February 21, 2017 New York City Exhibit 99.2

Legal Notice FORWARD LOOKING STATEMENTS Certain statements in this presentation may relate to our future business and financial performance and future events or developments involving us and our subsidiaries that are not purely historical and may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “should,” “can,” “expects,” “believes,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” “is confident that” and “seeks” or the negative of such terms or other variations on such terms or comparable terminology. Such forward looking statements include, but are not limited to, statements about our plans, objectives and intentions, outlooks or expectations for earnings, revenues, expenses or other future financial or business performance, strategies or expectations, or the impact of legal or regulatory matters on our business, results of operations or financial condition. Such statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, without limitation, the risks and uncertainties set forth under the section entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2015, and our Quarterly Report on Form 10-Q for the nine months ended September 30,2016, which are on file with the Securities and Exchange Commission (SEC) and available on our investor relations website at www.avangrid.com and on the SEC website at www.sec.gov. Additional information will also be set forth in subsequent filings with the SEC. You should consider these factors carefully in evaluating for-ward looking statements. Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of this presentation whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. Investors@AVANGRID.com James TorgersonChief Executive Officer Richard NicholasChief Financial Officer

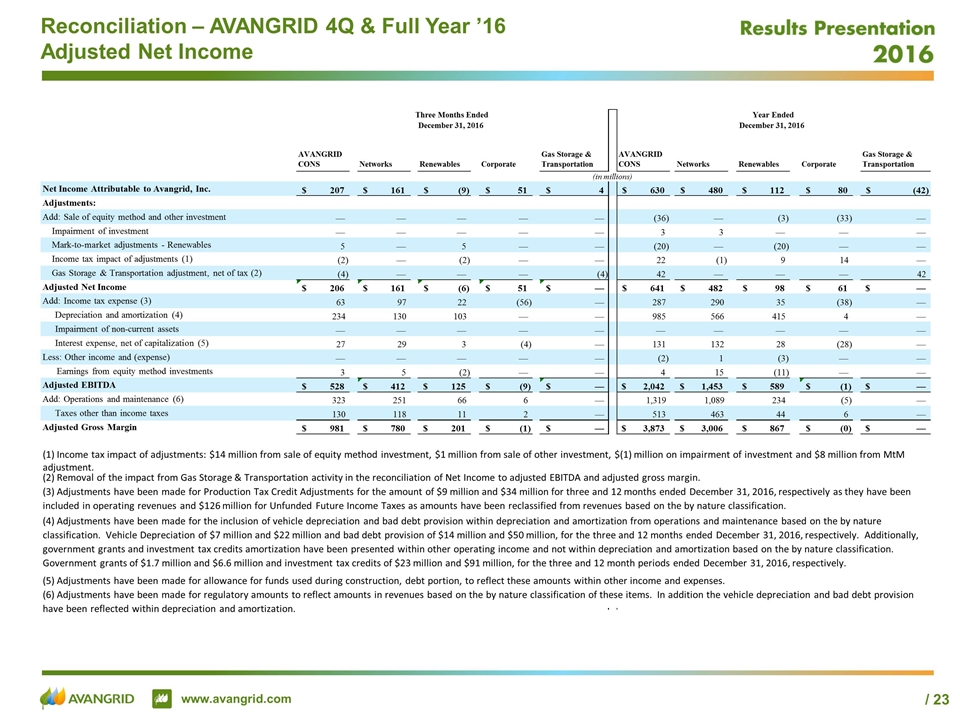

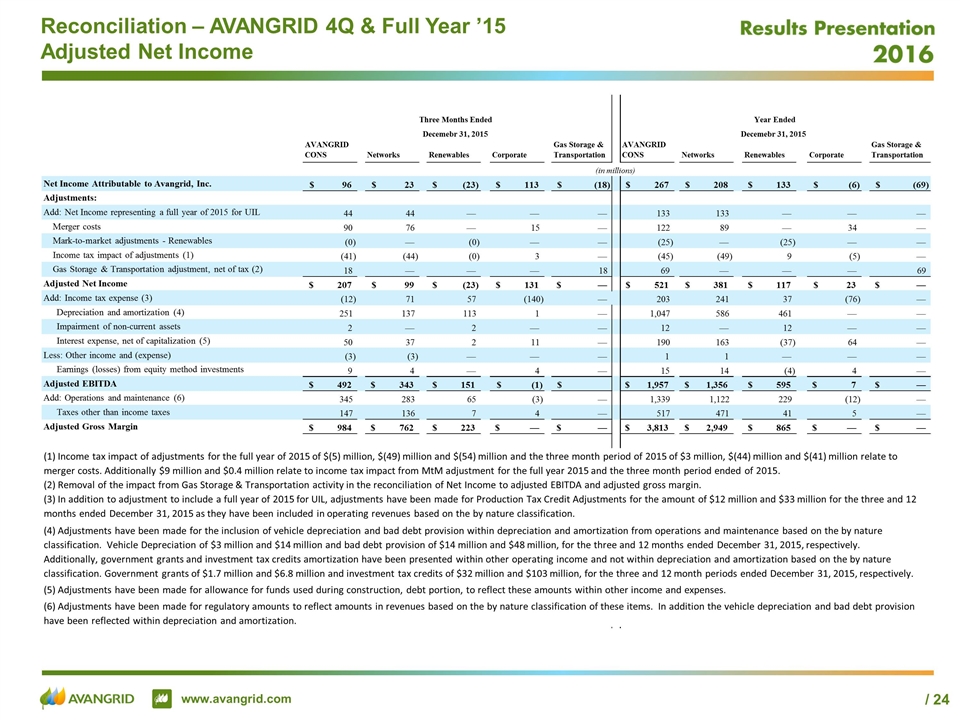

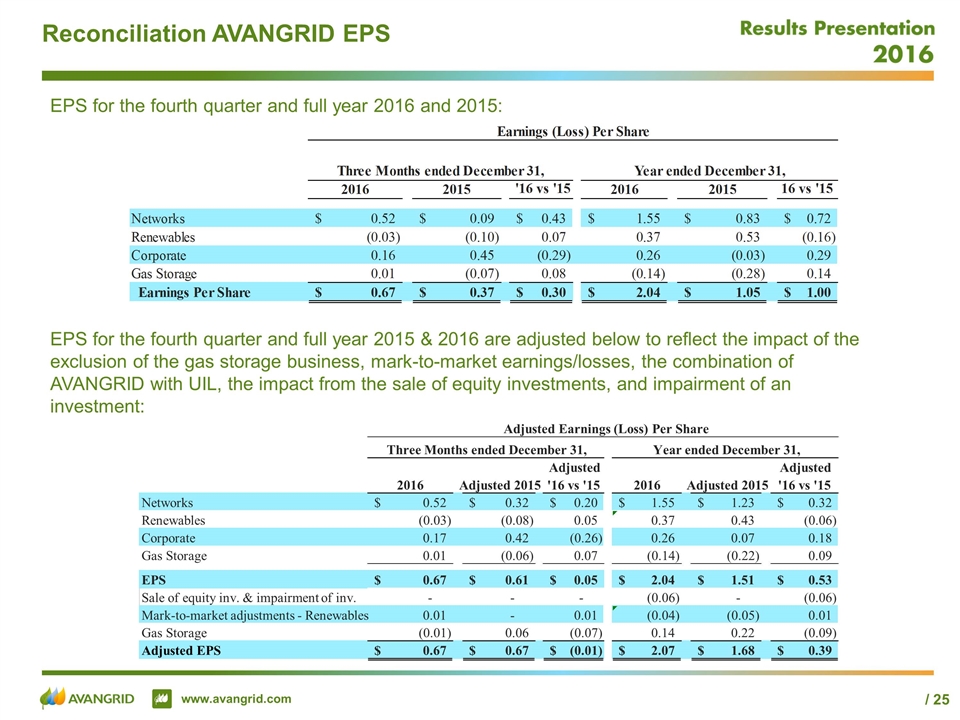

Legal Notice Use of Non-GAAP Financial Measures To supplement our consolidated financial statements presented in accordance with U.S. GAAP, AVANGRID considers certain non-GAAP financial measures that are not prepared in accordance with U.S. GAAP, including adjusted net income and adjusted EPS. The non-GAAP financial measures we use are specific to AVANGRID and the non-GAAP financial measures of other companies may not be calculated in the same manner. We use these non-GAAP financial measures, in addition to U.S. GAAP measures, to establish operating budgets and operational goals to manage and monitor our business, evaluate our operating and financial performance and to compare such performance to prior periods and to the performance of our competitors. We believe that presenting such non-GAAP financial measures is useful because such measures can be used to analyze and compare profitability between companies and industries because it eliminates the impact of financing and certain non-cash charges as well as allow for an evaluation of AVANGRID with a focus on the performance of its core operations. In addition, we present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance. We provide adjusted net income, which is adjusted to reflect the full twelve month period of results for UIL, excluding the costs of the combination of AVANGRID with UIL, mark-to-market adjustments to reflect the effect of mark-to-market changes in the fair value of derivative instruments used by AVANGRID to economically hedge market price fluctuations in related underlying physical transactions for the purchase and sale of electricity, adjustments for the non-core Gas Storage business, and the impairment of certain investments and excludes the sale of certain equity investments. We believe adjusted net income is more useful in understanding and evaluating actual and projected financial performance and contribution of AVANGRID core lines of business and to more fully compare and explain our results. The most directly comparable U.S. GAAP measure to adjusted net income is net income. We also provide adjusted EPS, which is adjusted net income converted to an earnings per share amount. The use of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, AVANGRID’s U.S. GAAP financial information, and investors are cautioned that the non-GAAP financial measures are limited in their usefulness, may be unique to AVANGRID, and should be considered only as a supplement to AVANGRID’s U.S. GAAP financial measures. The non-GAAP financial measures may not be comparable to other similarly titled measures of other companies and have limitations as analytical tools. Non-GAAP financial measures are not primary measurements of our performance under U.S. GAAP and should not be considered as alternatives to operating income, net income or any other performance measures determined in accordance with U.S. GAAP. About AVANGRID Avangrid, Inc. (NYSE: AGR) is a diversified energy and utility company with more than $30 billion in assets and operations in 25 states. The company operates regulated utilities and electricity generation through two primary lines of business. Avangrid Networks includes eight electric and natural gas utilities, serving approximately 3.2 million customers in New York and New England. Avangrid Renewables operates 6.5 gigawatts of electricity capacity, primarily through wind power, in states across the United States. AVANGRID employs approximately 7,000 people. The company was formed through a merger between Iberdrola USA, Inc. and UIL Holdings Corporation in 2015. Iberdrola S.A. (Madrid: IBE), a worldwide leader in the energy industry, owns 81.5% of the outstanding shares of AVANGRID common stock. For more information, visit www.avangrid.com.

2016 Highlights & 2017 Outlook James Torgerson

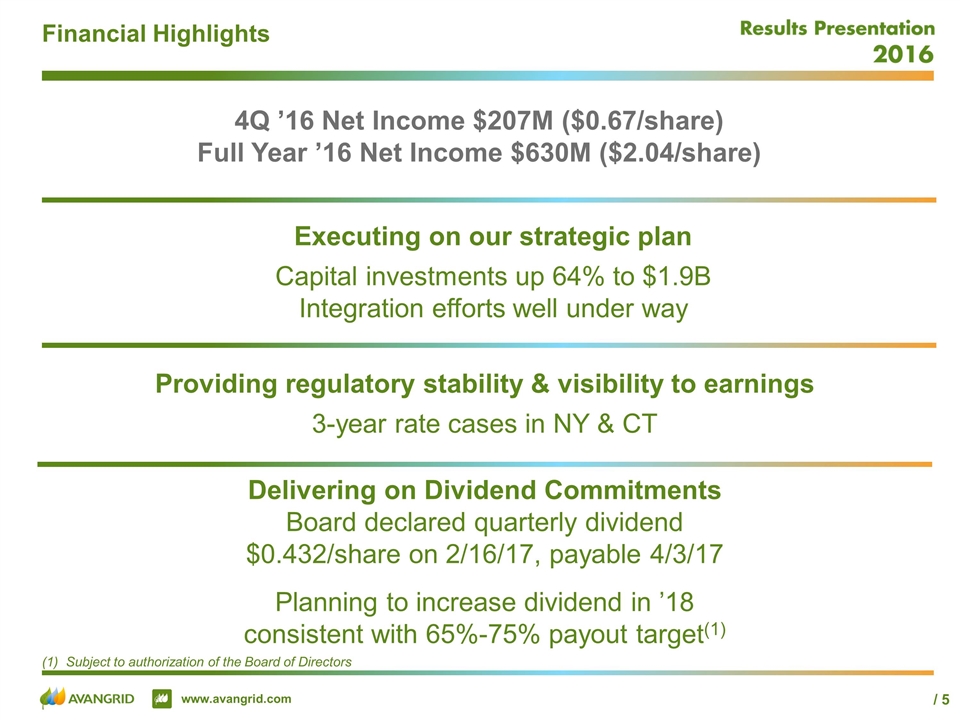

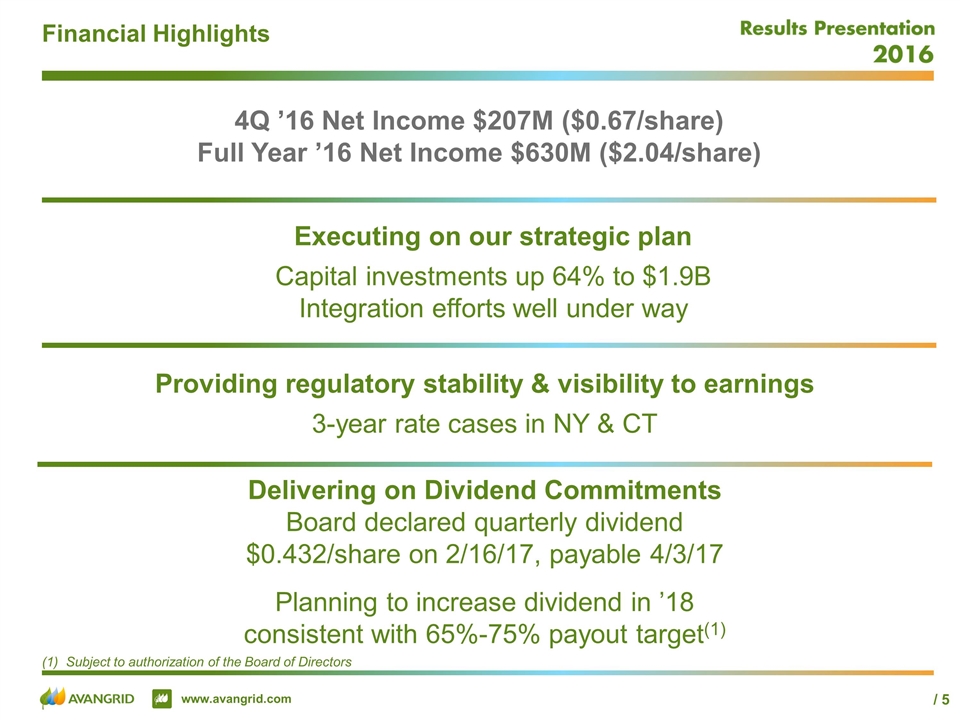

4Q ’16 Net Income $207M ($0.67/share) Full Year ’16 Net Income $630M ($2.04/share) Financial Highlights Executing on our strategic plan Capital investments up 64% to $1.9B Integration efforts well under way Providing regulatory stability & visibility to earnings 3-year rate cases in NY & CT Delivering on Dividend Commitments Board declared quarterly dividend $0.432/share on 2/16/17, payable 4/3/17 Planning to increase dividend in ’18 consistent with 65%-75% payout target(1) Subject to authorization of the Board of Directors

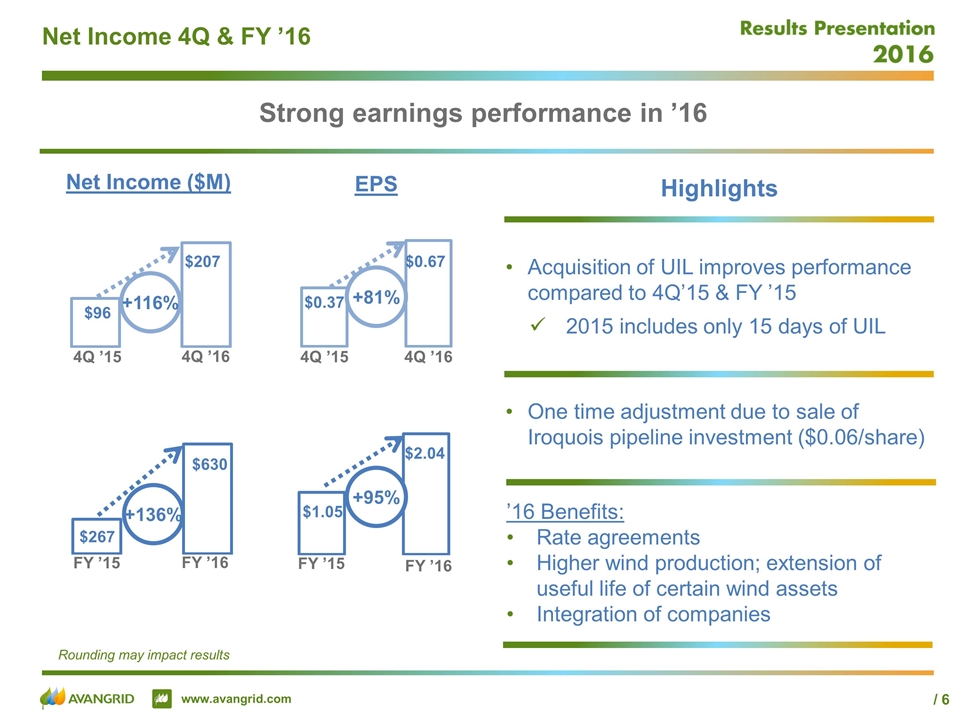

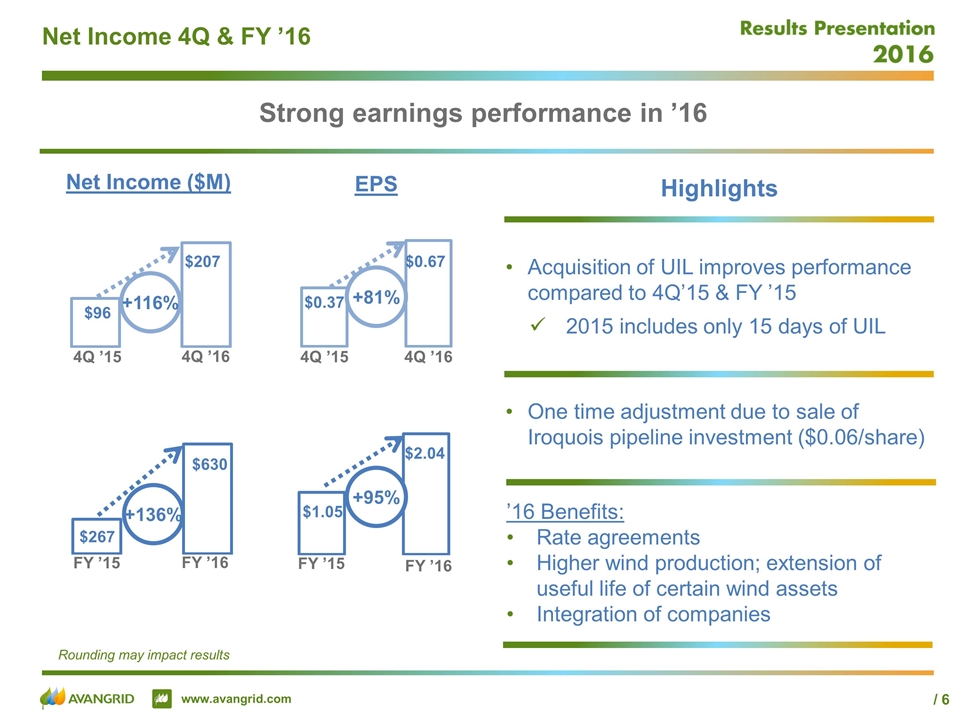

Net Income 4Q & FY ’16 Highlights Net Income ($M) EPS 4Q ’15 4Q ’16 4Q ’15 4Q ’16 FY ’15 FY ’16 FY ’15 FY ’16 +136% +95% Acquisition of UIL improves performance compared to 4Q’15 & FY ’15 2015 includes only 15 days of UIL Strong earnings performance in ’16 +116% +81% ’16 Benefits: Rate agreements Higher wind production; extension of useful life of certain wind assets Integration of companies One time adjustment due to sale of Iroquois pipeline investment ($0.06/share) Rounding may impact results

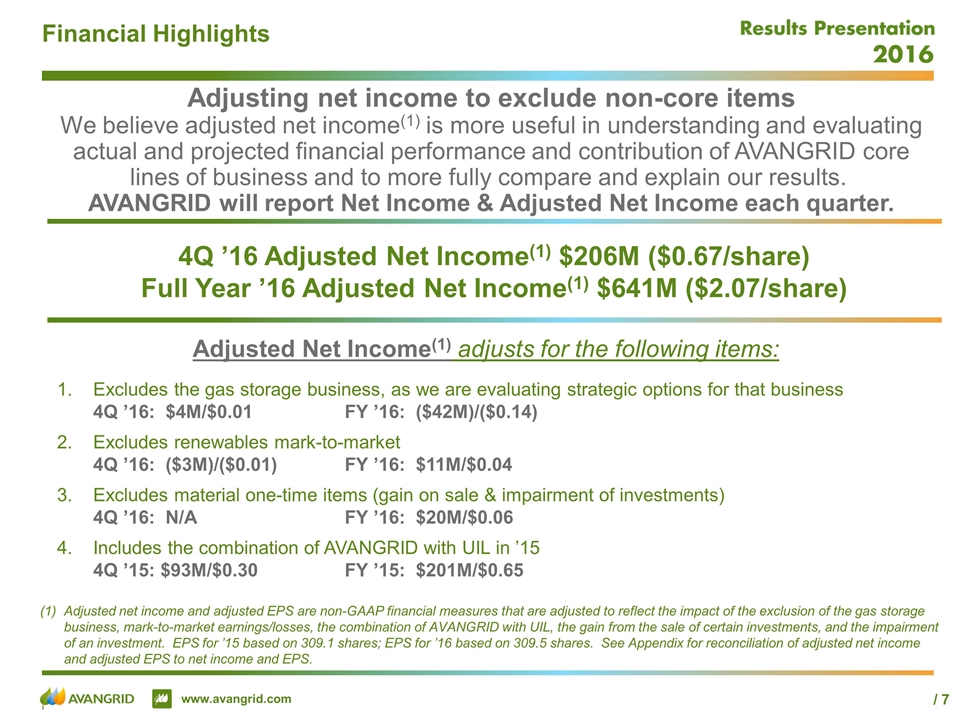

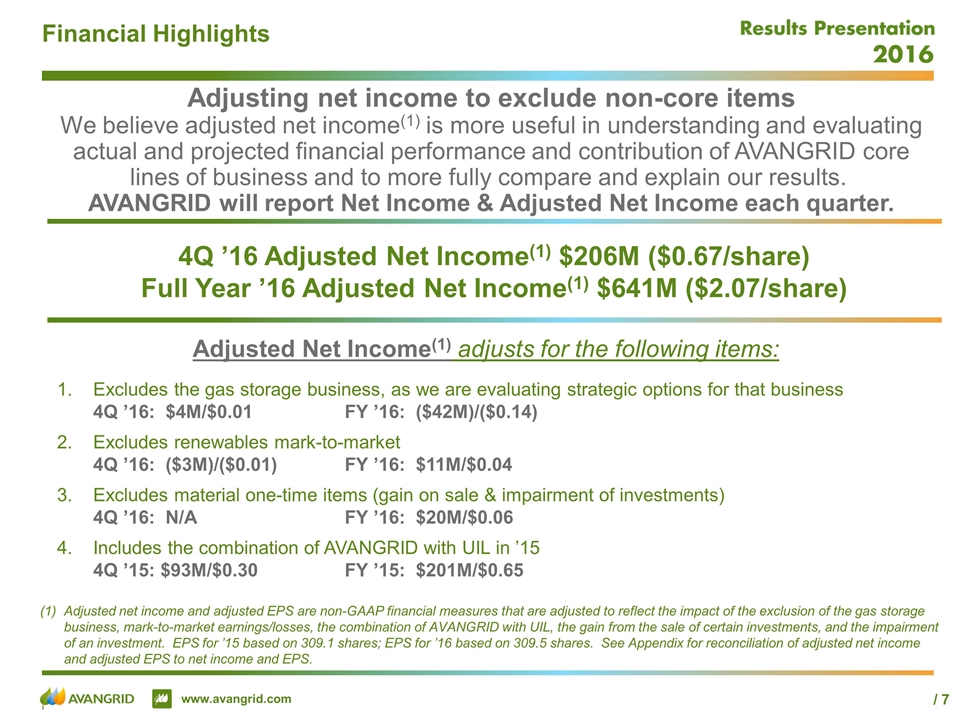

Financial Highlights Excludes the gas storage business, as we are evaluating strategic options for that business 4Q ’16: $4M/$0.01FY ’16: ($42M)/($0.14) Excludes renewables mark-to-market 4Q ’16: ($3M)/($0.01) FY ’16: $11M/$0.04 Excludes material one-time items (gain on sale & impairment of investments) 4Q ’16: N/AFY ’16: $20M/$0.06 Includes the combination of AVANGRID with UIL in ’15 4Q ’15: $93M/$0.30 FY ’15: $201M/$0.65 Adjusted Net Income(1) adjusts for the following items: Adjusted net income and adjusted EPS are non-GAAP financial measures that are adjusted to reflect the impact of the exclusion of the gas storage business, mark-to-market earnings/losses, the combination of AVANGRID with UIL, the gain from the sale of certain investments, and the impairment of an investment. EPS for ’15 based on 309.1 shares; EPS for ’16 based on 309.5 shares. See Appendix for reconciliation of adjusted net income and adjusted EPS to net income and EPS. Adjusting net income to exclude non-core items We believe adjusted net income(1) is more useful in understanding and evaluating actual and projected financial performance and contribution of AVANGRID core lines of business and to more fully compare and explain our results. AVANGRID will report Net Income & Adjusted Net Income each quarter. 4Q ’16 Adjusted Net Income(1) $206M ($0.67/share) Full Year ’16 Adjusted Net Income(1) $641M ($2.07/share)

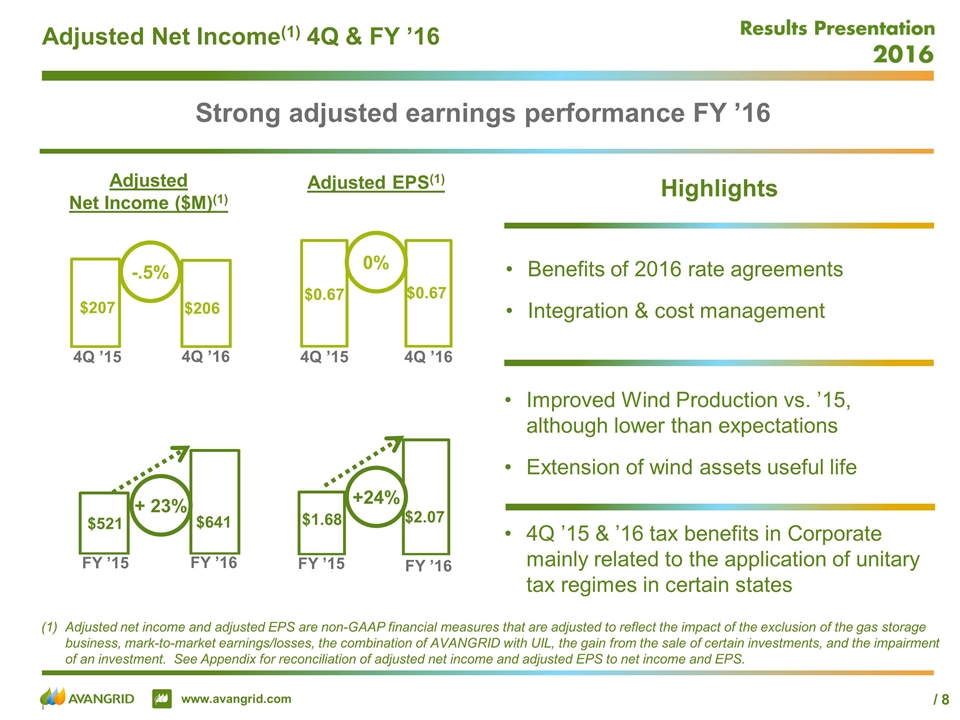

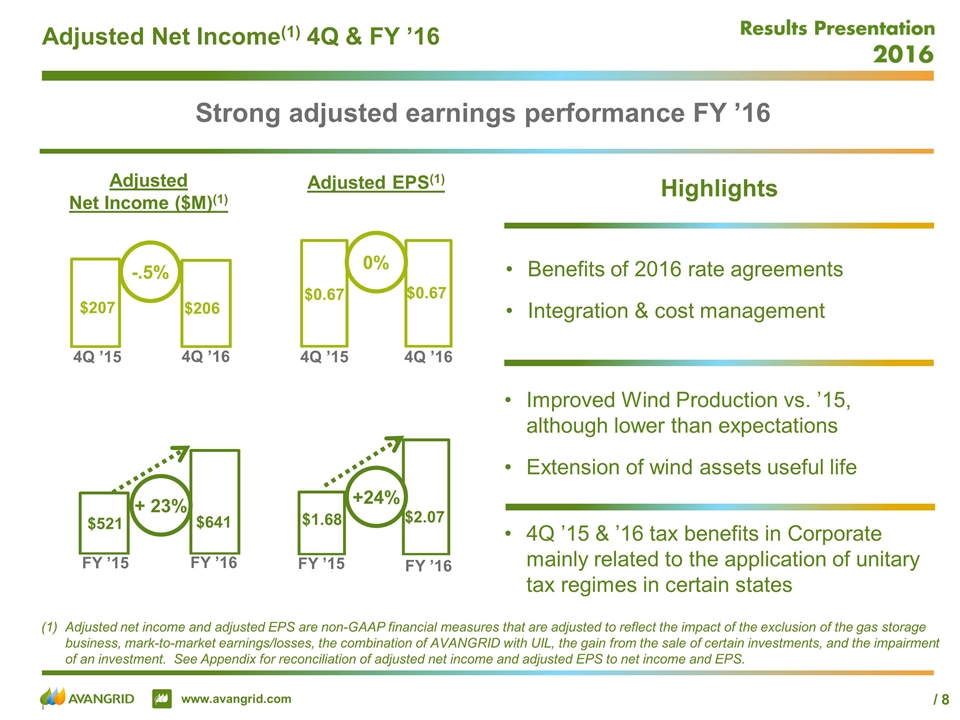

Adjusted Net Income(1) 4Q & FY ’16 Highlights Adjusted net income and adjusted EPS are non-GAAP financial measures that are adjusted to reflect the impact of the exclusion of the gas storage business, mark-to-market earnings/losses, the combination of AVANGRID with UIL, the gain from the sale of certain investments, and the impairment of an investment. See Appendix for reconciliation of adjusted net income and adjusted EPS to net income and EPS. Adjusted Net Income ($M)(1) Adjusted EPS(1) 4Q ’15 4Q ’16 4Q ’15 4Q ’16 FY ’15 FY ’16 FY ’15 FY ’16 + 23% +24% Improved Wind Production vs. ’15, although lower than expectations Extension of wind assets useful life Benefits of 2016 rate agreements Integration & cost management Strong adjusted earnings performance FY ’16 -.5% 0% 4Q ’15 & ’16 tax benefits in Corporate mainly related to the application of unitary tax regimes in certain states

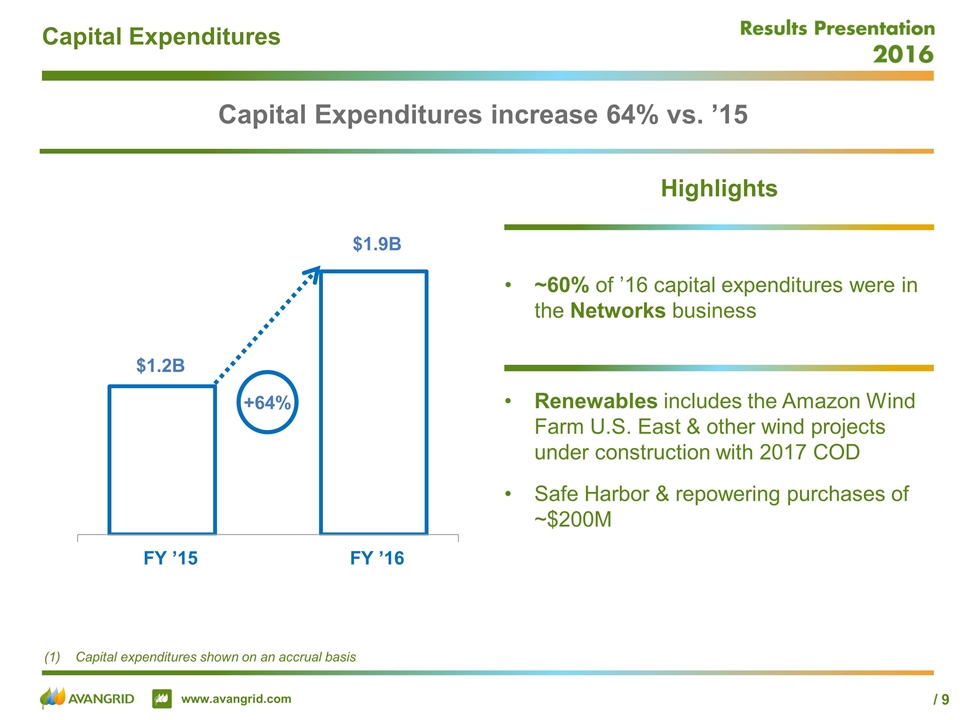

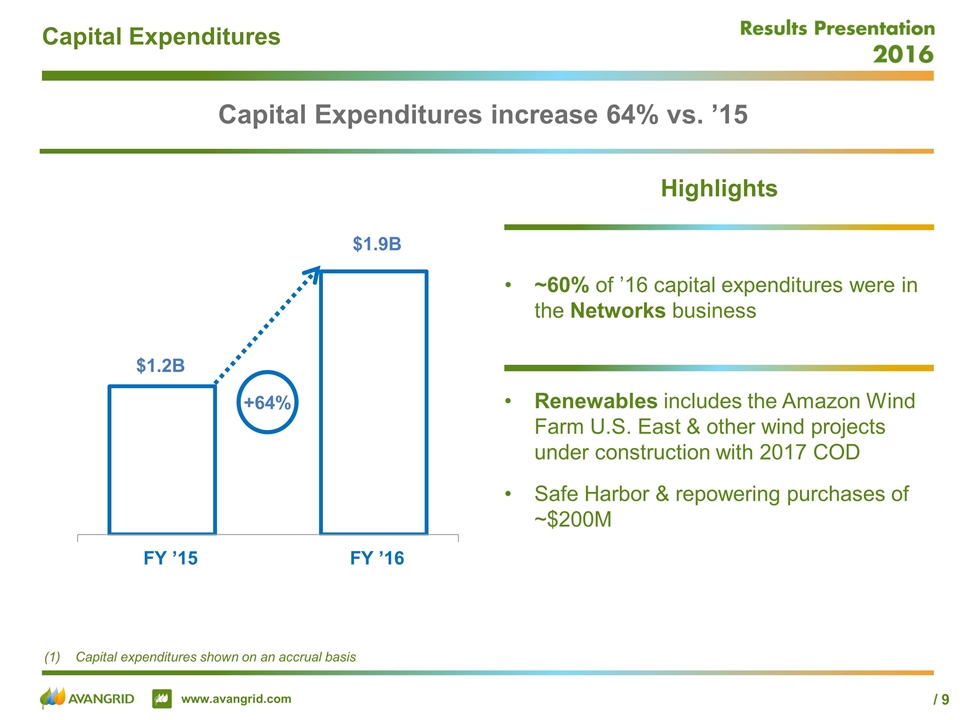

Capital Expenditures Highlights 0000 Renewables includes the Amazon Wind Farm U.S. East & other wind projects under construction with 2017 COD Safe Harbor & repowering purchases of ~$200M ~60% of ’16 capital expenditures were in the Networks business Capital Expenditures increase 64% vs. ’15 FY ’15 FY ’16 +64% $1.2B Capital expenditures shown on an accrual basis $1.9B

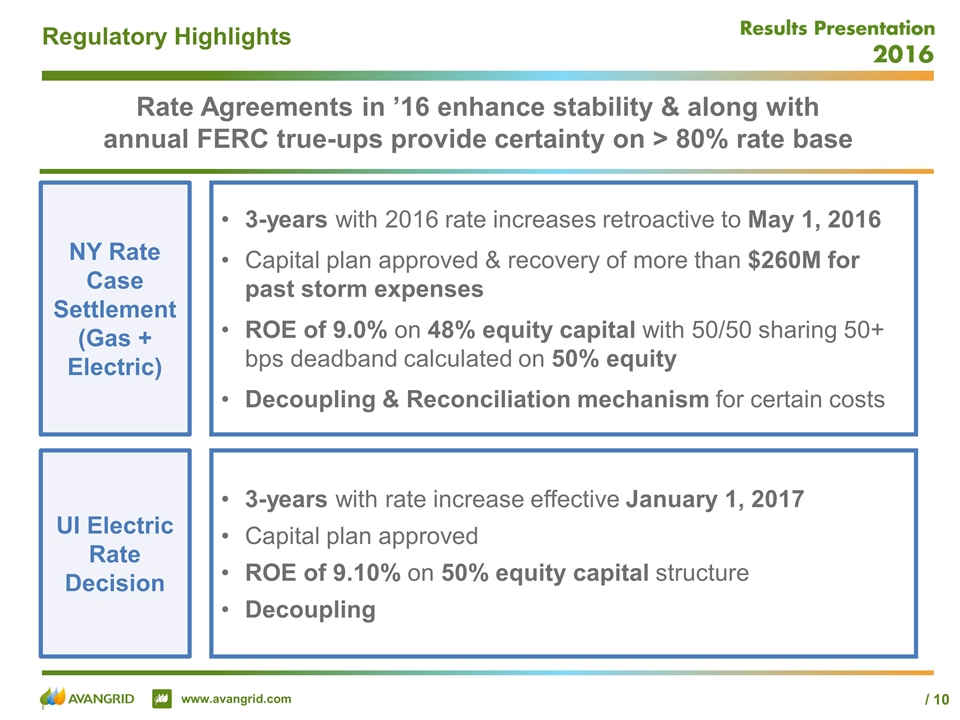

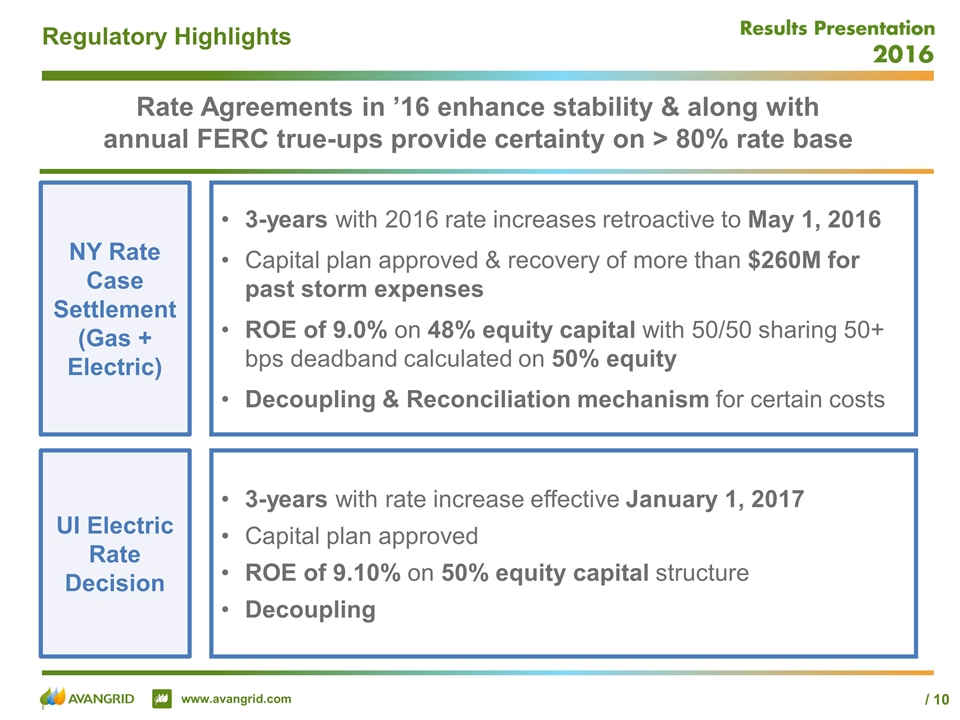

Regulatory Highlights 0000 Rate Agreements in ’16 enhance stability & along with annual FERC true-ups provide certainty on > 80% rate base NY Rate Case Settlement (Gas + Electric) 3-years with rate increase effective January 1, 2017 Capital plan approved ROE of 9.10% on 50% equity capital structure Decoupling 3-years with 2016 rate increases retroactive to May 1, 2016 Capital plan approved & recovery of more than $260M for past storm expenses ROE of 9.0% on 48% equity capital with 50/50 sharing 50+ bps deadband calculated on 50% equity Decoupling & Reconciliation mechanism for certain costs UI Electric Rate Decision

Dividends 0000 Committed to: Maintaining quarterly dividend floor of $0.432/share Payout target of 65-75% Quarterly dividends of $0.432/share paid in ’16 (1) Subject to authorization by the AVANGRID Board of Directors Planning to increase the dividend beginning in ’18(1)

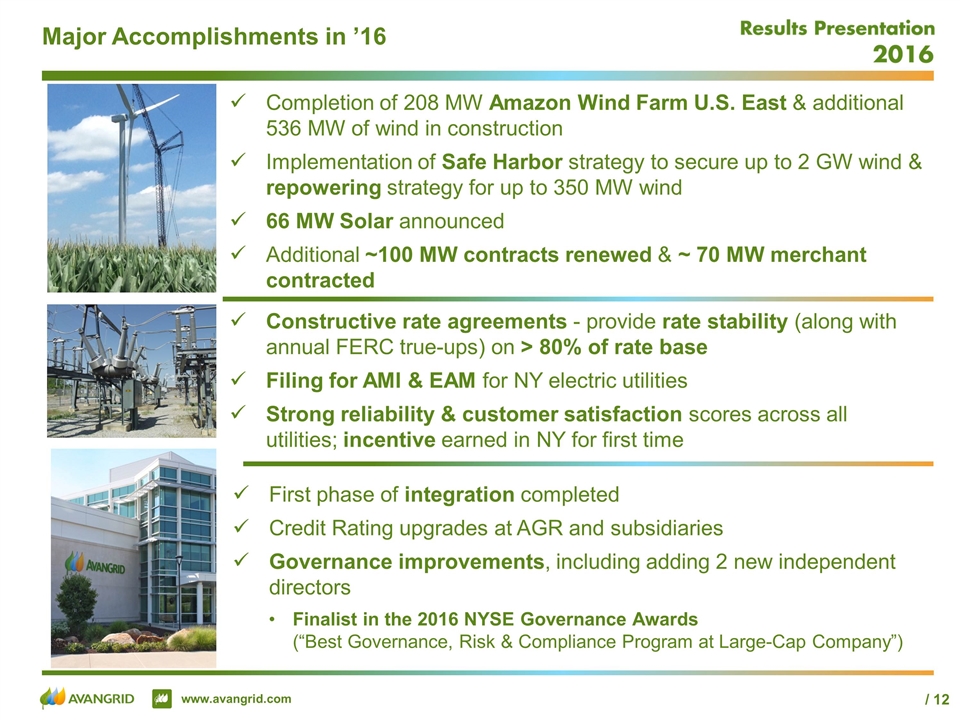

Major Accomplishments in ’16 0000 Completion of 208 MW Amazon Wind Farm U.S. East & additional 536 MW of wind in construction Implementation of Safe Harbor strategy to secure up to 2 GW wind & repowering strategy for up to 350 MW wind 66 MW Solar announced Additional ~100 MW contracts renewed & ~ 70 MW merchant contracted Constructive rate agreements - provide rate stability (along with annual FERC true-ups) on > 80% of rate base Filing for AMI & EAM for NY electric utilities Strong reliability & customer satisfaction scores across all utilities; incentive earned in NY for first time First phase of integration completed Credit Rating upgrades at AGR and subsidiaries Governance improvements, including adding 2 new independent directors Finalist in the 2016 NYSE Governance Awards (“Best Governance, Risk & Compliance Program at Large-Cap Company”)

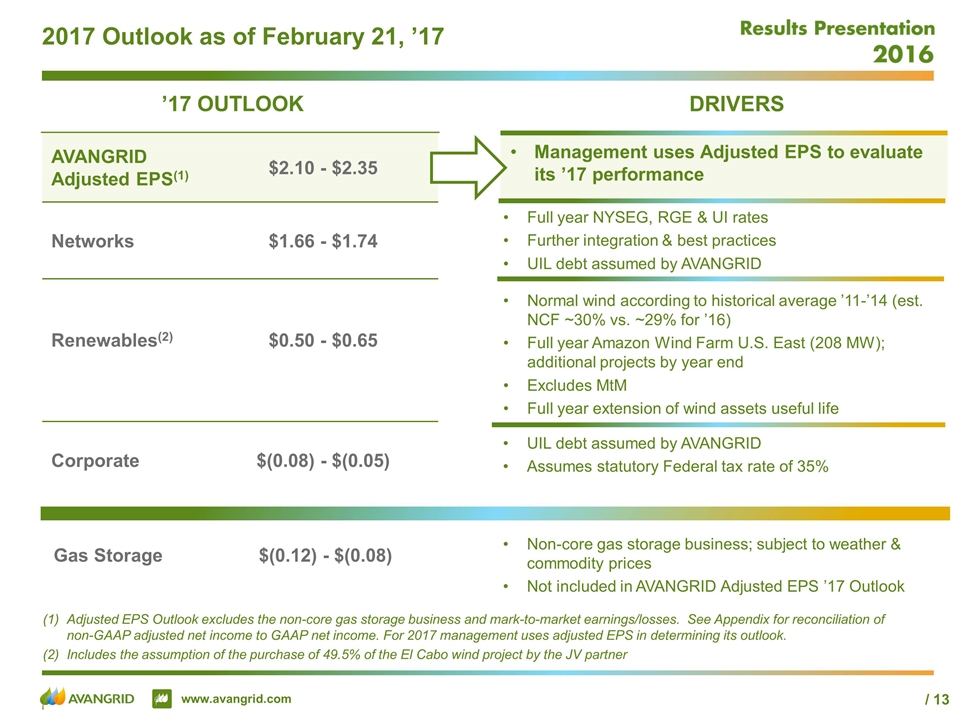

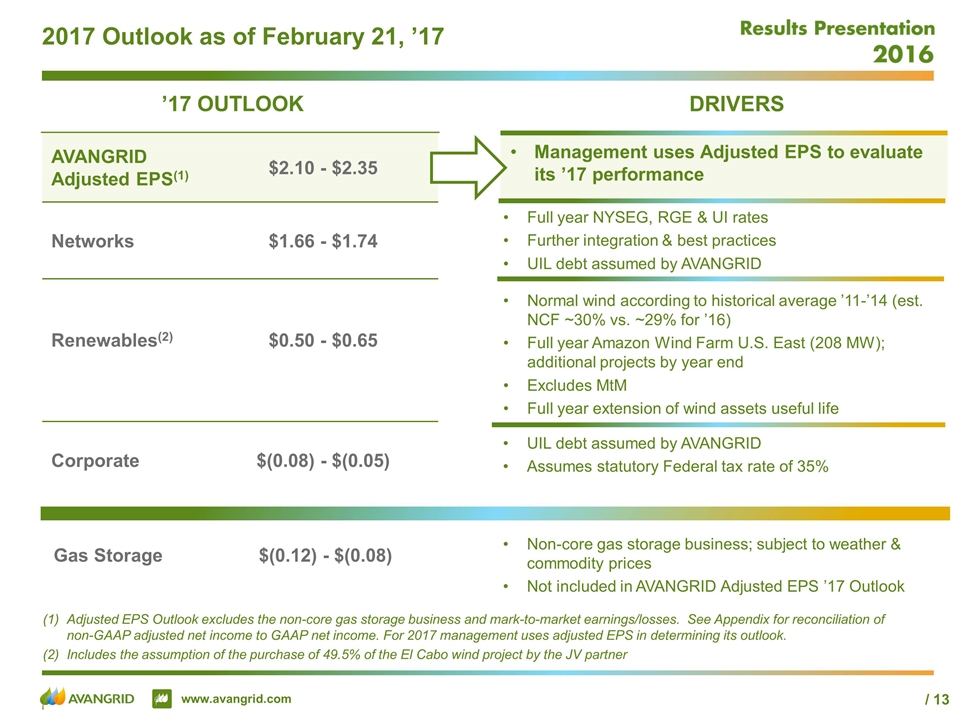

Management uses Adjusted EPS to evaluate its ’17 performance 2017 Outlook as of February 21, ’17 Adjusted EPS Outlook excludes the non-core gas storage business and mark-to-market earnings/losses. See Appendix for reconciliation of non-GAAP adjusted net income to GAAP net income. For 2017 management uses adjusted EPS in determining its outlook. Includes the assumption of the purchase of 49.5% of the El Cabo wind project by the JV partner DRIVERS Full year NYSEG, RGE & UI rates Further integration & best practices UIL debt assumed by AVANGRID Normal wind according to historical average ’11-’14 (est. NCF ~30% vs. ~29% for ’16) Full year Amazon Wind Farm U.S. East (208 MW); additional projects by year end Excludes MtM Full year extension of wind assets useful life ’17 OUTLOOK Non-core gas storage business; subject to weather & commodity prices Not included in AVANGRID Adjusted EPS ’17 Outlook AVANGRID Adjusted EPS(1) $2.10 - $2.35 Networks $1.66 - $1.74 Renewables(2) $0.50 - $0.65 Corporate $(0.08) - $(0.05) UIL debt assumed by AVANGRID Assumes statutory Federal tax rate of 35% Gas Storage $(0.12) - $(0.08)

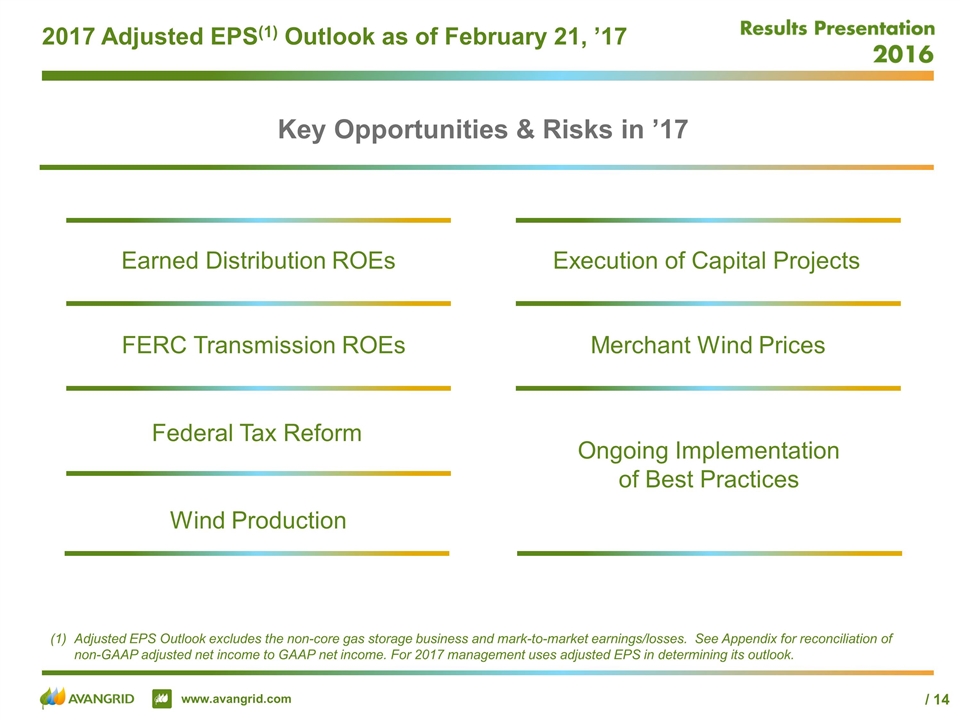

2017 Adjusted EPS(1) Outlook as of February 21, ’17 Federal Tax Reform Key Opportunities & Risks in ’17 Earned Distribution ROEs FERC Transmission ROEs Merchant Wind Prices Wind Production Execution of Capital Projects Ongoing Implementation of Best Practices Adjusted EPS Outlook excludes the non-core gas storage business and mark-to-market earnings/losses. See Appendix for reconciliation of non-GAAP adjusted net income to GAAP net income. For 2017 management uses adjusted EPS in determining its outlook.

2016 Financial Results Richard Nicholas

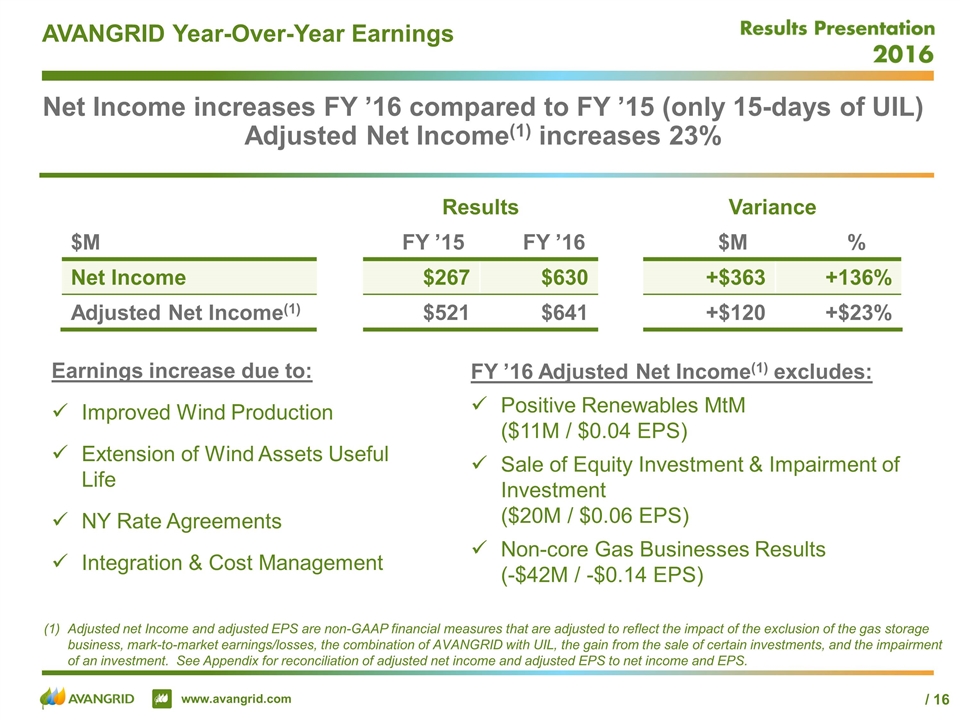

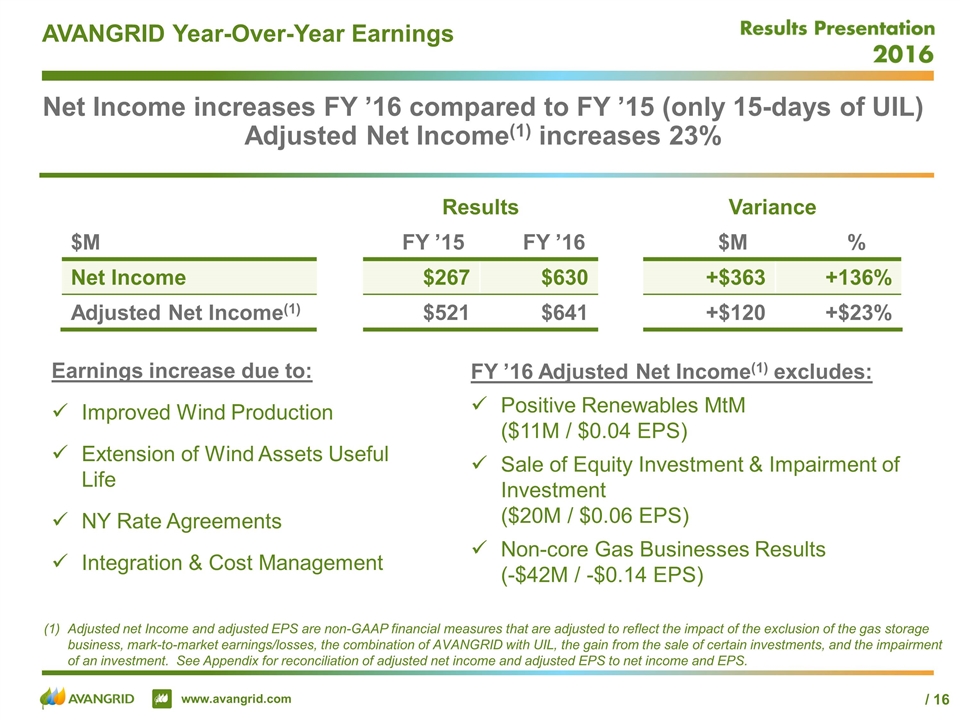

AVANGRID Year-Over-Year Earnings FY ’16 Adjusted Net Income(1) excludes: Positive Renewables MtM ($11M / $0.04 EPS) Sale of Equity Investment & Impairment of Investment ($20M / $0.06 EPS) Non-core Gas Businesses Results (-$42M / -$0.14 EPS) Net Income increases FY ’16 compared to FY ’15 (only 15-days of UIL) Adjusted Net Income(1) increases 23% Results Variance $M FY ’15 FY ’16 $M % Net Income $267 $630 +$363 +136% Adjusted Net Income(1) $521 $641 +$120 +$23% Earnings increase due to: Improved Wind Production Extension of Wind Assets Useful Life NY Rate Agreements Integration & Cost Management Adjusted net Income and adjusted EPS are non-GAAP financial measures that are adjusted to reflect the impact of the exclusion of the gas storage business, mark-to-market earnings/losses, the combination of AVANGRID with UIL, the gain from the sale of certain investments, and the impairment of an investment. See Appendix for reconciliation of adjusted net income and adjusted EPS to net income and EPS.

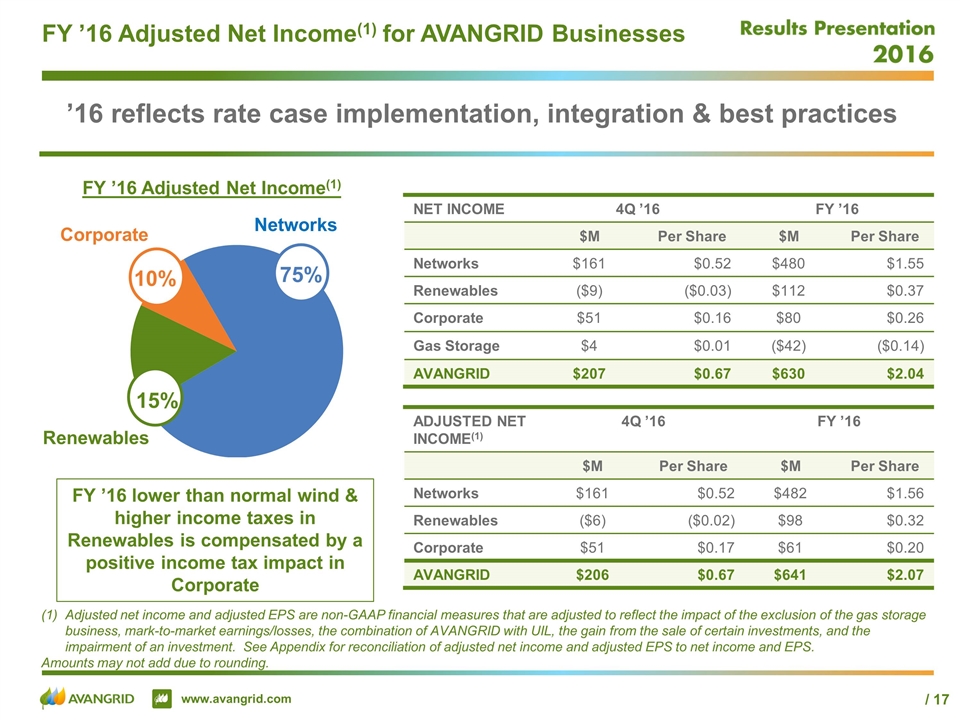

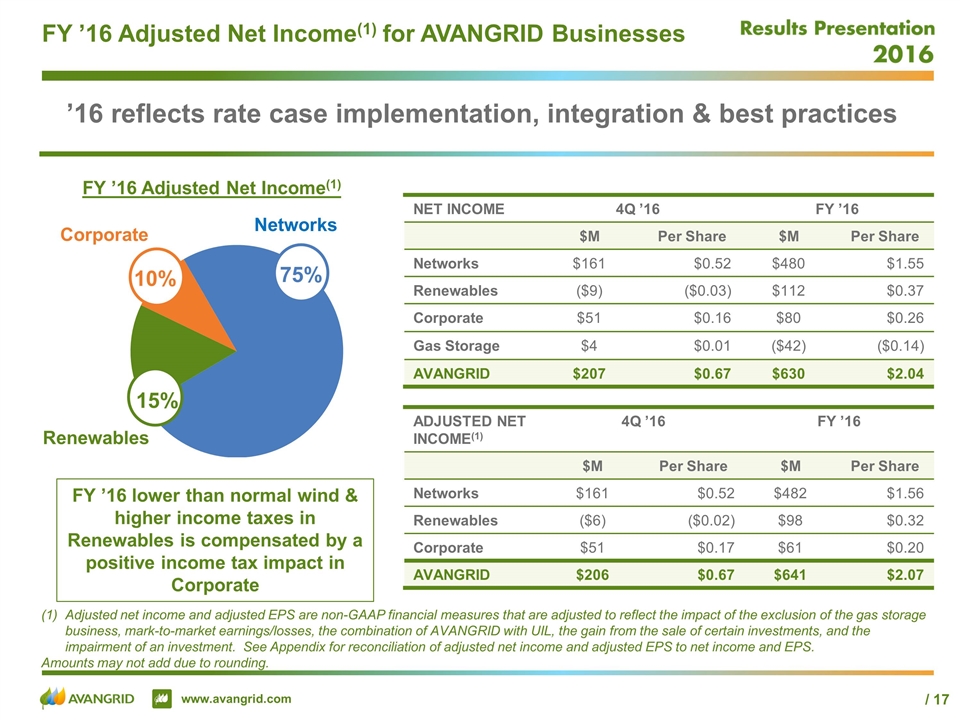

FY ’16 lower than normal wind & higher income taxes in Renewables is compensated by a positive income tax impact in Corporate FY ’16 Adjusted Net Income(1) for AVANGRID Businesses ’16 reflects rate case implementation, integration & best practices Adjusted net income and adjusted EPS are non-GAAP financial measures that are adjusted to reflect the impact of the exclusion of the gas storage business, mark-to-market earnings/losses, the combination of AVANGRID with UIL, the gain from the sale of certain investments, and the impairment of an investment. See Appendix for reconciliation of adjusted net income and adjusted EPS to net income and EPS. Amounts may not add due to rounding. Corporate FY ’16 Adjusted Net Income(1) Renewables Networks NET INCOME 4Q ’16 FY ’16 $M Per Share $M Per Share Networks $161 $0.52 $480 $1.55 Renewables ($9) ($0.03) $112 $0.37 Corporate $51 $0.16 $80 $0.26 Gas Storage $4 $0.01 ($42) ($0.14) AVANGRID $207 $0.67 $630 $2.04 ADJUSTED NET INCOME(1) 4Q ’16 FY ’16 $M Per Share $M Per Share Networks $161 $0.52 $482 $1.56 Renewables ($6) ($0.02) $98 $0.32 Corporate $51 $0.17 $61 $0.20 AVANGRID $206 $0.67 $641 $2.07

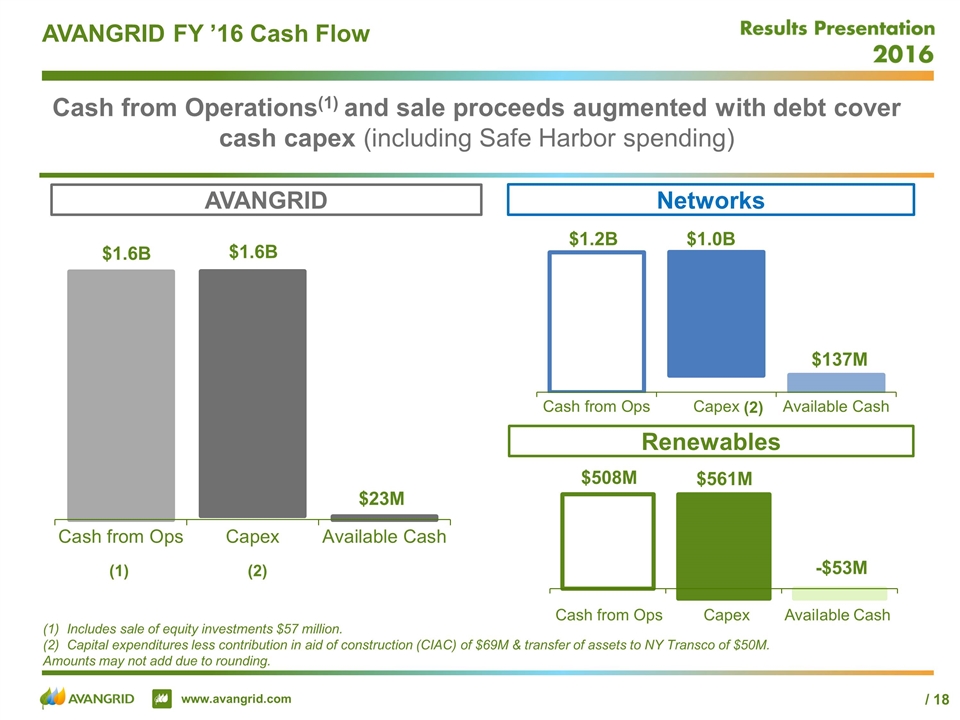

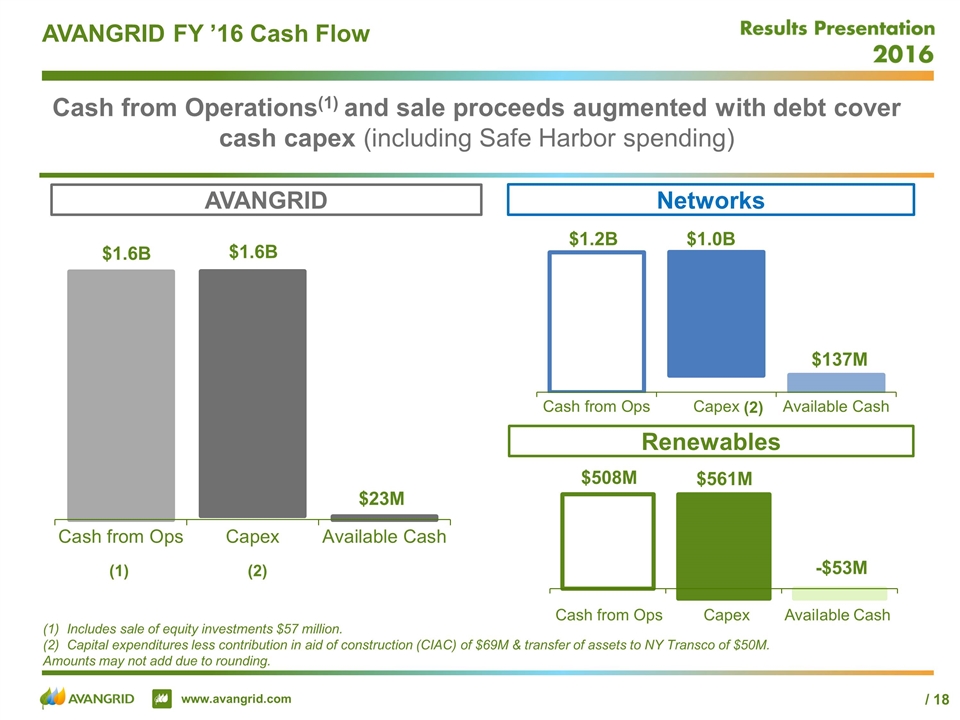

AVANGRID FY ’16 Cash Flow Cash from Operations(1) and sale proceeds augmented with debt cover cash capex (including Safe Harbor spending) Networks Renewables Includes sale of equity investments $57 million. Capital expenditures less contribution in aid of construction (CIAC) of $69M & transfer of assets to NY Transco of $50M. Amounts may not add due to rounding. AVANGRID (1) (2) (2) Cash from Ops Capex Available Cash

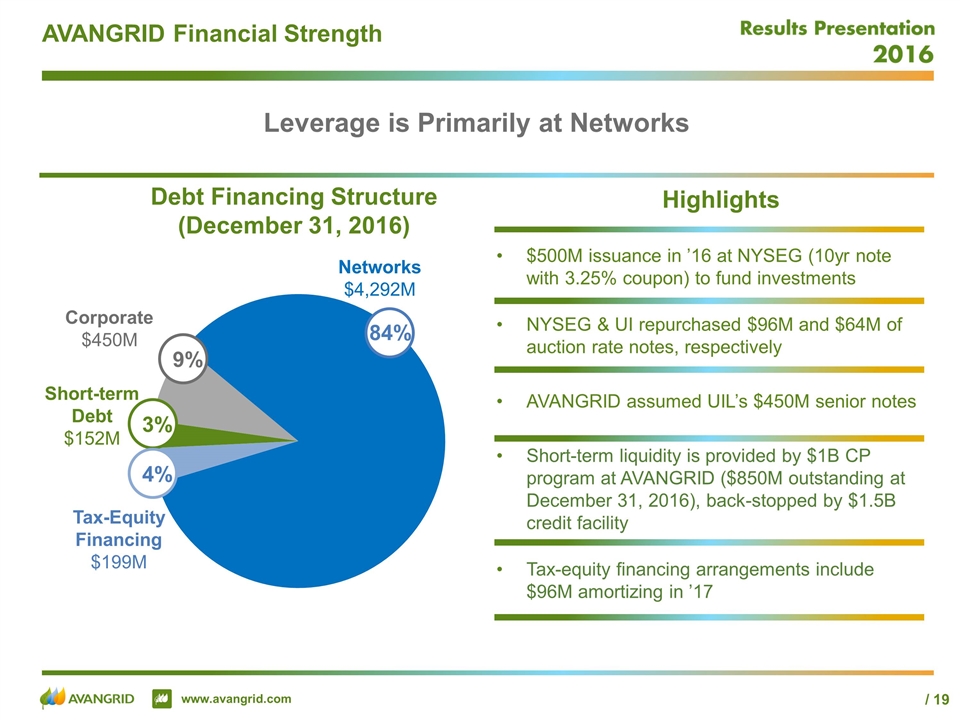

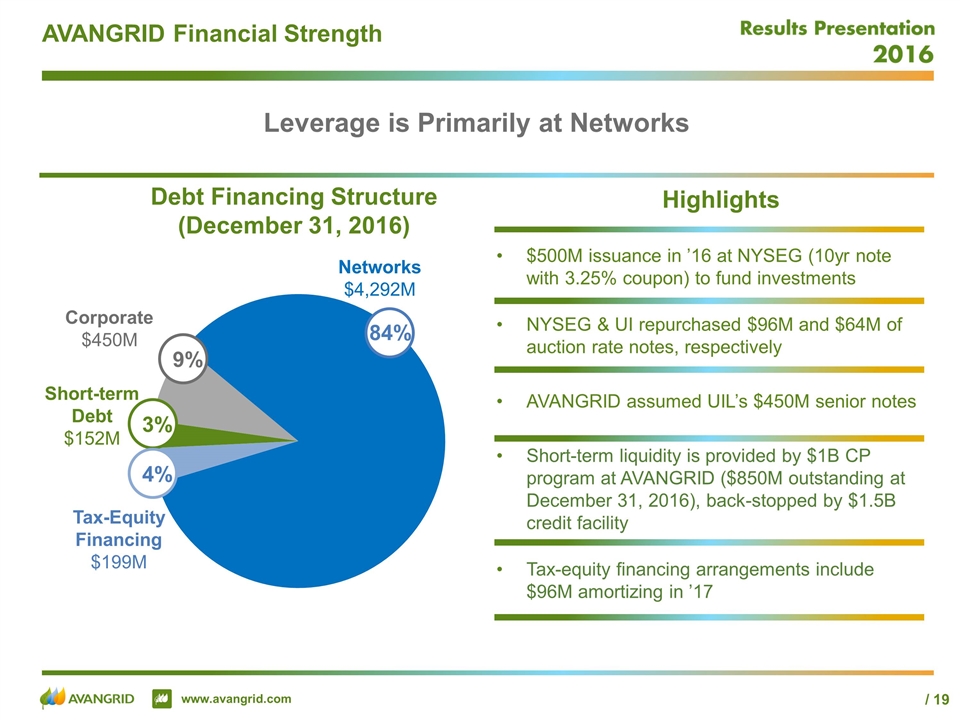

AVANGRID Financial Strength Leverage is Primarily at Networks $500M issuance in ’16 at NYSEG (10yr note with 3.25% coupon) to fund investments NYSEG & UI repurchased $96M and $64M of auction rate notes, respectively AVANGRID assumed UIL’s $450M senior notes Short-term liquidity is provided by $1B CP program at AVANGRID ($850M outstanding at December 31, 2016), back-stopped by $1.5B credit facility Tax-equity financing arrangements include $96M amortizing in ’17 Highlights Debt Financing Structure (December 31, 2016) Networks $4,292M Short-term Debt $152M 9% 84% Corporate $450M Tax-Equity Financing $199M 3% 4%

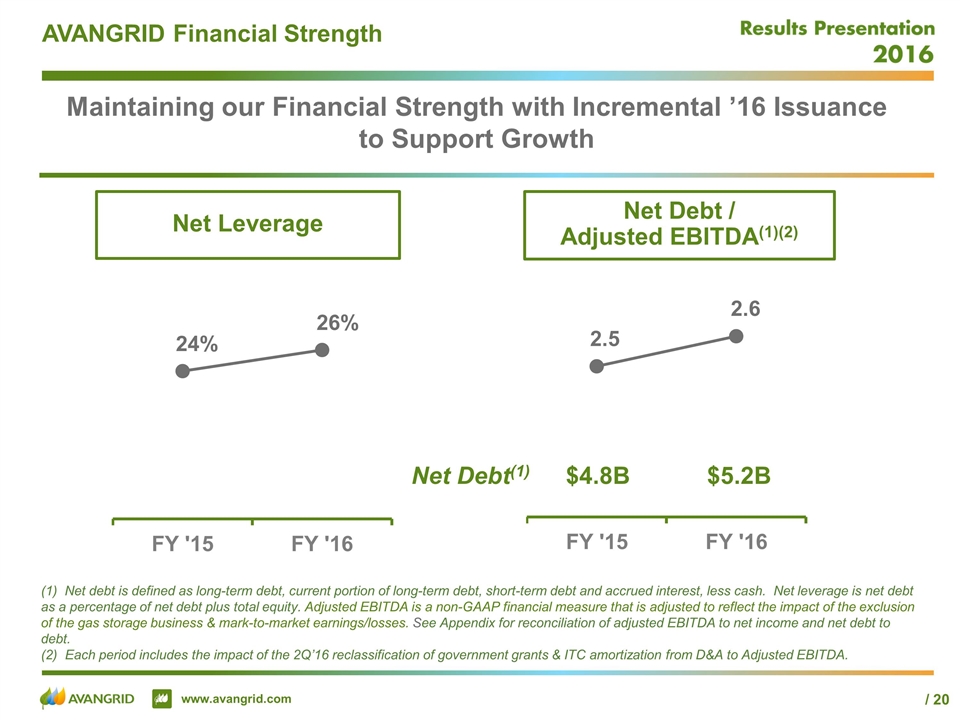

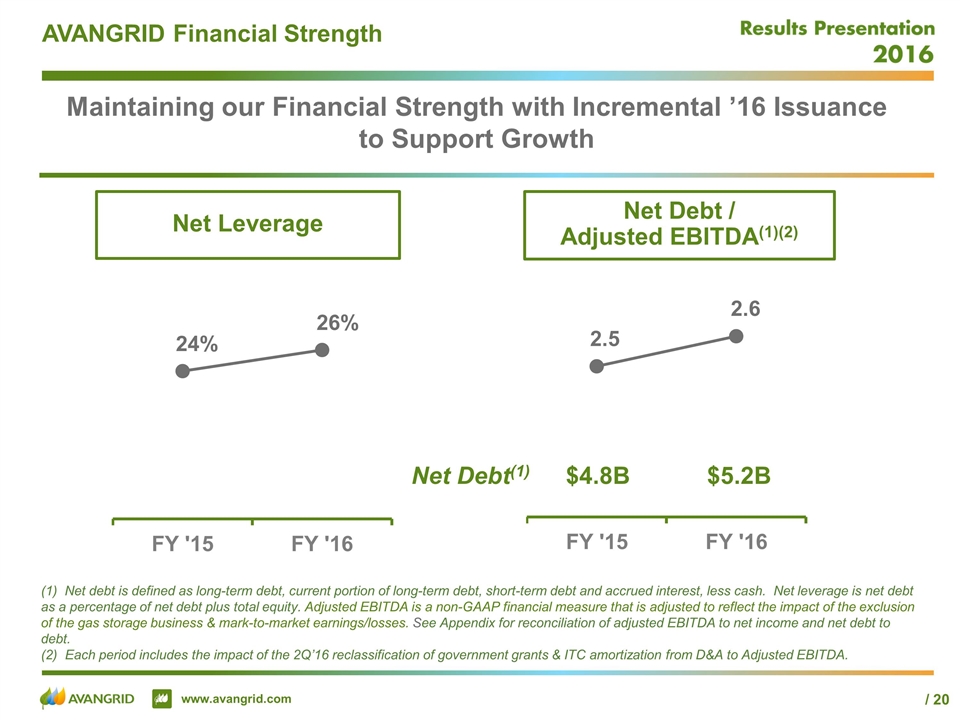

AVANGRID Financial Strength Maintaining our Financial Strength with Incremental ’16 Issuance to Support Growth YE‘16 Net Debt / Adjusted EBITDA(1)(2) Net Leverage Net debt is defined as long-term debt, current portion of long-term debt, short-term debt and accrued interest, less cash. Net leverage is net debt as a percentage of net debt plus total equity. Adjusted EBITDA is a non-GAAP financial measure that is adjusted to reflect the impact of the exclusion of the gas storage business & mark-to-market earnings/losses. See Appendix for reconciliation of adjusted EBITDA to net income and net debt to debt. Each period includes the impact of the 2Q’16 reclassification of government grants & ITC amortization from D&A to Adjusted EBITDA. $4.8B Net Debt(1) $5.2B

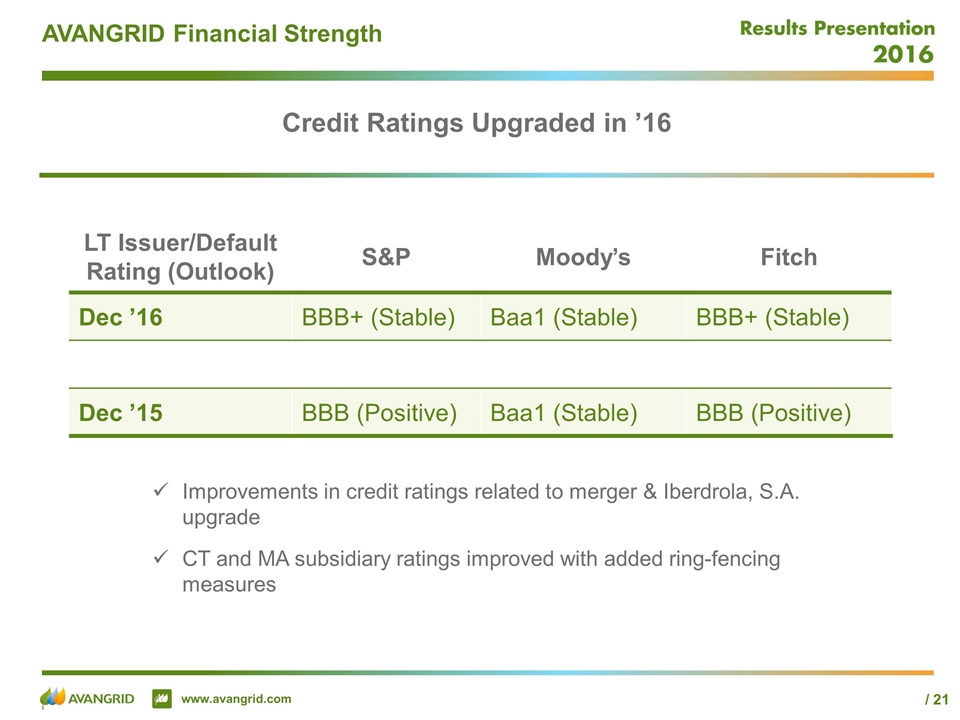

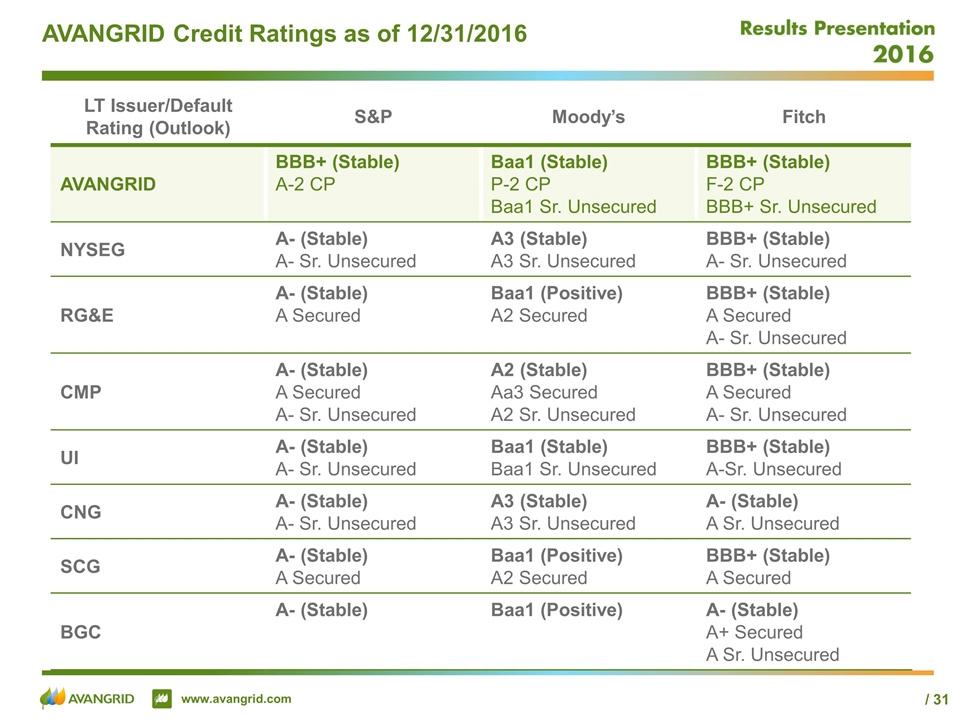

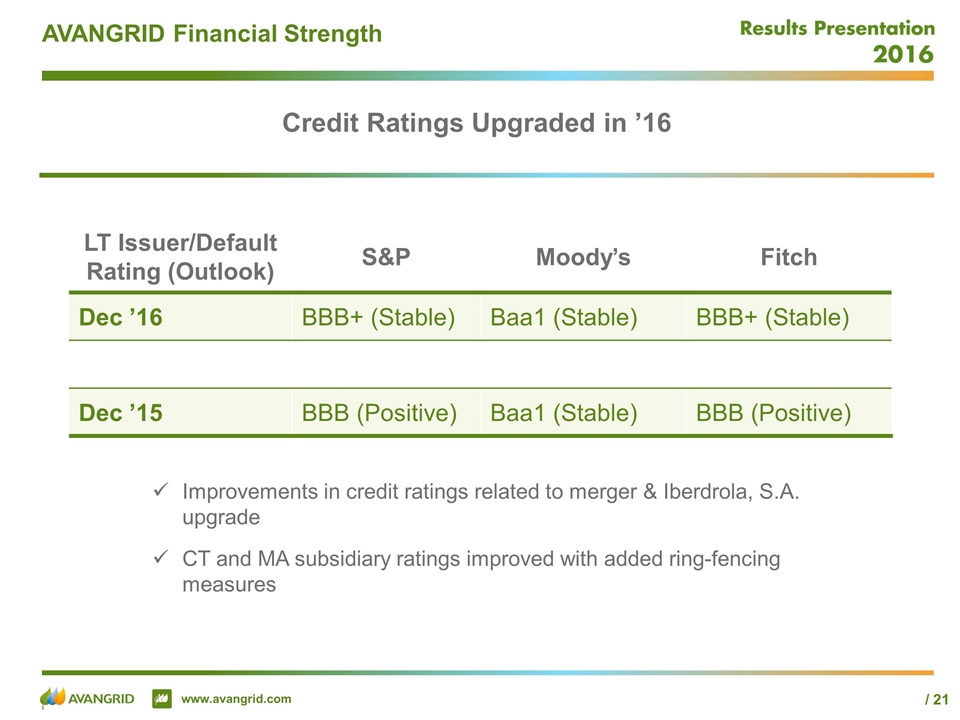

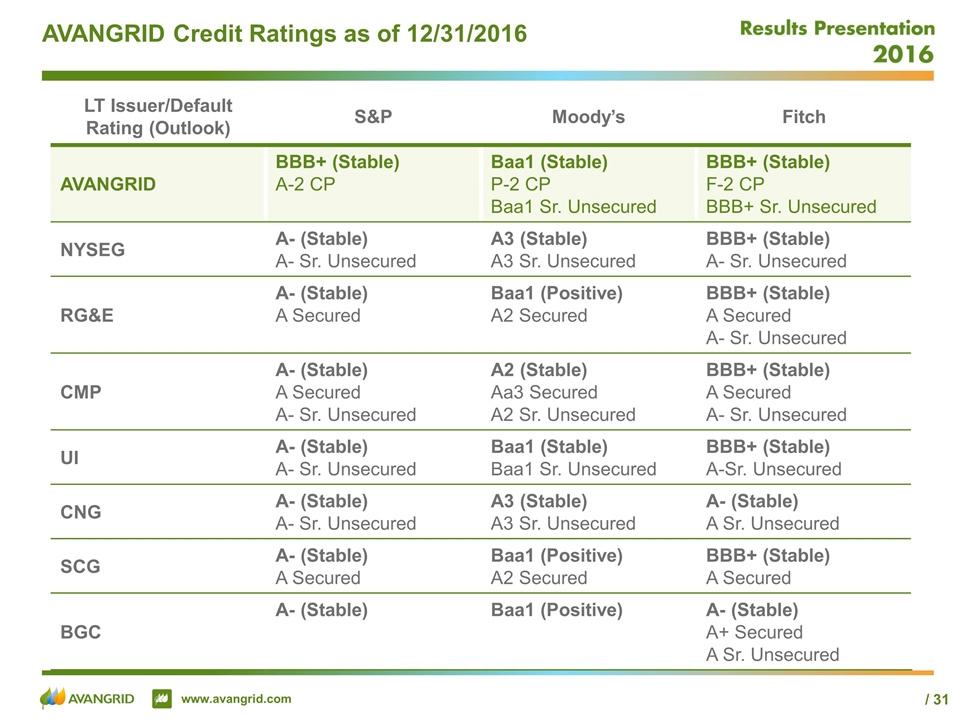

AVANGRID Financial Strength Credit Ratings Upgraded in ’16 Improvements in credit ratings related to merger & Iberdrola, S.A. upgrade CT and MA subsidiary ratings improved with added ring-fencing measures LT Issuer/Default Rating (Outlook) S&P Moody’s Fitch Dec ’16 BBB+ (Stable) Baa1 (Stable) BBB+ (Stable) Dec ’15 BBB (Positive) Baa1 (Stable) BBB (Positive)

Appendix

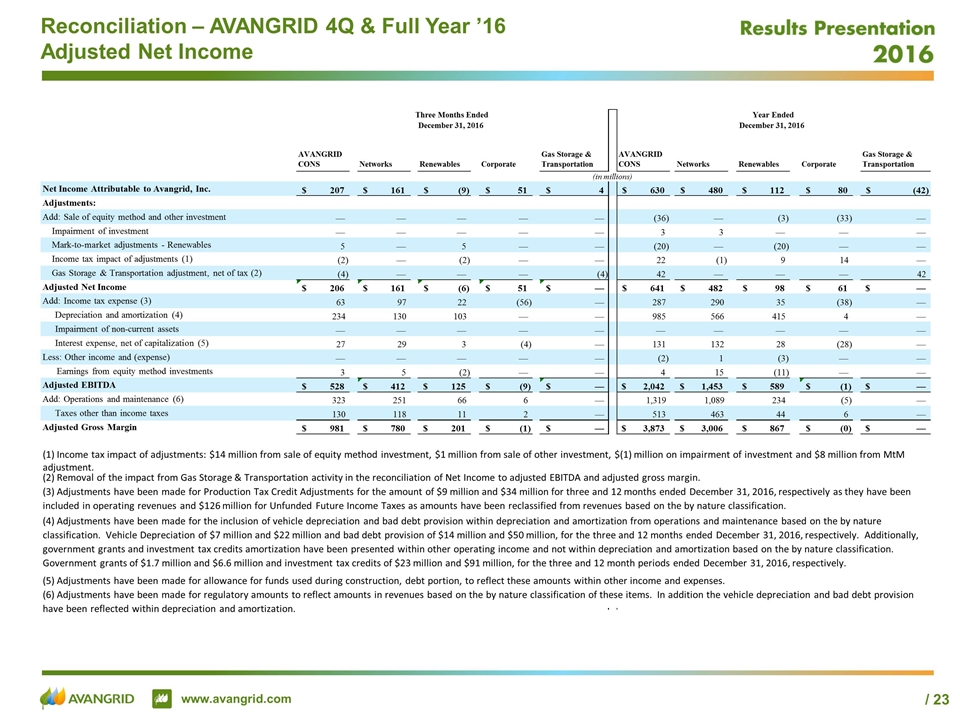

Reconciliation – AVANGRID 4Q & Full Year ’16 Adjusted Net Income AVANGRID CONS Networks Renewables Corporate Gas Storage & Transportation AVANGRID CONS Networks Renewables Corporate Gas Storage & Transportation Net Income Attributable to Avangrid, Inc. 207 $ 161 $ (9) $ 51 $ 4 $ 630 $ 480 $ 112 $ 80 $ (42) $ Adjustments: Add: Sale of equity method and other investment — — — — — (36) — (3) (33) — Impairment of investment — — — — — 3 3 — — — Mark-to-market adjustments - Renewables 5 — 5 — — (20) — (20) — — Income tax impact of adjustments (1) (2) — (2) — — 22 (1) 9 14 — Gas Storage & Transportation adjustment, net of tax (2) (4) — — — (4) 42 — — — 42 Adjusted Net Income 206 $ 161 $ (6) $ 51 $ — $ 641 $ 482 $ 98 $ 61 $ — $ Add: Income tax expense (3) 63 97 22 (56) — 287 290 35 (38) — Depreciation and amortization (4) 234 130 103 — — 985 566 415 4 — Impairment of non-current assets — — — — — — — — — — Interest expense, net of capitalization (5) 27 29 3 (4) — 131 132 28 (28) — Less: Other income and (expense) — — — — — (2) 1 (3) — — Earnings from equity method investments 3 5 (2) — — 4 15 (11) — — Adjusted EBITDA 528 $ 412 $ 125 $ (9) $ — $ 2,042 $ 1,453 $ 589 $ (1) $ — $ Add: Operations and maintenance (6) 323 251 66 6 — 1,319 1,089 234 (5) — Taxes other than income taxes 130 118 11 2 — 513 463 44 6 — Adjusted Gross Margin 981 $ 780 $ 201 $ (1) $ — $ 3,873 $ 3,006 $ 867 $ (0) $ — $ (1) Income tax impact of adjustments: $14 million from sale of equity method investment, $1 million from sale of other investment, $(1) million on impairment of investment and $8 million from MtM adjustment. (5) Adjustments have been made for allowance for funds used during construction, debt portion, to reflect these amounts within other income and expenses. (4) Adjustments have been made for the inclusion of vehicle depreciation and bad debt provision within depreciation and amortization from operations and maintenance based on the by nature classification. Vehicle Depreciation of $7 million and $22 million and bad debt provision of $14 million and $50 million, for the three and 12 months ended December 31, 2016, respectively. Additionally, government grants and investment tax credits amortization have been presented within other operating income and not within depreciation and amortization based on the by nature classification. Government grants of $1.7 million and $6.6 million and investment tax credits of $23 million and $91 million, for the three and 12 month periods ended December 31, 2016, respectively. (6) Adjustments have been made for regulatory amounts to reflect amounts in revenues based on the by nature classification of these items. In addition the vehicle depreciation and bad debt provision have been reflected within depreciation and amortization. (3) Adjustments have been made for Production Tax Credit Adjustments for the amount of $9 million and $34 million for three and 12 months ended December 31, 2016, respectively as they have been included in operating revenues and $126 million for Unfunded Future Income Taxes as amounts have been reclassified from revenues based on the by nature classification. Three Months Ended Year Ended December 31, 2016 December 31, 2016 (in millions) (2) Removal of the impact from Gas Storage & Transportation activity in the reconciliation of Net Income to adjusted EBITDA and adjusted gross margin.

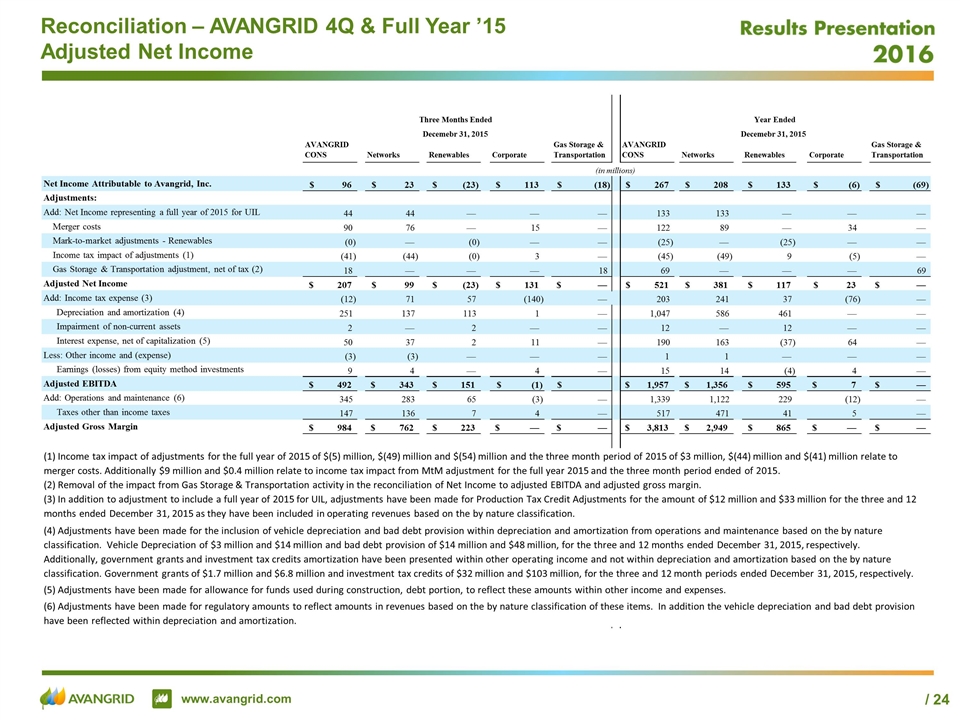

Reconciliation – AVANGRID 4Q & Full Year ’15 Adjusted Net Income AVANGRID CONS Networks Renewables Corporate Gas Storage & Transportation AVANGRID CONS Networks Renewables Corporate Gas Storage & Transportation Net Income Attributable to Avangrid, Inc. 96 $ 23 $ (23) $ 113 $ (18) $ 267 $ 208 $ 133 $ (6) $ (69) $ Adjustments: Add: Net Income representing a full year of 2015 for UIL 44 44 — — — 133 133 — — — Merger costs 90 76 — 15 — 122 89 — 34 — Mark-to-market adjustments - Renewables (0) — (0) — — (25) — (25) — — Income tax impact of adjustments (1) (41) (44) (0) 3 — (45) (49) 9 (5) — Gas Storage & Transportation adjustment, net of tax (2) 18 — — — 18 69 — — — 69 Adjusted Net Income 207 $ 99 $ (23) $ 131 $ — $ 521 $ 381 $ 117 $ 23 $ — $ Add: Income tax expense (3) (12) 71 57 (140) — 203 241 37 (76) — Depreciation and amortization (4) 251 137 113 1 — 1,047 586 461 — — Impairment of non-current assets 2 — 2 — — 12 — 12 — — Interest expense, net of capitalization (5) 50 37 2 11 — 190 163 (37) 64 — Less: Other income and (expense) (3) (3) — — — 1 1 — — — Earnings (losses) from equity method investments 9 4 — 4 — 15 14 (4) 4 — Adjusted EBITDA 492 $ 343 $ 151 $ (1) $ $ 1,957 $ 1,356 $ 595 $ 7 $ — $ Add: Operations and maintenance (6) 345 283 65 (3) — 1,339 1,122 229 (12) — Taxes other than income taxes 147 136 7 4 — 517 471 41 5 — Adjusted Gross Margin 984 $ 762 $ 223 $ — $ — $ 3,813 $ 2,949 $ 865 $ — $ — $ (5) Adjustments have been made for allowance for funds used during construction, debt portion, to reflect these amounts within other income and expenses. (2) Removal of the impact from Gas Storage & Transportation activity in the reconciliation of Net Income to adjusted EBITDA and adjusted gross margin. (6) Adjustments have been made for regulatory amounts to reflect amounts in revenues based on the by nature classification of these items. In addition the vehicle depreciation and bad debt provision have been reflected within depreciation and amortization. Three Months Ended Year Ended Decemebr 31, 2015 Decemebr 31, 2015 (in millions) (3) In addition to adjustment to include a full year of 2015 for UIL, adjustments have been made for Production Tax Credit Adjustments for the amount of $12 million and $33 million for the three and 12 months ended December 31, 2015 as they have been included in operating revenues based on the by nature classification. (4) Adjustments have been made for the inclusion of vehicle depreciation and bad debt provision within depreciation and amortization from operations and maintenance based on the by nature classification. Vehicle Depreciation of $3 million and $14 million and bad debt provision of $14 million and $48 million, for the three and 12 months ended December 31, 2015, respectively. Additionally, government grants and investment tax credits amortization have been presented within other operating income and not within depreciation and amortization based on the by nature classification. Government grants of $1.7 million and $6.8 million and investment tax credits of $32 million and $103 million, for the three and 12 month periods ended December 31, 2015, respectively. (1) Income tax impact of adjustments for the full year of 2015 of $(5) million, $(49) million and $(54) million and the three month period of 2015 of $3 million, $(44) million and $(41) million relate to merger costs. Additionally $9 million and $0.4 million relate to income tax impact from MtM adjustment for the full year 2015 and the three month period ended of 2015.

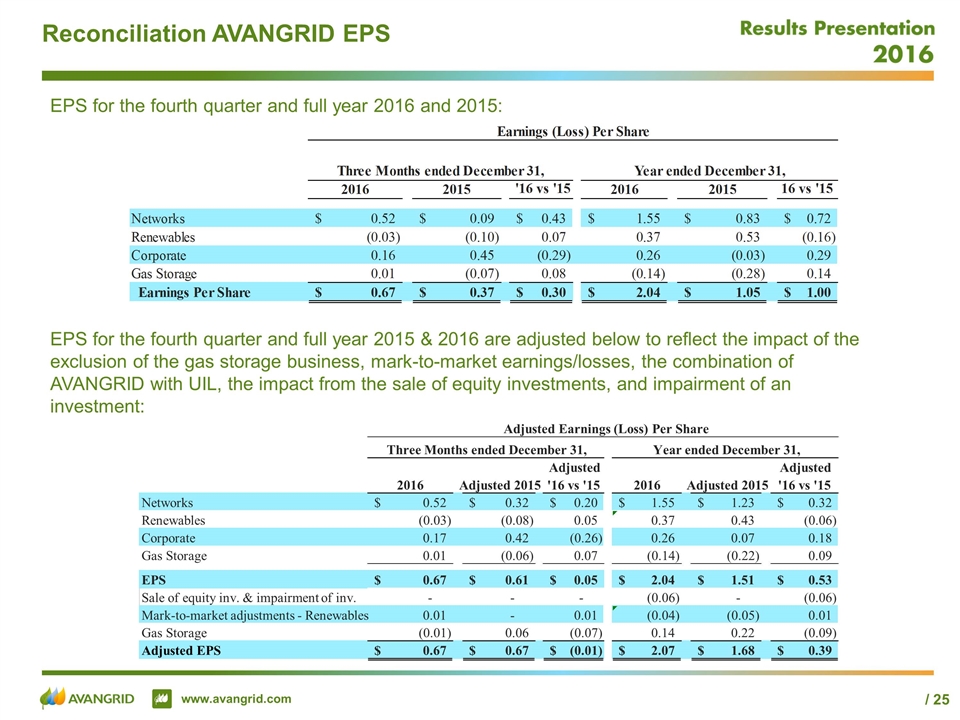

Reconciliation AVANGRID EPS EPS for the fourth quarter and full year 2016 and 2015: EPS for the fourth quarter and full year 2015 & 2016 are adjusted below to reflect the impact of the exclusion of the gas storage business, mark-to-market earnings/losses, the combination of AVANGRID with UIL, the impact from the sale of equity investments, and impairment of an investment: 2016 Adjusted 2015 Adjusted '16 vs '15 2016 Adjusted 2015 Adjusted '16 vs '15 Networks 0.52 $ 0.32 $ 0.20 $ 1.55 $ 1.23 $ 0.32 $ Renewables (0.03) (0.08) 0.05 0.37 0.43 (0.06) Corporate 0.17 0.42 (0.26) 0.26 0.07 0.18 Gas Storage 0.01 (0.06) 0.07 (0.14) (0.22) 0.09 EPS 0.67 $ 0.61 $ 0.05 $ 2.04 $ 1.51 $ 0.53 $ Sale of equity inv. & impairment of inv. - - - (0.06) - (0.06) Mark-to-market adjustments - Renewables 0.01 - 0.01 (0.04) (0.05) 0.01 Gas Storage (0.01) 0.06 (0.07) 0.14 0.22 (0.09) Adjusted EPS 0.67 $ 0.67 $ (0.01) $ 2.07 $ 1.68 $ 0.39 $ Adjusted Earnings (Loss) Per Share Three Months ended December 31, Year ended December 31,

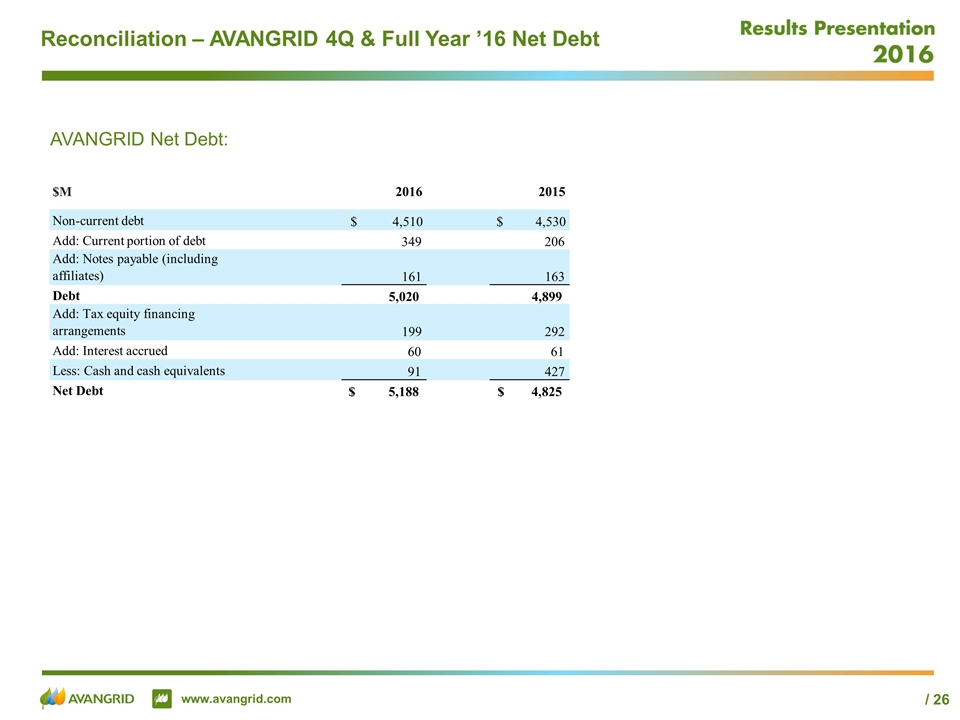

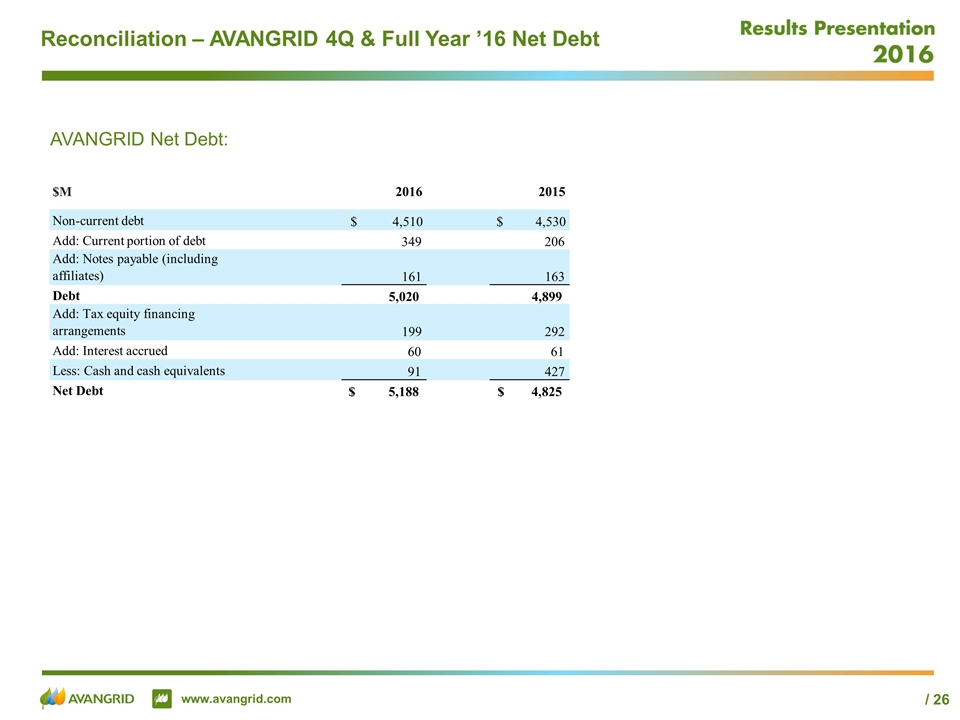

Reconciliation – AVANGRID 4Q & Full Year ’16 Net Debt AVANGRID Net Debt: $M 2016 2015 Non-current debt 4,510 $ 4,530 $ Add: Current portion of debt 349 206 Add: Notes payable (including affiliates) 161 163 Debt 5,020 4,899 Add: Tax equity financing arrangements 199 292 Add: Interest accrued 60 61 Less: Cash and cash equivalents 91 427 Net Debt 5,188 $ 4,825 $

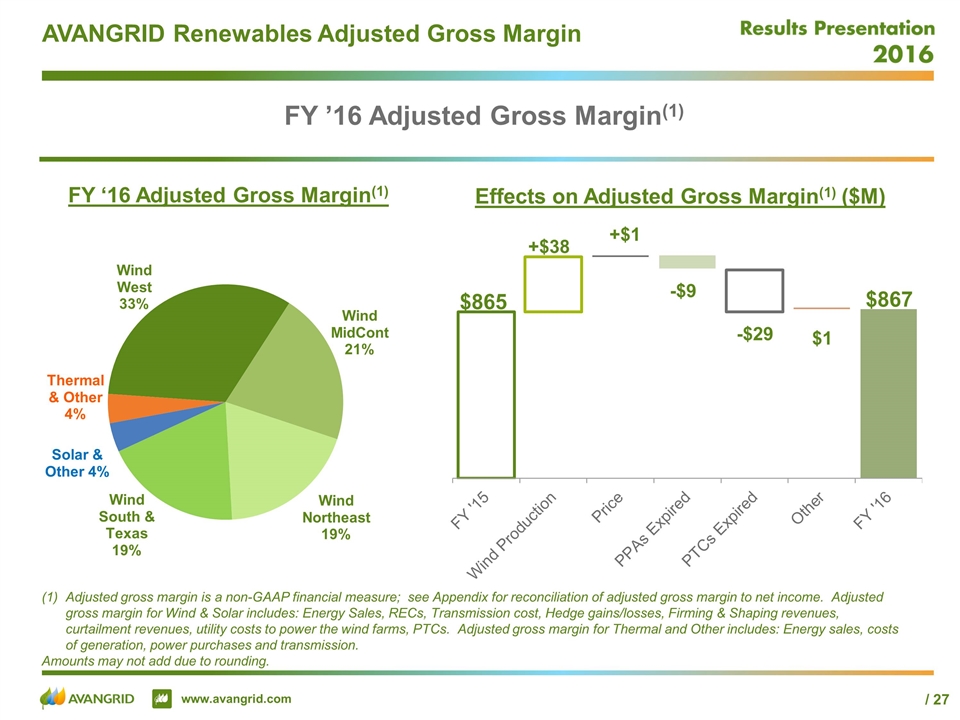

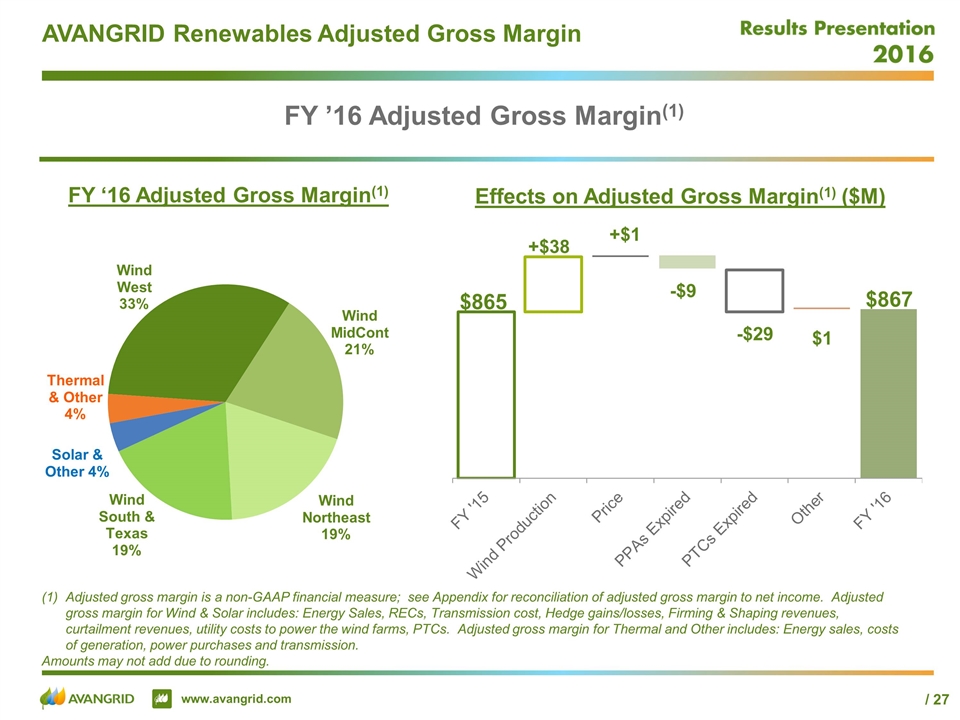

AVANGRID Renewables Adjusted Gross Margin FY ’16 Adjusted Gross Margin(1) $865 +$38 Adjusted gross margin is a non-GAAP financial measure; see Appendix for reconciliation of adjusted gross margin to net income. Adjusted gross margin for Wind & Solar includes: Energy Sales, RECs, Transmission cost, Hedge gains/losses, Firming & Shaping revenues, curtailment revenues, utility costs to power the wind farms, PTCs. Adjusted gross margin for Thermal and Other includes: Energy sales, costs of generation, power purchases and transmission. Amounts may not add due to rounding. $867 +$1 -$9 -$29 Effects on Adjusted Gross Margin(1) ($M) FY ‘16 Adjusted Gross Margin(1) $1

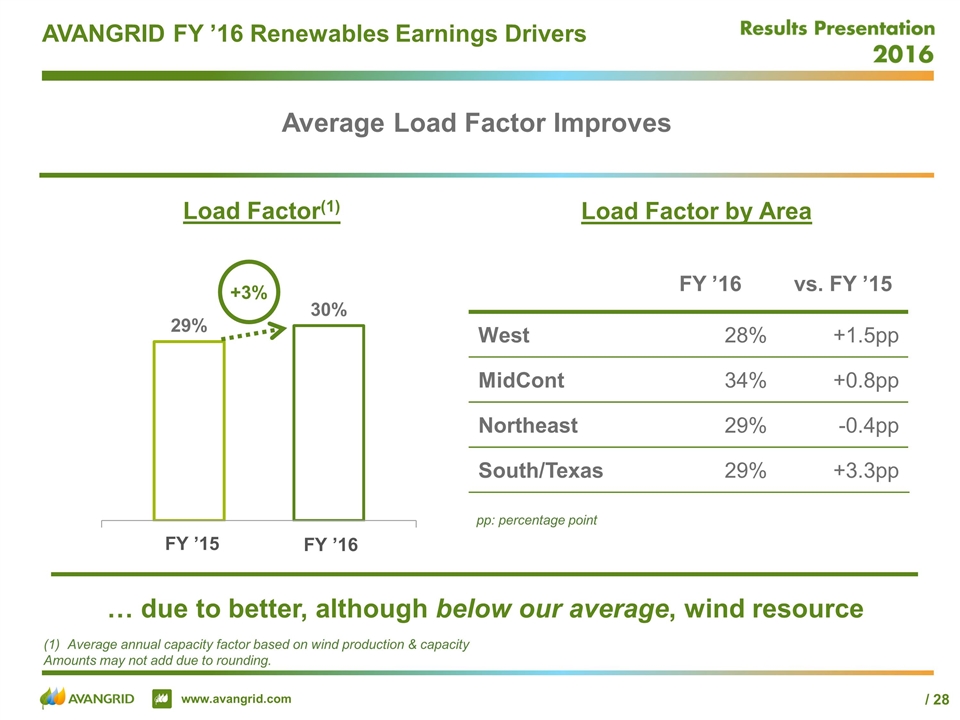

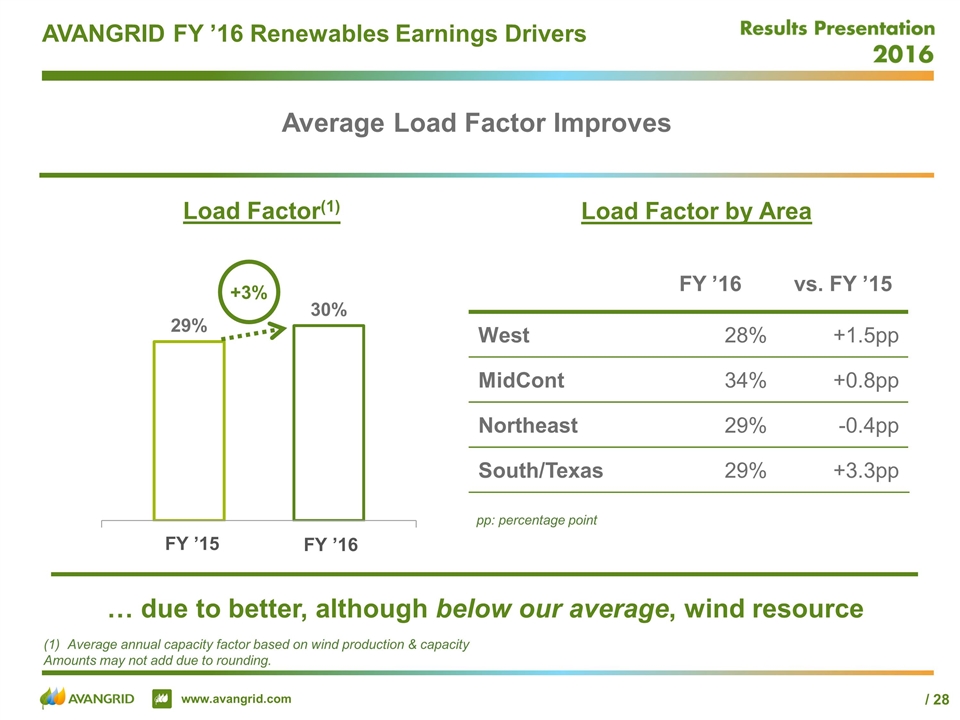

AVANGRID FY ’16 Renewables Earnings Drivers Average Load Factor Improves Load Factor(1) Average annual capacity factor based on wind production & capacity Amounts may not add due to rounding. … due to better, although below our average, wind resource FY ’15 FY ’16 +3% Load Factor by Area pp: percentage point FY ’16 vs. FY ’15 West 28% +1.5pp MidCont 34% +0.8pp Northeast 29% -0.4pp South/Texas 29% +3.3pp

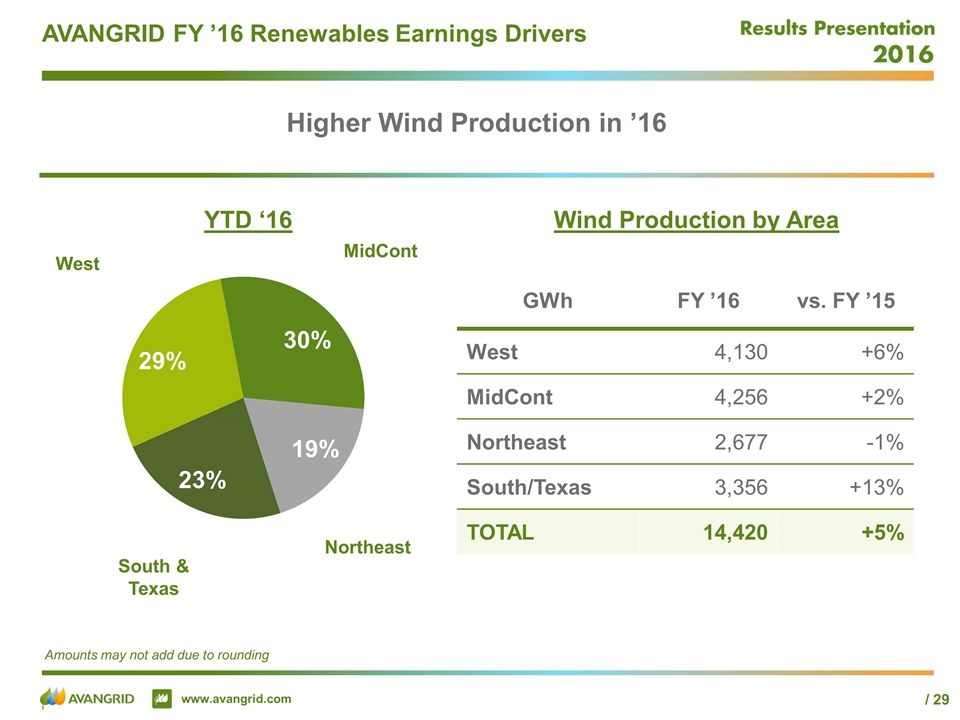

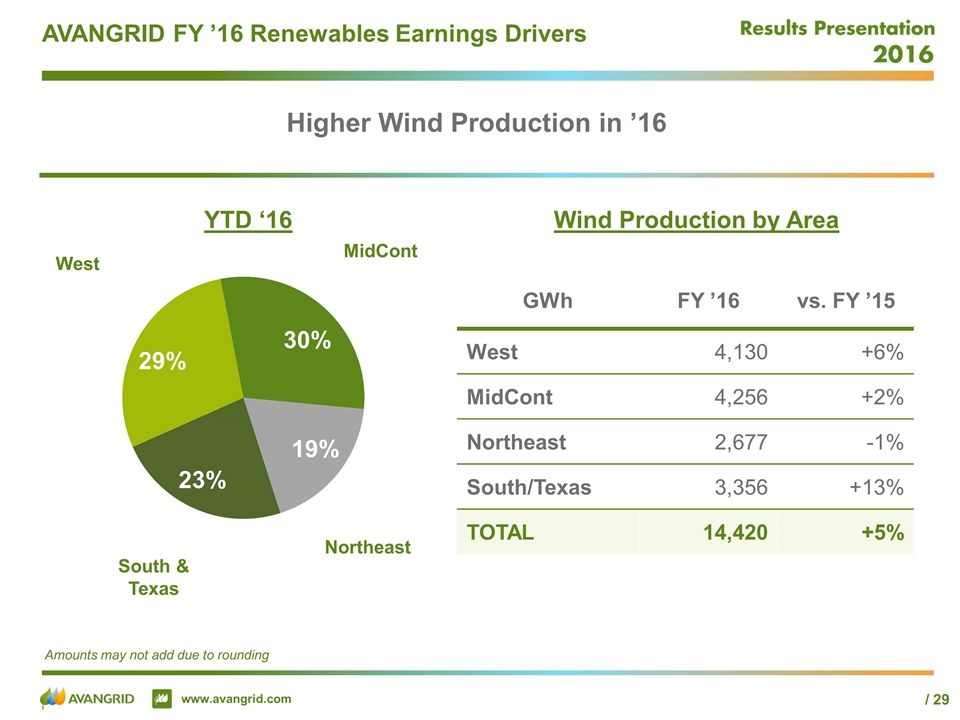

AVANGRID FY ’16 Renewables Earnings Drivers Higher Wind Production in ’16 YTD ‘16 Amounts may not add due to rounding Wind Production by Area GWh FY ’16 vs. FY ’15 West 4,130 +6% MidCont 4,256 +2% Northeast 2,677 -1% South/Texas 3,356 +13% TOTAL 14,420 +5% MidCont West South & Texas Northeast

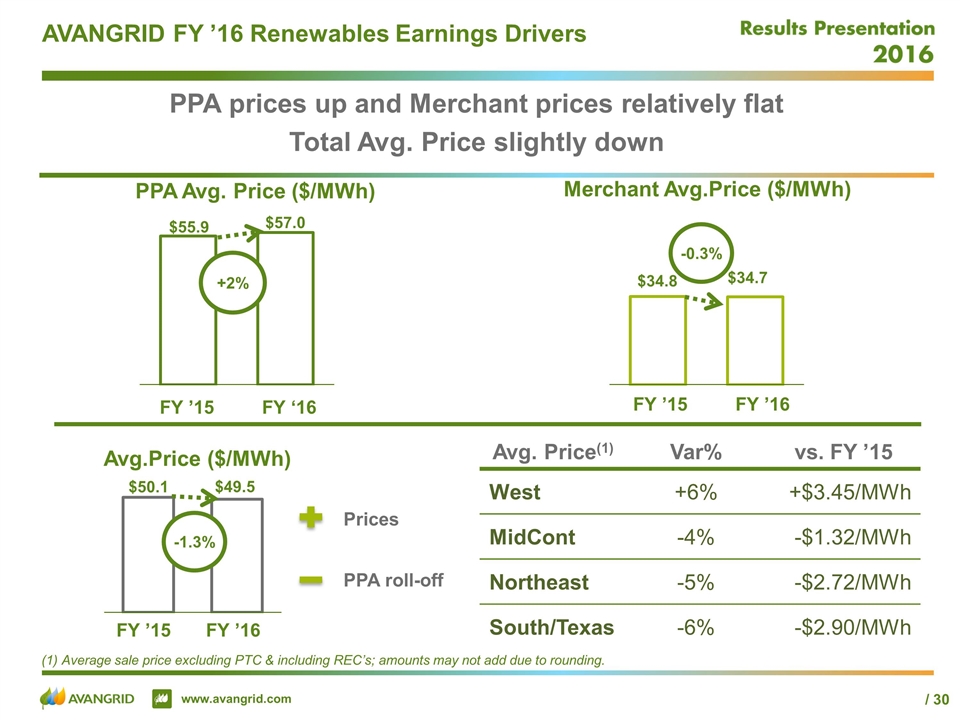

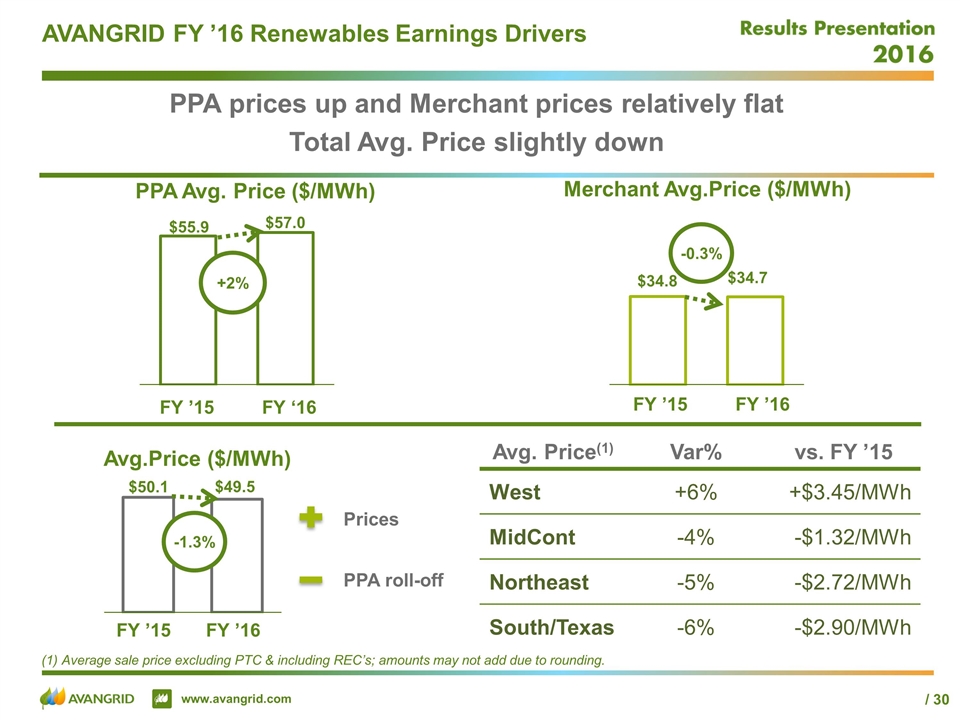

AVANGRID FY ’16 Renewables Earnings Drivers PPA prices up and Merchant prices relatively flat Total Avg. Price slightly down (1) Average sale price excluding PTC & including REC’s; amounts may not add due to rounding. FY ’15 FY ’16 -0.3% FY ’15 FY ‘16 +2% $55.9 $57.0 PPA Avg. Price ($/MWh) Merchant Avg.Price ($/MWh) FY ’15 FY ’16 -1.3% $50.1 $49.5 Avg.Price ($/MWh) Prices PPA roll-off Avg. Price(1) Var% vs. FY ’15 West +6% +$3.45/MWh MidCont -4% -$1.32/MWh Northeast -5% -$2.72/MWh South/Texas -6% -$2.90/MWh

AVANGRID Credit Ratings as of 12/31/2016 LT Issuer/Default Rating (Outlook) S&P Moody’s Fitch AVANGRID BBB+ (Stable) A-2 CP Baa1 (Stable) P-2 CP Baa1 Sr. Unsecured BBB+ (Stable) F-2 CP BBB+ Sr. Unsecured NYSEG A- (Stable) A- Sr. Unsecured A3 (Stable) A3 Sr. Unsecured BBB+ (Stable) A- Sr. Unsecured RG&E A- (Stable) A Secured Baa1 (Positive) A2 Secured BBB+ (Stable) A Secured A- Sr. Unsecured CMP A- (Stable) A Secured A- Sr. Unsecured A2 (Stable) Aa3 Secured A2 Sr. Unsecured BBB+ (Stable) A Secured A- Sr. Unsecured UI A- (Stable) A- Sr. Unsecured Baa1 (Stable) Baa1 Sr. Unsecured BBB+ (Stable) A-Sr. Unsecured CNG A- (Stable) A- Sr. Unsecured A3 (Stable) A3 Sr. Unsecured A- (Stable) A Sr. Unsecured SCG A- (Stable) A Secured Baa1 (Positive) A2 Secured BBB+ (Stable) A Secured BGC A- (Stable) Baa1 (Positive) A- (Stable) A+ Secured A Sr. Unsecured

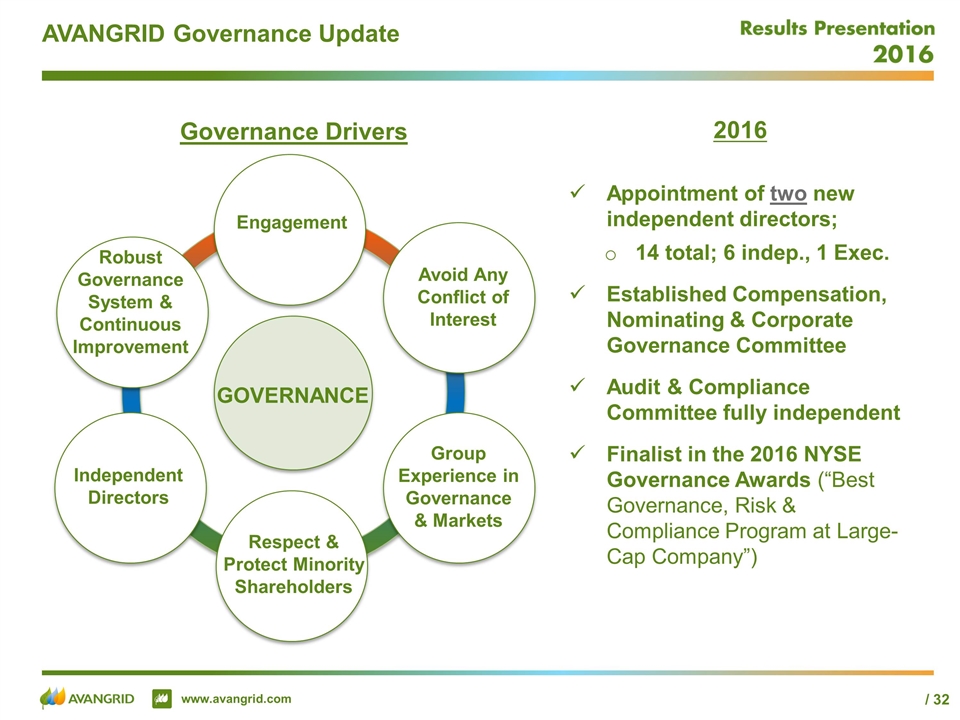

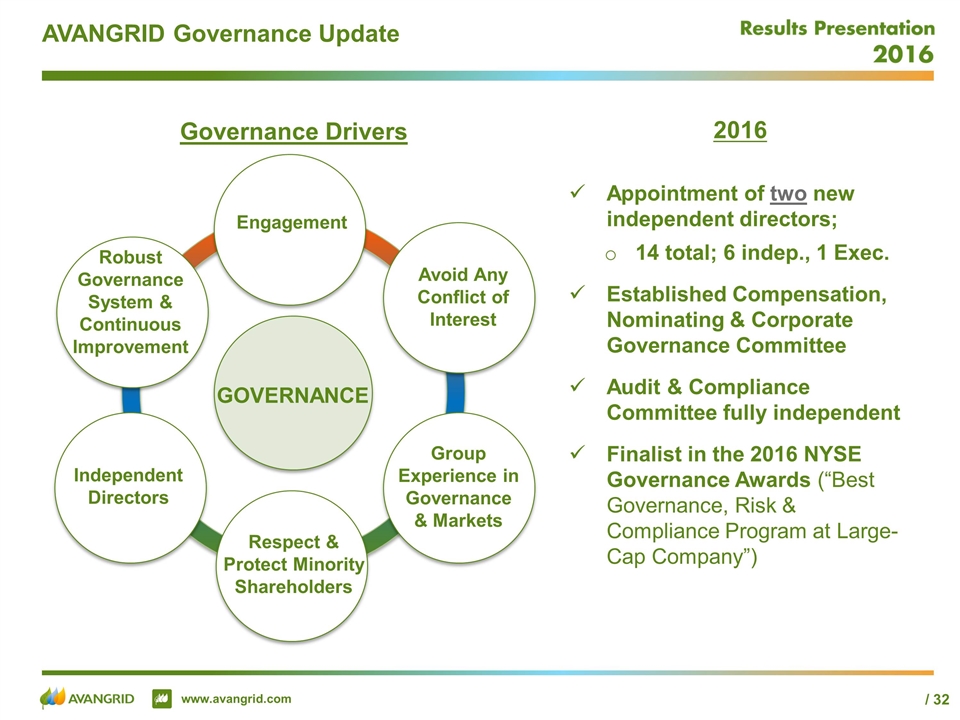

AVANGRID Governance Update Engagement Avoid Any Conflict of Interest Group Experience in Governance & Markets Independent Directors Respect & Protect Minority Shareholders GOVERNANCE Robust Governance System & Continuous Improvement Governance Drivers 2016 Appointment of two new independent directors; 14 total; 6 indep., 1 Exec. Established Compensation, Nominating & Corporate Governance Committee Audit & Compliance Committee fully independent Finalist in the 2016 NYSE Governance Awards (“Best Governance, Risk & Compliance Program at Large-Cap Company”)