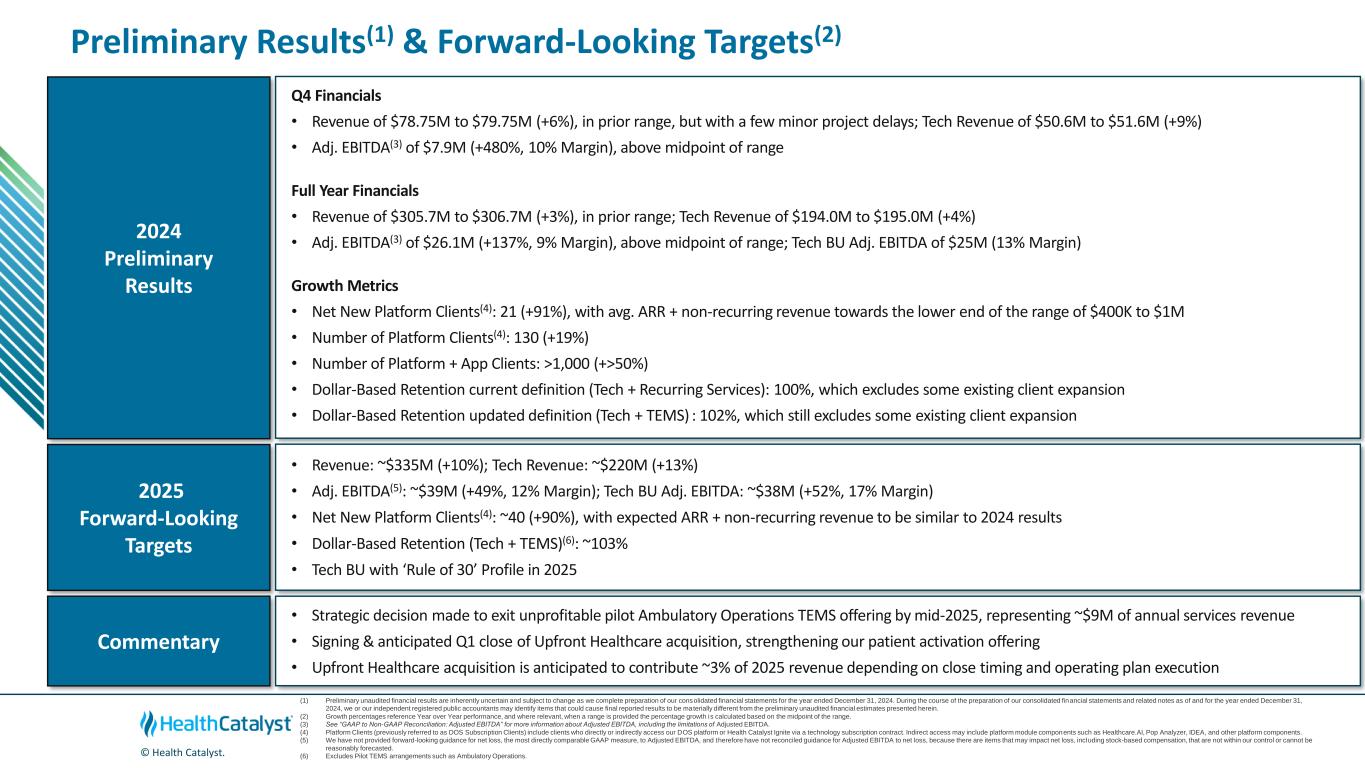

© Health Catalyst. Preliminary Results(1) & Forward-Looking Targets(2) Q4 Financials • Revenue of $78.75M to $79.75M (+6%), in prior range, but with a few minor project delays; Tech Revenue of $50.6M to $51.6M (+9%) • Adj. EBITDA(3) of $7.9M (+480%, 10% Margin), above midpoint of range Full Year Financials • Revenue of $305.7M to $306.7M (+3%), in prior range; Tech Revenue of $194.0M to $195.0M (+4%) • Adj. EBITDA(3) of $26.1M (+137%, 9% Margin), above midpoint of range; Tech BU Adj. EBITDA of $25M (13% Margin) Growth Metrics • Net New Platform Clients(4): 21 (+91%), with avg. ARR + non-recurring revenue towards the lower end of the range of $400K to $1M • Number of Platform Clients(4): 130 (+19%) • Number of Platform + App Clients: >1,000 (+>50%) • Dollar-Based Retention current definition (Tech + Recurring Services): 100%, which excludes some existing client expansion • Dollar-Based Retention updated definition (Tech + TEMS) : 102%, which still excludes some existing client expansion 2024 Preliminary Results 2025 Forward-Looking Targets • Revenue: ~$335M (+10%); Tech Revenue: ~$220M (+13%) • Adj. EBITDA(5): ~$39M (+49%, 12% Margin); Tech BU Adj. EBITDA: ~$38M (+52%, 17% Margin) • Net New Platform Clients(4): ~40 (+90%), with expected ARR + non-recurring revenue to be similar to 2024 results • Dollar-Based Retention (Tech + TEMS)(6): ~103% • Tech BU with ‘Rule of 30’ Profile in 2025 (1) Preliminary unaudited financial results are inherently uncertain and subject to change as we complete preparation of our consolidated financial statements for the year ended December 31, 2024. During the course of the preparation of our consolidated financial statements and related notes as of and for the year ended December 31, 2024, we or our independent registered public accountants may identify items that could cause final reported results to be materially different from the preliminary unaudited financial estimates presented herein. (2) Growth percentages reference Year over Year performance, and where relevant, when a range is provided the percentage growth is calculated based on the midpoint of the range. (3) See “GAAP to Non-GAAP Reconciliation: Adjusted EBITDA” for more information about Adjusted EBITDA, including the limitations of Adjusted EBITDA. (4) Platform Clients (previously referred to as DOS Subscription Clients) include clients who directly or indirectly access our DOS platform or Health Catalyst Ignite via a technology subscription contract. Indirect access may include platform module components such as Healthcare.AI, Pop Analyzer, IDEA, and other platform components. (5) We have not provided forward-looking guidance for net loss, the most directly comparable GAAP measure, to Adjusted EBITDA, and therefore have not reconciled guidance for Adjusted EBITDA to net loss, because there are items that may impact net loss, including stock-based compensation, that are not within our control or cannot be reasonably forecasted. (6) Excludes Pilot TEMS arrangements such as Ambulatory Operations. Commentary • Strategic decision made to exit unprofitable pilot Ambulatory Operations TEMS offering by mid-2025, representing ~$9M of annual services revenue • Signing & anticipated Q1 close of Upfront Healthcare acquisition, strengthening our patient activation offering • Upfront Healthcare acquisition is anticipated to contribute ~3% of 2025 revenue depending on close timing and operating plan execution

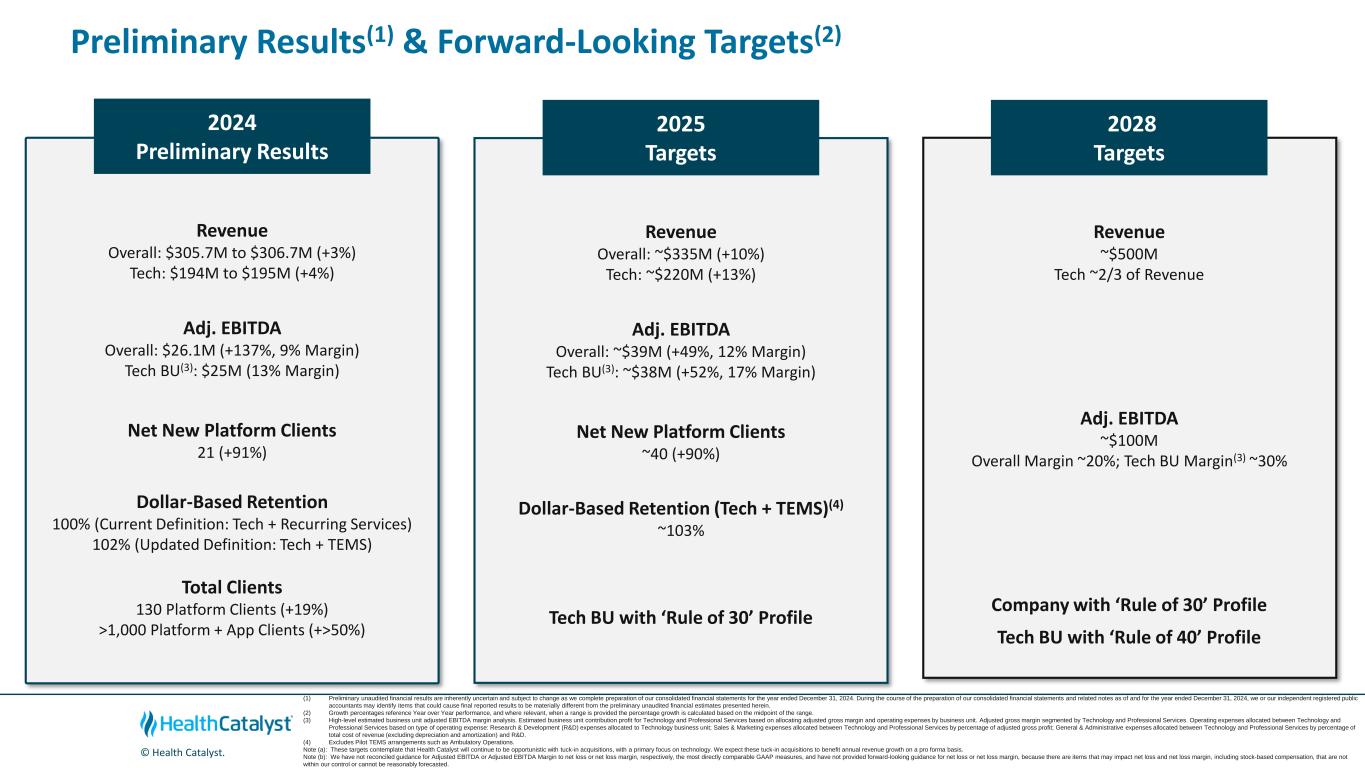

© Health Catalyst. (1) Preliminary unaudited financial results are inherently uncertain and subject to change as we complete preparation of our consolidated financial statements for the year ended December 31, 2024. During the course of the preparation of our consolidated financial statements and related notes as of and for the year ended December 31, 2024, we or our independent registered public accountants may identify items that could cause final reported results to be materially different from the preliminary unaudited financial estimates presented herein. (2) Growth percentages reference Year over Year performance, and where relevant, when a range is provided the percentage growth is calculated based on the midpoint of the range. (3) High-level estimated business unit adjusted EBITDA margin analysis. Estimated business unit contribution profit for Technology and Professional Services based on allocating adjusted gross margin and operating expenses by business unit. Adjusted gross margin segmented by Technology and Professional Services. Operating expenses allocated between Technology and Professional Services based on type of operating expense: Research & Development (R&D) expenses allocated to Technology business unit; Sales & Marketing expenses allocated between Technology and Professional Services by percentage of adjusted gross profit; General & Administrative expenses allocated between Technology and Professional Services by percentage of total cost of revenue (excluding depreciation and amortization) and R&D. (4) Excludes Pilot TEMS arrangements such as Ambulatory Operations. Note (a): These targets contemplate that Health Catalyst will continue to be opportunistic with tuck-in acquisitions, with a primary focus on technology. We expect these tuck-in acquisitions to benefit annual revenue growth on a pro forma basis. Note (b): We have not reconciled guidance for Adjusted EBITDA or Adjusted EBITDA Margin to net loss or net loss margin, respectively, the most directly comparable GAAP measures, and have not provided forward-looking guidance for net loss or net loss margin, because there are items that may impact net loss and net loss margin, including stock-based compensation, that are not within our control or cannot be reasonably forecasted. 2025 Targets Revenue Overall: ~$335M (+10%) Tech: ~$220M (+13%) Adj. EBITDA Overall: ~$39M (+49%, 12% Margin) Tech BU(3): ~$38M (+52%, 17% Margin) Net New Platform Clients ~40 (+90%) Dollar-Based Retention (Tech + TEMS)(4) ~103% Tech BU with ‘Rule of 30’ Profile 2028 Targets Revenue ~$500M Tech ~2/3 of Revenue Adj. EBITDA ~$100M Overall Margin ~20%; Tech BU Margin(3) ~30% Company with ‘Rule of 30’ Profile Tech BU with ‘Rule of 40’ Profile 2024 Preliminary Results Revenue Overall: $305.7M to $306.7M (+3%) Tech: $194M to $195M (+4%) Adj. EBITDA Overall: $26.1M (+137%, 9% Margin) Tech BU(3): $25M (13% Margin) Net New Platform Clients 21 (+91%) Dollar-Based Retention 100% (Current Definition: Tech + Recurring Services) 102% (Updated Definition: Tech + TEMS) Total Clients 130 Platform Clients (+19%) >1,000 Platform + App Clients (+>50%) Preliminary Results(1) & Forward-Looking Targets(2)