- RMNI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Rimini Street (RMNI) DEF 14ADefinitive proxy

Filed: 17 May 18, 8:30am

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

| Filed by the Registrantx | Filed by a Party other than the Registrant¨ |

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material under §240.14a-12 |

RIMINI STREET, INC.

(Name of Registrant as Specified In Its Charter)

N/A

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. | |||

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. | |||

| (1) | Title of each class of securities to which transaction applies:

| |||

| (2) | Aggregate number of securities to which transaction applies:

| |||

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

| |||

| (4) | Proposed maximum aggregate value of transaction:

| |||

| (5) | Total fee paid: | |||

| ¨ | Fee paid previously with preliminary materials. | |||

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. | |||

| (1) | Amount Previously Paid:

| |||

| (2) | Form, Schedule or Registration Statement No.:

| |||

| (3) | Filing Party:

| |||

| (4) | Date Filed:

| |||

RIMINI STREET, INC.

3993 Howard Hughes Parkway, Suite 500

Las Vegas, NV 89169

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

| Date: | Thursday, June 7, 2018 |

| Time: | 12:00 p.m. Pacific Time |

| Place: | Rimini Street, Inc. |

California Operations Center

6601 Koll Center Parkway, Suite 300

Pleasanton, California 94566

Dear Stockholder:

Notice is hereby given that the annual meeting of the stockholders (the “Annual Meeting”) of Rimini Street, Inc., a Delaware corporation (the “Company”), will be held at the Company’s California Operations Center located at 6601 Koll Center Parkway, Suite 300, Pleasanton, California 94566 on Thursday, June 7, 2018, at 12:00 p.m., Pacific Time, for the following purposes (which are more fully described in the Proxy Statement, which is attached to and made a part of this Notice):

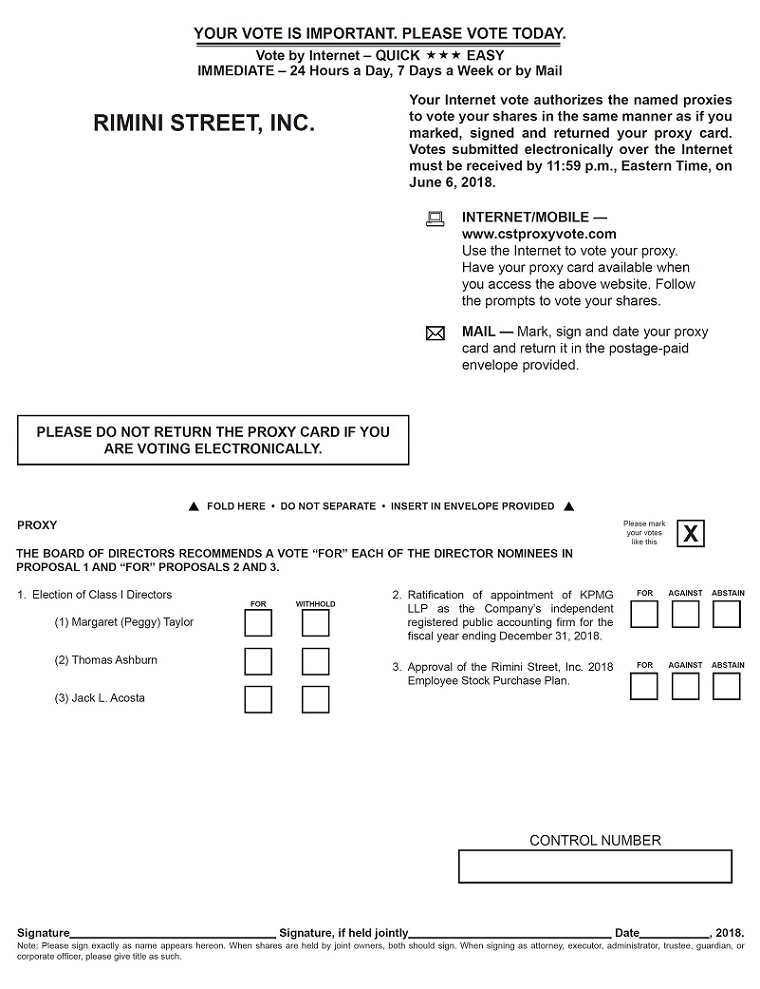

| 1. | To elect the three Class I director nominees identified in the accompanying Proxy Statement to the Board of Directors of the Company, each to hold office until the 2021 annual meeting of stockholders and until his or her successor is elected and qualified. |

| 2. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018. |

| 3. | To approve the Rimini Street, Inc. 2018 Employee Stock Purchase Plan. |

| 4. | To transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof. |

| Who can vote: | Stockholders of record at the close of business on April 18, 2018, (the “Record Date”) for the Annual Meeting, are entitled to notice of, and to attend and to vote at, the Annual Meeting and any postponement or adjournment thereof. | |

| How you can vote: | You may vote your proxy by (i) accessing the internet website specified on your proxy card or (ii) marking, signing and returning the enclosed proxy card in the pre-paid postage envelope provided. Stockholders who received their proxy card through an intermediary (such as a broker or bank) must deliver it in accordance with the instructions given by such intermediary. | |

| Who may attend: | All stockholders are cordially invited to attend the Annual Meeting in person. Stockholders of record as of the Record Date will be admitted to the Annual Meeting and any postponement or adjournment thereof upon presentation of identification. Please note that if your shares are held in the name of a bank, broker, or other nominee, and you wish to vote in person at the Annual Meeting, you must bring to the Annual Meeting a statement or letter from your bank, broker or other nominee showing your ownership of shares as of the record date and a proxy from the record holder of the shares authorizing you to vote at the Annual Meeting (such statement/letter and proxy are required in addition to your personal identification). |

Whether or not you plan to attend the Annual Meeting in person, you are encouraged to read the attached Proxy Statement and then cast your vote as promptly as possible in accordance with the instructions provided. Even if you have given your proxy, you may still vote in person if you attend the Annual Meeting and follow the instructions contained in the attached Proxy Statement.

| By Order of the Board of Directors | ||

| Rimini Street, Inc. | ||

| Sincerely, | ||

/s/ Seth A. Ravin | ||

Seth A. Ravin Chief Executive Officer and Chairman of the Board

|

Las Vegas, Nevada

May 17, 2018

YOUR VOTE IS IMPORTANT

Whether or not you expect to attend the Annual Meeting, you are urged to vote either via the internet website specified on your proxy card or by marking, signing and returning the enclosed proxy card in the pre-paid postage envelope provided. If you hold shares of common stock through a broker, bank or other nominee, your broker, bank or other nominee will vote your shares for you if you provide instructions on how to vote the shares. In the absence of instructions, your brokerage firm, bank or other nominees can only vote your shares on certain limited maters. It is important that you provide voting instructions because brokers, banks and other nominees do not, for example, have the authority to vote your shares for the election of directors without instructions from you.

Table of Contents

PLEASE CAREFULLY READ THE PROXY STATEMENT. EVEN IF YOU EXPECT TO ATTEND THE ANNUAL MEETING, PLEASE PROMPTLY COMPLETE, EXECUTE, DATE AND RETURN THE ENCLOSED PROXY CARD IN THE ACCOMPANYING POSTAGE-PAID ENVELOPE. NO POSTAGE IS NECESSARY IF MAILED IN THE UNITED STATES. YOU MAY ALSO VOTE ELECTRONICALLY VIA THE INTERNET BY FOLLOWING THE INSTRUCTIONS ON THE PROXY CARD. IF YOU VOTE BY INTERNET, THEN YOU NEED NOT RETURN A WRITTEN PROXY CARD BY MAIL. STOCKHOLDERS WHO ATTEND THE ANNUAL MEETING MAY REVOKE THEIR PROXIES AND VOTE IN PERSON IF THEY SO DESIRE.

RIMINI STREET, INC.

PROXY STATEMENT

FOR THE ANNUAL MEETING OF STOCKHOLDERS

To be Held Thursday, June 7, 2018

The following information is provided to each stockholder in connection with the Annual Meeting of Stockholders (the “Annual Meeting”) of Rimini Street, Inc. (the “Company”) to be held at the Company’s California Operations Center located at 6601 Koll Center Parkway, Suite 300, Pleasanton, California 94566 on Thursday, June 7, 2018, at 12:00 p.m., Pacific Time.

The enclosed proxy is for use at the Annual Meeting and any postponement or adjournment thereof. This proxy statement (this “Proxy Statement”) and form of proxy are being mailed to stockholders beginning on or about May 17, 2018.

The Company’s principal executive offices are located at 3993 Howard Hughes Parkway, Suite 500, Las Vegas, Nevada, 89169, and the Company’s website is www.riministreet.com.

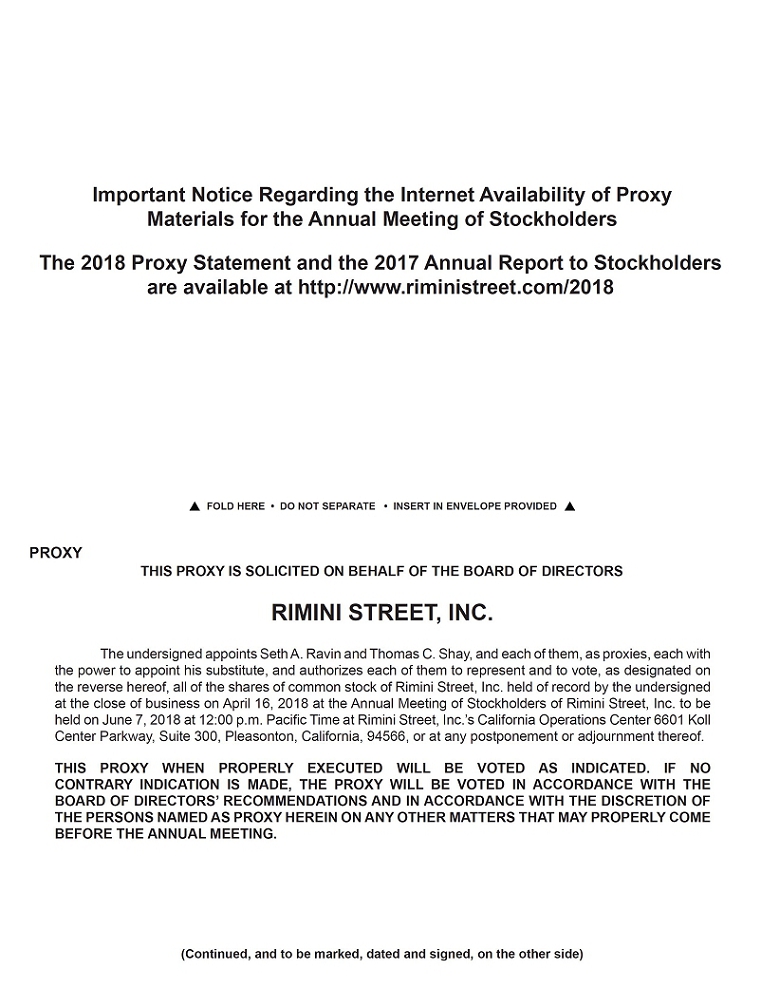

Important Notice Regarding the Availability of Proxy Materials for the Annual Meeting to be Held on June 7, 2018.This Notice of Annual Meeting of Stockholders and Proxy Statement and our 2017 Annual Report are available athttp://www.cstproxy.com/riministreet/2018 and through our website at the address specified above.

| 1 |

In May 2017, Rimini Street, Inc., a Nevada corporation (“RSI”) entered into an Agreement and Plan of Merger (the “Merger Agreement”) with GP Investments Acquisition Corp. (“GPIA”), a publicly-held special purpose acquisition company incorporated in the Cayman Islands and formed for the purpose of effecting a business combination with one or more businesses. Substantially all of GPIA’s assets consisted of cash and cash equivalents. The Merger Agreement was approved by the respective shareholders of RSI and GPIA in October 2017, and closing occurred on October 10, 2017, resulting in (i) the merger of a wholly-owned subsidiary of GPIA with and into RSI, with RSI as the surviving corporation (the “First Merger”), after which (ii) RSI merged with and into GPIA, with GPIA as the surviving corporation (the “Second Merger”, and collectively with the First Merger, the “Mergers”). Prior to consummation of the Mergers, GPIA domesticated as a Delaware corporation (the “Delaware Domestication”). Immediately after the Delaware Domestication and the consummation of the Second Merger, GPIA was renamed “Rimini Street, Inc.” (referred to herein as the “Company”, as distinguished from RSI with the same legal name). Upon consummation of the Mergers, RSI appointed seven of the nine members of the Board of Directors of the Company (the “Board”), and the former shareholders of RSI obtained an 83% interest in the outstanding shares of the Company’s common stock. The Company began trading on the Nasdaq Global Market on October 11, 2017.

| 2 |

Questions and Answers about the Annual Meeting and Voting

| Q: | What is this document? |

| A: | This document is the Proxy Statement of Rimini Street, Inc., which is being sent to stockholders in connection with our Annual Meeting. A proxy card is also being provided with this document. |

We have tried to make this document simple and easy to understand in accordance with Securities and Exchange Commission (“SEC”) rules. We refer to Rimini Street, Inc. as “we,” “us,” “our,” the “Company” or “Rimini Street.”

| Q: | Why am I receiving these materials? |

| A: | You are receiving these materials because you were one of our stockholders as of the close of business on April 18, 2018, the record date (the “Record Date”) for determining who is entitled to receive notice of and to vote at the Annual Meeting. We are soliciting your proxy (i.e., your permission) to vote your shares of Rimini Street common stock upon matters to be considered at the Annual Meeting. |

| Q: | Who may vote at the Annual Meeting? What are my voting rights? |

| A: | As of the Record Date, there were 59,474,790 shares of our common stock outstanding and entitled to be voted at the Annual Meeting. You may cast one vote for each share of common stock held by you as of the Record Date on each director nominee and on each of the other matters presented at the Annual Meeting. Stockholders do not have cumulative voting rights. |

| Q: | What proposals will be voted on at the Annual Meeting? |

| A: | There are three proposals to be considered and voted on at the Annual Meeting: |

| 1. | To elect the three Class I director nominees identified in this Proxy Statement to the Board, each to serve until the 2021 annual meeting of stockholders and until his or her successor is elected and qualified (the “Election of Directors”). |

| 2. | To ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending December 31, 2018 (the “Auditor Ratification Proposal”). |

| 3. | To approve the 2018 Rimini Street, Inc. Employee Stock Purchase Plan (the “ESPP Proposal”). |

The Company will also transact such other business as may properly come before the Annual Meeting or any adjournments or postponements thereof.

| Q: | How many shares must be represented to have a quorum and hold the Annual Meeting? |

| A: | The presence in person or by proxy of holders of a majority of our common stock issued and outstanding and entitled to vote as of the Record Date is needed for a quorum at the Annual Meeting. Abstentions and broker non-votes will be counted towards the quorum requirement. |

| Q: | How do I cast my vote? |

| A: | If you are a stockholder of record on the Record Date, you may vote in person at the Annual Meeting or in advance of the Annual Meeting. You can vote in advance of the Annual Meeting by completing, signing, dating and returning the enclosed proxy card in the accompanying pre-addressed, postage-paid envelope, or, if you prefer, by following the instructions on your proxy card for internet voting. Please have your proxy card with you if you are going to vote through the internet. If you attend the Annual Meeting in person, you may request a ballot when you arrive. |

| 3 |

If you hold your shares in street name through a broker, bank or other nominee rather than directly in your own name, you are considered the beneficial owner of those shares, and this Proxy Statement is being forwarded to you by your broker, bank or other nominee, together with a voting instruction card. To vote at the Annual Meeting, beneficial owners will need to contact the broker, bank or other nominee that holds their shares to obtain a “legal proxy” to bring to the Annual Meeting.

If you hold shares in the name of a broker, bank or other nominee you may be able to vote those shares by internet or telephone depending on the voting procedures used by your broker, bank or other nominee, as explained below under the question“How do I vote if my shares are held in “street name” by a broker, bank or other nominee?”

| Q: | How do I vote if my shares are held in “street name” by a broker, bank or other nominee? |

| A: | If your shares are held by a broker, bank or other nominee (this is called “street name”), your broker, bank or other nominee (your “Financial Institution”) will send you instructions for voting those shares. Many (but not all) Financial Institutions participate in a program provided through Broadridge Investor Communication Solutions that offers internet and telephone voting options. |

| Q: | How do I change my vote? |

| A: | You may revoke your proxy and change your vote at any time before it is exercised at the Annual Meeting. You can revoke a proxy (i) by giving written notice to the Company’s secretary at the address listed on the first page of this Proxy Statement, (ii) delivering an executed, later-dated proxy or (iii) voting in person at the Annual Meeting. However, your attendance at the Annual Meeting will not automatically revoke your proxy unless you also vote at the meeting or specifically request in writing that your proxy be revoked. If your shares of common stock are held in street name and you wish to change or revoke your voting instructions, you should contact your Financial Institution for information on how to do so. |

| Q: | What is the voting standard for the Election of Directors? |

| A: | In regard to the Election of Directors, you may vote “FOR” all or some of the nominees or you may “WITHHOLD” your vote for any nominee you specify. |

Directors are elected by a plurality of votes cast at the Annual Meeting. As a result, the three directors receiving the highest number of “FOR” votes will be elected as directors.

| Q: | What is the voting standard on the Auditor Ratification Proposal and the ESPP Proposal? |

| A: | You may vote “FOR,” “AGAINST” or “ABSTAIN” on each of the Auditor Ratification Proposal and the ESPP Proposal. |

The approval of each of these proposals requires the affirmative vote of a majority of the voting power of the shares of common stock present in person or represented by proxy at the Annual Meeting and entitled to vote.

Abstentions will have the same effect as a vote cast “AGAINST” each of these proposals.

| Q: | How does the Company’s Board of Directors recommend that I vote? |

| A: | The Board unanimously recommends that you vote: |

| · | “FOR” the election of each of the three Class I director nominees to the Board identified in this Proxy Statement; |

| · | “FOR” the Auditor Ratification Proposal; and |

| · | “FOR” the ESPP Proposal. |

| 4 |

| Q: | What are “broker votes” and “broker non-votes?” |

| A: | On certain “routine” matters, Financial Institutions have discretionary authority under applicable stock exchange rules to vote their customers’ shares if their customers do not provide voting instructions. When a Financial Institution votes its customers’ shares on a routine matter without receiving voting instructions (referred to as a“broker vote”), these shares are counted both for establishing a quorum to conduct business at the Annual Meeting and in determining the number of shares voted“FOR” or“AGAINST” the routine matter. For purposes of the Annual Meeting, the Auditor Ratification Proposal is considered a “routine” matter. |

Under New York Stock Exchange (“NYSE”) requirements generally applicable to Financial Institutions, (i) the Election of Directors and (ii) the ESPP Proposal are considered “non-routine” matters for which Financial Institutions do not have discretionary authority to vote their customers’ shares if their customers did not provide voting instructions. Therefore, for purposes of the Annual Meeting, if you hold your stock through an account at a Financial Institution, your Financial Institution may not vote your shares on your behalf on these proposals without receiving instructions from you. When a Financial Institution does not have the authority to vote its customers’ shares or does not exercise its authority, these situations are referred to as “broker non-votes.” Broker non-votes are only counted for establishing a quorum and will have no effect on the outcome of the vote.

We encourage you to provide voting instructions to your Financial Institution so that your shares will be voted at the Annual Meeting on all matters up for consideration.

| Q: | What information is available on the internet? |

| A: | A copy of this Proxy Statement and our 2017 Annual Report to Stockholders is available for download free of charge athttp://www.cstproxy.com/riministreet/2018. |

Our website address is www.riministreet.com. We use our website as a channel of distribution for important information about us. Important information, including press releases, analyst presentations and financial information regarding Rimini Street is routinely posted on and accessible on the Investor Relations subpage of our website.

In addition, we make available on the Investor Relations subpage of our website free of charge the reports we file with the SEC (e.g., our annual reports on Form 10-K, quarterly reports on Form 10-Q, current reports on Form 8-K, proxy statements on Schedule 14A, and ownership reports on Forms 3, 4 and 5). Further, copies of our Certificate of Incorporation and Bylaws, our Code of Business Conduct and Ethics, our Corporate Governance Guidelines and the charters for the Audit, Compensation and Nominating & Corporate Governance Committees of the Board are also available on the Investor Relations subpage of our website.

Information from our website is not incorporated by reference into this Proxy Statement.

| Q: | What if I return my proxy card (or complete the internet voting procedures) but do not provide voting instructions? |

| A: | The Board has named Seth A. Ravin, our Chief Executive Officer and Chairman of the Board, and Thomas C. Shay, our Senior Vice President, Chief Information Officer and Secretary, as official proxy holders. They will vote all proxies, or record an abstention or withholding as applicable, in accordance with the instructions you provide. |

IF YOU ARE A REGISTERED HOLDER AND SIGN AND RETURN YOUR PROXY CARD BUT GIVE NO DIRECTION OR COMPLETE THE INTERNET VOTING PROCEDURES BUT DO NOT SPECIFY HOW YOU WANT TO VOTE YOUR SHARES, YOUR SHARES WILL BE VOTED“FOR” THE ELECTION OF EACH OF THE THREE CLASS I DIRECTOR NOMINEES TO THE BOARD OF DIRECTORS;“FOR” THE AUDITOR RATIFICATION PROPOSAL; AND“FOR” THE ESPP PROPOSAL.

| 5 |

| Q: | Who is soliciting my vote? |

| A: | Our Board is soliciting your vote for matters being submitted for stockholder approval at the Annual Meeting. |

| Q: | Who will bear the cost for soliciting votes for the Annual Meeting? |

| A: | We will bear the cost of soliciting proxies. In addition to the use of mail, our directors, officers and non-officer employees may solicit proxies in person or by telephone or other means. These persons will not be compensated for the solicitation but may be reimbursed for out-of-pocket expenses. Morrow Sodali LLC has been retained by the Company to provide broker search and materials distribution services, as well as serve as the Company’s Administration Agent for the Annual Meeting for a fee of $2,500 plus distribution costs and other expenses. We have also made arrangements with certain Financial Institutions and other custodians to forward this material to the beneficial owners of our common stock, and we will reimburse them for their reasonable out-of-pocket expenses. |

| Q: | Who will count the votes? |

| A: | We have hired our Transfer Agent, Continental Stock Transfer & Trust Company, to tabulate the votes cast at the Annual Meeting and be responsible for determining whether or not a quorum is present. |

| Q: | Where can I find voting results of the Annual Meeting? |

| A: | We will announce preliminary voting results at the Annual Meeting and publish final results on a Current Report on Form 8-K that we expect to file with the SEC within four business days after the Annual Meeting (a copy of which will be available on the “Investors Relations” subpage of our website). |

| Q: | May I propose actions for consideration at the next Annual Meeting of Stockholders or nominate individuals to serve as directors? |

| A: | You may submit proposals for consideration at future stockholder meetings, including director nominations, if you satisfy the applicable requirements. Please see “Other Matters” for more details. |

| Q: | Whom should I contact with questions about the Annual Meeting? |

| A: | If you have any questions about this Proxy Statement or the Annual Meeting, please contact the Rimini Street Investor Relations Department by email at IR@riministreet.com or by calling (925) 523-7636. |

| Q: | What if I have more than one account? |

| A: | Please vote proxies for all accounts so that all your shares are voted. You may be able to consolidate multiple accounts through our Transfer Agent, Continental Stock Transfer & Trust Company online at www.continentalstock.com or by calling (212) 509-4000. |

| Q: | Will a list of stockholders entitled to vote at the Annual Meeting be available? |

| A: | In accordance with Delaware law, a list of stockholders entitled to vote at the Annual Meeting will be available at our California Operations Center, where the Annual Meeting will be located, on June 7, 2018, and will be accessible for ten days prior to the date of the Annual Meeting between the hours of 9:00 a.m. and 5:00 p.m., Monday through Friday, at both our principal executive offices in Nevada and our California Operations Center (see the first page of this Proxy Statement for address information). |

| 6 |

| Q: | Where and when is the Annual Meeting being held? |

| A: | We will hold the Annual Meeting at our California Operations Center located at 6601 Koll Center Parkway, Suite 300, Pleasanton, California 94566 on Thursday, June 7, 2018, at 12:00 p.m., Pacific Time, unless postponed or adjourned to a later date. |

| Q: | What are the implications of being an “Emerging Growth Company”? |

| A: | We are an “emerging growth company,” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act, and may remain an emerging growth company until the last day of the fiscal year ending December 31, 2020. The JOBS Act contains provisions that, among other things, reduce certain reporting requirements for an emerging growth company. For so long as we remain an emerging growth company, we are permitted and plan to rely on exemptions from certain disclosure requirements that are applicable to other public companies that are not emerging growth companies. These exemptions include reduced disclosure obligations regarding executive compensation. In addition, as an emerging growth company, we are not required to conduct votes seeking approval, on an advisory basis, of the compensation of our named executive officers or the frequency with which such votes must be conducted. We may take advantage of some or all these exemptions until such time as we are no longer an emerging growth company. We would cease to be an emerging growth company earlier than December 31, 2020 if we have more than $1 billion in annual revenue, we have more than $700 million in market value of our stock held by non-affiliates or we issue more than $1 billion of non-convertible debt over a three-year period. We have taken advantage of certain reduced reporting obligations in this Proxy Statement. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. |

| 7 |

ELECTION OF DIRECTORS

The Board has nominated each of the Class I directors named below for election at the Annual Meeting. All of the nominees currently serve as directors. Each person elected will serve until the 2021 annual meeting of stockholders and until his or her successor has been elected and has qualified. Although the Board does not contemplate that any of the nominees will be unable to serve, if such a situation arises, the Board may designate a substitute nominee or reduce the size of the Board. If the Board designates a substitute nominee, proxies will be voted for such substitute nominee.

The Nominating & Corporate Governance Committee of the Board (the “Nominating Committee”) is responsible for director recruitment and recommending to the Board all director nominees. Stockholders who wish to recommend a person for consideration as a director nominee should follow the procedures described below under the heading “Stockholder Recommendation of Nominees.” The Board selected the nominees for election at the Annual Meeting upon the unanimous recommendation of the members of the Nominating Committee.

The following table sets forth the names, ages and positions of the members of the Board as of April 25, 2018:

| Name | Age | Position(s) with the Company | ||

Class I Director Nominees (for term through 2021) | ||||

| Margaret (Peggy) Taylor(1)(2) | 66 | Lead Independent Director; Chair of Compensation Committee | ||

| Thomas Ashburn(1)(3) | 74 | Director; Chair of Nominating Committee | ||

| Jack L. Acosta(2) | 71 | Director; Chair of Audit Committee | ||

| Class II Directors (term continues through 2019) | ||||

| Thomas Shay | 52 | Director; Senior Vice President, Chief Information Officer and Secretary | ||

| Robin Murray(3) | 53 | Director | ||

| Antonio Bonchristiano | 51 | Director | ||

| Class III Directors (term continues through 2020) | ||||

| Seth A. Ravin | 51 | Chairman of the Board and Chief Executive Officer | ||

| Steve Capelli(1)(2)(3) | 61 | Director | ||

| Andrew Fleiss(1)(2)(3) | 39 | Director |

| (1) | Member of the Compensation Committee |

| (2) | Member of the Audit Committee |

| (3) | Member of the Nominating Committee |

| 8 |

Class I Director Nominees – Biographical Information

Margaret (Peggy) Taylor

Ms. Taylor has served as a member of the Board since the Mergers in October 2017, and previously served on the board of directors of RSI from January 2014 until October 2017. Ms. Taylor served as President of PeopleSoft Investments, Inc., an investment management and advisory services company and subsidiary of PeopleSoft, Inc. (acquired by Oracle Corporation), from January 2000 until her retirement in January 2005, and as Senior Vice President of Corporate Operations of PeopleSoft, Inc., an enterprise software company, from January 1989 to December 1999. Since January 2005, she has served as a private investor/advisor. From January 2000 to December 2003, Ms. Taylor served as President of Nevada Pacific Development Corp., a consulting services firm. From December 1999 to December 2000, Ms. Taylor served as Chief Executive Officer of Venture Builders, LLC, a consulting company for start-up businesses. From May 1986 to October 1988, Ms. Taylor served as a Vice President Trust and Investment Management at Hibernia Bank, a financial institution. From January 1983 to October 1985, Ms. Taylor served as Vice President of Organization, Planning, and Development at Bank of California, a financial institution. Ms. Taylor has also served on the Board of Directors of numerous publicly traded corporations, including Fair Isaac Corporation, a decision analytics company, from December 1999 to February 2012. In addition, Ms. Taylor has served and continues to serve as a member of the Board of Directors of various private companies. Ms. Taylor holds a Bachelor of Arts degree in Communications and Psychology from Lone Mountain College of California. Ms. Taylor has also completed the Corporate Governance Program at Stanford Business School and the Compensation Committees Program at Harvard Business School.

Director Qualifications. We believe Ms. Taylor is qualified to serve as a member of our Board because of her extensive experience in the enterprise software industry and serving on boards of directors of various technology companies.

Jack L. Acosta

Mr. Acosta has served as a member of the Board since the Mergers in October 2017, and previously served on the board of directors of RSI from October 2013 until October 2017. Mr. Acosta served as Chief Financial Officer and Vice President, Finance of Portal Software, a software company acquired by Oracle Corporation, from February 1999 until his retirement in September 2001. Since September 2001, he has served as a private investor/advisor. In addition, Mr. Acosta served as Secretary of Portal Software from February 1999 to April 1999. From July 1996 to January 1999, Mr. Acosta served as Executive Vice President and Chief Financial Officer of Sybase, Inc., a database company acquired by SAP AG. Mr. Acosta serves on the Board of Directors of Five9, Inc., a provider of cloud software for contact centers. From March 2004 to July 2009, Mr. Acosta served on the Board of Directors of SumTotal Systems, Inc., a provider of learning, performance, and compensation management software and services. Mr. Acosta has served and continues to serve as a member of various private company boards of directors. Mr. Acosta holds a Bachelor of Science in Industrial Relations from California State University, East Bay, a Masters of Science in Management Sciences from California State University, East Bay and an Honorary Doctor of Humane Letters degree from California State University, East Bay.

Director Qualifications.We believe Mr. Acosta is qualified to serve as a member of our Board because of his extensive experience in the enterprise software industry and serving on the boards of directors of various technology companies.

Thomas Ashburn

Mr. Ashburn has served as a member of the Board since the Mergers in October 2017, and previously served on the board of directors of RSI from January 2014 until October 2017. Mr. Ashburn served in various management positions at BEA Systems, Inc., an enterprise infrastructure software company acquired by Oracle Corporation, from February 2002 until his retirement in 2007, including President, Worldwide Field Organization, from May 2006 to 2007, Executive Vice President, Worldwide Field Organization, from August 2004 to May 2006, and Executive Vice President, Worldwide Services, from February 2002 to August 2004. Mr. Ashburn served as an advisor to BEA Systems, Inc. for Worldwide Services from August 2001 to February 2002. Prior to his service with BEA Systems, Inc., Mr. Ashburn served in various management positions at Hewlett-Packard Company, a multinational information technology company, including most recently as Vice President and General Manager, Hewlett-Packard Services, from 1998 to February 2001. Since 2007, Mr. Ashburn has served as a private investor/advisor. Mr. Ashburn has also served and continues to serve as a member of various private company boards of directors. Mr. Ashburn holds a Bachelor of Science in Industrial Technology from California State University, Long Beach.

| 9 |

Director Qualifications.We believe Mr. Ashburn is qualified to serve as a member of our Board because of his extensive experience in the enterprise software industry and serving on boards of directors of various technology companies.

Class II Directors – Biographical Information

Thomas Shay

Mr. Shay co-founded our company, has served as a member of the Board since the Mergers in October 2017, and previously served on the board of directors of RSI from September 2005 until October 2017. Mr. Shay has served as our (and prior to October 2017, RSI’s) Senior Vice President and Chief Information Officer since August 2012, Executive Vice President, Operations from October 2006 to August 2012, and Chief Technology Officer from January 2006 to October 2006. Mr. Shay has served as our (and prior to October 2017, RSI’s) Secretary since August 2006. From July 1989 to November 2004, Mr. Shay served in various roles at Sun Microsystems, Inc., a software and information technology company acquired by Oracle Corporation, most recently as Field Application Engineering Manager, Asia Pacific where he oversaw multiple engineering teams across Japan, China, Taiwan, Korea and Singapore. Mr. Shay holds a Bachelor of Science in Electrical Engineering from UCLA, and a Masters of Engineering in Electrical and Computer Engineering from Cornell University.

Director Qualifications.We believe Mr. Shay is qualified to serve as a member of our Board because of the perspective and experience he brings as our Chief Information Officer and a longstanding member of the Board. We also value his deep understanding of our business as it has evolved over time and his strong background in enterprise software maintenance and support.

Robin Murray

Mr. Murray has served as a member of the Board since the Mergers in October 2017, and previously served on the board of directors of RSI from June 2009 until October 2017. Mr. Murray is a partner at Adams Street Partners, LLC, a global venture capital firm and affiliate of the Company, which he joined in 2008. From 2001 to 2008, Mr. Murray served as a partner at 3i Ventures Corporation, a private equity and venture capital firm, where he led the Menlo Park, California office. From 1997 to 2001, Mr. Murray served as Chief Financial Officer of both iPIN Corporation, an electronic payment technology company acquired by Intel Corporation, and Ubicoms Ltd, a company acquired by The Hackett Group. From 1988 to 1995, Mr. Murray served in various roles in the London offices of J Sainsbury plc and Ernst & Young. Mr. Murray qualified as a Chartered Accountant with the Institute of Chartered Accountants of England & Wales. He holds a Bachelor of Science in Chemistry from Bristol University, England and a Masters of Business Administration from Stanford University Graduate School of Business.

Director Qualifications. We believe Mr. Murray is qualified to serve as a member of our Board because of his substantial corporate finance, business strategy and corporate development expertise gained from his significant experience in the venture capital industry analyzing, investing in and serving on the boards of directors of various private technology companies. We also value his perspective as a representative of one of our largest stockholders.

Antonio Bonchristiano

Mr. Bonchristiano has served as a member of the Board since the Mergers in October 2017, and previously served on the board of directors of GPIA from March 2015 until October 2017. He served as the Chief Executive Officer and Chief Financial Officer of GPIA from March 2015 until October 2017. He is a member of the Board and Chief Executive Officer of GP Investments, Ltd., a global private equity firm and affiliate of the Company, which he joined in 1993. He has served as a Managing Director of GP Investments since 1995. Prior to joining GP Investments, Mr. Bonchristiano was a Partner at Johnston Associates Inc., a finance consultancy based in London, and worked for Salomon Brothers Inc., an investment bank, in London and New York. Currently, he serves as a member of the Board of Directors of AMBEV, GP Advisors, and SPICE. Mr. Bonchristiano is also on the boards of several non-profit organizations, including: Fundacao Bienal and Fundacao Estudar in Sao Paulo, Brazil and John Carter Brown Library in Providence, Rhode Island. Previously, he served as a member of the boards of directors of several companies including BHG, Estacio, BR Properties, ALL, CEMAR, Gafisa, Submarino, Equatorial, BR Malls, Tempo and Magnesita Refratarios. He was also previously the Chief Financial Officer of SuperMar Supermercados and Founder and Chief Executive Officer of Submarino. Mr. Bonchristiano holds a Bachelor of Arts degree in Politics, Philosophy, and Economics from the University of Oxford.

| 10 |

Director Qualifications.We believe Mr. Bonchristiano is qualified to serve as a member of our Board due to his extensive experience in private equity, numerous directorship roles and financial expertise. We also value his perspective as a representative of one of our largest stockholders.

Class III Directors – Biographical Information

Seth A. Ravin

Mr. Ravin founded Rimini Street and has served as our (and prior to October 2017, RSI’s) Chief Executive Officer, Chairman of the Board and a director since September 2005 and also served as President from September 2005 to January 2011. Prior to joining us, Mr. Ravin served in various executive roles at TomorrowNow, Inc. from May 2002 to April 2005, most recently as President and a board director. TomorrowNow, Inc. was a supplier of software maintenance and support services for Oracle’s PeopleSoft and J.D. Edwards applications, and was acquired in January 2005 as a wholly-owned subsidiary of SAP America, Inc. From April 2000 to March 2001, Mr. Ravin served as Vice President of Inside Sales for Saba Software, Inc., a provider of e-Learning and human resource management software. From April 1996 to April 2000, Mr. Ravin served in various management roles at PeopleSoft, Inc., an enterprise software company acquired by Oracle, most recently as a Vice President of the Customer Sales Division. Mr. Ravin holds a Bachelor of Science in Business Administration from the University of Southern California.

Director Qualifications. We believe Mr. Ravin is qualified to serve as a member of our Board because of the perspective and experience he brings as Rimini Street’s Chief Executive Officer. We also value his deep understanding of Rimini Street’s business as it has evolved over time and his extensive senior management expertise in the software maintenance and support services industry.

Steve Capelli

Mr. Capelli has served as a member of the Board since the Mergers in October 2017, and previously served on the board of directors of RSI from January 2014 until October 2017. Mr. Capelli is the Chief Financial Officer of Blackberry Limited, an enterprise software and services company, a position he has held since October 2016, and has served as Blackberry Limited’s Chief Operating Officer since March 2018. Previously, Mr. Capelli served in various management positions at Sybase, Inc., an enterprise software and services company acquired by SAP, from December 1997 to April 2012, most recently as President, Worldwide Field Operations, from August 2006 to April 2012. Mr. Capelli served as a private investor/advisor from April 2012 until joining Blackberry Limited in October 2016. From August 1992 to December 1997, Mr. Capelli served in various management positions at Siemens-Pyramid, a subsidiary of Siemens Nixdorf, a computer and electronics company, including as Chief Financial Officer, Vice President of InterContinental Sales, and Director of Field Operations. From January 2005 to November 2005, Mr. Capelli served on the Board of Directors of Apropos Technology, Inc., a publicly traded business communication software firm. In addition, Mr. Capelli serves as a member of the Board of Directors of various private companies. Mr. Capelli holds a Bachelor of Science in Accounting from The College of New Jersey and a Masters of Business Administration from Rutgers University.

Director Qualifications.We believe Mr. Capelli is qualified to serve as a member of our Board because of his extensive experience in the enterprise software industry and serving on boards of directors of various technology companies.

| 11 |

Andrew Fleiss

Mr. Fleiss has served as a member of the Board since the Mergers in October 2017. He is a Managing Director of GP Investments, Ltd., a global private equity firm and affiliate of the company, which he joined in 2015, and has 19 years of experience in principal investments and investment banking. Prior to the Mergers, he primarily focused on identifying a suitable investment opportunity for GPIA and led the team structuring a transaction with and performing due diligence on the Company. Prior to joining GP Investments, Mr. Fleiss worked as a Principal at Liberty Partners, a private equity firm focused on control investments in manufacturing, services, healthcare and education companies, from September 2003 to June 2015. Prior to joining Liberty Partners, Mr. Fleiss worked from July 2000 to June 3003 as an Associate in the investment banking division of UBS Warburg focused on equity and debt financings, and mergers and acquisitions, for healthcare companies. Mr. Fleiss holds a Bachelor of Science degree in Psychology from Amherst College.

Director Qualifications. We believe Mr. Fleiss is qualified to serve as a member of our Board because of his extensive experience in private equity and investment banking and his lead role in structuring the transaction between the Company and GPIA.

Criteria and Diversity

Per our Corporate Governance Guidelines and the Charter for the Nominating Committee, the Nominating Committee determines, as appropriate, the desired qualifications, qualities, skills, and other expertise required to be a director and recommends to the full Board criteria to be considered in selecting director nominees, including character, judgment, diversity, age, expertise, corporate experience, length of service and other commitments.

The Nominating Committee reviews on an annual basis, in the context of recommending a slate of directors for stockholder approval, the composition of the Board. In determining whether to recommend a director for re-election, the Nominating Committee considers the director’s character and integrity, past attendance at meetings, participation in and contributions to the activities of the Board and the Company, and ability to contribute to the diversity of experience and perspectives on the Board. The Nominating Committee assesses its effectiveness in in this regard as part of its annual review of Board composition.

Stockholder Recommendations of Nominees

Per our Corporate Governance Guidelines, it is the policy of the Board that the Nominating Committee consider recommendations for candidates to the Board from stockholders. Stockholders may recommend director nominees for consideration by the Nominating Committee by writing to the Secretary of the Company at the address listed on the first page of this Proxy Statement and providing the information required in our Bylaws. Following verification of the stockholder status of the person submitting the recommendation, all properly submitted recommendations will be promptly brought to the attention of the Nominating Committee. The Nominating Committee does not formally distinguish between candidates recommended by stockholders and candidates recommended by other directors, management and others (including third-party search firms, which the Nominating Committee may retain from time to time). Stockholders who desire to nominate persons directly for election to the Board at the Company’s annual meeting of stockholders must meet the deadlines and other requirements set forth in our Bylaws.

Board of Directors Recommendation

THE BOARD RECOMMENDS THAT YOU VOTE“FOR” THE ELECTION OF EACH OF THE CLASS I DIRECTOR NOMINEES IDENTIFIED ABOVE.

Vote Required

Directors are elected by a plurality of the votes cast at the Annual Meeting.

| 12 |

Our business affairs are managed under the direction of the Board. Our Board of Directors consists of nine members, six of whom qualify as independent within the meaning of the independent director guidelines of the Nasdaq Global Market. Messrs. Ravin, Shay and Bonchristiano are not considered independent. For additional information, please see the disclosure under the heading “Board Determination of Independence” below.

Per our Certificate of Incorporation, the Board is divided into three staggered classes of directors. At each annual meeting of stockholders, a class of directors will be elected for a three-year term to succeed the same class whose term is then expiring, as follows:

| • | the Class I directors (who are nominated for reelection at the Annual Meeting) are Margaret Taylor, Thomas Ashburn and Jack Acosta, and their current terms will expire at the Annual Meeting if they are not reelected; |

| • | the Class II directors are Thomas Shay, Robin Murray and Antonio Bonchristiano, and their terms will expire at the 2019 annual meeting of stockholders; and |

| • | the Class III directors are Seth Ravin, Steve Capelli and Andrew Fleiss, and their terms will expire at the 2020 annual meeting of stockholders. |

Our Certificate of Incorporation and Bylaws provide that the number of directors, which is currently fixed at nine members, may be increased or decreased from time to time by a resolution of the Board. Each director’s term continues until the election and qualification of his or her successor, or his or her earlier death, resignation, or removal. Any increase or decrease in the number of directors generally will be distributed among the three classes so that, as nearly as possible, each class will consist of one-third of the total number of directors. This classification of the Board may have the effect of delaying or preventing changes in control of the Company.

There are no family relationships among any of our directors, director nominees or executive officers.

Certain Understandings Regarding the Appointment of Messrs. Bonchristiano and Fleiss to the Board of Directors

Upon consummation of the Mergers, RSI appointed seven of the nine members of the Board, and in accordance with the terms of the Merger Agreement, Messrs. Fleiss and Bonchristiano (the“GPIA Designated Directors”) were appointed as members of the Board by GPIC Ltd., a Bermuda company and an affiliate (the“GP Sponsor”)of GPIA’s ultimate parent entity, GP Investments, Ltd. Also, in accordance with the terms of the Merger Agreement, Mr. Bonchristiano was designated a Class II director, and Mr. Fleiss was designated a Class III director. The Merger Agreement also provides that if any GPIA Designated Director ceases to be a member of the Board for any reason prior to the expiration of such GPIA Designated Director’s initial term, as described above, then the GP Sponsor shall designate a replacement, and the Board shall appoint such designee, to serve as a GPIA Designated Director (or a successor of the GPIA Designated Director as described above) for the remainder of such initial term. The Merger Agreement also provides that, until the 2020 annual meeting of stockholders, at least one GPIA Designated Director will serve on each committee of the Board.

Corporate Governance Guidelines

Our Board of Directors has adopted Corporate Governance Guidelines outlining the corporate governance policies pursuant to which the Board oversees the business and strategy of the Company, addressing items such as the qualifications and responsibilities of our directors and director candidates and the specific oversight responsibilities of the Board. You can find a copy of our Corporate Governance Guidelines on the “Investor Relations” subpage of our website.

| 13 |

Code of Business Conduct and Ethics

Our Board has adopted a Code of Business Conduct and Ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. The purpose of the Code of Business Conduct and Ethics is to promote ethical conduct and deter wrongdoing. The policies outlined in the Code of Business Conduct and Ethics are designed to ensure that our employees, including our executive officers and members of the Board, act in accordance with not only the letter but also the spirit of the laws and regulations that apply to our business.

You can find a copy of our Code of Business Conduct and Ethics on the “Investor Relations” subpage of our website.

We will post amendments to or waivers from our Code of Business Conduct and Ethics with respect to directors and executive officers on the same website.

Our Corporate Governance Guidelines provide that at any time when the Chairman of the Board is not an independent director, the Board shall elect a “Lead Independent Director” in order to facilitate communications between Company management and non-employee directors. Because the Chairman of the Board, Mr. Ravin, also serves as our Chief Executive Officer, the Board has appointed Margaret (Peggy) Taylor to serve as its Lead Independent Director. As Lead Independent Director, Ms. Taylor communicates with our Chief Executive Officer and Chairman of the Board regarding feedback from executive sessions of the non-employee and/or independent directors, for which she is responsible for scheduling, preparing the agendas and chairing. She also serves as a liaison between members of our executive management and our non-employee and/or independent directors, disseminating information to the rest of the Board in a timely manner and raising issues with management on behalf of the non-employee and/or independent directors when appropriate.

As Chairman of the Board, Mr. Ravin is directly responsible for Board management, in particular by chairing Board meetings, providing input on the agendas for Board and Board committee meetings, evaluating the membership and chairs for Board committees and the effectiveness of the committees, and encouraging the Company’s non-employee and/or independent directors to meet regularly without management present.

The Board believes that this structure currently is appropriate for the Company as it permits our Chief Executive Officer to speak for and lead the Company and Board while also providing for effective oversight and independent leadership by an independent director.

Board Determination of Independence

Our Board has reviewed and analyzed the independence of each director, including each of the three Class I director nominees. The purpose of the review was to consider whether any particular relationships or transactions involving directors or their affiliates or immediate family members (i) were inconsistent with a determination that a particular director is independent for purposes of serving on the Board of Directors and its committees or (ii) could compromise his or her ability to exercise independent judgment in carrying out his or her responsibilities. During this review, the Board of Directors examined whether there were any transactions and/or relationships between directors or their affiliates or immediate family members and the Company and the substance of any such transactions or relationships. They also specifically considered each of the transactions identified under the heading “Related Person Transactions” below.

The Company’s common stock is listed on the Nasdaq Global Market. Under Nasdaq listing standards, independent directors must comprise a majority of a listed company’s Board of Directors. In addition, Nasdaq rules require that, subject to specified exceptions, each member of a listed company’s Audit, Compensation and Nominating Committees be independent. Under Nasdaq rules, a director will only qualify as an “independent director” if, in the opinion of the Board, that person does not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director. Audit Committee members must also satisfy the independence criteria set forth in Rule 10A-3 under the Securities Exchange Act of 1934 (the“Exchange Act”). Compensation Committee members must also satisfy the independence criteria set forth in Rule 10C-1 under the Exchange Act.

| 14 |

In order to be considered independent for purposes of Rule 10A-3 and Rule 10C-1, a member of an Audit Committee or Compensation Committee of a listed company generally may not, other than in his or her capacity as a member of the committee, the Board of Directors, or any other Board committee: (1) accept, directly or indirectly, any consulting, advisory, or other compensatory fee from the listed company or any of its subsidiaries; or (2) be an affiliated person of the listed company or any of its subsidiaries.

Following its most recent independence review, which was conducted in connection with the preparation of this Proxy Statement, the Board determined that Messrs. Acosta, Ashburn, Capelli, Murray and Fleiss and Ms. Taylor, representing six of the Company’s nine directors and all of the members of the Audit, Compensation and Nominating committees, are “independent directors” as defined under the applicable rules and regulations of the SEC and the listing standards of the Nasdaq Global Market.

Board of Director Meetings and Attendance; Annual Meeting Attendance

The Board holds regularly scheduled, in-person board meetings quarterly, and typically each Board committee meets separately in connection with these meetings. The Board and each committee hold telephonic meetings in-between in-person meetings as needed. The Board, which was constituted immediately following the Mergers in October 2017, held two meetings in 2017; the Audit Committee held four meetings; the Compensation Committee held one meeting; and the Nominating Committee held one meeting. Each director attended at least 75% of the total number of Board meetings and meetings of the Committees on which he or she served during the period the director was on the Board or Committee in 2017.

Per our Corporate Governance Guidelines, the Company encourages, but does not require, directors to attend annual stockholders’ meetings. The 2018 Annual Meeting is our first annual meeting of stockholders following the Mergers, and, as a result of the Mergers, neither RSI nor GPIA held an annual meeting of stockholders in 2017.

While the Board believes that management speaks for the Company, the Board acknowledges that individual Board members may, from time to time, communicate with various constituencies that are involved with the Company, but it is expected that Board members would do this with the knowledge of management and, in most cases, only at the request of management. Stockholders who wish to communicate directly with our non-management directors can follow the procedures outlined in our “Policies and Procedures for Stockholder Communications to Independent Directors” (our“Stockholder Communications Policy”), a copy of which appears on the “Investor Relations” subpage of our website (see the first page of this Proxy Statement).

In accordance with our Stockholder Communications Policy, our General Counsel (or another member of the Legal Department designated by the General Counsel) reviews all incoming stockholder communications and, if appropriate (i.e.,the communication is not part of a mass mailing, a product complaint or inquiry, job inquiry or business solicitation and is not patently offensive or otherwise inappropriate material), routes such communications to the appropriate member(s) of the Board or, if none is specified, to the Chairman of the Board. The Legal Department reviewer may decide in the exercise of his or her judgment whether a response to any stockholder communication is necessary. The General Counsel provides a report to the Nominating Committee on a quarterly basis of any stockholder communications received to which a member of the Legal Department has responded.

Our Stockholder Communications Policy is administered by the Nominating Committee. This procedure does not apply to (a) communications to non-management directors from officers or directors of the Company who are also stockholders, or (b) stockholder proposals submitted pursuant to Rule 14a-8 under the Exchange Act.

Committees of the Board of Directors

Under our Bylaws, the Board has the authority to appoint committees, and, accordingly, has appointed an Audit Committee, a Compensation Committee, and a Nominating & Corporate Governance Committee, each of which has the composition and responsibilities described below. Members serve on these committees until their resignation or until otherwise determined by the Board.

| 15 |

Audit Committee

The Audit Committee is comprised of Messrs. Acosta (Chair), Capelli and Fleiss and Ms. Taylor. Our Board has determined that each of the members of the Audit Committee satisfies the requirements for independence and financial literacy under the rules of the Nasdaq Global Market and the SEC and has further determined that Mr. Acosta qualifies as an “Audit Committee financial expert” as defined by applicable SEC rulemaking and satisfies the financial sophistication requirements of the Nasdaq Global Market. The Audit Committee is responsible for, among other things:

| • | selecting and hiring our independent registered public accounting firm; |

| • | supervising and evaluating the performance and independence of our independent registered public accounting firm; |

| • | approving the audit and audit fees and pre-approving any non-audit services to be performed by our independent registered public accounting firm; |

| • | reviewing our financial statements and related disclosures and reviewing our critical accounting policies and practices; |

| • | reviewing and discussing with management and the independent registered public accounting firm the results of our annual audit, the quarterly reviews of our financial statements, and our publicly filed reports; |

| • | preparing the Audit Committee Report that the SEC requires in our annual proxy statement; |

| • | reviewing the adequacy and effectiveness of our internal control policies and procedures and our disclosure controls and procedures; |

| • | reviewing and discussing with management and the independent registered public accounting firm, the overall adequacy and effectiveness of our legal, regulatory and ethical compliance programs; |

| • | overseeing the internal audit function; |

| • | reviewing and discussing with management reports regarding compliance with applicable laws, regulations and internal compliance programs; |

| • | overseeing procedures for the treatment of complaints on accounting, internal accounting controls or audit matters, including the confidential, anonymous submission (and the appropriate treatment of) concerns submitted by Company employees (e.g., via the Company’s Whistleblower Hotlines) regarding accounting or auditing matters that they believe to be questionable or to be violations of the Company’s Code of Business Conduct and Ethics, the U.S. federal securities laws (or similar state and federal laws) or the Company’s Anti-Corruption Policy (including the Foreign Corrupt Practices Act and similar laws); and |

| • | reviewing and overseeing any related person transactions. |

You can find a copy of the Audit Committee’s Charter on the “Investor Relations” subpage of our website.

Compensation Committee

The Compensation Committee is comprised of Ms. Taylor (Chair) and Messrs. Ashburn, Capelli and Fleiss. Our Board has determined that each member of the Compensation Committee meets the requirements for independence under the rules of the Nasdaq Global Market and applicable SEC rules and regulations, as well as Section 162(m) of the Internal Revenue Code. The Compensation Committee is responsible for, among other things:

| 16 |

| • | reviewing and approving our Chief Executive Officer’s and, in consultation with our Chief Executive Officer, other executive officers’ annual base salaries, incentive compensation plans, including the specific goals and amounts, equity compensation, employment agreements, severance arrangements, change in control agreements, and any other benefits, compensation or arrangements; |

| • | administering our equity compensation plans; |

| • | overseeing our overall compensation philosophy, compensation plans, and benefits programs; and |

| • | reviewing and evaluating director compensation. |

Subject to compliance with applicable laws and regulations, the Compensation Committee may delegate its authority to one or more subcommittees.

The Compensation Committee has the authority to engage advisors, such as compensation consultants, to assist it in carrying out its responsibilities. In connection with any such engagement, the Compensation Committee assesses the advisor’s independence in accordance with SEC and Nasdaq rules. In 2017, the Compensation Committee engaged Willis Towers Watson to provide advice on the design and amount of executive and director compensation and the grant date valuation of awards issued under our equity plans prior to the consummation of the Mergers.

You can find a copy of the Compensation Committee’s Charter on the “Investor Relations” subpage of our website.

Nominating & Corporate Governance Committee

The Nominating Committee is comprised of Messrs. Ashburn (Chair), Capelli, Fleiss and Murray. Our Board has determined that each member of the Nominating Committee meets the requirements for independence under the rules of the Nasdaq Global Market. The Nominating Committee is responsible for, among other things:

| • | evaluating and making recommendations regarding the composition, organization, and governance of the Board and its committees; |

| • | evaluating and making recommendations regarding the creation of additional committees, a change in mandate of our committees and dissolution of our committees; |

| • | reviewing and making recommendations with regard to our Corporate Governance Guidelines; and |

| • | reviewing and approving conflicts of interest of our directors and corporate officers, other than related person transactions reviewed by the Audit Committee. |

You can find a copy of the Nominating Committee’s Charter on the “Investor Relations” subpage of our website.

The Board’s Role in Risk Oversight

Risk management is primarily the responsibility of our Company’s senior management team, while the Board is responsible for the overall supervision and oversight of our Company’s risk management activities.

| 17 |

The Board’s oversight of the material risks faced by the Company occurs at both the full Board level and at the committee level. For example, the Audit Committee has oversight responsibility not only for financial reporting with respect to the Company’s major financial exposures and the steps management has taken to monitor and control such exposures, but also for the effectiveness of management’s enterprise risk management process that monitors key business risks (including cybersecurity) facing the Company. Specifically, as stated in its Charter, one of the responsibilities of the Audit Committee is to “review and discuss with management and the independent auditor the Company’s major financial risk exposures and the steps management has taken to monitor and control those exposures, including the Company’s guidelines and policies with respect to risk assessment and risk management pertaining to financial, accounting, investment and tax matters.” In connection with its risk oversight role, at each of its quarterly, in-person meetings, the Audit Committee also meets privately in separate executive sessions with representatives from the Company’s independent registered public accounting firm (without any members of Company management present) and with the Company’s Senior Director of Internal Audit and Compliance Frameworks (without other members of Company management present). Per its Charter, the mission of the Internal Audit Department is to assist the Company in accomplishing its objectives by bringing a “systematic and disciplined approach to evaluate and improve the effectiveness of the organization’s risk management, control, and governance processes.” Finally, the Audit Committee also receives quarterly reports regarding the Company’s testing and controls implemented in compliance with the requirements of the Sarbanes-Oxley Act of 2002 and quarterly updates from the Company’s General Counsel on legal matters that may have a material impact on the Company’s financial statements or compliance procedures that pertain to financial, accounting or tax matters of the Company.

In addition, as stated in its Charter, one of the responsibilities of the Compensation Committee is to “review and discuss with management the risks arising from the Company’s compensation policies and practices for all employees that are reasonably likely to have a material adverse effect on the Company.”

Further, the Company’s General Counsel reports in person to the full Board on at least a quarterly basis to keep the directors informed concerning legal risks, ongoing litigation and other legal matters involving the Company and the Company’s legal risk mitigation efforts. Finally, at each Board meeting, our Chief Executive Officer meets with the other directors in executive session to address operational and strategic matters, including areas of risk and opportunity that require Board attention. Further, on no less than an annual basis, the full Board reviews in detail the Company’s short- and long-term strategies, including consideration of risks facing the Company.

By its nature, risk oversight is an evolving process requiring the Company to continually look for opportunities to further embed systematic enterprise risk management into ongoing business processes across the organization. The Board actively encourages management to continue to review and improve its methods of assessing and mitigating risk.

Compensation Committee Interlocks and Insider Participation

None of the members of our Compensation Committee is or has been an officer or employee of the Company. None of our executive officers currently serves, or in the past year has served, as a member of the Compensation Committee (or other board committee performing equivalent functions or, in the absence of any such committee, the entire Board) or as a director of any entity that has one or more executive officers serving on the Board or the Compensation Committee.

Policies and Procedures for Related Person Transactions

The Company has adopted a formal written policy providing that our executive officers, directors, nominees for election as directors, beneficial owners of more than 5% of any class of our capital stock, any member of the immediate family of any of the foregoing persons, and any firm, corporation or other entity in which any of the foregoing persons is employed or is a general partner or principal or in a similar position or in which such person has a 5% or greater beneficial ownership interest, are not permitted to enter into a related party transaction with us without the approval of the Audit Committee, subject to the exceptions described below. In approving or rejecting any such proposal, the Audit Committee will consider the relevant facts and circumstances available and deemed relevant to the Audit Committee, including whether the transaction is on terms no less favorable than terms generally available to an unaffiliated third party under the same or similar circumstances and the extent of the related party’s interest in the transaction. The Audit Committee has determined that certain transactions will not require Audit Committee approval, including certain employment arrangements of executive officers, director compensation, transactions with another company at which a related party’s only relationship is as a director, non-executive employee or beneficial owner of less than 10% of that company’s outstanding capital stock, transactions where a related party’s interest arises solely from the ownership of our common stock and all holders of our common stock received the same benefit on a pro rata basis, and transactions available to all employees generally.

| 18 |

| · | Upon consummation of the Merger Agreement with GPIA, we assumed an outstanding loan payable to the GP Sponsor with a face amount of approximately $3.0 million. This loan is non-interest bearing and is not due and payable until the outstanding principal balance under our amended credit facility is less than $95.0 million. |

| · | As of December 31, 2017, entities affiliated with Adams Street Partners LLP and its affiliates, (“ASP”) owned approximately 39.2% of our issued and outstanding shares of common stock. Robin Murray is a partner with Adams Streets Partners and a member of the Board. Additionally, an ASP affiliate owns a $10.0 million indirect interest in our amended credit facility and provided a guarantee in exchange for warrants that were issued in 2014, which guarantee expired in November 2017. For the year ended December 31, 2017, we invoiced two ASP portfolio companies for software support services for an aggregate of $2.5 million. |

| 19 |

Our named executive officers (our“Named Executive Officers”) for 2017, which consist of the person who served as our principal executive officer during 2017 and the next two most highly compensated executive officers who were serving as executive officers as of December 31, 2017, are as follows:

| • | Seth A. Ravin, our Chief Executive Officer and Chairman of the Board; |

| • | Thomas Sabol, our Senior Vice President and Chief Financial Officer; and |

| • | David Rowe, our Senior Vice President and Chief Marketing Officer. |

The following table presents summary information regarding the total compensation for services rendered in all capacities that was awarded to, earned by, and paid to our Named Executive Officers.

| Name and Position | Year | Salary | Bonus | Stock Awards | Option Awards(3) | Non-Equity Incentive Plan Compensation(6) | All Other Compensation | Total | ||||||||||||||||||||||

| Seth A. Ravin,Chief Executive Officer | 2017 | $ | 300,000 | $ | - | $ | - | $ | - | $ | 186,600 | $ | 49,351 | (7) | $ | 535,951 | ||||||||||||||

| and Chairman of the Board | 2016 | 300,000 | - | - | - | 313,950 | 134,069 | 748,019 | ||||||||||||||||||||||

| Thomas Sabol,Senior Vice President | 2017 | $ | 308,333 | (1) | $ | 100,000 | (2) | $ | - | $ | 646,194 | (4) | $ | 68,565 | $ | 1,718 | (8) | $ | 1,124,810 | |||||||||||

| and Chief Financial Officer | 2016 | 28,461 | - | - | - | 9,147 | 38 | 37,646 | ||||||||||||||||||||||

| David Rowe,Senior Vice President | 2017 | $ | 250,000 | $ | - | $ | - | $ | 586,418 | (5) | $ | 93,300 | $ | 10,468 | (9) | $ | 940,186 | |||||||||||||

| and Chief Marketing Officer | 2016 | 250,000 | - | - | 156,976 | 10,450 | 417,426 | |||||||||||||||||||||||

| (1) | As discussed below under “Executive Employment Agreements,” the Compensation Committee approved an increase in Mr. Sabol’s base salary from $300,000 to $350,000, effective November 1, 2017, resulting in a pro-rated salary paid for 2017 of $308,333. |

| (2) | This amount represents a one-time discretionary bonus that was awarded to Mr. Sabol by the Compensation Committee in October 2017 in recognition of his individual contributions towards the consummation of the Mergers and the resulting listing of the Company’s common stock on the Nasdaq Global Market. The amount awarded is payable in monthly installments of $10,000 commencing in November 2017, whereby $20,000 was paid in 2017 and the remaining $80,000 is payable in 2018. Under the terms of his offer letter agreement (described below under “Executive Employment Agreements”), Mr. Sabol was eligible to receive a one-time bonus in the amount of $100,000 upon the listing of the Company’s common stock on the Nasdaq or the NYSE; the Compensation Committee chose to honor this obligation even though Mr. Sabol’s offer letter agreement specified that such listing must occur by April 1, 2017. |

| (3) | The aggregate grant date fair value for stock option awards was computed in accordance with Accounting Standards Codification (“ASC”) Topic 718,Compensation – Stock Compensation, of the Financial Accounting Standards Board (“FASB”). A discussion of all assumptions made in the valuation of the awards is in Note 7,Stock Options, to our consolidated financial statements for the year ended December 31, 2017, included in our Annual Report on Form 10-K filed with the SEC on March 15, 2018. For purposes of this table, the entire fair value of awards are reflected in the year of grant, whereas under FASB ASC 718, the fair value of awards is recognized in our consolidated financial statements over the vesting period. |

| (4) | In June 2017, we granted to Mr. Sabol a stock option for 239,412 shares of common stock vesting in one-third increments on each of November 28, 2017, 2018 and 2019, provided that Mr. Sabol remains continuously employed by the Company through the applicable vesting dates. As determined in accordance with FASB ASC 718, the grant date fair value of the award is approximately $2.70 per share. |

| (5) | In June 2017, we granted to Mr. Rowe a stock option for 239,412 shares that vested 100% on January 1, 2018. As determined in accordance with FASB ASC 718, the grant date fair value of the award is approximately $2.45 per share. |

| (6) | Represents amounts earned under our Bonus Program as discussed below under “Non-Equity Incentive Plan Compensation.” |

| 20 |

| (7) | For 2017, All Other Compensation for Mr. Ravin is primarily comprised of rental payments of $36,796 for an apartment near our California Operations Center in Pleasanton, California, as well as certain health expenses incurred on business trips and trial-related expenses. Mr. Ravin maintains his primary residence near our corporate headquarters in Las Vegas, Nevada. |

| (8) | All Other Compensation for Mr. Sabol is primarily comprised of a $1,250 matching 401(k) plan contribution in 2017. |

| (9) | All Other Compensation for Mr. Rowe is primarily comprised of a $10,000 matching 401(k) plan contribution in 2017. |

Non-Equity Incentive Plan Compensation

Our Named Executive Officers are eligible for quarterly incentive compensation payments under our performance-based Company Bonus Program that are based upon both (x) the Company’s achievement (expressed as a percentage) of pre-determined financial or operational goals for the quarter, subject to adjustment (upward or downward) based upon the achievement (also expressed as a percentage) of pre-determined Company-wide client satisfaction goals for that quarter (the“quarterly Company performance factors”) and (y) the individual employee’s achievement of pre-determined individual goals and objectives for the quarter as well as their overall contributions to the Company’s success (expressed as a percentage), generally determined at the discretion of their manager (the“quarterly individual performance factor”).

The quarterly performance bonus is calculated following the end of each fiscal quarter by multiplying the individual’s quarterly target incentive amount by (i) the percentage achievement of the quarterly Company performance factors and (ii) the percentage achievement of the quarterly individual performance factor. Seventy-five percent of this amount is paid by the end of the following fiscal quarter and, for retention purposes, the remaining 25% is deferred and paid out following the end of the fiscal year, subject to the employee’s continuous employment with the Company through year-end.

In 2017, the quarterly Company performance factors and relative weighting were: (i) aggregate client invoicing (80%), (ii) aggregate expenses (20%), and (iii) client satisfaction compared to plan (acted as an approximate +/- 1% modifier).

As noted above, the quarterly individual performance factor is generally tied to an employee’s achievement of individual goals and objectives for the quarter and the individual’s overall contribution to our success. In 2017, because their individual performance is so integrally tied to Company-level performance, the quarterly individual performance factors for each of our Named Executive Officers were tied to the Company’s overall performance, subject to additional adjustment in the discretion of Compensation Committee (taking into account the recommendations of the Chief Executive Officer). As identified in the table above under the column heading “Non-Equity Incentive Plan Compensation,” the total quarterly bonus payments earned by Messrs. Ravin, Sabol and Rowe in 2017 represented 62% of their respective total targeted quarterly bonus incentive compensation for fiscal year 2017.

Employment Agreements and Potential Payments upon Termination or Change in Control

Executive Employment Agreements

Seth A. Ravin