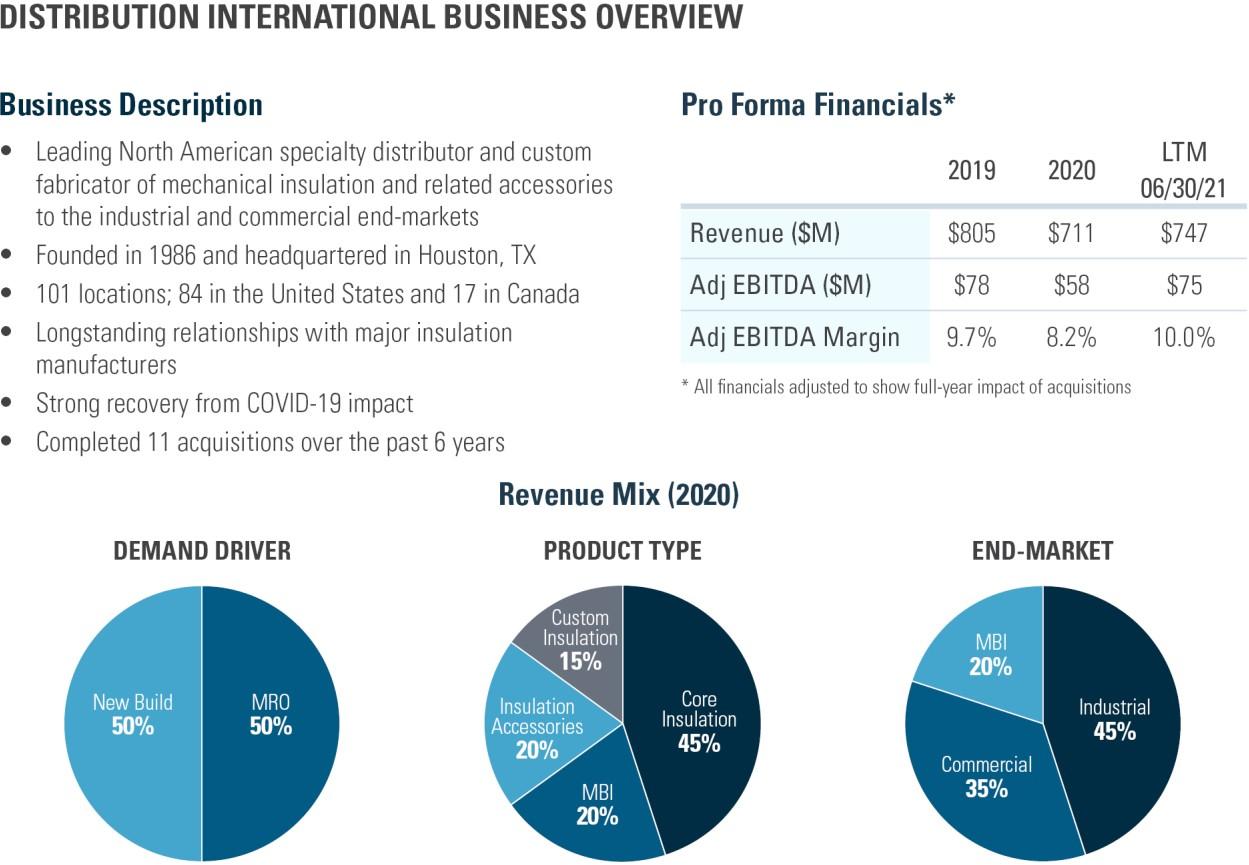

On a June 30, 2021 pro forma basis, the combined company had trailing twelve-month revenue of $3.93 billion and adjusted EBITDA of $647 million, inclusive of expected run rate synergies of $35 million to $40 million.

TopBuild plans to fund this transaction using cash on hand and long-term debt. At the close of the transaction, the Company’s net debt to pro forma adjusted EBITDA, is expected to be approximately 2.5 times pre-synergies.

In conclusion Buck added, “The identification and integration of acquisitions is a TopBuild core competency as evidenced by our successful M&A track record over the past six years. During this period, we have acquired 26 companies that are contributing over $820 million of annual revenue and creating tremendous value for our stakeholders. We are confident DI will be another outstanding addition to our Company and we welcome Steve and the DI team to TopBuild.”

The transaction, which has been approved by TopBuild’s Board of Directors, is subject to customary closing conditions, including expiration or termination of the waiting period under the Hart-Scott-Rodino Antitrust Improvements Act of 1976. The Company expects the transaction to close in the fourth quarter of 2021.

Supplemental information on TopBuild’s binding agreement to acquire DI will be available online at www.topbuild.com.

J.P. Morgan Securities LLC is serving as financial advisor to TopBuild and Jones Day is acting as legal counsel. RBC Capital Markets, LLC is serving as financial advisor, and Weil, Gotshal & Manges LLP is acting as legal counsel to Advent and DI.

Conference Call

A conference call to discuss the DI transaction is scheduled for today, September 8, at 8:30 a.m. Eastern Time. The call may be accessed by dialing (877) 407-9037. The conference call will be webcast simultaneously on the Company’s website at www.topbuild.com and an investor presentation will be available on the Company’s website when the call commences.