Forward Looking Statements and Financial Presentation This presentation contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. These statements include any anticipation or guidance as to future financial performance, including future revenue, earnings per share, gross margin, operating expense, operating margin, profitability, cash flow and other financial metrics. These forward-looking statements involve risks and uncertainties that could cause actual results to differ materially from those projected. In particular, the Company’s ability to predict future financial performance continues to be difficult due to, among other things: (a) quarter- over-quarter product mix fluctuations, which can materially impact profitability measures due to the broad gross margin ranges across our portfolio; (b) continued decline of average selling prices across our businesses; (c) effects of seasonality; (d) the ability of our suppliers and contract manufacturers to meet production, quality and delivery requirements for our forecasted demand; (e) inherent uncertainty related to global markets and the effect of such markets on demand for our products; (f) changes in customer demand; (g) our ability to attract and retain new customers, particularly in the 3D sensing market; (h) the risk that synergies and non-GAAP earnings accretion will not be realized or realized to the extent anticipated; (i) the risk that following the Oclaro transaction, Lumentum’s financing or operating strategies will not be successful; (j) litigation in respect of either Lumentum or Oclaro or the merger; and (k) disruption from the Oclaro merger making it more difficult to maintain customer, supplier, key personnel and other strategic relationships. All forward-looking statements involve risks and uncertainties that could cause actual events and terms to differ materially from those set forth herein, including those related to our business and growth opportunities. For more information on these risks, please refer to the "Risk Factors" section included in the Company’s Quarterly Report on Form 10-Q for the quarter ended December 29, 2018, to be filed with the Securities and Exchange Commission, in the S-4, as amended, filed by Lumentum with the Securities and Exchange Commission, which was declared effective May 31, 2018 in connection with the Oclaro transaction, and in the documents which are incorporated by reference therein, and in our other filings with the Securities and Exchange Commission, including the Company’s Annual Report on Form 10-K for the fiscal year ended June 30, 2018, filed by Lumentum with the Securities and Exchange Commission on August 28, 2018. In addition, the results contained in this presentation are valid only as of today’s date except where otherwise noted. The forward-looking statements contained in this presentation are made as of the date hereof and the Company assumes no obligation to update such statements, except as required by applicable law. Unless otherwise stated, all financial results and projections are on a non-GAAP basis. Our GAAP results, details about our non-GAAP financial measures, and a reconciliation between GAAP and non-GAAP results can be found in our fiscal second quarter 2019 earnings press release which is available on our web site, www.lumentum.com, under the investors section. We have not provided reconciliations from GAAP to non-GAAP measures for our outlook. A large portion of non-GAAP adjustments, such as derivative liability adjustments, restructuring charges, stock-based compensation, litigation, non-cash income tax expense and credits, and other costs and contingencies unrelated to current and future operations are by their nature highly volatile and we have low visibility as to the range that may be incurred in the future. © 2019 Lumentum Operations LLC 2

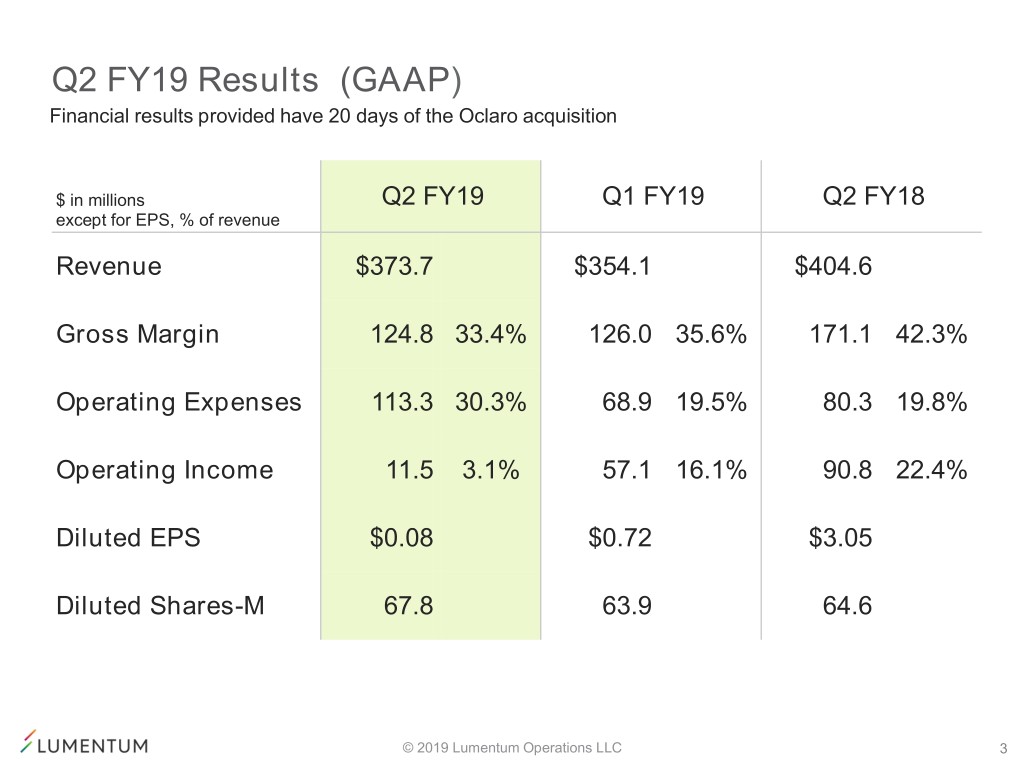

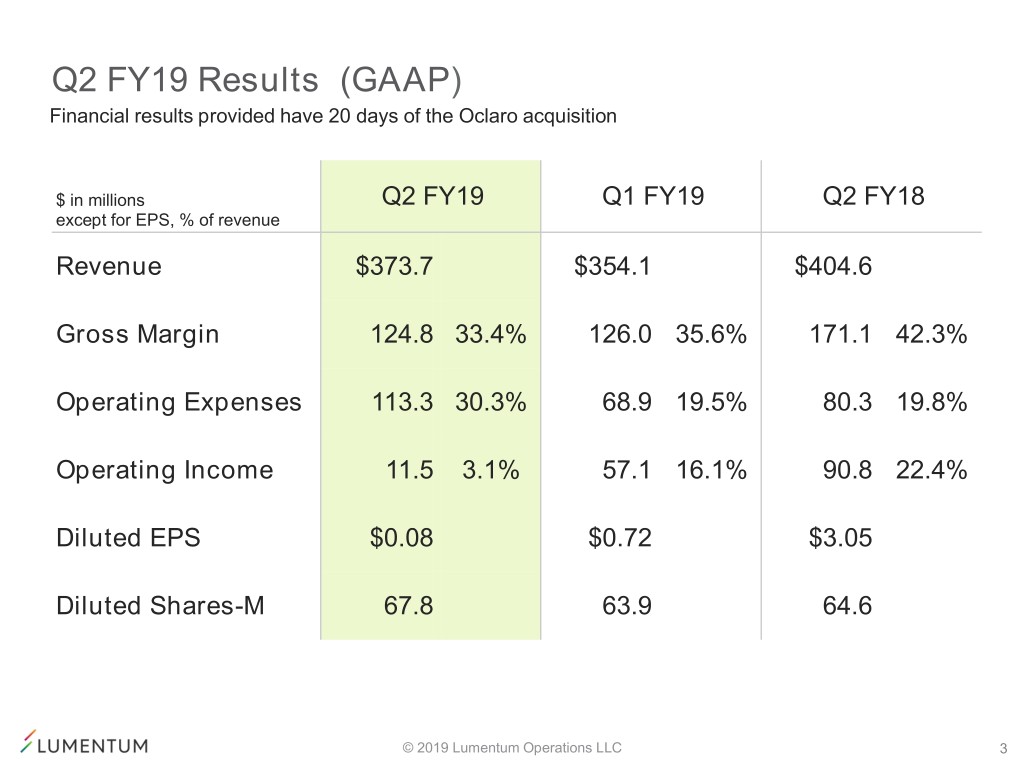

Q2 FY19 Results (GAAP) Financial results provided have 20 days of the Oclaro acquisition $ in millions Q2 FY19 Q1 FY19 Q2 FY18 except for EPS, % of revenue Revenue $373.7 $354.1 $404.6 Gross Margin 124.8 33.4% 126.0 35.6% 171.1 42.3% Operating Expenses 113.3 30.3% 68.9 19.5% 80.3 19.8% Operating Income 11.5 3.1% 57.1 16.1% 90.8 22.4% Diluted EPS $0.08 $0.72 $3.05 Diluted Shares-M 67.8 63.9 64.6 © 2019 Lumentum Operations LLC 3

Q2 FY19 Results (Non-GAAP) Financial results provided have 20 days of the Oclaro acquisition $ in millions Q2 FY19 Q1 FY19 Q2 FY18 except for EPS, % of revenue Revenue $373.7 $354.1 $404.6 6 Gross Margin 149.7 40.1% 142.6 40.3% 181.8 44.9% Operating Expenses 67.5 18.1% 57.9 16.4% 67.2 16.6% Operating Income 82.2 22.0% 84.7 23.9% 114.6 28.3% Diluted EPS $1.15 $1.31 $1.67 Diluted Shares-M 67.8 65.4 64.6 © 2019 Lumentum Operations LLC 4

Balance Sheet Selected Items Q2 FY19 Q1 FY19 $ in millions Cash and Short-term Investments $684.1 $734.3 Working Capital(1) 347.3 232.9 Property, Plant & Equipment, net 444.7 318.6 Total Assets 2,796.6 1,645.0 Total Liabilities(2) 1,236.9 625.7 Shareholder’s Equity(3) 1,559.7 1,019.3 (1) Working capital excluding cash and short-term investments. (2) Liabilities contains the new $500 million term loan. (3) Q1 FY19 includes convertible preferred stock of $35.8 million. © 2019 Lumentum Operations LLC 6

Q3 FY19 Guidance (Non-GAAP) Guidance provided is based on our expectations as of today and will not be updated or confirmed as of any other date. Q2 FY19 Q3 FY19 $ in millions Actual Estimate except for EPS, % of revenue Revenue $373.7 $420 - $440 Operating Margin 22% 16% - 18% Diluted EPS(1) $1.15 $0.76 - $0.94 (1) Diluted EPS for Q3 FY19 assumes 77 million shares which includes the full impact of the 11 million shares added from the Oclaro acquisition. © 2019 Lumentum Operations LLC 7