WELCOME Investor Day 2021 Exhibit 99.1

Dean Pohl VP, Investor Relations Welcome & Housekeeping

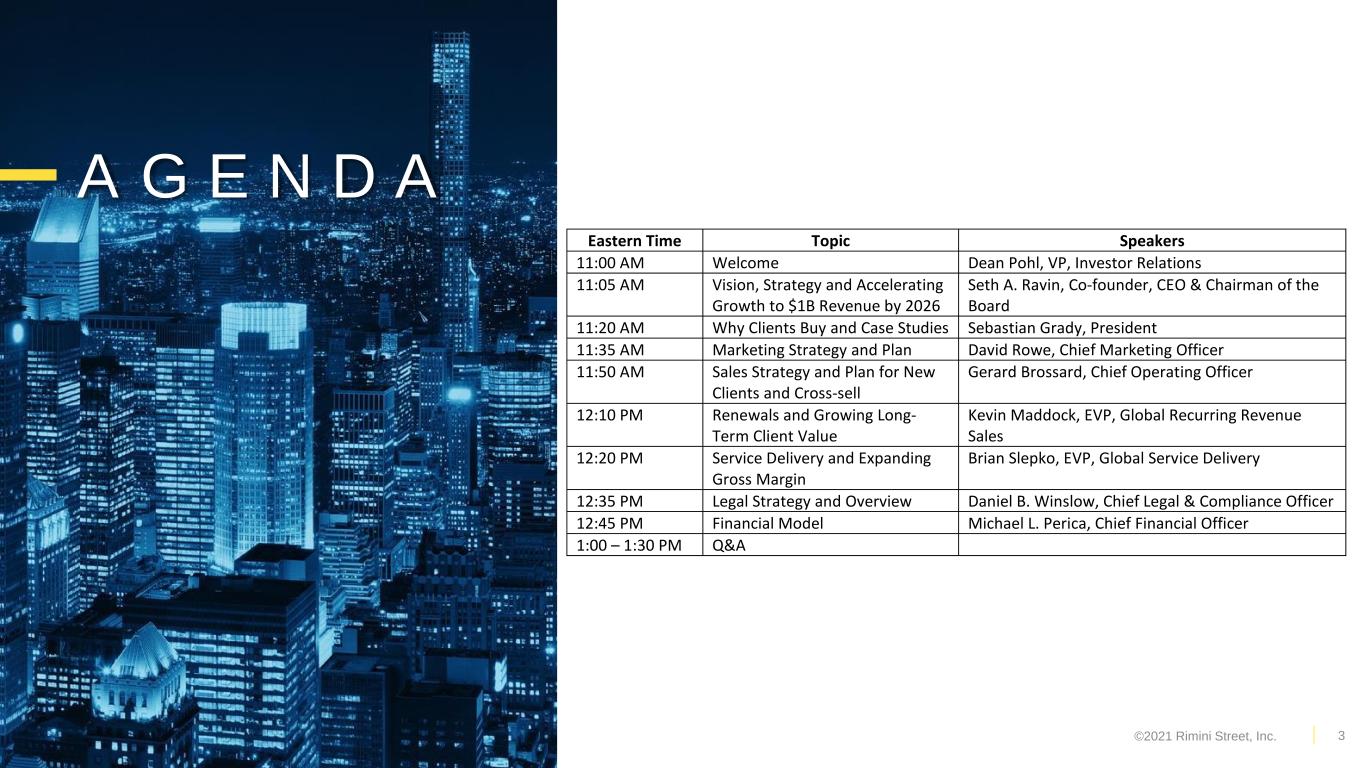

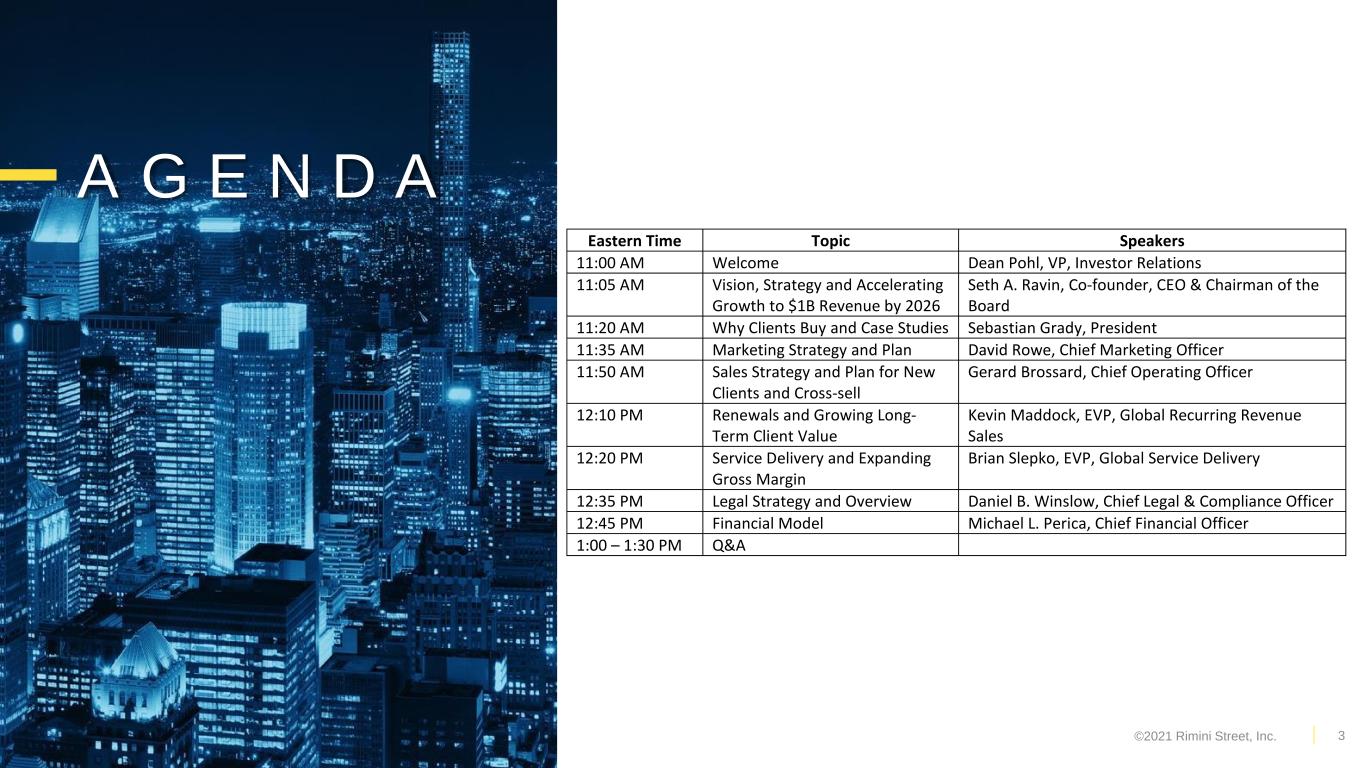

A G E N D A Eastern Time Topic Speakers 11:00 AM Welcome Dean Pohl, VP, Investor Relations 11:05 AM Vision, Strategy and Accelerating Growth to $1B Revenue by 2026 Seth A. Ravin, Co-founder, CEO & Chairman of the Board 11:20 AM Why Clients Buy and Case Studies Sebastian Grady, President 11:35 AM Marketing Strategy and Plan David Rowe, Chief Marketing Officer 11:50 AM Sales Strategy and Plan for New Clients and Cross-sell Gerard Brossard, Chief Operating Officer 12:10 PM Renewals and Growing Long- Term Client Value Kevin Maddock, EVP, Global Recurring Revenue Sales 12:20 PM Service Delivery and Expanding Gross Margin Brian Slepko, EVP, Global Service Delivery 12:35 PM Legal Strategy and Overview Daniel B. Winslow, Chief Legal & Compliance Officer 12:45 PM Financial Model Michael L. Perica, Chief Financial Officer 1:00 – 1:30 PM Q&A ©2021 Rimini Street, Inc. 3

Housekeeping Notes ▪ Today’s presentation is being recorded and will be available for playback on our Investor Relations site. ▪ Ask written questions anytime throughout the prepared presentations or Q&A session. We will answer as time permits. ©2021 Rimini Street, Inc. 4

Forward Looking Statement Certain statements included in this communication are not historical facts but are forward-looking statements for purposes of the safe harbor provisions under The Private Securities Litigation Reform Act of 1995. Forward-looking statements generally are accompanied by words such as “may,” “should,” “would,” “plan,” “intend,” “anticipate,” “believe,” “estimate,” “predict,” “potential,” “seem,” “seek,” “continue,” “future,” “will,” “expect,” “outlook” or other similar words, phrases or expressions. These forward-looking statements include, but are not limited to, statements regarding our expectations of future events, future opportunities, global expansion and other growth initiatives and our investments in such initiatives. These statements are based on various assumptions and on the current expectations of management and are not predictions of actual performance, nor are these statements of historical facts. These statements are subject to a number of risks and uncertainties regarding Rimini Street’s business, and actual results may differ materially. These risks and uncertainties include, but are not limited to, the duration of and operational and financial impacts on our business of the COVID-19 pandemic and related economic impact, as well as the actions taken by governmental authorities, clients or others in response to the COVID-19 pandemic; catastrophic events that disrupt our business or that of our current and prospective clients, changes in the business environment in which Rimini Street operates, including inflation and interest rates, and general financial, economic, regulatory and political conditions affecting the industry in which Rimini Street operates; adverse developments in pending litigation or in the government inquiry or any new litigation; our need and ability to raise additional equity or debt financing on favorable terms and our ability to generate cash flows from operations to help fund increased investment in our growth initiatives; the sufficiency of our cash and cash equivalents to meet our liquidity requirements; the terms and impact of our outstanding 13.00% Series A Preferred Stock; changes in taxes, laws and regulations; competitive product and pricing activity; difficulties of managing growth profitably; the customer adoption of our recently introduced products and services, including our Application Management Services (AMS), Rimini Street Advanced Database Security, and services for Salesforce Sales Cloud and Service Cloud products, in addition to other products and services we expect to introduce in the near future; the loss of one or more members of Rimini Street’s management team; uncertainty as to the long-term value of Rimini Street’s equity securities; and those discussed under the heading “Risk Factors” in Rimini Street’s Quarterly Report on Form 10-Q filed on November 5, 2020, and as updated from time to time by Rimini Street’s future Annual Reports on Form 10-K, Quarterly Reports on Form 10-Q, Current Reports on Form 8- K, and other filings by Rimini Street with the Securities and Exchange Commission. In addition, forward-looking statements provide Rimini Street’s expectations, plans or forecasts of future events and views as of the date of this communication. Rimini Street anticipates that subsequent events and developments will cause Rimini Street’s assessments to change. However, while Rimini Street may elect to update these forward-looking statements at some point in the future, Rimini Street specifically disclaims any obligation to do so, except as required by law. These forward-looking statements should not be relied upon as representing Rimini Street’s assessments as of any date subsequent to the date of this communication. 5©2021 Rimini Street, Inc.

Seth A. Ravin Co-founder, CEO & Chairman of the Board Vision, Strategy and Accelerating Growth to $1B Revenue by 2026

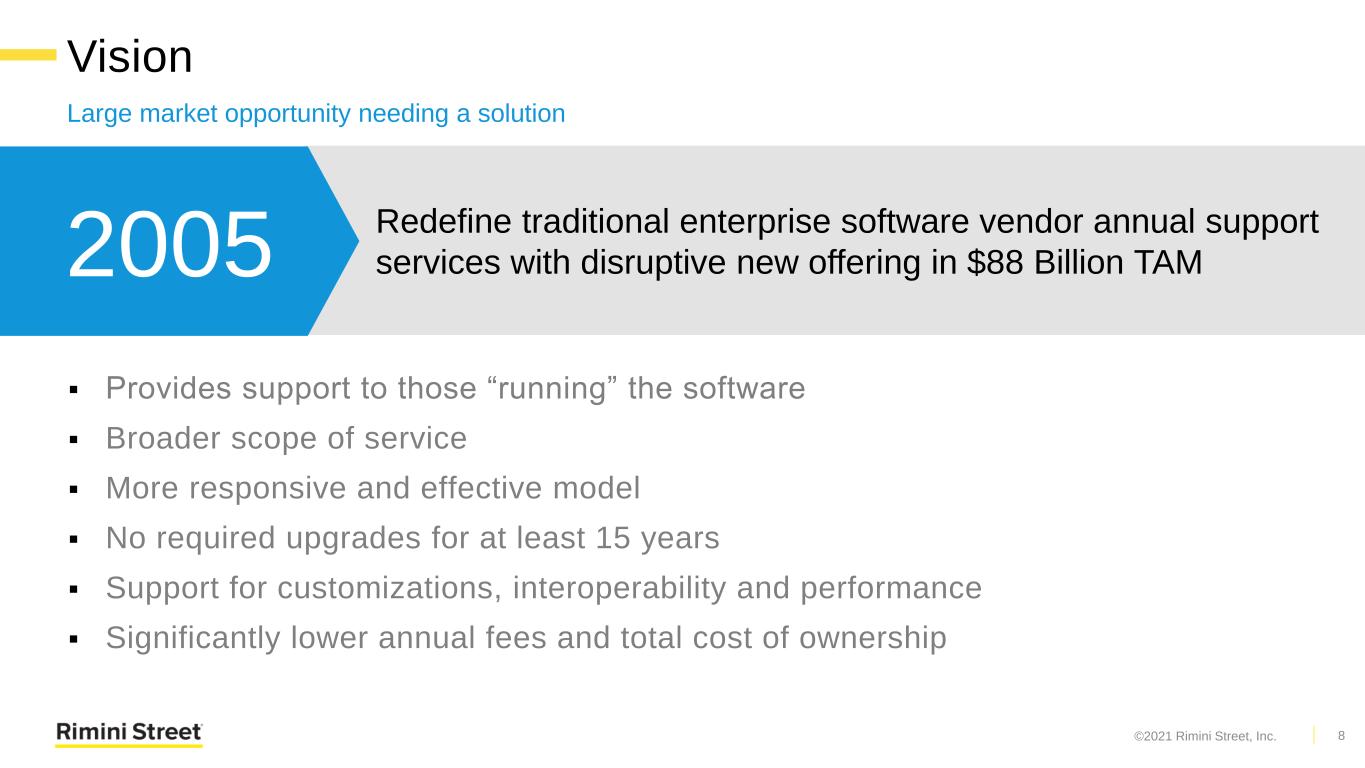

Vision Large market opportunity needing a solution ▪ Provides support to those “running” the software ▪ Broader scope of service ▪ More responsive and effective model ▪ No required upgrades for at least 15 years ▪ Support for customizations, interoperability and performance ▪ Significantly lower annual fees and total cost of ownership 8 Redefine traditional enterprise software vendor annual support services with disruptive new offering in $88 Billion TAM2005 ©2021 Rimini Street, Inc.

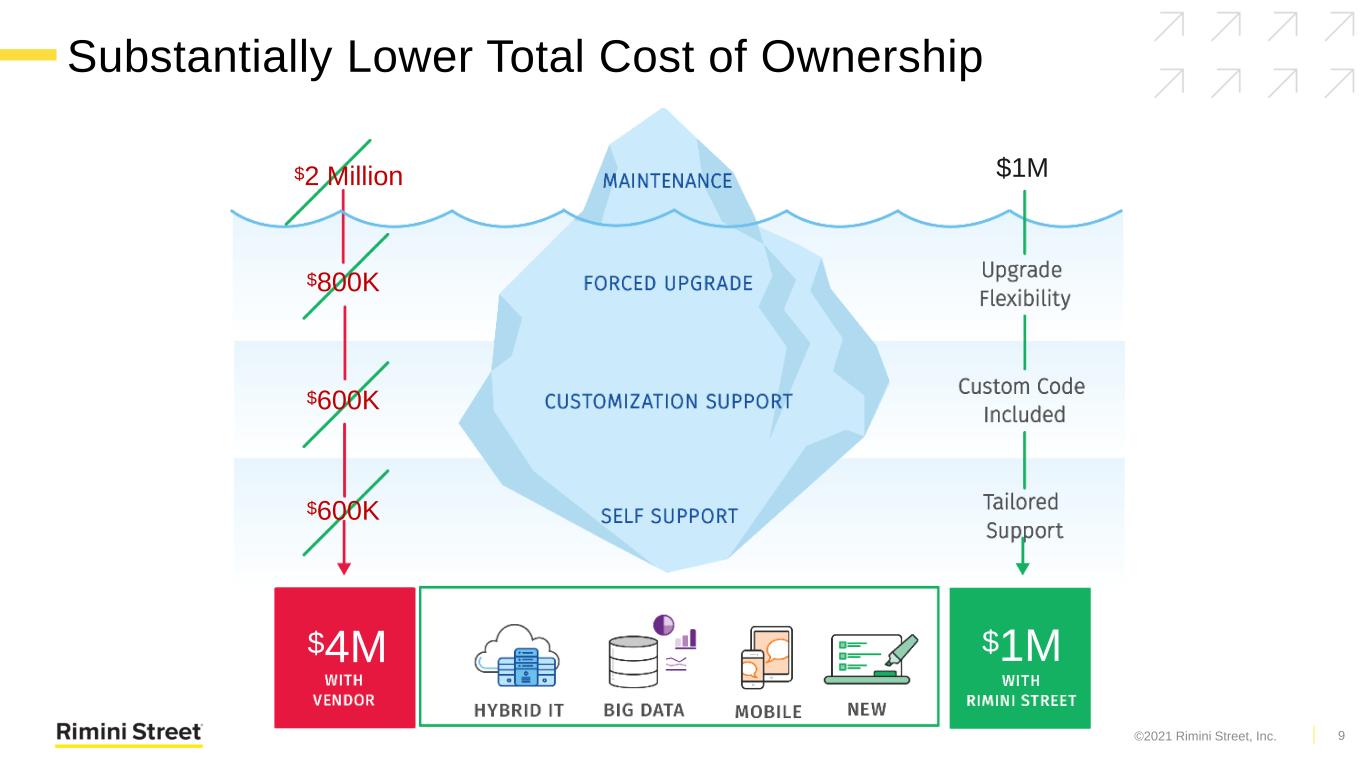

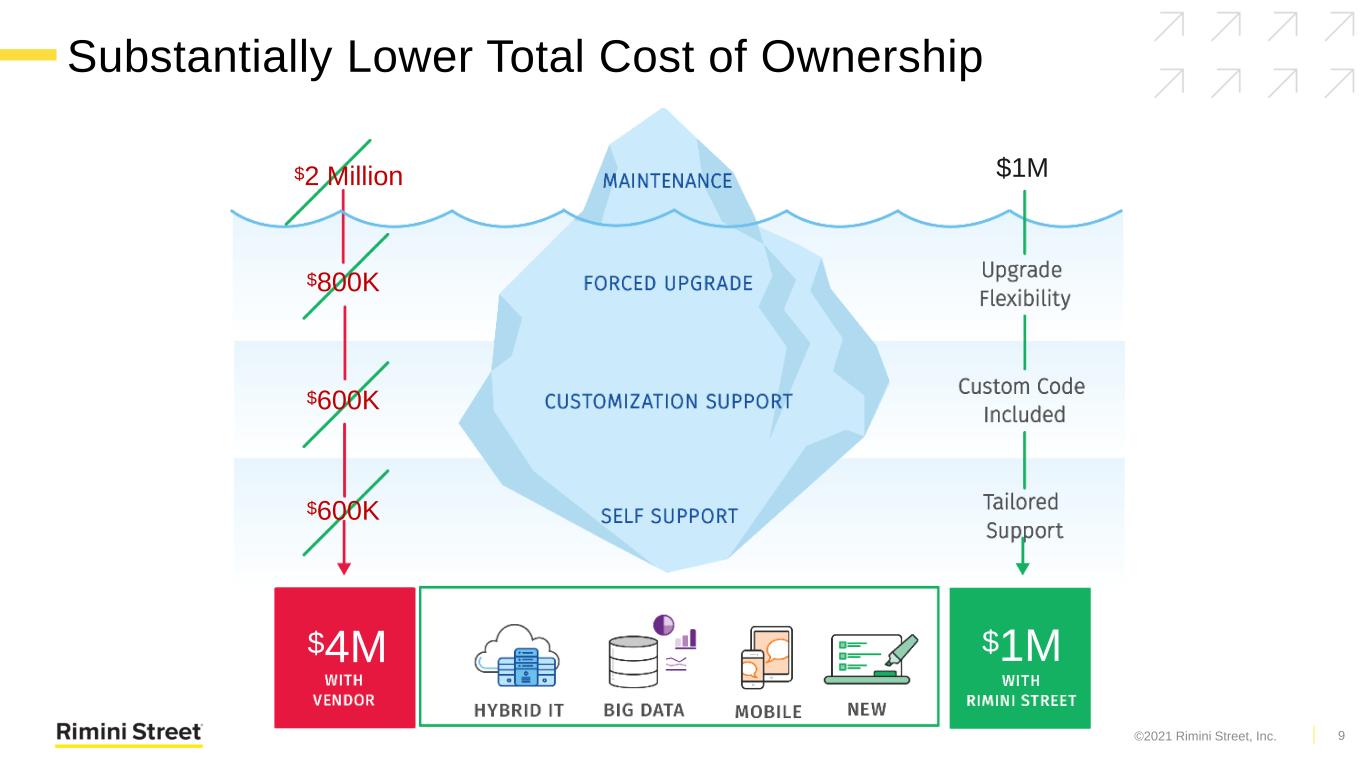

$2 Million $800K $600K $600K $1M $1M$4M Substantially Lower Total Cost of Ownership ©2021 Rimini Street, Inc. 9

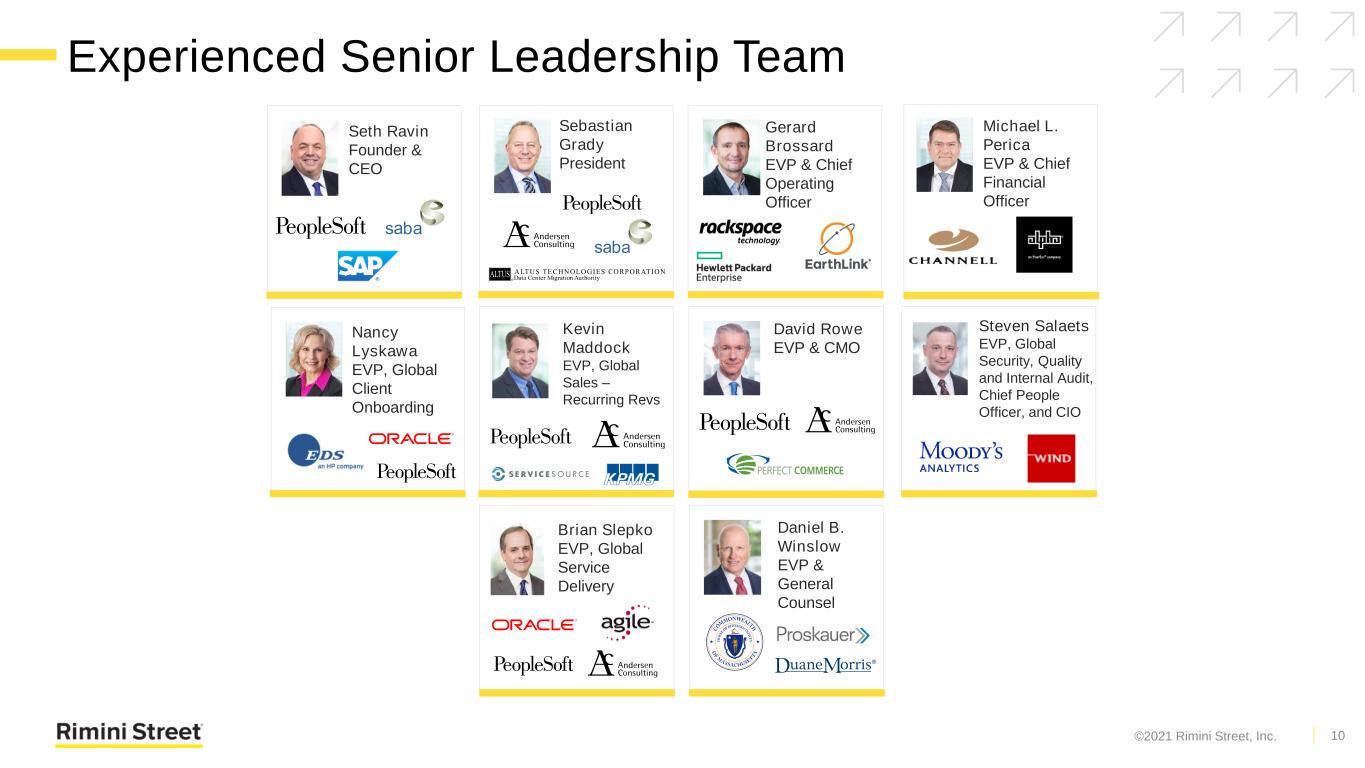

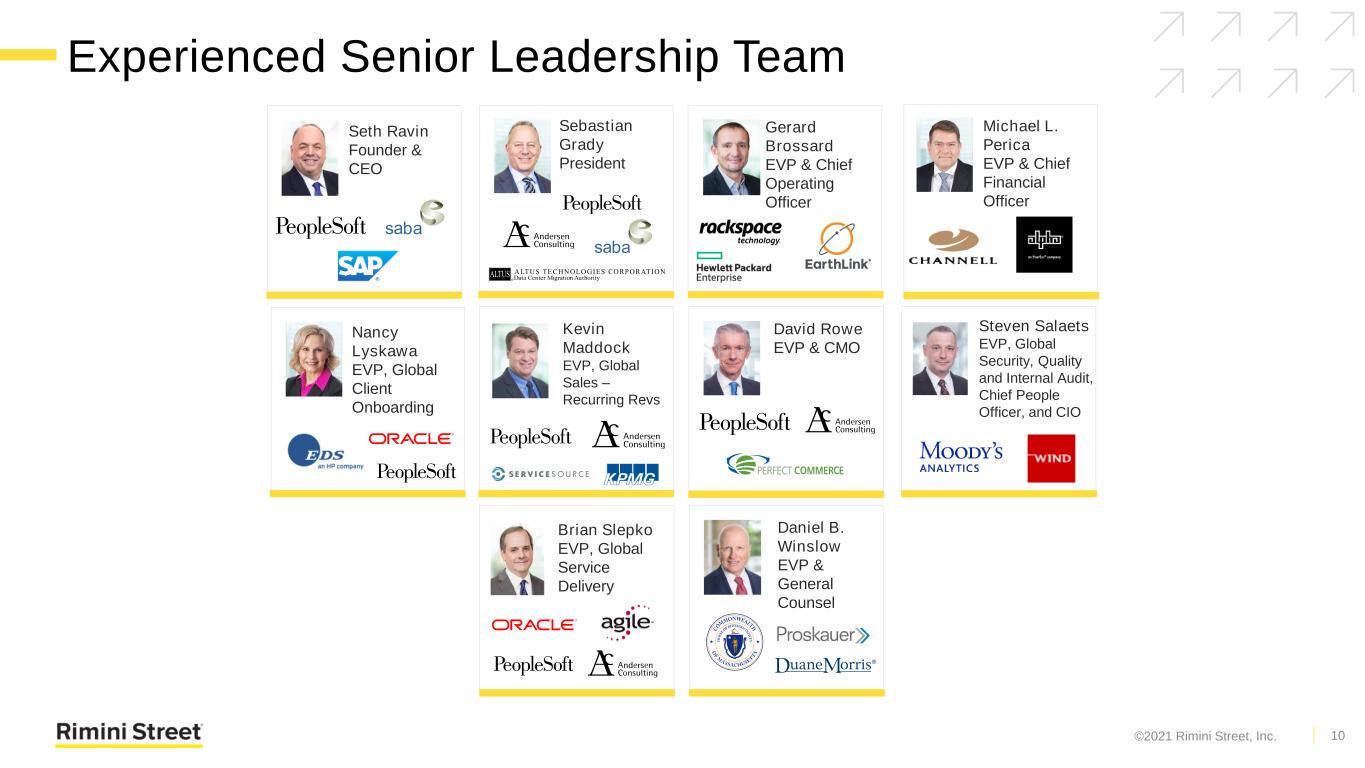

Sebastian Grady President Seth Ravin Founder & CEO Experienced Senior Leadership Team Gerard Brossard EVP & Chief Operating Officer Michael L. Perica EVP & Chief Financial Officer Nancy Lyskawa EVP, Global Client Onboarding Kevin Maddock EVP, Global Sales – Recurring Revs Brian Slepko EVP, Global Service Delivery Daniel B. Winslow EVP & General Counsel David Rowe EVP & CMO Steven Salaets EVP, Global Security, Quality and Internal Audit, Chief People Officer, and CIO ©2021 Rimini Street, Inc. 10

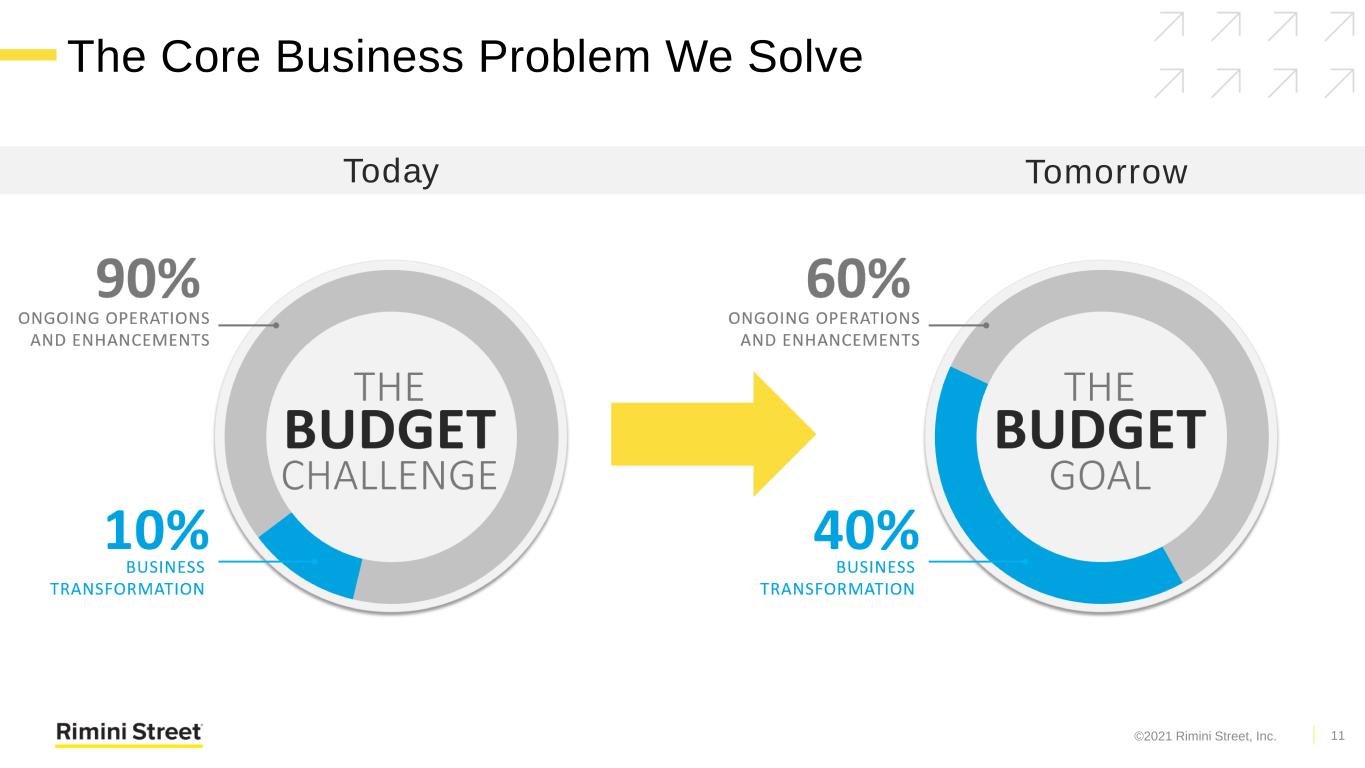

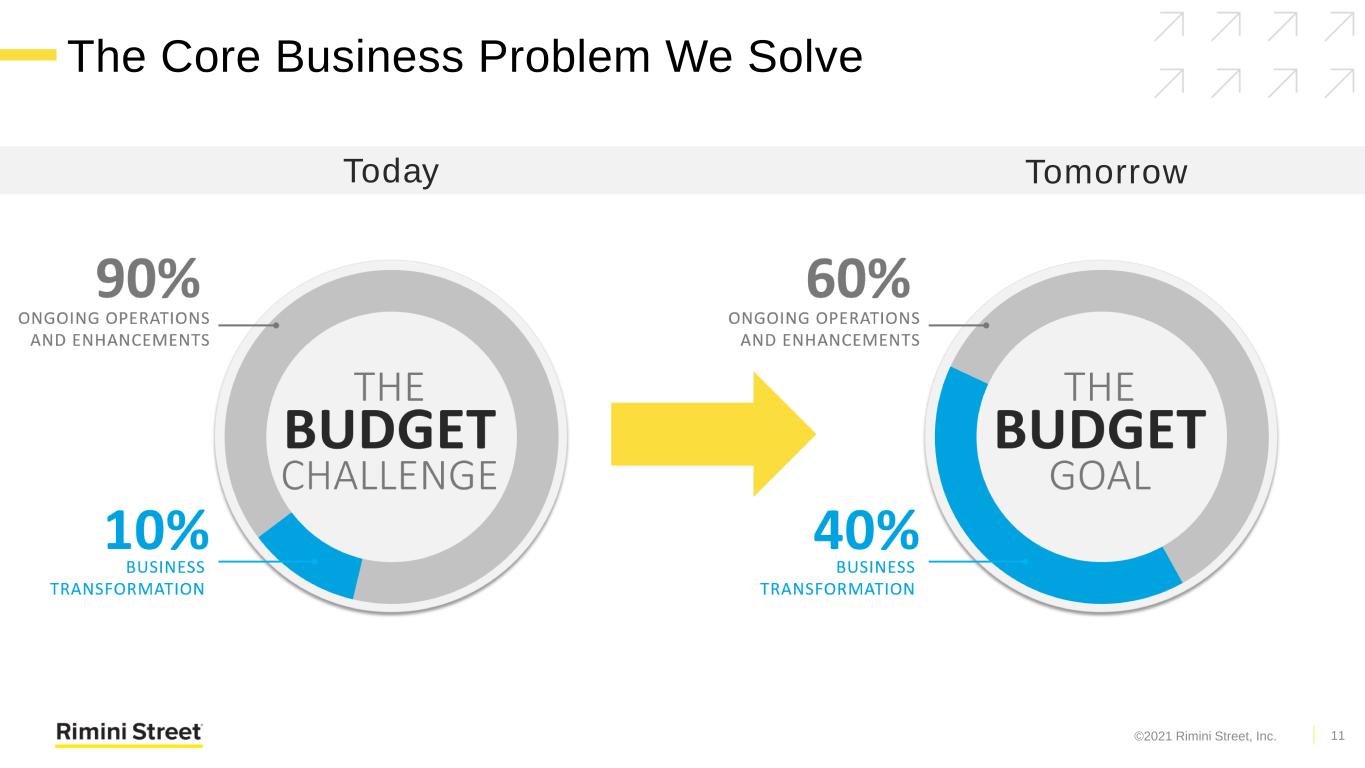

Today Tomorrow The Core Business Problem We Solve ©2021 Rimini Street, Inc. 11

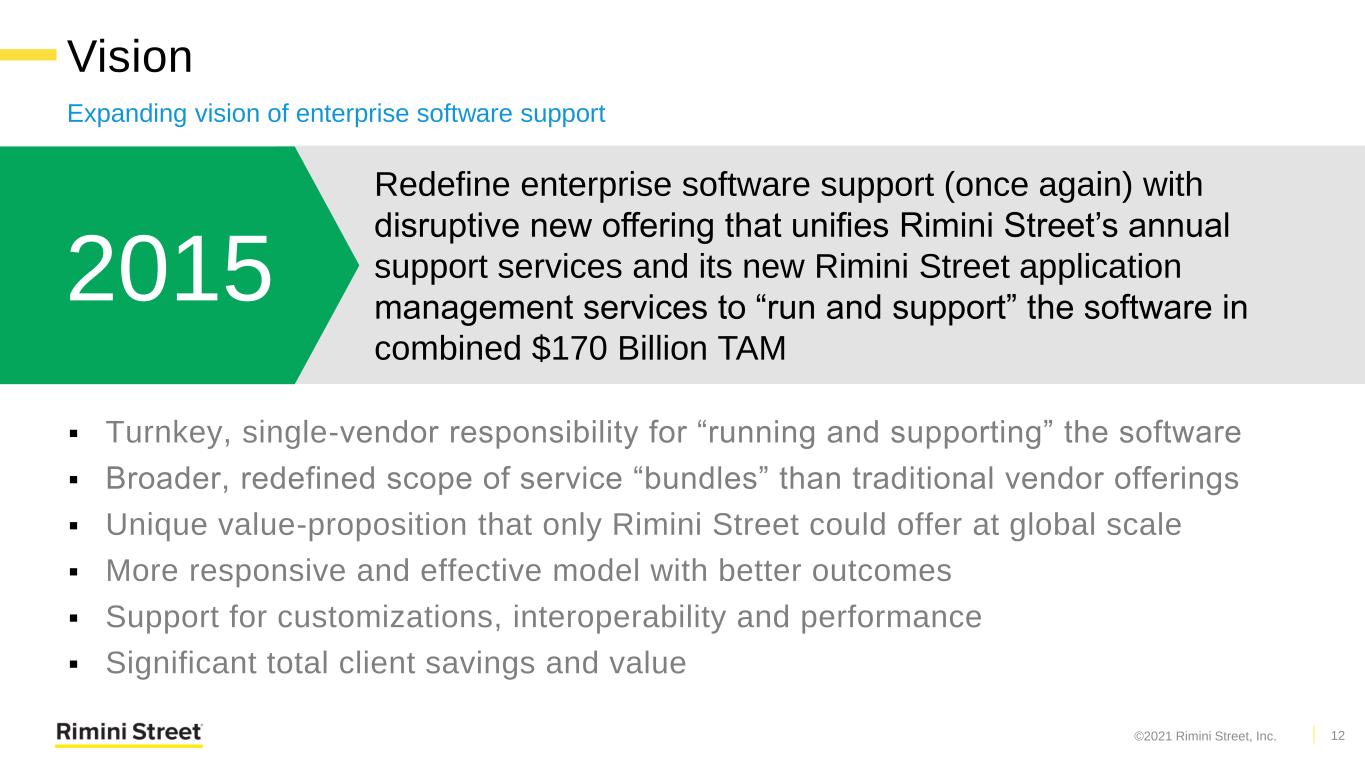

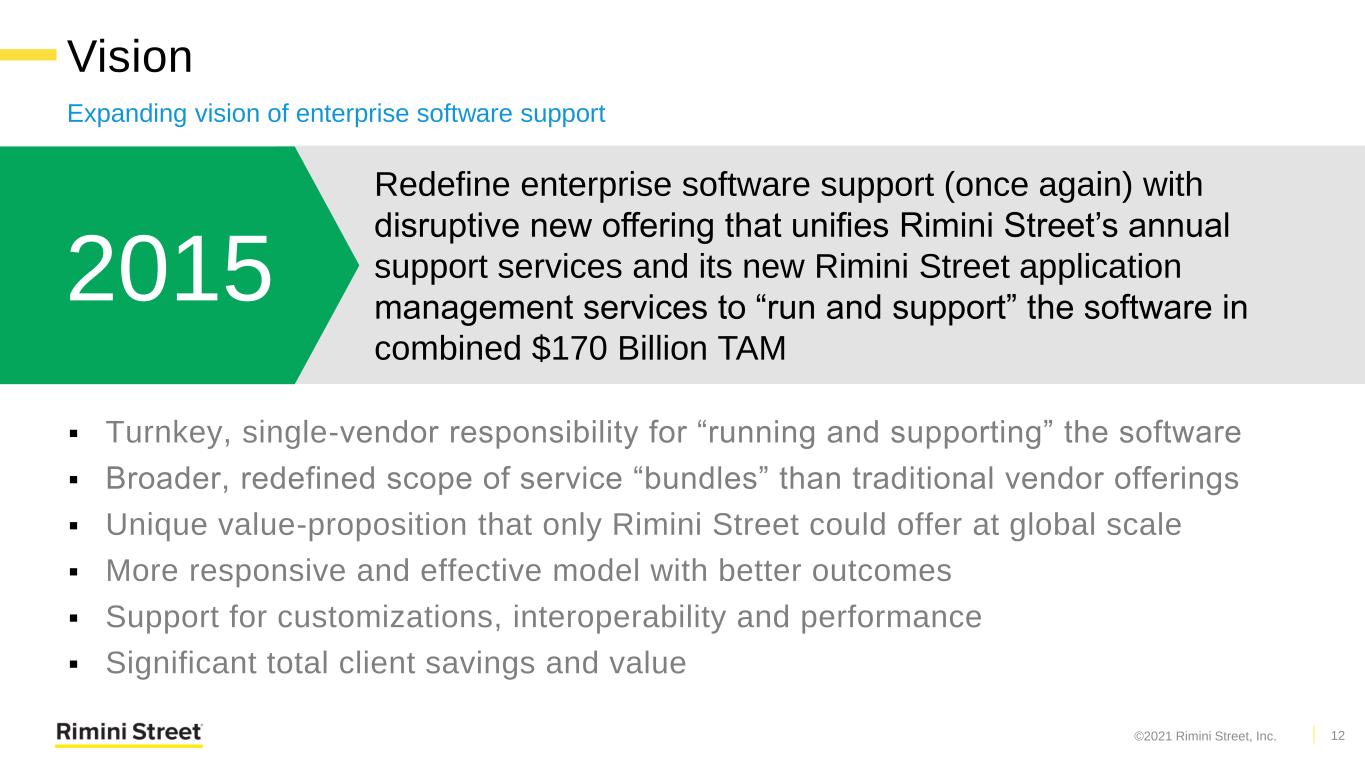

Vision Expanding vision of enterprise software support ▪ Turnkey, single-vendor responsibility for “running and supporting” the software ▪ Broader, redefined scope of service “bundles” than traditional vendor offerings ▪ Unique value-proposition that only Rimini Street could offer at global scale ▪ More responsive and effective model with better outcomes ▪ Support for customizations, interoperability and performance ▪ Significant total client savings and value 12 Redefine enterprise software support (once again) with disruptive new offering that unifies Rimini Street’s annual support services and its new Rimini Street application management services to “run and support” the software in combined $170 Billion TAM 2015 ©2021 Rimini Street, Inc.

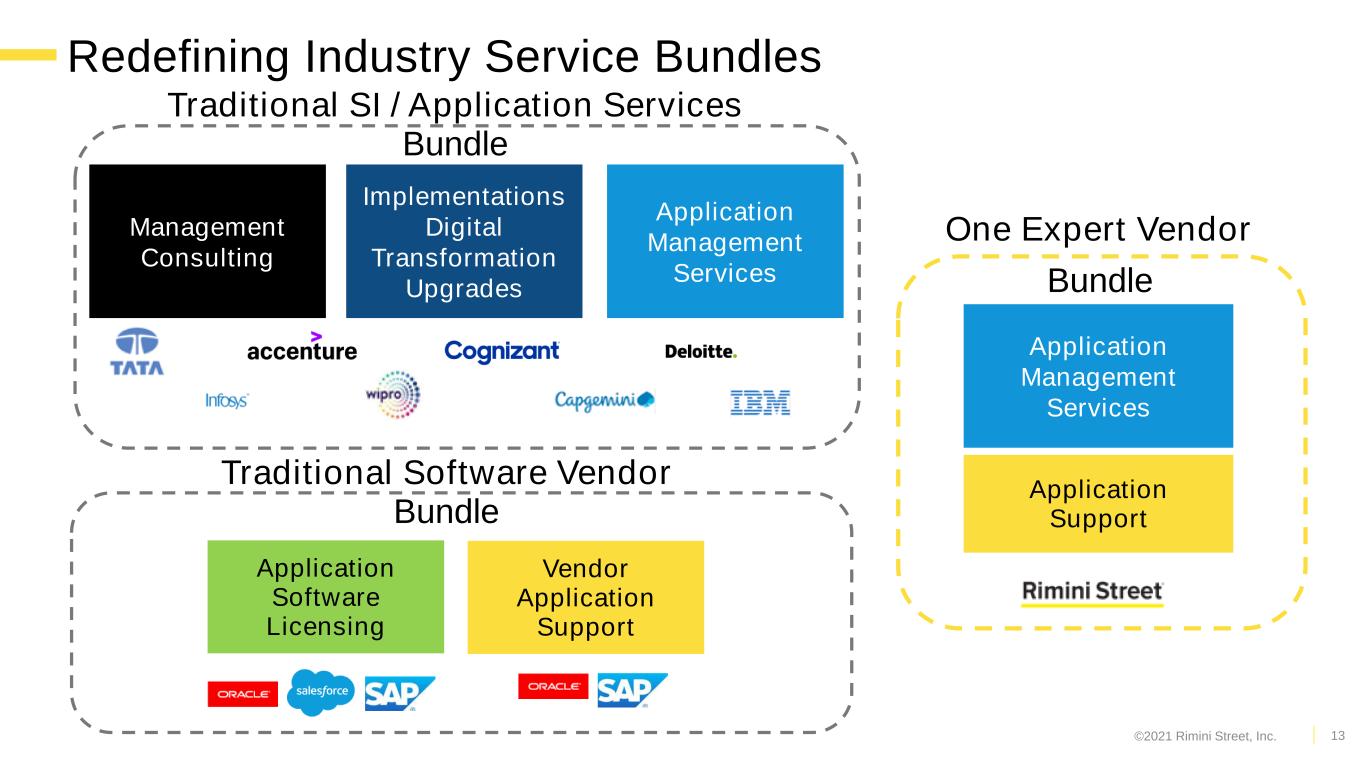

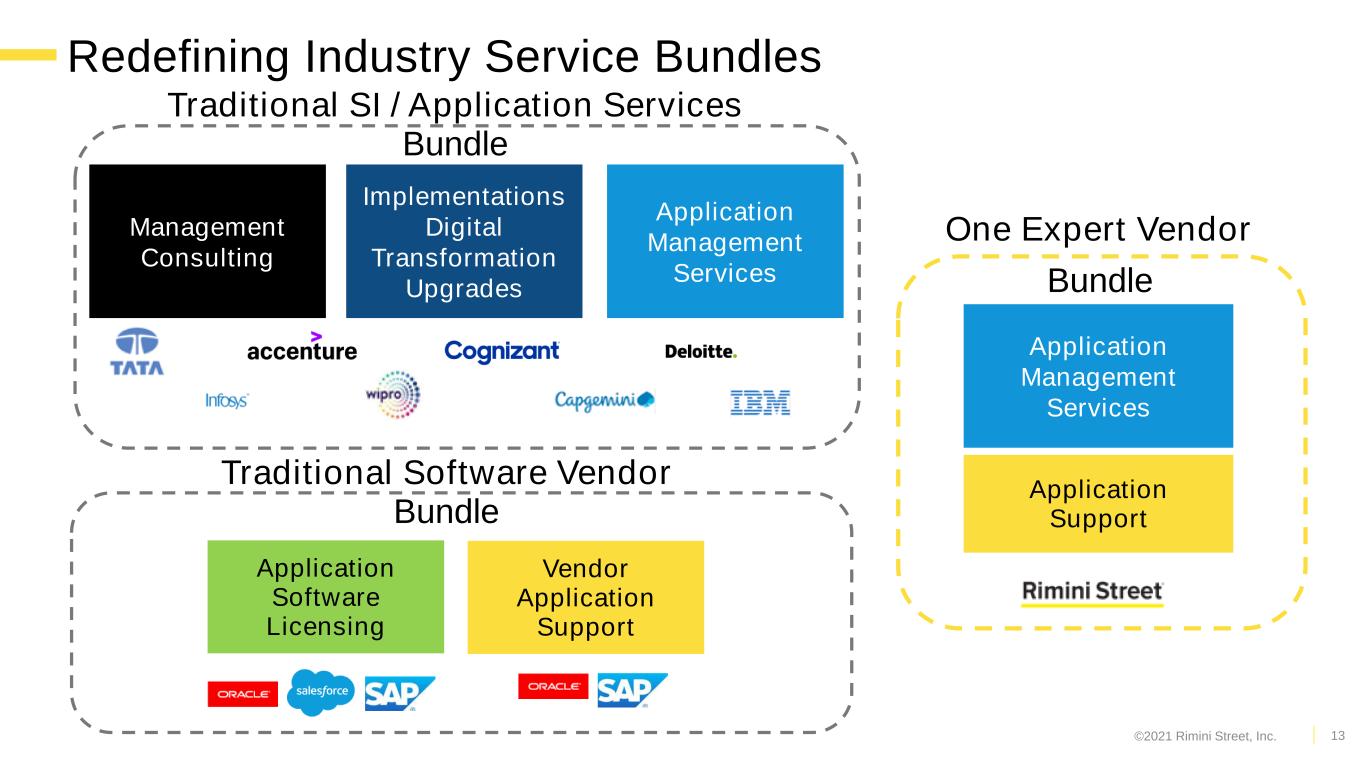

Redefining Industry Service Bundles • Unplanned interruption on IT service Management Consulting Implementations Digital Transformation Upgrades Application Management Services Application Software Licensing Vendor Application Support Application Management Services Application Support Traditional SI / Application Services Bundle Traditional Software Vendor Bundle One Expert Vendor Bundle ©2021 Rimini Street, Inc. 13

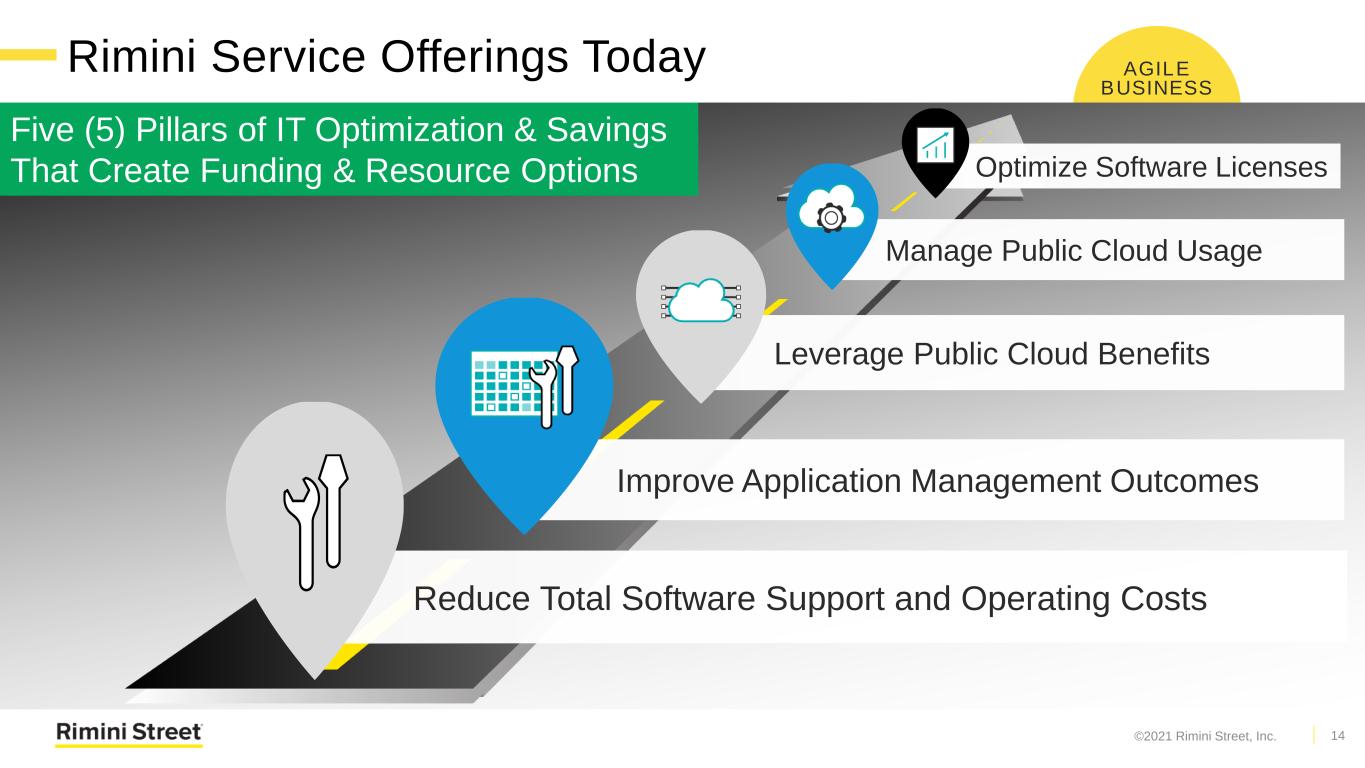

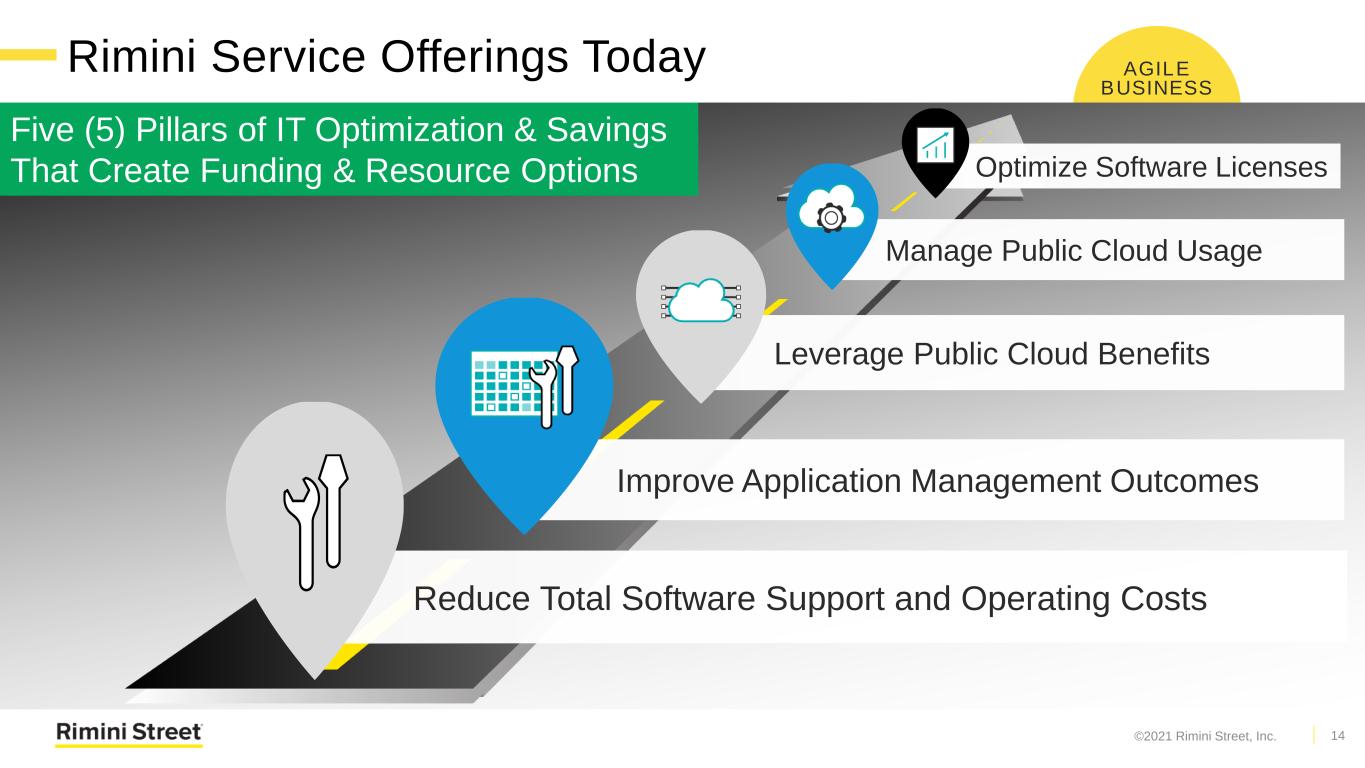

AGILE BUSINESS Optimize Software Licenses Manage Public Cloud Usage Leverage Public Cloud Benefits Improve Application Management Outcomes Reduce Total Software Support and Operating Costs Five (5) Pillars of IT Optimization & Savings That Create Funding & Resource Options Rimini Service Offerings Today ©2021 Rimini Street, Inc. 14

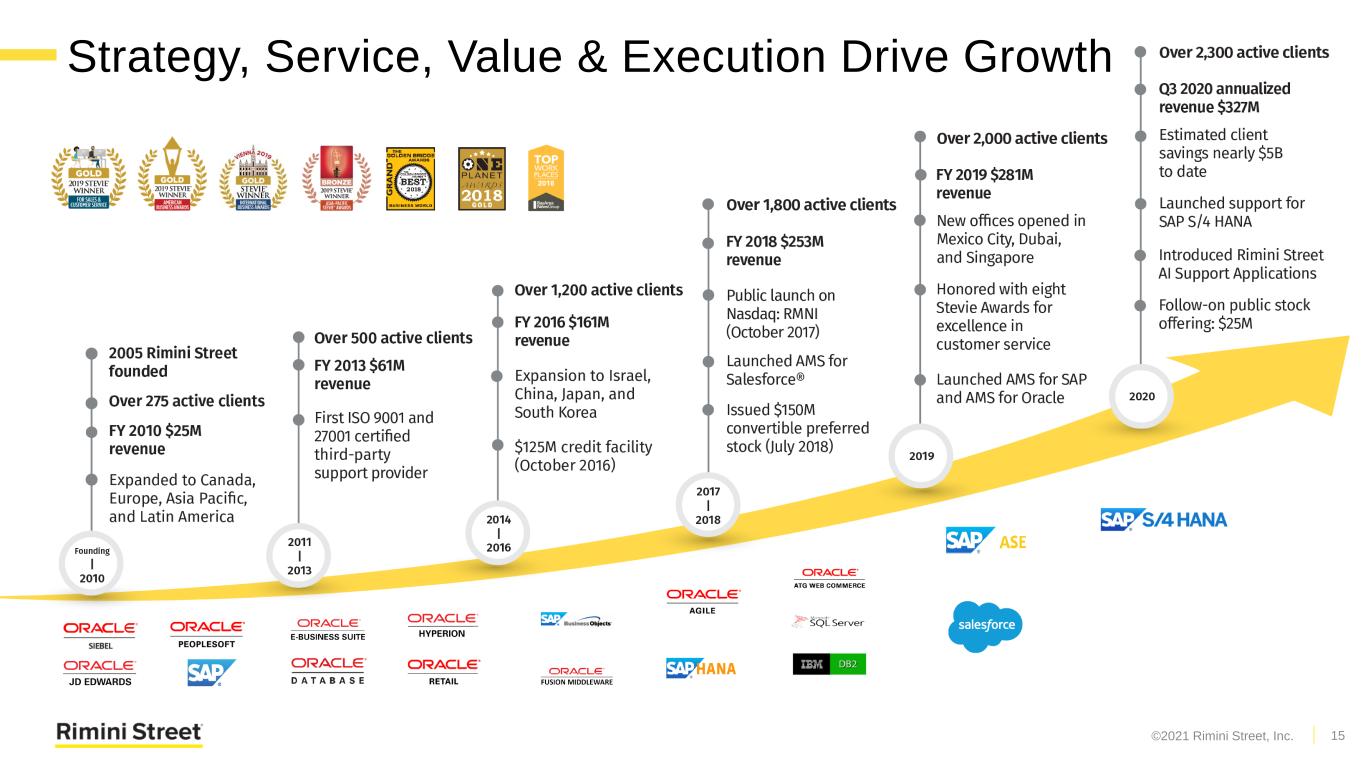

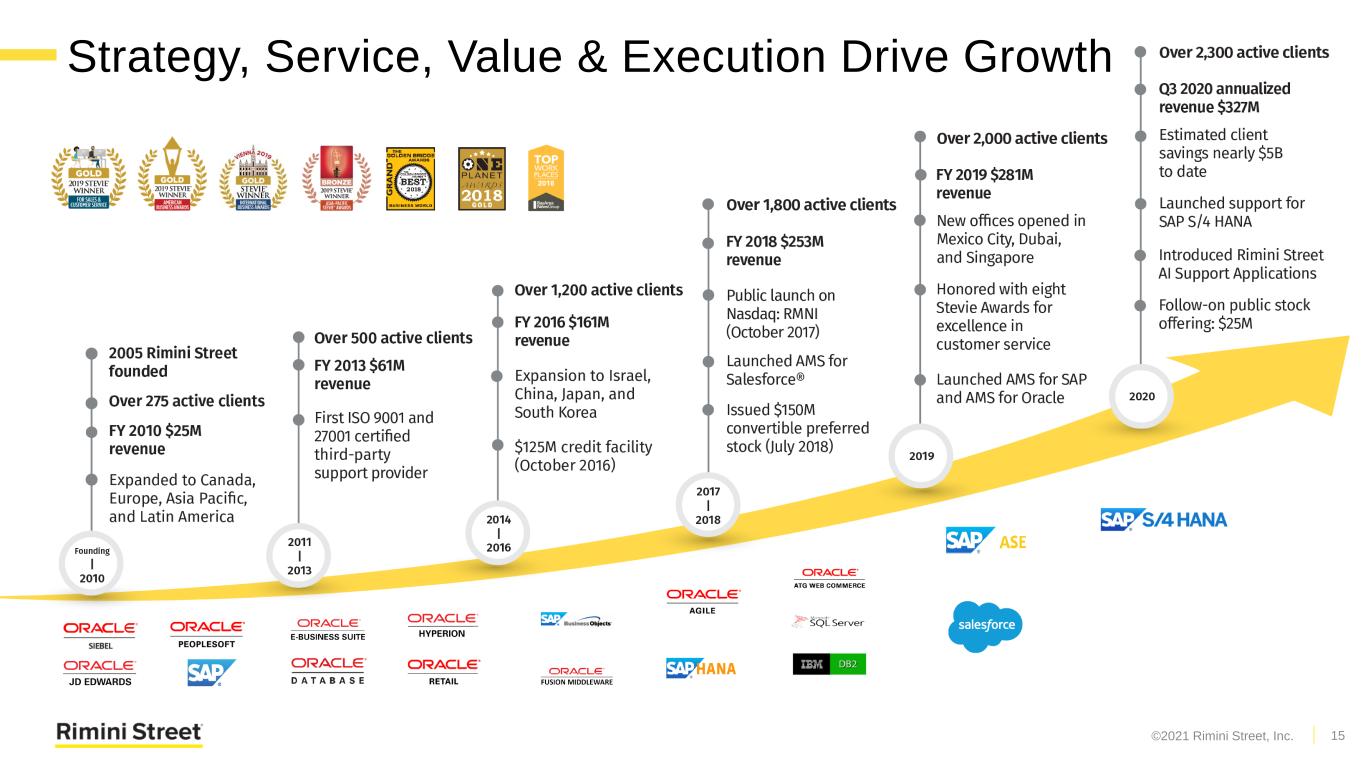

Strategy, Service, Value & Execution Drive Growth Property of Rimini Street ©2021 | Proprietary and Confidential 15©2021 Rimini Street, Inc.

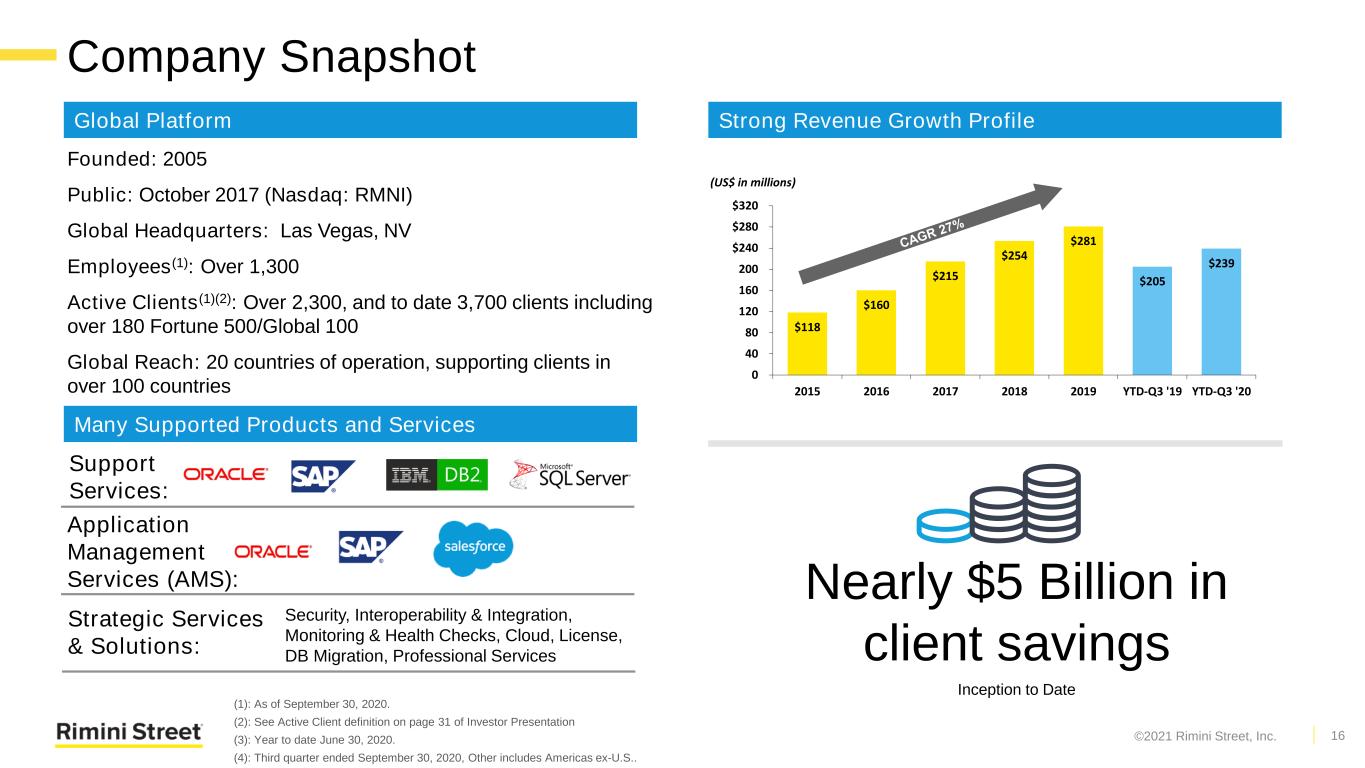

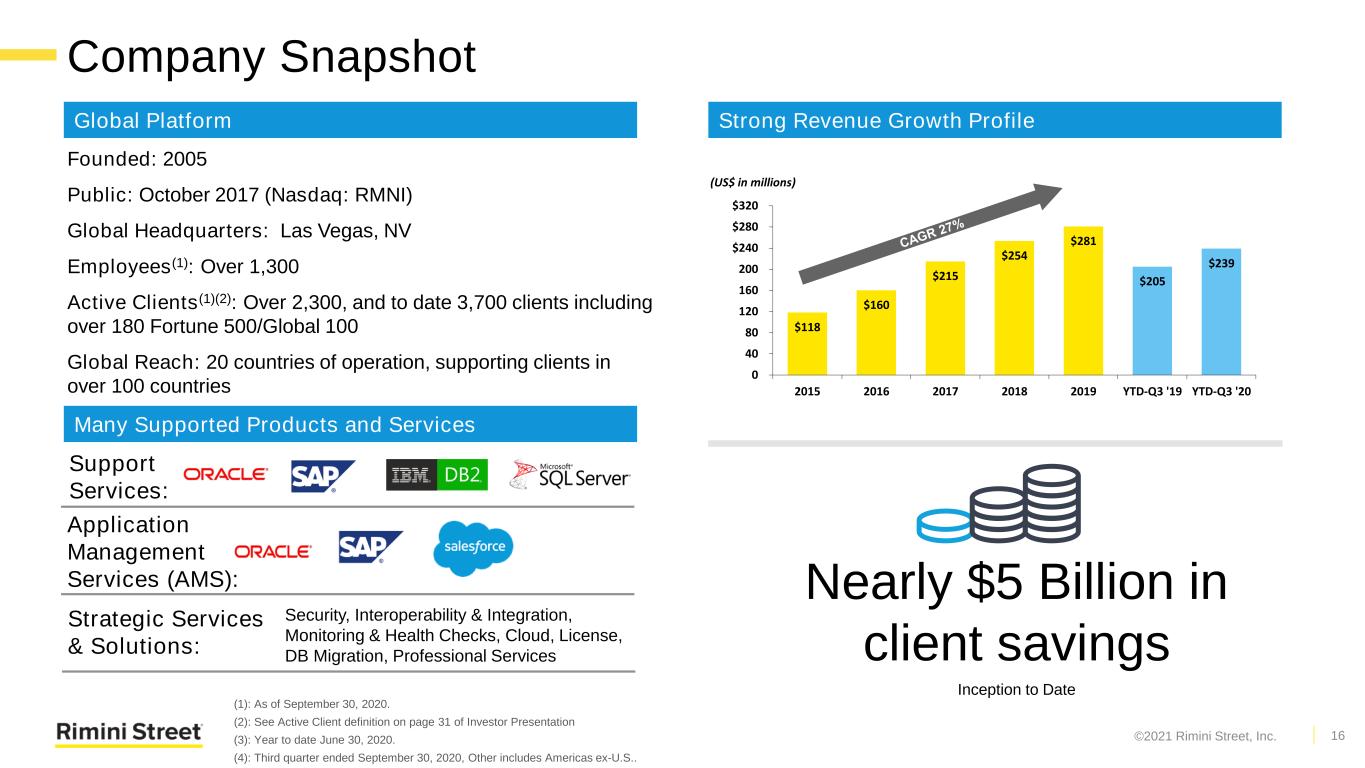

Founded: 2005 Public: October 2017 (Nasdaq: RMNI) Global Headquarters: Las Vegas, NV Employees(1): Over 1,300 Active Clients(1)(2): Over 2,300, and to date 3,700 clients including over 180 Fortune 500/Global 100 Global Reach: 20 countries of operation, supporting clients in over 100 countries Strong Revenue Growth Profile Many Supported Products and Services Global Platform (1): As of September 30, 2020. (2): See Active Client definition on page 31 of Investor Presentation (3): Year to date June 30, 2020. (4): Third quarter ended September 30, 2020, Other includes Americas ex-U.S.. Support Services: Application Management Services (AMS): Strategic Services & Solutions: Security, Interoperability & Integration, Monitoring & Health Checks, Cloud, License, DB Migration, Professional Services $118 $160 $215 $254 $281 $205 $239 0 40 80 120 160 200 $240 $280 $320 2015 2016 2017 2018 2019 YTD-Q3 '19 YTD-Q3 '20 (US$ in millions) Nearly $5 Billion in client savings Inception to Date Company Snapshot ©2021 Rimini Street, Inc. 16

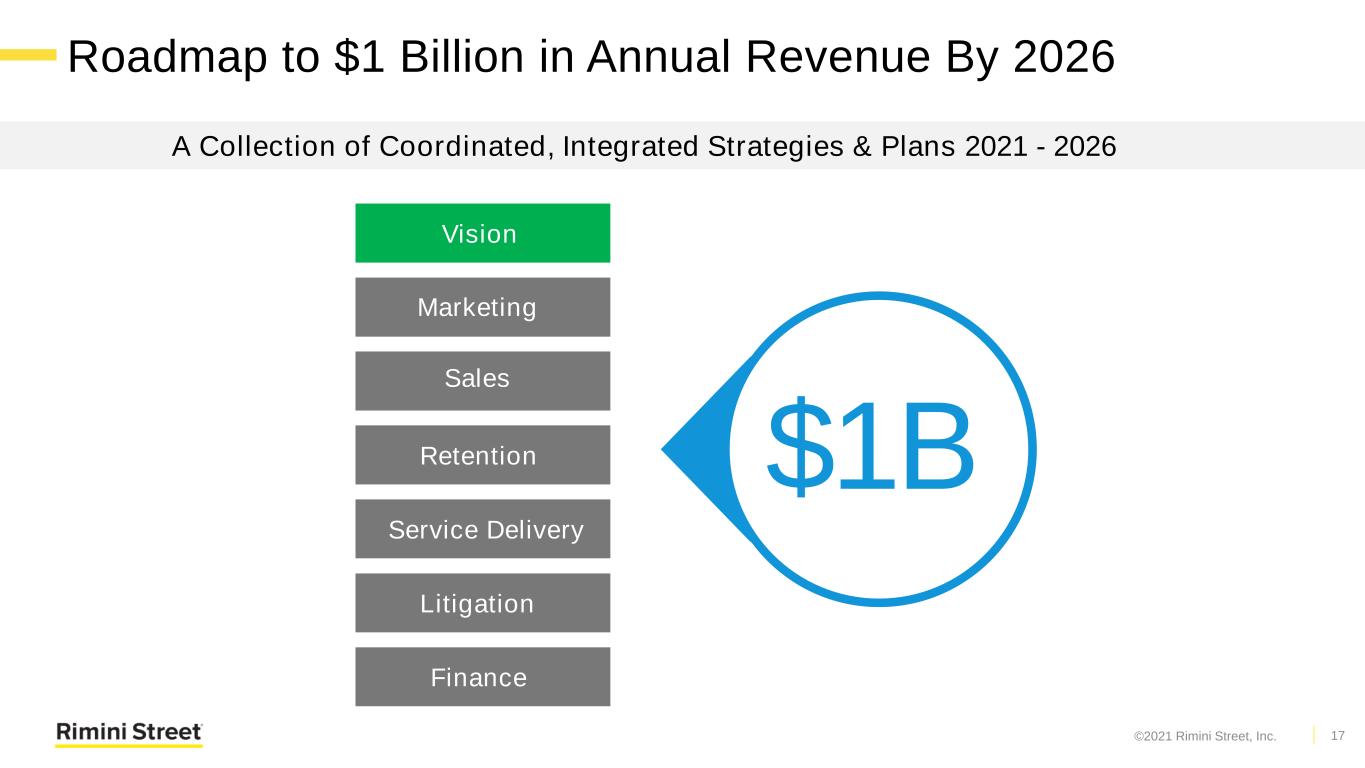

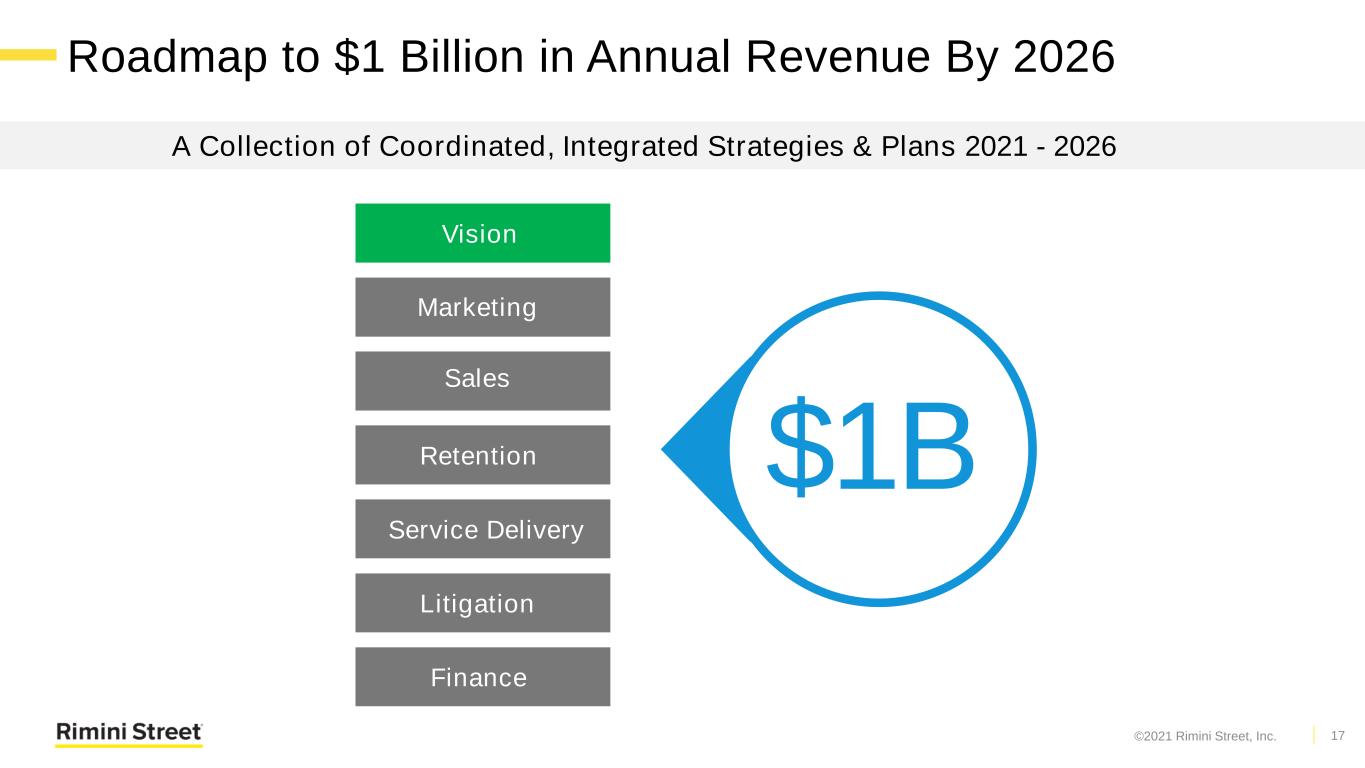

Roadmap to $1 Billion in Annual Revenue By 2026 17 Sales Retention Service Delivery Litigation Finance Marketing $1B A Collection of Coordinated, Integrated Strategies & Plans 2021 - 2026 Vision ©2021 Rimini Street, Inc.

Sebastian Grady President Why Clients Buy and Case Studies

Leading Global Companies Leveraging Rimini Street Organizations are avoiding and delaying expensive, low-value ERP upgrades and migrations 20©2021 Rimini Street, Inc.

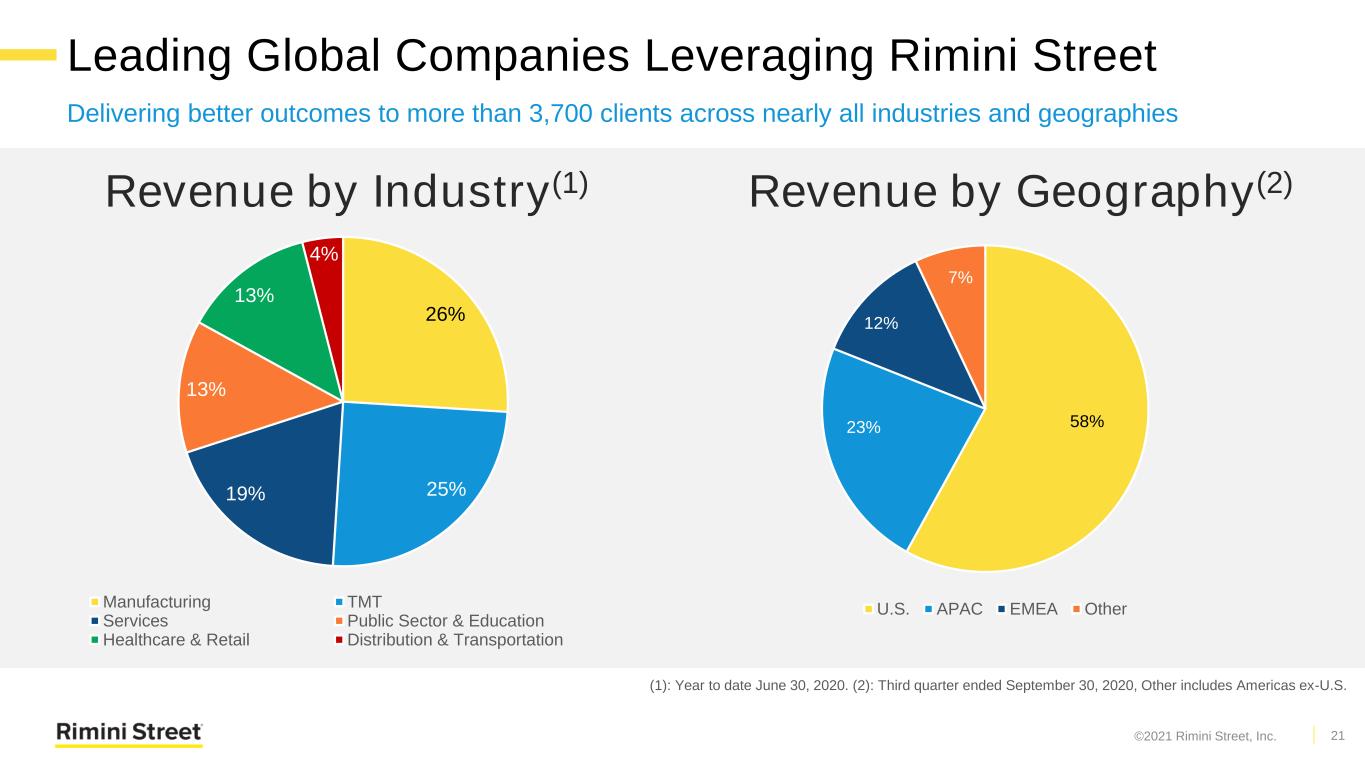

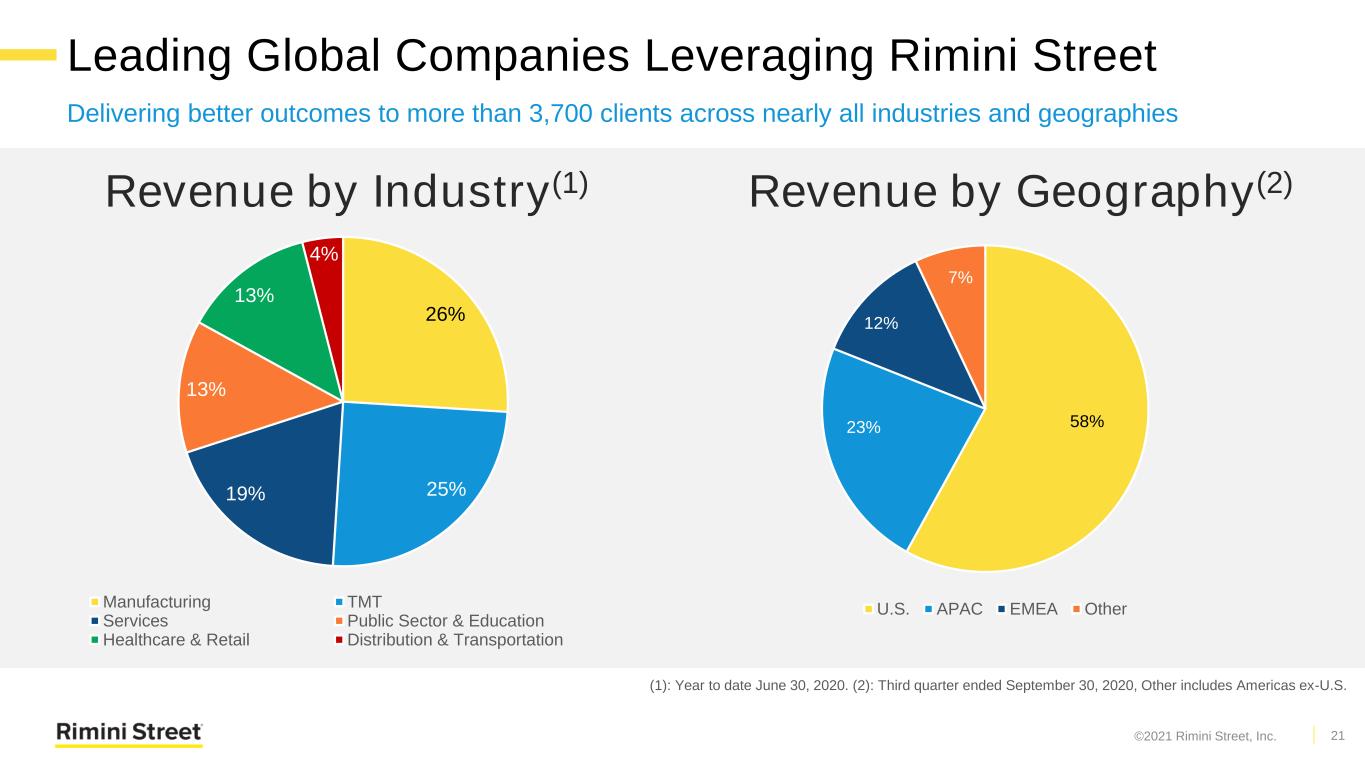

Delivering better outcomes to more than 3,700 clients across nearly all industries and geographies 21 26% 25%19% 13% 13% 4% Manufacturing TMT Services Public Sector & Education Healthcare & Retail Distribution & Transportation 58%23% 12% 7% U.S. APAC EMEA Other Revenue by Industry(1) Revenue by Geography(2) (1): Year to date June 30, 2020. (2): Third quarter ended September 30, 2020, Other includes Americas ex-U.S. Leading Global Companies Leveraging Rimini Street ©2021 Rimini Street, Inc.

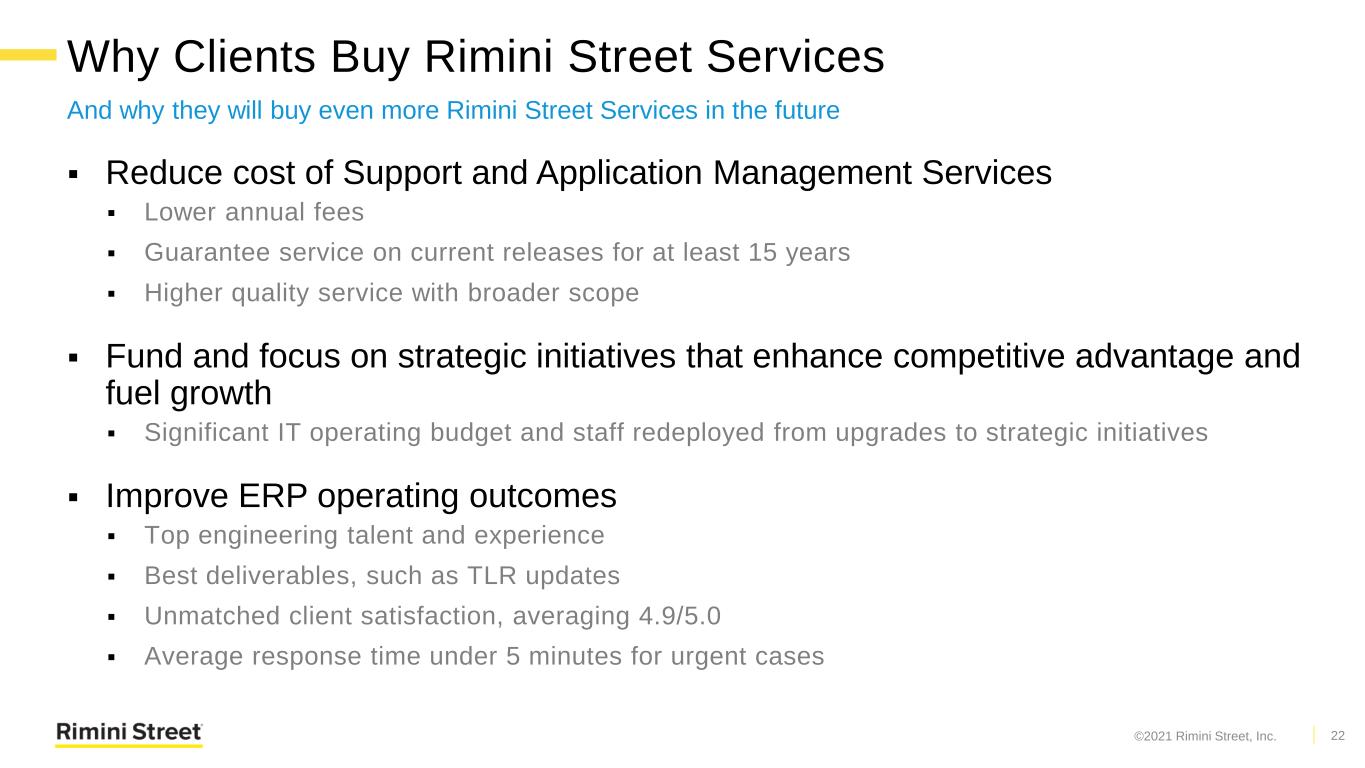

Why Clients Buy Rimini Street Services And why they will buy even more Rimini Street Services in the future ▪ Reduce cost of Support and Application Management Services ▪ Lower annual fees ▪ Guarantee service on current releases for at least 15 years ▪ Higher quality service with broader scope ▪ Fund and focus on strategic initiatives that enhance competitive advantage and fuel growth ▪ Significant IT operating budget and staff redeployed from upgrades to strategic initiatives ▪ Improve ERP operating outcomes ▪ Top engineering talent and experience ▪ Best deliverables, such as TLR updates ▪ Unmatched client satisfaction, averaging 4.9/5.0 ▪ Average response time under 5 minutes for urgent cases 22©2021 Rimini Street, Inc.

Why Clients Buy Rimini Street Services Clients BUY when they understand that Rimini Street solutions enable and help them achieve their strategic, financial and IT goals “Save time, money & resources; Get broader, better services and better response times; and you can fund innovation that supports growth” Rimini Street Sales Messaging Industry Challenges & Opportunities Retail Example: “What a difficult time to be in retail – with Amazon driving already thin margins for many retailers even thinner, and everyone needing to spend huge efforts and investments on acquiring clients and getting them to come back again…” Product / Release Specific Knowledge, Challenges & Opportunities Retail Example: “With the need to focus on client acquisition, IT will likely need to focus its attention on eCommerce solutions and sales analytics…things that are more important than back-end ERP transactions. Doing an S/4HANA migration won’t help sales growth or profit margins.” Client-Specific Circumstances, Challenges & Opportunities Retail Example: CIO: “Yes, sales are challenging for growth, and profits are getting squeezed – and so is my IT budget. The company wants us to focus on the projects you mentioned.” + ©2021 Rimini Street, Inc. 23

Client Spotlight Why Retail Clients Buy Rimini Street Support Services Retail Market Landscape ▪ Key Competitive Focus: Consumer acquisition, cost management, digital business models ▪ High Priority IT Spend: Ability to successfully compete with online retailers ▪ Rimini Success: 25% of top 100 U.S. retailers and many major global retailers ▪ Case Studies: Ross Stores, Nine West, Papa John’s, Savers, Pier 1, Cole Hahn, Circle K, Carico International, Hasegawa Co. 24 John Zavada, Petco “Rimini Street has been one of our bigger cost-saving initiatives that we’ve implemented.” “We actually have a tale of two stories…one that was a slam dunk with Oracle Financials…Retail Suite was actually new and that team basically was not very comfortable with this move. They're now raving fans.” ▪ $3B specialty retailer ▪ 1,500 stores, 25K employees ▪ Wanted to optimize enterprise software operating spend to fund innovation ▪ Scope ▪ PeopleSoft ▪ Oracle Database and Middleware ▪ Oracle Retail ▪ Hyperion ▪ Siebel ©2021 Rimini Street, Inc.

Client Spotlight Why Public Sector Clients Buy Rimini Street Support Services 25 Public Sector Market Landscape ▪ Key Competitive Focus: Constituent services, capital investment, balance budgets ▪ High Priority IT Spend: More efficient, cost-effective government services ▪ Rimini Success: More than 160 countries, provinces, states, counties, cities, agencies ▪ Case Studies: State of Florida, Gwinnett County, Government of Saskatchewan, Airservices Australia, The Jewish Agency of Israel ▪ $687M county council located in UK ▪ 800K residents, 400 adult and child services ▪ Wanted to reduce costs, use savings to maintain essential services and fund innovation ▪ Scope ▪ SAP ECC 6.0 ▪ Business Objects Sarah Stevenson, Head of Shared Services Center, NCC “There is significant pressure to drive cost reductions in our budget, but at the same time continue to maintain all our essential services and find ways to innovate. Rimini Street understands the importance of quality customer service, which not only delivers significant savings but gives us more time to plan for the future without the pressure of needing to follow a vendor-led upgrade path.” ©2021 Rimini Street, Inc.

Client Spotlight Why Services Clients Buy Rimini Street Support Services Construction and Engineering Services Market Landscape ▪ Key Competitive Focus: Capital investment, cost management, profitability, supply chain ▪ High Priority IT Spend: Streamlined operations and productivity ▪ Rimini Success: Over 50 global construction and engineering companies ▪ Case Studies: Toll Brothers, BrightSource, Kumagai Gumi, Ertech 26 Jay Fisher, CIO, BrandSafway “We were struggling with a mountain of tasks, which were incredibly time-consuming, and were looking into hiring additional personnel to help manage the workload… “ “We also knew that we weren’t realizing the full potential of our Salesforce system due to this backlog.” ▪ $6.7B global industrial, commercial and infrastructure engineering firm ▪ 32K employees, 253 global operations ▪ Wanted single-source vendor model w/ problem- solving capabilities to improve operations ▪ Support Scope ▪ Oracle EBS Unified Support and AMS ▪ Oracle Database ▪ JD Edwards ▪ Salesforce ▪ Advanced Application and Middleware Security ©2021 Rimini Street, Inc.

Client Spotlight Why Manufacturing Clients Buy Rimini Street Support Services Manufacturing Market Landscape ▪ Key Competitive Focus: Cash liquidity, increased ROIC, supply chain management ▪ High Priority IT Spend: Reduced operating costs through innovation and technology ▪ Rimini Success: 30 of the top 100 global manufacturers ▪ Case Studies: Mitsubishi, Bausch and Lomb, Tupperware, Kelly-Moore, HanesBrands, Del Monte, Libbey Glass, Ricoh, Lenox, Yamaha, American Standard, Seiko 27 Heegon Kim, Head of Department, Cloud Technology Team Hyundai Motor Group “The huge cost reductions we’ve achieved — with zero impact to our company-critical IT operations — have enabled us to invest in the technologies and expertise that will support future ground- breaking innovations.” ▪ $200B vehicle manufacturer and conglomerate ▪ 120,000 employees, 40+ countries of operation ▪ Wanted to optimize TCO, improve operations and reallocate resources to cloud and AI innovation ▪ Scope ▪ Oracle Database (~ 1,500 instances globally) ©2021 Rimini Street, Inc.

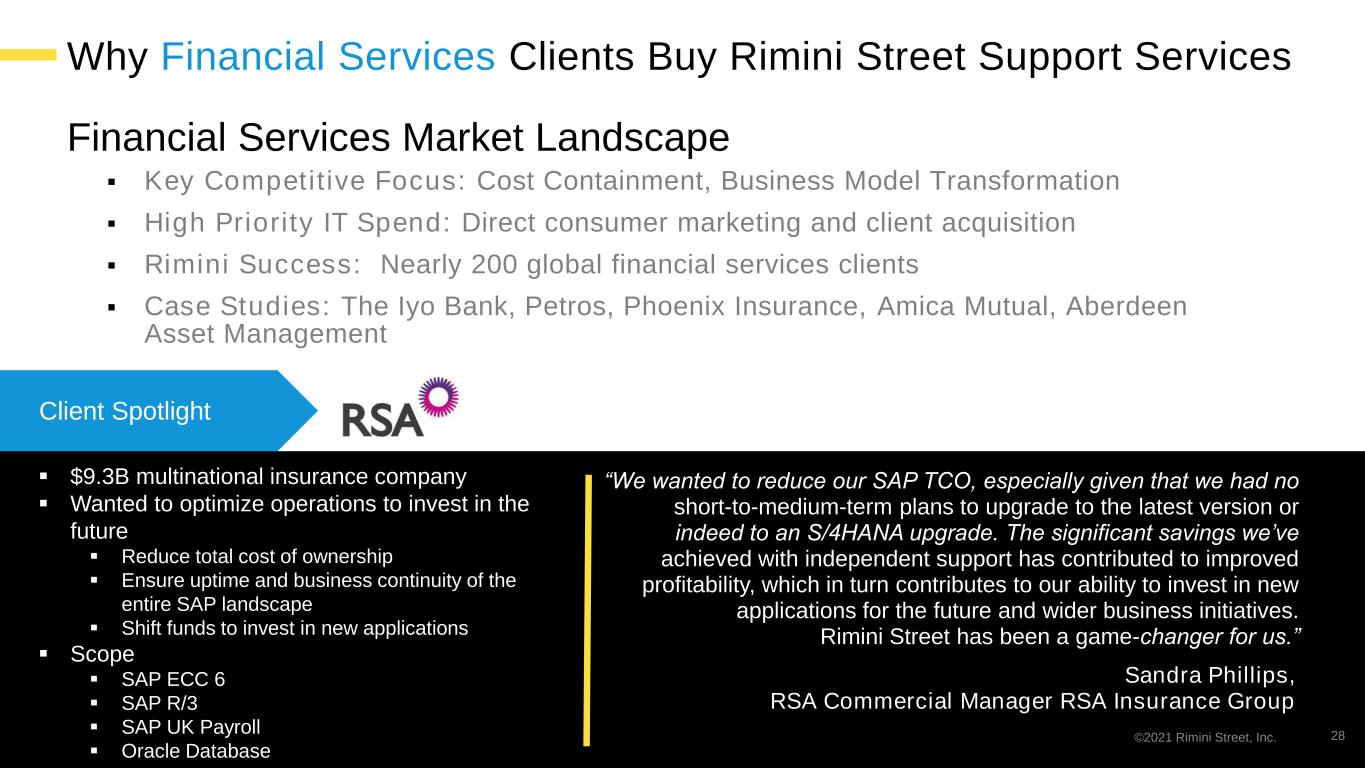

Client Spotlight Why Financial Services Clients Buy Rimini Street Support Services Financial Services Market Landscape ▪ Key Competitive Focus: Cost Containment, Business Model Transformation ▪ High Priority IT Spend: Direct consumer marketing and client acquisition ▪ Rimini Success: Nearly 200 global financial services clients ▪ Case Studies: The Iyo Bank, Petros, Phoenix Insurance, Amica Mutual, Aberdeen Asset Management 28 Sandra Phillips, RSA Commercial Manager RSA Insurance Group “We wanted to reduce our SAP TCO, especially given that we had no short-to-medium-term plans to upgrade to the latest version or indeed to an S/4HANA upgrade. The significant savings we’ve achieved with independent support has contributed to improved profitability, which in turn contributes to our ability to invest in new applications for the future and wider business initiatives. Rimini Street has been a game-changer for us.” ▪ $9.3B multinational insurance company ▪ Wanted to optimize operations to invest in the future ▪ Reduce total cost of ownership ▪ Ensure uptime and business continuity of the entire SAP landscape ▪ Shift funds to invest in new applications ▪ Scope ▪ SAP ECC 6 ▪ SAP R/3 ▪ SAP UK Payroll ▪ Oracle Database ©2021 Rimini Street, Inc.

Client Spotlight Why Distribution Clients Buy Rimini Street Support Services Distribution & Transportation Market Landscape ▪ Key Competitive Focus: Accelerate digitization, client acquisition, margins and reduce carbon ▪ High Priority IT Spend: Innovative technologies and analytics to improve inventory, logistics ▪ Rimini Success: More than 150 global distribution and transportation clients ▪ Case Studies: iMarketKorea, Nadro, King Architectural, Guest Services 29 Ingo Paas, CIO, Green Cargo “Our ambition is to deliver an IT roadmap that is driven by business needs rather than by IT, avoiding huge investments and the risks of migrating to other platforms. Knowing that we have Rimini Street as a trusted strategic partner ensuring the stability of our main SAP systems means we have the confidence and capacity to focus on the execution and further development of our goals.” ▪ $4.1B eco-friendly transportation leader in Scandinavia ▪ Wanted to optimize current systems to focus on modernization and digital transformation: ▪ Extend lifespan of mainframe & SAP applications – preserving original investments & lowering risk ▪ Implement agile, low-code IT model to modernize & accelerate business transformation w/ digital tools ▪ Scope ▪ SAP ECC 6 ▪ Business Objects ©2021 Rimini Street, Inc.

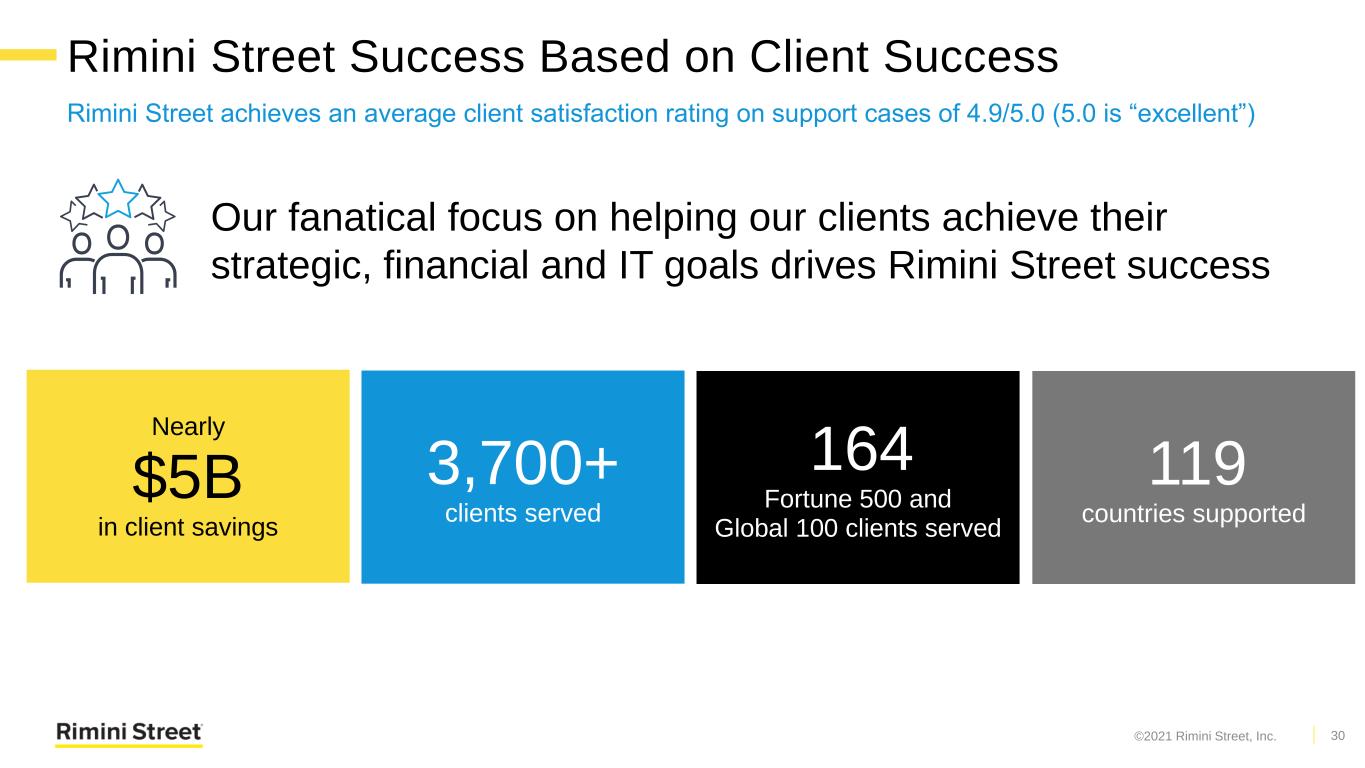

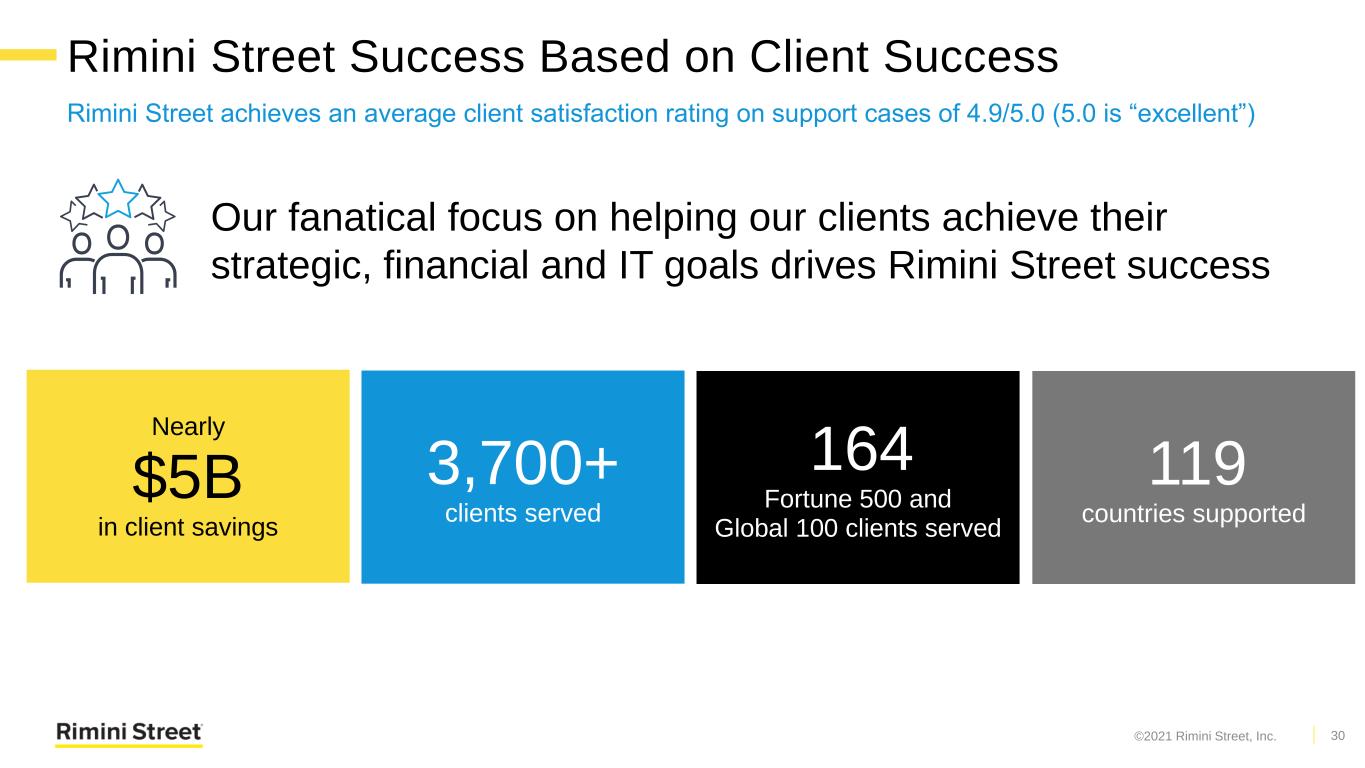

Rimini Street Success Based on Client Success Rimini Street achieves an average client satisfaction rating on support cases of 4.9/5.0 (5.0 is “excellent”) Our fanatical focus on helping our clients achieve their strategic, financial and IT goals drives Rimini Street success 30 Nearly $5B in client savings 3,700+ clients served 164 Fortune 500 and Global 100 clients served 119 countries supported ©2021 Rimini Street, Inc.

David Rowe Chief Marketing Officer Marketing Strategy and Plan

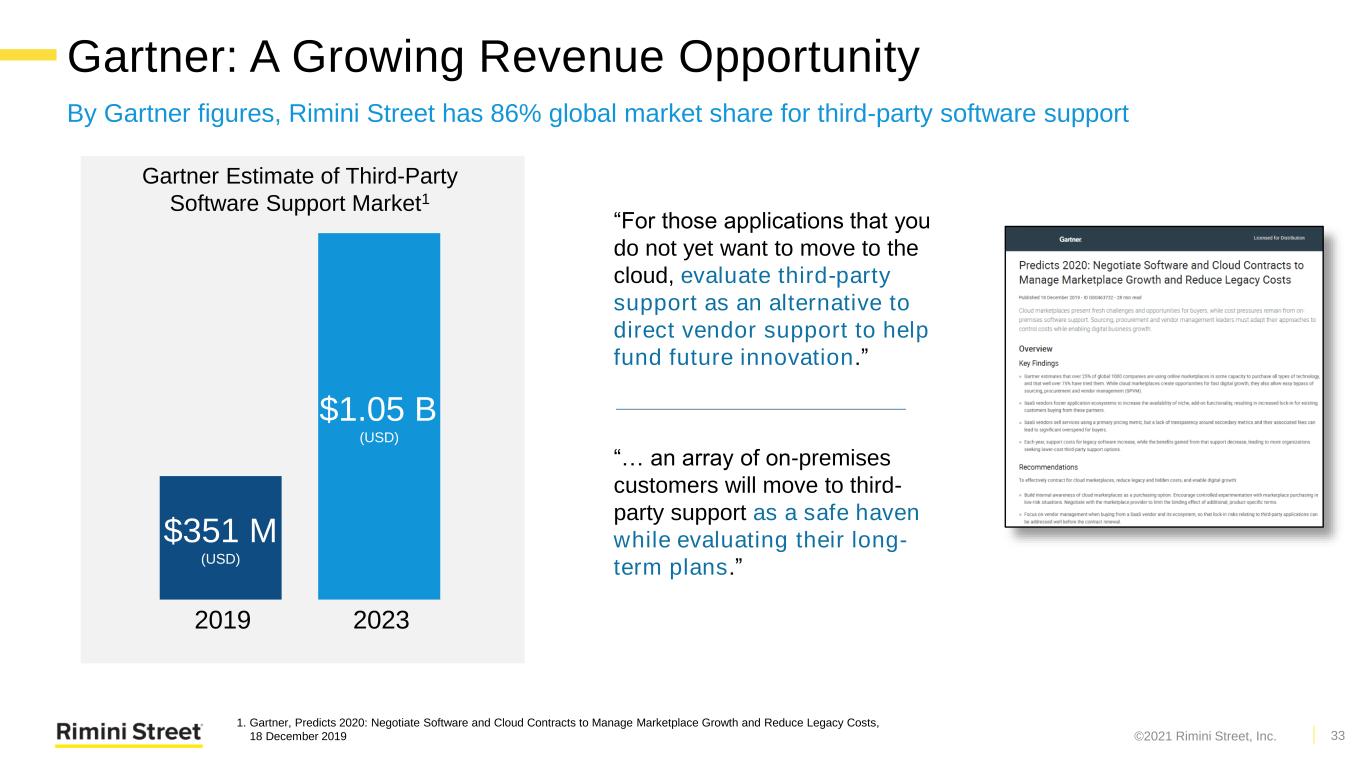

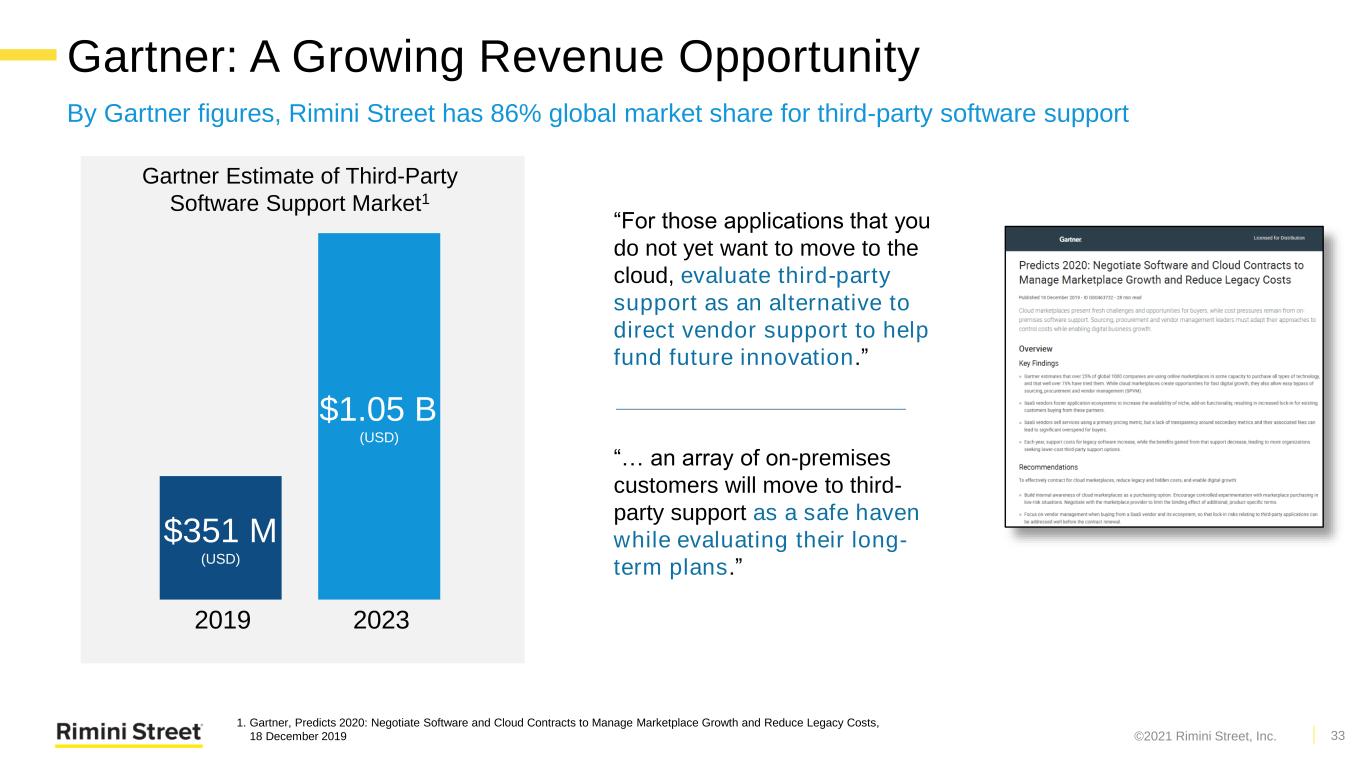

Gartner: A Growing Revenue Opportunity 33 $1.05 B (USD) $351 M (USD) 1. Gartner, Predicts 2020: Negotiate Software and Cloud Contracts to Manage Marketplace Growth and Reduce Legacy Costs, 18 December 2019 2019 2023 “For those applications that you do not yet want to move to the cloud, evaluate third-party support as an alternative to direct vendor support to help fund future innovation.” “… an array of on-premises customers will move to third- party support as a safe haven while evaluating their long- term plans.” Gartner Estimate of Third-Party Software Support Market1 By Gartner figures, Rimini Street has 86% global market share for third-party software support ©2021 Rimini Street, Inc.

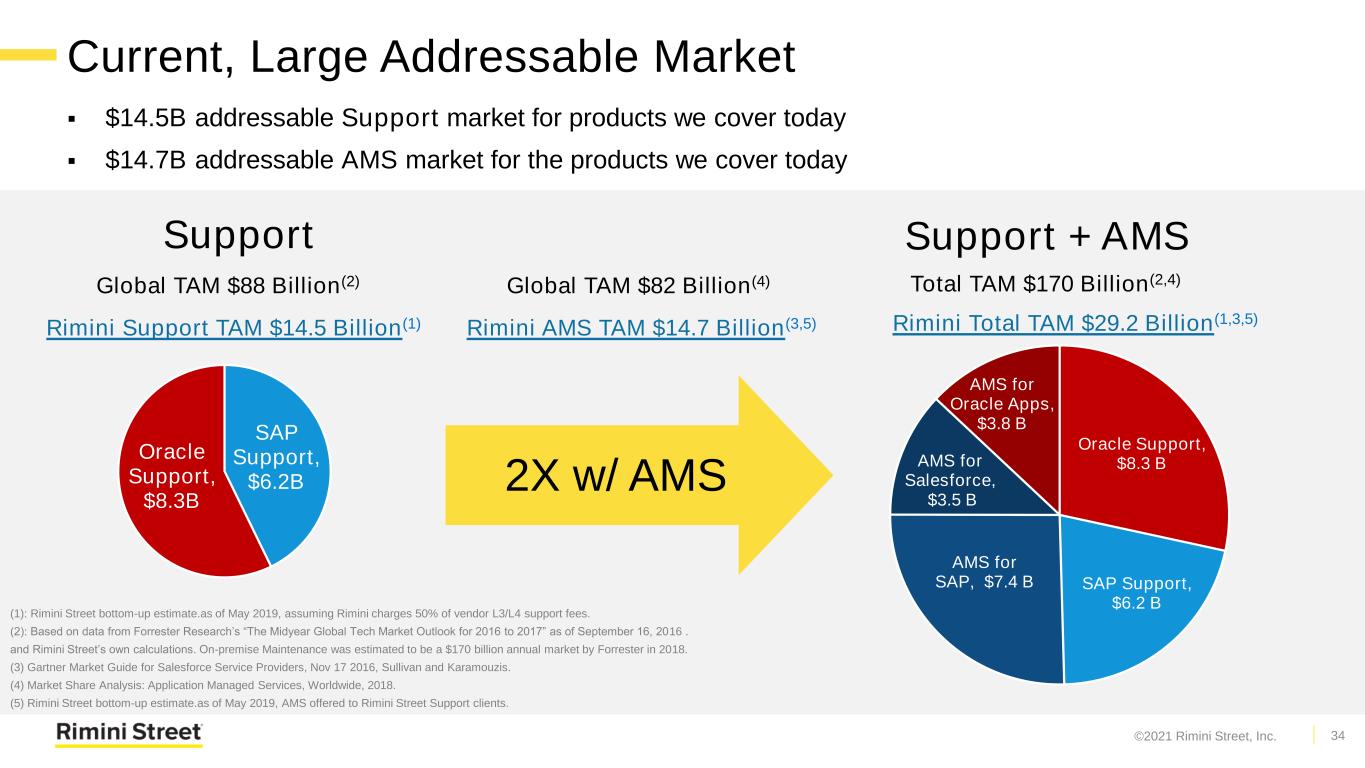

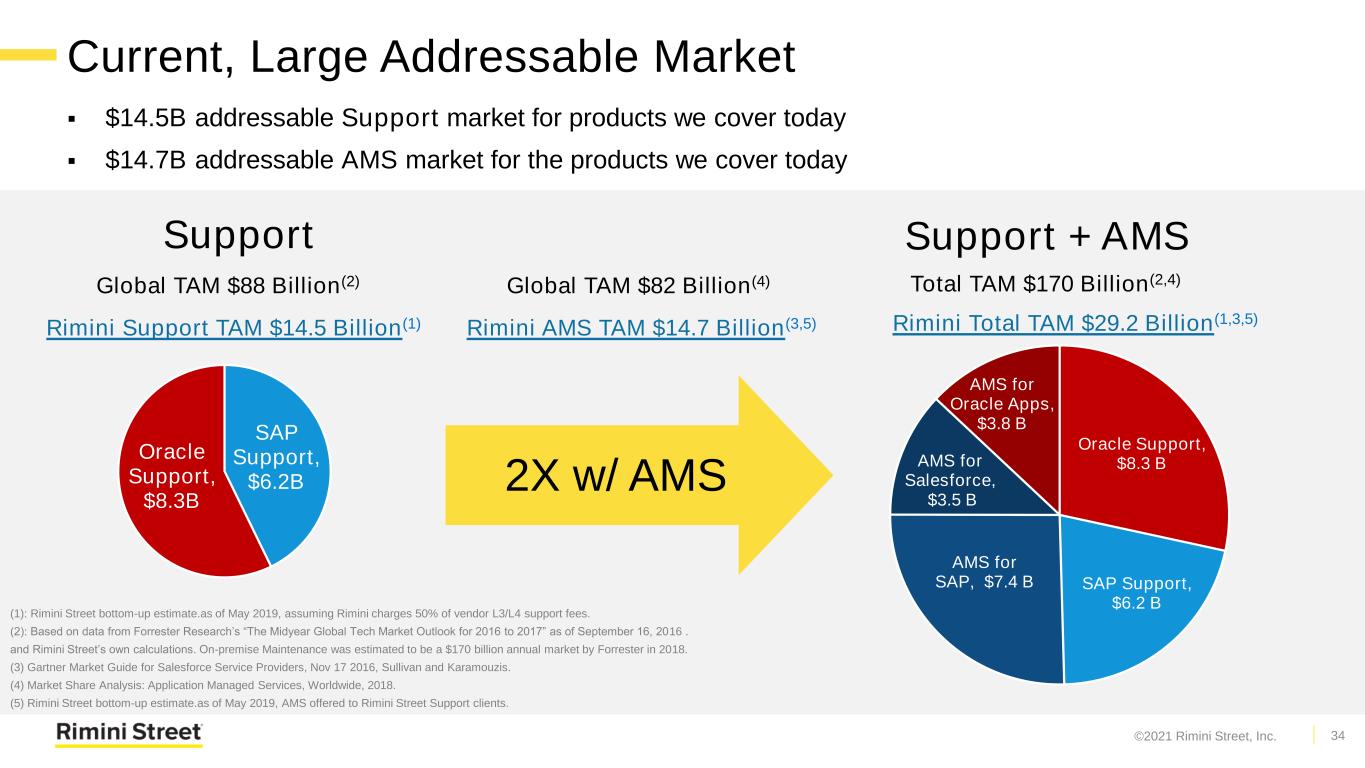

Current, Large Addressable Market ▪ $14.5B addressable Support market for products we cover today ▪ $14.7B addressable AMS market for the products we cover today 34 Oracle Support, $8.3 B SAP Support, $6.2 B AMS for SAP, $7.4 B AMS for Salesforce, $3.5 B AMS for Oracle Apps, $3.8 B Support Support + AMS 2X w/ AMS SAP Support, $6.2B Oracle Support, $8.3B Rimini Support TAM $14.5 Billion(1) Global TAM $88 Billion(2) Global TAM $82 Billion(4) Rimini AMS TAM $14.7 Billion(3,5) Rimini Total TAM $29.2 Billion (1,3,5) Total TAM $170 Billion(2,4) (1): Rimini Street bottom-up estimate.as of May 2019, assuming Rimini charges 50% of vendor L3/L4 support fees. (2): Based on data from Forrester Research’s “The Midyear Global Tech Market Outlook for 2016 to 2017” as of September 16, 2016 . and Rimini Street’s own calculations. On-premise Maintenance was estimated to be a $170 billion annual market by Forrester in 2018. (3) Gartner Market Guide for Salesforce Service Providers, Nov 17 2016, Sullivan and Karamouzis. (4) Market Share Analysis: Application Managed Services, Worldwide, 2018. (5) Rimini Street bottom-up estimate.as of May 2019, AMS offered to Rimini Street Support clients. ©2021 Rimini Street, Inc.

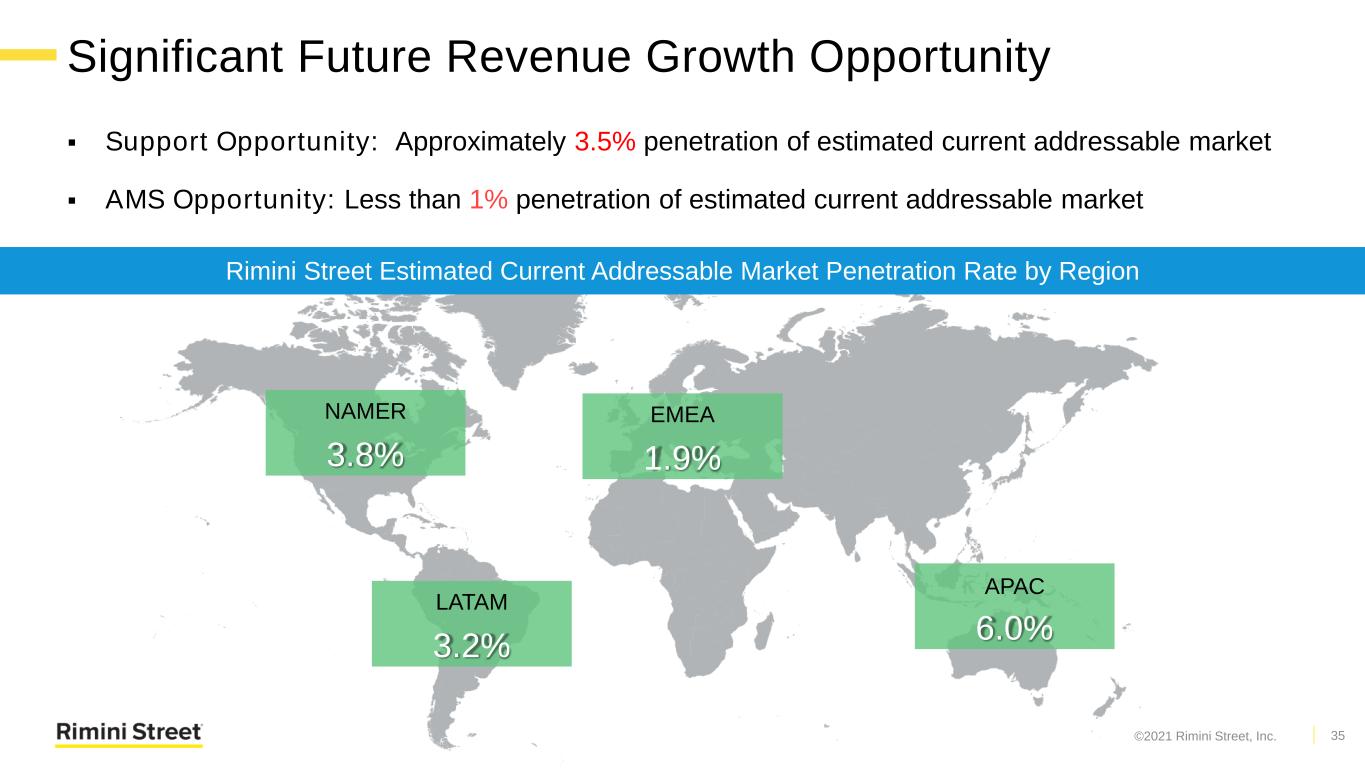

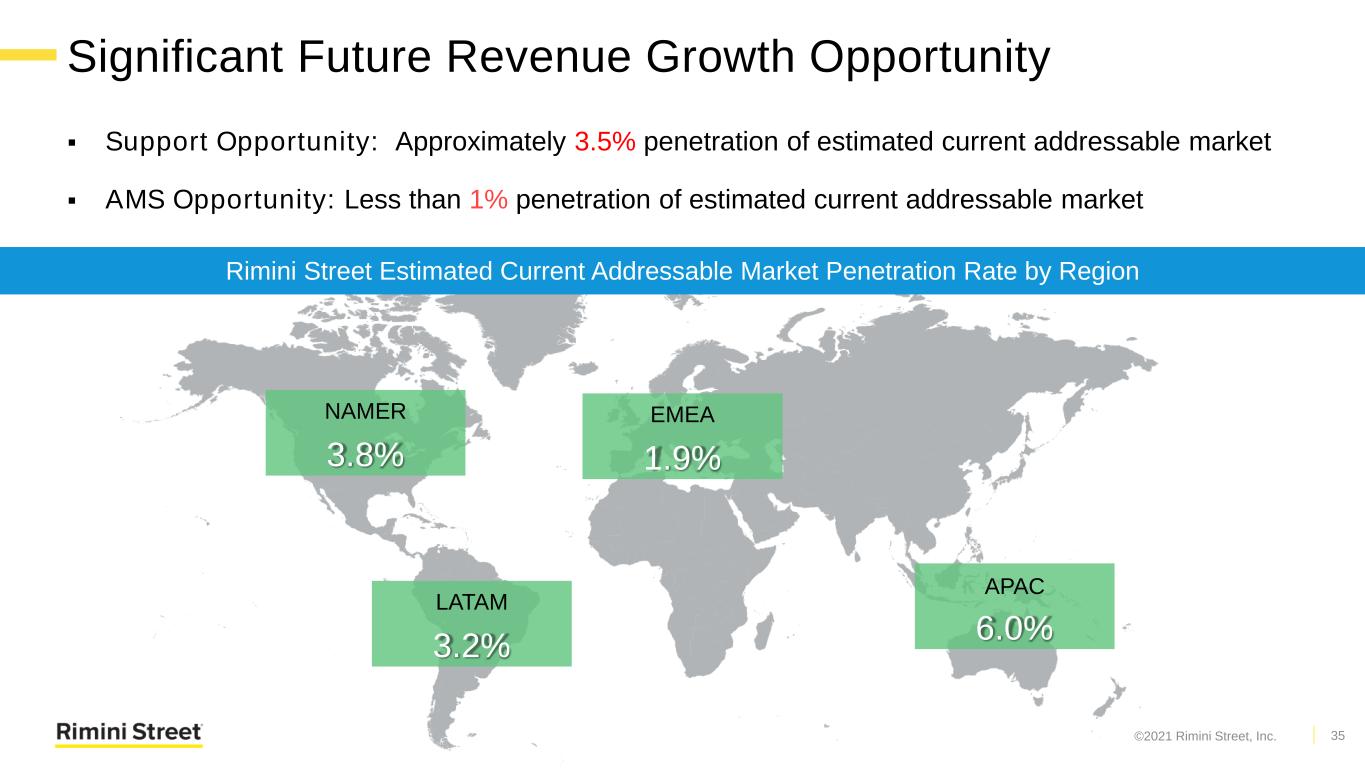

Significant Future Revenue Growth Opportunity ▪ Support Opportunity: Approximately 3.5% penetration of estimated current addressable market ▪ AMS Opportunity: Less than 1% penetration of estimated current addressable market 35 Rimini Street Estimated Current Addressable Market Penetration Rate by Region 6.0% APAC 1.9% EMEA 3.2% LATAM 3.8% NAMER ©2021 Rimini Street, Inc.

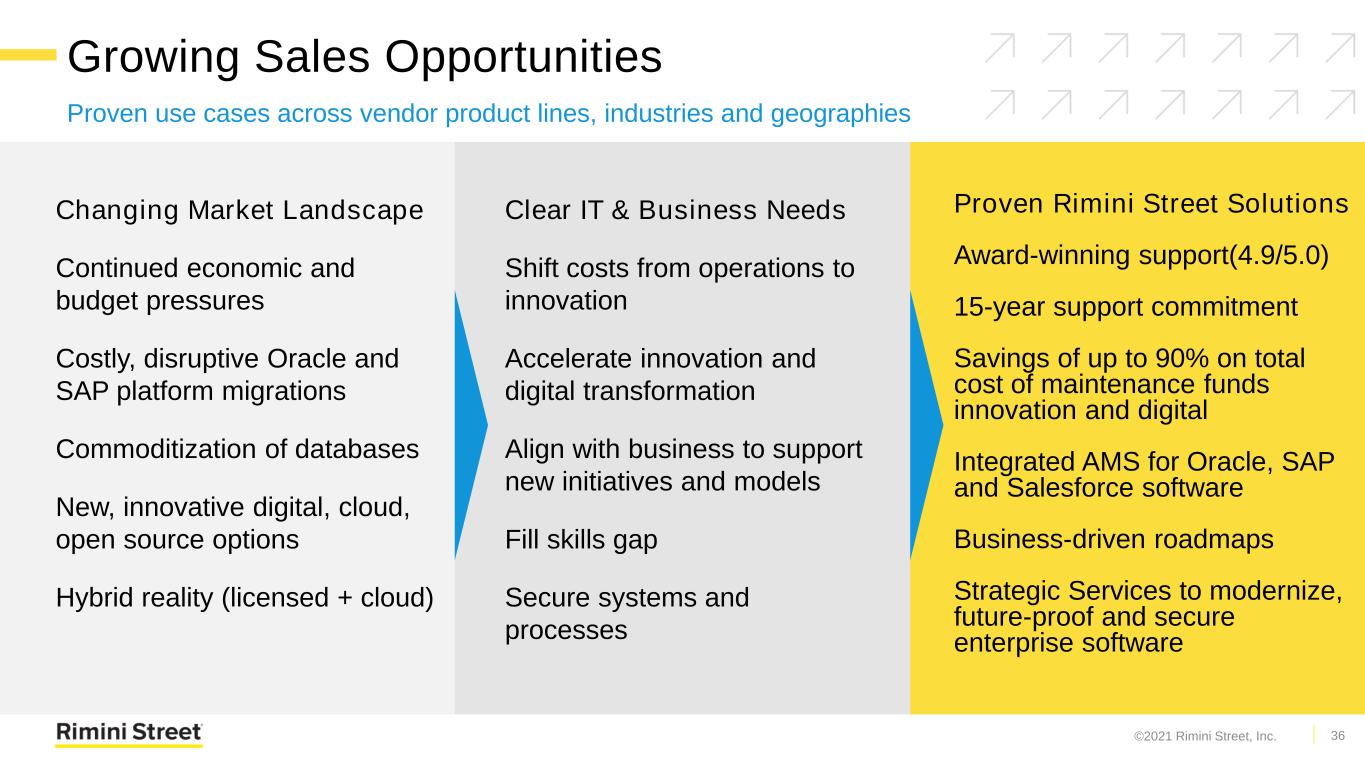

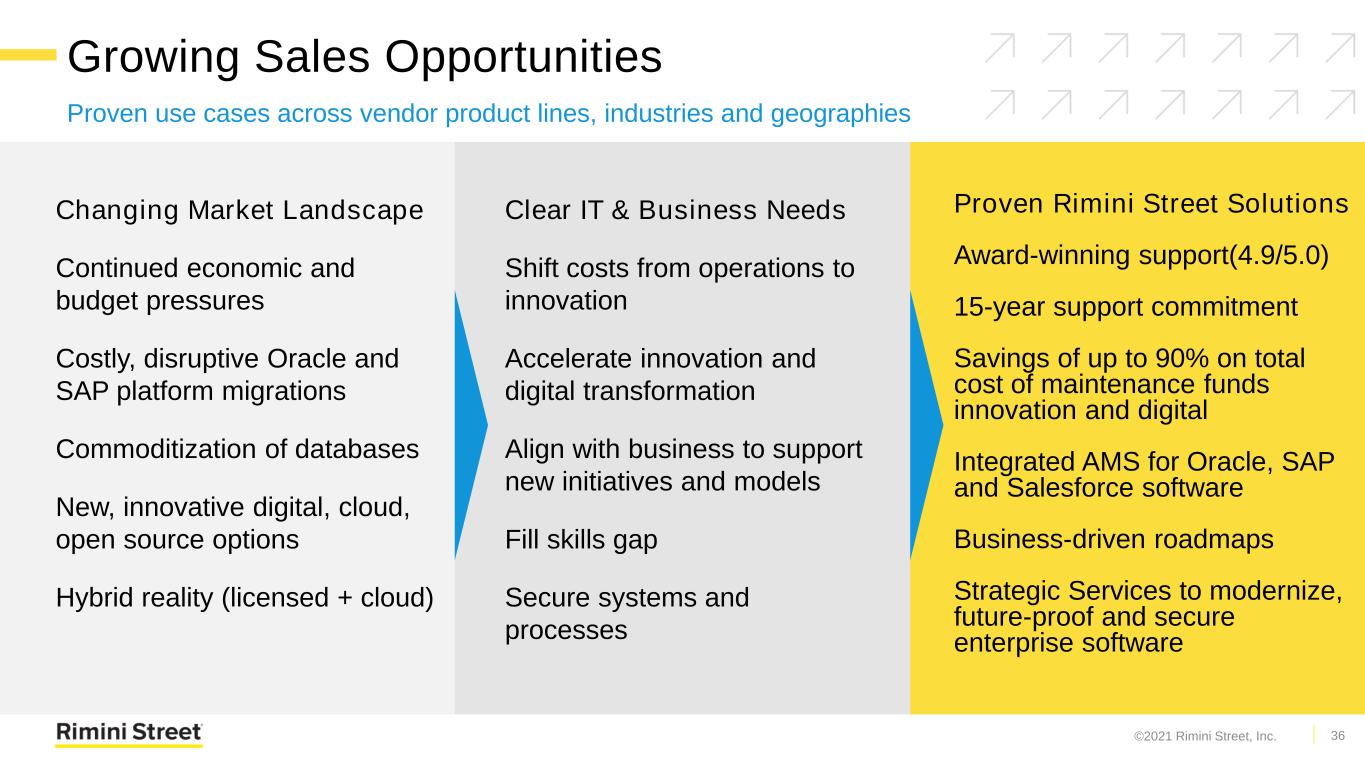

Changing Market Landscape Continued economic and budget pressures Costly, disruptive Oracle and SAP platform migrations Commoditization of databases New, innovative digital, cloud, open source options Hybrid reality (licensed + cloud) Clear IT & Business Needs Shift costs from operations to innovation Accelerate innovation and digital transformation Align with business to support new initiatives and models Fill skills gap Secure systems and processes Proven Rimini Street Solutions Award-winning support(4.9/5.0) 15-year support commitment Savings of up to 90% on total cost of maintenance funds innovation and digital Integrated AMS for Oracle, SAP and Salesforce software Business-driven roadmaps Strategic Services to modernize, future-proof and secure enterprise software Growing Sales Opportunities Proven use cases across vendor product lines, industries and geographies 36©2021 Rimini Street, Inc.

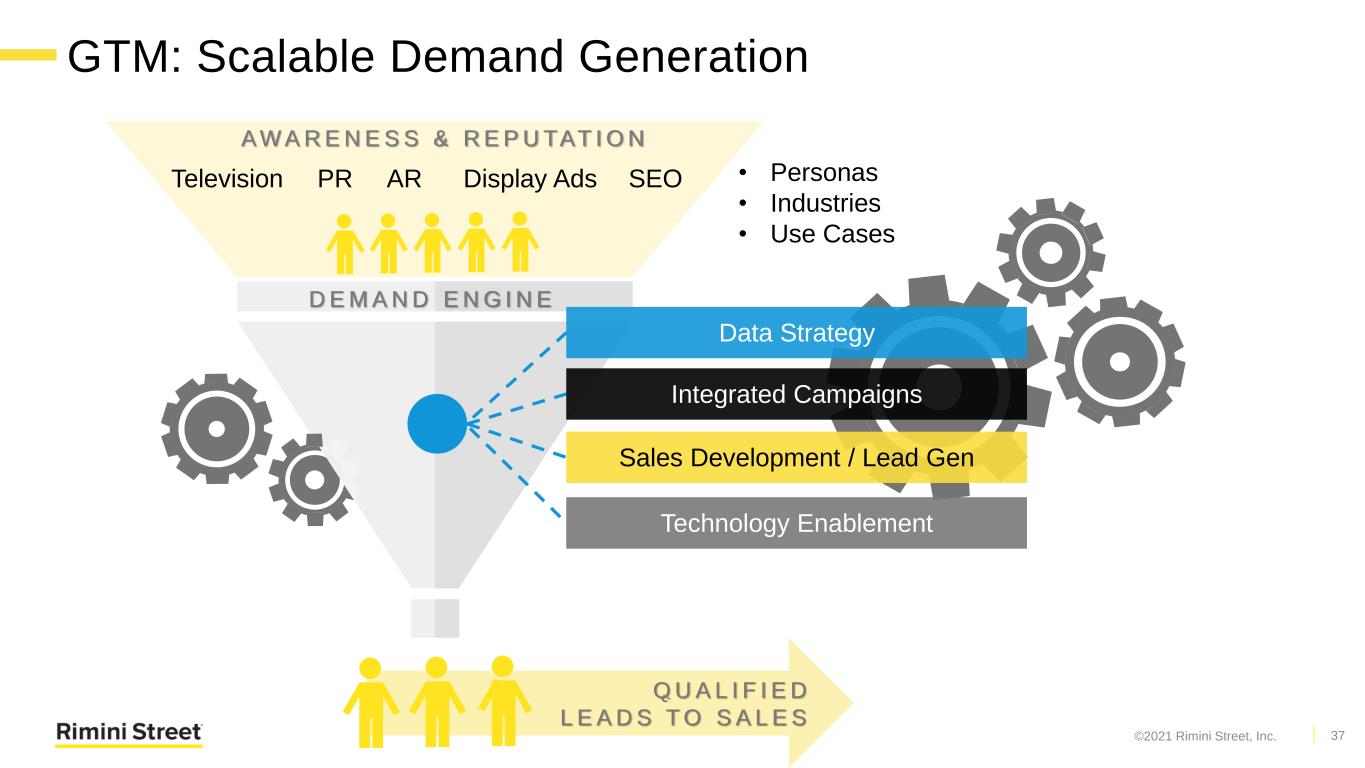

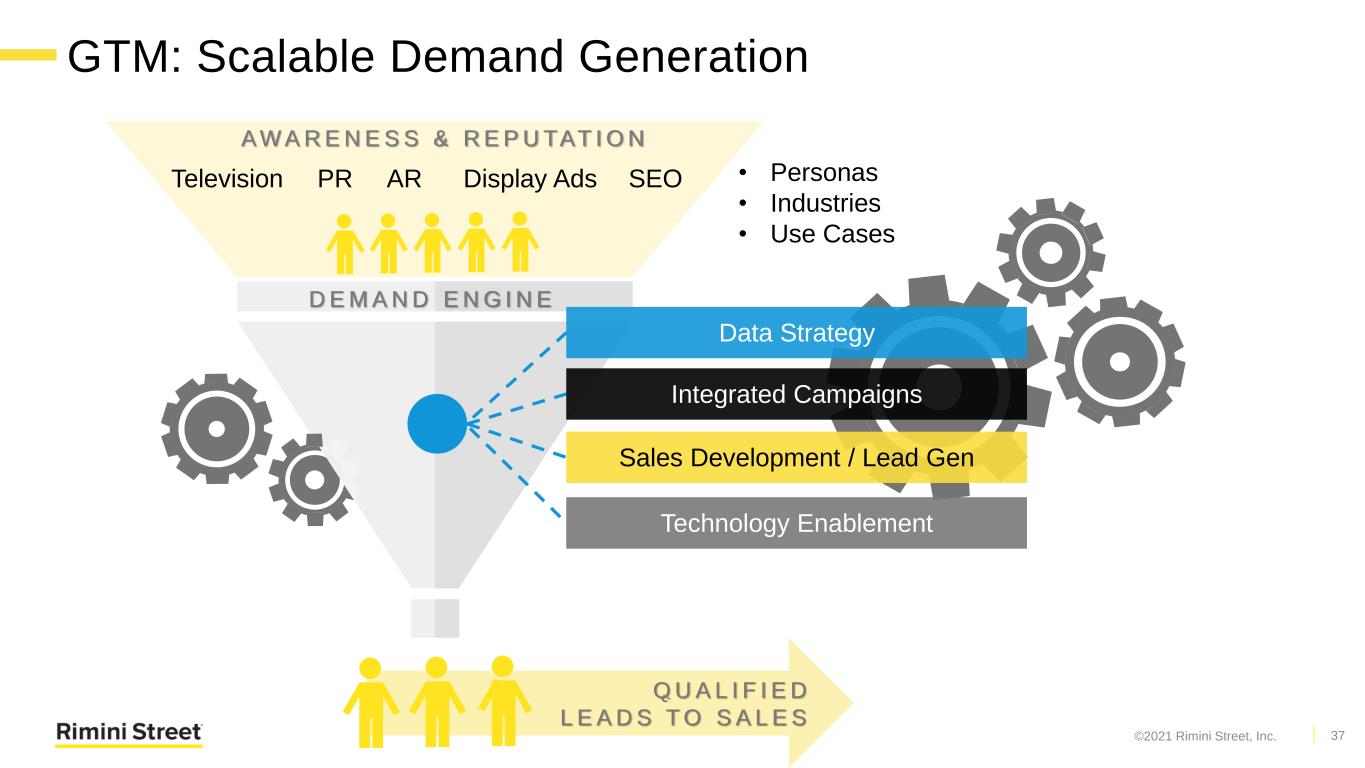

Q U A L I F I E D L E A D S T O S A L E S GTM: Scalable Demand Generation 37 D E M A N D E N G I N E Television PR AR Display Ads SEO A W A R E N E S S & R E P U TAT I O N • Personas • Industries • Use Cases Data Strategy Integrated Campaigns Sales Development / Lead Gen Technology Enablement ©2021 Rimini Street, Inc.

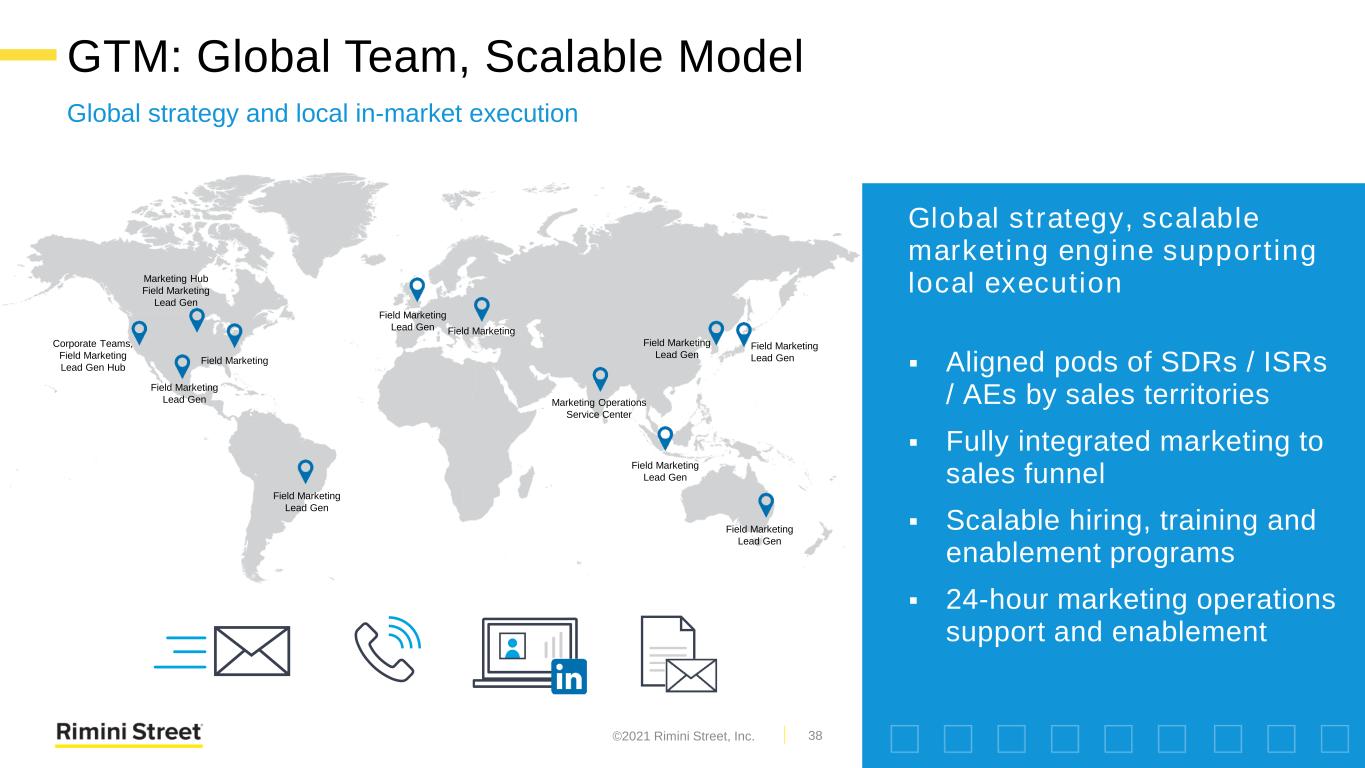

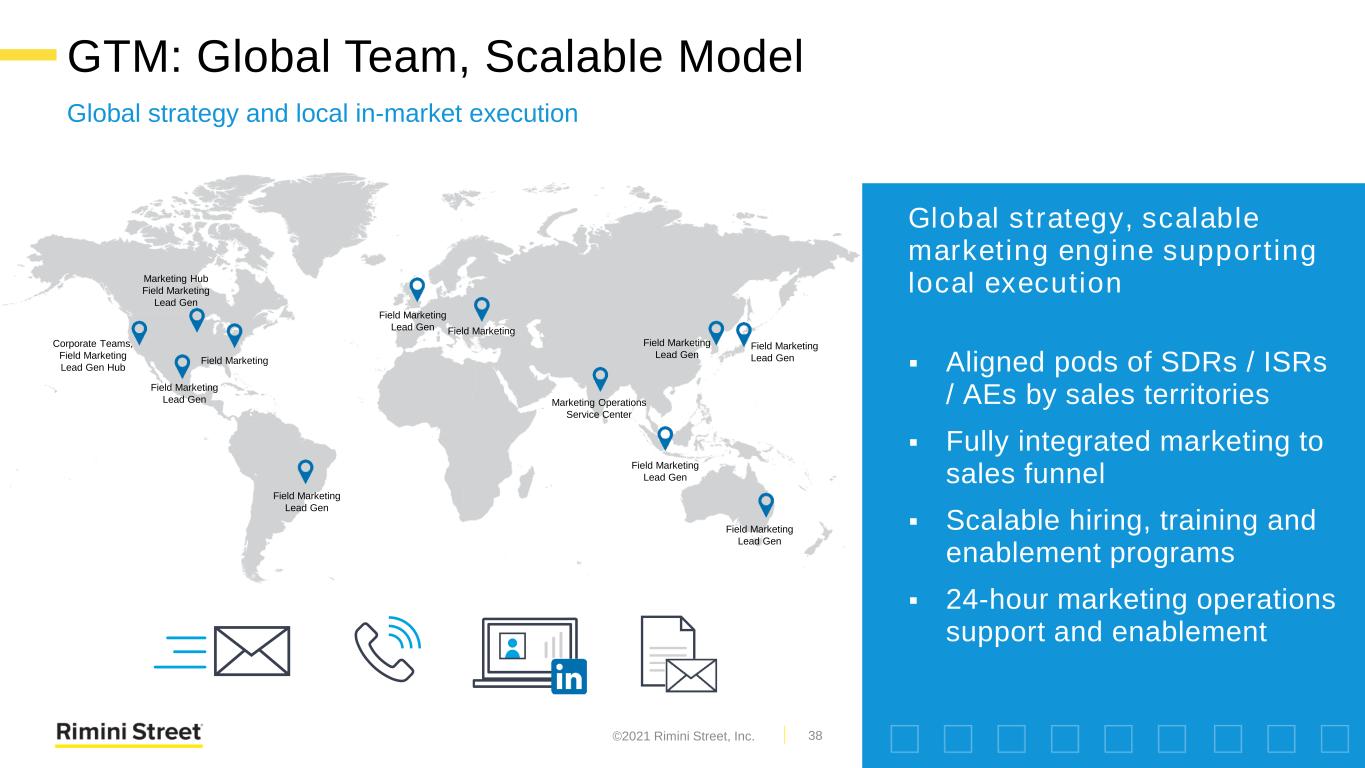

GTM: Global Team, Scalable Model Global strategy, scalable marketing engine supporting local execution ▪ Aligned pods of SDRs / ISRs / AEs by sales territories ▪ Fully integrated marketing to sales funnel ▪ Scalable hiring, training and enablement programs ▪ 24-hour marketing operations support and enablement 38 Corporate Teams, Field Marketing Lead Gen Hub Marketing Hub Field Marketing Lead Gen Field Marketing Lead Gen Field Marketing Lead Gen Field Marketing Lead Gen Field Marketing Lead Gen Field Marketing Lead Gen Field Marketing Lead Gen Field Marketing Marketing Operations Service Center Field Marketing Lead GenField Marketing Global strategy and local in-market execution ©2021 Rimini Street, Inc.

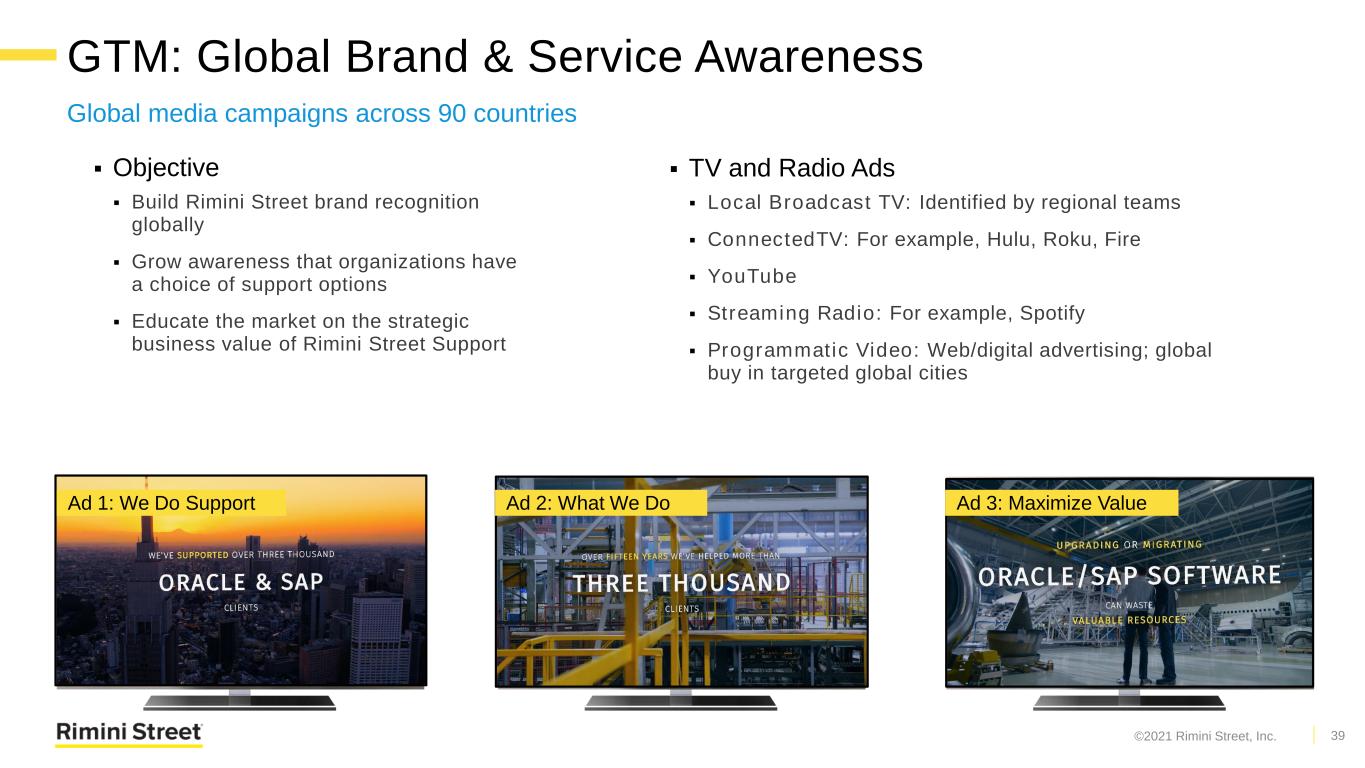

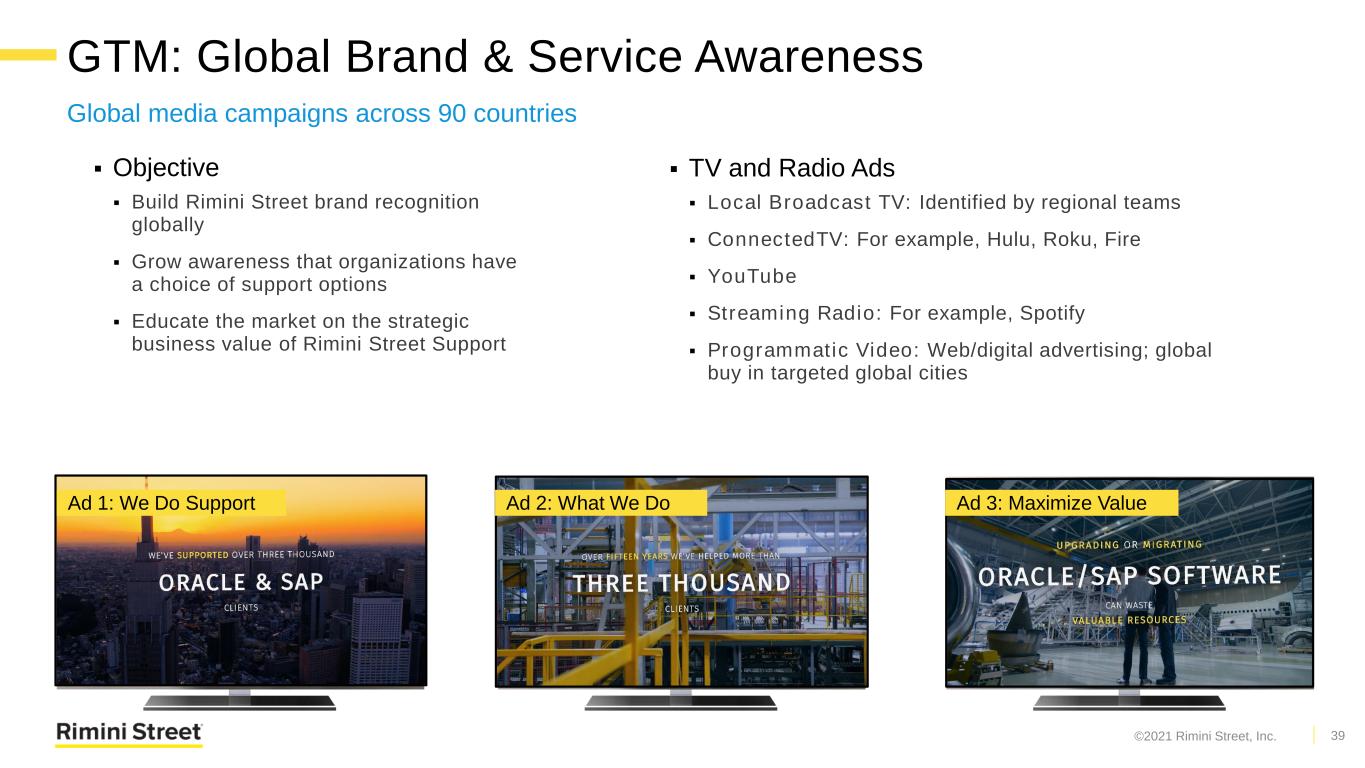

GTM: Global Brand & Service Awareness Global media campaigns across 90 countries 39 ▪ TV and Radio Ads ▪ Local Broadcast TV: Identified by regional teams ▪ ConnectedTV: For example, Hulu, Roku, Fire ▪ YouTube ▪ Streaming Radio: For example, Spotify ▪ Programmatic Video: Web/digital advertising; global buy in targeted global cities Ad 1: We Do Support Ad 2: What We Do Ad 3: Maximize Value ▪ Objective ▪ Build Rimini Street brand recognition globally ▪ Grow awareness that organizations have a choice of support options ▪ Educate the market on the strategic business value of Rimini Street Support ©2021 Rimini Street, Inc.

▪ Rimini Street leverages a modern, scalable website to effectively represent our brand and enables our prospects to complete up to 50% of their buyer journey digitally before interacting with Rimini Street sales team. ▪ Objectives ▪ Enable buyer journeys for multiple personas and various use cases ▪ Enable local language and culture experiences that engage prospects ▪ Deliver more leads and “make the phone ring” ▪ Deliver more qualified leads for Sales handover ▪ Lead and participate in wide-reaching virtual marketing events targeting CFO’s, CIO’s, IT Executives and Procurement GTM: Innovative Digital Platform & Virtual Events ©2021 Rimini Street, Inc. 40

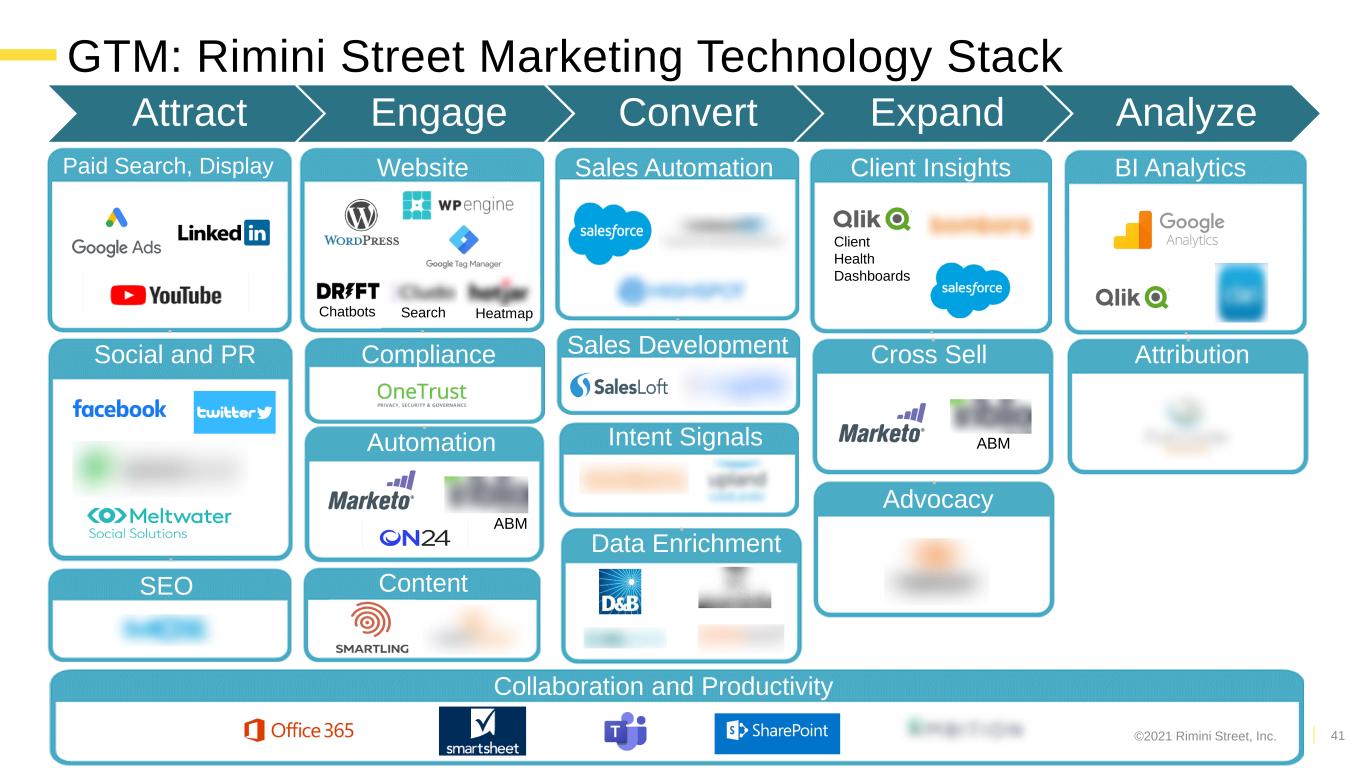

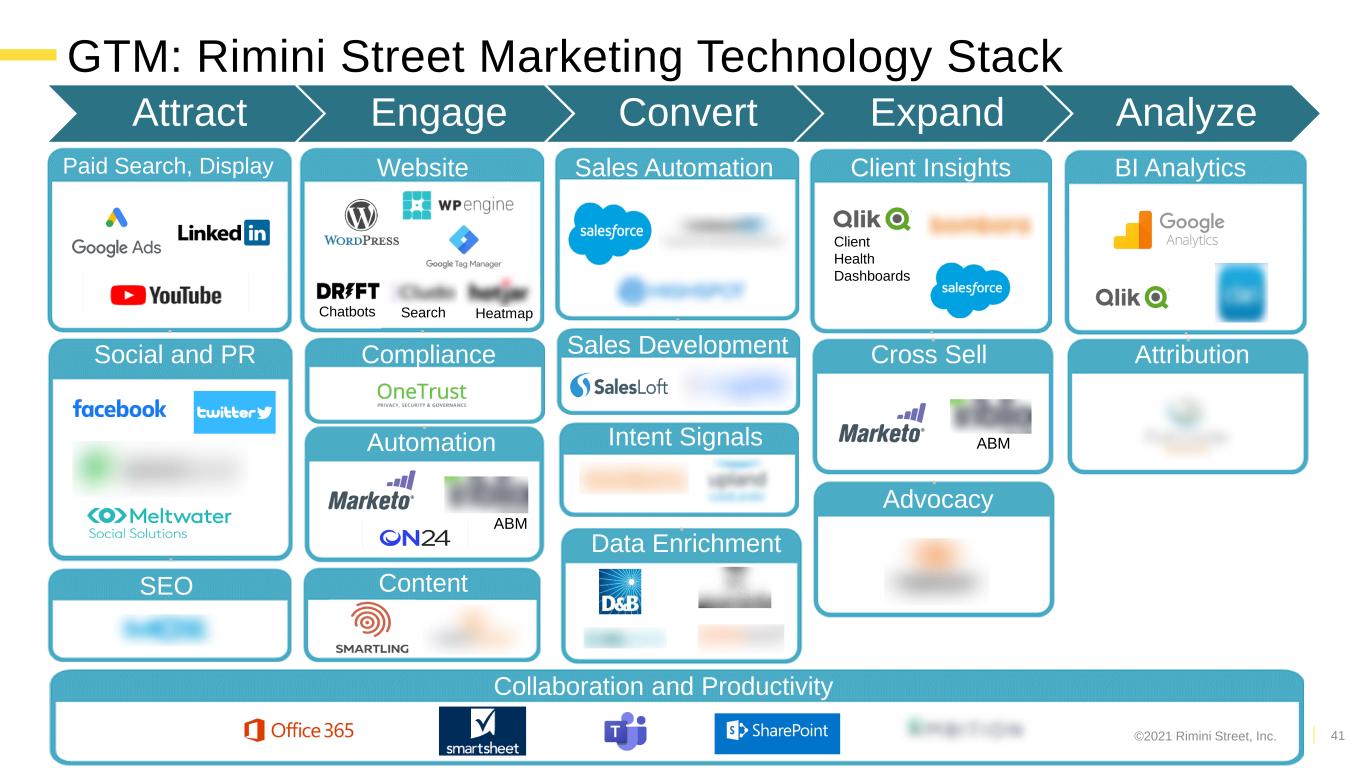

GTM: Rimini Street Marketing Technology Stack Attract Engage Convert Expand Analyze Paid Search, Display Social and PR SEO Website Search HeatmapChatbots Compliance Automation Content Sales Automation Sales Development Intent Signals Data Enrichment Client Health Dashboards Client Insights ABM Cross Sell Advocacy ABM BI Analytics Attribution Collaboration and Productivity ©2021 Rimini Street, Inc. 41

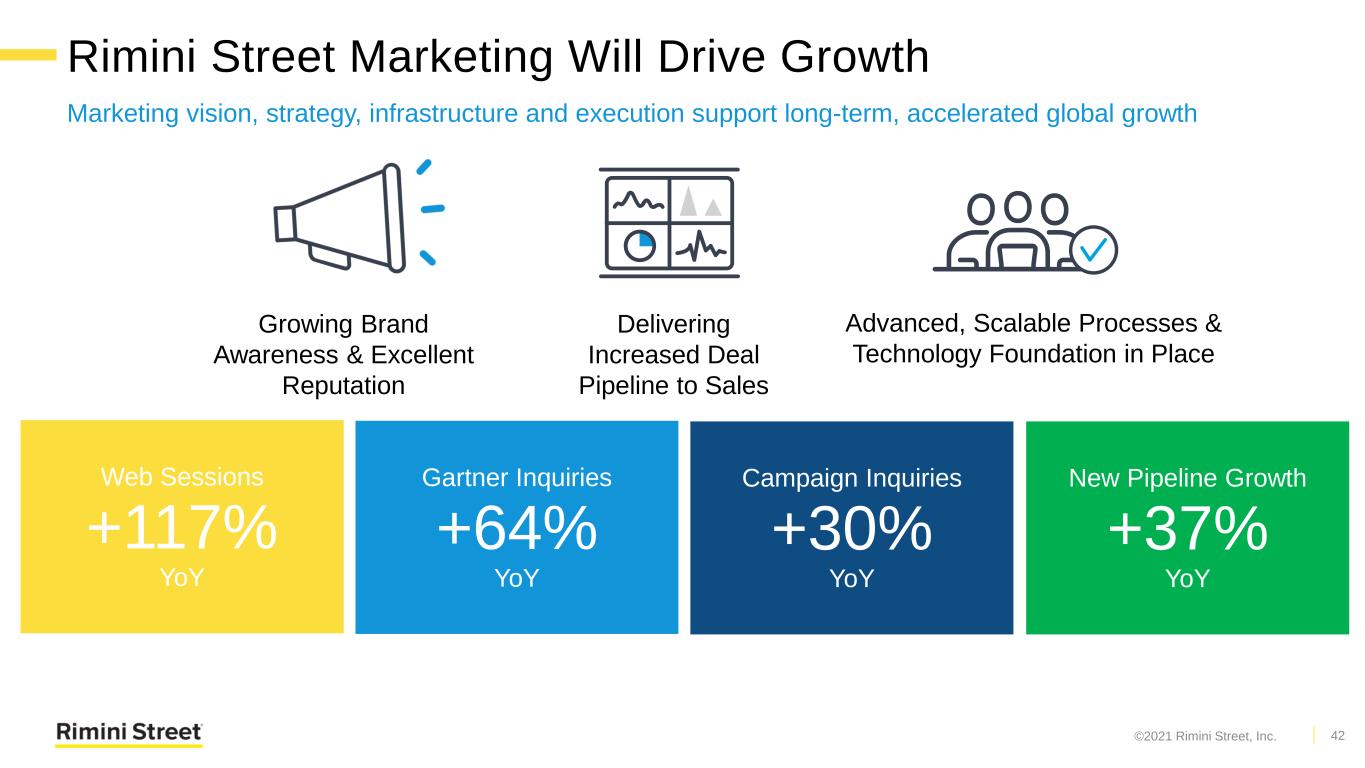

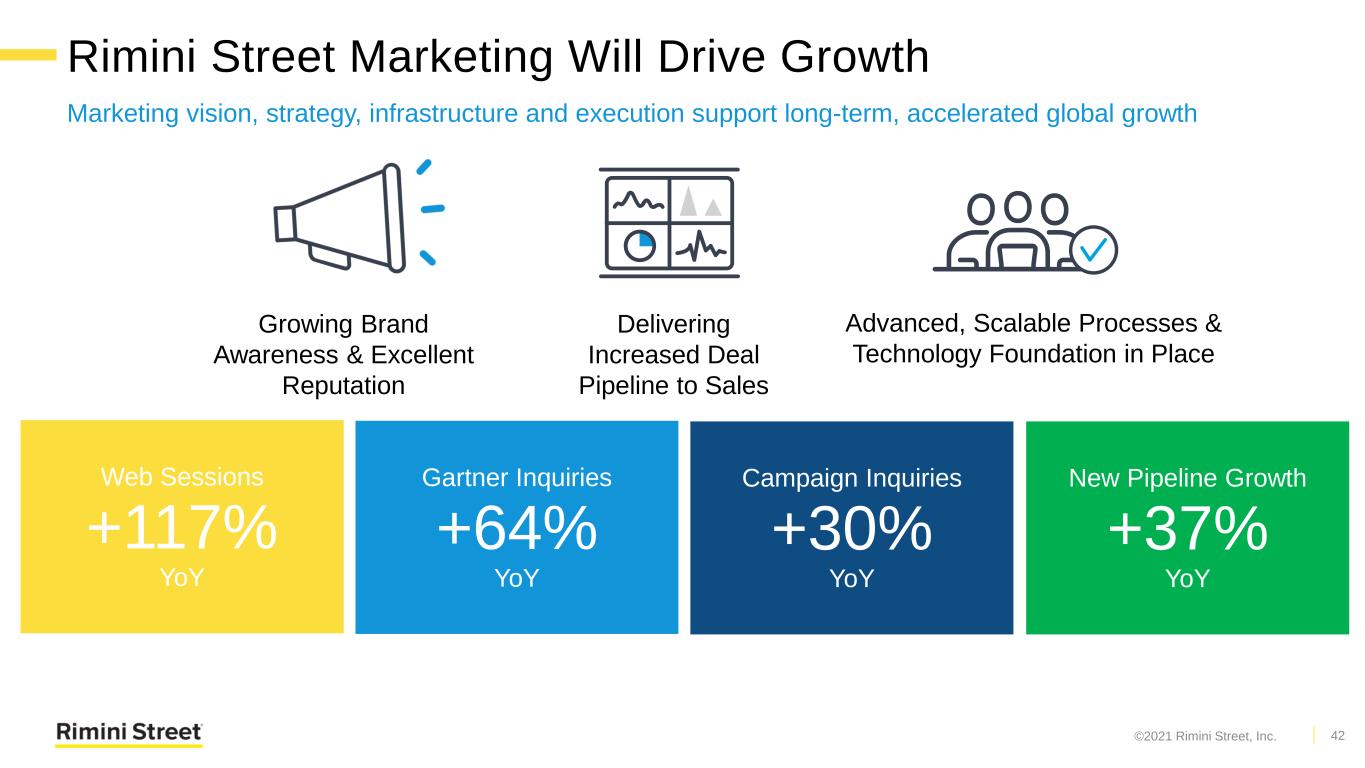

Rimini Street Marketing Will Drive Growth Marketing vision, strategy, infrastructure and execution support long-term, accelerated global growth 42 Growing Brand Awareness & Excellent Reputation Delivering Increased Deal Pipeline to Sales Advanced, Scalable Processes & Technology Foundation in Place Web Sessions +117% YoY Gartner Inquiries +64% YoY Campaign Inquiries +30% YoY New Pipeline Growth +37% YoY ©2021 Rimini Street, Inc.

Gerard Brossard Chief Operating Officer Sales Strategy and Plan for New Clients and Cross-sell

Road to $1 Billion in Annual Revenue By 2026 2021 execution strategy and plan to convert more opportunities and pipeline to revenue ▪ Implement consistent regional structure led by GM’s ▪ Re-accelerate North American growth ▪ Sell expanded portfolio of solutions ▪ Increase client retention and cross-sell ▪ Hire to quota capacity plan and increase productivity 45©2021 Rimini Street, Inc.

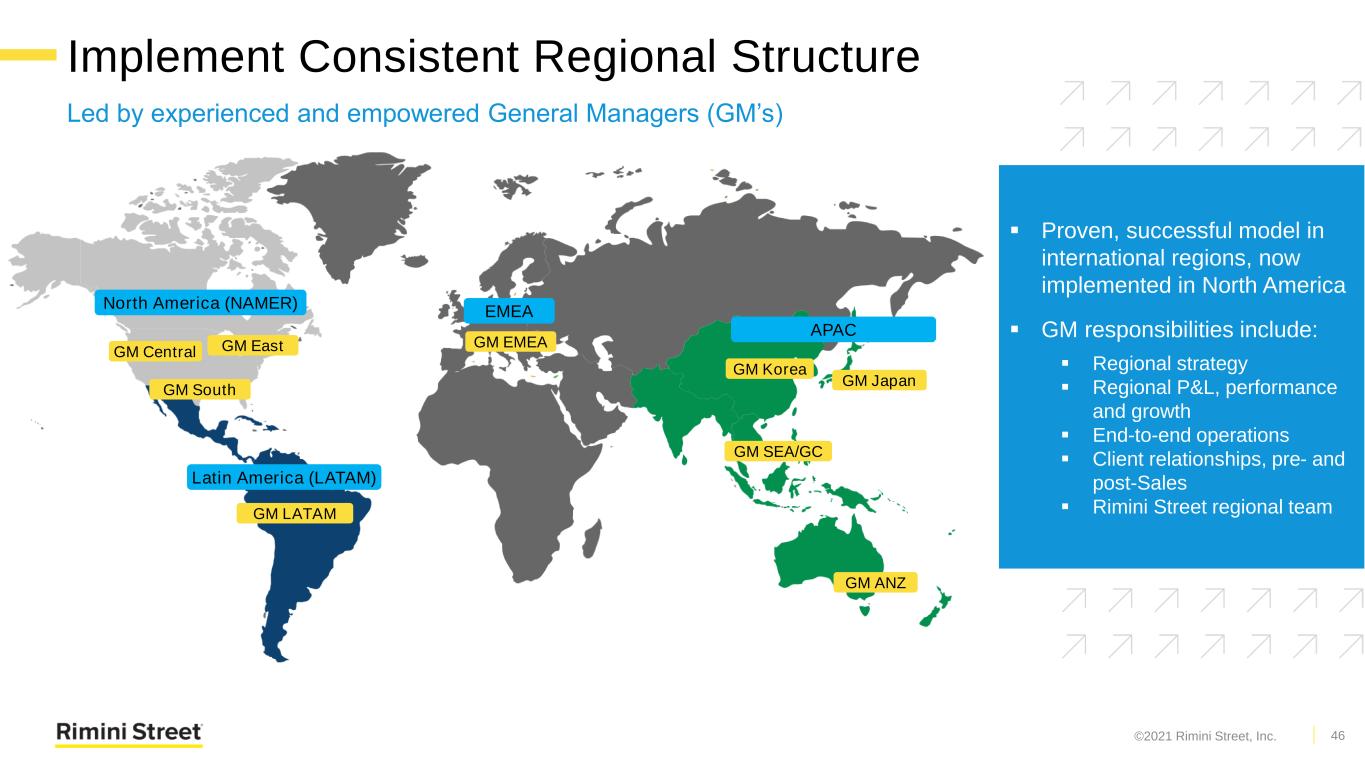

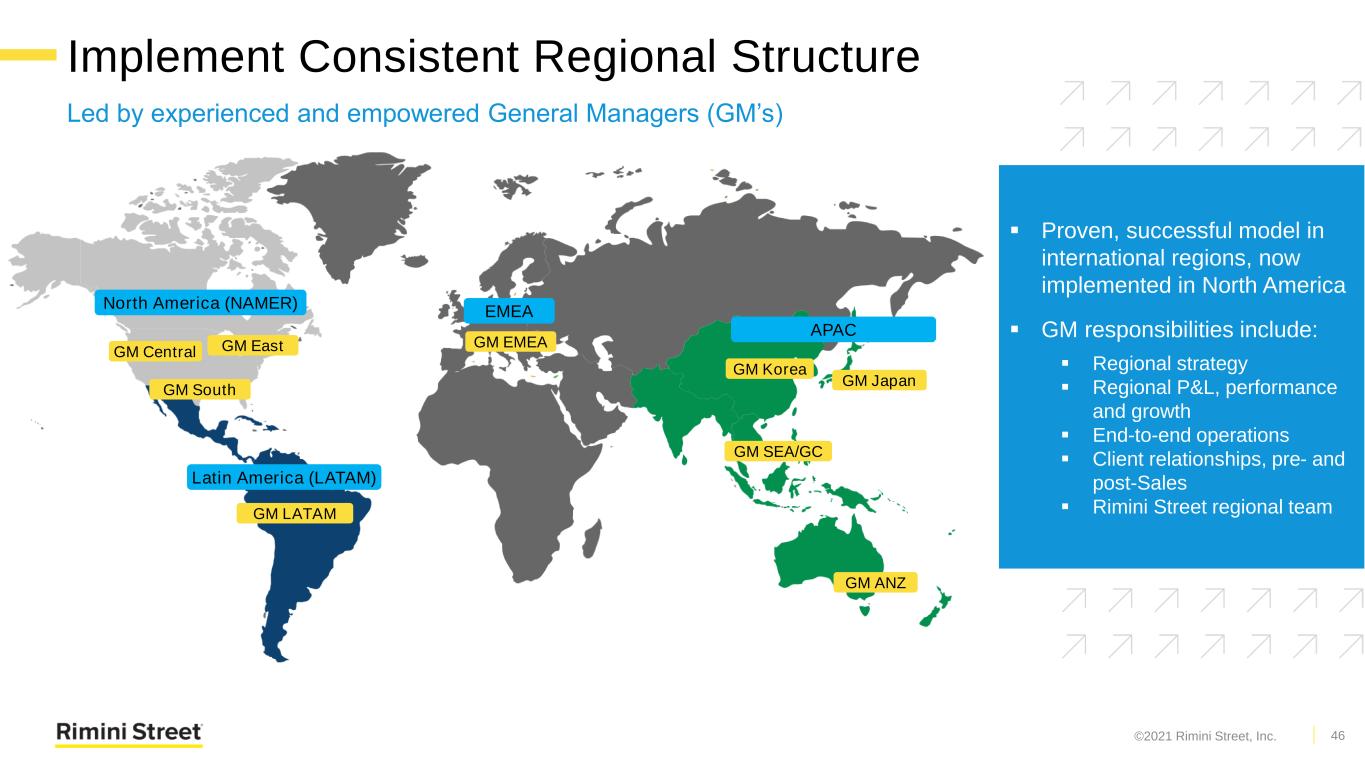

▪ Proven, successful model in international regions, now implemented in North America ▪ GM responsibilities include: ▪ Regional strategy ▪ Regional P&L, performance and growth ▪ End-to-end operations ▪ Client relationships, pre- and post-Sales ▪ Rimini Street regional team GM EMEA GM Central GM ANZ GM LATAM GM SEA/GC GM Japan North America (NAMER) GM Korea Implement Consistent Regional Structure GM East GM South EMEA Latin America (LATAM) APAC Led by experienced and empowered General Managers (GM’s) 46©2021 Rimini Street, Inc.

Re-Accelerate Growth In North America GM’s bring added executive leadership, focus and strategic execution to largest revenue territory ▪ Implement proven GM model in NAMER, with 3 Regions o East – includes Eastern Canada o Central & Northwest – includes Western Canada o South & Southwest ▪ Experienced GMs hired and in place for 2021 o Strengthening sales and client engagement leadership (VP, Director) where needed o Ensuring consistent cadence, process and discipline across sales cycle and client engagement o Driving the hiring of seller (SAE) headcount, including overlay sellers ▪ Mature big deal strategy and execution model o Proactive big deal strategy, disciplined sales cycle o Close more large deals with improved win rate, increase average deal size 47©2021 Rimini Street, Inc.

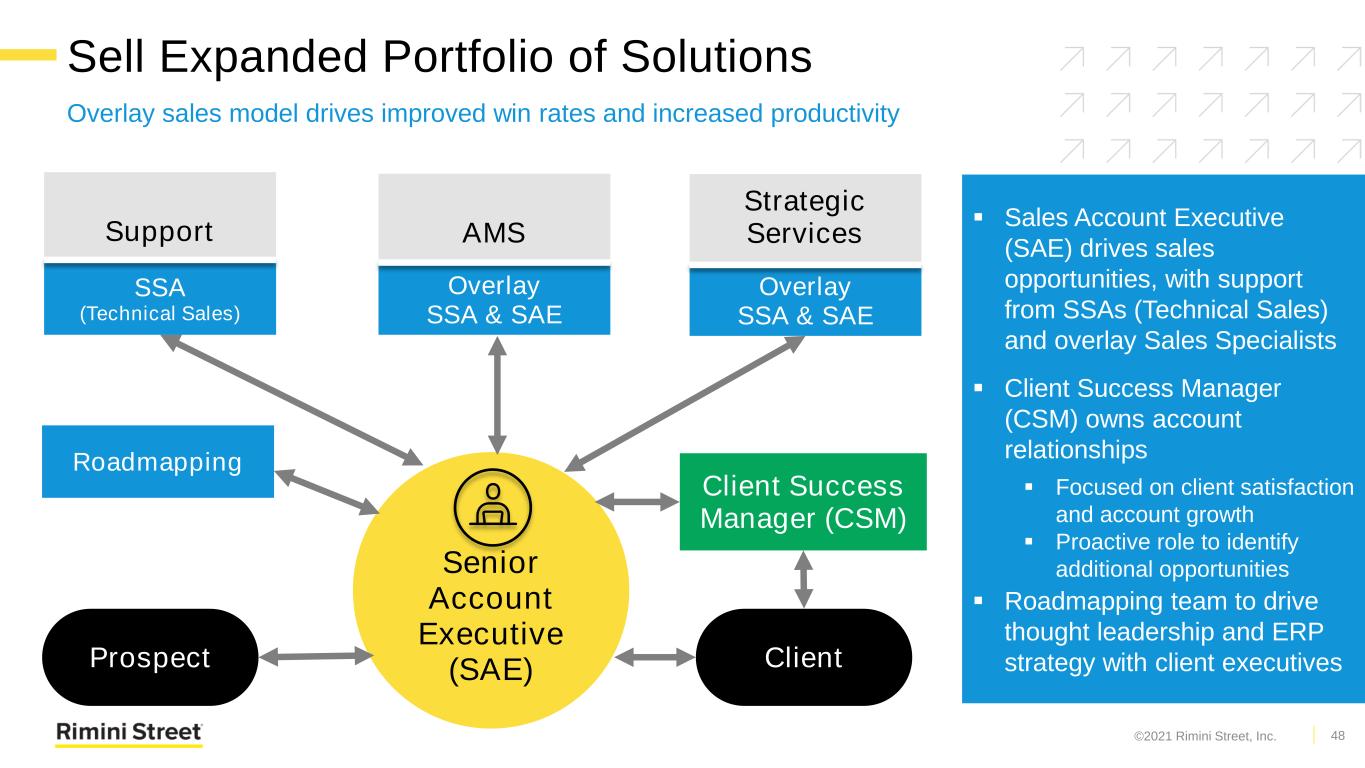

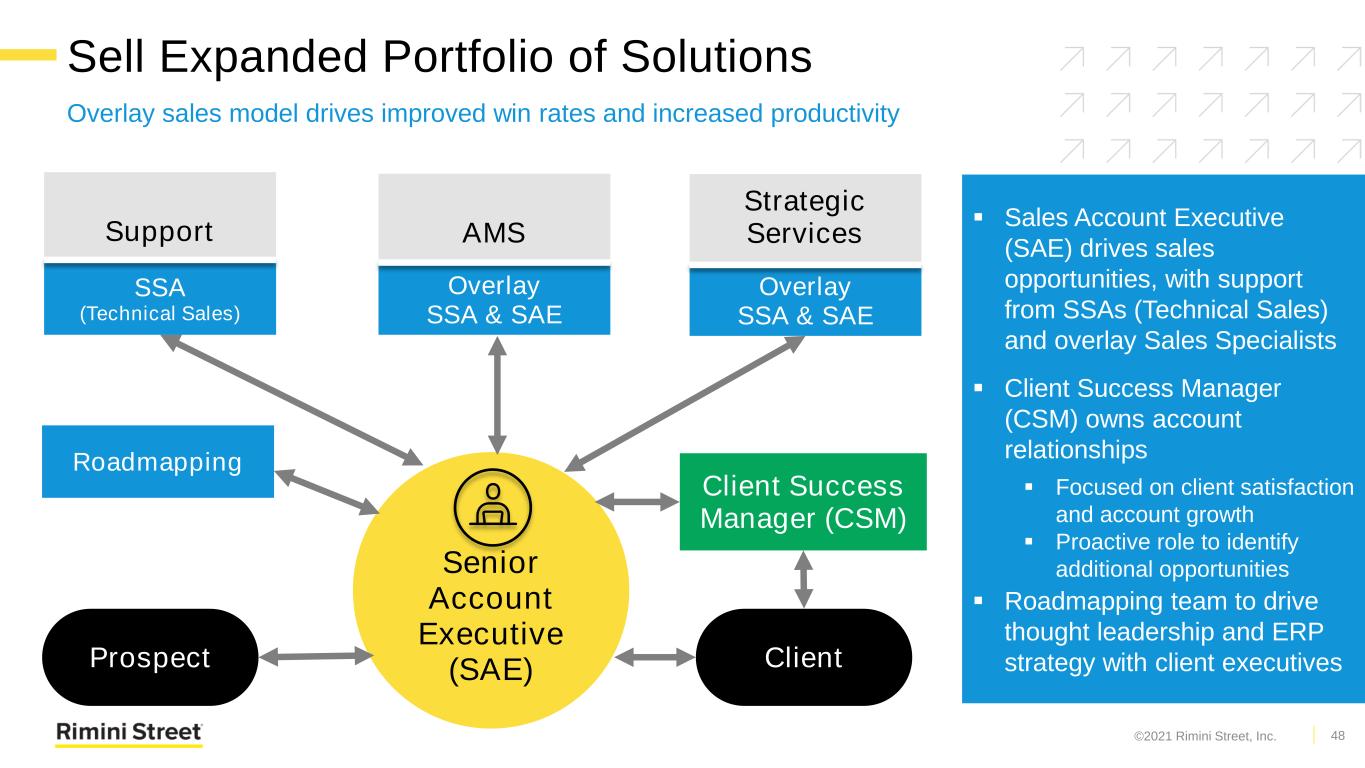

Sell Expanded Portfolio of Solutions Overlay sales model drives improved win rates and increased productivity Senior Account Executive (SAE) Prospect Support Client AMS Strategic Services Overlay SSA & SAE Client Success Manager (CSM) SSA (Technical Sales) Roadmapping 48 ▪ Sales Account Executive (SAE) drives sales opportunities, with support from SSAs (Technical Sales) and overlay Sales Specialists ▪ Client Success Manager (CSM) owns account relationships ▪ Focused on client satisfaction and account growth ▪ Proactive role to identify additional opportunities ▪ Roadmapping team to drive thought leadership and ERP strategy with client executives Overlay SSA & SAE ©2021 Rimini Street, Inc.

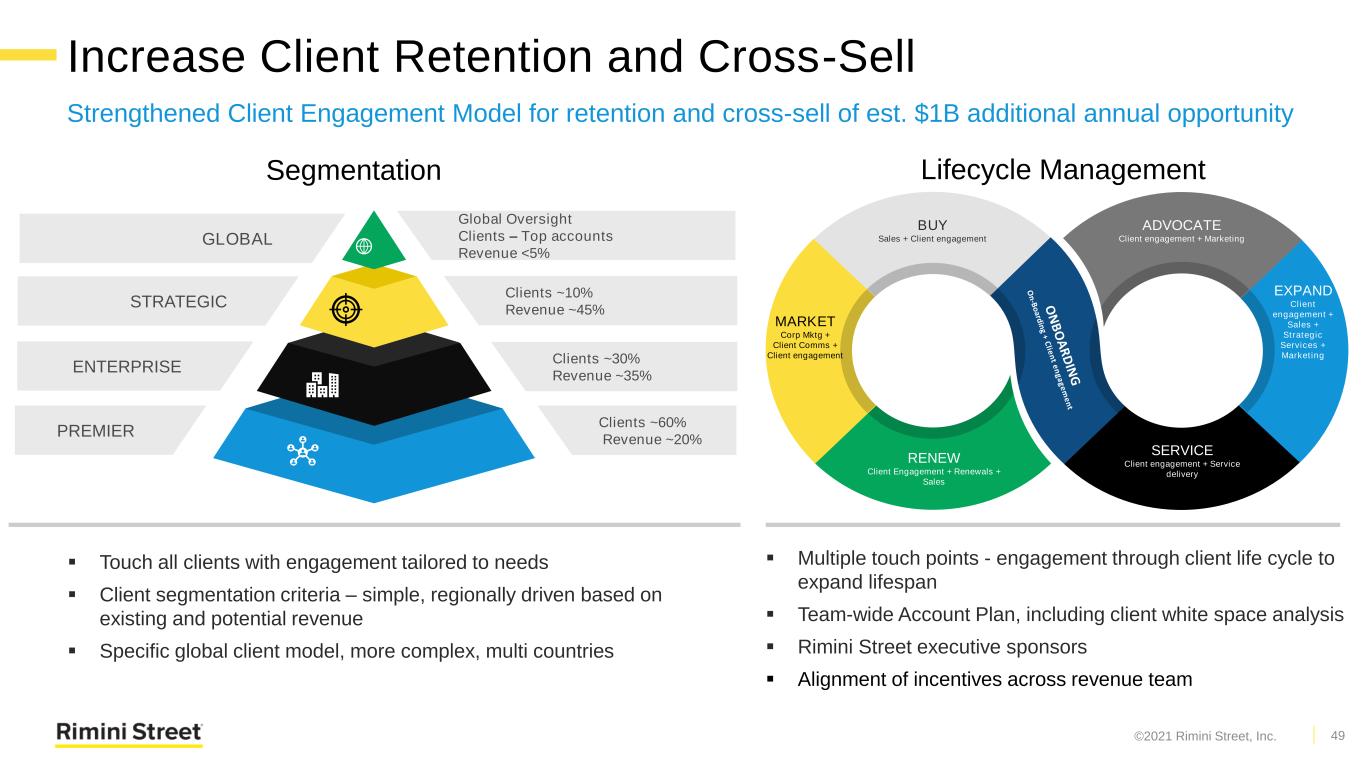

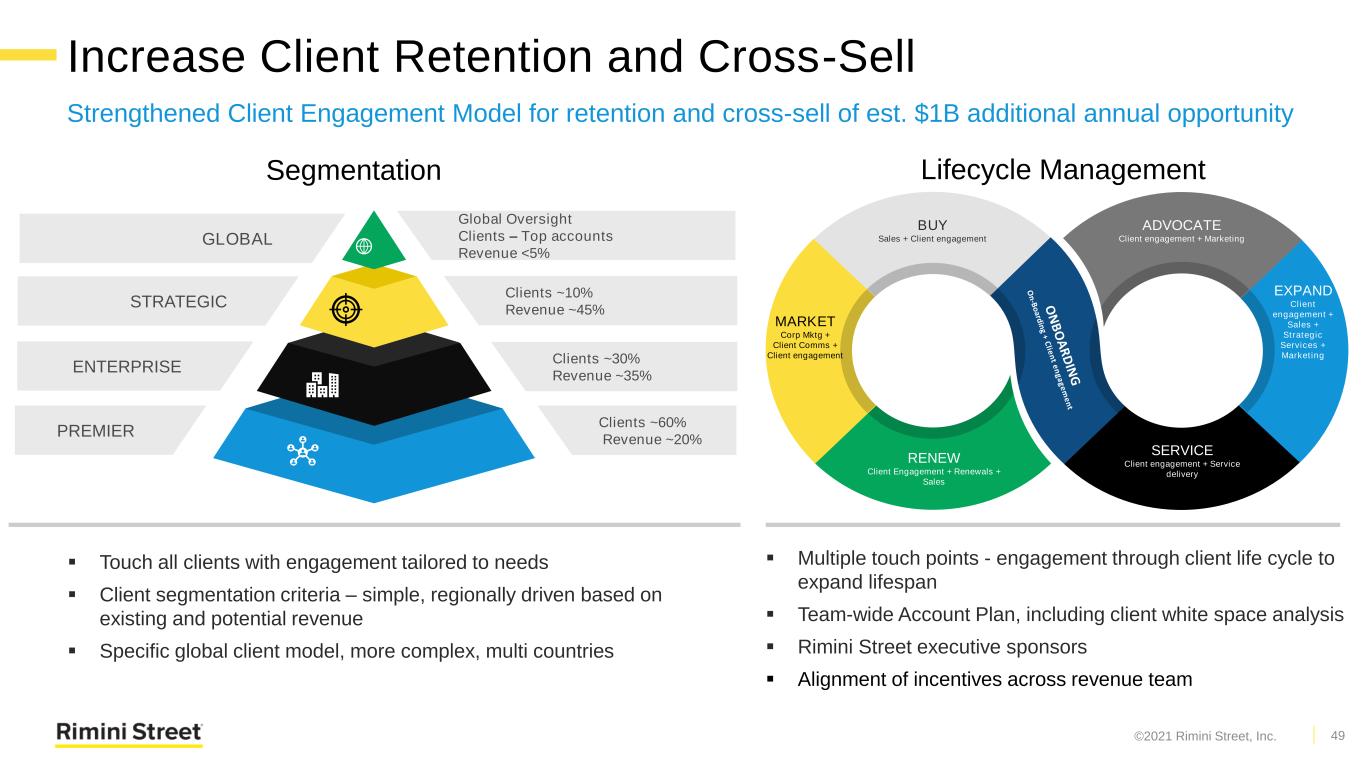

Increase Client Retention and Cross-Sell Strengthened Client Engagement Model for retention and cross-sell of est. $1B additional annual opportunity GLOBAL Global Oversight Clients – Top accounts Revenue <5% STRATEGIC Clients ~10% Revenue ~45% ENTERPRISE Clients ~30% Revenue ~35% PREMIER Clients ~60% Revenue ~20% BUY Sales + Client engagement RENEW Client Engagement + Renewals + Sales ADVOCATE Client engagement + Marketing SERVICE Client engagement + Service delivery EXPAND Client engagement + Sales + Strategic Services + Marketing MARKET Corp Mktg + Client Comms + Client engagement Segmentation Lifecycle Management ▪ Touch all clients with engagement tailored to needs ▪ Client segmentation criteria – simple, regionally driven based on existing and potential revenue ▪ Specific global client model, more complex, multi countries ▪ Multiple touch points - engagement through client life cycle to expand lifespan ▪ Team-wide Account Plan, including client white space analysis ▪ Rimini Street executive sponsors ▪ Alignment of incentives across revenue team 49©2021 Rimini Street, Inc.

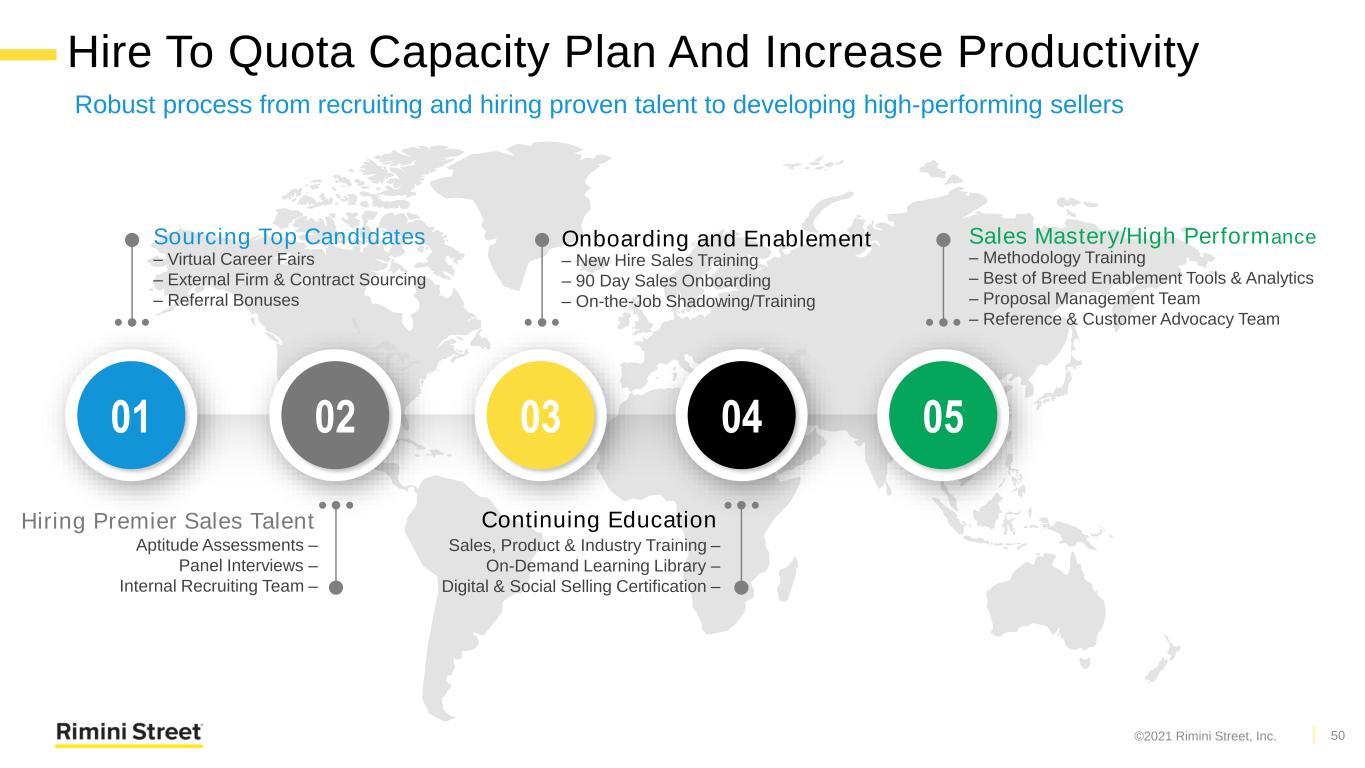

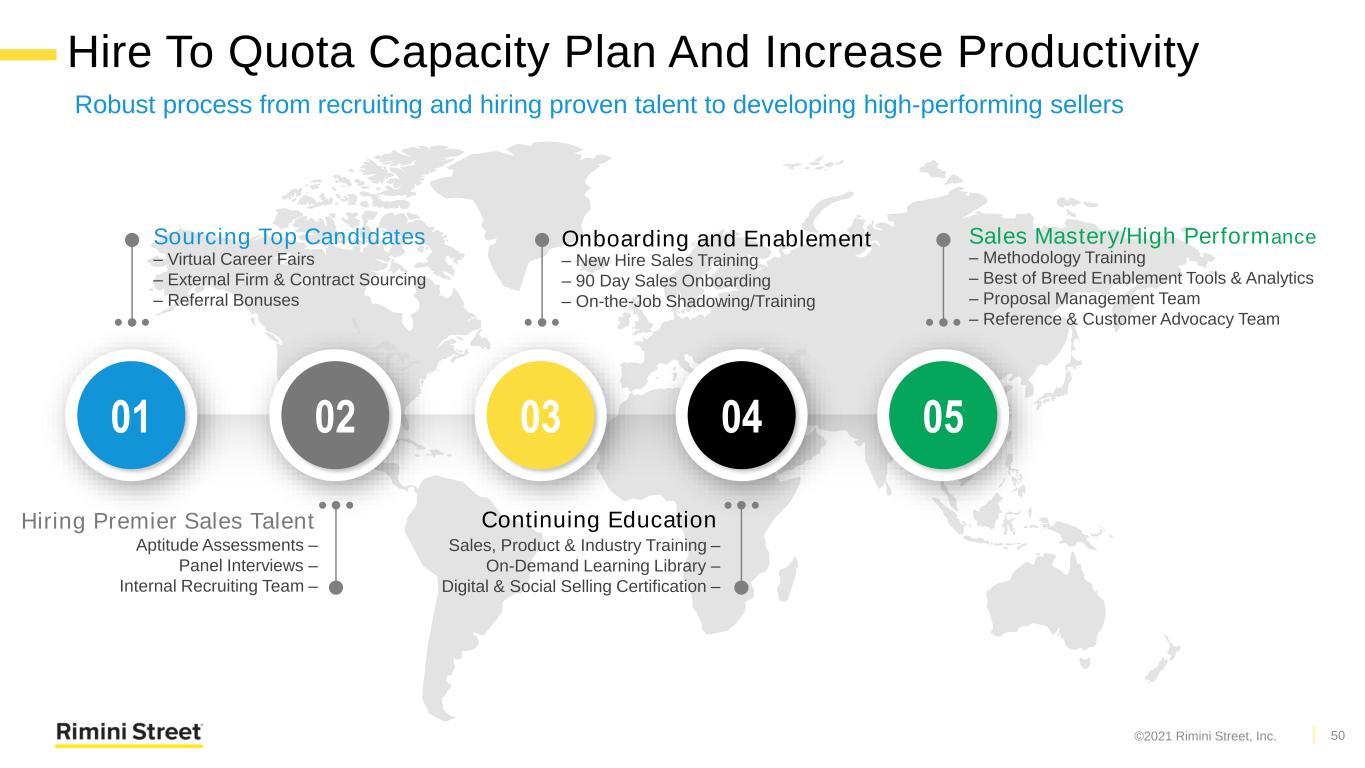

Hire To Quota Capacity Plan And Increase Productivity Robust process from recruiting and hiring proven talent to developing high-performing sellers 01 02 03 0504 – Virtual Career Fairs – External Firm & Contract Sourcing – Referral Bonuses Sourcing Top Candidates – New Hire Sales Training – 90 Day Sales Onboarding – On-the-Job Shadowing/Training Onboarding and Enablement – Methodology Training – Best of Breed Enablement Tools & Analytics – Proposal Management Team – Reference & Customer Advocacy Team Sales Mastery/High Performance Aptitude Assessments – Panel Interviews – Internal Recruiting Team – Hiring Premier Sales Talent Sales, Product & Industry Training – On-Demand Learning Library – Digital & Social Selling Certification – Continuing Education 50©2021 Rimini Street, Inc.

Kevin Maddock EVP, Global Recurring Revenue Sales Renewals and Growing Long-Term Client Value

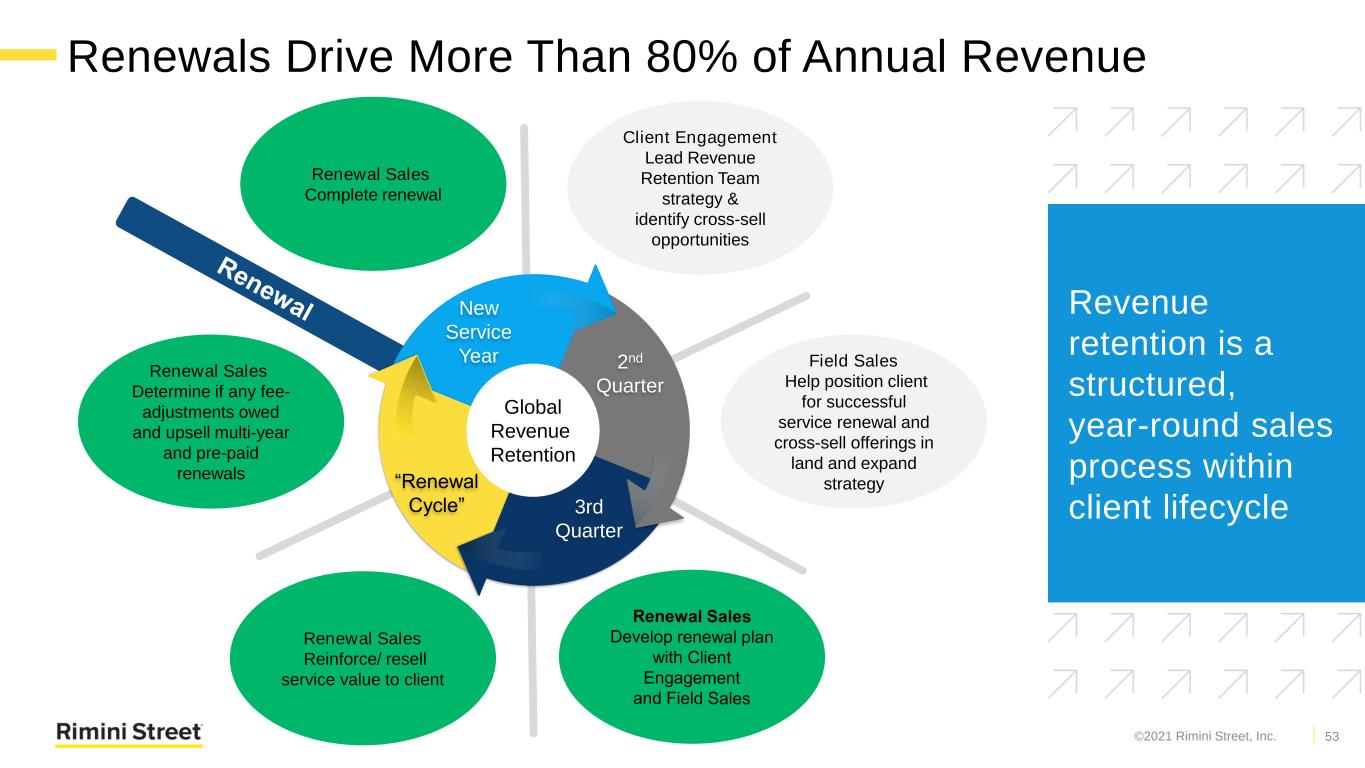

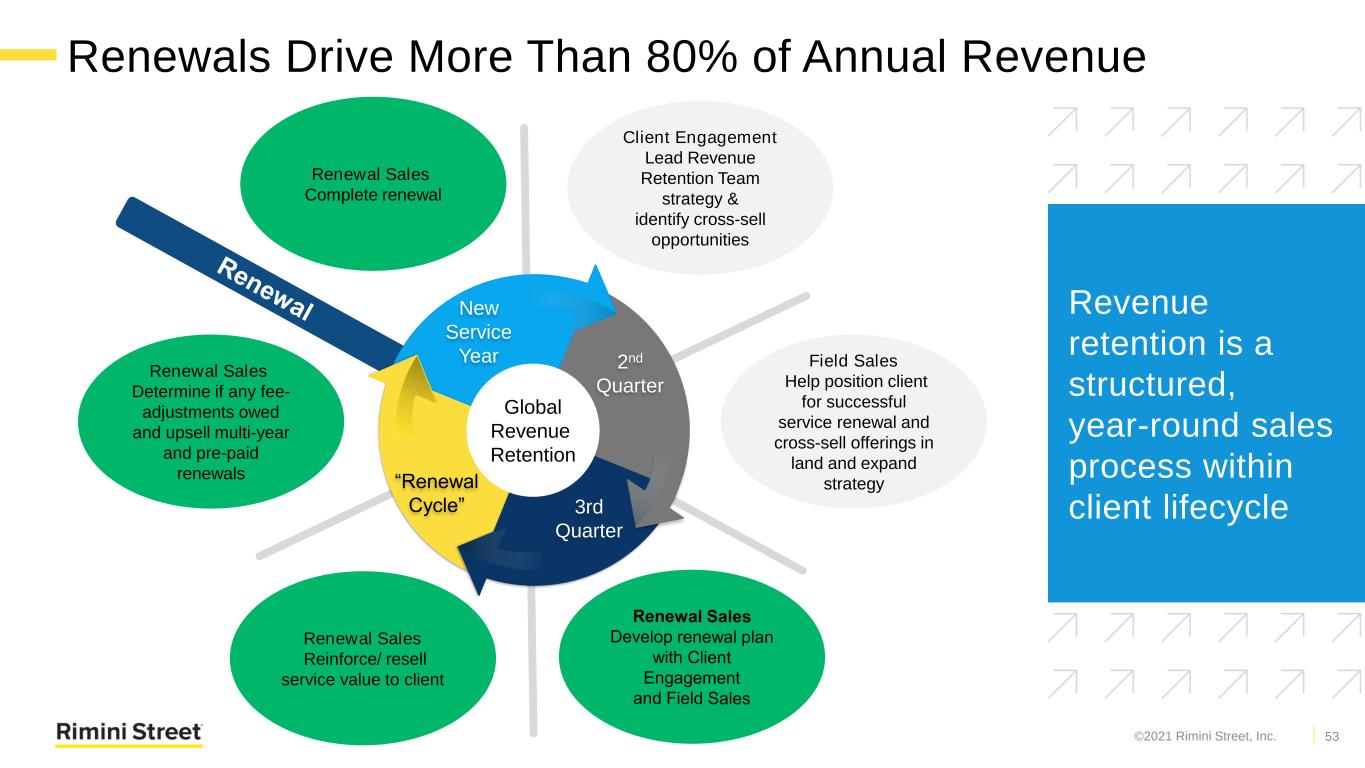

Renewals Drive More Than 80% of Annual Revenue Revenue retention is a structured, year-round sales process within client lifecycle 53 Client Engagement Lead Revenue Retention Team strategy & identify cross-sell opportunities Renewal Sales Reinforce/ resell service value to client Renewal Sales Complete renewal Renewal Sales Determine if any fee- adjustments owed and upsell multi-year and pre-paid renewals Field Sales Help position client for successful service renewal and cross-sell offerings in land and expand strategy New Service Year 2nd Quarter 3rd Quarter “Renewal Cycle” Global Revenue Retention ©2021 Rimini Street, Inc.

Increased Revenue Retention Rate and LTV Multiple factors will drive increased Revenue Retention Rates and grow LTV through 2026 ▪ Clients will run current ERP longer ▪ New vendor ERP products and releases fail to excite most organizations ▪ Vendor ERP migrations & upgrades seen as low-value, costly projects ▪ Global economic and industry challenges ▪ Savings better invested in more strategic initiatives that enhance competitive advantage and support growth ▪ Clients will expand Rimini Street Service footprint ▪ Longer-term use of current ERP creates opportunities for expanded service footprint ▪ Expanded service footprint creates more unique value-proposition, harder to displace ▪ Oracle and SAP AMS, Security and Interoperability solutions require Support Contract 54©2021 Rimini Street, Inc.

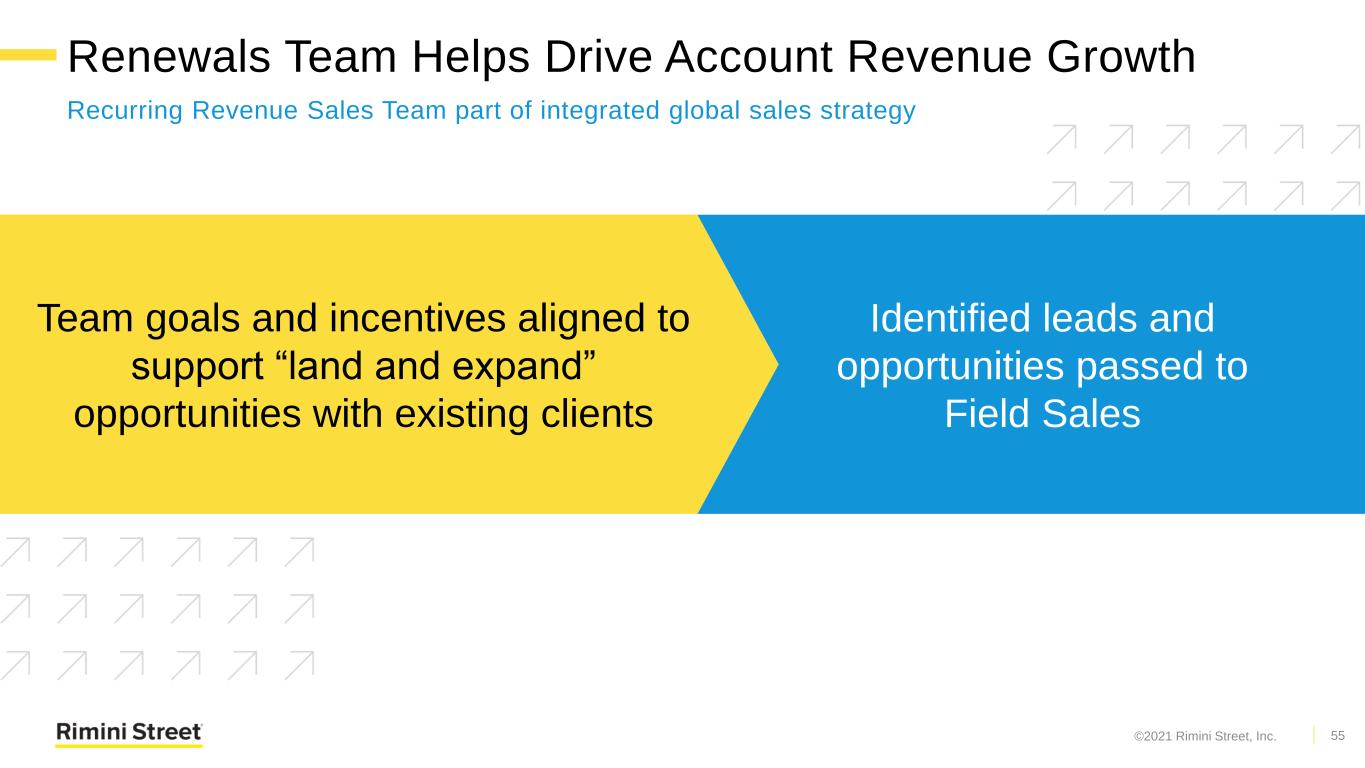

Renewals Team Helps Drive Account Revenue Growth Recurring Revenue Sales Team part of integrated global sales strategy 55 Identified leads and opportunities passed to Field Sales Team goals and incentives aligned to support “land and expand” opportunities with existing clients ©2021 Rimini Street, Inc.

Brian Slepko EVP, Global Service Delivery Service Delivery and Expanding Gross Margin

Global Service Delivery: Driving Principles 58 Quality Efficiency Scalability ©2021 Rimini Street, Inc.

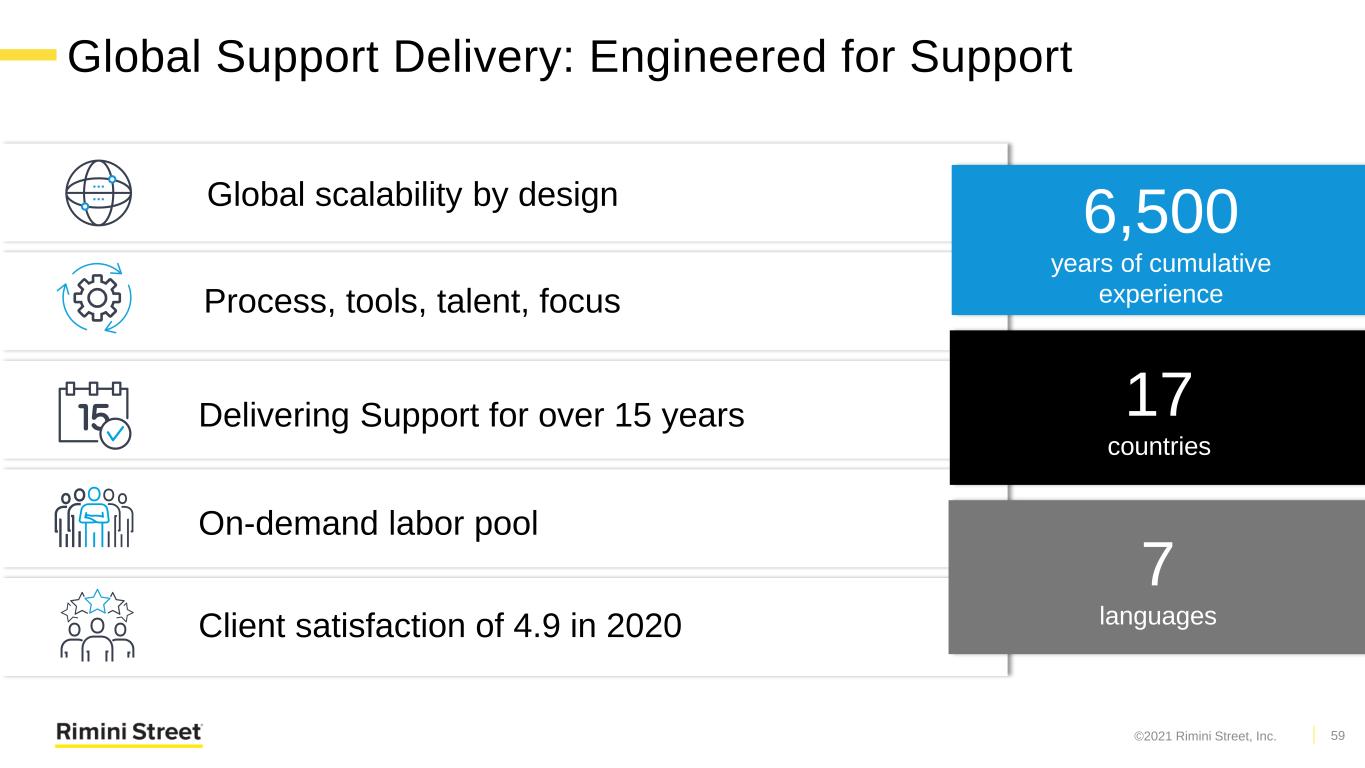

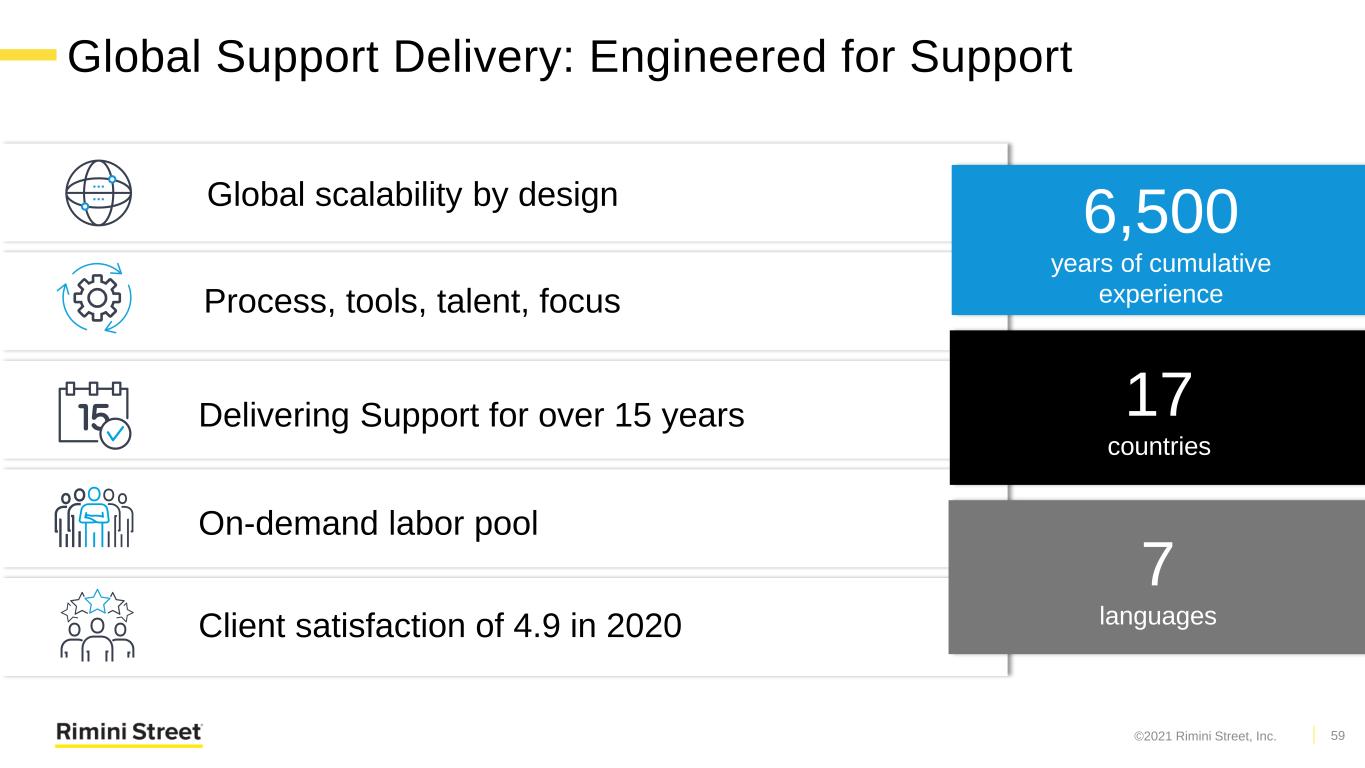

Global Support Delivery: Engineered for Support 59 Delivering Support for over 15 years Global scalability by design Process, tools, talent, focus On-demand labor pool Client satisfaction of 4.9 in 2020 6,500 years of cumulative experience 17 countries 7 languages ©2021 Rimini Street, Inc.

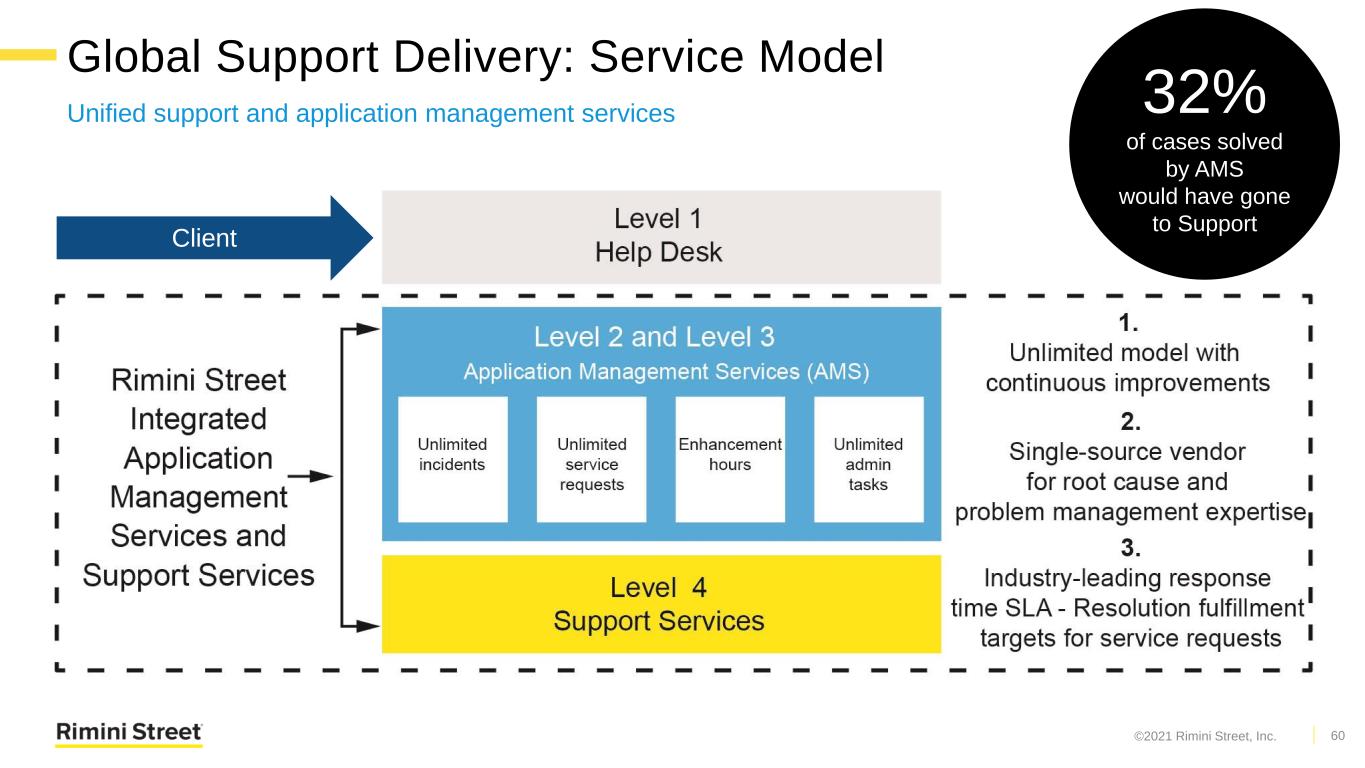

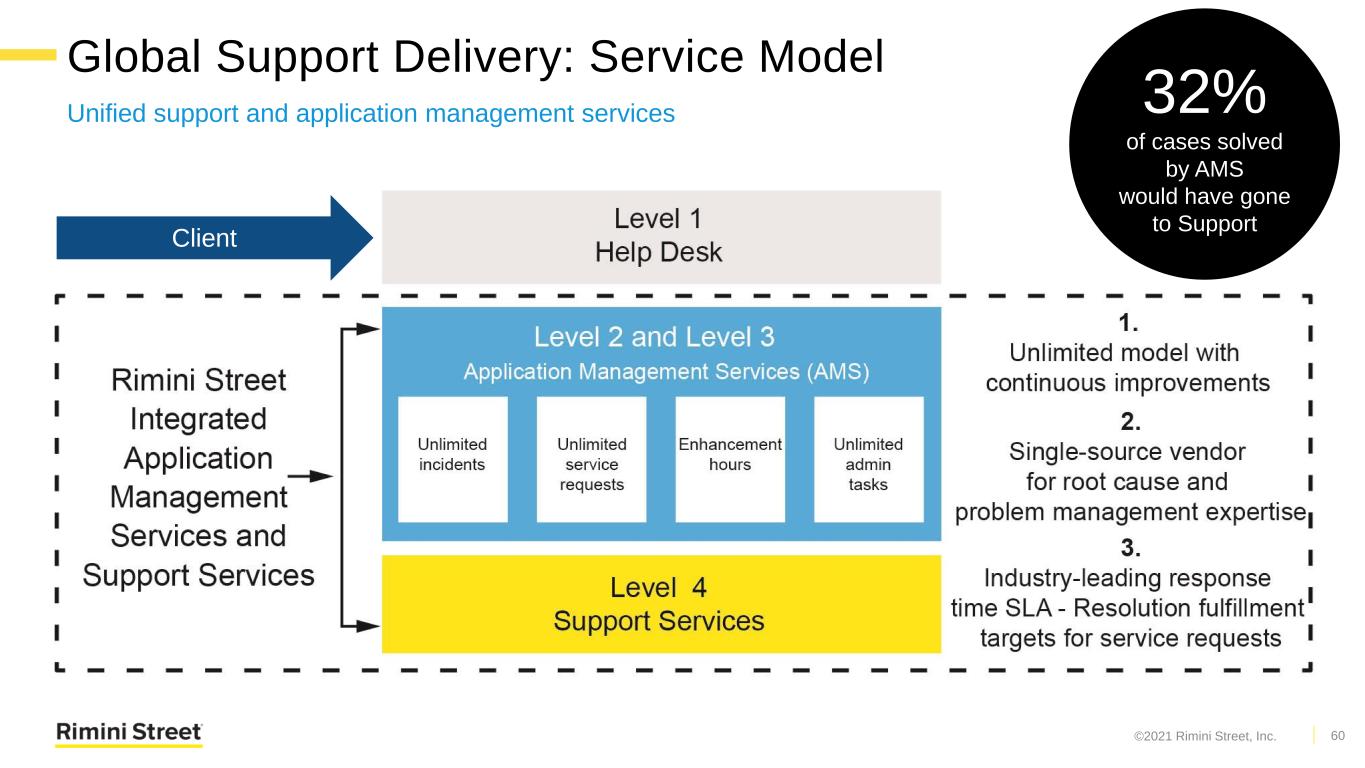

Global Support Delivery: Service Model Unified support and application management services 60 Client 32% of cases solved by AMS would have gone to Support ©2021 Rimini Street, Inc.

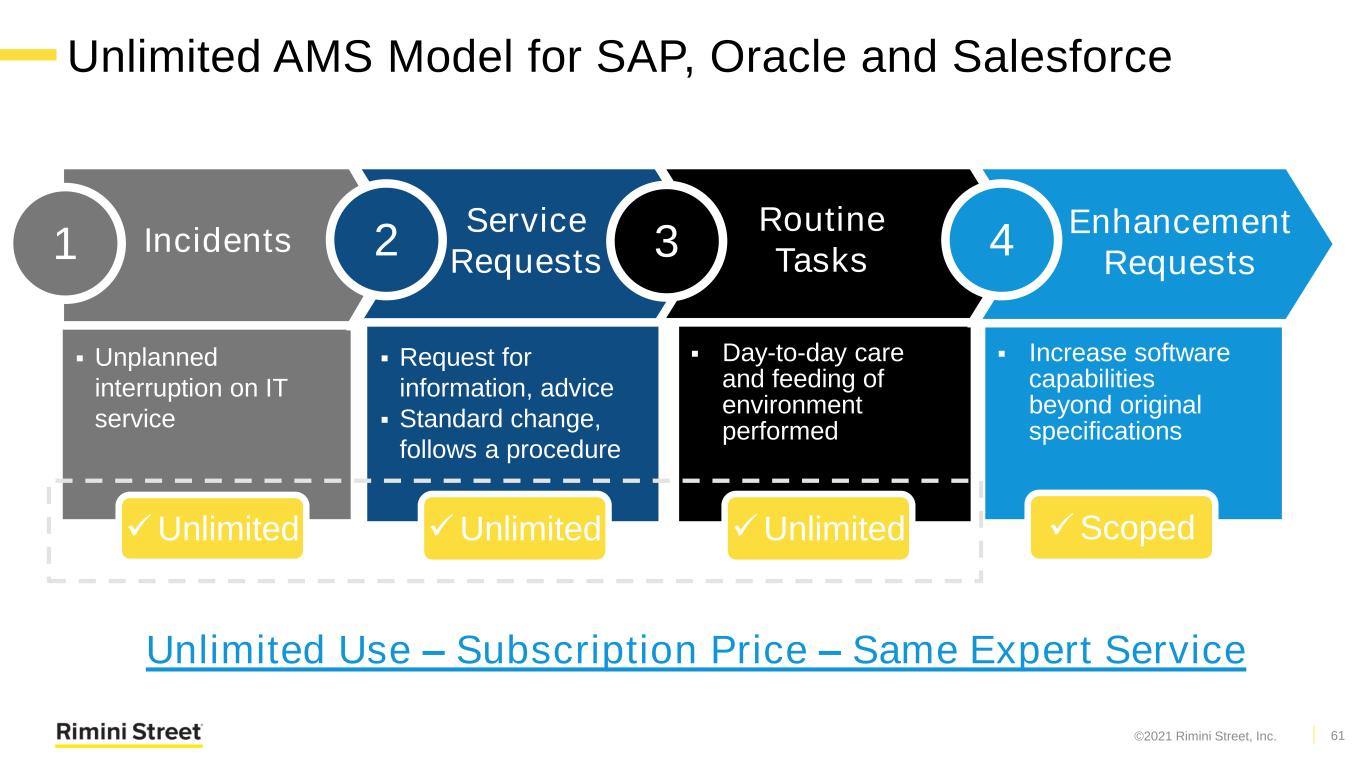

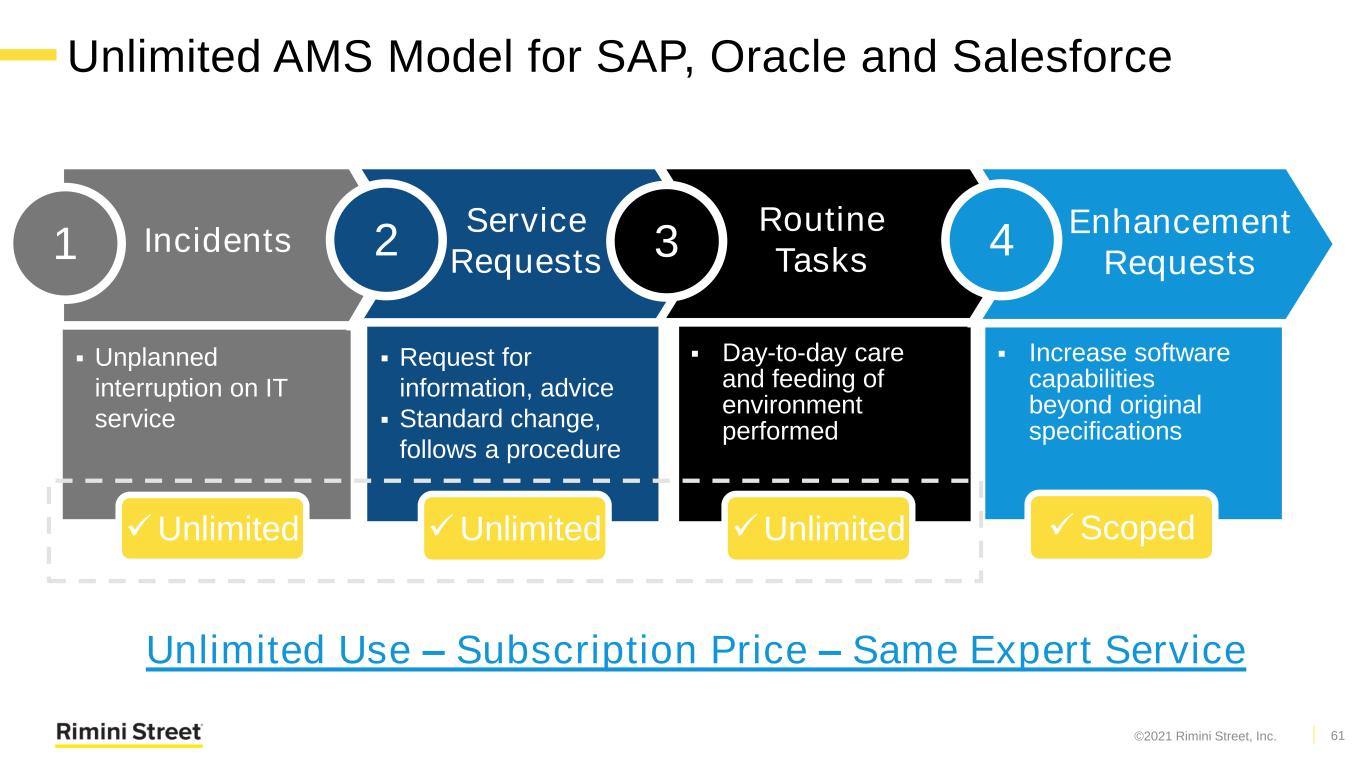

Incidents ▪ Unplanned interruption on IT service ▪ Increase software capabilities beyond original specifications Unlimited AMS Model for SAP, Oracle and Salesforce 1 2 3 4 Service Requests Routine Tasks ✓Unlimited ✓Unlimited ▪ Request for information, advice ▪ Standard change, follows a procedure ▪ Day-to-day care and feeding of environment performed ✓Scoped Unlimited Use – Subscription Price – Same Expert Service Enhancement Requests ✓Unlimited ©2021 Rimini Street, Inc. 61

1 3 4 2 Implement a quick work around, get the system up, minor code fix to stop issue reoccurrence. Work Around, Break Fix Modify existing IT process to prevent issue reoccurrence. Process Change Data Change Changing the data flow or data type fixes the problem. Based on the impact analysis. Major Enhancements ✓ Our model is built on 15-years of expertise in problem management ✓ Single vendor driving continuous improvements The Best AMS Ticket is the One that is Never Created ©2021 Rimini Street, Inc. 62

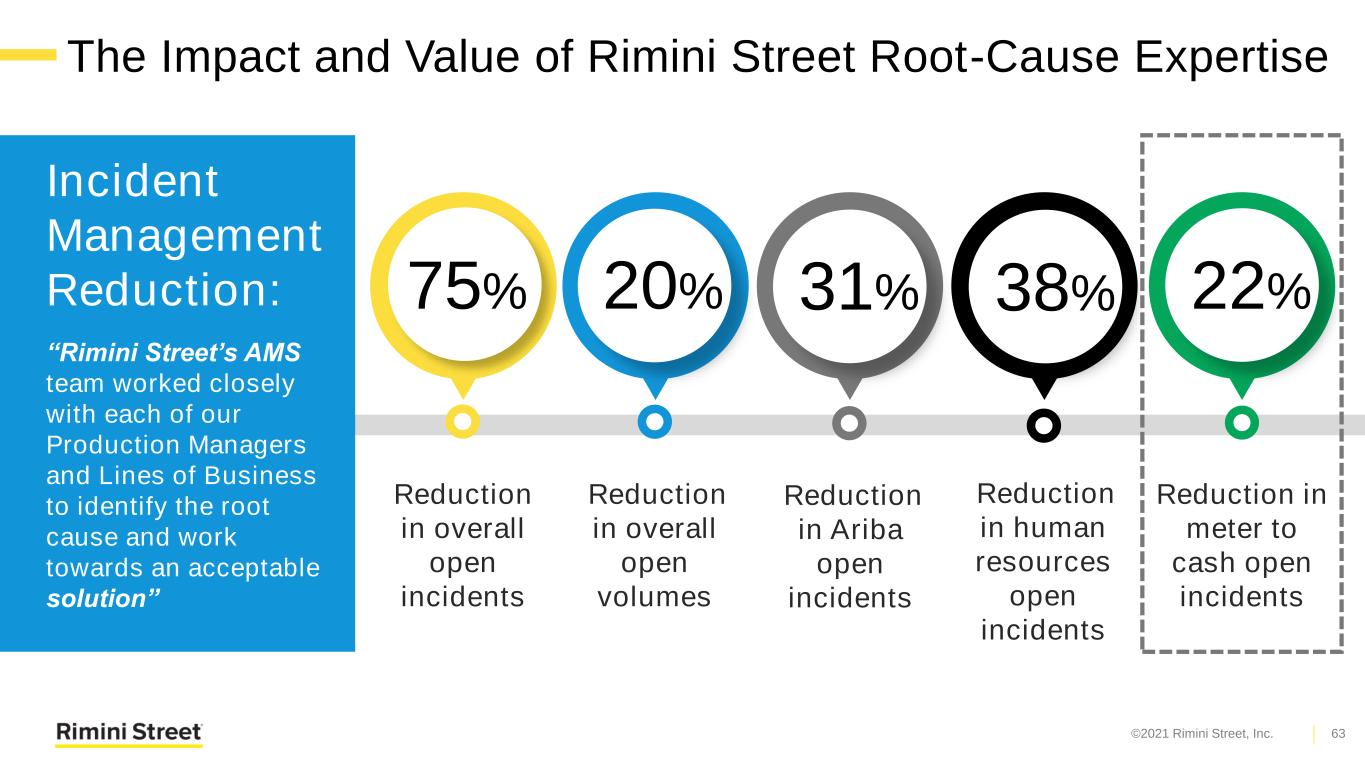

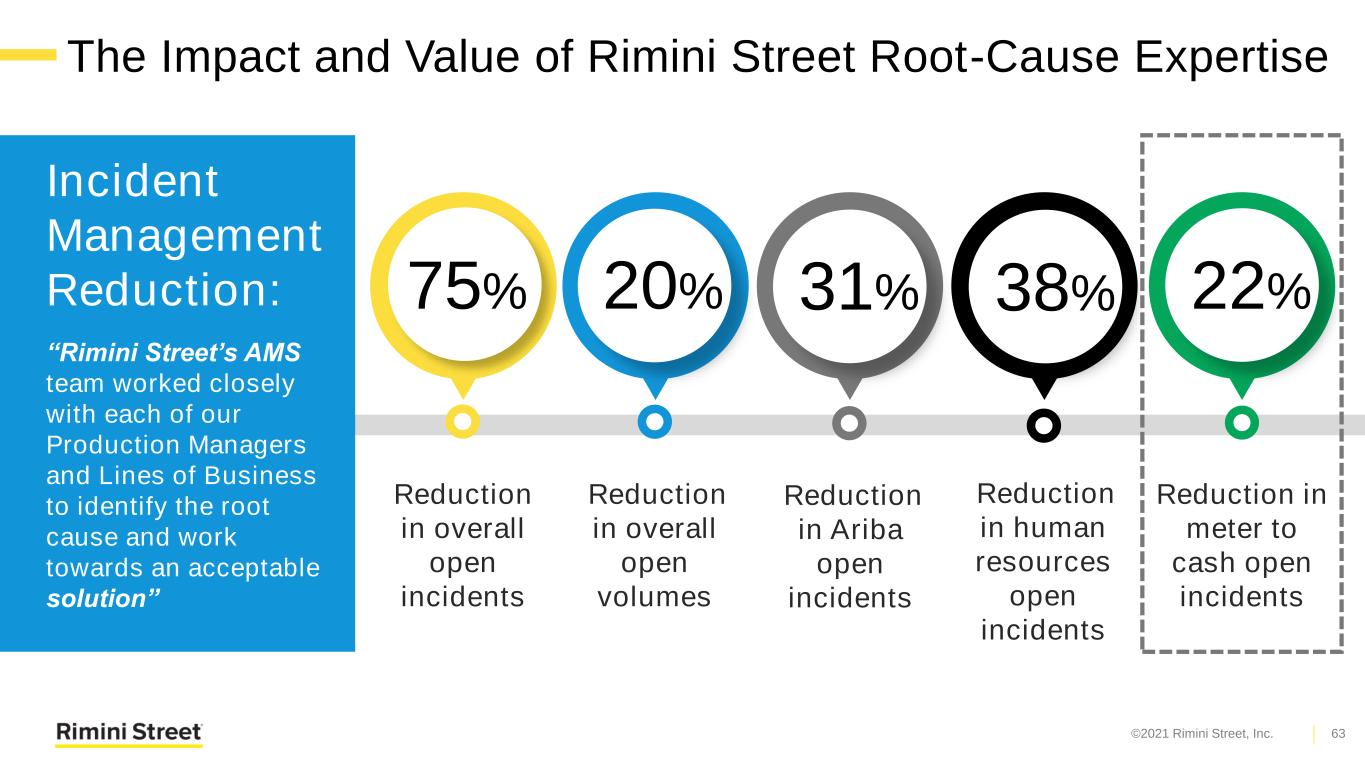

The Impact and Value of Rimini Street Root-Cause Expertise Reduction in overall open incidents Reduction in overall open volumes Reduction in meter to cash open incidents Incident Management Reduction: “Rimini Street’s AMS team worked closely with each of our Production Managers and Lines of Business to identify the root cause and work towards an acceptable solution” 75% 20% 31% Reduction in Ariba open incidents 38% Reduction in human resources open incidents 22% ©2021 Rimini Street, Inc. 63

y Moving to resolution-based with fulfillment targets Incident response SLA offering exceeds industry standards ONLY vendor offering response SLA’s on Service Requests Industry-Leading Service Level Agreements (SLA’s) Resolution-Based Industry Leading Unique Standard Offering ©2021 Rimini Street, Inc. 64

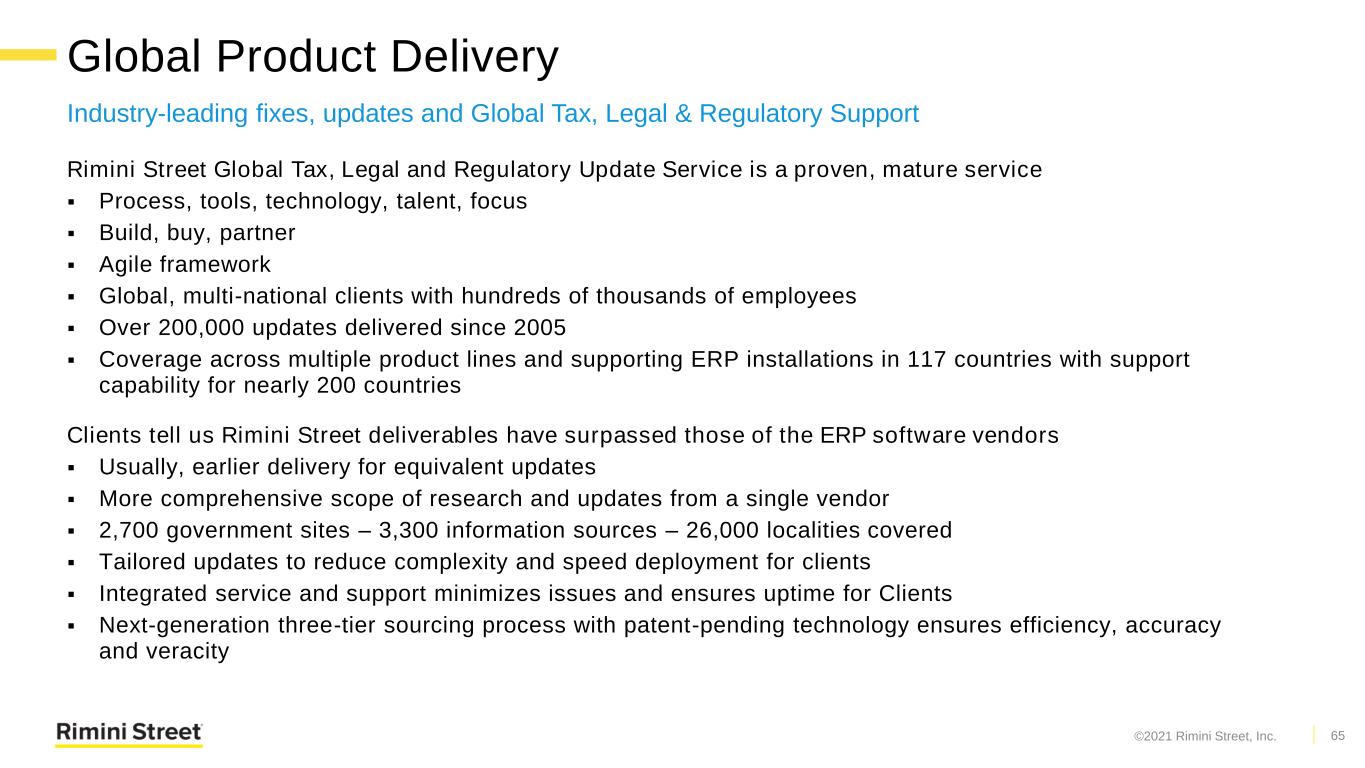

Global Product Delivery Industry-leading fixes, updates and Global Tax, Legal & Regulatory Support Rimini Street Global Tax, Legal and Regulatory Update Service is a proven, mature service ▪ Process, tools, technology, talent, focus ▪ Build, buy, partner ▪ Agile framework ▪ Global, multi-national clients with hundreds of thousands of employees ▪ Over 200,000 updates delivered since 2005 ▪ Coverage across multiple product lines and supporting ERP installations in 117 countries with support capability for nearly 200 countries Clients tell us Rimini Street deliverables have surpassed those of the ERP software vendors ▪ Usually, earlier delivery for equivalent updates ▪ More comprehensive scope of research and updates from a single vendor ▪ 2,700 government sites – 3,300 information sources – 26,000 localities covered ▪ Tailored updates to reduce complexity and speed deployment for clients ▪ Integrated service and support minimizes issues and ensures uptime for Clients ▪ Next-generation three-tier sourcing process with patent-pending technology ensures efficiency, accuracy and veracity 65©2021 Rimini Street, Inc.

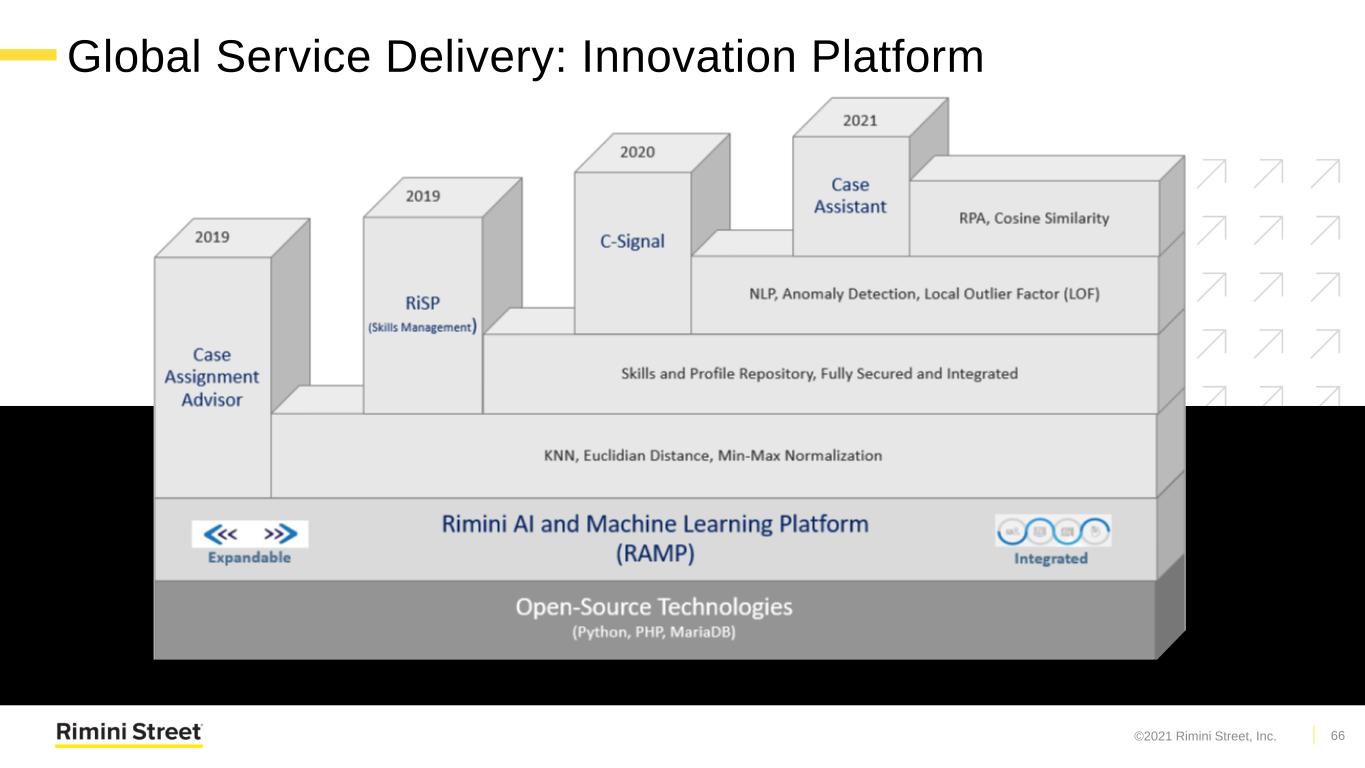

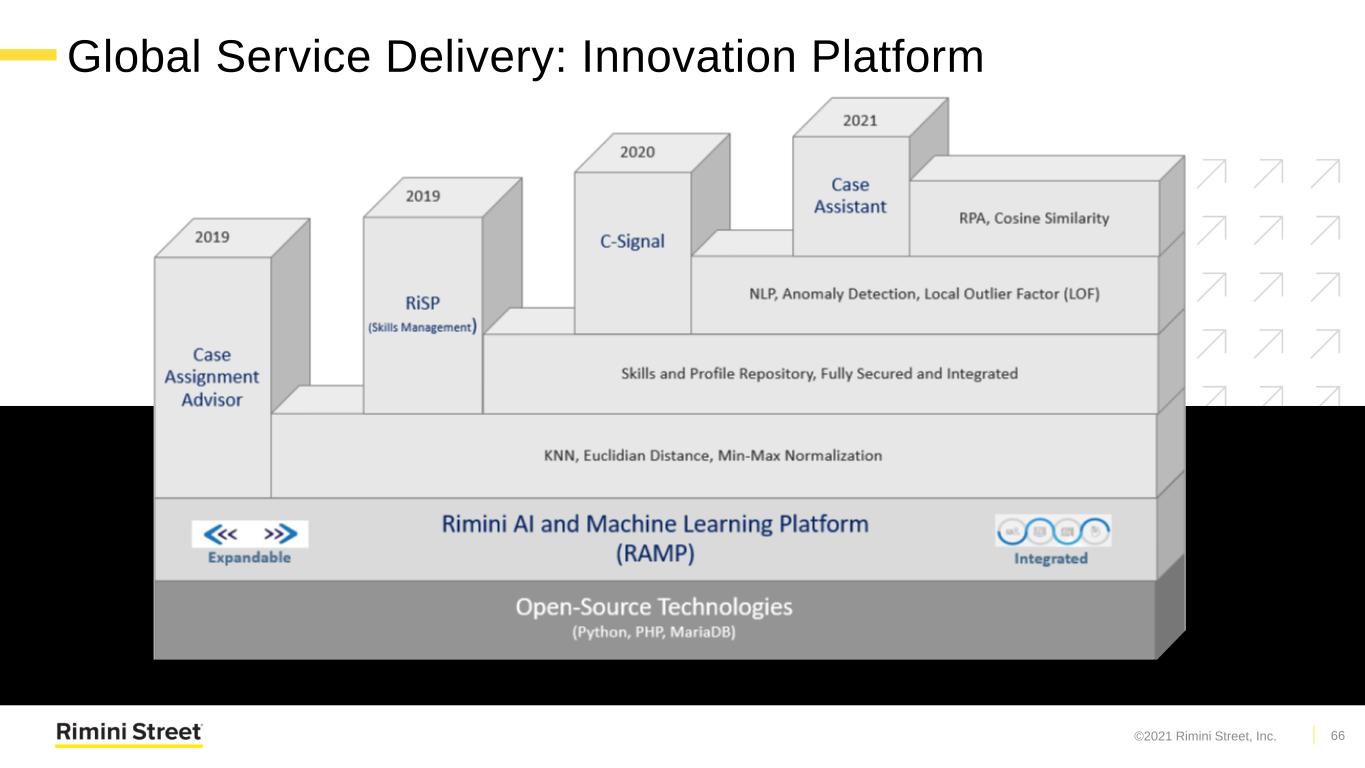

Global Service Delivery: Innovation Platform 66©2021 Rimini Street, Inc.

Global Service Delivery Innovation Case Assignment Advisor – patent pending & Stevie Award Gold winner Case Assignment Advisor... ▪ Finds best available Engineer for the case ▪ Considers load and availability vectors ▪ Considers business constraints vectors 67 35+ Vectors Integrated with Salesforce, ADP and other systems * ✓Static and Dynamic Skills ✓Normalized Euclidean Distance ✓Explain Me Feature ©2021 Rimini Street, Inc.

Global Service Delivery Innovation C-Sginal³– patent pending & Stevie Award Gold winner C-Signal... ▪ Accurately identifies sentiments and anomalies both positive and negative ▪ Helps us to proactively address cases and further improves client satisfaction ▪ Helps us to listen to voice of the customer 68 “Need Attention” Sentiments 40+ Vectors Integrated with Salesforce, ServiceNow and other systems ✓ “Need Attention” sentiments ✓ Positive sentiments ✓ Case life (Days) ✓ Back and forth count ✓ Request for update count ©2021 Rimini Street, Inc.

Global Service Delivery Innovation Results that drive improved client satisfaction, global scalability and expanded gross margins 69 Case Life (Days) Back and Forth Count Request for Update Count Case survey rating average 4.9/5.0 (5.0 is “Excellent”) Rimini Street speeds software issue resolution by 23% with new AI applications ©2021 Rimini Street, Inc.

Daniel B. Winslow EVP, Chief Legal Officer & Secretary Legal Strategy and Overview

Rimini Street Disrupting a $170 Billion Market Market disruptors often have to battle incumbents trying to preserve and control the market 72 2005 Founding 2014 Rimini Street Files Rimini II 2015 Rimini I Trial 2010 Oracle Files Rimini I 2022 Rimini II Trial (Expected) Rimini Street Annual Revenue $300M+ $0 2020 Injunction Dispute 2018 Injunction In Place “At all relevant times, Rimini Street, Inc. (“Rimini”) provided third-party support for Oracle’s enterprise software, in lawful competition with Oracle’s direct maintenance services.” – US Ninth Circuit Court of Appeals “[w]hat was (and is) at issue [in the litigation] is the manner in which Rimini performed that third-party support [for some licensees of specific Oracle products].” – US Federal District Court of Nevada NOTE: Timeline, dates and revenue not to scale 2017 Rimini Goes Public ©2021 Rimini Street, Inc.

Third Party Support Is Allowed and Legal The Court – and Oracle – agree that clients have right to choose their after-market support provider “whether third-party support is allowed under the licensing agreements is not at issue in this [Rimini II] lawsuit, nor was it at issue in [Rimini I].” - US Federal District Court of Nevada 73 “the [enterprise software] licenses … generally allow for a third- party service provider, like Rimini, to copy the software in place of the licensee and customize it for the licensee.” - US Federal District Court of Nevada “[o]ne of the key features of enterprise software is its customizability; the software can be modified to fit the specific needs of the organization licensing it.” - US Federal District Court of Nevada ▪ Licensees can choose support provider ▪ Third parties can provide support services to licensees ▪ Court declared Rimini Street to be “in lawful competition with Oracle’s direct maintenance services” ©2021 Rimini Street, Inc.

Litigation About “Manner” in Which Support Performed Litigation over “how” –what tools and processes – Rimini uses to provide support for certain Oracle products ▪ Rimini I (Final) ▪ Oracle filed against Rimini in 2010 ▪ Oracle lost 23 out of 24 claims ▪ Oracle won a claim of “Innocent Infringement” ▪ Rimini Street paid Oracle $35 million for “Fair Market license” ▪ Court ruled that certain Oracle software can only be used at the client’s “facilities” and that Rimini Street’s servers are not client’s “facilities” (Process 1.0) ▪ Court ruled Rimini Street cannot copy and share Oracle code, under the color of a license held by one client, for another client that also holds the same license (Process 1.0) ▪ Rimini Street complied with the Court findings, stopped using Process 1.0 and developed and deployed Process 2.0 by July 2014 that addresses Court ruling ▪ Court issued injunction against future use of Process 1.0 74 Innocent Infringement: Rimini “was not aware” and “had no reason to believe” that some of its legacy processes (“Process 1.0”) infringed certain Oracle copyrights. ©2021 Rimini Street, Inc.

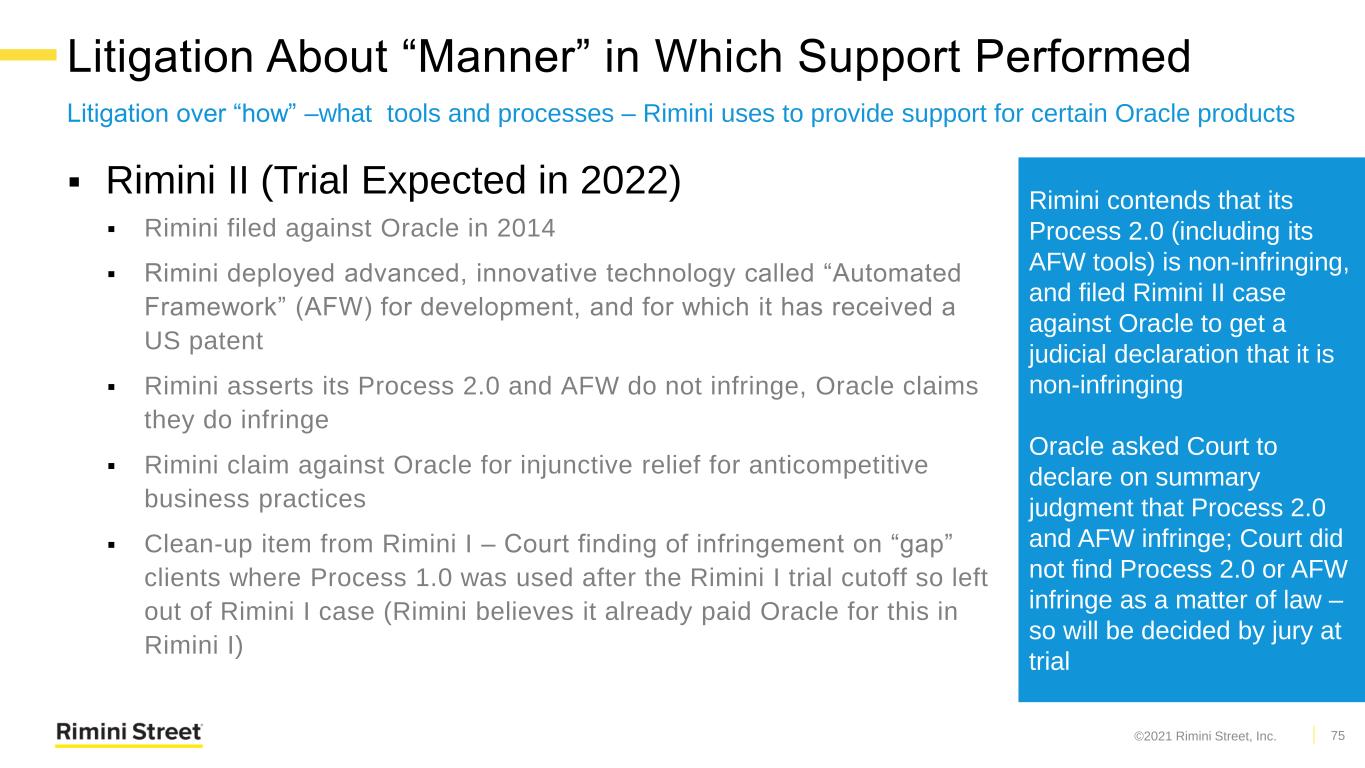

Litigation About “Manner” in Which Support Performed Litigation over “how” –what tools and processes – Rimini uses to provide support for certain Oracle products ▪ Rimini II (Trial Expected in 2022) ▪ Rimini filed against Oracle in 2014 ▪ Rimini deployed advanced, innovative technology called “Automated Framework” (AFW) for development, and for which it has received a US patent ▪ Rimini asserts its Process 2.0 and AFW do not infringe, Oracle claims they do infringe ▪ Rimini claim against Oracle for injunctive relief for anticompetitive business practices ▪ Clean-up item from Rimini I – Court finding of infringement on “gap” clients where Process 1.0 was used after the Rimini I trial cutoff so left out of Rimini I case (Rimini believes it already paid Oracle for this in Rimini I) 75 Rimini contends that its Process 2.0 (including its AFW tools) is non-infringing, and filed Rimini II case against Oracle to get a judicial declaration that it is non-infringing Oracle asked Court to declare on summary judgment that Process 2.0 and AFW infringe; Court did not find Process 2.0 or AFW infringe as a matter of law – so will be decided by jury at trial ©2021 Rimini Street, Inc.

We will fight the battles we need to fight to assure a fair, legal, and competitive marketplace for the $180 billion global enterprise software support spend, in general, and to protect our market right to aggressively challenge Oracle for a significant share of its $20 billion in annual support revenue, in particular. Strategic Litigation Rimini Street plans to accelerate its position as IT industry thought leader, innovation leader, and service leader 76©2021 Rimini Street, Inc.

Michael Perica Chief Financial Officer Financial Model

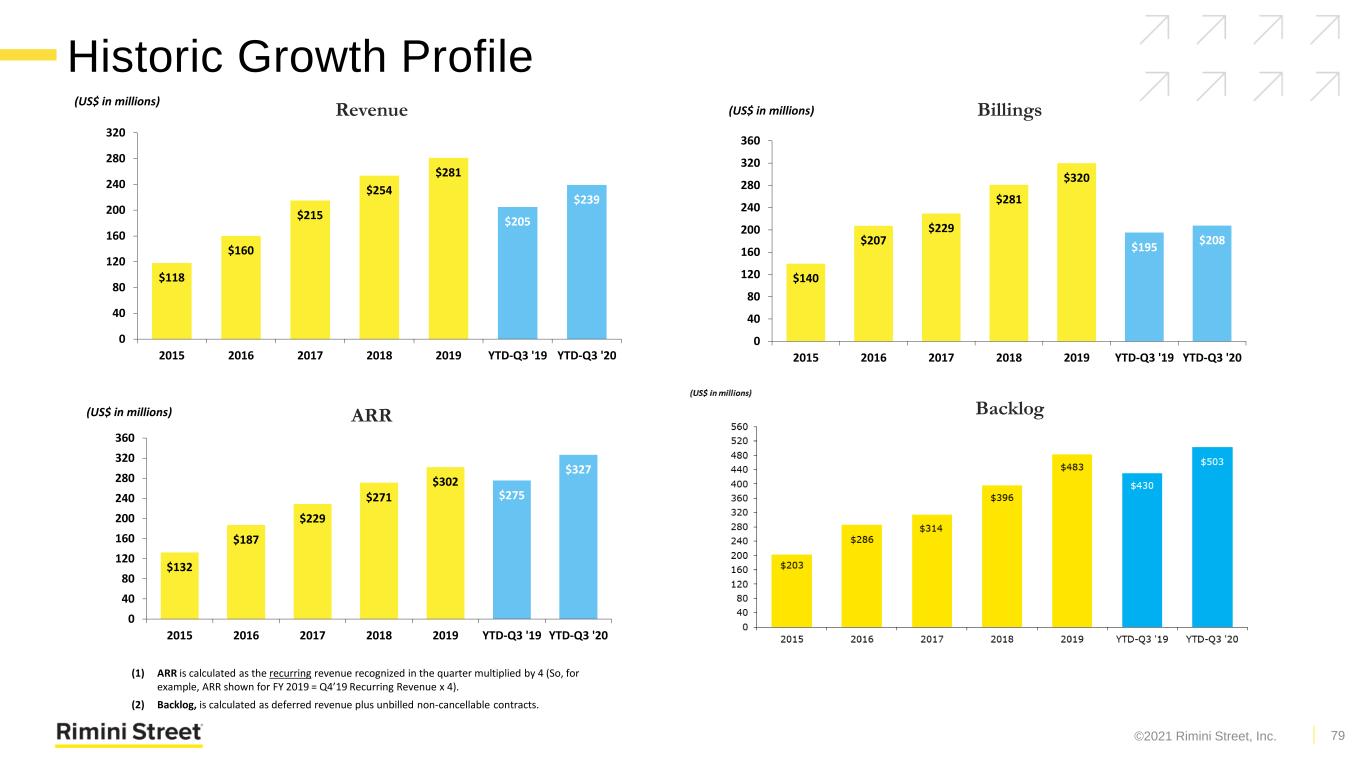

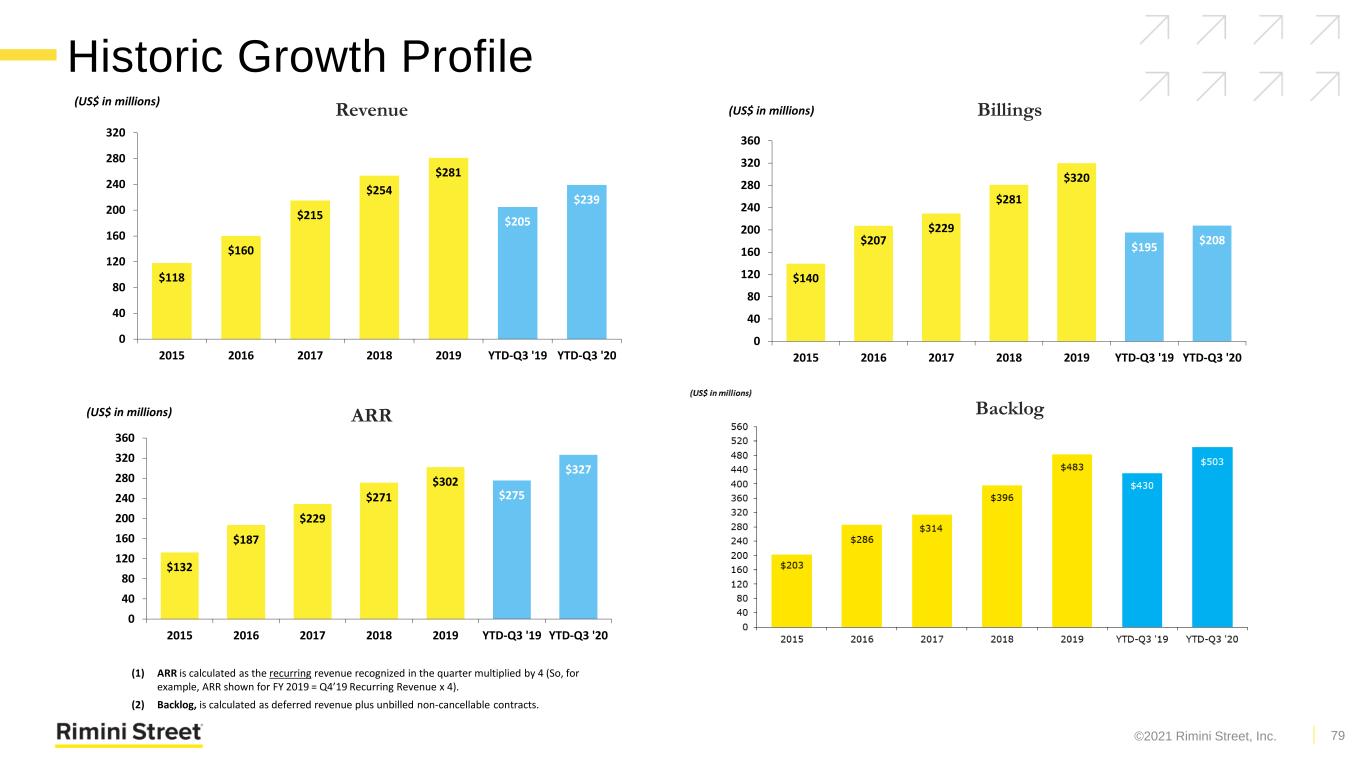

Historic Growth Profile 79 $140 $207 $229 $281 $320 $195 $208 0 40 80 120 160 200 240 280 320 360 2015 2016 2017 2018 2019 YTD-Q3 '19 YTD-Q3 '20 (US$ in millions) $118 $160 $215 $254 $281 $205 $239 0 40 80 120 160 200 240 280 320 2015 2016 2017 2018 2019 YTD-Q3 '19 YTD-Q3 '20 (US$ in millions) Revenue $132 $187 $229 $271 $302 $275 $327 0 40 80 120 160 200 240 280 320 360 2015 2016 2017 2018 2019 YTD-Q3 '19 YTD-Q3 '20 (US$ in millions) ARR (1) ARR is calculated as the recurring revenue recognized in the quarter multiplied by 4 (So, for example, ARR shown for FY 2019 = Q4’19 Recurring Revenue x 4). (2) Backlog, is calculated as deferred revenue plus unbilled non-cancellable contracts. Billings Backlog ©2021 Rimini Street, Inc.

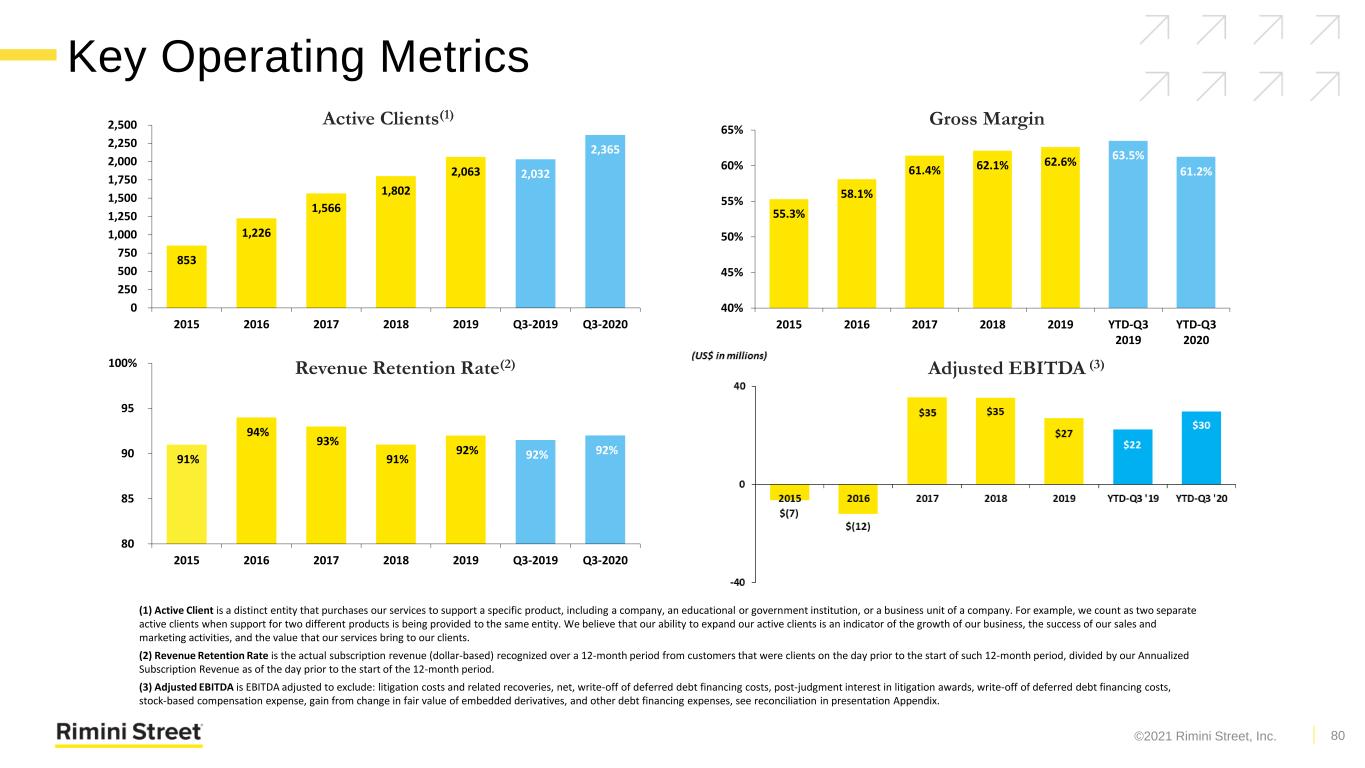

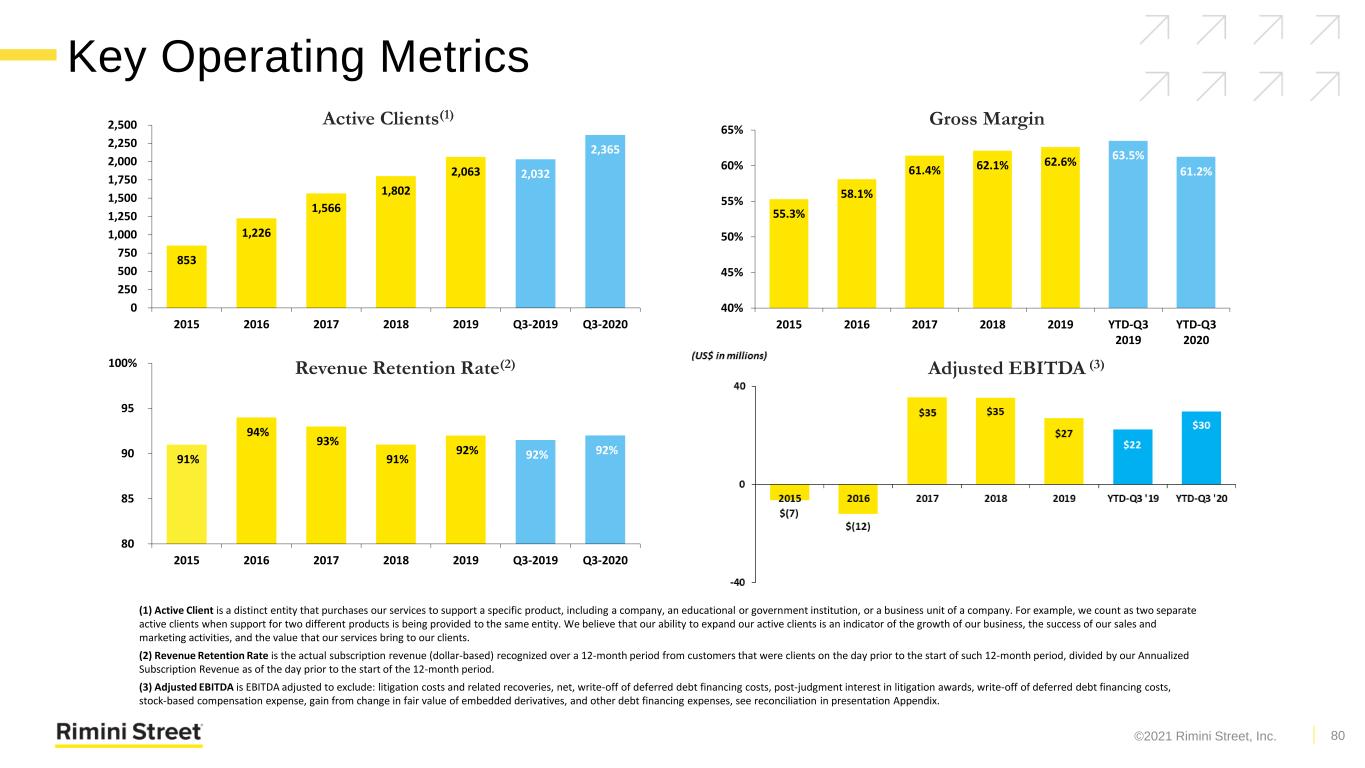

55.3% 58.1% 61.4% 62.1% 62.6% 63.5% 61.2% 40% 45% 50% 55% 60% 65% 2015 2016 2017 2018 2019 YTD-Q3 2019 YTD-Q3 2020 91% 94% 93% 91% 92% 92% 92% 80 85 90 95 100% 2015 2016 2017 2018 2019 Q3-2019 Q3-2020 853 1,226 1,566 1,802 2,063 2,032 2,365 0 250 500 750 1,000 1,250 1,500 1,750 2,000 2,250 2,500 2015 2016 2017 2018 2019 Q3-2019 Q3-2020 Key Operating Metrics (1) Active Client is a distinct entity that purchases our services to support a specific product, including a company, an educational or government institution, or a business unit of a company. For example, we count as two separate active clients when support for two different products is being provided to the same entity. We believe that our ability to expand our active clients is an indicator of the growth of our business, the success of our sales and marketing activities, and the value that our services bring to our clients. (2) Revenue Retention Rate is the actual subscription revenue (dollar-based) recognized over a 12-month period from customers that were clients on the day prior to the start of such 12-month period, divided by our Annualized Subscription Revenue as of the day prior to the start of the 12-month period. (3) Adjusted EBITDA is EBITDA adjusted to exclude: litigation costs and related recoveries, net, write-off of deferred debt financing costs, post-judgment interest in litigation awards, write-off of deferred debt financing costs, stock-based compensation expense, gain from change in fair value of embedded derivatives, and other debt financing expenses, see reconciliation in presentation Appendix. Revenue Retention Rate(2) Adjusted EBITDA (3) Active Clients(1) Gross Margin ©2021 Rimini Street, Inc. 80

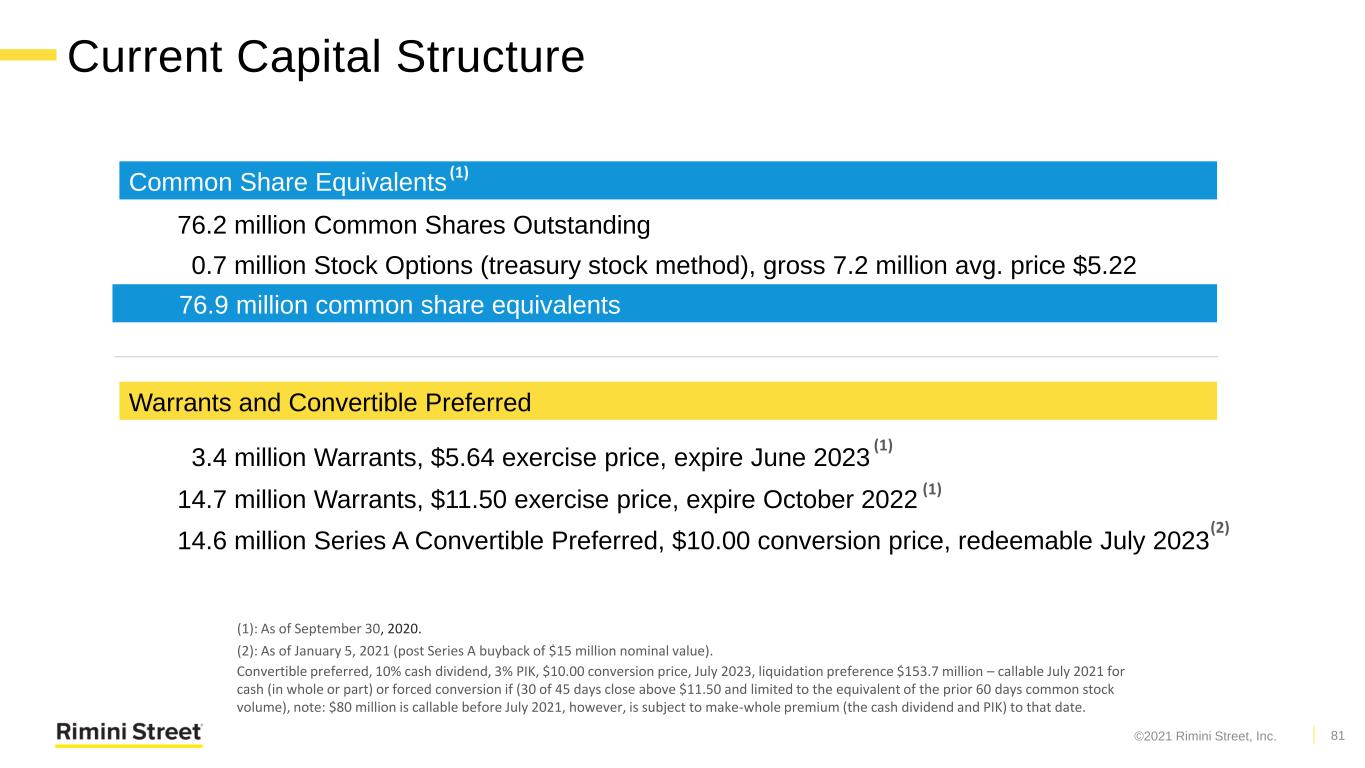

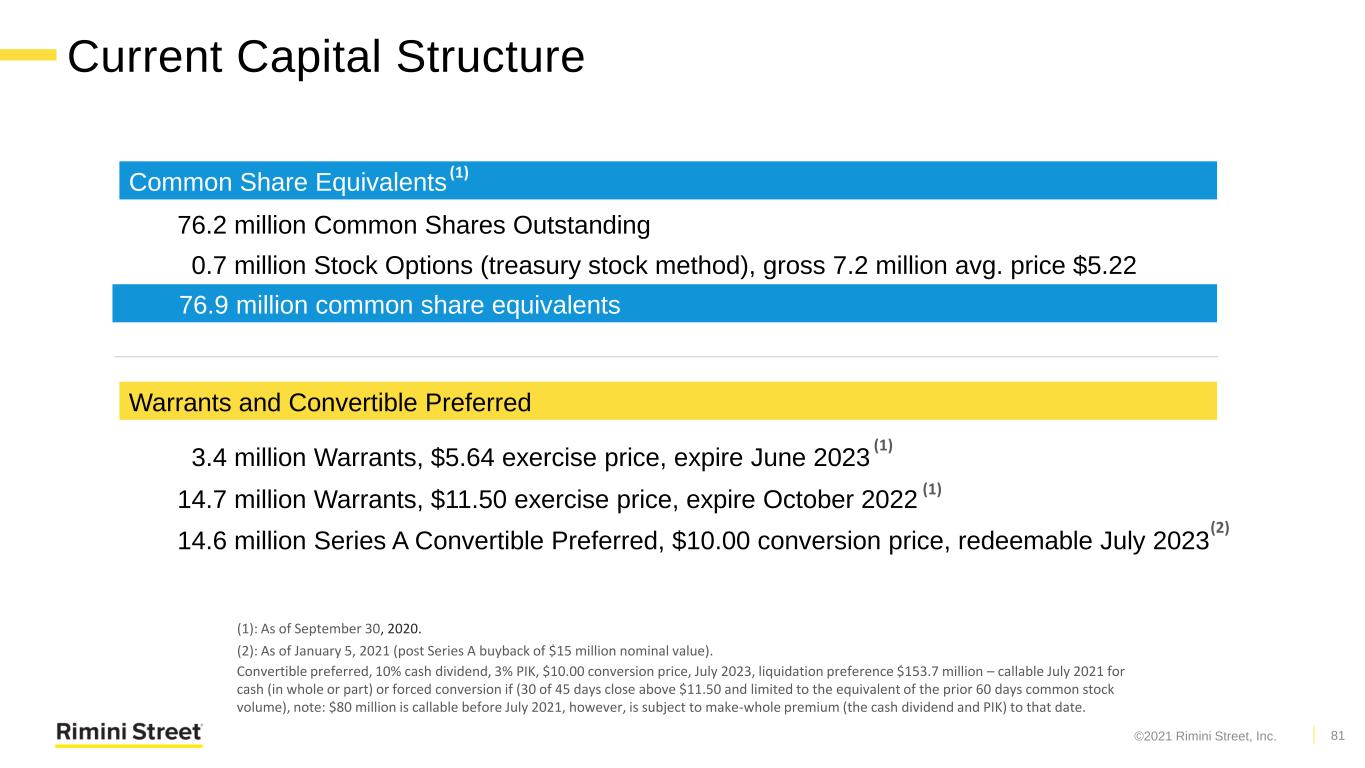

Current Capital Structure 81 14.6 million Series A Convertible Preferred, $10.00 conversion price, redeemable July 2023 76.2 million Common Shares Outstanding 0.7 million Stock Options (treasury stock method), gross 7.2 million avg. price $5.22 14.7 million Warrants, $11.50 exercise price, expire October 2022 76.9 million common share equivalents 3.4 million Warrants, $5.64 exercise price, expire June 2023 Common Share Equivalents Warrants and Convertible Preferred (1) (1) (1) (2) (1): As of September 30, 2020. . (2): As of January 5, 2021 (post Series A buyback of $15 million nominal value). Convertible preferred, 10% cash dividend, 3% PIK, $10.00 conversion price, July 2023, liquidation preference $153.7 million – callable July 2021 for cash (in whole or part) or forced conversion if (30 of 45 days close above $11.50 and limited to the equivalent of the prior 60 days common stock volume), note: $80 million is callable before July 2021, however, is subject to make-whole premium (the cash dividend and PIK) to that date. ©2021 Rimini Street, Inc.

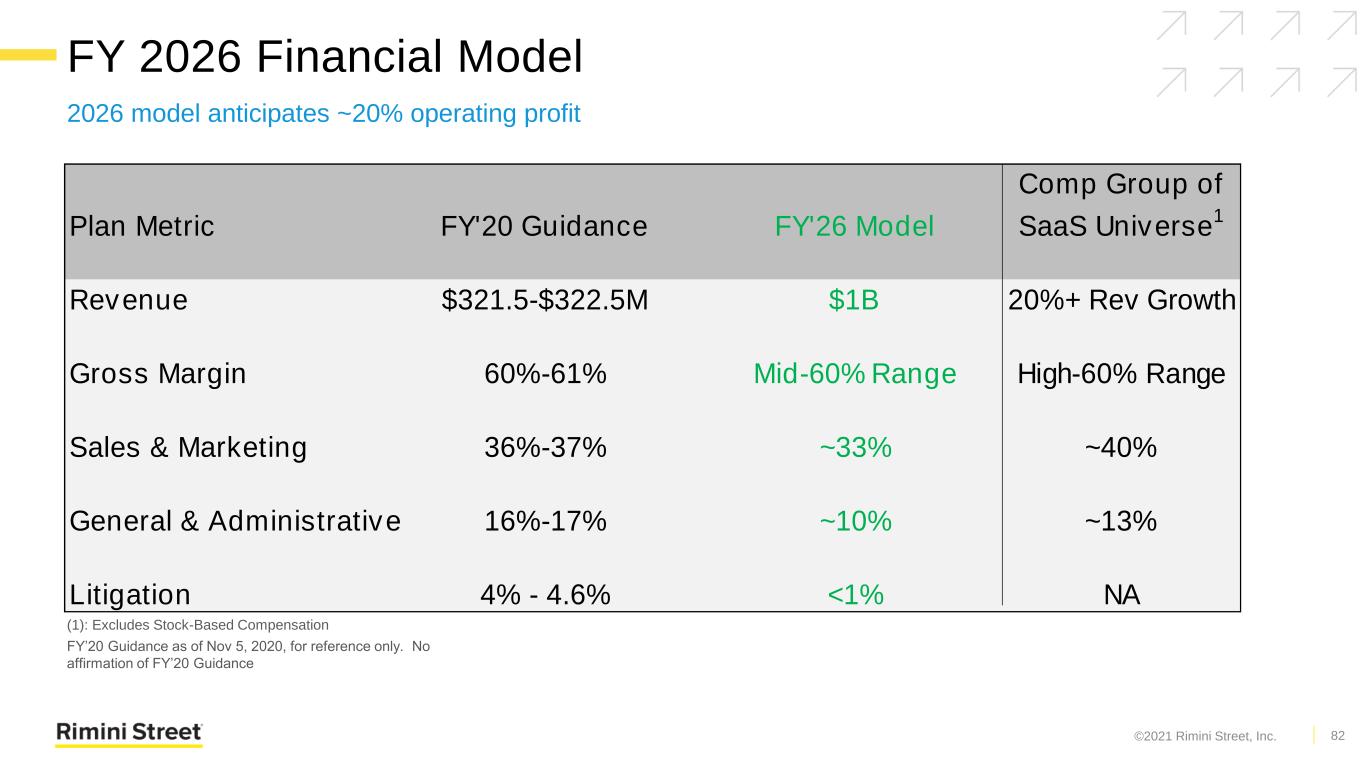

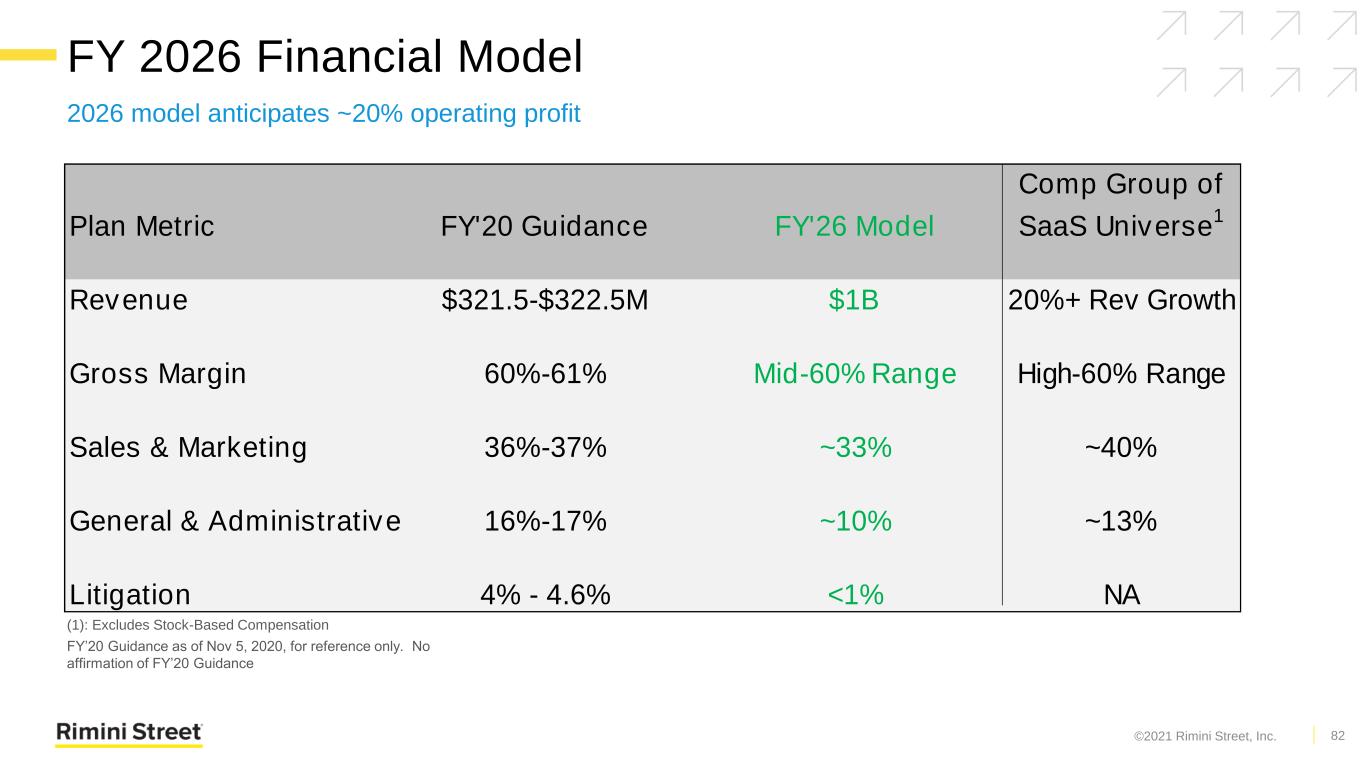

FY 2026 Financial Model 2026 model anticipates ~20% operating profit 82 Plan Metric FY'20 Guidance FY'26 Model Comp Group of SaaS Universe 1 Revenue $321.5-$322.5M $1B 20%+ Rev Growth Gross Margin 60%-61% Mid-60% Range High-60% Range Sales & Marketing 36%-37% ~33% ~40% General & Administrative 16%-17% ~10% ~13% Litigation 4% - 4.6% <1% NA (1): Excludes Stock-Based Compensation FY’20 Guidance as of Nov 5, 2020, for reference only. No affirmation of FY’20 Guidance ©2021 Rimini Street, Inc.

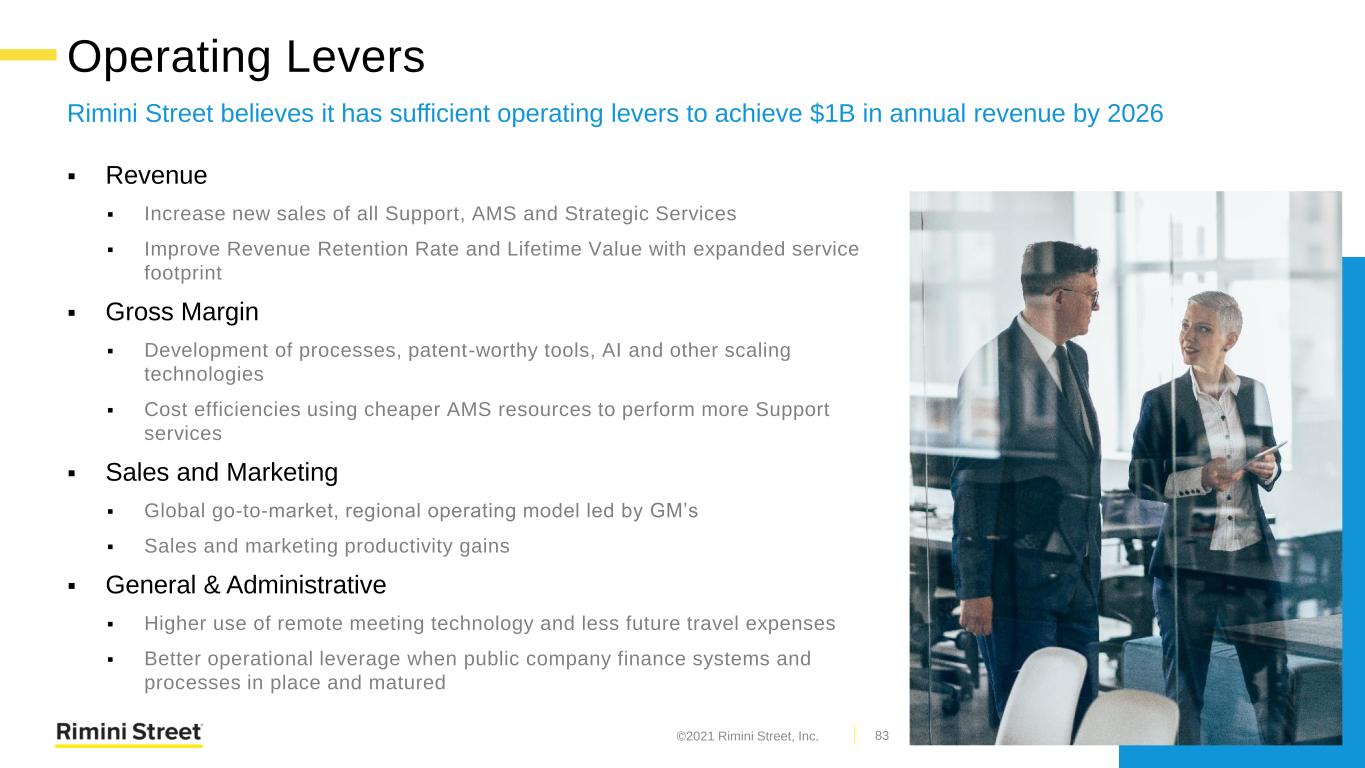

Operating Levers Rimini Street believes it has sufficient operating levers to achieve $1B in annual revenue by 2026 ▪ Revenue ▪ Increase new sales of all Support, AMS and Strategic Services ▪ Improve Revenue Retention Rate and Lifetime Value with expanded service footprint ▪ Gross Margin ▪ Development of processes, patent-worthy tools, AI and other scaling technologies ▪ Cost efficiencies using cheaper AMS resources to perform more Support services ▪ Sales and Marketing ▪ Global go-to-market, regional operating model led by GM’s ▪ Sales and marketing productivity gains ▪ General & Administrative ▪ Higher use of remote meeting technology and less future travel expenses ▪ Better operational leverage when public company finance systems and processes in place and matured 83©2021 Rimini Street, Inc.

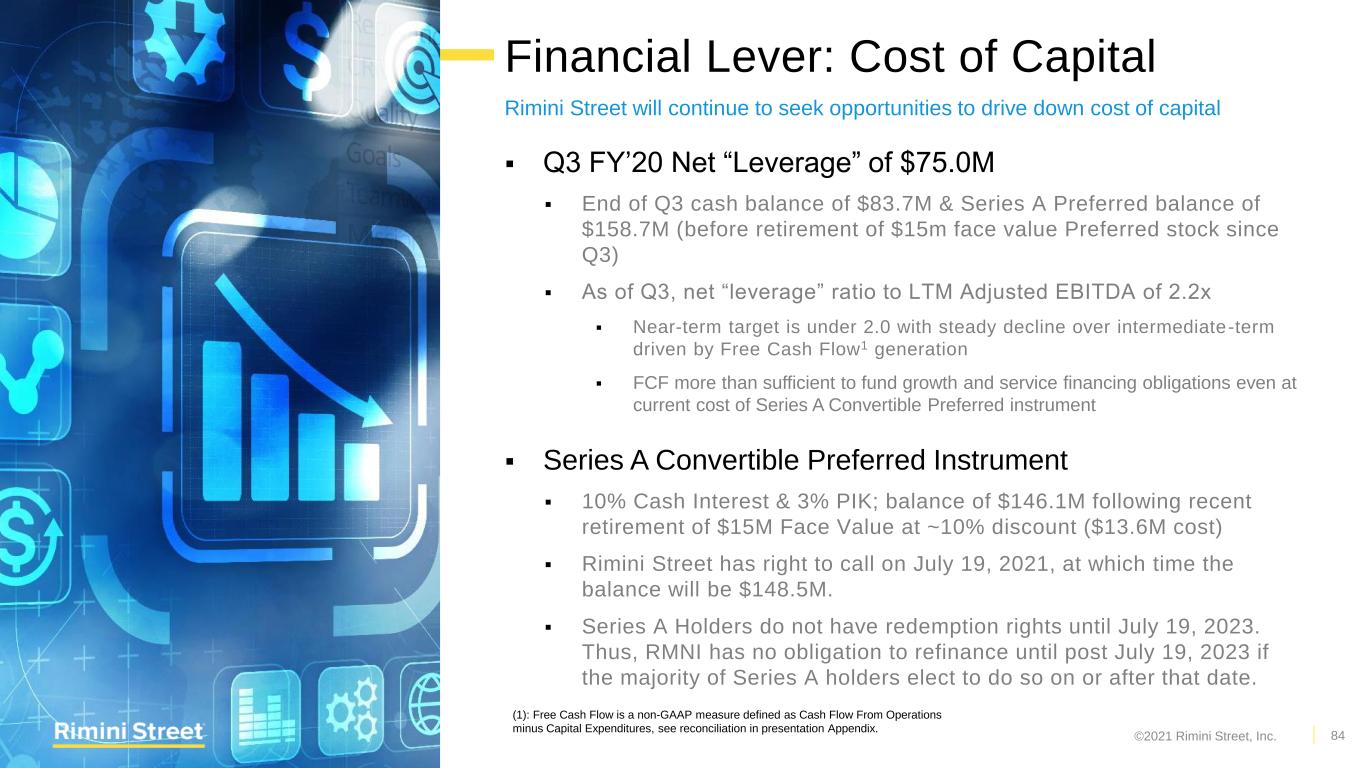

Financial Lever: Cost of Capital Rimini Street will continue to seek opportunities to drive down cost of capital ▪ Q3 FY’20 Net “Leverage” of $75.0M ▪ End of Q3 cash balance of $83.7M & Series A Preferred balance of $158.7M (before retirement of $15m face value Preferred stock since Q3) ▪ As of Q3, net “leverage” ratio to LTM Adjusted EBITDA of 2.2x ▪ Near-term target is under 2.0 with steady decline over intermediate-term driven by Free Cash Flow1 generation ▪ FCF more than sufficient to fund growth and service financing obligations even at current cost of Series A Convertible Preferred instrument ▪ Series A Convertible Preferred Instrument ▪ 10% Cash Interest & 3% PIK; balance of $146.1M following recent retirement of $15M Face Value at ~10% discount ($13.6M cost) ▪ Rimini Street has right to call on July 19, 2021, at which time the balance will be $148.5M. ▪ Series A Holders do not have redemption rights until July 19, 2023. Thus, RMNI has no obligation to refinance until post July 19, 2023 if the majority of Series A holders elect to do so on or after that date. 84 (1): Free Cash Flow is a non-GAAP measure defined as Cash Flow From Operations minus Capital Expenditures, see reconciliation in presentation Appendix. ©2021 Rimini Street, Inc.

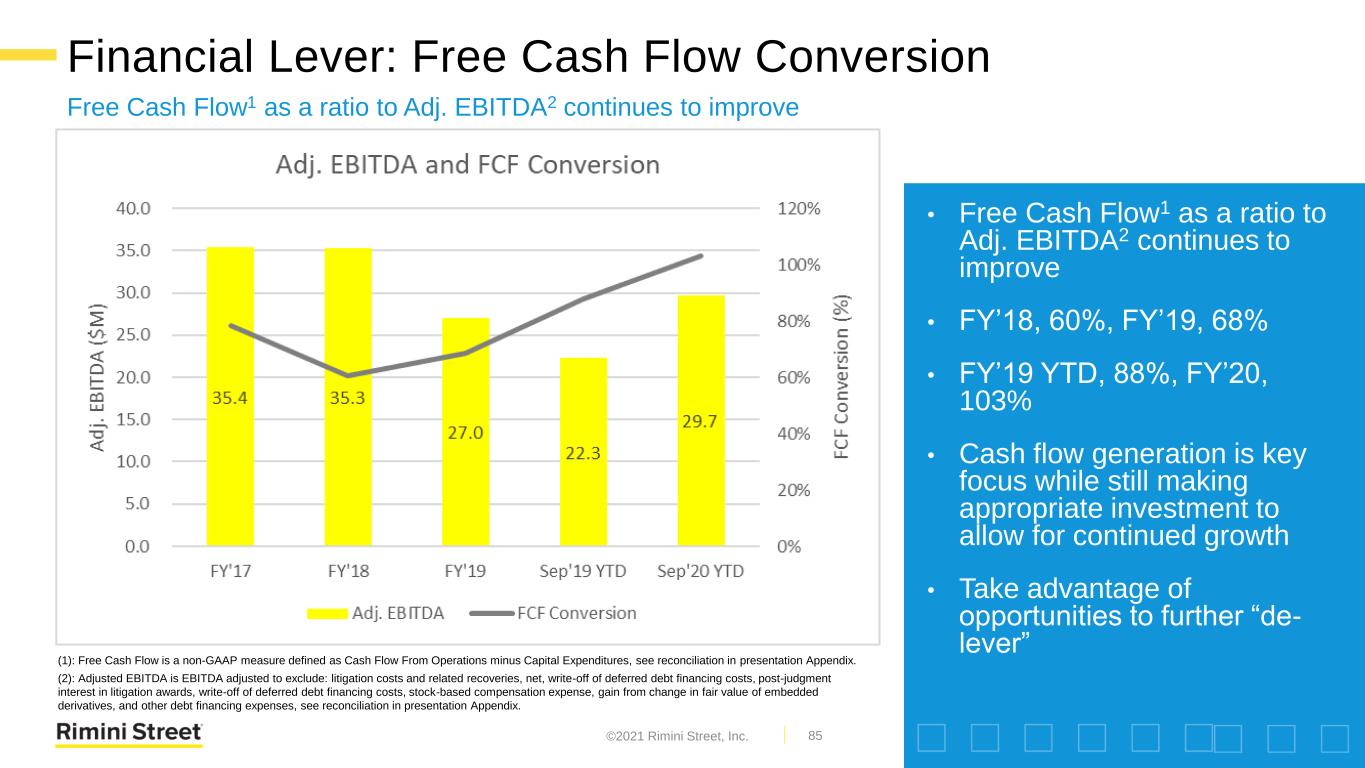

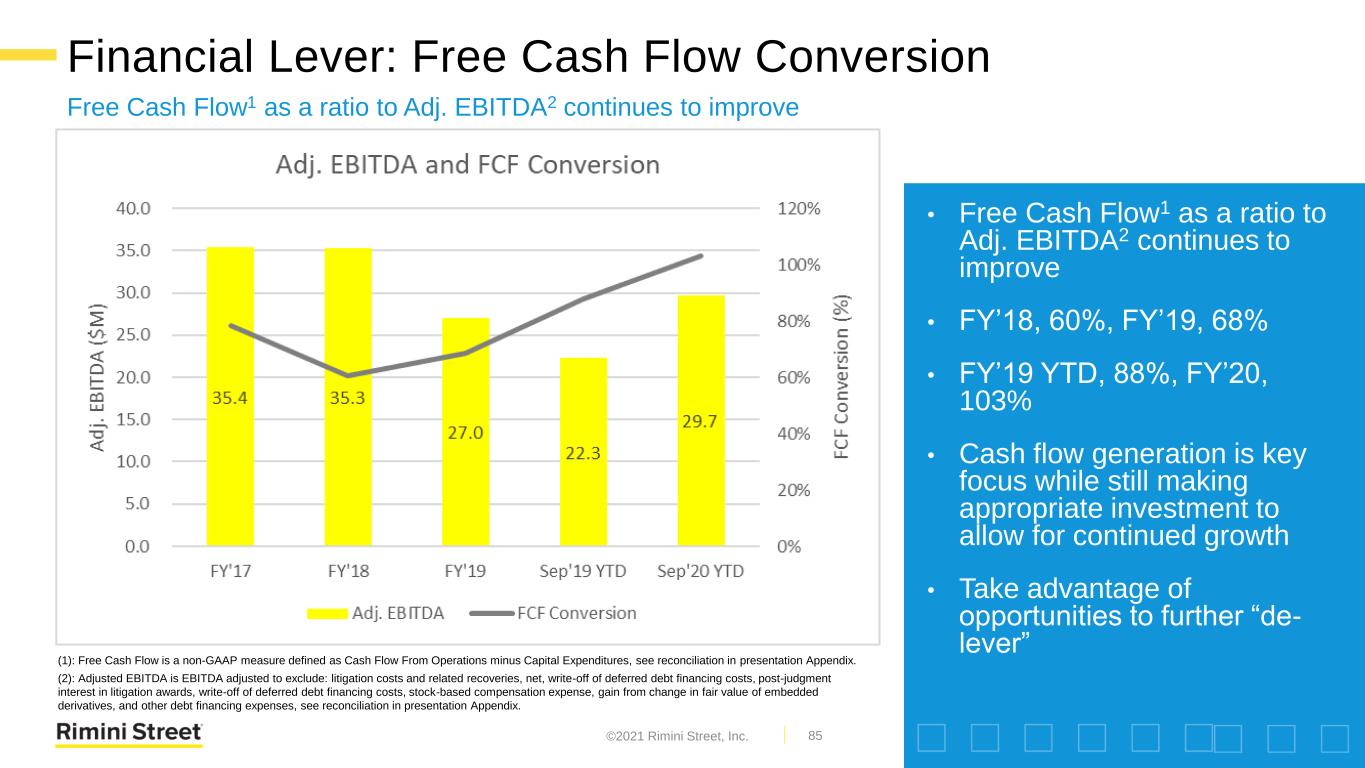

Financial Lever: Free Cash Flow Conversion Free Cash Flow1 as a ratio to Adj. EBITDA2 continues to improve • FY’18, 60%, FY’19, 68% • FY’19 YTD, 88%, FY’20, 103% • Cash flow generation is key focus while still making appropriate investment to allow for continued growth • Take advantage of opportunities to further “de-lever” • Free Cash Flow1 as a ratio to Adj. EBITDA2 continues to improve • FY’18, 60%, FY’19, 68% • FY’19 YTD, 88%, FY’20, 103% • Cash flow generation is key focus while still making appropriate investment to allow for continued growth • Take advantage of opportunities to further “de- lever” 85 (1): Free Cash Flow is a non-GAAP measure defined as Cash Flow From Operations minus Capital Expenditures, see reconciliation in presentation Appendix. (2): Adjusted EBITDA is EBITDA adjusted to exclude: litigation costs and related recoveries, net, write-off of deferred debt financing costs, post-judgment interest in litigation awards, write-off of deferred debt financing costs, stock-based compensation expense, gain from change in fair value of embedded derivatives, and other debt financing expenses, see reconciliation in presentation Appendix. ©2021 Rimini Street, Inc.

Financial Lever: Effective Tax Rate Rimini Street is a global company with fast-growing revenues outside of the US ▪ Short-Term Taxation ▪ Increased global tax due to significant revenue increase from outside US ▪ Optimizing operating model structure in certain high taxation international jurisdictions ▪ Mid-Term Tax Minimization Strategy ▪ Evaluating global structure to ensure optimal tax efficiency and utilization of substantial accrued US net operating losses (NOL) of approximately $170M. ▪ Long-Term Tax Planning ▪ Targeting consolidated effective tax-rate no greater than US Corporate rate ▪ Watching new US administration tax policy closely as a Tax Reform Act is expected ▪ US Corporate Tax rate increase not detrimental in short-term due to significant accrued NOLs 86©2021 Rimini Street, Inc.

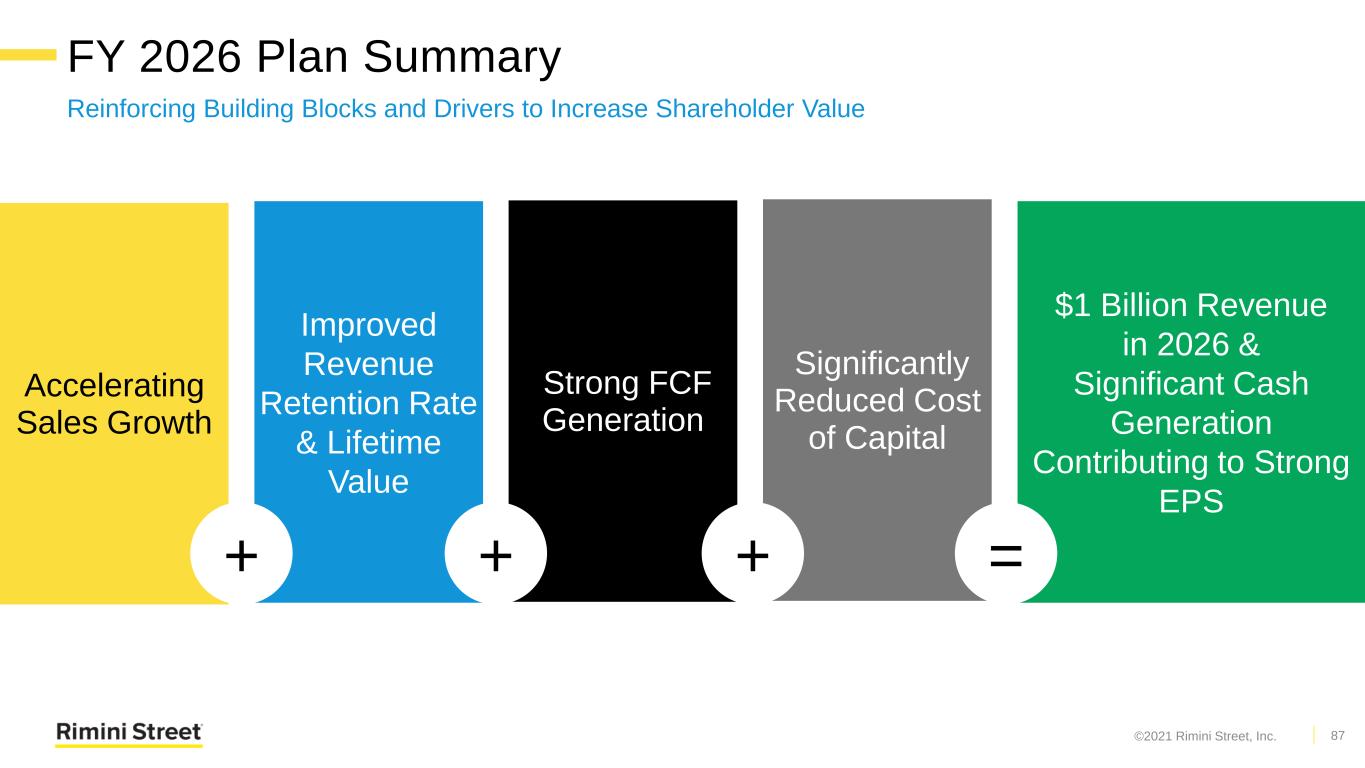

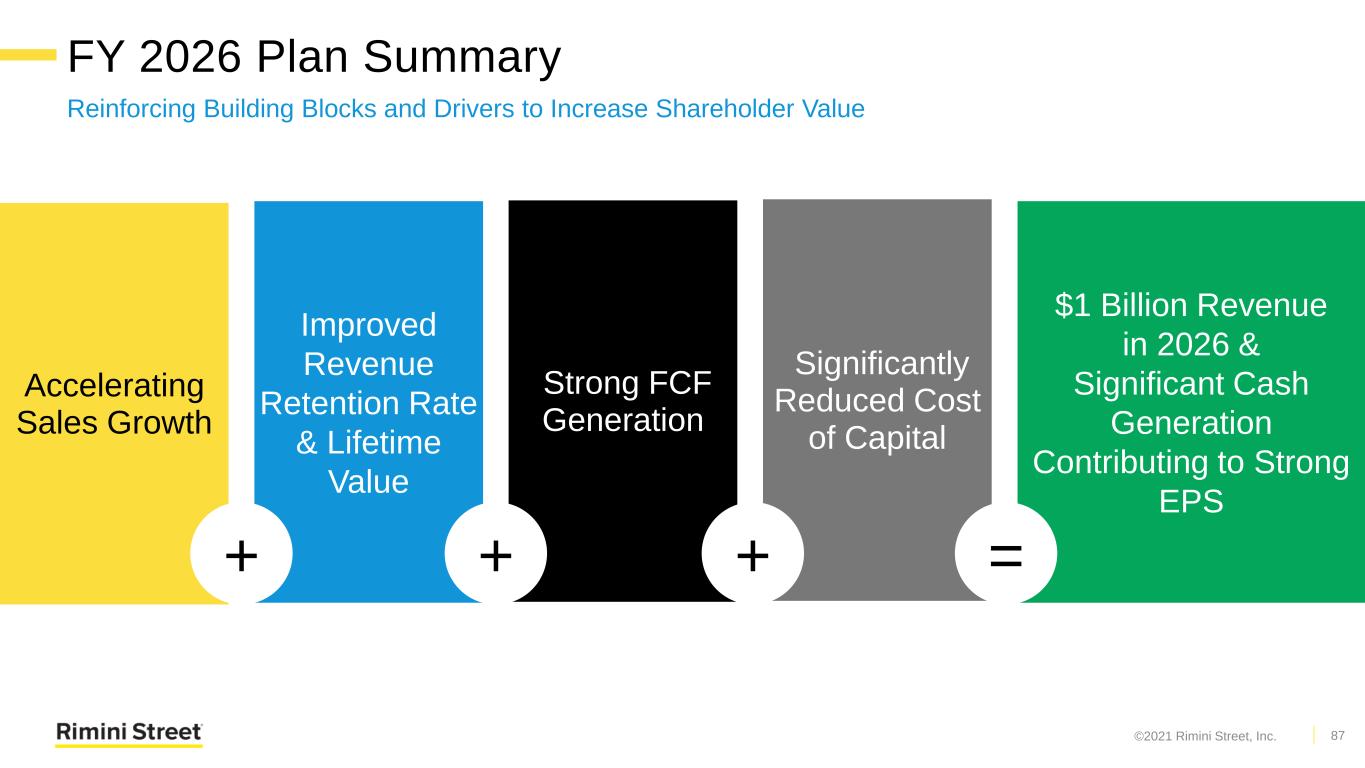

FY 2026 Plan Summary 87 Accelerating Sales Growth Improved Revenue Retention Rate & Lifetime Value Strong FCF Generation Significantly Reduced Cost of Capital $1 Billion Revenue in 2026 & Significant Cash Generation Contributing to Strong EPS + + + = Reinforcing Building Blocks and Drivers to Increase Shareholder Value ©2021 Rimini Street, Inc.

89 Q&A

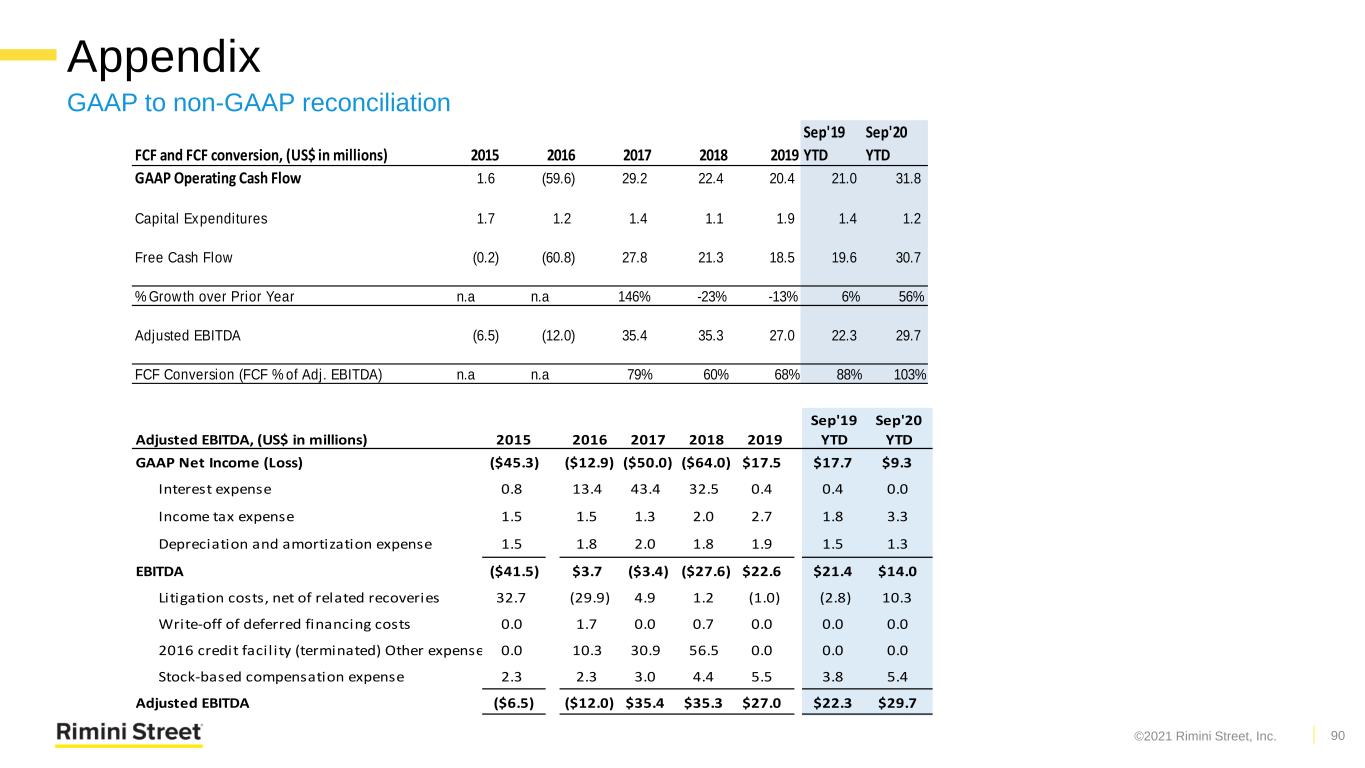

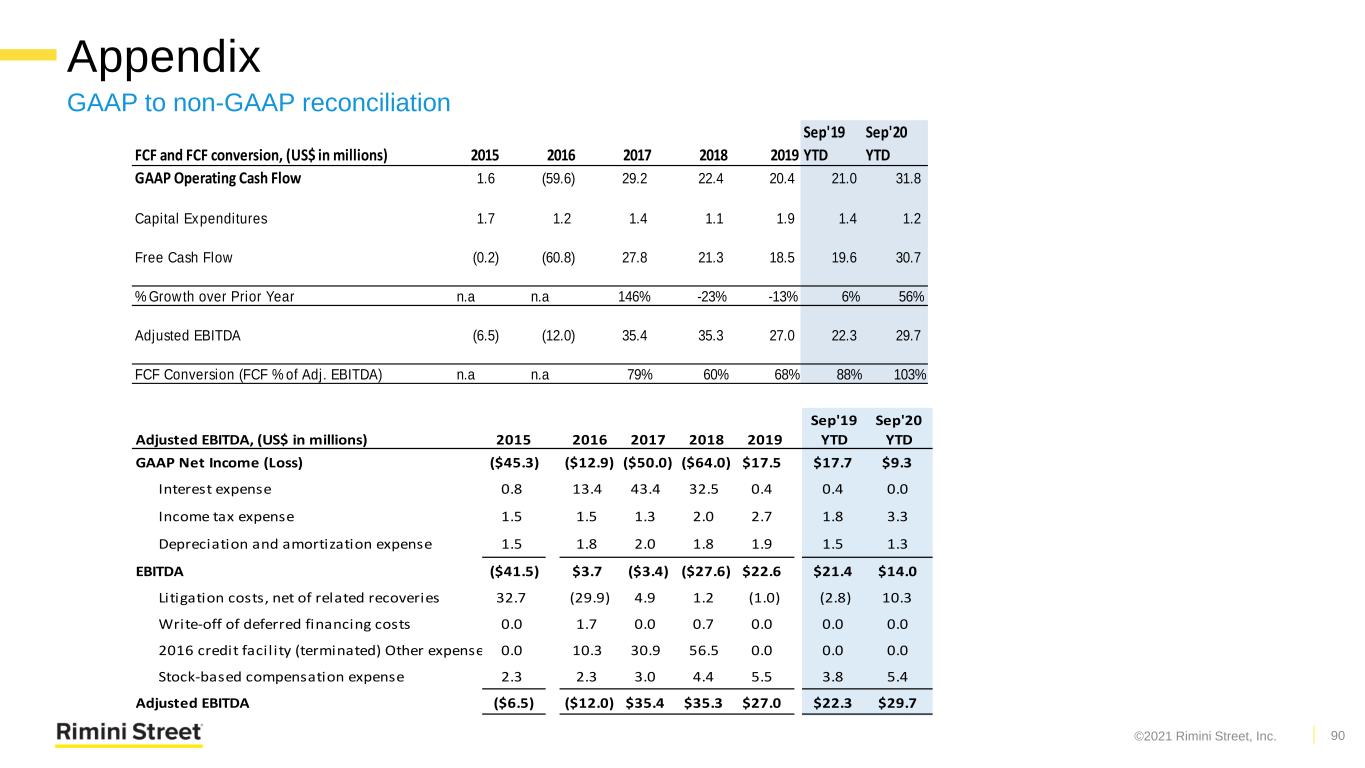

Appendix GAAP to non-GAAP reconciliation 90 Adjusted EBITDA, (US$ in millions) 2015 2016 2017 2018 2019 Sep'19 YTD Sep'20 YTD GAAP Net Income (Loss) ($45.3) ($12.9) ($50.0) ($64.0) $17.5 $17.7 $9.3 Interest expense 0.8 13.4 43.4 32.5 0.4 0.4 0.0 Income tax expense 1.5 1.5 1.3 2.0 2.7 1.8 3.3 Depreciation and amortization expense 1.5 1.8 2.0 1.8 1.9 1.5 1.3 EBITDA ($41.5) $3.7 ($3.4) ($27.6) $22.6 $21.4 $14.0 Litigation costs, net of related recoveries 32.7 (29.9) 4.9 1.2 (1.0) (2.8) 10.3 Write-off of deferred financing costs 0.0 1.7 0.0 0.7 0.0 0.0 0.0 2016 credit facil ity (terminated) Other expenses and adjustments 0.0 10.3 30.9 56.5 0.0 0.0 0.0 Stock-based compensation expense 2.3 2.3 3.0 4.4 5.5 3.8 5.4 Adjusted EBITDA ($6.5) ($12.0) $35.4 $35.3 $27.0 $22.3 $29.7 FCF and FCF conversion, (US$ in millions) 2015 2016 2017 2018 2019 Sep'19 YTD Sep'20 YTD GAAP Operating Cash Flow 1.6 (59.6) 29.2 22.4 20.4 21.0 31.8 Capital Expenditures 1.7 1.2 1.4 1.1 1.9 1.4 1.2 Free Cash Flow (0.2) (60.8) 27.8 21.3 18.5 19.6 30.7 % Growth over Prior Year n.a n.a 146% -23% -13% 6% 56% Adjusted EBITDA (6.5) (12.0) 35.4 35.3 27.0 22.3 29.7 FCF Conversion (FCF % of Adj. EBITDA) n.a n.a 79% 60% 68% 88% 103% ©2021 Rimini Street, Inc.

91 Revenue 2018 2019 2020 Q1 58.5 65.9 78.0 Q2 63.4 69.9 78.4 Q3 63.4 69.2 82.5 Q4 68.1 76.1 Full Year 253.4 281.1 YOY % chg. 17.9% 10.9% Calc. Billings 2018 2019 2020 Q1 72.9 65.7 65.2 Q2 68.7 78.1 74.2 Q3 36.8 51.3 68.3 Q4 102.7 124.7 Full Year 281.1 319.8 YOY % chg. 22.5% 13.8% Backlog 2018 2019 2020 Q1 346.9 400.9 466.7 Q2 357.3 420.7 475.9 Q3 354.4 430.1 502.8 Q4 396.3 482.9 Full Year 396.3 482.9 YOY % chg. 26.4% 21.9% Includes ASC 606 adjustments Deferred Rev. 2018 2019 2020 Q1 183.5 196.6 222.7 Q2 188.7 204.8 218.5 Q3 162.1 186.9 204.3 Q4 196.7 235.5 Full Year 196.7 235.5 YOY % chg. 16.4% 19.7% Appendix Quarterly breakout of key financial metrics ©2021 Rimini Street, Inc.