2CONFIDENTIAL | ©2015 8point3 Energy Partners©2018 8point3 Energy Partners ibdroot\Projects\IBD-NY\harpsichord2017\599292_1\Marketing Materials\04. Announcement Presentation\Project Leaf Announcement Presentation v05.pptx Disclaimer FORWARD LOOKING STATEMENTS This presentation includes various “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. All statements other than statements of historical fact are, or may be deemed to be, forward-looking statements. Forward looking statements are statements of future expectations that are based on management’s current expectations and assumptions and involve known and unknown risks and uncertainties that could cause actual results, performance or events to differ materially from those expressed or implied in these statements. Forward-looking statements include, among other things, statements expressing management’s expectations, beliefs, estimates, forecasts, projections and assumptions. You can identify our forward looking statements by words such as “anticipate”, “believe”, “estimate”, “expect”, “forecast”, “goals”, “objectives”, “outlook”, “intend”, “plan”, “predict”, “project”, “risks”, “schedule”, “seek”, “target”, “could”, “may”, “will”, “should” or “would” or other similar expressions that convey the uncertainty of future events or outcomes. In accordance with “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, these statements are accompanied by cautionary language identifying important factors, though not necessarily all such factors, which could cause future outcomes to differ materially from those set forth in forward-looking statements. In particular, expressed or implied statements concerning the sponsors’ ownership interest in the Partnership, expectations of plans, strategies, objectives and growth and anticipated financial and operational performance of the Partnership and its subsidiaries, including guidance regarding the Partnership’s revenue, net income, adjusted EBITDA, cash available for distribution and distributions, other future actions, conditions or events such as the commercial operation dates of projects, future operating results or the ability to generate sales, income or cash flow or to make distributions are forward-looking statements. Forward-looking statements are not guarantees of performance. They involve risks, uncertainties and assumptions. Future actions, conditions or events and future results of operations may differ materially from those expressed in these forward-looking statements. Forward-looking statements speak only as of the date of this presentation, February 5, 2018, and we disclaim any obligation to update such statements for any reason, except as required by law. All forward-looking statements contained in this presentation are expressly qualified in their entirety by the cautionary statements contained or referred to in this paragraph. Many of the factors that will determine these results are beyond our ability to control or predict. These factors include the risk factors described under “Risk Factors” in our 2017 Form 10-K filed with the Securities and Exchange Commission ("SEC") on February 5, 2018. If any of those risks occur, it could cause our actual results to differ materially from those contained in any forward-looking statement. Because of these risks and uncertainties, you should not place undue reliance on any forward-looking statement. ADDITIONAL INFORMATION AND WHERE TO FIND IT This communication contains information about the proposed merger transaction involving the Partnership and its subsidiaries and affiliates of Capital Dynamics, Limited (“CapDyn”). In connection with the proposed merger transaction, the Partnership will file with the SEC a proxy statement for the Partnership’s shareholders. The Partnership will mail the final proxy statement to its shareholders. INVESTORS AND SHAREHOLDERS ARE URGED TO READ THE PROXY STATEMENT AND OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC CAREFULLY WHEN THEY BECOME AVAILABLE BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PARTNERSHIP, CAPDYN, THE PROPOSED MERGER TRANSACTIONS AND RELATED MATTERS. Investors and shareholders will be able to obtain free copies of the proxy statement and other documents filed with the SEC by the Partnership through the website maintained by the SEC at www.sec.gov. In addition, investors and shareholders will be able to obtain free copies of documents filed by the Partnership with the SEC from the Partnership’s website, www. 8point3energypartners.com, under the heading “SEC Filings” in the “Investor Relations” tab. PARTICIPANTS IN THE SOLICITATION The Partnership and its general partner’s directors and executive officers, and First Solar, Inc. (“First Solar”) and SunPower Corporation (“SunPower”) and their respective directors and executive officers, are deemed to be participants in the solicitation of proxies from the shareholders of the Partnership in respect of the proposed merger transaction. Information regarding the directors and executive officers of the Partnership’s general partner, First Solar and SunPower is contained in our 2017 Form 10-K filed with the SEC on February 5, 2018, First Solar’s 2016 Form 10-K filed with the SEC on February 22, 2017 and SunPower’s 2016 Form 10-K filed with the SEC on February 17, 2017, respectively. Free copies of these documents may be obtained from the sources described above.

4CONFIDENTIAL | ©2015 8point3 Energy Partners©2018 8point3 Energy Partners ibdroot\Projects\IBD-NY\harpsichord2017\599292_1\Marketing Materials\04. Announcement Presentation\Project Leaf Announcement Presentation v05.pptx Transaction Summary Structure and Consideration Financing Approvals and Timing • Sale to Capital Dynamics of 100% of the outstanding equity interests in 8point3 Energy Partners LP and related entities (“8point3” or the “Company”) • All shareholders, including the Sponsors collectively, to receive: • $12.35 per share in cash; • Increased at closing based on a set daily rate representing cash expected to be generated between December 1, 2017 and closing; and • Decreased by dividends paid after January 12, 2018 and prior to closing • No incremental value to the Sponsors from Capital Dynamics in respect of their ownership of our general partner or incentive distribution rights in 8point3 Operating Company, LLC • To enhance value to all shareholders, at closing: • SunPower agreed to transfer Upper Tier SPWR Entity Class A Interests for no consideration; and • First Solar agreed to retain the lease arrangement with 8point3 on Maryland Solar through 2019 under certain circumstances • Implied Equity Value of approximately $977 million and Enterprise Value of approximately $1,658 million • ~$1.1 billion of committed debt financing • No financing contingency • Subject to approval by majority vote of 8point3’s Public Shareholders • Expected to close in fiscal Q2 or Q3 2018, subject to receipt of regulatory approvals and satisfaction of other customary conditions

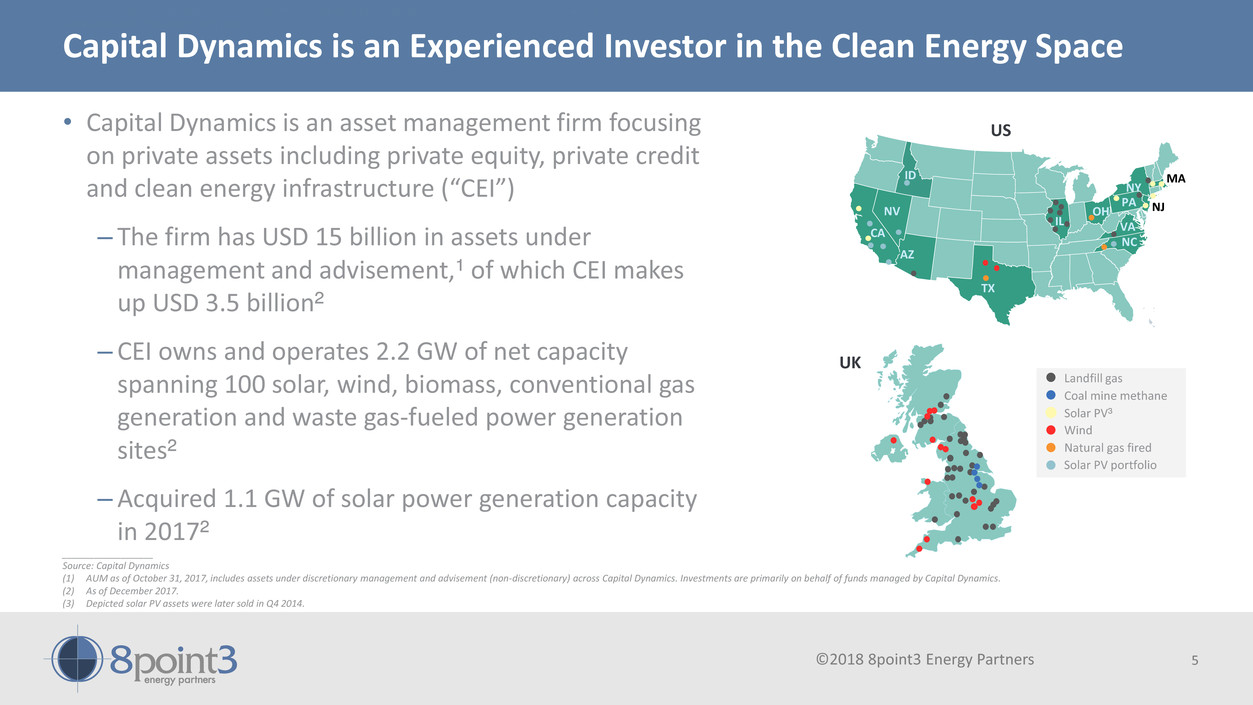

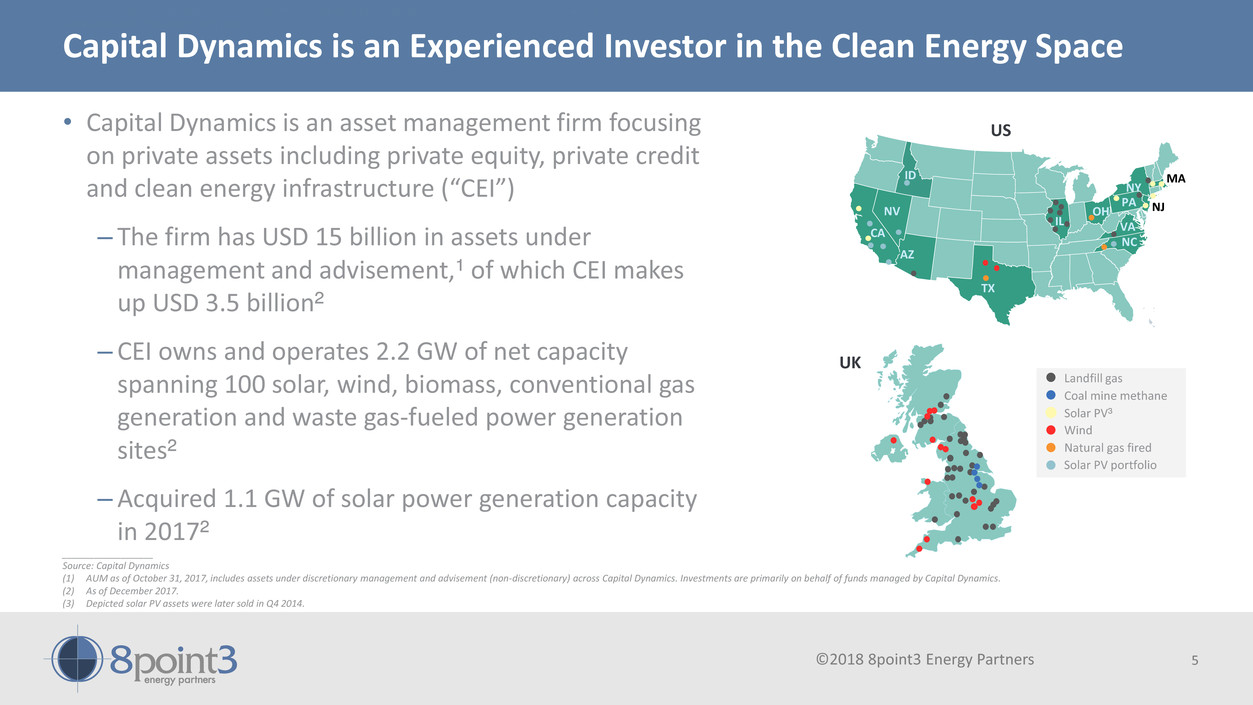

5CONFIDENTIAL | ©2015 8point3 Energy Partners©2018 8point3 Energy Partners ibdroot\Projects\IBD-NY\harpsichord2017\599292_1\Marketing Materials\04. Announcement Presentation\Project Leaf Announcement Presentation v05.pptx • Capital Dynamics is an asset management firm focusing on private assets including private equity, private credit and clean energy infrastructure (“CEI”) – The firm has USD 15 billion in assets under management and advisement,¹ of which CEI makes up USD 3.5 billion² – CEI owns and operates 2.2 GW of net capacity spanning 100 solar, wind, biomass, conventional gas generation and waste gas-fueled power generation sites² – Acquired 1.1 GW of solar power generation capacity in 2017² Capital Dynamics is an Experienced Investor in the Clean Energy Space UK Landfill gas Coal mine methane Solar PV³ Wind Natural gas fired Solar PV portfolio CA PA US AZ VA NY IL TX NJ ID OH NC MA NV ____________________ Source: Capital Dynamics (1) AUM as of October 31, 2017, includes assets under discretionary management and advisement (non-discretionary) across Capital Dynamics. Investments are primarily on behalf of funds managed by Capital Dynamics. (2) As of December 2017. (3) Depicted solar PV assets were later sold in Q4 2014.

6CONFIDENTIAL | ©2015 8point3 Energy Partners©2018 8point3 Energy Partners ibdroot\Projects\IBD-NY\harpsichord2017\599292_1\Marketing Materials\04. Announcement Presentation\Project Leaf Announcement Presentation v05.pptx Significant Challenges for 8point3 as a Stand-Alone Public Company • Challenging market conditions for 8point3 led the Sponsors to explore options for the sale of their interests in the Company – The evolving nature of the solar industry has enabled the Sponsors’ strategies of recycling capital faster and more efficiently by selling projects at a stage of construction and development that is earlier than best suited for 8point3 – 8point3’s higher cost of capital and difficulty in accessing the capital markets on a consistent basis resulted in several replacements of projects under the ROFO, as well as 8point3 later waiving its rights to acquire a number of ROFO projects from the Sponsors, with such waived projects subsequently acquired by third party buyers at purchase prices higher than those offered to 8point3 – On April 5, 2017, First Solar announced that it was reviewing alternatives for the sale of its interest in 8point3 and SunPower announced that it was evaluating strategic options for its investment in 8point3, which, if consummated, would remove the Sponsors as a consistent source of acquisition opportunities • Such challenges present strategic and financial implications for 8point3’s operations and prospects as a stand-alone public company without the Sponsors, and its resulting competitive position in the market for renewable energy assets – Lack of an acquisition pipeline or visible growth strategy – Difficulty maintaining a sustainable, long-term distribution growth strategy – Refinancing 8point3’s capital structure may be necessary, in the near-term and over time, with amortizing debt (among other financing options) in order to acquire additional projects • In light of these and other factors, the Sponsors’ and 8point3’s Boards determined that Capital Dynamics’s offer is the most compelling proposal to all shareholders relative to other options, including the option to continue as a stand-alone public company