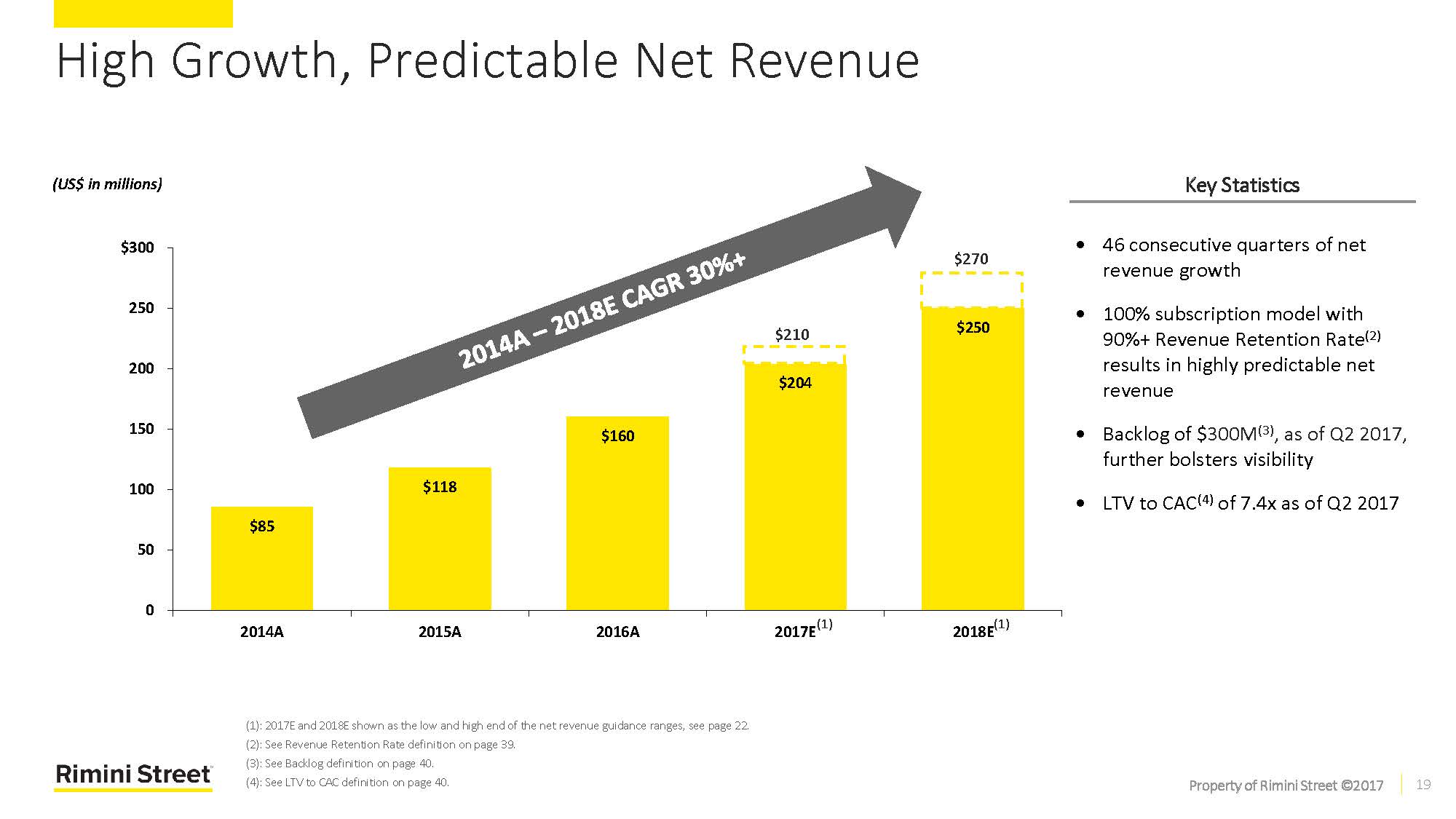

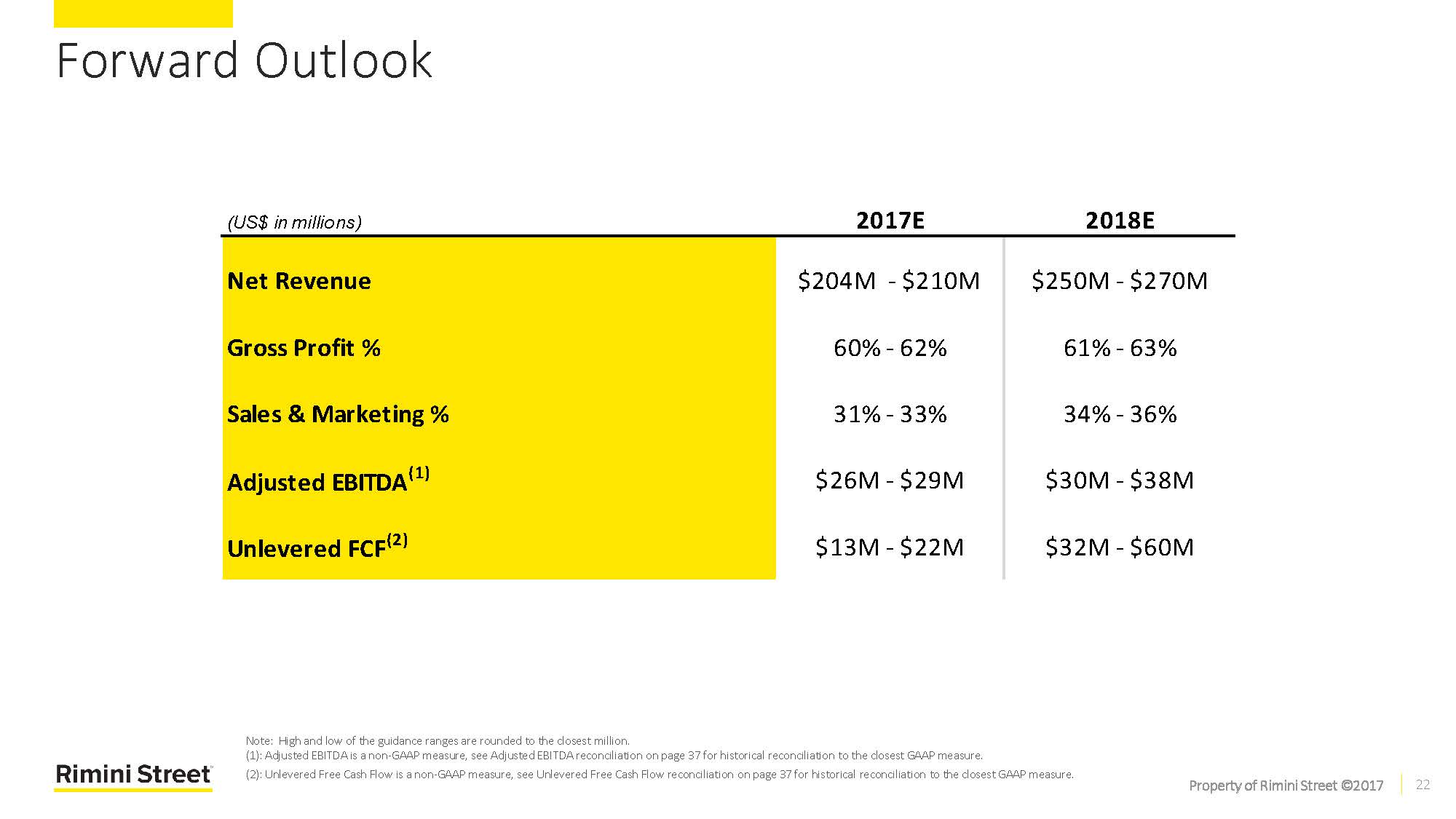

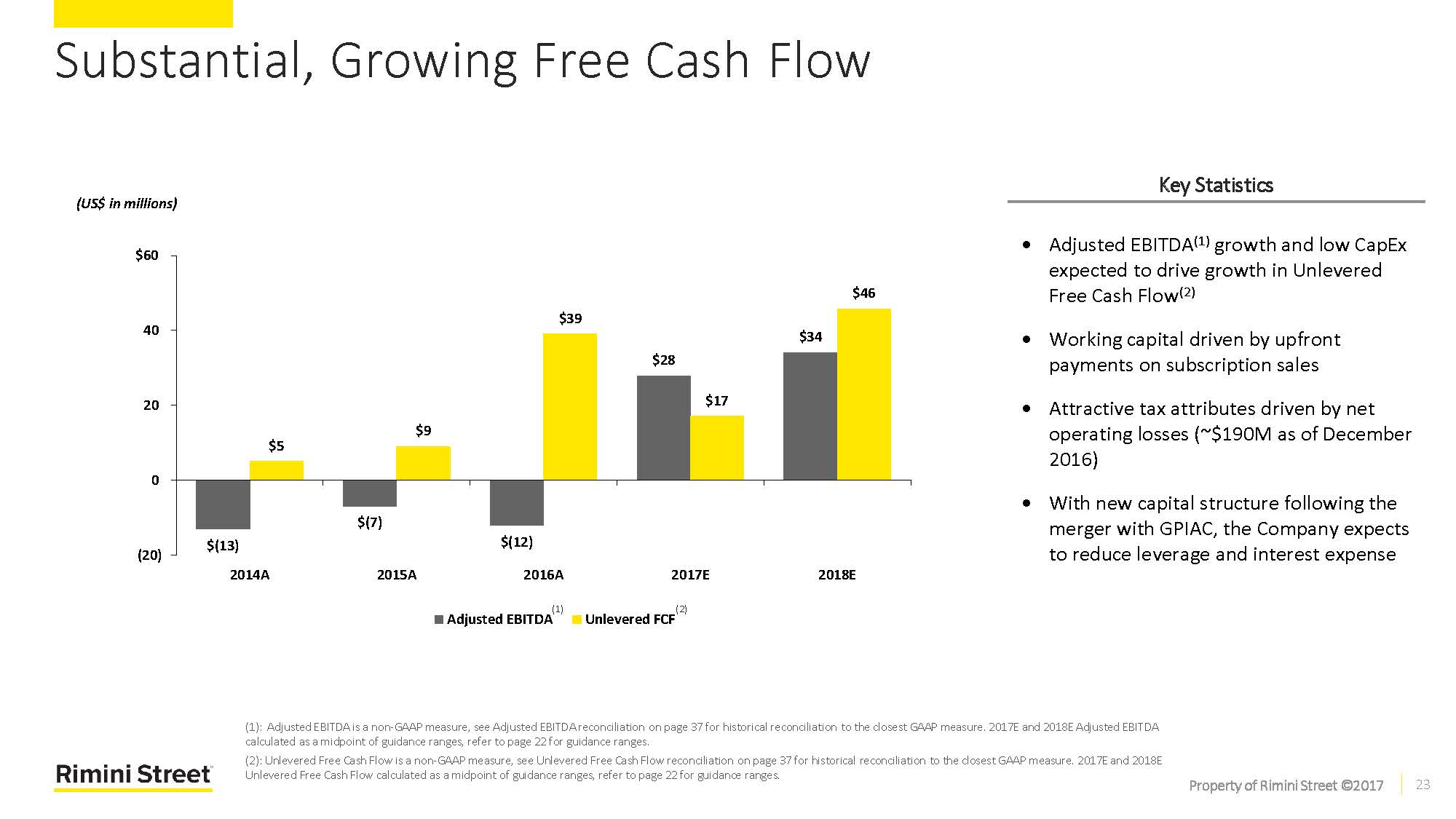

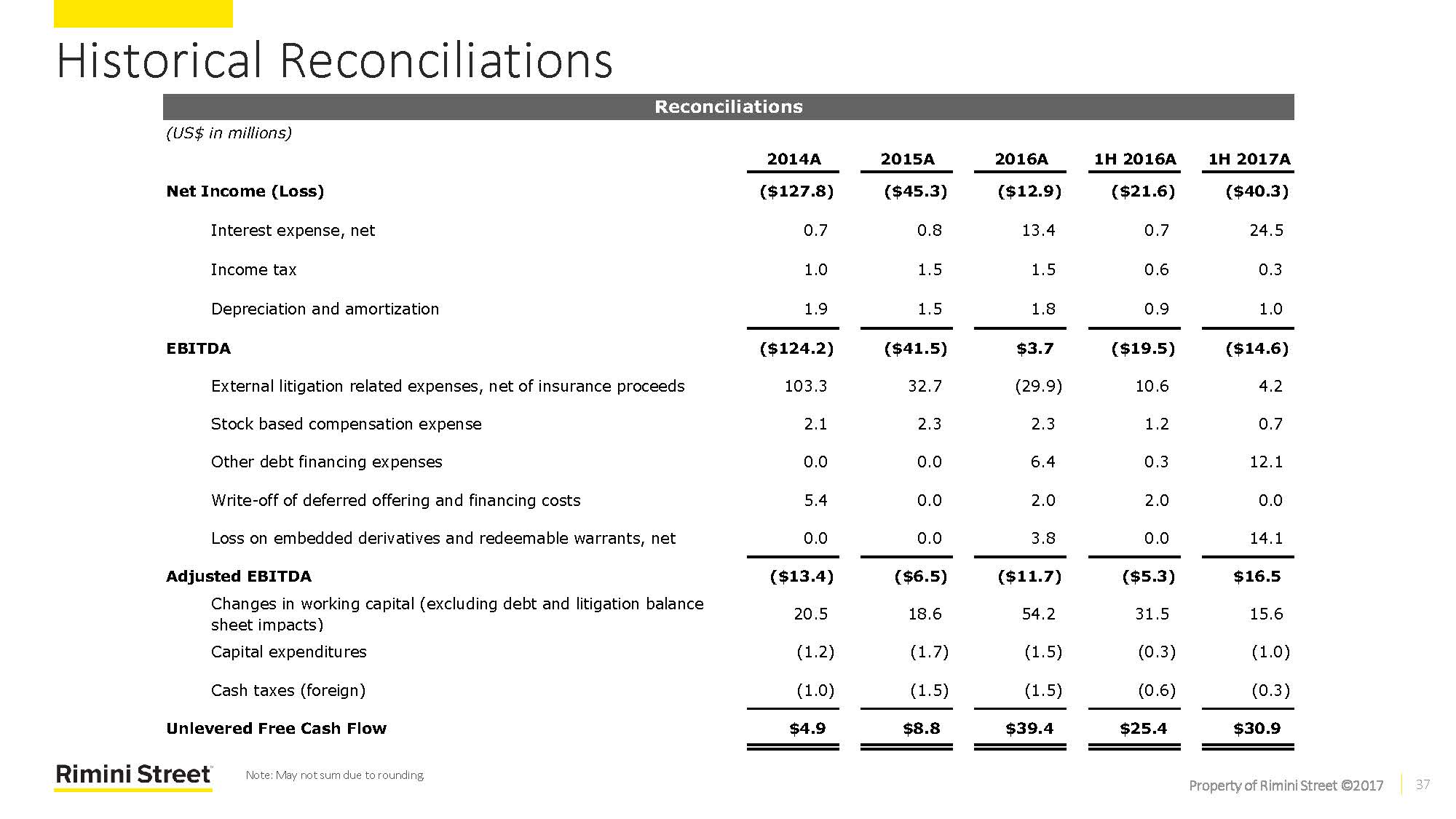

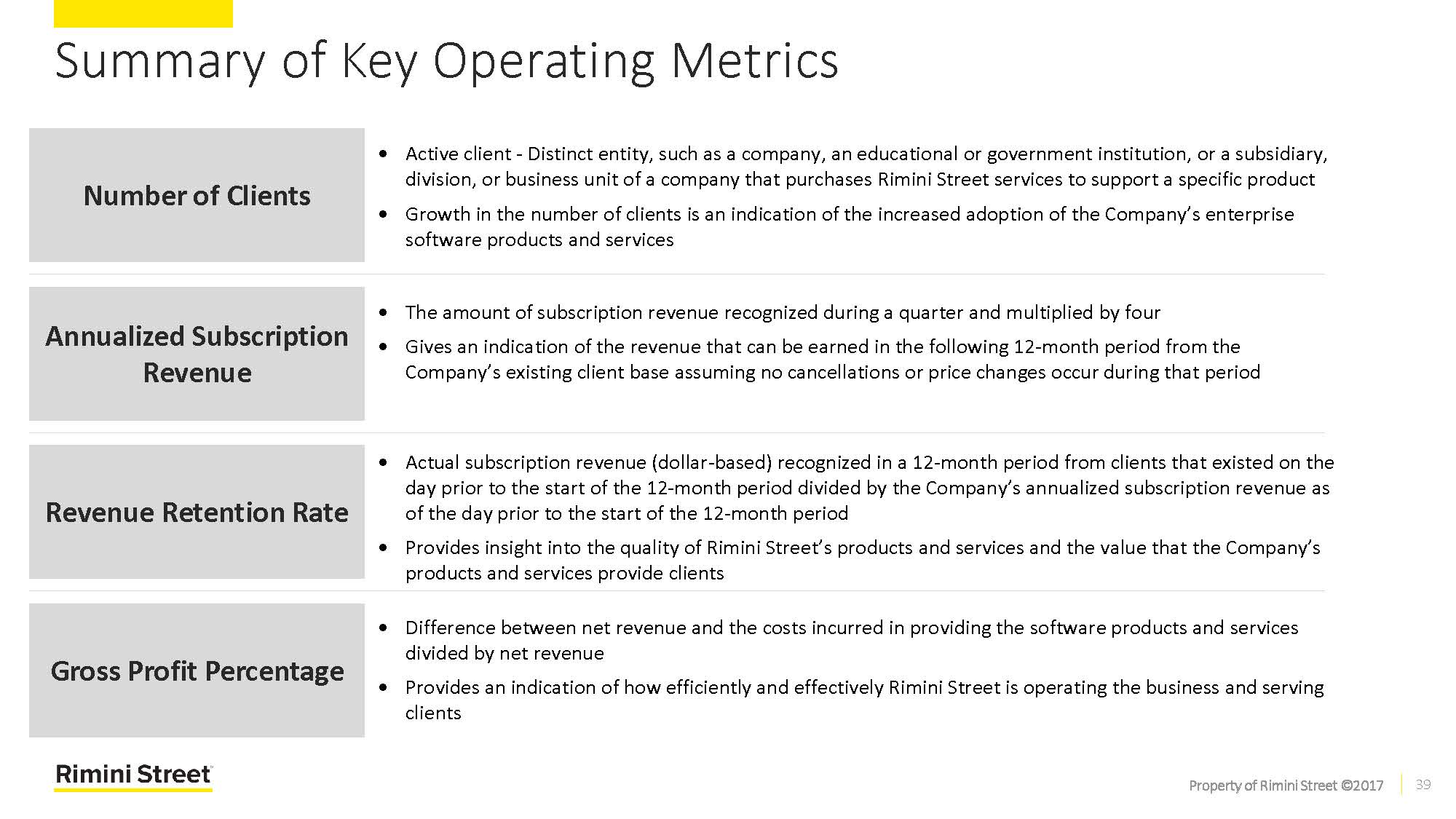

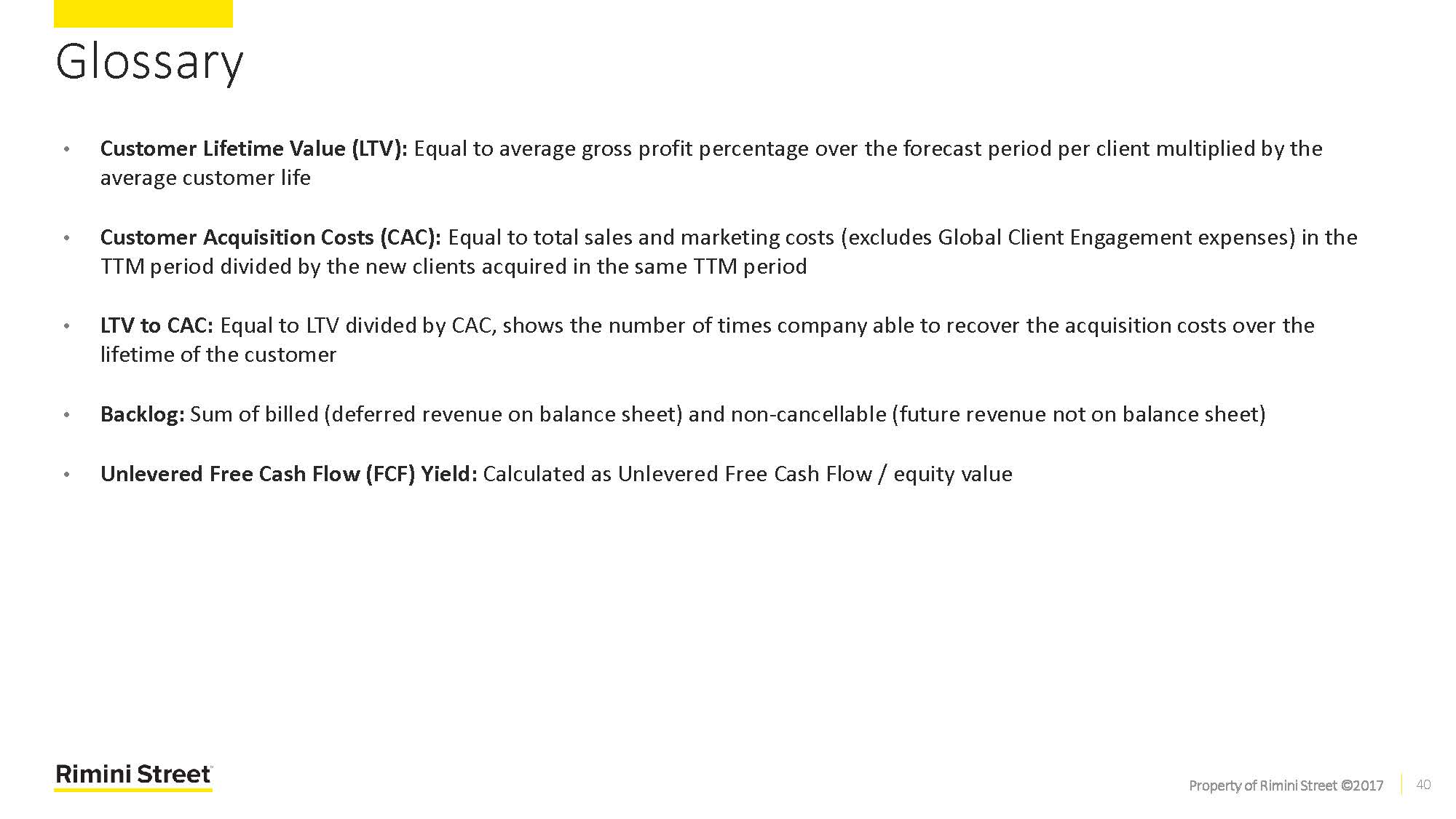

“Rimini Street” is a registered trademark of Rimini Street, Inc., and Rimini Street, the Rimini Street logo, and combinations thereof, and other marks marked by TM are trademarks of Rimini Street, Inc. ("Rimini“, the “Company”). All other trademarks remain the property of their respective owners, and unless otherwise specified, Rimini claims no affiliation, endorsement, or association with any such trademark holder or other companies referenced herein.Investor PresentationThis communication is for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to the proposed potential business combination between Rimini and GP Investments Acquisition Corp. (“GPIAC”) and related transactions and for no other purpose. The information contained herein does not purport to be all-inclusive. The data contained herein is derived from various internal and external sources. No representation is made as to the reasonableness of the assumptions made within or the accuracy or completeness of any projections, modelling or back-testing or any other information contained herein. Any data on past performance, modeling or back-testing contained herein is no indication as to future performance. Neither Rimini nor GPIAC assumes any obligation to update the information in this communication.Forward Looking StatementsCertain statements included in this communication are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions are intended to identify forward-looking statements. These forward-looking statements include, but are not limited to, statements regarding 2017 and 2018 net revenue estimates and forecasts of other financial and performance metrics, projections of customer savings, projections of market opportunity, expectations regarding the proposed business combination, including the expected benefits of the proposed business combination, and expectations regarding Adjusted EBITDA and Unlevered Free Cash Flow growth. These statements are based on various assumptions and on the current expectations of GPIAC and Rimini management and are not predictions of actual performance. These forward-looking statements are subject to a number of risks and uncertainties, including adverse litigation developments; the inability to refinance existing debt on favorable terms; GPIAC’s and Rimini’s respective businesses and the proposed potential transaction; the loss of one or more members of GPIAC’s or Rimini’s management team; the inability of the parties to successfully or timely consummate the proposed potential transaction, including the risk that any required regulatory approvals are not obtained, are delayed or are subject to unanticipated conditions that could adversely affect the combined company or the expected benefits of the proposed potential transaction or that the approval of the stockholders of GPIAC and/or the stockholders of Rimini for the transaction is not obtained; failure to realize the anticipated benefits of the proposed potential transaction, including as a result of a delay in consummating the proposed potential transaction or a delay or difficulty in integrating the businesses of GPIAC and Rimini; uncertainty as to the long-term value of GPIAC common stock; those discussed in GPIAC’s Annual Report on Form 10-K for the year ended December 31, 2016 under the heading “Risk Factors,” as updated from time to time by GPIAC’s Quarterly Reports on Form 10-Q and other documents of GPIAC on file or to be filed with the Securities and Exchange Commission (“SEC”) or in the joint proxy statement/prospectus that has been filed with the SEC by GPIAC. If the risks materialize or our assumptions prove incorrect, actual results could differ materially from the results implied by these forward looking statements. There may be additional risks that neither GPIAC nor Rimini presently know or that GPIAC and Rimini currently believe are immaterial that could also cause actual results to differ from those contained in the forward-looking statements. In addition, forward-looking statements provide GPIAC’S and Rimini’s expectations, plans or forecasts of future events and views as of the date of this communication. GPIAC and Rimini anticipate that subsequent events and developments will cause GPIAC’s and Rimini’s assessments to change. However, GPIAC and Rimini specifically disclaim any obligation to update any forward looking statements contained herein. These forward-looking statements should not be relied upon as representing GPIAC’s and Rimini’s assessments as of any date subsequent to the date of this communication. Any data on past performance, modeling or back-testing contained herein is no indication as to future performance.No Offer or SolicitationThis communication does not constitute an offer to sell or a solicitation of an offer to buy, or the solicitation of any vote or approval in any jurisdiction in connection with a proposed potential business combination between Rimini and GPIAC or any related transactions, nor shall there be any sale, issuance or transfer of securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful.Important Information for Investors and StockholdersIn connection with the transactions referred to in this communication, on June 30, 2017, GPIAC filed its Registration Statement with the SEC and on August 9, 2017, and August 30, 2017, GPIAC filed amended Registration Statements with the SEC containing a preliminary joint proxy statement of GPIAC and Rimini that also constitutes a preliminary prospectus of GPIAC. After the registration statement is declared effective GPIAC and Rimini will mail a definitive joint proxy statement/prospectus to stockholders of GPIAC and stockholders of Rimini Street.This communication is not a substitute for the joint proxy statement/prospectus or registration statement or for any other document that GPIAC may file with the SEC and send to GPIAC's stockholders and/or Rimini Street's stockholders in connection with the proposed transactions. INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE JOINT PROXY STATEMENT/PROSPECTUS AND OTHER DOCUMENTS FILED WITH THE SEC CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. Investors and security holders may obtain free copies of the joint proxy statement/prospectus (when available) and other documents filed with the SEC by GPIAC through the website maintained by the SEC at http://www.sec.gov. Copies of the documents filed with the SEC by GPIAC are available free of charge by contacting GPIAC at 150 E. 52nd Street, Suite 5003, New York, New York 10022, Attn: Investor Relations.Participants in the SolicitationGPIAC and Rimini Street and their respective directors and certain of their respective executive officers may be considered participants in the solicitation of proxies with respect to the proposed transactions under the rules of the SEC. Information about the directors and executive officers of GPIAC is set forth in its Annual Report on Form 10-K for the year ended December 31, 2016, which was filed with the SEC on March 16, 2017. Additional information regarding the participants in the proxy solicitations and a description of their direct and indirect interests, by security holdings or otherwise, will be included in the joint proxy statement/prospectus and other relevant materials to be filed with the SEC when they become available. These documents can be obtained free of charge from the sources indicated above.Non-GAAP Financial MeasuresThis communication includes non-GAAP financial measures, including EBITDA and Adjusted EBITDA, which are supplemental measures of performance that are neither required by, nor presented in accordance with U.S. generally accepted accounting principles ("GAAP"). EBITDA is calculated as earnings before interest and taxes plus depreciation and amortization. Adjusted EBITDA is calculated as EBITDA, excluding the impact of certain items that Rimini management does not consider representative of its ongoing operating performance. A reconciliation of such non-GAAP financial measures to GAAP financial measures is included as an appendix hereto.Rimini and GPIAC believe that such non-GAAP financial measures provide useful supplemental information to their respective board of directors, management teams and investors regarding certain financial and business trends relating to Rimini's financial condition and results of operation. Rimini and GPIAC believe such measures, when viewed in conjunction with its consolidated financial statements, consistency and comparability with Rimini’s past financial performance, facilitate period-to-period comparisons of operating performance and may facilitate comparisons with other companies. Undue reliance should not be placed on these measures as Rimini's only measures of operating performance, nor should such measures be considered in isolation from, or as a substitute for, financial information presented in compliance with GAAP. Non-GAAP financial measures as used in respect of Rimini may not be comparable to similarly titled amounts used by other companies. Legal Notice