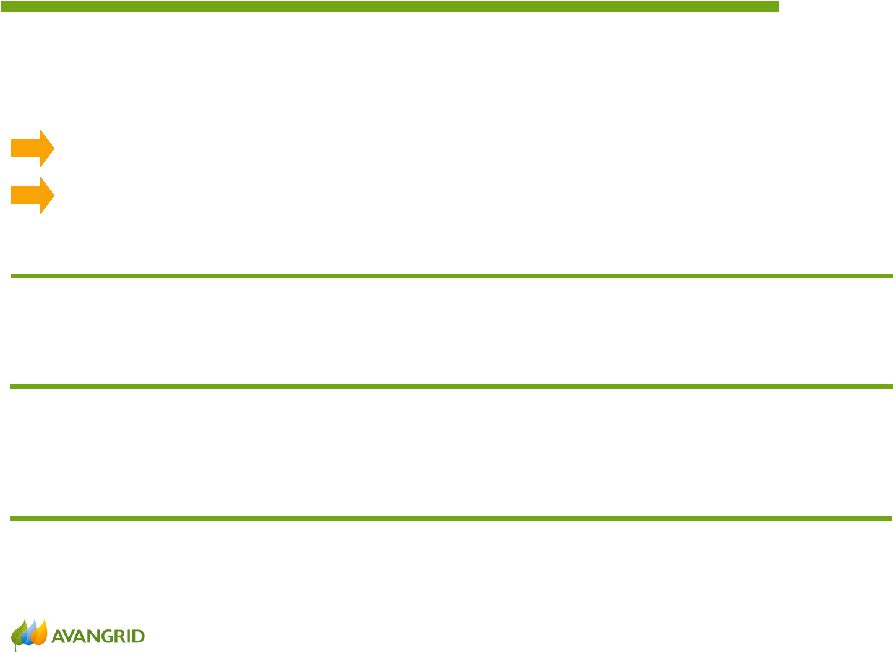

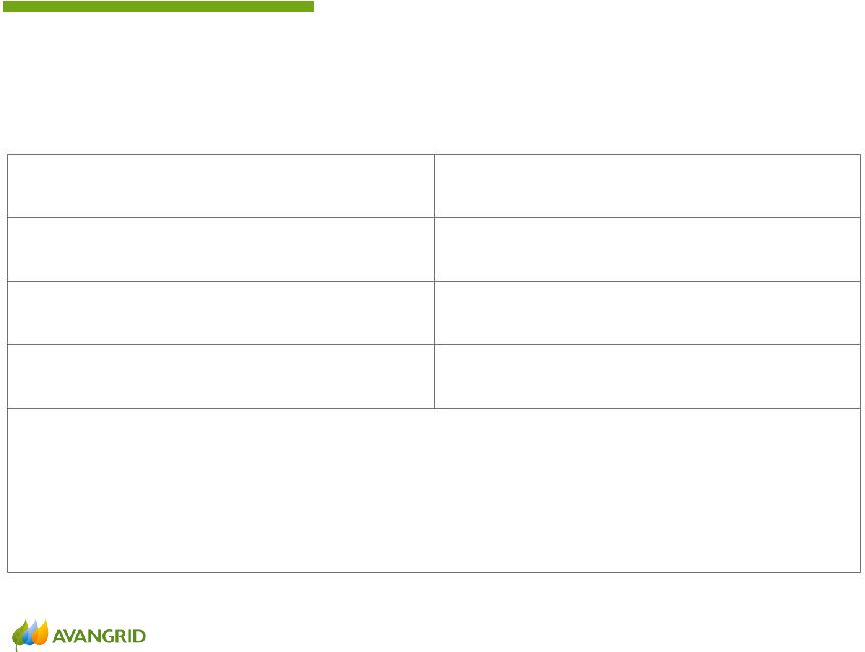

23 Avangrid, “utility of the future” Reconciliation AVANGRID 1Q ’18 Adjusted Net Income AVANGRID CONS Networks Renewables Corporate Gas Storage Net Income (Loss) Attributable to Avangrid, Inc. 244 200 $ 50 $ (5) $ (1) $ Adjustments: Add: Mark-to-market adjustments - Renewables (5) — (5) — — Restructuring charges (1) 1 1 — — — Loss from held for sale measurement (2) 5 — — — 5 Income tax impact of adjustments (3) 10 (0) 1 — 9 Gas Storage & Transportation adjustment, net of tax (4) (13) — — — (13) Adjusted Net Income 243 $ 201 $ 47 $ (5) $ — $ Add: Net loss attributable to noncontrolling interests (6) — (6) — — Income tax expense (5) 81 63 18 (1) — Depreciation and amortization (6) 255 147 108 — — Interest expense, net of capitalization (7) 38 24 9 5 — Less: Other income and (expense) — — — — — Earnings (losses) from equity method investments 2 2 — — — Adjusted EBITDA 608 $ 433 $ 176 $ (0) $ — $ Add: Operations and maintenance (8) 379 316 63 0 — Taxes other than income taxes 141 130 11 0 — Adjusted Gross Margin 1,129 $ 880 $ 249 $ 0 $ — $ (1) Restructuring charges relate to costs resulted from restructuring actions involving targeted voluntary workforce reductions within the Networks segment. (2) The amount of loss from measurement of assets and liabilities held for sale of Gas Storage & Transportation activity. (3) Income tax impact of adjustments: $1 million from mark-tomarket (MtM) adjustment, $(0.3) million from restructuring charges, $9 million from loss from held for sale measurement for the three months ended March 31, 2018. (4) Removal of the impact from Gas Storage & Transportation activity in the reconciliation of Net Income to adjusted EBITDA and adjusted gross margin. Three Months Ended March 31, 2018 (in millions) (5) Adjustments have been made for production tax credit adjustments for the amount of $28 million for three months ended March 31, 2018, have been reclassified from revenues to reflect classification by nature in the three months ended March 31, 2018. After reflecting these by nature classification adjustments the calculated effective income tax rate are impacted for the period presented under this by nature classification presentation. (6) Adjustments have been made for the inclusion of vehicle depreciation and bad debt provision within depreciation and amortization from operations and maintenance based on the by nature classification. Vehicle depreciation was $4 million and bad debt provision was $17 million in Networks, for the three months ended March 31, 2018. Additionally, government grants and investment tax credits amortization have been presented within other operating income and not within depreciation and amortization based on the by nature classification as follows: government grants of $1.0 million in Networks and investment tax credits of $22 million in Renewables, for the three months ended March 31, 2018. (7) Adjustments have been made for allowance for funds used during construction, debt portion, to reflect these amounts within other income and expenses in Networks for the periods presented. (8) Adjustments have been made for regulatory amounts to reflect amounts in revenues based on the by nature classification of these items for the periods presented. In addition, the vehicle depreciation and bad debt provision have been reflected within depreciation and amortization in Networks for the periods presented. |