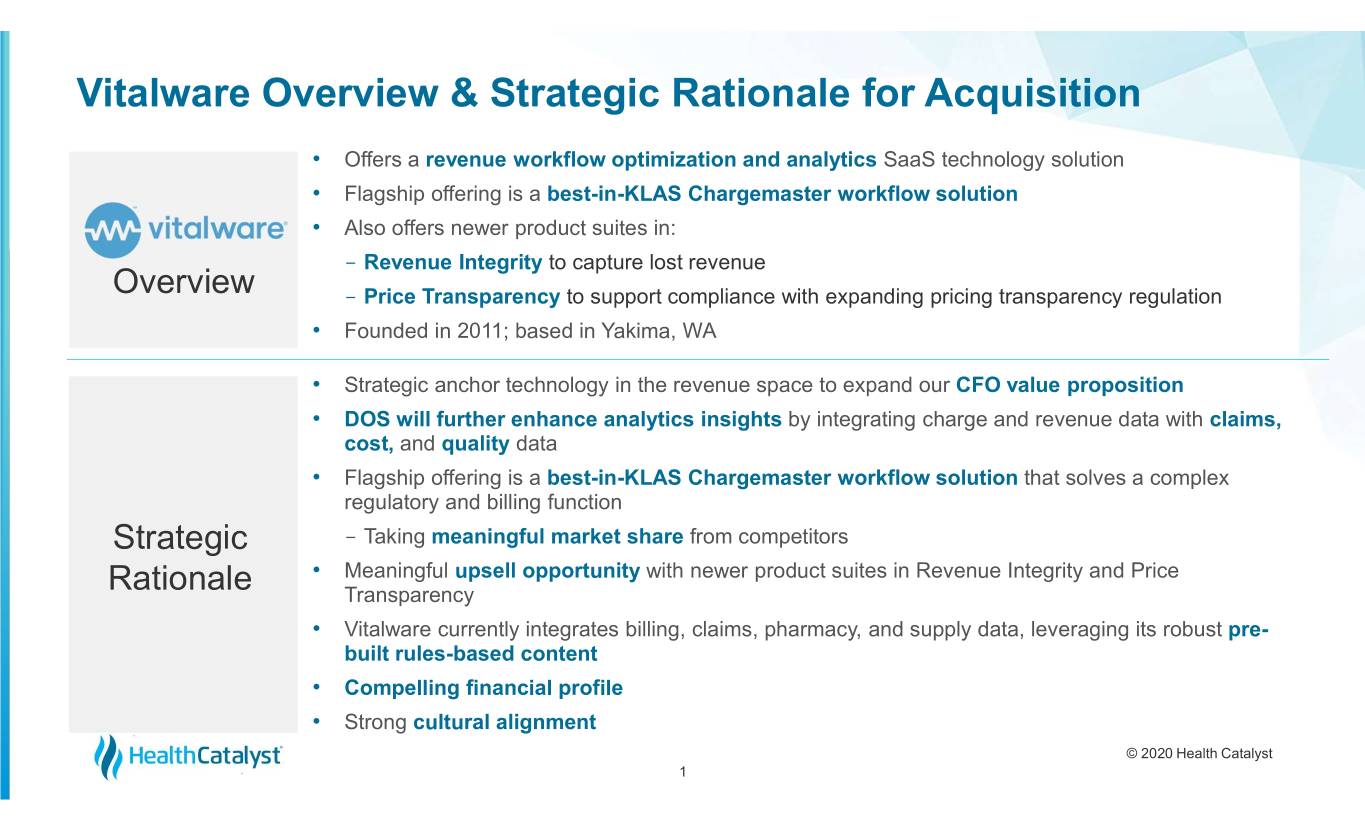

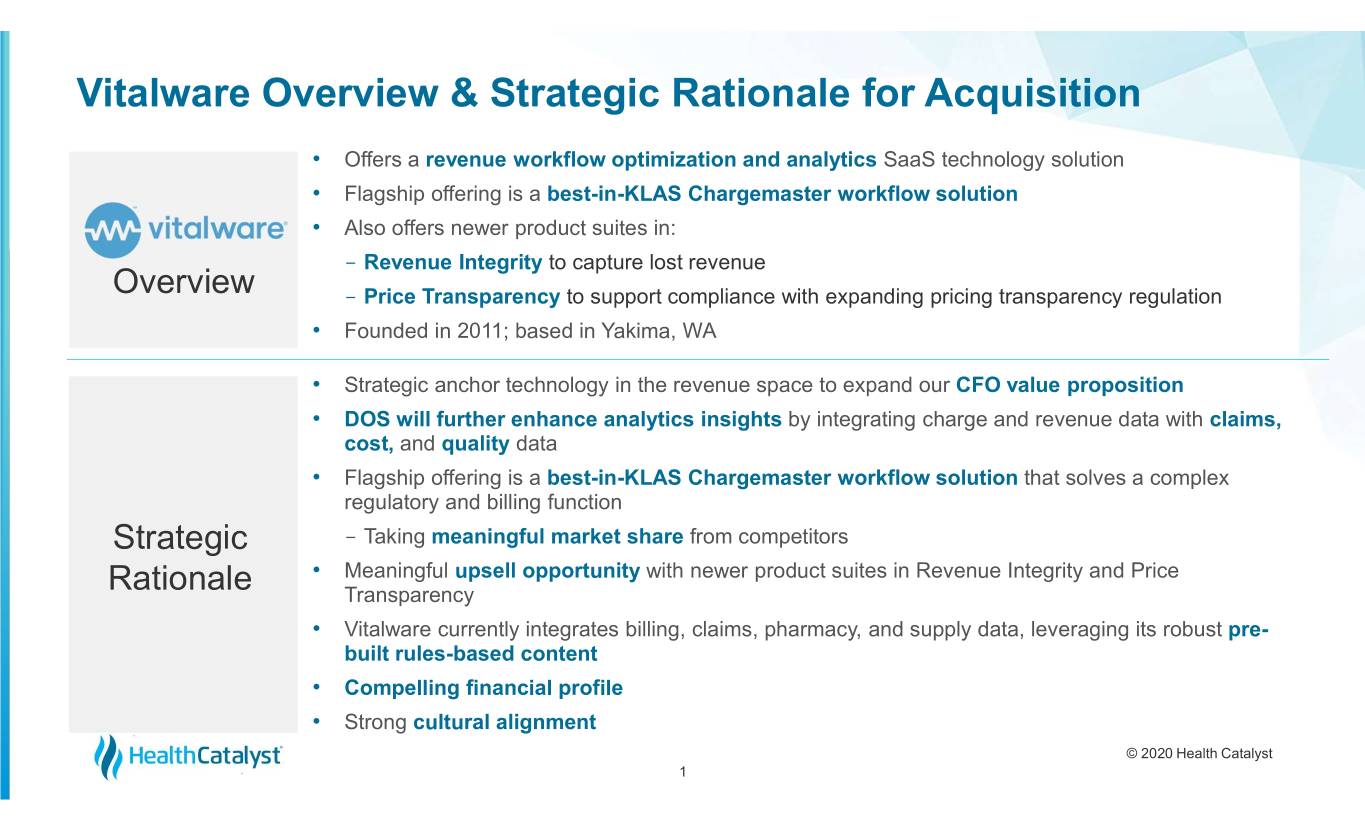

Vitalware Overview & Strategic Rationale for Acquisition • Offers a revenue workflow optimization and analytics SaaS technology solution • Flagship offering is a best-in-KLAS Chargemaster workflow solution • Also offers newer product suites in: - Revenue Integrity to capture lost revenue Overview - Price Transparency to support compliance with expanding pricing transparency regulation • Founded in 2011; based in Yakima, WA • Strategic anchor technology in the revenue space to expand our CFO value proposition • DOS will further enhance analytics insights by integrating charge and revenue data with claims, cost, and quality data • Flagship offering is a best-in-KLAS Chargemaster workflow solution that solves a complex regulatory and billing function Strategic - Taking meaningful market share from competitors • Meaningful upsell opportunity with newer product suites in Revenue Integrity and Price Rationale Transparency • Vitalware currently integrates billing, claims, pharmacy, and supply data, leveraging its robust pre- built rules-based content • Compelling financial profile • Strong cultural alignment © 2020 Health Catalyst 1 Proprietary and Confidential

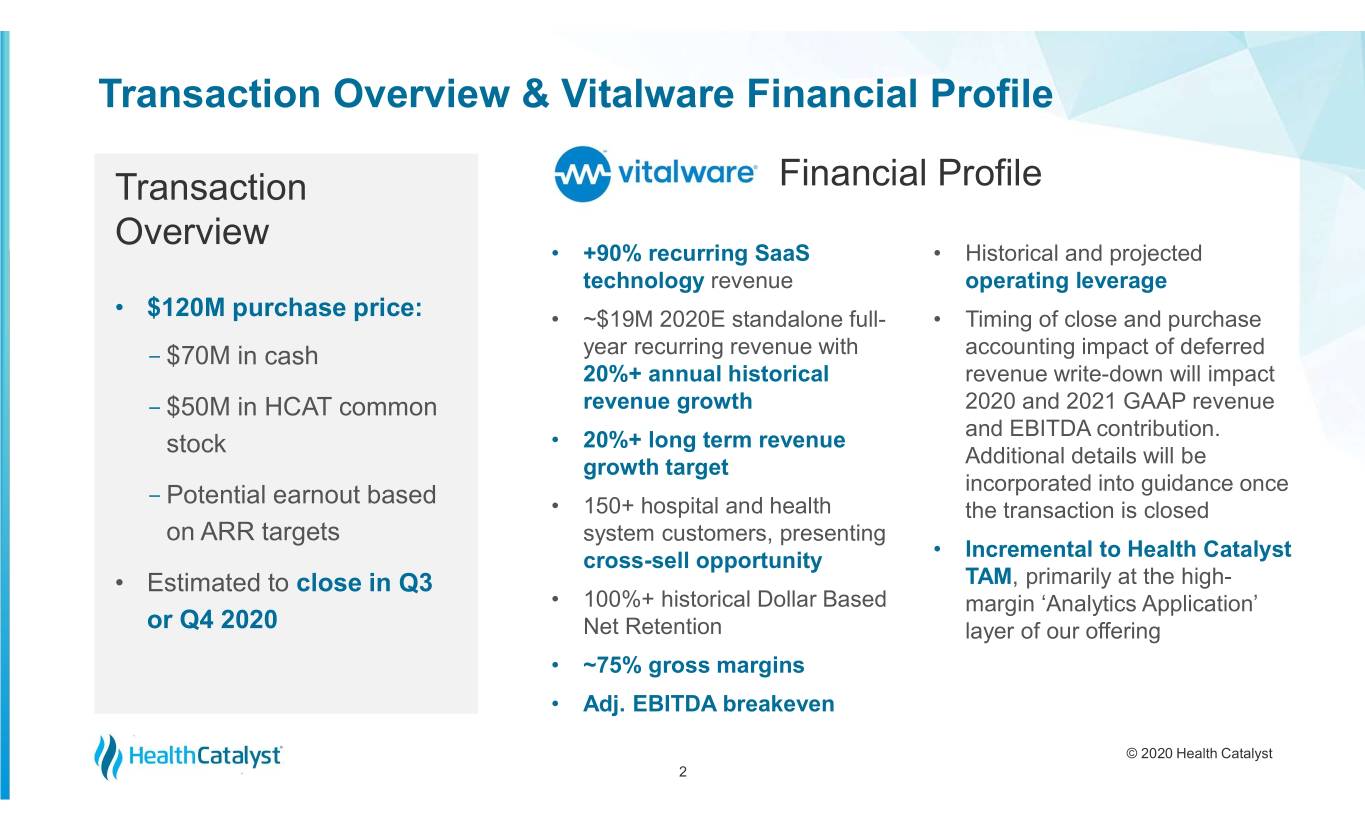

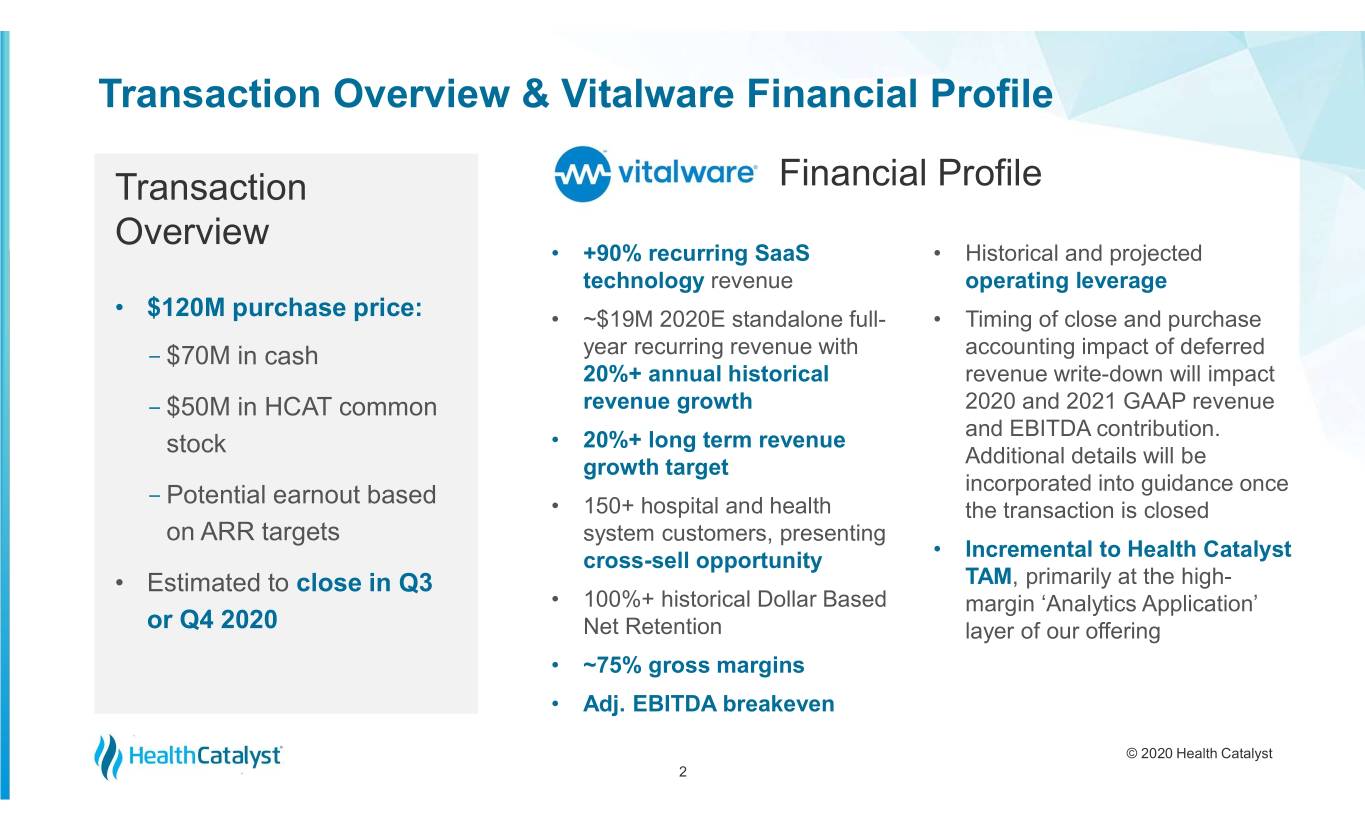

Transaction Overview & Vitalware Financial Profile Transaction Financial Profile Overview • +90% recurring SaaS • Historical and projected technology revenue operating leverage • $120M purchase price: • ~$19M 2020E standalone full- • Timing of close and purchase - $70M in cash year recurring revenue with accounting impact of deferred 20%+ annual historical revenue write-down will impact - $50M in HCAT common revenue growth 2020 and 2021 GAAP revenue and EBITDA contribution. stock • 20%+ long term revenue growth target Additional details will be incorporated into guidance once - Potential earnout based • 150+ hospital and health the transaction is closed on ARR targets system customers, presenting cross-sell opportunity • Incremental to Health Catalyst • Estimated to close in Q3 TAM, primarily at the high- • 100%+ historical Dollar Based margin ‘Analytics Application’ or Q4 2020 Net Retention layer of our offering • ~75% gross margins • Adj. EBITDA breakeven © 2020 Health Catalyst 2 Proprietary and Confidential

© 2020 Health Catalyst Health Catalyst Solution Proprietary and Confidential 3 ProfessionalServices Expertise: Services Analytical, clinical, financial, and operational experts facilitate and accelerate measurable improvement Clinical, Financial, and Operational Domain Experts Analysts, Data Scientists, and Data Engineers Strategic Consulting Readiness Assessment Opportunity Analysis Governance Outcomes Improvement Population Health Training 2 Analytics Applications: A robust set of applications, built on top of DOS, that generate meaningful insights for improvement Foundational Software Applications Domain-Specific Software Applications Tailored Analytics Accelerators Activity-based Patient Safety Costing (Patient Safety (CORUS) Monitor) Registries Clinical & Measures (Sepsis, Readmissions, Heart Authoring Failure, Joint Replacement, (Population Builder) CLABSI, COPD, etc.) Population Care Health Management Foundations Financial Benchmarking (Payment Model Analyzer, (Touchstone) Financial Management, Revenue Cycle, Hierarchical Condition Categories, etc.) Quality and EMR Embedded Regulatory Insights Measures (Care Gap Closure) Operational Dashboards (Supply Chain, Patient & Reporting Flow, Surgical Services, (Leading Wisely) Labor Management, Revenue Practice Management, etc.) Improvement and Workflow Optimization 1 The Data Operating System (DOSTM): A healthcare-specific, open, flexible, scalable platform for analytics, application development, and interoperability Real-time Text © 2020 Health Catalyst Source Reusable Data Machine Terminology Closed-Loop Streaming & Data Warehouse Cloud-based 3 Processing Big Data Connectors Logic Learning Services EMR Integration InteroperabilityProprietary and Confidential