POST-INTEGRATION BUSINESS UPDATE February 15, 2018 Exhibit 99.1

SAFE HARBOR STATEMENT 2 This webcast presentation contains a number of forward-looking statements. Words such as “build,” “drive,” “invent,” “innovate,” “expand,” “optimize,” “invest,” “launch,” “grow,” “execute,” “enable,” “continue,” “expect,” “opportunity,” “deliver,” “strengthen,” “leverage,” “will,” and variations of such words and similar expressions are intended to identify forward-looking statements. Examples of forward-looking statements include, but are not limited to, statements regarding Kraft Heinz’s plans, savings, e-commerce developments, investments, execution, sales, risk, growth, leverage, return of capital, innovation, anchor shareholders, cash flows,planning, credit rating, brands and efficiencies. These forward-looking statements are not guarantees of future performance and are subject to a number of risks and uncertainties, many of which are difficult to predict and beyond Kraft Heinz’s control. Important factors that affect Kraft Heinz’s business and operations and that may ca use actual results to differ materially from those in the forward-looking statements include, but are not limited to, operating in a highly competitive industry; changes in the re tail landscape or the loss of key retail customers; Kraft Heinz's ability to maintain, extend and expand Kraft Heinz's reputation and brand image; the impacts of Kraft Heinz's i nternational operations; Kraft Heinz's ability to leverage Kraft Heinz's brand value; Kraft Heinz's ability to predict, identify and interpret changes in consumer preferences and demand; Kraft Heinz's ability to drive revenue growth in Kraft Heinz's key product categories, increase Kraft Heinz's market share, or add products; an impairment of the ca rrying value of goodwill or other indefinite-lived intangible assets; volatility in commodity, energy and other input costs; changes in Kraft Heinz's management team or other k ey personnel; Kraft Heinz's ability to realize the anticipated benefits from Kraft Heinz's cost savings initiatives; changes in relationships with significant customers and sup pliers; the execution of Kraft Heinz's international expansion strategy; tax law changes or interpretations; legal claims or other regulatory enforcement actions; product recalls or product liability claims; unanticipated business disruptions; Kraft Heinz's ability to complete or realize the benefits from potential and completed acquisitions, alliances, divestitures or joint ventures; economic and political conditions in the United States and in various other nations in which Kraft Heinz operates; the volatility of capital markets ; increased pension, labor and people-related expenses; volatility in the market value of all or a portion of the derivatives Kraft Heinz uses; exchange rate fluctuations; risks associated with information technology and systems, including service interruptions, misappropriation of data or breaches of security; Kraft Heinz's inability to protec t intellectual property rights; impacts of natural events in the locations in which Kraft Heinz or its customers, suppliers or regulators operate; Kraft Heinz's indebtedness an d ability to pay such indebtedness; Kraft Heinz's ownership structure; the impact of future sales of Kraft Heinz's common stock in the public markets; Kraft Heinz's ability to continue to pay a regular dividend; changes in laws and regulations; restatements of Kraft Heinz's consolidated financial statements; and other factors. For additional info rmation on these and other factors that could affect Kraft Heinz’s forward-looking statements, see Kraft Heinz’s risk factors, as they may be amended from time to time, set forth in its filings with the Securities and Exchange Commission, including Kraft Heinz's most recently filed Annual Report on Form 10 -K. Kraft Heinz disclaims and does not undertake any obligation to update or revise any forward-looking statement in this presentation, except as required by applicable law or regulation. Market Data This webcast includes market and industry data and forecasts that have been obtained from internal reports as well as third -party market research, publicly available information and industry publications. While information is obtained from third -party sources believed to be reliable as of the date hereof, there can be no assurance as to the accuracy or completeness of such included information. While Kraft Heinz has taken reasonable steps to ensure that the inform ation is extracted accurately and in its proper context, it has not independently verified any of the data from third party sources or ascertained the underlying economic as sumptions relied upon therein.

3 A UNIQUE OPPORTUNITY IN CONSUMER STAPLES Bernardo Hees Chief Executive Officer

Note: Brand sales reflect total retail sales under brand umbrella. *Based on retail and foodservice sales. 4 AN UNPARALLELED PORTFOLIO OF LEADING BRANDS $1bn+ Brands* $500m - $1bn+ Brands Selected $100m – $500m Brands

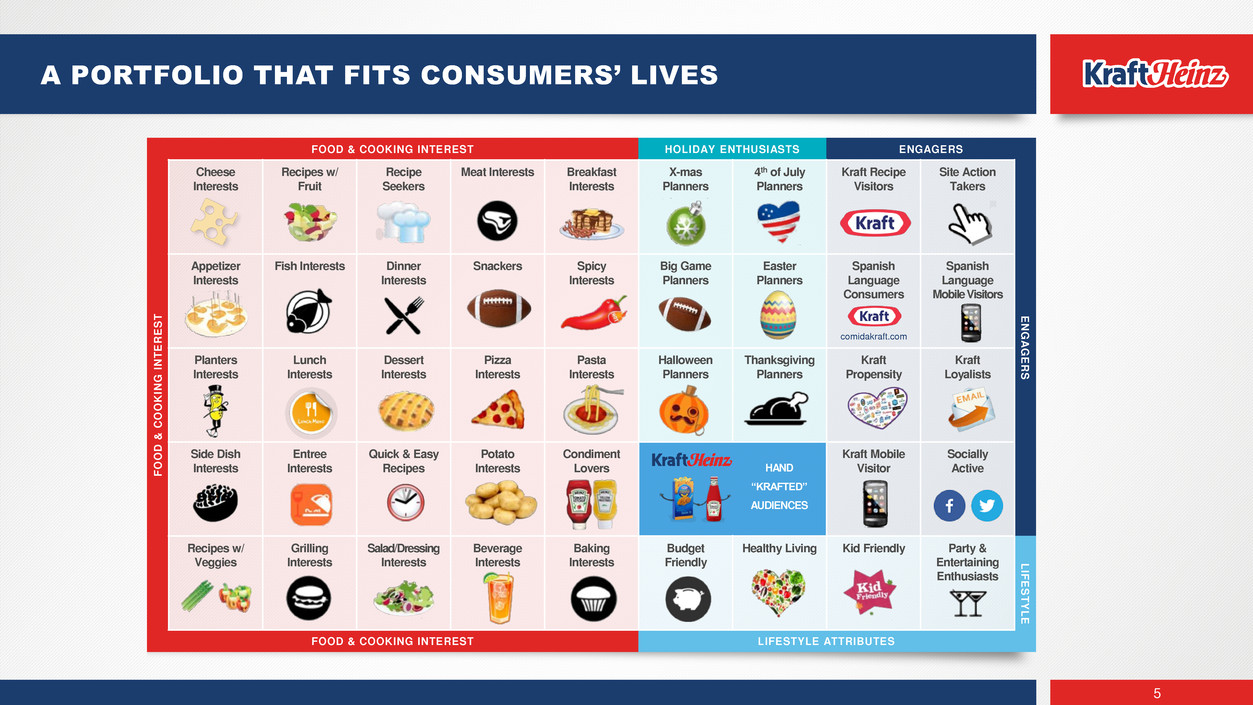

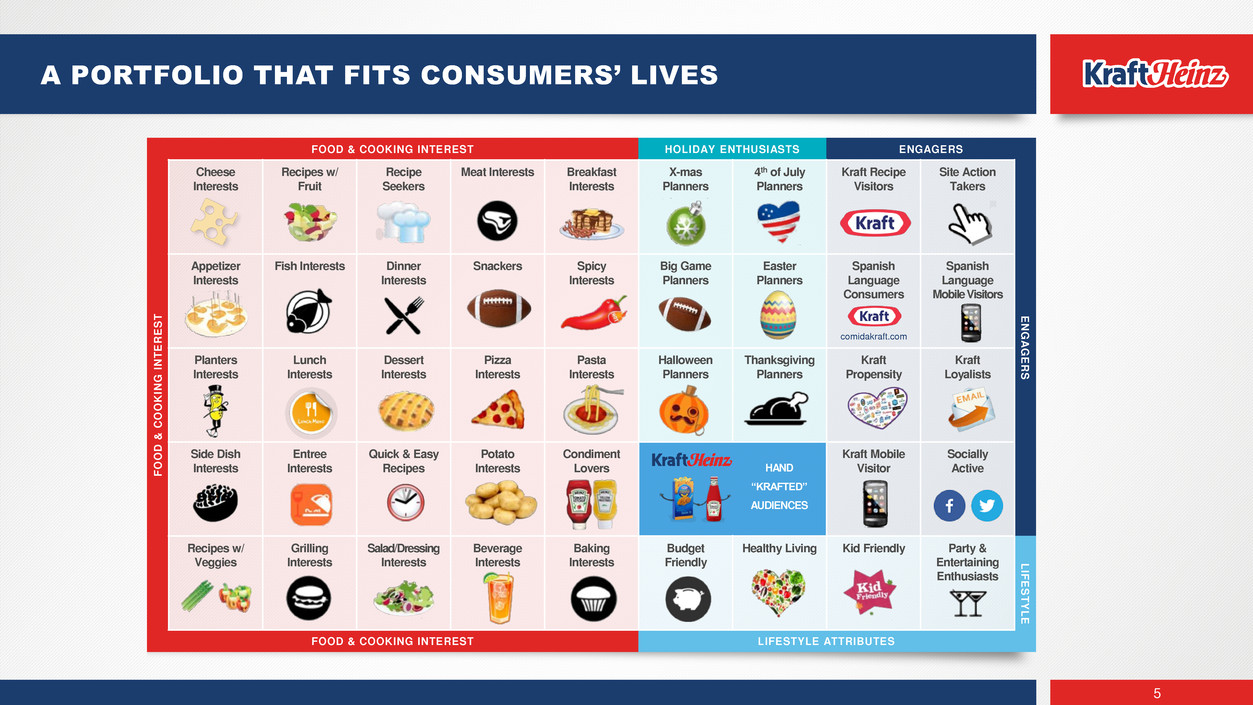

5 A PORTFOLIO THAT FITS CONSUMERS’ LIVES FOOD & COOKING INTEREST HOLIDAY ENTHUSIASTS ENGAGERS F O O D & C O O K IN G I N T E R E S T Cheese Interests Recipes w/ Fruit Recipe Seekers Meat Interests Breakfast Interests X-mas Planners 4th of July Planners Kraft Recipe Visitors Site Action Takers E N G A G E R S Appetizer Interests Fish Interests Dinner Interests Snackers Spicy Interests Big Game Planners Easter Planners Spanish Language Consumers Spanish Language Mobile Visitors Planters Interests Lunch Interests Dessert Interests Pizza Interests Pasta Interests Halloween Planners Thanksgiving Planners Kraft Propensity Kraft Loyalists Side Dish Interests Entree Interests Quick & Easy Recipes Potato Interests Condiment Lovers Kraft Mobile Visitor Socially Active Recipes w/ Veggies Grilling Interests Salad/Dressing Interests Beverage Interests Baking Interests Budget Friendly Healthy Living Kid Friendly Party & Entertaining Enthusiasts L IF E S T Y L E FOOD & COOKING INTEREST LIFESTYLE ATTRIBUTES comidakraft.com HAND “KRAFTED” AUDIENCES

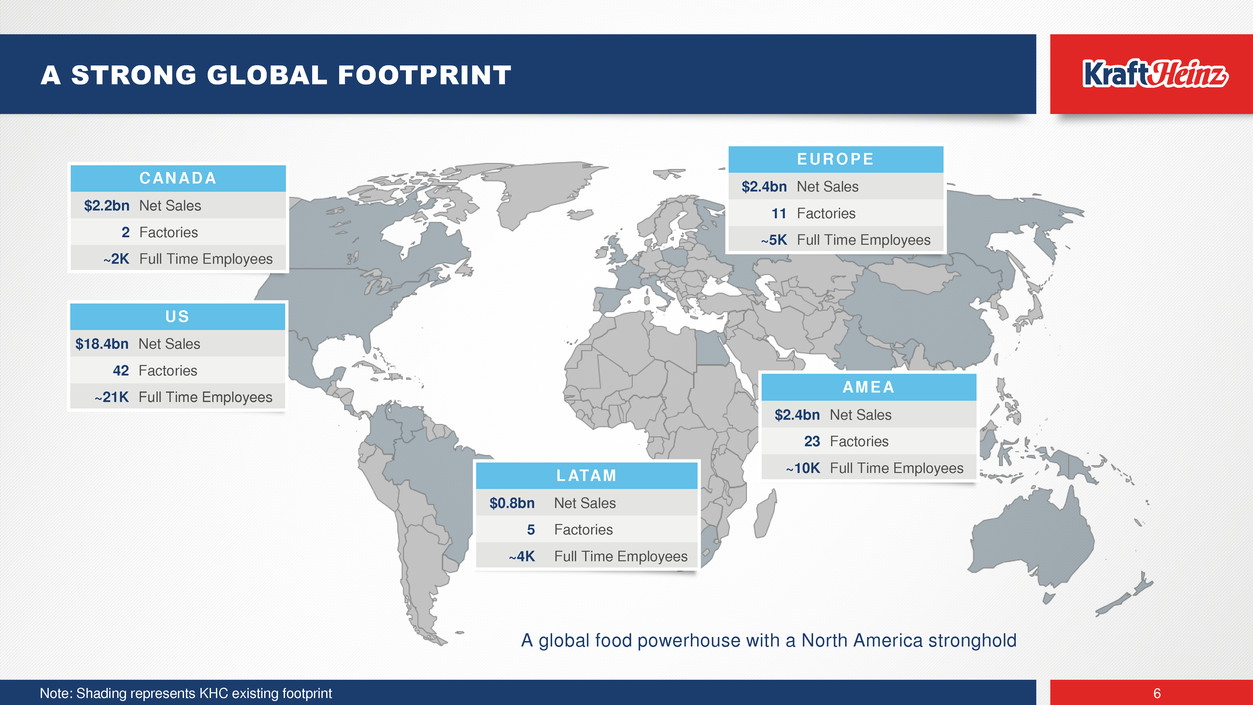

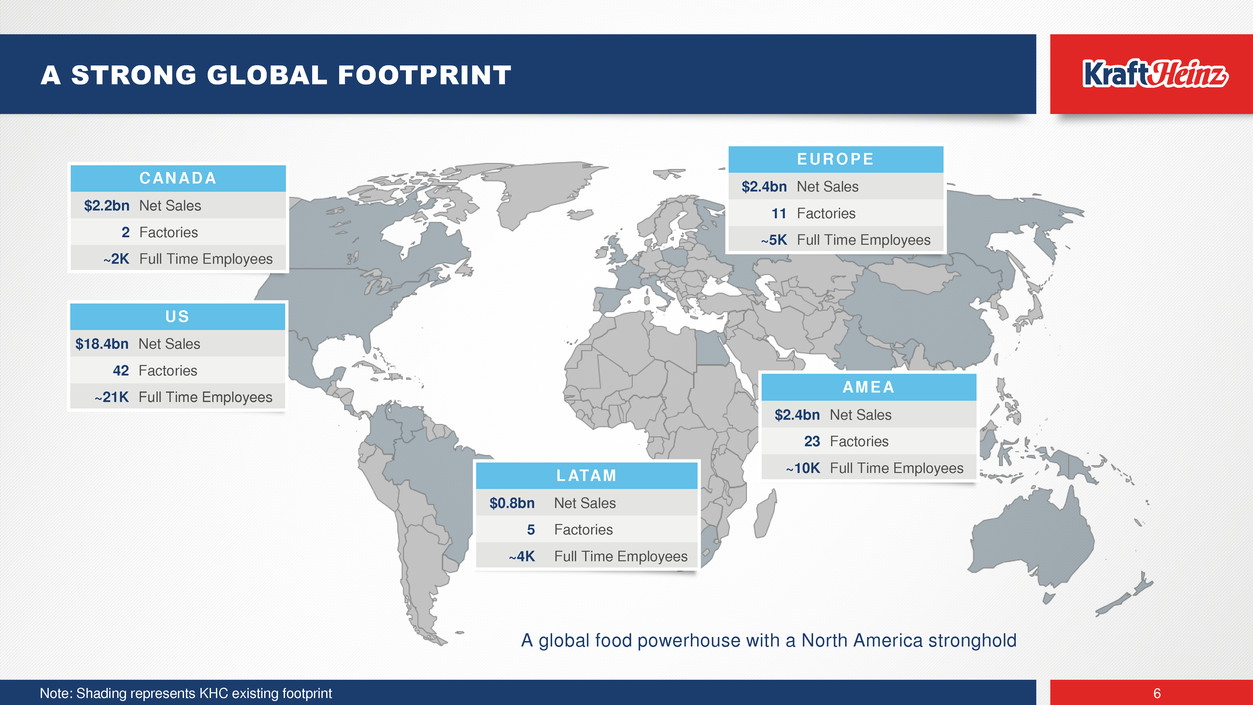

Note: Shading represents KHC existing footprint 6 A STRONG GLOBAL FOOTPRINT CANADA $2.2bn Net Sales 2 Factories ~2K Full Time Employees US $18.4bn Net Sales 42 Factories ~21K Full Time Employees EUROPE $2.4bn Net Sales 11 Factories ~5K Full Time Employees AMEA $2.4bn Net Sales 23 Factories ~10K Full Time Employees LATAM $0.8bn Net Sales 5 Factories ~4K Full Time Employees A global food powerhouse with a North America stronghold

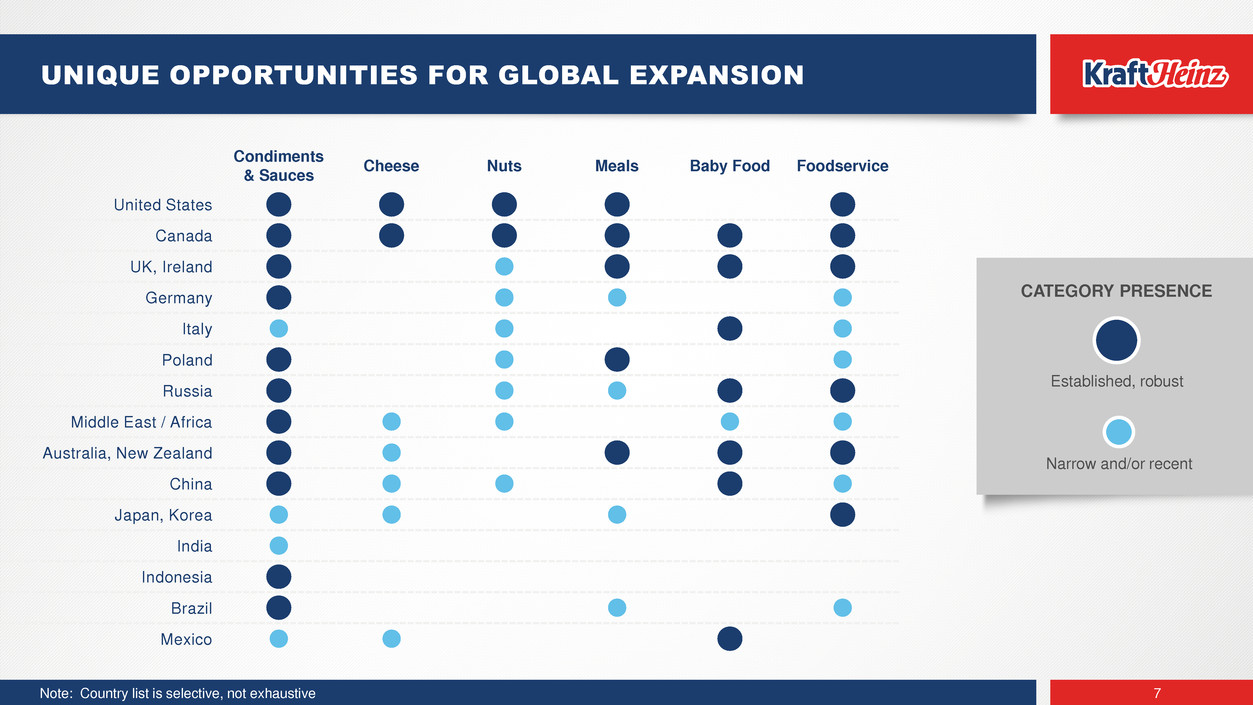

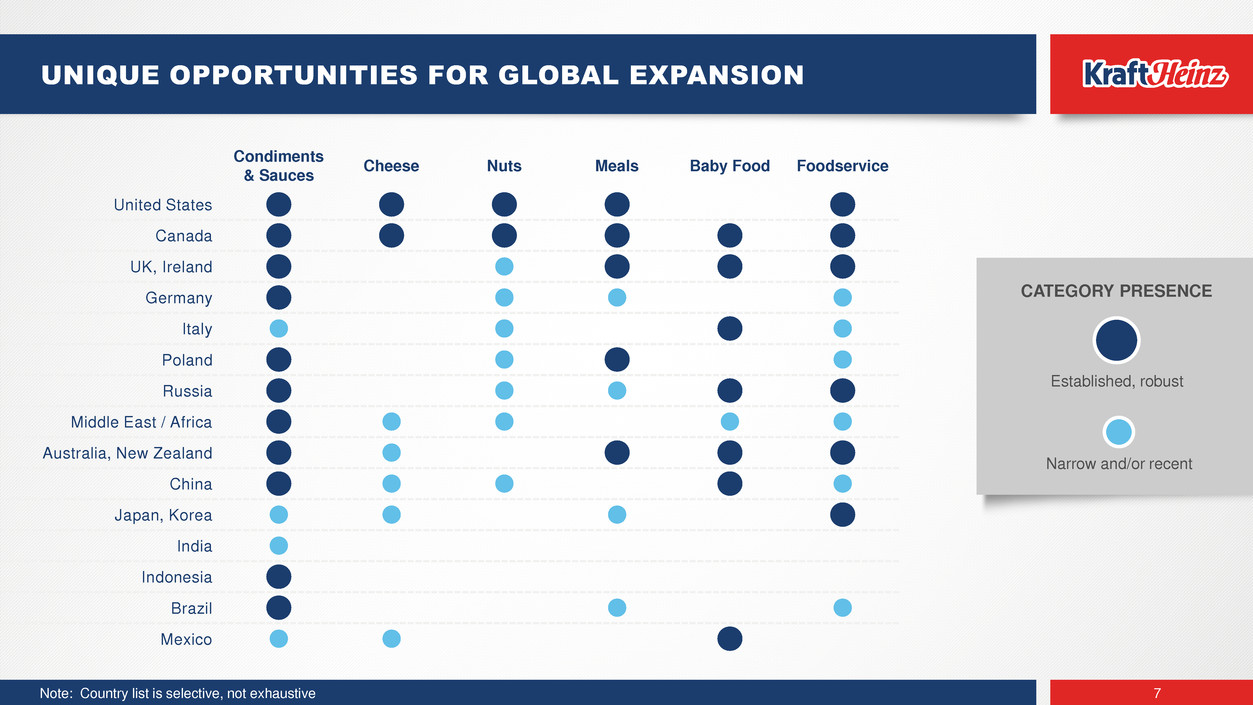

Note: Country list is selective, not exhaustive 7 UNIQUE OPPORTUNITIES FOR GLOBAL EXPANSION Condiments & Sauces Cheese Nuts Meals Baby Food Foodservice United States Canada UK, Ireland Germany Italy Poland Russia Middle East / Africa Australia, New Zealand China Japan, Korea India Indonesia Brazil Mexico Established, robust Narrow and/or recent CATEGORY PRESENCE

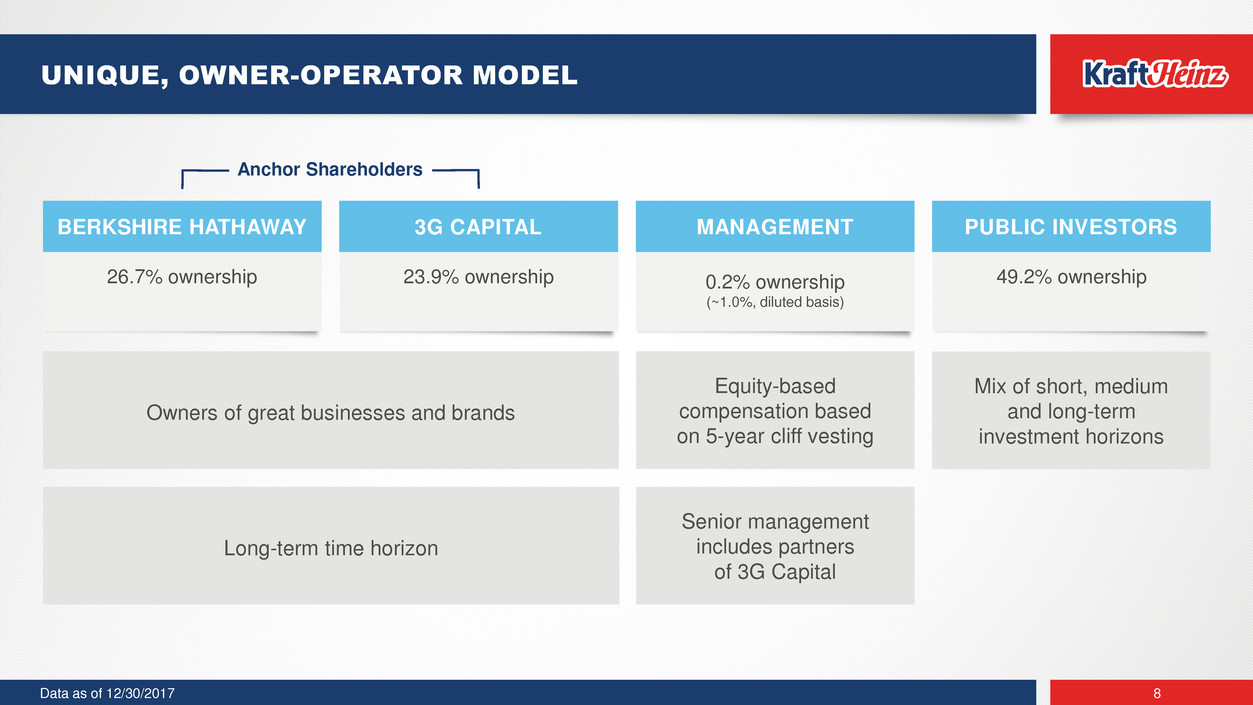

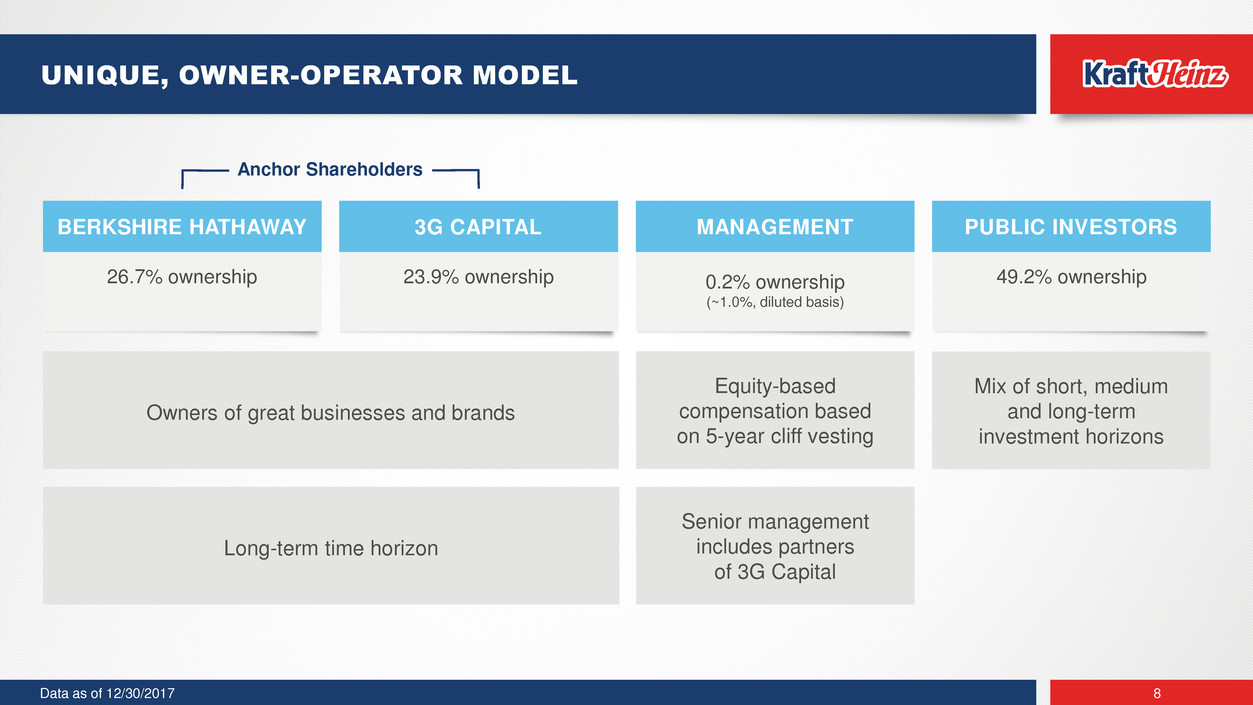

Data as of 12/30/2017 8 UNIQUE, OWNER-OPERATOR MODEL 26.7% ownership BERKSHIRE HATHAWAY 23.9% ownership 3G CAPITAL 0.2% ownership (~1.0%, diluted basis) MANAGEMENT 49.2% ownership PUBLIC INVESTORS Owners of great businesses and brands Long-term time horizon Equity-based compensation based on 5-year cliff vesting Senior management includes partners of 3G Capital Mix of short, medium and long-term investment horizons Anchor Shareholders

9 PURPOSE-LED VISION Bernardo Hees Chief Executive Officer

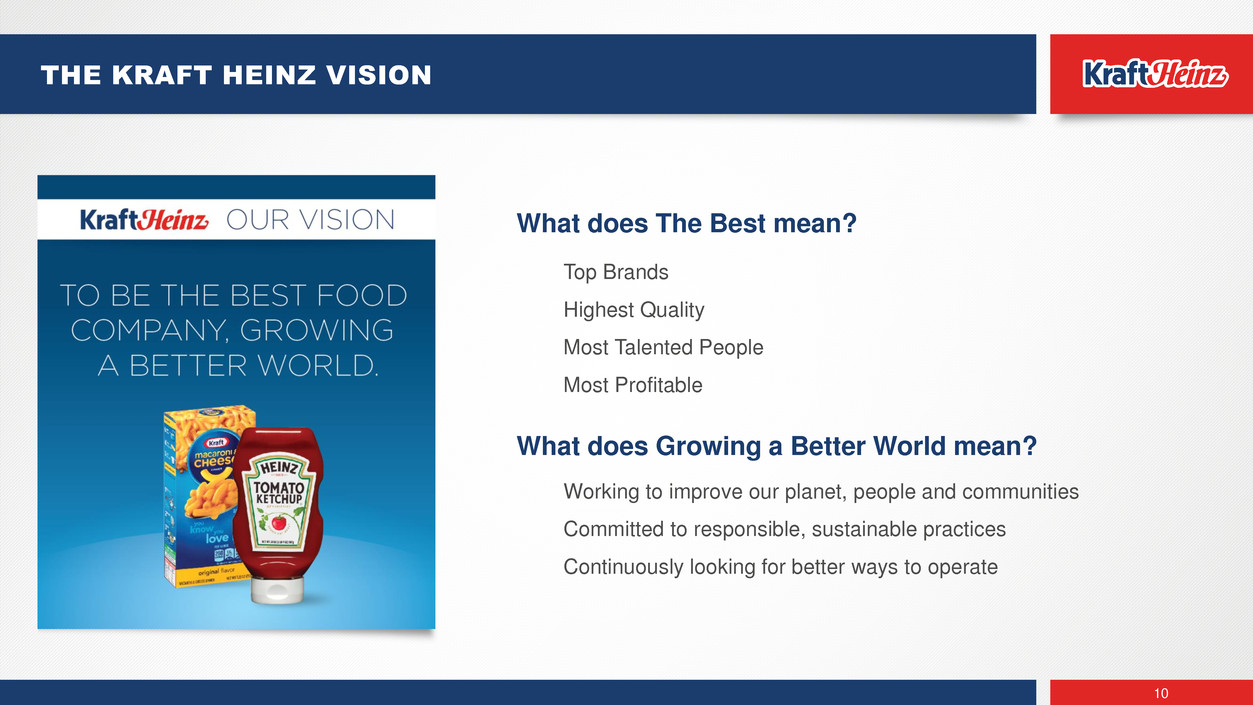

10 THE KRAFT HEINZ VISION What does The Best mean? Top Brands Highest Quality Most Talented People Most Profitable What does Growing a Better World mean? Working to improve our planet, people and communities Committed to responsible, sustainable practices Continuously looking for better ways to operate

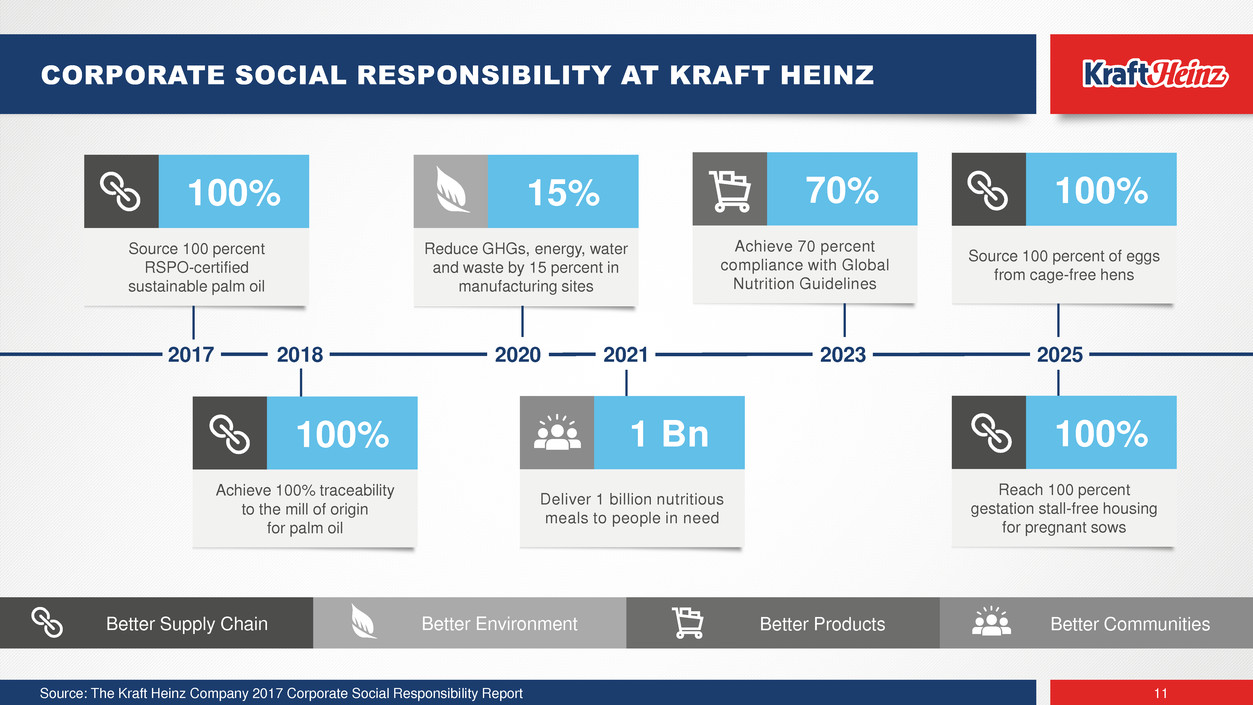

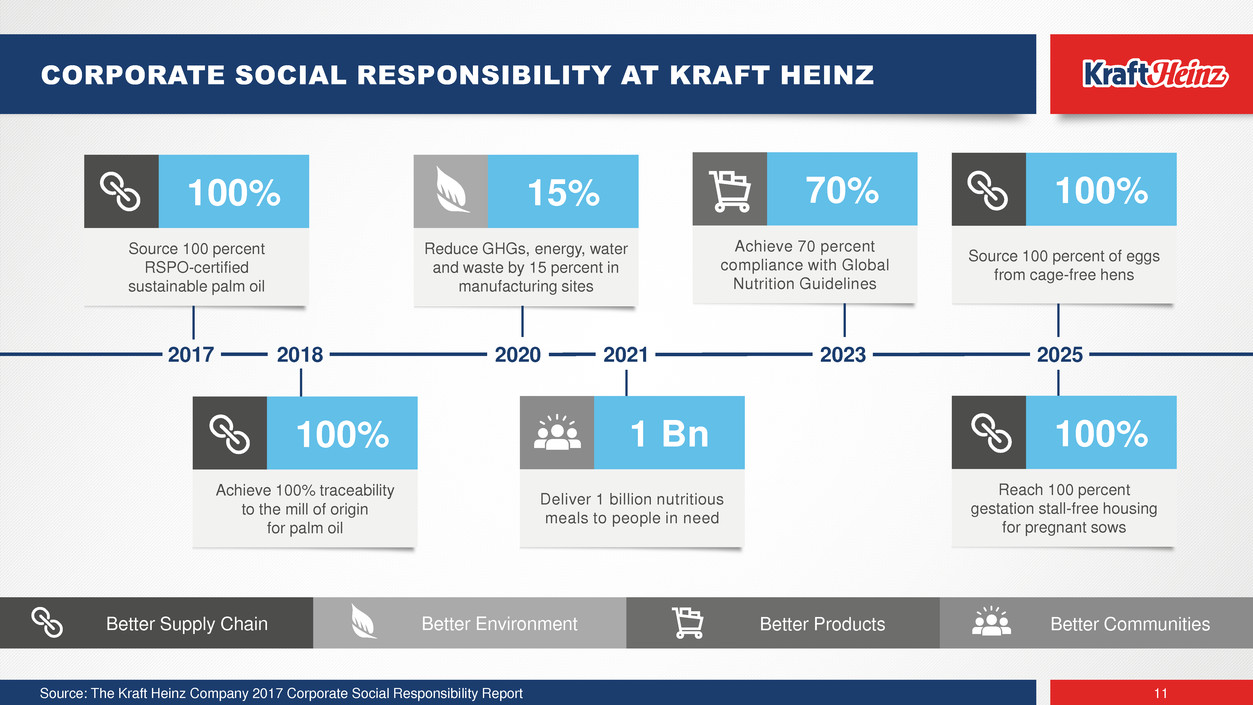

Better Environment Source: The Kraft Heinz Company 2017 Corporate Social Responsibility Report 11 CORPORATE SOCIAL RESPONSIBILITY AT KRAFT HEINZ Better Supply Chain Better Products Better Communities 2017 2018 2020 2021 2023 2025 1 Bn Deliver 1 billion nutritious meals to people in need 100% Achieve 100% traceability to the mill of origin for palm oil 100% Reach 100 percent gestation stall-free housing for pregnant sows 100% Source 100 percent of eggs from cage-free hens 70% Achieve 70 percent compliance with Global Nutrition Guidelines 15% Reduce GHGs, energy, water and waste by 15 percent in manufacturing sites 100% Source 100 percent RSPO-certified sustainable palm oil

12 OUR APPROACH TO FIGHTING HUNGER End World Hunger Providing improved food access & security as well as sustainable solution to help break cycles of hunger A Culture of Volunteerism In 2016, Kraft Heinz employees packaged nearly 3 million meals for people in need Building Communities Acting as a driving force for positive change through community investments & cause marketing partnerships 1 Billion Meals by 2021 Source: The Kraft Heinz Company 2017 Corporate Social Responsibility Report

13 BUILDING BETTER COMMUNITIES THROUGH SCALE RETAIL ACTIVITIES Since 2006, KHC has awarded nearly $4 million to 98 communities in Canada Since 2015, KHC has awarded more than $1 million to communities in the United States Kraft Hockeyville Selfie for Good Project Play Canada Cans for Good New Zealand Source: The Kraft Heinz Company 2017 Corporate Social Responsibility Report

14 ADAPTING & MODERNIZING FOR SUSTAINABLE GROWTH Bernardo Hees Chief Executive Officer

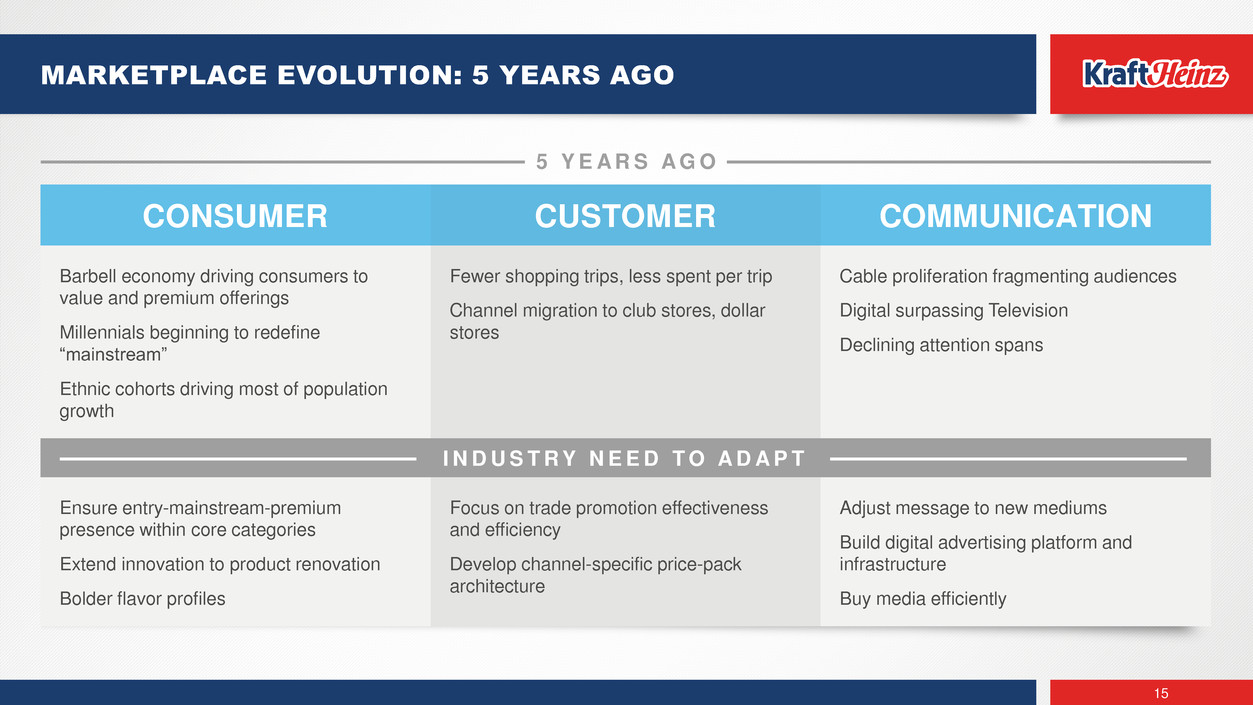

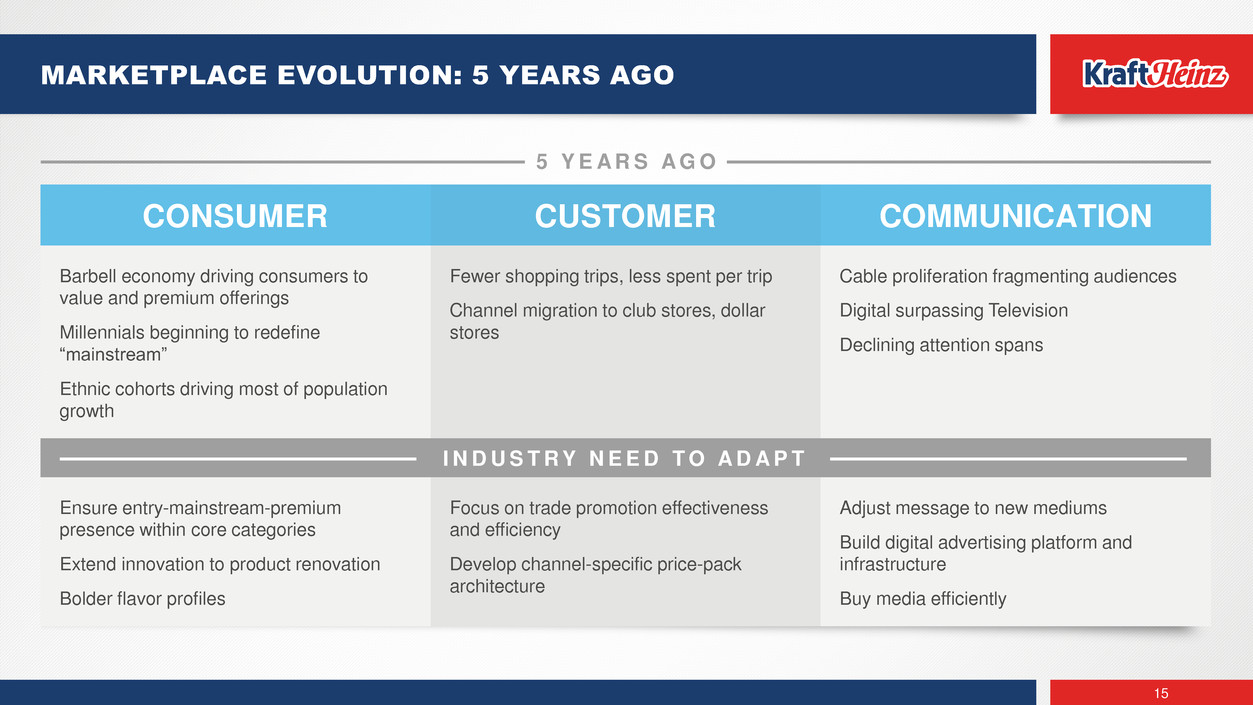

15 MARKETPLACE EVOLUTION: 5 YEARS AGO CONSUMER CUSTOMER COMMUNICATION Barbell economy driving consumers to value and premium offerings Millennials beginning to redefine “mainstream” Ethnic cohorts driving most of population growth Fewer shopping trips, less spent per trip Channel migration to club stores, dollar stores Cable proliferation fragmenting audiences Digital surpassing Television Declining attention spans I N D U S T R Y N E E D T O A D A P T Ensure entry-mainstream-premium presence within core categories Extend innovation to product renovation Bolder flavor profiles Focus on trade promotion effectiveness and efficiency Develop channel-specific price-pack architecture Adjust message to new mediums Build digital advertising platform and infrastructure Buy media efficiently 5 Y E A R S A G O

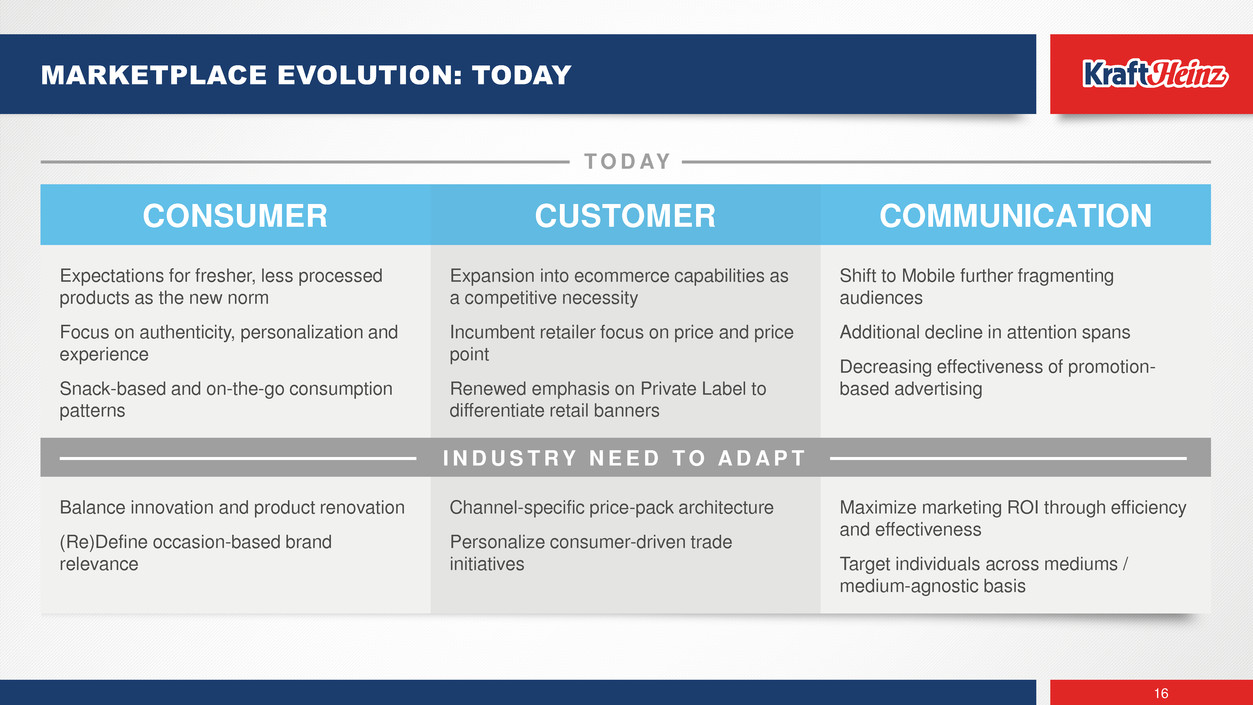

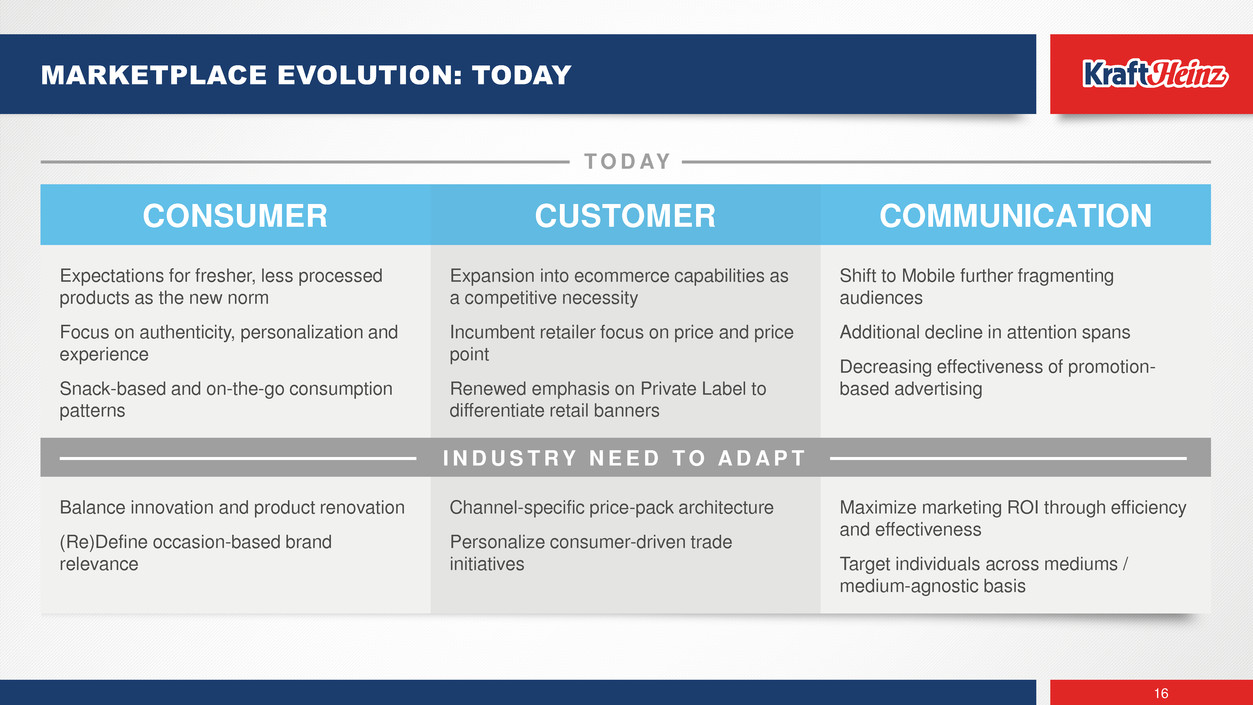

16 MARKETPLACE EVOLUTION: TODAY CONSUMER CUSTOMER COMMUNICATION Expectations for fresher, less processed products as the new norm Focus on authenticity, personalization and experience Snack-based and on-the-go consumption patterns Expansion into ecommerce capabilities as a competitive necessity Incumbent retailer focus on price and price point Renewed emphasis on Private Label to differentiate retail banners Shift to Mobile further fragmenting audiences Additional decline in attention spans Decreasing effectiveness of promotion- based advertising I N D U S T R Y N E E D T O A D A P T Balance innovation and product renovation (Re)Define occasion-based brand relevance Channel-specific price-pack architecture Personalize consumer-driven trade initiatives Maximize marketing ROI through efficiency and effectiveness Target individuals across mediums / medium-agnostic basis T O D AY

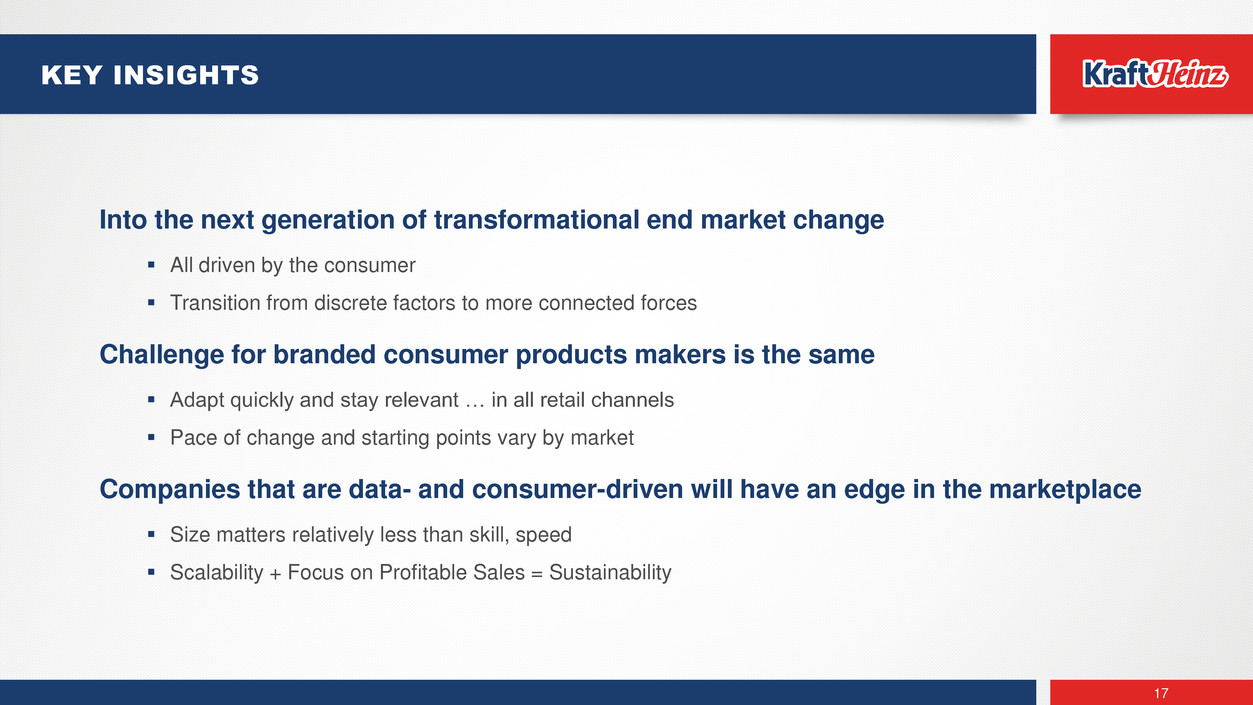

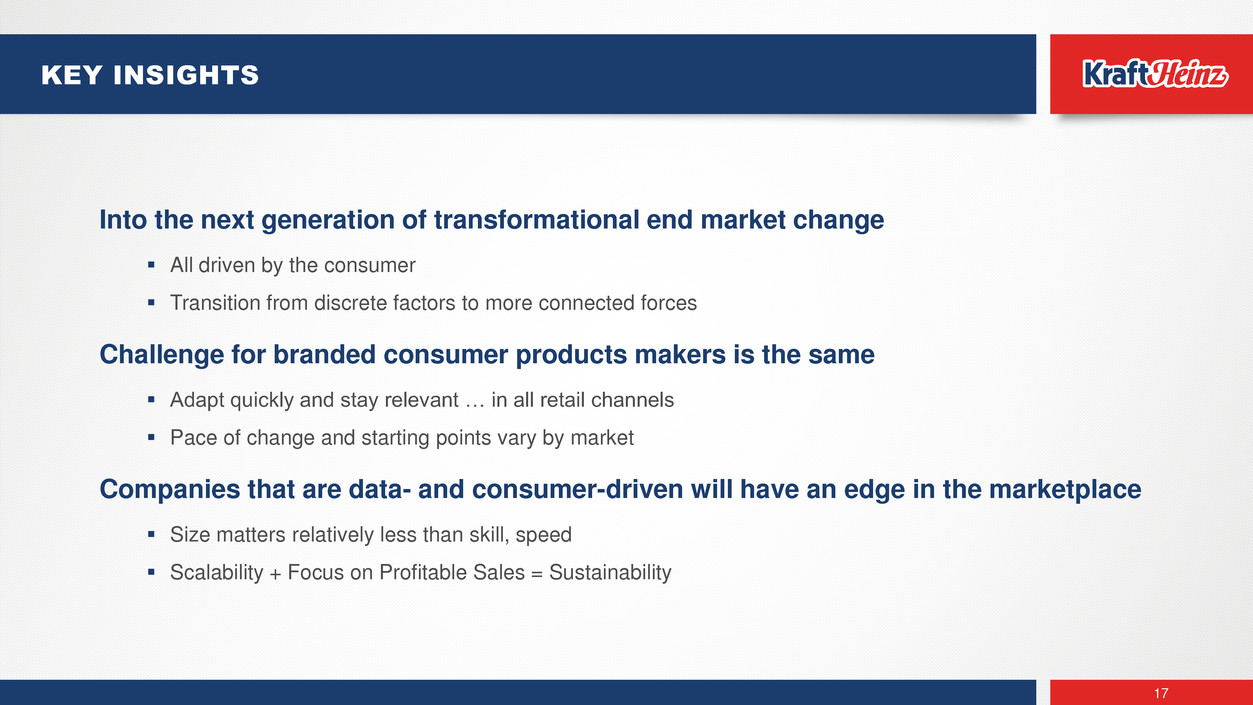

17 KEY INSIGHTS Into the next generation of transformational end market change All driven by the consumer Transition from discrete factors to more connected forces Challenge for branded consumer products makers is the same Adapt quickly and stay relevant … in all retail channels Pace of change and starting points vary by market Companies that are data- and consumer-driven will have an edge in the marketplace Size matters relatively less than skill, speed Scalability + Focus on Profitable Sales = Sustainability

18 KEY INITIATIVES TO DRIVE SUSTAINABLE GROWTH Data-Driven Marketing for Competitive Advantage Brand Building Through Innovation, Renovation & Investment Reinvent Category Management Expand Go-To-Market Capabilities Create Best-in-Class Operations Recruit, Develop, & Align our People 1 2 3 4 5 6

19 Data-Driven Marketing for Competitive Advantage 1 Magen Hanrahan U.S. Head of Media, Creative Services, and Marketing Services

20 JOURNEY TO BE THE #1 DATA-DRIVEN MARKETER Data-Driven Marketing for Competitive Advantage What does it mean to be Data-Driven at ? Deploying data to inform people-centric planning and buying decisions Defining and improving quality Measuring performance and providing transparency Reducing waste & delivering the strategic target to generate near term sales Reaching the right person, with the right message at the right moment 1

21 SUCCESS BUILT ON FOUR CORE ELEMENTS Data-Driven Marketing for Competitive Advantage PEOPLEINFRASTRUCTURE DATA RESULTS 1

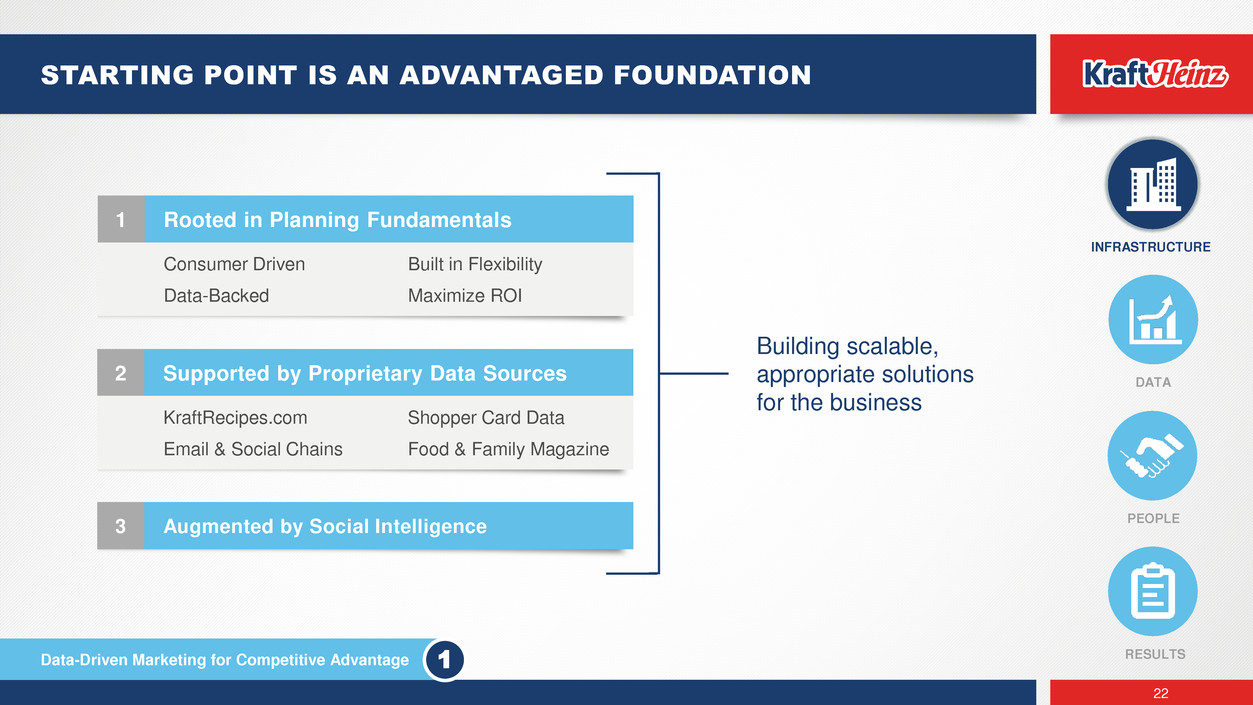

22 STARTING POINT IS AN ADVANTAGED FOUNDATION Data-Driven Marketing for Competitive Advantage PEOPLE INFRASTRUCTURE DATA RESULTS Building scalable, appropriate solutions for the business 1 Rooted in Planning Fundamentals Consumer Driven Data-Backed Built in Flexibility Maximize ROI 2 Supported by Proprietary Data Sources KraftRecipes.com Email & Social Chains Shopper Card Data Food & Family Magazine 3 Augmented by Social Intelligence 1

Sources: ComScore December 2017 (Multi-platform, Mobile), Brightcove Reporting Suite 2015 ,AAM Alliance for Audited Media, Kraft Internal Data, Social Data as of 5/15/2016 23 CROSS CHANNEL PROGRAMS ARE RICH 1ST PARTY DATA SOURCES Data-Driven Marketing for Competitive Advantage PEOPLE INFRASTRUCTURE DATA RESULTS 1B+ organic social impressions served 50K recipes professionally developed 726 videos 11M+ average monthly unique visitors 3rd largest CPG site 1+ million paying print magazine subscribers 10.3+ million consumers via email 1

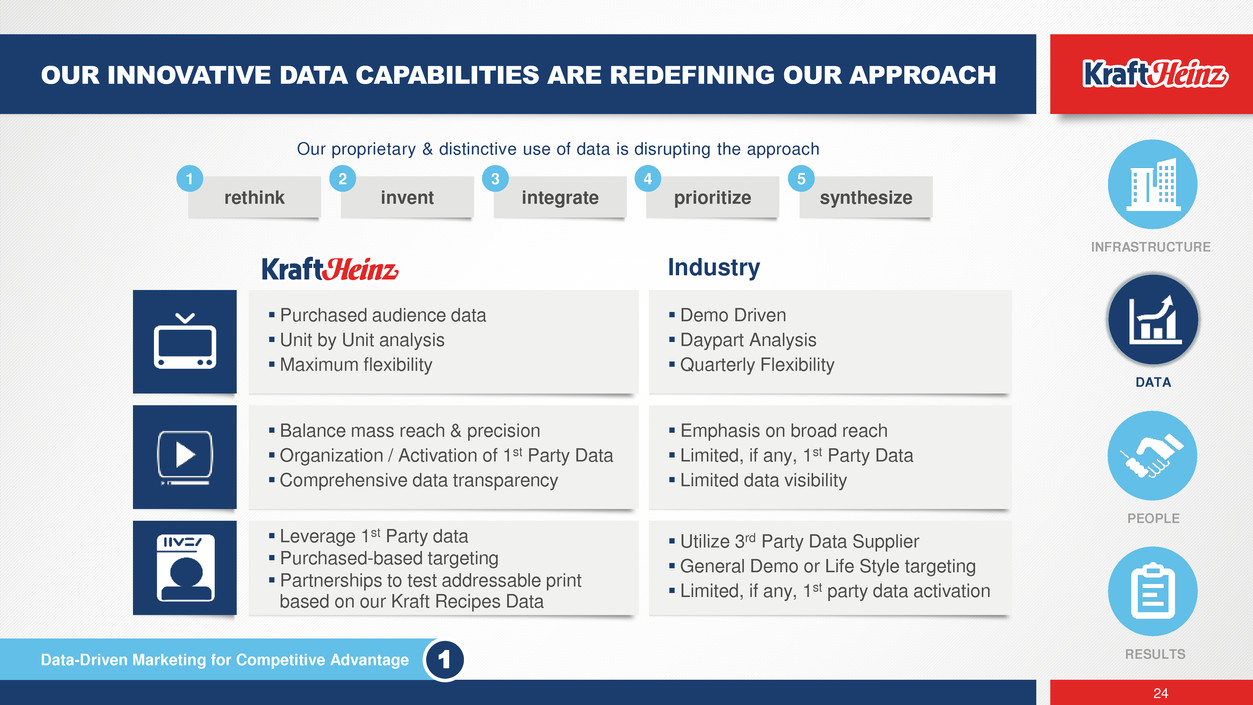

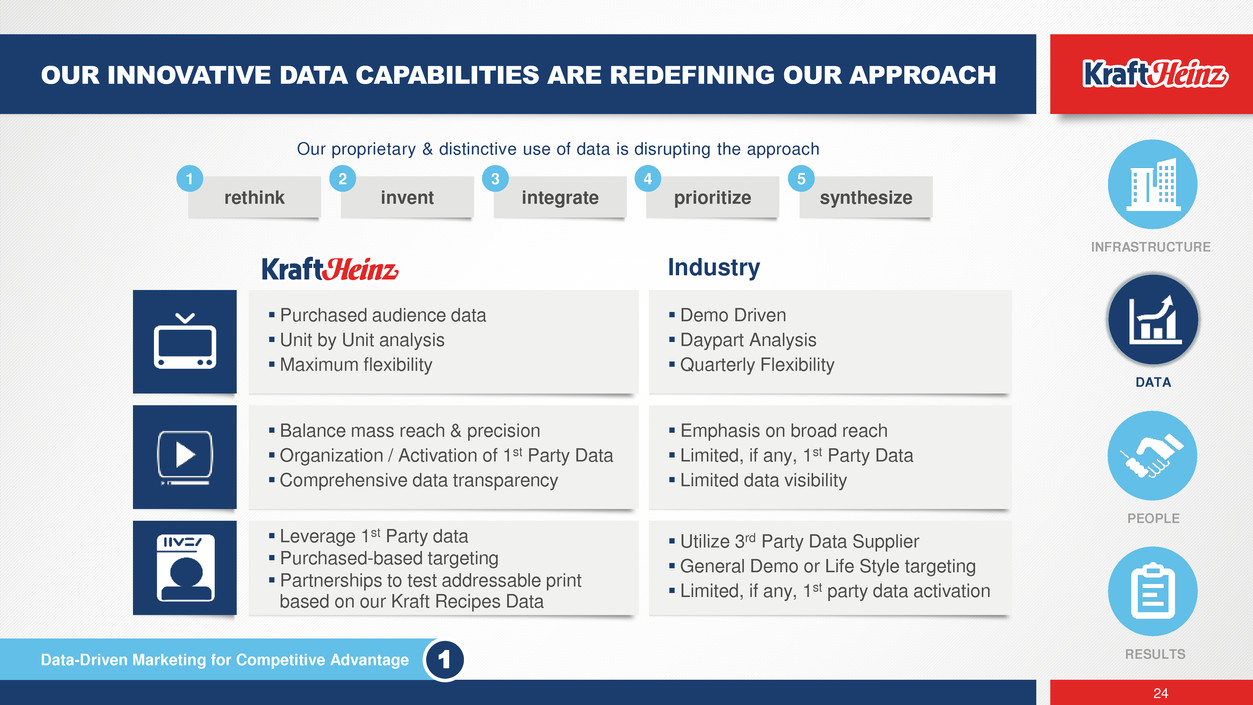

Industry Purchased audience data Unit by Unit analysis Maximum flexibility Demo Driven Daypart Analysis Quarterly Flexibility Balance mass reach & precision Organization / Activation of 1st Party Data Comprehensive data transparency Emphasis on broad reach Limited, if any, 1st Party Data Limited data visibility Leverage 1st Party data Purchased-based targeting Partnerships to test addressable print Utilize 3rd Party Data Supplier General Demo or Life Style targeting Limited, if any, 1st party data activation 24 OUR INNOVATIVE DATA CAPABILITIES ARE REDEFINING OUR APPROACH Data-Driven Marketing for Competitive Advantage PEOPLE INFRASTRUCTURE DATA RESULTS rethink 1 invent 2 integrate 3 prioritize 4 synthesize 5 Our proprietary & distinctive use of data is disrupting the approach 1 based on our Kraft Recipes Data

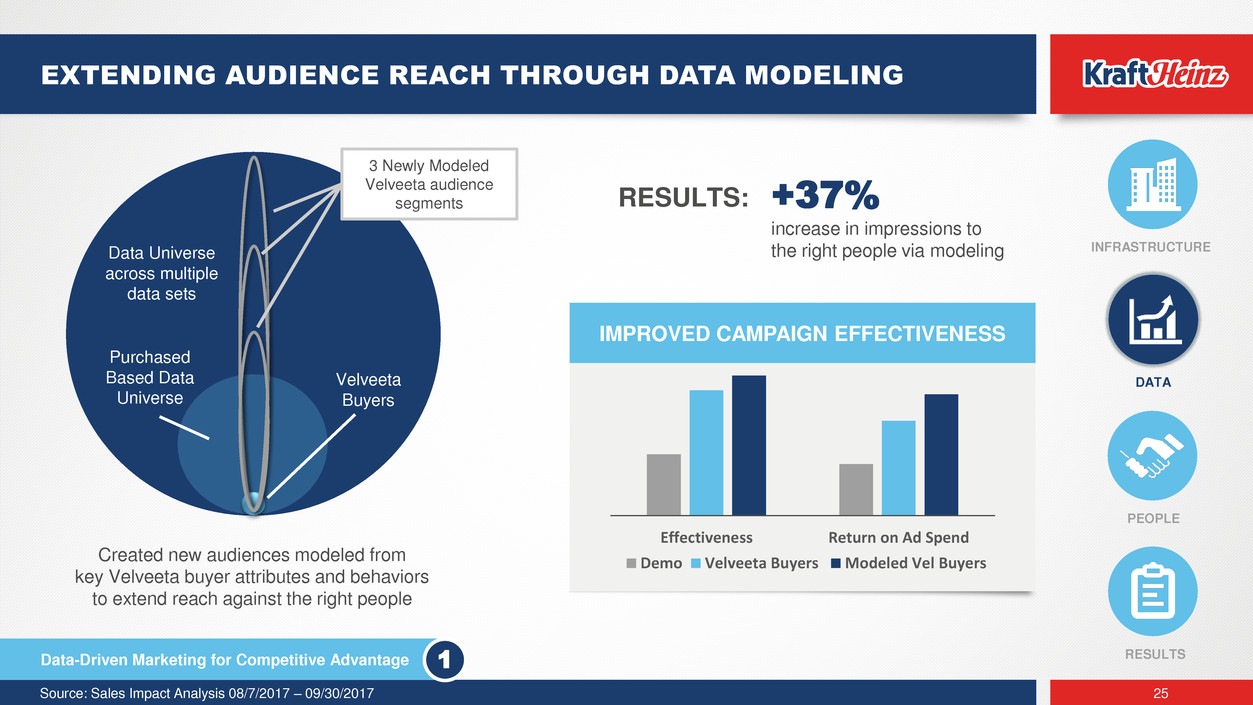

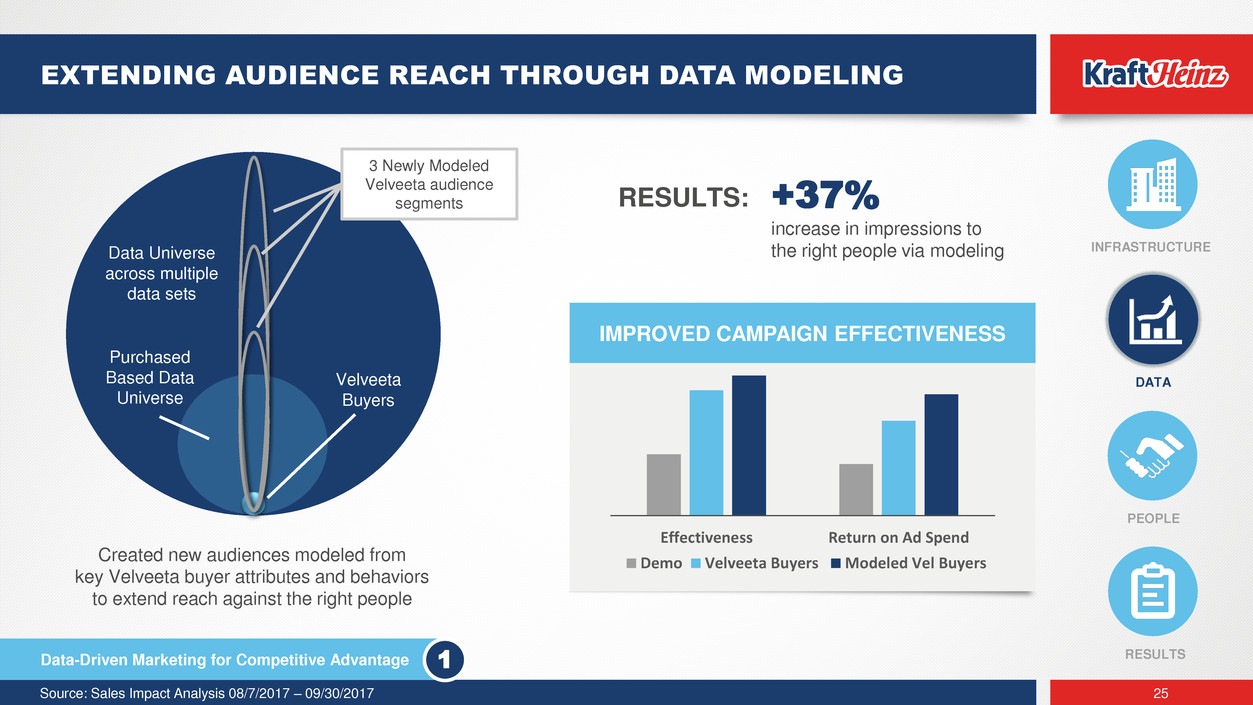

IMPROVED CAMPAIGN EFFECTIVENESS Source: Sales Impact Analysis 08/7/2017 – 09/30/2017 25 EXTENDING AUDIENCE REACH THROUGH DATA MODELING Data-Driven Marketing for Competitive Advantage 1 Created new audiences modeled from key Velveeta buyer attributes and behaviors to extend reach against the right people RESULTS: +37% increase in impressions to the right people via modeling Effectiveness Return on Ad Spend Demo Velveeta Buyers Modeled Vel Buyers PEOPLE INFRASTRUCTURE DATA RESULTS Velveeta Buyers Purchased Based Data Universe Data Universe across multiple data sets 3 Newly Modeled Velveeta audience segments

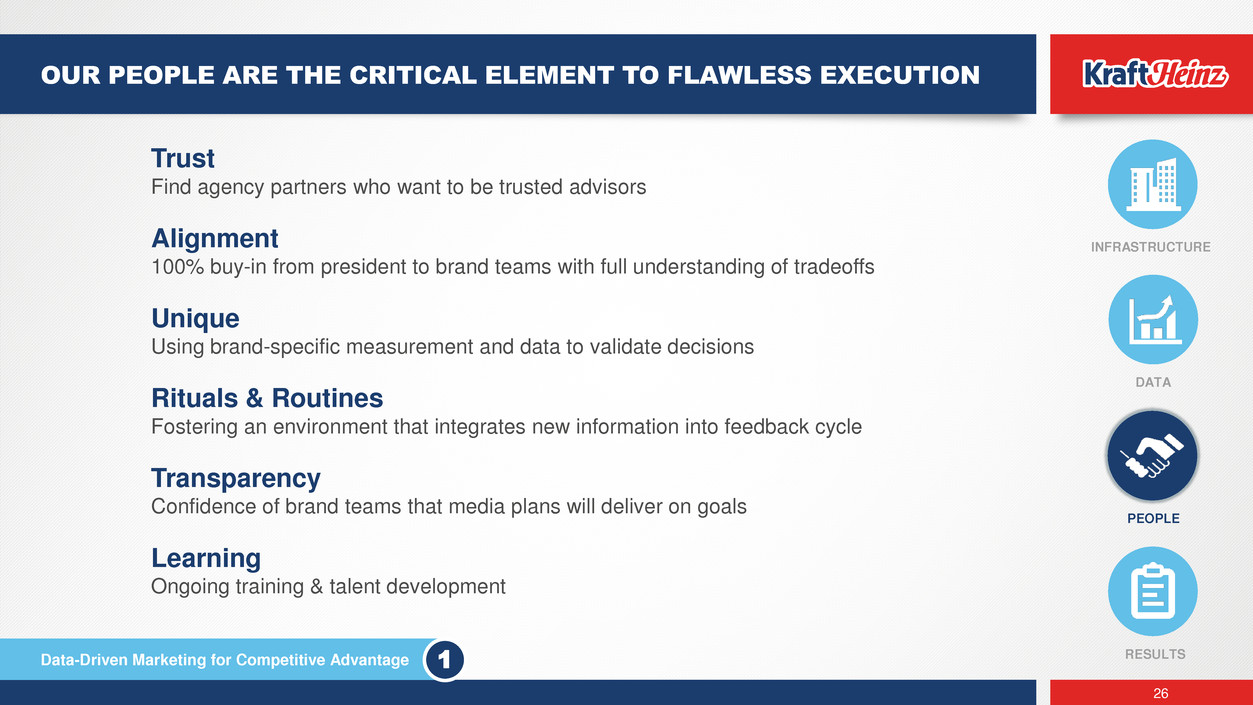

26 Data-Driven Marketing for Competitive Advantage PEOPLE INFRASTRUCTURE DATA RESULTS OUR PEOPLE ARE THE CRITICAL ELEMENT TO FLAWLESS EXECUTION Trust Find agency partners who want to be trusted advisors Alignment 100% buy-in from president to brand teams with full understanding of tradeoffs Unique Using brand-specific measurement and data to validate decisions Rituals & Routines Fostering an environment that integrates new information into feedback cycle Transparency Confidence of brand teams that media plans will deliver on goals Learning Ongoing training & talent development 1

DOLLAR SALES IMPACT Average dollar purchases per household, including non-buyers Data from 10/2/2015 – 01/23/2016 27 Data-Driven Marketing for Competitive Advantage BRINGING IT ALL TOGETHER TO DELIVER RESULTS 1 +$0.26+$0.28+$0.16 PEOPLE INFRASTRUCTURE DATA RESULTS Unexposed Exposed Q u ic k & Eas y K id F ri e n d ly E n te rta in in g

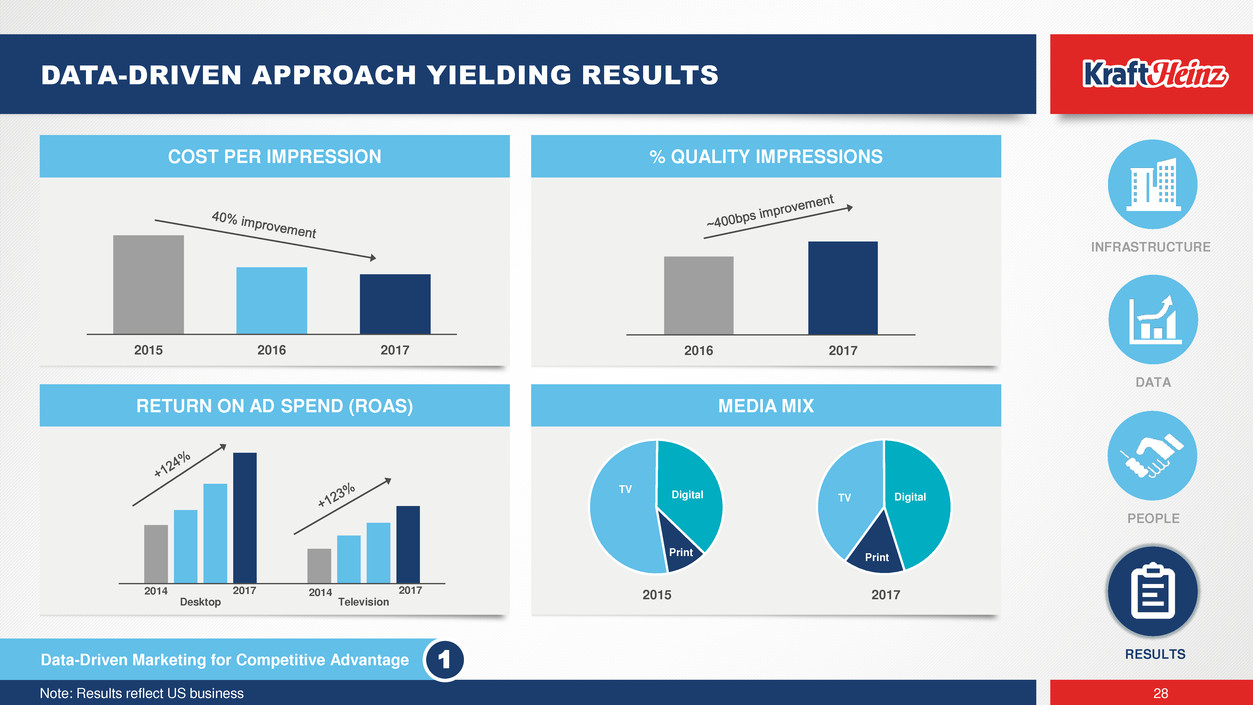

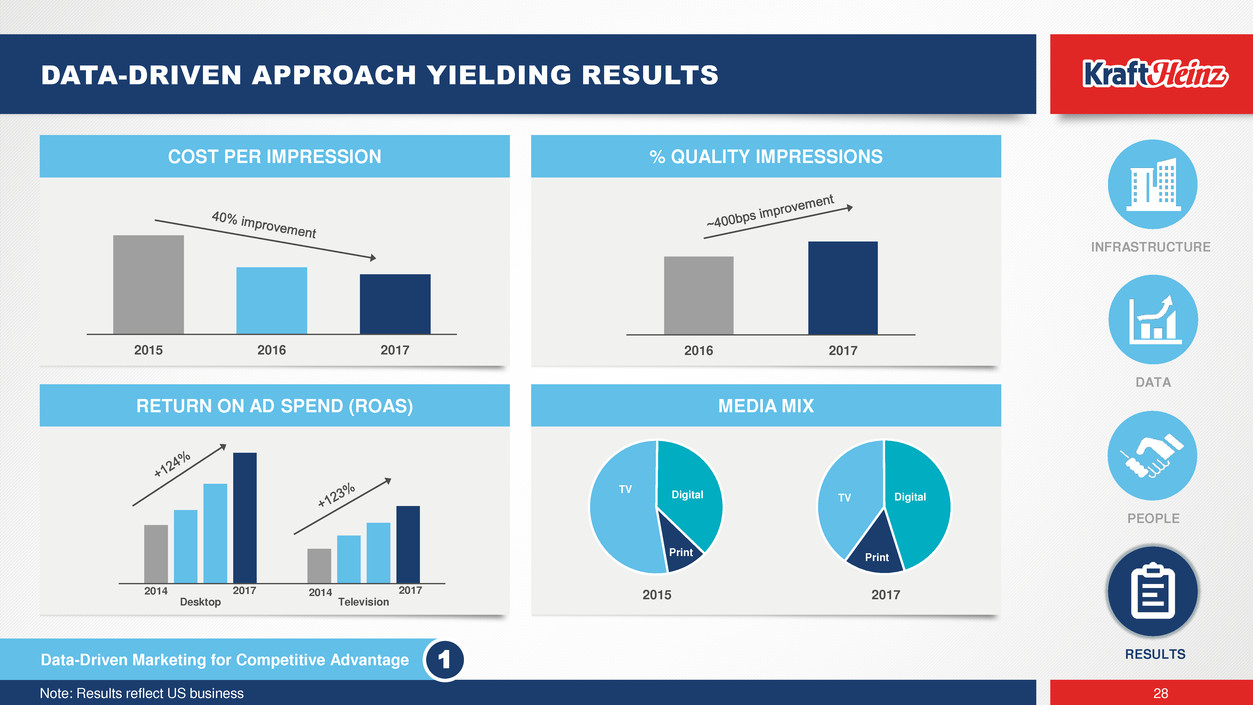

COST PER IMPRESSION % QUALITY IMPRESSIONS RETURN ON AD SPEND (ROAS) MEDIA MIX TV Digital Print TV Digital Print Note: Results reflect US business 28 Data-Driven Marketing for Competitive Advantage PEOPLE INFRASTRUCTURE DATA RESULTS DATA-DRIVEN APPROACH YIELDING RESULTS 2016 20172015 2016 2017 2015 20172014 20142017 2017 Desktop Television 1

29 Brand Building Through Innovation, Renovation & Investment 2 Michelle St. Jacques Head of U.S. Brands and R&D

3 Global Brands 30 3 GLOBAL BRANDS, 5 GLOBAL PLATFORMS & FOODSERVICE 5 Global Platforms & Foodservice 1 Condiments & Sauces 2 Cheese 3 Nuts 4 Meals 5 Baby Food FS Foodservice Brand Building Through Innovation, Renovation & Investment 2

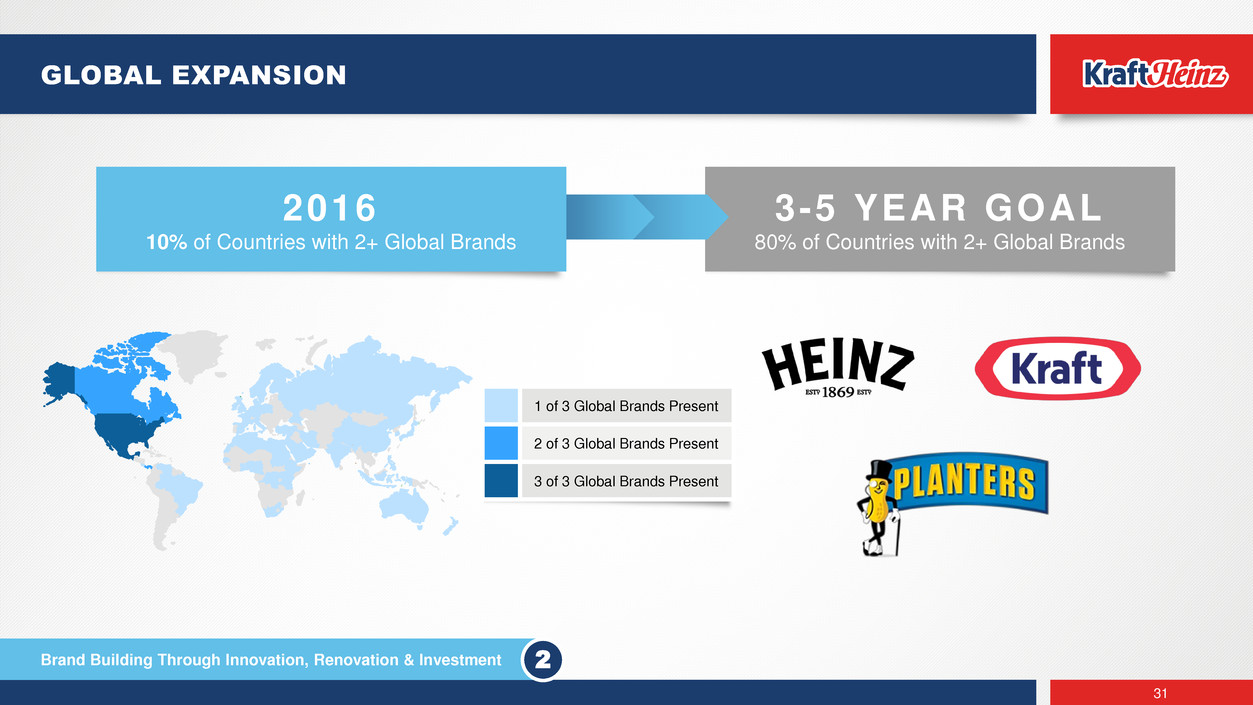

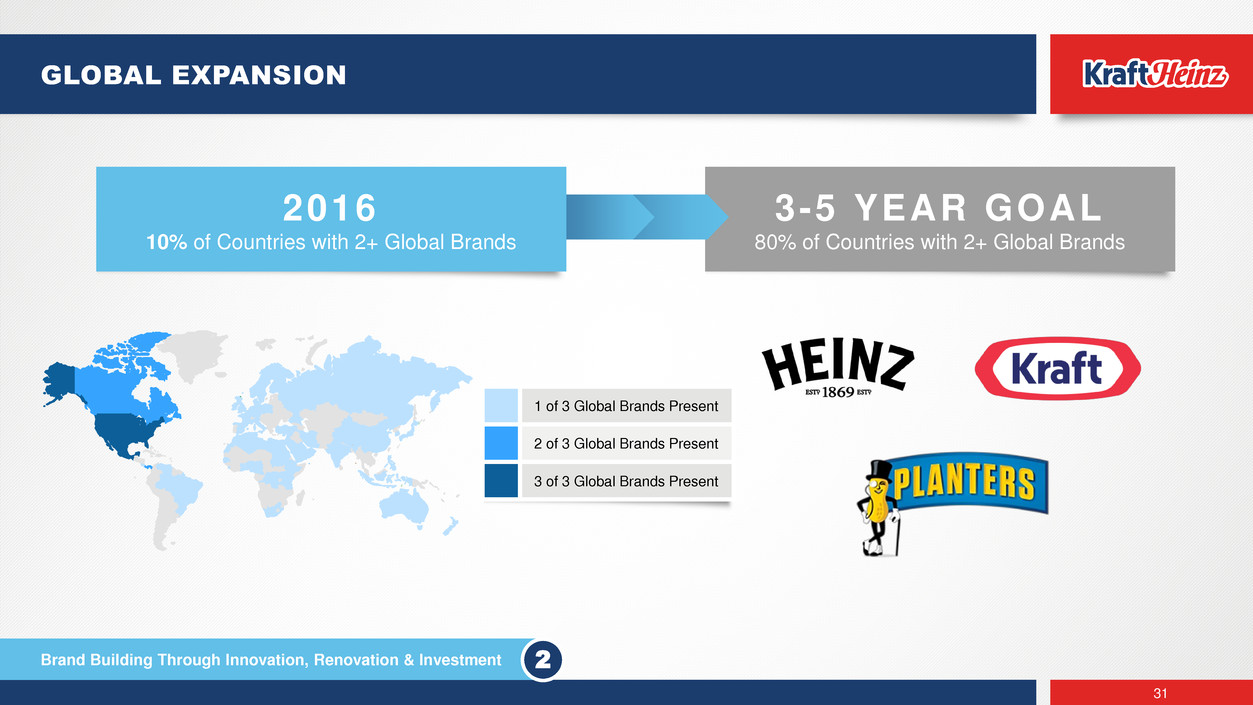

3-5 YEAR GOAL 80% of Countries with 2+ Global Brands 31 GLOBAL EXPANSION Brand Building Through Innovation, Renovation & Investment 1 of 3 Global Brands Present 2 of 3 Global Brands Present 3 of 3 Global Brands Present 2016 10% of Countries with 2+ Global Brands 2

32 CLEAR PORTFOLIO ROLES, MARKET-BY-MARKET, HELP US PRIORITIZE PORTFOLIO ROLE DEFINITION MARKET SHARE OBJECTIVE Powerhouse Large, profitable category leader Flagship brands / strong position Increase / Maintain Portfolio Bets On trend categories Under-indexed, but Right to Win Significant Increase Protect Strong position in large, but slower growth categories Maintain / Slight Decline Turnaround Categories / brands in weak position that need renovation Improve Trend Profitable Contributor Small; stable or “follower” status Category in decline Maintain / Decrease Foodservice Channels: QSR, FSR, Retail Host Categories where KHC has strong retail position / Right to Win Significant Increase BIG BET FOCUS BIG BET FOCUS BIG BET FOCUS Brand Building Through Innovation, Renovation & Investment 2

33 BUILDING BRANDS FOR THE FUTURE Our Approach: 1. Clear & Relevant Brand Positionings 2. Invest to Win Product Quality & Reaching our Consumer 3. Robust Strategy on How to Stretch Brands 4. Move Faster than Competition to Bring Innovation Against New Needstates & Occasions 5. Create Brand Moments that are Part of Culture & Conversation Brand Building Through Innovation, Renovation & Investment 2

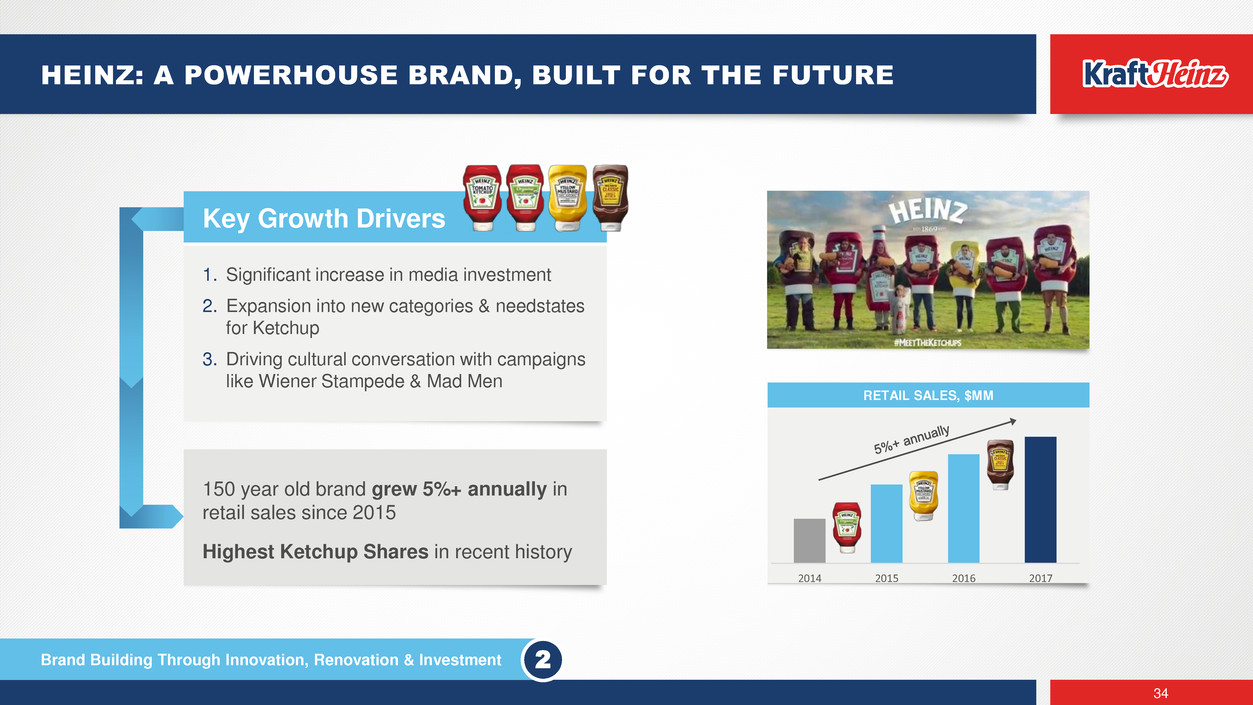

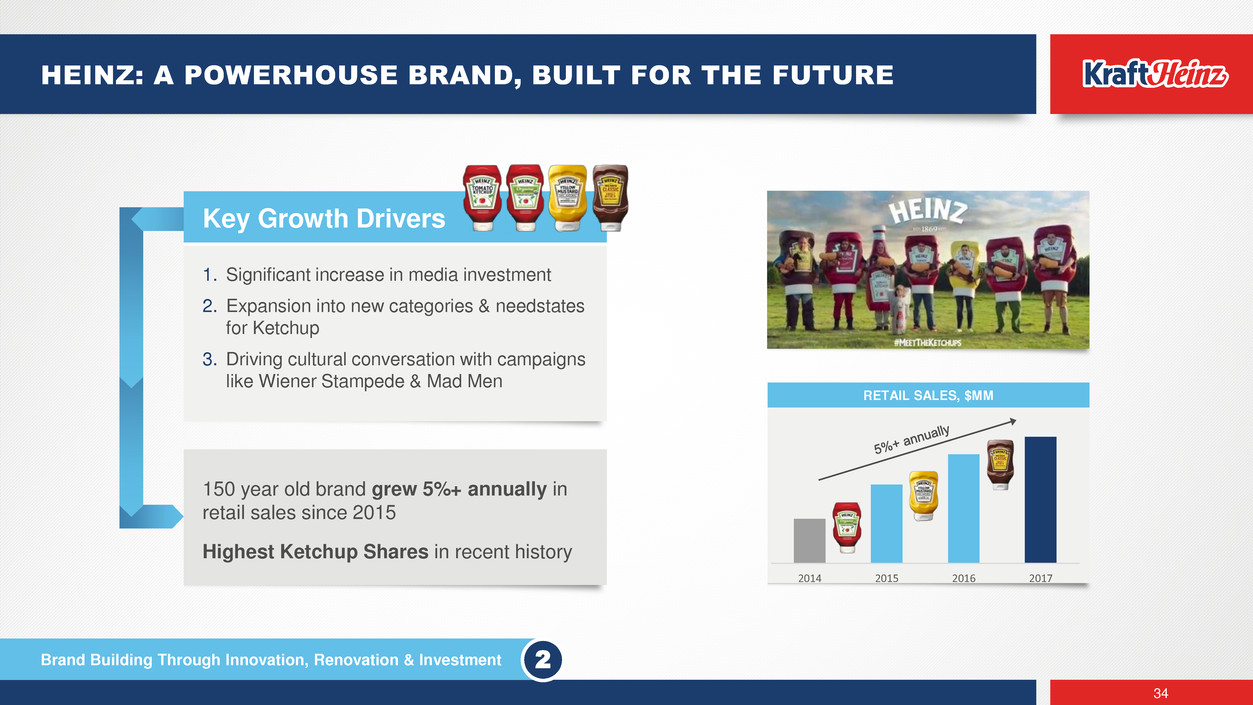

RETAIL SALES, $MM 2014 2015 2016 2017 34 HEINZ: A POWERHOUSE BRAND, BUILT FOR THE FUTURE Key Growth Drivers 1. Significant increase in media investment 2. Expansion into new categories & needstates for Ketchup 3. Driving cultural conversation with campaigns like Wiener Stampede & Mad Men 150 year old brand grew 5%+ annually in retail sales since 2015 Highest Ketchup Shares in recent history Brand Building Through Innovation, Renovation & Investment 2

KHC FROZEN MEALS RETAIL SALES GROWTH 35 FROZEN MEALS: A TURNAROUND STORY Key Growth Drivers 1. Launch new brand, Devour, against unmet consumer in category (men) 2. Re-invent the nutritional offering with launch of Smart Made 3. Drive more value on the core Drive category performance to growth after multiple years of decline Single biggest innovation launch in frozen meals in 2016 Brand Building Through Innovation, Renovation & Investment 2 ----2013---- ----2014---- ----2015---- ----2016---- ----2017---- -13.2% -18.9% -17.1% -14.3% +2.5%

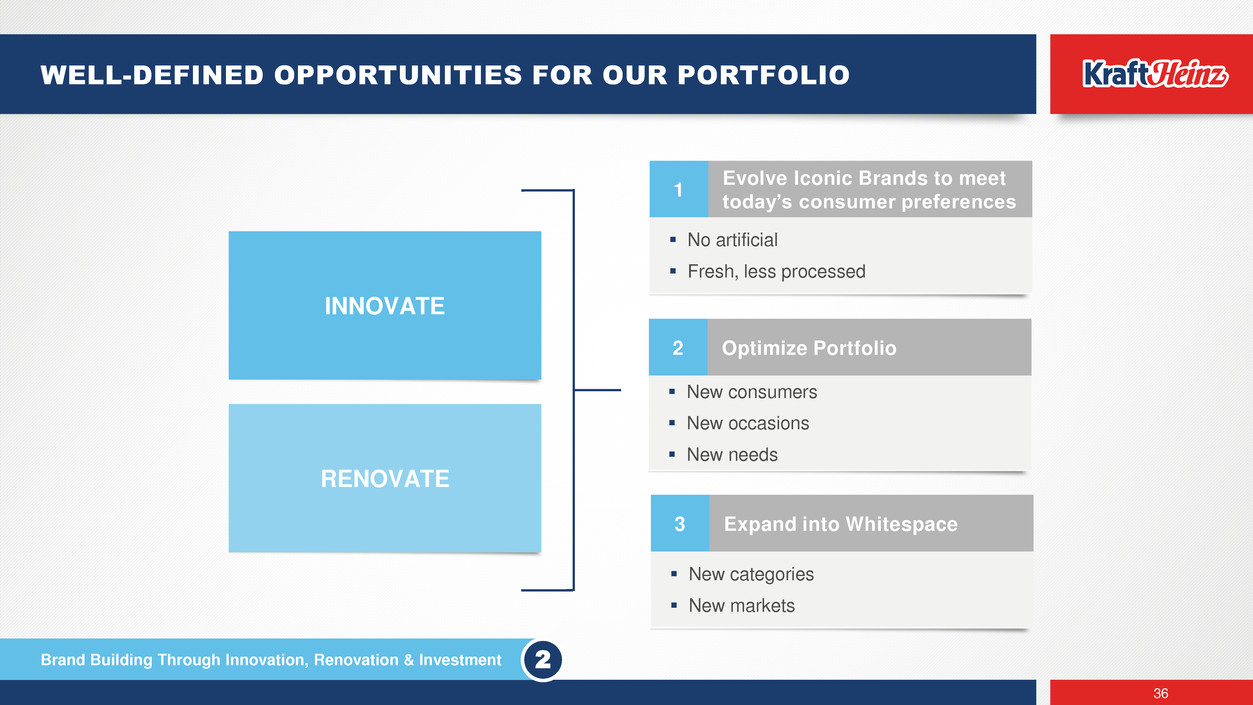

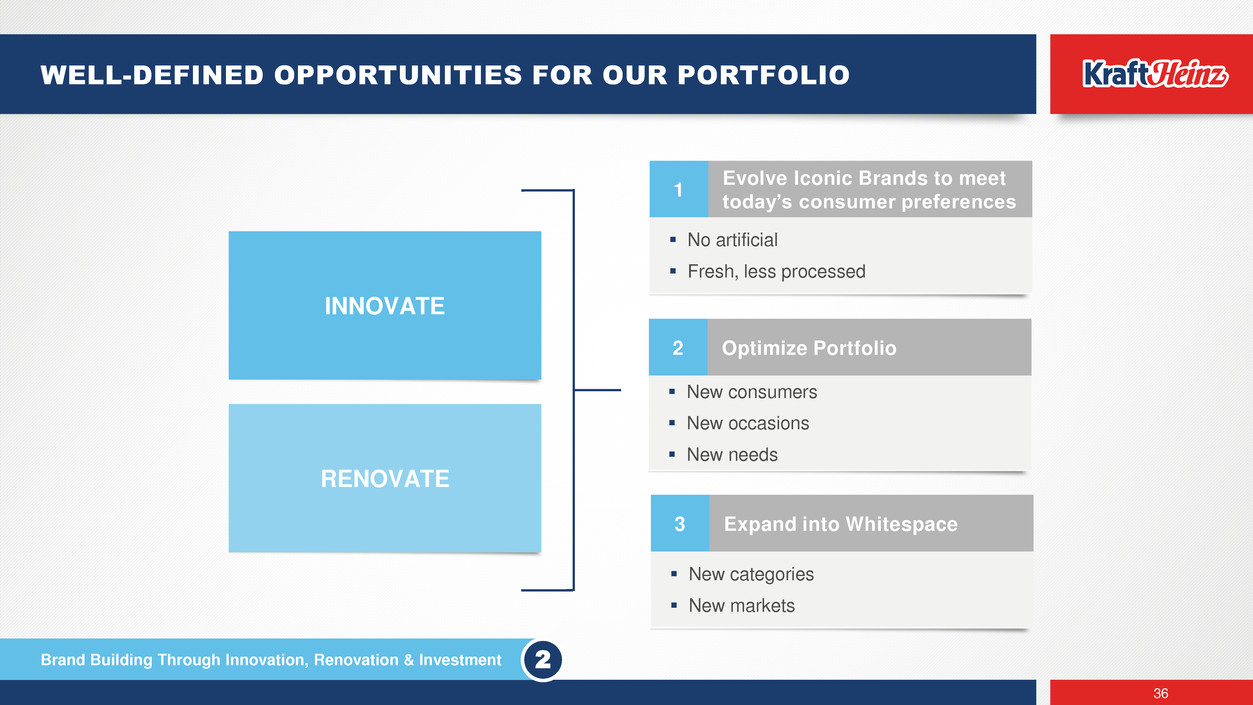

2 Optimize Portfolio New consumers New occasions New needs 36 WELL-DEFINED OPPORTUNITIES FOR OUR PORTFOLIO 1 Evolve Iconic Brands to meet today’s consumer preferences No artificial Fresh, less processed INNOVATE RENOVATE Brand Building Through Innovation, Renovation & Investment 2 3 Expand into Whitespace New categories New markets

37 A ROBUST PIPELINE OF BIG BETS AGAINST KEY OPPORTUNITIES 1 EVOLVE OUR ICONIC BRANDS 2 OPTIMIZE THE PORTFOLIO 3 EXPAND INTO WHITESPACE Brand Building Through Innovation, Renovation & Investment 2

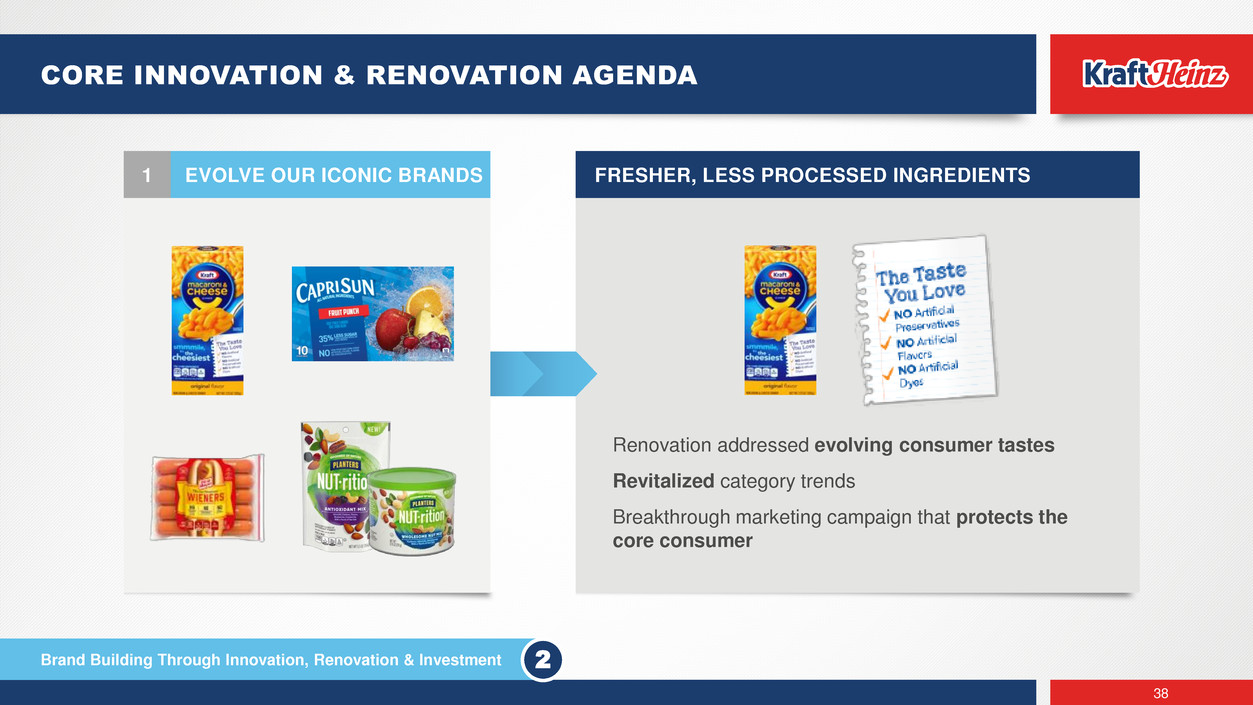

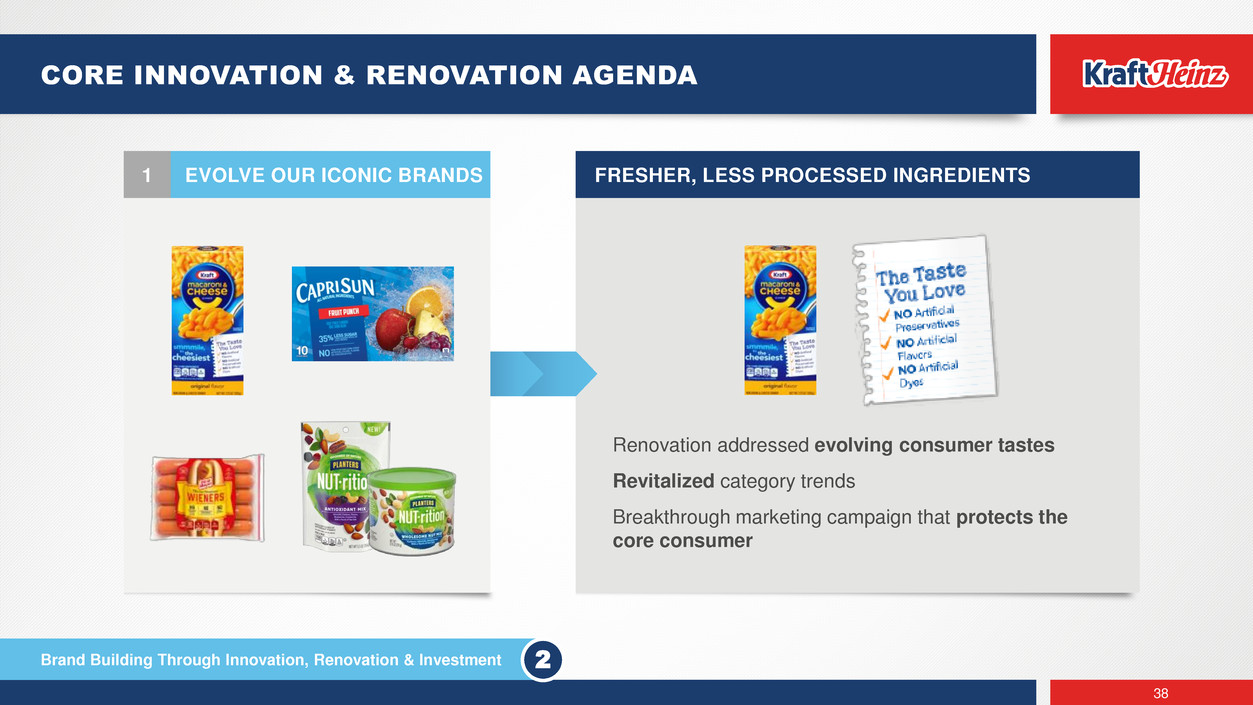

FRESHER, LESS PROCESSED INGREDIENTS Renovation addressed evolving consumer tastes Revitalized category trends Breakthrough marketing campaign that protects the core consumer 38 CORE INNOVATION & RENOVATION AGENDA 1 EVOLVE OUR ICONIC BRANDS Brand Building Through Innovation, Renovation & Investment 2

NEW CONSUMER NEEDSTATE KHC is the category leader1 in Adult Meal Combos, P3 Oscar Mayer Natural Protein Plates is expanding the category2 Best-in-class trial & repeat rates3 1) Nielsen xAOC L52 W/E 12/30/2017, 2) Nielsen Homescan Panel, Total U.S, 26 W/E 09/23/17, 3) Nielsen Homescan Panel, Total US, Three Periods Post Launch 39 CORE INNOVATION & RENOVATION AGENDA 2 OPTIMIZE THE PORTFOLIO Brand Building Through Innovation, Renovation & Investment 2

NEW CATEGORY, EXISTING MARKET Younger consumers shifting to better for you options Heinz brand leveraged strong heritage and quality credential in Europe, Australia and Brazil Encouraged Trade-up 40 CORE INNOVATION & RENOVATION AGENDA 3 EXPAND INTO WHITESPACE Brand Building Through Innovation, Renovation & Investment 2

41 CORE INNOVATION & RENOVATION AGENDA NEW CATEGORY, NEW MARKET China’s nut market is large & growing, opportunity for expandable consumption Planters offers superior quality Emphasis on burgeoning ecommerce channel Brand Building Through Innovation, Renovation & Investment 2 3 EXPAND INTO WHITESPACE

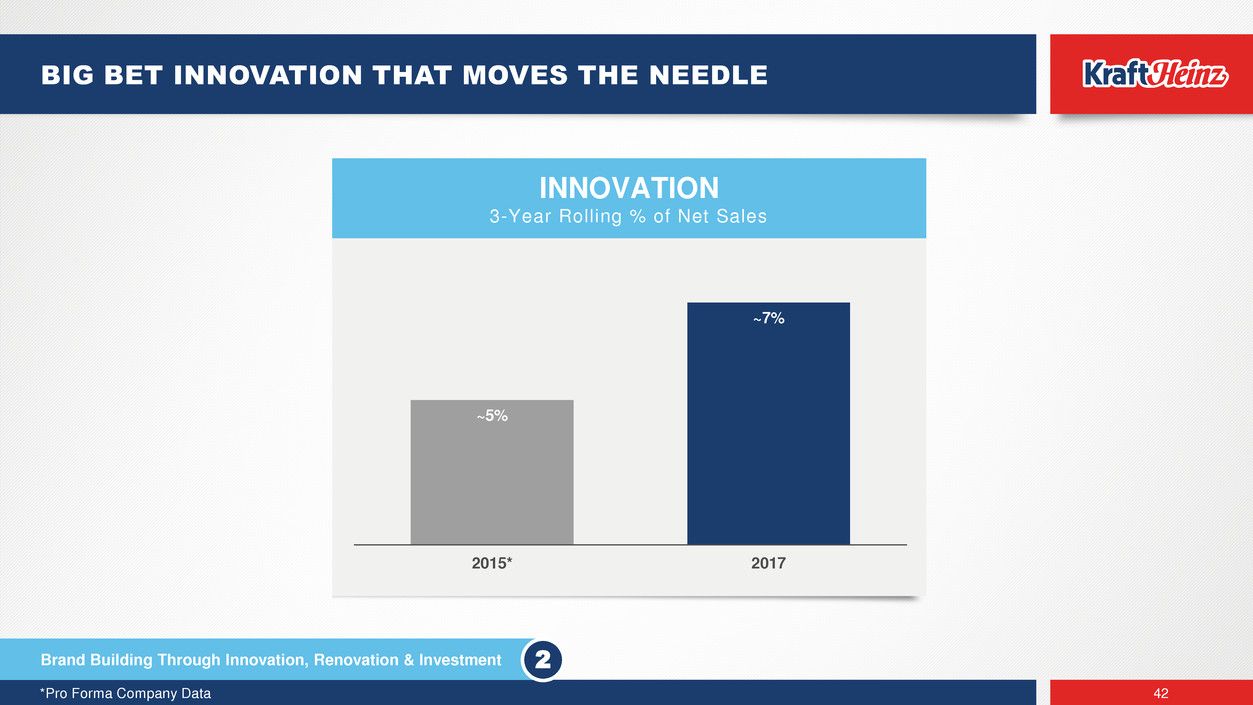

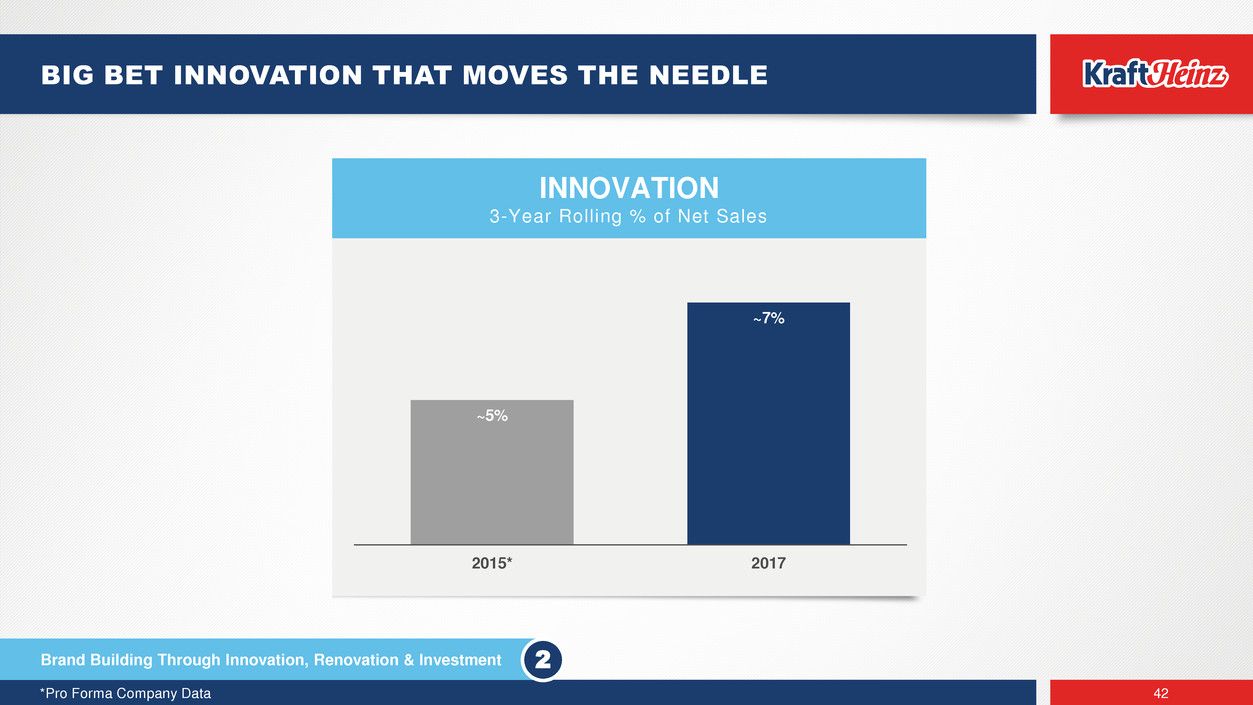

*Pro Forma Company Data 42 BIG BET INNOVATION THAT MOVES THE NEEDLE INNOVATION 3-Year Rolling % of Net Sales ~5% ~7% 2015* 2017 Brand Building Through Innovation, Renovation & Investment 2

43 Reinvent Category Management 3 Mike Donohoe Head of Kraft Cheese, Refrigerated Business Unit

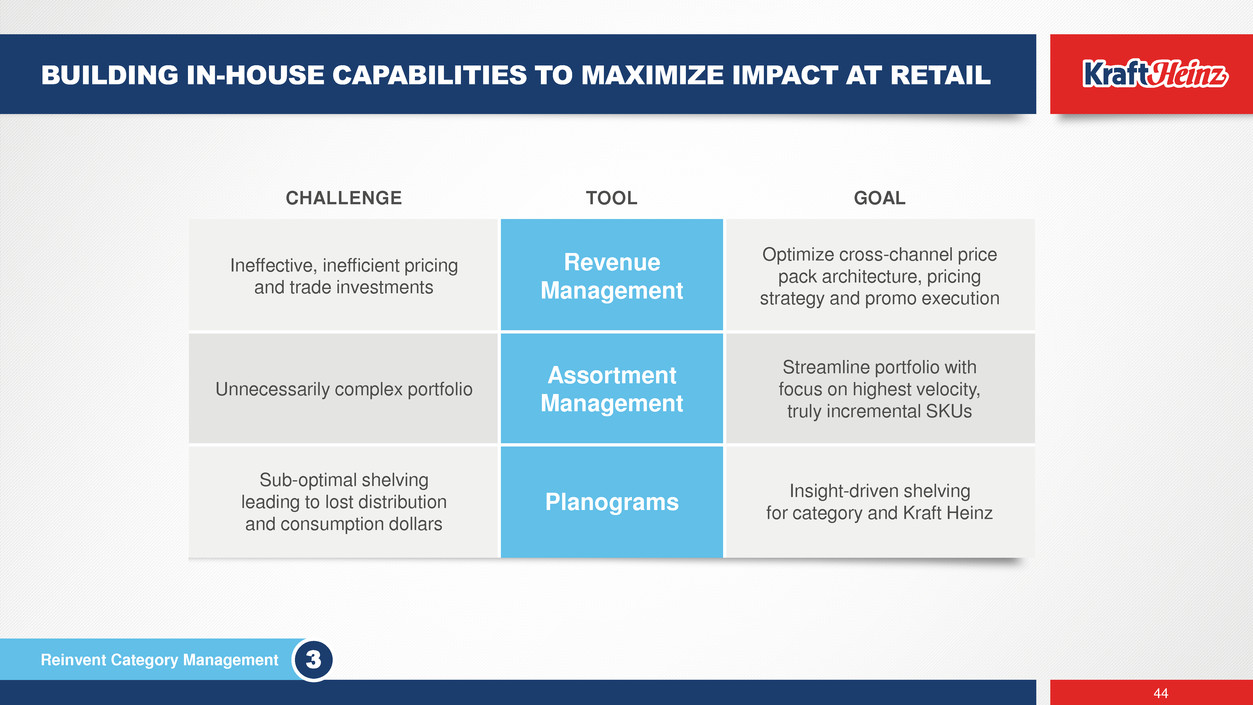

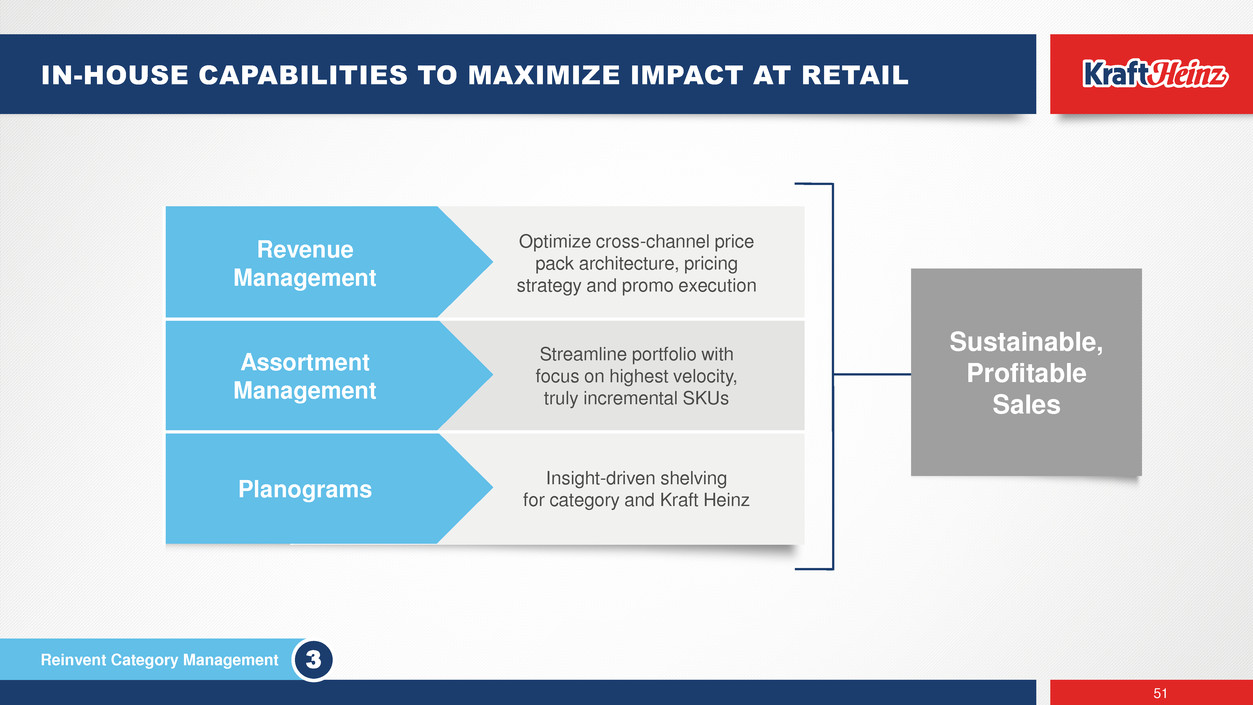

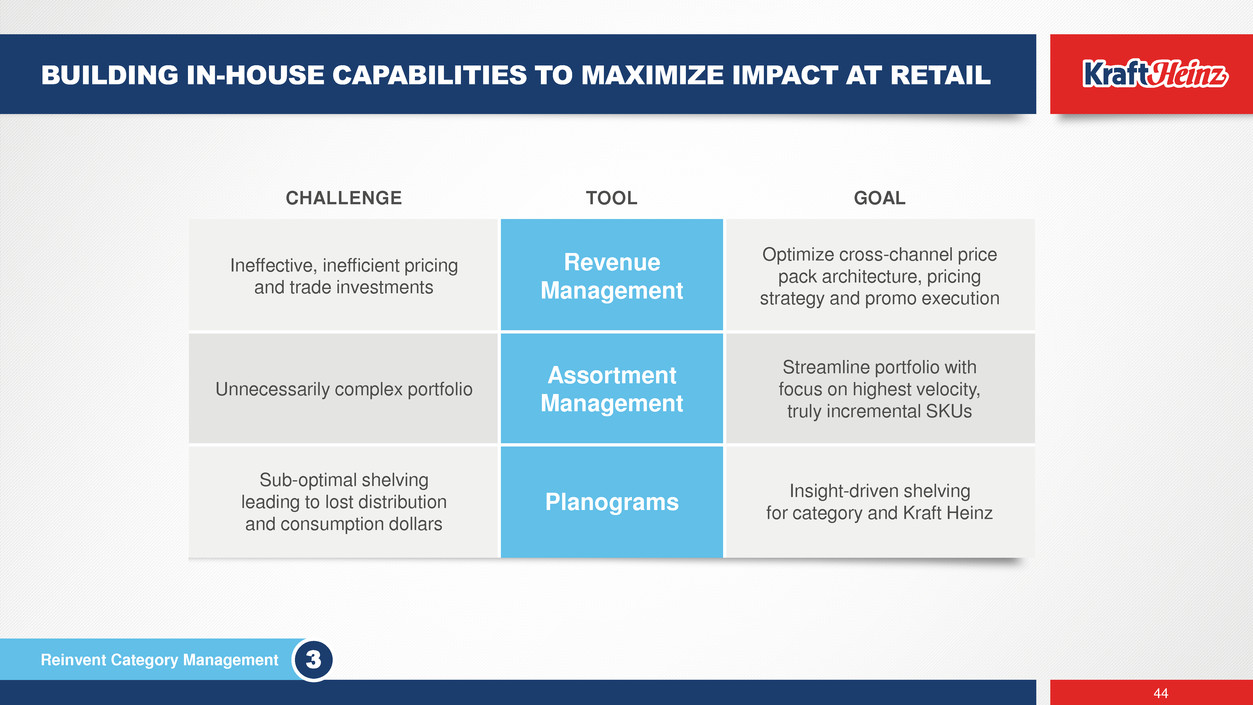

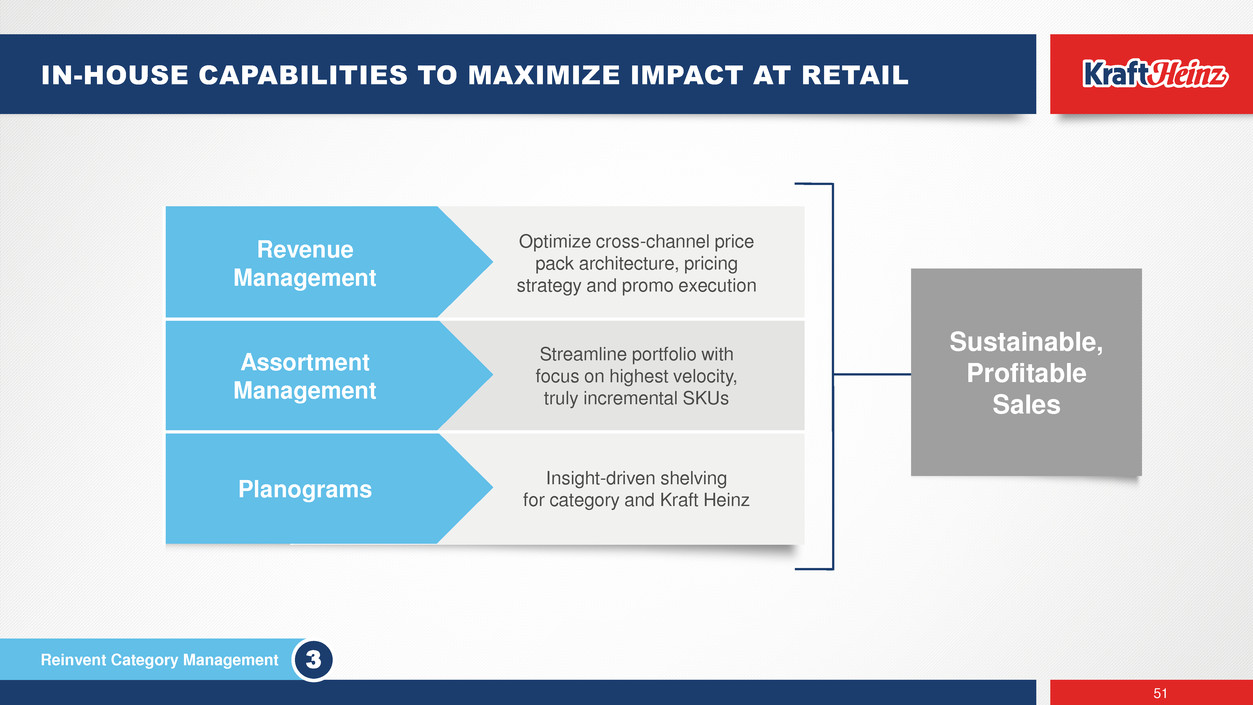

44 BUILDING IN-HOUSE CAPABILITIES TO MAXIMIZE IMPACT AT RETAIL Reinvent Category Management CHALLENGE TOOL GOAL Ineffective, inefficient pricing and trade investments Revenue Management Optimize cross-channel price pack architecture, pricing strategy and promo execution Unnecessarily complex portfolio Assortment Management Streamline portfolio with focus on highest velocity, truly incremental SKUs Sub-optimal shelving leading to lost distribution and consumption dollars Planograms Insight-driven shelving for category and Kraft Heinz 3

Conduct deep dive into performance & opportunities Emphasize rigorous & precise analytics Formulate strategy, customize tactics, & test competitive response Build organizational consensus on plan, benefits & potential risks Develop win-win story to assist customer discussion & negotiations Highlight evidenced-based, holistic category strategy Mechanize tracking tools that validate insight effectiveness Establish rituals & routines that create clear internal & external communication channels Execute contingency plans where needed, when necessary 45 ESTABLISHED PROCESS FOR WIN-WIN DECISION MAKING Reinvent Category Management Analyze Plan & Align Communicate Track Troubleshoot 3

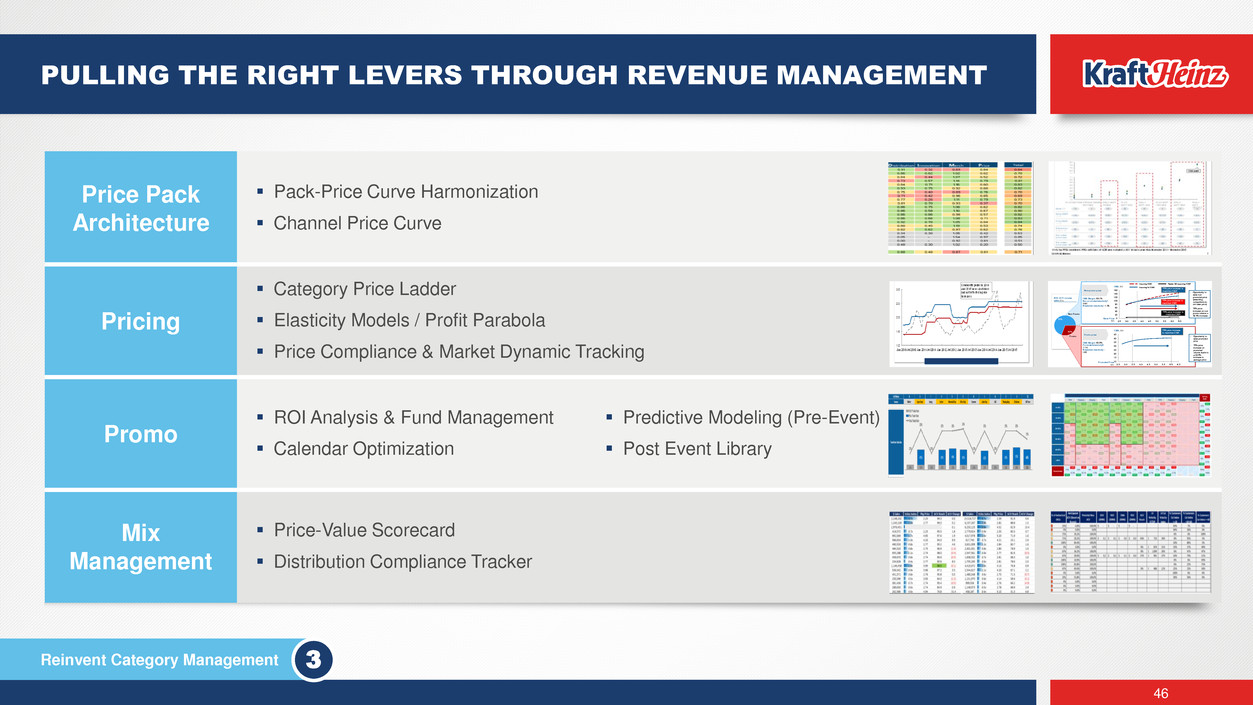

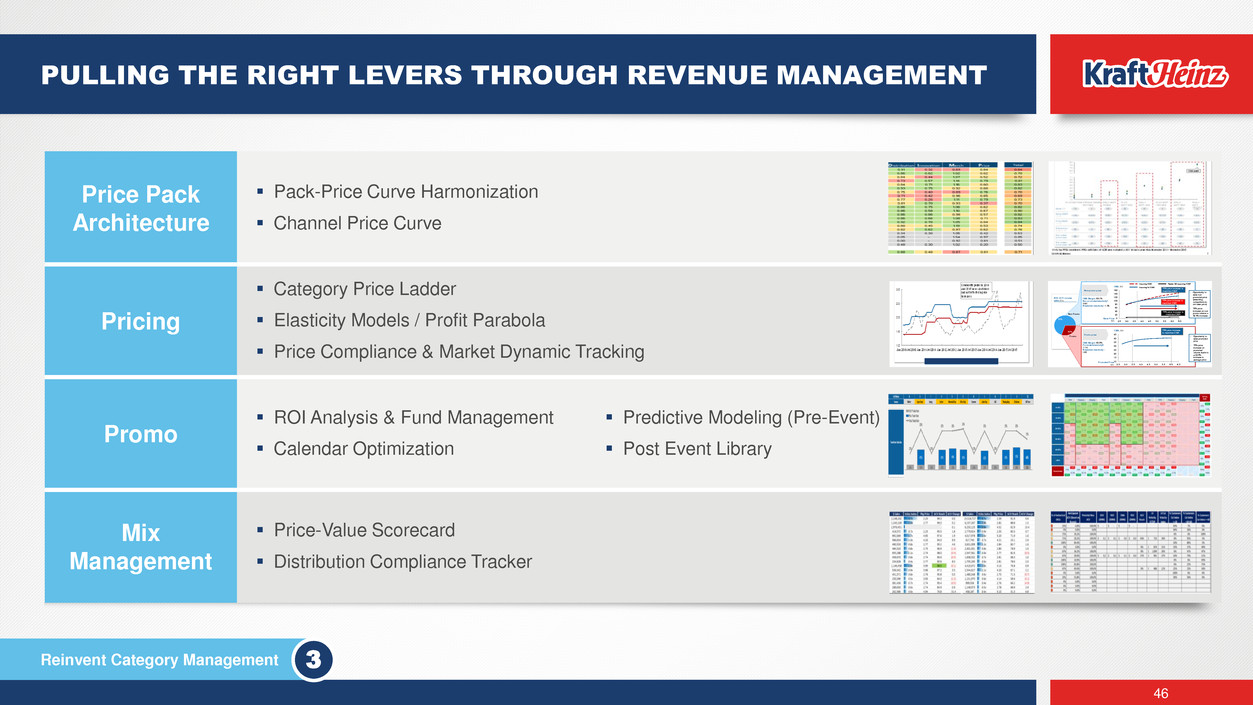

Price Pack Architecture Pack-Price Curve Harmonization Channel Price Curve Pricing Category Price Ladder Elasticity Models / Profit Parabola Price Compliance & Market Dynamic Tracking Promo ROI Analysis & Fund Management Calendar Optimization Predictive Modeling (Pre-Event) Post Event Library Mix Management Price-Value Scorecard Distribution Compliance Tracker 46 PULLING THE RIGHT LEVERS THROUGH REVENUE MANAGEMENT Reinvent Category Management 13 KHC can maximize CMA by increasing Philly Soft Cream Cheese’s average price by ~75%; existence of VCMC does not impact potential given small elasticities 60 100 80 40 20 6.56.0 160 140 120 0 5.54.52.5 5.04.03.53.0 CMA, $M SOURCE: Nielsen; KHC Promo Data; Team analysis CMA Margin: 60.5% Promoted elasticity3: -1.14 Breakeven elasticity: - 1.65 Non-promo price CMA Margin: 63.1% Non promoted elasticity1: -0.81 Breakeven elasticity: -1.58 • Opportunity to raise non promoted price (assuming competitors do not raise price) • 75% price increase on non promo volume = 52.5% increase Philly Soft CMA by price per lb (non-promoted and promoted)1 Base Price $/lb Retailer GM (assuming VCM)2 Assuming No VCMC Assuming VCMC Promoted Price $/lb 75% price increase to maximize CMA ▪ Opportunity to raise promoted price ▪ 75% price increase on promoted volume leads to a 22.5% increase in average price KHC 2015 volume sales (lbs) 2.5 3.0 3.5 4.0 4.5 5.0 5.5 6.0 6.5 30 20 45 10 40 35 25 15 CMA, $M 75% price increase to maximize CMA Promo Non Promo 70% 30% Main priority Promo price 1 Non promoted elasticity defined as: Own + external elasticity (internal removed as volume captured within KHC) 2 Category-wide outcomes based on volume impact from own elasticity (assumes flowback to internal and external brands) 3 Promoted price elasticity not decomposed 75% price increase to maximize CMA FDM ONLY SOFT – IS THE CATEGORY ELASTIC? A1.1 75% price increase to maximize CMA 3

Business Case: In Australia, household composition & Bean usage occasion had changed, but Heinz core pack type had not Combined shopper data, discrete modeling and game theory to design solution Action: Upsized one SKU, reduced size of another SKU, revamped packaging & price ladder Product / Packaging: No/No/No Re-invention Communication: 28 Week Support of TV, Holiday Print ads, & full digital support In-Store: Shelf talk, coolers & tearpads Action: +5% Base Price Business Case: Bacon had suboptimal good, better, best mix at key retailers Defined mandatory SKU compliance as well as prioritized retailer-specific SKU opportunities Action: Presented roadmap for retailers to achieve optimal mix Innovation: New Signature platform Communication: Don’t Run Out of Thanksgiving Media Campaign In-Store: Shippers, Cross Promo with Heinz Gravy Action: 2/$3 pricing alignment with Heinz Signature Gravy 47 REVENUE MANAGEMENT LEVERS IN ACTION Reinvent Category Management REVENUE MANAGEMENT 3

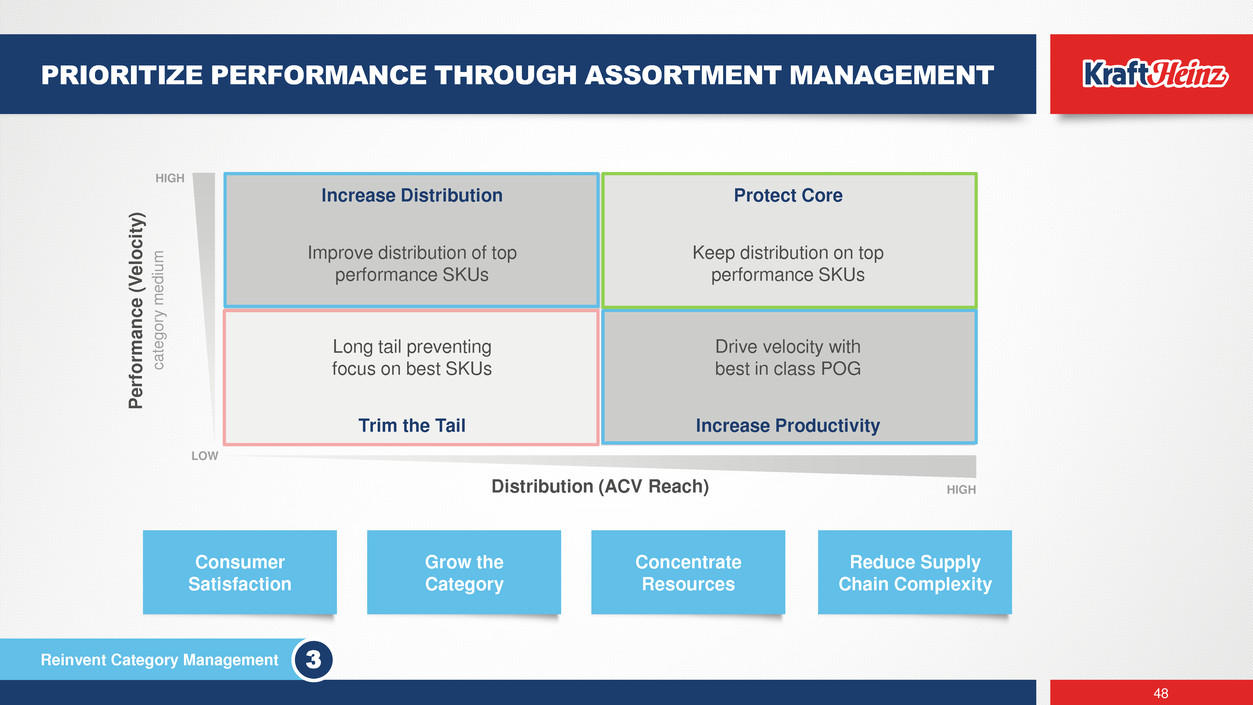

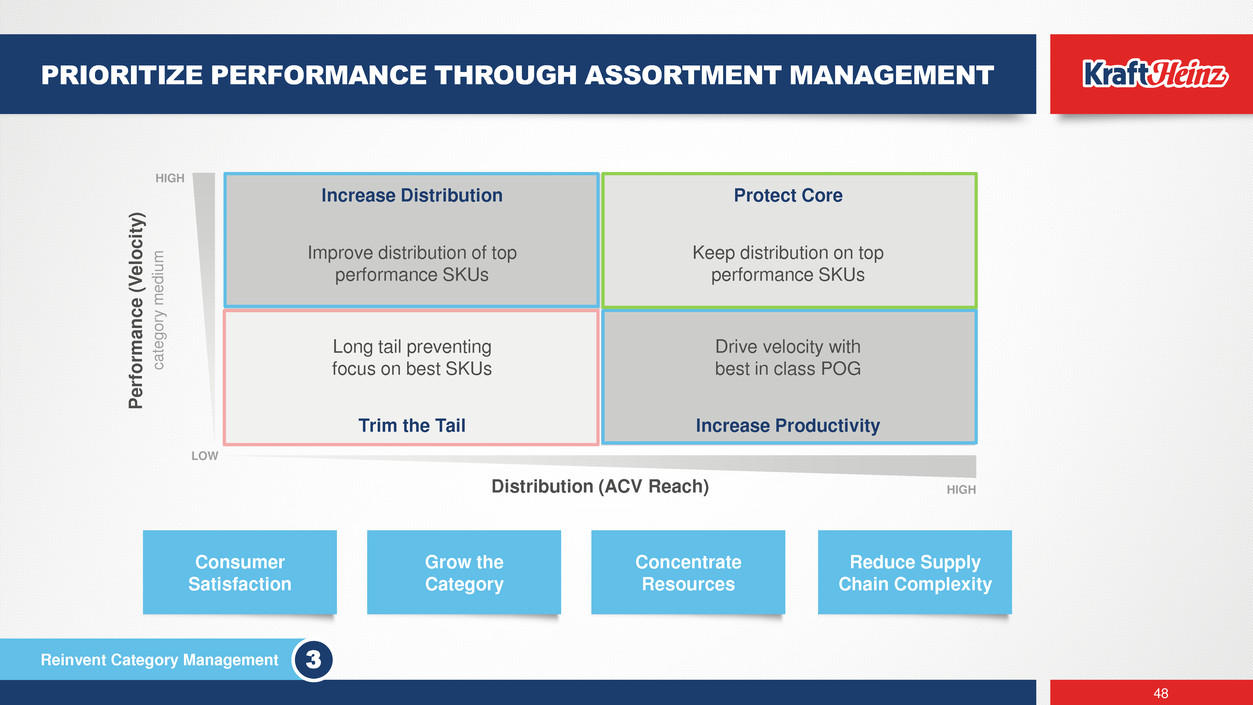

Increase Distribution Protect Core Improve distribution of top performance SKUs Keep distribution on top performance SKUs Long tail preventing focus on best SKUs Drive velocity with best in class POG Trim the Tail Increase Productivity 48 PRIORITIZE PERFORMANCE THROUGH ASSORTMENT MANAGEMENT Grow the Category Reduce Supply Chain Complexity Concentrate Resources Consumer Satisfaction Distribution (ACV Reach) Pe rfor m ance ( V e loci ty ) LOW HIGH HIGH c a te g o ry m e d iu m Reinvent Category Management 3

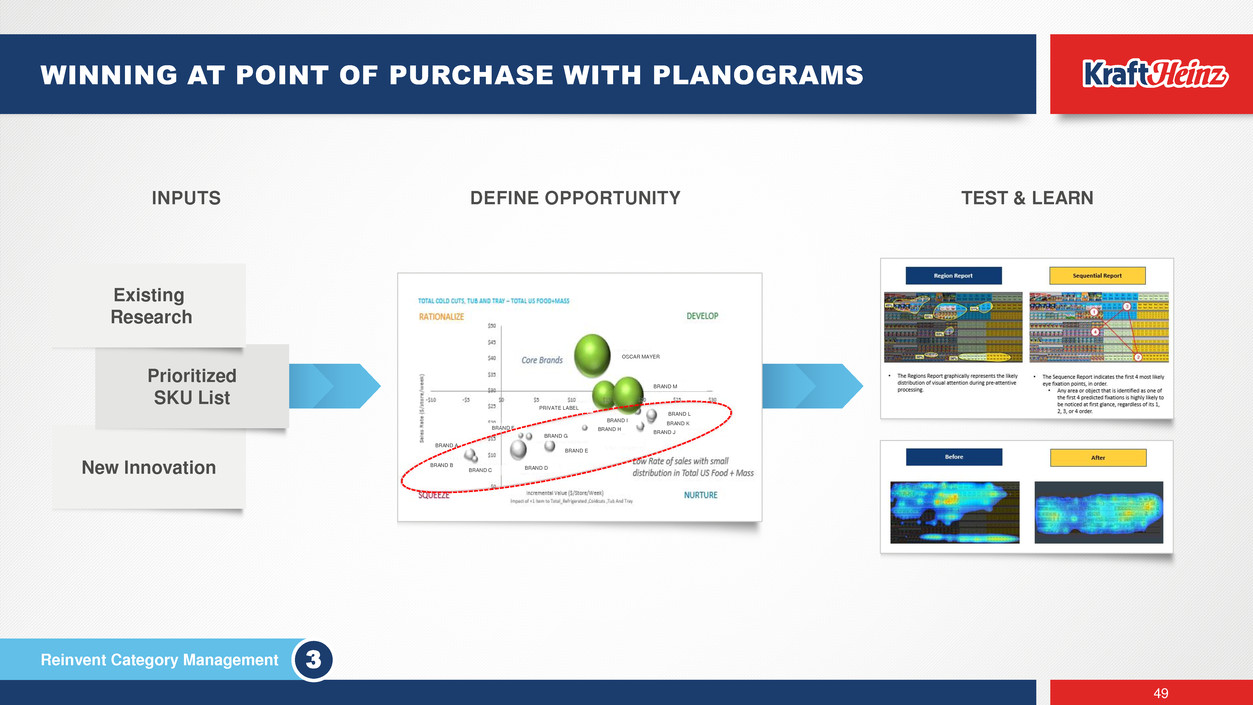

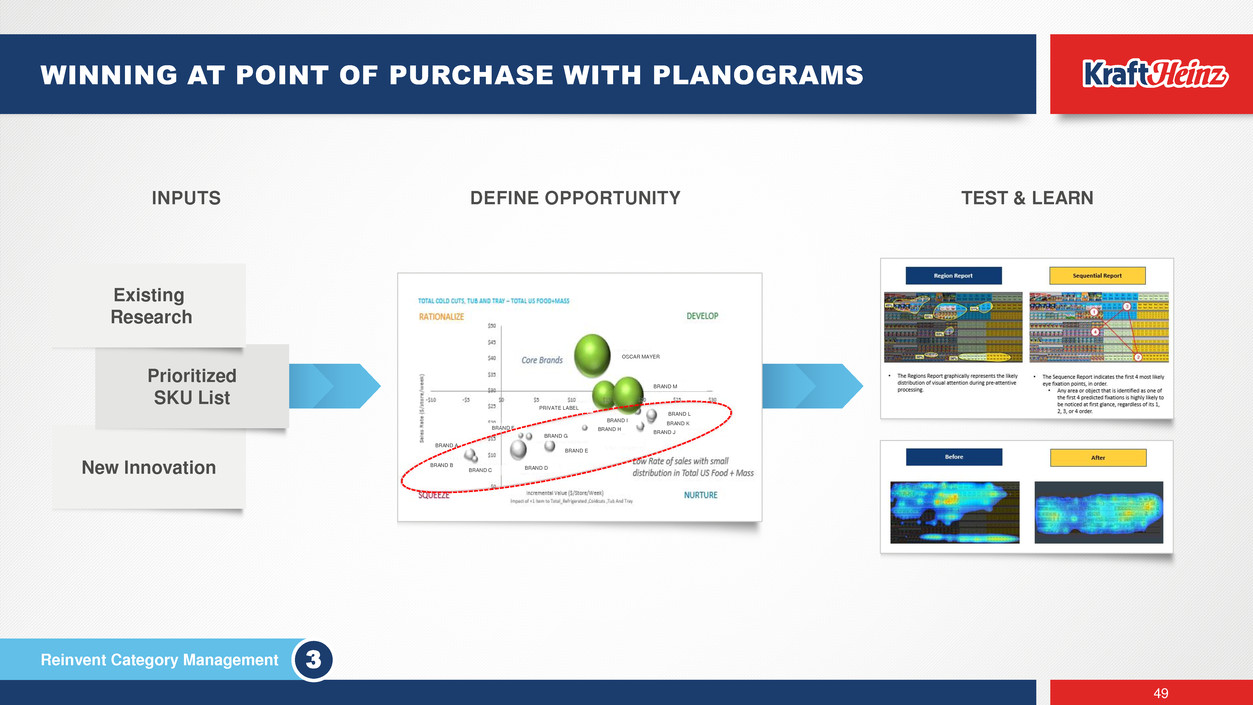

New Innovation 49 WINNING AT POINT OF PURCHASE WITH PLANOGRAMS Reinvent Category Management INPUTS DEFINE OPPORTUNITY TEST & LEARN 3 Prioritized SKU List Existing Research BRAND A BRAND B BRAND C BRAND D BRAND E BRAND F BRAND G BRAND H BRAND I BRAND J BRAND K BRAND L BRAND M OSCAR MAYER PRIVATE LABEL

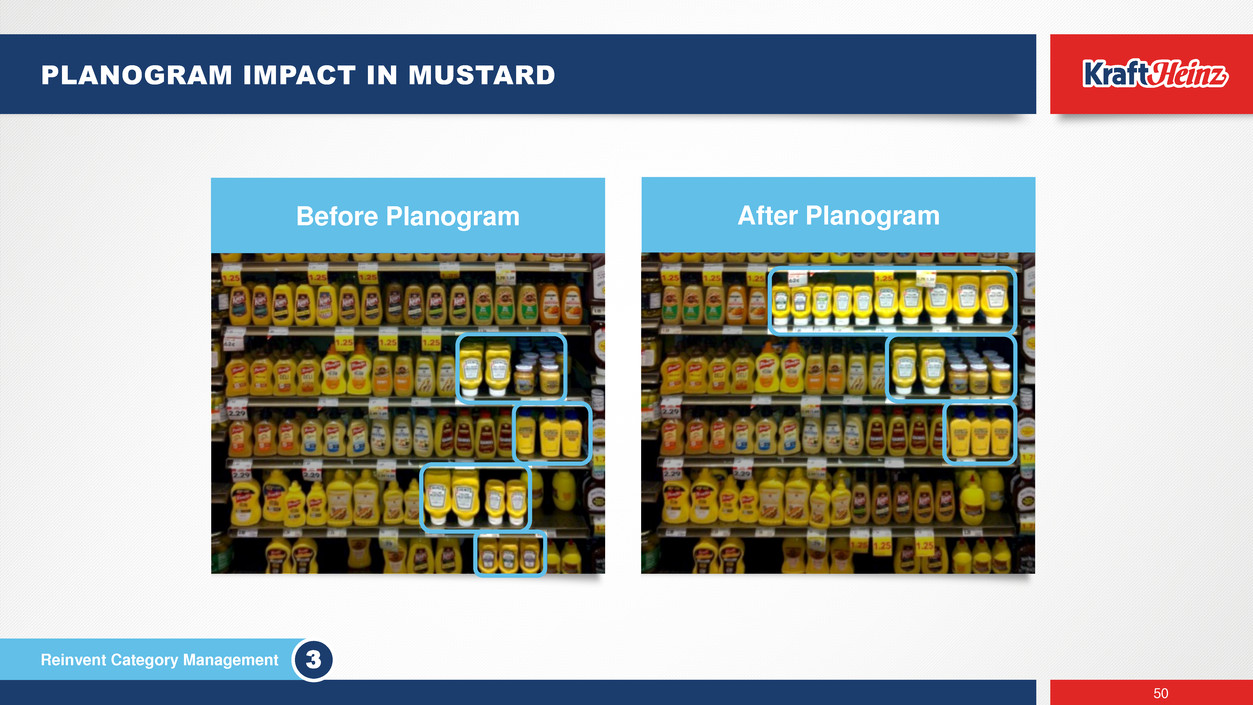

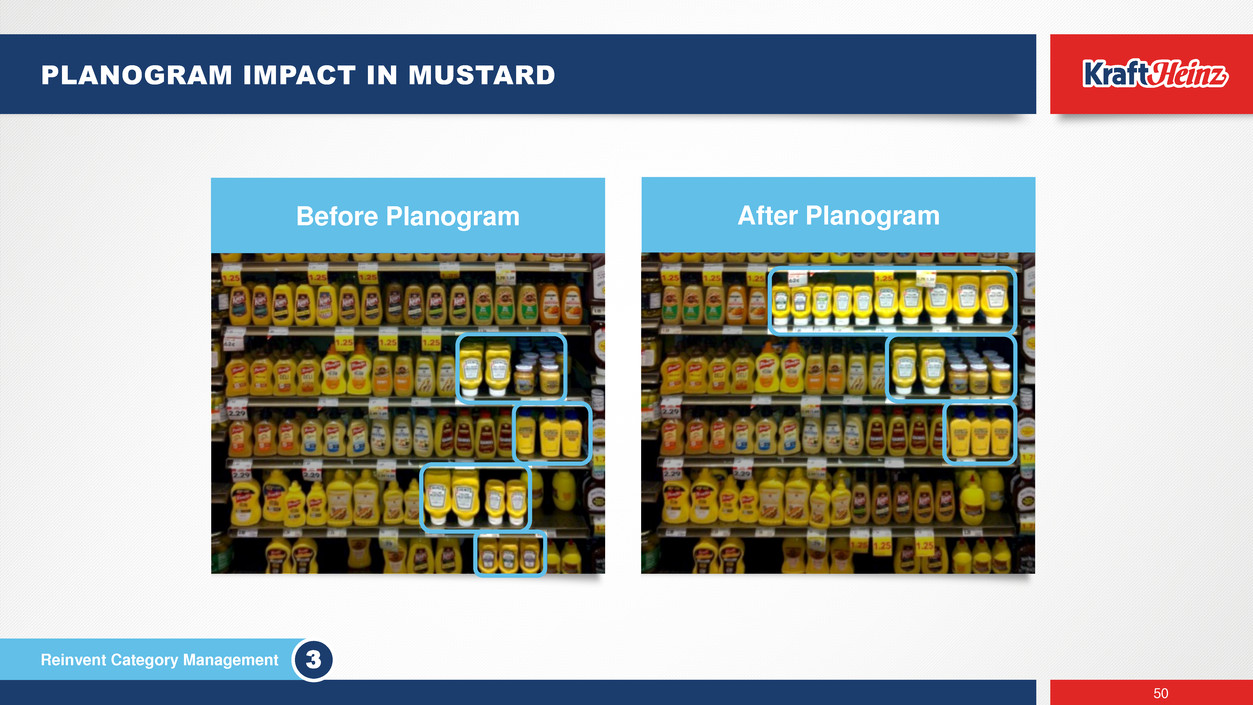

Before Planogram After Planogram 50 PLANOGRAM IMPACT IN MUSTARD Reinvent Category Management 3

Optimize cross-channel price pack architecture, pricing strategy and promo execution Streamline portfolio with focus on highest velocity, truly incremental SKUs Insight-driven shelving for category and Kraft Heinz 51 IN-HOUSE CAPABILITIES TO MAXIMIZE IMPACT AT RETAIL Revenue Management Assortment Management Planograms Sustainable, Profitable Sales Reinvent Category Management 3

52 Expand Go-To-Market Capabilities 4 Nina Barton President of Global Online & Digital Growth Initiatives

TRADITIONAL RETAIL FOODSERVICE E-COMMERCE 53 FOCUSED INVESTMENTS IN THREE AREAS Expand Go-To-Market Capabilities 4

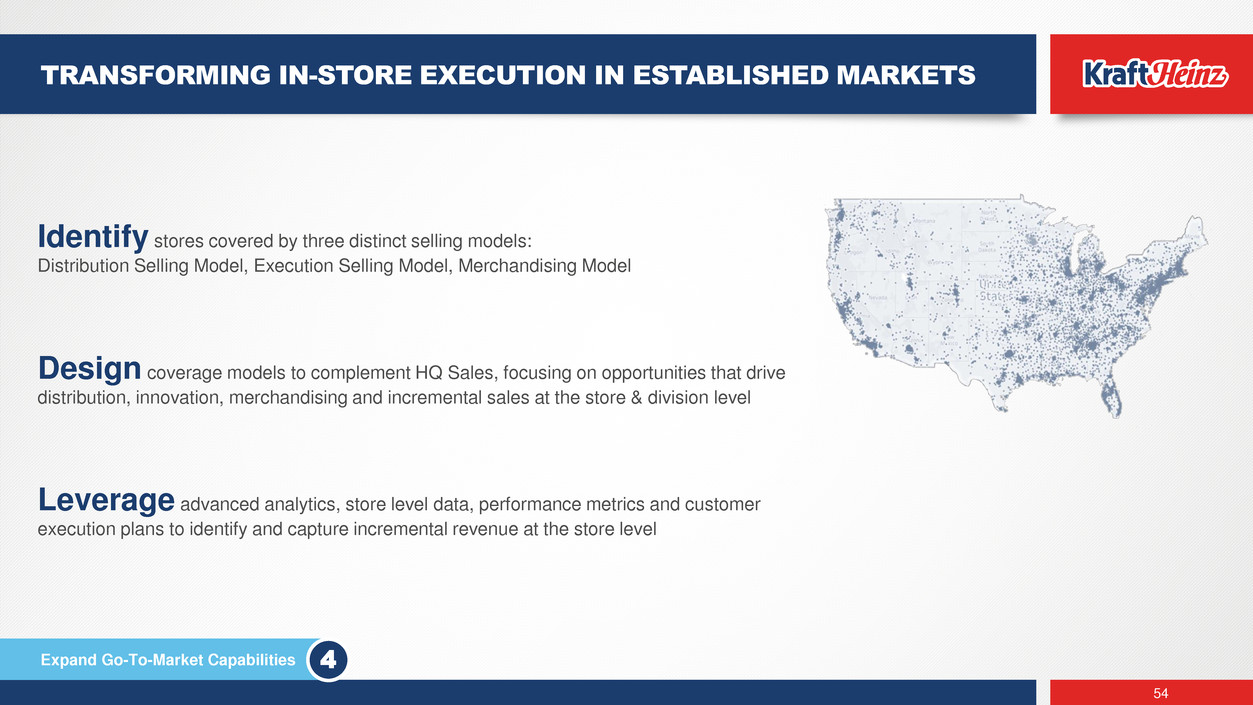

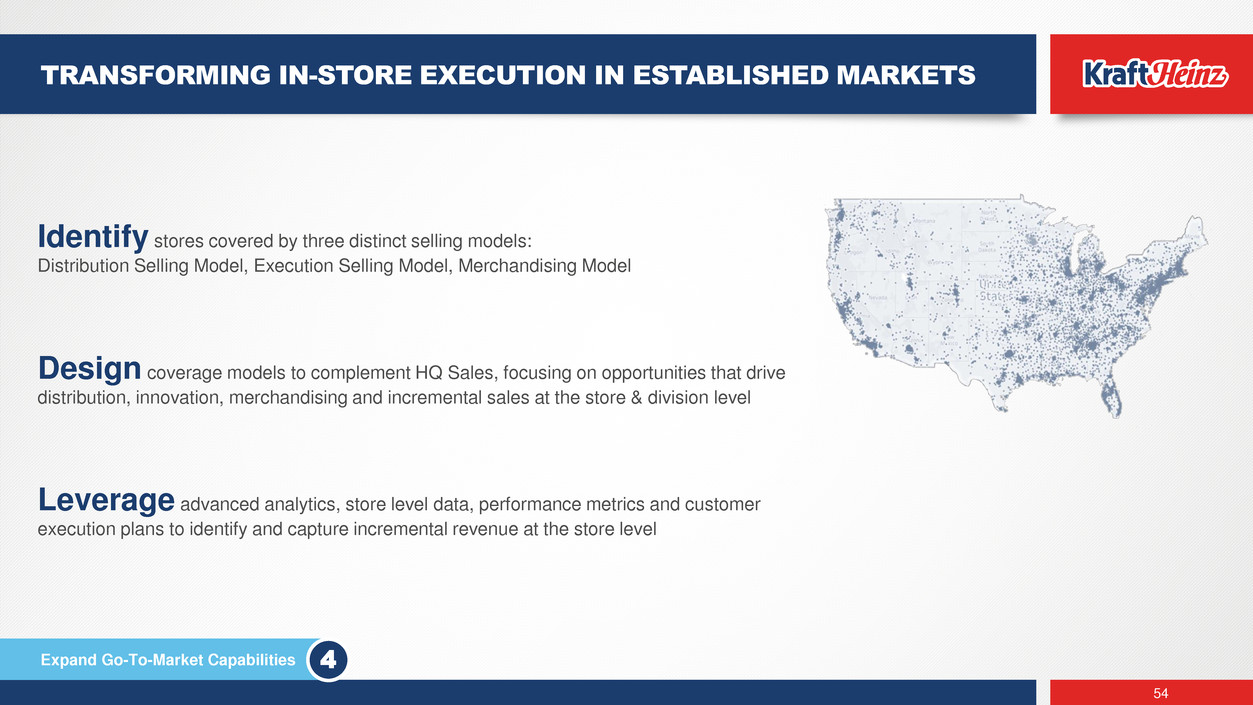

Identify stores covered by three distinct selling models: Distribution Selling Model, Execution Selling Model, Merchandising Model Design coverage models to complement HQ Sales, focusing on opportunities that drive distribution, innovation, merchandising and incremental sales at the store & division level Leverage advanced analytics, store level data, performance metrics and customer execution plans to identify and capture incremental revenue at the store level 54 TRANSFORMING IN-STORE EXECUTION IN ESTABLISHED MARKETS Expand Go-To-Market Capabilities 4

55 EXTENDING REACH IN LESS DEVELOPED MARKETS Expand Go-To-Market Capabilities KHC’s Key Success Factors for International Go-To-Market 1 4 4 2 3

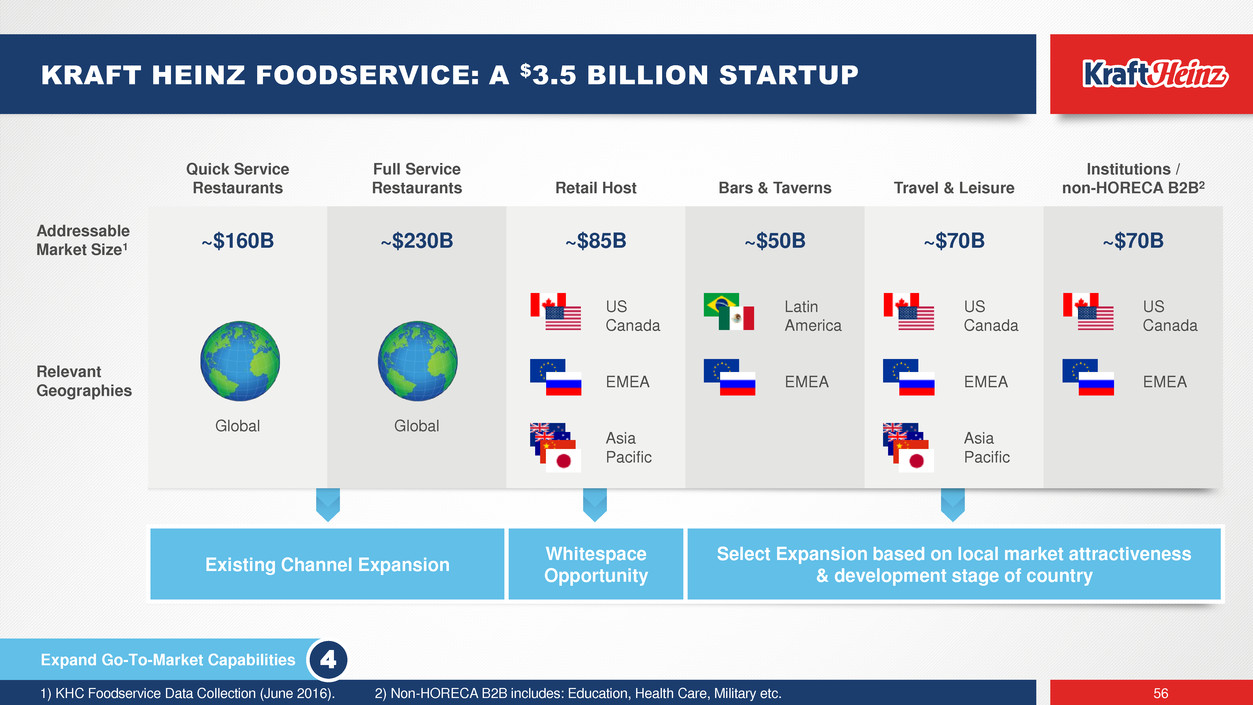

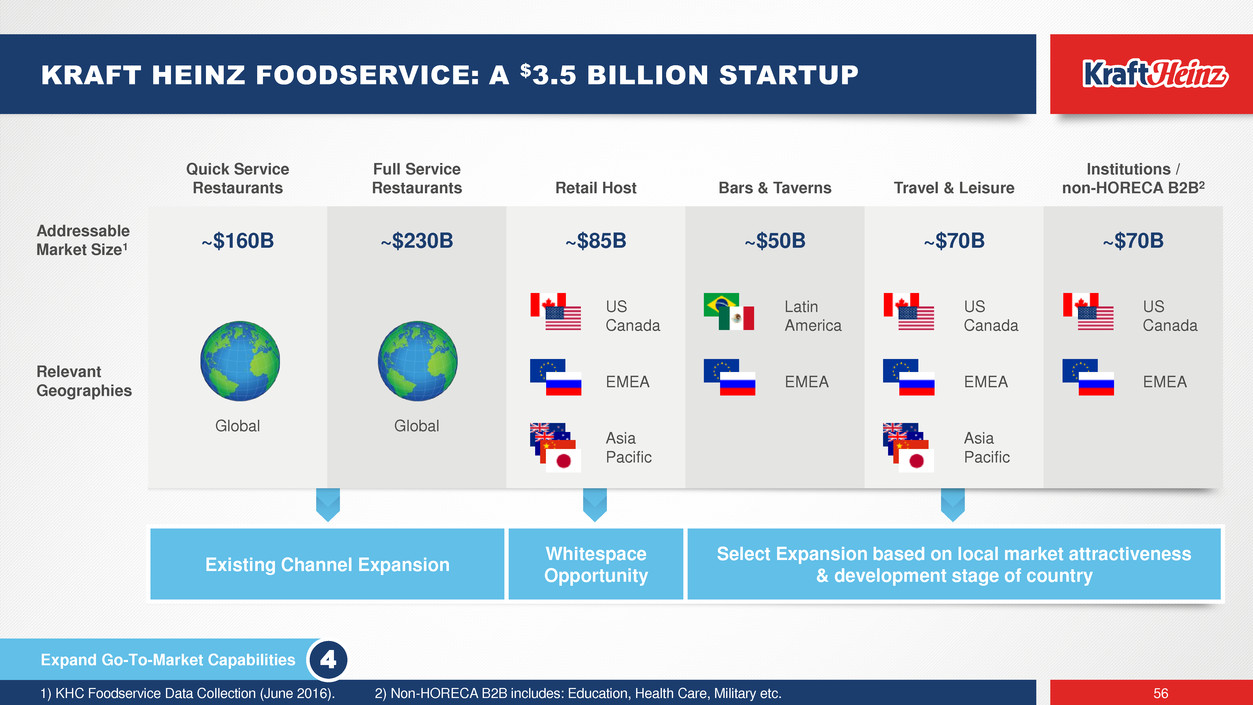

1) KHC Foodservice Data Collection (June 2016). 2) Non-HORECA B2B includes: Education, Health Care, Military etc. 56 KRAFT HEINZ FOODSERVICE: A $3.5 BILLION STARTUP Quick Service Restaurants Full Service Restaurants Retail Host Bars & Taverns Travel & Leisure Institutions / non-HORECA B2B2 Addressable Market Size1 ~$160B ~$230B ~$85B ~$50B ~$70B ~$70B Relevant Geographies Global Global US Canada EMEA Asia Pacific Latin America EMEA US Canada EMEA Asia Pacific US Canada EMEA Existing Channel Expansion Whitespace Opportunity Select Expansion based on local market attractiveness & development stage of country Expand Go-To-Market Capabilities 4

57 UNIQUE OPPORTUNITIES FOR GLOBAL EXPANSION Expand Go-To-Market Capabilities 4 Condiments & Sauces Cheese Nuts Meals Baby Food Foodservice United States Canada UK, Ireland Germany Italy Poland Russia Middle East / Africa Australia, New Zealand China Japan, Korea India Indonesia Brazil Mexico Established, robust Narrow and/or recent CATEGORY PRESENCE Note: Country list is selective, not exhaustive

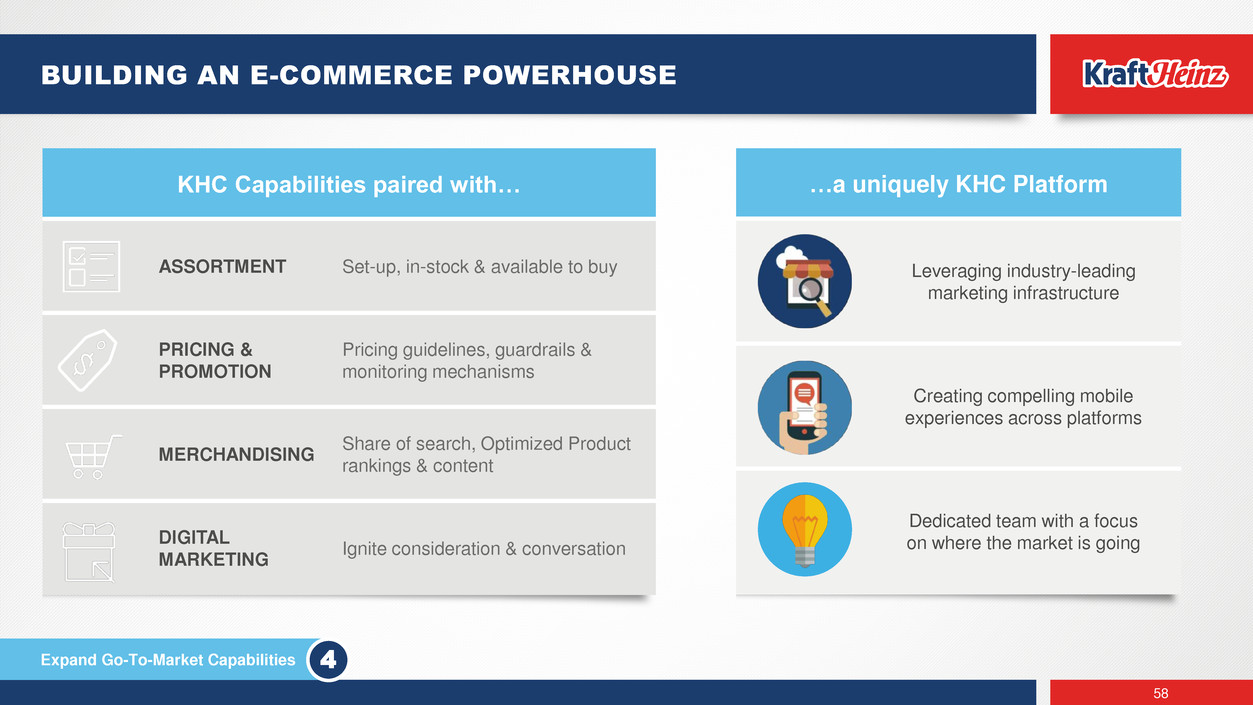

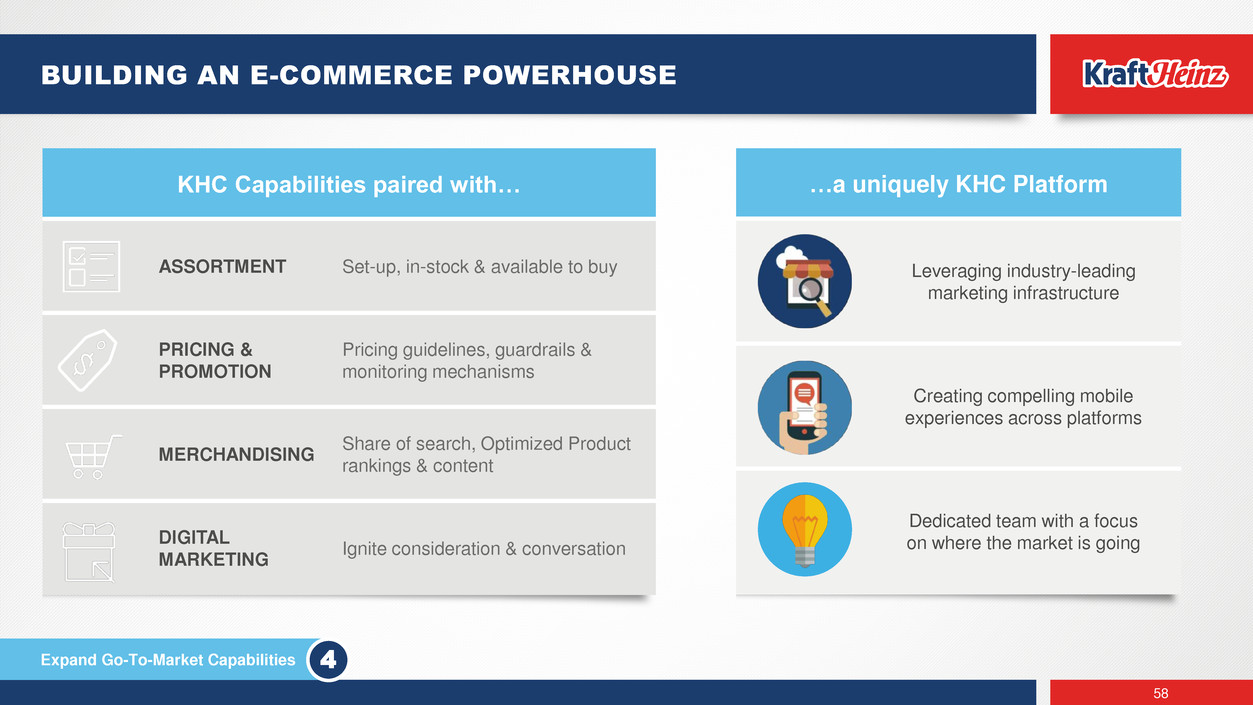

58 BUILDING AN E-COMMERCE POWERHOUSE Expand Go-To-Market Capabilities 4 KHC Capabilities paired with… ASSORTMENT Set-up, in-stock & available to buy PRICING & PROMOTION Pricing guidelines, guardrails & monitoring mechanisms MERCHANDISING Share of search, Optimized Product rankings & content DIGITAL MARKETING Ignite consideration & conversation …a uniquely KHC Platform Leveraging industry-leading marketing infrastructure Creating compelling mobile experiences across platforms Dedicated team with a focus on where the market is going

59 FOCUSED E-COMMERCE EFFORTS IN TOP GEOGRAPHIES Expand Go-To-Market Capabilities North America Build dedicated e-commerce team Apply eCategory management playbook Europe Prioritize full basket retailers Deploy eCategory management capabilities APAC Focus on Baby Food and Planters online Develop e-commerce specific products 4

60 Create Best-in-Class Operations 5 Marcos Rodrigues Head of the Global Center of Excellence

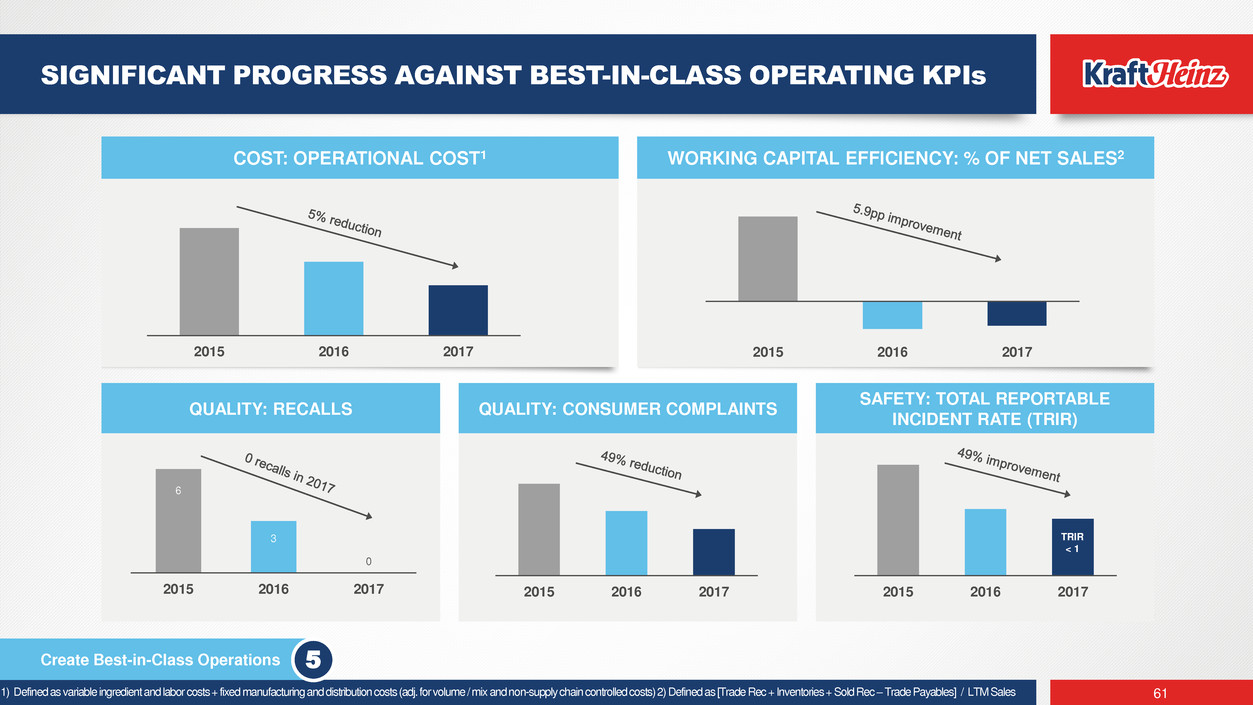

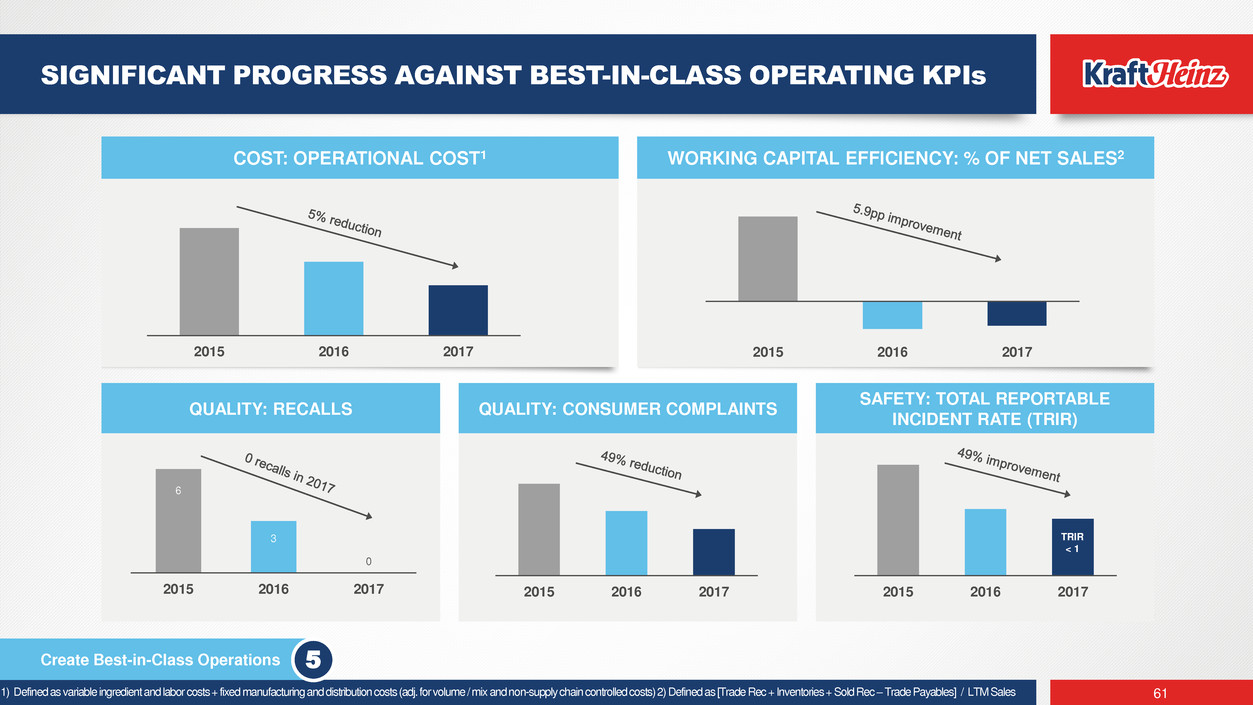

QUALITY: RECALLS QUALITY: CONSUMER COMPLAINTS SAFETY: TOTAL REPORTABLE INCIDENT RATE (TRIR) 6 3 0 2015 2016 2017 COST: OPERATIONAL COST1 WORKING CAPITAL EFFICIENCY: % OF NET SALES2 2015 2016 20172015 2016 2017 1) Defined as variable ingredient and labor costs + fixed manufacturing and distribution costs (adj. for volume / mix and non-supply chain controlled costs) 2) Defined as [Trade Rec + Inventories + Sold Rec –Trade Payables] / LTM Sales 61 SIGNIFICANT PROGRESS AGAINST BEST-IN-CLASS OPERATING KPIs Create Best-in-Class Operations 5 2015 2016 2017 2015 2016 2017 TRIR < 1

Value Engineering E-auction Low-cost Country Sourcing Rationalize manufacturing & distribution footprint Outsource non-core SKUs, repatriate high-volume SKUs Improve line flexibility and capacity to meet business needs Automate planning and process Implement Enterprise Resource Planning Optimize network Global ZBB adoption Share best practices Leverage Global Center of Excellence (GCOE) 62 OPERATING EXCELLENCE FOCUSED ON FOUR AREAS Create Best-in-Class Operations 5 COST SERVICE QUALITY SAFETY

63 GLOBAL CENTER OF EXCELLENCE TO DRIVE BEST PRACTICES Create Best-in-Class Operations 5 Capabilities Process standardization across geographies Improve policy, procedures, guidelines Steer transformational projects Projects Measure & map opportunities Design steps and deliverables Equip zones Results Transparent & challenging targets Remove bottlenecks Empower people to deliver commitments

TRIR - 64 AMBITION TO BE THE BEST Create Best-in-Class Operations 5 COST Become the most cost efficient operation in the industry SERVICE Be regarded by customers as the best service level in the industry QUALITY Achieve & sustain zero recalls globally & become global benchmark on consumer complaints SAFETY All zones achieving & sustaining TRIR below 1

65 Recruit, Develop, & Align our People 6 Melissa Werneck Global Head of People, Performance and Information Technology

66 KRAFT HEINZ CULTURE Recruit, Develop, & Align our People 6 OWNERSHIP HIGH PERFORMANCE MERITOCRACY LOVE FOR BRANDS DREAMING BIG

67 AN INTEGRATED GLOBAL WORKFORCE EMPLOYEES BY TYPE Full Time 97% Part Time 2% Seasonal 1% Total 100% EMPLOYEES BY GENDER Female 38% Male 62% EXECUTIVE LEADERSHIP TEAM African American 5% Asian 5% Hispanic or Latino 50% Non-U.S. 12% White 28% WOMEN IN MANAGEMENT ROLES Total 30% Recruit, Develop, & Align our People 6 RECRUITING TRAINING ALIGNING MOTIVATING

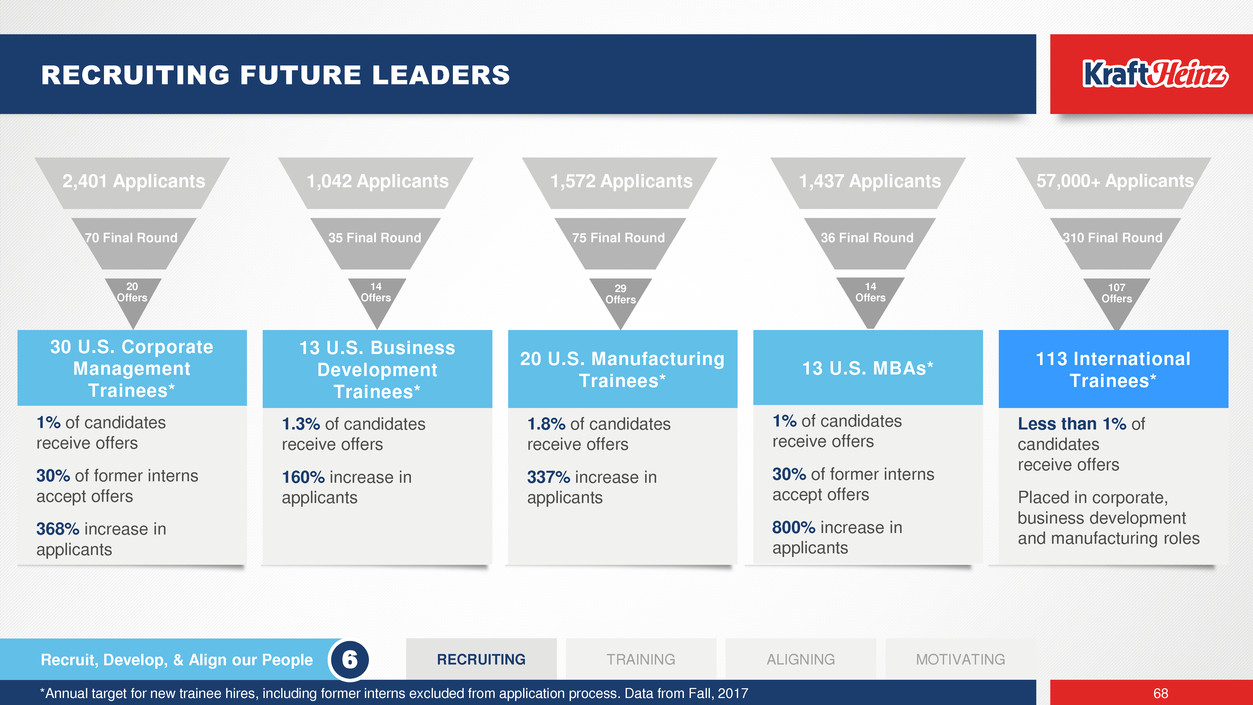

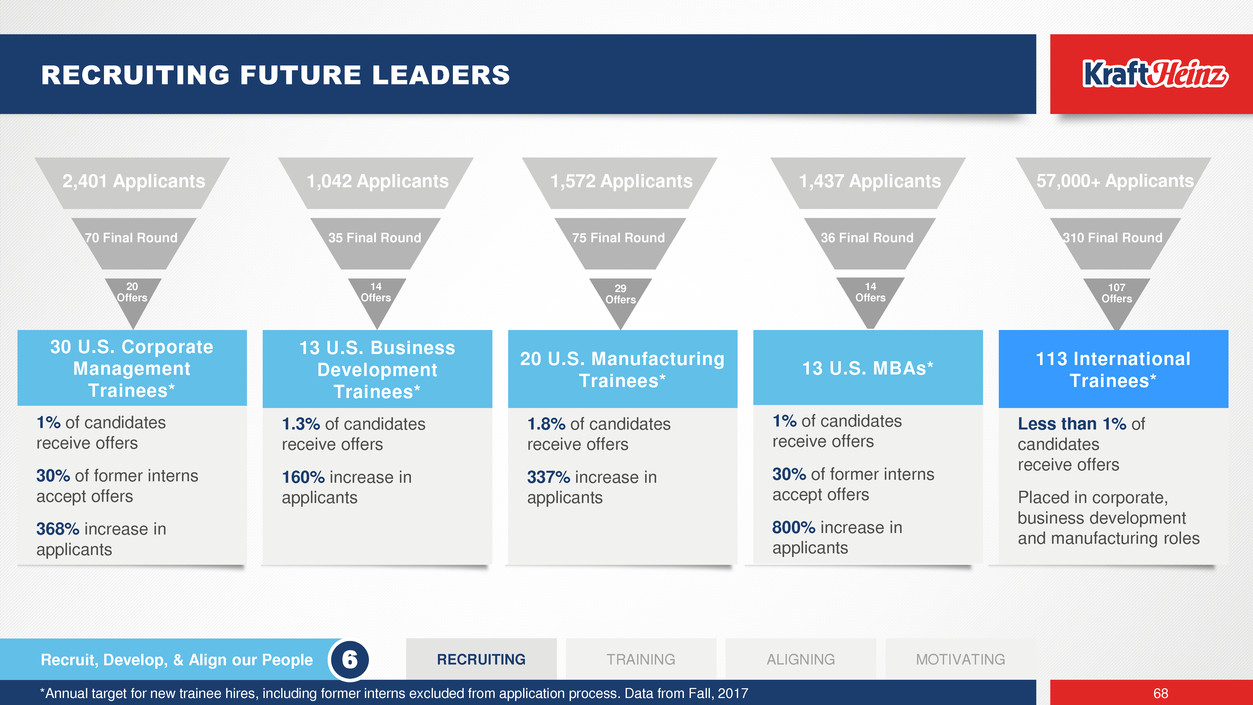

68 RECRUITING FUTURE LEADERS 2,401 Applicants 70 Final Round 20 Offers Recruit, Develop, & Align our People 6 RECRUITING TRAINING ALIGNING MOTIVATING 1,042 Applicants 35 Final Round 14 Offers 1,572 Applicants 75 Final Round 29 Offers 1,437 Applicants 36 Final Round 14 Offers 57,000+ Applicants 310 Final Round 107 Offers 30 U.S. Corporate Management Trainees* 1% of candidates receive offers 30% of former interns accept offers 368% increase in applicants 13 U.S. Business Development Trainees* 1.3% of candidates receive offers 160% increase in applicants 20 U.S. Manufacturing Trainees* 1.8% of candidates receive offers 337% increase in applicants 13 U.S. MBAs* 1% of candidates receive offers 30% of former interns accept offers 800% increase in applicants 113 International Trainees* Less than 1% of candidates receive offers Placed in corporate, business development and manufacturing roles *Annual target for new trainee hires, including former interns excluded from application process. Data from Fall, 2017

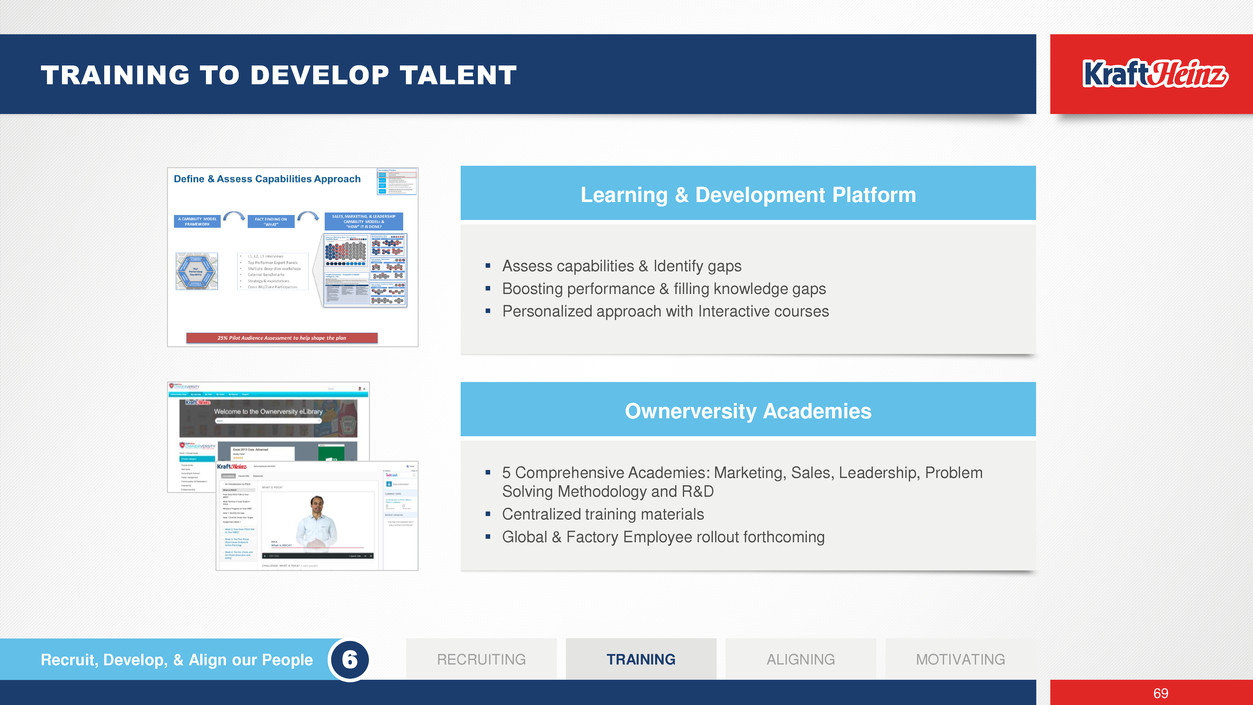

69 TRAINING TO DEVELOP TALENT Learning & Development Platform Assess capabilities & Identify gaps Boosting performance & filling knowledge gaps Personalized approach with Interactive courses Ownerversity Academies 5 Comprehensive Academies: Marketing, Sales, Leadership, Problem Solving Methodology and R&D Centralized training materials Global & Factory Employee rollout forthcoming Recruit, Develop, & Align our People 6 RECRUITING TRAINING ALIGNING MOTIVATING

70 7,400+ Employees worldwide took part in 2018 MBO Cascade Challenging Initiatives Driven by KHC Goals Meaningful Deliverables tie directly to KHC Results Aligning Complete Organizational Cohesion Leading Cascade from and sign off by CEO ALIGNING BEHIND BUSINESS OBJECTIVES Recruit, Develop, & Align our People 6 RECRUITING TRAINING ALIGNING MOTIVATING

Targeting a higher incentive pay than peers ensuring above market Total Target Cash Compensation 71 MOTIVATING OUR PEOPLE You… as an individual or team deliver against your objective We… as an organization deliver against our objective How We Pay for Performance: Recruit, Develop, & Align our People 6 RECRUITING TRAINING ALIGNING MOTIVATING

72 SUSTAINABLE, LONG-TERM VALUE CREATION David Knopf Chief Financial Officer

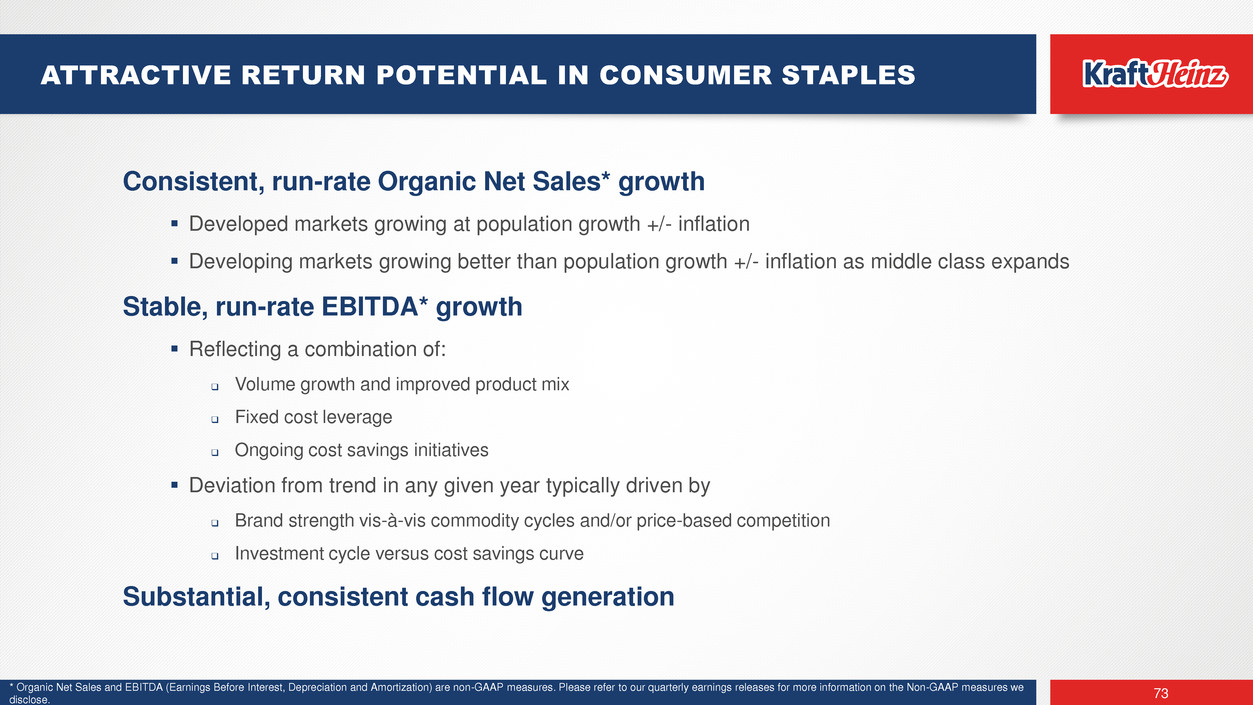

* Organic Net Sales and EBITDA (Earnings Before Interest, Depreciation and Amortization) are non-GAAP measures. Please refer to our quarterly earnings releases for more information on the Non-GAAP measures we disclose. 73 ATTRACTIVE RETURN POTENTIAL IN CONSUMER STAPLES Consistent, run-rate Organic Net Sales* growth Developed markets growing at population growth +/- inflation Developing markets growing better than population growth +/- inflation as middle class expands Stable, run-rate EBITDA* growth Reflecting a combination of: Volume growth and improved product mix Fixed cost leverage Ongoing cost savings initiatives Deviation from trend in any given year typically driven by Brand strength vis-à-vis commodity cycles and/or price-based competition Investment cycle versus cost savings curve Substantial, consistent cash flow generation

74 KRAFT HEINZ LONG-TERM FINANCIAL GOALS Profitable Sales Growth Data-driven marketing for competitive advantage Build brands through innovation, renovation and investments Reinvent category management Expand go-to-market capabilities Best in Class Margins Best-in-class operations Ownership mentality Recruit, develop and align our people Superior Return of Capital with Strong Balance Sheet Sustainable, top tier EPS growth Industry-leading cash flow generation Commitment to a strong dividend payout

75 PERFORMANCE SINCE THE KRAFT HEINZ MERGER Delivered, exceeded or on track with every commitment made at 2015 merger announcement Stable sales and market share performance despite significant steps to transform North American business Integration Program delivered more cumulative savings than originally expected Constant-currency EBITDA grew more than net Integration Program savings Significant actions to reduce financial risk Deleveraged consistent with commitment to strong and improving Investment Grade credit rating

76 KRAFT HEINZ COMMITMENT TO INVESTMENT GRADE PROFILE Business Strengths Significant scale with unparalleled brands and leading category positions Broad geographic footprint and product offerings with substantial international whitespace Strong margins and cash flow generation enhanced through cost savings Balanced Financial Policy Maintain ongoing medium-term net leverage target of 3.0x Appropriate commitments regarding return of capital to shareholders Deploy excess cash against opportunities on a risk-adjusted return basis Long-Term Anchor Shareholders Committed, long-term anchor shareholders (Berkshire Hathaway and 3G Capital) Management team with long track records of stability and success

A UNIQUE OPPORTUNITY IN CONSUMER STAPLES