Exhibit 99.3

PART IV

Item 15 — Exhibits, Financial Statement Schedules

(a)(1) Financial Statements

The following consolidated financial statements of NRG Yield LLC and related notes thereto, together with the reports thereon of KPMG LLP, are included herein:

Consolidated Statements of Income — Years ended December 31, 2016, 2015 and 2014

Consolidated Statements of Comprehensive Income — Years ended December 31, 2016, 2015 and 2014

Consolidated Balance Sheets — As of December 31, 2016 and 2015

Consolidated Statements of Cash Flows — Years ended December 31, 2016, 2015 and 2014

Consolidated Statements of Members' Equity — Years ended December 31, 2016, 2015 and 2014

Notes to Consolidated Financial Statements

(a)(2) Not applicable

(a)(3) Exhibits: See Exhibit Index submitted as a separate section of this report

(b) Exhibits

See Exhibit Index submitted as a separate section of this report

(c) Not applicable

1

Report of Independent Registered Public Accounting Firm

The Members

NRG Yield LLC:

We have audited the accompanying consolidated balance sheets of NRG Yield LLC and subsidiaries as of December 31, 2016 and 2015, and the related consolidated statements of operations, comprehensive (loss) income, members’ equity, and cash flows for each of the years in the three-year period ended December 31, 2016. These consolidated financial statements are the responsibility of the Company’s management. Our responsibility is to express an opinion on these consolidated financial statements and financial statement schedule based on our audits.

We conducted our audits in accordance with the standards of the Public Company Accounting Oversight Board (United States). Those standards require that we plan and perform the audit to obtain reasonable assurance about whether the financial statements are free of material misstatement. An audit includes examining, on a test basis, evidence supporting the amounts and disclosures in the financial statements. An audit also includes assessing the accounting principles used and significant estimates made by management, as well as evaluating the overall financial statement presentation. We believe that our audits provide a reasonable basis for our opinion.

In our opinion, the consolidated financial statements referred to above present fairly, in all material respects, the financial position of NRG Yield LLC and subsidiaries as of December 31, 2016 and 2015, and the results of their operations and their cash flows for each of the years in the three‑year period ended December 31, 2016, in conformity with U.S. generally accepted accounting principles.

(signed) KPMG LLP

Philadelphia, PA

May 9, 2017

2

NRG YIELD LLC

CONSOLIDATED STATEMENTS OF OPERATIONS

| Year ended December 31, | |||||||||||

| (In millions) | 2016 (a) | 2015 (a) | 2014 (a) | ||||||||

| Operating Revenues | |||||||||||

| Total operating revenues | $ | 1,021 | $ | 953 | $ | 828 | |||||

| Operating Costs and Expenses | |||||||||||

| Cost of operations | 306 | 321 | 277 | ||||||||

| Depreciation and amortization | 297 | 297 | 233 | ||||||||

| Impairment losses | 183 | — | — | ||||||||

| General and administrative | 14 | 10 | 8 | ||||||||

| Acquisition-related transaction and integration costs | 1 | 3 | 4 | ||||||||

| Total operating costs and expenses | 801 | 631 | 522 | ||||||||

| Operating Income | 220 | 322 | 306 | ||||||||

| Other Income (Expense) | |||||||||||

| Equity in earnings of unconsolidated affiliates | 60 | 31 | 22 | ||||||||

| Other income, net | 3 | 3 | 6 | ||||||||

| Loss on debt extinguishment | — | (9 | ) | (1 | ) | ||||||

| Interest expense | (268 | ) | (254 | ) | (211 | ) | |||||

| Total other expense, net | (205 | ) | (229 | ) | (184 | ) | |||||

| Net Income | 15 | 93 | 122 | ||||||||

| Less: Net (loss) income attributable to noncontrolling interests | (142 | ) | (51 | ) | 3 | ||||||

| Net Income Attributable to NRG Yield LLC | $ | 157 | $ | 144 | $ | 119 | |||||

(a) Retrospectively adjusted as discussed in Note 1, Nature of Business.

See accompanying notes to consolidated financial statements.

3

NRG YIELD LLC

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

| Year ended December 31, | |||||||||||

2016 (a) | 2015 (a) | 2014 (a) | |||||||||

| (In millions) | |||||||||||

| Net Income | $ | 15 | $ | 93 | $ | 122 | |||||

| Other Comprehensive Income (Loss) | |||||||||||

| Unrealized gain (loss) on derivatives | 13 | (17 | ) | (65 | ) | ||||||

| Other comprehensive income (loss) | 13 | (17 | ) | (65 | ) | ||||||

| Comprehensive Income | 28 | 76 | 57 | ||||||||

| Less: Comprehensive (loss) income attributable to noncontrolling interests | (142 | ) | (52 | ) | 1 | ||||||

| Comprehensive Income Attributable to NRG Yield LLC | $ | 170 | $ | 128 | $ | 56 | |||||

(a) Retrospectively adjusted as discussed in Note 1, Nature of Business.

See accompanying notes to consolidated financial statements.

4

NRG YIELD LLC

CONSOLIDATED BALANCE SHEETS

December 31, 2016 (a) | December 31, 2015 (a) | ||||||

| ASSETS | (In millions) | ||||||

| Current Assets | |||||||

| Cash and cash equivalents | $ | 321 | $ | 110 | |||

| Restricted cash | 165 | 131 | |||||

| Accounts receivable — trade | 92 | 101 | |||||

| Accounts receivable — affiliates | 1 | 4 | |||||

| Inventory | 39 | 36 | |||||

| Derivative instruments | 2 | — | |||||

| Notes receivable — current | 16 | 17 | |||||

| Prepayments and other current assets | 20 | 20 | |||||

| Total current assets | 656 | 419 | |||||

| Property, plant and equipment, net | 5,460 | 5,878 | |||||

| Other Assets | |||||||

| Equity investments in affiliates | 1,152 | 797 | |||||

| Notes receivable — non-current | 14 | 30 | |||||

| Intangible assets, net | 1,286 | 1,362 | |||||

| Derivative instruments | 1 | — | |||||

| Other non-current assets | 51 | 136 | |||||

| Total other assets | 2,504 | 2,325 | |||||

| Total Assets | $ | 8,620 | $ | 8,622 | |||

| LIABILITIES AND MEMBERS' EQUITY | |||||||

| Current Liabilities | |||||||

| Current portion of long-term debt — external | $ | 291 | $ | 264 | |||

| Accounts payable — trade | 23 | 23 | |||||

| Accounts payable — affiliate | 40 | 86 | |||||

| Derivative instruments | 32 | 39 | |||||

| Accrued expenses and other current liabilities | 85 | 76 | |||||

| Total current liabilities | 471 | 488 | |||||

| Other Liabilities | |||||||

| Long-term debt — external | 5,098 | 4,743 | |||||

| Long-term debt — affiliate | 618 | 618 | |||||

| Accounts payable — affiliate | 9 | — | |||||

| Derivative instruments | 44 | 61 | |||||

| Other non-current liabilities | 76 | 72 | |||||

| Total non-current liabilities | 5,845 | 5,494 | |||||

| Total Liabilities | 6,316 | 5,982 | |||||

| Commitments and Contingencies | |||||||

| Members' Equity | |||||||

| Contributed capital | 1,995 | 2,176 | |||||

| Retained earnings | 79 | 100 | |||||

| Accumulated other comprehensive loss | (83 | ) | (96 | ) | |||

| Noncontrolling interest | 313 | 460 | |||||

| Total Members' Equity | 2,304 | 2,640 | |||||

| Total Liabilities and Members’ Equity | $ | 8,620 | $ | 8,622 | |||

(a) Retrospectively adjusted as discussed in Note 1, Nature of Business.

See accompanying notes to consolidated financial statements.

5

NRG YIELD LLC

CONSOLIDATED STATEMENTS OF CASH FLOWS

| Year ended December 31, | |||||||||||

2016 (a) | 2015 (a) | 2014 (a) | |||||||||

| (In millions) | |||||||||||

| Cash Flows from Operating Activities | |||||||||||

| Net income | $ | 15 | $ | 93 | $ | 122 | |||||

| Adjustments to reconcile net income to net cash provided by operating activities: | |||||||||||

| Equity in earnings of unconsolidated affiliates | (60 | ) | (31 | ) | (22 | ) | |||||

| Distributions from unconsolidated affiliates | 58 | 60 | 21 | ||||||||

| Depreciation, amortization and ARO accretion | 300 | 299 | 235 | ||||||||

| Amortization of financing costs | 8 | 7 | 6 | ||||||||

| Amortization of intangibles and out-of-market contracts | 75 | 54 | 28 | ||||||||

| Loss on debt extinguishment | — | 9 | 1 | ||||||||

| Impairment losses | 183 | — | — | ||||||||

| Changes in derivative instruments | (15 | ) | (43 | ) | (12 | ) | |||||

| Loss on disposal of asset components | 6 | 3 | — | ||||||||

| Cash provided by (used in) changes in other working capital: | |||||||||||

| Changes in prepaid and accrued capacity payments | (8 | ) | (12 | ) | — | ||||||

| Changes in other working capital | 7 | (18 | ) | (17 | ) | ||||||

| Net Cash Provided by Operating Activities | 569 | 421 | 362 | ||||||||

| Cash Flows from Investing Activities | |||||||||||

| Acquisition of businesses, net of cash acquired | — | (37 | ) | (901 | ) | ||||||

| Acquisition of Drop Down Assets, net of cash acquired | (77 | ) | (698 | ) | (311 | ) | |||||

| Capital expenditures | (20 | ) | (29 | ) | (60 | ) | |||||

| Receipt of indemnity from supplier | — | — | 57 | ||||||||

| (Increase) decrease in restricted cash | (34 | ) | (1 | ) | 25 | ||||||

| Cash receipts from notes receivable | 17 | 17 | 14 | ||||||||

| Proceeds from renewable energy grants | — | — | 422 | ||||||||

| Return of investment from unconsolidated affiliates | 28 | 42 | 4 | ||||||||

| Investments in unconsolidated affiliates | (83 | ) | (402 | ) | (2 | ) | |||||

| Other | 4 | — | 11 | ||||||||

| Net Cash Used in Investing Activities | (165 | ) | (1,108 | ) | (741 | ) | |||||

| Cash Flows from Financing Activities | |||||||||||

| Contributions from tax equity investors, net of distributions | 5 | 122 | 190 | ||||||||

| Capital contributions from NRG | — | — | 2 | ||||||||

| Distributions and return of capital to NRG prior to the acquisition of Drop Down Assets | (170 | ) | (76 | ) | (333 | ) | |||||

| Proceeds from the issuance of class A and class C units | — | 599 | 630 | ||||||||

| Payments of distributions | (183 | ) | (139 | ) | (101 | ) | |||||

| Proceeds from the revolving credit facility | 60 | 551 | 500 | ||||||||

| Payments for the revolving credit facility | (366 | ) | (245 | ) | — | ||||||

| Proceeds from issuance of long-term debt — external | 740 | 6 | 178 | ||||||||

| Proceeds from issuance of long-term debt — affiliate | — | 281 | 337 | ||||||||

| Payments of debt issuance costs | (15 | ) | (7 | ) | (28 | ) | |||||

| Payments for long-term debt — external | (264 | ) | (724 | ) | (626 | ) | |||||

| Net Cash (Used in) Provided by Financing Activities | (193 | ) | 368 | 749 | |||||||

| Net Increase (Decrease) in Cash and Cash Equivalents | 211 | (319 | ) | 370 | |||||||

| Cash and Cash Equivalents at Beginning of Period | 110 | 429 | 59 | ||||||||

| Cash and Cash Equivalents at End of Period | $ | 321 | $ | 110 | $ | 429 | |||||

| Supplemental Disclosures | |||||||||||

| Interest paid, net of amount capitalized | $ | (266 | ) | $ | (274 | ) | $ | (192 | ) | ||

| Non-cash investing and financing activities: | |||||||||||

| Additions (reductions) to fixed assets for accrued capital expenditures | 3 | 1 | (21 | ) | |||||||

| Decrease to fixed assets for accrued grants | — | — | 34 | ||||||||

| Increase in debt due to accrued interest converted to debt | — | — | 11 | ||||||||

| Net contributions from NRG (net distributions/return of capital to NRG), non cash | $ | 66 | $ | (13 | ) | $ | 1,058 | ||||

(a) Retrospectively adjusted as discussed in Note 1, Nature of Business.

See accompanying notes to consolidated financial statements.

6

NRG YIELD LLC

CONSOLIDATED STATEMENTS OF MEMBERS' EQUITY

| (In millions) | Contributed Capital | Retained Earnings | Accumulated Other Comprehensive Loss | Noncontrolling Interest | Total Members' Equity | |||||||||||||||

Balances at December 31, 2013 (a) | $ | 1,302 | $ | 101 | $ | (17 | ) | $ | 58 | $ | 1,444 | |||||||||

| Members' equity - March 2017 Drop Down Assets | 91 | 14 | — | — | 105 | |||||||||||||||

| Balances at December 31, 2013 | $ | 1,393 | $ | 115 | $ | (17 | ) | $ | 58 | $ | 1,549 | |||||||||

Net income (c) | — | 119 | — | 3 | 122 | |||||||||||||||

Unrealized loss on derivatives (c) | — | — | (63 | ) | (2 | ) | (65 | ) | ||||||||||||

| Payment for June 2014 Drop Down Assets | (357 | ) | — | — | — | (357 | ) | |||||||||||||

Capital contributions from NRG, non-cash (b)(c) | 922 | — | — | 136 | 1,058 | |||||||||||||||

Distributions and returns of capital to NRG, net of contributions (c) | (280 | ) | — | — | (51 | ) | (331 | ) | ||||||||||||

| Capital contributions from tax equity investors | — | — | — | 190 | 190 | |||||||||||||||

| Proceeds from the issuance of Class A units | 630 | — | — | — | 630 | |||||||||||||||

| Distributions paid to NRG on Class B and Class D units | — | (60 | ) | — | — | (60 | ) | |||||||||||||

| Distributions paid to Yield, Inc. | — | (41 | ) | — | — | (41 | ) | |||||||||||||

| Balances at December 31, 2014 | $ | 2,308 | $ | 133 | $ | (80 | ) | $ | 334 | $ | 2,695 | |||||||||

Net income (loss) (c) | — | 144 | — | (51 | ) | 93 | ||||||||||||||

Unrealized loss on derivatives (c) | — | — | (16 | ) | (1 | ) | (17 | ) | ||||||||||||

| Payment for January 2015 and November 2015 Drop Down Assets | (698 | ) | — | — | — | (698 | ) | |||||||||||||

| Capital contributions from tax equity investors | — | — | — | 122 | 122 | |||||||||||||||

| Noncontrolling interest acquired in Spring Canyon acquisition | — | — | — | 74 | 74 | |||||||||||||||

Distributions paid to NRG, net of contributions(c) | (28 | ) | (38 | ) | — | (10 | ) | (76 | ) | |||||||||||

Distributions paid to NRG, net of contributions, non-cash (c) | (5 | ) | — | (8 | ) | (13 | ) | |||||||||||||

| Proceeds from the issuance of Class C Common Stock | 599 | — | — | — | 599 | |||||||||||||||

| Distributions paid to NRG on Class B and Class D units | — | (70 | ) | — | — | (70 | ) | |||||||||||||

| Distributions paid to Yield, Inc. | — | (69 | ) | — | — | (69 | ) | |||||||||||||

| Balances at December 31, 2015 | $ | 2,176 | $ | 100 | $ | (96 | ) | $ | 460 | $ | 2,640 | |||||||||

| Net income (loss) | — | 157 | — | (142 | ) | 15 | ||||||||||||||

| Unrealized gain on derivatives | — | — | 13 | — | 13 | |||||||||||||||

| Payment for CVSR Drop Down Asset | (77 | ) | — | — | — | (77 | ) | |||||||||||||

| Distribution to Yield, Inc., non-cash | — | (5 | ) | — | — | (5 | ) | |||||||||||||

| Capital contributions from tax equity investors, net of distributions | — | — | — | 5 | 5 | |||||||||||||||

| Distributions paid to NRG | (170 | ) | — | — | (10 | ) | (180 | ) | ||||||||||||

| Contributions from NRG, net of distributions, non-cash | 66 | — | — | — | 66 | |||||||||||||||

| Distributions paid to NRG on Class B and Class D units | — | (81 | ) | — | — | (81 | ) | |||||||||||||

| Distributions paid to Yield, Inc. | — | (92 | ) | — | — | (92 | ) | |||||||||||||

| Balances at December 31, 2016 | $ | 1,995 | $ | 79 | $ | (83 | ) | $ | 313 | $ | 2,304 | |||||||||

(a) As previously reported in the Company's audited financial statements for the year ended December 31, 2016, included in the Company's 2016 Form 10-K.

(b) Capital contributions from NRG, non-cash, primarily represent Drop Down Assets' equity transferred from NRG to the Company in accordance with guidance on business combinations between entities under common control, as further described in Note 1, Nature of Business.

(c) Retrospectively adjusted, as discussed in Note 1, Nature of Business.

See accompanying notes to consolidated financial statements.

7

NRG YIELD LLC

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

Note 1 — Nature of Business

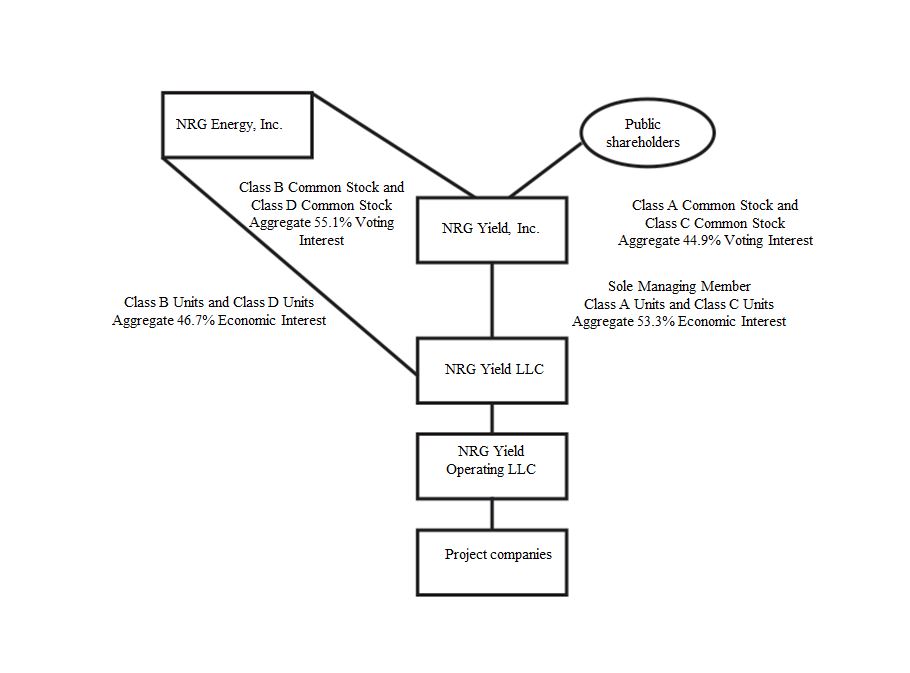

NRG Yield LLC, together with its consolidated subsidiaries, or the Company, is the primary vehicle through which NRG owns, operates and acquires contracted renewable and conventional generation and thermal infrastructure assets. NRG owns 100% of the Company's Class B units and Class D units and receives distributions through its ownership of these units. NRG Yield, Inc., or Yield, Inc., owns 100% of the Company's Class A units and Class C units. NRG Yield LLC, through its wholly owned subsidiary, NRG Yield Operating LLC, or Yield Operating LLC, holds a portfolio of renewable and conventional generation and thermal infrastructure assets, primarily located in the Northeast, Southwest, Midwest and California regions of the U.S.

Yield, Inc. closed its initial public offering of Class A common stock in July 2013, which was then followed by a Class A common stock offering in July 2014, a Recapitalization in May 2015, as described below, and a Class C common stock offering in June 2015.

Effective May 14, 2015, Yield, Inc. amended its certificate of incorporation to create two new classes of capital stock, Class C common stock and Class D common stock, and distributed shares of the Class C common stock and Class D common stock to holders of Yield, Inc.'s outstanding Class A common stock and Class B common stock, respectively, through a stock split. The stock split is referred to as the Recapitalization. The Company also amended its operating agreement to reflect the Recapitalization. Effective May 14, 2015, each Class A unit of the Company was automatically reclassified into one Class A unit and one Class C unit and each Class B unit of the Company was automatically reclassified into one Class B unit and one Class D unit.

The following table represents the structure of the Company as of December 31, 2016:

8

As of December 31, 2016, the Company's operating assets are comprised of the following projects:

| Projects | Percentage Ownership | Net Capacity (MW) (a) | Offtake Counterparty | Expiration | ||||||

| Conventional | ||||||||||

| El Segundo | 100 | % | 550 | Southern California Edison | 2023 | |||||

| GenConn Devon | 50 | % | 95 | Connecticut Light & Power | 2040 | |||||

| GenConn Middletown | 50 | % | 95 | Connecticut Light & Power | 2041 | |||||

| Marsh Landing | 100 | % | 720 | Pacific Gas and Electric | 2023 | |||||

| Walnut Creek | 100 | % | 485 | Southern California Edison | 2023 | |||||

| 1,945 | ||||||||||

| Utility Scale Solar | ||||||||||

| Agua Caliente | 16 | % | 46 | Pacific Gas and Electric | 2039 | |||||

| Alpine | 100 | % | 66 | Pacific Gas and Electric | 2033 | |||||

| Avenal | 50 | % | 23 | Pacific Gas and Electric | 2031 | |||||

| Avra Valley | 100 | % | 26 | Tucson Electric Power | 2032 | |||||

| Blythe | 100 | % | 21 | Southern California Edison | 2029 | |||||

| Borrego | 100 | % | 26 | San Diego Gas and Electric | 2038 | |||||

| CVSR | 100 | % | 250 | Pacific Gas and Electric | 2038 | |||||

| Desert Sunlight 250 | 25 | % | 63 | Southern California Edison | 2035 | |||||

| Desert Sunlight 300 | 25 | % | 75 | Pacific Gas and Electric | 2040 | |||||

| Kansas South | 100 | % | 20 | Pacific Gas and Electric | 2033 | |||||

| Roadrunner | 100 | % | 20 | El Paso Electric | 2031 | |||||

| TA High Desert | 100 | % | 20 | Southern California Edison | 2033 | |||||

Utah Solar Portfolio (e) | 50 | % | 265 | PacifiCorp | 2036 | |||||

| 921 | ||||||||||

| Distributed Solar | ||||||||||

| AZ DG Solar Projects | 100 | % | 5 | Various | 2025 - 2033 | |||||

| PFMG DG Solar Projects | 51 | % | 4 | Various | 2032 | |||||

| 9 | ||||||||||

| Wind | ||||||||||

| Alta I | 100 | % | 150 | Southern California Edison | 2035 | |||||

| Alta II | 100 | % | 150 | Southern California Edison | 2035 | |||||

| Alta III | 100 | % | 150 | Southern California Edison | 2035 | |||||

| Alta IV | 100 | % | 102 | Southern California Edison | 2035 | |||||

| Alta V | 100 | % | 168 | Southern California Edison | 2035 | |||||

Alta X (b) | 100 | % | 137 | Southern California Edison | 2038 | |||||

Alta XI (b) | 100 | % | 90 | Southern California Edison | 2038 | |||||

| Buffalo Bear | 100 | % | 19 | Western Farmers Electric Co-operative | 2033 | |||||

Crosswinds (b) | 74.3 | % | 16 | Corn Belt Power Cooperative | 2027 | |||||

Elbow Creek (b) | 75 | % | 92 | NRG Power Marketing LLC | 2022 | |||||

Elkhorn Ridge (b) | 50.3 | % | 41 | Nebraska Public Power District | 2029 | |||||

Forward (b) | 75 | % | 22 | Constellation NewEnergy, Inc. | 2017 | |||||

Goat Wind (b) | 74.9 | % | 113 | Dow Pipeline Company | 2025 | |||||

Hardin (b) | 74.3 | % | 11 | Interstate Power and Light Company | 2027 | |||||

| Laredo Ridge | 100 | % | 80 | Nebraska Public Power District | 2031 | |||||

Lookout (b) | 75 | % | 29 | Southern Maryland Electric Cooperative | 2030 | |||||

Odin (b) | 74.9 | % | 15 | Missouri River Energy Services | 2028 | |||||

| Pinnacle | 100 | % | 55 | Maryland Department of General Services and University System of Maryland | 2031 | |||||

San Juan Mesa (b) | 56.3 | % | 68 | Southwestern Public Service Company | 2025 | |||||

9

| Projects | Percentage Ownership | Net Capacity (MW) (a) | Offtake Counterparty | Expiration | ||||||

Sleeping Bear (b) | 75 | % | 71 | Public Service Company of Oklahoma | 2032 | |||||

| South Trent | 100 | % | 101 | AEP Energy Partners | 2029 | |||||

Spanish Fork (b) | 75 | % | 14 | PacifiCorp | 2028 | |||||

Spring Canyon II (b) | 90.1 | % | 29 | Platte River Power Authority | 2039 | |||||

Spring Canyon III (b) | 90.1 | % | 25 | Platte River Power Authority | 2039 | |||||

| Taloga | 100 | % | 130 | Oklahoma Gas & Electric | 2031 | |||||

Wildorado (b) | 74.9 | % | 121 | Southwestern Public Service Company | 2027 | |||||

| 1,999 | ||||||||||

| Thermal | ||||||||||

Thermal equivalent MWt(c) | 100 | % | 1,319 | Various | Various | |||||

| NRG Energy Center Dover LLC | 100 | % | 103 | NRG Power Marketing LLC | 2018 | |||||

| Thermal generation | 100 | % | 20 | Various | Various | |||||

| 1,442 | ||||||||||

Total net capacity (excluding equivalent MWt) (d) | 4,997 | |||||||||

(a) Net capacity represents the maximum, or rated, generating capacity of the facility multiplied by the Company's percentage ownership in the facility as of December 31, 2016.

(b) Projects are part of tax equity arrangements.

(c) For thermal energy, net capacity represents MWt for steam or chilled water and excludes 134 MWt available under the right-to-use provisions contained in agreements between two of the Company's thermal facilities and certain of its customers.

(d) NRG Yield's total generation capacity is net of 6 MWs for noncontrolling interest for Spring Canyon II and III. NRG Yield's generation capacity including this noncontrolling interest was 5,003 MWs.

(e) Represents interests in Four Brothers Solar, LLC, Granite Mountain Holdings, LLC, and Iron Springs Holdings, LLC, all acquired as part of the March 2017 Drop Down Assets acquisition (ownership percentage is based upon cash to be distributed).

In addition to the facilities owned or leased in the table above, the Company entered into partnerships to own or purchase solar power generation projects, as well as other ancillary related assets from a related party via intermediate funds. The Company does not consolidate these partnerships and accounts for them as equity method investments. The Company's net interest in these projects is 131 MW based on cash to be distributed. For further discussions, refer to Note 5, Investments Accounted for by the Equity Method and Variable Interest Entities to the Consolidated Financial Statements.

Substantially all of the Company's generation assets are under long-term contractual arrangements for the output or capacity from these assets. The thermal assets are comprised of district energy systems and combined heat and power plants that produce steam, hot water and/or chilled water and, in some instances, electricity at a central plant. Three out of the fourteen district energy systems are subject to rate regulation by state public utility commissions while the other district energy systems have rates determined by negotiated bilateral contracts.

As described in Note 13, Related Party Transactions, the Company has a management services agreement with NRG for various services, including human resources, accounting, tax, legal, information systems, treasury, and risk management.

During the years ending December 31, 2016 and 2015 the Company completed three acquisitions of Drop Down Assets from NRG. The accounting guidance requires retrospective combination of the entities for all periods presented as if the combination has been in effect from the beginning of the financial statement period or from the date the entities were under common control (if later than the beginning of the financial statement period). For further discussion, see Note 3, Business Acquisitions.

In addition, as further described in Note 3, Business Acquisitions, on March 27, 2017, the Company acquired the following from NRG, referred to as the March 2017 Drop Down Assets: (i) Agua Caliente Borrower 2 LLC, which owns a 16% interest in the Agua Caliente solar farm, one of the NRG ROFO assets and (ii) NRG's interests in seven utility-scale solar farms located in Utah that were part of NRG's November 2, 2016 acquisition of projects from SunEdison, or Utah Solar Portfolio. The Company paid total cash consideration of $130 million, plus a $1 million working capital adjustment, and assumed non-recourse debt of $ $328 million, which is consolidated, as well as its pro-rata share of non-recourse project-level debt of $135 million. The acquisition was funded with cash on hand. The acquisition of the March 2017 Drop Down Assets was accounted for as a transfer of entities under common control. In connection with the retrospective adjustment of prior periods, the Company adjusted its financial statements to reflect its results of operations, financial position and cash flows as if it recorded its interests in the Aqua Caliente Borrower 2 LLC from the beginning of the financial statement period, and its interests in the Utah Solar Portfolio from November 2, 2016.

10

Note 2 — Summary of Significant Accounting Policies

Basis of Presentation and Principles of Consolidation

The Company's consolidated financial statements have been prepared in accordance with GAAP. The ASC is the source of authoritative GAAP to be applied by nongovernmental entities. In addition, the rules and interpretative releases of the SEC under authority of federal securities laws are also sources of authoritative GAAP for SEC registrants.

The consolidated financial statements include the Company's accounts and operations and those of its subsidiaries in which it has a controlling interest. All significant intercompany transactions and balances have been eliminated in consolidation. The usual condition for a controlling financial interest is ownership of a majority of the voting interests of an entity. However, a controlling financial interest may also exist through arrangements that do not involve controlling voting interests. As such, the Company applies the guidance of ASC 810, Consolidations, or ASC 810, to determine when an entity that is insufficiently capitalized or not controlled through its voting interests, referred to as a variable interest entity, or VIE, should be consolidated.

Cash and Cash Equivalents

Cash and cash equivalents include highly liquid investments with an original maturity of three months or less at the time of purchase. Cash and cash equivalents held at project subsidiaries was $110 million and $93 million as of December 31, 2016 and 2015, respectively.

Restricted Cash

Restricted cash consists primarily of funds held to satisfy the requirements of certain debt agreements and funds held within the Company's projects that are restricted in their use. Of these funds as of December 31, 2016, approximately $25 million is designated for current debt service payments, $13 million is designated to fund operating expenses and $37 million is designated for distributions to the Company, with the remaining $90 million restricted for reserves including debt service, performance obligations and other reserves, as well as capital expenditures.

Trade Receivables and Allowance for Doubtful Accounts

Trade receivables are reported on the balance sheet at the invoiced amount adjusted for any write-offs and the allowance for doubtful accounts. The allowance for doubtful accounts is reviewed periodically based on amounts past due and significance. The allowance for doubtful accounts was immaterial as of December 31, 2016 and 2015.

Inventory

Inventory consists principally of spare parts and fuel oil. Spare parts inventory is valued at weighted average cost, unless evidence indicates that the weighted average cost will not be recovered with a normal profit in the ordinary course of business. Fuel oil inventory is valued at the lower of weighted average cost or market. The Company removes fuel inventories as they are used in the production of steam, chilled water or electricity. Spare parts inventory are removed when they are used for repairs, maintenance or capital projects.

Property, Plant and Equipment

Property, plant and equipment are stated at cost or, in the case of third party business acquisitions, fair value; however impairment adjustments are recorded whenever events or changes in circumstances indicate that their carrying values may not be recoverable. See Note 3, Business Acquisitions, for more information on acquired property, plant and equipment. Significant additions or improvements extending asset lives are capitalized as incurred, while repairs and maintenance that do not improve or extend the life of the respective asset are charged to expense as incurred. Depreciation is computed using the straight-line method over the estimated useful lives. Certain assets and their related accumulated depreciation amounts are adjusted for asset retirements and disposals with the resulting gain or loss included in cost of operations in the consolidated statements of operations.

Asset Impairments

Long-lived assets that are held and used are reviewed for impairment whenever events or changes in circumstances indicate carrying values may not be recoverable. Such reviews are performed in accordance with ASC 360. An impairment loss is indicated if the total future estimated undiscounted cash flows expected from an asset are less than its carrying value. An impairment charge is measured by the difference between an asset's carrying amount and fair value with the difference recorded in operating costs and expenses in the statements of operations. Fair values are determined by a variety of valuation methods, including appraisals, sales prices of similar assets and present value techniques. For further discussion of the Company's long-lived asset impairments, refer to Note 9, Asset Impairments.

11

Investments accounted for by the equity method are reviewed for impairment in accordance with ASC 323, Investments-Equity Method and Joint Ventures, which requires that a loss in value of an investment that is an other-than-temporary decline should be recognized. The Company identifies and measures losses in the value of equity method investments based upon a comparison of fair value to carrying value.

Debt Issuance Costs

Debt issuance costs are capitalized and amortized as interest expense on a basis which approximates the effective interest method over the term of the related debt. Debt issuance costs related to the long term debt are presented as a direct deduction from the carrying amount of the related debt in both the current and prior periods. Debt issuance costs related to the senior secured revolving credit facility line of credit are recorded as a non-current asset on the balance sheet and are amortized over the term of the loan.

Intangible Assets

Intangible assets represent contractual rights held by the Company. The Company recognizes specifically identifiable intangible assets including power purchase agreements, leasehold improvements, customer relationships, customer contracts, and development rights when specific rights and contracts are acquired. These intangible assets are amortized primarily on a straight-line basis.

Notes Receivable

Notes receivable consist of receivables related to the financing of required network upgrades. The notes issued with respect to network upgrades will be repaid within a 5-year period following the date each facility reached commercial operations.

Income Taxes

The Company is classified as a partnership for federal and state income tax purposes. Therefore, federal and state income taxes are assessed at the partner level. Accordingly, no provision has been made for federal or state income taxes in the accompanying financial statements.

Revenue Recognition

Thermal Revenues

Steam and chilled water revenue is recognized based on customer usage as determined by meter readings taken at month-end. Some locations read customer meters throughout the month, and recognize estimated revenue for the period between meter read date and month-end. The Thermal Business subsidiaries collect and remit state and local taxes associated with sales to their customers, as required by governmental authorities. These taxes are presented on a net basis in the income statement.

Power Purchase Agreements, or PPAs

The majority of the Company’s revenues are obtained through PPAs or other contractual agreements, which are accounted for as operating leases under ASC 840. ASC 840 requires the minimum lease payments received to be amortized over the term of the lease and contingent rentals are recorded when the achievement of the contingency becomes probable. Judgment is required by management in determining the economic life of each generating facility, in evaluating whether certain lease provisions constitute minimum payments or represent contingent rent and other factors in determining whether a contract contains a lease and whether the lease is an operating lease or capital lease.

Certain of these leases have no minimum lease payments and all of the rental income under these leases is recorded as contingent rent on an actual basis when the electricity is delivered. The contingent rental income recognized in the years ended December 31, 2016, 2015 and 2014 was $553 million, $416 million and $296 million, respectively.

Derivative Financial Instruments

The Company accounts for derivative financial instruments under ASC 815, Derivatives and Hedging, or ASC 815, which requires the Company to record all derivatives on the balance sheet at fair value unless they qualify for a NPNS exception. Changes in the fair value of non-hedge derivatives are immediately recognized in earnings. Changes in the fair value of derivatives accounted for as hedges, if elected for hedge accounting, are either:

| • | Recognized in earnings as an offset to the changes in the fair value of the related hedged assets, liabilities and firm commitments; or |

12

| • | Deferred and recorded as a component of accumulated OCI until the hedged transactions occur and are recognized in earnings. |

The Company's primary derivative instruments are power purchase or sale contracts used to mitigate variability in earnings due to fluctuations in market prices, fuels purchase contracts used to control customer reimbursable fuel cost, and interest rate instruments used to mitigate variability in earnings due to fluctuations in interest rates. On an ongoing basis, the Company assesses the effectiveness of all derivatives that are designated as hedges for accounting purposes in order to determine that each derivative continues to be highly effective in offsetting changes in fair values or cash flows of hedged items. Internal analyses that measure the statistical correlation between the derivative and the associated hedged item determine the effectiveness of such a contract designated as a hedge. If it is determined that the derivative instrument is not highly effective as a hedge, hedge accounting will be discontinued prospectively. In this case, the gain or loss previously deferred in accumulated OCI would be frozen until the underlying hedged item is delivered unless the transaction being hedged is no longer probable of occurring in which case the amount in OCI would be immediately reclassified into earnings. If the derivative instrument is terminated, the effective portion of this derivative deferred in accumulated OCI will be frozen until the underlying hedged item is delivered.

Revenues and expenses on contracts that qualify for the NPNS exception are recognized when the underlying physical transaction is delivered. While these contracts are considered derivative financial instruments under ASC 815, they are not recorded at fair value, but on an accrual basis of accounting. If it is determined that a transaction designated as NPNS no longer meets the scope exception, the fair value of the related contract is recorded on the balance sheet and immediately recognized through earnings.

Concentrations of Credit Risk

Financial instruments which potentially subject the Company to concentrations of credit risk consist primarily of accounts receivable, notes receivable and derivative instruments, which are concentrated within entities engaged in the energy and financial industry. These industry concentrations may impact the overall exposure to credit risk, either positively or negatively, in that the customers may be similarly affected by changes in economic, industry or other conditions. In addition, many of the Company's projects have only one customer. However, the Company believes that the credit risk posed by industry concentration is offset by the diversification and creditworthiness of its customer base. See Note 6, Fair Value of Financial Instruments, for a further discussion of derivative concentrations and Note 12, Segment Reporting, for concentration of counterparties.

Fair Value of Financial Instruments

The carrying amount of cash and cash equivalents, restricted cash, accounts receivable, accounts receivable - affiliate, accounts payable, current portion of account payable - affiliate, and accrued expenses and other current liabilities approximate fair value because of the short-term maturity of these instruments. See Note 6, Fair Value of Financial Instruments, for a further discussion of fair value of financial instruments.

Asset Retirement Obligations

Asset retirement obligations, or AROs, are accounted for in accordance with ASC 410-20, Asset Retirement Obligations, or ASC 410-20. Retirement obligations associated with long-lived assets included within the scope of ASC 410-20 are those for which a legal obligation exists under enacted laws, statutes, and written or oral contracts, including obligations arising under the doctrine of promissory estoppel, and for which the timing and/or method of settlement may be conditional on a future event. ASC 410-20 requires an entity to recognize the fair value of a liability for an ARO in the period in which it is incurred and a reasonable estimate of fair value can be made.

Upon initial recognition of a liability for an ARO, the asset retirement cost is capitalized by increasing the carrying amount of the related long-lived asset by the same amount. Over time, the liability is accreted to its future value, while the capitalized cost is depreciated over the useful life of the related asset. The Company's AROs are primarily related to the future dismantlement of equipment on leased property and environmental obligations related to site closures and fuel storage facilities. The Company records AROs as part of other non-current liabilities on its balance sheet.

The following table represents the balance of ARO obligations as of December 31, 2016 and 2015, along with the additions and accretion related to the Company's ARO obligations for the year ended December 31, 2016:

| (In millions) | |||

| Balance as of December 31, 2015 | $ | 43 | |

| Revisions in estimates for current obligations | 2 | ||

| Accretion — expense | 3 | ||

| Balance as of December 31, 2016 | $ | 48 | |

13

Guarantees

The Company enters into various contracts that include indemnification and guarantee provisions as a routine part of its business activities. Examples of these contracts include operation and maintenance agreements, service agreements, commercial sales arrangements and other types of contractual agreements with vendors and other third parties, as well as affiliates. These contracts generally indemnify the counterparty for tax, environmental liability, litigation and other matters, as well as breaches of representations, warranties and covenants set forth in these agreements. Because many of the guarantees and indemnities the Company issues to third parties and affiliates do not limit the amount or duration of its obligations to perform under them, there exists a risk that the Company may have obligations in excess of the amounts agreed upon in the contracts mentioned above. For those guarantees and indemnities that do not limit the liability exposure, the Company may not be able to estimate what the liability would be, until a claim is made for payment or performance, due to the contingent nature of these contracts.

Investments Accounted for by the Equity Method

The Company has investments in various energy projects accounted for by the equity method, seven of which are VIEs, where the Company is not a primary beneficiary, and two of which are owned by a subsidiary that is consolidated as a VIE, as described in Note 5, Investments Accounted for by the Equity Method and Variable Interest Entities. The equity method of accounting is applied to these investments in affiliates because the ownership structure prevents the Company from exercising a controlling influence over the operating and financial policies of the projects. Under this method, equity in pre-tax income or losses of the investments is reflected as equity in earnings of unconsolidated affiliates. Distributions from equity method investments that represent earnings on the Company's investment are included within cash flows from operating activities and distributions from equity method investments that represent a return of the Company's investment are included within cash flows from investing activities.

Sale Leaseback Arrangements

The Company is party to sale-leaseback arrangements that provide for the sale of certain assets to a third party and simultaneous leaseback to the Company. In accordance with ASC 840-40, Sale-Leaseback Transactions, if the seller-lessee retains, through the leaseback, substantially all of the benefits and risks incident to the ownership of the property sold, the sale-leaseback transaction is accounted for as a financing arrangement. An example of this type of continuing involvement would include an option to repurchase the assets or the buyer-lessor having the option to sell the assets back to the Company. This provision is included in most of the Company’s sale-leaseback arrangements. As such, the Company accounts for these arrangements as financings.

Under the financing method, the Company does not recognize as income any of the sale proceeds received from the lessor that contractually constitutes payment to acquire the assets subject to these arrangements. Instead, the sale proceeds received are accounted for as financing obligations and leaseback payments made by the Company are allocated between interest expense and a reduction to the financing obligation. Interest on the financing obligation is calculated using the Company’s incremental borrowing rate at the inception of the arrangement on the outstanding financing obligation. Judgment is required to determine the appropriate borrowing rate for the arrangement and in determining any gain or loss on the transaction that would be recorded either at the end of or over the lease term.

Business Combinations

The Company accounts for its business combinations in accordance with ASC 805, Business Combinations, or ASC 805. For third party acquisitions, ASC 805 requires an acquirer to recognize and measure in its financial statements the identifiable assets acquired, the liabilities assumed, and any noncontrolling interest in the acquiree at fair value at the acquisition date. It also recognizes and measures the goodwill acquired or a gain from a bargain purchase in the business combination and determines what information to disclose to enable users of an entity's financial statements to evaluate the nature and financial effects of the business combination. In addition, transaction costs are expensed as incurred. For acquisitions that relate to entities under common control, ASC 805 requires retrospective combination of the entities for all periods presented as if the combination has been in effect from the beginning of the financial statement period of from the date the entities were under common control (if later than the beginning of the financial statement period). The difference between the cash paid and historical value of the entities' equity is recorded as a distribution/contribution from/to NRG with the offset to contributed capital. Transaction costs are expensed as incurred.

14

Use of Estimates

The preparation of consolidated financial statements in accordance with GAAP requires management to make estimates and assumptions. These estimates and assumptions impact the reported amount of assets and liabilities and disclosures of contingent assets and liabilities as of the date of the consolidated financial statements. They also impact the reported amount of net earnings during the reporting period. Actual results could be different from these estimates.

In recording transactions and balances resulting from business operations, the Company uses estimates based on the best information available. Estimates are used for such items as plant depreciable lives, uncollectible accounts, environmental liabilities, acquisition accounting and legal costs incurred in connection with recorded loss contingencies, among others. In addition, estimates are used to test long-lived assets for impairment and to determine the fair value of impaired assets. As better information becomes available or actual amounts are determinable, the recorded estimates are revised. Consequently, operating results can be affected by revisions to prior accounting estimates.

Tax Equity Arrangements

Certain portions of the Company’s noncontrolling interests in subsidiaries represent third-party interests in the net assets under certain tax equity arrangements, which are consolidated by the Company, that have been entered into to finance the cost of wind facilities eligible for certain tax credits. Additionally, certain portions of the Company’s investments in unconsolidated affiliates reflect the Company’s interests in tax equity arrangements, that are not consolidated by the Company, that have been entered into to finance the cost of distributed solar energy systems under operating leases or PPAs eligible for certain tax credits. The Company has determined that the provisions in the contractual agreements of these structures represent substantive profit sharing arrangements. Further, the Company has determined that the appropriate methodology for calculating the noncontrolling interest and investment in unconsolidated affiliates that reflects the substantive profit sharing arrangements is a balance sheet approach utilizing the hypothetical liquidation at book value, or HLBV, method. Under the HLBV method, the amounts reported as noncontrolling interests and investment in unconsolidated affiliates represent the amounts the investors to the tax equity arrangements would hypothetically receive at each balance sheet date under the liquidation provisions of the contractual agreements, assuming the net assets of the funding structures were liquidated at their recorded amounts determined in accordance with GAAP. The investors’ interests in the results of operations of the funding structures are determined as the difference in noncontrolling interests and investment in unconsolidated affiliates at the start and end of each reporting period, after taking into account any capital transactions between the structures and the funds’ investors. The calculations utilized to apply the HLBV method include estimated calculations of taxable income or losses for each reporting period.

Reclassifications

Certain prior year amounts have been reclassified for comparative purposes.

Recent Accounting Developments

ASU 2016-18 — In November 2016, the FASB issued ASU No. 2016-18, Statement of Cash Flows (Topic 230), Restricted Cash, or ASU No. 2016-18. The amendments of ASU No. 2016-18 were issued to address the diversity in classification and presentation of changes in restricted cash and restricted cash equivalents on the statement of cash flows which is currently not addressed under Topic 230. The amendments of ASU No. 2016-18 would require an entity to include amounts generally described as restricted cash and restricted cash equivalents with cash and cash equivalents when reconciling the beginning of period and end of period total amounts on the statement of cash flows. The amendments of ASU No. 2016-18 are effective for annual reporting periods beginning after December 15, 2017, and interim periods within those annual periods. Early adoption is permitted and the adoption of ASU No. 2016-18 should be applied retrospectively. The Company is currently evaluating the impact of the standard on the Company’s statement of cash flows.

ASU 2016-16 — In October 2016, the FASB issued ASU No. 2016-16, Income Taxes (Topic 740), Intra-Entity Transfers of Assets Other Than Inventory, or ASU No. 2016-16. The amendments of ASU No. 2016-16 were issued to improve the accounting for the income tax consequences of intra-entity transfers of assets other than inventory. Current GAAP prohibits the recognition of current and deferred income taxes for an intra-entity asset transfer until the asset has been sold to an outside party which has resulted in diversity in practice and increased complexity within financial reporting. The amendments of ASU No. 2016-16 would require an entity to recognize the income tax consequences of an intra-entity transfer of an asset other than inventory when the transfer occurs and do not require new disclosure requirements. The amendments of ASU No. 2016-16 are effective for annual reporting periods beginning after December 15, 2017, and interim periods within those annual periods. Early adoption is permitted and the adoption of ASU No. 2016-16 should be applied on a modified retrospective basis through a cumulative-effect adjustment directly to retained earnings as of the beginning of the period of adoption. The Company is currently evaluating the impact of the standard on the Company's results of operations, cash flows and financial position.

15

ASU 2016-15 — In August 2016, the FASB issued ASU No. 2016-15, Statement of Cash Flows (Topic 230), Classification of Certain Cash Receipts and Cash Payments, or ASU No. 2016-15. The amendments of ASU No. 2016-15 were issued to address eight specific cash flow issues for which stakeholders have indicated to the FASB that a diversity in practice existed in how entities were presenting and classifying these items in the statement of cash flows. The issues addressed by ASU No. 2016-15 include but are not limited to the classification of debt prepayment and debt extinguishment costs, payments made for contingent consideration for a business combination, proceeds from the settlement of insurance proceeds, distributions received from equity method investees and separately identifiable cash flows and the application of the predominance principle. The amendments of ASU No. 2016-15 are effective for public entities for fiscal years beginning after December 15, 2017 and interim periods in those fiscal years. Early adoption is permitted, including adoption in an interim fiscal period with all amendments adopted in the same period. The adoption of ASU No. 2016-15 is required to be applied retrospectively. The Company is currently evaluating the impact of the standard on the Company's statement of cash flows.

ASU 2016-07 — In March 2016, the FASB issued ASU No. 2016-07, Investments - Equity Method and Joint Ventures (Topic 323), or ASU No. 2016-07. The amendments of ASU No. 2016-07 eliminate the requirement that when an investment qualifies for use of the equity method as a result of an increase in the level of ownership interest or degree of influence, an investor must adjust the investment, results of operations, and retained earnings retroactively on a step-by-step basis as if the equity method had been in effect during all previous periods that the investment had been held. The amendments require that the equity method investor add the cost of acquiring the additional interest in the investee to the current basis of the investor's previously held interest and adopt the equity method of accounting with no retroactive adjustment to the investment. In addition, ASU No. 2016-07 requires that an entity that has an available-for-sale equity security that becomes qualified for the equity method of accounting recognize through earnings the unrealized holding gain or loss in accumulated other comprehensive income at the date the investment becomes qualified for use of the equity method. The Company adopted this standard effective January 1, 2017. The adoption of ASU No. 2016-07 is required to be applied prospectively. The Company does not expect the standard to have a material impact on its results of operations, cash flows and financial position.

ASU 2016-02 — In 2016, the FASB issued ASU No. 2016-02, Leases (Topic 842), or Topic 842, with the objective to increase transparency and comparability among organizations by recognizing lease assets and lease liabilities on the balance sheet and to improve financial reporting by expanding the related disclosures. The guidance in Topic 842 provides that a lessee that may have previously accounted for a lease as an operating lease under current GAAP should recognize the assets and liabilities that arise from a lease on the balance sheet. In addition, Topic 842 expands the required quantitative and qualitative disclosures with regards to lease arrangements. The Company expects to adopt the standard effective January 1, 2019 utilizing the required modified retrospective approach for the earliest period presented. The Company expects to elect certain of the practical expedients permitted, including the expedient that permits the Company to retain its existing lease assessment and classification. The Company is currently working through an adoption plan and evaluating the anticipated impact on the Company's results of operations, cash flows and financial position. While the Company is currently evaluating the impact the new guidance will have on its financial position and results of operations, the Company expects to recognize lease liabilities and right of use assets. The extent of the increase to assets and liabilities associated with these amounts remains to be determined pending the Company’s review of its existing lease contracts and service contracts which may contain embedded leases. As this review is still in process, it is currently not practicable to quantify the impact of adopting the ASU at this time.

ASU 2016-01 — In January 2016, the FASB issued ASU No. 2016-01, Financial Instruments - Overall (Subtopic 825-10): Recognition and Measurement of Financial Assets and Financial Liabilities, or ASU No. 2016-01. The amendments of ASU No. 2016-01 eliminate available-for-sale classification of equity investments and require that equity investments (except those accounted for under the equity method of accounting, or those that result in consolidation of the investee) to be generally measured at fair value with changes in fair value recognized in net income. Further, the amendments require that financial assets and financial liabilities to be presented separately in the notes to the financial statements, grouped by measurement category and form of financial asset. The guidance in ASU No. 2016-01 is effective for financial statements issued for fiscal years beginning after December 15, 2017, and interim periods within those annual periods. The Company is currently evaluating the impact of the standard on the Company's results of operations, cash flows and financial position.

16

ASU 2015-16 — In September 2015, the FASB issued ASU No. 2015-16, Business Combinations (Topic 805): Simplifying the Accounting for Measurement-Period Adjustments, or ASU No. 2015-16. The amendments of ASU No. 2015-16 require that an acquirer recognize measurement period adjustments to the provisional amounts recognized in a business combination in the reporting period during which the adjustments are determined. Additionally, the amendments of ASU No. 2015-16 require the acquirer to record in the same period's financial statements the effect on earnings of changes in depreciation, amortization or other income effects, if any, as a result of the measurement period adjustment, calculated as if the accounting had been completed at the acquisition date as well as disclosing on either the face of the income statement or in the notes the portion of the amount recorded in current period earnings that would have been recorded in previous reporting periods. The guidance in ASU No. 2015-16 is effective for financial statements issued for fiscal years beginning after December 15, 2015, and interim periods within those fiscal years. The amendments should be applied prospectively. The Company adopted ASU No. 2015-16 for the year ended December 31, 2016, and the adoption did not have a material impact on the Company's results of operations, cash flows and financial position.

ASU 2014-09 — In May 2014, the FASB issued ASU No. 2014-09, Revenue from Contracts with Customers (Topic 606), or ASU No. 2014-09, which was further amended through various updates issued by the FASB thereafter. The amendments of ASU No. 2014-09 completed the joint effort between the FASB and the IASB, to develop a common revenue standard for GAAP and IFRS, and to improve financial reporting. The guidance under Topic 606 provides that an entity should recognize revenue to depict the transfer of goods or services to customers in an amount that reflects the consideration to which the entity expects to be entitled to in exchange for the goods or services provided and establishes a five step model to be applied by an entity in evaluating its contracts with customers. The Company expects to adopt the standard effective January 1, 2018 and apply the guidance retrospectively to contracts at the date of adoption. The Company will recognize the cumulative effect of applying Topic 606 at the date of initial application, as prescribed under the modified retrospective transition method. The Company also expects to elect the practical expedient available under Topic 606 for measuring progress toward complete satisfaction of a performance obligation and for disclosure requirements of remaining performance obligations. The practical expedient allows an entity to recognize revenue in the amount to which the entity has the right to invoice such that the entity has a right to the consideration in an amount that corresponds directly with the value to the customer for performance completed to date by the entity. The majority of the Company's revenues are obtained through PPAs, which are currently accounted for as operating leases. In connection with the implementation of Topic 842, as described above, the Company expects to elect certain of the practical expedients permitted, including the expedient that permits the Company to retain its existing lease assessment and classification. As leases are excluded from the scope of Topic 606, the Company expects the standard to have an immaterial impact on the Company's results of operations, cash flows and financial position, however, the Company continues to assess the impact in connection with its plan of adoption.

Note 3 — Business Acquisitions

2017 Acquisitions

March 2017 Drop Down Assets — On March 27, 2017, the Company acquired the following from NRG: (i) Agua Caliente Borrower 2 LLC, which owns a 16% interest (approximately 31% of NRG's 51% interest) in the Agua Caliente solar farm, one of the NRG ROFO assets, representing ownership of approximately 46 net MW of capacity and (ii) NRG's interests in the Utah Solar Portfolio. Agua Caliente is located in Yuma County, AZ and sells power subject to a 25-year PPA with Pacific Gas and Electric, with 22 years remaining on that contract. The seven utility-scale solar farms in the Utah Solar Portfolio are owned by the following entities: Four Brothers Capital, LLC, Iron Springs Capital, LLC, and Granite Mountain Capital, LLC. These utility-scale solar farms achieved commercial operations in 2016, sell power subject to 20-year PPAs with PacifiCorp, a subsidiary of Berkshire Hathaway and are part of a tax equity structure with Dominion Solar Projects III, Inc., or Dominion, through which the Company is entitled to receive 50% of cash to be distributed, as further described below. The Company paid cash consideration of $130 million, plus $1 million of working capital. The acquisition of the March 2017 Drop Down Assets was funded with cash on hand and is referred to as March 2017 Drop Down Assets. The Company recorded the acquired interests as equity method investments. The Company also assumed debt of $41 million and $287 million on Agua Caliente Borrower 2 LLC and the Utah Solar Portfolio, respectively, as further described in Note 10, Long-term Debt.

The assets and liabilities transferred to the Company relate to interests under common control by NRG and were recorded at historical cost in accordance with ASC 805-50, Business Combination - Related Issues. The difference between the cash paid and the historical value of the entities' equity of $8 million was recorded as an adjustment to the Company's contributed capital. Since the transaction constituted a transfer of entities under common control, the accounting guidance requires retrospective combination of the entities for all periods presented as if the combination has been in effect from the beginning of the financial statement period or from the date the entities were under common control (if later than the beginning of the financial statement period).

17

2016 Acquisitions

CVSR Drop Down — Prior to September 1, 2016, the Company had a 48.95% interest in CVSR, which was accounted for as an equity method investment. On September 1, 2016, the Company acquired from NRG the remaining 51.05% interest of CVSR Holdco LLC, which indirectly owns the CVSR solar facility, CVSR Drop Down, for total cash consideration of $78.5 million, plus an immaterial working capital adjustment. The acquisition was funded with cash on hand. The Company also assumed additional debt of $496 million, which represents 51.05% of the CVSR project level debt and 51.05% of the notes issued under the CVSR Holdco Financing Agreement, as further described in Note 10, Long-term Debt. In connection with the retrospective adjustment of prior periods, the Company now consolidates CVSR and 100% of its debt, consisting of $771 million of project level debt and $200 million of notes issued under the CVSR Holdco Financing Agreement as of September 1, 2016.

The assets and liabilities transferred to the Company relate to interests under common control by NRG and were recorded at historical cost in accordance with ASC 805-50, Business Combinations - Related Issues. The difference between the cash paid and historical value of the entities' equity was recorded as a distribution to NRG with the offset to contributed capital. Because the transaction constituted a transfer of net assets under common control, the guidance requires retrospective combination of the entities for all periods presented as if the combination has been in effect since the inception of common control. In connection with the retrospective adjustment of prior periods, the Company has removed the equity method investment from all prior periods and adjusted its financial statements to reflect its results of operations, financial position and cash flows as if it had consolidated CVSR from the beginning of the financial statement period. As of June 30, 2016, the Company's recast consolidated balance sheet included a net receivable of $67 million related to current litigation with SunPower pursuant to indemnities in the project. The agreement between NRG and the Company for the CVSR Drop Down acquisition specified that all amounts related to the litigation with SunPower were excluded from the acquisition. Accordingly, prior to close of the transaction, the net receivable was transferred to NRG as a net reduction to its ownership interest in CVSR.

The following is the summary of historical net liabilities assumed in connection with the CVSR Drop Down as of September 1, 2016:

| CVSR | |||

| (In millions) | |||

| Current assets | $ | 95 | |

| Property, plant and equipment | 826 | ||

| Non-current assets | 13 | ||

| Total assets | 934 | ||

Debt (a) | 966 | ||

| Other current and non-current liabilities | 12 | ||

| Total liabilities | 978 | ||

Net liabilities assumed | (44 | ) | |

| Accumulated other comprehensive loss | (25 | ) | |

| Historical net liabilities assumed | $ | (19 | ) |

(a) Net of deferred financing costs of $5 million.

The Company incurred and expensed acquisition-related transaction costs related to the acquisition of CVSR of $1 million for the year ended December 31, 2016. Since the acquisition date, CVSR has contributed $22 million in operating revenues and a $2 million in net loss to the Company.

18

The following tables present the Company's historical information summary combining the financial information for the CVSR Drop Down and March 2017 Drop Down Assets transferred in connection with the acquisitions

| As of December 31, 2016 | |||||||||||

| As Previously Reported | March 2017 Drop Down Assets | As Currently Reported | |||||||||

| (In millions) | |||||||||||

| Current assets | $ | 645 | $ | 11 | $ | 656 | |||||

| Property, plant and equipment | 5,460 | — | 5,460 | ||||||||

| Non-current assets | 2,062 | 442 | 2,504 | ||||||||

| Total assets | 8,167 | 453 | 8,620 | ||||||||

| Debt | 5,728 | 279 | 6,007 | ||||||||

| Other current and non-current liabilities | 304 | 5 | 309 | ||||||||

| Total liabilities | 6,032 | 284 | 6,316 | ||||||||

| Net assets | $ | 2,135 | $ | 169 | $ | 2,304 | |||||

| As of December 31, 2015 | |||||||||||||||

| As Previously Reported | CVSR | March 2017 Drop Down Assets | As Currently Reported (a) | ||||||||||||

| (In millions) | |||||||||||||||

| Current assets | $ | 321 | $ | 98 | $ | — | $ | 419 | |||||||

| Property, plant and equipment | 5,056 | 822 | — | 5,878 | |||||||||||

| Non-current assets | 2,231 | (6 | ) | 100 | 2,325 | ||||||||||

| Total assets | 7,608 | 914 | 100 | 8,622 | |||||||||||

| Debt | 4,835 | 843 | — | 5,678 | |||||||||||

| Other current and non-current liabilities | 339 | (35 | ) | — | 304 | ||||||||||

| Total liabilities | 5,174 | 808 | — | 5,982 | |||||||||||

| Net assets | $ | 2,434 | $ | 106 | $ | 100 | $ | 2,640 | |||||||

| Year ended December 31, 2016 | |||||||||||

| As Previously Reported | March 2017 Drop Down Assets | As Currently Reported | |||||||||

| (In millions) | |||||||||||

| Total operating revenues | $ | 1,021 | $ | — | $ | 1,021 | |||||

| Operating income | 220 | — | 220 | ||||||||

| Net (loss) income | (2 | ) | 17 | 15 | |||||||

| Year ended December 31, 2015 | |||||||||||||||

| As Previously Reported | CVSR | March 2017 Drop Down Assets | As Currently Reported | ||||||||||||

| (In millions) | |||||||||||||||

| Total operating revenues | $ | 869 | $ | 84 | $ | — | $ | 953 | |||||||

| Operating income | 279 | 43 | — | 322 | |||||||||||

| Net income | 78 | 10 | 5 | 93 | |||||||||||

| Year ended December 31, 2014 | |||||||||||||||

As Previously Reported (a) | CVSR | March 2017 Drop Down Assets | As Currently Reported | ||||||||||||

| (In millions) | |||||||||||||||

| Total operating revenues | $ | 746 | $ | 82 | $ | — | $ | 828 | |||||||

| Operating income | 266 | 40 | — | 306 | |||||||||||

| Net income | 108 | 9 | 5 | 122 | |||||||||||

19

2015 Acquisitions

November 2015 Drop Down Assets from NRG — On November 3, 2015, the Company acquired the November 2015 Drop Down Assets, a portfolio of 12 wind facilities totaling 814 net MW, from NRG for cash consideration of $209 million, subject to working capital adjustments. In February 2016, NRG made a final working capital payment of $2 million, reducing total cash consideration to $207 million. The Company is responsible for its pro-rata share of non-recourse project debt of $193 million and noncontrolling interest associated with a tax equity structure of $159 million (as of the acquisition date).

The Company funded the acquisition with borrowings from its revolving credit facility. The assets and liabilities transferred to the Company relate to interests under common control by NRG and were recorded at historical cost. The difference between the cash paid and historical value of the entities' equity was recorded as a distribution from NRG with the offset to contributed capital.

The Class A interests of NRG Wind TE Holdco are owned by a tax equity investor, or TE Investor, who receives 99% of allocations of taxable income and other items until the flip point, which occurs when the TE Investor obtains a specified return on its initial investment, at which time the allocations to the TE Investor change to 8.53%. The Company generally receives 75% of CAFD until the flip point, at which time the allocations to the Company of CAFD change to 68.60%. If the flip point has not occurred by a specified date, 100% of CAFD is allocated to the TE Investor until the flip point occurs. NRG Wind TE Holdco is a VIE and the Company is the primary beneficiary, through its position as managing member, and consolidates NRG Wind TE Holdco.

The following is a summary of assets and liabilities transferred in connection with the acquisition as of November 3, 2015:

| NRG Wind TE Holdco | |||

| (In millions) | |||

| Current assets | $ | 30 | |

| Property, plant and equipment | 669 | ||

| Non-current assets | 177 | ||

| Total assets | 876 | ||

| Debt | 193 | ||

| Other current and non-current liabilities | 32 | ||

| Total liabilities | 225 | ||

| Less: noncontrolling interest | 282 | ||

| Net assets acquired | $ | 369 | |

Desert Sunlight — On June 29, 2015, the Company acquired 25% of the membership interest in Desert Sunlight Investment Holdings, LLC, which owns two solar photovoltaic facilities that total 550 MW, located in Desert Center, California from EFS Desert Sun, LLC, an affiliate of GE Energy Financial Services for a purchase price of $285 million. Power generated by the facilities is sold to Southern California Edison and Pacific Gas and Electric under long-term PPAs with approximately 20 years and 25 years of remaining contract life, respectively. The Company accounts for its 25% investment as an equity method investment.

Spring Canyon — On May 7, 2015, the Company acquired a 90.1% interest in Spring Canyon II, a 32 MW wind facility, and Spring Canyon III, a 28 MW wind facility, each located in Logan County, Colorado, from Invenergy Wind Global LLC. The purchase price was funded with cash on hand. Power generated by Spring Canyon II and Spring Canyon III is sold to Platte River Power Authority under long-term PPAs, each with approximately 24 years of remaining contract life.

University of Bridgeport Fuel Cell — On April 30, 2015, the Company completed the acquisition of the University of Bridgeport Fuel Cell project in Bridgeport, Connecticut from FuelCell Energy, Inc. The project added an additional 1.4 MW of thermal capacity to the Company's portfolio, with a 12-year contract, with the option for a 7-year extension. The acquisition is reflected in the Company's Thermal segment.

20

January 2015 Drop Down Assets from NRG — On January 2, 2015, the Company acquired the following projects from NRG: (i) Laredo Ridge, an 80 MW wind facility located in Petersburg, Nebraska, (ii) Tapestry, which includes Buffalo Bear, a 19 MW wind facility in Buffalo, Oklahoma; Taloga, a 130 MW wind facility in Putnam, Oklahoma; and Pinnacle, a 55 MW wind facility in Keyser, West Virginia, and (iii) Walnut Creek, a 485 MW natural gas facility located in City of Industry, California, for total cash consideration of $489 million, including $9 million for working capital, plus assumed project-level debt of $737 million. The Company funded the acquisition with cash on hand and drawings under its revolving credit facility. The assets and liabilities transferred to the Company relate to interests under common control by NRG and were recorded at historical cost. The difference between the cash paid and the historical value of the entities' equity of $61 million was recorded as a distribution to NRG and reduced the balance of its contributed capital.

2014 Acquisitions

Alta Wind Portfolio Acquisition — On August 12, 2014, the Company acquired 100% of the membership interests of Alta Wind Asset Management Holdings, LLC, Alta Wind Company, LLC, Alta Wind X Holding Company, LLC and Alta Wind XI Holding Company, LLC, which collectively own seven wind facilities that total 947 MW located in Tehachapi, California and a portfolio of associated land leases, or the Alta Wind Portfolio. Power generated by the Alta Wind Portfolio is sold to Southern California Edison under long-term PPAs with 21 years of remaining contract life for Alta I-V. The Alta Wind X and XI PPAs began in 2016 with a term of 22 years and sold energy and renewable energy credits on a merchant basis during the years ending December 31, 2015 and 2014.

The purchase price for the Alta Wind Portfolio was $923 million, which consisted of a base purchase price of $870 million, as well as a payment for working capital of $53 million, plus the assumption of $1.6 billion of non-recourse project-level debt. In order to fund the purchase price, the Company completed an equity offering of 12,075,000 shares of its Class A common stock at an offering price of $54.00 per share on July 29, 2014, which resulted in net proceeds of $630 million, after underwriting discounts and expenses. In addition, on August 5, 2014, NRG Yield Operating LLC issued $500 million of Senior Notes, which bear interest at a rate of 5.375% and mature in August 2024.

The acquisition was recorded as a business combination under ASC 805-50, with identifiable assets acquired and liabilities assumed provisionally recorded at their estimated fair values on the acquisition date. The accounting for the business combination was completed as of August 11, 2015, at which point the fair values became final. The following table summarizes the provisional amounts recognized for assets acquired and liabilities assumed as of December 31, 2014, as well as adjustments made through August 11, 2015, when the allocation became final.

21

The purchase price of $923 million was allocated as follows:

| Acquisition Date Fair Value at December 31, 2014 | Measurement period adjustments | Revised Acquisition Date | ||||||||||

| Assets | (In millions) | |||||||||||

| Cash | $ | 22 | $ | — | $ | 22 | ||||||

| Current and non-current assets | 49 | (2 | ) | 47 | ||||||||

| Property, plant and equipment | 1,304 | 6 | 1,310 | |||||||||

| Intangible assets | 1,177 | (6 | ) | 1,171 | ||||||||

| Total assets acquired | 2,552 | (2 | ) | 2,550 | ||||||||

| Liabilities | ||||||||||||

| Debt | 1,591 | — | 1,591 | |||||||||

| Current and non-current liabilities | 38 | (2 | ) | 36 | ||||||||

| Total liabilities assumed | 1,629 | (2 | ) | 1,627 | ||||||||

| Net assets acquired | $ | 923 | $ | — | $ | 923 | ||||||

The Company incurred and expensed acquisition-related transaction costs related to the acquisition of the Alta Wind Portfolio of $2 million for the year ended December 31, 2014.