77 RIO ROBLES, SAN JOSE, CALIFORNIA 95134

PROPOSED MERGERS—YOUR VOTE IS VERY IMPORTANT

Dear Class A Shareholders:

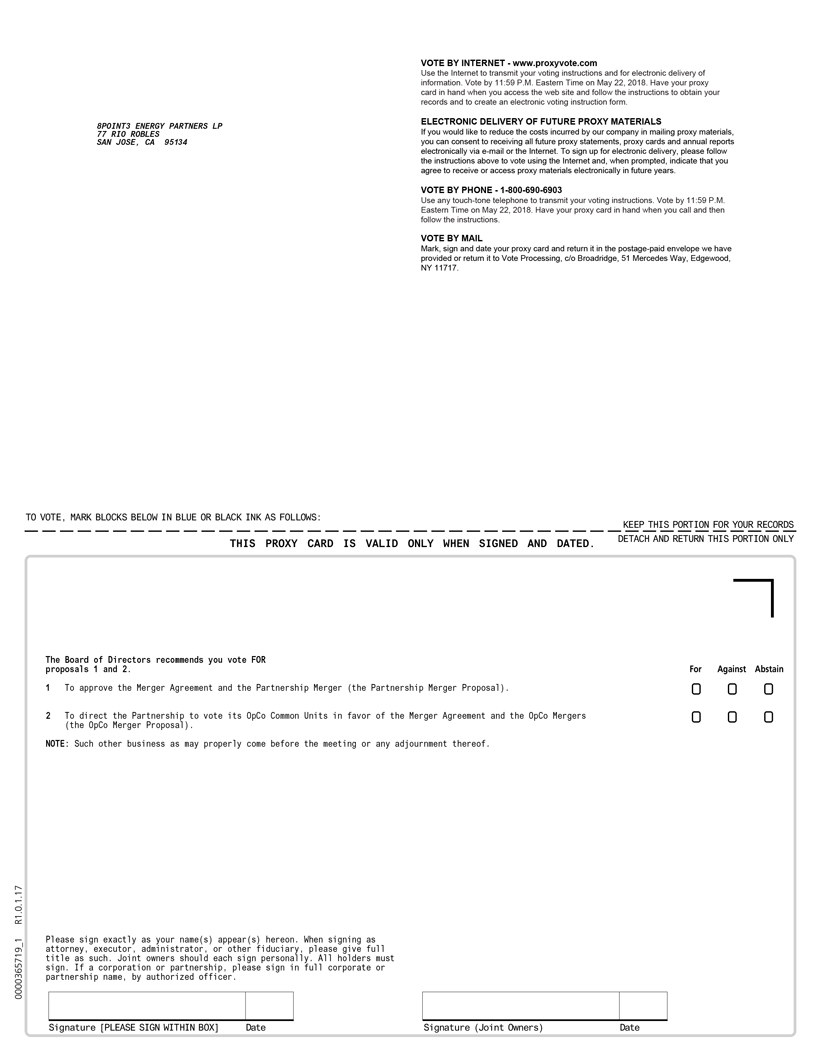

We cordially invite you to attend a special meeting of the holders (the “Shareholders”) of Class A shares representing limited partner interests (“Class A shares”) in 8point3 Energy Partners LP, a Delaware limited partnership (the “Partnership”), to be held on May 23, 2018 at 9:00 a.m. (Pacific Time), at 77 Rio Robles, San Jose, California 95134 (the “Shareholder Meeting”).

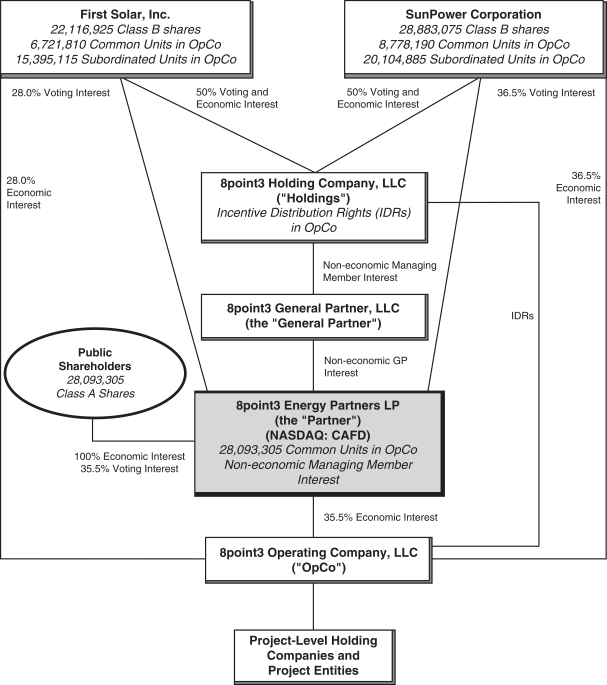

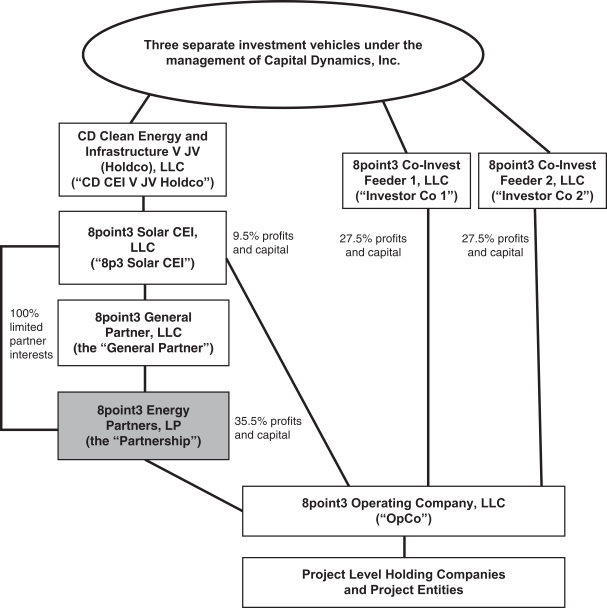

On February 5, 2018, the Partnership entered into an Agreement and Plan of Merger and Purchase Agreement (the “Merger Agreement”) with 8point3 General Partner, LLC, a Delaware limited liability company and the general partner of the Partnership (the “General Partner”), 8point3 Operating Company, LLC, a Delaware limited liability company (“OpCo” and, together with the Partnership and the General Partner, the “Partnership Entities”), 8point3 Holding Company, LLC, a Delaware limited liability company, 8point3 Solar CEI, LLC, a Delaware limited liability company (“8point3 Solar”), 8point3Co-Invest Feeder 1, LLC, a Delaware limited liability company (“Investor Co 1”), 8point3Co-Invest Feeder 2, LLC, a Delaware limited liability company (“Investor Co 2”), CD Clean Energy and Infrastructure V JV (Holdco), LLC, a Delaware limited liability company (“CD CEI V JV Holdco” and, together with 8point3 Solar, Investor Co 1 and Investor Co 2, collectively, “Parent”), 8point3 Partnership Merger Sub, LLC, a Delaware limited liability company and wholly owned subsidiary of 8point3 Solar (“Partnership Merger Sub”), 8point3 OpCo Merger Sub 1, LLC, a Delaware limited liability company and wholly owned subsidiary of Parent (“OpCo Merger Sub 1”), and 8point3 OpCo Merger Sub 2, LLC, a Delaware limited liability company and wholly owned subsidiary of Parent (“OpCo Merger Sub 2” and, together with OpCo Merger Sub 1, the “OpCo Merger Subs” and, the OpCo Merger Subs, together with Parent and Partnership Merger Sub, the “Parent Entities”).

Pursuant to the Merger Agreement, (i) OpCo Merger Sub 1 will, upon the terms and subject to the conditions thereof, merge with and into OpCo (“OpCo Merger 1”), with OpCo surviving OpCo Merger 1, (ii) OpCo Merger Sub 2 will, upon the terms and subject to the conditions thereof, merge with and into OpCo (“OpCo Merger 2” and, together with OpCo Merger 1, the “OpCo Mergers”), with OpCo surviving OpCo Merger 2, and (iii) Partnership Merger Sub will, upon the terms and subject to the conditions thereof, merge with and into the Partnership (the “Partnership Merger” and, together with the OpCo Mergers, the “Mergers”), with the Partnership surviving the Partnership Merger.

Upon the closing of the Transactions (as defined below), each issued and outstanding Class A share, each issued and outstanding common unit representing a limited liability company interest in OpCo (“OpCo Common Unit”), other than the OpCo Common Units owned by the Partnership, and each issued and outstanding subordinated unit representing a limited liability company interest in OpCo (“OpCo Subordinated Unit”) will represent the right to receive an amount in cash equal to $12.35 per share or unit, as applicable, and, in each case, without interest and less any applicable withholding taxes, subject to adjustment at closing at a set daily rate representing cash expected to be generated between December 1, 2017 and closing less distributions declared (to the extent the record date has passed prior to closing) or paid after January 12, 2018 and prior to closing (as further described in the attached proxy statement), and each share or unit shall no longer be outstanding, automatically be canceled and cease to exist, upon the terms and subject to the conditions set forth in the Merger Agreement.

The conflicts committee (the “GP Conflicts Committee”) of the board of directors of the General Partner (the “General Partner Board”), consisting of three independent directors, after consultation with its independent legal and financial advisors, has unanimously (i) determined that the Mergers, including the Merger Agreement and the transactions contemplated thereby on the terms set forth therein (the “Transactions”), are advisable, fair and reasonable to, and in the best interests of, the Partnership Group (as defined in the Amended and Restated Agreement of Limited Partnership, dated as of June 24, 2015 (the “Partnership Agreement”)) and the holders of Class A shares of the Partnership (other than the General Partner, First Solar, Inc., a Delaware corporation (“First Solar”), SunPower Corporation, a Delaware corporation (“SunPower” and, together with First Solar, the “Sponsors”) and their affiliates) (the “Public Shareholders”), (ii) approved the Mergers, including the Merger Agreement and the Transactions, such approval constituting “Special Approval” pursuant to Section 7.9(a) of the Partnership Agreement, (iii) recommended to the General Partner Board that the General Partner Board approve the Mergers and consummate the Transactions on the terms set forth in the Merger Agreement and (iv) recommended to the Public Shareholders that the Public Shareholders approve the Merger Agreement and the Mergers.

The General Partner Board, based in part upon the recommendation of the GP Conflicts Committee, unanimously (i) determined that it is in the best interests of the General Partner, the Partnership Group, the Shareholders and the holders of the OpCo Common Units and OpCo Subordinated Units (the holders of such OpCo Common Units and OpCo Subordinated Units, the “Unitholders”), and declared it advisable, for the Partnership Entities to enter into the Merger Agreement and to consummate the