Q3 FY18 Conference Call May 2, 2018

© 2018 Lumentum Operations LLC Forward Looking Statement and Financial Presentation This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include any anticipation or guidance as to future financial performance, including future revenue, earnings per share, gross margin, operating expense, operating margin, profitability, cash flow and other financial metrics, anticipated trends for our products including new orders and delivery timing, technologies and the markets in which we operate as well as our strategies and position in our markets. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected. In particular, the Company’s ability to predict future financial performance continues to be difficult due to, among other things: (a) quarter-over-quarter product mix fluctuations, which can materially impact profitability measures due to the broad gross margin ranges across our portfolio; (b) continued decline of average selling prices across our businesses; (c) effects of seasonality; (d) the ability of our suppliers and contract manufacturers to meet production, quality and delivery requirements for our forecasted demand; (e) inherent uncertainty related to global markets and the effect of such markets on demand for our products; (f) changes in customer demand; (g) our ability to attract and retain new customers, particularly in the 3D sensing market. All forward-looking statements involve risks and uncertainties that could cause actual events and terms to differ materially from those set forth herein, including those related to our business and growth opportunities; (h) the risk that the Oclaro transaction does not close, due to the failure of one or more conditions to closing or the failure of the businesses (including personnel) to be integrated successfully after closing; (i) the risk that synergies and non-GAAP earnings accretion will not be realized or realized to the extent anticipated; (j) uncertainty as to the market value of the Lumentum merger consideration to be paid in the merger; (k) the risk that required governmental or Oclaro stockholder approvals of the merger (including U.S. or China antitrust approvals) will not be obtained or that such approvals will be delayed beyond current expectations; (l) the risk that following this transaction, Lumentum’s financing or operating strategies will not be successful; (m) litigation in respect of either company or the merger; and (n) disruption from the merger making it more difficult to maintain customer, supplier, key personnel and other strategic relationships. For more information on these risks, please refer to the "Risk Factors" section included in the Company’s Quarterly Report on Form 10-Q for the quarter ended March 31, 2018 as filed with the Securities and Exchange Commission, in the S-4 to be filed by Lumentum with the Securities and Exchange Commission at a future date in connection with the Oclaro transaction and in the documents which are incorporated by reference therein, and in our other filings with the Securities and Exchange Commission. In addition, the results contained in this presentation are valid only as of today’s date except where otherwise noted. The forward- looking statements contained in this presentation are made as of the date hereof and the Company assumes no obligation to update such statements, except as required by applicable law. Unless otherwise stated, all financial results and projections are on a non-GAAP basis. Our GAAP results, details about our non-GAAP financial measures, and a reconciliation between GAAP and non-GAAP results can be found in our fiscal third quarter 2018 earnings press release which is available on our web site, www.lumentum.com, under the investors section. We have not provided reconciliations from GAAP to non-GAAP measures for our outlook. A large portion of non-GAAP adjustments, such as derivative liability adjustments, restructuring charges, stock-based compensation, litigation, non-cash income tax expense and credits, and other costs and contingencies unrelated to current and future operations are by their nature highly volatile and we have low visibility as to the range that may be incurred in the future. 2

© 2018 Lumentum Operations LLC Additional Information and Where to Find It/Participants in the Merger Solicitation This presentation references a proposed business combination involving Lumentum Holdings Inc. and Oclaro, Inc. In connection with the proposed transaction, Lumentum will file with the Securities and Exchange Commission a Registration Statement on Form S-4 that includes the preliminary proxy statement of Oclaro and that will also constitute a prospectus of Lumentum. The information in the preliminary proxy statement/prospectus is not complete and may be changed. Lumentum may not sell the common stock referenced in the proxy statement/prospectus until the Registration Statement on Form S-4 filed with the Securities and Exchange Commission becomes effective. The preliminary proxy statement/prospectus and this presentation are not offers to sell Lumentum securities, are not soliciting an offer to buy Lumentum securities in any state where the offer and sale is not permitted and are not a solicitation of any vote or approval. The definitive proxy statement/prospectus will be mailed to stockholders of Oclaro. LUMENTUM AND OCLARO URGE INVESTORS AND SECURITY HOLDERS TO READ THE DEFINITIVE PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION. Investors and security holders will be able to obtain these materials (when they are available) and other documents filed with the Securities and Exchange Commission free of charge at the Securities and Exchange Commission’s website, www.sec.gov. Copies of documents filed with the Securities and Exchange Commission by Lumentum (when they become available) may be obtained free of charge on Lumentum’s website at www.lumentum.com or by directing a written request to Lumentum Holdings Inc., Investor Relations, 400 North McCarthy Boulevard, Milpitas, CA 95035. Copies of documents filed with the Securities and Exchange Commission by Oclaro (when they become available) may be obtained free of charge on Oclaro’s website at www.oclaro.com or by directing a written request to Oclaro, Inc. Investor Relations, 225 Charcot Avenue, San Jose, CA 95131. Each of Lumentum Holdings Inc., Oclaro, Inc. and their respective directors, executive officers and certain other members of management and employees may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information regarding these persons who may, under the rules of the Securities and Exchange Commission, be considered participants in the solicitation of Oclaro stockholders in connection with the proposed transaction will be set forth in the proxy statement/prospectus described above to be filed with the Securities and Exchange Commission. Additional information regarding Lumentum’s executive officers and directors is included in Lumentum’s definitive proxy statement, which was filed with the Securities and Exchange Commission on September 19, 2017. Additional information regarding Oclaro’s executive officers and directors is included in Oclaro’s definitive proxy statement, which was filed with the Securities and Exchange Commission on September 27, 2017. You can obtain free copies of these documents using the information in the paragraph immediately above. 3

© 2018 Lumentum Operations LLC Q3 FY18 Results (GAAP) $ in millions except for EPS, % of revenue Q3 FY18 Q2 FY18 Q3 FY17 Revenue $298.8 $404.6 $255.8 Gross Margin 97.0 32.5% 171.1 42.3% 82.1 32.1% Operating Expenses 71.5 23.9% 80.3 19.8% 68.5 26.8% Operating Income 25.5 8.5% 90.8 22.4% 13.6 5.3% Diluted EPS $0.04 $3.05 $(0.92) Diluted Shares-M 63.3 64.6 61.0 4

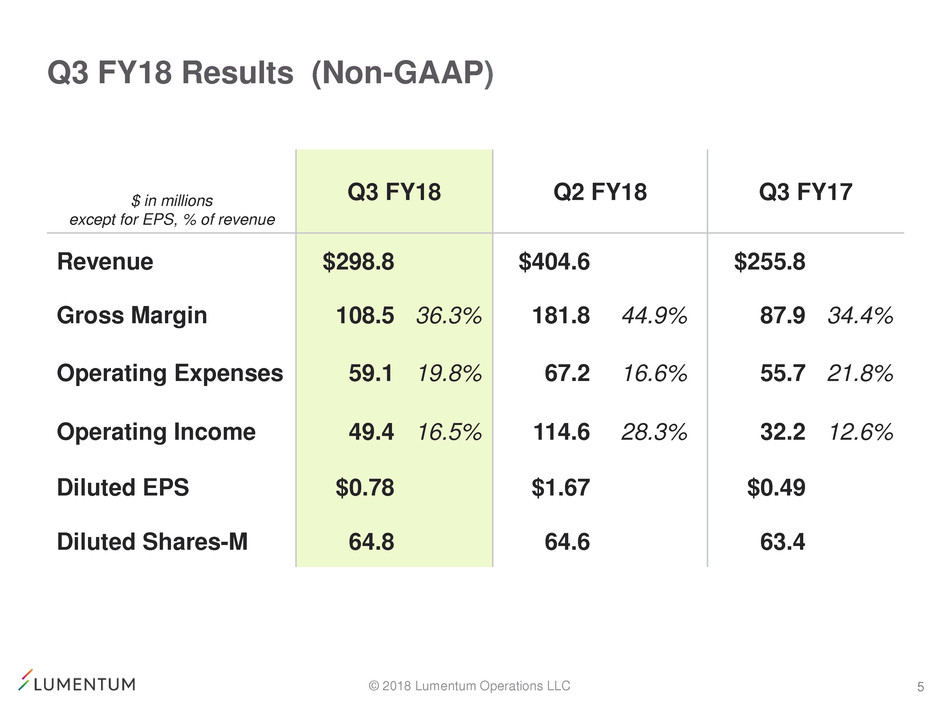

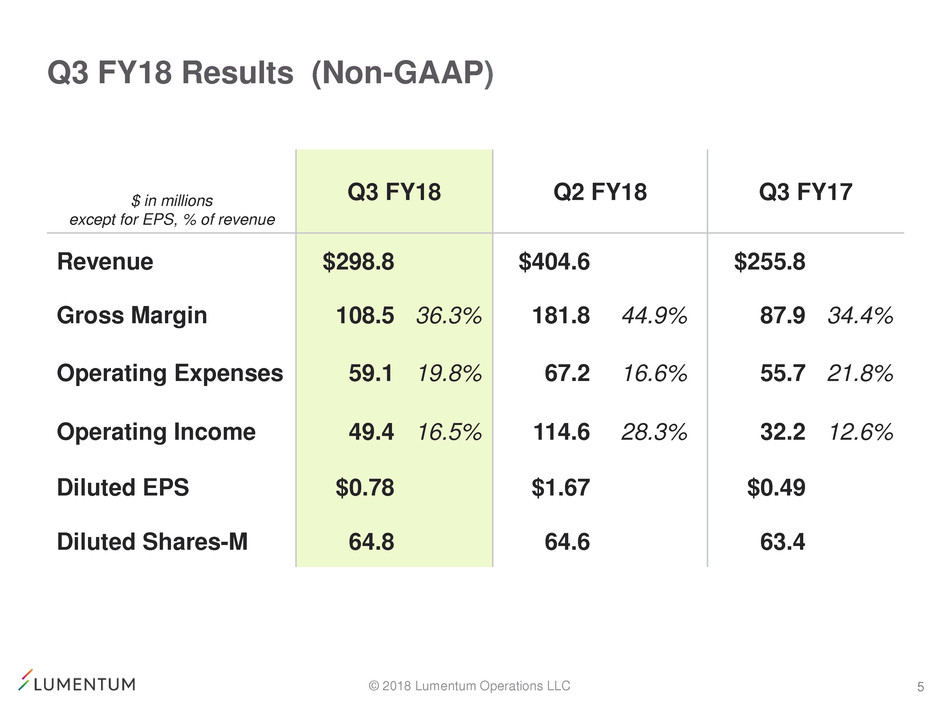

© 2018 Lumentum Operations LLC Q3 FY18 Results (Non-GAAP) $ in millions except for EPS, % of revenue Q3 FY18 Q2 FY18 Q3 FY17 Revenue $298.8 $404.6 $255.8 Gross Margin 108.5 36.3% 181.8 44.9% 87.9 34.4% Operating Expenses 59.1 19.8% 67.2 16.6% 55.7 21.8% Operating Income 49.4 16.5% 114.6 28.3% 32.2 12.6% Diluted EPS $0.78 $1.67 $0.49 Diluted Shares-M 64.8 64.6 63.4 5

© 2018 Lumentum Operations LLC Q3 FY18 Segment Results (Non-GAAP) $ in millions Q3 FY18 Q2 FY18 Q3 FY17 Revenue $298.8 $404.6 $255.8 Optical Communications 246.3 360.1 216.1 Telecom 122.6 110.2 164.9 Datacom 36.3 34.4 39.0 Industrial & Consumer(1) 87.4 215.5 12.2 Commercial Lasers 52.5 44.5 39.7 Gross Margin 36.3% 44.9% 34.4% Optical Communications 33.7% 45.0% 33.1% Commercial Lasers 48.4% 44.7% 41.3% 6 (1) Industrial & Consumer contains 3D sensing revenues as well as diode lasers sold into industrial applications.

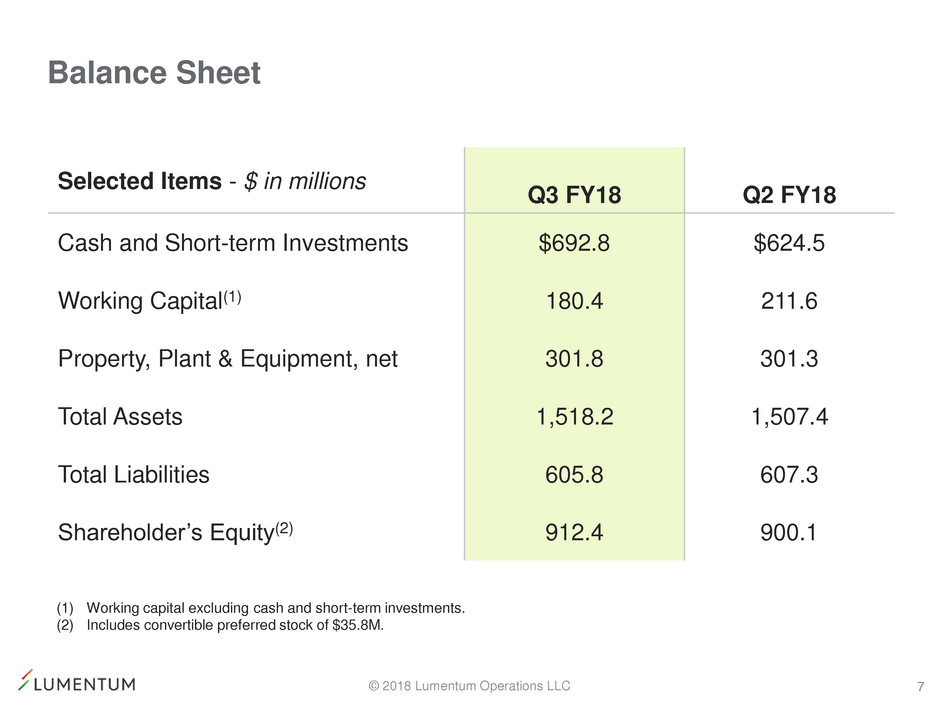

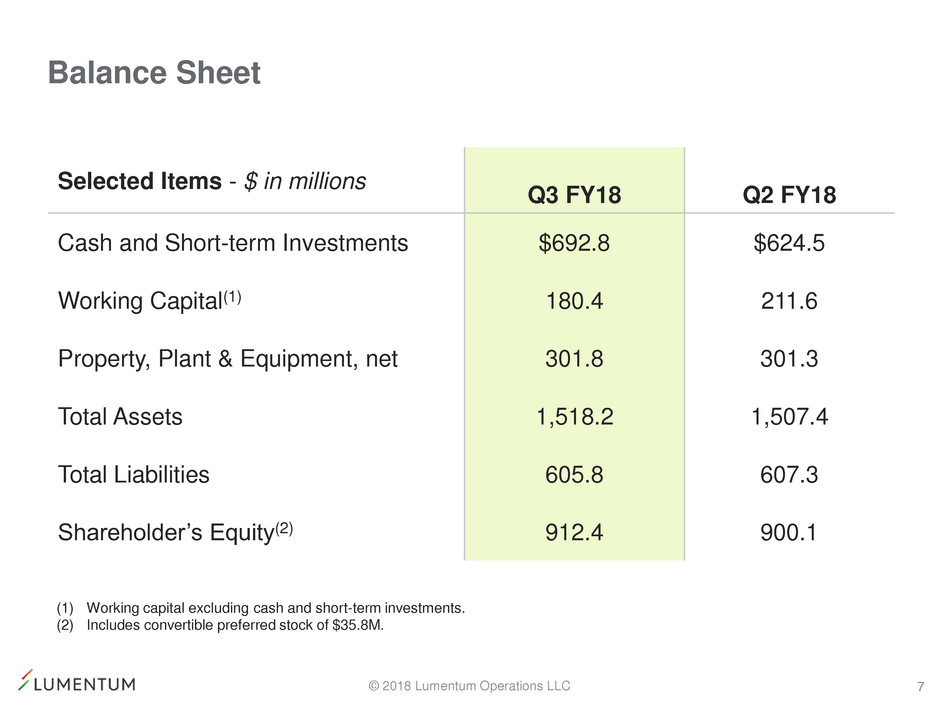

© 2018 Lumentum Operations LLC Balance Sheet 7 Selected Items - $ in millions Q3 FY18 Q2 FY18 Cash and Short-term Investments $692.8 $624.5 Working Capital(1) 180.4 211.6 Property, Plant & Equipment, net 301.8 301.3 Total Assets 1,518.2 1,507.4 Total Liabilities 605.8 607.3 Shareholder’s Equity(2) 912.4 900.1 (1) Working capital excluding cash and short-term investments. (2) Includes convertible preferred stock of $35.8M.

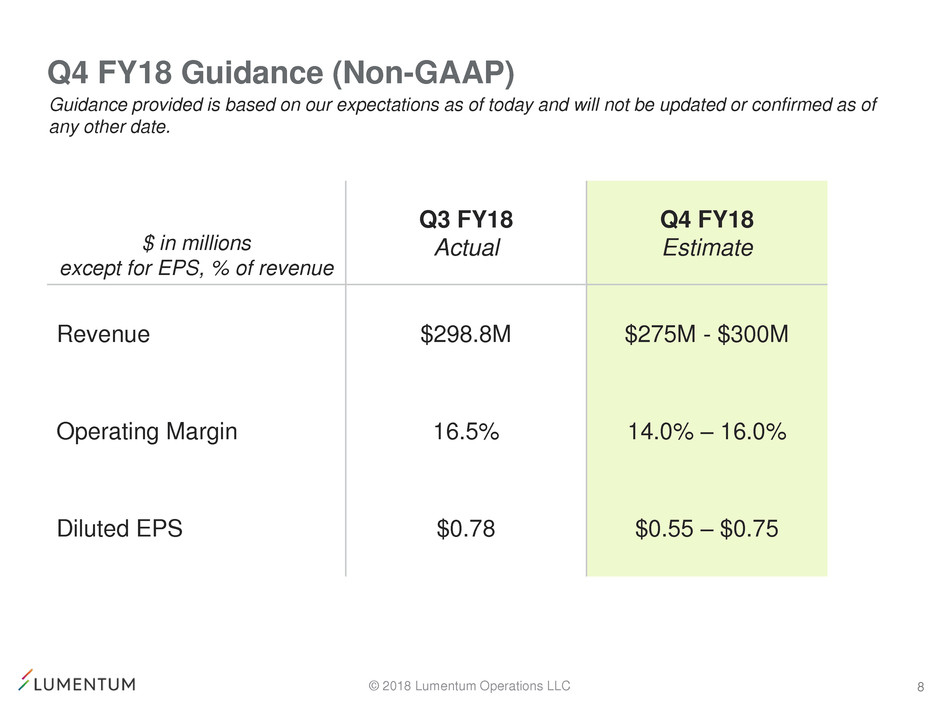

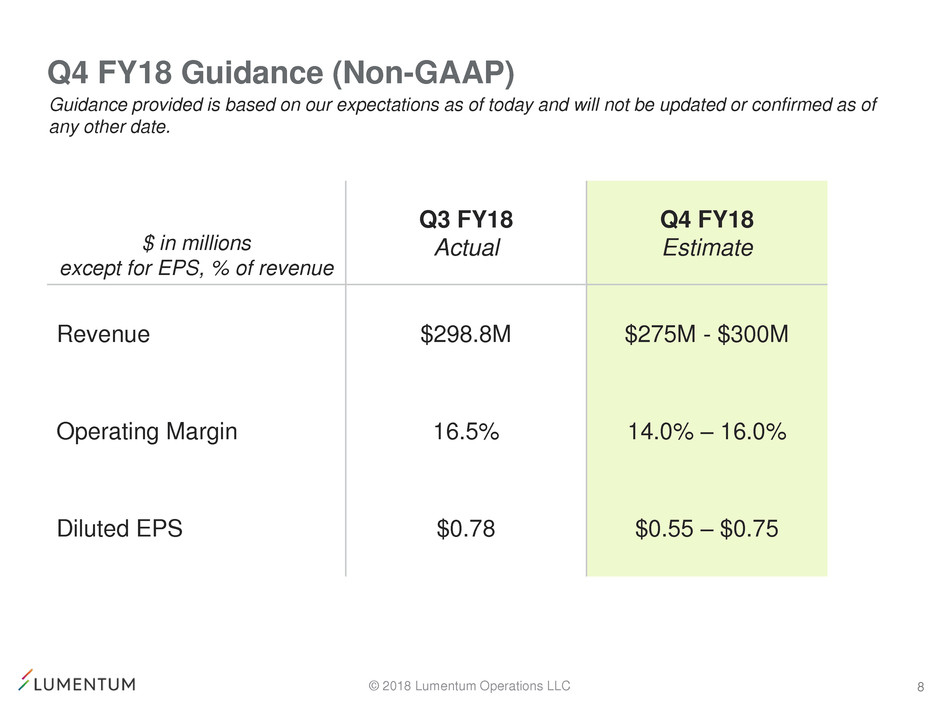

© 2018 Lumentum Operations LLC Q4 FY18 Guidance (Non-GAAP) 8 $ in millions except for EPS, % of revenue Q3 FY18 Actual Q4 FY18 Estimate Revenue $298.8M $275M - $300M Operating Margin 16.5% 14.0% – 16.0% Diluted EPS $0.78 $0.55 – $0.75 Guidance provided is based on our expectations as of today and will not be updated or confirmed as of any other date.