(xii) secured Indebtedness otherwise permitted to be incurred by the Indenture that limits the right of the debtor to dispose of the assets securing such Indebtedness;

(xiii) Purchase Money Indebtedness that imposes restrictions of the type described in clause (c) above on the property so acquired;

(xiv) provisions in agreements or instruments which prohibit the payment or making of dividends or other distributions other than on a pro rata basis;

(xv) restrictions in Investments in persons that are Restricted Subsidiaries;

(xvi) any amendments, modifications, restatements, renewals, increases, supplements, refundings, replacements or refinancings of the contracts, instruments or obligations referred to in clauses (i) through (xv) above;provided that such amendments, modifications, restatements, renewals, increases, supplements, refundings, replacements or refinancings are, in Cedar Fair’s good faith judgment, not materially more restrictive as a whole with respect to such encumbrances and restrictions than those prior to such amendment, modification, restatement, renewal, increase, supplement, refunding, replacement or refinancing;

(xvii) Indebtedness or other agreements including, without limitation, agreements described in clause (ix) of this paragraph, of any Restricted Subsidiary that is not an Issuer or a Guarantor that impose restrictions solely on such Restricted Subsidiary and its Subsidiaries; or

(xviii) any restriction on cash or other deposits or net worth imposed by customers, licensors or lessors or required by insurance, surety or bonding companies, in each case under contracts entered into in the ordinary course of business.

Merger, amalgamation, consolidation or sale of assets

The Indenture provides that Cedar Fair shall not consolidate, amalgamate or merge with or into (whether or not Cedar Fair is the surviving entity), or sell, assign, transfer, lease, convey or otherwise dispose of all or substantially all of its properties or assets in one or more related transactions to, another person unless:

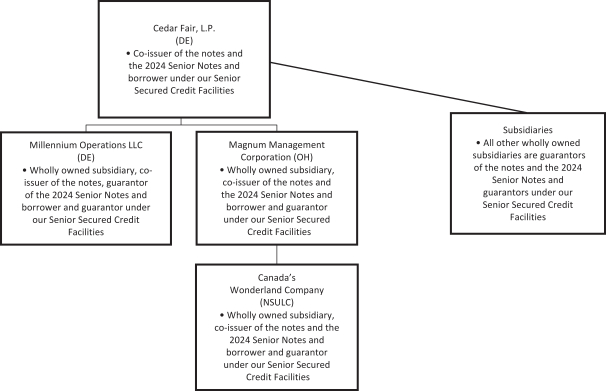

(a) Cedar Fair is the surviving person or the person formed by or surviving any such consolidation, amalgamation or merger (if other than Cedar Fair) or to which such sale, assignment, transfer, lease, conveyance or other disposition shall have been made is a corporation, limited partnership or limited liability company organized or existing under the laws of the United States, any state thereof or the District of Columbia; provided, however, that if the surviving person is a limited liability company or limited partnership, there shall be aco-issuer of the Notes that is a corporation;

(b) the person formed by or surviving any such consolidation, amalgamation or merger (if other than Cedar Fair) or the person to which such sale, assignment, transfer, lease, conveyance or other disposition shall have been made assumes all Cedar Fair’s obligations pursuant to a supplemental indenture in form reasonably satisfactory to the Trustee, under the Notes and the Indenture;

(c) immediately after such transaction, no Default or Event of Default exists;

(d) Cedar Fair or the person formed by or surviving any such consolidation, amalgamation or merger (if other than Cedar Fair) or to which such sale, assignment, transfer, lease, conveyance or other disposition will have been made: (i) will have a Total Indebtedness to Consolidated Cash Flow Ratio of Cedar Fair immediately after the transaction equal to or less than Cedar Fair’s Total Indebtedness to Consolidated Cash Flow Ratio of Cedar Fair immediately preceding the transaction or (ii) would, at the time of such transaction after giving pro forma effect thereto, be permitted to incur at least $1.00 of additional Indebtedness pursuant to the first paragraph in the covenant described under “—Certain covenants—Limitation on incurrence of indebtedness”; and

(e) Cedar Fair or the person formed by or surviving any such consolidation, amalgamation or merger (if other than Cedar Fair) or to which such sale, assignment, transfer, lease, conveyance or other disposition

148