Exhibit (a)(1)(B)

NOTICE OF INTENT TO TENDER

Shares of Common Stock

Pursuant to the Offer to Purchase

Dated May 17, 2019

by

AB Private Credit Investors Corporation

of

Up to 1,267,852.231 Shares of its Common Stock

at a Purchase Price Per Share of Common Stock Equal to

$9.97, which price was our Net Asset Value per Share as of March 31, 2019

THE OFFER AND WITHDRAWAL RIGHTS WILL EXPIRE AT 5:00 P.M., NEW YORK CITY TIME, ON

JUNE 25, 2019, UNLESS THE OFFER IS EXTENDED OR WITHDRAWN (SUCH TIME AND DATE, AS THEY

MAY BE EXTENDED, THE “EXPIRATION DATE”).

Complete this Notice of Intent and return or deliver it to your financial advisor.

If you do not have a Bernstein financial advisor, you may return it to:

1345 Avenue of the Americas, Attn: Private Client, 40th Floor

New York, NY 10105; or fax it to (212)407-5850.

For additional information, call your Bernstein financial advisor.

If you have any questions or need assistance in completing this Notice of Intent, please contact your financial advisor, or, if you do not have a Bernstein financial advisor, AllianceBernstein Investor Services, Inc. (“ABIS”) at the following address: 1345 Avenue of the Americas, Attn: Private Client, 40th Floor, New York, NY 10105, fax no. (212)407-5850.

DELIVERY OF THIS NOTICE OF INTENT OR OTHER DOCUMENTS TO AN ADDRESS OTHER THAN TO YOUR FINANCIAL ADVISOR, OR, IF YOU DO NOT HAVE A BERNSTEIN FINANCIAL ADVISOR, ABIS AT THE ADDRESS SET FORTH ABOVE DOES NOT CONSTITUTE A VALID DELIVERY.

THE OFFER TO PURCHASE AND THIS NOTICE OF INTENT, INCLUDING THE ACCOMPANYING INSTRUCTIONS, SHOULD BE READ CAREFULLY BEFORE THIS NOTICE OF INTENT IS COMPLETED.

Ladies and Gentlemen:

I/we, the undersigned, hereby tender to AB Private Credit Investors Corporation, an externally managed,non-diversified,closed-end management investment company incorporated in Maryland that has elected to be regulated as a business development company under the Investment Company Act of 1940, as amended (the “Fund”), the number of shares of common stock, par value $0.01 per share (the “Shares”), identified below at $9.97 per share, net to the seller in cash, less any applicable withholding taxes and without interest, upon the terms and subject to the conditions set forth in the Offer to Purchase, dated May 17, 2019 (the “Offer to Purchase”), and in this Notice of Intent to Tender (this “Notice of Intent,” which, together with the Offer to Purchase, as each may be amended or supplemented from time to time, constitute the “Offer”). The Offer will expire at 5:00 P.M., New York City time, on June 25, 2019, unless the Offer is extended or withdrawn. The Offer is being conducted as a result of the reduction of the asset coverage ratio applicable to the Fund from 200% for 150%. The undersigned acknowledge that he/she has reviewed the Offer to Purchase.

Subject to and effective on acceptance for payment of, and payment for, the Shares tendered with this Notice of Intent in accordance with, and subject to, the terms of the Offer, I/we hereby sell, assign and transfer to, or upon the order of, the Fund, all right, title and interest in and to all of the Shares that are being tendered hereby, subject to the cutback provisions of the Offer, and all authority conferred or agreed to be conferred in this Notice of Intent will survive the death or incapacity of the undersigned and the obligation of the undersigned, and the obligation of the undersigned hereunder will be binding on the heirs, personal representatives, successors and assigns of the undersigned.

I/we certify that I/we have complied with all requirements as stated in the instructions on the reverse side, am/are the registered holder(s) of the Shares identified below, and give the instructions in this Notice of Intent and warrant that I/we have full power and authority to tender, sell, assign and transfer the tendered Shares and the Shares identified below are free and clear of all liens, charges, encumbrances, security interests, claims, restrictions and equities whatsoever, together with all rights and benefits arising therefrom, provided that any dividends or distributions which may be declared, paid, issued, distributed, made or transferred on or in respect of such Shares to stockholders of record on or prior to the date on which the Shares are taken up and paid for pursuant to the Offer shall be for the account of such stockholders.

I/we hereby represent and warrant that the transfer and assignment contemplated in this Notice of Intent are in compliance with all applicable laws and regulations. I/we will, on request by the Fund or its designee, execute any additional documents deemed by the Fund to be necessary or desirable to complete the sale, assignment and transfer of the tendered Shares, all in accordance with the terms of the Offer. I/we make the representations and warranties to the Fund set forth in Section 3 of the Offer to Purchase and understand that the tender of Shares made hereby constitutes an acceptance of the terms and conditions of the Offer (including if the Offer is extended or amended, the terms and conditions of such extension or amendment).

I/we understand that the tender of Shares constitutes a representation and warranty to the Fund that the undersigned has/have a net long position in the Shares or other securities exercisable or exchangeable therefore and that such tender complies with Rule14e-4 promulgated under the Securities Exchange Act of 1934, as amended (the “Exchange Act”). I/we authorize the Fund to withhold all applicable taxes andtax-related items legally payable by the signatory hereto.

All authority conferred or agreed to be conferred pursuant to this Notice of Intent shall be binding on the successors, assigns, heirs, personal representatives, executors, administrators and other legal representatives of the undersigned and shall not be affected by, and shall survive, the death or incapacity of the undersigned.

NOTE: ORIGINAL SIGNATURE MUST BE PROVIDED ON THE FOLLOWING PAGE—SEE PART 4.

2

PART 1 Name and Address (Please Complete; Joint Owners Should Complete for Each):

|

Name of Stockholder: |

|

Social Security No. |

|

or Taxpayer Identification No.: |

|

AB PCIC |

|

Account No.: |

|

Telephone No.: |

|

Name of Joint Stockholder: |

|

Social Security No. |

|

or Taxpayer Identification No.: |

|

Telephone No.: |

Part 2 Shares Being Tendered:

Such tender is with respect to (specify one):

| | ☐ | 25% of the undersigned’s Shares |

| | ☐ | A portion of the undersigned’s Shares expressed as the following percentage of holdings as of November 27, 2018, which may not exceed 25%: ____ % |

Part 3 Payment

100% of cash payment will be made to the undersigned’s Disbursement Account on file.

Part 4 Signature(s)

If joint ownership, all parties must sign. If fiduciary, partnership or corporation, indicate title of signatory under signature lines.

| | | | | | |

Signature (signature should appear exactly as on your Subscription Agreement) | | | | | | Signature (signature should appear exactly as on your Subscription Agreement) |

Print Name of Stockholder | | | | | | Print Name of Stockholder |

Title (if applicable) | | | | | | Title (if applicable) |

| Date:_________________ | | | | | | Date:________________ |

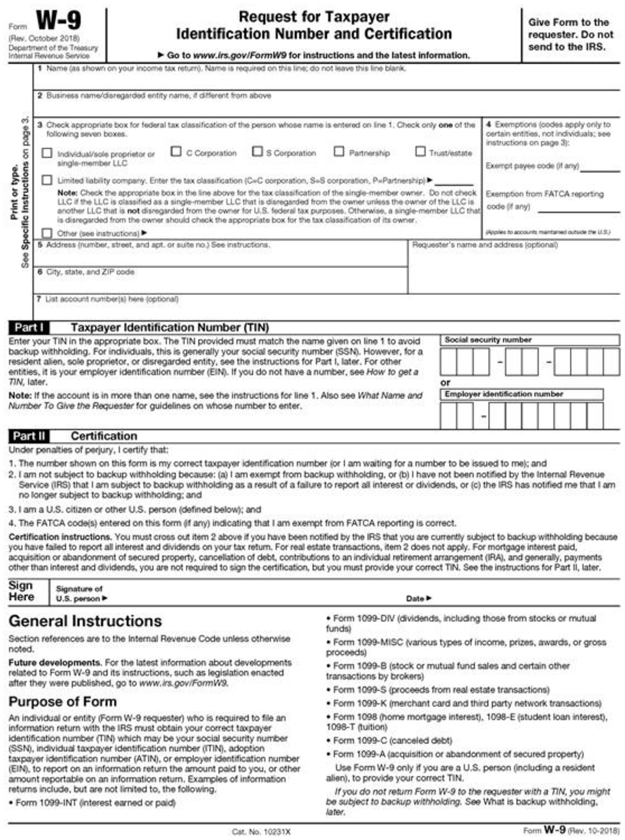

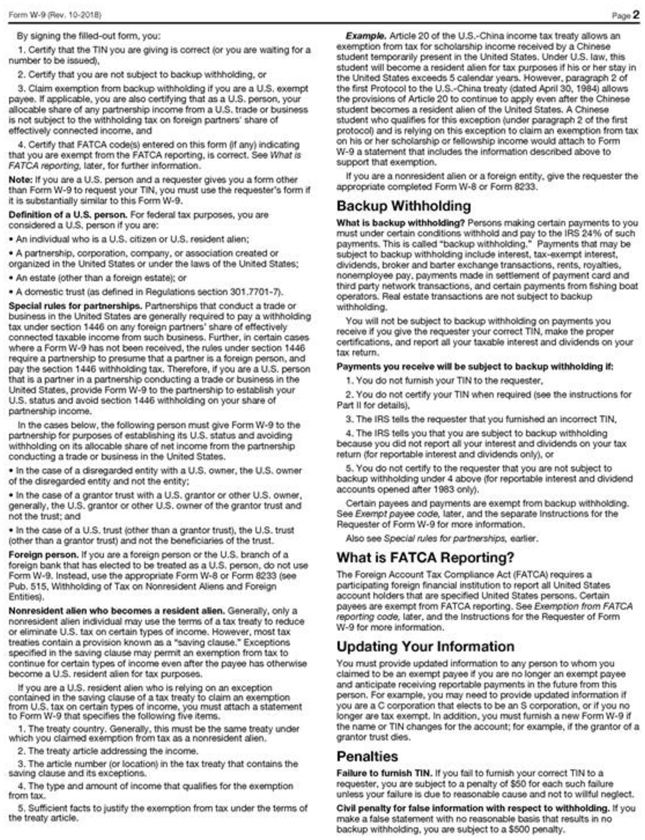

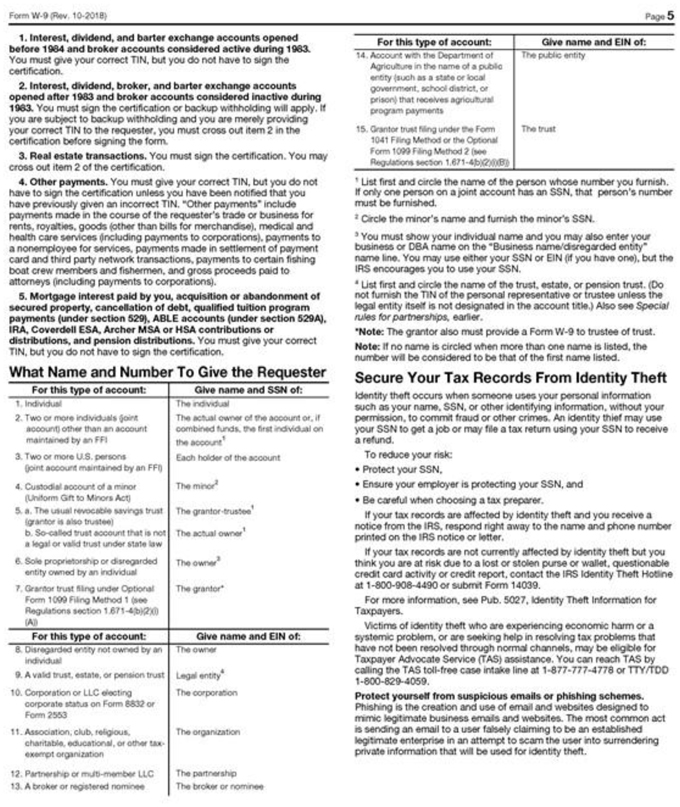

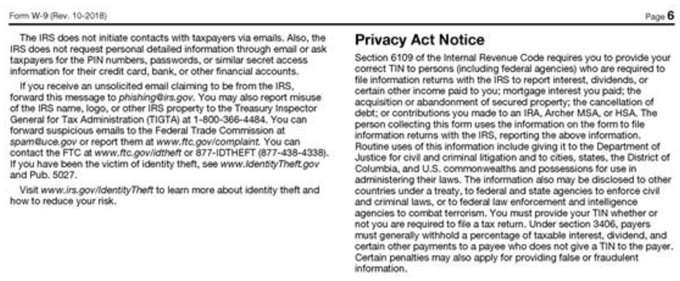

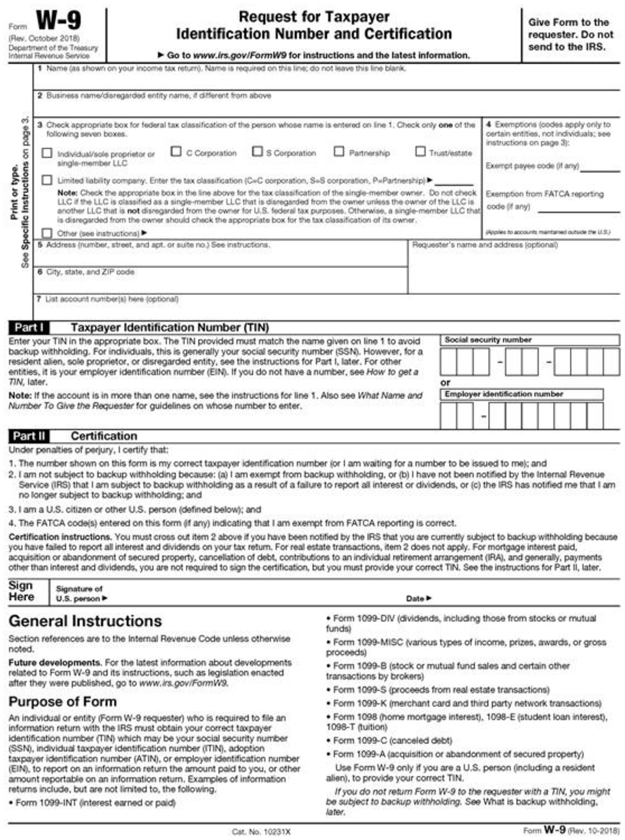

U.S. Federal Withholding Tax.PLEASE COMPLETE AND SUBMIT THE ACCOMPANYING IRS FORMW-9 TO CERTIFY YOUR TAXPAYER ID OR (IF DIFFERENT) SOCIAL SECURITY NUMBER IF YOU ARE A U.S. HOLDER (AS DEFINED IN SECTION 13 OF THE OFFER TO PURCHASE). Please note that the Fund may withhold 24% of your proceeds as required by the IRS if the Taxpayer ID or Social Security Number is not properly certified on our records. If you are aNon-U.S. Holder (as defined in Section 13 of the Offer to Purchase), please complete and submit an IRS FormW-8BEN,W-8BEN-E,W-8IMY (with any required attachments),W-8ECI, or W8EXP, as applicable (which may be obtained from the IRS website). Additionally, as described in more detail in Section 13 of the Offer to Purchase, the Fund generally will withhold an amount of U.S. federal income tax equal to 30% of the gross payments payable to aNon-U.S. Holder.Non-U.S. Holders should refer to “13. Material U.S. Federal Income TaxConsequences—Non-U.S. Holders” in the Offer to Purchase for a general description of the applicability of withholding tax to proceeds from the Offer.

3

INSTRUCTIONS FOR COMPLETING THE NOTICE OF INTENT

| 1. | Requirements of Tender. For a stockholder validly to tender Shares pursuant to the Offer, this Notice of Intent, properly completed and duly executed (or an originally signed photocopy hereof), together with any required signature guarantees, and any other required documents, must be received by the stockholder’s financial advisor, or, if the stockholder does not have a Bernstein financial advisor, to ABIS at 1345 Avenue of the Americas, Attn: Private Client, 40th Floor, New York, NY 10105, fax no. (212)407-5850 prior to the Expiration Date. |

The method of delivery of all documents, including this Notice of Intent and any other required documents, is at the sole election and risk of the tendering stockholder. Shares will be deemed delivered only when actually received by the stockholder’s financial advisor, or, if the stockholder does not have a Bernstein financial advisor, to ABIS. If delivery is by mail, then registered mail with return receipt requested, properly insured, is recommended. In all cases, sufficient time should be allowed to ensure timely delivery prior to the expiration of the Offer.No conditional tenders will be accepted. All tendering stockholders, by execution of this Notice of Intent (or an originally signed photocopy hereof), waive any right to receive any notice of the acceptance for payment of their Shares.

| 2. | Signatures on Notice of Intent, Stock Powers and Endorsements.If any of the Shares tendered hereby are owned of record by two or more joint owners, all such persons must sign this Notice of Intent. If this Notice of Intent or any certificate or stock power is signed by a director, executor, administrator, guardian,attorney-in-fact, officer of a corporation or other person acting in a fiduciary or representative capacity, he or she should so indicate when signing by providing such title where called for in Part 4. |

| 3. | Stock Transfer Taxes. The Fund will pay any stock transfer taxes with respect to the transfer and sale of Shares to it pursuant to the Offer. If, however, payment of the purchase price is to be made to, or if Shares not tendered or accepted for payment are to be registered in the name of, any person(s) other than the registered owner(s), or if Shares tendered hereby are registered in the name(s) of any person(s) other than the person(s) signing this Notice of Intent, the amount of any stock transfer taxes (whether imposed on the registered owner(s) or such person(s)) payable on account of the transfer to such person(s) will be deducted from the purchase price unless satisfactory evidence of the payment of such taxes or exemption therefrom is submitted with this Notice of Intent. |

| 4. | Irregularities. The Fund will determine in its sole discretion the number of Shares to accept, and the validity, eligibility and acceptance for payment of any tender, and the Fund’s determinations will be final and binding on all parties, except as finally determined in a subsequent judicial proceeding if the Fund’s determinations are challenged by stockholders. There is no obligation to give notice of any defects or irregularities to stockholders. See Section 3 of the Offer to Purchase for additional information. |

| 5. | Withholding Taxes. PLEASE COMPLETE AND SUBMIT THE ACCOMPANYING IRS FORMW-9 TO CERTIFY YOUR TAXPAYER ID OR SOCIAL SECURITY NUMBER IF YOU ARE A U.S. HOLDER (AS DEFINED IN SECTION 13 OF THE OFFER TO PURCHASE). Please note that the Fund may withhold 24% of your proceeds as required by the IRS if the Taxpayer ID or Social Security Number is not properly certified on our records. If you are aNon-U.S. Holder (as defined in Section 13 of the Offer to Purchase), please complete and submit an IRS FormW-8BEN,W-8BEN-E,W-8IMY (with any required attachments),W-8ECI, or W8EXP, as applicable (which may be obtained from the IRS website (www.irs.gov)). |

| 6. | Inadequate Space. If the space provided in Part 2 of this Notice of Intent is inadequate, the percentage of Shares should be listed on a separated signed schedule attached hereto. |

| 7. | Requests for Assistance or Additional Copies. Questions and requests for assistance or additional copies of the Offer to Purchase, this Notice of Intent and the Guidelines for Certification of Taxpayer Identification Number on FormW-9 may be directed to the stockholder’s financial advisor, or, if the stockholder does not have a Bernstein financial advisor, to ABIS, at its address set forth on the first page of this Notice of Intent. |

4

IMPORTANT U.S. TAX INFORMATION

This is a summary of certain material U.S. federal income tax considerations. Stockholders should consult with their tax advisors regarding the tax consequences with respect to their particular circumstances.

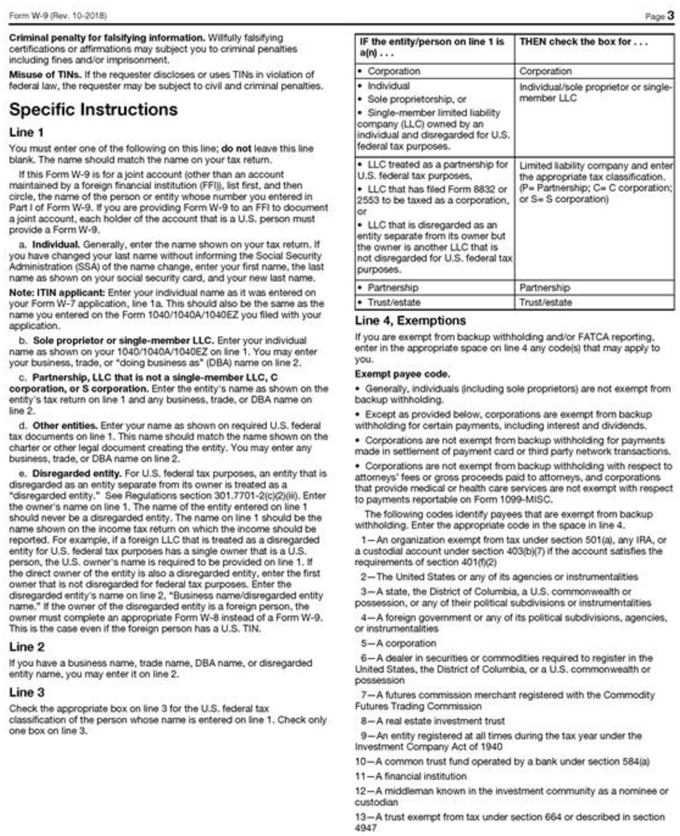

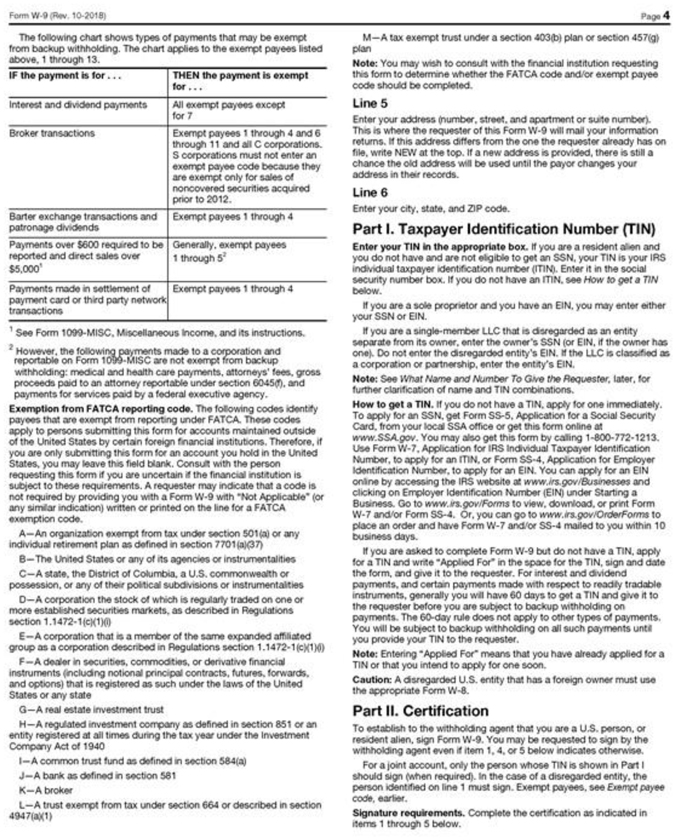

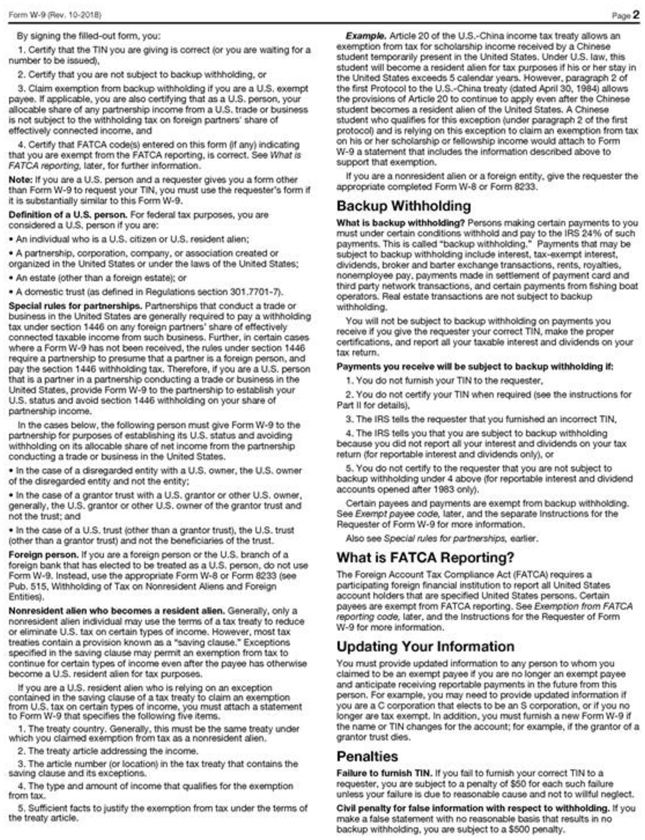

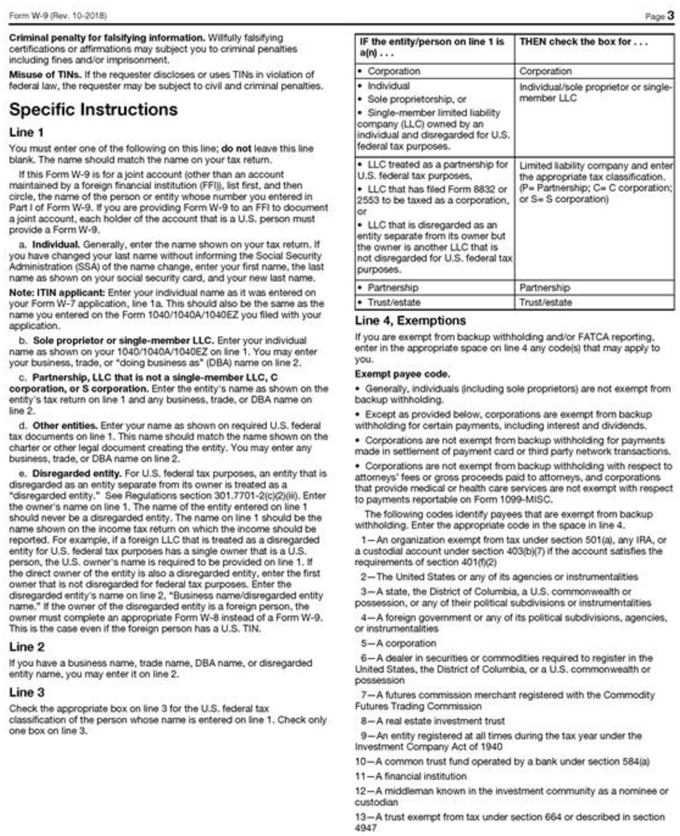

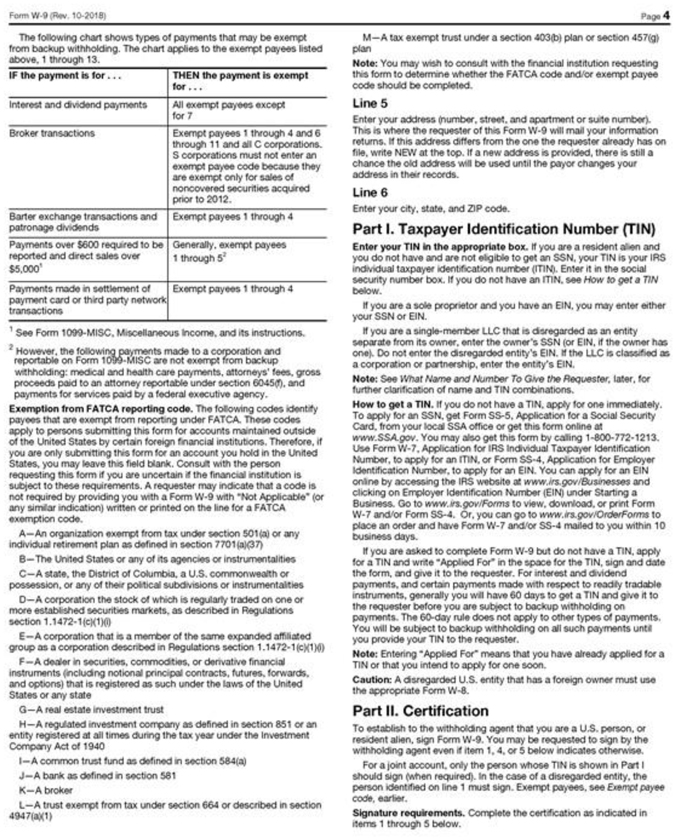

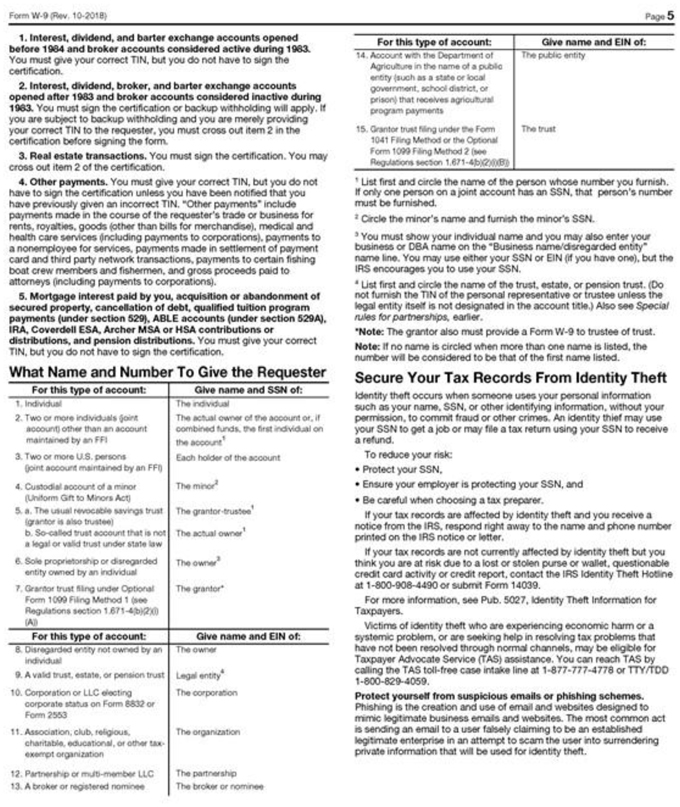

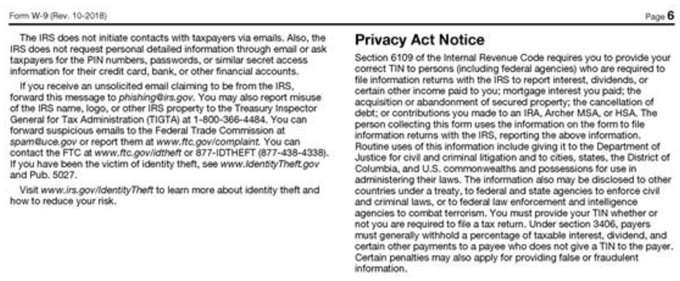

In order to avoid backup withholding of U.S. federal income tax on payments pursuant to the Offer, a U.S. Holder (as defined in Section 13 of the Offer to Purchase) tendering Shares must, unless an exemption applies, timely provide the Fund with such stockholder’s correct taxpayer identification number (“TIN”), certify under penalties of perjury that such TIN is correct (or that such stockholder is waiting for a TIN to be issued), and provide certain other certifications by completing the IRS FormW-9 accompanying this Notice of Intent. If a stockholder does not provide his, her or its correct TIN or fails to provide the required certifications, the IRS may impose certain penalties on such stockholder and payment to such stockholder pursuant to the Offer may be subject to U.S. federal backup withholding tax at a rate currently equal to 24%. All U.S. Holders tendering Shares pursuant to the Offer should complete and sign the IRS FormW-9 to provide the information and certification necessary to avoid U.S. federal backup withholding tax (unless an applicable exemption exists and is proved in a manner satisfactory to the Fund). To the extent that a U.S. Holder designates another U.S. person to receive payment, such other person may be required to provide a properly completed IRS FormW-9.

Backup withholding is not an additional tax. Rather, the amount of the backup withholding may be credited against the U.S. federal income tax liability of the person subject to the backup withholding. If backup withholding results in an overpayment of tax, a refund can be obtained by the stockholder by timely providing the required information to the IRS.

If the stockholder has not been issued a TIN and has applied for a TIN or intends to apply for a TIN in the near future, then the stockholder should write “APPLIED FOR” in the space for the TIN in Part I of the IRS FormW-9 and should sign and date the IRS FormW-9. If the Fund has not been provided with a properly certified TIN by the time of payment, U.S. federal backup withholding tax will apply. If the Shares are held in more than one name or are not in the name of the actual owner, consult the instructions on the IRS FormW-9 for additional guidance on which name and TIN to report.

Certain stockholders (including, among others, “C corporations,” individual retirement accounts and certain foreign individuals and entities) are not subject to U.S. federal backup withholding tax but may be required to provide evidence of their exemption from such backup withholding tax. Exempt U.S. stockholders should check the “Exempt payee” box on the IRS FormW-9. See the accompanying IRS FormW-9 for more instructions.

Non-U.S. Holders, such asnon-resident alien individuals and foreign entities, including a disregarded U.S. domestic entity that has a foreign owner, should not complete an IRS FormW-9. Instead, to establish an applicable withholding exemption, aNon-U.S. Holder (or a stockholder’snon-U.S. designee, if any) may be required to properly complete and submit an IRS FormW-8BEN,W-8BEN-E,W-8IMY (with any required attachments),W-8ECI, orW-8EXP, as applicable, signed under penalties of perjury, attesting to such exempt status (which may be obtained on the IRS website (www.irs.gov)).

For withholding purposes, we expect to treat each exchange of Shares for cash pursuant to the Offer by aNon-U.S. Holder as a dividend for U.S. federal income tax purposes (and not as a sale or exchange). As a result, the Fund generally will withhold an amount of U.S. federal income tax equal to 30% of the gross payments payable to aNon-U.S. Holder.Non-U.S. Holders should refer to “13. Material U.S. Federal Income TaxConsequences—Non-U.S. Holders” in the Offer to Purchase for a general description of the applicability of withholding tax to proceeds from the Offer.

Stockholders are urged to consult their tax advisors to determine whether they are exempt from these withholding tax and reporting requirements.

5

6

7

8

9

10

11