Use these links to rapidly review the document

Table of Contents

Table of Contents 2

Table of Contents

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-203073

Prospectus

The Men's Wearhouse, Inc.

Offer to Exchange

up to $600,000,000 principal amount of its 7.00% Senior Notes due 2022

which have been registered under the Securities Act of 1933

for

any and all of its outstanding unregistered 7.00% Senior Notes due 2022

THE EXCHANGE OFFER WILL EXPIRE AT 5:00 P.M.,

NEW YORK CITY TIME,

ON JUNE 23, 2015, UNLESS EXTENDED

This is an offer to exchange new 7.00% Senior Notes due 2022 (the "new notes") of The Men's Wearhouse, Inc. ("Men's Wearhouse" or the "Company") that have been registered under the Securities Act of 1933, as amended (the "Securities Act"), for the Company's currently outstanding, unregistered 7.00% Senior Notes due 2022 (the "original notes" and together with the new notes, the "notes").

Terms of the new notes offered in the exchange offer:

- •

- The new notes will be governed by the original indenture and the terms of the new notes are substantially identical to the terms of the original notes that were issued on June 18, 2014, except that the new notes will be registered under the Securities Act, will not contain any legend restricting their transfer, registration rights or provisions for special interest and will bear a different CUSIP number.

- •

- There is no established trading market for the new notes, and the Company does not intend to apply for listing of the new notes on any securities exchange or market quotation system.

- •

- The original notes are, and the new notes will be, guaranteed, jointly and severally, on an unsecured basis by Twin Hill Acquisition Company, Inc., Renwick Technologies, Inc., TMW Merchants LLC, TMW Purchasing LLC, MWDC Holding Inc., MWDC Texas Inc., K&G Men's Company Inc., JA Holding, Inc., JA Apparel Corp., Nashawena Mills Corp., Edera Inc., Joseph Abboud Manufacturing Corp., JA Apparel, LLC, Jos. A. Bank Clothiers, Inc., The Joseph A. Bank Mfg. Co., Inc. and TS Servicing Co., LLC (collectively, the "Guarantors") and each future direct and indirect wholly-owned (i.e. 100% owned) U.S. subsidiary of the Company that becomes a borrower or a guarantor under the Term Loan Facility (as defined herein).

- •

- The notes and the guarantees are not secured obligations of the Company or the Guarantors and are effectively subordinated to our and the Guarantors' existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness.

Terms of the exchange offer:

- •

- The exchange offer expires at 5:00 p.m., New York City time, on June 23, 2015, unless it is extended.

- •

- The exchange offer is subject to customary conditions that may be waived by the Company.

- •

- All original notes that are validly tendered and not validly withdrawn prior to the expiration of the exchange offer will be exchanged for an equal principal amount of new notes.

- •

- Tenders of original notes may be withdrawn at any time prior to the expiration of the exchange offer.

- •

- None of the Company or the Guarantors will receive any proceeds from the issuance of new notes in the exchange offer.

- •

- The exchange of the original notes for the new notes will not be a taxable exchange for United States federal income tax purposes.

- •

- If you fail to tender your original notes, you will continue to hold unregistered securities and it may be difficult for you to transfer them.

See "Risk Factors" beginning on page 10 for a discussion of matters that participants in the exchange offer should consider.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is May 26, 2015.

Table of Contents

Table of Contents

| | |

SUMMARY | | 1 |

RATIO OF EARNINGS TO FIXED CHARGES | | 10 |

RISK FACTORS | | 10 |

THE EXCHANGE OFFER | | 28 |

USE OF PROCEEDS | | 38 |

CAPITALIZATION | | 38 |

SELECTED FINANCIAL DATA OF MEN'S WEARHOUSE | | 39 |

UNAUDITED PRO FORMA CONDENSED COMBINED FINANCIAL DATA | | 41 |

DESCRIPTION OF OTHER INDEBTEDNESS. | | 47 |

DESCRIPTION OF NOTES | | 50 |

MATERIAL UNITED STATES FEDERAL INCOME TAX CONSIDERATIONS | | 100 |

BOOK-ENTRY, DELIVERY AND FORM | | 105 |

PLAN OF DISTRIBUTION | | 109 |

LEGAL MATTERS | | 110 |

EXPERTS | | 110 |

WHERE YOU CAN FIND MORE INFORMATION; INCORPORATION BY REFERENCE | | 110 |

JOS. A. BANK FINANCIAL STATEMENTS | | F-1 |

This prospectus incorporates important business and financial information about the Company that is not included in or delivered with this prospectus. The Company will provide this information to you at no charge upon written or oral request directed to: The Men's Wearhouse, Inc., 6380 Rogerdale Road, Houston, TX 77072, 281-776-7000, Attn: Corporate Compliance. In order to ensure timely delivery of the information, any request should be made by June 16, 2015.

Each broker-dealer that receives new notes for its own account pursuant to the exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such new notes. The accompanying letter of transmittal states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act. This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of new notes received in exchange for original notes where such new notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, starting on the date hereof (the "Expiration Date") and ending on the close of business 90 days after the Expiration Date, we will make this prospectus available to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

The Company has not authorized any person to give you any information or to make any representations about the exchange offer other than those contained in this prospectus. If you are given any information or representations that are not discussed in this prospectus, you must not rely on that information or those representations. This prospectus is not an offer to sell or a solicitation of an offer to buy any securities other than the securities to which it relates. In addition, this prospectus is not an offer to sell or the solicitation of an offer to buy those securities in any jurisdiction in which the offer or solicitation is not authorized, or in which the person making the offer or solicitation is not qualified to do so, or to any person to whom it is unlawful to make an offer or solicitation. The delivery of this prospectus and any exchange made under this prospectus do not, under any circumstances, mean that there has not been any change in the affairs of the Company since the date of this prospectus or that information contained in this prospectus is correct as of any time subsequent to its date.

i

Table of Contents

Notice to Investors

This prospectus contains summaries of the terms of certain agreements in a manner we believe to be accurate in all material respects. However, we refer you to the actual agreements for complete information relating to those agreements. All summaries contained in this prospectus are qualified in their entirety by this reference.

Notice to New Hampshire Residents

Neither the fact that a registration statement or an application for a license has been filed under Chapter 421-B of the New Hampshire Revised Statutes Annotated, as amended, with the State of New Hampshire nor the fact that a security is effectively registered or a person is licensed in the State of New Hampshire constitutes a finding by the Secretary of State that any document filed under RSA 421-B is true, complete and not misleading. Neither any such fact nor the fact that an exemption or exception is available for a security or a transaction means that the Secretary of State has passed in any way upon the merits or qualifications of, or recommended or given approval to, any person, security or transaction. It is unlawful to make, or cause to be made, to any prospective purchaser, customer, or client any representation inconsistent with the provisions of this paragraph.

INFORMATION REGARDING FORWARD-LOOKING STATEMENTS

Certain statements made in this prospectus contain "forward-looking" information (as defined in the Private Securities Litigation Reform Act of 1995) that involves risk and uncertainty. These forward-looking statements may include, but are not limited to, references to, sales, earnings, margins, costs, number and costs of store openings, future capital expenditures, acquisitions, synergies, demand for clothing, market trends in the retail and corporate apparel clothing business, currency fluctuations, inflation and various economic and business trends. Forward-looking statements may be made by management orally or in writing, including, but not limited to, Management's Discussion and Analysis of Financial Condition and Results of Operations included in our Annual Report on Form 10-K for the fiscal year ended January 31, 2015 incorporated by reference in this prospectus.

Forward-looking statements are not guarantees of future performance and a variety of factors could cause actual results to differ materially from the anticipated or expected results expressed in or suggested by these forward-looking statements. Factors that might cause or contribute to such differences include, but are not limited to: actions by governmental entities; domestic and international economic activity and inflation; success, or lack thereof, in executing our internal operating plans and new store and new market expansion plans, as well as integration of acquisitions including Jos. A. Bank Clothiers, Inc.; performance issues with key suppliers; disruption in buying trends due to homeland security concerns; severe weather; foreign currency fluctuations; government export and import policies; advertising or marketing activities of competitors; and legal proceedings. Future results will also be dependent upon our ability to continue to identify and complete successful expansions and penetrations into existing and new markets and our ability to integrate such expansions with our existing operations.

These forward-looking statements are based upon management's current beliefs or expectations and are inherently subject to significant business, economic and competitive uncertainties and contingencies and third party approvals, many of which are beyond our control. These forward-looking statements are intended to convey the Company's expectations about the future, and speak only as of the date they are made. We undertake no obligation to publicly update or revise any forward-looking statement that may be made from time to time, whether as a result of new information, future developments or otherwise.

ii

Table of Contents

Guarantors

| | |

| TWIN HILL ACQUISITION COMPANY, INC. | | JA APPAREL CORP. |

RENWICK TECHNOLOGIES, INC. |

|

NASHAWENA MILLS CORP. |

TMW MERCHANTS LLC |

|

EDERA INC. |

TMW PURCHASING LLC |

|

JOSEPH ABBOUD MANUFACTURING CORP. |

MWDC HOLDING INC. |

|

JA APPAREL, LLC |

MWDC TEXAS INC. |

|

JOS. A. BANK CLOTHIERS, INC. |

K&G MEN'S COMPANY INC. |

|

THE JOSEPH A. BANK MFG. CO., INC. |

JA HOLDING, INC. |

|

TS SERVICING CO., LLC |

iii

Table of Contents

SUMMARY

This summary highlights information contained elsewhere or incorporated by reference in this prospectus and does not contain all the information you should consider before tendering original notes in the exchange offer. You should carefully read the entire prospectus, including the documents incorporated in it by reference. The following summary is qualified in its entirety by, and should be read in conjunction with, the more detailed information appearing elsewhere in this prospectus. In particular, you should read the section entitled "Risk Factors" included elsewhere in this prospectus and our financial statements and the related notes thereto that appear elsewhere in, or incorporated by reference into, this prospectus. This prospectus and the letter of transmittal that accompanies it collectively constitute the exchange offer.

References in this prospectus to "fiscal year" or "fiscal" refer to our financial reporting years ending on the Saturday closest to January 31 in the following calendar year. In this prospectus, unless otherwise specified or as the context otherwise requires, "Men's Wearhouse," "the Company," "we," "our," "ours" and "us" refer to The Men's Wearhouse, Inc. and its consolidated subsidiaries. References to "Jos. A. Bank" or "JOSB" refer to Jos. A. Bank Clothiers, Inc. and its consolidated subsidiaries.

Our Company

Founded in 1973, we are the largest specialty retailer of men's suits and the largest provider of tuxedo rental product in the United States ("U.S.") and Canada. At January 31, 2015, we operated a total of 1,758 retail stores, with 1,635 stores in the U.S. and Puerto Rico as well as 123 stores in Canada. Our U.S. retail stores are operated under the brand names Men's Wearhouse (698 stores), Men's Wearhouse and Tux (210 stores), Jos. A. Bank (636 stores, excluding 15 franchise stores), and K&G (91 stores) in 50 states, the District of Columbia and Puerto Rico. Our 123 Canadian stores are operated under the brand name Moores Clothing for Men ("Moores") in ten provinces. In addition, at January 31, 2015, we operated 34 retail dry cleaning, laundry and heirlooming facilities through MW Cleaners in Texas. Also, we recently acquired JA Holding, Inc. ("JA Holding"), the parent company of the American clothing brand Joseph Abboud® and a U.S. tailored clothing factory. These operations comprise our retail segment.

In our retail segment, we offer our products and services through our four retail merchandising brands—Men's Wearhouse/Men's Wearhouse and Tux, Jos. A. Bank, Moores, K&G—and the internet at www.menswearhouse.com, www.josbank.com and www.josephabboud.com. Our stores are located throughout the U.S. and Canada and carry a wide selection of exclusive and non-exclusive merchandise brands. MW Cleaners is also included in the retail segment, as these operations have not had a significant effect on our revenues or expenses. Also, as a result of our acquisition of JA Holding, we operate a factory in New Bedford, Massachusetts that manufactures quality U.S. made tailored clothing including designer suits, tuxedos, sport coats and slacks which we sell in our Men's Wearhouse stores and at www.josephabboud.com.

Additionally, our corporate apparel segment includes our corporate apparel and uniform operations conducted by Twin Hill in the U.S. and Dimensions, Alexandra and Yaffy in the United Kingdom ("UK"). These operations provide corporate clothing uniforms and workwear to workforces through multiple channels including managed corporate accounts, catalogs and the Internet. We offer a wide variety of customer branded apparel such as shirts, blouses, trousers, skirts and suits as well as a wide range of other products from aprons to safety vests to high visibility police outerwear. With respect to our managed contracts, we generally provide complete management of our customers' corporate clothing programs from design, fabric buying and manufacture to measuring, product roll-outs and ongoing stock replacement and replenishment.

1

Table of Contents

The Acquisition of Jos. A. Bank

On June 18, 2014, pursuant to a merger agreement by and among Men's Wearhouse, Jos. A. Bank, and Java Corp. ("Purchaser"), a Delaware corporation and a direct wholly-owned subsidiary of Men's Wearhouse, we acquired all of the issued and outstanding shares of common stock of Jos. A. Bank for $65.00 per share, net to the seller in cash, or total consideration of approximately $1.8 billion and enterprise value of approximately $1.5 billion. In connection with the acquisition, Purchaser merged with and into Jos. A. Bank, with Jos. A. Bank surviving as a wholly-owned subsidiary of Men's Wearhouse.

Concurrently with the closing of the acquisition, in addition to issuing the original notes, we entered into (i) a $1.1 billion aggregate principal amount senior secured credit facility (the "Term Loan Facility") and (ii) a $500.0 million asset-based revolving facility (the "ABL Facility" together with the Term Loan Facility, the "Credit Facilities"). In connection with the acquisition and the entering into of the Credit Facilities, our existing credit agreement and all of our existing indebtedness was repaid in full, all commitments thereunder were terminated and the security interests with respect thereto were released (the "Refinancing"). As of January 31, 2015, there was approximately $1,087.2 million issued and outstanding under the Term Loan Facility and, except for letters of credit totaling approximately $18.5 million issued and outstanding, no amounts were drawn on the ABL Facility.

Recent Developments

On April 7, 2015, we entered into the Incremental Facility Agreement No. 1 to the credit agreement governing the Term Loan Facility to incur an aggregate principal amount of $400 million in Tranche B-1 Term Loans (the "Tranche B-1 Term Loans"). The Tranche B-1 Term Loans mature on June 18, 2021, the same date as the term loans under the existing Term Loan Facility, and bear interest at a fixed rate of 5.00% per annum. The net proceeds of the Tranche B-1 Term Loans were used to refinance a portion of the term loans under the existing Term Loan Facility and, as a result, the incurrence of the Tranche B-1 Term Loans did not impact the total amount borrowed under the Term Loan Facility. See "Description of Other Indebtedness."

2

Table of Contents

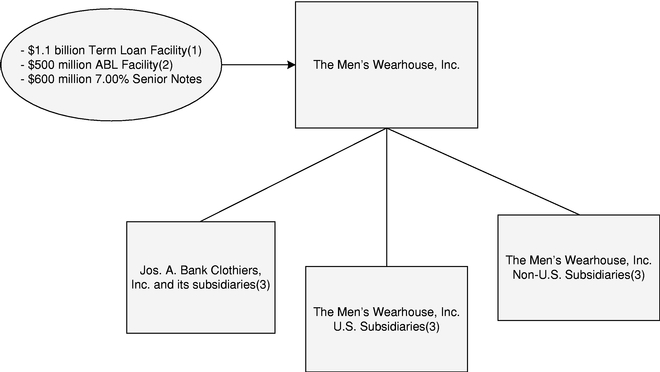

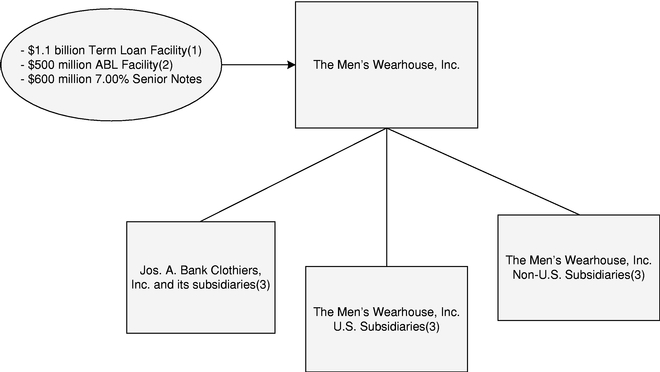

Our Structure

Our corporate organizational structure is as follows:

- (1)

- $1.1 billion aggregate principal amount of senior secured term B loans. As of January 31, 2015, there was approximately $1,087.2 million issued and outstanding under the Term Loan Facility.

- (2)

- Up to $500.0 million asset-based revolving facility. As of January 31, 2015, except for letters of credit totaling approximately $18.5 million issued and outstanding, no amounts were drawn on the ABL Facility.

- (3)

- Our non-U.S. subsidiaries and certain of our U.S. subsidiaries are not guarantors of the notes, nor guarantors or co-borrowers of the Term Loan Facility. See "Description of Notes." In addition, certain of our non-U.S. subsidiaries are borrowers and guarantors under our ABL Facility. See "Description of Other Indebtedness—ABL Facility." For the twelve months ended January 31, 2015, our non-guarantor subsidiaries accounted for 14.6% of our net sales. As of January 31, 2015, our non-guarantor subsidiaries accounted for approximately 9.8% of our total consolidated assets (excluding intercompany transactions) and approximately 2.7% of our consolidated liabilities (excluding intercompany transactions). See "Selected Financial Data of Men's Wearhouse" and "Unaudited Pro Forma Condensed Combined Financial Information."

Corporate Information

The Men's Wearhouse began operations in 1973 as a partnership and was incorporated as The Men's Wearhouse, Inc. under the laws of Texas in May 1974. Our principal corporate and executive offices are located at 6380 Rogerdale Road, Houston, Texas 77072-1624 (telephone number 281-776-7000) and at 6100 Stevenson Blvd., Fremont, California 94538-2490 (telephone number 510-657-9821), respectively.

3

Table of Contents

The Exchange Offer

On June 18, 2014, we completed an offering of $600.0 million aggregate principal amount of our 7.00% Senior Notes due 2022 (the "original notes") in a transaction exempt from registration under the Securities Act. Concurrently with the consummation of the acquisition of all of the issued and outstanding shares of Jos. A. Bank, pursuant to a supplemental indenture, Jos. A. Bank and its subsidiaries agreed to guarantee the original notes on an unsecured basis. In connection with the offering of the original notes, we entered into a registration rights agreement, dated as of June 18, 2014, with the initial purchasers of the original notes. In the registration rights agreement, we agreed to offer our new 7.00% Senior Notes due 2022, which will be registered under the Securities Act (the "new notes") in exchange for the original notes. Pursuant to the registration rights agreement, we agreed, among other things, to file the registration statement of which this prospectus is a part and to deliver this prospectus to the holders of the original notes. You should read the discussion under the heading "Description of Notes" for information regarding the notes.

| | | | |

The Exchange Offer | | This is an offer to exchange $1,000 in principal amount of new notes for each $1,000 in principal amount of outstanding original notes. The new notes are substantially identical to the original notes, except that: |

| | (1) | | the new notes will be freely transferable, other than as described in this prospectus; |

| | (2) | | the new notes will not contain any legend restricting their transfer; |

| | (3) | | holders of the new notes will not be entitled to the rights of the holders of the original notes under the registration agreement; and |

| | (4) | | the new notes will not contain any provisions regarding the payment of Additional Interest (as defined herein). |

| | We believe that you can transfer the new notes without complying with the registration and prospectus delivery provisions of the Securities Act if you: |

| | (1) | | acquire the new notes in the ordinary course of your business; |

| | (2) | | are not and do not intend to become engaged in a distribution of the new notes; |

| | (3) | | are not an affiliate of the Company; |

| | (4) | | are not a broker-dealer that acquired the original notes directly from the Company; and |

| | (5) | | are not a broker-dealer that acquired the original notes as a result of market-making or other trading activities. |

| | If any of these conditions are not satisfied and you transfer any new notes without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. |

4

Table of Contents

| | | | |

Registration Rights | | We have agreed to use commercially reasonable efforts to consummate the exchange offer or cause the original notes to be registered under the Securities Act to permit resales. If we are not in compliance with our obligations under the registration agreement, then Additional Interest (in addition to the interest otherwise due on the original notes that are the subject of the registration agreement or the new notes) will accrue on the original notes. If the exchange offer is completed on the terms and within the time period contemplated by this prospectus, no Additional Interest will be payable on the original notes. See "The Exchange Offer—Additional Interest." |

No Minimum Condition | | The exchange offer is not conditioned on any minimum aggregate principal amount of original notes being tendered for exchange. |

Expiration Date | | The exchange offer will expire at 5:00 p.m., New York City time, on June 23, 2015, unless it is extended. |

Exchange Date | | Original notes will be accepted for exchange beginning on the first business day following the expiration date, upon surrender of the original notes. |

Conditions to the Exchange Offer | | Our obligation to complete the exchange offer is subject to certain conditions. See "The Exchange Offer—Conditions to the Exchange Offer." We reserve the right to terminate or amend the exchange offer at any time before the expiration date if various specified events occur. |

Withdrawal Rights | | You may withdraw the tender of your original notes at any time before the expiration date. Any original notes not accepted for any reason will be returned to you without expense as promptly as practicable after the expiration or termination of the exchange offer. |

Procedures for Tendering Original Notes | | See "The Exchange Offer—How to Tender." |

Material United States Federal Income Tax Considerations | | The exchange of original notes for new notes by U.S. Holders, as defined below, should not be a taxable exchange for U.S. federal income tax purposes, and U.S. Holders should not recognize any taxable gain or loss as a result of the exchange. See "Material United States Federal Income Tax Considerations." |

5

Table of Contents

| | | | |

Effect on Holders of Original Notes | | If the exchange offer is completed on the terms and within the period contemplated by this prospectus, holders of original notes will have no further registration or other rights under the registration agreement, except under limited circumstances involving the initial purchasers or holders of original notes who are not eligible to participate in the exchange offer. Holders of original notes who do not tender their original notes will continue to hold those original notes. All untendered, and tendered but unaccepted, original notes will continue to be subject to the restrictions on transfer provided for in the original notes and the indenture under which the original notes have been, and the new notes are being, issued. To the extent that original notes are tendered and accepted in the exchange offer, the trading market, if any, for the original notes could be adversely affected. See "The Exchange Offer—Other." |

Use of Proceeds | | We will not receive any proceeds from the issuance of the new notes in the exchange offer. |

Exchange Agent | | The Bank of New York Mellon Trust Company, N.A. is serving as exchange agent in connection with the exchange offer. |

6

Table of Contents

The Notes

The new notes are substantially identical to the original notes, except for the transfer restrictions and registration rights relating to the original notes. The new notes will evidence the same debt as the original notes, be guaranteed, jointly and severally, on an unsecured basis by each of our existing and future direct and indirect wholly-owned (i.e. 100% owned) U.S. subsidiaries who are or become a borrower or guarantor under the Term Loan Facility, and be entitled to the benefits of the indenture.

| | |

Issuer | | The Men's Wearhouse, Inc., a Texas corporation. |

Securities Offered | | $600.0 million aggregate principal amount of new notes in exchange for $600.0 million aggregate principal amount of original notes. |

Interest | | The new notes will accrue interest from the most recent date to which interest has been paid at a rate of 7.00% per year. |

Interest Payment Dates | | Interest on the new notes will be payable semi-annually in arrears on each January 1 and July 1. |

Maturity | | July 1, 2022. |

Note Guarantees | | The new notes will be guaranteed, jointly and severally, on an unsecured basis by the Guarantors and each future direct and indirect wholly-owned (i.e. 100% owned) U.S. subsidiary that becomes a borrower or a guarantor under the Term Loan Facility. In the event that the lenders under the Term Loan Facility exercise their discretion to release a Guarantor under the Term Loan Facility, which is permitted under certain circumstances, then such Guarantor will also be released from their guarantee of the notes under the indenture. See "Description of Notes—Note Guarantees" and "Risk Factors—The lenders under our Term Loan Facility may in their discretion release the guarantors under their facilities in a variety of circumstances, which will cause those guarantors to be released from their guarantees of the notes." |

Ranking | | The new notes and the related guarantees will be our and the Guarantors, respective, senior unsecured obligations and will rank equally in right of payment to all present and future senior indebtedness, senior in right of payment to all present and future subordinated indebtedness, and effectively subordinated in right of payment to any of our and the Guarantors' secured indebtedness (to the extent of the value of the assets securing such indebtedness) including the obligation under the Credit Facilities. The new notes will be structurally subordinated to all existing and future indebtedness and obligations of any non-guarantor subsidiaries including the obligations of certain of our non-U.S. subsidiaries under the ABL Facility. |

| | As of January 31, 2015, we have approximately $1,087.2 million of secured debt outstanding. In addition we have approximately $432.5 million of availability under the ABL Facility, excluding letters of credit issued and outstanding totaling approximately $18.5 million, all of which is secured by a first-priority lien on the ABL priority collateral. |

7

Table of Contents

| | |

| | As of January 31, 2015, our non-guarantor subsidiaries had an aggregate of approximately $70.2 million of total liabilities (excluding intercompany transactions and borrowing availability under the ABL Facility), all of which is structurally senior to the notes and the related guarantees. |

| | For the fiscal year ended January 31, 2015, our non-guarantor subsidiaries accounted for 14.6% of our net sales. As of January 31, 2015, our non-guarantor subsidiaries accounted for approximately 9.8% of our total consolidated assets (excluding intercompany transactions). See "Selected Financial Data of Men's Wearhouse" and "Unaudited Pro Forma Condensed Combined Financial Information." |

Optional Redemption | | We will have the option to redeem some or all of the new notes at any time on or after July 1, 2017, at a redemption price equal to 100% of the principal amount thereof, plus a premium declining ratably on an annual basis to par and accrued and unpaid interest, if any, to the date of redemption. We will also have the option to redeem some or all of the new notes at anytime before July 1, 2017 at a redemption price of 100% of the principal amount of the notes to be redeemed, plus a "make-whole" premium and accrued and unpaid interest, if any, to the date of redemption. |

| | In addition, at any time before July 1, 2017, we may redeem up to 35% of the aggregate principal amount of the notes at a redemption price of 107.000% of the principal amount of the notes with the proceeds from certain equity issuances plus accrued and unpaid interest, if any, to the date of redemption. See "Description of Notes—Optional Redemption." |

Change of Control | | If we experience specific changes of control, we may be required to offer to purchase the notes at 101% of their aggregate principal amount plus accrued and unpaid interest thereon to the date of purchase. If holders of not less than 90% of the principal amount of the outstanding notes accept a change of control offer, we will have the right to redeem all of the notes then outstanding at a purchase price equal to 101% of the principal amount thereof, plus accrued and unpaid interest thereon. Our ability to purchase the notes upon a change of control may be limited by the terms of the Credit Facilities. We can not assure you that we will have the financial resources to purchase the notes in such circumstances. See "Description of Notes—Repurchase at the Option of Holders Upon a Change of Control." |

Asset Sales | | If we sell certain assets, under certain circumstances we may be required to offer to purchase the notes at 100% of their aggregate principal amount plus accrued and unpaid interest thereon to the date of purchase. See "Description of Notes—Certain Covenants—Limitation on Asset Sales." |

Certain Covenants | | The indenture governing the notes contains covenants that, among other things, limit our ability and the ability of our restricted subsidiaries to: |

8

Table of Contents

| | |

| | • incur additional indebtedness or issue certain preferred stock; |

| | • pay dividends or repurchase or redeem capital stock or make other restricted payments; |

| | • limit dividends or other payments by our restricted subsidiaries to us or our other restricted subsidiaries; |

| | • incur liens; |

| | • enter into certain types of transactions with our affiliates; and |

| | • consolidate or merge with or into other companies. |

| | These and other covenants contained in the indenture under which the original notes have been, and the new notes are being, issued are subject to important exceptions and qualifications. See "Description of Notes—Certain Covenants." |

Covenant Suspension | | During any period of time that (i) the ratings assigned to the notes by both of Moody's Investors Service, Inc. and Standard & Poor's Ratings Service are equal to or higher than Baa3 (or the equivalent) and BBB– (or the equivalent), respectively, and (ii) no default or event of default has occurred and is continuing under the indenture relating to the notes, we and our restricted subsidiaries will not be subject to most of the covenants discussed above. See "Description of Notes—Certain Covenants—Covenant Suspension." In the event that we and our restricted subsidiaries are not subject to such covenants for any period of time as a result of the preceding sentence and, on any subsequent date, one or both of such ratings agencies withdraws or downgrades the ratings assigned to the notes below the level set forth above or a default or event of default occurs and is continuing under the indenture relating to the notes, then we and our restricted subsidiaries will thereafter again be subject to such covenants. |

Absence of a Public Market for the Notes | | The new notes are a new issue of securities for which there is currently no public trading market. There can be no assurance as to the development or liquidity of any market for any of the notes. We do not intend to apply for listing of any of the notes or, if issued, the new notes on any securities exchange or for quotation through any annotated quotation system. See "Risk Factors—Risks Relating to the Notes—There is no public market for the notes, which could limit their market price or your ability to sell them." |

Risk Factors | | Before tendering original notes, holders should carefully consider all of the information set forth and incorporated by reference in this prospectus and, in particular, should evaluate the specific risk factors set forth under "Risk Factors," beginning on page 10. |

9

Table of Contents

RATIO OF EARNINGS TO FIXED CHARGES

Our ratio of earnings to fixed charges for each of the fiscal years indicated was as follows:

| | | | | | | | | | | | | | | |

| | Fiscal Year | |

|---|

| | 2014 | | 2013 | | 2012 | | 2011 | | 2010 | |

|---|

| | | 1.0x | | | 3.1x | | | 4.4x | | | 4.3x | | | 2.8x | |

RISK FACTORS

Before tendering original notes, prospective participants in the exchange offer should consider carefully the following risks. The new notes, like the original notes, entail the following risks:

Risks Relating to the Notes

You may not be able to sell your original notes if you do not exchange them for registered new notes in the exchange offer.

If you do not exchange your original notes for new notes in the exchange offer, your original notes will continue to be subject to the restrictions on transfer as stated in the legends on the original notes. In general, you may not offer, sell or otherwise transfer the original notes in the United States unless they are:

- •

- registered under the Securities Act;

- •

- offered or sold under an exemption from the Securities Act and applicable state securities laws; or

- •

- offered or sold in a transaction not subject to the Securities Act and applicable state securities laws.

Currently, we do not anticipate that we will register the original notes under the Securities Act. Except for limited instances involving the initial purchasers or holders of original notes who are not eligible to participate in the exchange offer, we will not be under any obligation to register the original notes under the Securities Act under the registration rights agreement or otherwise. Also, if the exchange offer is completed on the terms and within the time period contemplated by this prospectus, no Additional Interest will be payable on your original notes.

Your ability to sell your original notes may be significantly more limited and the price at which you may be able to sell your original notes may be significantly lower if you do not exchange them for registered new notes in the exchange offer.

To the extent that original notes are exchanged in the exchange offer, the trading market, if any, for the original notes that remain outstanding may be significantly more limited. As a result, the liquidity of the original notes not tendered for exchange in the exchange offer could be adversely affected. The extent of the market for original notes will depend upon a number of factors, including the number of holders of original notes remaining outstanding and the interest of securities firms in maintaining a market in the original notes. An issue of securities with a similar outstanding market value available for trading, which is called the "float," may command a lower price than would be comparable to an issue of securities with a greater float. As a result, the market price for original notes that are not exchanged in the exchange offer may be affected adversely to the extent that original notes exchanged in the exchange offer reduce the float. The reduced float also may make the trading price of the original notes that are not exchanged more volatile.

10

Table of Contents

You may not be able to offer or resell the new notes due to state securities law restrictions on the resale of the new notes.

In order to comply with the securities laws of certain jurisdictions, the new notes may not be offered or resold by any holder, unless they have been registered or qualified for sale in such jurisdictions or an exemption from registration or qualification is available and the requirements of such exemption have been satisfied. Currently, we do not intend to register or qualify the resale of the new notes in any such jurisdictions. However, generally an exemption is available for sales to registered broker-dealers and certain institutional buyers. Other exemptions under applicable state securities laws also may be available.

Some holders who exchange their original notes may be deemed to be underwriters and must comply with Securities Act requirements governing resale of their new notes.

If you exchange your original notes in the exchange offer for the purpose of participating in a distribution of the new notes, you may be deemed to have received restricted securities and, if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

We will not accept your original notes for exchange if you fail to follow the exchange offer procedures and, as a result, your original notes will continue to be subject to existing transfer restrictions and you may not be able to sell your original notes.

We will issue exchange notes as part of the exchange offer only after a timely receipt of your original notes, including a properly completed and duly executed letter of transmittal or an agent's message and all other required documents. Therefore, if you want to tender your original notes, please allow sufficient time to ensure timely delivery. If we do not receive your original notes, letter of transmittal or agent's message and other required documents by the expiration date of the exchange offer, we will not accept your original notes for exchange. We are under no duty to give notification of defects or irregularities with respect to the tenders of original notes for exchange. If there are defects or irregularities with respect to your tender of original notes, we will not accept your original notes for exchange. See "The Exchange Offer."

Our increased leverage could adversely affect our ability to raise additional capital to fund our operations, limit our ability to react to changes in the economy or our industry, expose us to interest rate risk to the extent of our variable rate debt and prevent us from meeting our obligations under the Credit Facilities or the indenture governing the notes.

After entering into the Credit Facilities and completing the offering of the original notes, our leverage has increased substantially. As of January 31, 2015, our total indebtedness is approximately $1,687.2 million. In addition, we have up to $432.5 million of additional borrowing availability under the ABL Facility, excluding letters of credit totaling approximately $18.5 million issued and outstanding.

Our leverage could have important consequences for you, including:

- •

- increasing our vulnerability to adverse economic, industry or competitive developments;

- •

- requiring a substantial portion of cash flow from operations to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities;

- •

- making it more difficult for us to satisfy our obligations with respect to our indebtedness, including the notes, and any failure to comply with the obligations of any of our debt instruments, including restrictive covenants and borrowing conditions, could result in an event of default under the Credit Facilities and the indenture governing the notes;

11

Table of Contents

- •

- restricting us from making strategic acquisitions or causing us to make non-strategic divestitures;

- •

- limiting our ability to obtain additional financing for working capital, capital expenditures, product development, debt service requirements, acquisitions and general corporate or other purposes; and

- •

- limiting our flexibility in planning for, or reacting to, changes in our business or market conditions and placing us at a competitive disadvantage compared to our competitors who are less highly leveraged and who therefore may be able to take advantage of opportunities that our leverage prevents us from exploiting.

Despite our high indebtedness level, we will still be able to incur significant additional amounts of debt, which could exacerbate the risks associated with our substantial indebtedness.

We and our subsidiaries may be able to incur substantial additional indebtedness in the future. Although the Credit Facilities and the indenture governing the notes contain restrictions on the incurrence of additional indebtedness, these restrictions are subject to a number of significant qualifications and exceptions, and, under certain circumstances, the amount of indebtedness that could be incurred in compliance with these restrictions could be substantial. If new debt is added to our and our subsidiaries' existing debt levels, the related risks that we now face would increase. In addition, the Credit Facilities and the indenture governing the notes will not prevent us from incurring obligations that do not constitute indebtedness under those agreements. As of January 31, 2015, we have up to $432.5 million of additional borrowing availability under the ABL Facility, excluding letters of credit totaling approximately $18.5 million issued and outstanding.

We may not be able to generate sufficient cash to service all of our indebtedness, including the notes, and fund our working capital and capital expenditures, and we may be forced to take other actions to satisfy our obligations under our indebtedness, which may not be successful.

Our ability to make scheduled payments on our indebtedness, including the notes, will depend upon our future operating performance and on our ability to generate cash flow in the future, which is subject to general economic, financial, business, competitive, legislative, regulatory and other factors that are beyond our control. We cannot assure you that our business will generate sufficient cash flow from operations, or that future borrowings, including borrowings under the ABL Facility, will be available to us in an amount sufficient to enable us to pay our indebtedness, including the notes, or to fund our other liquidity needs. See "Management's Discussion and Analysis of Financial Condition and Results of Operations—Liquidity and Capital Resources" in our Annual Report on Form 10-K for the fiscal year ended January 31, 2015 incorporated by reference herein.

If our cash flows and capital resources are insufficient to fund our debt service obligations, we could face substantial liquidity problems and could be forced to reduce or delay investment and capital expenditures or to dispose of material assets or operations, seek additional equity capital or restructure or refinance our indebtedness, including the notes. We may not be able to affect any such alternative measures, if necessary, on commercially reasonable terms or at all and, even if successful, such alternative actions may not allow us to meet our scheduled debt service obligations. The Credit Facilities and the indenture that governs the notes contain restrictions on our ability to dispose of assets and use the proceeds from any such disposition.

If we cannot make scheduled payments on our debt, we will be in default and, as a result, the holders of the notes could declare all outstanding principal and interest to be due and payable, the lenders under the Credit Facilities could declare all outstanding amounts under such facilities due and payable and, with respect to the ABL Facility, terminate their commitments to loan money, and, in each case, foreclose against the assets securing the borrowings under the Credit Facilities, and we could

12

Table of Contents

be forced into bankruptcy or liquidation, which could result in you losing all or a portion of your investment in the notes.

If our indebtedness is accelerated, we may need to refinance all or a portion of our indebtedness, including the notes, before maturity. We cannot assure you that we will be able to refinance any of our indebtedness, including the Credit Facilities, on commercially reasonable terms or at all. We cannot assure you that we will be able to obtain sufficient funds to enable us to repay or refinance our debt obligations on commercially reasonable terms, or at all.

We rely, to a certain extent, on our subsidiaries to generate cash and, as such, our ability to make payments on our indebtedness will be dependent on cash flow generated by these subsidiaries.

We rely, to a certain extent, on our subsidiaries to generate cash. Accordingly, repayment of our indebtedness, including the notes, is dependent, to a certain extent, on the generation of cash flow by our subsidiaries and their ability to make such cash available to us, by dividend, debt repayment or otherwise. Each of our subsidiaries are distinct legal entities and they do not have any obligation to pay amounts due on the notes or to make funds available for that purpose (other than the Guarantors in connection with their guarantees) or other obligations in the form of loans, distributions or otherwise. Our subsidiaries may not generate sufficient cash from operations to enable us to make principal and interest payments on our indebtedness, including the notes, or to fund our and our subsidiaries' other cash obligations.

The lenders under our Term Loan Facility may in their discretion release the guarantors under their facilities in a variety of circumstances, which will cause those guarantors to be released from their guarantees of the notes.

The lenders under our Term Loan Facility have the discretion to release guarantors under these facilities in a variety of circumstances, which may cause those guarantors to be released from their guarantees of the notes. So long as any obligations under our Term Loan Facility remain outstanding, any guarantee of the notes may be released without action by, or consent of, any holder of notes or the trustee under the indenture governing the notes if, at the discretion of lenders under our Term Loan Facility, the related guarantor is no longer a guarantor of obligations under our Term Loan Facility. You will not have a claim as a creditor against any subsidiary that is no longer a guarantor of the notes, and the indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those subsidiaries will effectively be senior to your claims as a holder of the notes.

The agreements and instruments governing our debt impose restrictions that may limit our operating and financial flexibility.

The Credit Facilities and the indenture governing the notes contain a number of significant restrictions and covenants that may limit our ability to:

- •

- incur additional indebtedness;

- •

- sell assets or consolidate or merge with or into other companies;

- •

- pay dividends or repurchase or redeem capital stock;

- •

- make certain investments;

- •

- issue capital stock of our subsidiaries;

- •

- incur liens;

- •

- prepay, redeem or repurchase subordinated debt; and

- •

- enter into certain types of transactions with our affiliates.

13

Table of Contents

These covenants could have the effect of limiting our flexibility in planning for or reacting to changes in our business and the markets in which we compete. In addition, the ABL Facility requires us to comply with a financial maintenance covenant under certain circumstances. Operating results below current levels or other adverse factors, including a significant increase in interest rates, could result in our being unable to comply with the financial covenants contained in the ABL Facility, if applicable. If we violate this covenant and are unable to obtain a waiver from our lenders, our debt under the ABL Facility would be in default and could be accelerated by our lenders. Because of cross-default provisions in the agreements and instruments governing our indebtedness, a default under one agreement or instrument could result in a default under, and the acceleration of, our other indebtedness. In addition, the lenders under the Credit Facilities could proceed against the collateral securing that indebtedness.

If our indebtedness is accelerated, we may not be able to repay our debt or borrow sufficient funds to refinance it. Even if we are able to obtain new financing, it may not be on commercially reasonable terms, on terms that are acceptable to us, or at all. If our debt is in default for any reason, our business, financial condition and results of operations could be materially and adversely affected. In addition, complying with these covenants may also cause us to take actions that are not favorable to holders of the notes and may make it more difficult for us to successfully execute our business strategy and compete against companies that are not subject to such restrictions.

Our variable rate indebtedness subjects us to interest rate risk, which could cause our debt service obligations to increase.

We are exposed to interest rate risk through our variable rate borrowings under the Credit Facilities. Borrowings under such facilities bear interest at a variable rate, based on an adjusted LIBOR rate, plus an applicable margin. Interest rates are currently at relatively low levels. If interest rates increase, our debt service obligations on the variable rate indebtedness will increase even though the amount borrowed remained the same, and our net income and cash flows, including cash available for servicing our indebtedness, will correspondingly decrease. Assuming all capacity under the ABL Facility is fully drawn, each one percentage point change in interest rates would result in approximately a $5.0 million change in annual interest expense. Assuming the LIBOR rate surpassed the 1% LIBOR floor provision on our Term Loan, we would be exposed to interest rate risk on the Term Loan. To partially mitigate such interest rate risk, we entered into an interest rate swap to exchange variable interest rate payments for fixed interest rate payments for a portion of the outstanding Term Loan balance. In addition, we entered into the Incremental Facility Agreement No. 1 to the credit agreement governing the Term Loan Facility to refinance $400 million principal amount of term loans that bore interest at a variable rate with $400 million principal amount of Tranche B-1 Term Loans, which bear interest at a fixed rate of 5.00% per annum. See "Summary—Recent Developments." After consideration of the swap and the refinancing, each one percentage point change in interest rates would result would result in an approximate $1.8 million change in annual interest expense on our Term Loan.

If the notes are rated investment grade at any time by both S&P and Moody's, certain covenants contained in the indenture will be suspended, and the holders of the notes will lose the protection of these covenants.

The indenture contains certain covenants that will be suspended and cease to have any effect from and after the first date when the notes are rated investment grade by both S&P and Moody's so long as no default or event of default exists. See "Description of Notes—Certain Covenants—Covenant Suspension." These covenants restrict, among other things, our ability to pay dividends, incur additional debt and to enter into certain types of transactions. Because we would not be subject to these restrictions at any time that the notes are rated investment grade, we would be able to make dividends and distributions and incur substantial additional debt; however, during this time the covenants in the

14

Table of Contents

Credit Facilities will still apply. If after these covenants are suspended, S&P or Moody's were to downgrade their ratings of the notes to a non-investment grade level or withdraw their ratings, the covenants would be reinstated and the holders of the notes would again have the protection of these covenants. However, any liens or indebtedness incurred or other transactions entered into during such time as the notes were rated investment grade would not result in an event of default in the event the covenants in the notes are subsequently reinstated.

We face risks related to rating agency downgrades.

Rating agencies continuously evaluate the notes and may revise their rating of the notes. If such rating agencies lower the rating of the notes in the future, the market price of the notes could be adversely affected, and you may not be able to resell your notes at favorable prices or at all. In addition, if any of our other outstanding debt is rated and subsequently downgraded, raising capital will become more difficult, borrowing costs under the ABL Facility and other future borrowings may increase and the market price of the notes may decrease.

Your right to receive payments on the notes and the guarantees is effectively subordinated to our and the Guarantors' secured indebtedness.

The notes and the guarantees are not secured obligations of the Company or the Guarantors and are effectively subordinated to our and the Guarantors' existing and future secured indebtedness to the extent of the value of the assets securing such indebtedness. In particular, the notes and the guarantees are effectively subordinated to the indebtedness under the Term Loan Facility and borrowings under the ABL Facility, which are secured by first-priority liens on substantially all of the assets of Men's Wearhouse and the Guarantors. As of January 31, 2015, we have approximately $1,087.2 million of secured indebtedness outstanding and $432.5 million of additional borrowing availability under the ABL Facility, excluding letters of credit totaling approximately $18.5 million issued and outstanding, all of which is secured. See "Description of Other Indebtedness" and "Unaudited Pro Forma Condensed Combined Financial Information." We and our subsidiaries may incur additional secured indebtedness in the future.

If we or a Guarantor becomes insolvent or is liquidated, the lenders under our or the Guarantors' secured indebtedness will have claims on the assets securing their indebtedness and will have priority over any claim for payment under the notes or the guarantees to the extent of such security. If the lenders under the Credit Facilities accelerate the payment of any funds borrowed thereunder and we are unable to repay such indebtedness, the lenders could foreclose on substantially all of our assets and the assets of the Guarantors securing such indebtedness. In this event, our secured lenders would be entitled to be repaid in full from the proceeds of the liquidation of those assets before those assets or the proceeds therefrom would be available for distribution to other creditors, including holders of the notes. Holders of the notes will participate in our remaining assets ratably with all holders of any of our unsecured indebtedness that is deemed to be of the same class as the notes, and potentially with all of our other general creditors, and it is possible that there would be no assets remaining after satisfaction of the claims of such secured creditors from which claims of the holders of the notes could be satisfied or, if any assets remained, they might be insufficient to satisfy such claims fully.

The notes are structurally subordinated to all indebtedness of our current and future subsidiaries that do not guarantee the notes.

You will not have any claim as a creditor against any of our current or future subsidiaries that do not guarantee the notes. Indebtedness and other liabilities, including trade payables, whether secured or unsecured, of those subsidiaries are effectively senior to your claims against us and the Guarantors. In addition, the indenture governing the notes and the credit agreements governing our Credit Facilities, subject to some limitations, permit these subsidiaries to incur additional indebtedness and do not

15

Table of Contents

contain any limitation on the amount of other liabilities, such as trade payables, that may be incurred by these subsidiaries. Certain of our non-guarantor subsidiaries are borrowers and guarantors under the ABL Facility and the notes are structurally subordinated to such indebtedness. As of January 31, 2015, our non-guarantor subsidiaries had an aggregate of approximately $70.2 million of total liabilities (excluding intercompany transactions and borrowing availability under the ABL Facility), all of which is structurally senior to the notes and the related guarantees. For the twelve months ended January 31, 2015, our non-guarantor subsidiaries accounted for 14.6% of our net sales and, as of January 31, 2015, accounted for approximately 9.8% of our total consolidated assets (excluding intercompany transactions).

The Credit Facilities may prohibit us from making payments on the notes.

The Credit Facilities may limit our ability to make payments on outstanding indebtedness other than regularly scheduled interest and principal payments as and when due. As a result, the Credit Facilities could prohibit us from making any payment on the notes in the event that the notes are accelerated or the holders thereof require us to repurchase the notes upon the occurrence of a change of control. Any such failure to make payments on the notes would cause us to default under the indenture, which in turn would likely be a default under the Credit Facilities and other outstanding and future indebtedness.

We may not be able to purchase the notes upon a change of control or pursuant to an asset sale offer.

Upon a change of control, as defined under the indenture governing the notes, each holder of the notes will have the right to require us to offer to purchase all of the notes then outstanding at a price equal to 101% of their principal amount plus accrued and unpaid interest. We cannot assure you that we would have sufficient funds available to repay all of our indebtedness, or other payment obligations that would become payable upon a change of control, and to repurchase all of the notes. Our failure to offer to purchase all outstanding notes or to purchase all validly tendered notes would be an event of default under the indenture. Such an event of default may cause the acceleration of our other debt, including the Credit Facilities. The credit agreements governing our Credit Facilities and the indenture governing the notes may limit or prohibit our subsidiaries' ability to make cash available to us, by dividend, debt repayment or otherwise, to enable us to purchase the notes in the event of a change of control or if an asset sale offer is required, unless and until the indebtedness under the Credit Facilities are repaid in full and any other indebtedness that contains similar provisions is repaid, or we obtain a waiver from the holders of such indebtedness to provide us with sufficient cash to repurchase the notes. Our other debt also may contain restrictions on repayment requirements with respect to specified events or transactions that constitute a change of control under the indenture. In addition, in certain circumstances specified in the indenture governing the notes, we will be required to commence a prepayment offer, as defined under the indenture governing the notes, pursuant to which we will be obligated to offer to purchase the applicable notes at a price equal to 100% of their principal amount plus accrued and unpaid interest. Our other debt may contain restrictions that would limit or prohibit us from completing any such asset sale offer. Our failure to purchase any such notes when required under the indenture would be an event of default. See "Description of Notes—Repurchase at the Option of Holders Upon a Change of Control" and "Description of Notes—Certain Covenants—Limitation of Asset Sales."

You may not be able to determine when a change of control giving rise to your right to have the notes repurchased by us has occurred following a sale of "substantially all" of our assets.

A change of control, as defined in the indenture governing the notes, will require us to make an offer to repurchase all outstanding notes. The definition of change of control includes a phrase relating to the sale, lease or transfer of "all or substantially all" of our assets. There is no precisely established

16

Table of Contents

definition of the phrase "substantially all" under applicable law. Accordingly, the ability of a holder of notes to require us to repurchase their notes as a result of a sale, assignment, transfer, lease, conveyance or disposition of all or substantially all of our properties or assets to another individual, group or entity may be uncertain.

We may enter into certain transactions that would not constitute a change of control but that result in an increase of our indebtedness.

Subject to limitations under the indenture governing the notes and the credit agreements governing the Credit Facilities, we could, in the future, enter into certain transactions, including acquisitions, refinancings or other recapitalizations, that would not constitute a change of control under such agreements, but that could increase the amount of indebtedness outstanding at such time or otherwise affect our capital structure or credit ratings in a way that adversely affects the holders of the notes. See "Description of Notes—Repurchase at the Option of Holders upon a Change of Control."

There is no public market for the notes, which could limit their market price or your ability to sell them.

The new notes will be new securities for which there is currently no public trading market. We do not intend to apply for listing of the notes on any securities exchange or for the inclusion of the notes in any automated quotation system. If any of the notes are traded after their initial issuance, they may trade at a discount from their principal amount depending on many factors, including prevailing interest rates, the market for similar securities and other factors, including general economic conditions and our financial condition, performance and prospects. Any decline in trading prices, regardless of the cause, may adversely affect the liquidity and trading markets for the new notes.

Volatile trading prices may require you to hold the notes for an indefinite period of time.

If a market develops for the notes, the notes may trade at prices higher or lower than their initial offering price. The trading price would depend on many factors, such as prevailing interest rates, the market for similar securities, general economic conditions and our financial condition, performance and prospects. Historically, the market for non-investment grade debt has been subject to disruptions that have caused substantial fluctuation in the prices of these securities. Disruptions of this type could have an adverse effect on the price of the notes. You should be aware that you may be required to bear the financial risk of an investment in the notes for an indefinite period of time.

Federal and state statutes allow courts, under specific circumstances, to void guarantees and require note holders to return payments received from the Guarantors.

The notes are guaranteed by certain of our domestic subsidiaries. Under the federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a guarantee could be voided, or claims in respect of a guarantee could be subordinated to all other debts of that Guarantor if, among other things, the Guarantor, at the time it incurred the indebtedness evidenced by its guarantee:

- •

- received less than reasonably equivalent value or fair consideration for the incurrence of the guarantee; and

- •

- was insolvent or rendered insolvent by reason of the incurrence of the guarantee; or

- •

- was engaged in a business or transaction for which the Guarantor's remaining assets constituted unreasonably small capital; or

- •

- intended to incur, or believed that it would incur, debts beyond its ability to pay those debts as they mature.

In addition, any payment by that Guarantor pursuant to its guarantee could be voided and required to be returned to the Guarantor, or to a fund for the benefit of the creditors of the Guarantor.

17

Table of Contents

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a Guarantor would be considered insolvent if:

- •

- the sum of its debts, including contingent liabilities, was greater than the fair saleable value of all of its assets;

- •

- the present fair saleable value of its assets was less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or

- •

- it could not pay its debts as they become due.

If we are not in compliance with our obligations under the registration agreement related to the notes, then Additional Interest will accrue on the principal amount of the original notes.

We have agreed to use commercially reasonable efforts to consummate the exchange offer of the original notes by July 13, 2015 or cause the original notes to be registered under the Securities Act to permit resales. If we are not in compliance with our obligations under the registration agreement related to the notes, then Additional Interest will accrue on the principal amount of the original notes, in addition to the stated interest on the original notes, from and including the date on which a registration default occurs to but excluding the date on which all registration defaults have been cured. Additional Interest will accrue at a rate of 0.25% per annum on the principal amount of the notes during the 90 day period after the occurrence of the registration default and will increase by 0.25% per annum at the end of each subsequent 90 day period. In no event will the rate of Additional Interest exceed 1.00% per annum on the principal amount.

Risks Relating to Our Business

Our business is particularly sensitive to economic conditions and consumer confidence.

While economic conditions have improved recently, U.S., UK and global economic and political conditions could negatively impact consumer confidence and the level of consumer discretionary spending. The continuation and/or recurrence of these market, political and economic conditions could intensify the adverse effect of such conditions on our revenues and operating results. Consumer confidence may also be adversely affected by national and international security concerns such as war, terrorism, public health events or natural disasters (or the threat of any of these).

Our business may be adversely affected by a worsening of economic conditions, increases in consumer debt levels and applicable interest rates, uncertainties regarding future economic prospects or a decline in consumer confidence or credit availability. During an actual or perceived economic downturn, fewer customers may shop with us and those who do shop may limit the amounts of their purchases. As a result, we could be required to take significant markdowns and/or increase our marketing and promotional expenses in response to the lower than anticipated levels of demand for our products. In addition, promotional and/or prolonged periods of deep discount pricing by our competitors could have a material adverse effect on our business. Also, as a result of adverse market, political or economic conditions, customers may delay or postpone indefinitely roll-outs of new corporate wear programs, which could have a material adverse effect on our corporate apparel segment.

Our ability to continue to expand our core stores may be limited.

A large part of our growth has resulted from the addition of new Men's Wearhouse stores and the increased sales volume and profitability provided by these stores. In addition, the recent acquisition of Jos. A. Bank significantly increased the total number of retail stores we operate. As of January 31,

18

Table of Contents

2015, we operate 698 Men's Wearhouse stores, 636 Jos. A. Bank stores, 123 Moores stores, and 91 K&G stores. We will continue to depend on adding new stores to increase our sales volume and profitability; however, we believe that our ability to increase the number of new stores in the U.S. and Canada may be limited. Therefore, we may not be able to achieve the same rate of growth as we have historically.

In addition, our ability to open new stores will depend on our ability to obtain suitable locations, negotiate acceptable lease terms, hire qualified personnel and open and operate new stores on a timely and profitable basis. Continued expansion will place increasing demands on our operational, managerial and administrative resources. These increased demands could cause us to operate our business less effectively and in turn, could adversely affect our financial performance and results of operations. Further, the results achieved by our existing stores may not be indicative of the performance or market acceptance of stores in other locations and the opening of new stores in existing markets may adversely affect sales and profits of established stores in those same markets.

Certain of our expansion strategies may present greater risks.

We are continuously assessing opportunities to expand store concepts and complementary products and services related to our core business, such as corporate apparel and uniform sales. We may expend both capital and personnel resources on such business opportunities which may or may not be successful. Additionally, any new concept is subject to certain risks, including customer acceptance, competition, product differentiation and the ability to obtain suitable sites. We cannot assure you that we will be able to develop and grow new concepts to a point where they will become profitable or generate positive cash flow.

We may not realize the anticipated benefits of the acquisition of Jos. A. Bank, which could adversely impact our business and our operating results.

We intend to continue the operations of Jos. A. Bank as a separate, stand-alone brand; however, we have devoted and will continue to devote significant managerial attention and resources into the integration of Jos. A. Bank. While we believe that we have sufficient resources to accomplish the integration successfully, there are a number of significant risks involved. We cannot assure you that:

- •

- the anticipated benefits of the acquisition, including cost savings and synergies, will be fully realized in the anticipated time frame, or at all;

- •

- the costs incurred or the technical difficulties related to the integration of Jos. A. Bank's business and operations into ours will not be greater than expected;

- •

- unanticipated costs, charges and expenses will not result from the acquisition and integration;

- •

- litigation relating to the acquisition will not be filed;

- •

- we will be able to retain key personnel or labor issues will not arise; and

- •

- the acquisition and integration will not cause disruption to our business, operations and relationships with our customers, employees, suppliers and other important third parties.

If we are unable to integrate Jos. A. Bank and manage the integration process successfully, or to achieve a substantial portion of the anticipated benefits of the acquisition within the time frame anticipated by management, it could have a material adverse effect on our business, financial condition or results of operations.

19

Table of Contents

Any future acquisitions that we may undertake could be difficult to integrate, disrupt our business, dilute shareholder value and harm our operating results.

In the event we complete one or more new acquisitions, we may be subject to a variety of risks, including risks associated with an ability to integrate acquired assets, systems or operations into our existing operations, diversion of management's attention from core operational matters, higher costs, or unexpected difficulties or problems with acquired assets or entities, outdated or incompatible technologies, labor difficulties or an inability to realize anticipated synergies and efficiencies, whether within anticipated time frames or at all. If one or more of these risks are realized, it could have an adverse impact on our financial condition and operating results.

Our business is seasonal.

Our business is subject to seasonal fluctuations. For example, our tuxedo rental revenues are heavily concentrated in the second and third quarters while the fourth quarter is considered the seasonal low point. In addition, Jos. A. Bank has historically experienced increased customer traffic during the holiday season and its increased marketing efforts during the holiday season have historically resulted in sales and net earnings generated in the fourth quarter, which are significantly larger as compared to the other three quarters. Any factors negatively affecting us during these peak periods, including inclement weather or unfavorable economic conditions, could have a significant adverse effect on our revenues and operating results. With respect to our corporate apparel sales, seasonal fluctuations are not significant but customer decisions to rebrand, revise or delay their corporate wear programs can cause significant variations in quarterly results. Because of the seasonality of our sales, results for any quarter are not necessarily indicative of the results that may be achieved for the full year.

Comparable sales may continue to fluctuate on a regular basis.

Our comparable sales have fluctuated significantly in the past on both an annual and quarterly basis and are expected to continue to fluctuate in the future. We believe that a variety of factors affect comparable sales results including, but not limited to, consumer confidence and the level of consumer discretionary spending, changes in economic conditions and consumer disposable income, spending patterns and debt levels, consumer credit availability, weather conditions, the timing of certain holiday seasons, the number and timing of new store openings, changes in the popularity of a retail center, the timing and level of promotional pricing or markdowns, store closings, relocations and remodels, changes in fashion trends and our merchandise mix or other competitive factors. Comparable sales fluctuations may impact our ability to leverage our fixed direct expenses, including store rent and store asset depreciation, which may adversely affect our financial condition or results of operations.

The loss of, or disruption in, our distribution centers could result in delays in the delivery of merchandise to our stores.