3Q 2016 Earnings October 25, 2016 Exhibit 99.2

Legal Notices FORWARD LOOKING STATEMENTS Certain statements in this presentation may relate to our future business and financial performance and future events or developments involving us and our subsidiaries that are not purely historical and may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “should,” “can,” “expects,” “believes,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” “is confident that” and “seeks” or the negative of such terms or other variations on such terms or comparable terminology. Such forward-looking statements include, but are not limited to, statements about our plans, objectives and intentions, outlooks or expectations for earnings, revenues, expenses or other future financial or business performance, strategies or expectations, or the impact of legal or regulatory matters on our business, results of operations or financial condition. Such statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, without limitation, the risks and uncertainties set forth under the section entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2015 and our Quarterly Report on Form 10-Q for the six months ended June 30, 2016, which are on file with the Securities and Exchange Commission (SEC) and available on our investor relations website at www.avangrid.com and on the SEC website at www.sec.gov. Additional information will also be set forth in subsequent filings with the SEC. You should consider these factors carefully in evaluating for-ward looking statements. Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of this presentation whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Legal Notices Use of Non-GAAP Financial Measures To supplement our consolidated financial statements presented in accordance with U.S. GAAP, AVANGRID considers certain non-GAAP financial measures that are not prepared in accordance with U.S. GAAP, including adjusted net income and adjusted EPS. The non-GAAP financial measures we use are specific to AVANGRID and the non-GAAP financial measures of other companies may not be calculated in the same manner. We use these non-GAAP financial measures, in addition to U.S. GAAP measures, to establish operating budgets and operational goals to manage and monitor our business, evaluate our operating and financial performance and to compare such performance to prior periods and to the performance of our competitors. We believe that presenting such non-GAAP financial measures is useful because such measures can be used to analyze and compare profitability between companies and industries because it eliminates the impact of financing and certain non-cash charges. In addition, we present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance. We provide adjusted net income, which is adjusted to reflect the full nine month pro forma results of the merged UIL entities, the costs of the combination of AVANGRID with UIL, and the impairment of certain investments and excludes the sale of certain equity investments and certain mark-to-market changes in the fair value of derivative instruments used by AVANGRID to economically hedge market price fluctuations in related underlying physical transactions for the purchase and sale of electricity and gas. We believe adjusted net income is more useful in understanding and evaluating actual and projected financial performance and contribution of AVANGRID lines of business and to more fully compare and explain our results. The most directly comparable U.S. GAAP measure to adjusted net income is net income. We also provide adjusted EPS, which is adjusted net income converted to an earnings per share amount. The use of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, AVANGRID’s U.S. GAAP financial information, and investors are cautioned that the non-GAAP financial measures are limited in their usefulness, may be unique to AVANGRID, and should be considered only as a supplement to AVANGRID’s U.S. GAAP financial measures. The non-GAAP financial measures may not be comparable to other similarly titled measures of other companies and have limitations as analytical tools. Non-GAAP financial measures are not primary measurements of our performance under U.S. GAAP and should not be considered as alternatives to operating income, net income or any other performance measures determined in accordance with U.S. GAAP. About AVANGRID Avangrid, Inc. (NYSE: AGR) is a diversified energy and utility company with more than $30 billion in assets and operations in 25 states. The company operates regulated utilities and electricity generation through two primary lines of business. Avangrid Networks includes eight electric and natural gas utilities, serving 3.1 million customers in New York and New England. Avangrid Renewables operates approximately 6.6 gigawatts of electricity capacity, primarily through wind power, in states across the United States. AVANGRID employs approximately 7,000 people. The company was formed through a merger between Iberdrola USA, Inc. and UIL Holdings Corporation in 2015. Iberdrola S.A. (Madrid: IBE), a worldwide leader in the energy industry, owns 81.5% of AVANGRID. For more information, visit www.avangrid.com.

Legal Notices Presenters: James P. TorgersonChief Executive Officer Richard J. NicholasChief Financial Officer Investors@AVANGRID.com

AVANGRID Quarterly Update 3Q ’16 & YTD ‘16

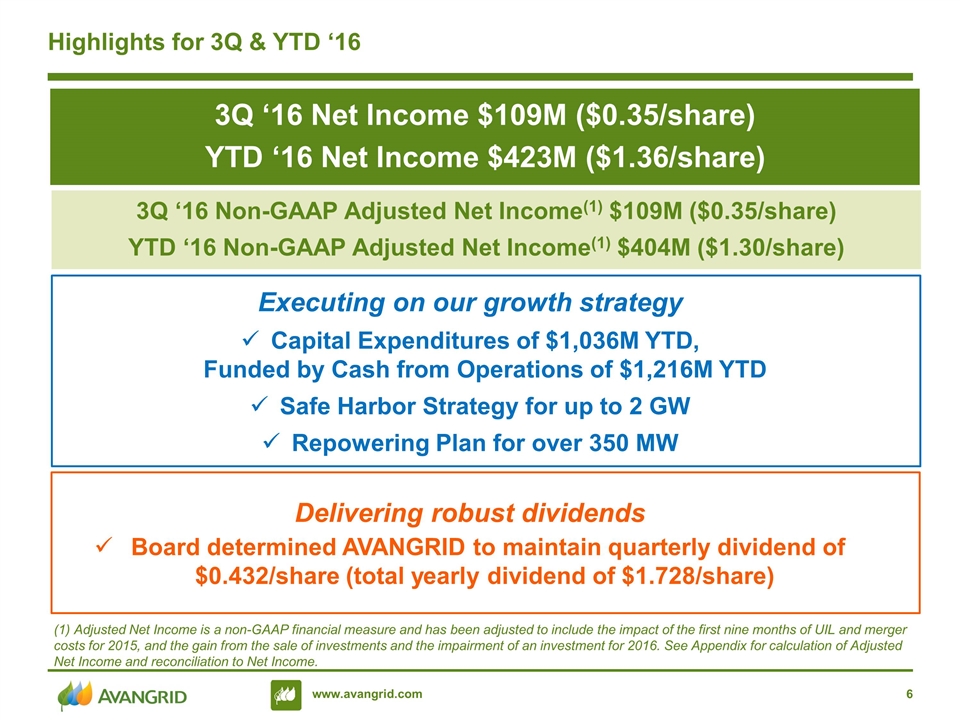

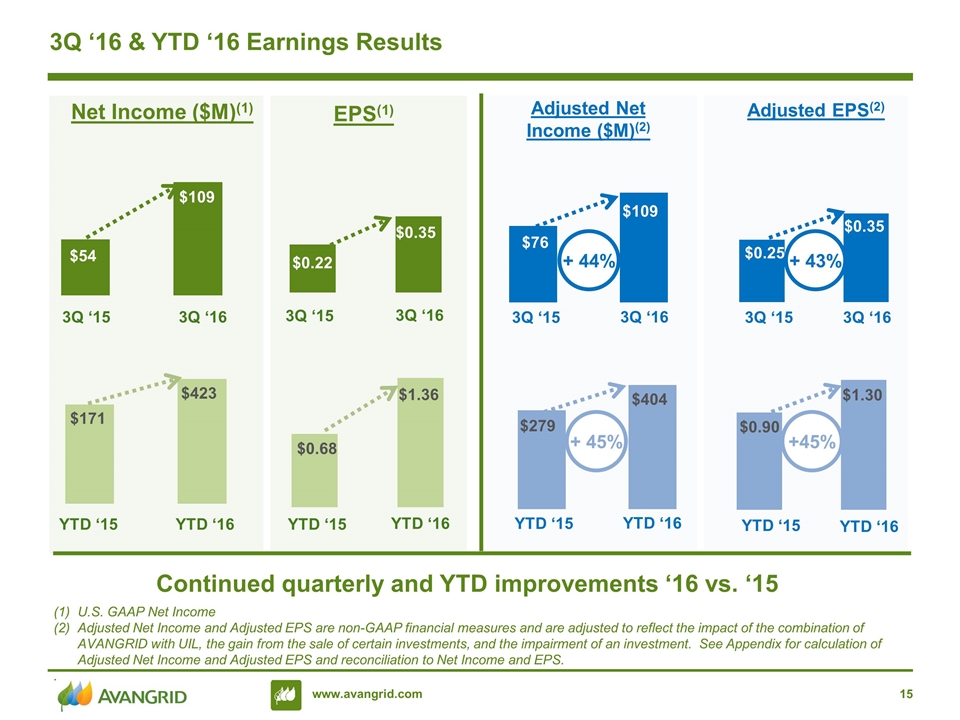

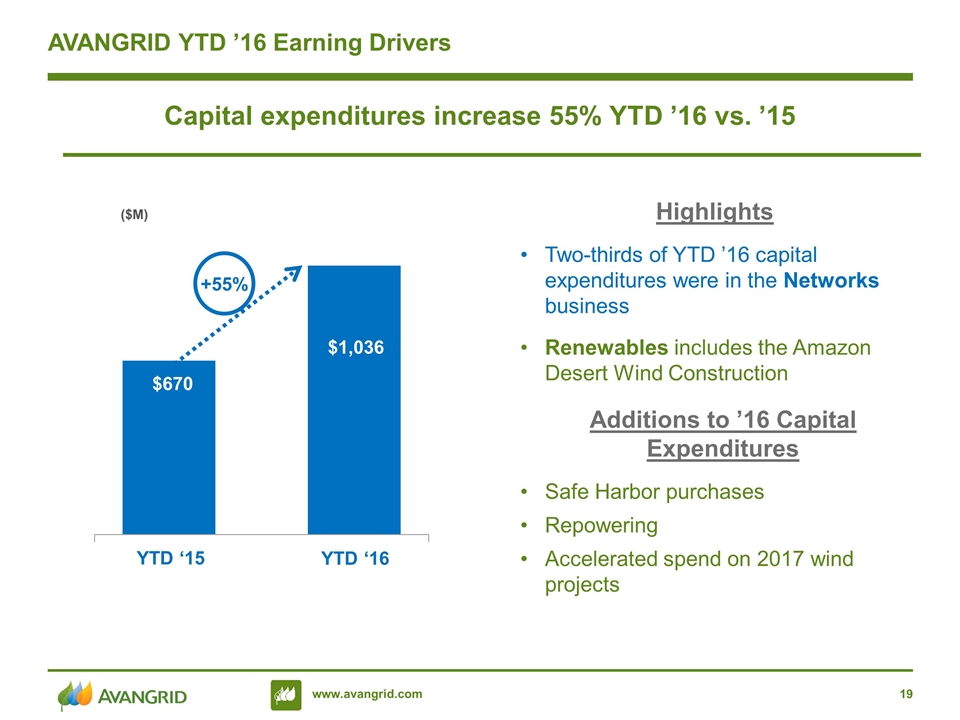

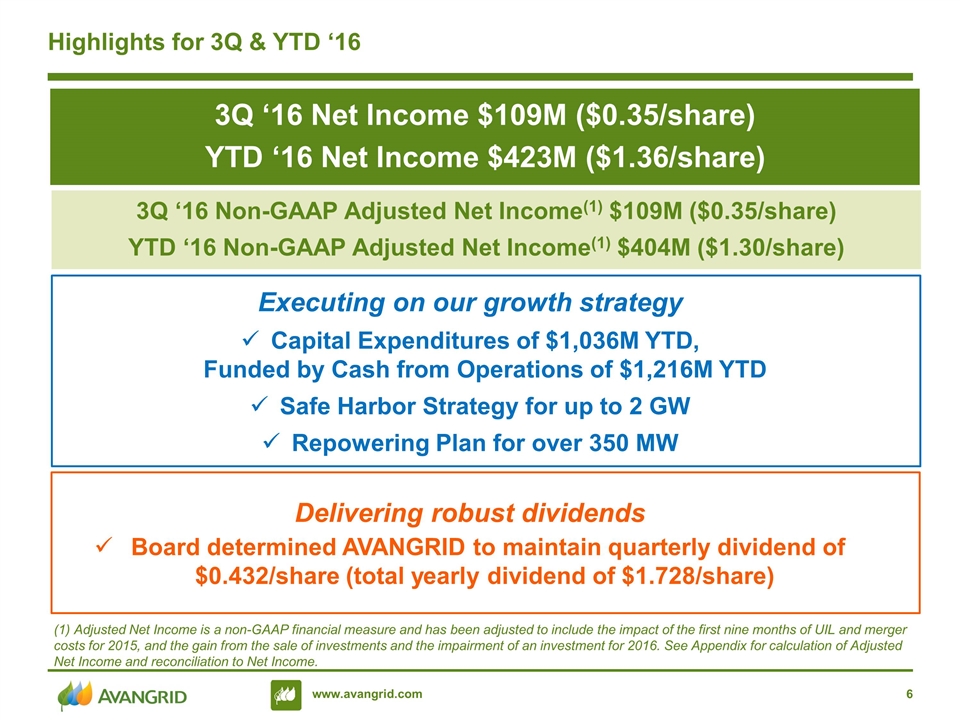

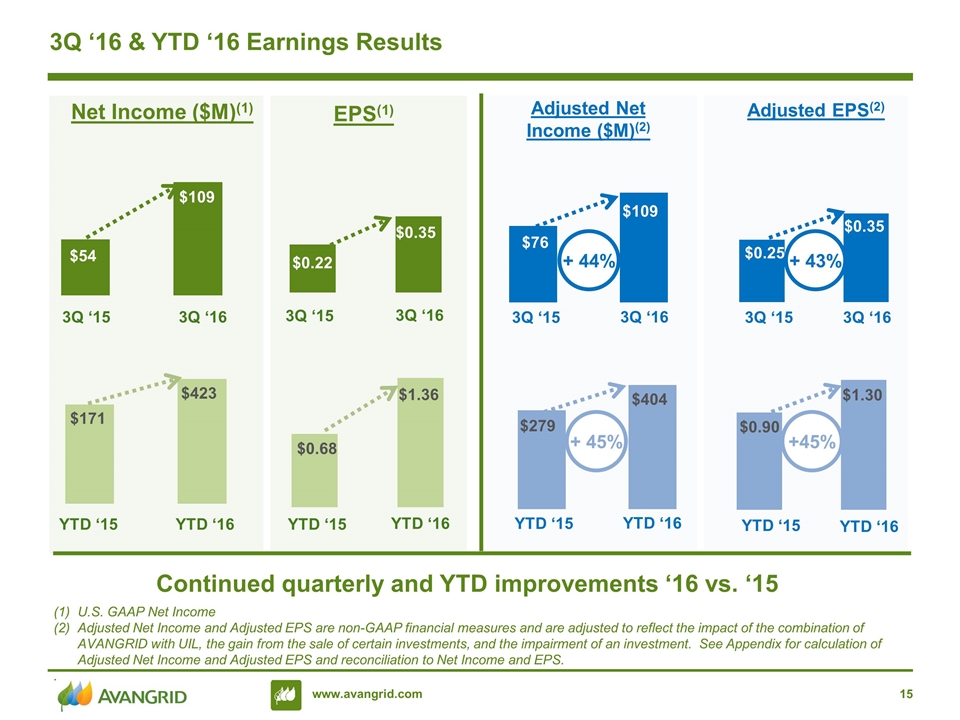

Highlights for 3Q & YTD ‘16 (1) Adjusted Net Income is a non-GAAP financial measure and has been adjusted to include the impact of the first nine months of UIL and merger costs for 2015, and the gain from the sale of investments and the impairment of an investment for 2016. See Appendix for calculation of Adjusted Net Income and reconciliation to Net Income. Executing on our growth strategy Capital Expenditures of $1,036M YTD, Funded by Cash from Operations of $1,216M YTD Safe Harbor Strategy for up to 2 GW Repowering Plan for over 350 MW Delivering robust dividends Board determined AVANGRID to maintain quarterly dividend of $0.432/share (total yearly dividend of $1.728/share) 3Q ‘16 Net Income $109M ($0.35/share) YTD ‘16 Net Income $423M ($1.36/share) 3Q ‘16 Non-GAAP Adjusted Net Income(1) $109M ($0.35/share) YTD ‘16 Non-GAAP Adjusted Net Income(1) $404M ($1.30/share)

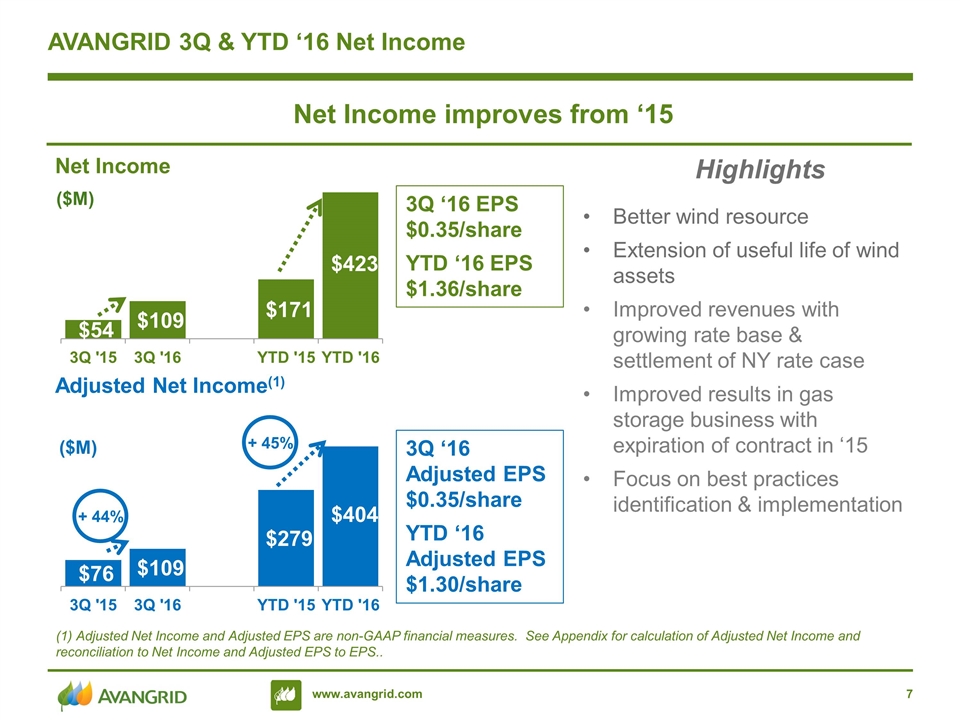

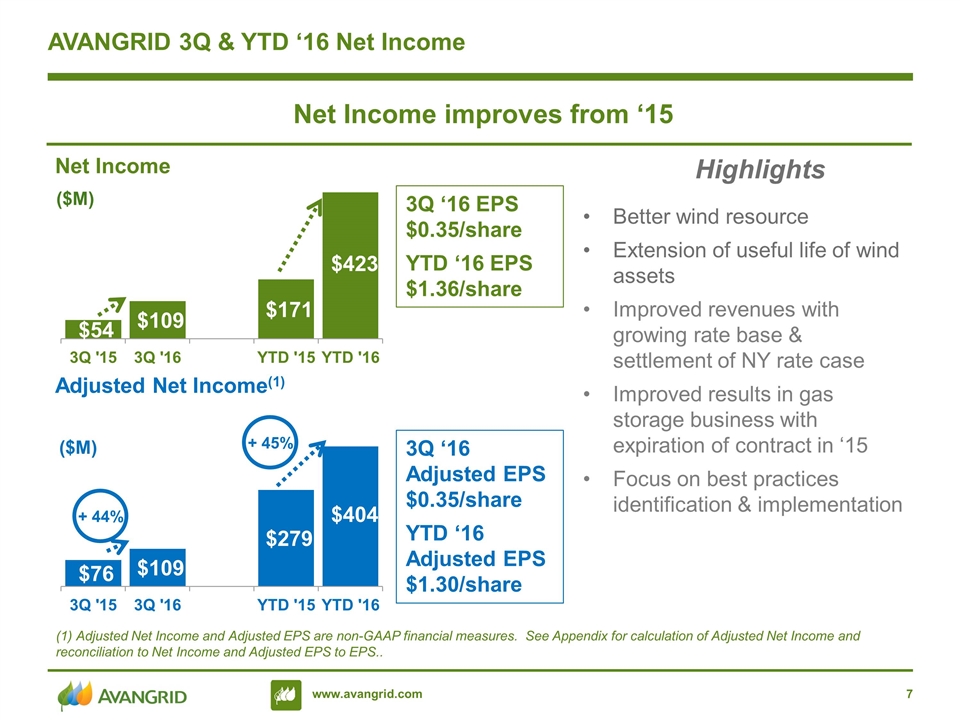

AVANGRID 3Q & YTD ‘16 Net Income Better wind resource Extension of useful life of wind assets Improved revenues with growing rate base & settlement of NY rate case Improved results in gas storage business with expiration of contract in ‘15 Focus on best practices identification & implementation Highlights ($M) Net Income improves from ‘15 3Q ‘16 EPS $0.35/share YTD ‘16 EPS $1.36/share 3Q ‘16 Adjusted EPS $0.35/share YTD ‘16 Adjusted EPS $1.30/share ($M) (1) Adjusted Net Income and Adjusted EPS are non-GAAP financial measures. See Appendix for calculation of Adjusted Net Income and reconciliation to Net Income and Adjusted EPS to EPS..

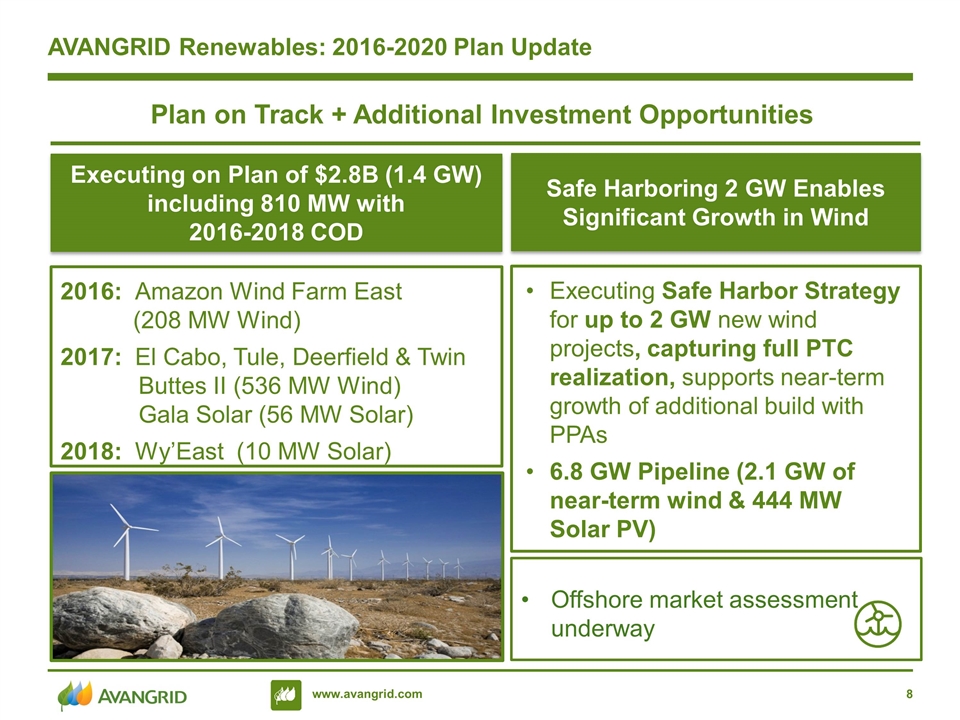

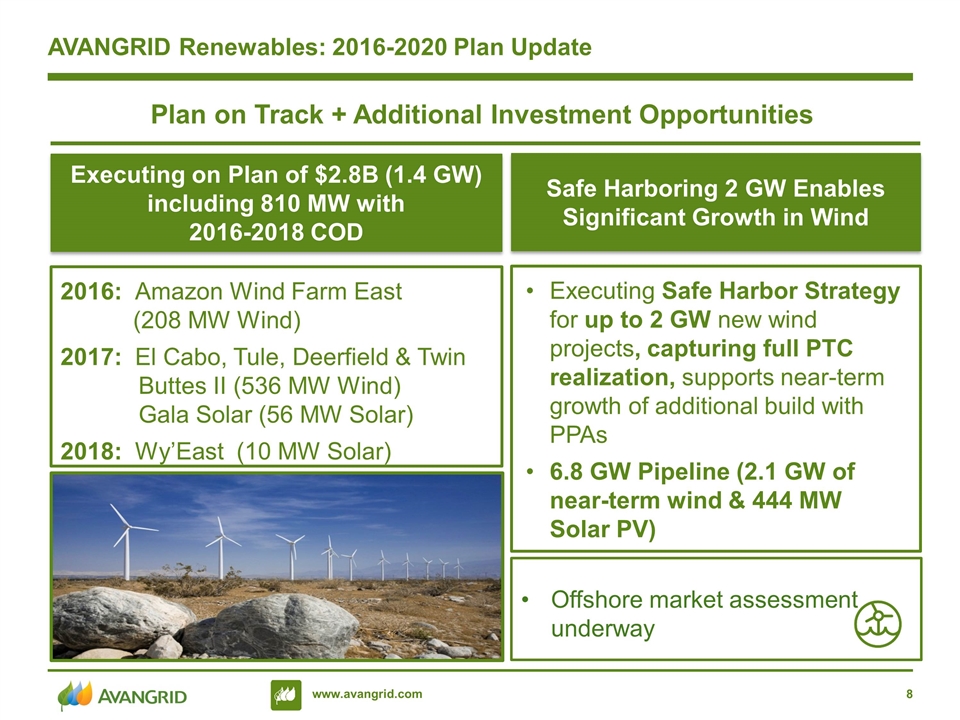

AVANGRID Renewables: 2016-2020 Plan Update Plan on Track + Additional Investment Opportunities Executing on Plan of $2.8B (1.4 GW) including 810 MW with 2016-2018 COD 2016: Amazon Wind Farm East (208 MW Wind) 2017: El Cabo, Tule, Deerfield & Twin Buttes II (536 MW Wind) Gala Solar (56 MW Solar) 2018: Wy’East (10 MW Solar) Executing Safe Harbor Strategy for up to 2 GW new wind projects, capturing full PTC realization, supports near-term growth of additional build with PPAs 6.8 GW Pipeline (2.1 GW of near-term wind & 444 MW Solar PV) Safe Harboring 2 GW Enables Significant Growth in Wind Offshore market assessment underway

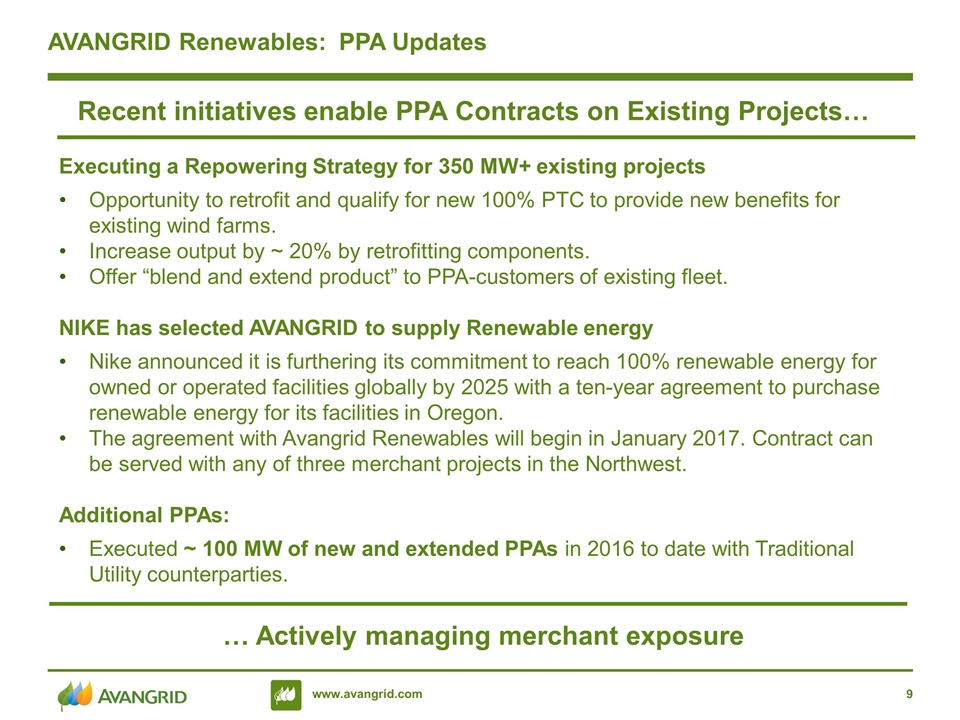

AVANGRID Renewables: PPA Updates Executing a Repowering Strategy for 350 MW+ existing projects Opportunity to retrofit and qualify for new 100% PTC to provide new benefits for existing wind farms. Increase output by ~ 20% by retrofitting components. Offer “blend and extend product” to PPA-customers of existing fleet. NIKE has selected AVANGRID to supply Renewable energy Nike announced it is furthering its commitment to reach 100% renewable energy for owned or operated facilities globally by 2025 with a ten-year agreement to purchase renewable energy for its facilities in Oregon. The agreement with Avangrid Renewables will begin in January 2017. Contract can be served with any of three merchant projects in the Northwest. Additional PPAs: Executed ~ 100 MW of new and extended PPAs in 2016 to date with Traditional Utility counterparties. Recent initiatives enable PPA Contracts on Existing Projects… … Actively managing merchant exposure

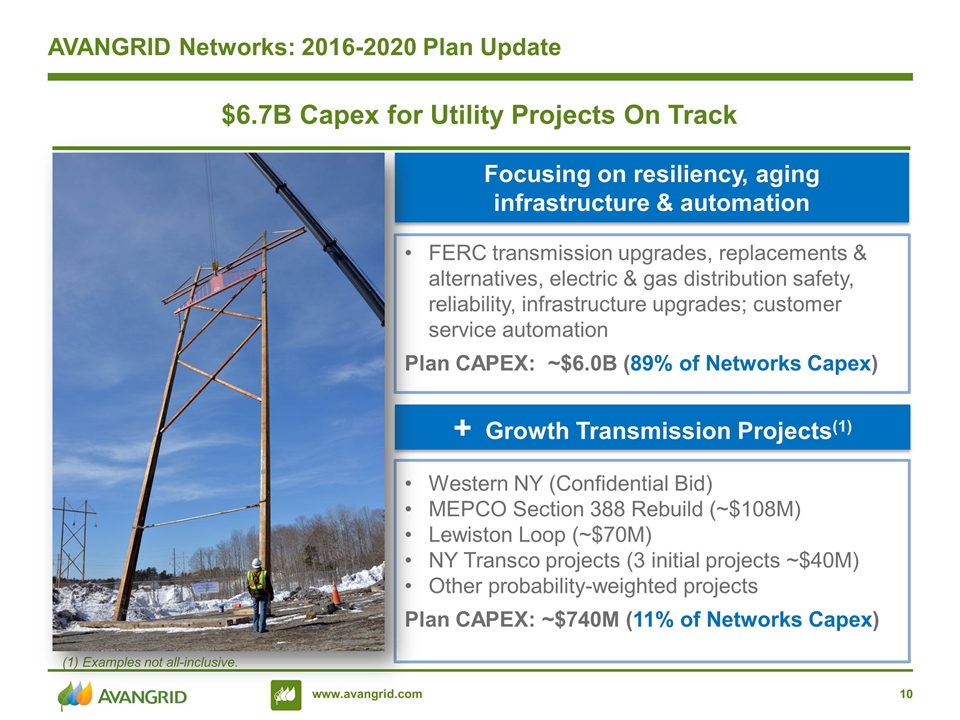

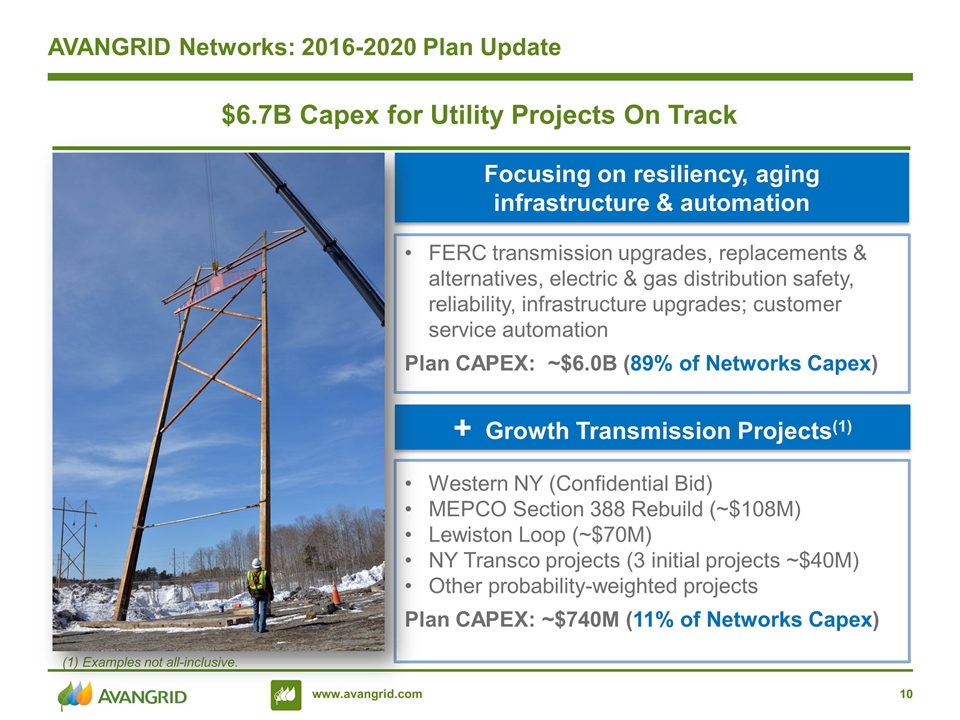

AVANGRID Networks: 2016-2020 Plan Update $6.7B Capex for Utility Projects On Track Focusing on resiliency, aging infrastructure & automation FERC transmission upgrades, replacements & alternatives, electric & gas distribution safety, reliability, infrastructure upgrades; customer service automation Plan CAPEX: ~$6.0B (89% of Networks Capex) + Growth Transmission Projects(1) Western NY (Confidential Bid) MEPCO Section 388 Rebuild (~$108M) Lewiston Loop (~$70M) NY Transco projects (3 initial projects ~$40M) Other probability-weighted projects Plan CAPEX: ~$740M (11% of Networks Capex) (1) Examples not all-inclusive.

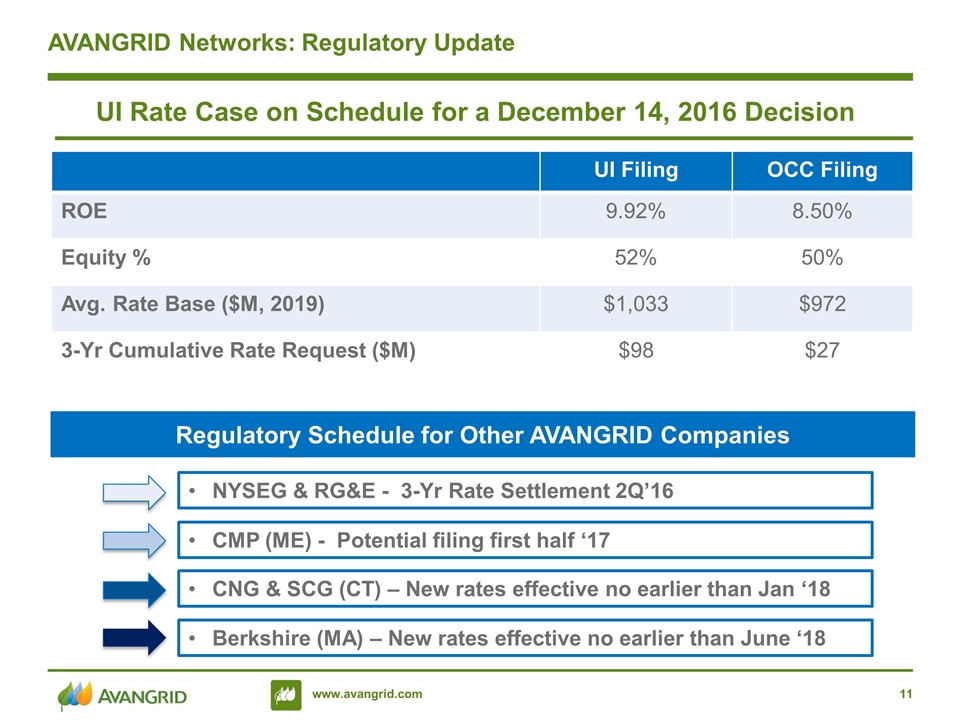

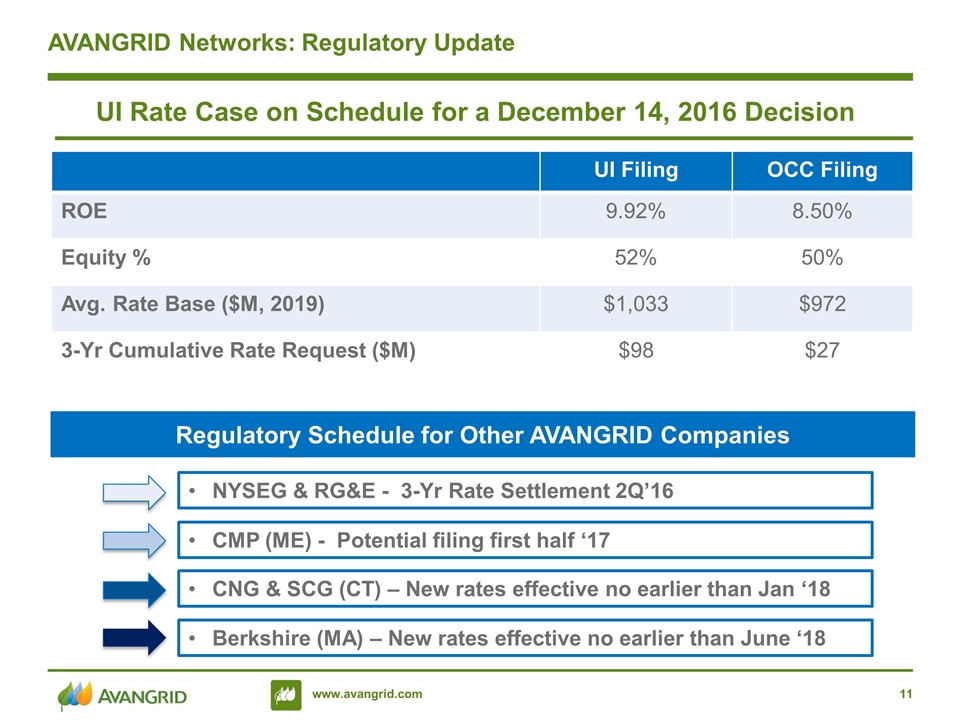

AVANGRID Networks: Regulatory Update UI Rate Case on Schedule for a December 14, 2016 Decision Regulatory Schedule for Other AVANGRID Companies NYSEG & RG&E - 3-Yr Rate Settlement 2Q’16 CMP (ME) - Potential filing first half ‘17 CNG & SCG (CT) – New rates effective no earlier than Jan ‘18 Berkshire (MA) – New rates effective no earlier than June ‘18 UI Filing OCC Filing ROE 9.92% 8.50% Equity % 52% 50% Avg. Rate Base ($M, 2019) $1,033 $972 3-Yr Cumulative Rate Request ($M) $98 $27

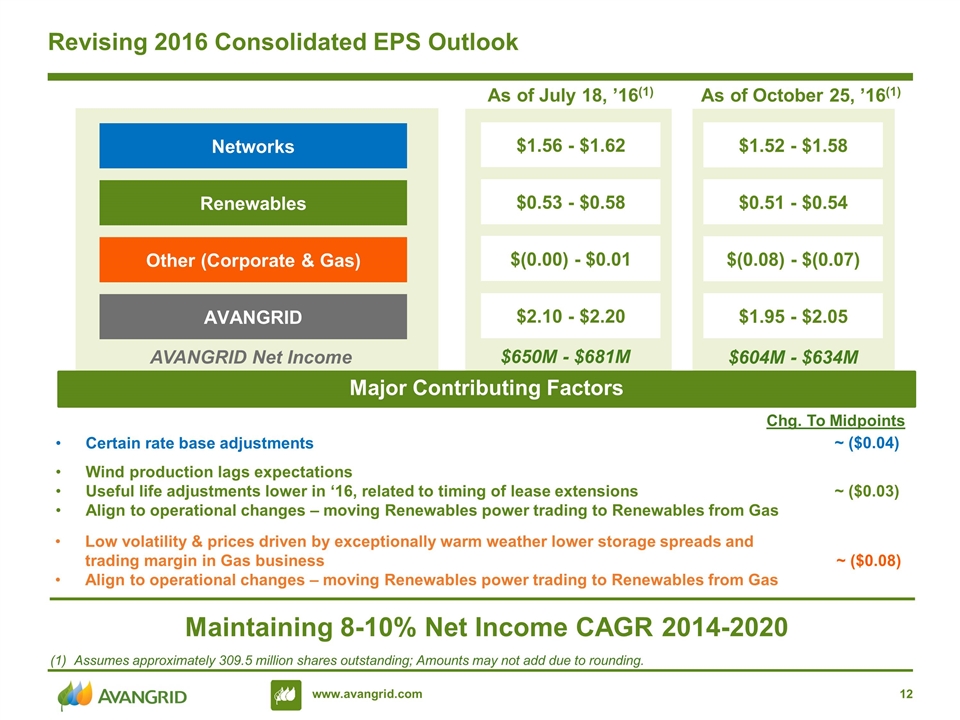

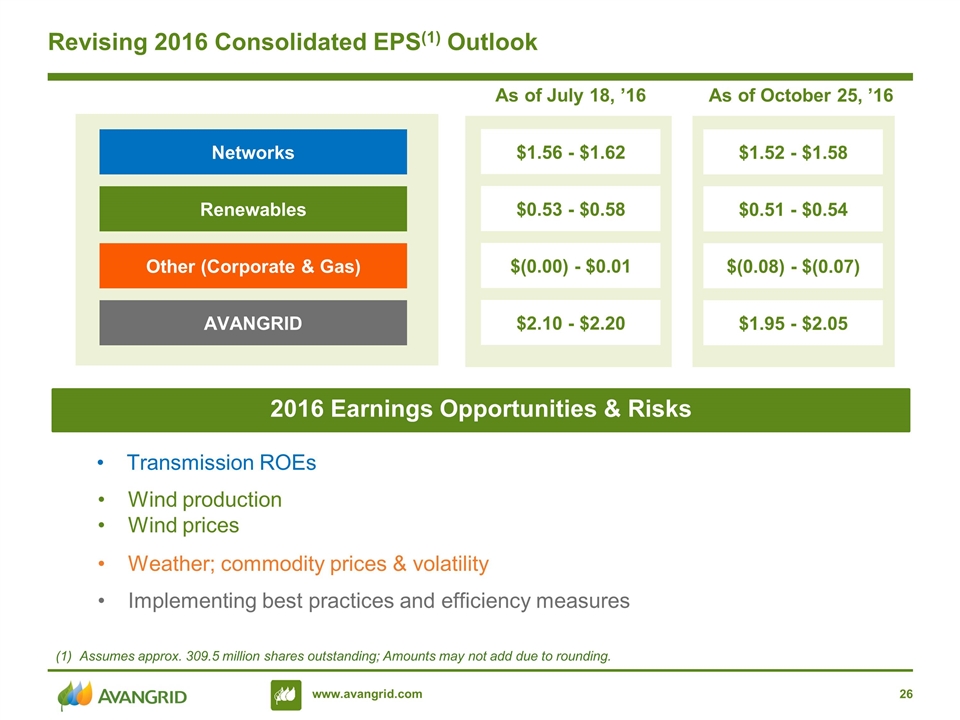

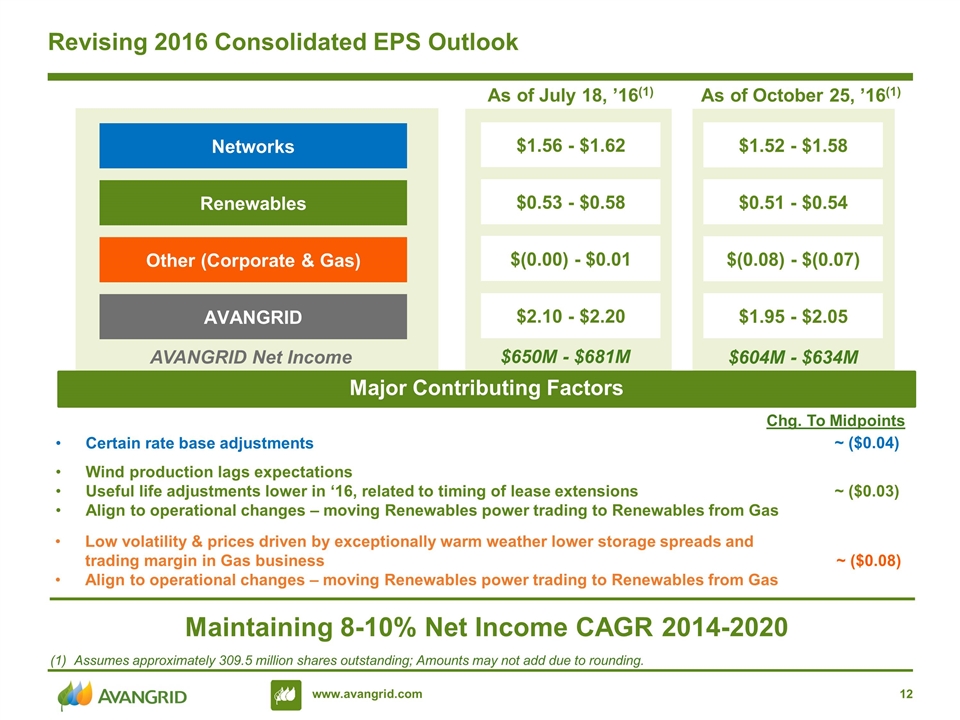

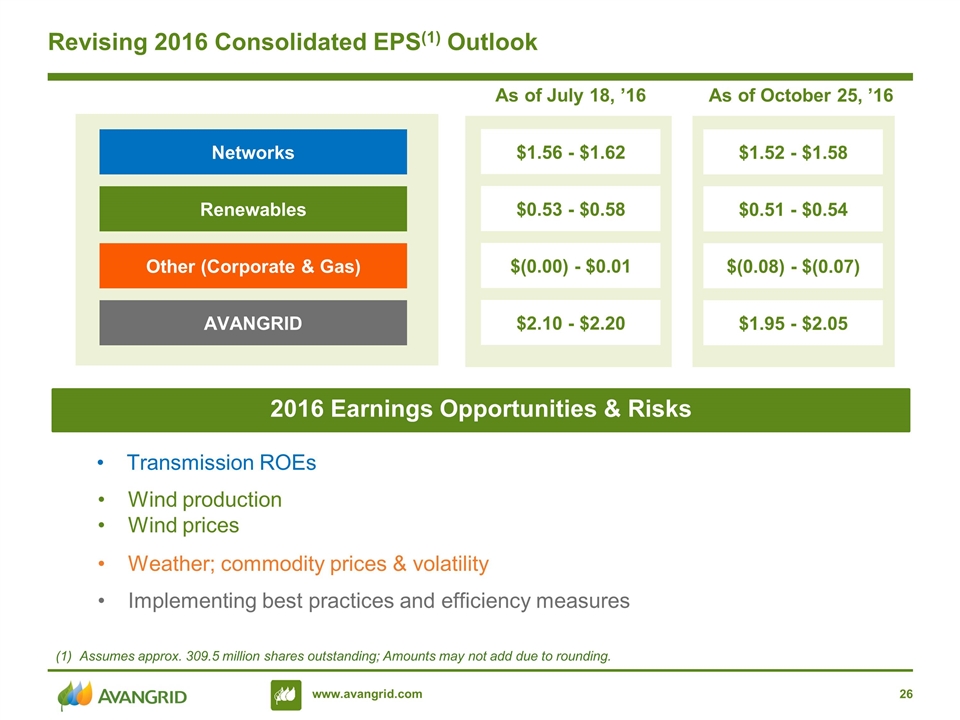

Revising 2016 Consolidated EPS Outlook Networks Renewables Other (Corporate & Gas) AVANGRID $1.56 - $1.62 $0.53 - $0.58 $(0.00) - $0.01 $2.10 - $2.20 As of July 18, ’16(1) $1.52 - $1.58 $0.51 - $0.54 $(0.08) - $(0.07) $1.95 - $2.05 As of October 25, ’16(1) Assumes approximately 309.5 million shares outstanding; Amounts may not add due to rounding. Major Contributing Factors Certain rate base adjustments Wind production lags expectations Useful life adjustments lower in ‘16, related to timing of lease extensions Align to operational changes – moving Renewables power trading to Renewables from Gas Low volatility & prices driven by exceptionally warm weather lower storage spreads and trading margin in Gas business Align to operational changes – moving Renewables power trading to Renewables from Gas ~ ($0.04) ~ ($0.03) ~ ($0.08) Maintaining 8-10% Net Income CAGR 2014-2020 Chg. To Midpoints AVANGRID Net Income $650M - $681M $604M - $634M

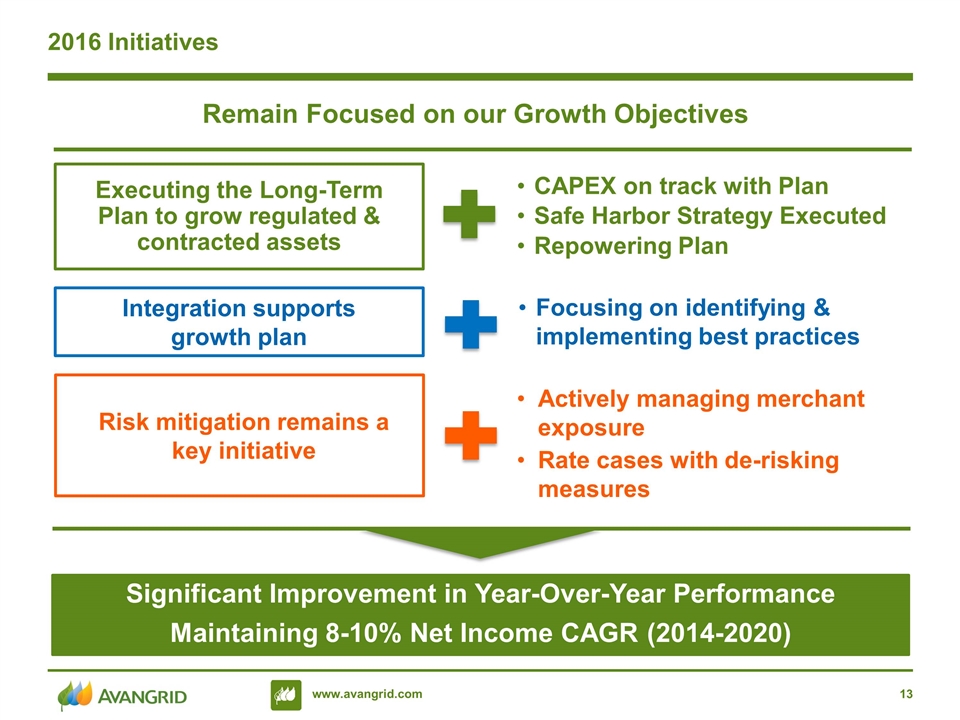

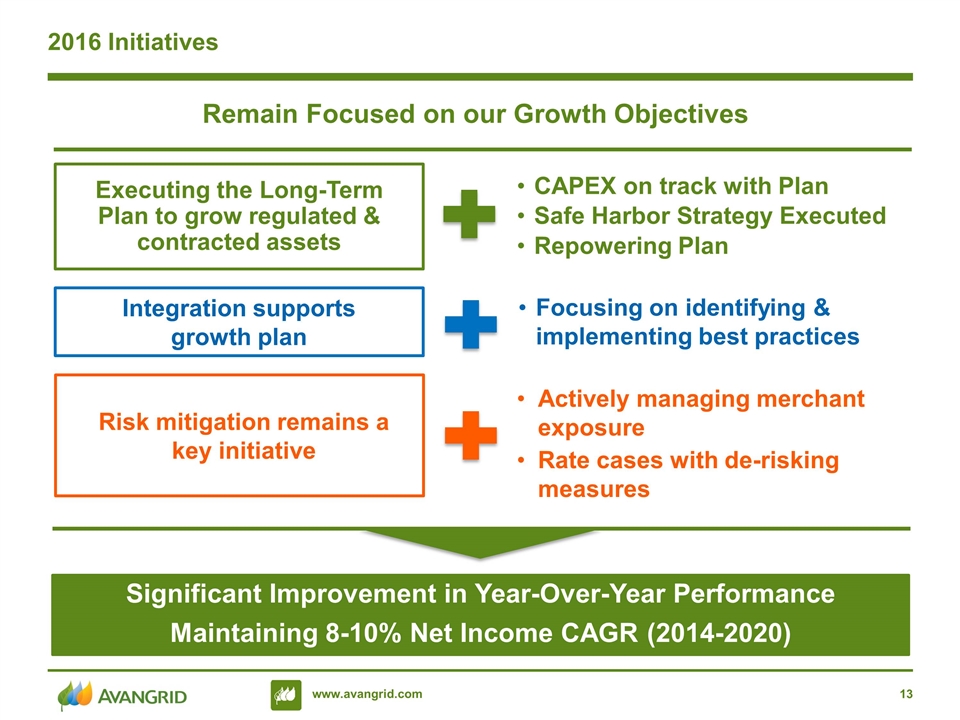

2016 Initiatives Remain Focused on our Growth Objectives Executing the Long-Term Plan to grow regulated & contracted assets Significant Improvement in Year-Over-Year Performance Maintaining 8-10% Net Income CAGR (2014-2020) Integration supports growth plan Risk mitigation remains a key initiative CAPEX on track with Plan Safe Harbor Strategy Executed Repowering Plan Focusing on identifying & implementing best practices Actively managing merchant exposure Rate cases with de-risking measures

3Q & YTD ‘16 AVANGRID 3Q & YTD ‘16 Financial Updates

3Q ‘16 & YTD ‘16 Earnings Results 3Q ‘15 3Q ‘16 3Q ‘15 3Q ‘16 Net Income ($M)(1) EPS(1) YTD ‘15 YTD ‘16 YTD ‘15 YTD ‘16 U.S. GAAP Net Income Adjusted Net Income and Adjusted EPS are non-GAAP financial measures and are adjusted to reflect the impact of the combination of AVANGRID with UIL, the gain from the sale of certain investments, and the impairment of an investment. See Appendix for calculation of Adjusted Net Income and Adjusted EPS and reconciliation to Net Income and EPS. . Adjusted Net Income ($M)(2) Adjusted EPS(2) 3Q ‘15 3Q ‘16 3Q ‘15 3Q ‘16 + 44% + 43% YTD ‘15 YTD ‘16 YTD ‘15 YTD ‘16 + 45% +45% Continued quarterly and YTD improvements ‘16 vs. ‘15

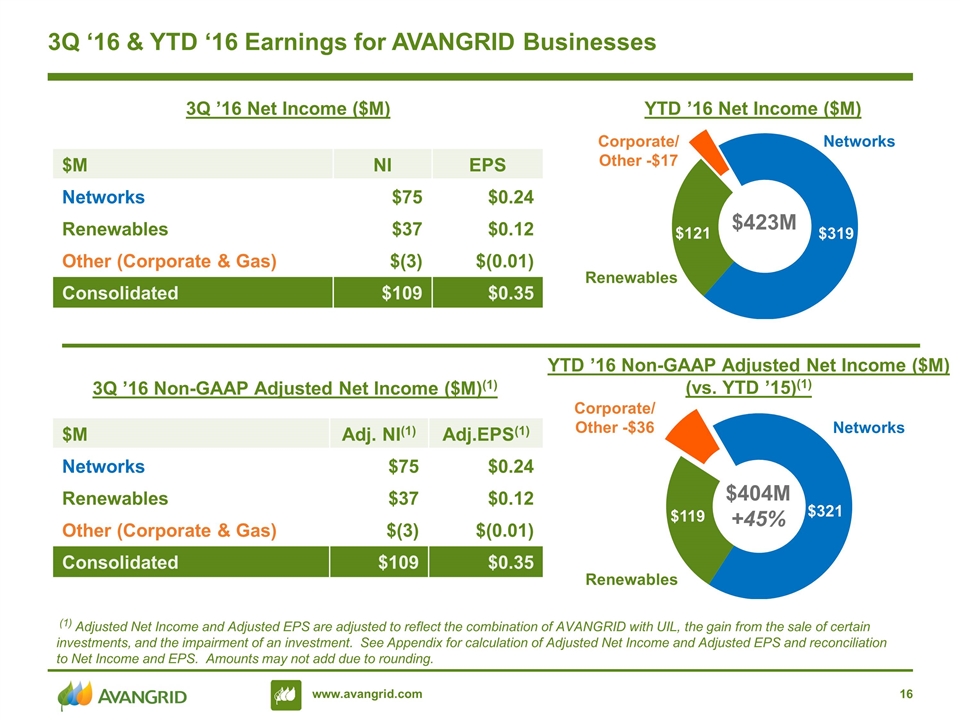

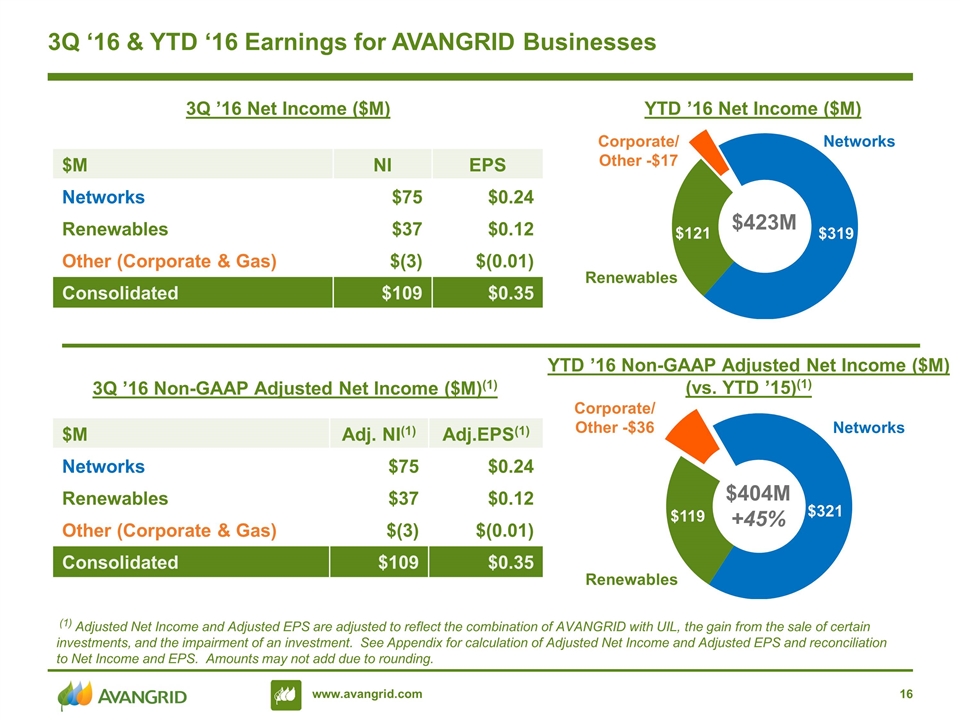

$M NI EPS Networks $75 $0.24 Renewables $37 $0.12 Other (Corporate & Gas) $(3) $(0.01) Consolidated $109 $0.35 3Q ‘16 & YTD ‘16 Earnings for AVANGRID Businesses (1) Adjusted Net Income and Adjusted EPS are adjusted to reflect the combination of AVANGRID with UIL, the gain from the sale of certain investments, and the impairment of an investment. See Appendix for calculation of Adjusted Net Income and Adjusted EPS and reconciliation to Net Income and EPS. Amounts may not add due to rounding. Corporate/ Other -$17 YTD ’16 Net Income ($M) 3Q ’16 Net Income ($M) $M Adj. NI(1) Adj.EPS(1) Networks $75 $0.24 Renewables $37 $0.12 Other (Corporate & Gas) $(3) $(0.01) Consolidated $109 $0.35 YTD ’16 Non-GAAP Adjusted Net Income ($M) (vs. YTD ’15)(1) 3Q ’16 Non-GAAP Adjusted Net Income ($M)(1) Corporate/ Other -$36 Networks Renewables Renewables Networks

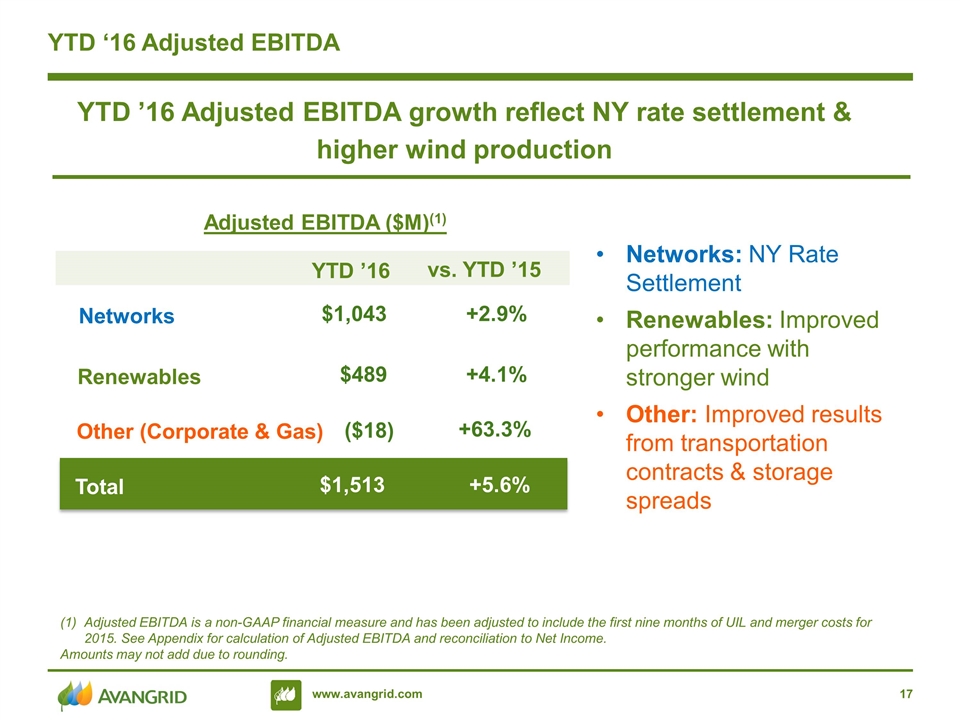

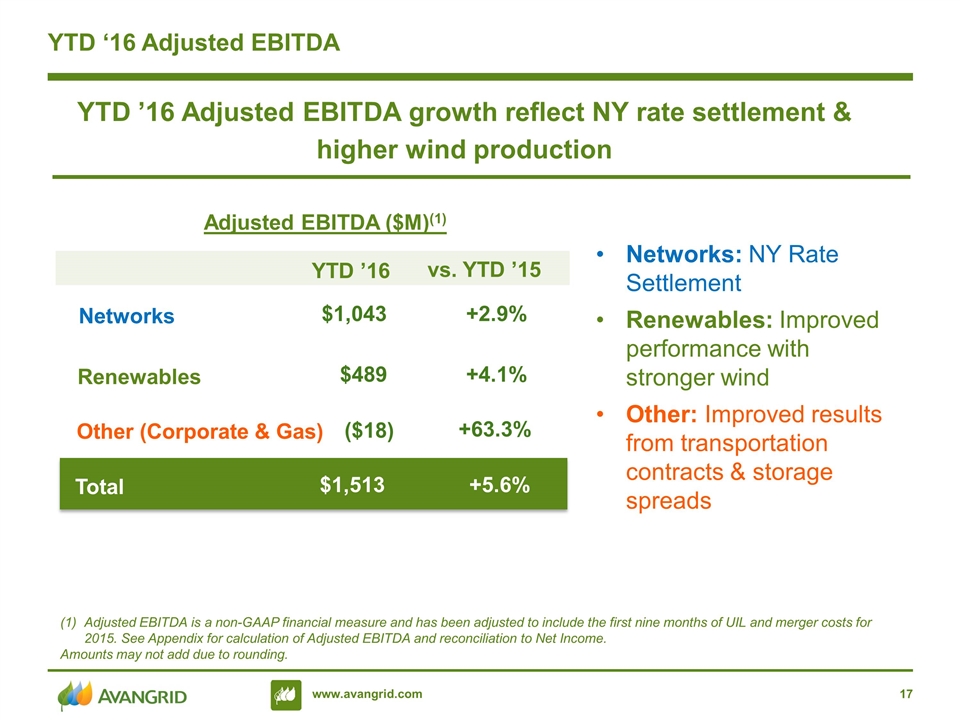

YTD ‘16 Adjusted EBITDA YTD ’16 Adjusted EBITDA growth reflect NY rate settlement & higher wind production Adjusted EBITDA is a non-GAAP financial measure and has been adjusted to include the first nine months of UIL and merger costs for 2015. See Appendix for calculation of Adjusted EBITDA and reconciliation to Net Income. Amounts may not add due to rounding. Adjusted EBITDA ($M)(1) vs. YTD ’15 YTD ’16 Networks +2.9% $1,043 Renewables +4.1% $489 Other (Corporate & Gas) +63.3% ($18) Total +5.6% $1,513 Networks: NY Rate Settlement Renewables: Improved performance with stronger wind Other: Improved results from transportation contracts & storage spreads

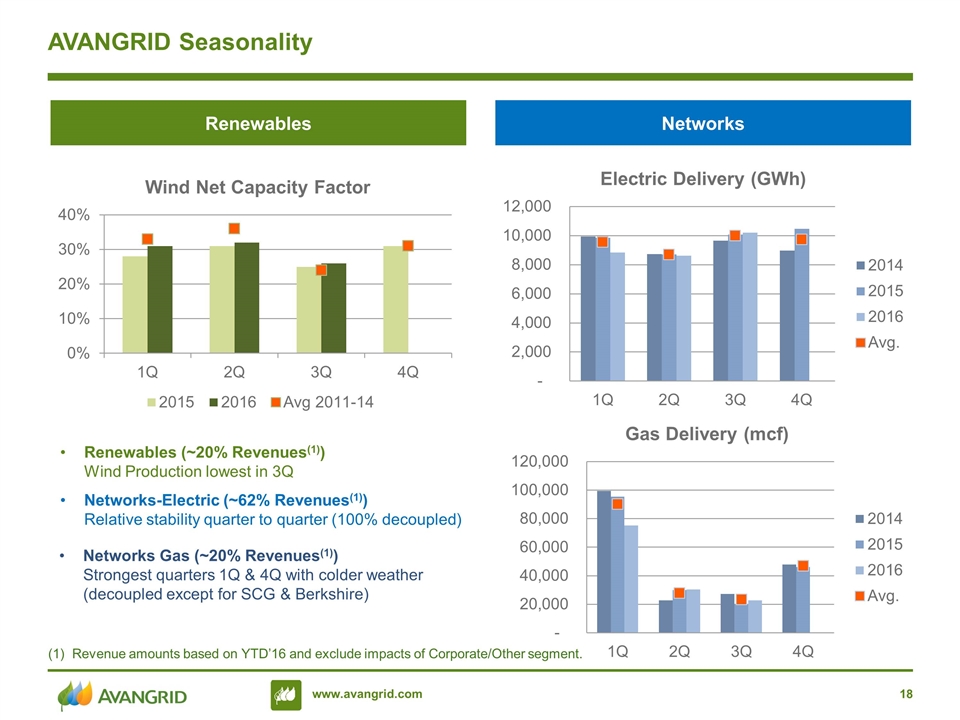

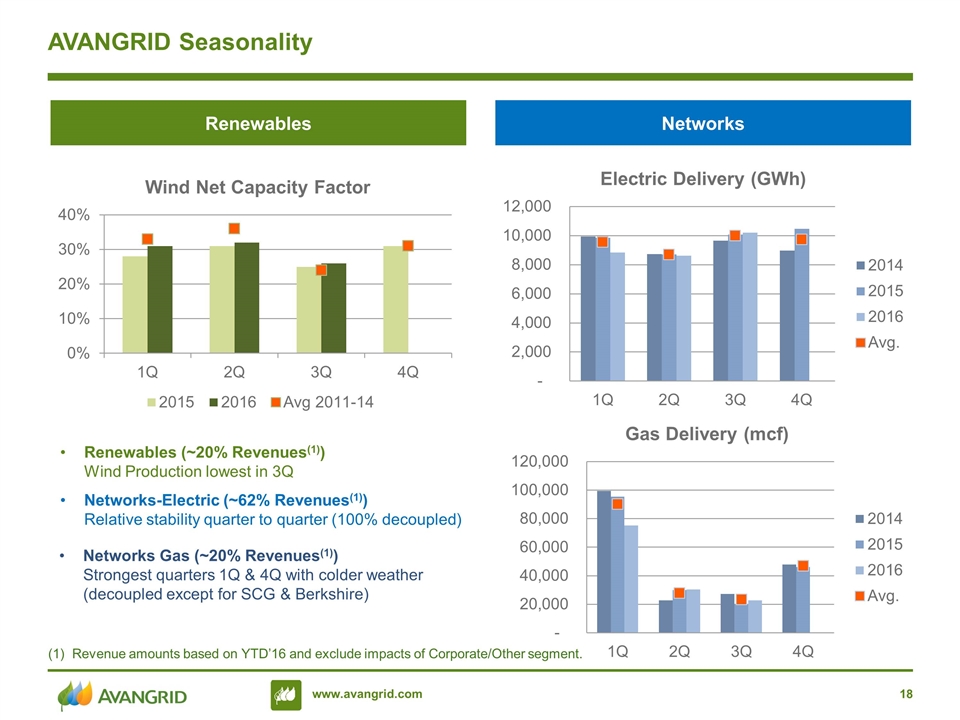

AVANGRID Seasonality Renewables Networks Networks-Electric (~62% Revenues(1)) Relative stability quarter to quarter (100% decoupled) Networks Gas (~20% Revenues(1)) Strongest quarters 1Q & 4Q with colder weather (decoupled except for SCG & Berkshire) Revenue amounts based on YTD’16 and exclude impacts of Corporate/Other segment. Renewables (~20% Revenues(1)) Wind Production lowest in 3Q

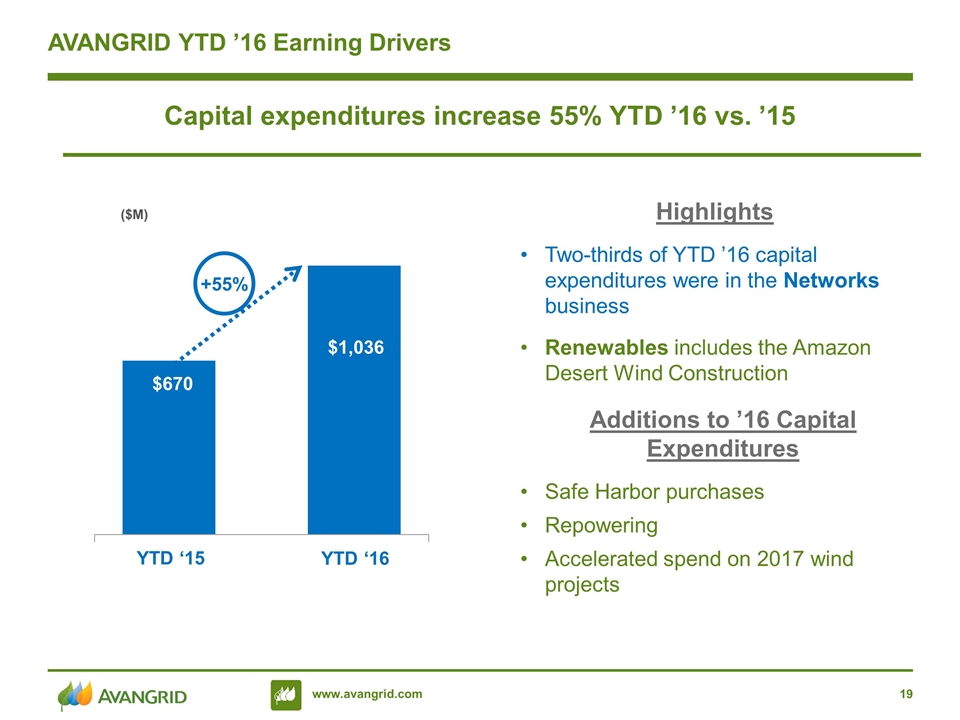

Additions to ’16 Capital Expenditures Safe Harbor purchases Repowering Accelerated spend on 2017 wind projects AVANGRID YTD ’16 Earning Drivers Capital expenditures increase 55% YTD ’16 vs. ’15 YTD ‘15 YTD ‘16 +55% Highlights Two-thirds of YTD ’16 capital expenditures were in the Networks business Renewables includes the Amazon Desert Wind Construction ($M)

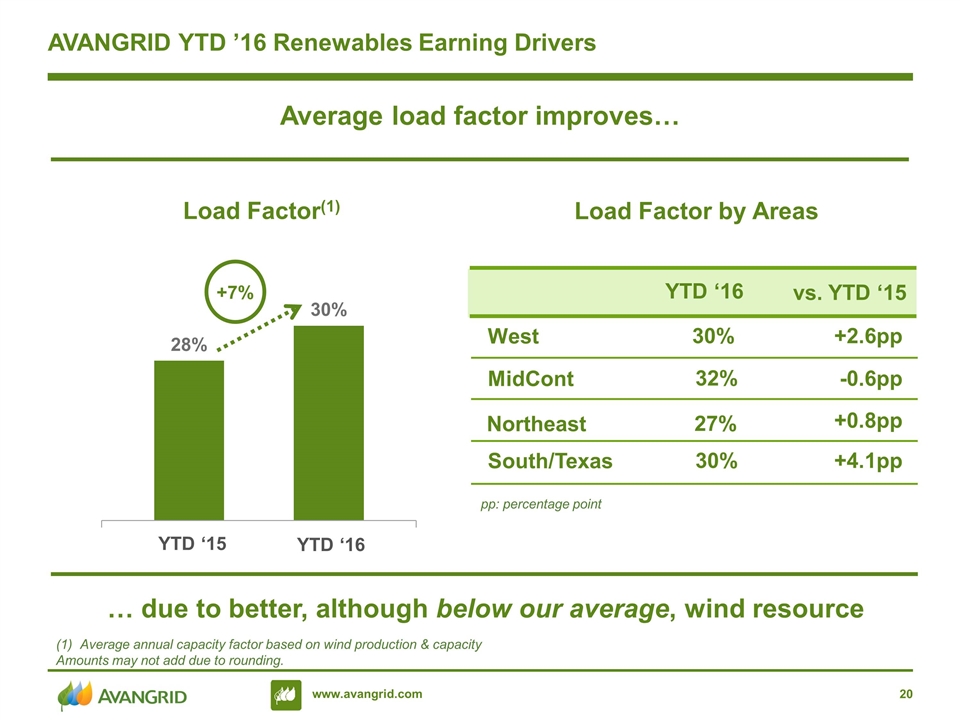

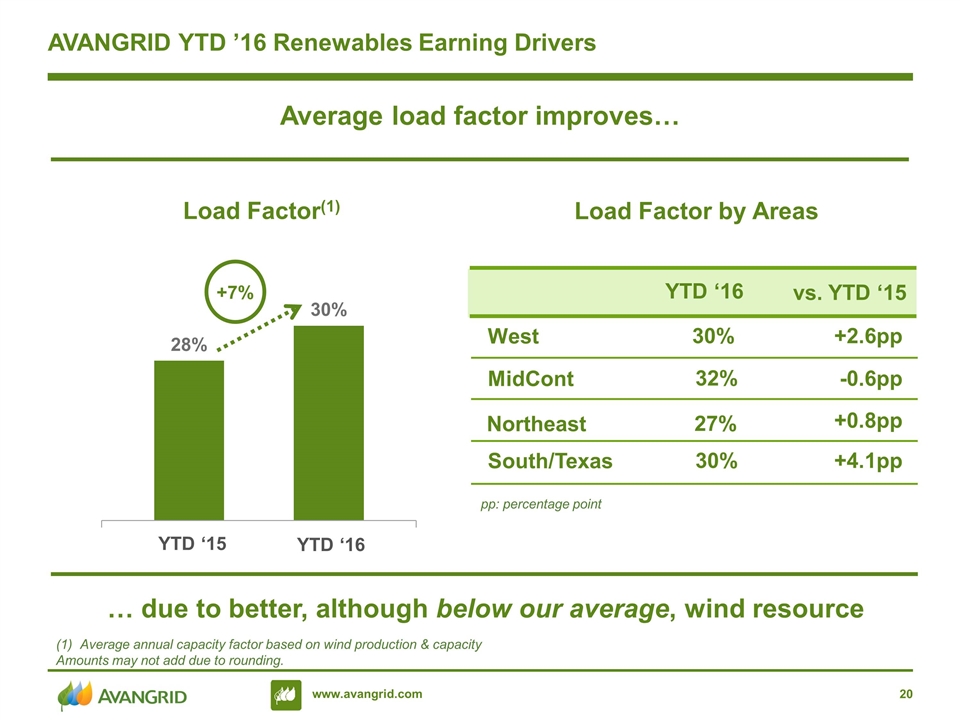

AVANGRID YTD ’16 Renewables Earning Drivers Average load factor improves… Load Factor(1) Average annual capacity factor based on wind production & capacity Amounts may not add due to rounding. … due to better, although below our average, wind resource YTD ‘15 YTD ‘16 +7% Load Factor by Areas West 30% +2.6pp vs. YTD ‘15 YTD ‘16 MidCont 32% -0.6pp Northeast 27% +0.8pp South/Texas 30% +4.1pp pp: percentage point

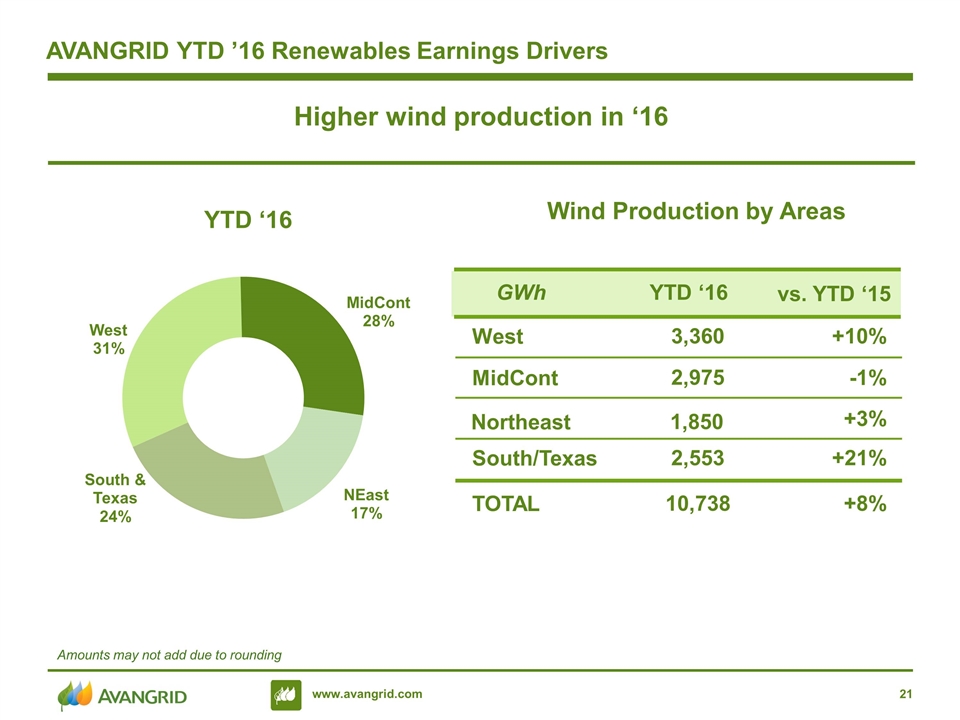

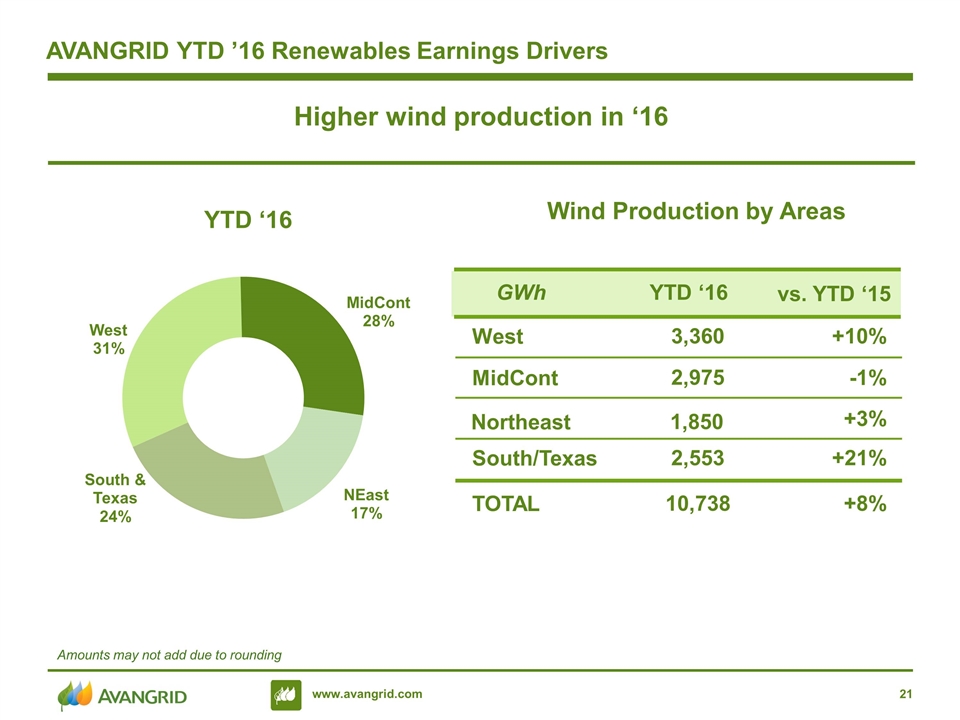

AVANGRID YTD ’16 Renewables Earnings Drivers Higher wind production in ‘16 YTD ‘16 West 3,360 +10% vs. YTD ‘15 YTD ‘16 MidCont 2,975 -1% Northeast 1,850 +3% South/Texas 2,553 +21% GWh TOTAL 10,738 +8% Amounts may not add due to rounding Wind Production by Areas

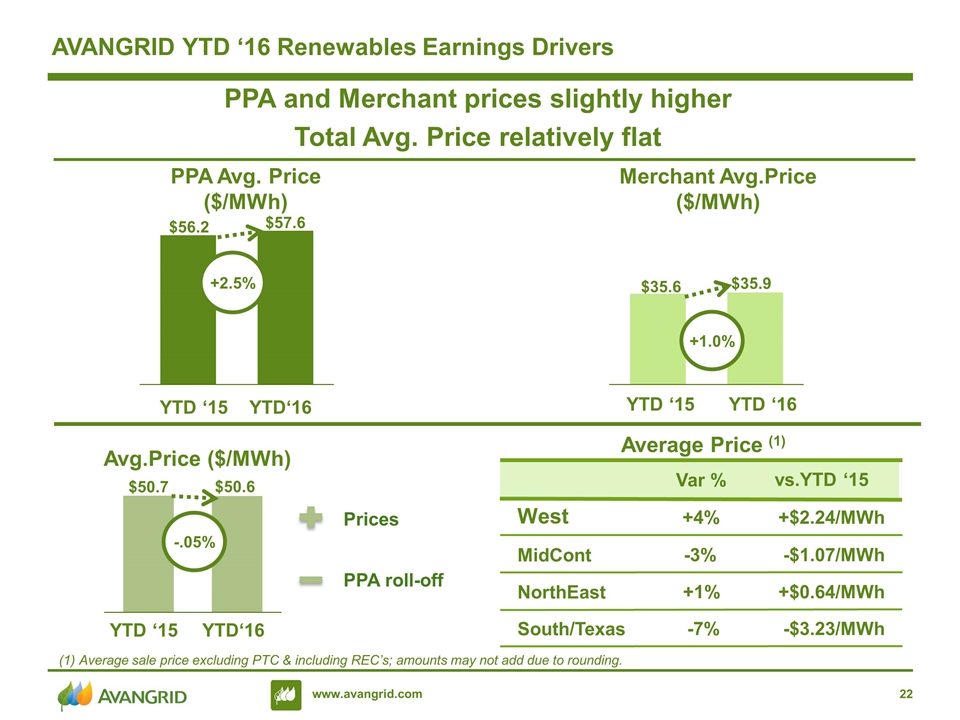

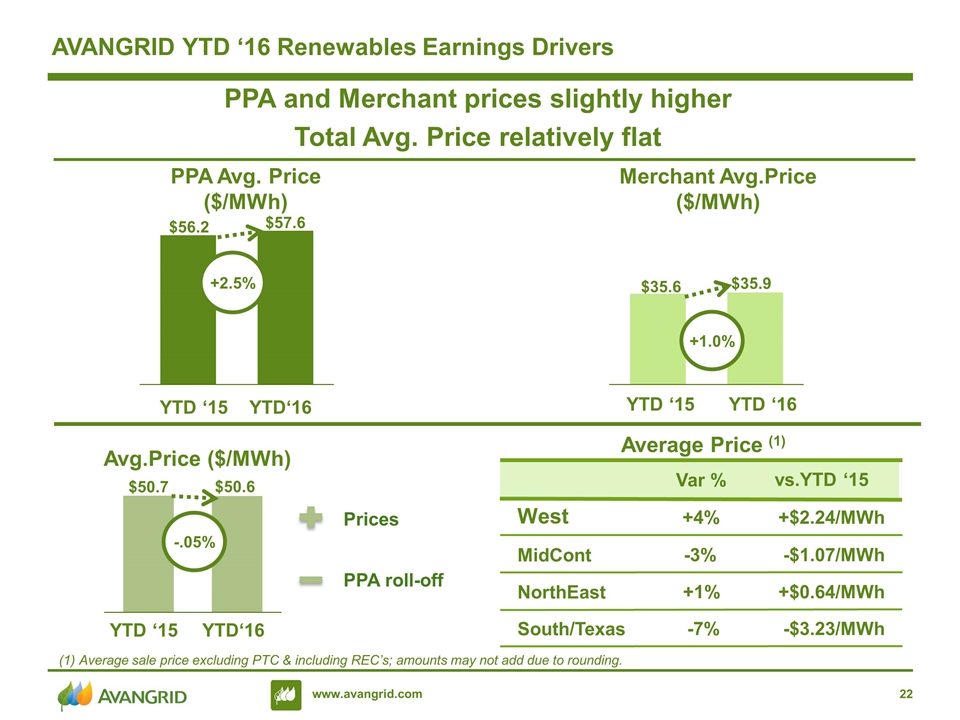

AVANGRID YTD ‘16 Renewables Earnings Drivers PPA and Merchant prices slightly higher Total Avg. Price relatively flat Average Price (1) (1) Average sale price excluding PTC & including REC’s; amounts may not add due to rounding. West +4% +$2.24/MWh vs.YTD ‘15 Var % MidCont -3% -$1.07/MWh NorthEast +1% +$0.64/MWh South/Texas -7% -$3.23/MWh YTD ‘15 YTD ‘16 +1.0% YTD ‘15 YTD‘16 +2.5% $56.2 $57.6 PPA Avg. Price ($/MWh) Merchant Avg.Price ($/MWh) YTD ‘15 YTD‘16 -.05% $50.7 $50.6 Avg.Price ($/MWh) Prices PPA roll-off

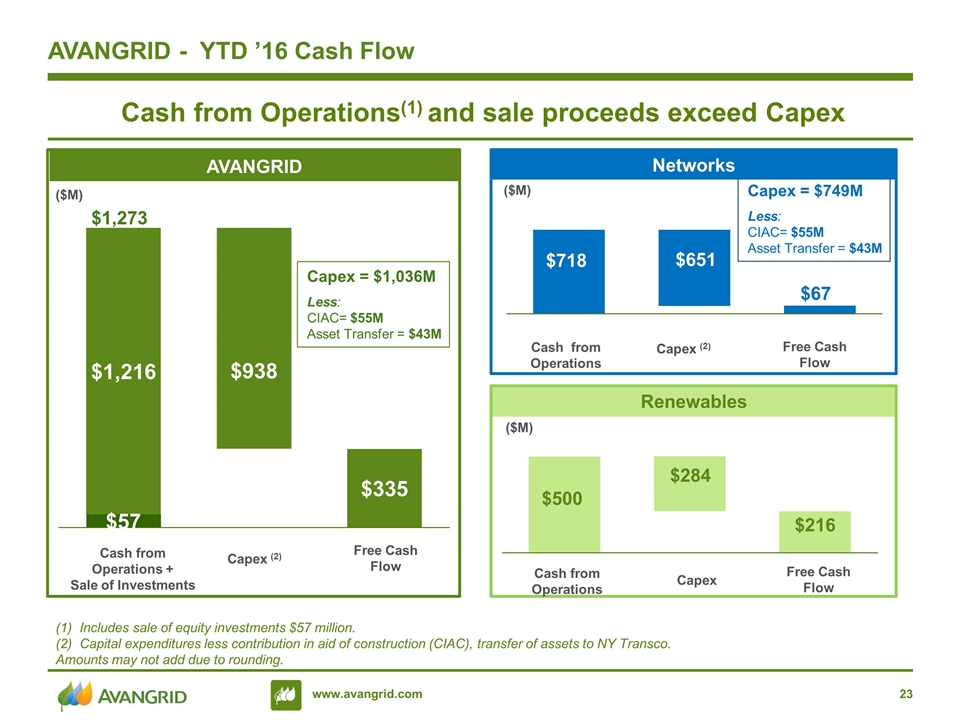

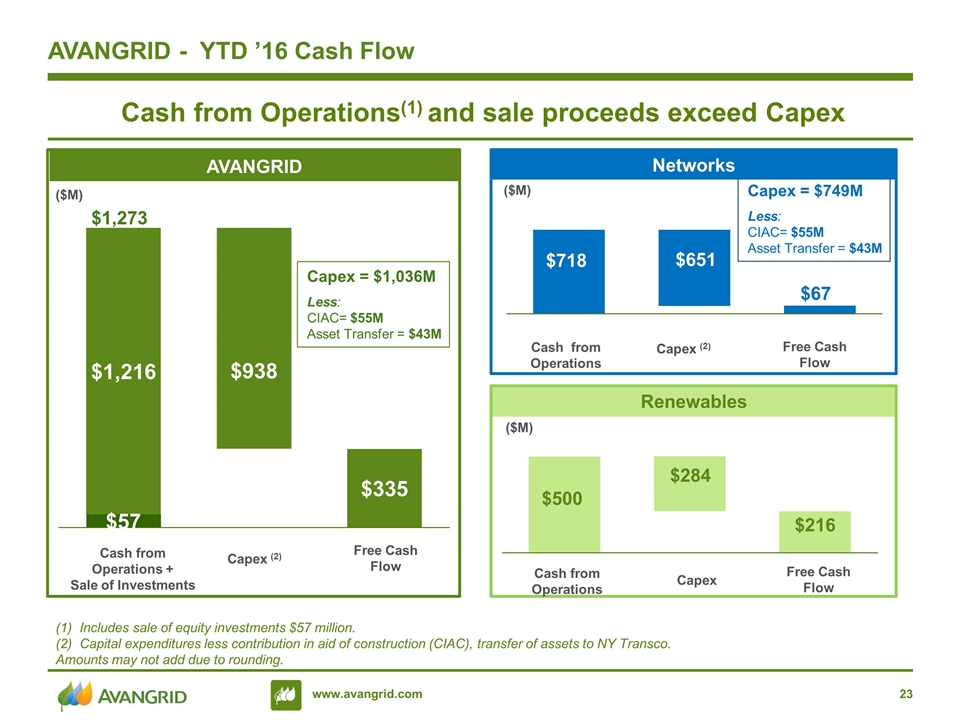

($M) Cash from Operations(1) and sale proceeds exceed Capex Free Cash Flow AVANGRID - YTD ’16 Cash Flow Capex (2) Cash from Operations + Sale of Investments AVANGRID Networks Renewables Free Cash Flow Capex Cash from Operations Free Cash Flow Capex (2) Cash from Operations ($M) ($M) Includes sale of equity investments $57 million. Capital expenditures less contribution in aid of construction (CIAC), transfer of assets to NY Transco. Amounts may not add due to rounding. $284 $500 $216 $965 Capex = $1,036M Less: CIAC= $55M Asset Transfer = $43M $1,273

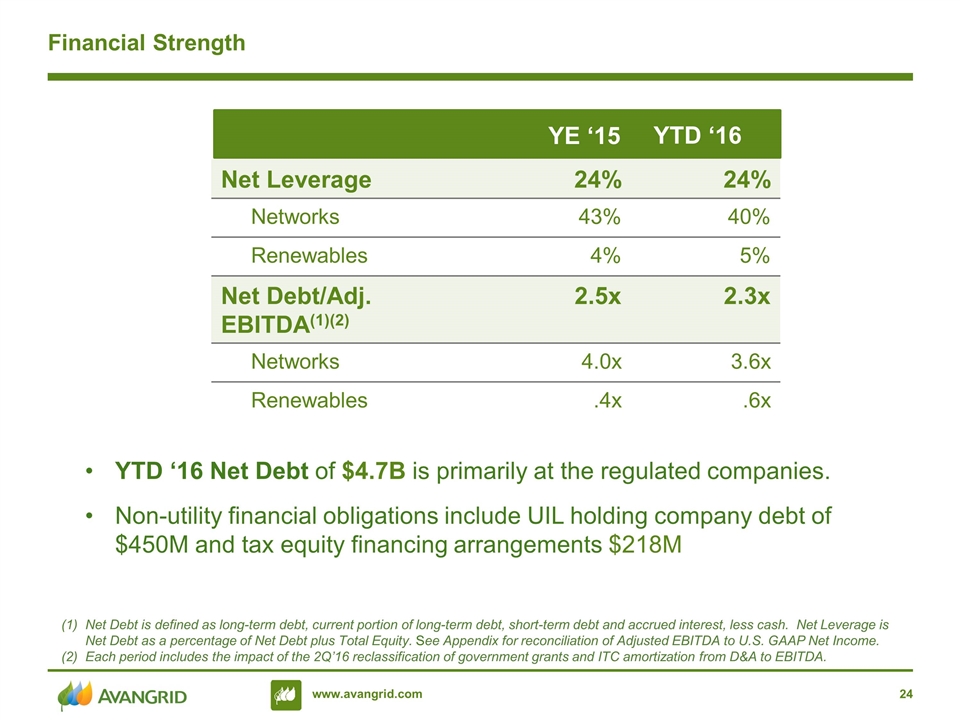

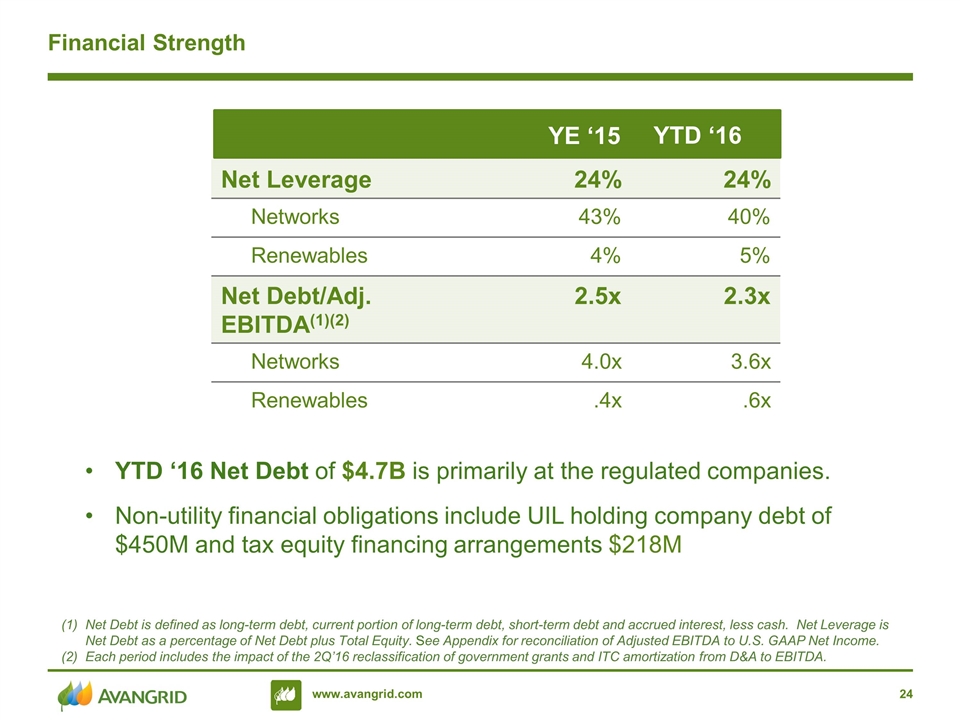

Financial Strength Net Debt is defined as long-term debt, current portion of long-term debt, short-term debt and accrued interest, less cash. Net Leverage is Net Debt as a percentage of Net Debt plus Total Equity. See Appendix for reconciliation of Adjusted EBITDA to U.S. GAAP Net Income. Each period includes the impact of the 2Q’16 reclassification of government grants and ITC amortization from D&A to EBITDA. 2016-2020 2016-2020 $B $B Net Leverage 24% 24% Networks 43% 40% Renewables 4% 5% Net Debt/Adj. EBITDA(1)(2) 2.5x 2.3x Networks 4.0x 3.6x Renewables .4x .6x YE ‘15 YTD ‘16 Net Debt of $4.7B is primarily at the regulated companies. Non-utility financial obligations include UIL holding company debt of $450M and tax equity financing arrangements $218M YTD ‘16

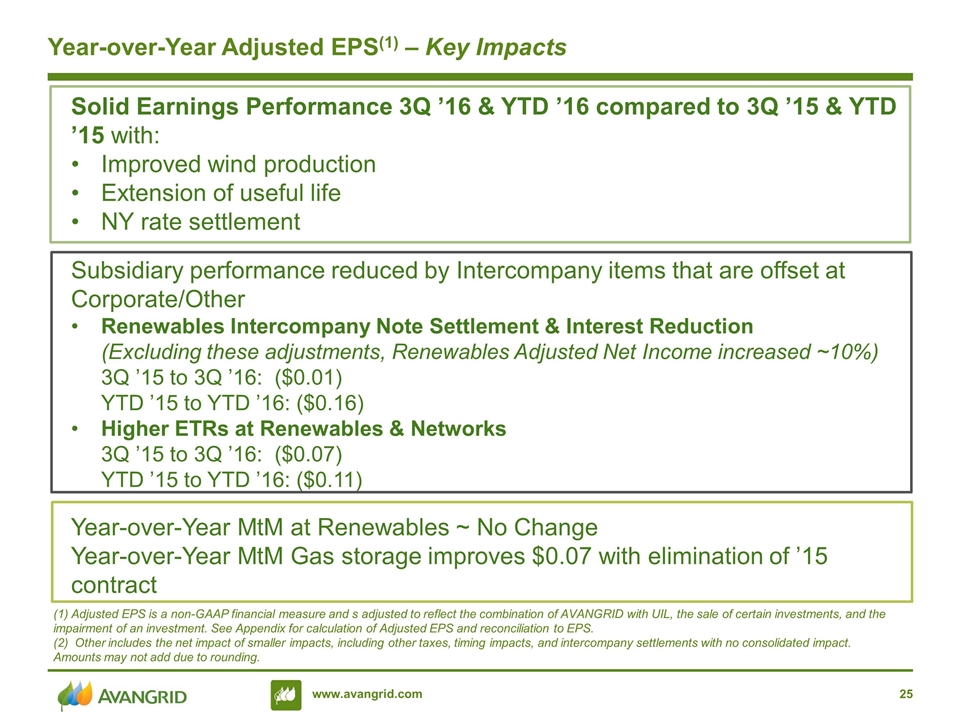

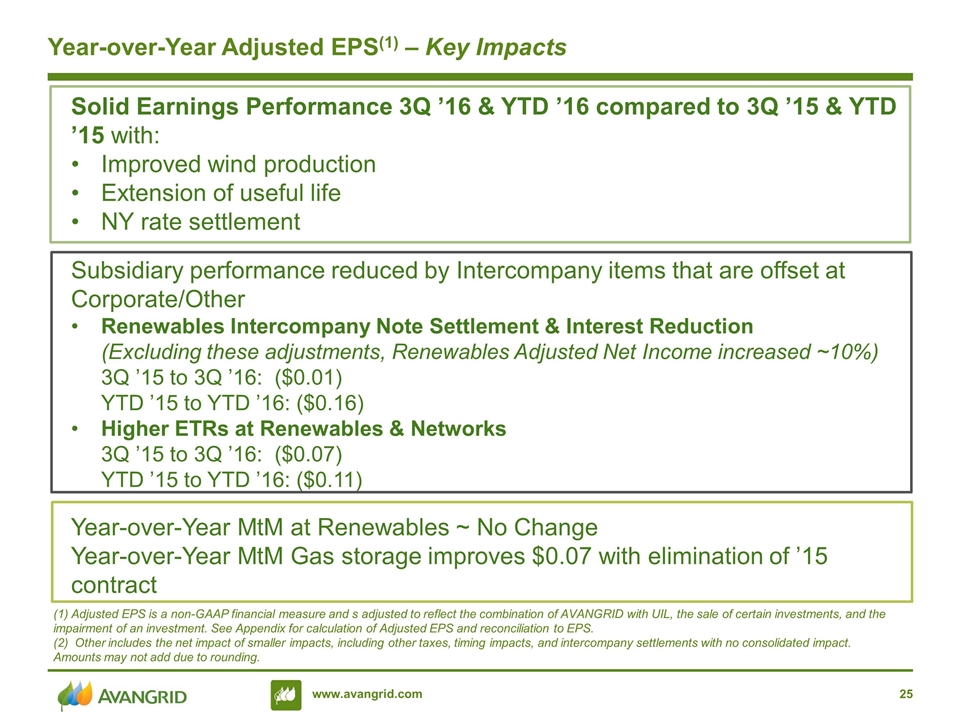

Year-over-Year Adjusted EPS(1) – Key Impacts (1) Adjusted EPS is a non-GAAP financial measure and s adjusted to reflect the combination of AVANGRID with UIL, the sale of certain investments, and the impairment of an investment. See Appendix for calculation of Adjusted EPS and reconciliation to EPS. (2) Other includes the net impact of smaller impacts, including other taxes, timing impacts, and intercompany settlements with no consolidated impact. Amounts may not add due to rounding. Solid Earnings Performance 3Q ’16 & YTD ’16 compared to 3Q ’15 & YTD ’15 with: Improved wind production Extension of useful life NY rate settlement Subsidiary performance reduced by Intercompany items that are offset at Corporate/Other Renewables Intercompany Note Settlement & Interest Reduction (Excluding these adjustments, Renewables Adjusted Net Income increased ~10%) 3Q ’15 to 3Q ’16: ($0.01) YTD ’15 to YTD ’16: ($0.16) Higher ETRs at Renewables & Networks 3Q ’15 to 3Q ’16: ($0.07) YTD ’15 to YTD ’16: ($0.11) Year-over-Year MtM at Renewables ~ No Change Year-over-Year MtM Gas storage improves $0.07 with elimination of ’15 contract

Revising 2016 Consolidated EPS(1) Outlook Networks Renewables Other (Corporate & Gas) AVANGRID $1.56 - $1.62 $0.53 - $0.58 $(0.00) - $0.01 $2.10 - $2.20 As of July 18, ’16 $1.52 - $1.58 $0.51 - $0.54 $(0.08) - $(0.07) $1.95 - $2.05 As of October 25, ’16 Assumes approx. 309.5 million shares outstanding; Amounts may not add due to rounding. 2016 Earnings Opportunities & Risks Transmission ROEs Wind production Wind prices Weather; commodity prices & volatility Implementing best practices and efficiency measures

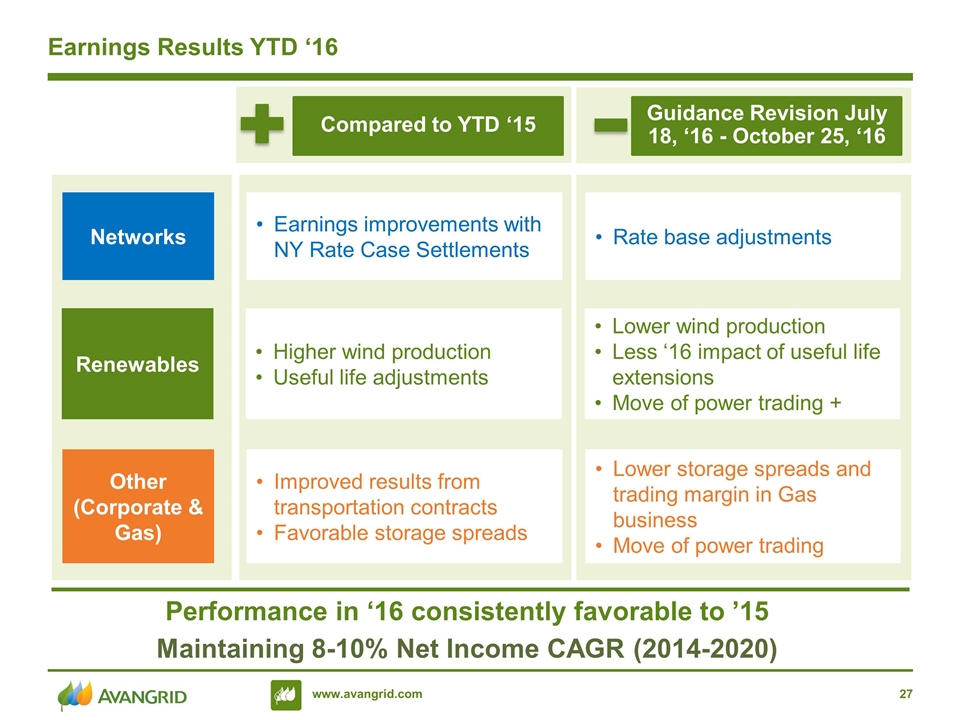

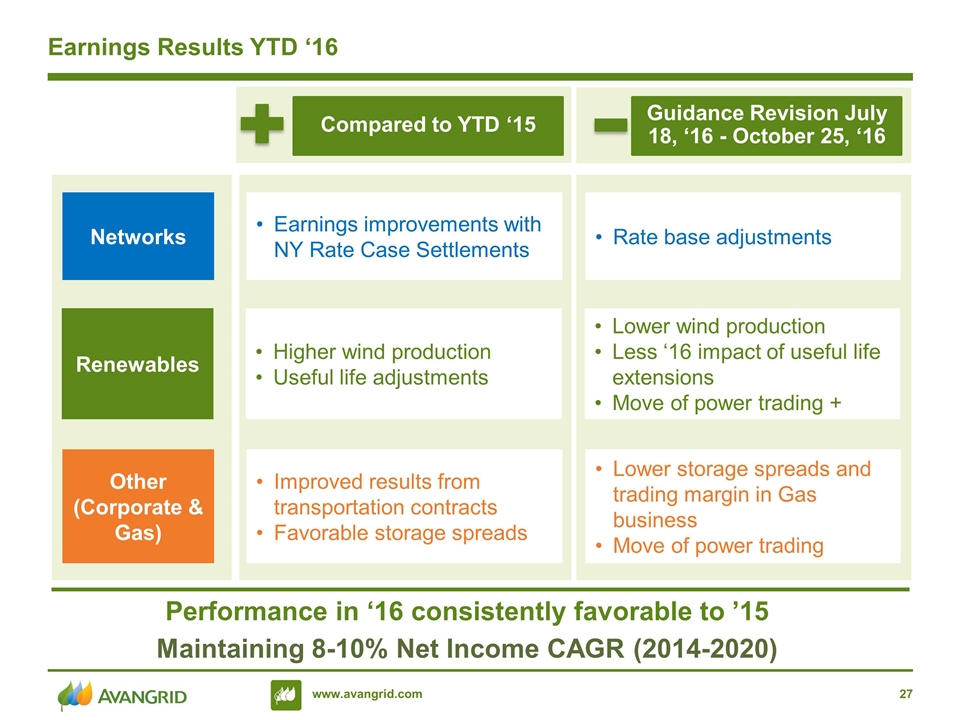

Earnings Results YTD ‘16 Compared to YTD ‘15 Networks Renewables Other (Corporate & Gas) Earnings improvements with NY Rate Case Settlements Higher wind production Useful life adjustments Improved results from transportation contracts Favorable storage spreads Guidance Revision July 18, ‘16 - October 25, ‘16 Rate base adjustments Lower wind production Less ‘16 impact of useful life extensions Move of power trading + Lower storage spreads and trading margin in Gas business Move of power trading Performance in ‘16 consistently favorable to ’15 Maintaining 8-10% Net Income CAGR (2014-2020)

Appendix

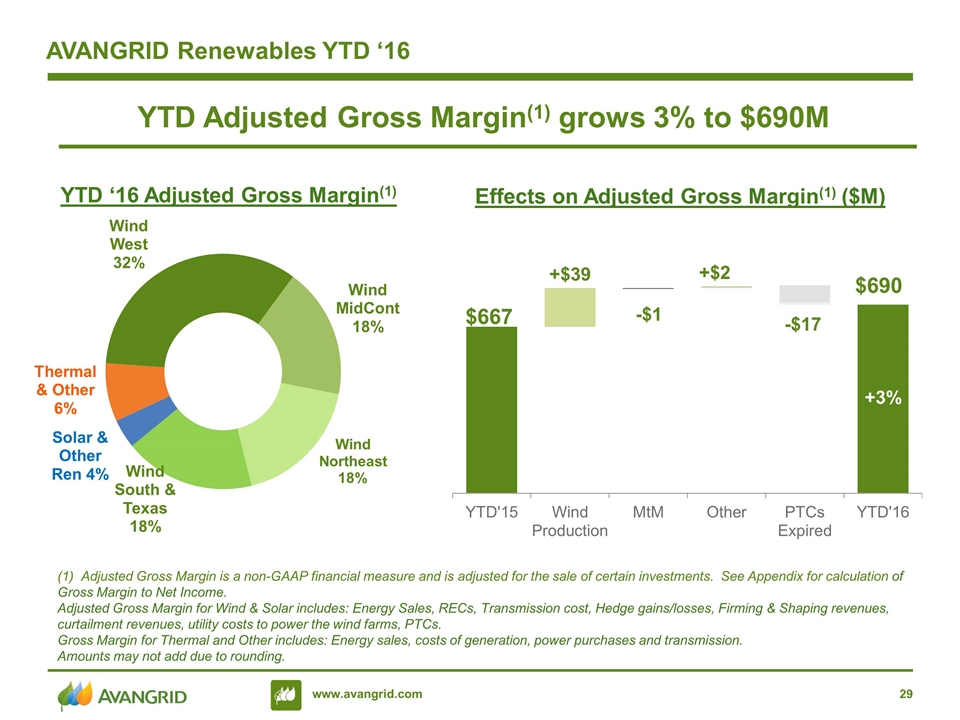

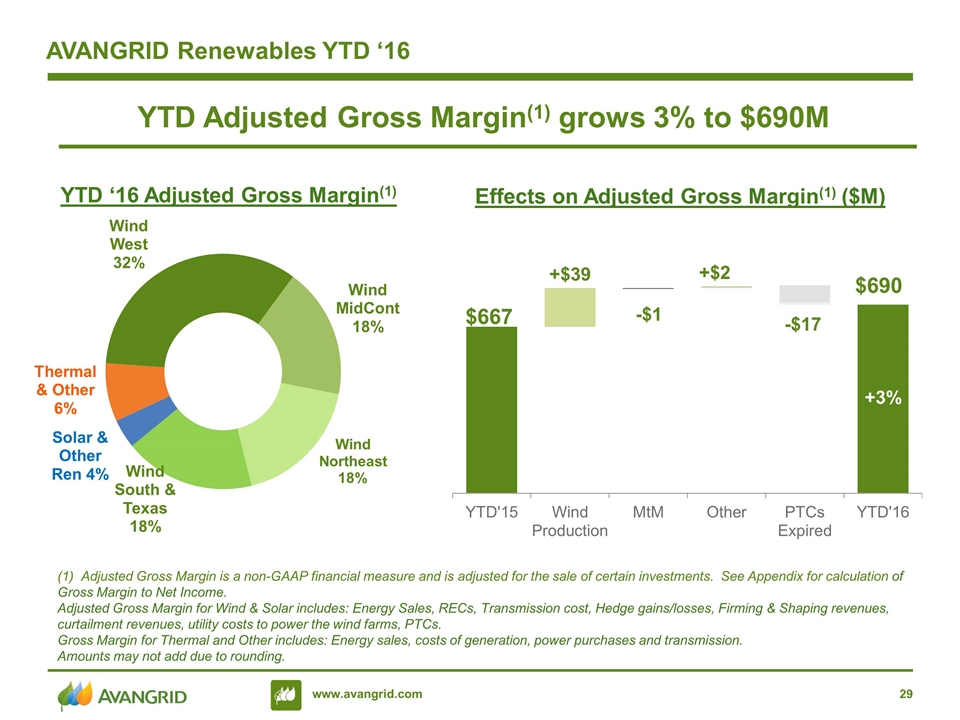

AVANGRID Renewables YTD ‘16 YTD Adjusted Gross Margin(1) grows 3% to $690M $667 +$39 Adjusted Gross Margin is a non-GAAP financial measure and is adjusted for the sale of certain investments. See Appendix for calculation of Gross Margin to Net Income. Adjusted Gross Margin for Wind & Solar includes: Energy Sales, RECs, Transmission cost, Hedge gains/losses, Firming & Shaping revenues, curtailment revenues, utility costs to power the wind farms, PTCs. Gross Margin for Thermal and Other includes: Energy sales, costs of generation, power purchases and transmission. Amounts may not add due to rounding. $690 -$1 +$2 -$17 Effects on Adjusted Gross Margin(1) ($M) +3% YTD ‘16 Adjusted Gross Margin(1)

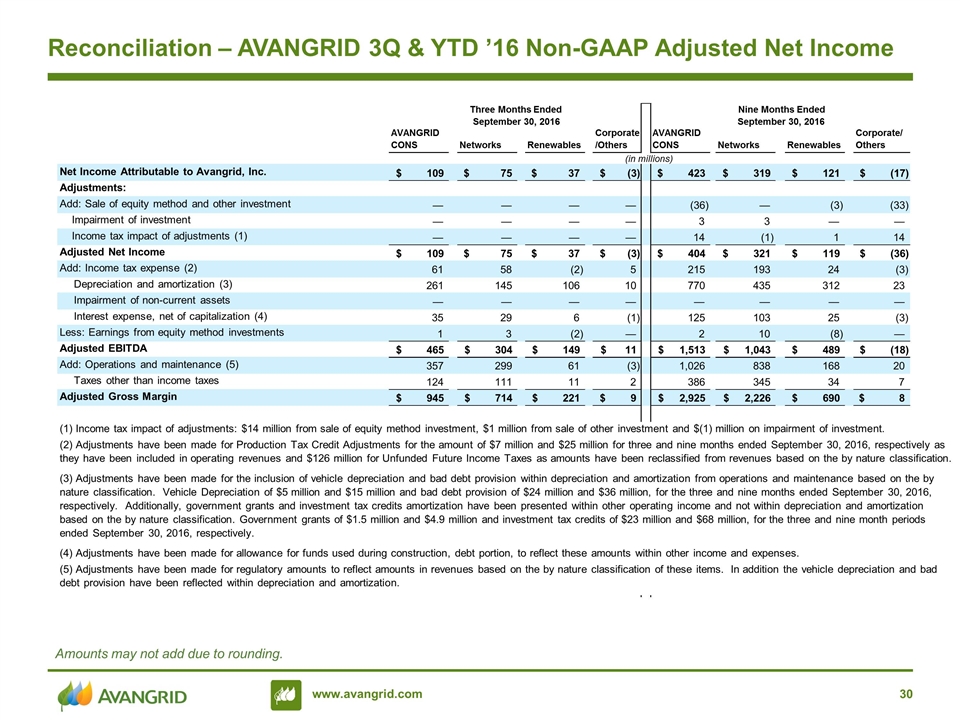

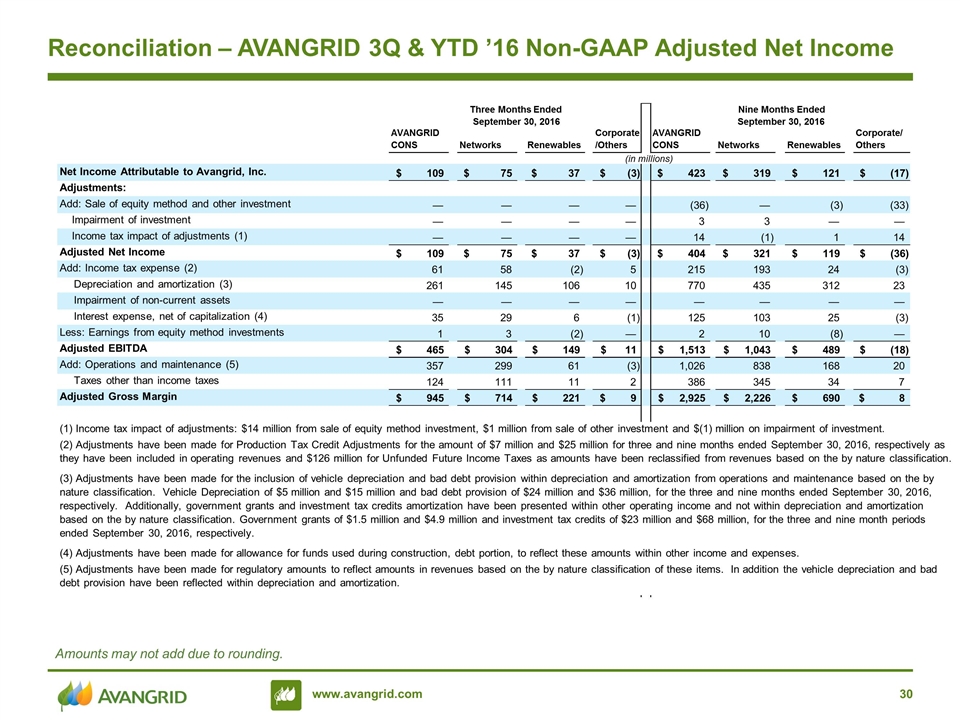

Reconciliation – AVANGRID 3Q & YTD ’16 Non-GAAP Adjusted Net Income Amounts may not add due to rounding. AVANGRID CONS Networks Renewables Corporate /Others AVANGRID CONS Networks Renewables Corporate/ Others Net Income Attributable to Avangrid, Inc. 109 $ 75 $ 37 $ (3) $ 423 $ 319 $ 121 $ (17) $ Adjustments: Add: Sale of equity method and other investment — — — — (36) — (3) (33) Impairment of investment — — — — 3 3 — — Income tax impact of adjustments (1) — — — — 14 (1) 1 14 Adjusted Net Income 109 $ 75 $ 37 $ (3) $ 404 $ 321 $ 119 $ (36) $ Add: Income tax expense (2) 61 58 (2) 5 215 193 24 (3) Depreciation and amortization (3) 261 145 106 10 770 435 312 23 Impairment of non-current assets — — — — — — — — Interest expense, net of capitalization (4) 35 29 6 (1) 125 103 25 (3) Less: Earnings from equity method investments 1 3 (2) — 2 10 (8) — Adjusted EBITDA 465 $ 304 $ 149 $ 11 $ 1,513 $ 1,043 $ 489 $ (18) $ Add: Operations and maintenance (5) 357 299 61 (3) 1,026 838 168 20 Taxes other than income taxes 124 111 11 2 386 345 34 7 Adjusted Gross Margin 945 $ 714 $ 221 $ 9 $ 2,925 $ 2,226 $ 690 $ 8 $ (1) Income tax impact of adjustments: $14 million from sale of equity method investment, $1 million from sale of other investment and $(1) million on impairment of investment. (4) Adjustments have been made for allowance for funds used during construction, debt portion, to reflect these amounts within other income and expenses. (3) Adjustments have been made for the inclusion of vehicle depreciation and bad debt provision within depreciation and amortization from operations and maintenance based on the by nature classification. Vehicle Depreciation of $5 million and $15 million and bad debt provision of $24 million and $36 million, for the three and nine months ended September 30, 2016, respectively. Additionally, government grants and investment tax credits amortization have been presented within other operating income and not within depreciation and amortization based on the by nature classification. Government grants of $1.5 million and $4.9 million and investment tax credits of $23 million and $68 million, for the three and nine month periods ended September 30, 2016, respectively. (5) Adjustments have been made for regulatory amounts to reflect amounts in revenues based on the by nature classification of these items. In addition the vehicle depreciation and bad debt provision have been reflected within depreciation and amortization. (2) Adjustments have been made for Production Tax Credit Adjustments for the amount of $7 million and $25 million for three and nine months ended September 30, 2016, respectively as they have been included in operating revenues and $126 million for Unfunded Future Income Taxes as amounts have been reclassified from revenues based on the by nature classification. Three Months Ended Nine Months Ended September 30, 2016 September 30, 2016 (in millions)

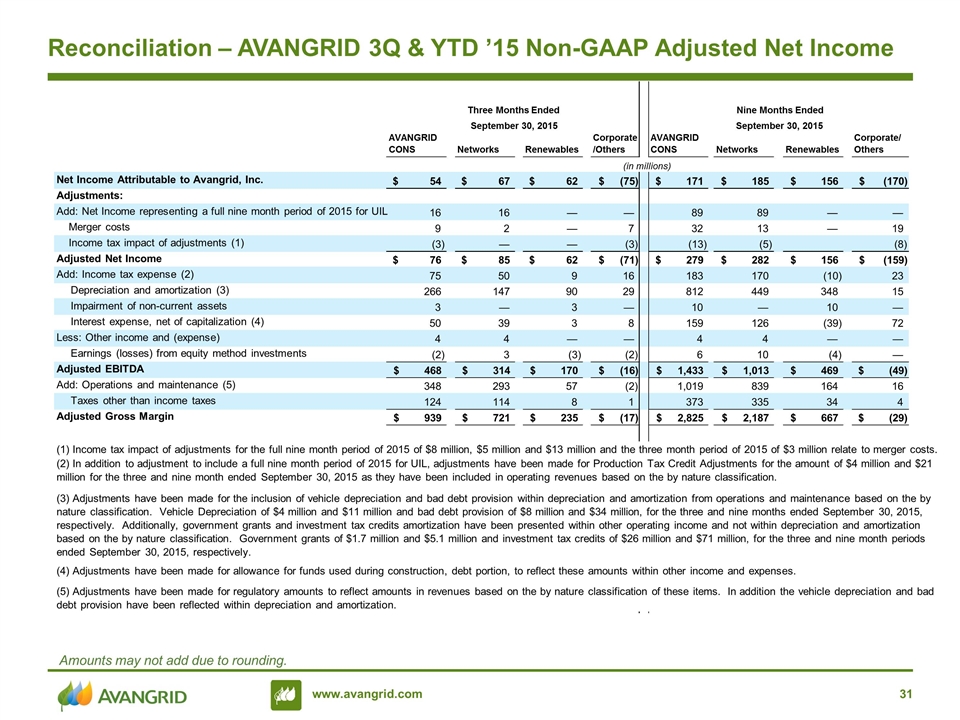

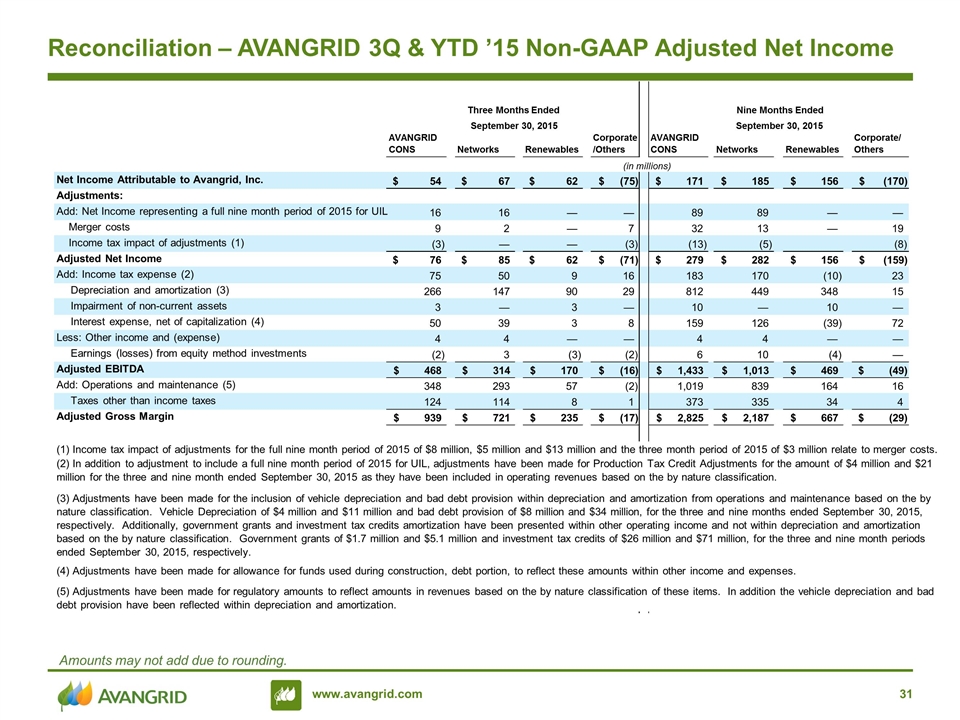

Reconciliation – AVANGRID 3Q & YTD ’15 Non-GAAP Adjusted Net Income Amounts may not add due to rounding. AVANGRID CONS Networks Renewables Corporate /Others AVANGRID CONS Networks Renewables Corporate/ Others Net Income Attributable to Avangrid, Inc. 54 $ 67 $ 62 $ (75) $ 171 $ 185 $ 156 $ (170) $ Adjustments: Add: Net Income representing a full nine month period of 2015 for UIL 16 16 — — 89 89 — — Merger costs 9 2 — 7 32 13 — 19 Income tax impact of adjustments (1) (3) — — (3) (13) (5) (8) Adjusted Net Income 76 $ 85 $ 62 $ (71) $ 279 $ 282 $ 156 $ (159) $ Add: Income tax expense (2) 75 50 9 16 183 170 (10) 23 Depreciation and amortization (3) 266 147 90 29 812 449 348 15 Impairment of non-current assets 3 — 3 — 10 — 10 — Interest expense, net of capitalization (4) 50 39 3 8 159 126 (39) 72 Less: Other income and (expense) 4 4 — — 4 4 — — Earnings (losses) from equity method investments (2) 3 (3) (2) 6 10 (4) — Adjusted EBITDA 468 $ 314 $ 170 $ (16) $ 1,433 $ 1,013 $ 469 $ (49) $ Add: Operations and maintenance (5) 348 293 57 (2) 1,019 839 164 16 Taxes other than income taxes 124 114 8 1 373 335 34 4 Adjusted Gross Margin 939 $ 721 $ 235 $ (17) $ 2,825 $ 2,187 $ 667 $ (29) $ (1) Income tax impact of adjustments for the full nine month period of 2015 of $8 million, $5 million and $13 million and the three month period of 2015 of $3 million relate to merger costs. (4) Adjustments have been made for allowance for funds used during construction, debt portion, to reflect these amounts within other income and expenses. (5) Adjustments have been made for regulatory amounts to reflect amounts in revenues based on the by nature classification of these items. In addition the vehicle depreciation and bad debt provision have been reflected within depreciation and amortization. Three Months Ended Nine Months Ended September 30, 2015 September 30, 2015 (in millions) (2) In addition to adjustment to include a full nine month period of 2015 for UIL, adjustments have been made for Production Tax Credit Adjustments for the amount of $4 million and $21 million for the three and nine month ended September 30, 2015 as they have been included in operating revenues based on the by nature classification. (3) Adjustments have been made for the inclusion of vehicle depreciation and bad debt provision within depreciation and amortization from operations and maintenance based on the by nature classification. Vehicle Depreciation of $4 million and $11 million and bad debt provision of $8 million and $34 million, for the three and nine months ended September 30, 2015, respectively. Additionally, government grants and investment tax credits amortization have been presented within other operating income and not within depreciation and amortization based on the by nature classification. Government grants of $1.7 million and $5.1 million and investment tax credits of $26 million and $71 million, for the three and nine month periods ended September 30, 2015, respectively.

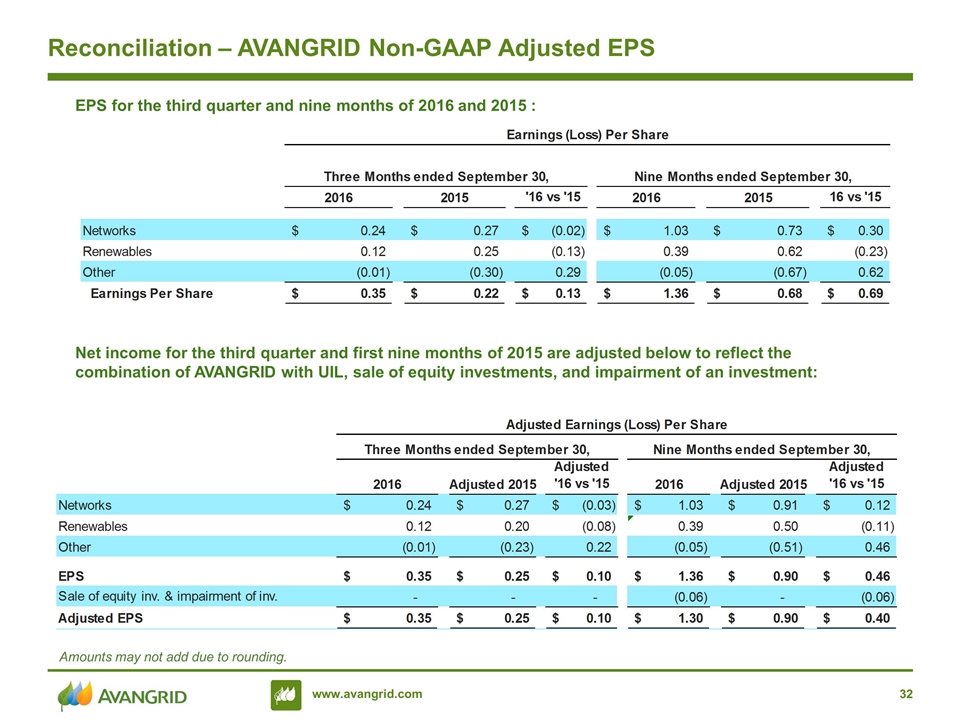

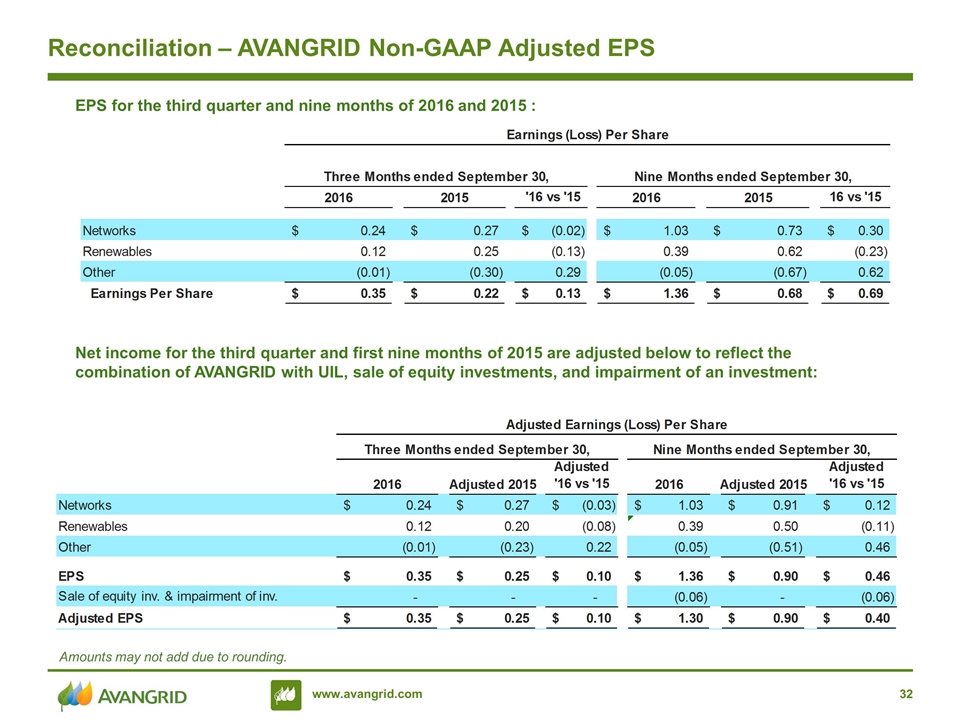

Reconciliation – AVANGRID Non-GAAP Adjusted EPS Amounts may not add due to rounding. EPS for the third quarter and nine months of 2016 and 2015 : Net income for the third quarter and first nine months of 2015 are adjusted below to reflect the combination of AVANGRID with UIL, sale of equity investments, and impairment of an investment: