A. Stephen Meadows

Chief Accounting Officer

February 22, 2016

Securities and Exchange Commission

Division of Corporate Finance

100 F Street, N. E.

Washington, DC 20549-0405

Branch Chief

Re: WestRock Company

Form 10-K for the Fiscal Year ended September 30, 2015

Filed November 27, 2015

File No. 001-37484

Mr. Hiller:

Reference is made to the letter dated February 5, 2016 (the “Comment Letter”) to Mr. Ward H. Dickson, Chief Financial Officer of WestRock Company (the “Company”, “WestRock”, “our” or “we”), setting forth the comments of the staff (the “Staff”) of the Division of Corporation Finance of the Securities and Exchange Commission (the “Commission”) regarding the filing referenced above.

This letter sets forth the Company’s response to the Staff’s comment. For your convenience, the Staff’s comment contained in the Comment Letter has been restated below in its entirety, with the response to the comment set forth immediately following the comment.

Form 10-K for Fiscal Year Ended September 30, 2015

Financial Statements

Note 19 – Segment Information, page 108

We note disclosure indicating that subsequent to your recent merger, you aligned your financial results into four reportable segments: corrugated packaging, consumer packaging, specialty chemicals, and land and development.

You indicate the corrugated packaging segment consists of corrugated mill and packaging operations, as well as your recycling operations; while the consumer packaging segment consists of consumer mills, folding carton, beverage, merchandising displays, home, health and beauty dispensing, and partition operations.

Please clarify the extent to which your various operations, mills and products represent operating segments that have been aggregated in your corrugated packaging and consumer packaging reportable segments; and submit the analysis that you performed in concluding aggregation of each of the operating segments would be consistent with the criteria in FASB ASC paragraph 280-10-50-11.

Response:

In accordance with FASB ASC paragraphs 280-10-50-1 through 50-9, we have determined that our operating segments and reportable segments are Corrugated Packaging, Consumer Packaging, Specialty Chemicals, and Land and Development. We do not aggregate any of our operating segments in order to determine our reportable segments.

504 Thrasher Street • Norcross, GA 30071 • 678-291-7377

www.westrock.com

In accordance with FASB ASC paragraph 280-10-50-1, the operating segments have been organized based on how our chief operating decision maker (“CODM”) reviews the various businesses. As stated, the operational businesses comprise two packaging systems, Corrugated Packaging and Consumer Packaging, a Specialty Chemicals business and a Land and Development business. The Specialty Chemicals and Land and Development businesses are individually unique from each other and from our two packaging systems, and are therefore considered as two separate segments and reviewed as such by the CODM. The Company’s remaining business is the manufacture and converting of various paper products, primarily in North America, plus some relatively small operations in South America, Europe and Asia. The packaging systems are conducted through two separate systems since the nature of the manufacturing processes, the products, the customers and the markets are different for these two systems. A full description of these two segments is included in our recent 10-K on pages 5 and 6.

Each of the two packaging systems are unique “holistic systems” unto themselves with minimal overlap and are operationally managed and reviewed by the CODM as such. The goal of the segment leadership is to maximize the profitability of the entire portfolio of assets within each respective system either through the sale of product to our customers direct from our mills or from our downstream converting plants. Note that each system has its own high degree of integration, in that a significant portion of the mills’ upstream production, within each system, is used to provide product to the downstream converting operations, within each system.

The CODM reviews each of these two systems separately on a holistic basis. The Corrugated Packaging and Consumer Packaging operating segments production of containerboard or paperboard (respectively) in our mills, and the consumption of the mills production within the converting operations, require frequent decisions to be made on an integrated basis. Due to the high fixed costs of the mills, the entire system benefits if the mills run at high capacity, therefore, incremental converting volume decisions are frequently made based on the impact on the system. Key operating decisions affecting capital investments, acquisitions, plant closures, etc. (for both the mills, logistics and converting plants), are made by the CODM based on what the CODM believes will provide the best benefit for the entire system. Recent examples include:

| |

| • | The recent acquisition of certain entities of Cenveo Inc. and the pending Grupo Gondi joint venture which will provide yet greater vertical integration |

| |

| • | The recent acquisition of the Dublin, GA and Newberg, OR corrugated mills, with the subsequent decision to close the Coshocton, OH and Uncasville, CT corrugated mills, and the Newberg mill |

| |

| • | The recent investment in many new warehouses located at strategic locations between the corrugated mills and the corrugated converting plants, in order to improve availability and speed of delivery of products to converting customers |

In conclusion, these two vertically integrated operating segments produce different products and serve different customer types and markets. As such, we believe that they act as independent operating segments – Corrugated Packaging and Consumer Packaging.

Identification of operating segments

In identifying our operating segments we considered FASB ASC paragraph 280-10-50-1 which states:

“An operating segment is a component of a public entity that has all of the following characteristics:

| |

| a. | It engages in business activities from which it may earn revenues and incur expenses (including revenues and expenses relating to transactions with other components of the same public entity), |

| |

| b. | Its operating results are regularly reviewed by the public entity’s chief operating decision maker to make decisions about resources to be allocated to the segment and assess its performance, and |

| |

| c. | Its discrete financial information is available.” |

Chief operating decision maker

In order to properly identify which components of our business meet all three of the criteria above, we first identified our CODM. In identifying our CODM, we considered FASB ASC paragraph 280-10-50-5 which states:

“The term chief operating decision maker identifies a function, not necessarily a manager with a specific title. That function is to allocate resources to and assess the performance of the segments of a public entity. Often the chief operating decision maker of a public entity is its chief executive officer or chief operating officer, but it may be a group consisting of, for example, the enterprise's president, executive vice presidents, and others.” (Emphasis added)

Based on our organizational and management structure, Steve Voorhees, CEO, serves as the CODM because he makes the key operating decisions including the allocation of resources and assessment of performance for the four operating segments of the organization.

| |

| • | Approval of operating budgets |

| |

| • | Approval of capital expenditure budgets |

| |

| • | Approval of restructuring activities |

| |

| • | Approval of acquisitions |

| |

| • | Approval of pricing decisions for largest customers |

Furthermore, in making the determination that Mr. Voorhees is the CODM, we considered the following:

| |

| • | Mr. Voorhees has four operational leaders that report directly to him: |

| |

| ◦ | Jim Porter, President, Paper Solutions |

| |

| ◦ | Bob Beckler, President, Packaging Solutions |

| |

| ◦ | Michael Wilson, CEO, Ingevity1 (Specialty Chemicals) |

| |

| ◦ | Ken Seeger, President, Land and Development |

| |

| • | While these four leaders have authority to make decisions in the respective businesses that they manage, they do not have the authority to allocate resources and assess performance across the entire organization (rather, this authority is held by Mr. Voorhees). |

Management Approach

After our determination of Mr. Voorhees as the CODM, we further considered which components of our business meet the three criteria of ASC 280-10-50-1 by considering the guidance in ASC 280-10-05-3 to 05-4 which states:

05-3 “…The guidance in this Subtopic requires that general-purpose financial statements include selected information reported on a single basis of segmentation. The method for determining what information to report is referred to as the management approach. The management approach is based on the way that management organizes the segments within the public entity for making operating decisions and assessing performance. Consequently, the segments are evident from the structure of the public entity's internal organization, and financial statement preparers should be able to provide the required information in a cost-effective and timely manner.”

05-4 “The management approach facilitates consistent descriptions of a public entity in its annual report and various other published information. It focuses on financial information that a public entity's decision makers use to make decisions about the public entity's operating matters. The components that management establishes for that purpose are called operating segments.”

______________________

| |

1 | As previously disclosed, we intend to complete the separation of our specialty chemicals business, now called Ingevity, through a spin-off or other alternative transaction. |

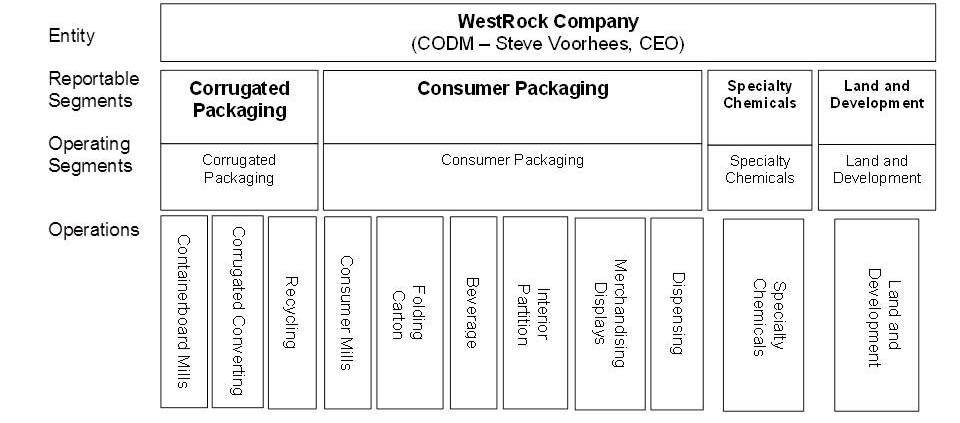

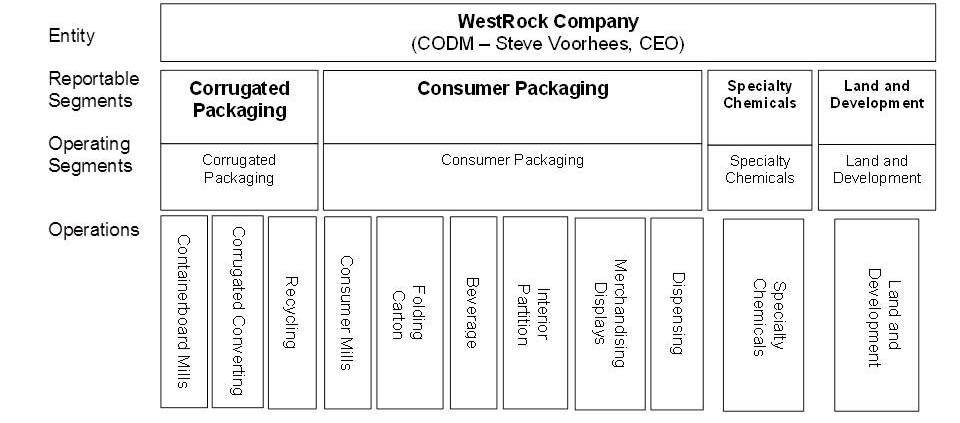

In considering “the way that management organizes the segments within the public entity for making operating decisions and assessing performance,” we considered the organizational and management structure of WestRock Company. The following chart outlines the organization of the Company’s operations and illustrates our four operating segments, which are also our reportable segments:

As noted above, our CODM has four operational leaders that report to him. Michael Wilson leads the Specialty Chemicals segment and Ken Seeger leads the Land and Development segment. Jim Porter and Bob Beckler share leadership responsibilities for the Corrugated Packaging segment and Consumer Packaging segment. This is due to the fact that Mr. Porter has responsibility for “Paper Solutions” (which includes all of the Company’s mills in both the Corrugated Packaging segment and Consumer Packaging segment) while Mr. Beckler has responsibility for “Packaging Solutions” (which includes all of the Company’s converting facilities in both the Corrugated Packaging segment and Consumer Packaging segment). The alignment of these leaders as heads of “Paper Solutions” and “Packaging Solutions” is a market-facing solution (i.e. that allows us to approach major customers in a unified manner so as to better serve them and create increased opportunities for WestRock across our product portfolio.

We considered whether this indicated that our operating segments should be organized around “Paper Solutions” and “Packaging Solutions” rather than Corrugated Packaging and Consumer Packaging. Upon evaluation, we determined that these market-facing groups did not meet the criteria of ASC 280-10-50-1 as our CODM does not use financial information about “Paper Solutions” or “Packaging Solutions” to allocate resources or assess performance of our organization. For example, “Paper Solutions” includes all of the Company’s mills, but the results of the corrugated mills do not have an impact on decisions made about the consumer mills. Rather, the entire corrugated system (the recycling operations, the mills and the corrugated container plants) is reviewed holistically (on a vertically-integrated basis) to make key operational decisions about the allocation of resources and to assess performance. Further, none of our senior executives’ short-term or long-term compensation plans are linked to the financial results of the market-facing structure; rather, they are linked to the consolidated results of the Company.

We also considered the guidance in ASC 280-10-50-6 which states:

“a public entity may produce reports in which its business activities are presented in a variety of different ways. If the chief operating decision maker uses more than one set of segment information, other factors may identify a single set of components as constituting a public entity’s operating segments, including the nature of the business activities of each component, the existence of managers responsible for them, and information presented to the Board of Directors.” (Emphasis added)

Our presentation of the four operating/reportable segments is consistent with the nature of the business activities of each component, the existence of managers responsible for them, and the information our chief financial officer presents to the board of directors and how we disclose our results publicly. Based on our continued interaction with investors and analysts, we believe that our structure is consistent with how they also look at our business and evaluate our results and future prospects.

Our CODM has regular discussions with our Presidents, regarding the performance of their operations and utilizes these conversations and financial information obtained to assess the performance of the operating segments. In assessing the financial information that the CODM uses to allocate resources and assess the performance of our organization, we considered the information that is provided to our CODM on a recurring basis. On a monthly basis, the CODM receives selected consolidated and operating/reportable segment financial information, primarily in our monthly meeting with operational and non-operational executives, including the following:

| |

| • | Sales and income by operating/reportable segment as well as other levels that facilitate the understanding of the operating/reportable segment results |

| |

| • | Adjusted EBITDA and Adjusted EBITDA margin by operating/reportable segment |

| |

| • | Comparisons of actual results versus forecasts and budgets by operating/reportable segment |

| |

| • | Forecasted consolidated and segment sales and segment income by operating/reportable segments for various future periods |

| |

| • | Various information related to capital expenditures by operating/reportable segment and for the entire company, including comparisons against budget and forecast |

| |

| • | Corrugated integrated profitability reports |

| |

| • | Consolidated GAAP and adjusted earnings per share |

| |

| • | Consolidated Adjusted EBITDA, consolidated company leverage ratio and consolidated free cash flow |

| |

| • | Performance to date against consolidated multi-year incentive financial goals |

| |

| • | Consolidated income statement, balance sheet, cash flow and other items germane to the period such as consolidated restructuring costs, SG&A by operating/reportable segments, consolidated days sales outstanding, days payables outstanding, days inventory outstanding and net working capital trend and published index information of selected commodities, net debt pay down |

Since selected divisional information is included in the financial information received by the CODM, we considered whether the divisions should be identified as separate operating segments. Excluding the Specialty Chemicals and Land and Development divisions, which are also operating and reporting segments, we have nine divisions (three within Corrugated Packaging and six within Consumer Packaging). These divisions do not meet the definition of an operating segment in accordance with ASC 280-10-50-1 since the operating results of these divisions are not regularly reviewed by our CODM to make decisions about the allocation of resources and assess performance of our business. Further, the division managers do not report to the CODM, but rather they report to the segment managers. Finally, we do not communicate financial results of the divisions in our public communications.

Segment Management

In identifying our operating segments, we further considered which components of our business meet the three criteria of ASC 280-10-50-1 by considering the guidance in ASC 280-10-50-7 which states:

“Generally, an operating segment has a segment manager who is directly accountable to and maintains regular contact with the chief operating decision maker to discuss operating activities, financial results, forecasts, or plans for the segment. The term segment manager identifies a function, not necessarily a manager with a specific title.” (Emphasis added)

We summarize our operating segment managers in the table below:

|

| |

| Operating Segments | Segment Managers |

| Corrugated Packaging | Jim Porter, President, Paper Solutions; Bob Beckler, President, Packaging Solutions |

| Consumer Packaging | Jim Porter, President, Paper Solutions; Bob Beckler, President, Packaging Solutions |

| Specialty Chemicals | Michael Wilson, CEO Ingevity |

| Land and Development | Ken Seeger, President |

Consistent with ASC 280-10-50-7, each operating segment is managed by a segment manager(s) that has overall responsibility for the operating results of its operations and has regular contact with the CODM in order to discuss operating activities, financial results, budgeting and forecasting, capital planning, or other plans for the operations. Due to the level of integration between our mills and converting operations, decisions are made based on the consolidated impact of items such as customer decisions.

As noted above, the Corrugated Packaging and Consumer Packaging segments consist of overlapping sets of components for which managers are held responsible. In light of this we considered the guidance in ASC 280-10-50-9 which states:

“The characteristics in paragraphs 280-10-50-1 and 280-10-50-3 may apply to two or more overlapping sets of components for which managers are held responsible. That structure is sometimes referred to as a matrix form of organization. For example, in some public entities, certain managers are responsible for different product and service lines worldwide, while other managers are responsible for specific geographic areas. The chief operating decision maker regularly reviews the operating results of both sets of components, and financial information is available for both. In that situation, the components based on products and services would constitute the operating segments” (Emphasis added).

As such, consistent with this guidance, we believe that our operating segments more closely reflect our vertically integrated products and services (e.g., Consumer Packaging and Corrugated Packaging) as discussed above.

Other Considerations

| |

| 1) | Our segment managers develop a bottoms-up budget that is presented to our CODM for review and input. Our CODM suggests changes, reviews revisions and approves the final budget that is presented to our board of directors. |

| |

| 2) | Quarterly we provide our board of directors with a Quarterly Financial Results presentation that is presented by our chief financial officer. It reflects our Consolidated as well as operating/reportable segment results. Although materials may change from presentation to presentation, the following is an example of the items that are generally provided in the Quarterly Financial Results presentation. Items included from period to period may vary and may compare against various periods such as actual vs. prior year, budget, forecast, etc. |

| |

| ▪ | Financial summary showing consolidated items such as: net sales, adjusted EBITDA, adjusted EPS, free cash flow, as well as other items germane to the quarter such as share repurchases, leverage ratio and/or other items from time to time such as net debt and/or net debt reduction, the impact of price, volume or commodity costs, each of which may be for the period or vs. prior year, previous periods, budgets, forecasts and/or analyst consensus. |

| |

| ▪ | Key financial metrics – consolidated information such as net sales, segment income, adjusted EBITDA and margin, Adjusted Net Income, GAAP EPS, Adjusted EPS, operating cash flow, capital expenditures, and free cash flow and/or free cash flow per share. |

| |

| ▪ | Adjusted EBITDA Bridge – the bridge compares Adjusted EBITDA generally from the current period to the prior year quarter with bars for items such as price/mix, volume, inflation/deflation, |

productivity/synergies and etc. Other similar bridges may be done on segment income or adjusted EPS.

| |

| ▪ | Results by operating/reportable segment – showing Net Sales, Segment Income and Segment Income as a percentage of sales, and Adjusted EBITDA and margin for the current and prior year period and/or various periods. In addition, the chart may contain a bridge similar to the Adjusted EBITDA Bridge discussed above for each segment and bullets regarding various points of interest for the quarter such as shipments, price and etc. |

| |

| ▪ | Consolidated Income Statements, Balance Sheets and/or Cash Flows |

| |

| ▪ | Consolidated Financial Position Chart – reflecting cash, outstanding debt, equity and components of debt and credit ratings, etc. |

| |

| ▪ | Synergy & Performance Improvement Chart(s) – information regarding our progress towards our $1 billion total productivity objective |

| |

| ▪ | Other charts that are less recurring include but are not limited to: |

| |

| • | Business Environment information – various slides showing containerboard and paperboard pricing/trends and/or index pricing by substrate |

| |

| • | Commodity information – information on price and/or quantities |

| |

| • | Consolidated Company data showing: Days Payables Outstanding, Days Inventory Outstanding, Days Sales Outstanding and Net Working Capital Days, Consolidated Accounts Receivable aging, Financing Summary or Debt Profile. |

| |

| • | Consolidated Restructuring costs – with costs summarized by category such as: acquisition, integration and plant closing and cash and non-cash for various periods. |

| |

| • | Consolidated Net Debt Bridge – bridge of net debt between two periods by source or use such as: pension, restructuring, capital expenditures, acquisitions, dividends, share repurchases and others. |

| |

| • | Other items that may be germane at the time, such as pension contributions, pension assets and liabilities, acquisitions, dividend changes, SG&A, synergy and performance improvement data, etc.; as well as information on acquisitions or comparisons of our operating/reportable segment results compared to analyst estimates. |

We expect similar items to be presented in the future. In addition to the Financial Results presentation, there may be a variety of other data provided to the BOD which includes items such as safety, customer satisfaction, key objectives and other various operational items presented by the business leaders.

Conclusion:

Based on factors outlined above, we have concluded that our operating segments are Corrugated Packaging, Consumer Packaging, Specialty Chemicals, and Land and Development. Additionally, as outlined above we do not aggregate any operating segments into reportable segments. In response to your request, we acknowledge:

| |

| • | The Company is responsible for the adequacy and accuracy of the disclosure in the filing; |

| |

| • | Staff comments or changes to disclosure in response to staff comments do not foreclose the Commission from taking any action with respect to the filing; and |

| |

| • | the Company may not assert Staff comments as a defense in any proceeding initiated by the Commission or any person under the federal securities laws of the United States. |

Sincerely,

/s/ A. Stephen Meadows

A. Stephen Meadows

Chief Accounting Officer

John Cannarella

Steven C. Voorhees

Ward H. Dickson

Robert B. McIntosh