The Group’s ratings are discussed under “—Ratings” below.

Our Company

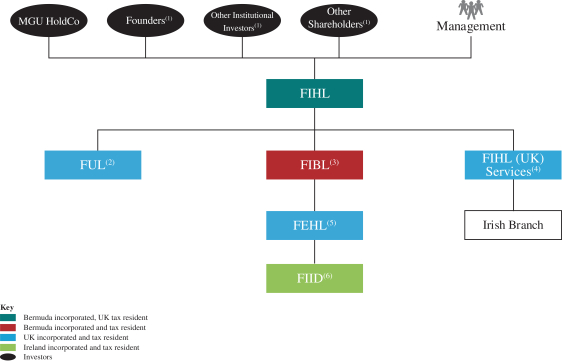

Fidelis is a leading global provider of bespoke and specialty insurance and property reinsurance products. We believe our differentiated underwriting positions us well to generate strong returns across (re)insurance cycles. Current Fidelis is led by Mr. Daniel Burrows who has more than 35 years of experience in the insurance industry and is supported by a highly experienced management team that manages the operations of Current Fidelis based on our founding principles.

Following the Separation Transactions, Current Fidelis is positioned as a global, specialty insurance provider with exclusive right of first access to Fidelis MGU’s underwriting business during the term of the Framework Agreement. Based on Fidelis’ historical experience, we expect this long-term partnership to deliver strong returns to our shareholders, primarily driven by our underwriting results. We aim to be good stewards of capital by effectively balancing capital deployment across market opportunities with capital distributions to our shareholders.

We will continue to benefit from decades of thought and process leadership and innovation through our strategic relationship with Fidelis MGU. The management team of Fidelis MGU, led by Mr. Brindle, has a robust track record built across multiple platforms. Mr. Brindle has more than 38 years of underwriting leadership, including founding Lancashire and holding leading roles at Syndicates 488 and 2488 at Lloyd’s. Teams led by Mr. Brindle oversaw Lancashire stock price appreciation of 412.0% from December 16, 2005 (the date of Lancashire’s initial public offering) to December 31, 2013 (immediately prior to his retirement from Lancashire), significantly exceeding the 71.0% price appreciation from a group of Lancashire’s publicly traded insurance company peers for the period (including Ace, XL, Arch, Everest, PartnerRe, Axis, Allied World, RenaissanceRe, Validus, Montpelier, Greenlight Re, Third Point Re, Hiscox, Amlin, Catlin, Beazley and Novae). Past performance of Lancashire is no guarantee of future results for Fidelis. Mr. Brindle and his team also outperformed at Lloyd’s by delivering a 17.5% return on a straight average for Syndicates 488 and 2488 during his time there from 1986 to 1998, compared to Lloyd’s average return of 0.9% over the same period. Past performance of Syndicates 488 and 2488 is no guarantee of future results for Fidelis. Further, while at Fidelis, between 2017 and 2022 Mr. Brindle and his management team achieved strong, consistent underwriting performance with an average loss ratio of 45.3%, an average combined ratio of 85.8% and an average standard deviation of combined ratio of 6.5% compared with the peer average of 64.3%, 99.5% and 8.1%, respectively. Over this same period, Fidelis’ average loss ratios for each of its Specialty, Bespoke and Reinsurance pillars was 42.8%, 26.7% and 64.9%, respectively, compared to its peers’ average loss ratios of 61.4%, 61.4% and 72.1%, respectively. Fidelis’ combined ratio was 86.0%, 76.3%, 86.6%, 80.6%, 92.9% and 92.1% in 2017, 2018, 2019, 2020, 2021 and 2022, respectively, compared to a peer average combined ratio of 109.4%, 96.9%, 96.7%, 103.7%, 96.6% and 93.5% in 2017, 2018, 2019, 2020, 2021 and 2022, respectively. In the three months ended March 31, 2023, our loss ratio was 41.3% and combined ratio was 79.1% compared with a peer average of 59.3% and 90.5%, respectively. Fidelis’ peer group includes Arch, Argo, Aspen, Markel, W. R. Berkley, Hiscox, Beazley, Lancashire, Everest Re, Axis Capital and RenaissanceRe (except for the three months ended March 31, 2023 which excludes Aspen, Hiscox, Beazley and Lancashire as the information is not available for this period). In each case, prior underwriting and combined ratio performance is no guarantee of future performance. Each of the Fidelis and financial peer combined ratios is calculated as the sum of losses and loss adjustment expenses, policy acquisition expenses and general and administrative expenses as a percentage of NPE in all periods except 2018. In 2018, the Fidelis combined ratio included a negative $2.1 million adjustment to NPE as a result of the costs to acquire a derivative instrument to protect against Typhoon Jebi losses and a $10 million positive adjustment to investment returns recognized on the derivative. Financial peer combined ratios were calculated as the average of the reported combined ratios of each company.

We will continue to focus on nimble underwriting designed to capitalize on current market trends and dislocations as well as emerging risk solutions. We expect to maintain at a minimum the existing underwriting standards and where appropriate will look for enhancements. The team of underwriters at Fidelis MGU continues

160