- BNED Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

PRE 14A Filing

Barnes & Noble Education (BNED) PRE 14APreliminary proxy

Filed: 2 Aug 24, 8:31am

| ☒ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

BARNES & NOBLE EDUCATION, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

| ☒ | No fee required. |

☐ | Fee paid previously with preliminary materials. |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a6(i)(1) and 0-11. |

| | | Sincerely, | |

| | |  | |

| | | ||

| | | William C. Martin | |

| | | Chairman of the Board of Directors |

| 1. | To elect seven directors to serve until the 2025 annual meeting of stockholders and until their respective successors are duly elected and qualified, or until their earlier death, resignation, retirement, disqualification or removal; |

| 2. | To approve the Company’s Amended and Restated Equity Incentive Plan to, among other things, increase the number of shares authorized to be issued under the Plan; |

| 3. | To vote on an advisory (non-binding) basis to approve executive compensation for named executive officers; |

| 4. | To ratify the appointment of BDO USA, P.C. as the independent registered public accountants for the Company’s fiscal year ending May 3, 2025; |

| 5. | To approve the Company’s Amended and Restated Certificate of Incorporation to decrease the aggregate number of authorized shares of our common stock, par value $0.01 per share (“Common Stock”), from 10,000,000,000 shares to 200,000,000 shares; and |

| 6. | To approve the adjournment of the Annual Meeting to a later date, if necessary or appropriate, to allow for the solicitation of additional proxies in the event that there are insufficient votes at the time of the Annual Meeting to approve the other proposals. |

| | | Sincerely, | |

| | |  | |

| | |||

| | | Michael C. Miller | |

| | | Chief Legal Officer & Secretary | |

| | | ||

| | | Basking Ridge, New Jersey | |

| | | [•], 2024 |

| | General Information | | |||

| | Date and Time | | | September 18, 2024, at 9:00 a.m. (Eastern Time) | |

| | Place | | | Live online webcast that is available via www.virtualshareholdermeeting.com/BNED2024 | |

| | Record Date | | | August 6, 2024 | |

| | Voting Matters and Recommendations | | |||

| | Voting Matter | | | Board of Directors Recommendations | |

| | Election of seven directors | | | FOR ALL NOMINEES | |

| | Approval of the Company’s Amended and Restated Equity Incentive Plan to, among other things, increase the number of shares authorized to be issued under the Plan | | | FOR | |

| | Vote on an advisory (non-binding) basis to approve executive compensation for named executive officers | | | FOR | |

| | Ratification of BDO USA, P.C. as the independent registered public accountants for the Company’s fiscal year ending May 3, 2025 | | | FOR | |

| | Approval of the Company’s Amended and Restated Certificate of Incorporation to decrease the aggregate number of authorized shares of our common stock, par value $0.01 per share, from 10,000,000,000 shares to 200,000,000 shares | | | FOR | |

| | Adjournment of the Annual Meeting to a later date, if necessary or appropriate, to allow for the solicitation of additional proxies in the event that there are insufficient votes at the time of the Annual Meeting to approve the other proposals in this Proxy Statement | | | FOR | |

| Governance Highlights | |||

✔ We elect all directors annually ✔ None of our director nominees serve on an excessive number of public company boards ✔ The Board of Directors follows Corporate Governance Guidelines ✔ Each committee of our Board of Directors has a published charter that is reviewed and discussed at least annually ✔ We have adopted a Corporate Social Responsibility Policy ✔ The Company has made significant progress in rolling out diversity, equity, and inclusion initiatives and over 50% of our directors are women or racial or ethnic minorities | | | ✔ We are committed to maintaining an active dialogue with our stockholders. Over the past year, we have reached out to stockholders owning approximately 50% of our outstanding common shares to discuss governance and executive compensation issues ✔ Our Audit Committee, Compensation Committee and Corporate Governance and Nominating Committee are 100% comprised of independent directors ✔ Independent directors and Board of Director committees meet regularly and frequently without management present ✔ Our Corporate Governance and Nominating Committee oversees our Board of Directors’ annual self-evaluation ✔ The roles of Chairman of the Board and Chief Executive Officer are separated |

| Executive Compensation Highlights | |||

✔ A majority of executive pay is tied to performance-based and equity incentives ✔ For Fiscal 2024, there were no equity awards to named executive officers ✔ Directors and executive officers and other members of senior management are subject to stock ownership targets and retention guidelines ✔ Incentive awards granted are subject to clawback and/or recoupment policies under the Equity Incentive Plan and Executive Incentive Compensation Clawback Policy ✔ Long-term incentives comprise a significant portion of target compensation for executive officers ✔ The vesting of awards that are assumed or substituted in connection with a change in control only accelerates as a result of the change in control if a participant experiences a qualifying termination of employment | | | ✔ Restricted stock awards to executives are subject to a one-year minimum vesting period ✔ The Company does not provide for any tax gross-ups on perquisites or other benefits ✔ Named executive officers are only entitled to limited perquisites ✔ All employees are prohibited from hedging, and directors, executive officers, and other members of senior management may not pledge our stock without the approval of the Audit Committee ✔ The Equity Incentive Plan prohibits the repricing of awards without stockholder approval ✔ Equity Incentive Plan design aligns pay with performance. For example, given the ongoing strategic alternatives review process and the Company’s performance, there was no payout on the Company financial performance measure for short-term cash incentive awards for the named executive officers in Fiscal 2024 |

| Skills and Attributes | | | Hoffman | | | Madnani | | | Martin | | | Nader | | | Singer | | | Walker | | | Warren |

| Academia / Education | | | | | | | | | | | | | ✔ | | | ||||||

| Accounting, Internal Control Risk Management | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | |

| Business Head / Executive | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Business Operations | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | |

| CEO and Executive | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | |

| Commercial Business | | | ✔ | | | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | ||

| Corporate Governance | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Customer Engagement / Marketing | | | ✔ | | | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | ||

| Data Analytics | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | | | | | ✔ | ||

| Defense Industry or Military | | | | | | | ✔ | | | ✔ | | | | | ✔ | | | ||||

| Digital / e-Commerce | | | ✔ | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | |

| Digital Experience | | | ✔ | | | | | ✔ | | | | | | | ✔ | | | ✔ | |||

| Financial Expertise and Literacy | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Financing and Investments | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | |

| Government / Public Policy | | | | | | | | | | | | | ✔ | | | ||||||

| International Business | | | ✔ | | | ✔ | | | | | ✔ | | | ✔ | | | ✔ | | | ||

| Knowledge of Company Business | | | | | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | ||

| Legal Expertise | | | | | | | ✔ | | | | | ✔ | | | | | |||||

| Operational and Strategy Planning | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Other Relevant Industry | | | ✔ | | | ✔ | | | | | | | | | ✔ | | | ✔ | |||

| Public Company | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Retail Experience | | | ✔ | | | | | | | | | | | | | ||||||

| Science, Technology, and Innovation | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Sustainability and Corporate Responsibility | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ | | | ✔ |

| Name | | | Age | | | Director Since | | | Position |

| Nominees for Election at the Annual Meeting | | | | | | | |||

| Emily S. Hoffman* | | | 46 | | | 2024 | | | Current Director, Chair of the Corporate Governance and Nominating Committee, Member of the Compensation Committee, and Director Nominee |

| Sean Vijay Madnani* | | | 45 | | | 2024 | | | Current Director, Chair of the Audit Committee, Member of the Compensation Committee and the Corporate Governance and Nominating Committee, and Director Nominee |

| William C. Martin | | | 46 | | | 2024 | | | Chairman of the Board, Member of the Strategy and Operational Review Committee, and Director Nominee |

| Elias N. Nader* | | | 60 | | | 2024 | | | Current Director, Chair of the Compensation Committee, Member of the Corporate Governance and Nominating Committee, and Director Nominee |

| Eric B. Singer | | | 50 | | | 2024 | | | Current Director, Chair of the Strategy and Operational Review Committee, and Director Nominee |

| Kathryn (“Kate”) Eberle Walker* | | | 47 | | | 2022 | | | Current Director, Member of the Audit Committee, and Director Nominee |

| Denise Warren* | | | 60 | | | 2022 | | | Current Director, Member of the Audit Committee, and Director Nominee |

| * | Independent for purposes of the NYSE listing standards. |

| • | overseeing the quality and integrity of our financial statements, accounting practices and financial information we provide to the Securities and Exchange Commission (“SEC”) or the public; |

| • | reviewing our annual and interim financial statements, the report of our independent registered public accounting firm on our annual financial statements, Management’s Report on Internal Control over Financial Reporting and the disclosures under Management’s Discussion and Analysis of Financial Condition and Results of Operations; |

| • | selecting and appointing an independent registered public accounting firm; |

| • | pre-approving all services to be provided to us by our independent registered public accounting firm; |

| • | reviewing with our independent registered public accounting firm and our management the accounting firm’s significant findings and recommendations upon the completion of the annual financial audit and quarterly reviews; |

| • | reviewing and evaluating the qualification, performance, fees and independence of our registered public accounting firm; |

| • | meeting with our independent registered public accounting firm and our management regarding our internal controls, critical accounting policies and practices, and other matters; |

| • | discussing with our independent registered public accounting firm and our management earnings releases prior to their issuance; |

| • | overseeing our enterprise risk assessment and management; |

| • | overseeing our internal audit function; |

| • | reviewing and approving related party transactions (see “Certain Relationships and Related Transactions” below); and |

| • | overseeing our compliance program, response to regulatory actions involving financial, accounting and internal control matters, internal controls and risk management policies. |

| • | setting and reviewing our general policy regarding executive compensation; |

| • | determining the compensation of our Chief Executive Officer and other executive officers; |

| • | approving employment agreements for our Chief Executive Officer and other executive officers; |

| • | reviewing the benefits provided to our Chief Executive Officer and other executive officers; |

| • | setting and reviewing director compensation; |

| • | overseeing our overall compensation structure, practices and benefit plans; |

| • | administering our executive bonus and equity-based incentive plans; |

| • | assessing the independence of compensation consultants, legal counsel and other advisors to the Compensation Committee and hiring, approving the fees and overseeing the work of, and terminating the services of such advisors; and |

| • | participating in succession planning for Chief Executive Officer and other executive officers. |

| • | overseeing our corporate governance practices; |

| • | reviewing and recommending to our Board of Directors amendments to our committee charters and other corporate governance guidelines; |

| • | reviewing and making recommendations to our Board of Directors regarding the structure of our various Board of Directors committees; |

| • | identifying, reviewing and recommending to our Board of Directors individuals for election to the Board of Directors; |

| • | adopting and reviewing policies regarding the consideration of Board of Directors candidates proposed by stockholders and other criteria for Board of Directors membership; and |

| • | overseeing our Board of Directors’ annual self-evaluation. |

| • | stockholder’s name, number of shares owned, length of period held, and proof of ownership; |

| • | name, age and address of candidate; |

| • | a detailed resume describing, among other things, the candidate’s educational background, occupation, employment history for at least the previous five years, and material outside commitments (e.g., memberships on other Board of Directors and committees, charitable foundations, etc.); |

| • | a supporting statement which describes the candidate’s reasons for seeking election to the Board of Directors; |

| • | a description of any arrangements or understandings between the candidate and the Company and/or the stockholder; and |

| • | a signed statement from the candidate, confirming his/her willingness to serve on the Board of Directors. |

| • | Medical and Dental Coverage |

| • | Life Insurance |

| • | Short- and Long-Term Disability Plans |

| • | Paid Time Off |

| • | Wellness Programs |

| • | Commuter Benefits |

| • | 401(k) Defined Contribution Plan |

| • | Employee Assistance Program that includes counseling, convenience services, childcare and eldercare resources, access to legal resources, financial planning, chronic condition support and much more |

| • | Employee Discounts |

| • | Remote/hybrid positions for non-store employees |

| • | Tuition Assistance for all corporate employees and full-time store employees in the role of Assistant Store Manager and above |

| Name of Beneficial Owner | | | Common Stock Beneficially Owned | | | Percent of Class(1) |

| 5% Stockholders | | | | | ||

Immersion Corporation(2) | | | 11,006,702 | | | 42.0% |

Entities affiliated with TopLids LendCo, LLC(3) | | | 4,476,614 | | | 17.1% |

Vital Fundco, LLC(4) | | | 3,224,463 | | | 12.3% |

Outerbridge Capital Management, LLC(5) | | | 2,076,136 | | | 7.9% |

| | | | | |||

Directors, Director Nominees and Named Executive Officers(6) | | | | | ||

Michael P. Huseby(7) | | | 18,542 | | | * |

Kevin F. Watson(8) | | | — | | | — |

Michael C. Miller(9) | | | 4,946 | | | * |

Jonathan Shar(10) | | | 6,046 | | | * |

Seema Paul(11) | | | 1,066 | | | * |

David Henderson(12) | | | 1,151 | | | * |

Elias N. Nader(13) | | | 7,441 | | | * |

Emily S. Hoffman(14) | | | 7,441 | | | * |

Eric B. Singer(15) | | | 112,441 | | | * |

William C. Martin(16) | | | 125,441 | | | * |

Sean Vijay Madnani(17) | | | 7,441 | | | * |

Kathryn Eberle Walker(18) | | | 118 | | | * |

Denise Warren(19) | | | 118 | | | * |

All directors, director nominees and current executive officers as a group (11 persons)(20) | | | 272,499 | | | 1.0% |

| * | Less than 1% |

| (1) | Based on 26,208,036 shares of Common Stock outstanding as of July 26, 2024. Pursuant to SEC rules, a person is deemed to be the “beneficial owner” of a voting security if such person has (or shares) either investment power or voting power over such security or has (or shares) the right to acquire such security within 60 days by any of a number of means, including upon the exercise of options or warrants, the conversion of convertible securities or the vesting of restricted stock units. A beneficial owner’s percentage ownership is determined by assuming that options, warrants, convertible securities and restricted stock units that are held by the beneficial owner, but not those held by any other person, and which are exercisable or convertible within 60 days, have been exercised or converted. |

| (2) | Based on the Schedule 13D filed on June 12, 2024 by each of Toro 18 Holdings LLC (“Toro 18”), Immersion Corporation (“Immersion”), William C. Martin, Eric B. Singer, Emily S. Hoffman and Elias N. Nader. Toro 18, Immersion, Mr. Martin and Mr. Singer have shared voting power and shared dispositive power with respect to the shares listed in the table above. Toro 18 directly and beneficially owns the shares. Immersion, as the sole member of Toro 18, may be deemed to beneficially own the shares. As the Chief Strategy Officer of Toro 18, Mr. Martin may be deemed to beneficially own the shares. As President and Chief Executive Officer of Toro 18, Mr. Singer may be deemed to beneficially own the shares. The business address of each of Toro 18, Immersion and Mr. Singer is 2999 N.E. 191st Street, Suite 610, Aventura, Florida 33180. The business address of Mr. Martin is c/o Raging Capital Ventures, Ten Princeton Avenue, P.O. Box 228, Rocky Hill, New Jersey 08553. The business address of Ms. Hoffman is P.O. Box 660, Princeton, New Jersey 08542. The business address of Mr. Nader is c/o QuickLogic Corporation, 2220 Lundy Avenue, San Jose, California 95131. |

| (3) | Based on the Schedule 13G/A filed on June 20, 2024 by each of Lids Holdings, Inc., TopLids LendCo, LLC, Fanatics Leader Topco, Inc., Fanatics Lids College, Inc., FanzzLids Holdings, LLC, Fanatics Leader Holdings, LLC, Kynetic F, LLC, and Michael G. Rubin. The shares listed on the table above represents (i) 11,539 shares of Common Stock directly held by Fanatics Leader Topco, Inc. and beneficially owned by Kynetic F, LLC and Michael G. Rubin, each of which has shared dispositive power and voting power, (ii) 11,539 shares of Common Stock directly held by Lids Holdings, Inc. and beneficially owned by FanzzLids Holdings, LLC, Fanatics Leader Holdings, LLC, Fanatics Leader Topco, Inc., Kynetic F, LLC and Michael G. Rubin, each of which has shared dispositive power and voting power, (iii) 4,608 shares of Common Stock directly held by Fanatics Lids College, Inc. and beneficially owned by FanzzLids Holdings, LLC, Fanatics Leader |

| (4) | Based on the Schedule 13G filed on June 13, 2024 jointly by Vital Fundco, LLC (“Vital Fundco”) and Francisco Partners Agility GP II Management, LLC (“FP Agility GP II Management”), Vital Fundco and FP Agility GP II Management have shared voting power and shared dispositive power with respect to 3,224,463 shares of Common Stock. The shares listed in the table above are directly held by Vital FundCo. FP Agility GP II Management is the management entity of Vital Fundco and in such capacity may be deemed to beneficially own the shares. |

| (5) | Based on the Schedule 13D/A filed on June 11, 2024 jointly by Outerbridge Capital Management, LLC, Outerbridge Special Opportunities Fund, LP, Outerbridge Special Opportunities GP, LLC and Rory Wallace (collectively, the “Outerbridge Entities”), the Outerbridge Entities have shared voting power and shared dispositive power with respect to 207,613,525 shares of Common Stock. On June 11, 2024, the Company effected a 1-for-100 reverse stock split (the “Reverse Stock Split”) of the Common Stock. The number of shares beneficially owned by the Outerbridge Entities was adjusted by dividing by 100 to reflect the Reverse Stock Split. The number of shares listed in the table above reflects such adjustment and fractional shares resulting from the Reverse Stock Split have been rounded up to the nearest whole share. The address of Outerbridge Capital Management, LLC, Outerbridge Special Opportunities Fund, LP, Outerbridge Special Opportunities GP, LLC and Rory Wallace is listed as 767 Third Avenue, 11th Floor, New York, New York 10017. |

| (6) | The address of all of the officers and directors listed below is in the care of Barnes & Noble Education, Inc., 120 Mountain View Blvd., Basking Ridge, New Jersey 07920. |

| (7) | Includes 10,566 fully vested, unexercised options. The number of shares beneficially owned by Mr. Huseby as listed in the table above was adjusted by dividing by 100 to reflect the Reverse Stock Split and fractional shares resulting from the Reverse Stock Split have been rounded up to the nearest whole share. Mr. Huseby served as Chief Executive Officer during Fiscal 2024 and through June 11, 2024, when he resigned and Mr. Shar was appointed as Chief Executive Officer. |

| (8) | Mr. Watson was appointed Executive Vice President, Chief Financial Officer, effective September 7, 2023. Mr. Watson does not beneficially own any Common Stock of the Company. |

| (9) | Includes 2,808 fully vested, unexercised options, 1,021 options that vest within 60 days of July 26, 2024, and 185 restricted stock units that vest within 60 days of July 26, 2024. |

| (10) | Includes 2,452 fully vested, unexercised options, 748 options that vest within 60 days of July 26, 2024, and 154 restricted stock units that vest within 60 days of July 26, 2024. |

| (11) | Includes 85 restricted stock units that vest within 60 days of July 26, 2024. |

| (12) | Mr. Henderson retired effective as of June 2, 2023. The number of shares beneficially owned by Mr. Henderson as listed in the table above was adjusted by dividing by 100 to reflect the Reverse Stock Split and fractional shares resulting from the Reverse Stock Split have been rounded up to the nearest whole share. |

| (13) | Includes 7,441 restricted stock units that vest within 60 days of July 26, 2024. |

| (14) | Includes 7,441 restricted stock units that vest within 60 days of July 26, 2024. |

| (15) | Includes 7,441 restricted stock units that vest within 60 days of July 26, 2024. |

| (16) | Includes 7,441 restricted stock units that vest within 60 days of July 26, 2024. |

| (17) | Includes 7,441 restricted stock units that vest within 60 days of July 26, 2024, but for which the recipient has elected to defer settlement and receipt. |

| (18) | Includes 118 fully vested restricted stock units for which the recipient has elected to defer settlement and receipt. The number of RSUs listed in the table above reflects the adjustment resulted from the Reverse Stock Split and fractional shares have been rounded to the nearest whole share. |

| (19) | Includes 118 fully vested restricted stock units for which the recipient has elected to defer settlement and receipt. The number of RSUs listed in the table above reflects the adjustment resulted from the Reverse Stock Split and fractional shares have been rounded to the nearest whole share. |

| (20) | Does not include shares held by Mr. Huseby and Mr. Henderson who departed the Company as of the date of this Proxy Statement. |

| Named Executive Officer | | | Position |

Michael P. Huseby(1) | | | Chief Executive Officer |

Kevin F. Watson(2) | | | Executive Vice President, Chief Financial Officer |

| Michael C. Miller | | | Executive Vice President, Corporate Development & Affairs, Chief Legal Officer, and Secretary |

Jonathan Shar(1) | | | Executive Vice President, BNED Retail and President, Barnes & Noble College Bookseller, LLC |

| Seema C. Paul | | | Senior Vice President, Chief Accounting Officer |

David Henderson(3) | | | Former Executive Vice President, Strategic Services, and President, MBS Textbook Exchange, LLC |

| (1) | Mr. Huseby served as Chief Executive Officer during Fiscal 2024 and through June 11, 2024, when he resigned and Mr. Shar was appointed as Chief Executive Officer. |

| (2) | Mr. Watson was appointed as the Company’s Executive Vice President and Chief Financial Officer, effective September 7, 2023. |

| (3) | Mr. Henderson retired effective as of June 2, 2023. |

| • | Fiscal 2024 revenue grew 1.6% to $1.57 billion, primarily driven by 48% growth in First Day Complete revenue. |

| • | $27.6 million improvement in Net Loss from Continuing Operations from last year. |

| • | First Day Complete Spring 2024 store count grew to 160 stores, representing enrollment of approximately 805,000 undergraduate and post-graduate students, an increase of 39% compared to last year. |

| • | Entered into agreements to raise $95 million of new equity capital through a $50 million new equity investment led by Immersion Corporation and a $45 million fully backstopped equity rights offering. |

| • | Negotiated the conversion of approximately $34 million of outstanding term loan debt and accrued interest held by affiliates of Fanatics, Lids, and VitalSource Technologies into BNED Common Stock. |

| • | Refinanced our asset backed loan facility with our first lien holders, providing the Company with access to a $325 million facility maturing in 2028. |

| ✔ | Tie a majority of executive pay to performance-based cash and equity incentives; |

| ✔ | Align annual incentive payouts to individual and company-based performance goals; |

| ✔ | Vest equity awards over time to promote retention and require a one-year minimum vesting period for equity awards; |

| ✔ | Accelerate equity only upon termination of employment following a change in control (double trigger); |

| ✔ | Subject incentive compensation (including cash and equity) to a clawback policy; |

| ✔ | Require executive officers and directors to meet stock ownership targets and retention guidelines; |

| ✔ | Engage with stockholders regarding governance and/or executive compensation issues; |

| ✔ | Conduct an annual risk assessment of our executive compensation program; and |

| ✔ | Conduct an annual say-on-pay vote. |

| ✘ | Pay current dividends or dividend equivalents on unearned performance shares and unvested restricted stock units; |

| ✘ | Permit option repricing without stockholder approval; |

| ✘ | Provide significant perquisites; |

| ✘ | Pay tax gross-ups to executives; |

| ✘ | Provide supplemental executive retirement benefits; or |

| ✘ | Permit hedging for any employee or, without the approval of the Audit Committee, pledging by executive officers or directors. |

| Stockholders Were Concerned About | | | How We Addressed Their Concerns | ||||||

| • | | | No stock ownership guidelines for executive officers | | | • | | | Adopted stock ownership guidelines for executive officers (in addition to the existing guidelines for directors); only fully vested and owned shares count toward ownership requirement |

| | | | | | | ||||

| • | | | Clawback provisions only applied to equity awards | | | • | | | Adopted a compensation recoupment policy (“clawback policy”) that applies to all incentive compensation (cash and equity) |

| • | The Company did not issue equity awards to executive officers and directors during Fiscal 2024. |

| • | On April 25, 2023, the Compensation Committee approved the retention agreements with each of Messrs. Miller and Shar and Ms. Paul providing for cash retention bonuses in the following amounts: (i) $450,000 to Mr. Miller; (ii) $450,000 to Mr. Shar and (iii) $350,000 to Ms. Paul. On September 8, 2023, the Compensation Committee approved amendments to such retention agreements to provide that the retention bonuses would be payable as follows: (i) fifty percent (50%) of such bonus becoming due on September 1, 2023 (amended from November 1, 2023), and (ii) the remaining fifty percent (50%) becoming due on February 1, 2024 (amended from April 1, 2024), subject to continued employment through such dates, provided that if, prior to December 31, 2023, an NEO voluntarily resigns (other than due to Disability (as defined in the retention agreement) or Good Reason (as defined in the retention agreement) or the NEO is terminated for Cause, the Company reserved the right to clawback, in its sole and exclusive discretion, the first payment to such NEO on a pro rata basis. |

| • | On September 6, 2023, the Company announced the appointment of Mr. Watson as the Company’s Executive Vice President, Chief Financial Officer effective September 7, 2023. In connection with Mr. Watson’s appointment, Mr. Watson entered into an offer letter dated August 28, 2023 with the Company which provides for (i) an annual base salary of $540,000, (ii) a $5,000 sign on bonus, (iii) eligibility to earn an annual bonus with a target payout of 85% of his annual base salary, (iv) a guaranteed annual bonus for Fiscal 2024, prorated based on his time employed during the applicable fiscal year, and (v) eligibility to participate in the Company’s next stock grant, at levels commensurate with other similarly situated executives. On January 31, 2024, the Compensation Committee approved an amendment to Mr. Watson’s offer letter to accelerate payment of a portion of his guaranteed bonus ($191,250) to February 2024, with the remaining portion ($114,750) paid on May 3, 2024, following the end of Fiscal 2024. |

| • | On September 14, 2023, the Company and Mr. Huseby entered into a performance incentive agreement, providing for retention and performance cash incentive bonus opportunities as follows: (i) $220,000 payable on or about September 15, 2023, (ii) $220,000 if the Company’s second quarter Fiscal 2024 EBITDA meets or exceeds the Company’s plan, (iii) $220,000 if the Company remains in compliance with its existing credit agreements through December 31, 2023, (iv) $220,000 upon completion of a transaction approved by the ATC, and (v) $220,000 if awarded by the Board in its discretion upon a recommendation from the ATC. Such agreement also provided for accelerated payment rights for Mr. Huseby in the event that the Company terminates the employment of Mr. Huseby without Cause (as defined in the performance incentive agreement) or if Mr. Huseby’s employment ends because of Disability or for Good Reason (each as defined in the performance incentive agreement). If, prior to December 31, 2023, Mr. Huseby voluntarily resigned (other than due to Disability or for Good Reason), or his employment was terminated by the Company for Cause, the Company reserved the right to clawback any performance incentive bonus payments paid through such date on a pro rata basis. |

| • | On April 15, 2024, in connection with a Standby, Securities Purchase and Debt Conversion Agreement, dated as of April 16, 2024 (the “Purchase Agreement”), by and among the Company, Toro 18 Holdings LLC, Outerbridge Capital Management, LLC, Selz Family 2011 Trust, Vital Fundco, LLC, and TopLids LendCo, LLC, Mr. Huseby entered into a letter agreement with the Company related to his compensation. Pursuant to the letter agreement, Mr. Huseby agreed to amendments to his employment agreement, pursuant to which, among other things, he agreed to a revised decreased severance amount of $750,000. Mr. Huseby also agreed to provide transition services as a consultant for six months following the effective date of any termination of his employment that triggers a right to receive such severance in return for compensation of $750,000 to be paid at the end of such six-month period regardless of whether the Company requests that he render any transition services. |

| • | On June 11, 2024, Mr. Huseby resigned as Chief Executive Officer, and Mr. Shar was appointed as the Company’s new Chief Executive Officer. There were no changes to Mr. Shar’s compensation as a result of the appointment. |

| • | attract, retain, and motivate talented executives responsible for the success of our organization; |

| • | provide compensation to executives that is externally competitive, internally equitable, performance-based, and aligned with stockholder interests; and |

| • | ensure that total compensation levels are reflective of company and individual performance and provide executives with the opportunity to receive above-market total compensation for exceptional business performance. |

| 2U, Inc. | | | Grand Canyon Education, Inc. |

| Adtalem Global Education Inc. | | | John Wiley & Sons, Inc. |

| American Eagle Outfitters, Inc. | | | Lands’ End, Inc. |

| Bright Horizons Family Solutions Inc. | | | Scholastic Corporation |

| Chegg, Inc. | | | Stride, Inc. |

| Express, Inc. | | | Urban Outfitters, Inc. |

| Graham Holdings Company | | |

| Named Executive Officer | | | Base Salary in Fiscal 2023 | | | Base Salary in Fiscal 2024 | | | Percentage Change |

Michael P. Huseby(1) | | | $1,100,000 | | | $1,100,000 | | | 0% |

Kevin F. Watson(2) | | | $— | | | $540,000 | | | 0% |

| Michael C. Miller | | | $600,000 | | | $600,000 | | | 0% |

| Jonathan Shar | | | $550,000 | | | $550,000 | | | 0% |

| Seema C. Paul | | | $335,000 | | | $360,000 | | | 7% |

David Henderson(3) | | | $550,000 | | | $— | | | 0% |

| (1) | Mr. Huseby served as Chief Executive Officer during Fiscal 2024 and through June 11, 2024, when he resigned and Mr. Shar was appointed as Chief Executive Officer. |

| (2) | Mr. Watson was appointed as the Company’s Executive Vice President, Chief Financial Officer, effective as of September 7, 2023. |

| (3) | Mr. Henderson retired from the Company effective as of June 2, 2023. |

| Named Executive Officer | | | Annual Target as Percentage of Salary |

| Michael P. Huseby | | | 100% |

| Kevin F. Watson | | | 85% |

| Michael C. Miller | | | 85% |

| Jonathan Shar | | | 85% |

| Seema C. Paul | | | 75% |

| • | a balance among short- and long-term incentives; cash and equity-based compensation; and fixed and variable pay; |

| • | multiple performance metrics; |

| • | the Clawback Policy; |

| • | the “Stock Ownership Guidelines” and holding guidelines; |

| • | the Company’s anti-hedging and pledging policies; and |

| • | limited change-in-control benefits. |

| Name and Principal Position | | | Fiscal Year | | | Salary(1) | | | Bonus(2) | | | Stock Awards(3) | | | Option Awards(4) | | | All Other Compensation(5) | | | Total |

Michael P. Huseby(6) Chief Executive Officer | | | 2024 | | | 1,100,000 | | | 660,000 | | | — | | | — | | | 27,099 | | | 1,787,099 |

| | 2023 | | | 1,100,000 | | | — | | | 360,556 | | | 390,970 | | | 39,257 | | | 1,890,783 | ||

| | 2022 | | | 1,100,000 | | | — | | | 1,650,002 | | | 1,877,394 | | | 38,710 | | | 4,666,106 | ||

Kevin F. Watson(7) Executive Vice President, Chief Financial Officer | | | 2024 | | | 336,462 | | | 311,000 | | | — | | | — | | | 1,075 | | | 648,537 |

| | 2023 | | | — | | | — | | | — | | | — | | | — | | | — | ||

| | 2022 | | | — | | | — | | | — | | | — | | | — | | | — | ||

Michael C. Miller Chief Legal Officer and Executive Vice President, Corporate Development & Affairs, and Secretary | | | 2024 | | | 600,000 | | | 600,000 | | | — | | | — | | | 4,574 | | | 1,204,574 |

| | 2023 | | | 600,000 | | | 150,000 | | | 131,112 | | | 142,172 | | | 11,485 | | | 1,034,769 | ||

| | 2022 | | | 600,000 | | | — | | | 600,005 | | | 682,695 | | | 7,970 | | | 1,890,670 | ||

Jonathan Shar(6) Executive Vice President, BNED Retail | | | 2024 | | | 550,000 | | | 600,000 | | | — | | | — | | | 8,097 | | | 1,158,097 |

| | 2023 | | | 550,000 | | | 150,000 | | | 109,261 | | | 118,477 | | | 12,593 | | | 940,331 | ||

| | 2022 | | | 550,000 | | | — | | | 500,008 | | | 568,910 | | | 8,277 | | | 1,627,195 | ||

Seema C. Paul(8) Senior Vice President, Chief Accounting Officer | | | 2024 | | | 360,000 | | | 350,000 | | | — | | | — | | | 6,274 | | | 716,274 |

| | 2023 | | | 335,000 | | | 87,500 | | | 60,093 | | | — | | | 9,839 | | | 492,432 | ||

| | 2022 | | | 335,000 | | | — | | | 275,000 | | | — | | | 5,631 | | | 615,631 | ||

David Henderson(9) Former Executive Vice President, Strategic Services, and President, MBS Textbook Exchange, LLC | | | 2024 | | | 148,077 | | | — | | | — | | | — | | | 1,050,710 | | | 1,198,787 |

| | 2023 | | | 550,000 | | | — | | | 49,168 | | | 53,315 | | | 30,314 | | | 682,797 | ||

| | 2022 | | | 550,000 | | | — | | | 225,007 | | | 256,016 | | | 29,068 | | | 1,060,091 |

| (1) | This column represents base salary earned during each fiscal year. For Mr. Henderson, the amount for 2024 also includes $99,423 of accrued but unused paid time off paid in connection with his retirement. |

| (2) | This column represents the retention and incentive bonus awards earned and paid during Fiscal 2024 and for Mr. Watson, the amount represents his sign-on bonus ($5,000) and guaranteed pro rata annual bonus ($306,000). |

| (3) | Amounts reported under the Stock Awards column represent, with respect to Fiscal 2023 and 2022, Restricted Stock Unit grants. The grant date fair value of restricted stock awards is computed in accordance with Financial Accounting Standards Board (“FASB”) Accounting Standards Codification 718, Compensation-Stock Compensation (“ASC 718”). The stock awards value is determined to be the fair market value of the underlying Company shares on the grant date, which is determined based on the closing price of the Company’s Common Stock on the grant date. These amounts do not reflect compensation actually received by the NEO. |

| (4) | Amounts reported under the Option Awards column represent the grant date fair value of option awards determined pursuant to FASB ASC 718, excluding estimated forfeitures. The assumptions used to calculate the value of option awards are set forth under Note 12 of the Notes to Consolidated Financial Statements included in our annual report on Form 10-K for the applicable fiscal year. These amounts do not reflect compensation actually received by the NEO. |

| (5) | This column represents the value of all other compensation, as detailed in the table below. |

| (6) | Mr. Huseby served as Chief Executive Officer during Fiscal 2024 and through June 11, 2024, when he resigned and Mr. Shar was appointed as Chief Executive Officer. |

| (7) | Mr. Watson was appointed Executive Vice President, Chief Financial Officer, effective September 7, 2023. |

| (8) | Ms. Paul was not an NEO in Fiscal 2022 and 2023. |

| (9) | Mr. Henderson was not an NEO in Fiscal 2022. Mr. Henderson retired effective June 2, 2023. |

| Name and Principal Position | | | Fiscal Year | | | Long-Term Disability Insurance(1) | | | Life and AD&D Insurance(2) | | | 401(k) Company Match(3) | | | Cell Phone | | | Severance | | | Total Other Compensation |

| Michael P. Huseby | | | 2024 | | | $13,718 | | | $12,181 | | | $— | | | $1,200 | | | $— | | | $27,099 |

| | 2023 | | | $13,718 | | | $12,108 | | | $12,231 | | | $1,200 | | | $— | | | $39,257 | ||

| | 2022 | | | $13,718 | | | $12,023 | | | $11,769 | | | $1,200 | | | $— | | | $38,710 | ||

| Kevin F. Watson | | | 2024 | | | $— | | | $275 | | | $— | | | $800 | | | $— | | | $1,075 |

| | 2023 | | | $— | | | $— | | | $— | | | $— | | | $— | | | $— | ||

| | 2022 | | | $— | | | $— | | | $— | | | $— | | | $— | | | $— | ||

| Michael C. Miller | | | 2024 | | | $— | | | $466 | | | $2,908 | | | $1,200 | | | $— | | | $4,574 |

| | 2023 | | | $— | | | $393 | | | $9,892 | | | $1,200 | | | $— | | | $11,485 | ||

| | 2022 | | | $— | | | $308 | | | $6,462 | | | $1,200 | | | $— | | | $7,970 | ||

| Jonathan Shar | | | 2024 | | | $— | | | $466 | | | $6,431 | | | $1,200 | | | $— | | | $8,097 |

| | 2023 | | | $— | | | $393 | | | $11,000 | | | $1,200 | | | $— | | | $12,593 | ||

| | 2022 | | | $— | | | $308 | | | $6,769 | | | $1,200 | | | $— | | | $8,277 | ||

| Seema C. Paul | | | 2024 | | | $— | | | $466 | | | $4,608 | | | $1,200 | | | $— | | | $6,274 |

| | 2023 | | | $— | | | $393 | | | $8,246 | | | $1,200 | | | $— | | | $9,839 | ||

| | 2022 | | | $— | | | $308 | | | $4,123 | | | $1,200 | | | $— | | | $1,508 | ||

David Henderson(5) | | | 2024 | | | $95 | | | $110 | | | $5,547 | | | $— | | | $1,036,442(4) | | | $1,050,710 |

| | 2023 | | | $571 | | | $1,013 | | | $12,000 | | | $— | | | $— | | | $30,314 | ||

| | 2022 | | | $576 | | | $1,013 | | | $6,807 | | | $— | | | $— | | | $29,068 |

| (1) | This represents the premiums paid by the Company for long-term disability insurance. |

| (2) | This represents the premiums paid by the Company for life and accidental death and dismemberment insurance. |

| (3) | In August 2023, upon management’s recommendation, the Compensation Committee approved the conversion of the Company’s 401(k) plan match to a year end match to be awarded at the Compensation Committee’s discretion based upon the Company’s Fiscal 2024 results. |

| (4) | The amount for Fiscal 2024 includes the aggregate cash payment of $1,017,500 that Mr. Henderson received in connection with his retirement, and COBRA reimbursements of $18,942. |

| (5) | Total other income for Mr. Henderson also includes (i) leased vehicle expense of $8,516, $13,904 and $17,846 for 2024, 2023 and 2022, respectively; and (ii) reimbursement of country club fees of $2,826 and $2,826 for 2023 and 2022, respectively. Mr. Henderson retired effective June 2, 2023. |

| Name | | | Stock Award Grant Date | | | RSU | | | Number of Shares or Units of Stock That Have Not Vested(1)(2) | | | Market Value of Shares or Units of Stock That Have Not Vested(3) | | | Vesting Dates |

Michael P. Huseby(4) | | | 9/23/21 | | | RSU | | | 509 | | | $10,134 | | | 9/23/24 |

| | 6/16/22 | | | RSU | | | 1,019 | | | $20,269 | | | 6/16/24, 6/16/25 | ||

| Kevin F. Watson | | | — | | | — | | | — | | | $— | | | — |

| Michael C. Miller | | | 9/23/21 | | | RSU | | | 185 | | | $3,685 | | | 9/23/24 |

| | 6/16/22 | | | RSU | | | 370 | | | $7,371 | | | 6/16/24, 6/16/25 | ||

| Jonathan Shar | | | 9/23/21 | | | RSU | | | 154 | | | $3,071 | | | 9/23/24 |

| | 6/16/22 | | | RSU | | | 308 | | | $6,142 | | | 6/16/24, 6/16/25 | ||

| Seema C. Paul | | | 9/23/21 | | | RSU | | | 85 | | | $1,689 | | | 9/23/24 |

| | 6/16/22 | | | RSU | | | 170 | | | $3,378 | | | 6/16/24, 6/16/25 |

| (1) | Share numbers reflect adjustments following the Company’s 1-for-100 reverse stock split effective June 11, 2024. |

| (2) | This column represents outstanding grants of shares of restricted stock units (RSU). |

| (3) | Market values have been calculated using pre-reverse stock split share numbers and a stock price of $0.1990 (closing price of our Common Stock on April 26, 2024, the last trading day of Fiscal 2024). |

| (4) | Mr. Huseby terminated employment effective June 11, 2024, and the RSUs included in the table above were forfeited in their entirety on such date. |

| Name | | | Number of Securities Underlying Unexercised Options (#) Exercisable(1) | | | Number of Securities Underlying Unexercised Options (#) Unexercisable(1) | | | Option Exercise Price ($)(1) | | | Option Expiration Date(2) |

| Michael P. Huseby | | | 4,263 | | | 1,421 | | | $246 | | | 9/22/30 |

| | 4,263 | | | 1,421 | | | $500 | | | 9/22/30 | ||

| | 706 | | | 706 | | | $1,330 | | | 9/23/31 | ||

| | 653 | | | 653 | | | $1,080 | | | 9/23/31 | ||

| | 326 | | | 979 | | | $236 | | | 6/16/32 | ||

| | 353 | | | 1,059 | | | $486 | | | 6/16/32 | ||

| Michael C. Miller | | | 1,043 | | | 387 | | | $246 | | | 9/22/30 |

| | 775 | | | 387 | | | $500 | | | 9/22/30 | ||

| | 257 | | | 256 | | | $1,330 | | | 9/23/31 | ||

| | 237 | | | 237 | | | $1,080 | | | 9/23/31 | ||

| | 119 | | | 356 | | | $236 | | | 6/16/32 | ||

| | 128 | | | 384 | | | $486 | | | 6/16/32 | ||

| Jonathan Shar | | | 814 | | | 271 | | | $246 | | | 9/22/30 |

| | 814 | | | 271 | | | $500 | | | 9/22/30 | ||

| | 198 | | | 198 | | | $1,080 | | | 9/23/31 | ||

| | 214 | | | 214 | | | $1,330 | | | 9/23/31 | ||

| | 99 | | | 297 | | | $236 | | | 6/16/32 | ||

| | 107 | | | 321 | | | $486 | | | 6/16/32 |

| (1) | Share numbers and option exercise prices reflect adjustments following the Company’s 1-for-100 reverse stock split effective June 11, 2024. |

| (2) | Option expiration dates reflect the applicable expiration date as of the end of Fiscal 2024. Mr. Huseby’s options all provide for a 90-day post termination exercise period, and such options will automatically expire if not exercised by this date. |

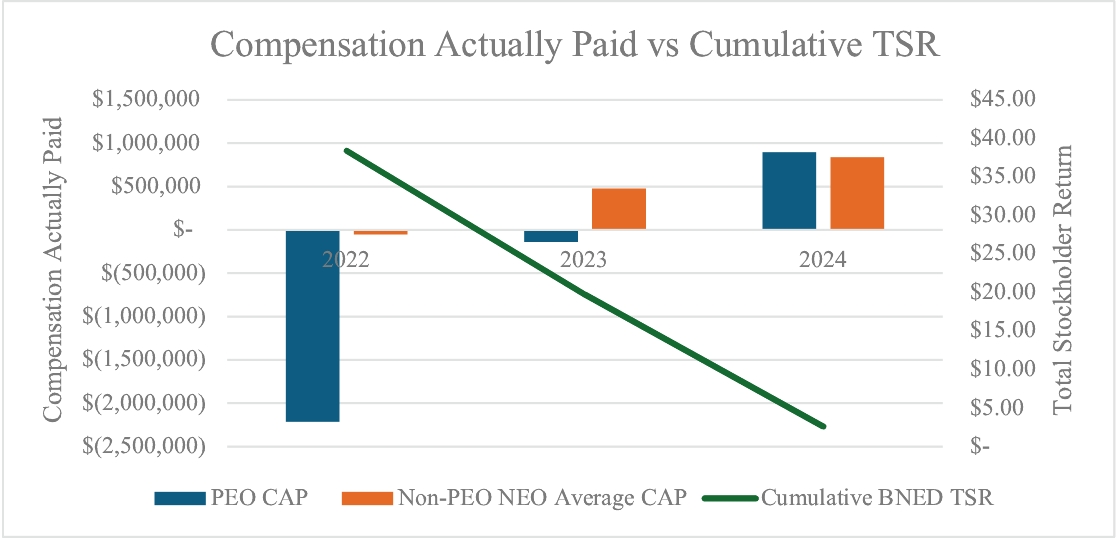

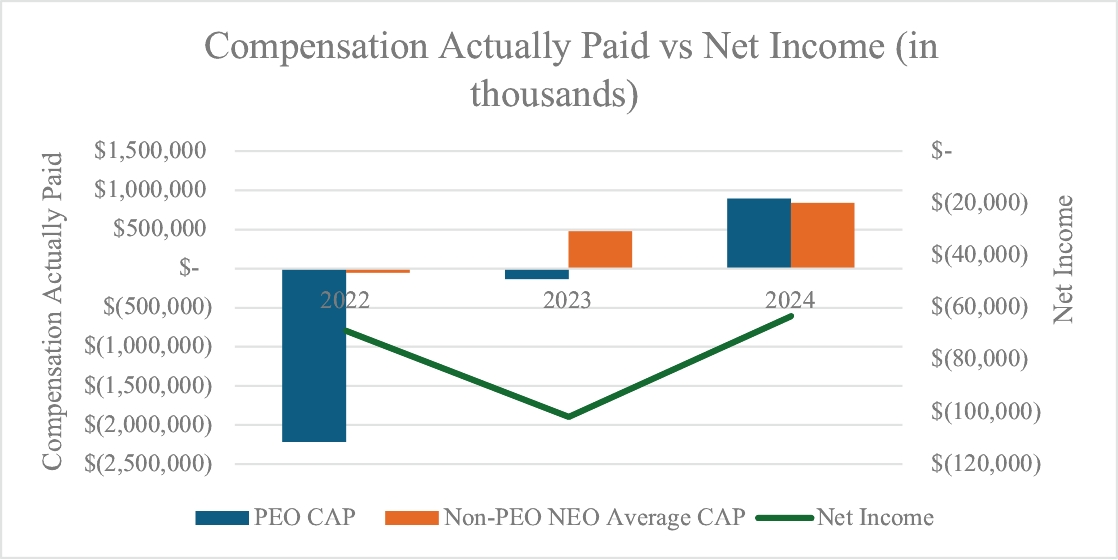

| Fiscal Year | | | Summary Compensation Table Total for CEO ($)(1) | | | Compensation Actually Paid to CEO ($)(2) | | | Average Summary Compensation Table Total for Non-CEO Named Executive Officers (“NEOs”) ($)(3) | | | Average Compensation Actually Paid to Non-CEO NEOs ($)(2)(3) | | | Value of Initial Fixed $100 Investment Based on Total Stockholder Return ($)(4) | | | Net Income ($ thousands) |

| 2024 | | | 1,787,099 | | | 895,431 | | | 985,254 | | | 838,305 | | | 2.62 | | | (63,211) |

| 2023 | | | 1,890,783 | | | (134,970) | | | 1,045,680 | | | 478,125 | | | 19.72 | | | (101,862) |

| 2022 | | | 4,666,106 | | | (2,214,193) | | | 1,788,493 | | | (50,246) | | | 38.43 | | | (68,857) |

| (1) | Mr. Huseby was the CEO each of Fiscal 2024, 2023 and 2022. |

| (2) | SEC rules require certain adjustments be made to the Summary Compensation Table totals to determine Compensation Actually Paid as reported in the Pay versus Performance Table. Compensation Actually Paid does not necessarily represent cash and/or equity value transferred to the applicable NEO without restriction, but rather is a value calculated under applicable SEC rules. In general, Compensation Actually Paid is calculated as Summary Compensation Table total compensation adjusted to include the fair market value of equity awards as of the end of the applicable fiscal year or, if earlier, the vesting date (rather than the grant date). NEOs do not participate in a defined benefit plan so no adjustment for pension benefits is included in the table below. Similarly, no adjustment is made for dividends as dividends are factored into the fair value of the award. |

| (3) | The non-CEO named executive officers include the following individuals in each year: |

| (4) | Total Stockholder Return is determined based on the value of an initial fixed investment of $100 on April 30, 2021. |

| Item and Value Added (Deducted) | | | 2024 | | | 2023 | | | 2022 |

| For CEO: | | | | | | | |||

| Summary Compensation Table Total | | | $1,787,099 | | | $1,890,783 | | | $4,666,106 |

| - Summary Compensation Table “Option Awards” column value | | | — | | | (390,970) | | | (1,877,394) |

| - Summary Compensation Table “Stock Awards” column value | | | — | | | (360,556) | | | (1,650,002) |

| + Year End fair value of outstanding and unvested equity awards granted in the fiscal year | | | — | | | 468,285 | | | 829,586 |

| +/- change in fair value of outstanding and unvested equity awards granted in prior years | | | $(660,563) | | | $(1,247,961) | | | $(5,703,253) |

| + vest date fair value of equity awards granted in the covered year | | | — | | | — | | | — |

| +/- change in fair value of prior-year equity awards vested in the fiscal year | | | (231,105) | | | (494,551) | | | 1,520,765 |

| Compensation Actually Paid | | | $895,431 | | | $(134,970) | | | $(2,214,193) |

| For Non-CEO NEOs (Average) | | | | | | | |||

| Summary Compensation Table Total | | | 985,254 | | | 1,045,680 | | | 1,788,493 |

| - Summary Compensation Table “Option Awards” column value | | | — | | | (114,923) | | | (625,803) |

| - Summary Compensation Table “Stock Awards” column value | | | — | | | (105,983) | | | (550,007) |

| + Year End fair value of outstanding and unvested equity awards granted in the fiscal year | | | — | | | 96,692 | | | 276,531 |

| +/- change in fair value of outstanding and unvested equity awards granted in prior years | | | (86,179) | | | (173,534) | | | (1,181,555) |

| Item and Value Added (Deducted) | | | 2024 | | | 2023 | | | 2022 |

| + vest date fair value of equity awards granted in the covered year | | | — | | | — | | | — |

| +/- change in fair value of prior-year equity awards vested in the fiscal year | | | (32,382) | | | (76,849) | | | 242,095 |

| - fair value of awards granted during prior year forfeited during year determined as of prior year end | | | (28,388) | | | (192,960) | | | — |

| Compensation Actually Paid | | | $838,305 | | | $478,125 | | | $(50,246) |

| Name | | | Paid in Cash | | | Number of Restricted Stock Units (Number of Shares) | | | Value | | | Total Compensation |

Emily C. Chiu(5) | | | $55,000 | | | — | | | $— | | | $55,000 |

Mario R. Dell’Aera, Jr.(3) | | | $303,997 | | | — | | | $— | | | $303,997 |

Daniel A. DeMatteo(5) | | | $52,500 | | | — | | | $— | | | $52,500 |

Kathryn Eberle Walker(3) | | | $207,129 | | | — | | | $— | | | $207,129 |

David G. Golden(3) | | | $220,000 | | | — | | | $— | | | $220,000 |

Steven Panagos(2)(4) | | | $390,484 | | | — | | | $— | | | $390,484 |

John R. Ryan(3) | | | $272,809 | | | — | | | $— | | | $272,809 |

Rory Wallace(4) | | | $398,506 | | | — | | | $— | | | $398,506 |

Raphael Wallander(2)(4) | | | $390,484 | | | — | | | $— | | | $390,484 |

Denise Warren(3) | | | $214,306 | | | — | | | $— | | | $214,306 |

| (1) | None of the directors hold unvested restricted units or shares as of the end of Fiscal 2024. |

| (2) | Appointed to the Board of Directors effective August 11, 2023. |

| (3) | Includes two payments of $50,000 each paid in cash in lieu of equity. |

| (4) | Compensation received includes monthly payments made to Messrs. Panagos, Wallace and Wallander as members of the ATC. Mr. Wallace served on the ATC from August 11, 2023 to April 15, 2024. |

| (5) | Ms. Chiu and Mr. DeMatteo did not stand for re-election at the 2023 annual meeting of stockholders of the Company. |

| • | Increase by 2,000,000 the number of shares of common stock available for issuance under the Equity Incentive Plan, for an aggregate total of 2,179,093 shares (post-reverse stock split); |

| • | Amend the definition of a “Change of Control” to remove existing exceptions for incremental stock purchases by Mr. Leonard Riggio and his affiliates and replace with similar exceptions for incremental stock purchases by Immersion Corporation or its affiliates; and |

| • | remove the minimum one-year vesting requirement to give the Company additional flexibility in attracting and retaining key talent. |

| • | Remaining shares available under the Equity Incentive Plan, |

| • | Projected equity granting practices, and |

| • | Current and total potential dilution of outstanding awards, remaining available shares, and newly requested shares. |

| i. | during any period of 24 consecutive months, a change in the composition of a majority of the Board, as constituted on the first day of such period, that was not supported by a majority of the incumbent directors; |

| ii. | the consummation of certain mergers or consolidations of the Company with any other corporation, or the sale of all or substantially all the assets of the Company, following which the Company’s then current stockholders cease to own more than 50% of the combined voting power of the surviving entity; or |

| iii. | the acquisition by a third party (other than Immersion Corporation and its affiliates) of 40% or more of the combined voting power of the then outstanding voting securities of the Company. An award agreement may provide for a different definition of Change of Control than is provided for in the Equity Incentive Plan, any definition of Change of Control set forth in any award agreement will provide that a Change of Control would not occur until consummation or effectiveness of a Change of Control of the Company, rather than upon the announcement, commencement, stockholder approval or other potential occurrence of any event or transaction that, if completed, would result in a change of control of the Company. |

| • | Incentive Stock Options. A participant will not recognize any taxable income on grant or exercise of an incentive stock option. The exercise of an incentive stock option may, however, result in the imposition of the alternative minimum tax. The Company is not entitled to a deduction on grant or exercise of an incentive stock option unless the participant disposes of the shares within 12 months after exercise or within 2 years after the date of grant. If, however, such shares are disposed of within either of the above-described periods, then in the year of that disposition, the participant will recognize compensation taxable as ordinary income equal to the excess of the lesser of (i) the amount realized upon that disposition, and (ii) the excess of the fair market value of those shares on the date of exercise over the exercise price. |

| • | Other Awards. A participant will not recognize any taxable income on grant of non-statutory stock options, stock appreciation rights, restricted stock units or performance awards. On exercise of non-statutory stock options or stock appreciation rights, on expiration of a restriction period for restricted shares (except as described below) or the settlement of restricted share units, or on expiration of a performance period for performance awards, the participant will recognize compensation income, subject to withholding if the participant is an employee or a former employee, and the Company may be entitled to a deduction equal to the value of the Common Stock or cash the participant receives (minus, in the case of a non-statutory stock option, the option exercise price paid by the participant or in the case of a stock appreciation right, the base price applicable to the award). With respect to restricted shares, a participant may elect to recognize taxable income on the grant date in an amount equal to the fair market value of the restricted shares at such time. |

| Name and Position | | | Dollar Value ($)(1) | | | Number of Shares/Units |

| Jonathan Shar, Chief Executive Officer | | | 3,711,600 | | | 360,000 |

| Seema Paul, Senior Vice President and Chief Accounting Officer | | | 206,200 | | | 20,000 |

| All current executive officers, as a group (4 persons) | | | 3,971,800 | | | 380,000 |

| All non-executive officer employees as a group | | | 11,942,589 | | | 1,158,350 |

| (1) | For all employees, the dollar value reflects the number of PSUs multiplied by $10.31, the closing trading price of the Company’s common stock on July 30, 2024. The amounts do not reflect the grant date fair value under FASB ASC 718 or the compensation that may actually be received by the employee. |

| Plan category | | | [a] Number of securities to be issued upon exercise of outstanding options, warrants and rights(1) | | | [b] Weighted- average exercise price of outstanding options, warrants and rights(1) | | | [c] Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column [a]) |

| Equity compensation plans approved by stockholders | | | 30,044 | | | 520.00 | | | 69,130 |

| Equity compensation plans not approved by stockholders | | | N/A | | | N/A | | | N/A |

| Total | | | 30,044 | | | $520.00 | | | 69,130 |

| (1) | Represents shares of Common Stock to be issued upon vesting of outstanding restricted stock units, which shares are issued for no additional consideration. |

| | | Fiscal 2024 | | | Fiscal 2023 | |

Audit Fees(1) | | | $— | | | $— |

Audit-Related Fees(1) | | | — | | | — |

Tax Fees(1) | | | — | | | — |

All Other Fees(2) | | | 27,889 | | | 27,293 |

| Total | | | $27,889 | | | $27,293 |

| (1) | The Company did not incur any audit fees, audit-related fees, or tax fees from BDO during Fiscal 2024 and Fiscal 2023. |

| (2) | Consists of fees billed for rendering profit sharing audit services for MBS Textbook Exchange, LLC, a wholly-owned subsidiary of the Company. |

| | | By Order of the Board of Directors | |

| | | ||

| | | William C. Martin, Chairman of the Board of Directors | |

| | | ||

| | | [•], 2024 |