Annual Shareholders Meeting May 22, 2019 Exhibit 99.1

Forward Looking Statements This presentation contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These forward-looking statements are subject to risks and uncertainties, including, but not limited to: The credit and concentration risks of our lending activities; Changes in general economic conditions, either nationally or in our market areas; Competitive market pricing factors and interest rate risks; Market interest rate volatility; Investments in new branches and new business opportunities; Balance sheet (for example, loans) concentrations; Fluctuations in demand for loans and other financial services in our market areas; Changes in legislative or regulatory requirements or the results of regulatory examinations; The ability to recruit and retain key management and staff; Risks associated with our ability to implement our expansion strategy and merger integration; Stability of funding sources and continued availability of borrowings; Adverse changes in the securities markets; The inability of key third-party providers to perform their obligations to us; Changes in accounting policies and practices and the use of estimates in determining fair value of certain of our assets, which estimates may prove to be incorrect and result in significant declines in valuation; and These and other risks as may be detailed from time to time in our filings with the Securities and Exchange Commission. The Company cautions readers not to place undue reliance on any forward-looking statements. Moreover, you should treat these statements as speaking only as of the date they are made and based only on information then actually known to the Company. The Company does not undertake and specifically disclaims any obligation to revise any forward-looking statements to reflect the occurrence of anticipated or unanticipated events or circumstances after the date of such statements. These risks could cause our actual results in 2018 and beyond to differ materially from those expressed in any forward-looking statements by, or on behalf of, us, and could negatively affect the Company’s operating results, financial condition and stock price performance.

Welcome! Our 450 employees are now shareholders in PUB through the creation of an Employee Stock Ownership Plan. We created the ESOP to ensure that employee’s interests are aligned with shareholder’s interests and to provide a retirement benefit to our employees.

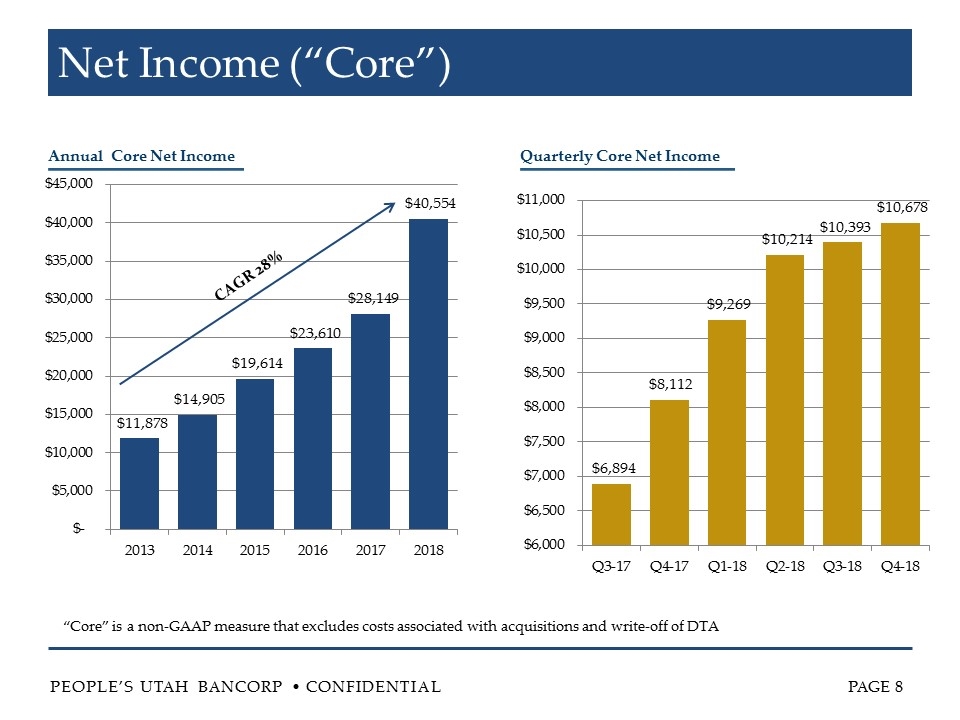

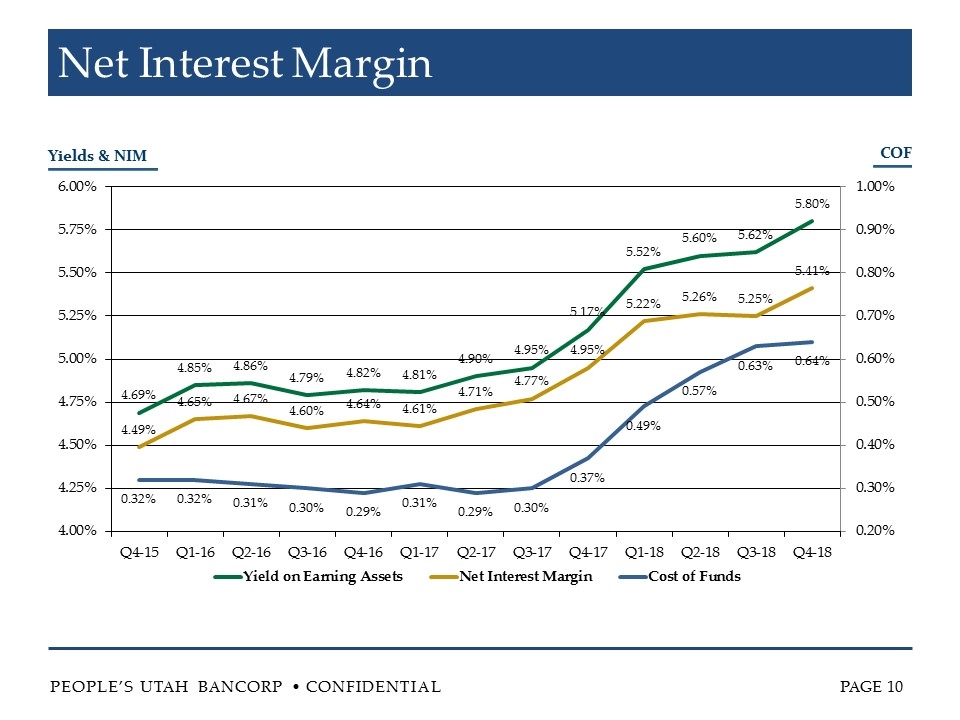

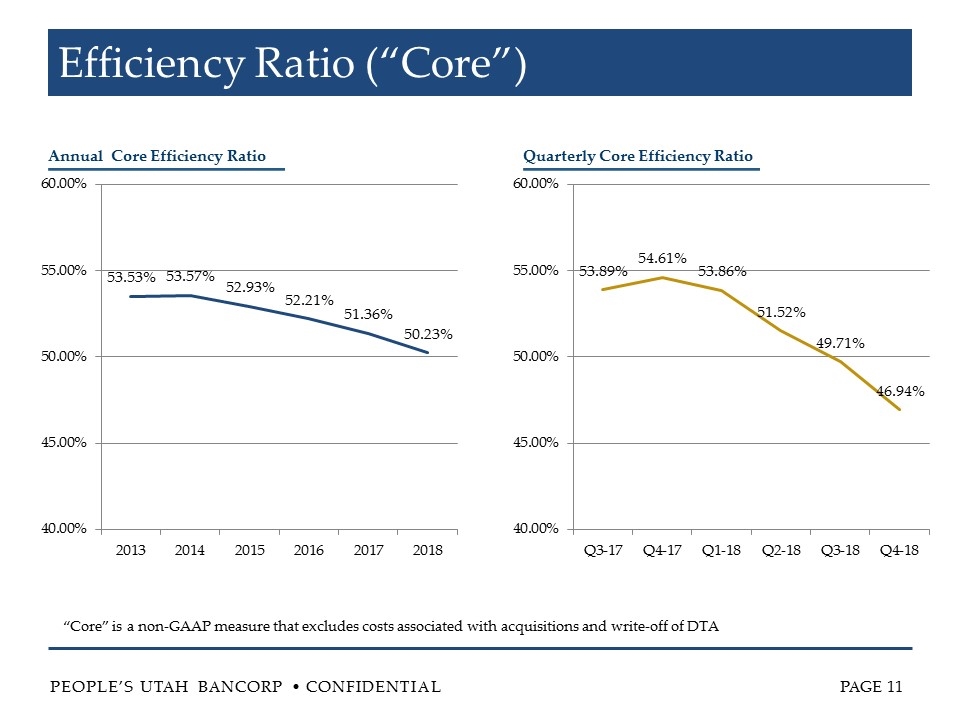

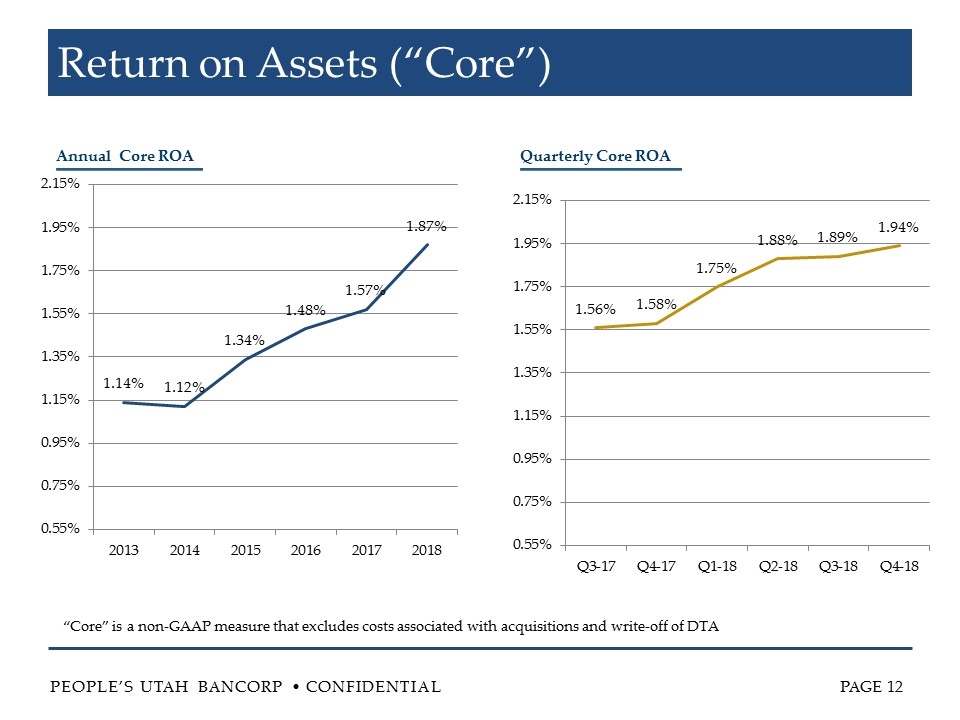

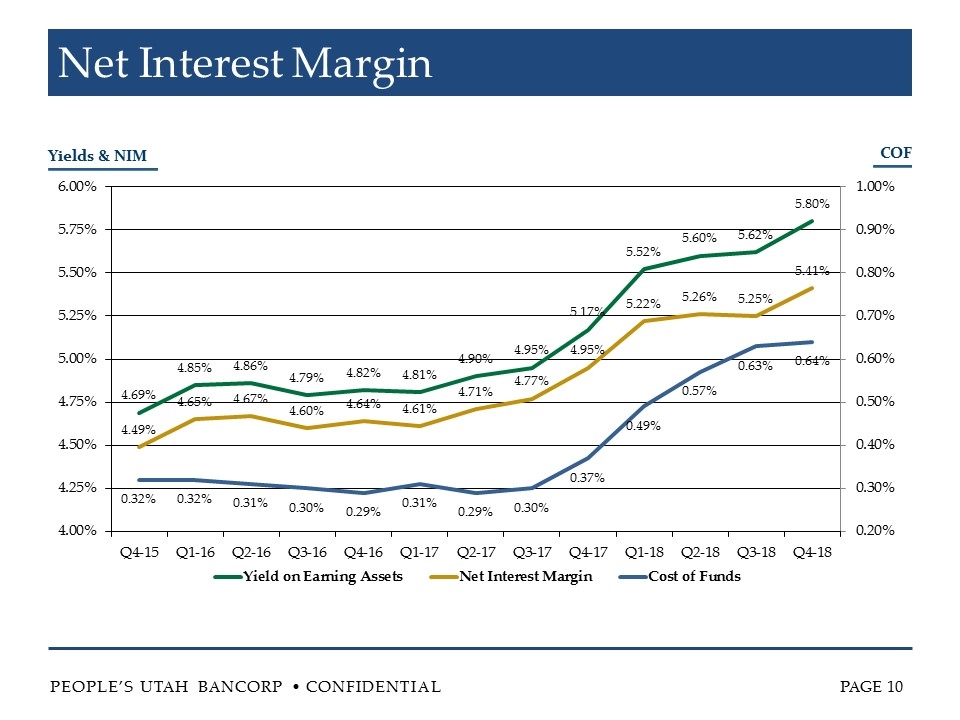

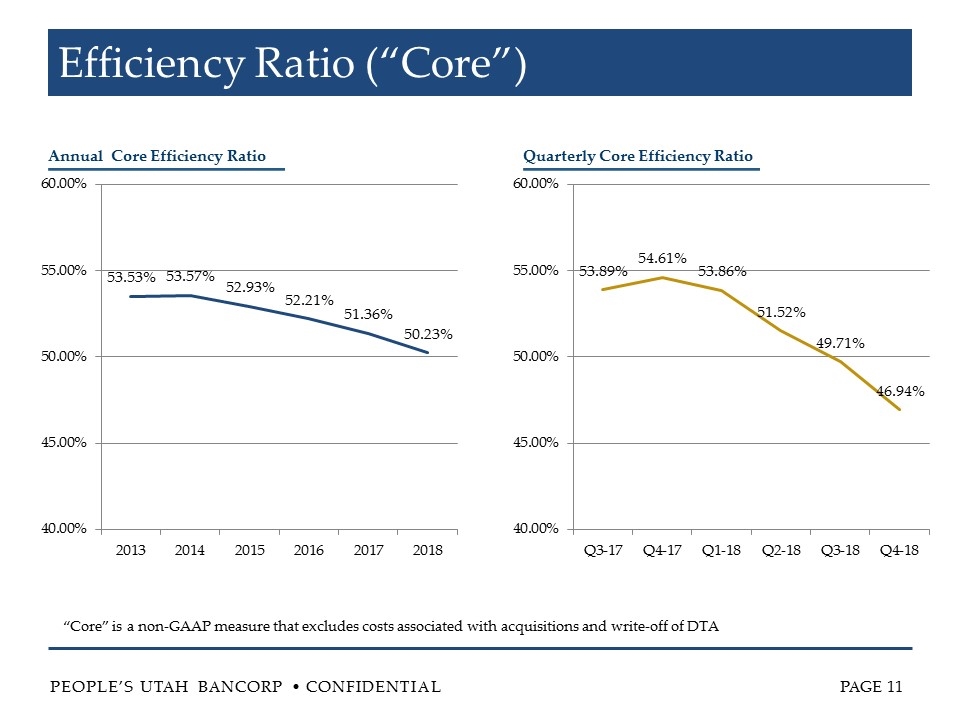

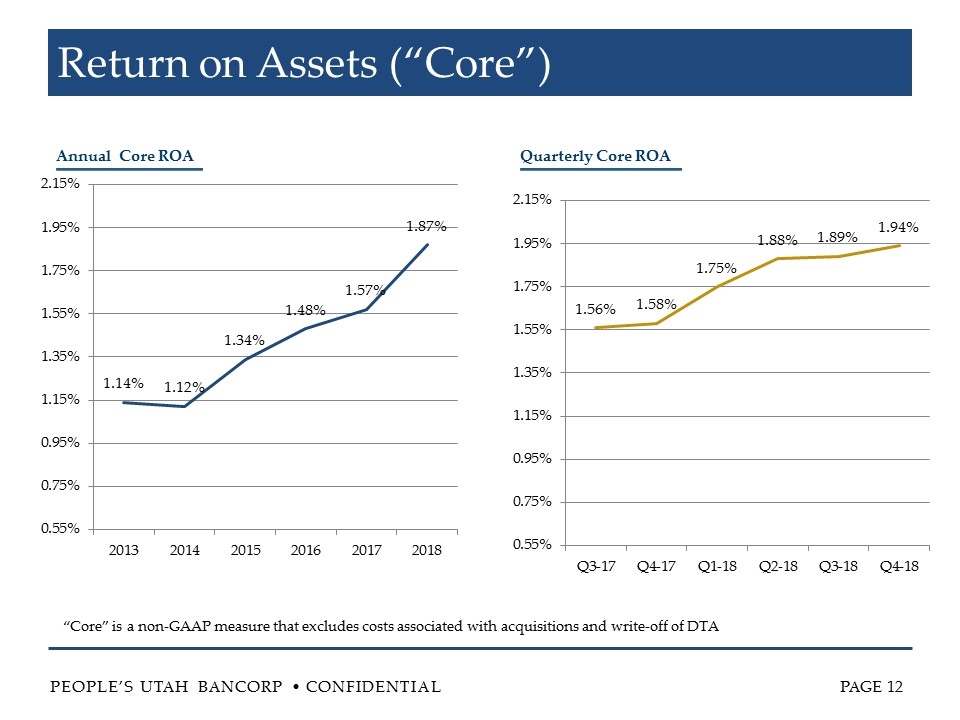

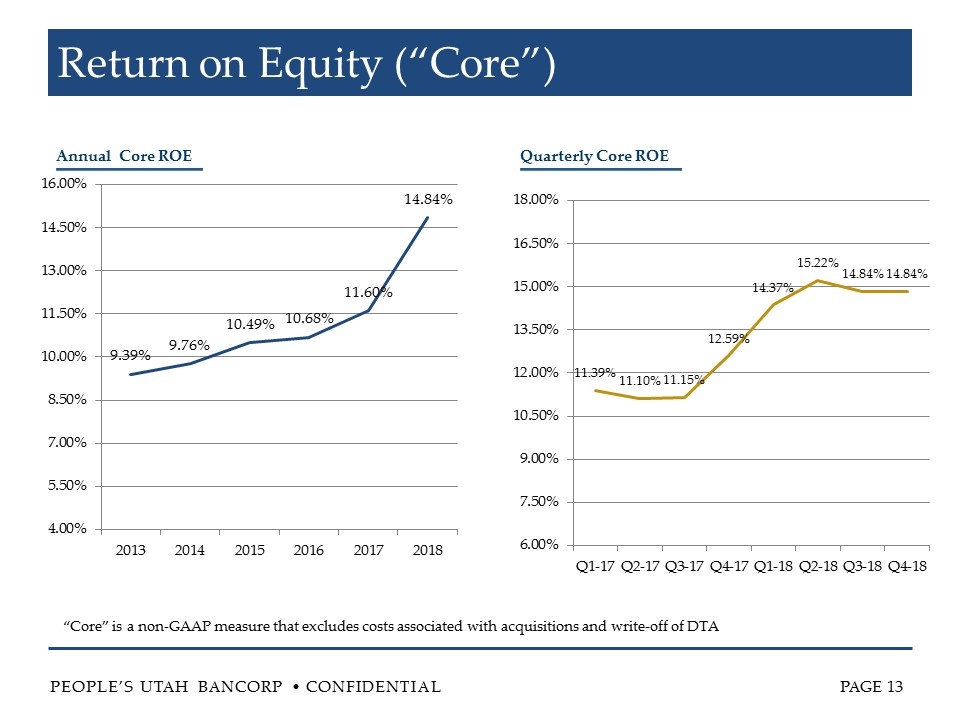

2018 Year in Review Financial Performance: Record return on average assets of 1.87%; Record return on equity of 14.85%; Record net income of $40.6 million; Net interest margins widened 55 bps to 5.29%; Grew average loans $425 million, or 33%, to $1.7 billion; Grew average deposits $286 million, or 19%, to $1.8 billion; Improved efficiency ratio to 50%.

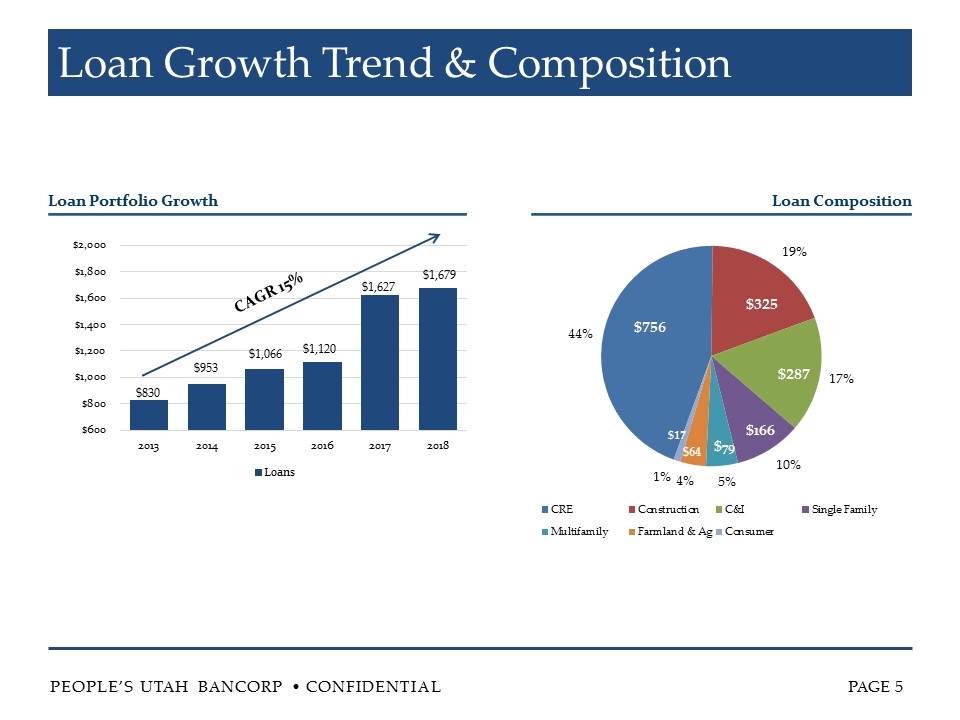

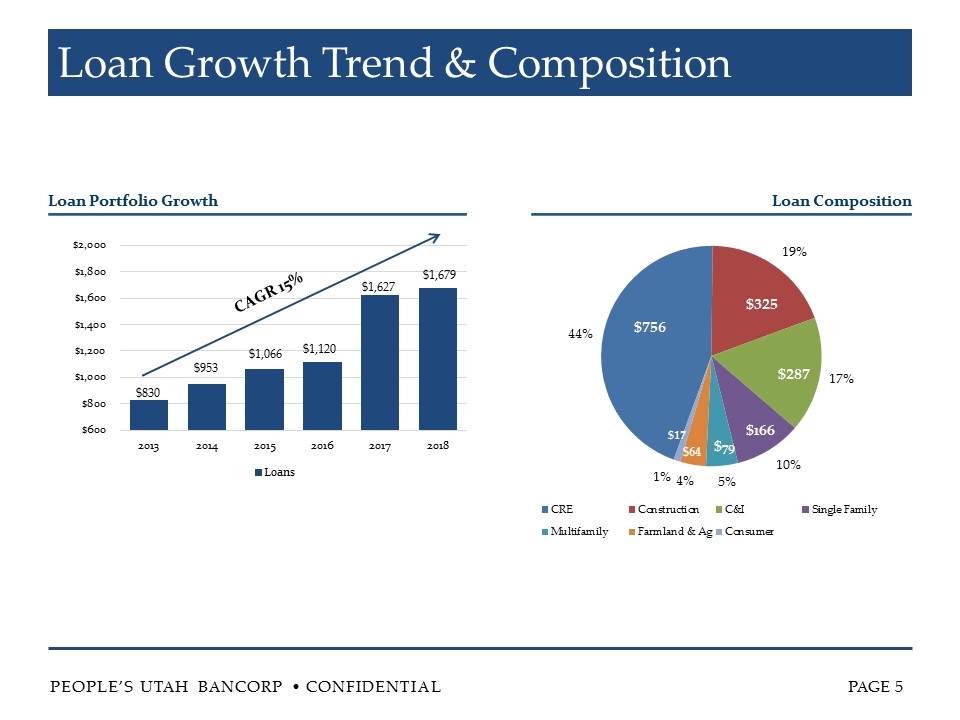

Loan Growth Trend & Composition Loan Portfolio Growth $830 $953 $1,066 $1,120 $1,627 CAGR 15% Loan Composition $1,679

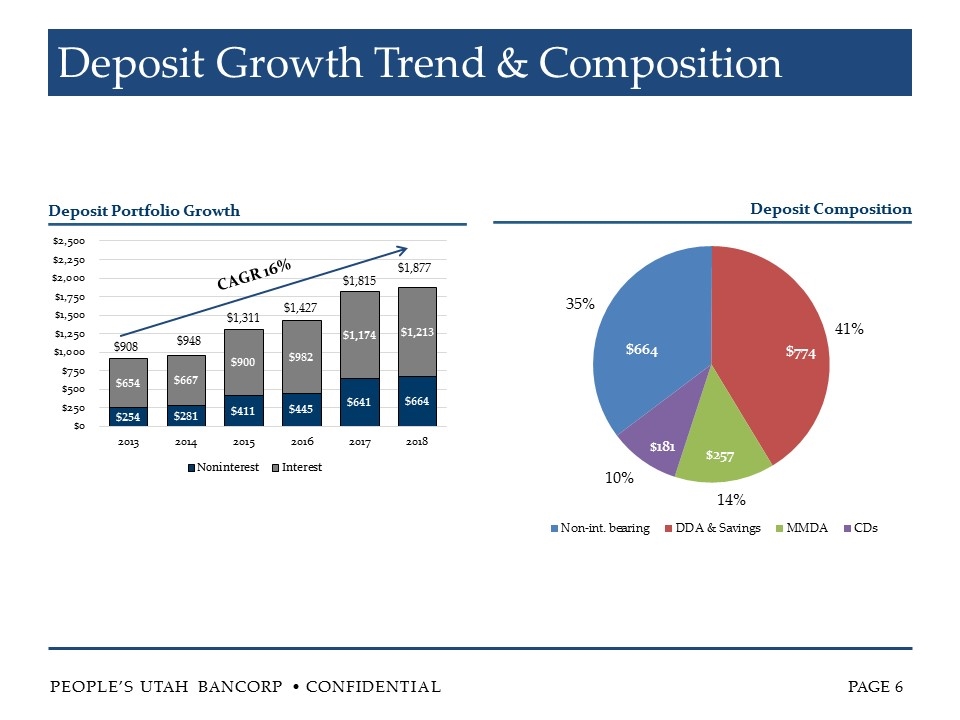

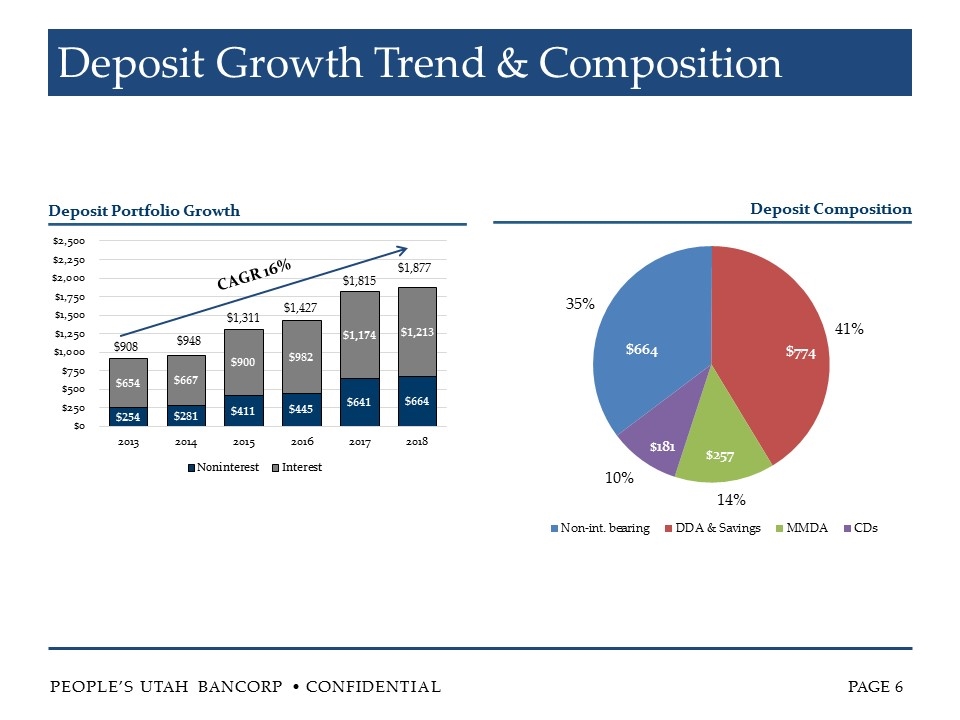

Deposit Growth Trend & Composition Deposit Portfolio Growth CAGR 16% $908 $948 $1,311 $1,427 $1,877 Deposit Composition $1,815

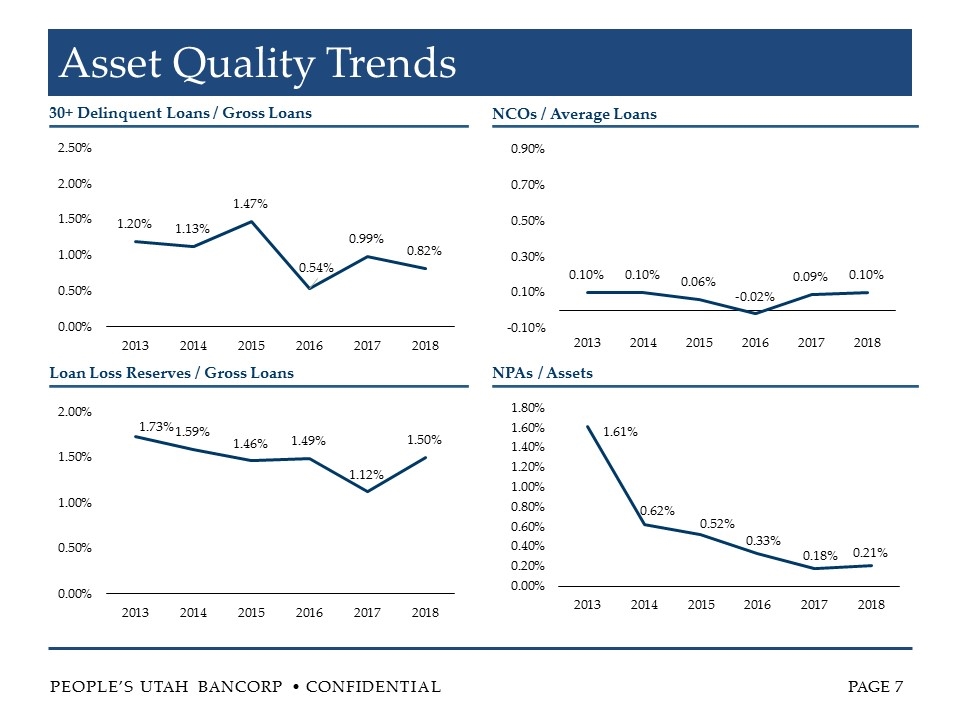

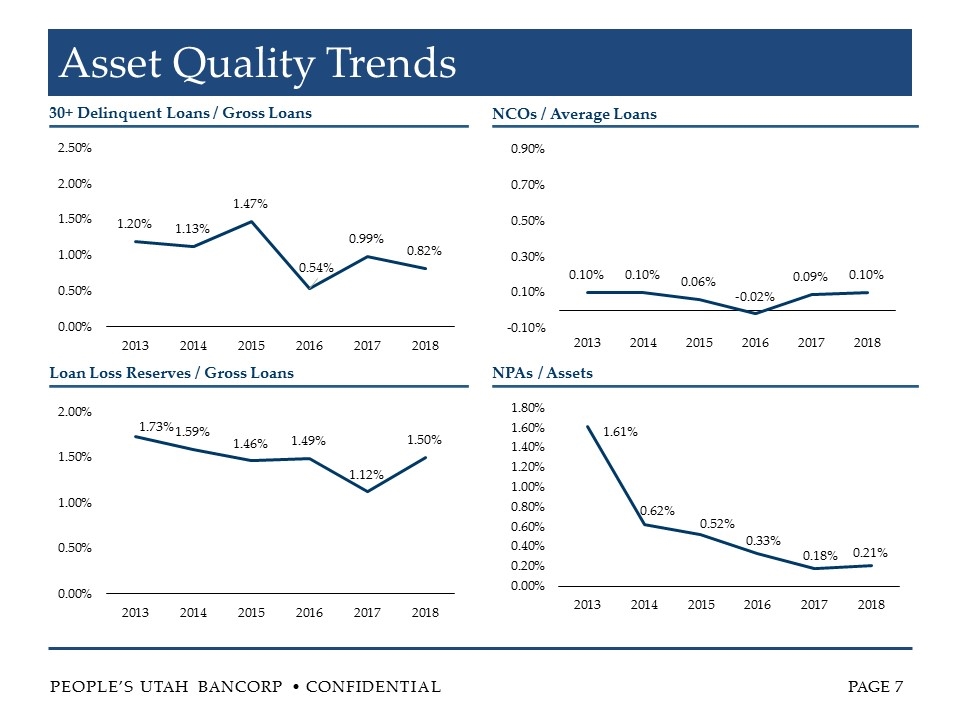

Asset Quality Trends 30+ Delinquent Loans / Gross Loans NCOs / Average Loans Loan Loss Reserves / Gross Loans NPAs / Assets

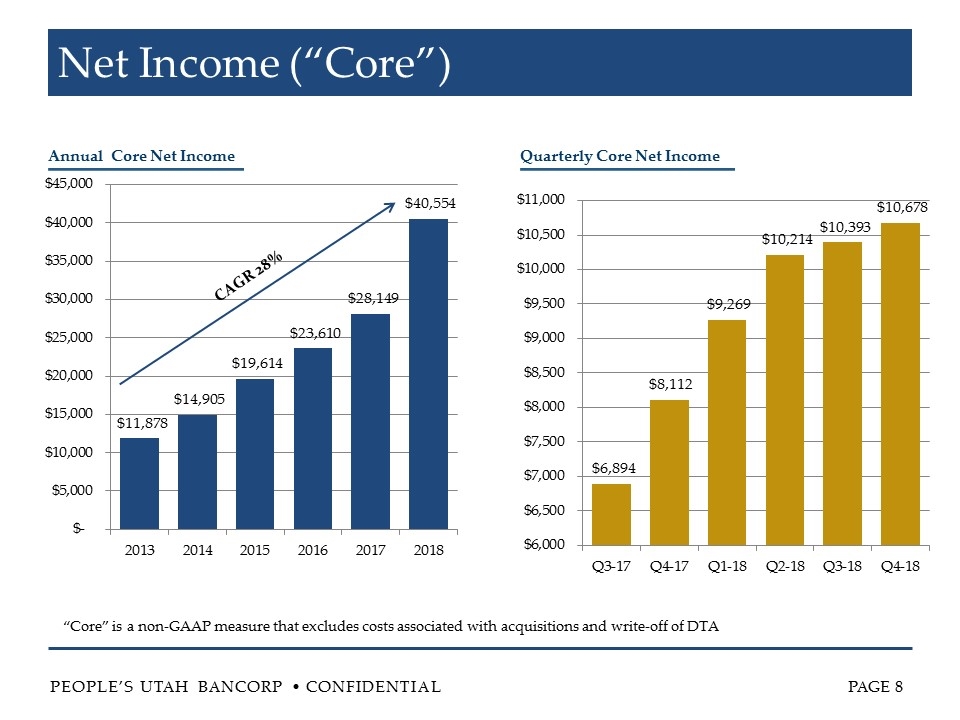

Net Income (“Core”) Annual Core Net Income Quarterly Core Net Income “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA CAGR 28%

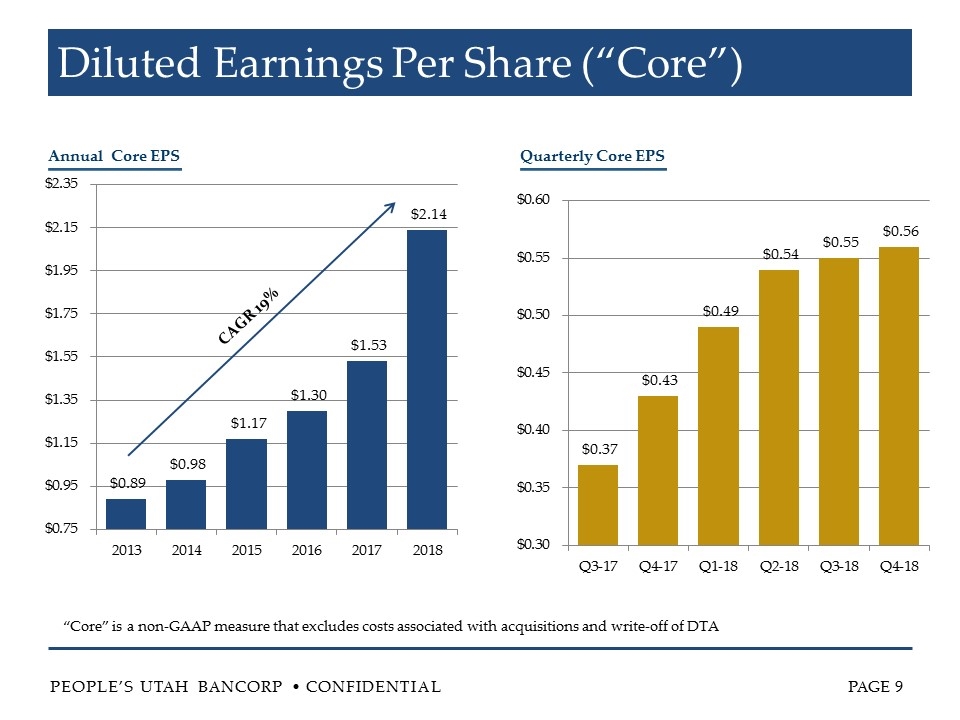

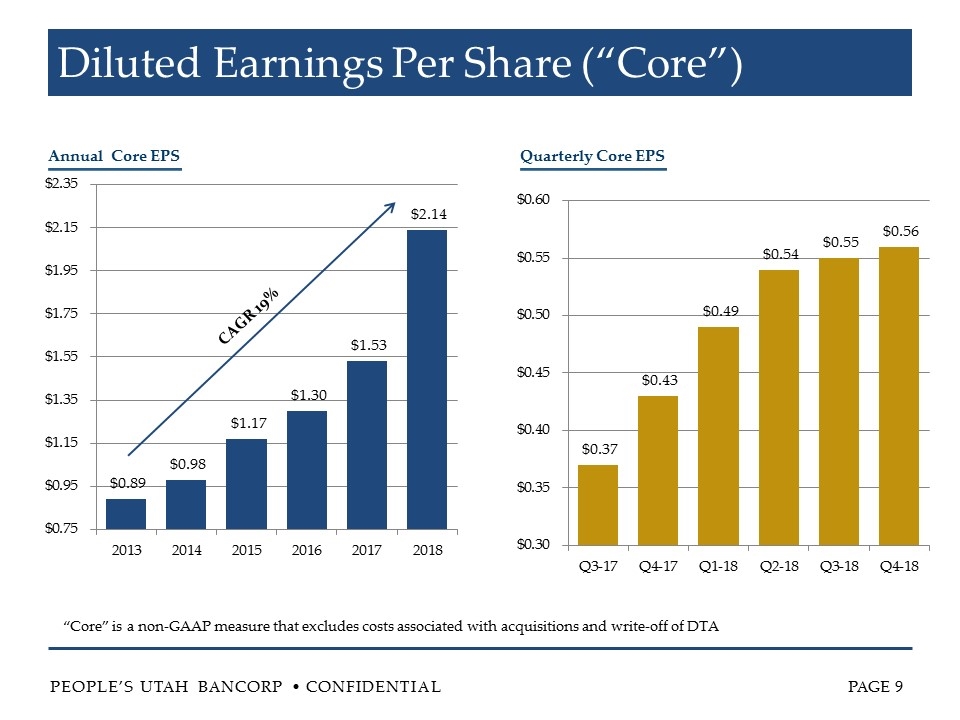

Diluted Earnings Per Share (“Core”) Annual Core EPS Quarterly Core EPS “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA CAGR 19%

Net Interest Margin Yields & NIM COF

Efficiency Ratio (“Core”) Annual Core Efficiency Ratio Quarterly Core Efficiency Ratio “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA

Return on Assets (“Core”) Annual Core ROA Quarterly Core ROA “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA

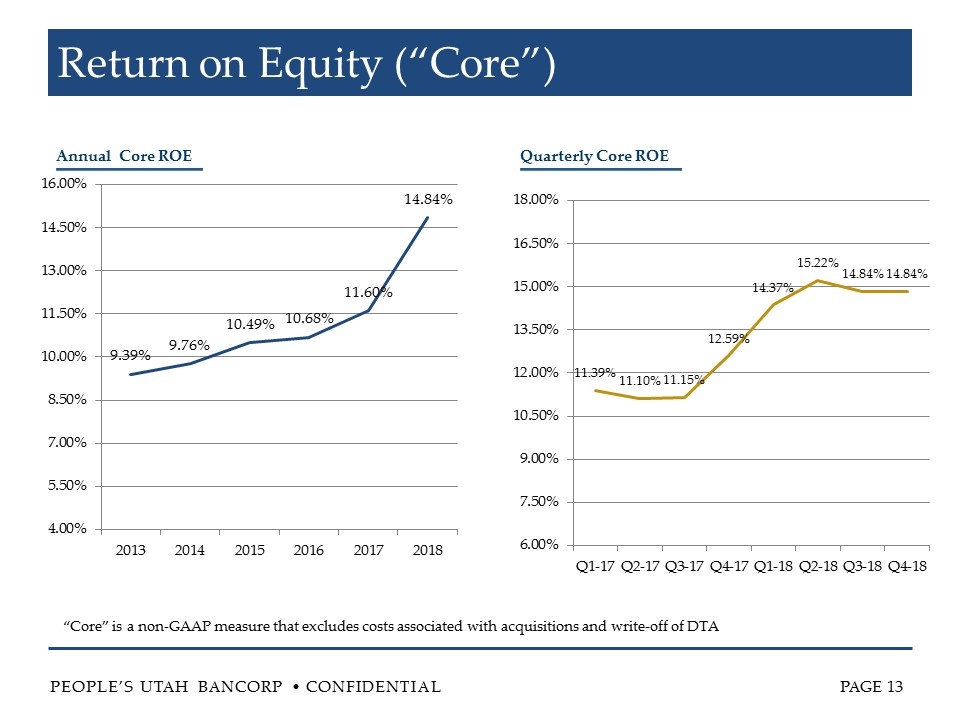

Return on Equity (“Core”) Annual Core ROE Quarterly Core ROE “Core” is a non-GAAP measure that excludes costs associated with acquisitions and write-off of DTA

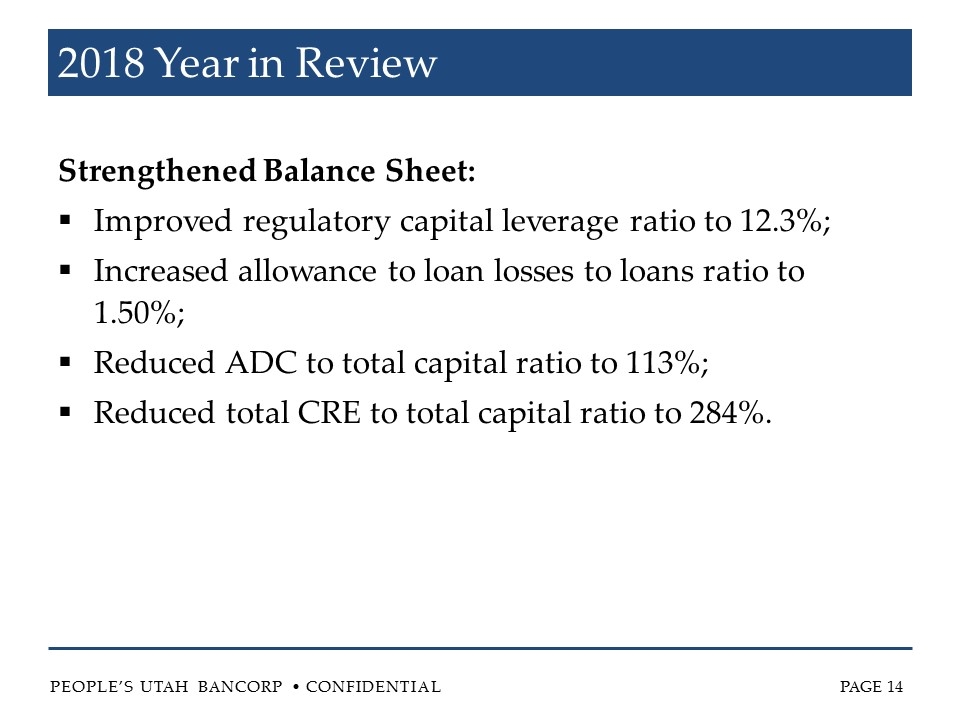

2018 Year in Review Strengthened Balance Sheet: Improved regulatory capital leverage ratio to 12.3%; Increased allowance to loan losses to loans ratio to 1.50%; Reduced ADC to total capital ratio to 113%; Reduced total CRE to total capital ratio to 284%.

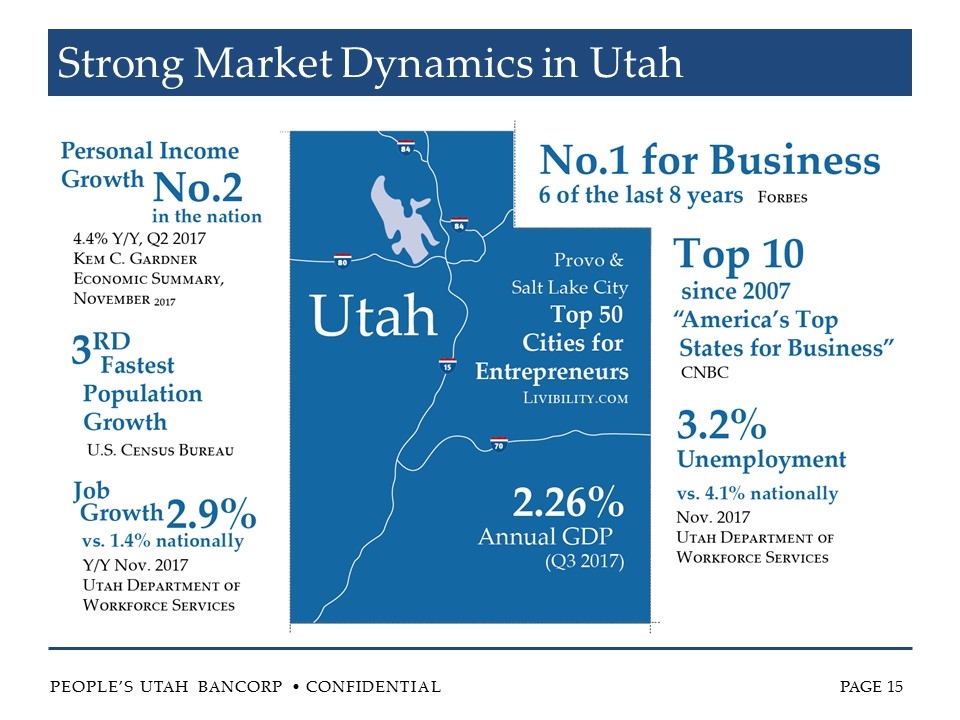

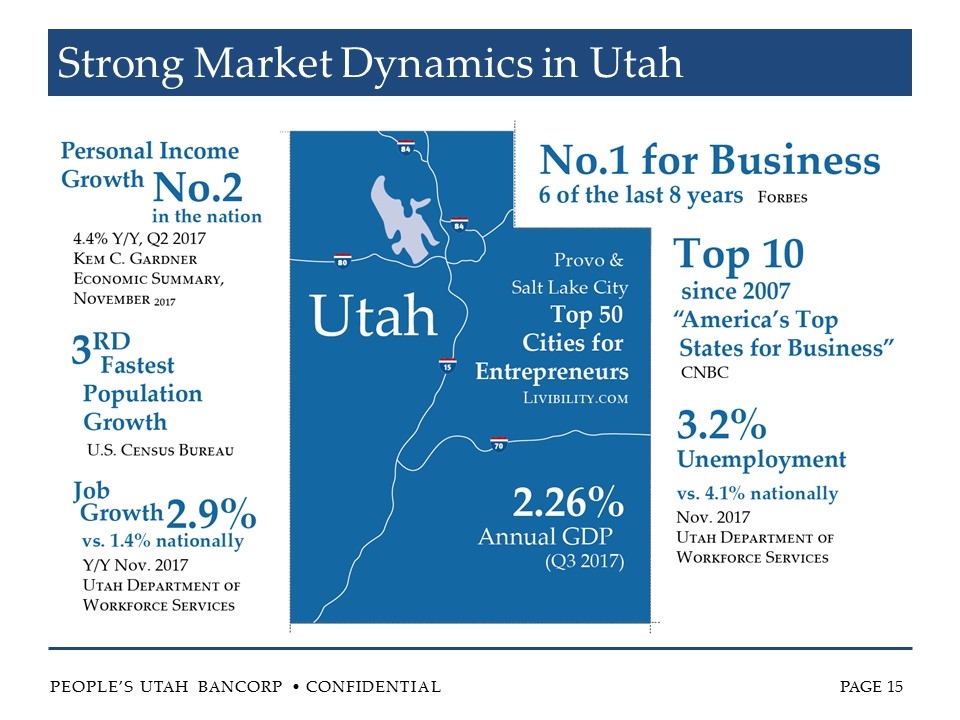

Strong Market Dynamics in Utah

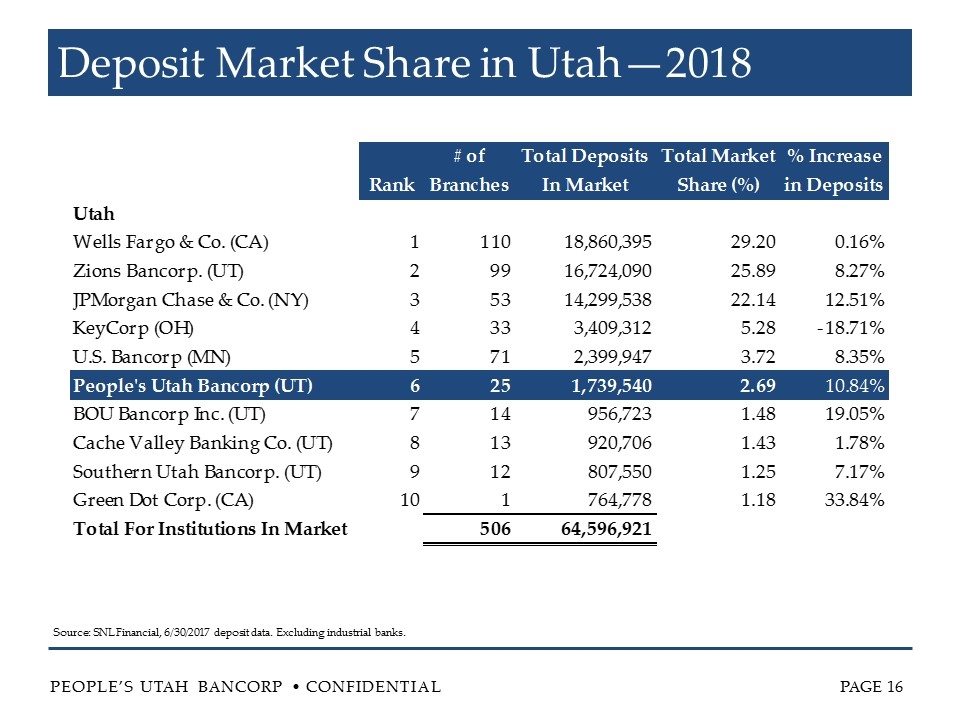

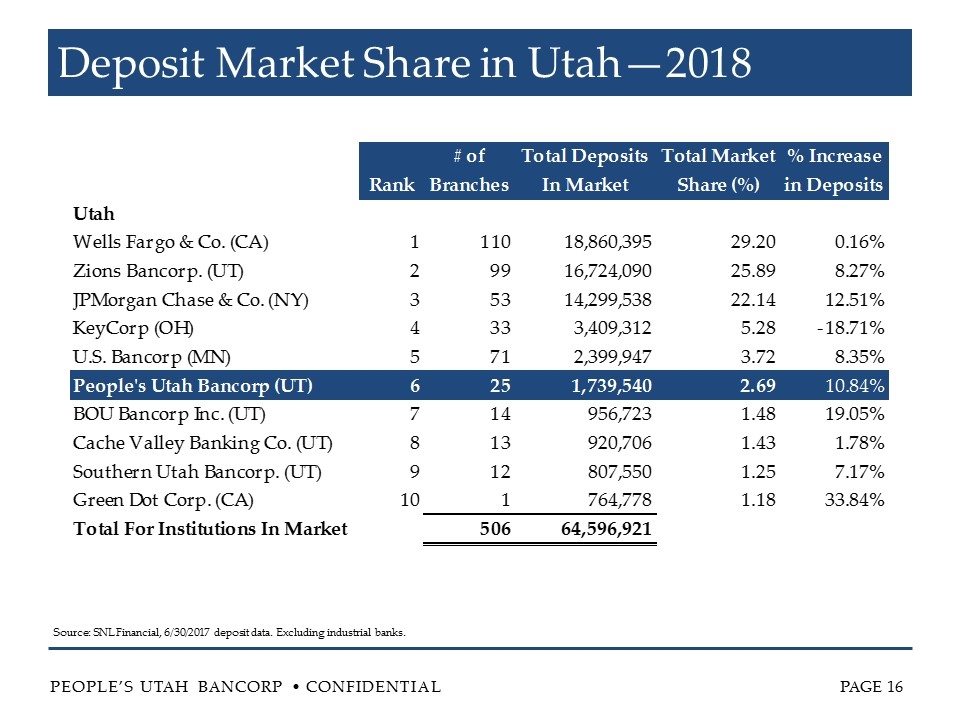

Deposit Market Share in Utah—2018 Source: SNL Financial, 6/30/2017 deposit data. Excluding industrial banks.

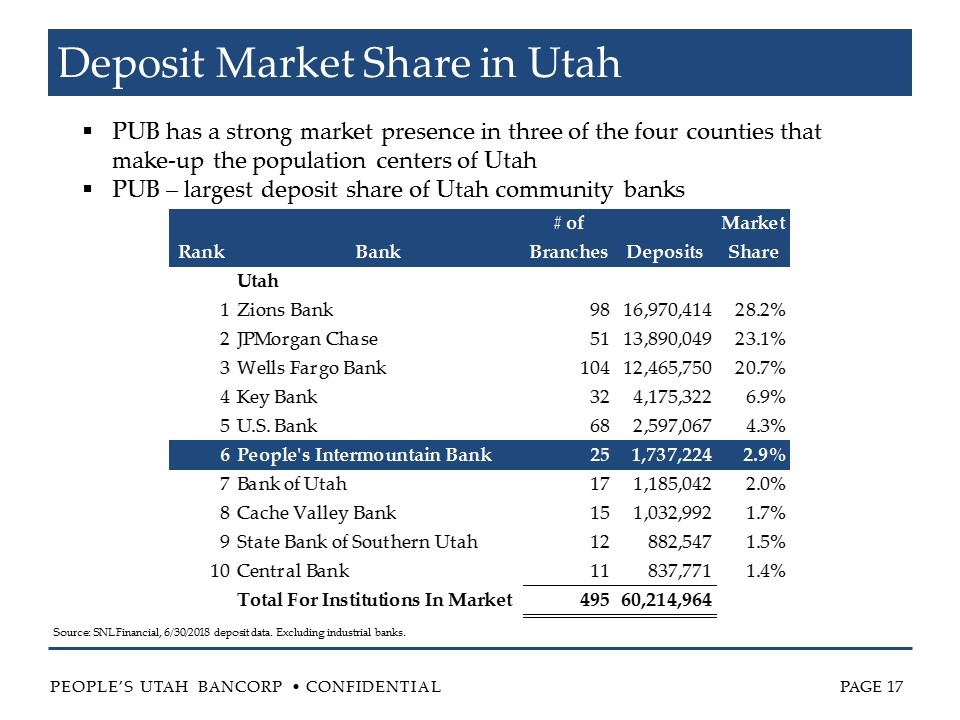

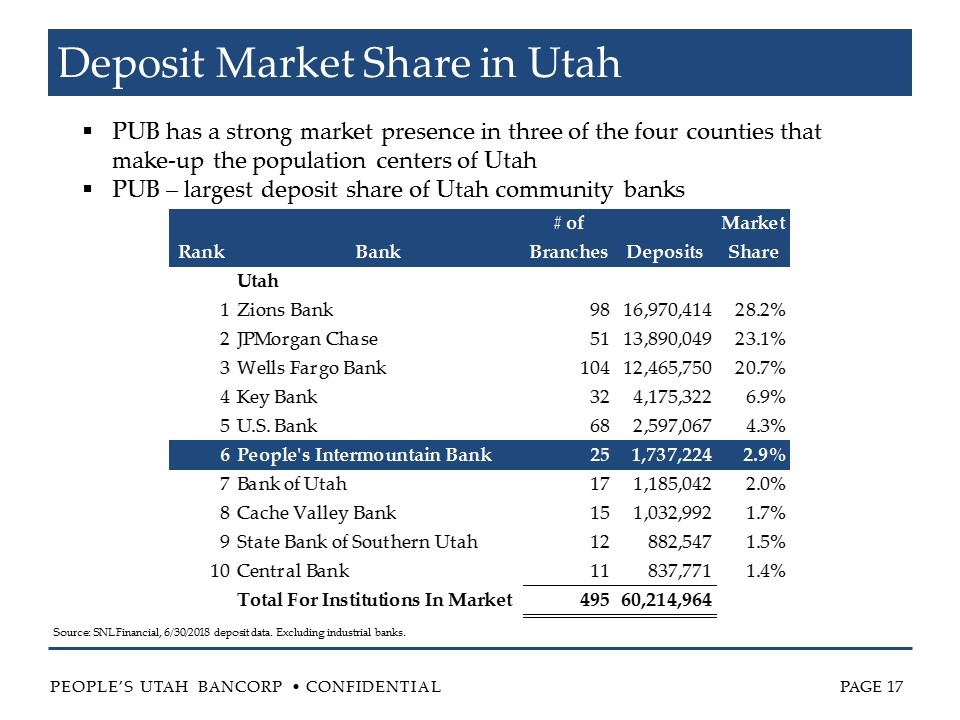

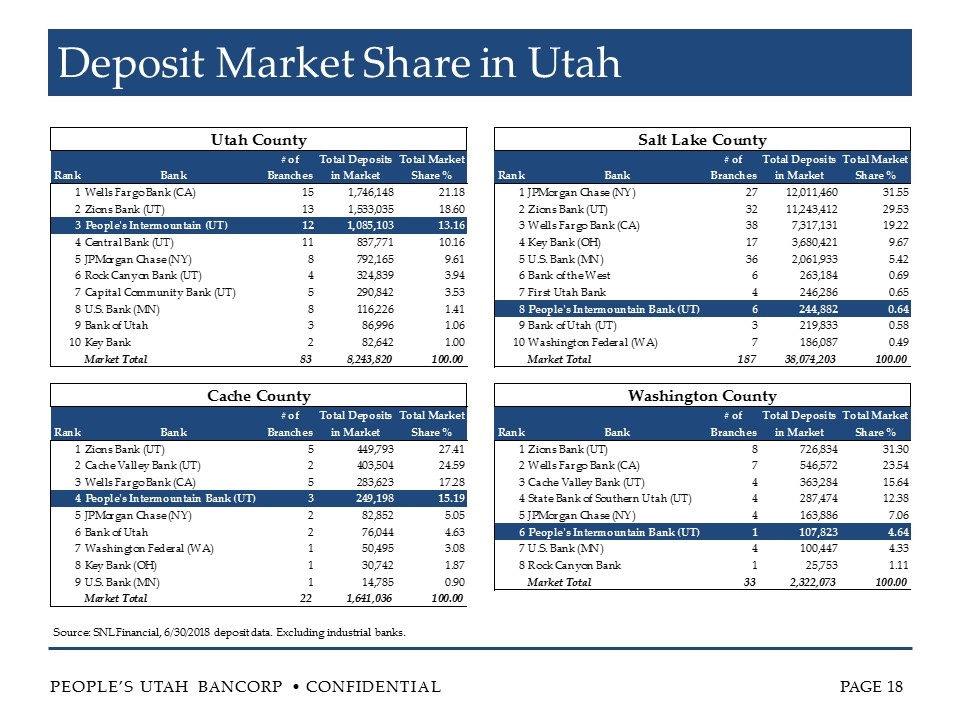

Deposit Market Share in Utah PUB has a strong market presence in three of the four counties that make-up the population centers of Utah PUB – largest deposit share of Utah community banks Source: SNL Financial, 6/30/2018 deposit data. Excluding industrial banks.

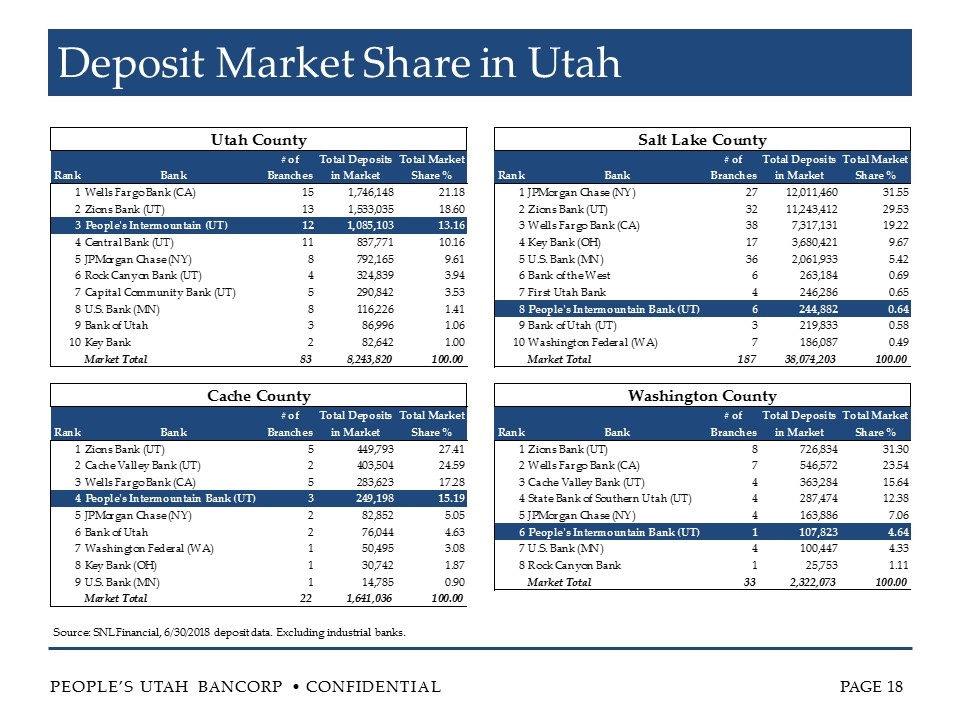

Deposit Market Share in Utah Source: SNL Financial, 6/30/2018 deposit data. Excluding industrial banks.

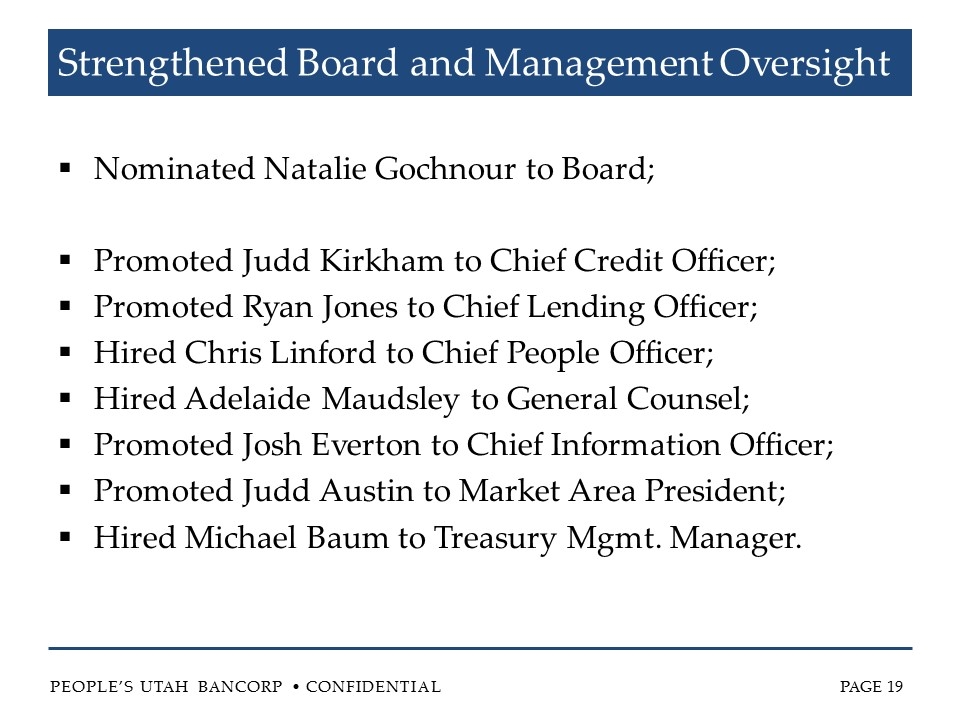

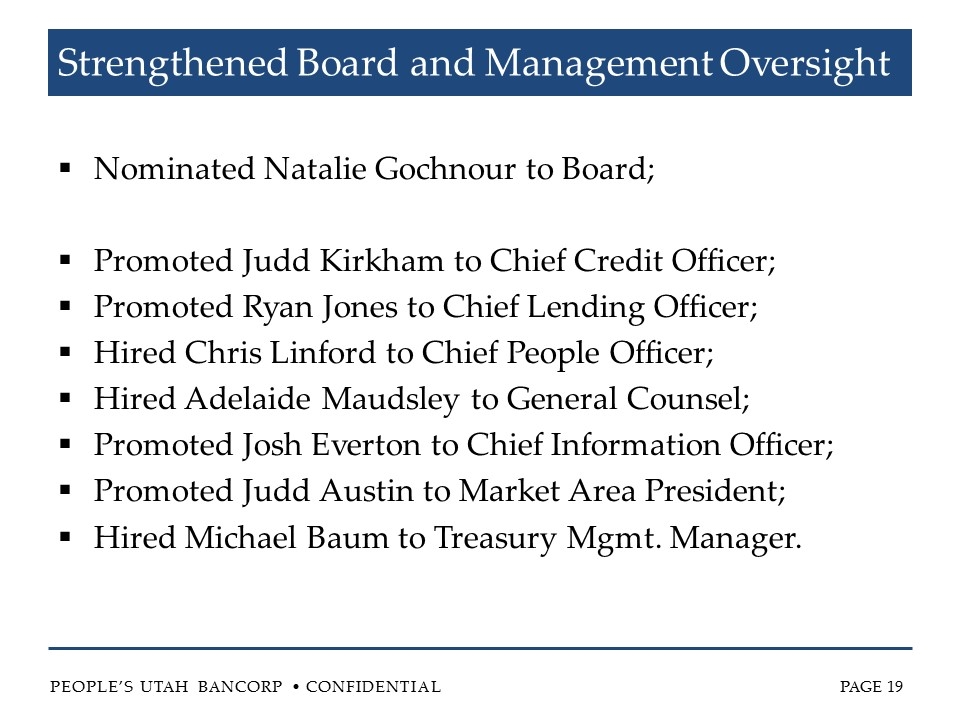

Strengthened Board and Management Oversight Nominated Natalie Gochnour to Board; Promoted Judd Kirkham to Chief Credit Officer; Promoted Ryan Jones to Chief Lending Officer; Hired Chris Linford to Chief People Officer; Hired Adelaide Maudsley to General Counsel; Promoted Josh Everton to Chief Information Officer; Promoted Judd Austin to Market Area President; Hired Michael Baum to Treasury Mgmt. Manager.

Executive Leadership Team Len E. Williams Chief Executive Officer Mark K. Olson Chief Financial Officer Rick W. Anderson President Judd P. Kirkham Chief Credit Officer Ryan H. Jones Chief Lending Officer Chris Linford Chief People Officer

Refined Vision, Purpose, and Values Vision To be the best bank for your business. Purpose We create value and stability for our clients, employees, and other stakeholders by delivering customized financial solutions. Values We care. We are safe. We innovate. We execute. We are professional. Integrity is absolute.

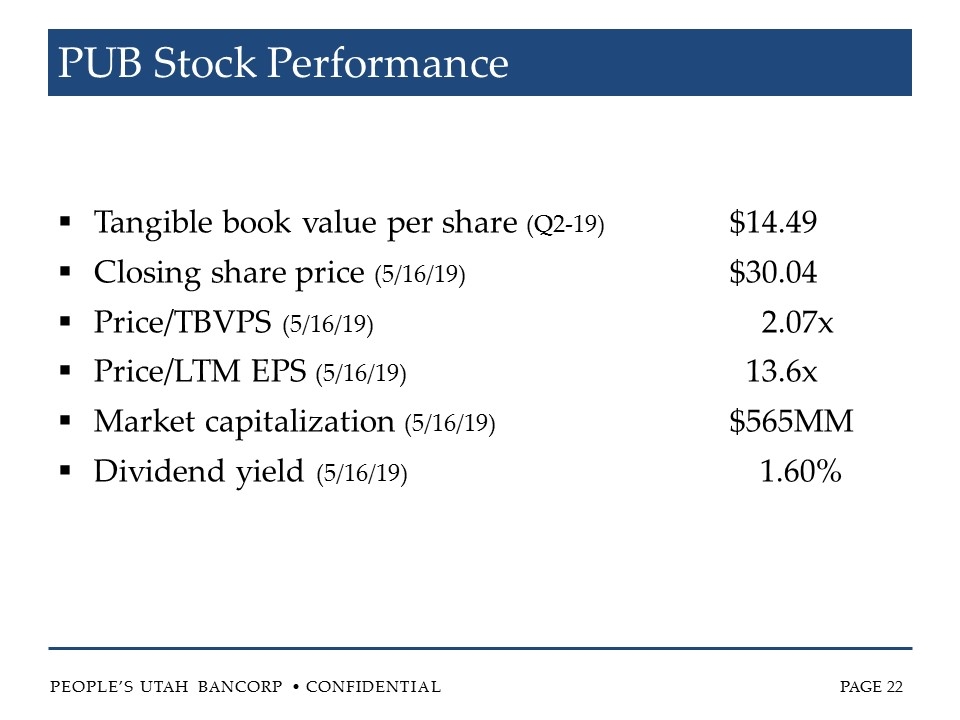

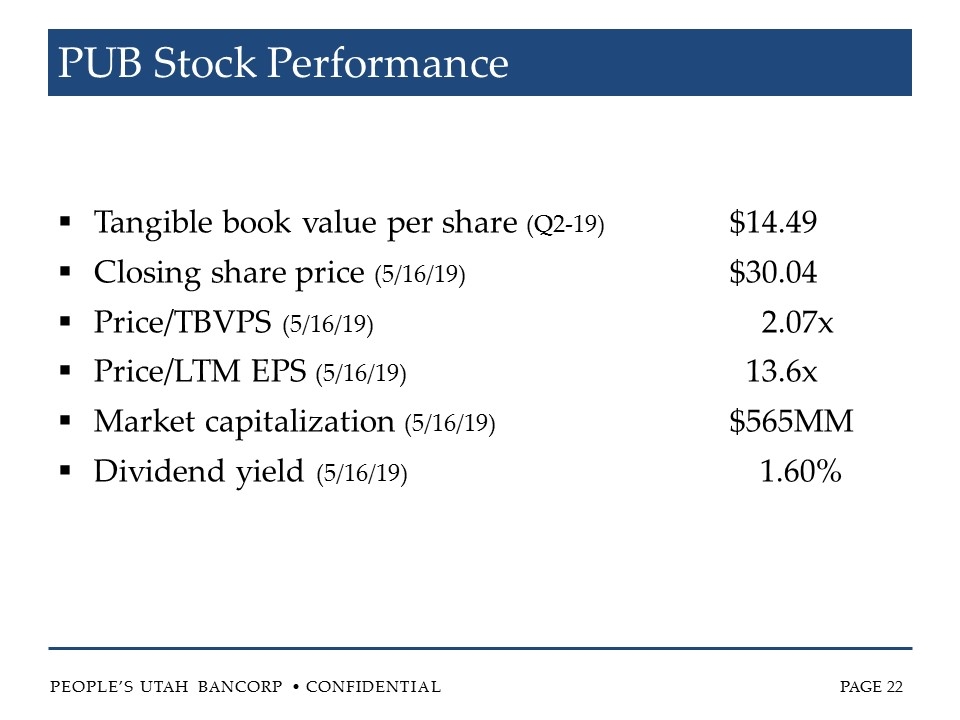

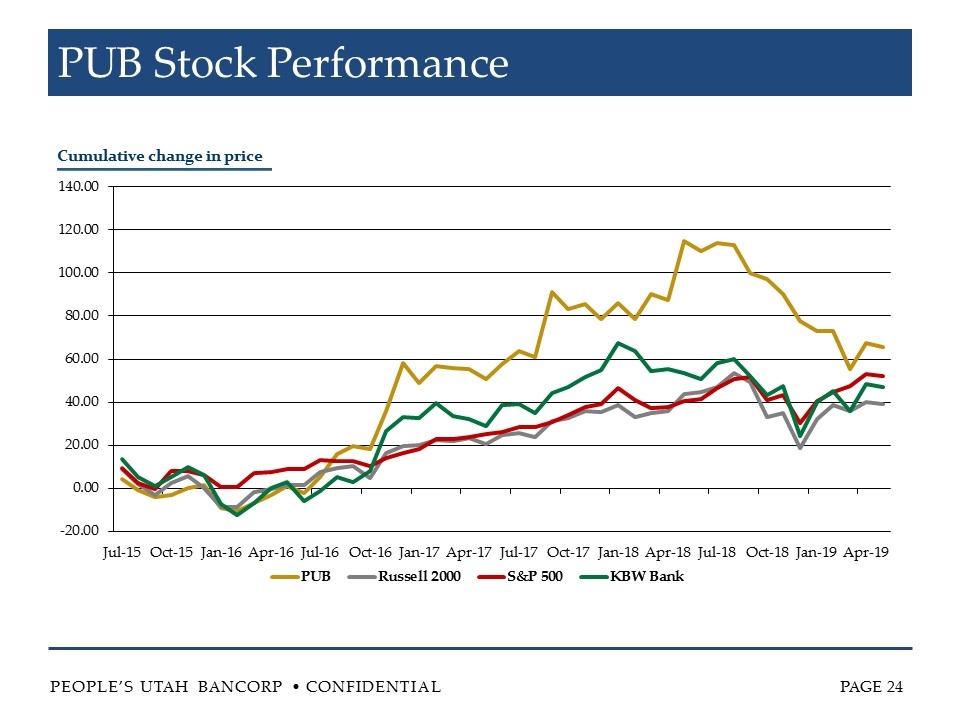

PUB Stock Performance Tangible book value per share (Q2-19) $14.49 Closing share price (5/16/19) $30.04 Price/TBVPS (5/16/19) 2.07x Price/LTM EPS (5/16/19) 13.6x Market capitalization (5/16/19)$565MM Dividend yield (5/16/19) 1.60%

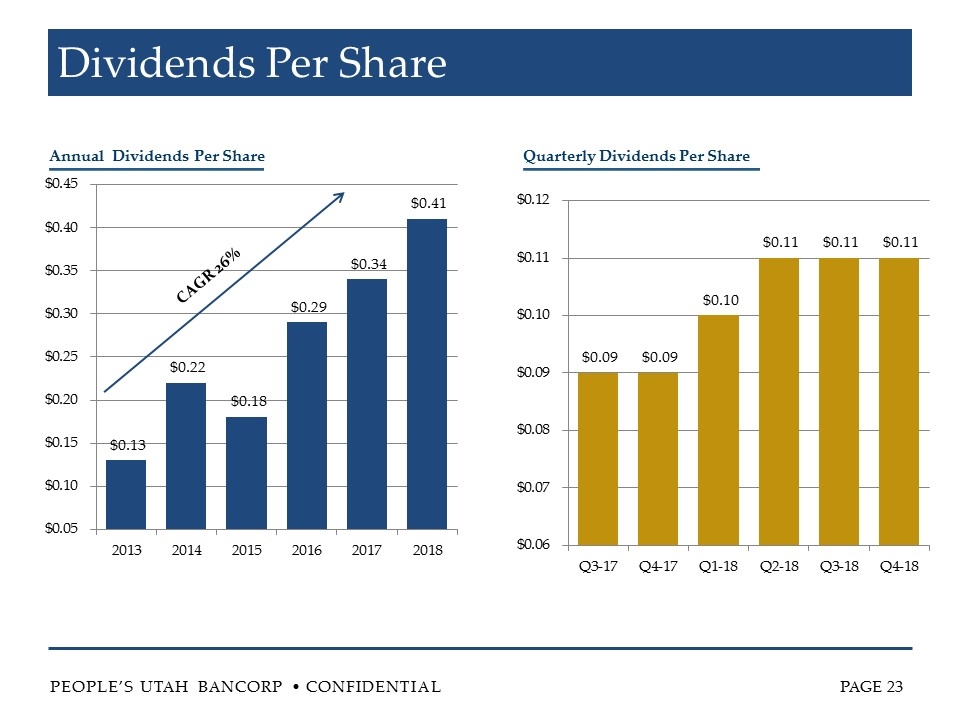

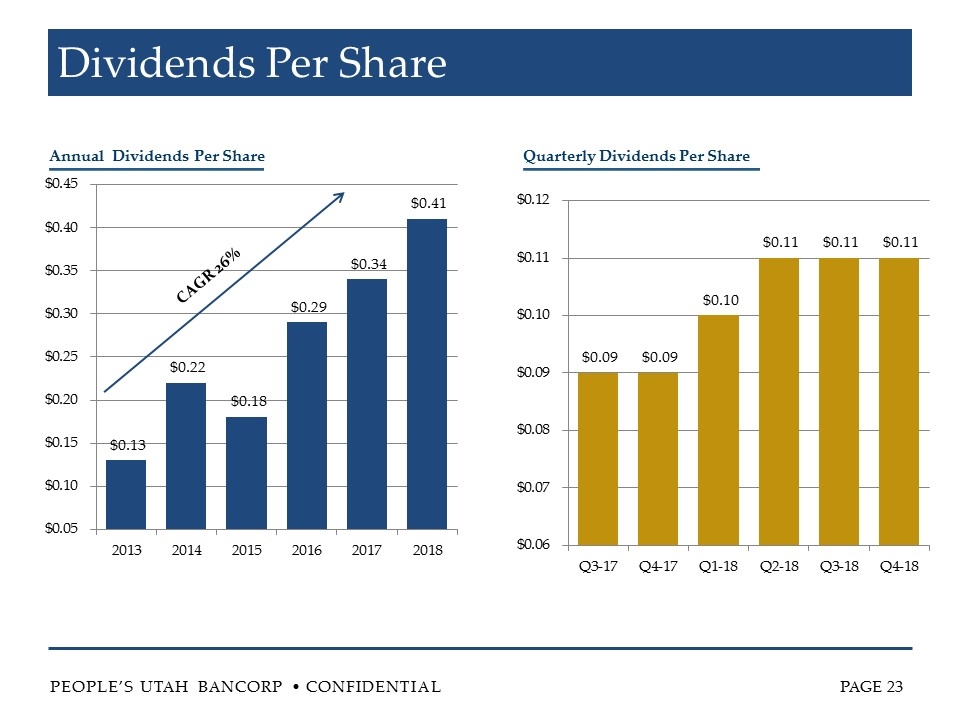

Dividends Per Share Annual Dividends Per Share Quarterly Dividends Per Share CAGR 26%

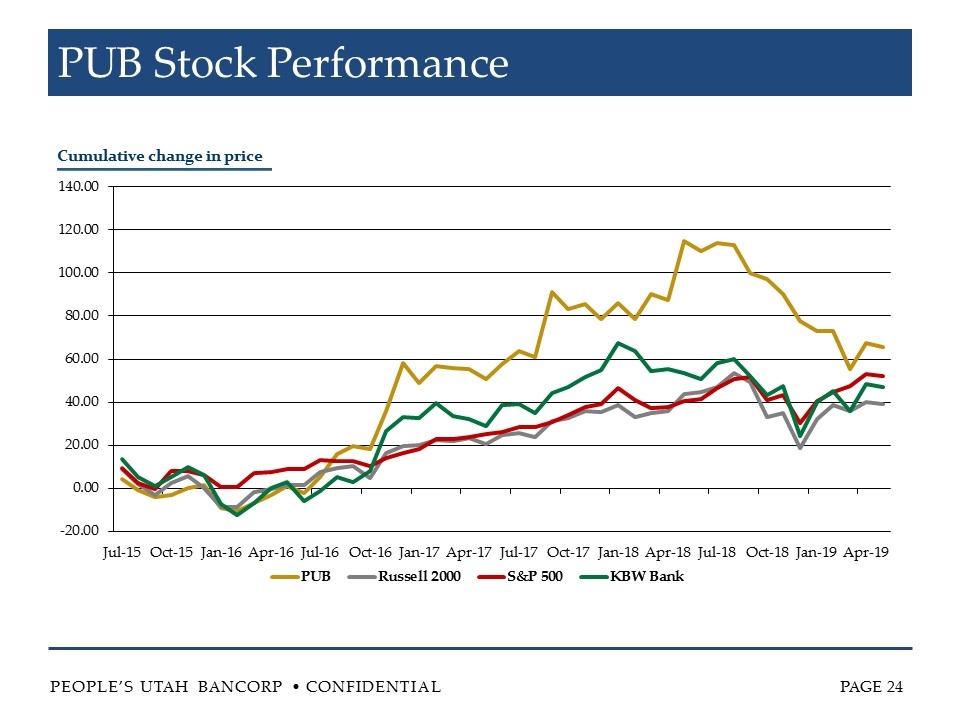

PUB Stock Performance Cumulative change in price

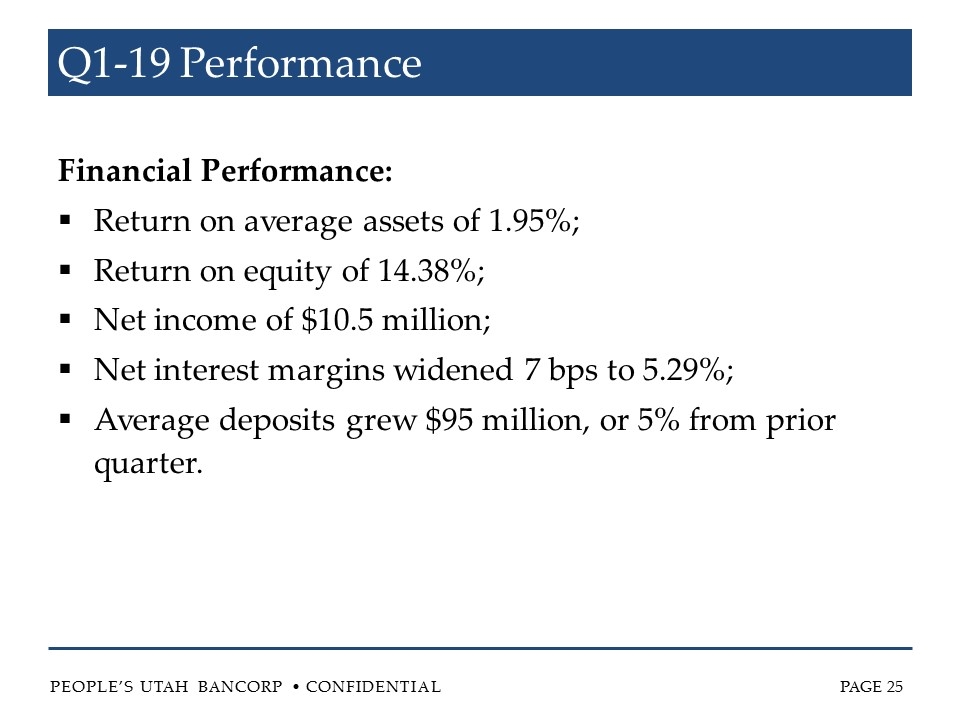

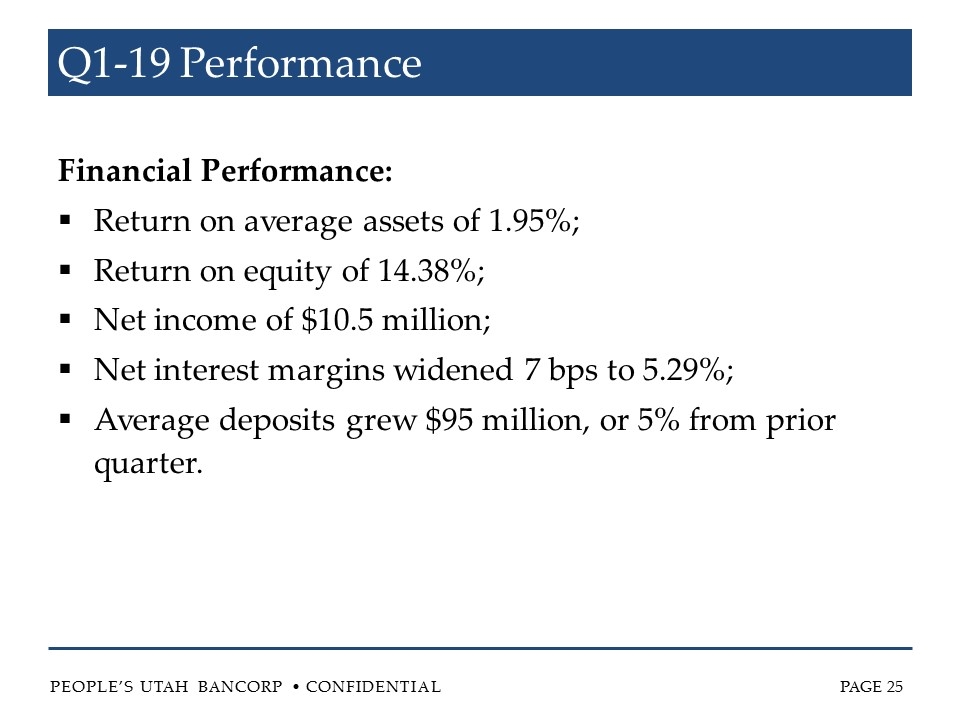

Q1-19 Performance Financial Performance: Return on average assets of 1.95%; Return on equity of 14.38%; Net income of $10.5 million; Net interest margins widened 7 bps to 5.29%; Average deposits grew $95 million, or 5% from prior quarter.

2019 Looking Forward Unify bank through a single brand promise and identify a single name, logo, motto, and a more contemporary look; Open business branch in Pleasant Grove; Open UT County Commercial Business Center; Rebuild Alpine branch; Grow commercial deposits through treasury management services (Will implement new treasury system in Q4-19); Implement new commercial loan origination system (nCino in Q3-19); Continue to aggressively focus on M&A.

Thank You! Grateful to our team who live our core values every day; Appreciate our clients for their business and loyalty; Indebted to you, our shareholders for the confidence, loyalty, and trust you give to us.

Annual Shareholders Meeting May 22, 2019