Exhibit 99.2

Legal Notice Investors@AVANGRID.com James Torgerson Chief Executive Officer Richard Nicholas Chief Financial Officer FORWARD LOOKING STATEMENTS Certain statements in this presentation may relate to our future business and financial performance and future events or developments involving us and our subsidiaries that are not purely historical and may constitute “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Forward-looking statements may be identified by the use of forward-looking terms such as “may,” “will,” “should,” “can,” “expects,” “believes,” “anticipates,” “intends,” “plans,” “estimates,” “projects,” “assumes,” “guides,” “targets,” “forecasts,” “is confident that” and “seeks” or the negative of such terms or other variations on such terms or comparable terminology. Such forward looking statements include, but are not limited to, statements about our plans, objectives and intentions, outlooks or expectations for earnings, revenues, expenses or other future financial or business performance, strategies or expectations, or the impact of legal or regulatory matters on our business, results of operations or financial condition. Such statements are based upon the current beliefs and expectations of our management and are subject to significant risks and uncertainties that could cause actual outcomes and results to differ materially. Important factors that could cause actual results to differ materially from those indicated by such forward-looking statements include, without limitation, the risks and uncertainties set forth under the section entitled “Risk Factors” and “Management’s Discussion and Analysis of Financial Condition and Results of Operations” in our Annual Report on Form 10-K for the year ended December 31, 2016 and our Quarterly Report on Form 10-Q for the six months ended June 30, 2017, which is on file with the Securities and Exchange Commission (SEC) and available on our investor relations website at www.Avangrid.com and on the SEC website at www.sec.gov. Additional information will also be set forth in subsequent filings with the SEC. You should consider these factors carefully in evaluating for-ward looking statements. Should one or more of these risks or uncertainties materialize, or should any of the underlying assumptions prove incorrect, actual results may vary in material respects from those expressed or implied by these forward-looking statements. You should not place undue reliance on these forward-looking statements. We do not undertake any obligation to update or revise any forward-looking statements to reflect events or circumstances after the date of this presentation whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws. About AVANGRID Avangrid, Inc. (NYSE: AGR) is a diversified energy and utility company with approximately $32 billion in assets and operations in 27 states. The company owns regulated utilities and electricity generation assets through two primary lines of business, Avangrid Networks and Avangrid Renewables. Avangrid Networks is comprised of eight electric and natural gas utilities, serving approximately 3.2 million customers in New York and New England. Avangrid Renewables operates 6.6 gigawatts of electricity capacity, primarily through wind power, in 23 states across the United States. AVANGRID employs approximately 6,800 people. For more information, visit www.avangrid.com.

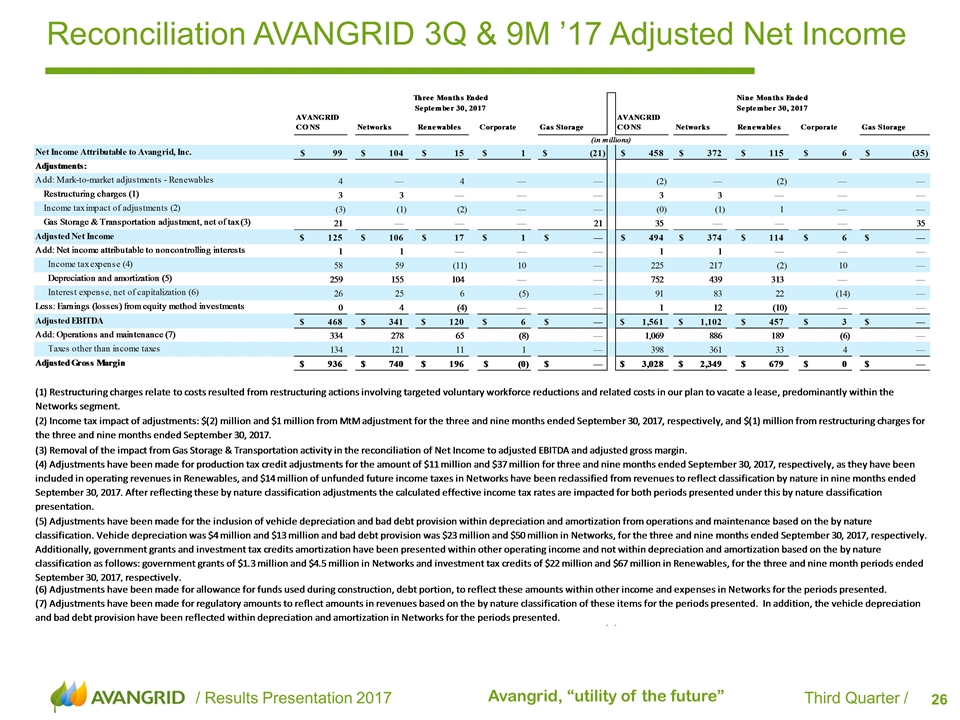

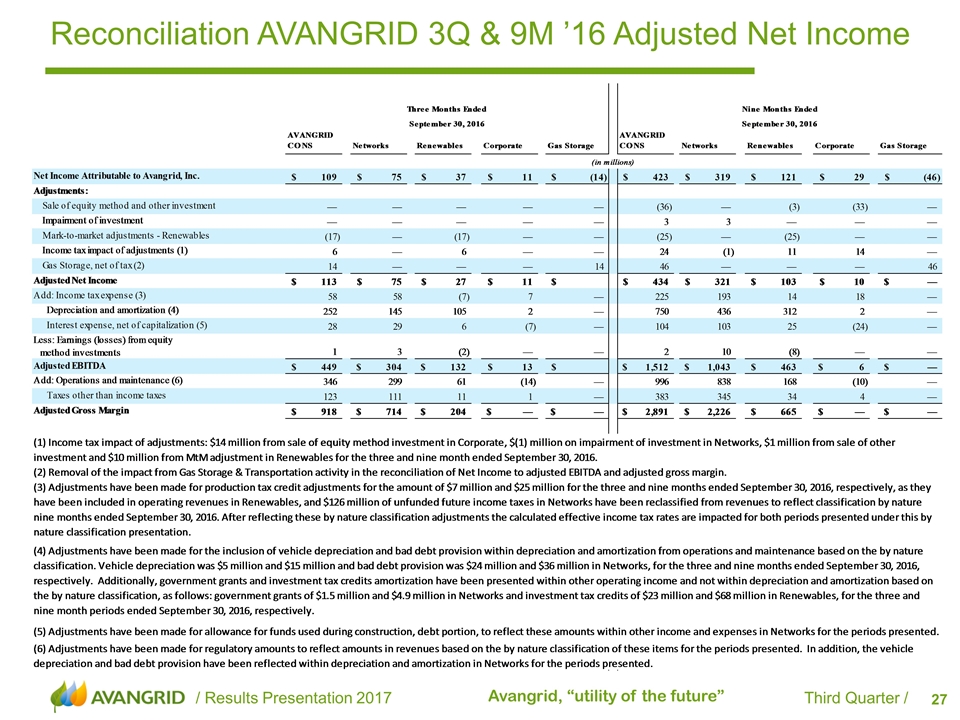

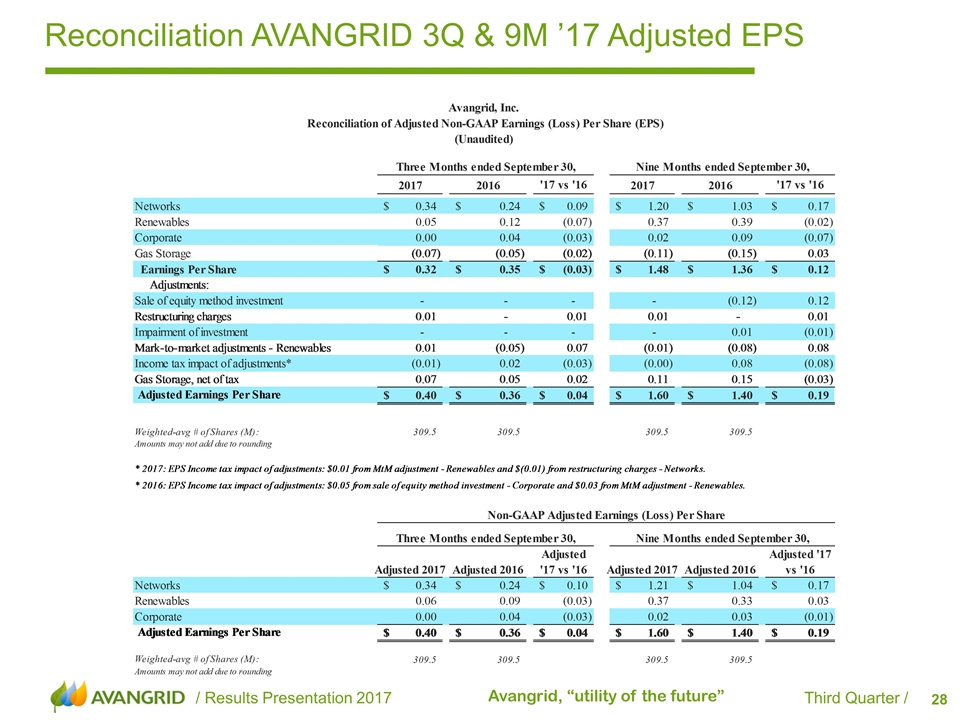

Legal Notice Use of Non-GAAP Financial Measures To supplement our consolidated financial statements presented in accordance with U.S. GAAP, AVANGRID considers certain non-GAAP financial measures that are not prepared in accordance with U.S. GAAP, including adjusted net income, adjusted EPS, adjusted gross margin and adjusted EBITDA. The non-GAAP financial measures we use are specific to AVANGRID and the non-GAAP financial measures of other companies may not be calculated in the same manner. We use these non-GAAP financial measures, in addition to U.S. GAAP measures, to establish operating budgets and operational goals to manage and monitor our business, evaluate our operating and financial performance and to compare such performance to prior periods and to the performance of our competitors. We believe that presenting such non-GAAP financial measures is useful because such measures can be used to analyze and compare profitability between companies and industries because it eliminates the impact of financing and certain non-cash charges as well as allow for an evaluation of AVANGRID with a focus on the performance of its core operations. In addition, we present non-GAAP financial measures because we believe that they and other similar measures are widely used by certain investors, securities analysts and other interested parties as supplemental measures of performance. We provide adjusted net income, which is adjusted to reflect the effect of mark-to-market changes in the fair value of derivative instruments used by AVANGRID to economically hedge market price fluctuations in related underlying physical transactions for the purchase and sale of electricity, adjustments for the non-core Gas Storage business, restructuring charges, and the impairment of certain investments and excludes the sale of certain equity investments. We define adjusted EBITDA as net income attributable to AVANGRID, adding back income tax expense, depreciation, amortization, impairment of non-current assets and interest expense, net of capitalization, and then subtracting other income and earnings from equity method investments. We also define adjusted gross margin as adjusted EBITDA adding back operations and maintenance and taxes other than income taxes and then subtracting transmission wheeling. The most directly comparable U.S. GAAP measure to adjusted EBITDA and adjusted gross margin is net income. We believe that presenting these non-GAAP financial measures is useful in understanding and evaluating actual and projected financial performance and contribution of AVANGRID core lines of business and to more fully compare and explain our results. The most directly comparable U.S. GAAP measure to adjusted net income is net income. We also provide adjusted EPS, which is adjusted net income converted to an earnings per share amount. The use of non-GAAP financial measures is not intended to be considered in isolation or as a substitute for, or superior to, AVANGRID’s U.S. GAAP financial information, and investors are cautioned that the non-GAAP financial measures are limited in their usefulness, may be unique to AVANGRID, and should be considered only as a supplement to AVANGRID’s U.S. GAAP financial measures. The non-GAAP financial measures may not be comparable to other similarly titled measures of other companies and have limitations as analytical tools. Non-GAAP financial measures are not primary measurements of our performance under U.S. GAAP and should not be considered as alternatives to operating income, net income or any other performance measures determined in accordance with U.S. GAAP.

3Q & 9M ’17 Highlights James Torgerson

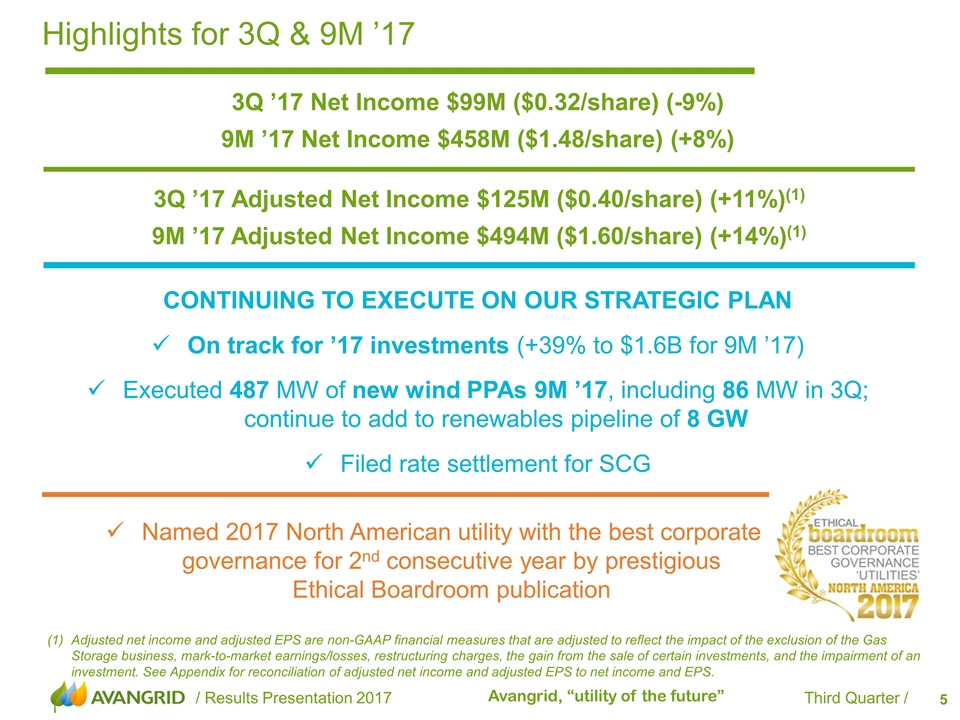

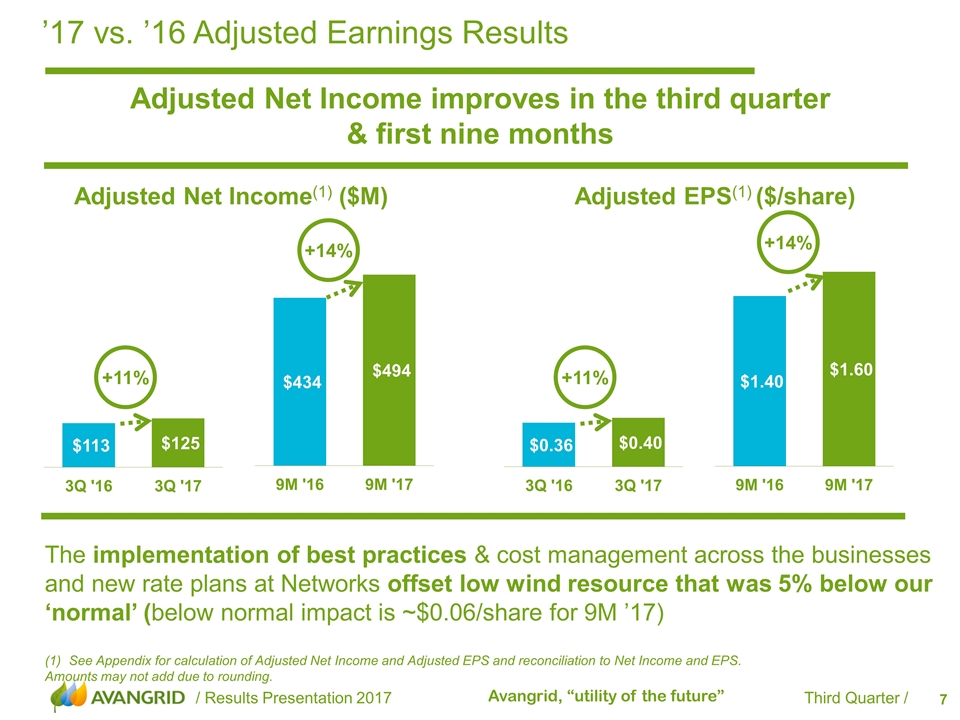

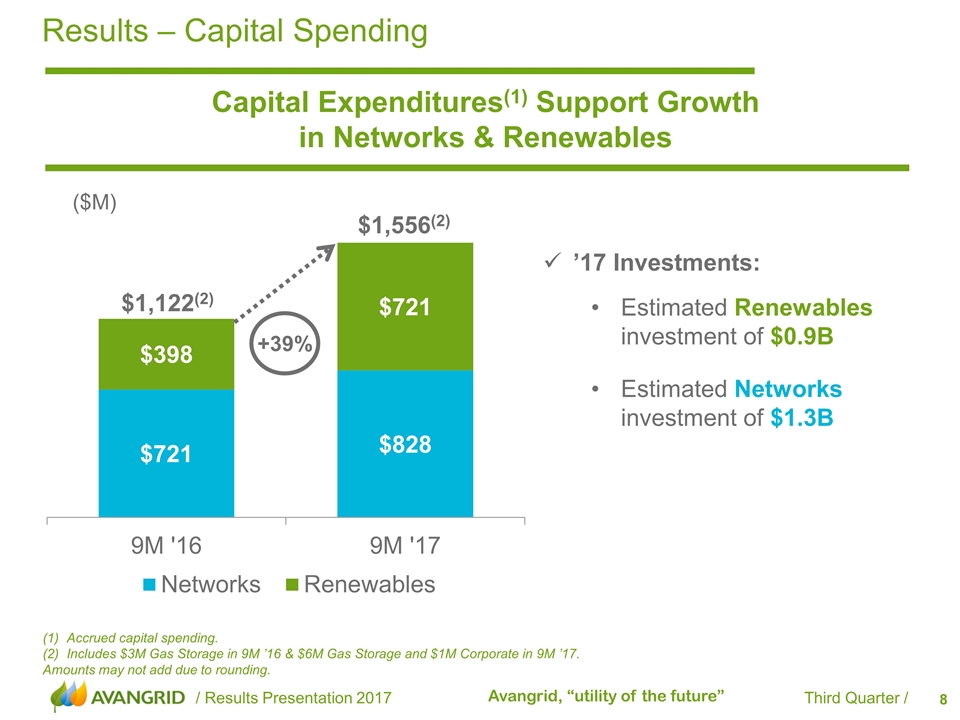

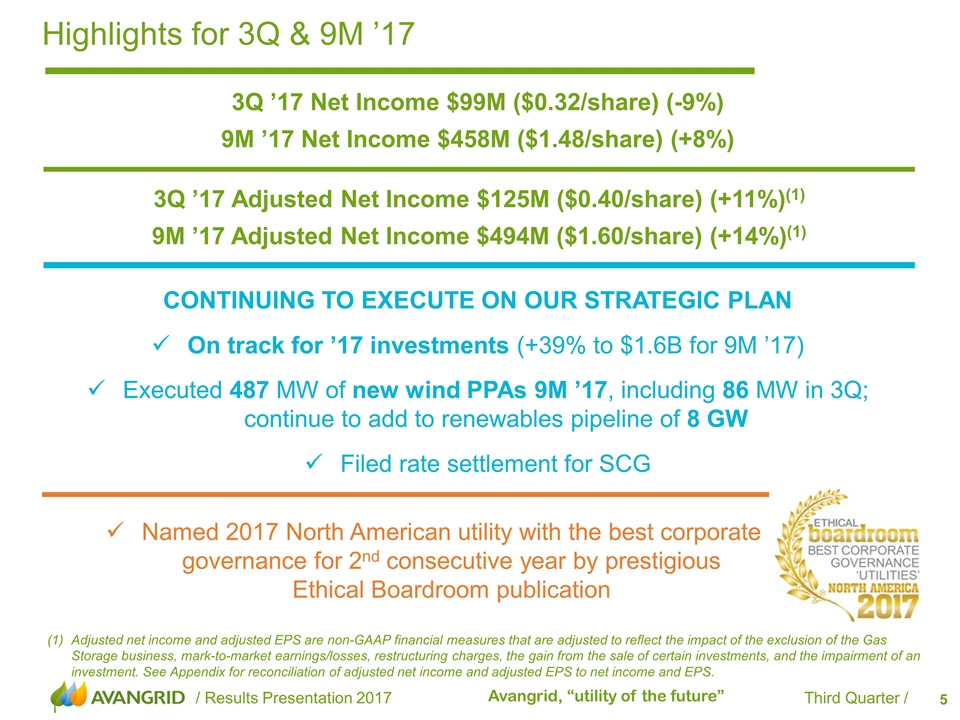

Continuing to Execute on our strategic plan On track for ’17 investments (+39% to $1.6B for 9M ’17) Executed 487 MW of new wind PPAs 9M ’17, including 86 MW in 3Q; continue to add to renewables pipeline of 8 GW Filed rate settlement for SCG Highlights for 3Q & 9M ’17 Named 2017 North American utility with the best corporate governance for 2nd consecutive year by prestigious Ethical Boardroom publication Adjusted net income and adjusted EPS are non-GAAP financial measures that are adjusted to reflect the impact of the exclusion of the Gas Storage business, mark-to-market earnings/losses, restructuring charges, the gain from the sale of certain investments, and the impairment of an investment. See Appendix for reconciliation of adjusted net income and adjusted EPS to net income and EPS. 3Q ’17 Adjusted Net Income $125M ($0.40/share) (+11%)(1) 9M ’17 Adjusted Net Income $494M ($1.60/share) (+14%)(1) 3Q ’17 Net Income $99M ($0.32/share) (-9%) 9M ’17 Net Income $458M ($1.48/share) (+8%)

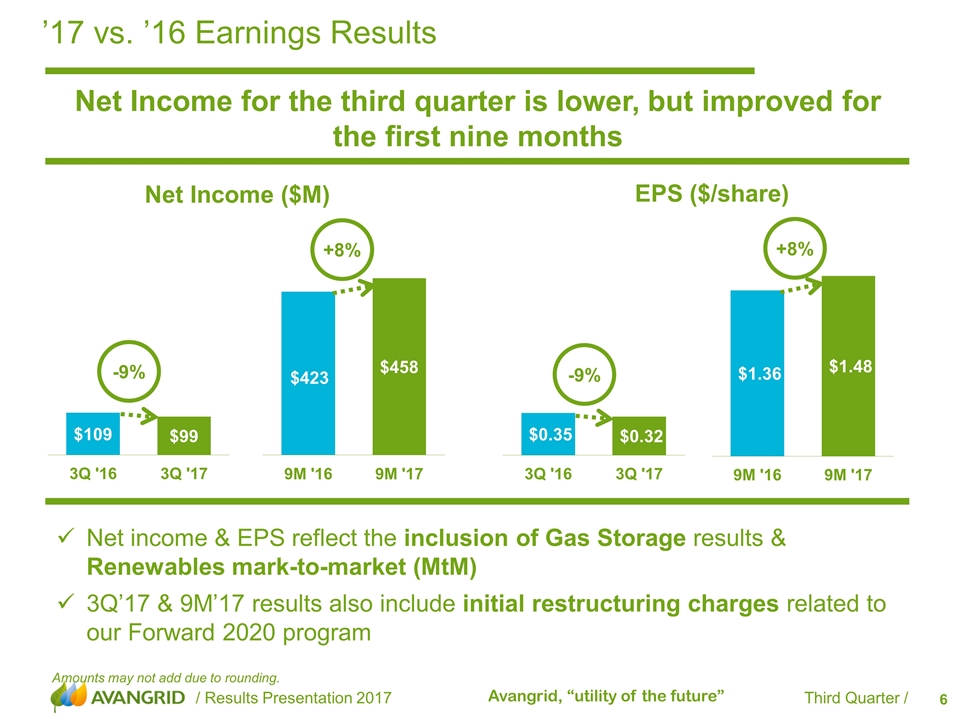

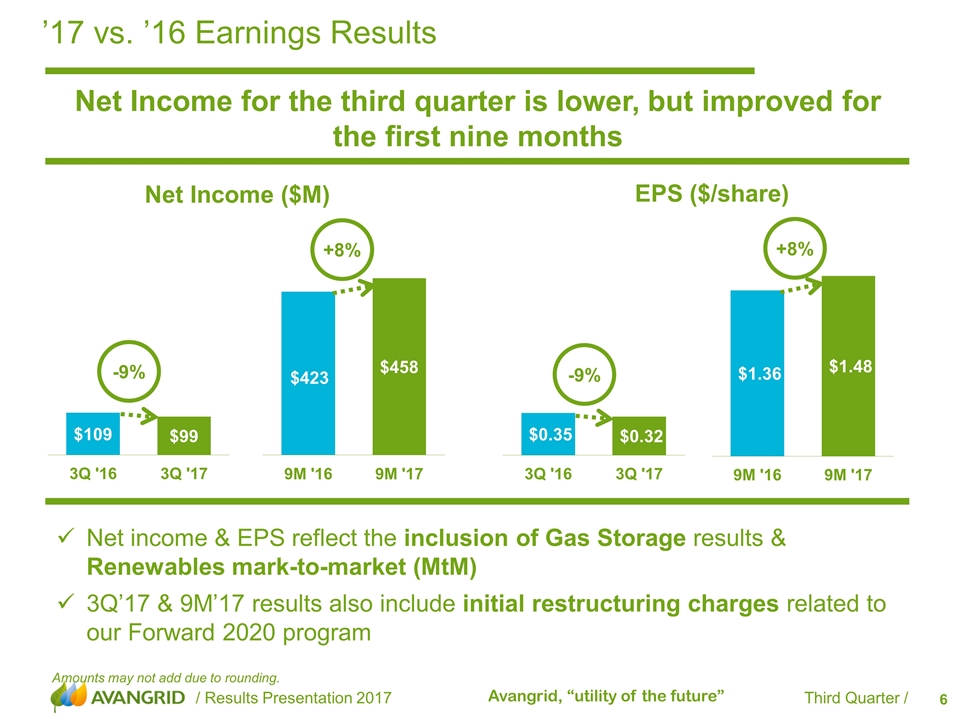

’17 vs. ’16 Earnings Results Net Income ($M) EPS ($/share) -9% +8% -9% +8% Amounts may not add due to rounding. Net Income for the third quarter is lower, but improved for the first nine months Net income & EPS reflect the inclusion of Gas Storage results & Renewables mark-to-market (MtM) 3Q’17 & 9M’17 results also include initial restructuring charges related to our Forward 2020 program

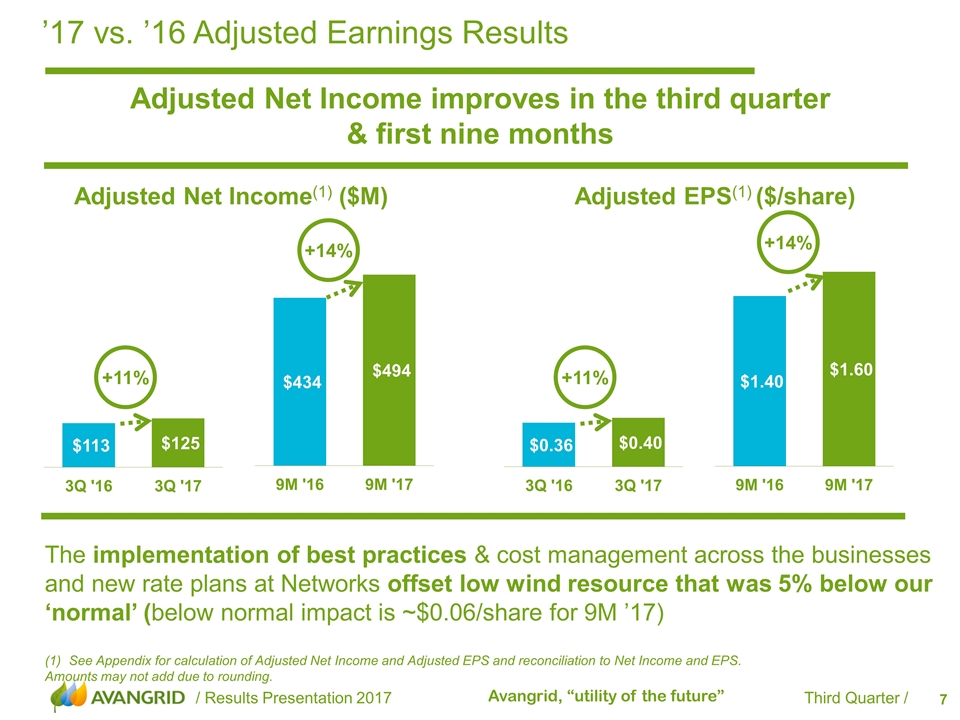

Adjusted Net Income improves in the third quarter & first nine months ’17 vs. ’16 Adjusted Earnings Results See Appendix for calculation of Adjusted Net Income and Adjusted EPS and reconciliation to Net Income and EPS. Amounts may not add due to rounding. Adjusted Net Income(1) ($M) Adjusted EPS(1) ($/share) +11% +14% +11% +14% The implementation of best practices & cost management across the businesses and new rate plans at Networks offset low wind resource that was 5% below our ‘normal’ (below normal impact is ~$0.06/share for 9M ’17)

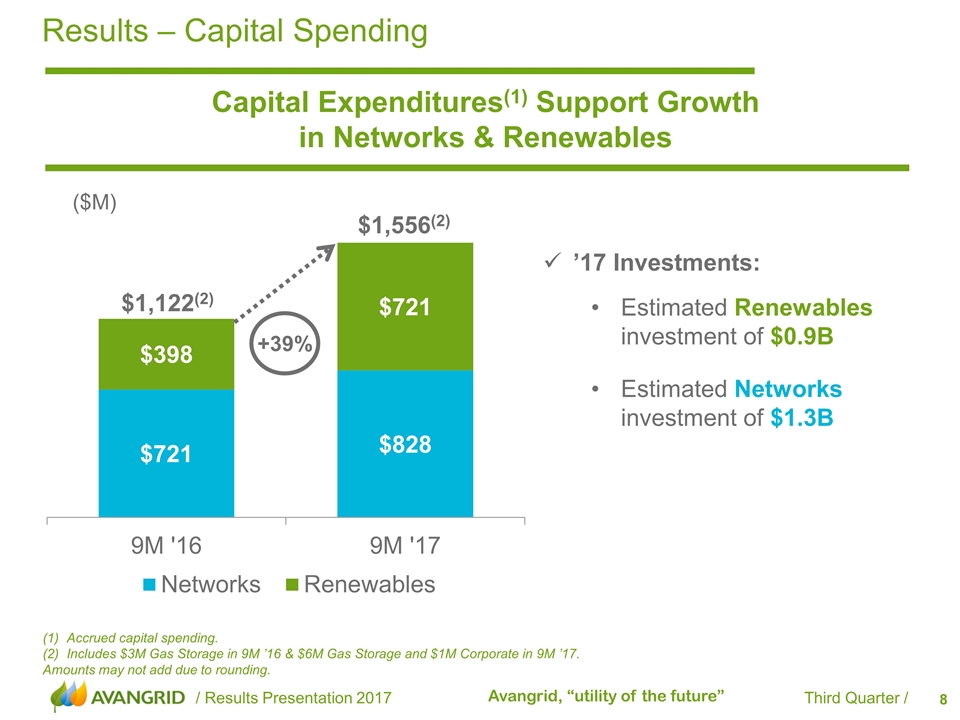

Results – Capital Spending Capital Expenditures(1) Support Growth in Networks & Renewables Accrued capital spending. Includes $3M Gas Storage in 9M ’16 & $6M Gas Storage and $1M Corporate in 9M ’17. Amounts may not add due to rounding. +39% ’17 Investments: Estimated Renewables investment of $0.9B Estimated Networks investment of $1.3B ($M) $1,556(2) $xxx $1,122(2)

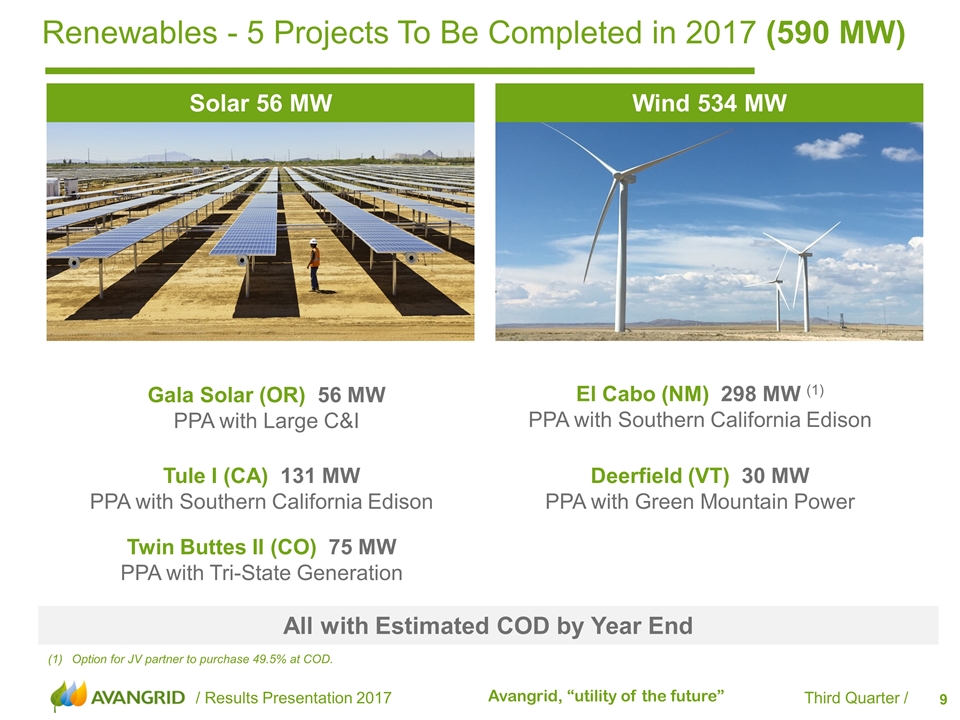

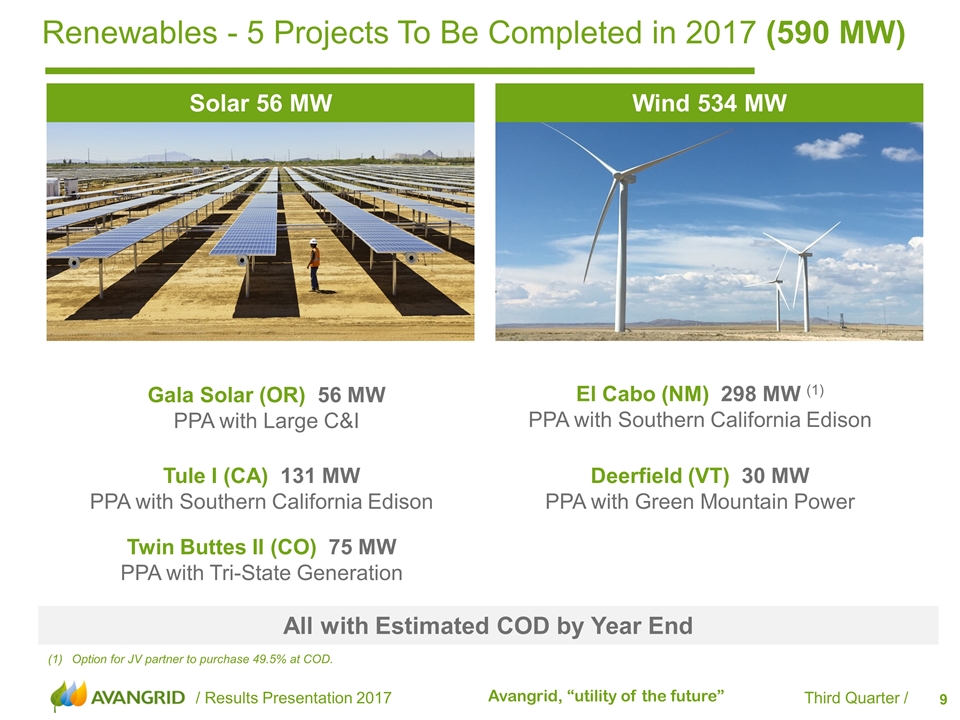

Gala Solar (OR) 56 MW PPA with Large C&I Renewables - 5 Projects To Be Completed in 2017 (590 MW) Solar 56 MW Wind 534 MW Option for JV partner to purchase 49.5% at COD. El Cabo (NM) 298 MW (1) PPA with Southern California Edison Twin Buttes II (CO) 75 MW PPA with Tri-State Generation Deerfield (VT) 30 MW PPA with Green Mountain Power Tule I (CA) 131 MW PPA with Southern California Edison All with Estimated COD by Year End

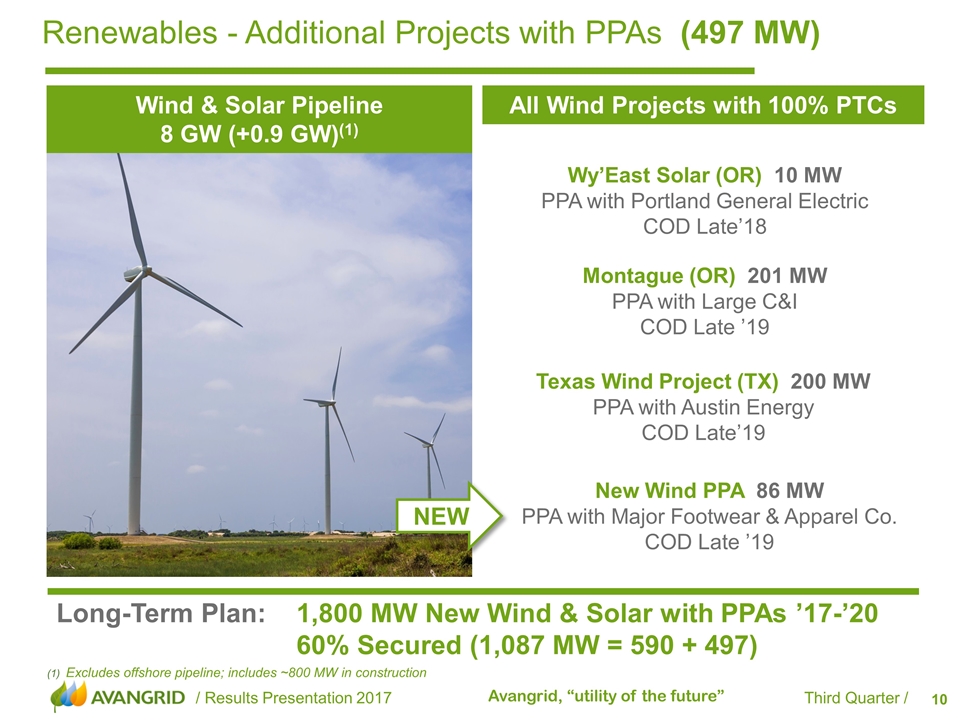

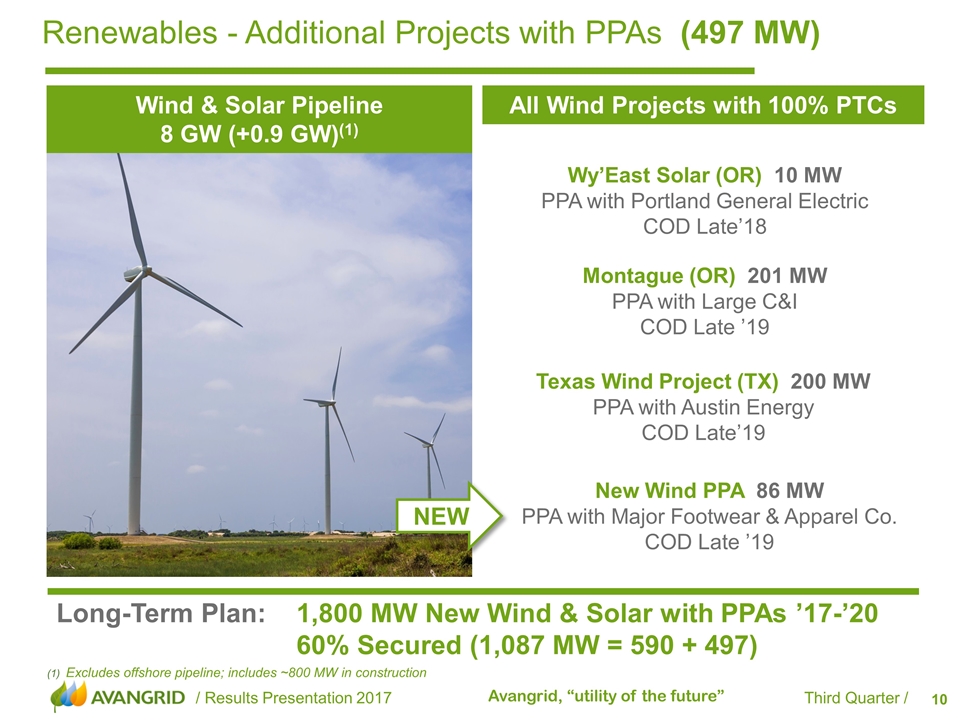

Montague (OR) 201 MW PPA with Large C&I COD Late ’19 Renewables - Additional Projects with PPAs (497 MW) Wy’East Solar (OR) 10 MW PPA with Portland General Electric COD Late’18 Texas Wind Project (TX) 200 MW PPA with Austin Energy COD Late’19 All Wind Projects with 100% PTCs Wind & Solar Pipeline 8 GW (+0.9 GW)(1) New Wind PPA 86 MW PPA with Major Footwear & Apparel Co. COD Late ’19 Long-Term Plan: 1,800 MW New Wind & Solar with PPAs ’17-’20 60% Secured (1,087 MW = 590 + 497) NEW (1) Excludes offshore pipeline; includes ~800 MW in construction

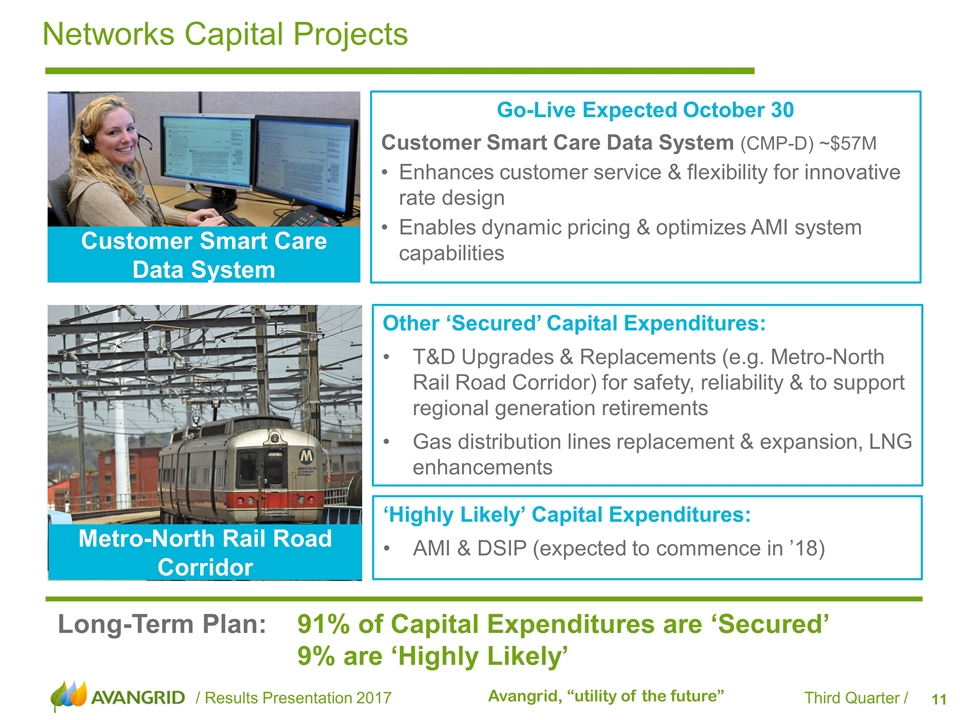

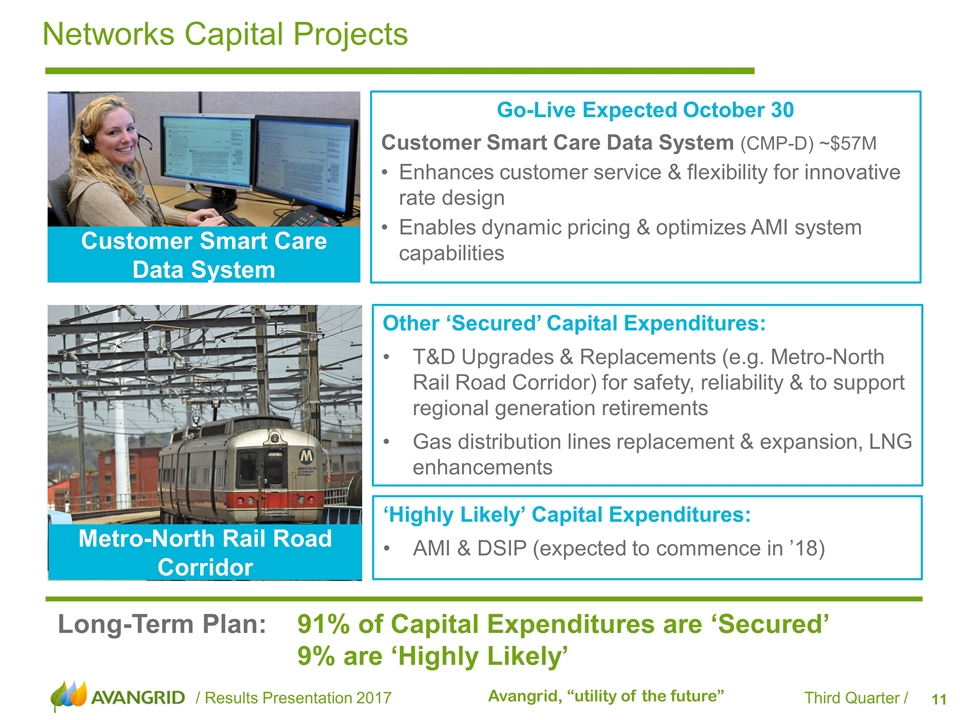

Long-Term Plan: 91% of Capital Expenditures are ‘Secured’ 9% are ‘Highly Likely’ Networks Capital Projects Go-Live Expected October 30 Customer Smart Care Data System (CMP-D) ~$57M Enhances customer service & flexibility for innovative rate design Enables dynamic pricing & optimizes AMI system capabilities Customer Smart Care Data System Other ‘Secured’ Capital Expenditures: T&D Upgrades & Replacements (e.g. Metro-North Rail Road Corridor) for safety, reliability & to support regional generation retirements Gas distribution lines replacement & expansion, LNG enhancements Metro-North Rail Road Corridor ‘Highly Likely’ Capital Expenditures: AMI & DSIP (expected to commence in ’18)

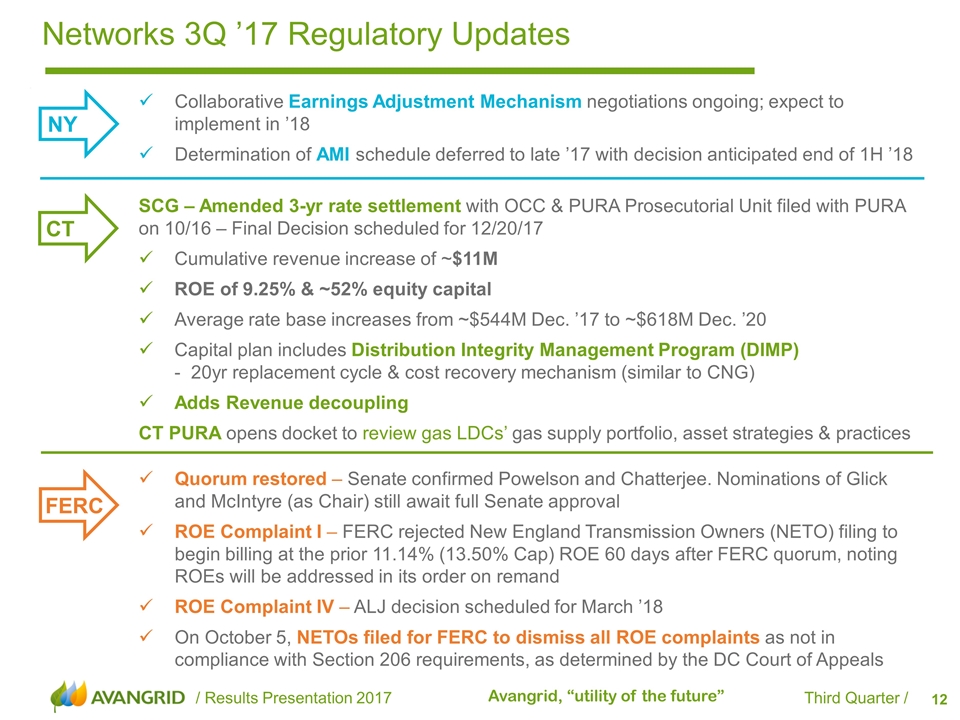

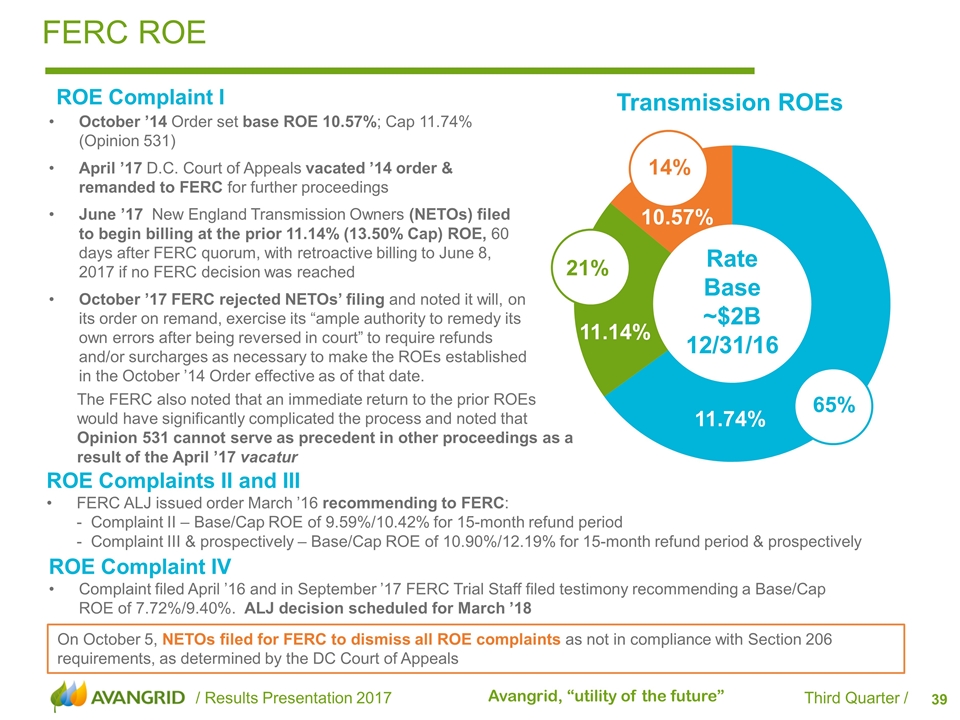

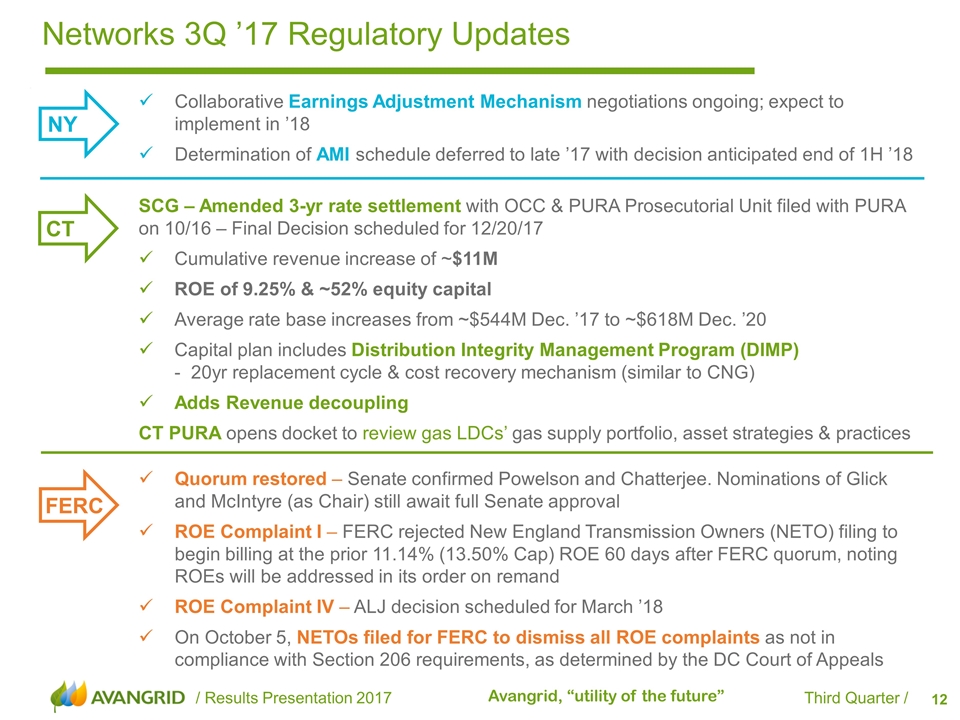

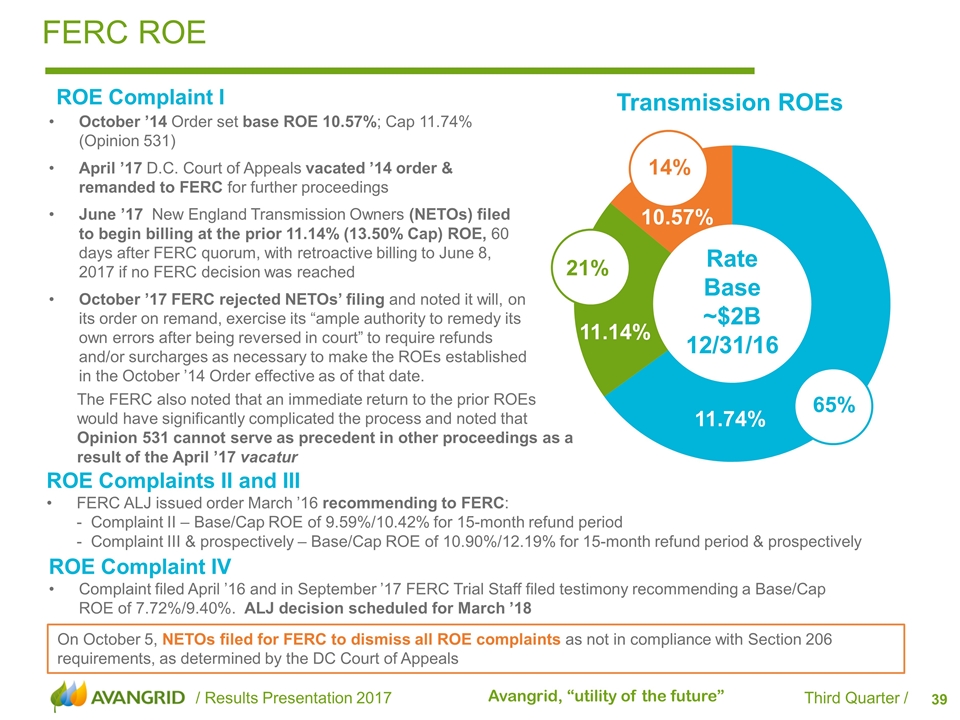

SCG – Amended 3-yr rate settlement with OCC & PURA Prosecutorial Unit filed with PURA on 10/16 – Final Decision scheduled for 12/20/17 Cumulative revenue increase of ~$11M ROE of 9.25% & ~52% equity capital Average rate base increases from ~$544M Dec. ’17 to ~$618M Dec. ’20 Capital plan includes Distribution Integrity Management Program (DIMP) - 20yr replacement cycle & cost recovery mechanism (similar to CNG) Adds Revenue decoupling CT PURA opens docket to review gas LDCs’ gas supply portfolio, asset strategies & practices Networks 3Q ’17 Regulatory Updates Collaborative Earnings Adjustment Mechanism negotiations ongoing; expect to implement in ’18 Determination of AMI schedule deferred to late ’17 with decision anticipated end of 1H ’18 NY Quorum restored – Senate confirmed Powelson and Chatterjee. Nominations of Glick and McIntyre (as Chair) still await full Senate approval ROE Complaint I – FERC rejected New England Transmission Owners (NETO) filing to begin billing at the prior 11.14% (13.50% Cap) ROE 60 days after FERC quorum, noting ROEs will be addressed in its order on remand ROE Complaint IV – ALJ decision scheduled for March ’18 On October 5, NETOs filed for FERC to dismiss all ROE complaints as not in compliance with Section 206 requirements, as determined by the DC Court of Appeals CT FERC

Earnings performance in ’17 impacted by low wind resource Reaffirming ’17 Adjusted EPS(1) Outlook of $2.10-$2.35 Executing on Opportunities in Core Businesses New & existing wind projects ’17 investments in line with expectations 3-year rate plans & FERC formula rates give >80% rate certainty Implementing Best Practices: Forward 2020 Continue to anticipate raising the dividend in ’18 AVANGRID Highlights Executing on our Commitment to Deliver 8-10% CAGR Through 2020 Potential for Additional Growth Beyond Long-term Plan Massachusetts Clean Energy RFP & Offshore Wind RFP NY Transmission & Renewables solicitations (1) See Appendix for calculation of Adjusted Net Income and Adjusted EPS and reconciliation to Net Income and EPS.

3Q & 9M ’17 Financial Results Richard Nicholas

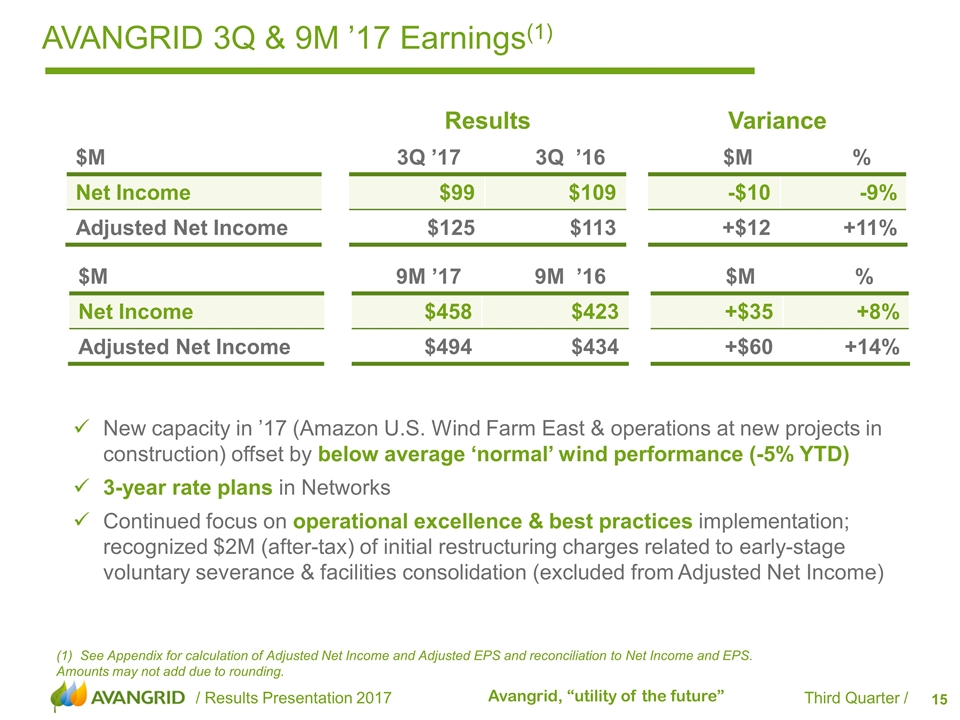

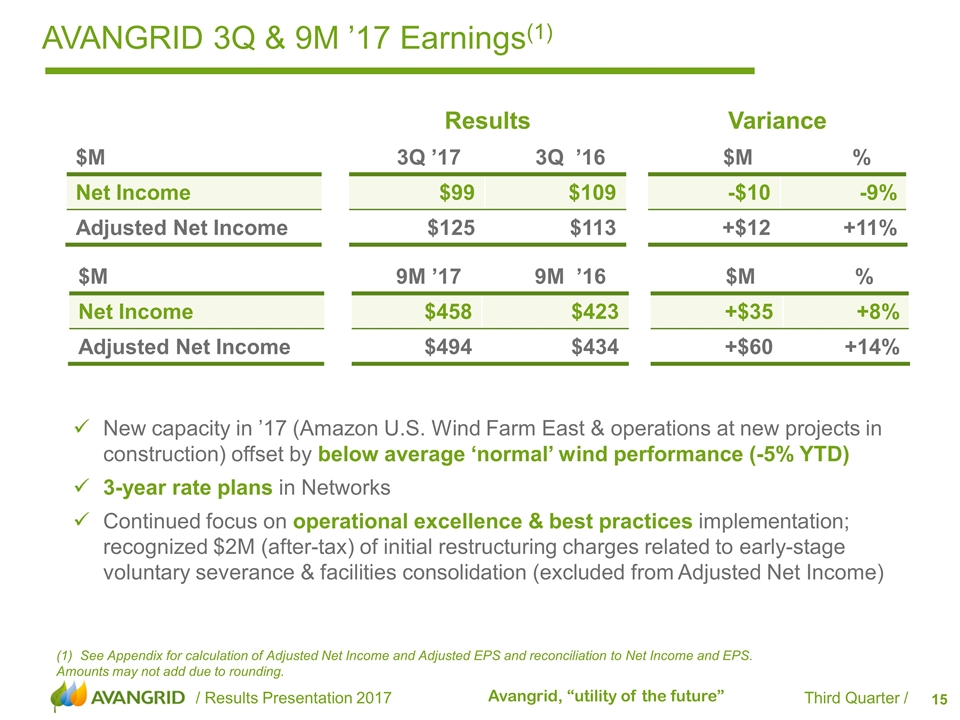

AVANGRID 3Q & 9M ’17 Earnings(1) (1) See Appendix for calculation of Adjusted Net Income and Adjusted EPS and reconciliation to Net Income and EPS. Amounts may not add due to rounding. Results Variance $M 3Q ’17 3Q ’16 $M % Net Income $99 $109 -$10 -9% Adjusted Net Income $125 $113 +$12 +11% New capacity in ’17 (Amazon U.S. Wind Farm East & operations at new projects in construction) offset by below average ‘normal’ wind performance (-5% YTD) 3-year rate plans in Networks Continued focus on operational excellence & best practices implementation; recognized $2M (after-tax) of initial restructuring charges related to early-stage voluntary severance & facilities consolidation (excluded from Adjusted Net Income) $M 9M ’17 9M ’16 $M % Net Income $458 $423 +$35 +8% Adjusted Net Income $494 $434 +$60 +14%

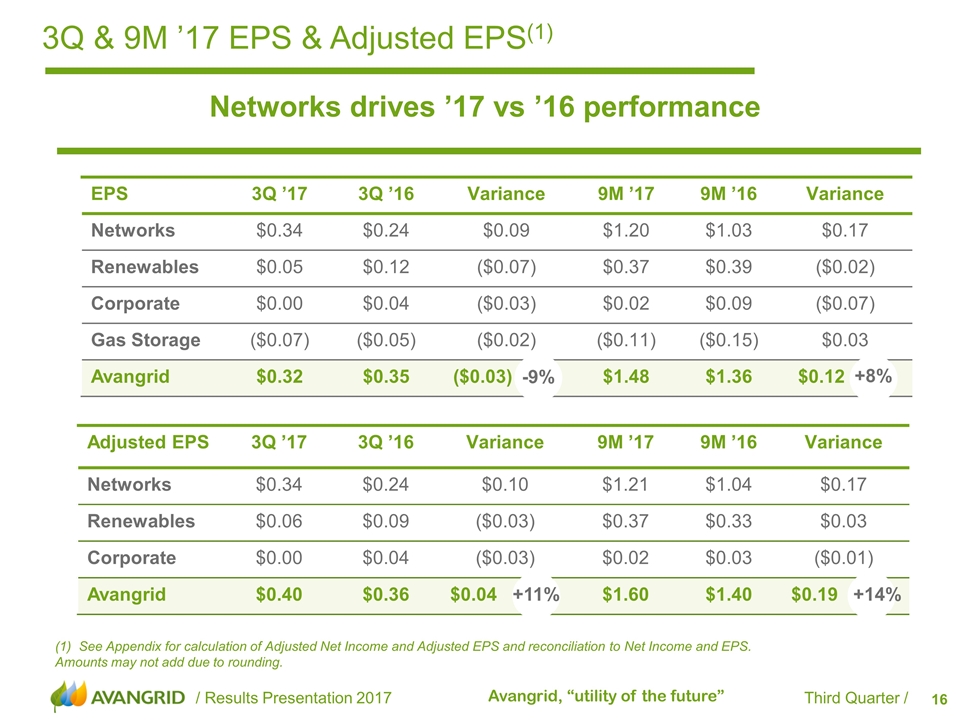

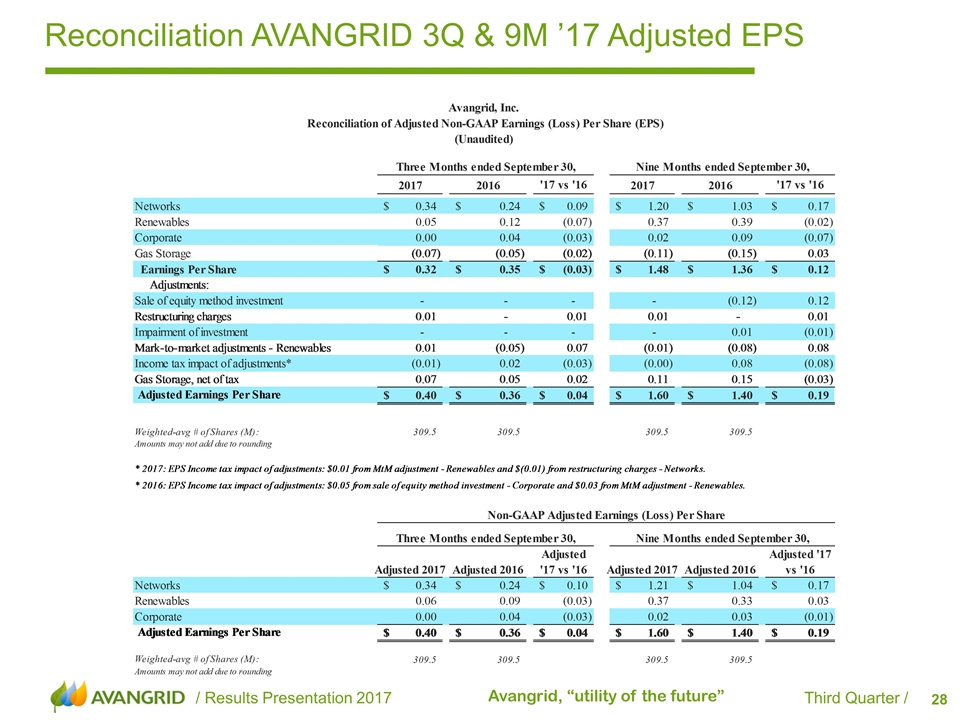

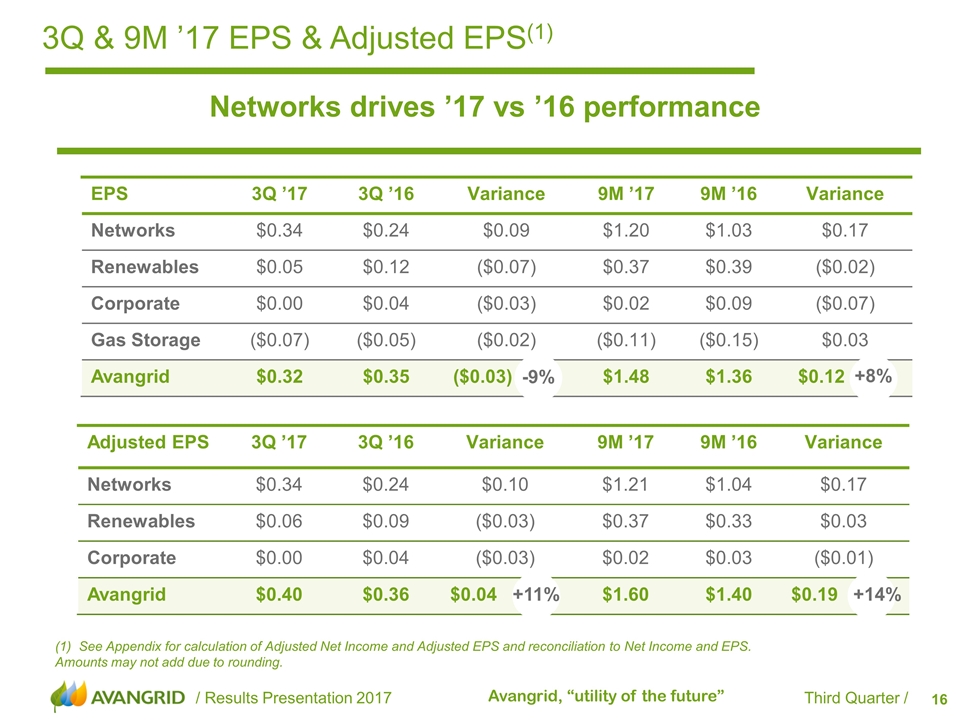

3Q & 9M ’17 EPS & Adjusted EPS(1) (1) See Appendix for calculation of Adjusted Net Income and Adjusted EPS and reconciliation to Net Income and EPS. Amounts may not add due to rounding. EPS 3Q ’17 3Q ’16 Variance 9M ’17 9M ’16 Variance Networks $0.34 $0.24 $0.09 $1.20 $1.03 $0.17 Renewables $0.05 $0.12 ($0.07) $0.37 $0.39 ($0.02) Corporate $0.00 $0.04 ($0.03) $0.02 $0.09 ($0.07) Gas Storage ($0.07) ($0.05) ($0.02) ($0.11) ($0.15) $0.03 Avangrid $0.32 $0.35 ($0.03) –9% $1.48 $1.36 $0.12 +8% Adjusted EPS 3Q ’17 3Q ’16 Variance 9M ’17 9M ’16 Variance Networks $0.34 $0.24 $0.10 $1.21 $1.04 $0.17 Renewables $0.06 $0.09 ($0.03) $0.37 $0.33 $0.03 Corporate $0.00 $0.04 ($0.03) $0.02 $0.03 ($0.01) Avangrid $0.40 $0.36 $0.04 +11% $1.60 $1.40 $0.19 +14% Networks drives ’17 vs ’16 performance -9% +8% +11% +14%

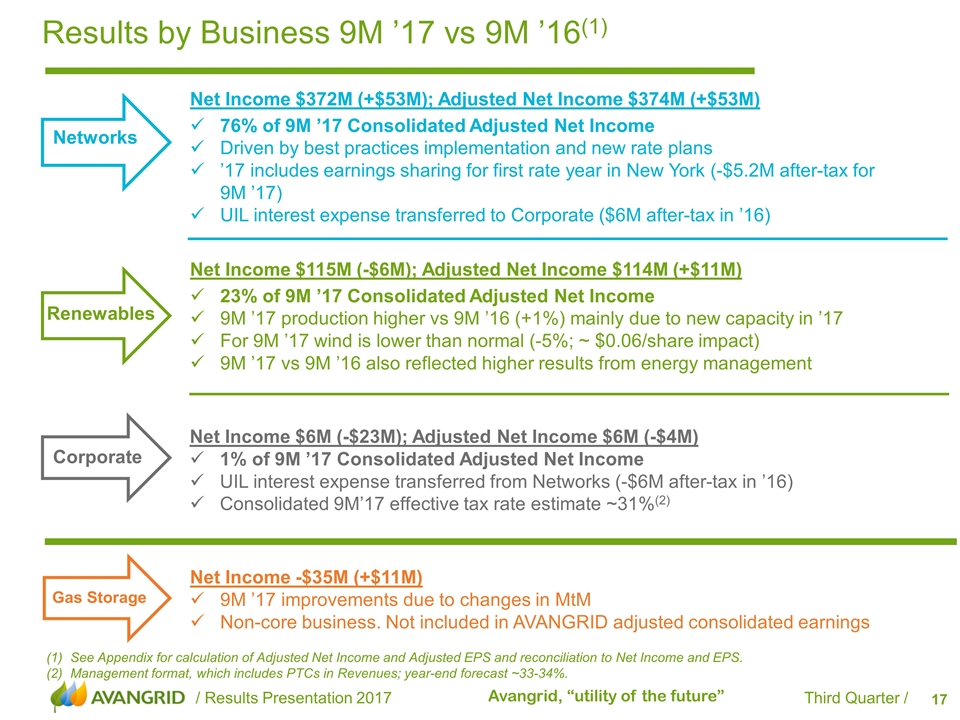

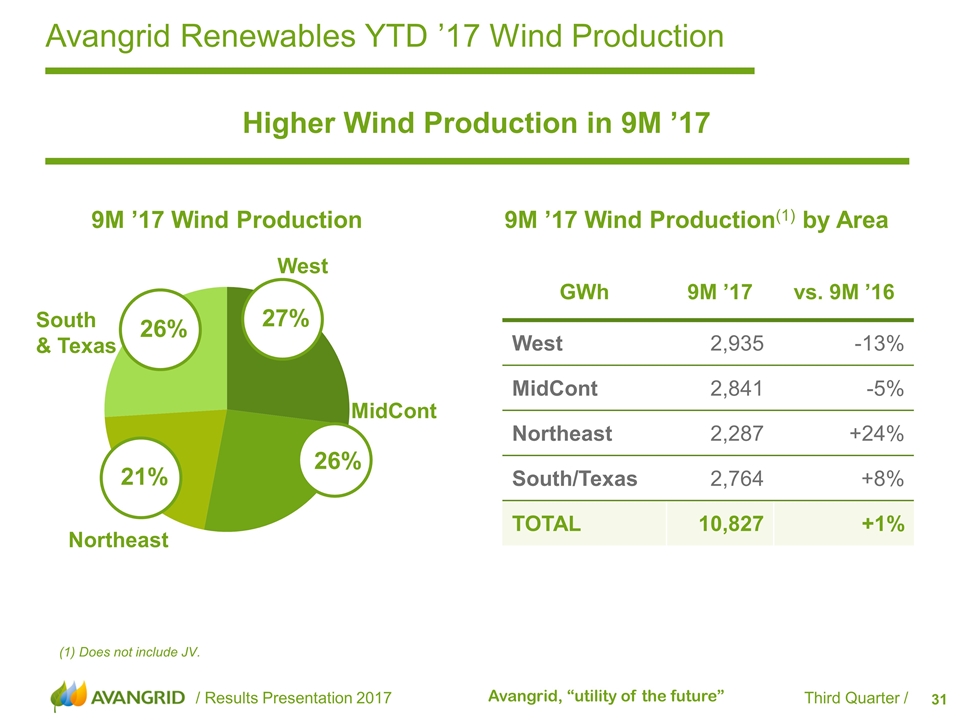

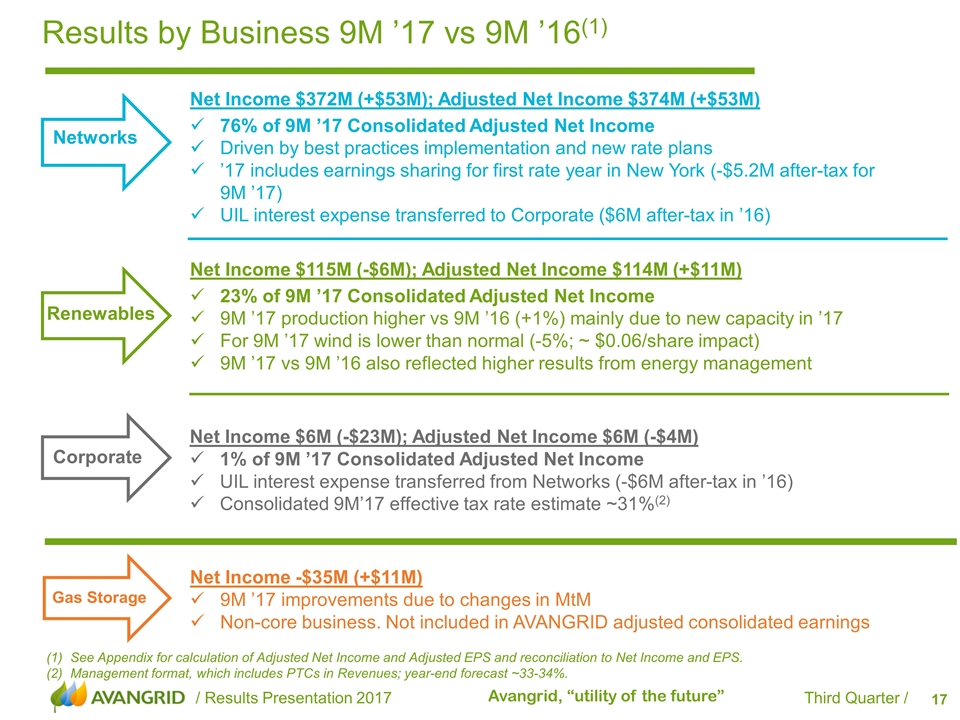

Net Income $115M (-$6M); Adjusted Net Income $114M (+$11M) 23% of 9M ’17 Consolidated Adjusted Net Income 9M ’17 production higher vs 9M ’16 (+1%) mainly due to new capacity in ’17 For 9M ’17 wind is lower than normal (-5%; ~ $0.06/share impact) 9M ’17 vs 9M ’16 also reflected higher results from energy management Net Income $6M (-$23M); Adjusted Net Income $6M (-$4M) 1% of 9M ’17 Consolidated Adjusted Net Income UIL interest expense transferred from Networks (-$6M after-tax in ’16) Consolidated 9M’17 effective tax rate estimate ~31%(2) See Appendix for calculation of Adjusted Net Income and Adjusted EPS and reconciliation to Net Income and EPS. Management format, which includes PTCs in Revenues; year-end forecast ~33-34%. Net Income -$35M (+$11M) 9M ’17 improvements due to changes in MtM Non-core business. Not included in AVANGRID adjusted consolidated earnings Net Income $372M (+$53M); Adjusted Net Income $374M (+$53M) 76% of 9M ’17 Consolidated Adjusted Net Income Driven by best practices implementation and new rate plans ’17 includes earnings sharing for first rate year in New York (-$5.2M after-tax for 9M ’17) UIL interest expense transferred to Corporate ($6M after-tax in ’16) Results by Business 9M ’17 vs 9M ’16(1) Gas Storage Networks Renewables Corporate

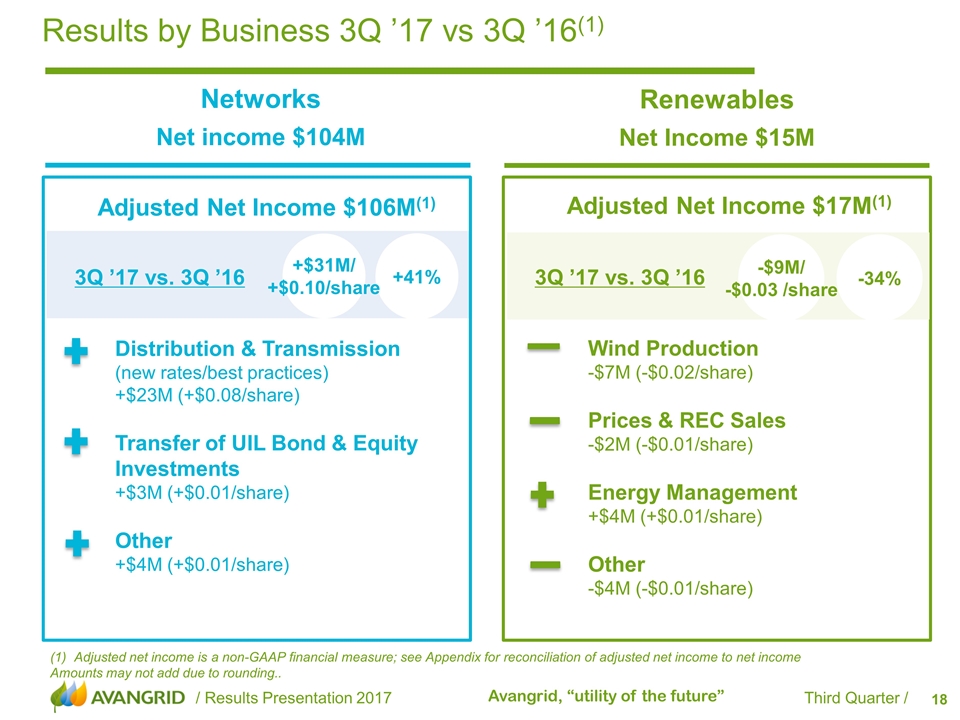

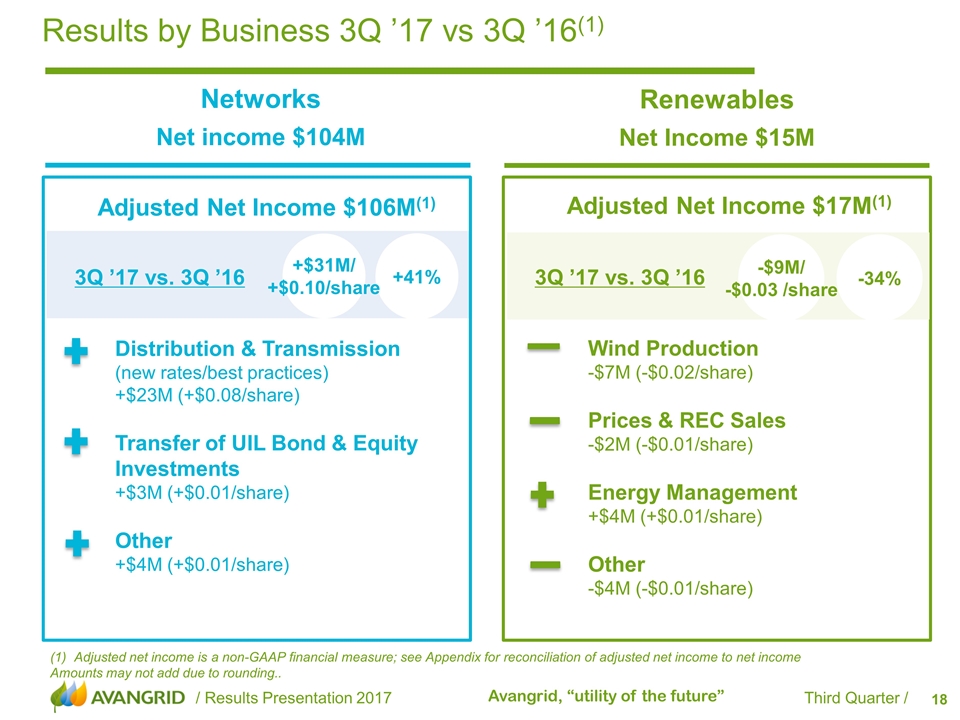

Results by Business 3Q ’17 vs 3Q ’16(1) Adjusted net income is a non-GAAP financial measure; see Appendix for reconciliation of adjusted net income to net income Amounts may not add due to rounding.. Renewables Net Income $15M Networks Net income $104M Adjusted Net Income $17M(1) Adjusted Net Income $106M(1) 3Q ’17 vs. 3Q ’16 3Q ’17 vs. 3Q ’16 -34% -$9M/ -$0.03 /share +41% +$31M/ +$0.10/share Wind Production -$7M (-$0.02/share) Prices & REC Sales -$2M (-$0.01/share) Energy Management +$4M (+$0.01/share) Other -$4M (-$0.01/share) Distribution & Transmission (new rates/best practices) +$23M (+$0.08/share) Transfer of UIL Bond & Equity Investments +$3M (+$0.01/share) Other +$4M (+$0.01/share)

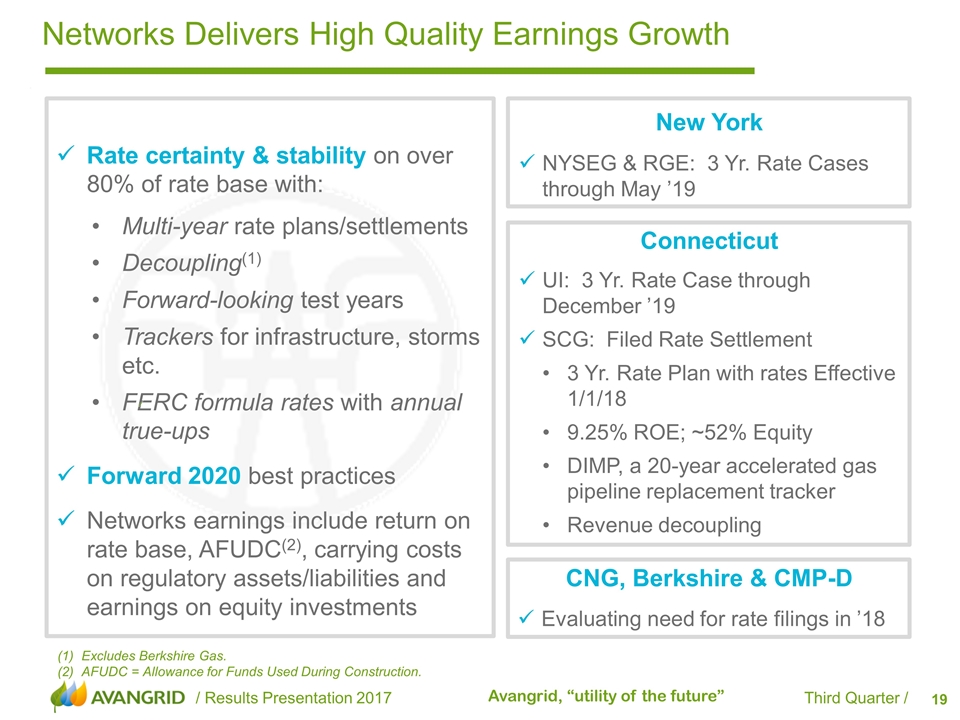

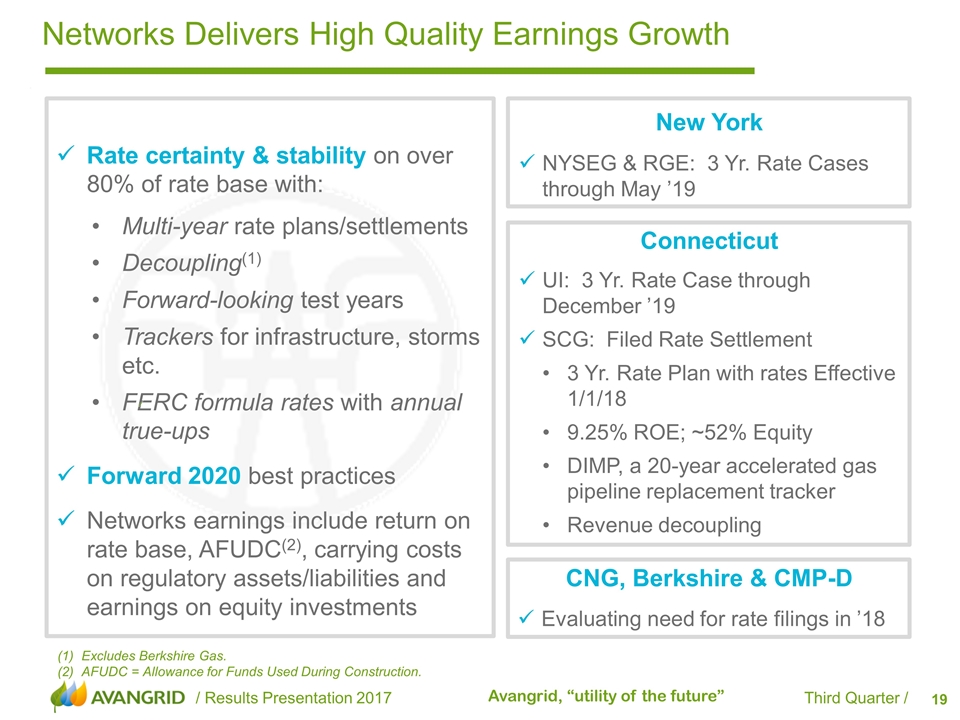

Rate certainty & stability on over 80% of rate base with: Multi-year rate plans/settlements Decoupling(1) Forward-looking test years Trackers for infrastructure, storms etc. FERC formula rates with annual true-ups Forward 2020 best practices Networks earnings include return on rate base, AFUDC(2), carrying costs on regulatory assets/liabilities and earnings on equity investments Networks Delivers High Quality Earnings Growth Excludes Berkshire Gas. AFUDC = Allowance for Funds Used During Construction. New York NYSEG & RGE: 3 Yr. Rate Cases through May ’19 Connecticut UI: 3 Yr. Rate Case through December ’19 SCG: Filed Rate Settlement 3 Yr. Rate Plan with rates Effective 1/1/18 9.25% ROE; ~52% Equity DIMP, a 20-year accelerated gas pipeline replacement tracker Revenue decoupling CNG, Berkshire & CMP-D Evaluating need for rate filings in ’18

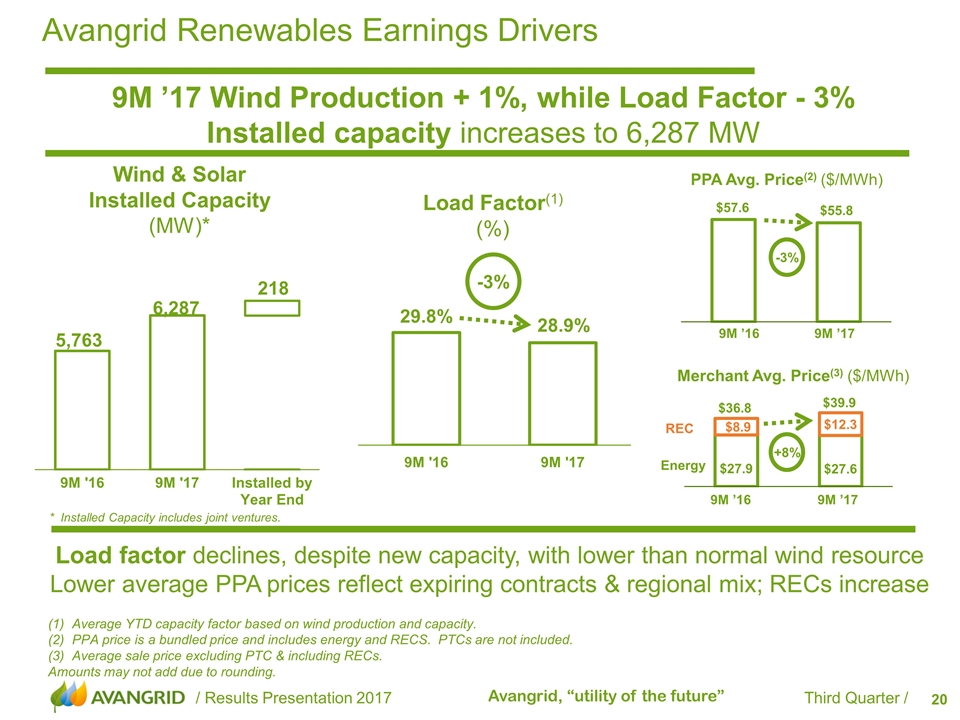

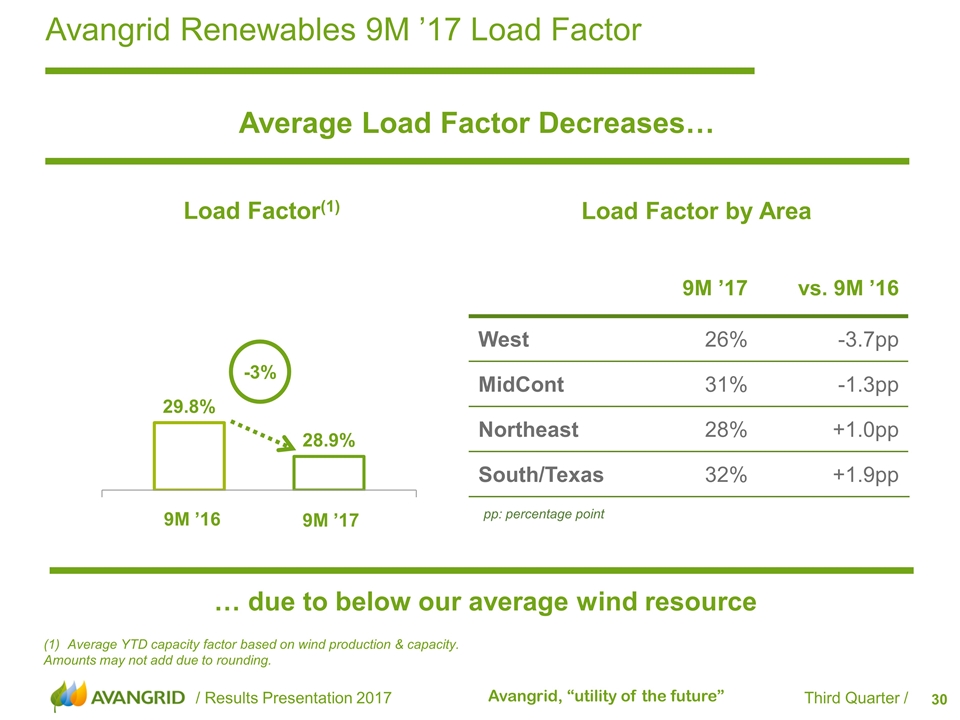

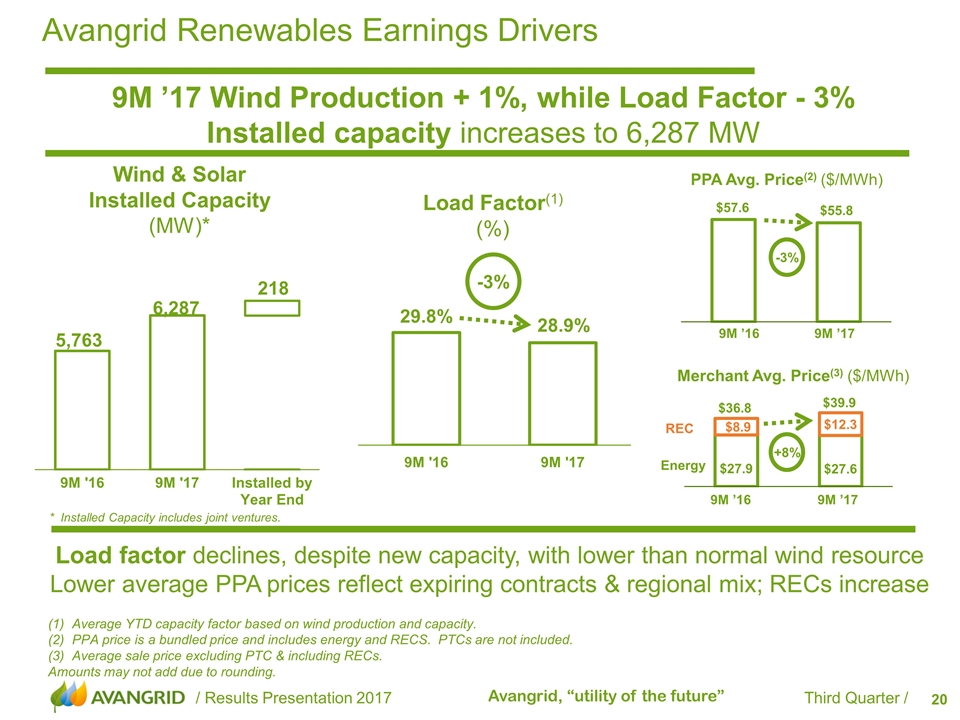

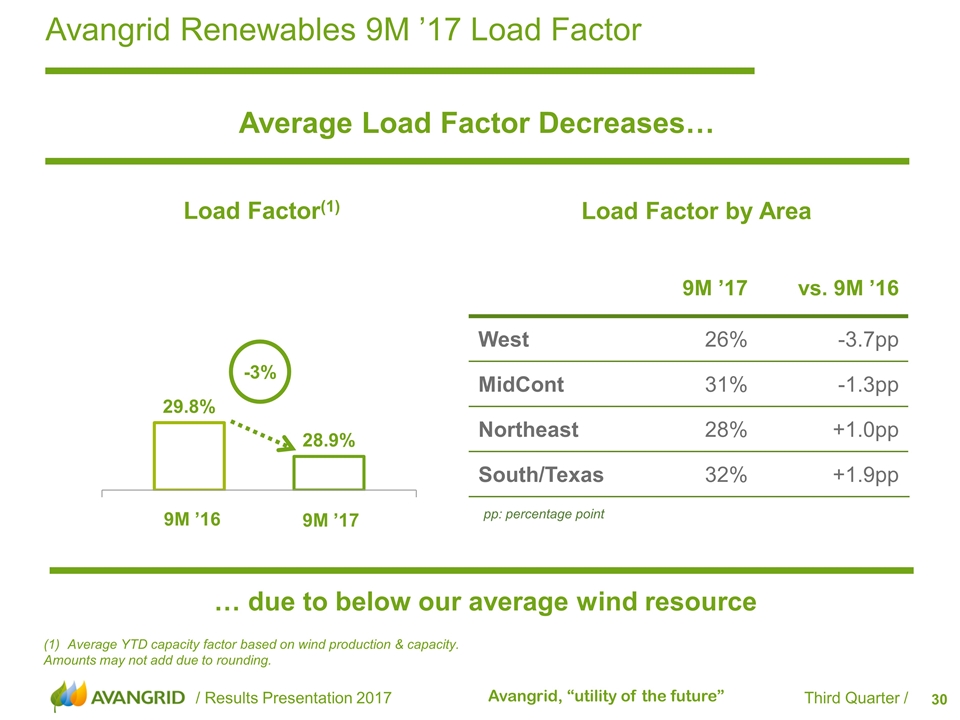

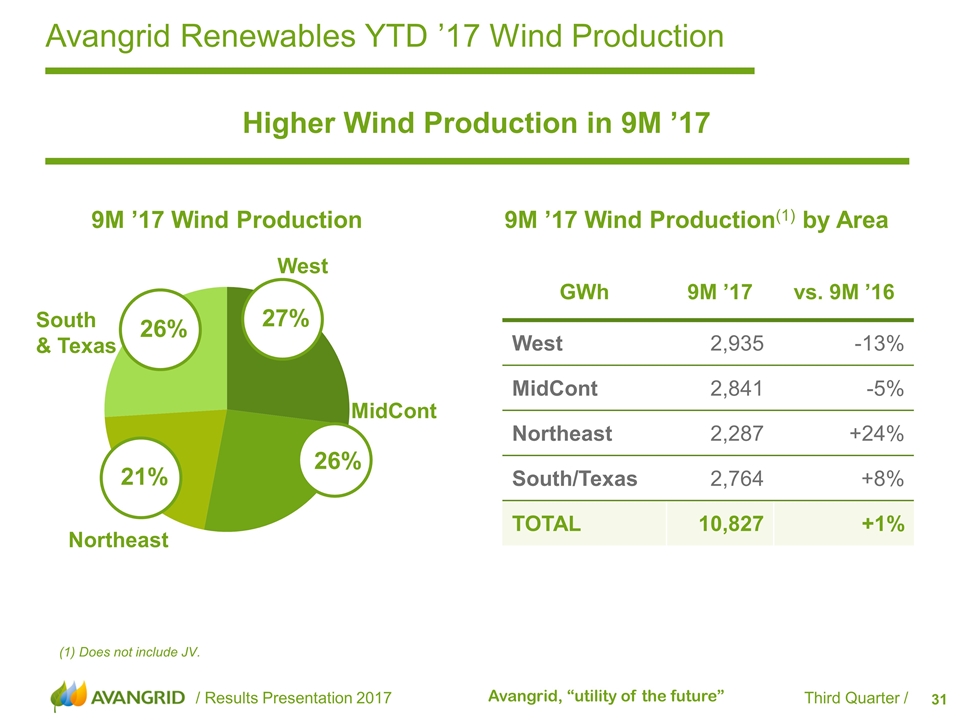

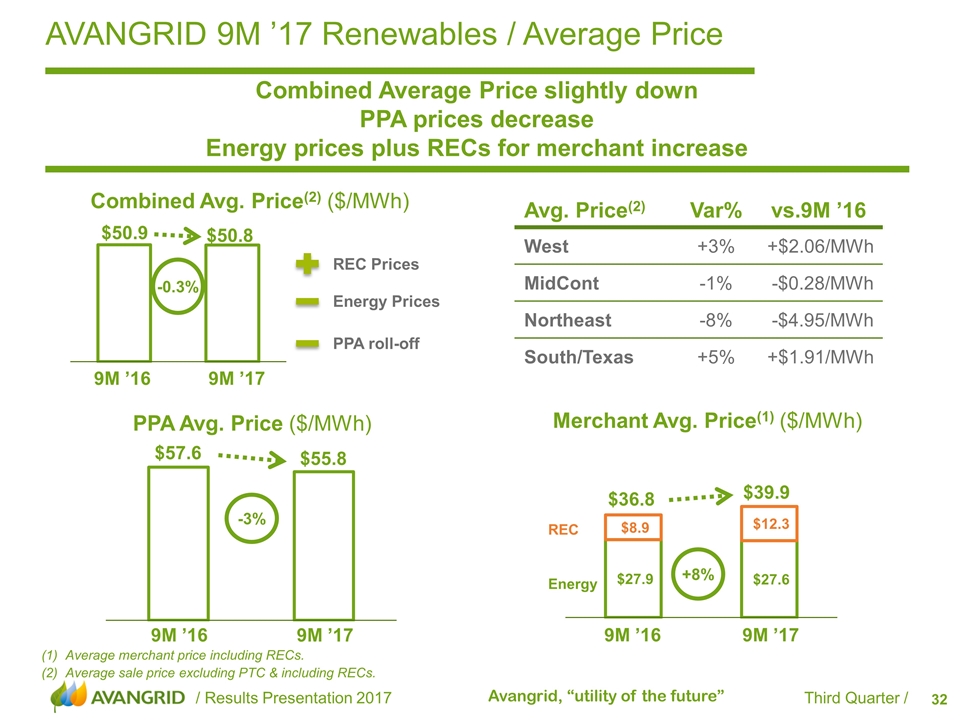

Load Factor(1) (%) -3% 29.8% 28.9% Avangrid Renewables Earnings Drivers 9M ’17 Wind Production + 1%, while Load Factor - 3% Installed capacity increases to 6,287 MW Load factor declines, despite new capacity, with lower than normal wind resource Lower average PPA prices reflect expiring contracts & regional mix; RECs increase Wind & Solar Installed Capacity (MW)* Average YTD capacity factor based on wind production and capacity. PPA price is a bundled price and includes energy and RECS. PTCs are not included. Average sale price excluding PTC & including RECs. Amounts may not add due to rounding. * Installed Capacity includes joint ventures. 9M ’16 9M ’17 PPA Avg. Price(2) ($/MWh) -3% 9M ’16 9M ’17 +8% Merchant Avg. Price(3) ($/MWh) REC Energy $57.6 $55.8

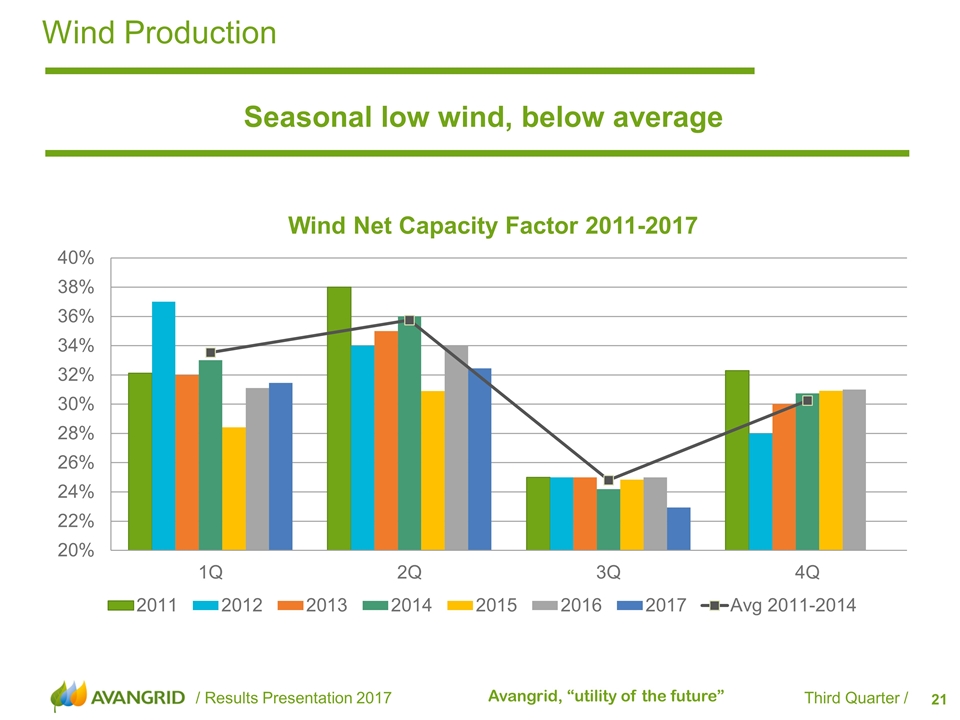

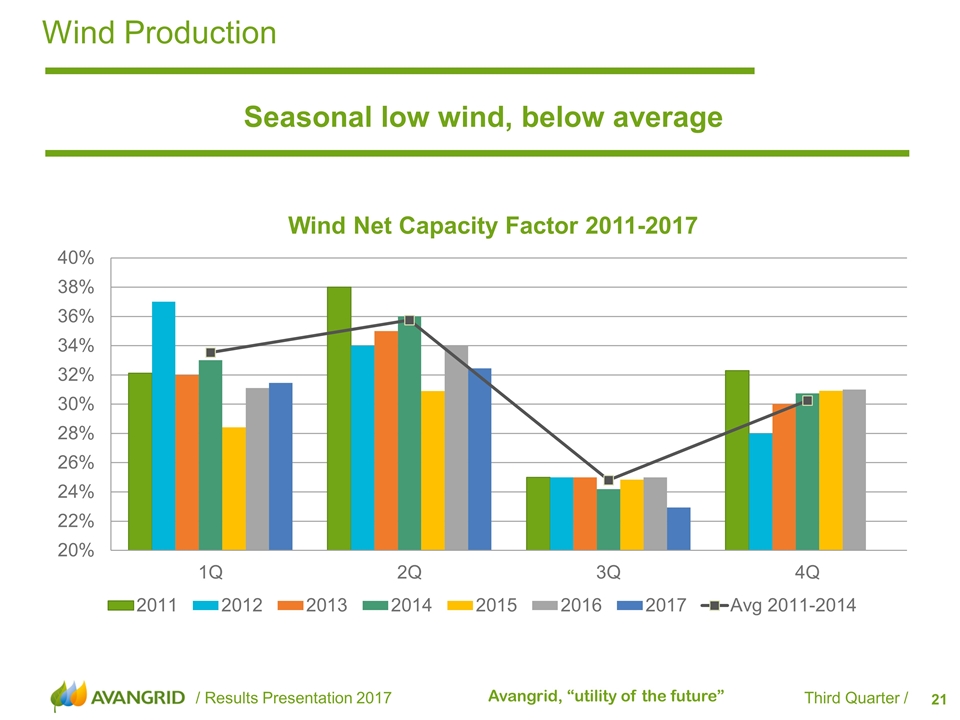

Wind Production Seasonal low wind, below average

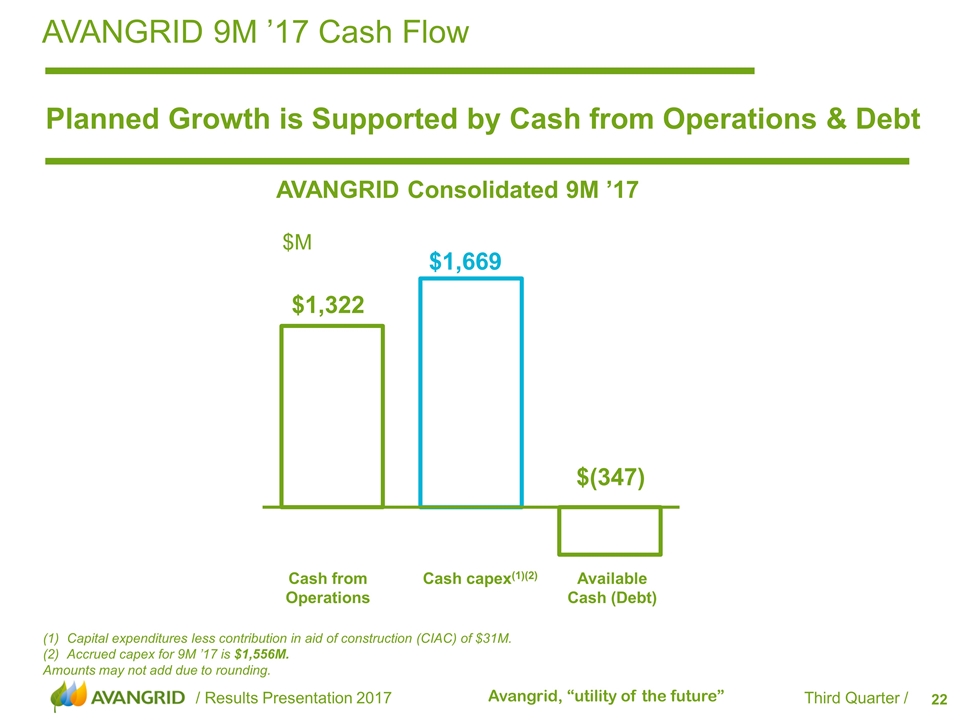

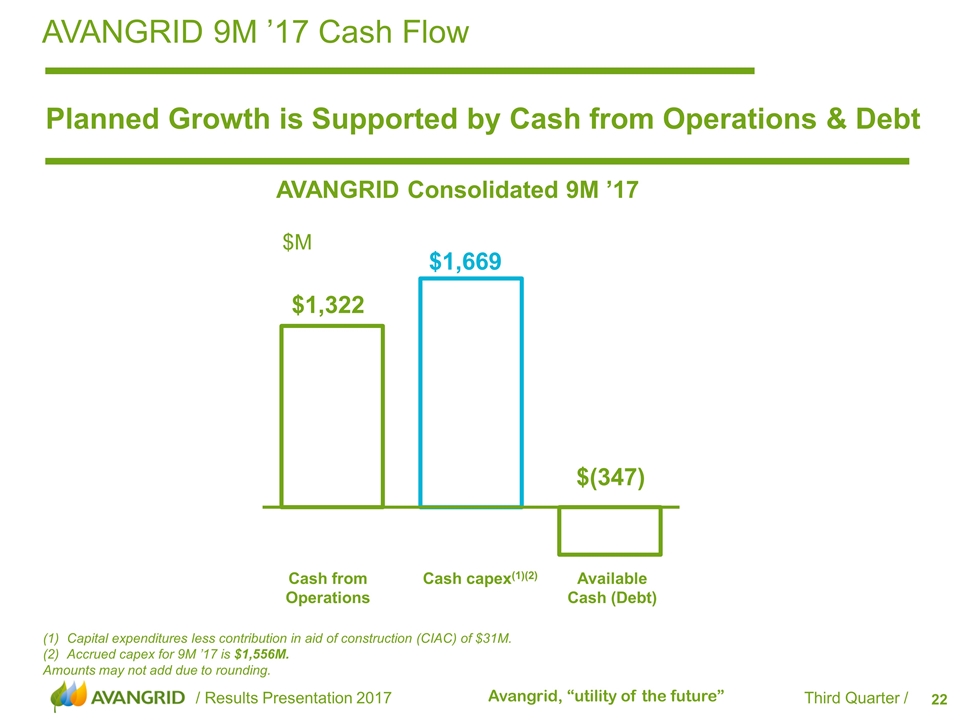

Capital expenditures less contribution in aid of construction (CIAC) of $31M. Accrued capex for 9M ’17 is $1,556M. Amounts may not add due to rounding. AVANGRID 9M ’17 Cash Flow Planned Growth is Supported by Cash from Operations & Debt $M AVANGRID Consolidated 9M ’17 Cash from Operations Cash capex(1)(2) Available Cash (Debt) $1,322

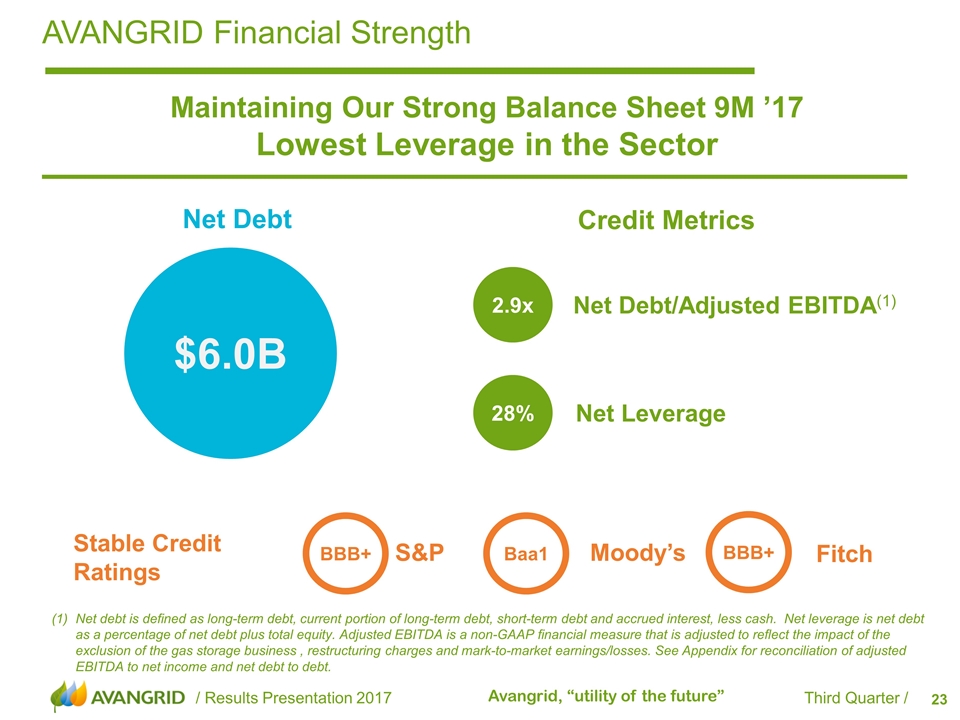

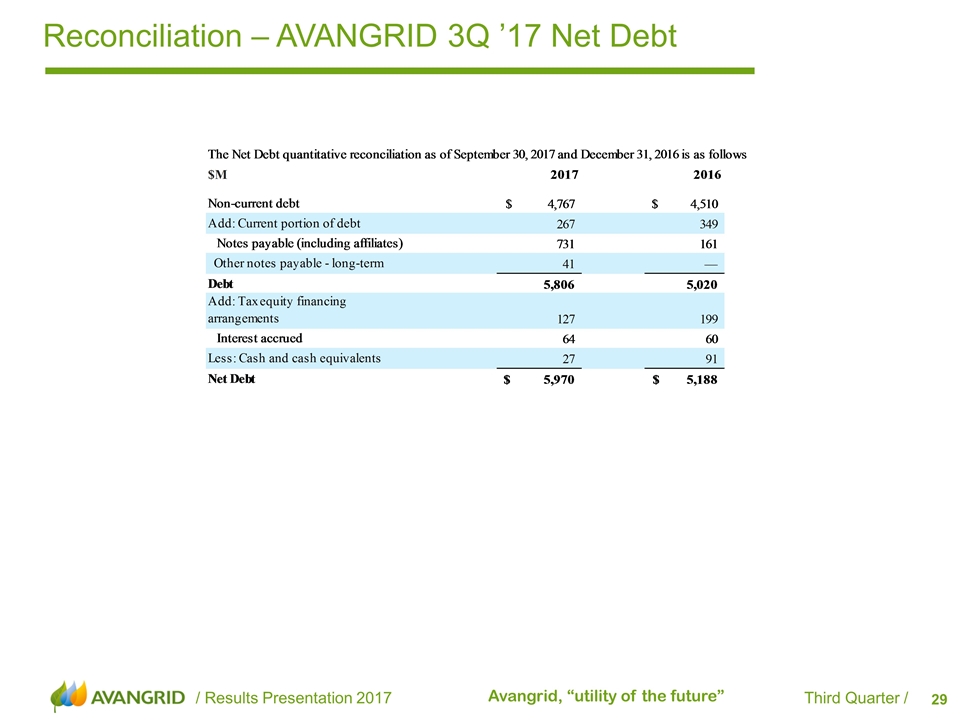

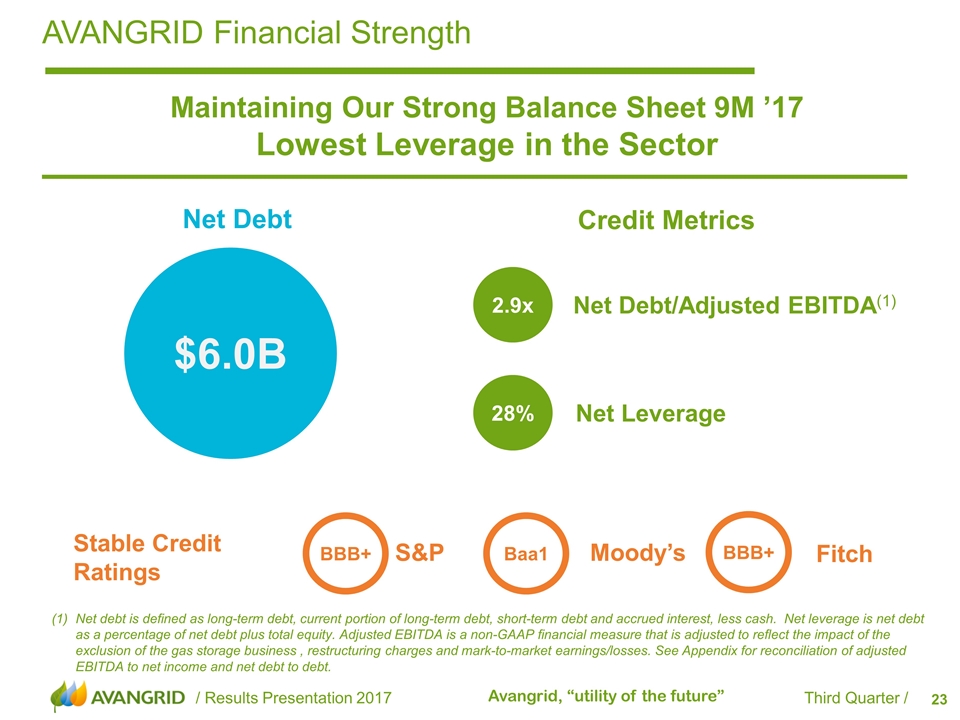

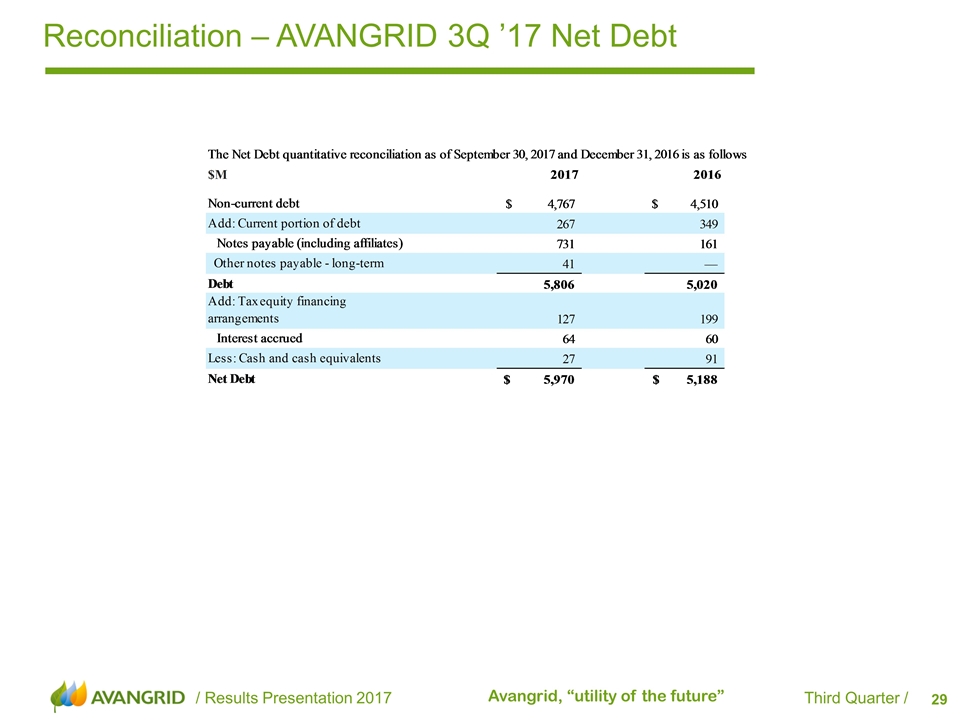

AVANGRID Financial Strength Maintaining Our Strong Balance Sheet 9M ’17 Lowest Leverage in the Sector $6.0B Net Debt Credit Metrics Net Debt/Adjusted EBITDA(1) Net Leverage 2.9x 28% Net debt is defined as long-term debt, current portion of long-term debt, short-term debt and accrued interest, less cash. Net leverage is net debt as a percentage of net debt plus total equity. Adjusted EBITDA is a non-GAAP financial measure that is adjusted to reflect the impact of the exclusion of the gas storage business , restructuring charges and mark-to-market earnings/losses. See Appendix for reconciliation of adjusted EBITDA to net income and net debt to debt. BBB+ Baa1 BBB+ S&P Stable Credit Ratings Moody’s Fitch

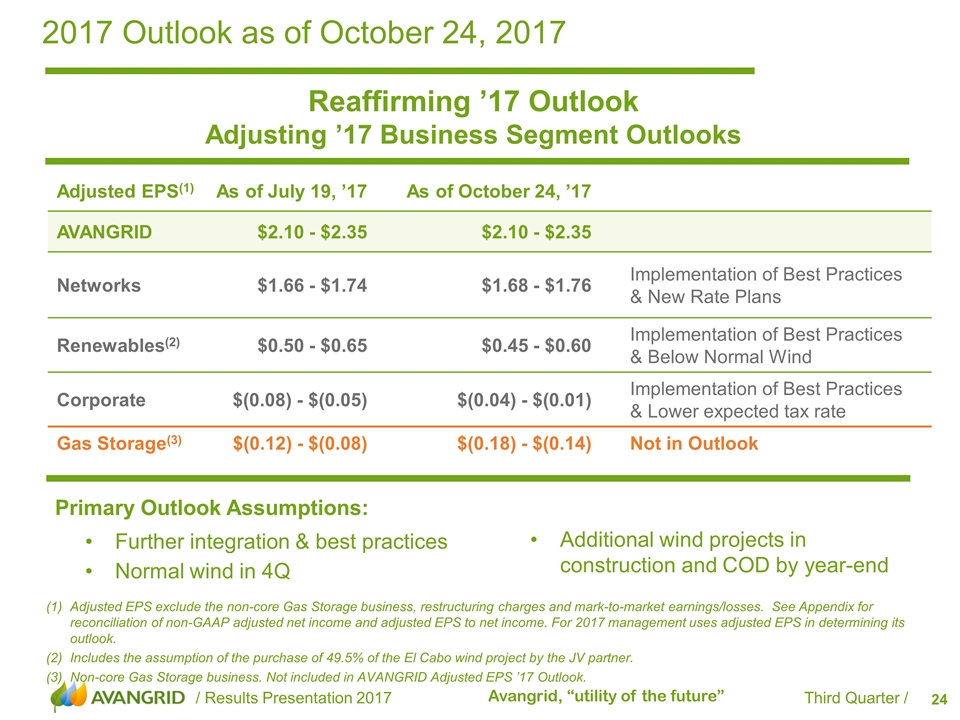

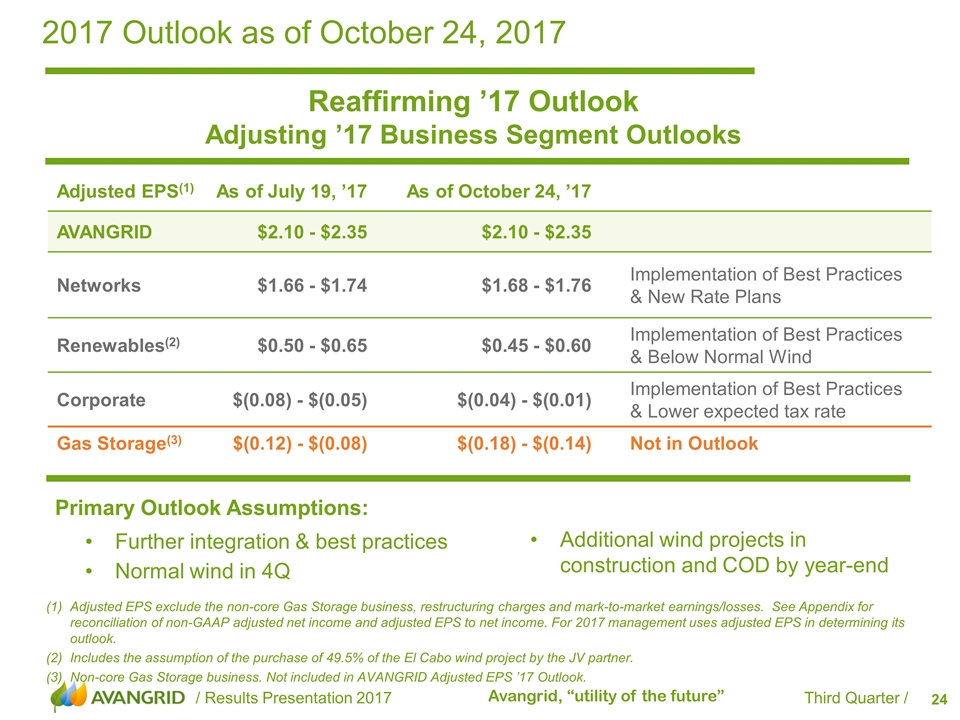

Reaffirming ’17 Outlook Adjusting ’17 Business Segment Outlooks 2017 Outlook as of October 24, 2017 Adjusted EPS exclude the non-core Gas Storage business, restructuring charges and mark-to-market earnings/losses. See Appendix for reconciliation of non-GAAP adjusted net income and adjusted EPS to net income. For 2017 management uses adjusted EPS in determining its outlook. Includes the assumption of the purchase of 49.5% of the El Cabo wind project by the JV partner. Non-core Gas Storage business. Not included in AVANGRID Adjusted EPS ’17 Outlook. Adjusted EPS(1) As of July 19, ’17 As of October 24, ’17 AVANGRID $2.10 - $2.35 $2.10 - $2.35 Networks $1.66 - $1.74 $1.68 - $1.76 Implementation of Best Practices & New Rate Plans Renewables(2) $0.50 - $0.65 $0.45 - $0.60 Implementation of Best Practices & Below Normal Wind Corporate $(0.08) - $(0.05) $(0.04) - $(0.01) Implementation of Best Practices & Lower expected tax rate Gas Storage(3) $(0.12) - $(0.08) $(0.18) - $(0.14) Not in Outlook Primary Outlook Assumptions: Further integration & best practices Normal wind in 4Q Additional wind projects in construction and COD by year-end

Appendix

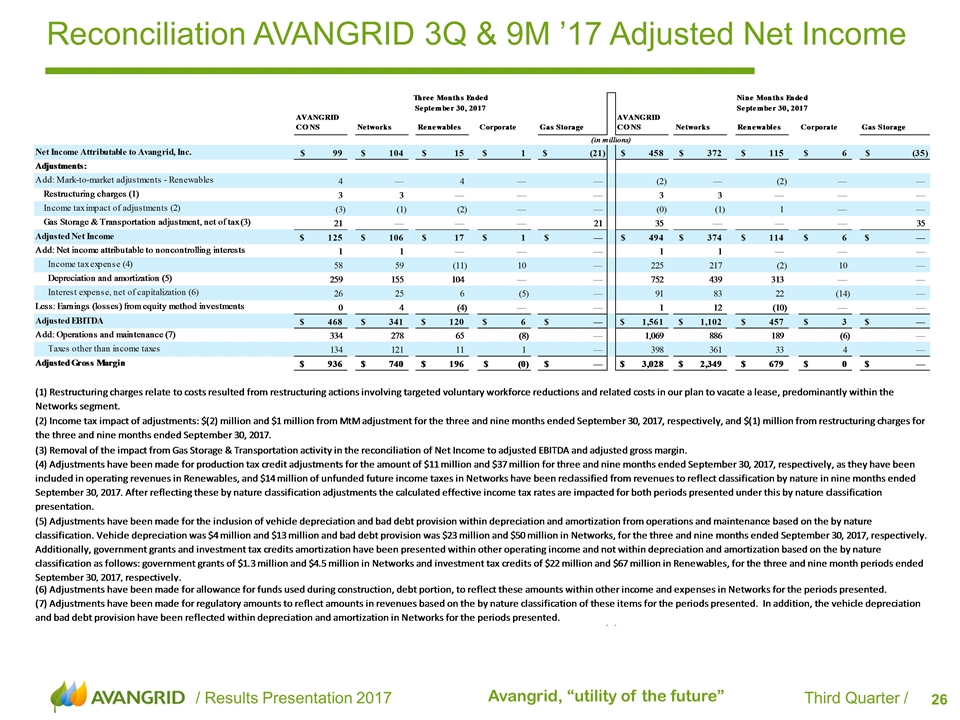

Reconciliation AVANGRID 3Q & 9M ’17 Adjusted Net Income

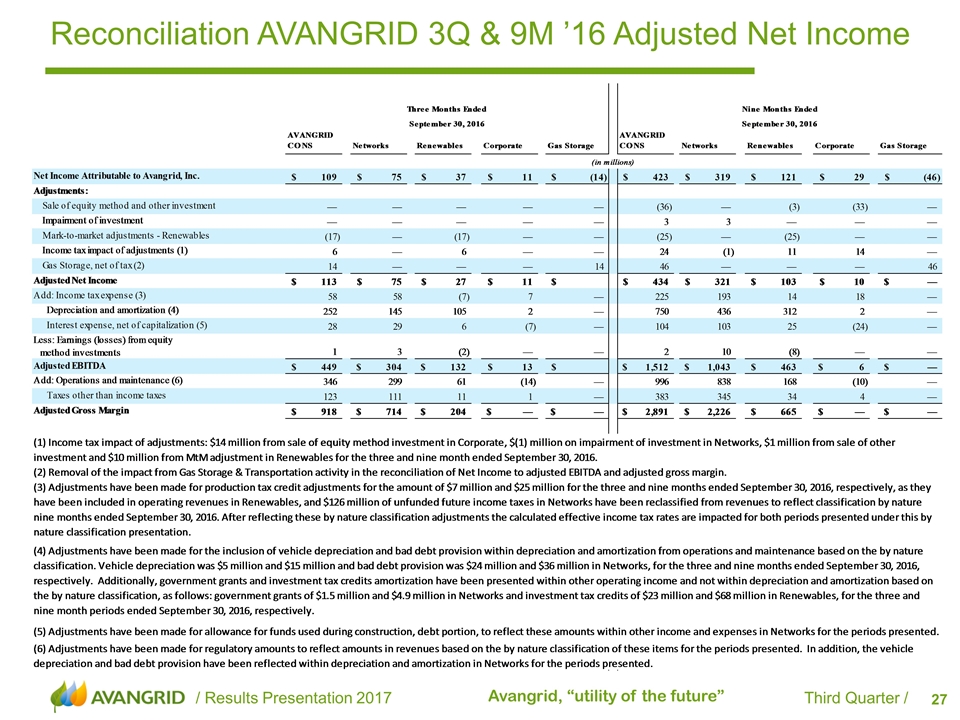

Reconciliation AVANGRID 3Q & 9M ’16 Adjusted Net Income

Reconciliation AVANGRID 3Q & 9M ’17 Adjusted EPS

Reconciliation – AVANGRID 3Q ’17 Net Debt

Avangrid Renewables 9M ’17 Load Factor Average Load Factor Decreases… Load Factor(1) Average YTD capacity factor based on wind production & capacity. Amounts may not add due to rounding. … due to below our average wind resource 9M ’16 9M ’17 -3% Load Factor by Area pp: percentage point 9M ’17 vs. 9M ’16 West 26% -3.7pp MidCont 31% -1.3pp Northeast 28% +1.0pp South/Texas 32% +1.9pp

Avangrid Renewables YTD ’17 Wind Production Higher Wind Production in 9M ’17 9M ’17 Wind Production (1) Does not include JV. 9M ’17 Wind Production(1) by Area GWh 9M ’17 vs. 9M ’16 West 2,935 -13% MidCont 2,841 -5% Northeast 2,287 +24% South/Texas 2,764 +8% TOTAL 10,827 +1% Northeast MidCont South & Texas West 27% 21% 26% 26%

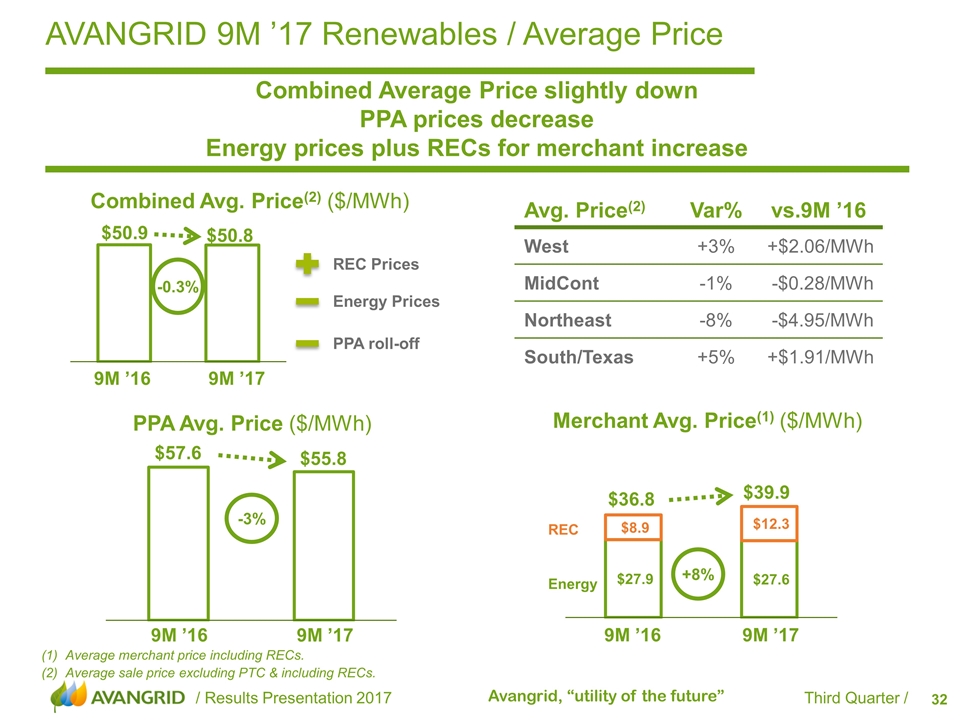

9M ’16 9M ’17 +8% Merchant Avg. Price(1) ($/MWh) REC Energy AVANGRID 9M ’17 Renewables / Average Price Combined Average Price slightly down PPA prices decrease Energy prices plus RECs for merchant increase Average merchant price including RECs. Average sale price excluding PTC & including RECs. 9M ’16 9M ’17 PPA Avg. Price ($/MWh) -3% $57.6 $55.8 9M ’16 9M ’17 -0.3% $50.9 $50.8 Combined Avg. Price(2) ($/MWh) REC Prices PPA roll-off Energy Prices Avg. Price(2) Var% vs.9M ’16 West +3% +$2.06/MWh MidCont -1% -$0.28/MWh Northeast -8% -$4.95/MWh South/Texas +5% +$1.91/MWh

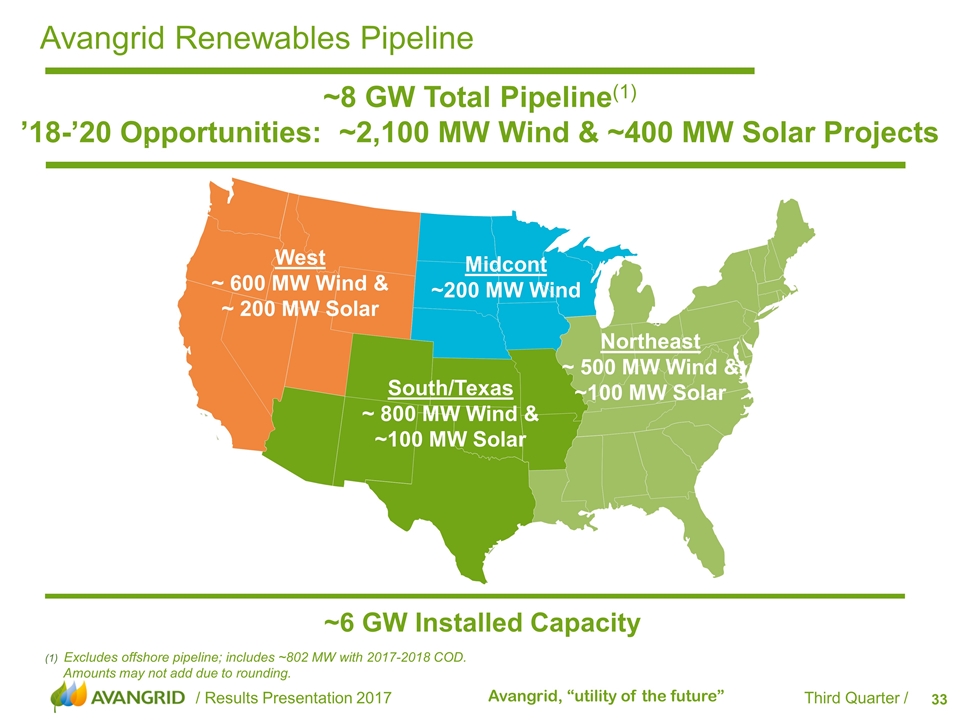

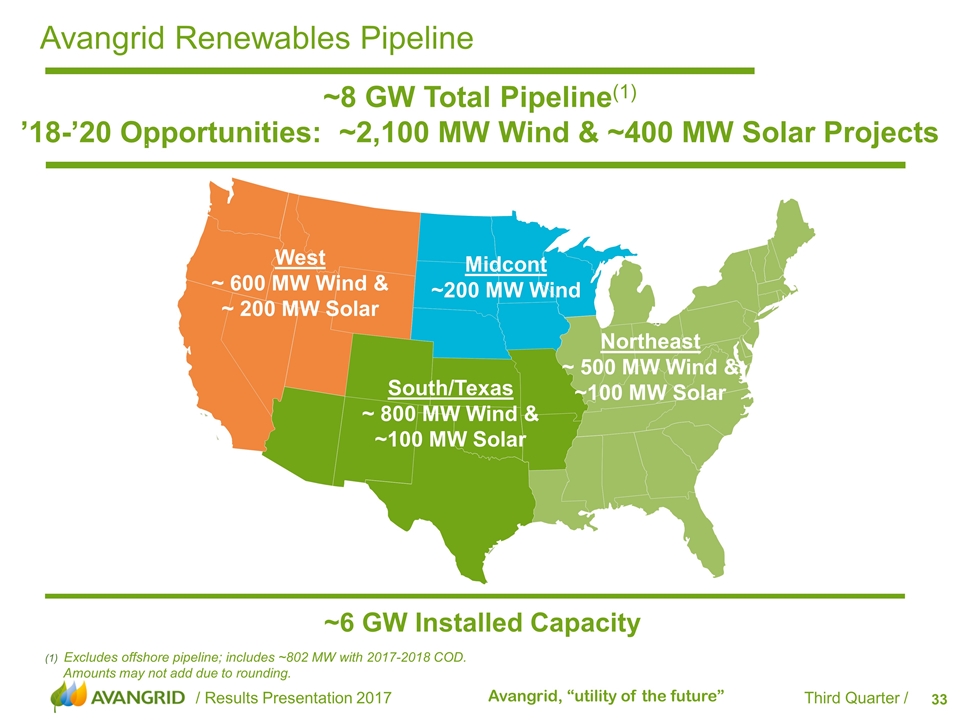

Avangrid Renewables Pipeline ~8 GW Total Pipeline(1) ’18-’20 Opportunities: ~2,100 MW Wind & ~400 MW Solar Projects (1) Excludes offshore pipeline; includes ~802 MW with 2017-2018 COD. Amounts may not add due to rounding. West ~ 600 MW Wind & ~ 200 MW Solar South/Texas ~ 800 MW Wind & ~100 MW Solar Midcont ~200 MW Wind Northeast ~ 500 MW Wind & ~100 MW Solar ~6 GW Installed Capacity

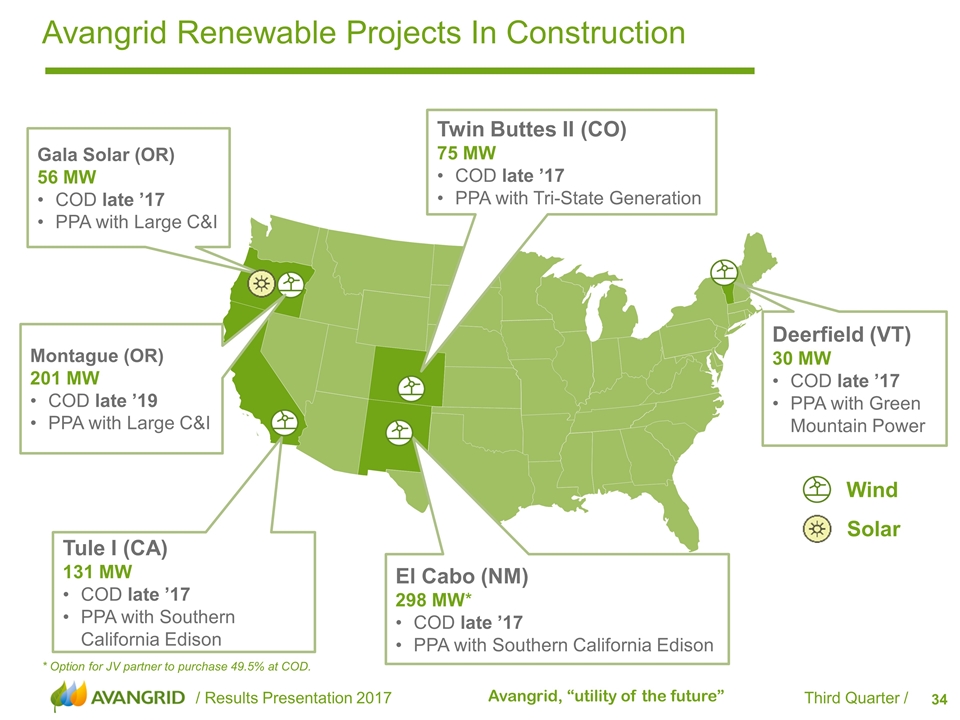

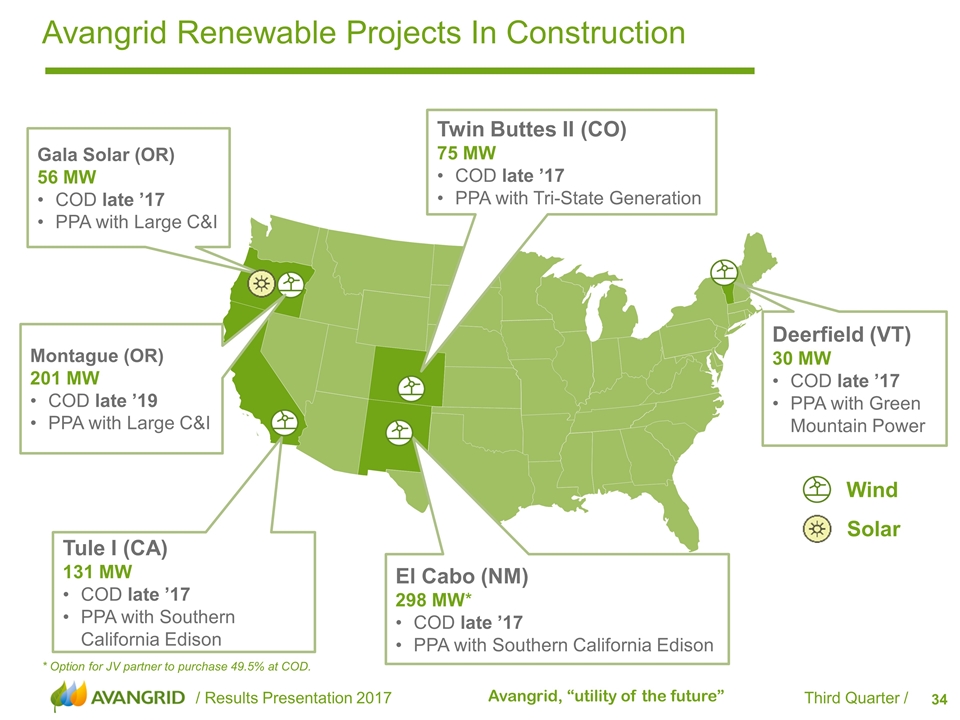

Avangrid Renewable Projects In Construction * Option for JV partner to purchase 49.5% at COD. Gala Solar (OR) 56 MW COD late ’17 PPA with Large C&I El Cabo (NM) 298 MW* COD late ’17 PPA with Southern California Edison Deerfield (VT) 30 MW COD late ’17 PPA with Green Mountain Power Twin Buttes II (CO) 75 MW COD late ’17 PPA with Tri-State Generation Tule I (CA) 131 MW COD late ’17 PPA with Southern California Edison Wind Solar Montague (OR) 201 MW COD late ’19 PPA with Large C&I

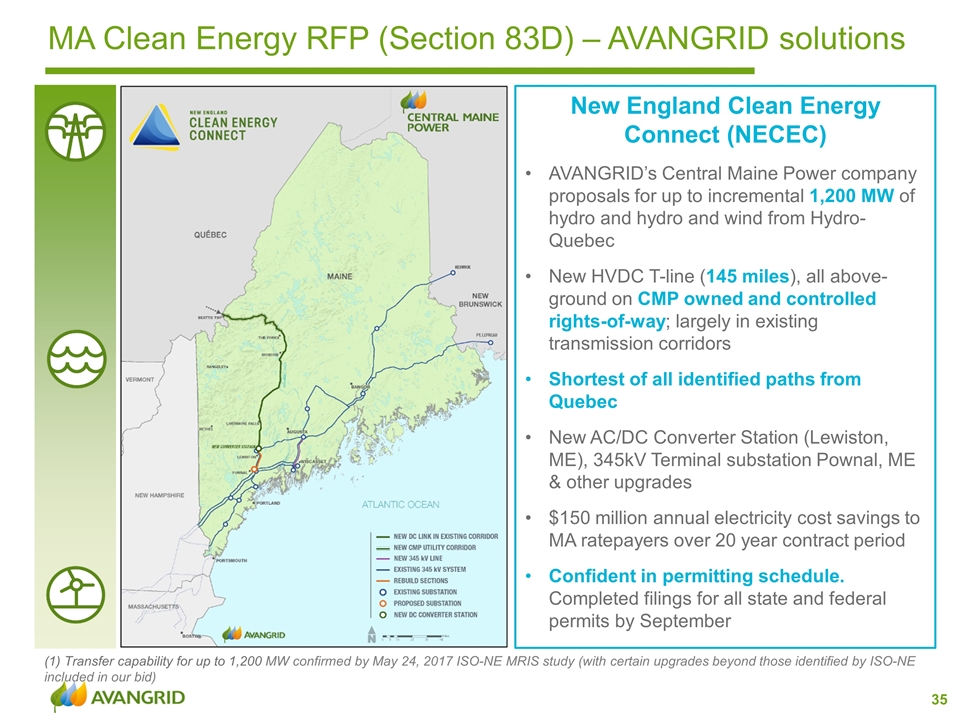

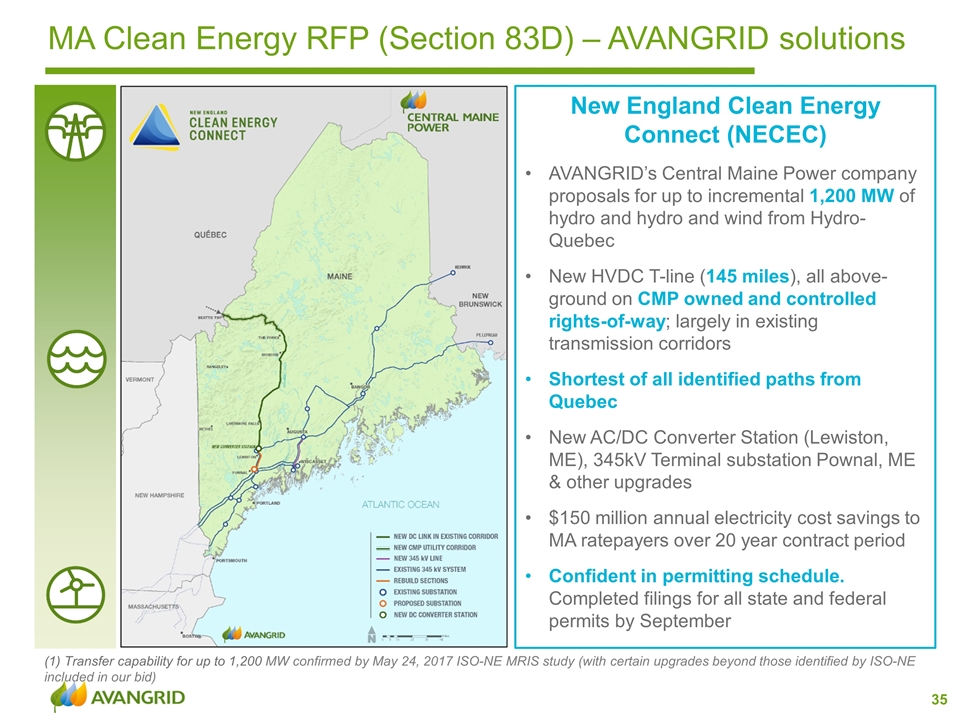

MA Clean Energy RFP (Section 83D) – AVANGRID solutions New England Clean Energy Connect (NECEC) AVANGRID’s Central Maine Power company proposals for up to incremental 1,200 MW of hydro and hydro and wind from Hydro-Quebec New HVDC T-line (145 miles), all above-ground on CMP owned and controlled rights-of-way; largely in existing transmission corridors Shortest of all identified paths from Quebec New AC/DC Converter Station (Lewiston, ME), 345kV Terminal substation Pownal, ME & other upgrades $150 million annual electricity cost savings to MA ratepayers over 20 year contract period Confident in permitting schedule. Completed filings for all state and federal permits by September (1) Transfer capability for up to 1,200 MW confirmed by May 24, 2017 ISO-NE MRIS study (with certain upgrades beyond those identified by ISO-NE included in our bid)

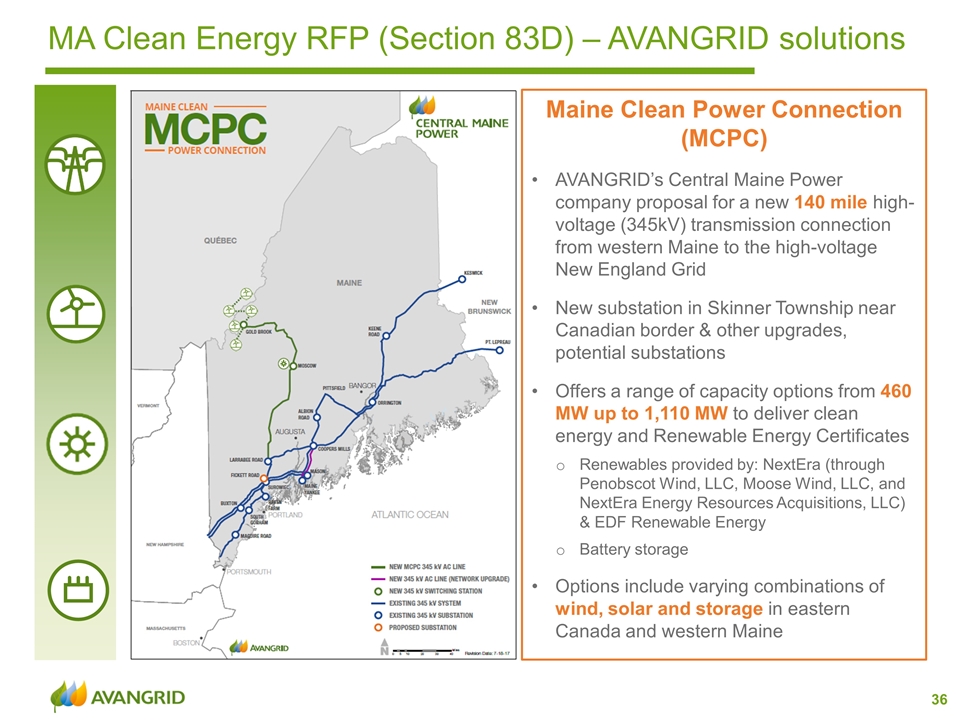

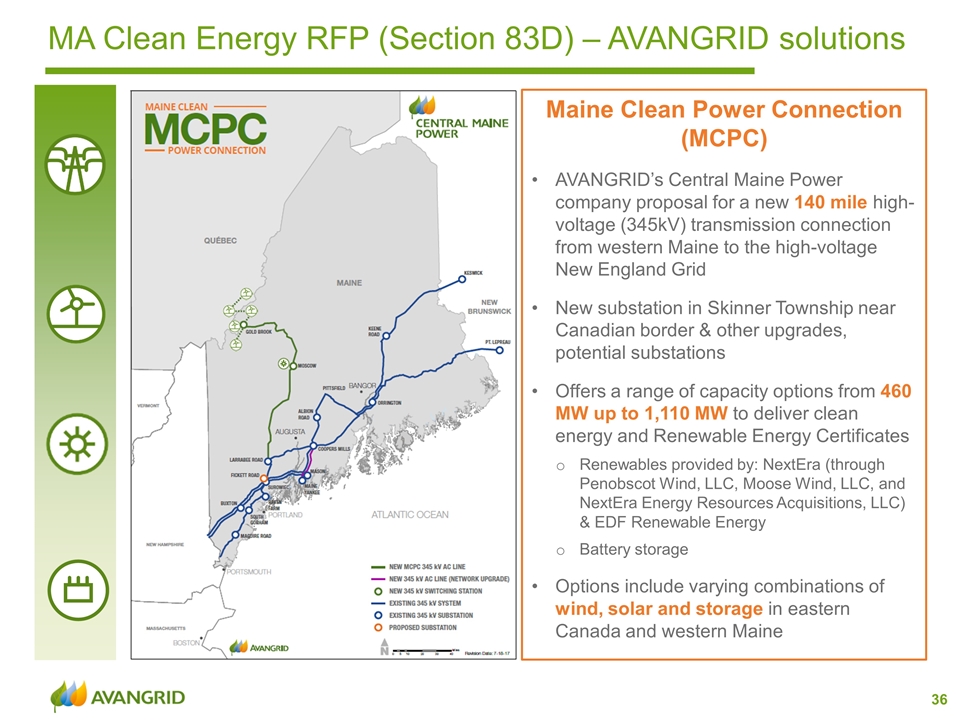

MA Clean Energy RFP (Section 83D) – AVANGRID solutions Maine Clean Power Connection (MCPC) AVANGRID’s Central Maine Power company proposal for a new 140 mile high-voltage (345kV) transmission connection from western Maine to the high-voltage New England Grid New substation in Skinner Township near Canadian border & other upgrades, potential substations Offers a range of capacity options from 460 MW up to 1,110 MW to deliver clean energy and Renewable Energy Certificates Renewables provided by: NextEra (through Penobscot Wind, LLC, Moose Wind, LLC, and NextEra Energy Resources Acquisitions, LLC) & EDF Renewable Energy Battery storage Options include varying combinations of wind, solar and storage in eastern Canada and western Maine

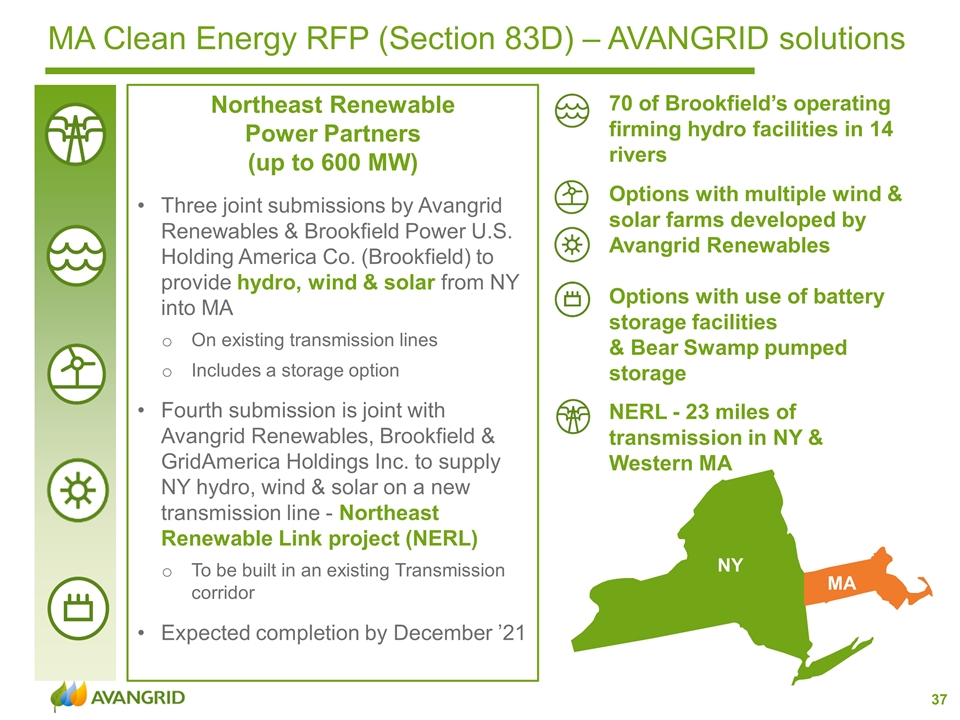

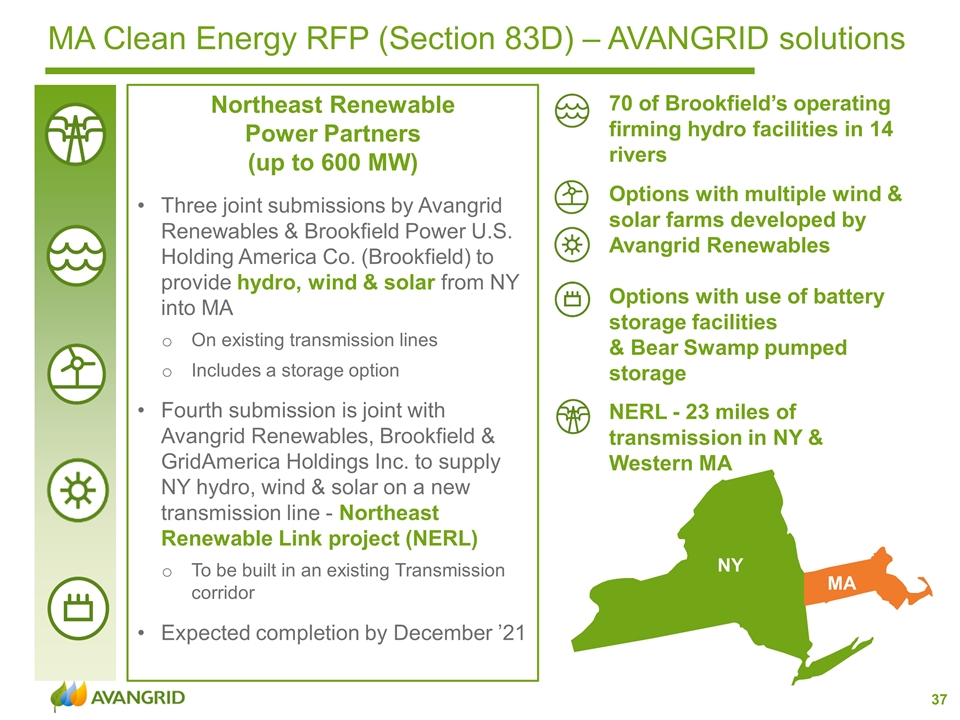

MA Clean Energy RFP (Section 83D) – AVANGRID solutions Northeast Renewable Power Partners (up to 600 MW) Three joint submissions by Avangrid Renewables & Brookfield Power U.S. Holding America Co. (Brookfield) to provide hydro, wind & solar from NY into MA On existing transmission lines Includes a storage option Fourth submission is joint with Avangrid Renewables, Brookfield & GridAmerica Holdings Inc. to supply NY hydro, wind & solar on a new transmission line - Northeast Renewable Link project (NERL) To be built in an existing Transmission corridor Expected completion by December ’21 MA NY 70 of Brookfield’s operating firming hydro facilities in 14 rivers NERL - 23 miles of transmission in NY & Western MA Options with multiple wind & solar farms developed by Avangrid Renewables Options with use of battery storage facilities & Bear Swamp pumped storage

Avangrid Renewables Offshore Strategy Growth Opportunity in Early-Stage Market with Strong Potential Offshore Pipeline(1): 50% ownership in Vineyard Wind (joint with Copenhagen Infrastructure Partners (CIP)), a 166,886 acre lease ~15 mi south of Martha’s Vineyard, MA Plans to participate in MA RFP for Offshore wind – bids due December ’17 Development team: significant experience from Avangrid Renewables, Iberdrola Group & CIP 100% ownership of 122,405 acre lease ~24 miles off coast of Kitty Hawk, NC (signed lease with Bureau of Ocean & Energy Management October ’17) (1) Based on National Renewable Energy Laboratory’s estimate of 3 MW per square kilometer, Vineyard Wind and Kitty Hawk have potential capacity of ~2.0 GW and ~1.5 GW, respectively. Actual size of the wind projects TBD. Project Timelines Beyond 2020

14% 65% 21% 10.57% FERC ROE ROE Complaint I October ’14 Order set base ROE 10.57%; Cap 11.74% (Opinion 531) April ’17 D.C. Court of Appeals vacated ’14 order & remanded to FERC for further proceedings June ’17 New England Transmission Owners (NETOs) filed to begin billing at the prior 11.14% (13.50% Cap) ROE, 60 days after FERC quorum, with retroactive billing to June 8, 2017 if no FERC decision was reached October ’17 FERC rejected NETOs’ filing and noted it will, on its order on remand, exercise its “ample authority to remedy its own errors after being reversed in court” to require refunds and/or surcharges as necessary to make the ROEs established in the October ’14 Order effective as of that date. ROE Complaints II and III FERC ALJ issued order March ’16 recommending to FERC: - Complaint II – Base/Cap ROE of 9.59%/10.42% for 15-month refund period - Complaint III & prospectively – Base/Cap ROE of 10.90%/12.19% for 15-month refund period & prospectively ROE Complaint IV Complaint filed April ’16 and in September ’17 FERC Trial Staff filed testimony recommending a Base/Cap ROE of 7.72%/9.40%. ALJ decision scheduled for March ’18 11.14% 11.74% Transmission ROEs Rate Base ~$2B 12/31/16 On October 5, NETOs filed for FERC to dismiss all ROE complaints as not in compliance with Section 206 requirements, as determined by the DC Court of Appeals The FERC also noted that an immediate return to the prior ROEs would have significantly complicated the process and noted that Opinion 531 cannot serve as precedent in other proceedings as a result of the April ’17 vacatur