FS/KKR Non-traded BDC liquidity plan june 2019 Filed by FS Investment Corporation II pursuant to Rule 425 under the Securities Act of 1933 and deemed filed under Rule 14a-12 of the Securities Exchange Act of 1934 Subject Companies: FS Investment Corporation III FS Investment Corporation IV Corporate Capital Trust II Commission File No. 814-00926

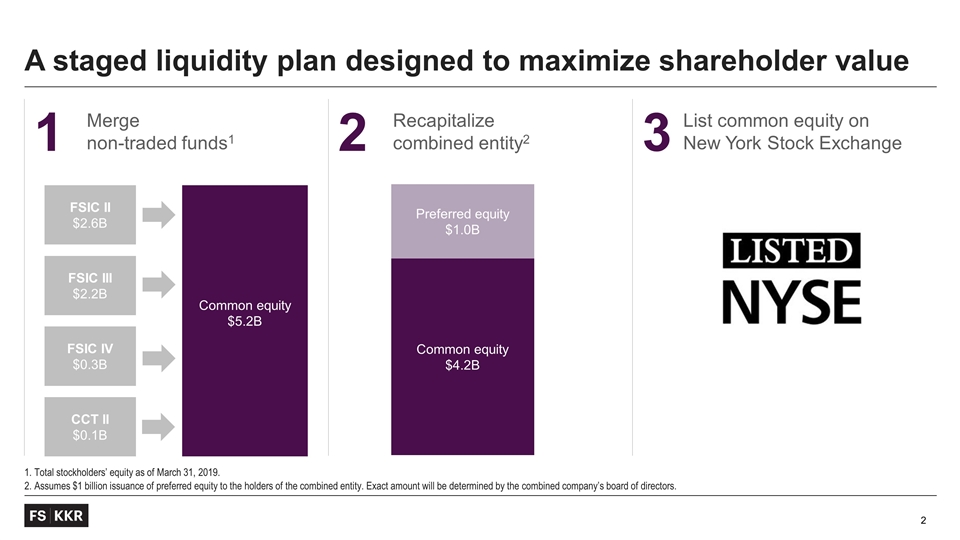

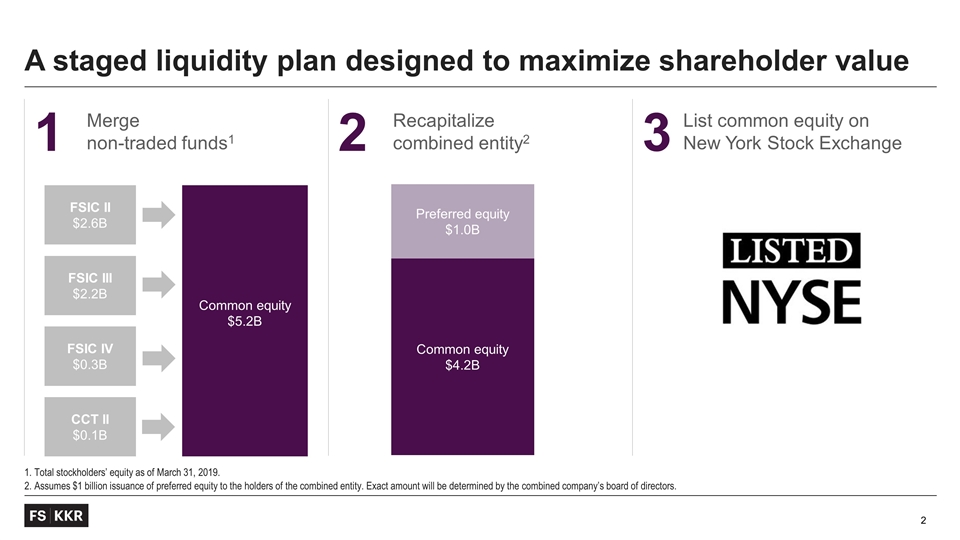

1 Merge non-traded funds1 2 Recapitalize combined entity2 3 List common equity on New York Stock Exchange 1. Total stockholders’ equity as of March 31, 2019. 2. Assumes $1 billion issuance of preferred equity to the holders of the combined entity. Exact amount will be determined by the combined company’s board of directors. A staged liquidity plan designed to maximize shareholder value Common equity $5.2B Common equity $4.2B Preferred equity $1.0B FSIC II $2.6B FSIC III $2.2B FSIC IV $0.3B CCT II $0.1B

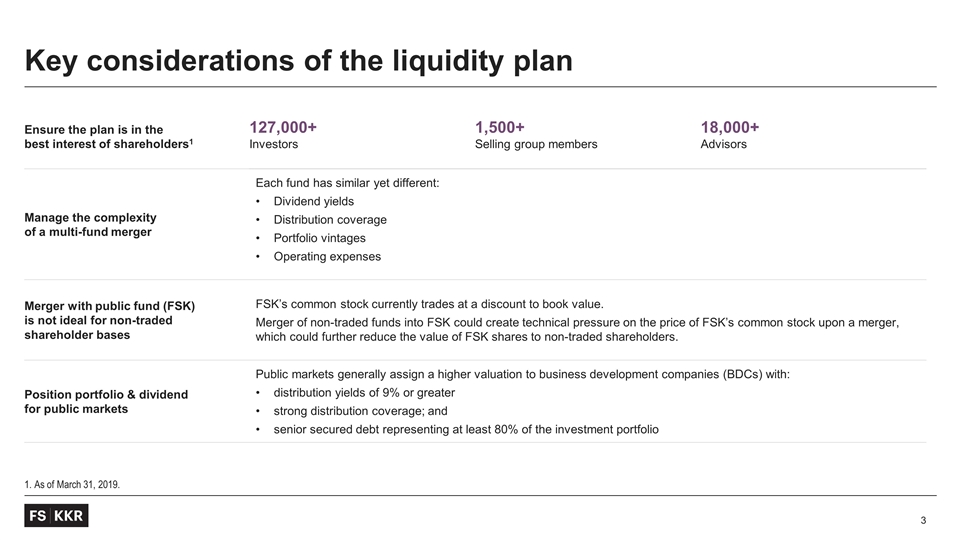

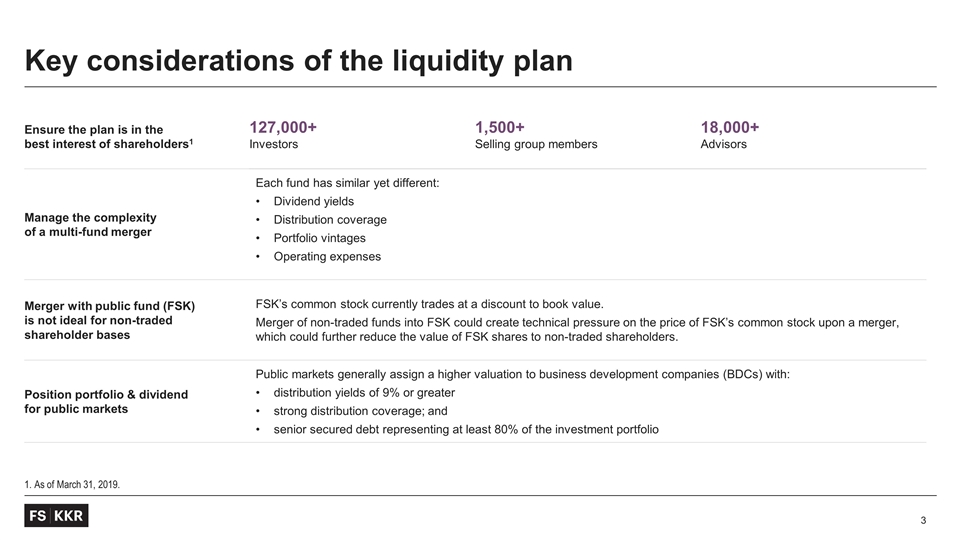

1. As of March 31, 2019. Key considerations of the liquidity plan Ensure the plan is in the best interest of shareholders1 127,000+ 1,500+ 18,000+ Investors Selling group members Advisors Manage the complexity of a multi-fund merger Each fund has similar yet different: Dividend yields Distribution coverage Portfolio vintages Operating expenses Merger with public fund (FSK) is not ideal for non-traded shareholder bases FSK’s common stock currently trades at a discount to book value. Merger of non-traded funds into FSK could create technical pressure on the price of FSK’s common stock upon a merger, which could further reduce the value of FSK shares to non-traded shareholders. Position portfolio & dividend for public markets Public markets generally assign a higher valuation to business development companies (BDCs) with: distribution yields of 9% or greater strong distribution coverage; and senior secured debt representing at least 80% of the investment portfolio

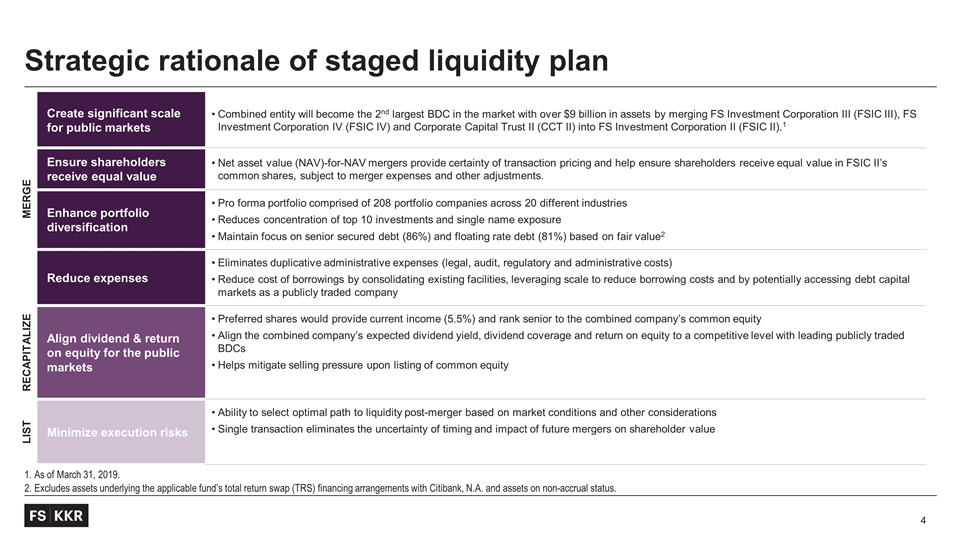

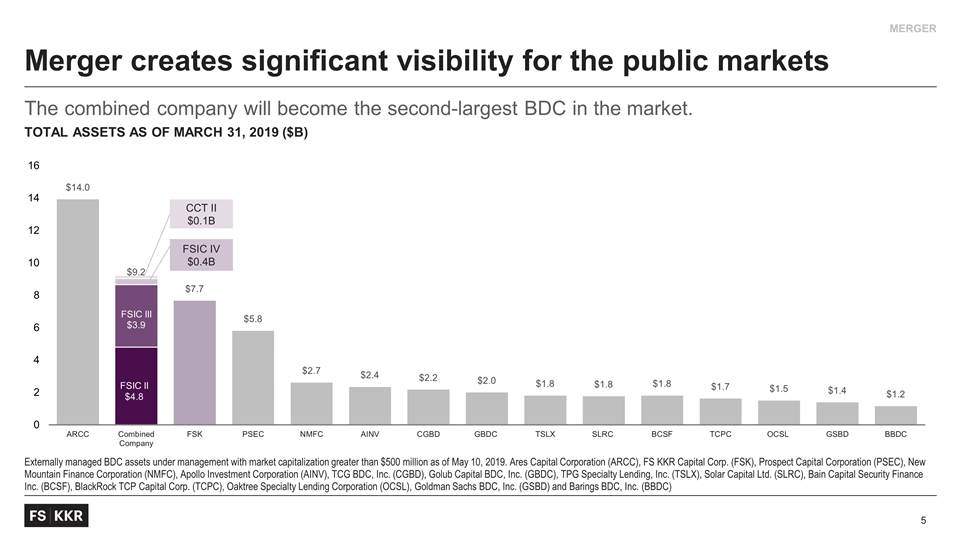

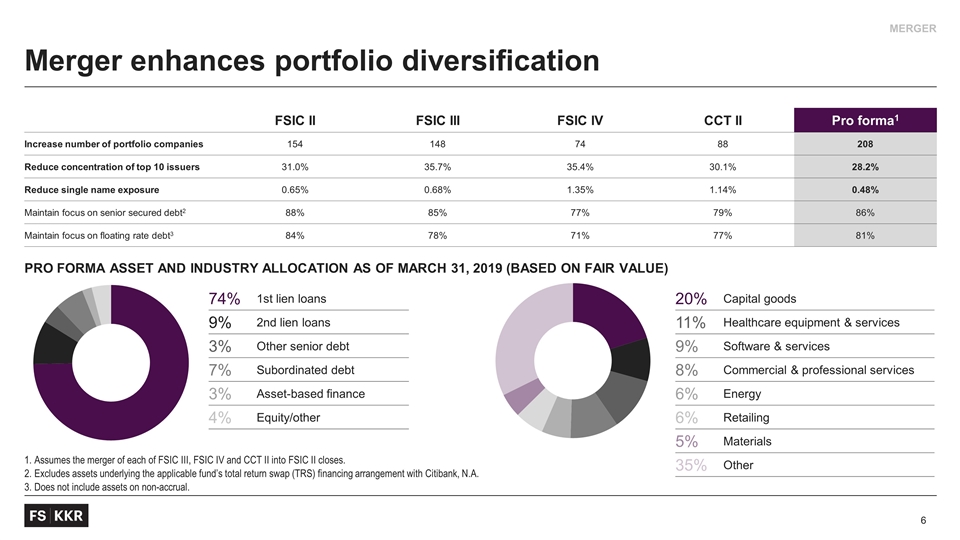

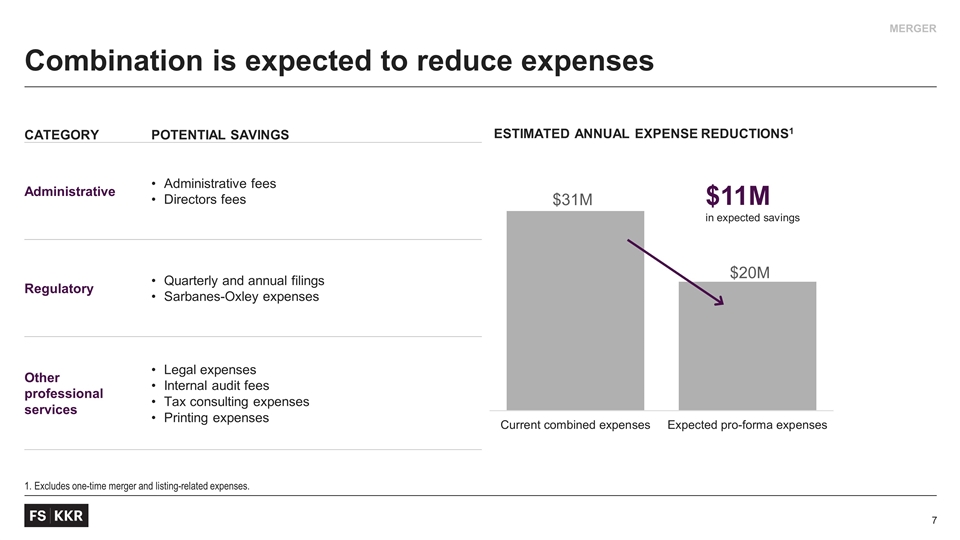

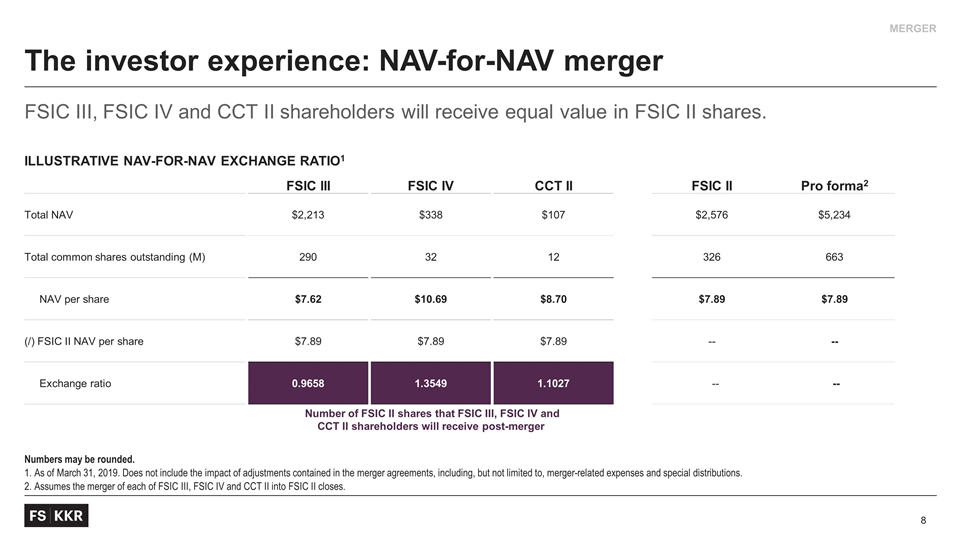

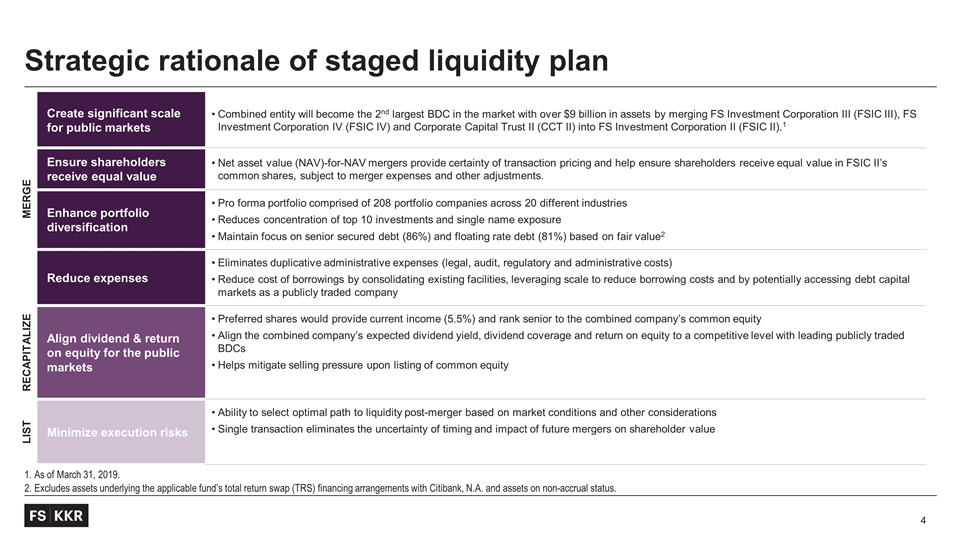

As of March 31, 2019. Excludes assets underlying the applicable fund’s total return swap (TRS) financing arrangements with Citibank, N.A. and assets on non-accrual status. Strategic rationale of staged liquidity plan MERGE Create significant scale for public markets Combined entity will become the 2nd largest BDC in the market with over $9 billion in assets by merging FS Investment Corporation III (FSIC III), FS Investment Corporation IV (FSIC IV) and Corporate Capital Trust II (CCT II) into FS Investment Corporation II (FSIC II).1 Ensure shareholders receive equal value Net asset value (NAV)-for-NAV mergers provide certainty of transaction pricing and help ensure shareholders receive equal value in FSIC II’s common shares, subject to merger expenses and other adjustments. Enhance portfolio diversification Pro forma portfolio comprised of 208 portfolio companies across 20 different industries Reduces concentration of top 10 investments and single name exposure Maintain focus on senior secured debt (86%) and floating rate debt (81%) based on fair value2 Reduce expenses Eliminates duplicative administrative expenses (legal, audit, regulatory and administrative costs) Reduce cost of borrowings by consolidating existing facilities, leveraging scale to reduce borrowing costs and by potentially accessing debt capital markets as a publicly traded company RECAPITALIZE Align dividend & return on equity for the public markets Preferred shares would provide current income (5.5%) and rank senior to the combined company’s common equity Align the combined company’s expected dividend yield, dividend coverage and return on equity to a competitive level with leading publicly traded BDCs Helps mitigate selling pressure upon listing of common equity LIST Minimize execution risks Ability to select optimal path to liquidity post-merger based on market conditions and other considerations Single transaction eliminates the uncertainty of timing and impact of future mergers on shareholder value

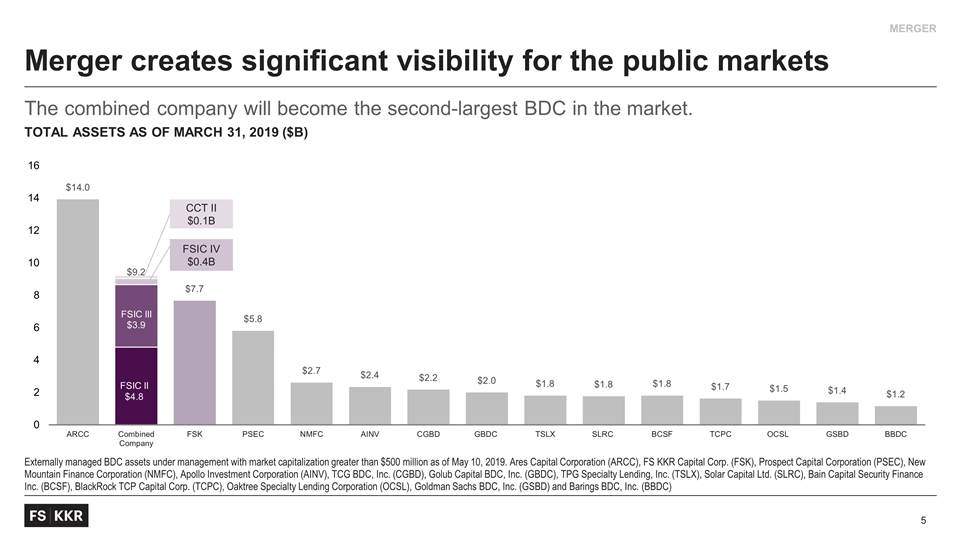

The combined company will become the second-largest BDC in the market. Total assets as of March 31, 2019 ($B) Externally managed BDC assets under management with market capitalization greater than $500 million as of May 10, 2019. Ares Capital Corporation (ARCC), FS KKR Capital Corp. (FSK), Prospect Capital Corporation (PSEC), New Mountain Finance Corporation (NMFC), Apollo Investment Corporation (AINV), TCG BDC, Inc. (CGBD), Golub Capital BDC, Inc. (GBDC), TPG Specialty Lending, Inc. (TSLX), Solar Capital Ltd. (SLRC), Bain Capital Security Finance Inc. (BCSF), BlackRock TCP Capital Corp. (TCPC), Oaktree Specialty Lending Corporation (OCSL), Goldman Sachs BDC, Inc. (GSBD) and Barings BDC, Inc. (BBDC) Merger creates significant visibility for the public markets MERGER FSIC IV $0.4B CCT II $0.1B FSIC II $4.8

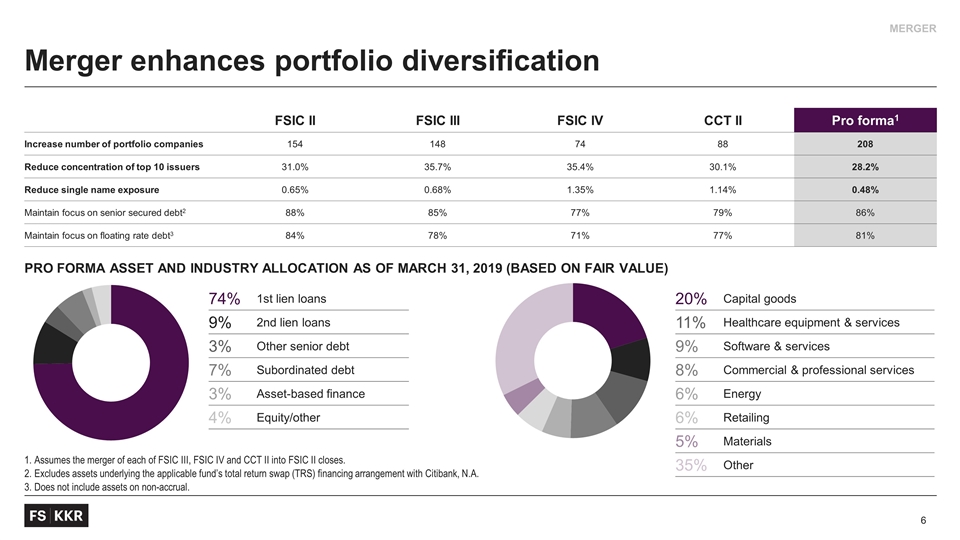

Pro forma asset and INDUSTRY allocation AS OF MARCH 31, 2019 (based on fair value) Assumes the merger of each of FSIC III, FSIC IV and CCT II into FSIC II closes. Excludes assets underlying the applicable fund’s total return swap (TRS) financing arrangement with Citibank, N.A. Does not include assets on non-accrual. Merger enhances portfolio diversification FSIC II FSIC III FSIC IV CCT II Pro forma1 Increase number of portfolio companies 154 148 74 88 208 Reduce concentration of top 10 issuers 31.0% 35.7% 35.4% 30.1% 28.2% Reduce single name exposure 0.65% 0.68% 1.35% 1.14% 0.48% Maintain focus on senior secured debt2 88% 85% 77% 79% 86% Maintain focus on floating rate debt3 84% 78% 71% 77% 81% 74% 1st lien loans 9% 2nd lien loans 3% Other senior debt 7% Subordinated debt 3% Asset-based finance 4% Equity/other 20% Capital goods 11% Healthcare equipment & services 9% Software & services 8% Commercial & professional services 6% Energy 6% Retailing 5% Materials 35% Other MERGER

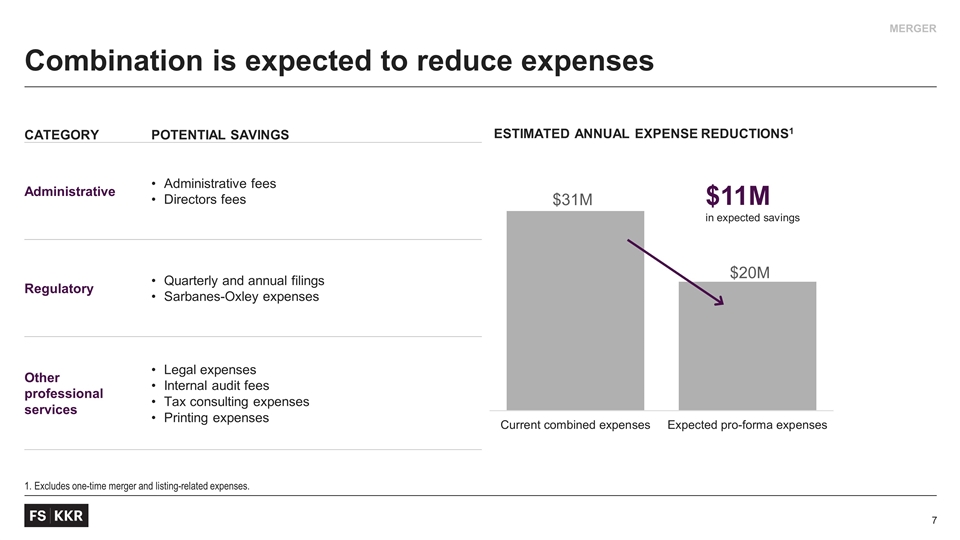

ESTIMATED ANNUAL EXPENSE REDUCTIONS1 1. Excludes one-time merger and listing-related expenses. Combination is expected to reduce expenses $11M in expected savings CATEGORY POTENTIAL SAVINGS Administrative Administrative fees Directors fees Regulatory Quarterly and annual filings Sarbanes-Oxley expenses Other professional services Legal expenses Internal audit fees Tax consulting expenses Printing expenses MERGER

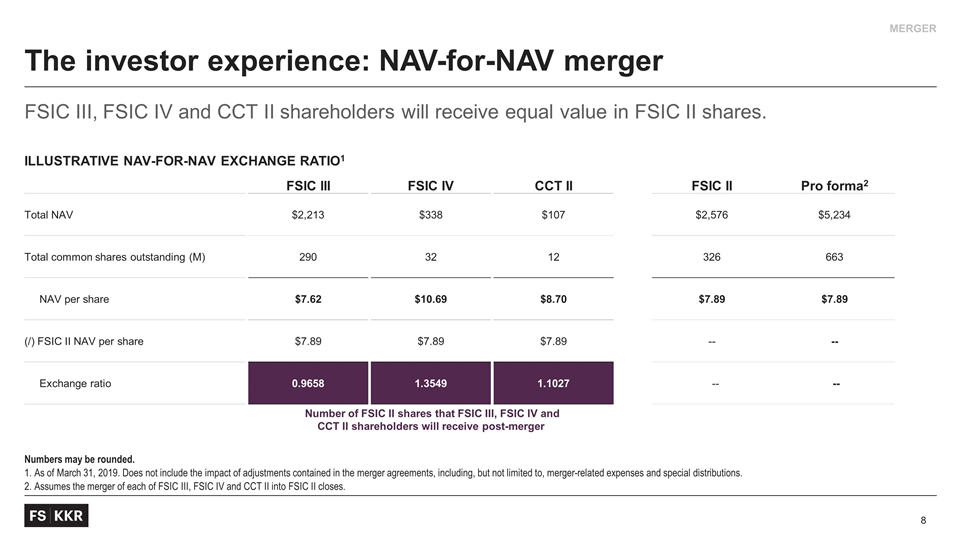

FSIC III, FSIC IV and CCT II shareholders will receive equal value in FSIC II shares. Illustrative nav-for-nav exchange ratio1 Numbers may be rounded. As of March 31, 2019. Does not include the impact of adjustments contained in the merger agreements, including, but not limited to, merger-related expenses and special distributions. Assumes the merger of each of FSIC III, FSIC IV and CCT II into FSIC II closes. The investor experience: NAV-for-NAV merger FSIC III FSIC IV CCT II FSIC II Pro forma2 Total NAV $2,213 $338 $107 $2,576 $5,234 Total common shares outstanding (M) 290 32 12 326 663 NAV per share $7.62 $10.69 $8.70 $7.89 $7.89 (/) FSIC II NAV per share $7.89 $7.89 $7.89 -- -- Exchange ratio 0.9658 1.3549 1.1027 ---- -- Number of FSIC II shares that FSIC III, FSIC IV and CCT II shareholders will receive post-merger MERGER

Preferred shares are expected to be structured to provide current income and a path to full liquidity. 1. Assumes an approximately $1 billion issuance of preferred equity to the common equity holders. Exact amount will be determined by the combined company’s board of directors. 2. Must be fully paid prior to payment of ordinary dividends on common stock. The investor experience: recapitalization Common equity $4.2B (goal to list on NYSE in 2019) Preferred equity $1.0B TERMS Preferred dividend 5.5%; cumulative2 Issuance Prior to the listing of the combined company’s common stock Amount 40M shares ($1 billion in liquidation preference) Listing Subject to market conditions after the listing of the combined company’s common stock Maturity Perpetual Liquidation preference $25.00 per share RECAPITALIZATION Common equity $5.2B ~80% POST-MERGER recapitalization Investors receive equal value in common and preferred shares1 ~20%

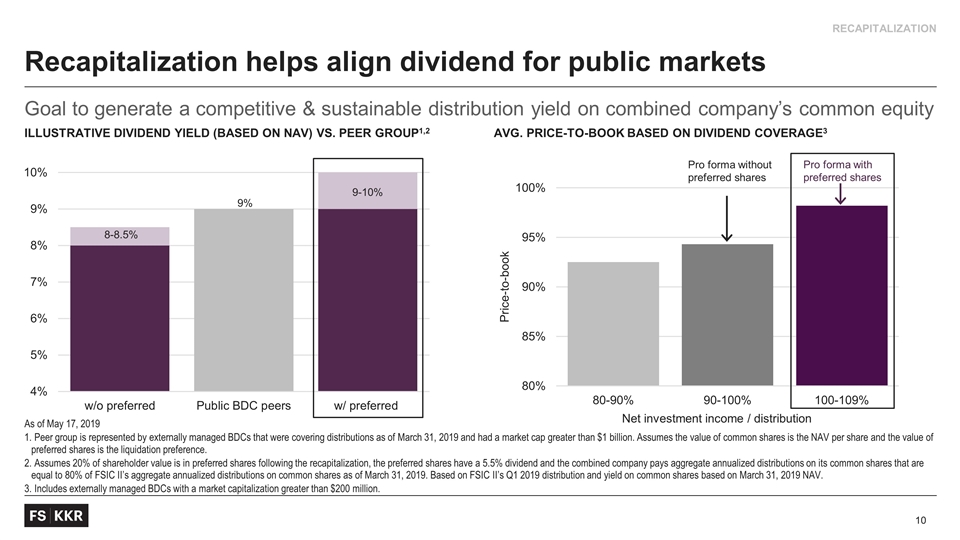

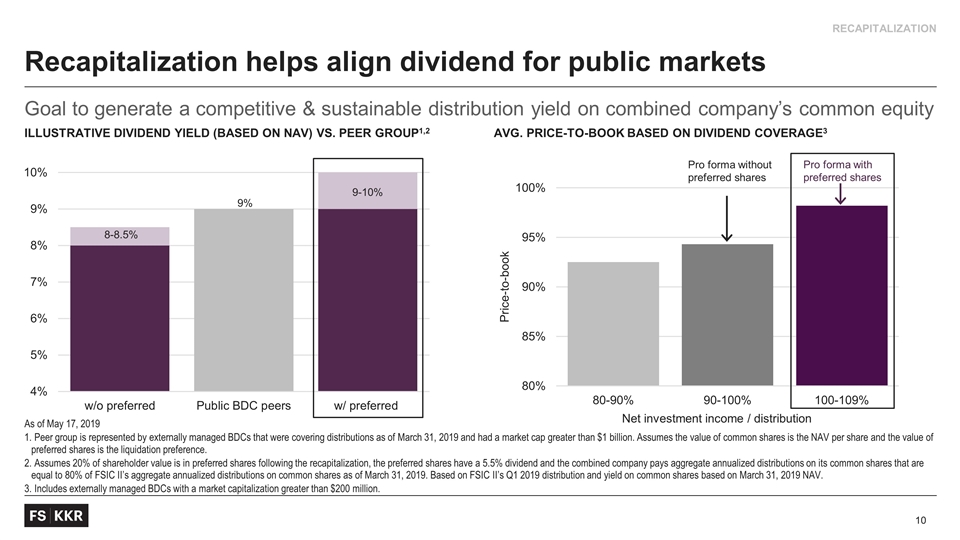

AVG. price-to-book based on DIVIDEND COVERAGE3 ILLUSTRATIVE dividend Yield (BASED ON NAV) VS. PEER GROUP1,2 As of May 17, 2019 Peer group is represented by externally managed BDCs that were covering distributions as of March 31, 2019 and had a market cap greater than $1 billion. Assumes the value of common shares is the NAV per share and the value of preferred shares is the liquidation preference. Assumes 20% of shareholder value is in preferred shares following the recapitalization, the preferred shares have a 5.5% dividend and the combined company pays aggregate annualized distributions on its common shares that are equal to 80% of FSIC II’s aggregate annualized distributions on common shares as of March 31, 2019. Based on FSIC II’s Q1 2019 distribution and yield on common shares based on March 31, 2019 NAV. Includes externally managed BDCs with a market capitalization greater than $200 million. Goal to generate a competitive & sustainable distribution yield on combined company’s common equity Recapitalization helps align dividend for public markets RECAPITALIZATION Pro forma without preferred shares Pro forma with preferred shares

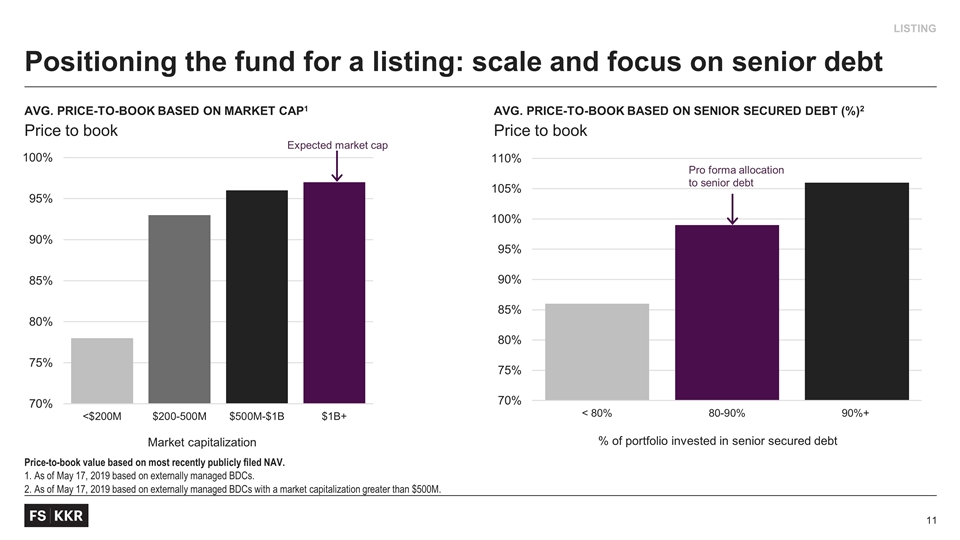

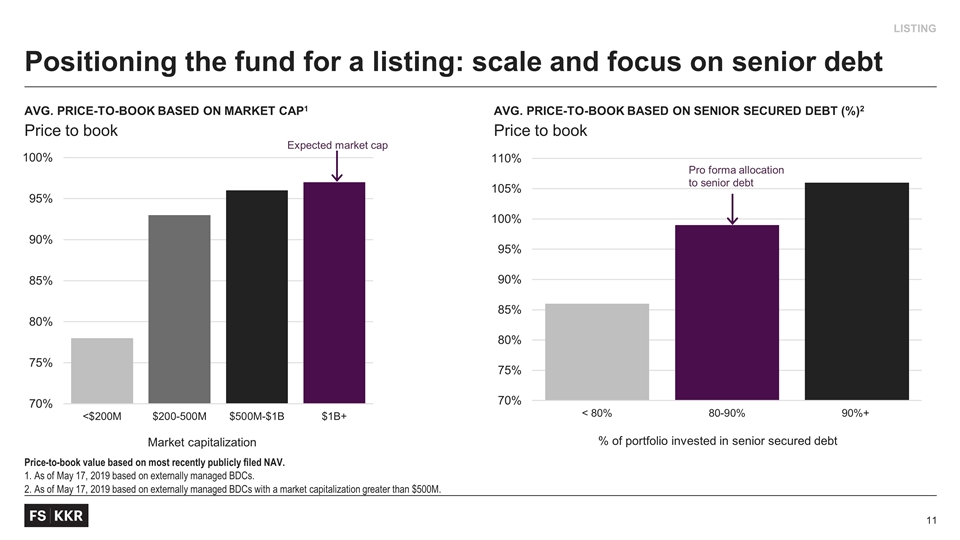

AVG. price-to-book based on market cap1 Price to book Avg. price-to-book based on Senior secured debt (%)2 Price to book Price-to-book value based on most recently publicly filed NAV. 1. As of May 17, 2019 based on externally managed BDCs. 2. As of May 17, 2019 based on externally managed BDCs with a market capitalization greater than $500M. Positioning the fund for a listing: scale and focus on senior debt LISTING Expected market cap Pro forma allocation to senior debt

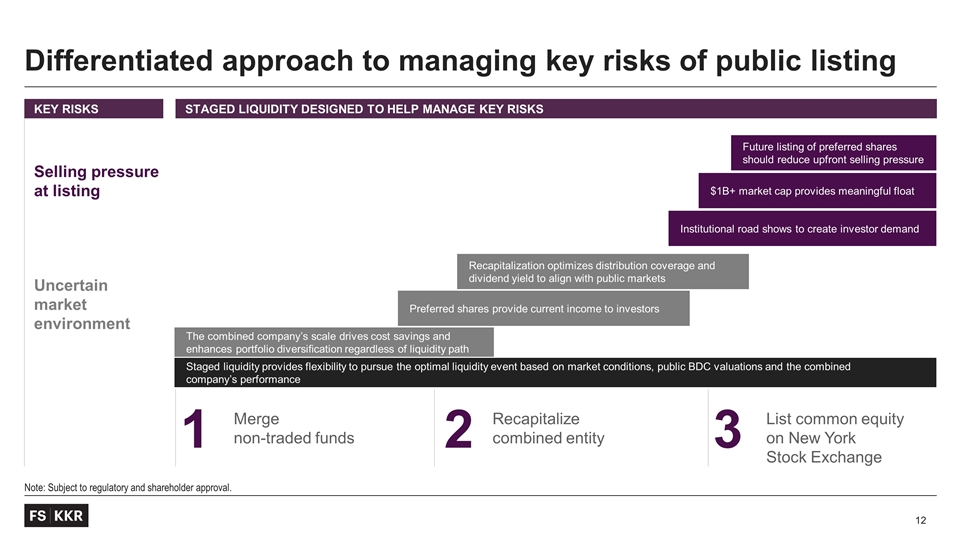

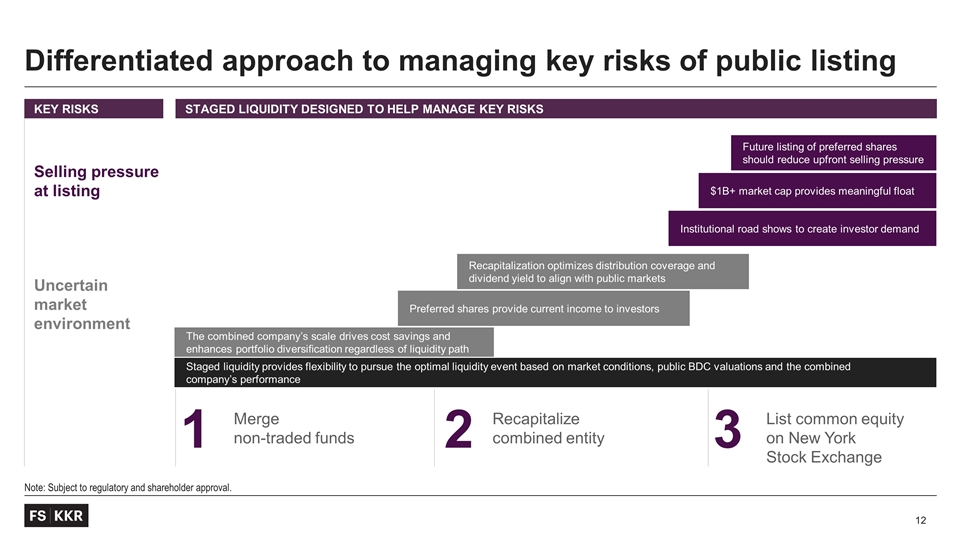

12 KEY RISKS STAGED LIQUIDITY DESIGNED TO HELP MANAGE KEY RISKS Selling pressure at listing Uncertain market environment 1 Merge non-traded funds 2 Recapitalize combined entity 3 List common equity on New York Stock Exchange Note: Subject to regulatory and shareholder approval. Differentiated approach to managing key risks of public listing $1B+ market cap provides meaningful float Future listing of preferred shares should reduce upfront selling pressure Institutional road shows to create investor demand The combined company’s scale drives cost savings and enhances portfolio diversification regardless of liquidity path Staged liquidity provides flexibility to pursue the optimal liquidity event based on market conditions, public BDC valuations and the combined company’s performance Recapitalization optimizes distribution coverage and dividend yield to align with public markets Preferred shares provide current income to investors

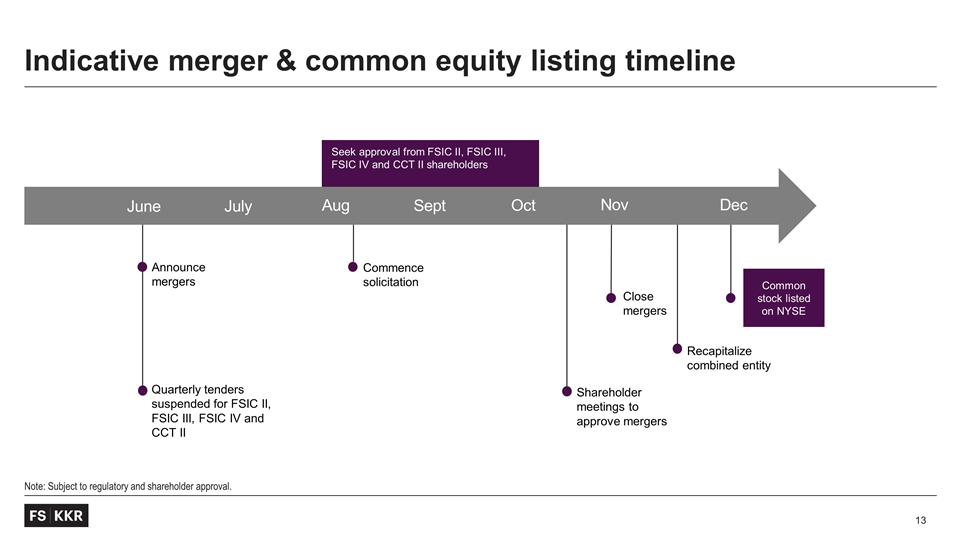

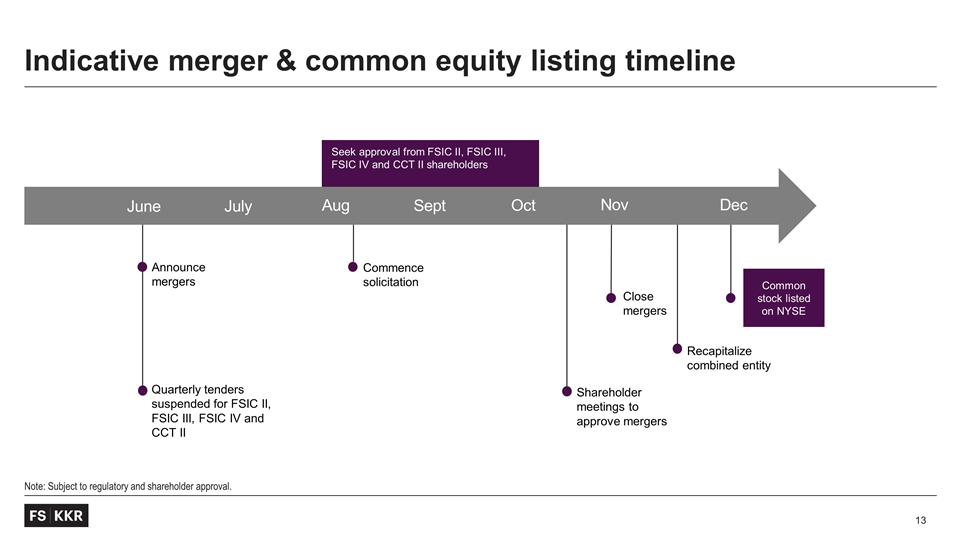

Announce mergers Commence solicitation Seek approval from FSIC II, FSIC III, FSIC IV and CCT II shareholders Note: Subject to regulatory and shareholder approval. Indicative merger & common equity listing timeline June July Aug Sept Oct Nov Dec Close mergers Common stock listed on NYSE Shareholder meetings to approve mergers Quarterly tenders suspended for FSIC II, FSIC III, FSIC IV and CCT II Recapitalize combined entity

Website Resources FSPROXY.COM FUND FACT SHEETS PRESS RELEASES FREQUENTLY ASKED QUESTIONS EMAIL INVITATIONS TO COME WEBINARS Webinars

Questions?

Forward-Looking Statements Statements included herein may constitute “forward-looking” statements as that term is defined in Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended by the Private Securities Litigation Reform Act of 1995, including statements with regard to future events or the future performance or operations of FS Investment Corporation II, FS Investment Corporation III, FS Investment Corporation IV and Corporate Capital Trust II (collectively, the “Funds”). Words such as “believes,” “expects,” “projects,” and “future” or similar expressions are intended to identify forward-looking statements. These forward-looking statements are subject to the inherent uncertainties in predicting future results and conditions. Certain factors could cause actual results to differ materially from those projected in these forward-looking statements. Factors that could cause actual results to differ materially include changes in the economy, risks associated with possible disruption to a Fund’s operations or the economy generally due to terrorism or natural disasters, future changes in laws or regulations and conditions in a Fund’s operating area, failure to obtain requisite shareholder approval for the Proposals (as defined below) set forth in the Proxy Statement (as defined below), failure to consummate the business combination transaction involving the Funds, uncertainties as to the timing of the consummation of the business combination transaction involving the Funds, unexpected costs, charges or expenses resulting from the business combination transaction involving the Funds, failure to realize the anticipated benefits of the business combination transaction involving the Funds, failure to consummate the recapitalization transaction and failure to list the common stock of the combined entity on a national securities exchange. Some of these factors are enumerated in the filings the Funds made with the Securities and Exchange Commission (the “SEC”) and will also be contained in the Proxy Statement when such document becomes available. The inclusion of forward-looking statements should not be regarded as a representation that any plans, estimates or expectations will be achieved. Any forward-looking statements speak only as of the date of this communication. Except as required by federal securities laws, the Funds undertake no obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise. Readers are cautioned not to place undue reliance on any of these forward-looking statements. Additional Information and Where to Find It This communication relates to a proposed business combination involving the Funds, along with related proposals for which shareholder approval will be sought (collectively, the “Proposals”). In connection with the Proposals, the Funds intend to file relevant materials with the SEC, including a registration statement on Form N-14, which will include a joint proxy statement of the Funds and a prospectus of FSIC II (the “Proxy Statement”). This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act. SHAREHOLDERS OF THE FUNDS ARE URGED TO READ ALL RELEVANT DOCUMENTS FILED WITH THE SEC, INCLUDING THE PROXY STATEMENT WHEN IT BECOMES AVAILABLE, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS THERETO, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT THE FUNDS, THE BUSINESS COMBINATION TRANSACTION INVOLVING THE FUNDS AND THE PROPOSALS. Investors and security holders will be able to obtain the documents filed with the SEC free of charge at the SEC’s website, www.sec.gov, or from the Funds’ website at www.fsinvestments.com. Participants in the Solicitation The Funds and their respective directors and trustees, executive officers and certain other members of management and employees, including employees of FS/KKR Advisor, LLC, Franklin Square Holdings, L.P. (which does business as FS Investments), KKR Credit Advisors (US) LLC and their respective affiliates, may be deemed to be participants in the solicitation of proxies from the stockholders of the Funds in connection with the Proposals. Information regarding the persons who may, under the rules of the SEC, be considered participants in the solicitation of the Funds’ stockholders in connection with the Proposals will be contained in the Proxy Statement when such document becomes available. This document may be obtained free of charge from the sources indicated above. Disclosures