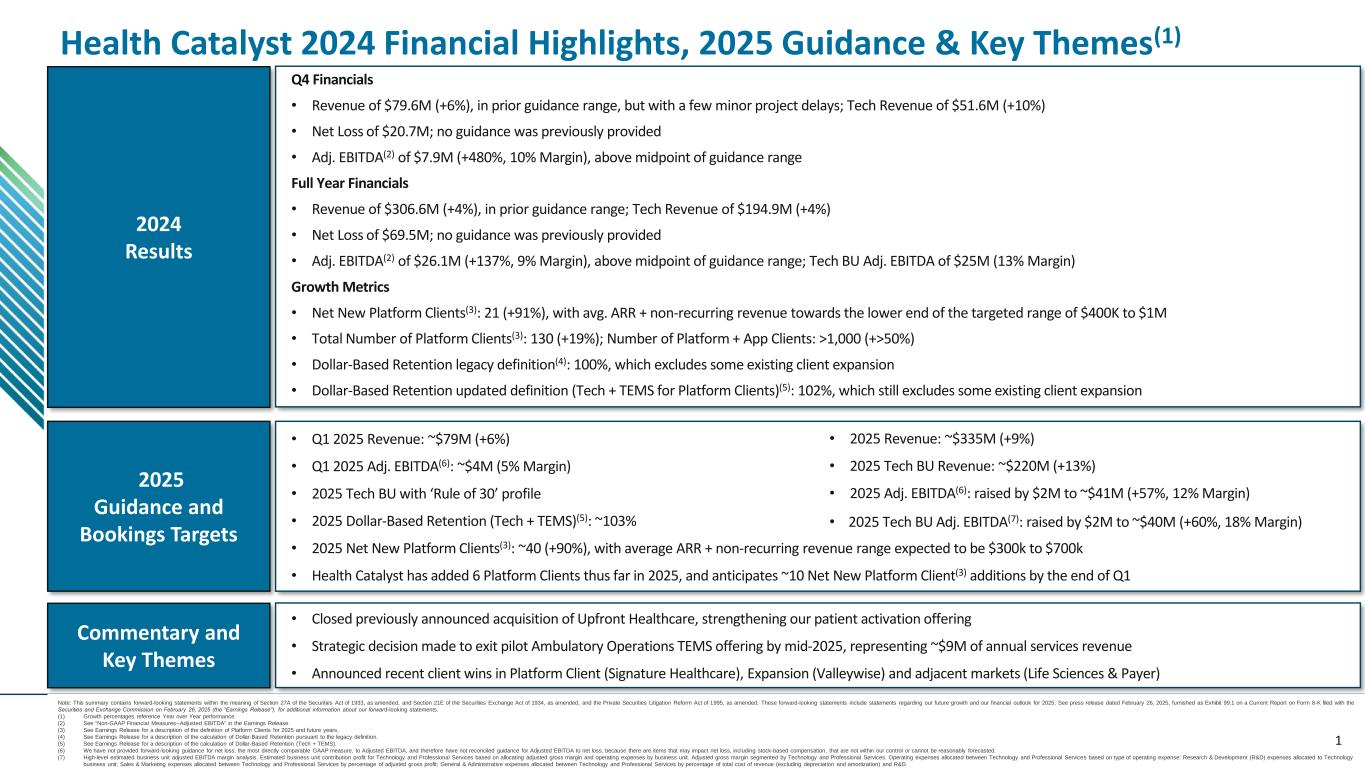

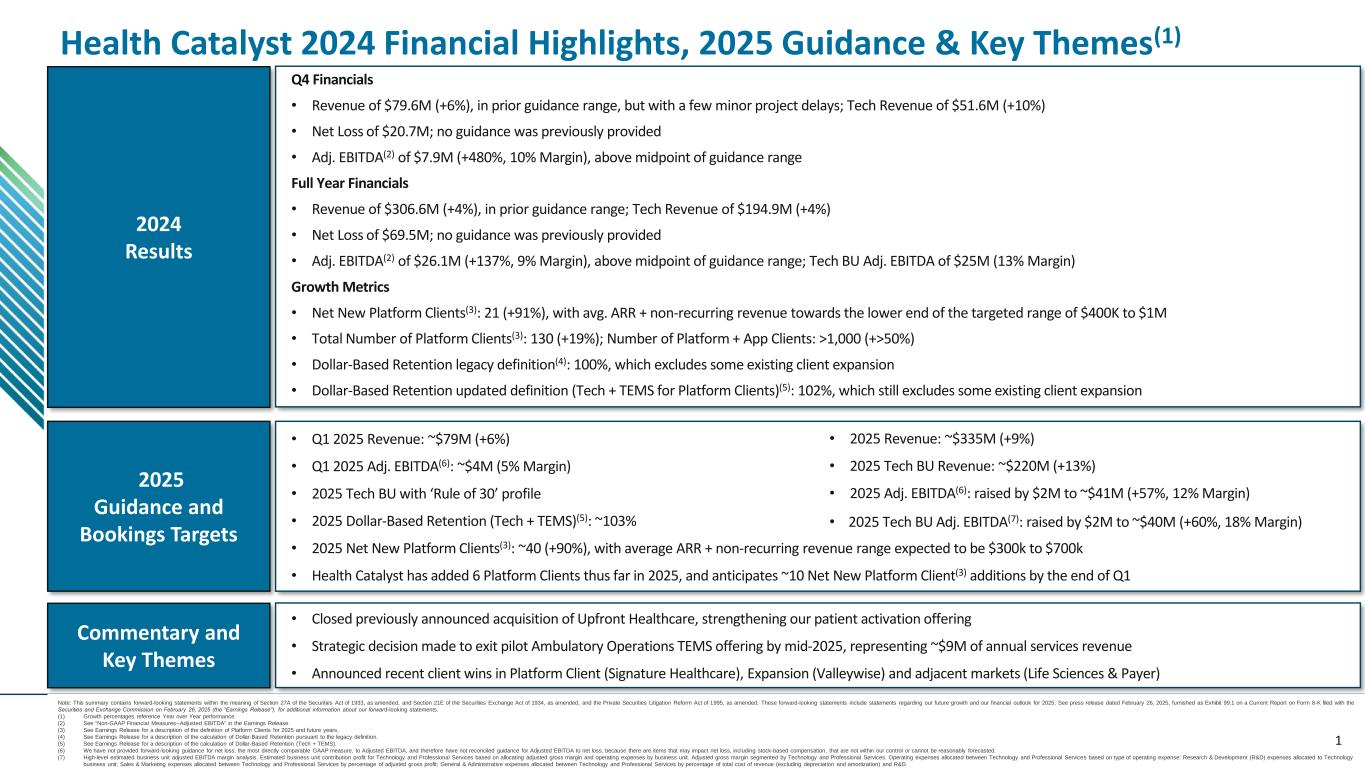

© Health Catalyst. Confidential and Proprietary. Note: This summary contains forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, and the Private Securities Litigation Reform Act of 1995, as amended. These forward-looking statements include statements regarding our future growth and our financial outlook for 2025. See press release dated February 26, 2025, furnished as Exhibit 99.1 on a Current Report on Form 8-K filed with the Securities and Exchange Commission on February 26, 2025 (the “Earnings Release”), for additional information about our forward-looking statements. (1) Growth percentages reference Year over Year performance. (2) See "Non-GAAP Financial Measures--Adjusted EBITDA" in the Earnings Release. (3) See Earnings Release for a description of the definition of Platform Clients for 2025 and future years. (4) See Earnings Release for a description of the calculation of Dollar-Based Retention pursuant to the legacy definition. (5) See Earnings Release for a description of the calculation of Dollar-Based Retention (Tech + TEMS). (6) We have not provided forward-looking guidance for net loss, the most directly comparable GAAP measure, to Adjusted EBITDA, and therefore have not reconciled guidance for Adjusted EBITDA to net loss, because there are items that may impact net loss, including stock-based compensation, that are not within our control or cannot be reasonably forecasted. (7) High-level estimated business unit adjusted EBITDA margin analysis. Estimated business unit contribution profit for Technology and Professional Services based on allocating adjusted gross margin and operating expenses by business unit. Adjusted gross margin segmented by Technology and Professional Services. Operating expenses allocated between Technology and Professional Services based on type of operating expense: Research & Development (R&D) expenses allocated to Technology business unit; Sales & Marketing expenses allocated between Technology and Professional Services by percentage of adjusted gross profit; General & Administrative expenses allocated between Technology and Professional Services by percentage of total cost of revenue (excluding depreciation and amortization) and R&D. Health Catalyst 2024 Financial Highlights, 2025 Guidance & Key Themes(1) 1 Q4 Financials • Revenue of $79.6M (+6%), in prior guidance range, but with a few minor project delays; Tech Revenue of $51.6M (+10%) • Net Loss of $20.7M; no guidance was previously provided • Adj. EBITDA(2) of $7.9M (+480%, 10% Margin), above midpoint of guidance range Full Year Financials • Revenue of $306.6M (+4%), in prior guidance range; Tech Revenue of $194.9M (+4%) • Net Loss of $69.5M; no guidance was previously provided • Adj. EBITDA(2) of $26.1M (+137%, 9% Margin), above midpoint of guidance range; Tech BU Adj. EBITDA of $25M (13% Margin) Growth Metrics • Net New Platform Clients(3): 21 (+91%), with avg. ARR + non-recurring revenue towards the lower end of the targeted range of $400K to $1M • Total Number of Platform Clients(3): 130 (+19%); Number of Platform + App Clients: >1,000 (+>50%) • Dollar-Based Retention legacy definition(4): 100%, which excludes some existing client expansion • Dollar-Based Retention updated definition (Tech + TEMS for Platform Clients)(5): 102%, which still excludes some existing client expansion 2024 Results 2025 Guidance and Bookings Targets • Q1 2025 Revenue: ~$79M (+6%) • Q1 2025 Adj. EBITDA(6): ~$4M (5% Margin) • 2025 Tech BU with ‘Rule of 30’ profile • 2025 Dollar-Based Retention (Tech + TEMS)(5): ~103% • 2025 Net New Platform Clients(3): ~40 (+90%), with average ARR + non-recurring revenue range expected to be $300k to $700k • Health Catalyst has added 6 Platform Clients thus far in 2025, and anticipates ~10 Net New Platform Client(3) additions by the end of Q1 Commentary and Key Themes • Closed previously announced acquisition of Upfront Healthcare, strengthening our patient activation offering • Strategic decision made to exit pilot Ambulatory Operations TEMS offering by mid-2025, representing ~$9M of annual services revenue • Announced recent client wins in Platform Client (Signature Healthcare), Expansion (Valleywise) and adjacent markets (Life Sciences & Payer) • 2025 Revenue: ~$335M (+9%) • 2025 Tech BU Revenue: ~$220M (+13%) • 2025 Adj. EBITDA(6): raised by $2M to ~$41M (+57%, 12% Margin) • 2025 Tech BU Adj. EBITDA(7): raised by $2M to ~$40M (+60%, 18% Margin)