Use these links to rapidly review the document

Table of Contents

As filed with the United States Securities and Exchange Commission on May 9, 2017

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-4

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

NRG Yield LLC

NRG Yield Operating LLC*

(Exact name of registrant as specified in its charter)

| Delaware Delaware (State or other jurisdiction of incorporation or organization) | 4911 4911 (Primary Standard Industrial Classification Code Number) | 32-0407370 30-0780012 (I.R.S. Employer Identification No.) |

804 Carnegie Center, Princeton, NJ 08540

Telephone: (609) 524-4500

(Address, including zip code, and telephone number, including

area code, of registrant's principal executive offices)

| Copies to: | ||

David R. Hill Executive Vice President and General Counsel 804 Carnegie Center Princeton, NJ 08540 Telephone: (609) 524-4500 | Gerald T. Nowak, P.C. Paul D. Zier Kirkland & Ellis LLP 300 North LaSalle Street Chicago, Illinois 60654 (312) 862-2000 | |

(Name, address, including zip code, and telephone number, including

area code, of agent for service)

Approximate date of commencement of proposed sale of the securities to the public:

The exchange will occur as soon as practicable after the effective date of this Registration Statement.

If the securities being registered on this Form are being offered in connection with the formation of a holding company and there is compliance with General Instruction G, check the following box. o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, smaller reporting company, or an emerging growth company. See the definitions of "large accelerated filer," "accelerated filer," "smaller reporting company," and "emerging growth company" in Rule 12b-2 of the Exchange Act. (Check one):

| Large accelerated filer o | Accelerated filer o | Non-accelerated filer ý (Do not check if a smaller reporting company) | Smaller reporting company o | Emerging growth company o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

If applicable, place an X in the box to designate the appropriate rule provision relied upon in conducting this transaction:

Exchange Act Rule 13e-4(i) (Cross-Border Issuer Tender Offer): o

Exchange Act Rule 14d-1(d) (Cross-Border Third-Party Tender Offer): o

CALCULATION OF REGISTRATION FEE

| Title of Each Class of Securities to be Registered | Amount to be Registered | Proposed Maximum Offering Price Per Unit(1) | Amount of Registration Fee | |||

|---|---|---|---|---|---|---|

5.000% Senior Notes due 2026 | $350,000,000 | 100% | $40,565 | |||

Guarantees related to the 5.000% Senior Notes due 2026(2) | — | — | —(3) | |||

| ||||||

- (1)

- Calculated in accordance with Rule 457 under the Securities Act of 1933, as amended.

- (2)

- No separate consideration was received for the issuance of the guarantees.

- (3)

- Pursuant to Rule 457(n), no separate fee is payable with respect to the guarantees being registered hereby.

The Registrants hereby amend this Registration Statement on such date or dates as may be necessary to delay its effective date until the Registrants shall file a further amendment which specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this Registration Statement shall become effective on such date as the Commission, acting pursuant to said Section 8(a), may determine.

- *

- The additional Co-Registrants listed on the next page are also included in this Form S-4 Registration Statement as additional Registrants.

Table of Additional Registrants

Exact Name of Additional Registrants* | Jurisdiction of Formation | I.R.S. Employer Identification No. | ||||

|---|---|---|---|---|---|---|

| Alta Wind 1-5 Holding Company, LLC | Delaware | 35-2526443 | ||||

| Alta Wind Company, LLC | Delaware | 47-2576803 | ||||

| NRG Energy Center Omaha LLC | Delaware | 35-2492633 | ||||

| NRG Energy Center Omaha Holdings LLC | Delaware | 46-4164574 | ||||

| NRG Yield DGPV Holding LLC | Delaware | 47-3724471 | ||||

| NRG South Trent Holdings LLC | Delaware | 27-2207561 | ||||

| NRG Yield RPV Holding LLC | Delaware | 47-2898953 | ||||

| NYLD Fuel Cell Holdings LLC | Delaware | 47-2588093 | ||||

| UB Fuel Cell, LLC | Connecticut | 46-5519511 | ||||

- *

- The address for each of the additional Registrants is c/o NRG Yield Operating LLC, 804 Carnegie Center, Princeton, NJ 08540, telephone: (609) 524-4500. The primary standard industrial classification number for each of the additional Registrants is 4911.

The name, address, including zip code of the agent for service for each of the additional Registrants is David R. Hill, Executive Vice President and General Counsel of NRG Yield, Inc., 804 Carnegie Center, Princeton, NJ 08540, Telephone: (609) 524-4500.

The information in this prospectus is not complete and may be changed. We may not sell these securities until the registration statement filed with the Securities and Exchange Commission is effective. The prospectus is not an offer to sell these securities nor a solicitation of an offer to buy these securities in any jurisdiction where the offer and sale is not permitted.

Subject to Completion Dated May 9, 2017

PRELIMINARY PROSPECTUS

NRG Yield Operating LLC

Exchange Offer for

$350,000,000 5.000% Senior Notes due 2026

We are offering to exchange:

up to $350,000,000 of our new 5.000% Senior Notes due 2026

(which we refer to as the "Exchange Notes")

for

a like amount of our outstanding 5.000% Senior Notes due 2026

(which we refer to as the "Old Notes")

We refer to the Exchange Notes and Old Notes collectively as the "notes."

Material Terms of Exchange Offer:

- •

- The terms of the Exchange Notes to be issued in the exchange offer are substantially identical to the Old Notes, except that the transfer restrictions and registration rights relating to the Old Notes will not apply to the Exchange Notes.

- •

- The Exchange Notes will be guaranteed on a full and unconditional and joint and several basis by each of our current and future subsidiaries that guarantees indebtedness under our Revolving Credit Facility (as defined herein).

- •

- There is no existing public market for the Old Notes or the Exchange Notes. We do not intend to list the Exchange Notes on any securities exchange or seek approval for quotation through any automated trading system.

- •

- You may withdraw your tender of Old Notes at any time before the expiration of the exchange offer. We will exchange all of the Old Notes that are validly tendered and not withdrawn.

- •

- The exchange offer expires at 12:00 midnight, New York City time, on , 2017, unless extended.

- •

- The exchange of Old Notes will not be a taxable event for U.S. federal income tax purposes.

- •

- The exchange offer is subject to certain customary conditions, including that it not violate applicable law or any applicable interpretation of the Staff of the Securities and Exchange Commission (the "SEC").

- •

- We will not receive any proceeds from the exchange offer.

For a discussion of certain factors that you should consider before participating in this exchange offer, see "Risk Factors" beginning on page 15 of this prospectus.

Neither the SEC nor any state securities commission has approved the notes to be distributed in the exchange offer, nor have any of these organizations determined that this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Each broker-dealer that receives Exchange Notes for its own account pursuant to this exchange offer must acknowledge that it will deliver a prospectus in connection with any resale of such Exchange Notes. The letter of transmittal accompanying this prospectus states that by so acknowledging and by delivering a prospectus, a broker-dealer will not be deemed to admit that it is an "underwriter" within the meaning of the Securities Act of 1933, as amended (the "Securities Act"). This prospectus, as it may be amended or supplemented from time to time, may be used by a broker-dealer in connection with resales of Exchange Notes where the Old Notes were acquired by such broker-dealer as a result of market-making activities or other trading activities. We have agreed that, starting on the expiration date and ending on the close of business one year after the expiration date, we will make this prospectus available, as amended or supplemented, to any broker-dealer for use in connection with any such resale. See "Plan of Distribution."

, 2017

WHERE YOU CAN FIND MORE INFORMATION | i | |||

INCORPORATION BY REFERENCE | ii | |||

SUMMARY | 1 | |||

SUMMARY OF THE EXCHANGE OFFER | 7 | |||

CONSEQUENCES OF NOT EXCHANGING OLD NOTES | 10 | |||

SUMMARY OF TERMS OF EXCHANGE NOTES | 11 | |||

RISK FACTORS | 15 | |||

FORWARD-LOOKING STATEMENTS | 20 | |||

EXCHANGE OFFER | 22 | |||

USE OF PROCEEDS | 33 | |||

RATIO OF EARNINGS TO FIXED CHARGES | 33 | |||

CAPITALIZATION | 34 | |||

DESCRIPTION OF CERTAIN OTHER INDEBTEDNESS | 35 | |||

DESCRIPTION OF THE NOTES | 40 | |||

BOOK-ENTRY, DELIVERY AND FORM | 65 | |||

CERTAIN FEDERAL INCOME TAX CONSEQUENCES | 67 | |||

PLAN OF DISTRIBUTION | 68 | |||

LEGAL MATTERS | 69 | |||

EXPERTS | 69 |

WHERE YOU CAN FIND MORE INFORMATION

NRG Yield Operating LLC ("Yield Operating LLC") is not currently required to file annual, quarterly and current reports and other information with the SEC. NRG Yield LLC ("Yield LLC") files periodic reports and other information with the SEC pursuant to Section 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). You may read and copy any document Yield LLC has filed or will file with the SEC at the SEC's public website (www.sec.gov) or at the Public Reference Room of the SEC located at 100 F Street, N.E., Washington, DC 20549. Copies of such materials can be obtained from the Public Reference Room of the SEC at prescribed rates. You can call the SEC at 1-800-SEC-0330 to obtain information on the operation of the Public Reference Room.

So long as Yield LLC continues to own, directly or indirectly, all of the equity interests of Yield Operating LLC, the quarterly, annual and current reports and consolidated financial statements referred to above in respect of Yield LLC will be deemed to satisfy the obligations of Yield Operating LLC under the reporting covenant of the indenture governing the notes. See "Description of the Notes—Certain Covenants—Reports."

i

The SEC allows us to "incorporate by reference" the information Yield LLC files with them into this prospectus, which means that we can disclose important information to you by referring you to those documents and those documents will be considered part of this prospectus. Information that Yield LLC files later with the SEC will automatically update and supersede the previously filed information. We incorporate by reference the documents listed below and any future filings Yield LLC makes with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act, until the completion of the exchange offer (other than portions of these documents deemed to be "furnished" or not deemed to be "filed," including the portions of these documents that are either (1) described in paragraphs (d)(1), (d)(2), (d)(3) or (e)(5) of Item 407 of Regulation S-K promulgated by the SEC or (2) furnished under Item 2.02 or Item 7.01 of a current report on Form 8-K, including any exhibits included with such Items):

- •

- Yield LLC's annual report on Form 10-K for the year ended December 31, 2016 filed on February 28, 2017, which we refer to as our "2016 Form 10-K";

- •

- Yield LLC's quarterly report on Form 10-Q for the quarter ended March 31, 2017 filed on May 2, 2017, which we refer to as our "First Quarter Form 10-Q"; and

- •

- Yield LLC's current reports on Form 8-K filed on February 3, 2017 and May 9, 2017.

Furthermore, all filings Yield LLC makes with the SEC under Sections 13(a), 13(c), 14 or 15(d) of the Exchange Act after the date of the initial filing of this registration statement and prior to effectiveness of the registration statement (other than portions of these documents deemed to be "furnished" or not deemed to be "filed," including the portions of these documents that are either (1) described in paragraphs (d)(1), (d)(2), (d)(3) or (e)(5) of Item 407 of Regulation S-K promulgated by the SEC or (2) furnished under Item 2.02 or Item 7.01 of a current report on Form 8-K, including any exhibits included with such Items) shall be deemed to be incorporated by reference into this prospectus.

If you make a request for such information in writing or by telephone, we will provide you, without charge, a copy of any or all of the information incorporated by reference in this prospectus. Any such request should be directed to:

NRG Yield Operating LLC

804 Carnegie Center

Princeton, NJ 08540

(609) 524-4500

Attention: General Counsel

You should rely only on the information contained in, or incorporated by reference in, this prospectus. We have not authorized anyone else to provide you with different or additional information. This prospectus does not offer to sell or solicit any offer to buy any notes in any jurisdiction where the offer or sale is unlawful. You should not assume that the information in this prospectus or in any document incorporated by reference is accurate as of any date other than the date on the front cover of the applicable document.

ii

This summary highlights selected information appearing elsewhere in this prospectus. This summary is not complete and does not contain all of the information that you should consider before deciding whether to participate in this exchange offer. You should carefully read this summary together with the entire prospectus, including the information set forth in the section entitled "Risk Factors" and the financial statements and related notes thereto, before deciding whether to participate in the exchange offer.

Unless the context otherwise requires or as otherwise indicated, references in this prospectus to "we," "our," "the Company" and "Yield" refer to Yield Operating LLC, together with its consolidated subsidiaries and direct parent Yield LLC and references to "Issuer" refer to Yield Operating LLC, exclusive of its subsidiaries. As of March 31, 2017, NRG Yield, Inc. ("Yield Inc.") (NYSE: NYLD.A, NYLD) owned approximately 53.4% of the economic interests in and was the sole managing member of Yield LLC.

We are a company formed to serve as the primary vehicle through which NRG Energy, Inc. ("NRG") (NYSE: NRG) owns, operates and acquires contracted renewable and conventional generation and thermal infrastructure assets. We believe we are well positioned to be a premier company for investors seeking stable and growing dividend income from a diversified portfolio of lower-risk high-quality assets.

We own a diversified portfolio of contracted renewable and conventional generation and thermal infrastructure assets in the United States. Our contracted generation portfolio collectively represents 4,879 net MW as of March 31, 2017. Each of these assets sells substantially all of its output pursuant to long-term offtake agreements with creditworthy counterparties. The weighted average remaining contract duration of these offtake agreements was approximately 16 years as of March 31, 2017, based on cash available for distribution ("CAFD"). We also own thermal infrastructure assets with an aggregate steam and chilled water capacity of 1,319 net MWt and electric generation capacity of 123 net MW. These thermal infrastructure assets provide steam, hot and/or chilled water, and, in some instances, electricity, to commercial businesses, universities, hospitals and governmental units in multiple locations, principally through long-term contracts or pursuant to rates regulated by state utility commissions.

Our primary business strategy is to focus on the acquisition and ownership of assets with predictable, long-term cash flows in order that it may be able to increase the cash distributions to Yield Inc. and NRG over time without compromising the ongoing stability of our business. Our plan for executing this strategy includes the following key components:

Focus on contracted renewable energy and conventional generation and thermal infrastructure assets. We own and operate utility scale and distributed renewable energy and natural gas-fired generation, thermal and other infrastructure assets with proven technologies, low operating risks and stable cash flows. We believe by focusing on this core asset class and leveraging our industry knowledge, we will maximize our strategic opportunities, be a leader in operational efficiency and maximize our overall financial performance.

Growing the business through acquisitions of contracted operating assets. We believe that our base of operations and relationship with NRG provide a platform in the conventional and renewable power generation and thermal sectors for strategic growth through cash accretive and tax advantaged acquisitions complementary to our existing portfolio. In addition to acquiring renewable generation, conventional generation and thermal infrastructure assets from third parties where we believe our knowledge of the market and operating expertise provides us with a competitive advantage, we entered

1

into a Right of First Offer Agreement with NRG (the "ROFO Agreement"). On February 24, 2017, we amended and restated the ROFO Agreement, expanding the NRG ROFO pipeline with the addition of 234 net MW of utility-scale solar projects, consisting of Buckthorn, a 154 net MW solar facility in Texas, and Hawaii solar projects, which have a combined capacity of 80 net MW. Under the ROFO Agreement, NRG has granted us and our affiliates a right of first offer on any proposed sale, transfer or other disposition of certain assets of NRG until February 24, 2022. In addition to the assets described in the table below which reflects the assets subject to sale, the ROFO Agreement also provides us with a right of first offer with respect to up to $250 million of equity in one or more distributed solar generation portfolios developed by affiliates of NRG, together with the assets listed in the table below (the "NRG ROFO Assets").

Asset | Fuel Type | Net Capacity (MW)(1) | COD | ||||

|---|---|---|---|---|---|---|---|

Ivanpah(2) | Solar | 195 | 2013 | ||||

Agua Caliente(3) | Solar | 102 | 2014 | ||||

Buckthorn | Solar | 154 | 2018 | ||||

Hawaii | Solar | 80 | 2019 | ||||

Carlsbad | Conventional | 527 | 2018 | ||||

Puente/Mandalay | Conventional | 262 | 2020 | ||||

Wind TE Holdco(4): | |||||||

Elkhorn Ridge | Wind | 13 | 2009 | ||||

San Juan Mesa | Wind | 22 | 2005 | ||||

Wildorado | Wind | 40 | 2007 | ||||

Crosswinds | Wind | 5 | 2007 | ||||

Forward | Wind | 7 | 2008 | ||||

Hardin | Wind | 4 | 2007 | ||||

Odin | Wind | 5 | 2007 | ||||

Sleeping Bear | Wind | 24 | 2007 | ||||

Spanish Fork | Wind | 5 | 2008 | ||||

Goat Wind | Wind | 37 | 2008/2009 | ||||

Lookout | Wind | 9 | 2008 | ||||

Elbow Creek | Wind | 30 | 2008 | ||||

Community | Wind | 30 | 2011 | ||||

Jeffers | Wind | 50 | 2008 | ||||

Minnesota Portfolio(5) | Wind | 38 | 2003/2006 | ||||

- (1)

- Represents the maximum, or rated, electricity generating capacity of the facility in MW multiplied by NRG's percentage ownership interest in the facility as of March 31, 2017.

- (2)

- Represents 49.95% of NRG's 50.01% ownership interest in Ivanpah. Following a sale of this 49.95% interest, the remaining 50.05% of Ivanpah would be owned by NRG, Google Inc. and BrightSource Energy Inc.

- (3)

- Represents NRG's 35% ownership interest in Agua Caliente. 49% of Agua Caliente is owned by BHE AC Holdings, LLC. As further described below, we acquired 16% of Agua Caliente from NRG on March 27, 2017.

- (4)

- Represents NRG's remaining 25% of the Class B interests of NRG Wind TE Holdco. NRG Yield, Inc. acquired 75% of the Class B interests in November 2015. A tax equity investor owns the Class A interests in NRG Wind TE Holdco.

- (5)

- Includes Bingham Lake, Eastridge, and Westridge projects.

2

NRG is not obligated to sell the remaining NRG ROFO Assets to us and, if offered by NRG, we cannot be sure whether these assets will be offered on acceptable terms, or that we will choose to consummate such acquisitions. In addition, NRG may offer additional assets to us, as described in the "Management's Discussion and Analysis of Financial Condition and Results of Operations" section of our 2016 Form 10-K.

On March 27, 2017, we acquired the following interests from NRG: (i) Agua Caliente Borrower 2 LLC, which owns a 16% interest (approximately 31% of NRG's 51% interest) in the Agua Caliente solar farm, one of the NRG ROFO Assets, representing ownership of approximately 46 net MW of capacity, and (ii) NRG's interests in seven utility-scale solar farms located in Utah, which are part of a tax equity structure with Dominion Solar Projects III, Inc. from which we would receive 50% of cash to be distributed. We paid cash consideration of $130 million, plus $1 million of working capital and assumed non-recourse project debt of $328 million, which we consolidate, as well as our pro-rata share of non-recourse project-level debt of $135 million. The purchase price for the acquisition was funded with cash on hand.

On May 1, 2017, NRG offered us the remaining 25% interest in NRG Wind TE Holdco, an 814 net MW portfolio of twelve wind projects. We currently own a 75% interest in the portfolio which we acquired in 2015. The acquisition is subject to approval by Yield Inc.'s independent directors.

Primary focus on North America. We intend to primarily focus our investments in North America (including the unincorporated territories of the United States). We believe that industry fundamentals in North America present it with significant opportunity to acquire renewable, natural gas-fired generation and thermal infrastructure assets, without creating significant exposure to currency and sovereign risk. By primarily focusing our efforts on North America, we believe we will best leverage our regional knowledge of power markets, industry relationships and skill sets to maximize our performance.

Stable, high quality cash flows. Our facilities have a highly stable, predictable cash flow profile consisting of predominantly long-life electric generation assets that sell electricity under long-term fixed priced contracts or pursuant to regulated rates with investment grade and certain other credit-worthy counterparties. Additionally, our facilities have minimal fuel risk. For our conventional assets, fuel is provided by the toll counterparty or the cost thereof is a pass-through cost under the applicable Contract—for—Difference ("CfD"). Renewable facilities have no fuel costs, and most of our thermal infrastructure assets have contractual or regulatory tariff mechanisms for fuel cost recovery. The offtake agreements for our conventional and renewable generation facilities have a weighted-average remaining duration of approximately 16 years as of March 31, 2017, based on CAFD, providing long-term cash flow stability. Our generation offtake agreements with counterparties for whom credit ratings are available have a weighted-average Moody's rating of A3 based on rated capacity under contract. All of our assets are in the United States and accordingly have no currency or repatriation risks.

High quality, long-lived assets with low operating and capital requirements. We benefit from a portfolio of relatively newly-constructed assets, other than thermal infrastructure assets. Our assets are comprised of proven and reliable technologies, provided by leading original solar and wind equipment manufacturers such as General Electric, Siemens AG, SunPower Corporation, First Solar Inc., Vestas Wind Systems A/S, Suzlon Energy Ltd. and Mitsubishi Corporation. Given the modern nature of the portfolio, which includes a substantial number of relatively low operating and maintenance cost solar and wind generation assets, we expect to achieve high fleet availability and expend modest maintenance-related capital expenditures. Additionally, with the support of services provided by NRG, we expect to continue to implement the same rigorous preventative operating and management practices that NRG uses across its fleet of assets.

3

Significant scale and diversity. We own and operate a large and diverse portfolio of contracted electric generation and thermal infrastructure assets. As of March 31, 2017, our 4,879 net MW contracted generation portfolio benefits from significant diversification in terms of technology, fuel type, counterparty and geography. Our thermal business consists of 12 operations, seven of which are district energy centers that provide steam and chilled water to approximately 705 customers, and five of which provide generation. We believe our scale and access to best practices across the fleet improves our business development opportunities through enhanced industry relationships, reputation and understanding of regional power market dynamics. Furthermore, our diversification reduces our operating risk profile and reliance on any single market.

Relationship with NRG. We believe our relationship with NRG, including NRG's expressed intention to maintain a controlling interest in us, provides significant benefits to us, including:

- •

- Management and Operational Expertise. We have access to the significant resources of NRG, the largest competitive power generator in the United States, to support the operational, financial, legal, regulatory and environmental functions of our business.

- •

- Development and Acquisition Track Record. NRG's development and strategic teams are focused on the development and acquisition of renewable and conventional generation assets, which may provide future growth opportunities for us in addition to the assets set forth in the ROFO Agreement. We believe NRG's ownership position in us incentivizes NRG to support our growth strategy, including through the development of renewable and conventional generation projects. During 2016, NRG acquired 1,639 MWs of utility scale solar and wind projects and 107 MWs of distributed generation and community solar projects that are currently under development or in operation.

- •

- Financing Expertise. With the support of NRG, we have been able to achieve a successful track record of sourcing attractive low-cost, long duration capital to fund acquisitions. We expect to continue to realize benefits from NRG's financing and structuring expertise as well as its relationships with financial institutions and other lenders.

Environmentally well-positioned portfolio of assets. As of March 31, 2017, our portfolio of electric generation assets consists of 2,934 net MW of renewable generation capacity that are non-emitting sources of power generation. Our conventional assets consist of the dual fuel-fired GenConn assets as well as the Marsh Landing and Walnut Creek simple cycle natural gas-fired peaking generation facilities and the El Segundo combined cycle natural gas-fired peaking facility. We do not anticipate having to expend any significant capital expenditures in the foreseeable future to comply with current environmental regulations applicable to our generation assets. Taken as a whole, we believe our strategy will be a net beneficiary of current and potential environmental legislation and regulatory requirements that may serve as a catalyst for capacity retirements and improve market opportunities for environmentally well-positioned assets like our assets once such assets' current offtake agreements expire.

Thermal infrastructure business has high entry costs. Significant capital has been invested to construct our thermal infrastructure assets, serving as a barrier to entry in the markets in which such assets operate. As of March 31, 2017, our thermal gross property, plant, and equipment was approximately $472 million. Our thermal district energy centers are located in urban city areas, with the chilled water and steam delivery systems located underground. Constructing underground delivery systems in urban areas requires long lead times for permitting, rights of way and inspections and is costly. By contrast, the incremental cost to add new customers in existing markets is relatively low. Once thermal infrastructure is established, we believe it has the ability to retain customers over long periods of time and to compete effectively for additional business against stand-alone on-site heating and cooling generation facilities. Installation of stand-alone equipment can require significant

4

modification to a building as well as significant space for equipment and funding for capital expenditures. Our system technologies often provide economies of scale in terms of fuel procurement, ability to switch between multiple types of fuel to generate thermal energy, and fuel conversion efficiency.

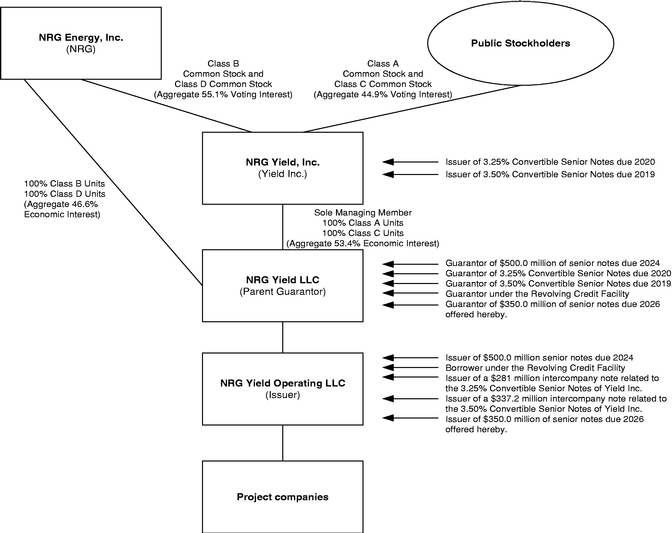

As of March 31, 2017, Yield Inc. owned an aggregate 53.4% economic interest in Yield LLC. The following table summarizes certain relevant aspects of our organizational structure:

We and our peer group, along with the broader energy sector, have recently experienced volatile conditions in the capital markets, including debt and equity markets, due to continued depressed commodity markets. Additionally, we are subject to a variety of risks related to our competitive position and business strategies. Some of the more significant challenges and risks include if we are unable to to address costs or delays in the construction and operation of new plants, if we are unable to address the volatility in power prices and fuel costs, if we are unable to utilize our leveraged capital structure and if governmental regulation is revised in a such a manner that is less favorable to us. See "Risk Factors" contained elsewhere in this prospectus, the "Risk Factors Related to the Company's Business" section

5

of our 2016 Form 10-K for a discussion of the factors you should consider before deciding to participate in this exchange offer.

Both Yield LLC and Yield Operating LLC were formed as Delaware limited liability companies on March 5, 2013. Our principal executive offices are located at NRG Yield Operating LLC, 804 Carnegie Center, Princeton, New Jersey. Our telephone number is (609) 524-4500. Our website is located athttp://www.nrgyield.com. Yield Operating LLC is not currently required to file or furnish periodic reports and other information with the SEC pursuant to Section 13(a) or 15(d) of the Securities Exchange Act of 1934, as amended (the "Exchange Act"). See "Incorporation by Reference." Yield LLC files periodic reports and other information with the SEC pursuant to Section 15(d) of the Exchange Act. Information on our website or any other website is not incorporated by reference into this prospectus and does not constitute a part of this prospectus. The SEC maintains an internet site athttp://www.sec.gov that contains reports and other information regarding issuers that file electronically with the SEC.

6

On August 18, 2016, we sold, through a private placement exempt from the registration requirements of the Securities Act, $350,000,000 of our 5.000% Senior Notes due 2026, which are eligible to be exchanged for Exchange Notes. We refer to these notes as "Old Notes" in this prospectus.

Simultaneously with the private placement, we entered into a registration rights agreement with the initial purchasers of the Old Notes (the "Registration Rights Agreement"). Under the Registration Rights Agreement, we are required to use commercially reasonable efforts to register Exchange Notes with the SEC having substantially identical terms as the Old Notes (except for the provisions relating to the transfer restrictions and payment of additional interest) as part of an offer to exchange freely tradable exchange notes for the notes, and use commercially reasonable efforts to consummate the exchange offer within 365 days after the issue date of the Old Notes. If required under certain circumstances, Yield Operating LLC and the guarantors will file a shelf registration statement with the SEC covering resales of the notes.

We refer to the notes to be registered under this exchange offer registration statement as "Exchange Notes" and collectively with the Old Notes, we refer to them as the "notes" in this prospectus. You may exchange your Old Notes for the applicable Exchange Notes in this exchange offer. You should read the discussion under the headings "—Summary of Terms of Exchange Notes," "Exchange Offer" and "Description of the Notes" for further information regarding the Exchange Notes.

Exchange Notes offered | $350,000,000 aggregate principal amount of 5.000% Senior Notes due 2026. | |

Exchange offer | We are offering to exchange the Old Notes for a like principal amount at maturity of the Exchange Notes. Old Notes may be exchanged only in minimum principal amounts of $2,000 and integral multiples of $1,000 in excess thereof. The exchange offer is being made pursuant to the Registration Rights Agreement which grants the initial purchasers and any subsequent holders of the Old Notes certain exchange and registration rights. This exchange offer is intended to satisfy those exchange and registration rights with respect to the Old Notes. After the exchange offer is complete, you will no longer be entitled to any exchange or registration rights with respect to your Old Notes. | |

Expiration date; Withdrawal of tender | The exchange offer will expire at 12:00 midnight, New York City time, on , 2017, or a later time if we choose to extend this exchange offer in our sole and absolute discretion. You may withdraw your tender of Old Notes at any time prior to 12:00 midnight, New York City time, on the expiration date. All outstanding Old Notes that are validly tendered and not validly withdrawn will be exchanged. We will issue the Exchange Notes promptly after the expiration of the exchange offer. Any Old Notes not accepted by us for exchange for any reason will be returned to you at our expense promptly after the expiration or termination of the exchange offer. |

7

Resales | We believe that you can offer for resale, resell and otherwise transfer the Exchange Notes without complying with the registration and prospectus delivery requirements of the Securities Act so long as: | |

• you acquire the Exchange Notes in the ordinary course of business; | ||

• you are not participating, do not intend to participate, and have no arrangement or understanding with any person to participate, in the distribution of the Exchange Notes; | ||

• you are not an affiliate of ours; and | ||

• you are not a broker-dealer. | ||

If any of these conditions is not satisfied and you transfer any Exchange Notes without delivering a proper prospectus or without qualifying for a registration exemption, you may incur liability under the Securities Act. We do not assume, or indemnify you against, any such liability. | ||

Broker-Dealer | Each broker-dealer acquiring Exchange Notes issued for its own account in exchange for Old Notes, which it acquired through market-making activities or other trading activities, must acknowledge that it will deliver a proper prospectus when any Exchange Notes issued in the exchange offer are transferred. A broker-dealer may use this prospectus for an offer to resell, a resale or other retransfer of the Exchange Notes issued in the exchange offer. See "Plan of Distribution." | |

Conditions to the exchange offer | Our obligation to accept for exchange, or to issue the Exchange Notes in exchange for, any Old Notes is subject to certain customary conditions, including our determination that the exchange offer does not violate any law, statute, rule, regulation or interpretation by the Staff of the SEC or any regulatory authority or other foreign, federal, state or local government agency or court of competent jurisdiction, some of which may be waived by us. We currently expect that each of the conditions will be satisfied and that no waivers will be necessary. See "Exchange Offer—Conditions to the exchange offer." | |

Procedures for tendering Old Notes Held in the Form of Book-Entry interests | The Old Notes were issued as global securities and were deposited upon issuance with Delaware Trust Company, which issued uncertificated depositary interests in those outstanding Old Notes, which represent a 100% interest in those Old Notes, to The Depositary Trust Company ("DTC"). | |

Beneficial interests in the outstanding Old Notes, which are held by direct or indirect participants in DTC, are shown on, and transfers of the Old Notes can only be made through, records maintained in book-entry form by DTC. |

8

You may tender your outstanding Old Notes by instructing your broker or bank where you keep the Old Notes to tender them for you. In some cases you may be asked to submit the letter of transmittal that may accompany this prospectus. By tendering your Old Notes you will be deemed to have acknowledged and agreed to be bound by the terms set forth under "Exchange Offer." Your outstanding Old Notes must be tendered in minimum denominations of $2,000 and integral multiples of $1,000 in excess thereof. | ||

In order for your tender to be considered valid, the exchange agent must receive a confirmation of book-entry transfer of your outstanding Old Notes into the exchange agent's account at DTC, under the procedure described in this prospectus under the heading "Exchange Offer," on or before 12:00 midnight, New York City time, on the expiration date of the exchange offer. | ||

Special procedures for beneficial owners | If you are the beneficial owner of book-entry interests and your name does not appear on a security position listing of DTC as the holder of the book-entry interests or if you are a beneficial owner of Old Notes that are registered in the name of a broker, dealer, commercial bank, trust company or other nominee and you wish to tender the book-entry interest or Old Notes in the exchange offer, you should contact the person in whose name your book- entry interests or Old Notes are registered promptly and instruct that person to tender on your behalf. | |

United States federal income tax considerations | The exchange offer should not result in any income, gain or loss to the holders of Old Notes or to us for United States federal income tax purposes. See "Certain Federal Income Tax Consequences." | |

Use of proceeds | We will not receive any proceeds from the issuance of the Exchange Notes in the exchange offer. | |

Exchange agent | Delaware Trust Company is serving as the exchange agent for the exchange offer. | |

Shelf registration statement | In limited circumstances, holders of Old Notes may require us to register their Old Notes under a shelf registration statement. |

9

CONSEQUENCES OF NOT EXCHANGING OLD NOTES

If you do not exchange your Old Notes in the exchange offer, your Old Notes will continue to be subject to the restrictions on transfer currently applicable to the Old Notes. In general, you may offer or sell your Old Notes only:

- •

- if they are registered under the Securities Act and applicable state securities laws;

- •

- if they are offered or sold under an exemption from registration under the Securities Act and applicable state securities laws; or

- •

- if they are offered or sold in a transaction not subject to the Securities Act and applicable state securities laws.

We do not currently intend to register the Old Notes under the Securities Act. Under some circumstances, however, holders of the Old Notes, including holders who are not permitted to participate in the exchange offer or who may not freely resell Exchange Notes received in the exchange offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of notes by these holders. For more information regarding the consequences of not tendering your Old Notes and our obligation to file a shelf registration statement, see "Exchange Offer—Consequences of failure to exchange."

10

SUMMARY OF TERMS OF EXCHANGE NOTES

The summary below describes the principal terms of the Exchange Notes, the guarantees and the related indenture. Certain of the terms and conditions described below are subject to important limitations and exceptions. The "Description of the Notes" section of this prospectus contains more detailed descriptions of the terms and conditions of the Exchange Notes and the related indenture.

Issuer | NRG Yield Operating LLC | |

Securities offered | $350.0 million in aggregate principal amount of 5.000% Senior Notes due 2026. The Exchange Notes will evidence the same debt as the Old Notes. | |

Maturity date | The Exchange Notes will mature on September 15, 2026. | |

Interest rate | The Exchange Notes will accrue interest at the rate of 5.000% per annum. | |

Interest payment dates | Interest on the Exchange Notes will be payable on March 15 and September 15 of each year. The Exchange Notes will accrue interest from and including the last interest payment date on which interest has been paid on the Old Notes and, if no interest has been paid, the Exchange Notes will accrue interest since the issue date of the Old Notes. | |

No interest will be paid on either the Exchange Notes or the Old Notes at the time of exchange. Accordingly, the holders of Old Notes that are accepted for exchange will not receive accrued but unpaid interest on such Old Notes at the time of tender. Rather, that interest will be payable on the Exchange Notes delivered in exchange for the Old Notes on the first interest payment date following the expiration date of the exchange offer. | ||

Ranking | The Exchange Notes will: | |

• be general unsecured obligations of Yield Operating LLC; | ||

• bepari passu in right of payment with all existing and future senior indebtedness of Yield Operating LLC, including Yield Operating LLC's indebtedness under the Revolving Credit Facility (as defined herein); | ||

• be senior in right of payment to any future subordinated indebtedness of Yield Operating LLC; and | ||

• be guaranteed as described under "—Parent Guarantee" and "—Subsidiary Guarantees". |

11

The Exchange Notes will be effectively subordinated to all borrowings under the Revolving Credit Facility, which is secured by substantially all of the assets of Yield Operating LLC and the guarantors of the Exchange Notes, and any other secured indebtedness (including any secured hedging obligations) of Yield Operating LLC or the guarantors of the notes, in each case to the extent of the value of the assets that secure the Revolving Credit Facility or such other secured indebtedness. See "Risk Factors—Risks related to the notes—In the event of a bankruptcy or insolvency, holders of our secured indebtedness and other secured obligations will have a prior secured claim to any collateral securing such indebtedness or other obligations." | ||

Parent Guarantee | The Exchange Notes will be guaranteed by Yield LLC, Yield Operating LLC's parent company (the "Parent Guarantor"). The parent guarantee of the Exchange Notes will: | |

• be a general unsecured obligation of the Parent Guarantor; | ||

• bepari passu in right of payment with all existing and future senior indebtedness of the Parent Guarantor, including the Parent Guarantor's guarantee under the Revolving Credit Facility; and | ||

• be senior in right of payment to any future subordinated indebtedness of the Parent Guarantor. | ||

The Parent Guarantor's guarantee of the Exchange Notes will be effectively subordinated to the Parent Guarantor's guarantee under the Revolving Credit Facility and any other secured indebtedness of the Parent Guarantor (including any hedging obligations), in each case, to the extent of the value of the assets of the Parent Guarantor that secure the Revolving Credit Facility or such other secured indebtedness. | ||

Subsidiary Guarantees | In addition to the guarantee by the Parent Guarantor, the Exchange Notes will be guaranteed on a joint and several basis by each wholly-owned subsidiary of Yield Operating LLC that guarantees any obligations of Yield Operating LLC under the Revolving Credit Facility or any other material indebtedness of Yield Operating LLC. Each subsidiary guarantee of the notes will: | |

• be a general unsecured obligation of that subsidiary guarantor; | ||

• bepari passu in right of payment with all existing and future senior indebtedness of that subsidiary guarantor, including the subsidiary guarantor's guarantee under the Revolving Credit Facility; and | ||

• be senior in right of payment to any future subordinated indebtedness of that subsidiary guarantor. |

12

Each subsidiary guarantor's guarantee of the Exchange Notes will be effectively subordinated to such subsidiary guarantor's guarantee under the Revolving Credit Facility and any other secured indebtedness of such subsidiary guarantor (including any hedging obligations), in each case, to the extent of the value of the assets of such subsidiary guarantor that secures the Revolving Credit Facility or such other secured indebtedness. | ||

Our operations are primarily conducted through our subsidiaries and, therefore, we will depend on the cash flow of our subsidiaries to meet our obligations under the notes. Not all of our subsidiaries will guarantee the Exchange Notes. | ||

The Exchange Notes will be structurally subordinated in right of payment to all indebtedness and other liabilities and commitments of our non-guarantor subsidiaries. The subsidiary guarantors accounted for approximately 2% and 2% of Yield Operating LLC's revenues from operations for the year period ended December 31, 2016 and three months ended March 31, 2017, respectively. The subsidiary guarantors held approximately 10% and 9% of Yield Operating LLC's consolidated assets as of December 31, 2016 and March 31, 2017, respectively. As of December 31, 2016 and March 31, 2017, Yield Operating LLC's non-guarantor subsidiaries had approximately $4,388 million and $4,347 million, respectively in aggregate principal amount of non-current liabilities and outstanding trade payables of approximately $18 million and $25 million, respectively. See "Risk Factors—Risks related to the notes—We may not have access to the cash flow and other assets of our subsidiaries that may be needed to make payment on the notes." | ||

Optional redemption | Prior to September 15, 2019, we may redeem up to 35% of the notes with an amount equal to the net cash proceeds of certain equity offerings at the redemption price listed in the "Description of the Notes—Optional Redemption" section of this prospectus, plus accrued and unpaid interest;provided at least 65% of the aggregate principal amount of the notes remain outstanding after the redemption and the redemption occurs within 90 days of such equity offering. | |

We may redeem some or all of the notes at any time prior to September 15, 2021 at a price equal to 100% of the principal amount of the notes redeemed plus a "make-whole" premium and accrued and unpaid interest. | ||

On or after September 15, 2021, we may redeem some or all of the notes at the redemption prices listed in the "Description of the Notes—Optional Redemption" section of this prospectus, plus accrued and unpaid interest. |

13

Change of control offer | If a change of control triggering event occurs, subject to certain conditions, we must offer to repurchase the notes at a price equal to 101% of the principal amount of the notes, plus accrued and unpaid interest to the date of repurchase. See "Description of the Notes—Repurchase at the option of holders—Change of control triggering event." | |

Covenants | We have agreed to certain restrictions on incurring liens to secure indebtedness. See "Description of the Notes—Certain Covenants." | |

Events of default | For a discussion of events that will permit acceleration of the payment of the principal of and accrued interest on the Notes, see "Description of the Notes—Events of default and remedies." | |

No prior market | The Exchange Notes will be new securities for which there is currently no market. We cannot assure you as to the liquidity of markets that may develop for the Exchange Notes, your ability to sell the notes or the price at which you would be able to sell the notes. See "Risk Factors—Risks related to the notes—Your ability to transfer the notes may be limited by the absence of an active trading market, and there is no assurance that any active market will develop for the notes." | |

Listing | We do not intend to list the Exchange Notes on any securities exchange. | |

Use of proceeds | We will not receive any proceeds from the issuance of the Exchange Notes. See "Use of Proceeds." | |

Form and denomination | The Exchange Notes will be delivered in fully-registered form. The Exchange Notes will be represented by one or more global notes, deposited with the trustee as a custodian for DTC and registered in the name of Cede & Co., DTC's nominee. Beneficial interests in the global notes will be shown on, and any transfers will be effective only through, records maintained by DTC and its participants. The Exchange Notes will be issued in denominations of $2,000 and integral multiples of $1,000. | |

Governing law | The Exchange Notes and the indenture governing the Exchange Notes will be governed by, and construed in accordance with, the laws of the State of New York. | |

Trustee | Delaware Trust Company (successor in interest to Law Debenture Trust Company of New York), as trustee. |

14

You should carefully consider the risk factors set forth below and the risk factors incorporated into this prospectus by reference to our 2016 Form 10-K as well as the other information contained in and incorporated by reference into this prospectus before deciding to participate in this exchange offer. The selected risks described below and the risks that are incorporated into this prospectus by reference to our 2016 Form 10-K are not our only risks. Additional risks and uncertainties not currently known to us or those we currently view to be immaterial also may materially and adversely affect our business, financial condition or results of operations. Any of the following risks or any of the risks described in our 2016 Form 10-K could materially and adversely affect our business, financial condition, operating results or cash flow. In such a case, the trading price of the notes could decline, or we may not be able to make payments of interest and principal on the notes, and you may lose all or part of your original investment.

Risks related to the notes

Credit rating downgrades could adversely affect the trading price of the notes.

The trading price for the notes may be affected by our credit rating. Credit ratings are continually revised. Any downgrade in our credit rating could adversely affect the trading prices of the notes or the trading markets for the notes to the extent the trading markets for the notes develop.

Despite current indebtedness levels, we may still be able to incur substantially more debt. This could increase the risks associated with our already substantial leverage.

We may be able to incur substantial additional indebtedness in the future. The terms of the indenture governing the notes offered hereby and other indentures relating to outstanding indebtedness restrict our ability to do so, but we retain the ability to incur material amounts of additional indebtedness. If new indebtedness is added to our current indebtedness levels, the related risks that we now face could increase. See "Description of Certain Other Indebtedness."

To service our indebtedness, we will require a significant amount of cash. Our ability to generate cash depends on many factors beyond our control.

Our ability to make payments on and to refinance our indebtedness, including these notes, and to fund planned capital expenditures depends on our ability to generate cash in the future. This, to a significant extent, is subject to general economic, financial, competitive, legislative, tax, regulatory, environmental and other factors that are beyond our control.

Based on our current level of operations and anticipated cost savings and operating improvements, we believe our cash flow from operations, available cash and available borrowings under our Revolving Credit Facility, will be adequate to meet our future liquidity needs for at least the next twelve months.

We cannot assure you, however, that our business will generate sufficient cash flow from operations, that currently anticipated cost savings and operating improvements will be realized on schedule or at all or that future borrowings will be available to us under our Revolving Credit Facility in an amount sufficient to enable us to pay our indebtedness, including the notes offered hereby, or to fund our other liquidity needs. We may need to refinance all or a portion of our indebtedness, including the notes offered hereby on or before maturity. We cannot assure you that we will be able to refinance any of our indebtedness on commercially reasonable terms or at all.

In the event of a bankruptcy or insolvency, holders of our secured indebtedness and other secured obligations will have a prior secured claim to any collateral securing such indebtedness or other obligations.

Holders of our secured indebtedness and other secured obligations will have a prior secured claim to any collateral securing such indebtedness or other obligations. Holders of our secured indebtedness

15

and the secured indebtedness of the guarantors will have claims that are prior to your claims as holders of the notes to the extent of the value of the assets securing that other indebtedness. Our Revolving Credit Facility is secured by first priority liens on substantially all of our assets and the assets of the guarantors. We have granted first and second priority liens on substantially all of our assets to secure our obligations under certain long-term power and gas hedges as well as interest rate hedges. In the event of any distribution or payment of our assets in any foreclosure, dissolution, winding-up, liquidation, reorganization or other bankruptcy proceeding, holders of secured indebtedness will have prior claims to those of our assets that constitute their collateral. Holders of the notes will participate ratably in our remaining assets with all holders of our unsecured indebtedness that is deemed to be of the same class as the notes, and potentially with all our other general creditors, based upon the respective amounts owed to each holder or creditor. In any of the foregoing events, we cannot assure you that there will be sufficient assets to pay amounts due on the notes. As a result, holders of notes may receive less, ratably, than holders of secured indebtedness.

Your right to receive payments on these notes could be adversely affected if any of our non-guarantor subsidiaries declare bankruptcy, liquidate or reorganize.

Some, but not all, of our subsidiaries will guarantee the notes. In the event of a bankruptcy, liquidation or reorganization of any of our non-guarantor subsidiaries, holders of their indebtedness and their trade creditors will generally be entitled to payment of their claims from the assets of those subsidiaries before any assets are made available for distribution to us. As of March 31, 2017, we had approximately $4,568 million of project-level debt which was incurred by our non-guarantor subsidiaries. In addition, our share of our unconsolidated affiliates' total indebtedness and letters of credit outstanding, as of March 31, 2017, totaled approximately $592 million and $88 million, respectively (calculated as our unconsolidated affiliates' total indebtedness as of such date multiplied by our percentage membership interest in such assets). We also had $454 million of letters of credit outstanding to support contracted obligations at our project-level entities as of March 31, 2017. In addition, the indenture governing the notes will permit us, subject to certain covenant limitations, to provide credit support for the obligations of the non-guarantor subsidiaries and such credit support may be effectively senior to our obligations under the notes. Further, the indenture governing the notes will allow us to transfer assets, including certain specified facilities, to the non-guarantor subsidiaries.

We may not have access to the cash flow and other assets of our subsidiaries that may be needed to make payment on the notes.

Much of our business is conducted through our subsidiaries. Although certain of our subsidiaries will guarantee the notes, some of our subsidiaries will not become guarantors and thus will not be obligated to make funds available to us for payment on the notes. Our ability to make payments on the notes will be dependent on the earnings and the distribution of funds from subsidiaries, some of which are non-guarantors. Our subsidiaries will be permitted under the terms of the indenture to incur additional indebtedness that may restrict or prohibit the making of distributions, the payment of dividends or the making of loans by such subsidiaries to us. We cannot assure you that the agreements governing the current and future indebtedness of our subsidiaries will permit our subsidiaries to provide us with sufficient dividends, distributions or loans to fund payments on the notes when due. Furthermore, certain of our subsidiaries and affiliates are already subject to project financing. Such entities will not guarantee our obligations on the notes. The debt agreements of these subsidiaries and project affiliates generally restrict their ability to pay dividends, make distributions or otherwise transfer funds to us.

16

We may not have the ability to raise the funds necessary to finance the change of control offer required by the indenture governing the notes.

Upon the occurrence of certain specific kinds of change of control events, we will be required to offer to repurchase all outstanding notes at 101% of the principal amount thereof plus accrued and unpaid interest, if any, to the date of repurchase. However, it is possible that we will not have sufficient funds at the time of a change of control to make the required repurchase of notes and/or that restrictions in our Revolving Credit Facility or other senior indebtedness will not allow such repurchases. In addition, certain important corporate events, such as leveraged recapitalizations that would increase the level of our indebtedness, would not constitute a "Change of Control" under the indenture. See "Description of the Notes—Repurchase at the Option of Holders."

Federal and state statutes allow courts, under specific circumstances, to void guarantees and require note holders to return payments received from guarantors.

Under the federal bankruptcy law and comparable provisions of state fraudulent transfer laws, a guarantee can be voided, or claims in respect of a guarantee can be subordinated to all other debts of that guarantor if, among other things, the guarantor, at the time it incurred the indebtedness evidenced by its guarantee:

- •

- received less than reasonably equivalent value or fair consideration for the incurrence of such guarantee; and

- •

- was insolvent or rendered insolvent by reason of such incurrence; or

- •

- was engaged in a business or transaction for which the guarantor's remaining assets constituted unreasonably small capital; or

- •

- intended to incur, or believed that it would incur, debts beyond its ability to pay such debts as they mature.

In addition, any payment by that guarantor pursuant to its guarantee can be voided and required to be returned to the guarantor, or to a fund for the benefit of the creditors of the guarantor.

The measures of insolvency for purposes of these fraudulent transfer laws will vary depending upon the law applied in any proceeding to determine whether a fraudulent transfer has occurred. Generally, however, a guarantor will be considered insolvent if:

- •

- the sum of its debts, including contingent liabilities, is greater than the fair saleable value of all of its assets; or

- •

- if the present fair saleable value of its assets is less than the amount that would be required to pay its probable liability on its existing debts, including contingent liabilities, as they become absolute and mature; or

- •

- it cannot pay its debts as they become due.

On the basis of historical financial information, recent operating history and other factors, we believe that each guarantor, after giving effect to its guarantee of the notes, will not be insolvent, will not have unreasonably small capital for the business in which it is engaged and will not have incurred debts beyond its ability to pay such debts as they mature. We cannot assure you, however, as to what standard a court would apply in making these determinations or that a court would agree with our conclusions in this regard.

17

Your ability to transfer the notes may be limited by the absence of an active trading market, and there is no assurance that any active trading market will develop for the notes.

The Exchange Notes will be registered under the Securities Act, but will constitute a new issue of securities for which there is no established trading market. We do not intend to have the notes listed on a national securities exchange or included in any automated quotation system.

The liquidity of any market for the notes will depend upon the number of holders of the notes, our performance, the market for similar securities, the interest in securities dealers making a market in the notes and other factors. Therefore, we cannot assure you that an active market for the notes or exchange notes will develop or, if developed, that it will continue. If an active market does not develop or is not maintained, the price and liquidity of the notes will be adversely affected.

Historically, the market for non investment-grade debt has been subject to disruptions that have caused substantial volatility in the prices of securities similar to the notes. We cannot assure you that the market, if any, for the notes will be free from similar disruptions or that any such disruptions may not adversely affect the prices at which you may sell your notes.

We offered the Old Notes in reliance upon an exemption from registration under the Securities Act and applicable state securities laws. Therefore, the Old Notes may be transferred or resold only in a transaction registered under or exempt from the Securities Act and applicable state securities laws. We are conducting the exchange offer pursuant to an effective registration statement, whereby we are offering to exchange the Old Notes for nearly identical notes that you will be able to trade without registration under the Securities Act provided you are not one of our affiliates. We cannot assure you that this exchange offer will be conducted in a timely fashion. Moreover, we cannot assure you that an active or liquid trading market for the Exchange Notes will develop. See "Exchange Offer."

Risks related to the exchange offer

Holders of Old Notes who fail to exchange their Old Notes in the exchange offer will continue to be subject to restrictions on transfer.

If you do not exchange your Old Notes for Exchange Notes in the exchange offer, you will continue to be subject to the restrictions on transfer applicable to the Old Notes. The restrictions on transfer of your Old Notes arise because we issued the Old Notes under exemptions from, or in transactions not subject to, the registration requirements of the Securities Act and applicable state securities laws. In general, you may only offer or sell the Old Notes if they are registered under the Securities Act and applicable state securities laws, or offered and sold under an exemption from these requirements. We do not plan to register the Old Notes under the Securities Act. For further information regarding the consequences of tendering your Old Notes in the exchange offer, see the discussion under the caption "Exchange Offer—Consequences of failure to exchange."

You must comply with the exchange offer procedures in order to receive new, freely tradable Exchange Notes.

Delivery of Exchange Notes in exchange for Old Notes tendered and accepted for exchange pursuant to the exchange offer will be made only after timely receipt by the exchange agent of the following:

- •

- certificates for outstanding notes or a book-entry confirmation of a book-entry transfer of outstanding notes into the exchange agent's account at DTC, as depository, including an agent's message, as defined in this prospectus, if the tendering holder does not deliver a letter of transmittal;

18

- •

- a complete and signed letter of transmittal, or facsimile copy, with any required signature guarantees, or, in the case of a book-entry transfer, an agent's message in place of the letter of transmittal; and

- •

- any other documents required by the letter of transmittal.

Therefore, holders of Old Notes who would like to tender Old Notes in exchange for Exchange Notes should allow enough time for the necessary documents to be timely received by the exchange agent. We are not required to notify you of defects or irregularities in tenders of Old Notes for exchange. Exchange Notes that are not tendered or that are tendered but we do not accept for exchange will, following consummation of the exchange offer, continue to be subject to the existing transfer restrictions under the Securities Act and, upon consummation of the exchange offer, certain registration and other rights under the Registration Rights Agreement will terminate. See "Exchange Offer—Procedures for tendering Old Notes through brokers and banks" and "Exchange Offer—Consequences of failure to exchange."

Some holders who exchange their Old Notes may be deemed to be underwriters, and these holders will be required to comply with the registration and prospectus delivery requirements in connection with any resale transaction.

If you exchange your Old Notes in the exchange offer for the purpose of participating in a distribution of the Exchange Notes, you may be deemed to have received restricted securities and, if so, will be required to comply with the registration and prospectus delivery requirements of the Securities Act in connection with any resale transaction.

An active trading market may not develop for the Exchange Notes.

The Exchange Notes have no established trading market and will not be listed on any securities exchange. The initial purchasers are not obligated to make a market in the Exchange Notes. The liquidity of any market for the exchange notes will depend upon various factors, including:

- •

- the number of holders of the exchange notes;

- •

- the interest of securities dealers in making a market for the Exchange Notes;

- •

- the overall market for high yield securities;

- •

- our financial performance or prospects; and

- •

- the prospects for companies in our industry generally.

Accordingly, we cannot assure you that a market or liquidity will develop for the Exchange Notes.

19

This prospectus, including the information incorporated into this prospectus by reference, contains "forward-looking statements," which involve risks and uncertainties. All statements, other than statements of historical facts, that are included in or incorporated by reference into this prospectus, or made in presentations, in response to questions or otherwise, that address activities, events or developments that we expect or anticipate to occur in the future, including such matters as projections, capital allocation, future capital expenditures, business strategy, competitive strengths, goals, future acquisitions or dispositions, development or operation of power generation assets, market and industry developments and the growth of our business and operations (often, but not always, through the use of words or phrases such as "will likely result," "are expected to," "will continue," "is anticipated," "estimated," "projection," "target," "goal," "objective" and "outlook"), are forward-looking statements. Although we believe that in making any such forward-looking statement our expectations are based on reasonable assumptions, any such forward-looking statement involves uncertainties and is qualified in its entirety by reference to the discussion of risk factors under "Risk Factors" contained elsewhere in this prospectus, the section captioned "Risk Factors Related to the Company's Business" of our 2016 Form 10-K, which is incorporated in this prospectus by reference, and the following important factors, among others, that could cause our actual results to differ materially from those projected in such forward-looking statement:

- •

- Our ability to maintain and grow our quarterly distributions;

- •

- Our ability to successfully identify, evaluate and consummate acquisitions from third parties;

- •

- Our ability to acquire assets from NRG;

- •

- Our ability to raise additional capital due to our indebtedness, corporate structure, market conditions or otherwise;

- •

- Hazards customary to the power production industry and power generation operations such as fuel and electricity price volatility, unusual weather conditions (including wind and solar conditions), catastrophic weather-related or other damage to facilities, unscheduled generation outages, maintenance or repairs, unanticipated changes to fuel supply costs or availability due to higher demand, shortages, transportation problems or other developments, environmental incidents, or electric transmission or gas pipeline system constraints and the possibility that we may not have adequate insurance to cover losses as a result of such hazards;

- •

- Our ability to operate our businesses efficiently, manage maintenance capital expenditures and costs effectively, and generate earnings and cash flows from our asset-based businesses in relation to our debt and other obligations;

- •

- The willingness and ability of counterparties to our offtake agreements to fulfill their obligations under such agreements;

- •

- Our ability to enter into contracts to sell power and procure fuel on acceptable terms and prices as current offtake agreements expire;

- •

- Government regulation, including compliance with regulatory requirements and changes in market rules, rates, tariffs and environmental laws;

- •

- Changes in law, including judicial decisions;

- •

- Operating and financial restrictions placed on us that are contained in the project-level debt facilities and other agreements of certain subsidiaries and project-level subsidiaries generally, in our Revolving Credit Facility and in our indentures governing the notes and the 2024 Senior Notes (as defined herein);

20

- •

- Cyber terrorism and inadequate cybersecurity, or the occurrence of a catastrophic loss and the possibility that we may not have adequate insurance to cover losses resulting from such hazards or the inability of our insurers to provide coverage;

- •

- Our ability ability to engage in successful mergers and acquisitions activity; and

- •

- Our ability to borrow additional funds and access capital markets, as well as our substantial indebtedness and the possibility that we may incur additional indebtedness going forward.

Forward-looking statements speak only as of the date on which they were made, and except as may be required by applicable law, we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which it is made or to reflect the occurrence of unanticipated events. The foregoing review of factors that could cause our actual results to differ materially from those contemplated in any forward looking statements included in this prospectus should not be construed as exhaustive. New factors emerge from time to time, and it is not possible for us to predict all of them; nor can we assess the impact of each such factor or the extent to which any factor, or combination of factors, may cause results to differ materially from those contained in any forward-looking statement. You should not unduly rely on such forward-looking statements.

21

Purpose of the exchange offer

The exchange offer is designed to provide holders of Old Notes with an opportunity to acquire Exchange Notes which, unlike the Old Notes, will be freely transferable at all times, subject to any restrictions on transfer imposed by state "blue sky" laws and provided that the holder is not our affiliate within the meaning of the Securities Act and represents that the Exchange Notes are being acquired in the ordinary course of the holder's business and the holder is not engaged in, and does not intend to engage in, a distribution of the Exchange Notes.

The Old Notes were originally issued and sold on August 18, 2016, to the initial purchasers, pursuant to the purchase agreement dated August 15, 2016. The Old Notes were issued and sold in a transaction not registered under the Securities Act in reliance upon the exemption provided by Section 4(2) of the Securities Act. The concurrent resale of the Old Notes by the initial purchasers to investors was done in reliance upon the exemptions provided by Rule 144A and Regulation S promulgated under the Securities Act. The Old Notes may not be reoffered, resold or transferred other than (i) to us or our subsidiaries, (ii) to a qualified institutional buyer in compliance with Rule 144A promulgated under the Securities Act, (iii) outside the United States to a non-U.S. person in a transaction complying with Rule 903 or Rule 904 of Regulation S under the Securities Act, (iv) pursuant to the exemption from registration provided by Rule 144 promulgated under the Securities Act (if available), (v) in accordance with another exemption from the registration requirements of the Securities Act or (vi) pursuant to an effective registration statement under the Securities Act.

In connection with the original issuance and sale of the Old Notes, we entered into the Registration Rights Agreement, pursuant to which we agreed to file with the SEC a registration statement covering the exchange by us of the Exchange Notes for the Old Notes, pursuant to the exchange offer. The Registration Rights Agreement provides that we will file with the SEC an exchange offer registration statement on an appropriate form under the Securities Act and offer to holders of Old Notes who are able to make certain representations the opportunity to exchange their Old Notes for Exchange Notes. Under some circumstances, holders of the Old Notes, including holders who are not permitted to participate in the exchange offer, may require us to file, and to cause to become effective, a shelf registration statement covering resales of Old Notes to these holders.

Under existing interpretations by the Staff of the SEC as set forth in no-action letters issued to third parties in other transactions, the Exchange Notes would, in general, be freely transferable after the exchange offer without further registration under the Securities Act; provided, however, that in the case of broker-dealers participating in the exchange offer, a prospectus meeting the requirements of the Securities Act must be delivered by such broker-dealers in connection with resales of the Exchange Notes. We have agreed to furnish a prospectus meeting the requirements of the Securities Act to any such broker-dealer for use in connection with any resale of any Exchange Notes acquired in the exchange offer. A broker-dealer that delivers such a prospectus to purchasers in connection with such resales will be subject to certain of the civil liability provisions under the Securities Act and will be bound by the provisions of the Registration Rights Agreement (including certain indemnification rights and obligations).

We do not intend to seek our own interpretation regarding the exchange offer, and we cannot assure you that the Staff of the SEC would make a similar determination with respect to the Exchange Notes as it has in other interpretations to third parties.

22

Terms of the exchange offer; period for tendering outstanding Old Notes