Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration Number 333-203772

PROSPECTUS

MPG Holdco I Inc.

a wholly-owned subsidiary of

Metaldyne Performance Group Inc.

OFFER TO EXCHANGE

$600,000,000 aggregate principal amount of its 7.375% Senior Notes due 2022, the issuance of which has been

registered under the Securities Act of 1933, as amended,

for

all of its outstanding 7.375% Senior Notes due 2022

We are offering to exchange, upon the terms and subject to the conditions set forth in this prospectus and the accompanying letter of transmittal, all of our new 7.375% Senior Notes due 2022 (the “exchange notes”) for all of our outstanding 7.375% Senior Notes due 2022 (the “original notes” and collectively with the exchange notes, the “notes”). We are also offering the guarantees of the exchange notes by our parent, Metaldyne Performance Group Inc. (“MPG” or the “Company”) and certain of our subsidiaries. The terms of the exchange notes and the guarantees are described in this prospectus and are substantially identical to the terms of the original notes and the guarantees except that the issuance of the exchange notes has been registered pursuant to an effective registration statement under the Securities Act of 1933, as amended (the “Securities Act”). We will pay interest on the notes on April 15 and October 15 of each year. The notes mature on October 15, 2022. The principal features of the exchange offer are as follows:

| • | We will exchange all original notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer for an equal principal amount of exchange notes. |

| • | You may withdraw tendered original notes at any time prior to the expiration of the exchange offer. |

| • | The exchange offer expires at 5:00 p.m., New York City time, on June 8, 2015, unless extended. We do not currently intend to extend the expiration date. |

| • | The exchange of original notes for exchange notes pursuant to the exchange offer will not be a taxable event for U.S. federal income tax purposes. |

| • | We will not receive any proceeds from the exchange offer. |

| • | We do not intend to apply for listing of the exchange notes on any securities exchange or automated quotation system. All untendered original notes will continue to be subject to the restrictions on transfer set forth in the original notes and in the indenture. In general, the original notes may not be offered or sold except in a transaction registered under the Securities Act or pursuant to an exemption from, or in a transaction not subject to, the Securities Act and applicable state securities laws. Other than in connection with the exchange offer, we do not currently anticipate that we will register the original notes under the Securities Act. |

You should consider carefully therisk factors beginning on page 15 of this prospectus before participating in the exchange offer.

Each broker-dealer that receives exchange notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. The letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an “underwriter” within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of exchange notes received in exchange for original notes where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, starting on the expiration date of the exchange offer and ending on the close of business one year after the expiration date of the exchange offer, it will make this prospectus available to any broker-dealer for use in connection with any such resale. See “Plan of Distribution.”

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

You should rely only on the information contained in this prospectus. We have not authorized any person to provide you with any information or represent anything about us or the exchange offer that is not contained in this prospectus. If given or made, any such other information or representation should not be relied upon as having been authorized by us. We are offering to exchange the original notes for the exchange notes only in places where the exchange offer is permitted. You should not assume that the information contained in this prospectus is accurate as of any date other than the date on the front cover of this prospectus.

The date of this prospectus is May 8, 2015.

Table of Contents

| i | ||||

| i | ||||

| ii | ||||

| iv | ||||

| iv | ||||

| iv | ||||

| 1 | ||||

| 15 | ||||

| 34 | ||||

| 43 | ||||

| 44 | ||||

| 51 | ||||

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS | 53 | |||

| 82 | ||||

| 88 | ||||

| 95 | ||||

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT | 110 | |||

| 111 | ||||

| 113 | ||||

| 115 | ||||

| 181 | ||||

| 182 | ||||

| 183 | ||||

| 183 | ||||

| F-1 | ||||

Table of Contents

WHERE YOU CAN FIND ADDITIONAL INFORMATION

We and the guarantors have filed with the Securities and Exchange Commission, or the SEC, a registration statement on Form S-4 under the Securities Act with respect to the exchange notes being offered hereby. This prospectus, which forms a part of the registration statement, does not contain all of the information set forth in the registration statement. For further information with respect to us, the guarantors or the exchange notes, we refer you to the registration statement. We file reports and other information with the SEC. The registration statement, such reports and other information can be inspected and copied at the Public Reference Room of the SEC located at 100 F Street, N.E., Washington D.C. 20549. Copies of such materials, including copies of all or any portion of the registration statement, can be obtained from the Public Reference Room of the SEC at prescribed rates. You can call the SEC at 1-800-SEC-0330 to obtain information about the Public Reference Room. Such materials may also be accessed electronically by means of the SEC’s home page on the Internet (http://www.sec.gov). In addition, you may obtain these materials free of charge on the Company’s website (http://www.mpgdriven.com). The contents of our website have not been, and shall not be deemed to be incorporated by reference into this prospectus.

Under the terms of the indenture relating to the notes, we have agreed that, whether or not we are required to do so by the rules and regulations of the SEC, for so long as any of the notes remain outstanding, we will furnish to the trustee and holders of the notes the information specified therein in the manner specified therein. See “Description of Exchange Notes.”

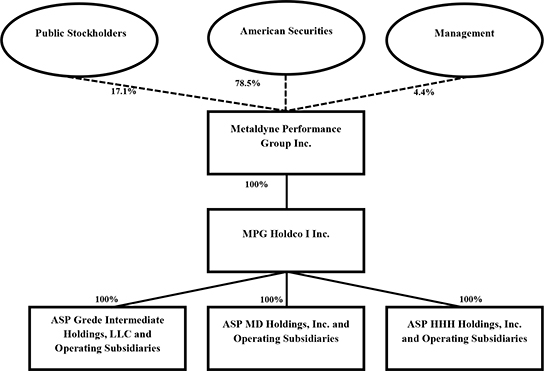

The reorganization of ASP HHI Holdings, Inc. (together with its subsidiaries, “HHI”), ASP MD Holdings, Inc. (together with its subsidiaries, “Metaldyne”) and ASP Grede Intermediate Holdings LLC (together with its subsidiaries, “Grede”) occurred on August 4, 2014 (the “Combination”) through mergers with three separate wholly-owned merger subsidiaries of Metaldyne Performance Group Inc. See “Summary—Company Organization and History.” MPG Holdco I Inc. (the “Issuer”) is a wholly-owned subsidiary of Metaldyne Performance Group Inc. and the direct parent of HHI, Metaldyne and Grede. Unless otherwise stated in this prospectus or as the context may otherwise require, references to “MPG” and the “Company” refer to Metaldyne Performance Group Inc. MPG is a holding company with no operations, assets or liabilities other than the equity of the Issuer. The Issuer is a holding company with no operations, assets or liabilities other than the equity of HHI, Metaldyne and Grede, the original notes and the Senior Credit Facilities. Unless otherwise stated in this prospectus or as the context may otherwise require, references to “we,” “our,” “us” and similar terms refer to the Issuer and all of its subsidiaries, including HHI, Metaldyne and Grede.

This prospectus presents HHI as the predecessor to MPG. HHI was acquired by a wholly-owned subsidiary of certain private equity funds affiliated with American Securities LLC (together with its affiliates, “American Securities”) and certain members of HHI management on October 5, 2012. Metaldyne was acquired by American Securities and certain members of Metaldyne management on December 18, 2012. The period from January 1, 2011 to October 5, 2012 is referred to as the Predecessor Period and the period from October 6, 2012 to September 28, 2014 is referred to as the Successor Period. The period from October 6, 2012 to December 31, 2012 is referred to as Successor Period 2012 and the period from January 1, 2012 to October 5, 2012 is referred to as Predecessor Period 2012. Grede was acquired by a wholly-owned subsidiary of American Securities and certain members of Grede management on June 2, 2014. The following timeline illustrates the periods for which financial information for HHI, Metaldyne and Grede are included in this prospectus.

| Year Ended December 31, 2014 | Year Ended December 31, 2013 | Year Ended December 31, 2012 | Year Ended December 31, 2011 | |||||

HHI |  | |||||||

| HHI, as the predecessor, is included from January 1, 2011 until December 31, 2014 in MPG. HHI was acquired by American Securities and certain members of HHI management on October 5, 2012. | ||||||||

i

Table of Contents

| Year Ended December 31, 2014 | Year Ended December 31, 2013 | Year Ended December 31, 2012 | Year Ended December 31, 2011 | |||||

| Metaldyne |  | |||||||

| Metaldyne is included from the date of its acquisition, December 18, 2012 until December 31, 2014, in MPG. | ||||||||

| Grede |  | |||||||

| Grede is included from the date of its acquisition, June 2, 2014 until December 31, 2014 in MPG. | ||||||||

This prospectus includes:

| • | audited consolidated balance sheets of MPG as of December 31, 2014 and 2013 and audited consolidated statements of operations, comprehensive income (loss), stockholders’ equity (deficit) and cash flows of MPG for the years ended December 31, 2014 and 2013, the periods from October 6, 2012 to December 31, 2012 and for MPG’s predecessor from January 1, 2012 to October 5, 2012; |

| • | in accordance with Rule 3-05 of Regulation S-X, audited consolidated statements of operations, comprehensive income, stockholders’ equity (deficit) and cash flows of MD Investors Corporation, Metaldyne’s subsidiary, for the 352-day period ended December 17, 2012 and for the year ended December 31, 2011; |

| • | in accordance with Rule 3-05 and Rule 3-10(g) of Regulation S-X Grede Holdings LLC’s audited consolidated statements of financial position as of December 29, 2013 and audited consolidated statements of operations, comprehensive income, members’ equity and cash flows for the year then ended; and |

| • | unaudited condensed consolidated statements of financial position of Grede Holdings LLC, Grede’s subsidiary, as of March 30, 2014 and December 29, 2013 and unaudited condensed consolidated statements of operations, comprehensive income, members’ equity (deficit) and cash flows of Grede Holdings LLC for the three month periods ended March 30, 2014 and March 31, 2013; |

| • | in accordance with Rule 3-05 of Regulation S-X, Grede Holdings LLC’s audited consolidated statements of financial position as of December 30, 2012 and audited consolidated statements of operations, comprehensive income, members’ equity (deficit) and cash flows for the years ended December 30, 2012 and January 1, 2012. |

We operate on a 13 week fiscal quarter which ends on the Sunday nearest to March 31, June 30 or September 30, as applicable. Our fiscal year ends on December 31. Further, prior to the Grede Transaction, Grede operated on a 52 or 53 week fiscal year which ends on the Sunday nearest to December 31. After the Grede Transaction, Grede’s fiscal year end will conform to our fiscal year end.

We use the following industry terms in describing our business in this prospectus:

| • | Advanced Machining and Assembly: Value-added precision machining to improve form, finish and function of components, and the assembly of multiple components into a ready-to-install module. |

ii

Table of Contents

| • | Aluminum Die Casting: A casting process where molten aluminum is injected under pressure into a solid mold to create a complex formed component. |

| • | Forging: The shaping of metal by a number of processes, including pressing and forming, typically classified according to temperature (cold, warm or hot). |

| • | Iron Casting: A manufacturing process by which molten iron (ductile or grey) is poured into a mold to produce components with complex dimensions. |

| • | Net Formed: A manufacturing technique which allows production of the component at or very close to the final (net) shape, reducing or eliminating scrap material and the need for surface finishing. |

| • | NVH: The noise, vibration and harshness characteristics of vehicles, particularly cars and trucks, which vehicle design engineers seek to reduce. |

| • | OEMs: Original equipment manufacturers. |

| • | Powder Metal Forming: The process of compacting metal powder in a mold, followed by heating the shaped component to just below the metal powder’s melting point to form complex Net Formed components. |

| • | Powertrain: Components of the vehicle that generate power and transfer it to the road surface, typically including the engine, transmission and driveline. |

| • | Rubber and Viscous Dampening Assemblies: Advanced rubber-to-metal bonded or silicone filled assemblies that reduce, restrict or prevent oscillations, torsion and bending in vehicle engines, thereby improving NVH characteristics. |

| • | Safety-Critical: Components that assist in the control and stability of a vehicle in motion and are fundamental to performance and safety. These components typically include chassis, suspension, steering and brake components. |

| • | Tier I suppliers: Suppliers of components and assemblies that are sold directly to OEMs. |

We use the following industry terms in this prospectus to describe our products and how they are organized and sourced in our industry:

| • | Platform: A shared set of common design, engineering, and production efforts over a number of Vehicle Nameplates or Powertrains with common architecture (e.g. Toyota MC-M, Ford Duratec35 engine). |

| • | Program: Manufacturing and development of certain automobile components including engines, transmissions and brake components (e.g. Toyota 051A, ZF’s 9HP transmission). |

| • | Vehicle Nameplate: A specific vehicle model built within a Platform for a vehicle OEM (e.g. Toyota Camry, Ford F-150). |

iii

Table of Contents

Illustrative examples of these terms are set forth below:

| Light Vehicle | Engine | Transmission | ||||

| Industry Segment | Ford Truck | 6-Cylinder | 6-Speed | |||

| Platform | PN96 | Duratec35 | 6R60W/6R75W/6R80W | |||

| Program | P415 | 3.7L V6 FFV | 6R80W (Business typically sourced to us at this level.) | |||

| Vehicle Nameplate | F-150 | N/A | N/A | |||

We own or have the rights to use various trademarks, service marks and trade names referred to in this prospectus. Solely for convenience, we refer to trademarks, service marks and trade names in this prospectus without the ™,SM and® symbols. Such references are not intended to indicate, in any way, that we will not assert, to the fullest extent permitted by law, our rights to our trademarks, service marks and trade names. Other trademarks, trade names or service marks appearing in this prospectus are the property of their respective owners.

MARKET AND INDUSTRY INFORMATION

Market and industry data used throughout this prospectus, including information relating to our relative position in the vehicle components industry, is based on the good faith estimates of our management, which in turn are based upon our management’s review of internal surveys, surveys commissioned by us, independent industry surveys and publications and other publicly available information prepared by third parties. All of the market data and industry information used in this prospectus involves a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. Although we believe that these sources are reliable, neither we nor the underwriters have independently verified this information. While we believe the estimated market position, market opportunity and market size information included in this prospectus is generally reliable, such information, which in part is derived from management’s estimates and beliefs, is inherently uncertain and imprecise.

Projections, assumptions and estimates of our future performance and the future performance of the industry in which we operate are necessarily subject to a high degree of uncertainty and risk due to a variety of factors, including those described in “Risk Factors,” “Forward-Looking Statements” and elsewhere in this prospectus. These and other factors could cause results to differ materially from those expressed in our estimates and beliefs and in the estimates prepared by independent parties.

CAUTIONARY DISCLOSURE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus contains “forward-looking statements” within the meaning of the U.S. Private Securities Litigation Reform Act of 1995. All statements other than statements of historical fact or relating to present facts or current conditions included in this prospectus are forward-looking statements. Forward-looking statements give our current expectations and projections relating to our financial condition, results of operations, plans, objectives, future performance and business. You can identify forward-looking statements by the fact that they do not relate strictly to historical or current facts. These statements may include words such as “anticipate,” “estimate,” “expect,” “project,” “plan,” “intend,” “believe,” “may,” “should,” “can have,” “likely” and other words and terms of similar meaning in connection with any discussion of the timing or nature of future operating or financial performance or other events.

iv

Table of Contents

The forward-looking statements contained in this prospectus are based on assumptions that we have made in light of our industry experience and our perceptions of historical trends, current conditions, expected future developments and other factors we believe are appropriate under the circumstances. As you read and consider this prospectus, you should understand that these statements are not guarantees of performance or results. They involve risks, uncertainties (many of which are beyond our control) and assumptions. Although we believe that these forward-looking statements are based on reasonable assumptions, you should be aware that many factors could affect our actual operating and financial performance and cause our performance to differ materially from the performance anticipated in the forward-looking statements. We believe these factors include, but are not limited to, those described under “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations.” Should one or more of these risks or uncertainties materialize, or should any of these assumptions prove incorrect, our actual operating and financial performance may vary in material respects from the performance projected in these forward-looking statements.

Some of our most significant risks are:

| • | volatility in the global economy impacting demand for new vehicles and our products; |

| • | a decline in vehicle production levels, particularly with respect to Platforms for which we are a significant supplier, or the financial distress of any of our major customers; |

| • | our dependence on large-volume customers for current and future sales; |

| • | our inability to realize all of the sales expected from awarded business or fully recover pre-production costs; |

| • | our inability to realize revenue expected from incremental business backlog; |

| • | a reduction in outsourcing by our customers, the loss of material production or Programs, or a failure to secure sufficient alternative Programs; |

| • | our significant competition; |

| • | our failure to offset continuing pressure from our customers to reduce our prices; |

| • | our failure to maintain our cost structure; |

| • | potential significant costs at our facility in Sandusky, Ohio; |

| • | disruption from the Combination of our operations and diversion of management’s attention; |

| • | our limited history of working as a single company and the inability to integrate HHI, Metaldyne and Grede successfully; |

| • | our substantial indebtedness; and |

| • | other factors that are described in “Risk Factors.” |

Any forward-looking statement made by us in this prospectus speaks only as of the date on which we make it. Factors or events that could cause our actual operating and financial performance to differ may emerge from time to time, and it is not possible for us to predict all of them. We undertake no obligation to publicly update any forward-looking statement, whether as a result of new information, future developments or otherwise.

You should read this prospectus with the understanding that our actual future results, levels of activity, performance and events and circumstances may be materially different from what we expect.

v

Table of Contents

The items in the following summary are described in more detail later in this prospectus. This summary provides an overview of selected information and does not contain all of the information you should consider. Therefore, you should also read the more detailed information set out in this prospectus, including the risk factors, the financial statements and related notes thereto, and the other documents to which this prospectus refers before making an investment decision. Unless otherwise stated in this prospectus or as the context may otherwise require, references to “MPG” and the “Company” refer to Metaldyne Performance Group Inc. MPG is a holding company with no operations, assets or liabilities other than the equity of the Issuer. The Issuer is a holding company with no operations, assets or liabilities other than the equity of HHI, Metaldyne and Grede, the original notes and the Senior Credit Facilities. Unless otherwise stated in this prospectus or as the context may otherwise require, references to “we,” “our,” “us” and similar terms refer to the Issuer and all of its subsidiaries, including HHI, Metaldyne and Grede.

See “Certain Terms” on page ii for certain industry terms used to describe our business.

Overview

MPG provides highly-engineered components for use in Powertrain and Safety-Critical Platforms for the global light, commercial, and industrial vehicle markets. We produce these components using complex metal-forming manufacturing technologies and processes for a global customer base of vehicle OEMs and Tier I suppliers. Our components help OEMs meet fuel economy, performance, and safety standards.

Our metal-forming manufacturing technologies and processes include Aluminum Die Casting, Forging, Iron Casting and Powder Metal Forming, as well as value-added manufacturing processes such as Advanced Machining and Assembly. These technologies and processes are used to create a wide range of customized Powertrain and Safety-Critical components that address requirements for power density (increased component strength to weight ratio), power generation, power / torque transfer, strength, and NVH.

Our business is comprised of three segments:

HHI: HHI manufactures highly-engineered metal-based products for the North American light vehicle market. These components are used in Powertrain and Safety-Critical applications, including transmission components, driveline components, wheel hubs, axle ring and pinion gears, sprockets, balance shaft gears, timing drive systems, variable valve timing (“VVT”) components, transfer case components and wheel bearings.

Metaldyne:Metaldyne manufactures highly-engineered metal-based Powertrain products for the global light vehicle markets. These components include connecting rods, VVT components, balance shaft systems, and crankshaft dampers, differential gears, pinions and assemblies, valve bodies, hollow and solid shafts, clutch modules and assembled end covers.

Grede: Grede manufactures cast, machined and assembled components for the light, commercial and industrial (agriculture, construction, mining, rail, wind energy and oil field) vehicle and equipment end-markets. These components are used in Powertrain and Safety-Critical applications, including turbocharger housings, differential carriers and cases, scrolls and covers, brake calipers and housings, knuckles, control arms and axle components.

See Note 22 of the notes to the consolidated financial statements contained elsewhere in this prospectus for financial information reported by segment and geographic area.

We primarily serve the global light vehicle and North American commercial and industrial vehicle and equipment end-markets with a focus on components for Powertrain and Safety-Critical applications. Demand in these end-markets, and therefore, our products, is driven by consumer preferences, regulatory requirements

1

Table of Contents

(particularly related to fuel economy and safety standards) and macro-economic factors. In addition to light vehicle OEMs, our customers include commercial vehicle manufacturers in the medium and heavy truck market. We also produce a wide variety of components to serve multiple industrial equipment end-markets with agriculture and construction equipment OEMs.

Contribution to our net sales by vehicle application follows:

| Year Ended December 31, 2014 | Year Ended December 31, 2013 | 2012 (1) | ||||||||||

Driveline | 19 | % | 18 | % | 15 | % | ||||||

Engine | 28 | 33 | 13 | |||||||||

Transmission | 23 | 24 | 23 | |||||||||

Safety-Critical | 17 | 18 | 42 | |||||||||

Other Specialty Products | 13 | 7 | 7 | |||||||||

|

|

|

|

|

| |||||||

| 100 | % | 100 | % | 100 | % | |||||||

|

|

|

|

|

| |||||||

| (1) | Reflects net sales contribution for Successor Period 2012 and Predecessor Period 2012, combined. |

For 2014, we generated:

| • | Net sales of $2.72 billion; |

| • | Adjusted EBITDA of $478.6 million, or 17.6% of net sales; and |

| • | Net income of $73.3 million. |

We define, reconcile and explain the importance of Adjusted EBITDA, a non-GAAP financial measure, in “—Summary Historical Financial and Other Data.”

Company Organization and History

The reorganization of HHI, Metaldyne and Grede occurred on August 4, 2014 through the mergers of three separate wholly-owned merger subsidiaries of MPG. A brief summary of the history of each of HHI, Metaldyne and Grede follows:

| • | HHI was formed in 2005 and, from 2005 through 2009, completed the strategic acquisitions of Impact Forge Group, LLC and Cloyes Gear and Products, Inc. and, following a §363 U.S. Bankruptcy Court supervised sale process, acquired certain assets and assumed specified liabilities from FormTech LLC, Jernberg Holdings, LLC and Delphi Automotive PLC’s wheel bearing operations. HHI was acquired by American Securities and certain members of HHI management on October 5, 2012 (the “HHI Transaction”). |

| • | Metaldyne was formed in 2009 as a new entity to acquire certain assets and assume specified liabilities from the former Metaldyne Corporation (“Oldco M Corporation”) following a §363 U.S. Bankruptcy Court supervised sale process. Oldco M Corporation was previously formed when MascoTech, Inc., a then-publicly traded company, was taken private and acquired Simpson Industries, Inc., another then-public company. Metaldyne was acquired by American Securities and certain members of Metaldyne management on December 18, 2012 (the “Metaldyne Transaction”). |

| • | Grede was formed in 2010 through a combination of the assets of the former Grede Foundries, Inc. and Citation Corporation, following a §363 U.S. Bankruptcy Court supervised sale process. Subsequently, Grede acquired Foseco-Morval Inc., GTL Precision Patterns Inc., Paxton-Mitchell |

2

Table of Contents

Corporation, Virginia Castings Industries LLC, Teknik, S.A. de C.V. and Novocast, S.A. de C.V. and established a global alliance with Georg Fischer Automotive AG (Europe / China). Grede was acquired by American Securities and certain members of Grede management on June 2, 2014 (the “Grede Transaction”). |

The following chart illustrates our simplified ownership structure:

3

Table of Contents

Recent Developments

Financial Results

Although our financial results for the first quarter ended March 29, 2015 have not been issued, we have reported the following unaudited financial results for the first quarter.

For the first quarter ended March 29, 2015, net sales were $765.2 million, compared to $540.5 million in the first quarter of 2014, representing a year-over-year increase of 42%. Our gross profit for the first quarter ended March 29, 2015 was $128.5 million, which was $45.3 million higher than 2014, an increase of 54%, and net income was $128.5 million for the quarter was $45.3 million higher than 2014, resulting in diluted earnings per share of $0.47. We reported Adjusted EBITDA of $132.6 million, compared to $99.7 million for the first quarter of 2014, representing a year-over-year increase of 33%, with EBITDA margins remaining strong at 17.3%. We also had capital expenditures of $60.7 million and Adjusted Free Cash Flow, defined as Adjusted EBITDA less capital expenditures, of $71.9 million in the first quarter of 2015.

In addition, we paid a voluntary repayment of $10.0 million on our outstanding Senior Term Loan during the first quarter of 2015 and our board of directors declared a quarterly cash dividend of $0.09 per share of common stock payable on May 26th, 2015 for those stockholders of record as of May 12th, 2015. We expect to secure a refinancing of our outstanding term loans. The anticipated terms would reduce annual cash debt service by $6-7 million and create an FX hedge by converting a portion of our U.S. dollar-denominated term loan into a Euro denominated term loan.

The Refinancing

On October 20, 2014, we entered into a senior secured credit facility (the “Senior Credit Facilities”) in aggregate principal amount of $1,600.0 million. The Senior Credit Facilities provide for (i) a seven-year $1,350.0 million term loan facility (the “Term Loan Facility”) and (ii) a five-year $250.0 million revolving credit facility (the “Revolving Credit Facility”). The Senior Credit Facilities are guaranteed by MPG and substantially all of our existing and future domestic restricted subsidiaries and are secured by substantially all of our and the guarantors’ assets on a first lien basis, subject, in each case, to certain limitations. On October 20, 2014, we also entered into an indenture pursuant to which we issued $600.0 million aggregate principal amount of the original notes. The original notes rank pari passu in right of payment with the Senior Credit Facilities, but are effectively subordinated to the Senior Credit Facilities to the extent of the value of the assets securing such indebtedness. For further information on the Senior Credit Facilities, see “Description of Other Indebtedness—Senior Credit Facilities.”

The net proceeds of the original notes and the borrowings under the Senior Credit Facilities, together with cash on hand, were used to prepay all amounts outstanding under each of HHI, Metaldyne and Grede’s existing senior secured credit facilities as described below:

| • | HHI’s senior secured credit facility consisting of (i) term loans in an original aggregate principal amount of $735.0 million (“HHI Term Loans”) and (ii) a $75.0 million revolving credit facility (“HHI Revolver” and together with the HHI Term Loans, the “HHI Credit Facilities”); |

| • | Metaldyne’s senior secured credit facility consisting of (i) a U.S. dollar term loan in an original aggregate principal amount of $537.0 million, (ii) a Euro denominated term loan in an original aggregate principal amount of €100.0 million (“Metaldyne Term Loans”) and (iii) a $75.0 million revolving credit facility (“Metaldyne Revolver” and together with the Metaldyne Term Loans, the “Metaldyne Credit Facilities”); and |

| • | Grede’s senior secured credit facility consisting of (i) term loans in an original aggregate principal amount of $600.0 million (“Grede Term Loans”) and (ii) a $75.0 million revolving credit facility (“Grede Revolver” and together with the Grede Term Loans, the “Grede Credit Facilities”). |

We refer to the HHI Credit Facilities, the Metaldyne Credit Facilities and the Grede Credit Facilities as the “existing senior secured credit facilities.” Collectively, we refer to the refinancing transactions described above and the payment of fees and expenses related to the foregoing as the “Refinancing” in this prospectus.

The Initial Public Offering

On December 12, 2014, MPG completed its initial public offering (“IPO”) of 10,000,000 shares of its common stock at a price of $15.00 per share, all of such shares sold by ASP MD Investco LP, an affiliate of American Securities. In connection with the IPO, the underwriters exercised their option to purchase an additional 1,447,663 shares of common stock, which was completed on January 15, 2015. As a result, the total IPO size was 11,447,663 shares of common stock.

Our Principal Stockholders

American Securities currently owns approximately 78.5% of MPG’s outstanding common stock. As a result, American Securities is able to exert significant voting influence over fundamental and significant corporate matters and transactions.

4

Table of Contents

American Securities may acquire or hold interests that compete directly with us, or may pursue acquisition opportunities which are complementary to our business, making such an acquisition unavailable to us. Our amended and restated certificate of incorporation contains provisions renouncing any interest or expectancy held by our directors affiliated with American Securities in certain corporate opportunities.

Headquartered in New York with an office in Shanghai, American Securities is a leading U.S. middle-market private equity firm that invests in market-leading North American companies. American Securities now has approximately $10 billion of assets under management and is investing from its sixth fund. The firm traces its roots to the family office founded in 1947 by William Rosenwald to invest and manage his share of the Sears, Roebuck & Co. fortune. American Securities focuses its core investments in the industrial sector including, general industrial, aerospace and defense, agriculture, environmental, automotive, recycling paper and packaging, power and energy, and specialty chemicals. American Securities has a strong understanding of our business and close relationships with the existing management. American Securities has a proven track record of successfully working with management teams to develop and implement strategies for sustained profitability.

Risks Affecting Our Business

Investing in the notes involves substantial risk. Before participating in the exchange offer, you should carefully consider all of the information in this prospectus, including risks discussed in “Risk Factors” beginning on page 15. Some of our most significant risks are:

| • | volatility in the global economy impacting demand for new vehicles and our products; |

| • | a decline in vehicle production levels, particularly with respect to Platforms for which we are a significant supplier, or the financial distress of any of our major customers; |

| • | our dependence on large-volume customers for current and future sales; |

| • | our inability to realize all of the sales expected from awarded business or fully recover pre-production costs; |

| • | our inability to realize revenue expected from incremental business backlog; |

| • | a reduction in outsourcing by our customers, the loss of material production or Programs, or a failure to secure sufficient alternative Programs; |

| • | our significant competition; |

| • | our failure to offset continuing pressure from our customers to reduce our prices; |

| • | our failure to maintain our cost structure; |

| • | potential significant costs at our facility in Sandusky, Ohio; |

| • | disruption from the Combination of our operations and diversion of management’s attention; and |

| • | our limited history of working as a single company and the inability to successfully integrate HHI, Metaldyne and Grede. |

5

Table of Contents

Ratio of Earnings to Fixed Charges

The following table sets forth information regarding our ratio of earnings to fixed charges for each of the periods shown. The ratio of earnings to fixed charges represents the number of times fixed charges are covered by earnings.

| Year Ended December 31, 2014 | Year Ended December 31, 2013 | Successor Period 2012(a) | Predecessor Period 2012(a) | Year Ended December 31, 2011 | Year Ended December 31, 2010 | |||||||||||||||||||

Ratio of Earnings to Fixed Charges | 1.54x | 2.23x | — | — | 3.20x | 3.80x | ||||||||||||||||||

|

|

|

|

|

|

|

|

|

|

|

| |||||||||||||

| (a) | The Company had a deficiency of earnings to fixed charges for the Predecessor Period 2012 and the Successor Period 2012 of $36.7 million and $47.1 million, respectively. |

Corporate Information

We are a Delaware corporation. MPG was incorporated on June 9, 2014. Our principal executive offices are located at 47659 Halyard Drive, Plymouth, MI 48170. Our telephone number at our principal executive offices is (734) 207-6200. Our corporate website iswww.mpgdriven.com. The information that appears on our website is not part of, and is not incorporated into, this prospectus.

6

Table of Contents

The Exchange Offer

On October 20, 2014, we completed a private offering of the original notes. Concurrently with the private offering, we entered into a registration rights agreement (the “Registration Rights Agreement”) with Deutsche Bank Securities Inc., Goldman, Sachs & Co. and Merrill Lynch, Pierce, Fenner & Smith Incorporated, as representatives for several initial purchasers. Pursuant to the Registration Rights Agreement, we agreed, among other things, to file the registration statement of which this prospectus is a part. The following is a summary of the exchange offer. For more information please see “The Exchange Offer.” The “Description of Exchange Notes” section of this prospectus contains a more detailed description of the terms and conditions of the exchange notes.

| General | The form and terms of the exchange notes are the same as the form and terms of the original notes except that:

• the issuance and sale of the exchange notes have been registered pursuant to an effective registration statement under the Securities Act; and

• the holders of the exchange notes will not be entitled to certain registration rights or the additional interest provisions of the Registration Rights Agreement, which permits an increase in the interest rate on the original notes in some circumstances relating to the timing of the exchange offer. See “The Exchange Offer.” | |

| The Exchange Offer | We are offering to exchange $600,000,000 aggregate principal amount of 7.375% Senior Notes due 2022 that have been registered under the Securities Act for all of our outstanding 7.375% Senior Notes due 2022 issued on October 20, 2014. | |

| The exchange offer will remain in effect for a limited time. We will accept any and all original notes validly tendered and not withdrawn prior to 5:00 p.m., New York City time, on June 8, 2015. Holders may tender some or all of their original notes pursuant to the exchange offer. However, the original notes may be tendered only in a denomination equal to $2,000 and any integral multiples of $1,000 in excess thereof. | ||

| Resale | Based upon interpretations by the staff of the SEC set forth in no-action letters issued to unrelated third-parties, we believe that the exchange notes may be offered for resale, resold or otherwise transferred by you without compliance with the registration and prospectus delivery requirements of the Securities Act, unless you:

• are an “affiliate” of ours within the meaning of Rule 405 under the Securities Act;

• are a broker-dealer that purchased the notes directly from us for resale under Rule 144A, Regulation S or any other available exemption under the Securities Act;

• acquired the exchange notes other than in the ordinary course of your business;

• have an arrangement with any person to engage in the distribution of the exchange notes; or

• are prohibited by law or policy of the SEC from participating in the exchange offer.

However, we have not obtained a no-action letter, and there can be no assurance that the SEC will make a similar determination with respect to the exchange offer. Furthermore, in order to participate in the exchange offer, you must make the representations set forth in the letter of transmittal that we are sending you with this prospectus. | |

7

Table of Contents

| Expiration Date | The exchange offer will expire at 5:00 p.m., New York City time, on June 8, 2015, unless we decide to extend it. We do not currently intend to extend the expiration date, although we reserve the right to do so. | |

| Conditions to the Exchange Offer | The exchange offer is subject to certain customary conditions, some of which may be waived by us. See “The Exchange Offer — Conditions to the Exchange Offer.” | |

| Procedures for Tendering Original Notes | To participate in the exchange offer, you must properly complete and duly execute a letter of transmittal, which accompanies this prospectus, and transmit it, along with all other documents required by such letter of transmittal, to the exchange agent on or before the expiration date at the address provided on the cover page of the letter of transmittal.

| |

In the alternative, you can tender your original notes by following the automatic tender offer program, or ATOP, procedures established by The Depository Trust Company, or DTC, for tendering notes held in book-entry form, as described in this prospectus, whereby you will agree to be bound by the letter of transmittal and we may enforce the letter of transmittal against you.

| ||

If a holder of original notes desires to tender such notes and the holder’s original notes are not immediately available, or time will not permit the holder’s original notes or other required documents to reach the exchange agent before the expiration date, or the procedure for book-entry transfer cannot be completed on a timely basis, a tender may be effected pursuant to the guaranteed delivery procedures described in this prospectus.

| ||

| For more details, please read “The Exchange Offer — Procedures for Tendering” and “The Exchange Offer — Book-Entry Transfer.” | ||

| Special Procedures for Beneficial Owners | If you are a beneficial owner of original notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee, and you wish to tender those original notes in the exchange offer, you should contact the registered holder promptly and instruct the registered holder to tender those original notes on your behalf. If you wish to tender on your own behalf, you must, prior to completing and executing the letter of transmittal and delivering your original notes, either make appropriate arrangements to register ownership of the original notes in your name or obtain a properly completed bond power from the registered holder. The transfer of registered ownership may take considerable time and may not be able to be completed prior to the expiration date. | |

| Withdrawal Rights | You may withdraw your tender of original notes at any time prior to 5:00 p.m., New York City time, on the expiration date of the exchange offer. Please read “The Exchange Offer — Withdrawal of Tenders.” | |

| Acceptance of Original Notes and Delivery of Exchange Notes | Subject to customary conditions, we will accept original notes that are properly tendered in the exchange offer and not withdrawn prior to the expiration date. The exchange notes will be delivered promptly following the expiration date. | |

| Consequences of Failure to Exchange Original Notes | If you do not exchange your original notes in the exchange offer, you will no longer be able to require us to register the original notes under the Securities Act, except in the limited circumstances provided under the Registration Rights Agreement. In addition, you will not be able to resell, offer to resell or otherwise transfer the original notes unless we have registered the original notes under the Securities Act, or unless you resell, offer to resell or otherwise transfer them under an exemption from the registration requirements of, or in a transaction not subject to, the Securities Act. | |

8

Table of Contents

| Dissenters’ Rights | Holders of original notes do not have any appraisal or dissenters’ rights in connection with the exchange offer. We intend to conduct the exchange offer in accordance with the applicable requirements of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and the rules and regulations of the SEC. | |

| Interest on the Exchange Notes and the Original Notes | The exchange notes will bear interest from the most recent interest payment date on which interest has been paid on the original notes. Holders whose original notes are accepted for exchange will be deemed to have waived the right to receive interest accrued on the original notes. | |

| Broker-Dealers | Each broker-dealer that receives exchange notes for its own account in exchange for original notes, where such original notes were acquired by such broker-dealer as a result of market-making activities or other trading activities, must acknowledge that it will deliver a prospectus in connection with any resale of such exchange notes. See “Plan of Distribution.” | |

| Material U.S. Federal Income Tax Considerations | The holder’s receipt of exchange notes in exchange for original notes will not constitute a taxable event for U.S. federal income tax purposes. Please read “Material U.S. Federal Income Tax Considerations.” | |

| Exchange Agent | Wilmington Trust, National Association, the trustee under the indenture governing the notes, or the indenture, is serving as exchange agent in connection with the exchange offer. | |

| Use of Proceeds | The issuance of the exchange notes will not provide us with any new proceeds. We are making the exchange offer solely to satisfy certain of our obligations under the Registration Rights Agreement. | |

| Fees and Expenses | We will bear all expenses related to the exchange offer. Please read “The Exchange Offer — Fees and Expenses.” | |

9

Table of Contents

The Exchange Notes

| Issuer | MPG Holdco I Inc. | |

| Notes Offered | Up to $600,000,000 in aggregate principal amount of 7.375% Senior Notes due 2022. The exchange notes and the original notes will be considered to be a single class for all purposes under the indenture, including waivers, amendments, redemptions and offers to purchase. | |

| Maturity Date | The exchange notes mature on October 15, 2022. | |

| Interest Rate | Interest on the exchange notes will be payable in cash and accrue at a rate of 7.375% per annum. | |

| Interest Payment Dates | April 15 and October 15 of each year, commencing on April 15, 2015. | |

| Guarantees | The exchange notes initially will be guaranteed, jointly and severally, by MPG and all of our wholly-owned domestic subsidiaries that guarantee the Senior Credit Facilities. See “Description of Exchange Notes— Subsidiary Guarantees.”

Our non-guarantor subsidiaries will include, but are not limited to, our foreign subsidiaries and their subsidiaries and certain immaterial subsidiaries that do not guarantee the Senior Credit Facilities. | |

| Ranking | The exchange notes and the related guarantees constitute our and the guarantors’ senior unsecured obligations:

• equally in right of payment with all of the Issuer’s and the guarantor’s existing and future senior indebtedness;

• senior in right of payment to all of the Issuer’s and the guarantor’s existing and future subordinated indebtedness;

• effectively subordinated to all of the Issuer’s and the guarantor’s existing and future secured indebtedness, including the borrowings under the Senior Credit Facilities, to the extent of the value of the assets securing such indebtedness; and

• structurally subordinated to existing and future indebtedness and other liabilities of our subsidiaries that do not guarantee the notes, to the extent of the assets of those subsidiaries. | |

| As of December 31, 2014, we had $1,961.8 million of indebtedness outstanding, including the notes offered hereby and $1,340.0 million under our Term Loan Facility which would have ranked effectively senior to the exchange notes as described above. In addition, as of the same date, we had approximately $234.4 million of availability under our new revolving credit facility (excluding $15.6 million of letters of credit outstanding). | ||

| Optional Redemption | On or after October 15, 2017, we may redeem the exchange notes, in whole or in part, at any time at the redemption prices described under “Description of Exchange Notes—Optional Redemption”, plus accrued and unpaid interest, if any, to, but not including, the redemption date. On or prior to October 15, 2017, we may also redeem up to 40% of the aggregate principal amount of the exchange notes, using proceeds of certain equity offerings at a redemption price set forth in this prospectus, plus accrued and unpaid interest thereon, if any, to, but not | |

10

Table of Contents

| including, the applicable redemption date. In addition, prior to October 15, 2017, we may redeem all or part of the exchange notes at a redemption price of 100% of the principal amount thereof, plus a make-whole premium and accrued and unpaid interest, if any, to, but not including, the applicable redemption date. See “Description of Exchange Notes—Optional Redemption.” | ||

| Change of Control Offer | If we experience specific kinds of change of control events, we may be required to offer to repurchase the exchange notes at a purchase price equal to 101% of the principal amount of the exchange notes repurchased, plus accrued and unpaid interest, if any, to, but not including, the applicable repurchase date. See “Description of Exchange Notes—Repurchase at the Option of Holders—Change of Control.” | |

| Asset Sale Offer | If we sell assets under certain circumstances, we must offer to repurchase the exchange notes at 100% of their principal amount, plus accrued and unpaid interest, if any, to, but not including, the applicable repurchase date. See “Description of Exchange Notes—Repurchase at the Option of Holders—Asset Sales. | |

| Certain Covenants | The indenture contains covenants that, among other things, will limit the ability of the Issuer and its restricted subsidiaries to:

• incur additional debt or issue certain disqualified stock and preferred stock;

• pay dividends or make certain other distributions on our capital stock or repurchase our capital stock or prepay subordinated indebtedness;

• create liens;

• make certain payments or other restricted payments;

• engage in transactions with affiliates; and

• sell certain assets or merge or consolidate with or into other companies or otherwise dispose of all or substantially all of their assets.

These covenants are subject to important exceptions and qualifications as described under “Description of Exchange Notes—Certain Covenants.” Many of these covenants will cease to apply to the exchange notes during any time that the exchange notes have investment grade ratings from both Moody’s Investors Service, Inc. (“Moody’s”) and Standard & Poor’s (“S&P”) so long as there is no default under the indenture governing to the exchange notes. See “Description of Exchange Notes—Certain Covenants—Covenant Suspension.” | |

| No Public Market | The exchange notes will be freely transferable but will be new securities for which there will not initially be a market. Although the initial purchasers have informed us that they intend to make a market in the exchange notes, such initial purchasers are not obligated to do so, and may discontinue market-making activities at any time without notice. Accordingly, we cannot assure you that a liquid market for the exchange notes will develop or be maintained. | |

| Risk Factors | You should carefully consider the information in the section entitled “Risk Factors” before participating in the exchange offer. | |

11

Table of Contents

SUMMARY HISTORICAL FINANCIAL AND OTHER DATA

The following table sets forth MPG’s summary historical financial and other data for the periods and as of the dates indicated. We derived the summary consolidated statement of operations data and statement of cash flow data for the year ended December 31, 2014, December 31, 2013, Successor Period 2012 and Predecessor Period 2012 from MPG’s audited consolidated financial statements included elsewhere in this prospectus. The Combination has been accounted for as a reorganization of entities under common control in a manner similar to a pooling of interests, and, as such, the bases of accounting of HHI, Metaldyne and Grede were carried over to MPG. These consolidated financial statements reflect the retrospective application of MPG’s capital structure and consolidated presentation of the Combination for the Successor Period. MPG’s historical capital structure has been retroactively adjusted to reflect the post-Combination capital structure for the Successor Period.

Our historical results are not necessarily indicative of future operating results and results of interim periods are not necessarily indicative of results for the entire year. You should read the information set forth below in conjunction with “Selected Historical Financial Data,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our financial statements and the related notes thereto included elsewhere in this prospectus.

| Successor | Predecessor | |||||||||||||||

| Year Ended, December 31, 2014 | Year Ended, December 31, 2013 | Successor Period 2012(1) | Predecessor Period 2012(1) | |||||||||||||

| (In millions, except per share amounts) | ||||||||||||||||

Statement of Operations Data: | ||||||||||||||||

Net sales | $ | 2,717.0 | $ | 2,017.3 | $ | 205.3 | $ | 680.5 | ||||||||

Cost of sales | 2,294.1 | 1,708.7 | 199.5 | 559.0 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Gross profit | 422.9 | 308.6 | 5.8 | 121.5 | ||||||||||||

Selling, general and administrative expenses | 194.6 | 123.2 | 14.4 | 116.6 | ||||||||||||

Acquisition costs | 13.0 | — | 25.9 | 13.4 | ||||||||||||

Goodwill impairment | 11.8 | — | — | — | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Operating profit (loss) | 203.5 | 185.4 | (34.5 | ) | (8.5 | ) | ||||||||||

Interest expense, net | 99.9 | 74.7 | 11.1 | 25.8 | ||||||||||||

Loss on debt extinguishment | 60.7 | — | — | — | ||||||||||||

Other, net | (11.3 | ) | 17.8 | 1.5 | 2.4 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Other expense, net | 149.3 | 92.5 | 12.6 | 28.2 | ||||||||||||

Income (loss) before tax | 54.2 | 92.9 | (47.1 | ) | (36.7 | ) | ||||||||||

Income tax expense (benefit) | (19.1 | ) | 35.0 | (15.2 | ) | (11.1 | ) | |||||||||

|

|

|

|

|

| |||||||||||

Net income (loss) | 73.3 | 57.9 | (31.9 | ) | (25.6 | ) | ||||||||||

Income attributable to noncontrolling interest | 0.4 | 0.3 | 0.0 | 0.2 | ||||||||||||

|

|

|

|

|

|

|

| |||||||||

Net income (loss) attributable to stockholders | $ | 72.9 | $ | 57.6 | $ | (31.9 | ) | $ | (25.8 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

Net income (loss) per share attributable to stockholders: (2) | ||||||||||||||||

Basic | $ | 1.09 | $ | 0.86 | $ | (0.48 | ) | $ | (1.46 | ) | ||||||

Diluted | 1.06 | 0.86 | (0.48 | ) | (1.46 | ) | ||||||||||

Basic weighted average shares outstanding | 67.1 | 67.1 | 67.1 | 17.7 | ||||||||||||

Diluted weighted average shares | 68.5 | 67.1 | 67.1 | 17.7 | ||||||||||||

Statement of Cash Flows Data: | ||||||||||||||||

Cash flows from operating activities | $ | 305.4 | $ | 234.3 | $ | (1.8 | ) | $ | 64.7 | |||||||

Cash flows from investing activities | (984.9 | ) | (116.7 | ) | (1,515.0 | ) | (31.3 | ) | ||||||||

Cash flows from financing activities | 776.7 | (91.1 | ) | 1,557.1 | (27.3 | ) | ||||||||||

Effect of exchange rates on cash | (8.9 | ) | 1.4 | — | 0.3 | |||||||||||

|

|

|

|

|

|

|

| |||||||||

Net increase (decrease) in cash and cash equivalents | $ | 88.3 | $ | 27.9 | $ | 40.3 | $ | 6.4 | ||||||||

Other Data: | ||||||||||||||||

Adjusted EBITDA (3) | $ | 478.6 | $ | 363.1 | $ | 29.4 | $ | 113.8 | ||||||||

12

Table of Contents

| Year Ended December 31, 2014 | Year Ended December 31, 2013 | |||||||

| (In millions) | ||||||||

Balance Sheet Data | ||||||||

Cash and cash equivalents | $ | 156.5 | $ | 68.2 | ||||

Property and equipment, net | 750.2 | 539.5 | ||||||

Total assets | 3,224.6 | 2,216.8 | ||||||

Long-term debt, including capital lease obligations | 1,960.2 | 1,259.7 | ||||||

Total debt | 1,961.8 | 1,280.0 | ||||||

Total liabilities | 2,699.7 | 1,891.6 | ||||||

Total stockholders’ equity (deficit) | 524.9 | 325.2 | ||||||

| (1) | The period from January 1, 2012 to October 5, 2012 is referred to as “Predecessor Period 2012.” The period from October 6, 2012 to December 31, 2012 is referred to as “Successor Period 2012.” |

| (2) | For the year ended December 31, 2013 and Successor Period 2012, the weighted average shares outstanding were retrospectively adjusted to reflect MPG common stock outstanding upon completion of the Combination, and the equivalent shares for outstanding stock-based compensation awards were retrospectively adjusted to reflect the conversion of those awards into options to purchase shares of MPG common stock. For Predecessor Period 2012, the weighted average shares outstanding reflect the capital structure of HHI prior to the HHI Transaction, and the equivalent shares for outstanding stock-based compensation reflect awards issued by HHI. |

| (3) | EBITDA is calculated as net income before interest expense, income tax expense (benefit) and depreciation and amortization. Adjusted EBITDA is calculated as EBITDA adjusted for: |

| • | (gain) loss on foreign currency; |

| • | (gain) loss on fixed assets; |

| • | debt transaction expenses; |

| • | stock-based compensation; |

| • | sponsor management fee; |

| • | non-recurring acquisition and purchase accounting related items; and |

| • | non-recurring operational items. |

Adjusted EBITDA eliminates the effects of items that we do not consider indicative of our core operating performance. Adjusted EBITDA is a supplemental measure of operating performance that does not represent and should not be considered as alternatives to net income, as determined under U.S. generally accepted accounting principles (“GAAP”), and our calculation of Adjusted EBITDA may not be comparable to those reported by other companies.

Management believes the inclusion of the adjustments to Adjusted EBITDA is appropriate to provide additional information to investors about certain material non-cash items and about unusual items that we do not expect to continue at the same level in the future. By providing this non-GAAP financial measure, together with a reconciliation to GAAP results, we believe we are enhancing investors’ understanding of our business and our results of operations, as well as assisting investors in evaluating how well we are executing strategic initiatives. We believe Adjusted EBITDA is used by investors as supplemental measures to evaluate the overall operating performance of companies in our industry.

Management uses Adjusted EBITDA or comparable metrics:

| • | as a measurement used in comparing our operating performance on a consistent basis; |

| • | to calculate incentive compensation for our employees; |

| • | for planning purposes, including the preparation of our internal annual operating budget; |

| • | to evaluate the performance and effectiveness of our operational strategies; and |

| • | to assess compliance with various metrics associated with our agreements governing our indebtedness. |

Adjusted EBITDA has limitations as an analytical tool, and you should not consider it in isolation, or as a substitute for analysis of our results as reported under GAAP. Some of the limitations are:

| • | Adjusted EBITDA does not reflect the significant interest expense, or the cash requirements necessary to service interest or principal payments, on our debt; |

| • | Adjusted EBITDA does not reflect all GAAP non-cash and non-recurring adjustments; |

| • | although depreciation and amortization are non-cash charges, the assets being depreciated and amortized may have to be replaced in the future, and Adjusted EBITDA does not reflect the cash requirements for such replacements; |

| • | Adjusted EBITDA does not reflect our tax expense or the cash requirements to pay our taxes; and |

| • | Adjusted EBITDA does not reflect the non-cash component of employee compensation. |

13

Table of Contents

To address these limitations, we reconcile Adjusted EBITDA to the most directly comparable GAAP measure, net income. Further, we also review GAAP measures and evaluate individual measures that are not included in Adjusted EBITDA.

The following table sets a reconciliation of Adjusted EBITDA to net income, the most directly comparable GAAP measure:

| Successor | Predecessor | |||||||||||||||

| Year Ended December 31, 2014 | Year Ended December 31, 2013 | Successor Period 2012 (a) | Predecessor Period 2012 (a) | |||||||||||||

| (In millions) | ||||||||||||||||

Adjusted EBITDA | $ | 478.6 | $ | 363.1 | $ | 29.4 | $ | 113.8 | ||||||||

Interest expense | (99.9 | ) | (74.7 | ) | (11.1 | ) | (25.8 | ) | ||||||||

Income tax expense | 19.1 | (35.0 | ) | 15.2 | 11.1 | |||||||||||

Depreciation and amortization | (210.8 | ) | (163.4 | ) | (18.7 | ) | (20.0 | ) | ||||||||

Loss on debt extinguishment | (60.7 | ) | — | — | — | |||||||||||

(Gain) loss on foreign currency | 15.7 | (2.3 | ) | (1.5 | ) | — | ||||||||||

(Gain) loss on fixed assets | (2.1 | ) | (1.4 | ) | — | 1.1 | ||||||||||

Debt transaction expenses | (3.0 | ) | (6.0 | ) | — | (2.4 | ) | |||||||||

Stock-based compensation | (17.3 | ) | (6.2 | ) | (0.1 | ) | — | |||||||||

Sponsor management fee | (5.1 | ) | (4.0 | ) | (0.6 | ) | (0.7 | ) | ||||||||

Non-recurring acquisition and purchase accounting related items (b) | (23.0 | ) | (10.5 | ) | (43.3 | ) | (103.4 | ) | ||||||||

Non-recurring operational items (c) | (18.2 | ) | (1.7 | ) | (1.2 | ) | 0.7 | |||||||||

|

|

|

|

|

|

|

| |||||||||

Net income | $ | 73.3 | $ | 57.9 | $ | (31.9 | ) | $ | (25.6 | ) | ||||||

|

|

|

|

|

|

|

| |||||||||

| (a) | The period from January 1, 2012 to October 5, 2012 is referred to as “Predecessor Period 2012.” The period from October 6, 2012 to December 31, 2012 is referred to as “Successor Period 2012.” |

| (b) | Comprised of acquisition and purchase accounting items including transaction related costs, inventory step-up and ASP MD purchase price adjustment. |

| (c) | Non-recurring operational items include charges for disposed operations, impairment charges, insurance proceeds, curtailment gain and other. |

14

Table of Contents

You should carefully consider the risks described below before participating in the exchange offer. The risks described below are not the only ones facing the Company. Additional risks and uncertainties not currently known to us or that we currently deem to be immaterial may also materially and adversely affect our business or results of operations in the future. Any of the following risks could materially adversely affect our business, financial condition or results of operations. In such case, you may lose all or part of your original investment in the notes.

Risks Related to the Exchange Offer

You may have difficulty selling the original notes that you do not exchange.

If you do not exchange your original notes for exchange notes in the exchange offer, you will continue to be subject to the restrictions on transfer of your original notes described in the legend on your original notes. The restrictions on transfer of your original notes arise because we issued the original notes under exemptions from, or in transactions not subject to, the registration requirements of the Securities Act and applicable state securities laws. In general, you may only offer or sell the original notes if they are registered under the Securities Act and applicable state securities laws, or offered and sold under an exemption from these requirements. Except as required by the Registration Rights Agreement, we do not intend to register the original notes under the Securities Act. The tender of original notes under the exchange offer will reduce the principal amount of the currently outstanding original notes. Due to the corresponding reduction in liquidity, this may have an adverse effect upon, and increase the volatility of, the market price of any currently outstanding original notes that you continue to hold following completion of the exchange offer.

There is no established trading market for the exchange notes, and you may not be able to sell them quickly or at the price that you paid.

The exchange notes are new issues of securities and will be freely transferrable, but there are currently no established trading markets for the exchange notes. Although the initial purchasers of the original notes have advised us that they currently intend to make a market in the exchange notes, they are not obligated to do so and may discontinuemarket-making activities at any time without notice. Furthermore, suchmarket- making activity will be subject to limits imposed by the Securities Act and the Exchange Act.

We also cannot assure you that you will be able to sell your exchange notes at a particular time or that the prices that you receive when you sell will be favorable. We also cannot assure you as to the level of liquidity of the trading market for the exchange notes or, in the case of any holders of the notes that do not exchange them, the trading market for the original notes following the exchange offer. Future trading prices of the exchange notes will depend on many factors, including:

| • | our operating performance and financial condition; |

| • | our ability to complete the offer to exchange the original notes for the exchange notes; |

| • | the interest of securities dealers in making a market; and |

| • | the market for similar securities. |

Historically, the market for non-investment grade debt has been subject to disruptions that have caused volatility in prices. It is possible that the market for the original notes and exchange notes will be subject to disruptions. Any disruptions may have a negative effect on noteholders, regardless of our prospects and financial performance.

15

Table of Contents

You must comply with the exchange offer procedures in order to receive new, freely tradable exchange notes.

Delivery of exchange notes in exchange for original notes tendered and accepted for exchange pursuant to the exchange offer will be made only after timely receipt by the exchange agent of book-entry transfer of original notes into the exchange agent’s account at DTC, as depositary, including an agent’s message (as defined herein). We are not required to notify you of defects or irregularities in tenders of original notes for exchange. Original notes that are not tendered or that are tendered but we do not accept for exchange will, following consummation of the exchange offer, continue to be subject to the existing transfer restrictions under the Securities Act and, upon consummation of the exchange offer certain registration and other rights under the Registration Rights Agreement will terminate. See “The Exchange Offer—Procedures for Tendering” and “The Exchange Offer—Consequences of Failure to Exchange.”

Some holders who exchange their original notes may be deemed to be underwriters, and these holders will be required to comply with the registration and prospectus delivery requirements in connection with any resale transaction.

If you exchange your original notes in the exchange offer for the purpose of participating in a distribution of the exchange notes, you may be deemed to have received restricted securities and, if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

Risks Related to Our Indebtedness and the Notes

Our substantial indebtedness could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, expose us to interest rate risk to the extent of our variable rate debt and prevent us from meeting our debt obligations.

As of December 31, 2014, we had total indebtedness of $1,961.8 million, including $1,340.0 million in aggregate principal amount of indebtedness under the Term Loan Facility and $600.0 million aggregate principal amount of the notes, and an additional $234.4 million of borrowing capacity available under the Revolving Credit Facility after giving effect to $15.6 million of outstanding letters of credit. This high level of indebtedness could have significant negative consequences, including:

| • | increasing our vulnerability to adverse economic, industry or competitive developments; |

| • | requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing funds available for working capital, capital expenditures, acquisitions, selling and marketing efforts, product development, future business opportunities and the ability to pay any future dividends; |

| • | exposing us to the risk of increased interest rates because certain of our borrowings, including and most significantly borrowings under the Senior Credit Facilities, are at variable rates of interest; |

| • | making it more difficult for us to satisfy our obligations with respect to our indebtedness, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under the agreements governing such indebtedness; |

| • | limiting our ability to borrow additional funds, or to dispose of assets to raise funds, if needed, for working capital, capital expenditures, acquisitions, product development and other corporate purposes; |

| • | restricting us from making strategic acquisitions or causing us to make non-strategic divestitures; and |

| • | limiting our flexibility in planning for, or reacting to, changes in our business or market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged and who, therefore, may be able to take advantage of opportunities that our leverage prevents us from exploiting. |

16

Table of Contents

The occurrence of any one or more of these events could have a material adverse effect on our business, financial condition, and results of operations. If we add new debt to our outstanding debt levels, the risks related to our indebtedness would increase.

We, including our subsidiaries, will have the ability to incur substantially more indebtedness, including senior secured indebtedness.

Subject to the restrictions in our Senior Credit Facilities and the indenture governing the notes, we, including our subsidiaries, may incur significant additional indebtedness. As of December 31, 2014 we had $1,961.8 million of indebtedness outstanding, including the notes offered hereby and $1,340.0 million under our Term Loan Facility which would have ranked effectively senior to the exchange notes as described above. In addition, as of the same date, we had approximately $234.4 million of availability under our new revolving credit facility (excluding $15.6 million of letters of credit outstanding).

Although the terms of our Senior Credit Facilities and the indenture governing the notes contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of important exceptions, and indebtedness incurred in compliance with these restrictions could be substantial. If we and our restricted subsidiaries incur significant additional indebtedness, the related risks that we face could increase.

Restrictions imposed by the indenture governing the notes, and by our Senior Credit Facilities and our other outstanding indebtedness, may limit our ability to operate our business and to finance our future operations or capital needs or to engage in other business activities.

The terms of our Senior Credit Facilities and the indenture governing the notes restrict us and our subsidiaries from engaging in specified types of transactions. These covenants restrict the Issuer’s ability and the ability of its restricted subsidiaries to, among other things:

| • | incur or guarantee additional indebtedness; |

| • | create liens; |

| • | pay dividends on their capital stock or redeem, repurchase or retire our capital stock or certain indebtedness; |

| • | make investments, loans, advances and acquisitions; |

| • | create restrictions on the payment of dividends or other amounts to the Issuer from certain of its subsidiaries or on pledging its or certain of its subsidiaries’ assets; |

| • | engage in transactions with our affiliates; |

| • | sell assets, including capital stock of the Issuer’s restricted subsidiaries; |

| • | consolidate or merge; |

| • | amend the terms of our or our subsidiaries’ organizational documents and certain indebtedness; and |

| • | change their line of business. |

In addition, our revolving credit facility requires us to comply, under certain circumstances, with a minimum senior secured net leverage ratio covenant. Our ability to comply with this covenant can be affected by events beyond our control, and we may not be able to satisfy them. A breach of this covenant would be an event of default. In the event of a default under our revolving credit facility, those lenders could elect to declare all amounts outstanding under our revolving credit facility to be immediately due and payable or terminate their commitments to lend additional money, which would also lead to a cross-default and cross-acceleration of amounts owing under our Term Loan Facility. If the indebtedness under our Senior Credit Facilities or the notes were to be accelerated, our assets may not be sufficient to repay such indebtedness in full. In particular, noteholders will be paid only if we have assets remaining after we pay amounts due on our secured indebtedness, including our Senior Credit Facilities. We have pledged a significant portion of our assets as collateral under our Senior Credit Facilities. See “Description of Other Indebtedness.”

17

Table of Contents

We may not be able to generate sufficient cash to service all of our indebtedness, including the notes, and may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on or to refinance our debt obligations depends on our financial condition and operating performance, which is subject to prevailing economic and competitive conditions and to certain financial, business and other factors beyond our control. We may not be able to maintain a level of cash flows from operating activities sufficient to permit us to pay the principal, premium, if any, and interest on our indebtedness, including the notes.