UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 20-F

(Mark One)

| ¨ | REGISTRATION STATEMENT PURSUANT TO SECTION 12(b) OR (g) OF THE SECURITIES EXCHANGE ACT OF 1934 |

OR

| x | ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the fiscal year ended December 31, 2015

OR

| ¨ | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from to

OR

| ¨ | SHELL COMPANY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

Date of event requiring this shell company report

Commission file number001-37452

CELYAD S.A.

(Exact name of Registrant as specified in its charter and translation of Registrant’s name into English)

Belgium

(Jurisdiction of incorporation or organization)

Rue Edouard Belin 12

1435 Mont-Saint-Guibert, Belgium

(Address of principal executive offices)

Christian Homsy, MD, MBA

Chief Executive Officer

Celyad SA

Rue Edouard Belin 12

1435 Mont-Saint-Guibert, Belgium

Tel: +32 10 394 100 Fax: +32 10 394 141

(Name, Telephone, E-mail and/or Facsimile number and Address of Company Contact Person)

Securities registered or to be registered pursuant to Section 12(b) of the Act.

| | |

Title of each class | | Name of each exchange on which registered |

| American Depositary Shares, each representing one ordinary share, | | The Nasdaq Stock Market LLC |

| Ordinary shares* | | The Nasdaq Stock Market LLC* |

| * | Not for trading, but only in connection with the registration of the American Depositary Shares. |

Securities registered or to be registered pursuant to Section 12(g) of the Act. None

Securities for which there is a reporting obligation pursuant to Section 15(d) of the Act. None

Indicate the number of outstanding shares of each of the issuer’s classes of capital or common stock as of the close of the period covered by the Annual Report.

Ordinary shares: 9,313,603 as of December 31, 2015

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. ¨ Yes x No

If this report is an annual or transition report, indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934. ¨ Yes x No

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. x Yes ¨ No

Indicate by check mark whether the registrant has submitted electronically and posted on its corporate Web site, if any, every Interactive Data File required to be submitted and posted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit and post such files). ¨ Yes x No

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, or a non-accelerated filer. See definition of “accelerated filer and large accelerated filer” in Rule 12b-2 of the Exchange Act. (Check one):

Large accelerated filer ¨ Accelerated filer ¨ Non-accelerated filer x

Indicate by check mark which basis of accounting the registrant has used to prepare the financial statements included in this filing:

| | | | |

| U.S. GAAP ¨ | | International Financial Reporting Standards as issued by the International Accounting Standards Board x | | Other ¨ |

If “Other” has been checked in response to the previous question, indicate by check mark which financial statement item the registrant has elected to follow. ¨ Item 17 ¨ Item 18

If this is an Annual Report, indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). ¨ Yes x No

TABLE OF CONTENTS

i

ii

INTRODUCTION

Unless otherwise indicated, “Celyad,” “the company,” “our company,” “we,” “us” and “our” refer to Celyad S.A. and its consolidated subsidiaries.

We own various trademark registrations and applications, and unregistered trademarks and service marks, including “CELYAD”, “C-CATH”, “C-CURE”, “-CATH”, “C-CATHez”, “CARDIO 3 BIOSCIENCES” and our corporate logo. All other trademarks or trade names referred to in this Annual Report on Form 20-F are the property of their respective owners. Trade names, trademarks and service marks of other companies appearing in this Annual Report on Form 20-F are the property of their respective holders. Solely for convenience, the trademarks and trade names in this Annual Report on Form 20-F may be referred to without the® and ™ symbols, but such references should not be construed as any indicator that their respective owners will not assert, to the fullest extent under applicable law, their rights thereto. We do not intend to use or display other companies’ trademarks and trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

Our audited consolidated financial statements have been prepared in accordance with International Financial Reporting Standards, or IFRS, as issued by the International Accounting Standards Board, or IASB. Our consolidated financial statements are presented in euros. All references in this Annual Report on Form 20-F to “$,” “US$,” “U.S.$,” “U.S. dollars,” “dollars” and “USD” mean U.S. dollars and all references to “€”, “EUR”, and “euros” mean euros, unless otherwise noted. Throughout this Annual Report on Form 20-F, references to ADSs mean ADSs or ordinary shares represented by ADSs, as the case may be.

1

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

This Annual Report on Form 20-F, or Annual Report, contains forward-looking statements. All statements other than present and historical facts and conditions contained in this Annual Report, including statements regarding our future results of operations and financial positions, business strategy, plans and our objectives for future operations, are forward-looking statements. When used in this Annual Report, the words “anticipate,” “believe,” “can,” “could,” “estimate,” “expect,” “intend,” “is designed to,” “may,” “might,” “plan,” “potential,” “predict,” “objective,” “should,” or the negative of these and similar expressions identify forward-looking statements. Forward-looking statements include, but are not limited to, statements about:

| • | | the initiation, timing, progress and results of our pre-clinical studies and clinical trials, and our research and development programs; |

| • | | our ability to advance drug product candidates into, and successfully commence and complete, clinical trials; |

| • | | our reliance on the success of our drug product candidates; |

| • | | the timing or likelihood of regulatory filings and approvals; |

| • | | our ability to develop sales and marketing capabilities; |

| • | | the commercialization of our drug product candidates, if approved; |

| • | | the pricing and reimbursement of our drug product candidates, if approved; |

| • | | the implementation of our business model, strategic plans for our business, drug product candidates and technology; |

| • | | the scope of protection we are able to establish and maintain for intellectual property rights covering our drug product candidates and technology; |

| • | | our ability to operate our business without infringing the intellectual property rights and proprietary technology of third parties; |

| • | | cost associated with defending intellectual property infringement, product liability and other claims; |

| • | | regulatory developments in the United States, the European Union and other jurisdictions where we plan to market our drug product candidates; |

| • | | estimates of our expenses, future revenues, capital requirements and our needs for additional financing; |

| • | | the potential benefits of strategic collaboration agreements and our ability to enter into strategic arrangements; |

| • | | our ability to maintain and establish collaborations or obtain additional grant funding or subsidies; |

| • | | the rate and degree of market acceptance of our drug product candidates; |

| • | | developments relating to our competitors and our industry, including competing therapies; |

| • | | our ability to effectively manage our anticipated growth; |

| • | | our ability to attract and retain qualified employees and key personnel; |

| • | | our ability to build our finance infrastructure, improve our accounting systems and controls and remedy the material weaknesses identified in our internal control over financial reporting; |

| • | | our expectations regarding the period during which we qualify as an emerging growth company under the JOBS Act; |

| • | | statements regarding future revenue, hiring plans, expenses, capital expenditures, capital requirements and share performance; |

| • | | our expectations regarding our PFIC status; |

| • | | the future trading price of our ADSs and our ordinary shares and impact of securities analysts’ reports on these prices; and |

| • | | other risks and uncertainties, including those listed under the caption “Risk factors.” |

2

You should refer to the section of this Annual Report titled “Risk factors” (ITEM 3, D) for a discussion of important factors that may cause our actual results to differ materially from those expressed or implied by our forward-looking statements. As a result of these factors, we cannot assure you that the forward-looking statements in this Annual Report will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame or at all. We undertake no obligation to publicly update any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

You should read this Annual Report and the documents that we reference in this Annual Report with the understanding that our actual future results may be materially different from what we expect. We qualify all of our forward-looking statements by these cautionary statements.

This Annual Report contains market data and industry forecasts that were obtained from industry publications. These data involve a number of assumptions and limitations, and you are cautioned not to give undue weight to such estimates. While we believe the market position, market opportunity and market size information included in this Annual Report is generally reliable, such information is inherently imprecise.

3

ITEM 1. DIRECTORS, SENIOR MANAGEMENT AND EMPLOYEE

Not applicable.

ITEM 2. OFFER STATISTICS AND EXPECTED TIMETABLE

Not applicable.

ITEM 3. KEY INFORMATION

A. Selected Financial Data

Statement of Income (Loss) Data:

| | | | | | | | | | | | |

| (€‘000) | | For the year ended 31

December | | | | |

| | | 2015 | | | 2014 | | | 2013 | |

Revenue | | | 3 | | | | 146 | | | | 0 | |

Cost of sales | | | (1 | ) | | | (115 | ) | | | 0 | |

Gross profit | | | 2 | | | | 31 | | | | 0 | |

Research and Development expenses | | | (22,766 | ) | | | (15,865 | ) | | | (9,046 | ) |

General administrative expenses | | | (7,230 | ) | | | (5,016 | ) | | | (3,972 | ) |

Other operating income | | | 322 | | | | 4,413 | | | | 64 | |

Operating Loss | | | (29,672 | ) | | | (16,437 | ) | | | (12,954 | ) |

Financial Result | | | 306 | | | | 236 | | | | (1,535 | ) |

Share of Loss of investments accounted for using the equity method | | | 252 | | | | (252 | ) | | | 0 | |

Loss before taxes | | | (29,114 | ) | | | (16,453 | ) | | | (14,489 | ) |

Income taxes | | | — | | | | — | | | | — | |

Loss for the year [2] | | | (29,114 | ) | | | (16,453 | ) | | | (14,489 | ) |

| | | | | | | | | | | | |

Basic and diluted loss per share (in €) | | | (3.43 | ) | | | (2.44 | ) | | | (3.53 | ) |

| | | | | | | | | | | | |

Weighted average number of outstanding shares | | | 8,481,583 | | | | 6,750,383 | | | | 4,099,216 | |

| | | | | | | | | | | | |

Statement of Financial Position Data:

| | | | | | | | | | | | | | | | |

| | | 2013 | | | 2014 | | | 2015 | |

| | | Euro | | | Euro | | | Euro | | | US$(1) | |

Cash and cash equivalents | | | 19,058 | | | | 27,633 | | | | 100,175 | | | | 109,461 | |

Total assets | | | 32,386 | | | | 43,976 | | | | 159,525 | | | | 174,313 | |

Total shareholders’ equity | | | 16,898 | | | | 26,684 | | | | 111,473 | | | | 121,807 | |

Trade non-current liabilities | | | 12,099 | | | | 11,239 | | | | 36,562 | | | | 39,951 | |

Total current liabilities | | | 3,389 | | | | 6,053 | | | | 11,490 | | | | 12,555 | |

Total liabilities | | | 15,488 | | | | 17,292 | | | | 48,052 | | | | 52,506 | |

Total liabilities and shareholders’ equity | | | 32,386 | | | | 43,976 | | | | 159,525 | | | | 174,313 | |

| | | | | | | | | | | | | | | | |

| (1) | At closing rate of 1.0927 $/€ |

4

Exchange Rate Information

The following table sets forth, for each period indicated, the low and high exchange rates for euros expressed in U.S. dollars, the exchange rate at the end of such period and the average of such exchange rates on the last day of each month during such period, based on the noon buying rate of the Federal Reserve Bank of New York for the euro. As used in this document, the term “noon buying rate” refers to the rate of exchange for the euro, expressed in U.S. dollars per euro, as certified by the Federal Reserve Bank of New York for customs purposes. The exchange rates set forth below demonstrate trends in exchange rates, but the actual exchange rates used throughout this Annual Report may vary.

| | | | | | | | | | | | | | | | | | | | |

| | | 2011 | | | 2012 | | | 2013 | | | 2014 | | | 2015 | |

High | | | 1.4875 | | | | 1.3463 | | | | 1.3816 | | | | 1.3927 | | | | 1.2015 | |

Low | | | 1.2926 | | | | 1.2062 | | | | 1.2774 | | | | 1.2101 | | | | 1.0524 | |

Rate at end of period | | | 1.2973 | | | | 1.3186 | | | | 1.3779 | | | | 1.2101 | | | | 1.0927 | |

Average rate per period | | | 1.3931 | | | | 1.2859 | | | | 1.3281 | | | | 1.3297 | | | | 1.1104 | |

The following table sets forth, for each of the last six months, the low and high exchange rates for euros expressed in U.S. dollars and the exchange rate at the end of the month based on the noon buying rate as described above.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | August

2015 | | | September

2015 | | | October

2015 | | | November

2015 | | | December

2015 | | | January

2016 | |

High | | | 1.158 | | | | 1.1358 | | | | 1.1437 | | | | 1.1026 | | | | 1.1025 | | | | 1.0964 | |

Low | | | 1.0868 | | | | 1.1104 | | | | 1.0963 | | | | 1.0562 | | | | 1.0573 | | | | 1.0743 | |

Rate at end of period | | | 1.114 | | | | 1.123 | | | | 1.123 | | | | 1.073 | | | | 1.089 | | | | 1.0855 | |

On February 29th, 2016, the noon buying rate of the Federal Reserve Bank of New York for the euro was €1.00 = $ 1.0888.

B. Capitalization and Indebtedness

Not applicable.

C. Reasons for the Offer and Use of Proceeds

Not applicable.

D. Risk Factors

Our business faces significant risks. You should carefully consider all of the information set forth in this Annual Report and in our other filings with the United States Securities and Exchange Commission, or the SEC, including the following risk factors which we face and which are faced by our industry. Our business, financial condition or results of operations could be materially adversely affected by any of these risks. This Annual Report also contains forward-looking statements that involve risks and uncertainties. Our results could materially differ from those anticipated in these forward-looking statements, as a result of certain factors including the risks described below and elsewhere in this report and our other SEC filings. See “Special Note Regarding Forward-Looking Statements” above.

Risks Related to Our Financial Position and Need for Additional Capital

We have incurred losses in each period since our inception and anticipate that we will continue to incur losses in the future.

We are not profitable and have incurred losses in each period since our inception. For the years ended December 31, 2015, 2014 and 2013, we incurred a loss for the year of € 29.1 million, €16.5 million and € 14.5 million, respectively. As of December 31, 2015, we had a retained loss of €100.3 million. We expect these losses to increase as we continue to incur significant research and development and other expenses related to our ongoing operations, continue to advance our drug product candidates through pre-clinical studies and clinical trials, seek regulatory approvals for our drug product candidates, scale-up manufacturing capabilities and hire additional personnel to support the development of our drug product candidates and to enhance our operational, financial and information management systems.

5

Even if we succeed in commercializing one or more of our drug product candidates, we will continue to incur losses for the foreseeable future relating to our substantial research and development expenditures to develop our technologies. We anticipate that our expenses will increase substantially if and as we:

| | • | | continue our research, pre-clinical and clinical development of our drug product candidates; |

| | • | | expand the scope of therapeutic indications of our current clinical trials for our drug product candidates; |

| | • | | initiate additional pre-clinical studies or additional clinical trials of existing drug product candidates or new drug product candidates; |

| | • | | further develop the manufacturing processes for our drug product candidates; |

| | • | | seek regulatory and marketing approvals for our drug product candidates that successfully complete clinical trials; |

| | • | | establish a sales, marketing and distribution infrastructure to commercialize any products for which we may obtain marketing approval, in the European Union and the United States; |

| | • | | make milestone or other payments under any in-license agreements; |

| | • | | maintain, protect and expand our intellectual property portfolio; and |

| | • | | create additional infrastructure to support our operations as a U.S. public company. |

We may encounter unforeseen expenses, difficulties, complications, delays and other unknown factors that may adversely affect our business. The size of our future losses will depend, in part, on the rate of future growth of our expenses and our ability to generate revenue.

Our prior losses and expected future losses have had and will continue to have an adverse effect on our shareholders’ equity and working capital. Further, the losses we incur may fluctuate significantly from quarter to quarter and year to year, such that a period to period comparison of our results of operations may not be a good indication of our future performance.

We have generated only limited revenue from sales of C-Cathez to date, and do not expect to generate material revenue until we receive regulatory approval for one of our drug product candidates.

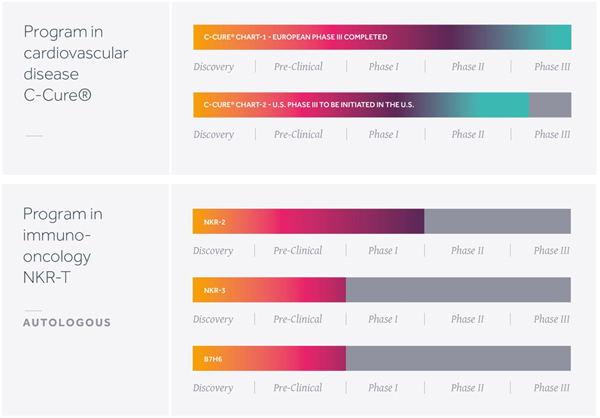

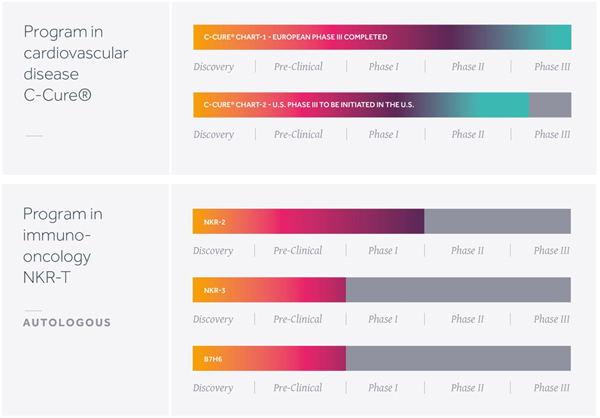

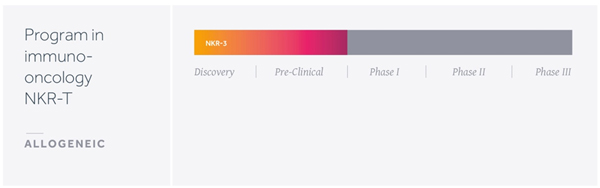

We have generated only limited revenue from sales of C-Cathez, our proprietary catheter for injecting cells into the heart, to research laboratories and clinical stage companies. We expect that revenue from sales of C-Cathezwill remain insignificant as we sell C-Cathez only to research laboratories and clinical stage companies. We have no drug products approved for commercial sale, have not generated any revenue from drug product sales, and do not anticipate generating any revenue from drug product sales until after we have received regulatory approval, if at all, for the commercial sale of a drug product candidate. As of the date of this Annual Report, C-Cure, our lead drug product candidate in cardiovascular disease, is in Phase 3 clinical development for the treatment of ischemic heart failure, or HF, while NKR-2, our lead drug product candidate in oncology, is in Phase 1 clinical development for the treatment of refractory or relapsed acute myeloid leukemia, or AML, and multiple myeloma, or MM. Our ability to generate revenue and achieve profitability depends significantly on our success in many factors, including:

| | • | | completing research regarding, and pre-clinical and clinical development of, our drug product candidates; |

| | • | | pursuing regulatory approvals and marketing authorizations for drug product candidates for which we complete clinical trials; |

| | • | | developing a sustainable and scalable commercial-scale manufacturing process for our drug product candidates, including establishing our own manufacturing capabilities and infrastructure or establishing and maintaining commercially viable supply relationships with third parties; |

| | • | | launching and commercializing drug product candidates for which we obtain regulatory approvals and marketing authorizations, either directly or with a collaborator or distributor; |

| | • | | obtaining market acceptance of our drug product candidates as viable treatment options; |

| | • | | addressing any competing technological and market developments; |

| | • | | identifying, assessing, acquiring and/or developing new drug product candidates; |

| | • | | negotiating favorable terms in any collaboration, licensing, or other arrangements into which we may enter; |

| | • | | maintaining, protecting, and expanding our portfolio of intellectual property rights, including patents, trade secrets, and know-how; and |

| | • | | attracting, hiring, and retaining qualified personnel. |

6

Even if one or more of the drug product candidates that we develop is approved for commercial sale, we anticipate incurring significant costs associated with commercializing any approved drug product candidate. Our expenses could increase beyond expectations if we are required by the U.S. Food and Drug Administration, or the FDA, European Medicines Agency, or EMA, or other applicable regulatory agencies, to change our manufacturing processes or assays, or to perform clinical, pre-clinical, or other types of studies in addition to those that we currently anticipate. If we are successful in obtaining regulatory approvals to market one or more of our drug product candidates, our revenue will be dependent, in part, upon the size of the markets in the territories for which we gain regulatory approval, the accepted price for the drug product, the ability to get coverage and adequate reimbursement, and whether we own the commercial rights for that territory. If the number of our addressable disease patients is not as significant as we estimate, the indication approved by regulatory authorities is narrower than we expect, or the reasonably accepted population for treatment is narrowed by competition, physician choice or treatment guidelines, we may not generate significant revenue from sales of such products, even if approved. If we are not able to generate revenue from the sale of any approved drug products, we may never become profitable.

If we fail to obtain additional financing, we will be unable to complete the development and commercialization of our drug product candidates.

Our operations have required substantial amounts of cash since inception. We expect to continue to spend substantial amounts to continue the clinical development of our drug product candidates, including our ongoing and planned clinical trials for C-Cure, NKR-2 and any of our future drug product candidates. If approved, we will require significant additional amounts in order to launch and commercialize our drug product candidates.

As of December 31, 2015, we had €100.2 million in cash and €7.3 million in short term investments. Over 2015, we raised €31.7 million though a private placement in March 2015 and €88.0 million in June 2015 in our global offering of 1,460,000 ordinary shares, consisting of an underwritten public offering of 1,168,000 ADSs and a concurrent European private placement of 292,000 ordinary shares.

We believe that our existing cash and short term investments, will be sufficient to fund our operations until at least the end of 2017. However, changing circumstances may cause us to increase our spending significantly faster than we currently anticipate, and we may need to spend more money than currently expected because of circumstances beyond our control. We may require additional capital for the further development and commercialization of our drug product candidates and may need to raise additional funds sooner if we choose to expand more rapidly than we presently anticipate.

We cannot be certain that additional funding will be available on acceptable terms, or at all. We have no committed source of additional capital and if we are unable to raise additional capital in sufficient amounts or on terms acceptable to us, we may have to significantly delay, scale back or discontinue the development or commercialization of our drug product candidates or other research and development initiatives. Our licenses may also be terminated if we are unable to meet the payment obligations under the agreements. We could be required to seek collaborators for our drug product candidates at an earlier stage than otherwise would be desirable or on terms that are less favorable than might otherwise be available or relinquish or license on unfavorable terms our rights to our drug product candidates in markets where we otherwise would seek to pursue development or commercialization ourselves. Any these events could significantly harm our business, prospects, financial condition and results of operations and cause the price of our American Depositary Shares, or ADSs, or ordinary shares to decline.

Raising additional capital may cause dilution to our existing shareholders, restrict our operations or require us to relinquish rights to our drug product candidates or technologies.

We may seek additional funding through a combination of equity offerings, debt financings, collaborations and/or licensing arrangements. To the extent that we raise additional capital through the sale of equity or convertible debt securities, your ownership interest will be diluted, and the terms may include liquidation or other preferences that adversely affect your rights as a holder of the ADSs or the ordinary shares. The incurrence of indebtedness and/or the issuance of certain equity securities could result in increased fixed payment obligations and could also result in certain additional restrictive covenants, such as limitations on our ability to incur additional debt and/or issue additional equity, limitations on our ability to acquire or license intellectual property rights and other operating restrictions that could adversely impact our ability to conduct our business. In addition, issuance of additional equity securities, or the possibility of such issuance, may cause the market price of the ADSs or the ordinary shares to decline. In the event that we enter into collaborations and/or licensing arrangements in order to raise capital, we may be required to accept unfavorable terms, including relinquishing or licensing to a third party on unfavorable terms our rights to technologies or drug product candidates that we otherwise would seek to develop or commercialize ourselves or potentially reserve for future potential arrangements when we might be able to achieve more favorable terms.

7

Risks Related to Product Development, Regulatory Approval and Commercialization

We may encounter substantial delays in our clinical trials or we may fail to demonstrate safety and efficacy to the satisfaction of applicable regulatory authorities.

Before obtaining regulatory approval or marketing authorization from regulatory authorities for the sale of our drug product candidates, if at all, we must conduct extensive clinical trials to demonstrate the safety and efficacy of the drug product candidates in humans. Clinical testing is expensive, time-consuming and uncertain as to outcome. We cannot guarantee that any clinical trials will be conducted as planned or completed on schedule, if at all. A failure of one or more clinical trials can occur at any stage of testing. Events that may prevent successful or timely completion of clinical development include:

| | • | | delays in raising, or inability to raise, sufficient capital to fund the planned clinical trials; |

| | • | | delays in reaching a consensus with regulatory agencies on trial design; |

| | • | | identifying, recruiting and training suitable clinical investigators; |

| | • | | delays in reaching agreement on acceptable terms with prospective clinical research organizations, or CROs, and clinical trial sites; |

| | • | | delays in obtaining required Investigational Review Board, or IRB, approval at each clinical trial site; |

| | • | | delays in recruiting suitable patients to participate in our clinical trials; |

| | • | | delays due to changing standard of care for the diseases we are studying; |

| | • | | adding new clinical trial sites; |

| | • | | imposition of a clinical hold by regulatory agencies, after an inspection of our clinical trial operations or trial sites; |

| | • | | failure by our CROs, other third parties or us to adhere to clinical trial requirements; |

| | • | | catastrophic loss of drug product candidates due to shipping delays or delays in customs in connection with delivery to foreign countries for use in clinical trials; |

| | • | | failure to perform in accordance with the FDA’s good clinical practices, or GCPs, or applicable regulatory guidelines in other countries; |

| | • | | delays in the testing, validation, manufacturing and delivery of our drug product candidates to the clinical sites; |

| | • | | delays in having patients complete participation in a trial or return for post-treatment follow-up; |

| | • | | clinical trial sites or patients dropping out of a trial; |

| | • | | occurrence of serious adverse events associated with the drug product candidate that are viewed to outweigh its potential benefits; or |

| | • | | changes in regulatory requirements and guidance that require amending or submitting new clinical protocols. |

For example, our Investigational New Drug Application, or IND, for the use of C-Cure in our planned Phase 3 clinical trial of C-Cure for the treatment of ischemic HF in the United States and Europe, or CHART-2, was initially submitted to the FDA in January 2012. This IND became effective in December 2013 for administration of the cells with Myostar, a Biologics catheter used for the injection of therapeutic agents into the heart, and manufactured by Biologics Delivery Systems Group, Cordis Corporation, a Johnson & Johnson company. Prior to initiating the trial, in August 2014, we filed an amendment to the IND requesting among other changes to the initial submission, the use of our proprietary cell injection catheter called C-Cathez. In January 2015, the FDA issued a clinical hold on CHART-2. The clinical hold on CHART-2 was lifted in December 2015.

Any inability to successfully complete pre-clinical and clinical development could result in additional costs to us or impair our ability to generate revenues from product sales, regulatory and commercialization milestones and royalties. Clinical trial delays could also shorten any periods during which we may have the exclusive right to commercialize our drug product candidates or allow our competitors to bring products to market before we do, which could impair our ability to successfully commercialize our drug product candidates and may harm our business and results of operations.

If the results of our clinical trials are inconclusive or if there are safety concerns or adverse events associated with our drug product candidates, we may:

| | • | | be delayed in obtaining marketing approval for our drug product candidates, if at all; |

| | • | | obtain approval for indications or patient populations that are not as broad as intended or desired; |

| | • | | obtain approval with labeling that includes significant use or distribution restrictions or safety warnings; |

8

| | • | | be subject to changes in the way the product is administered; |

| | • | | be required to perform additional clinical trials to support approval or be subject to additional post-marketing testing requirements; |

| | • | | have regulatory authorities withdraw their approval of the product or impose restrictions on its distribution in the form of a risk evaluation and mitigations strategy, or REMS, plan; |

| | • | | be subject to the addition of labeling statements, such as warnings or contraindications; |

| | • | | experience damage to our reputation. |

Our drug product candidates could potentially cause other adverse events that have not yet been predicted. As described above, any of these events could prevent us from achieving or maintaining market acceptance of our drug product candidates and impair our ability to commercialize our products if they are ultimately approved by applicable regulatory authorities.

Our drug product candidates may cause undesirable side effects or have other properties that could halt their clinical development, prevent their regulatory approval, limit their commercial potential, or result in significant negative consequences.

As with most biological drug products, use of our drug product candidates could be associated with side effects or adverse events which can vary in severity from minor reactions to death and in frequency from infrequent to prevalent. Undesirable side effects or unacceptable toxicities caused by our drug product candidates could cause us or regulatory authorities to interrupt, delay, or halt clinical trials. The FDA, EMA, or comparable foreign regulatory authorities could delay or deny approval of our drug product candidates for any or all targeted indications and negative side effects could result in a more restrictive label for any product that is approved. Side effects such as toxicity or other safety issues associated with the use of our drug product candidates could also require us or our collaborators to perform additional studies or halt development or sale of these drug product candidates.

Treatment-related side effects could also affect patient recruitment or the ability of enrolled subjects to complete the trial, or could result in potential product liability claims. In addition, these side effects may not be appropriately or timely recognized or managed by the treating medical staff. Any of these occurrences may materially and adversely harm our business, financial condition and prospects.

Additionally, if one or more of our drug product candidates receives marketing approval, and we or others later identify undesirable side effects caused by such products, including during any long-term follow-up observation period recommended or required for patients who receive treatment using our products, a number of potentially significant negative consequences could result, including:

| | • | | regulatory authorities may withdraw approvals of such product; |

| | • | | regulatory authorities may require additional warnings on the label; |

| | • | | we may be required to create a REMS plan which could include a medication guide outlining the risks of such side effects for distribution to patients, a communication plan for healthcare providers, and/or other elements to assure safe use; |

| | • | | we could be sued and held liable for harm caused to patients; and |

| | • | | our reputation may suffer. |

Any of the foregoing could prevent us from achieving or maintaining market acceptance of the particular drug product candidate, if approved, and could significantly harm our business, results of operations, and prospects.

If we encounter difficulties enrolling patients in our clinical trials, our clinical development activities could be delayed or otherwise adversely affected.

The timely completion of clinical trials in accordance with their protocols depends, among other things, on our ability to enroll a sufficient number of patients who remain in the trial until its conclusion. We may experience difficulties in patient enrollment in our clinical trials for a variety of reasons, including:

| | • | | the size and nature of the patient population; |

| | • | | the patient eligibility criteria defined in the protocol; |

| | • | | the size of the population required for analysis of the trial’s primary endpoints; |

9

| | • | | the proximity of patients to trial sites; |

| | • | | the design of the trial; |

| | • | | our ability to recruit clinical trial investigators with the appropriate competencies and experience; |

| | • | | competing clinical trials for similar therapies; |

| | • | | clinicians’ and patients’ perceptions as to the potential advantages and side effects of the drug product candidate being studied in relation to other available therapies, including any new drugs or treatments that may be approved for the indications we are investigating; |

| | • | | our ability to obtain and maintain patient consents; and |

| | • | | the risk that patients enrolled in clinical trials will not complete a clinical trial. |

In addition, our clinical trials will compete with other clinical trials for drug product candidates that are in the same therapeutic areas as our drug product candidates, and this competition will reduce the number and types of patients available to us, because some patients who might have opted to enroll in our trials may instead opt to enroll in a trial being conducted by one of our competitors. Because the number of qualified clinical investigators is limited, we expect to conduct some of our clinical trials at the same clinical trial sites that some of our competitors use, which will reduce the number of patients who are available for our clinical trials at such clinical trial sites. Moreover, because our drug product candidates represent a departure from more commonly used methods for ischemic HF and cancer treatment, potential patients and their doctors may be inclined to use conventional therapies, rather than enroll patients in our clinical trials.

Even if we are able to enroll a sufficient number of patients in our clinical trials, delays in patient enrollment may result in increased costs or may affect the timing or outcome of our clinical trials, which could prevent completion of these trials and adversely affect our ability to advance the development of our drug product candidates.

Clinical development is a lengthy and expensive process with an uncertain outcome, and results of earlier studies and trials as well as data from any interim analysis of ongoing clinical trials may not be predictive of future trial results. Clinical failure can occur at any stage of clinical development.

Clinical testing is expensive and can take many years to complete, and its outcome is inherently uncertain. Failure can occur at any time during the clinical trial process. Although drug product candidates may demonstrate promising results in early clinical (human) trials and pre-clinical (animal) studies, they may not prove to be effective in subsequent clinical trials. For example, testing on animals may occur under different conditions than testing in humans and therefore the results of animal studies may not accurately predict human experience. Likewise, early clinical trials may not be predictive of eventual safety or effectiveness results in larger-scale pivotal clinical trials. The results of pre-clinical studies and previous clinical trials as well as data from any interim analysis of ongoing clinical trials of our drug product candidates, as well as studies and trials of other products with similar mechanisms of action to our drug product candidates, may not be predictive of the results of ongoing or future clinical trials. For example, the positive results generated in our Phase 2 clinical trial of C-Cure for the treatment of patients with ischemic HF do not ensure that our ongoing Phase 3 clinical trial of C-Cure for the treatment of patients with ischemic HF in Europe and Israel, or CHART-1, or CHART-2, which we expect to initiate end of Q2 2016, will demonstrate similar results or observations. Drug product candidates in later stages of clinical trials may fail to show the desired safety and efficacy traits despite having progressed through pre-clinical studies and earlier clinical trials. In addition to the safety and efficacy traits of any drug product candidate, clinical trial failures may result from a multitude of factors including flaws in trial design, dose selection, placebo effect and patient enrollment criteria. A number of companies in the pharmaceutical industry have suffered significant setbacks in advanced clinical trials due to lack of efficacy or adverse safety profiles, notwithstanding promising results in earlier trials, and it is possible that we will as well. Based upon negative or inconclusive results, we or our collaborators may decide, or regulators may require us, to conduct additional clinical trials or pre-clinical studies. In addition, data obtained from trials and studies are susceptible to varying interpretations, and regulators may not interpret our data as favorably as we do, which may delay, limit or prevent regulatory approval.

The regulatory approval processes of the FDA, EMA and other comparable regulatory authorities is lengthy, time-consuming, and inherently unpredictable, and we may experience significant delays in the clinical development and regulatory approval, if any, of our drug product candidates.

The research, testing, manufacturing, labeling, approval, selling, import, export, marketing, and distribution of drug products, including biologics, are subject to extensive regulation by the FDA, EMA and other comparable regulatory authorities. We are not permitted to market any biological drug product in the United States until we receive a Biologics License Application, or BLA, from the FDA or a marketing authorization application, or MAA, from the EMA. We have not previously submitted a BLA to the FDA, MAA to the EMA, or similar approval filings to comparable foreign authorities. A BLA must include extensive pre-clinical and clinical data and supporting information to establish that the drug product candidate is safe, pure, and potent for each desired

10

indication. The BLA must also include significant information regarding the chemistry, manufacturing, and controls for the product, and the manufacturing facilities must complete a successful pre-license inspection. We expect the nature of our drug product candidates to create further challenges in obtaining regulatory approval. For example, the FDA and EMA have limited experience with commercial development of genetically modified T-cell therapies for cancer. The FDA may also require a panel of experts, referred to as an Advisory Committee, to deliberate on the adequacy of the safety and efficacy data to support licensure. The opinion of the Advisory Committee, although not binding, may have a significant impact on our ability to obtain licensure of the drug product candidates based on the completed clinical trials. Accordingly, the regulatory approval pathway for our drug product candidates may be uncertain, complex, expensive, and lengthy, and approval may not be obtained.

Obtaining and maintaining regulatory approval of our drug product candidates in one jurisdiction does not mean that we will be successful in obtaining regulatory approval of our drug product candidates in other jurisdictions.

If we obtain and maintain regulatory approval of our drug product candidates in one jurisdiction, such approval does not guarantee that we will be able to obtain or maintain regulatory approval in any other jurisdiction, but a failure or delay in obtaining regulatory approval in one jurisdiction may have a negative effect on the regulatory approval process in others. For example, even if the FDA grants marketing approval of a drug product candidate, comparable regulatory authorities in foreign jurisdictions must also approve the manufacturing, marketing and promotion of the drug product candidate in those countries. Approval procedures vary among jurisdictions and can involve requirements and administrative review periods different from those in the United States, including additional pre-clinical studies or clinical trials as clinical trials conducted in one jurisdiction may not be accepted by regulatory authorities in other jurisdictions. In many jurisdictions outside the United States, a drug product candidate must be approved for reimbursement before it can be approved for sale in that jurisdiction. In some cases, the price that we intend to charge for our products is also subject to approval.

Obtaining foreign regulatory approvals and compliance with foreign regulatory requirements could result in significant delays, difficulties and costs for us and could delay or prevent the introduction of our products in certain countries. If we fail to comply with the regulatory requirements in international markets and/or to receive applicable marketing approvals, our target market will be reduced and our ability to realize the full market potential of our drug product candidates will be harmed.

A Breakthrough Therapy Designation by the FDA for our drug product candidates may not lead to a faster development or regulatory review or approval process, and it does not increase the likelihood that our drug product candidates will receive marketing approval.

We may seek a Breakthrough Therapy Designation for some of our drug product candidates. A breakthrough therapy is defined as a product that is intended, alone or in combination with one or more other products, to treat a serious or life-threatening disease or condition, and preliminary clinical evidence indicates that the product may demonstrate substantial improvement over existing therapies on one or more clinically significant endpoints, such as substantial treatment effects observed early in clinical development. For drug product candidates that have been designated as breakthrough therapies, interaction and communication between the FDA and the sponsor of the trial can help to identify the most efficient path for clinical development while minimizing the number of patients placed in ineffective control regimens. Drug product candidates designated as breakthrough therapies by the FDA are also eligible for accelerated approval.

Designation as a breakthrough therapy is within the discretion of the FDA. Accordingly, even if we believe one of our drug product candidates meets the criteria for designation as a breakthrough therapy, the FDA may disagree and instead determine not to make such designation. In any event, the receipt of a Breakthrough Therapy Designation for a drug product candidate may not result in a faster development process, review or approval compared to drugs considered for approval under conventional FDA procedures and does not assure ultimate approval by the FDA. In addition, even if one or more of our drug product candidates qualify as breakthrough therapies, the FDA may later decide that the drug product candidates no longer meet the conditions for qualification.

A Fast Track Designation by the FDA may not actually lead to a faster development or regulatory review or approval process.

We may seek Fast Track Designation for some of our drug product candidates. If a product is intended for the treatment of a serious or life-threatening condition and the product demonstrates the potential to address unmet medical needs for this condition, the product sponsor may apply for Fast Track Designation. The FDA has broad discretion whether or not to grant this designation, so even if we believe a particular drug product candidate is eligible for this designation, we cannot assure you that the FDA would decide to grant it. Even if we do receive Fast Track Designation, we may not experience a faster development process, review or approval compared to conventional FDA procedures. The FDA may withdraw Fast Track Designation if it believes that the designation is no longer supported by data from our clinical development program.

We may seek Orphan Drug Designation for some of our drug product candidates, and we may be unsuccessful or may be unable to maintain the benefits associated with Orphan Drug Designation, including the potential for market exclusivity.

As part of our business strategy, we may seek Orphan Drug Designation for some of our drug product candidates, and we may be unsuccessful. Regulatory authorities in some jurisdictions, including the United States and the European Union, may designate products for relatively small patient populations as orphan drugs. Under the Orphan Drug Act, the FDA may designate a product as an orphan drug if it is a product intended to treat a rare disease or condition, which is generally defined as a patient population of fewer

11

than 200,000 individuals annually in the United States, or a patient population greater than 200,000 in the United States where there is no reasonable expectation that the cost of developing the product will be recovered from sales in the United States. In the United States, Orphan Drug Designation entitles a party to financial incentives such as opportunities for grant funding towards clinical trial costs, tax advantages and user-fee waivers.

Similarly, in the European Union, the EMA’s Committee for Orphan Medicinal Products grants Orphan Drug Designation to promote the development of products that are intended for the diagnosis, prevention or treatment of life-threatening or chronically debilitating conditions affecting not more than five in 10,000 persons in the European Union and for which no satisfactory method of diagnosis, prevention, or treatment has been authorized (or the product would be a significant benefit to those affected). Additionally, designation is granted for products intended for the diagnosis, prevention, or treatment of a life-threatening, seriously debilitating or serious and chronic condition and when, without incentives, it is unlikely that sales of the product in the European Union would be sufficient to justify the necessary investment in developing the product. In the European Union, Orphan Drug Designation entitles a party to financial incentives such as reduction of fees or fee waivers.

Generally, if a drug product candidate with an Orphan Drug Designation subsequently receives the first marketing approval for the indication for which it has such designation, the product is entitled to a period of marketing exclusivity, which precludes the EMA or the FDA from approving another marketing application for the same product and indication for that time period, except in limited circumstances. The applicable period is seven years in the United States and ten years in Europe. The European exclusivity period can be reduced to six years if a product no longer meets the criteria for Orphan Drug Designation or if the drug is sufficiently profitable so that market exclusivity is no longer justified.

Even if we obtain orphan drug exclusivity for a product, that exclusivity may not effectively protect the product from competition because different products can be approved for the same condition or the same products can be approved for different conditions. If one of our drug product candidates that receives an orphan drug designation is approved for a particular indication or use within the rare disease, the FDA may later approve the same product for additional indications or uses within that rare disease that are not protected by our exclusive approval. Even after an orphan drug is approved, the FDA can subsequently approve the same product for the same condition if the FDA concludes that the later product is clinically superior in that it is shown to be safer, more effective or makes a major contribution to patient care. In addition, a designated orphan drug may not receive orphan drug exclusivity if it is approved for a use that is broader than the indication for which it received orphan designation. Moreover, orphan drug exclusive marketing rights in the United States may be lost if the FDA later determines that the request for designation was materially defective or if the manufacturer is unable to assure sufficient quantity of the product to meet the needs of patients with the rare disease or condition or if another product with the same active moiety is determined to be safer, more effective, or represents a major contribution to patient care. Orphan Drug Designation neither shortens the development time or regulatory review time of a product nor gives the product any advantage in the regulatory review or approval process. While we intend to seek Orphan Drug Designation for some of our drug product candidates, we may never receive such designations. Even if we do receive such designations, there is no guarantee that we will enjoy the benefits of those designations.

Even if we receive regulatory approval of our drug product candidates, we will be subject to ongoing regulatory obligations and continued regulatory review, which may result in significant additional expense and we may be subject to penalties if we fail to comply with regulatory requirements or experience unanticipated problems with our drug product candidates.

If our drug product candidates are approved, they will be subject to ongoing regulatory requirements for manufacturing, labeling, packaging, storage, advertising, promotion, sampling, record-keeping, conduct of post-marketing studies, and submission of safety, efficacy, and other post-market information, including both federal and state requirements in the United States and requirements of comparable foreign regulatory authorities.

Manufacturers and manufacturers’ facilities are required to comply with extensive FDA, and comparable foreign regulatory authority, requirements, including ensuring that quality control and manufacturing procedures conform to current Good Manufacturing Practices, or cGMP, and in certain cases Good Tissue Practices, or cGTP, regulations. As such, we and our contract manufacturers will be subject to continual review and inspections to assess compliance, to the extent applicable, with cGMP and adherence to commitments made in any BLA, other marketing application, and previous responses to inspection observations. Accordingly, we and others with whom we work must continue to expend time, money, and effort in all areas of regulatory compliance, including manufacturing, production, and quality control.

Any regulatory approvals that we receive for our drug product candidates may be subject to limitations on the approved indicated uses for which the product may be marketed or to the conditions of approval, or contain requirements for potentially costly post-marketing testing, including Phase 4 clinical trials and surveillance to monitor the safety and efficacy of the drug product candidate. The FDA may also require a REMS program as a condition of approval of our drug product candidates, which could entail requirements for long-term patient follow-up, a medication guide, physician communication plans or additional elements to ensure safe use, such as restricted distribution methods, patient registries and other risk minimization tools. In addition, if the FDA or a comparable foreign regulatory authority approves our drug product candidates, we will have to comply with requirements including submissions of safety and other post-marketing information and reports, registration, as well as continued compliance with cGMPs and cGCPs for any clinical trials that we conduct post-approval.

12

The FDA may impose consent decrees or withdraw approval if compliance with regulatory requirements and standards is not maintained or if problems occur after the product reaches the market. Later discovery of previously unknown problems with our drug product candidates, including adverse events of unanticipated severity or frequency, or with our third-party manufacturers or manufacturing processes, or failure to comply with regulatory requirements, may result in revisions to the approved labeling to add new safety information; imposition of post-market studies or clinical trials to assess new safety risks; or imposition of distribution restrictions or other restrictions under a REMS program. Other potential consequences include, among other things:

| | • | | restrictions on the marketing or manufacturing of our products, withdrawal of the product from the market, or voluntary or mandatory product recalls; |

| | • | | fines, warning letters, or holds on clinical trials; |

| | • | | refusal by the FDA to approve pending applications or supplements to approved applications filed by us or suspension or revocation of license approvals; |

| | • | | product seizure or detention, or refusal to permit the import or export of our drug product candidates; and |

| | • | | injunctions or the imposition of civil or criminal penalties. |

The FDA strictly regulates marketing, labeling, advertising, and promotion of products that are placed on the market. Products may be promoted only for the approved indications and in accordance with approved label. The FDA and other agencies actively enforce the laws and regulations prohibiting the promotion of off-label uses, and a company that is found to have improperly promoted off-label uses may be subject to significant liability. The policies of the FDA and of other regulatory authorities may change and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of our drug product candidates. We cannot predict the likelihood, nature or extent of government regulation that may arise from future legislation or administrative action, either in the United States or abroad. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, we may lose any marketing approval that we may have obtained and we may not achieve or sustain profitability.

We will need to obtain FDA approval of any proposed product trade names, and any failure or delay associated with such approval may adversely impact our business.

Any trade name we intend to use for our drug product candidates will require approval from the FDA, regardless of whether we have secured a formal trademark registration from the United States Patent and Trademark Office, or USPTO. The FDA typically conducts a review of proposed product names, including an evaluation of potential for confusion with other product names and/or medication or prescribing errors. The FDA may also object to any product name we submit if it believes the name inappropriately implies medical claims. If the FDA objects to any of our proposed product names, we may be required to adopt an alternative name for our drug product candidates. If we adopt an alternative name, we would lose the benefit of our existing trademark applications for such drug product candidate, and may be required to expend significant additional resources in an effort to identify a suitable product name that would qualify under applicable trademark laws, not infringe the existing rights of third parties and be acceptable to the FDA. We may be unable to build a successful brand identity for a new trademark in a timely manner or at all, which would limit our ability to commercialize our drug product candidates.

Even if we obtain regulatory approval of our drug product candidates, the products may not gain market acceptance among physicians, patients, hospitals and others in the medical community.

Our autologous engineered-cell therapies may not become broadly accepted by physicians, patients, hospitals, and others in the medical community. Numerous factors will influence whether our drug product candidates are accepted in the market, including:

| | • | | the clinical indications for which our drug product candidates are approved; |

| | • | | physicians, hospitals, and patients considering our drug product candidates as a safe and effective treatment; |

| | • | | the potential and perceived advantages of our drug product candidates over alternative treatments; |

| | • | | the prevalence and severity of any side effects; |

| | • | | product labeling or product insert requirements of the FDA, EMA, or other regulatory authorities; |

| | • | | limitations or warnings contained in the labeling approved by the FDA or EMA; |

| | • | | the timing of market introduction of our drug product candidates as well as competitive products; |

| | • | | the cost of treatment in relation to alternative treatments; |

| | • | | the availability of adequate coverage, reimbursement and pricing by third-party payors and government authorities; |

| | • | | the willingness of patients to pay out-of-pocket in the absence of coverage by third-party payors and government authorities; |

13

| | • | | relative convenience and ease of administration, including as compared to alternative treatments and competitive therapies; and |

| | • | | the effectiveness of our sales and marketing efforts. |

In addition, although we are not utilizing embryonic stem cells in our drug product candidates, adverse publicity due to the ethical and social controversies surrounding the therapeutic use of such technologies, and reported side effects from any clinical trials using these technologies or the failure of such trials to demonstrate that these therapies are safe and effective may limit market acceptance our drug product candidates due to the perceived similarity between our drug product candidates and these other therapies. If our drug product candidates are approved but fail to achieve market acceptance among physicians, patients, hospitals, or others in the medical community, we will not be able to generate significant revenue.

Even if our products achieve market acceptance, we may not be able to maintain that market acceptance over time if new products or technologies are introduced that are more favorably received than our products, are more cost effective or render our products obsolete.

Coverage and reimbursement may be limited or unavailable in certain market segments for our drug product candidates, which could make it difficult for us to sell our drug product candidates profitably.

Successful sales of our drug product candidates, if approved, depend on the availability of adequate coverage and reimbursement from third-party payors. In addition, because our drug product candidates represent novel approaches to the treatment of ischemic HF and cancer, we cannot accurately estimate the potential revenue from our drug product candidates. Patients who are provided medical treatment for their conditions generally rely on third-party payors to reimburse all or part of the costs associated with their treatment. Adequate coverage and reimbursement from governmental healthcare programs, such as Medicare and Medicaid, and commercial payors are critical to new product acceptance.

Government authorities and third-party payors, such as private health insurers and health maintenance organizations, decide which drugs and treatments they will cover and the amount of reimbursement. Coverage and reimbursement by a third-party payor may depend upon a number of factors, including the third-party payor’s determination that use of a product is:

| | • | | a covered benefit under its health plan; |

| | • | | safe, effective and medically necessary; |

| | • | | appropriate for the specific patient; |

| | • | | neither experimental nor investigational. |

In the United States, no uniform policy of coverage and reimbursement for products exists among third-party payors. As a result, obtaining coverage and reimbursement approval of a product from a government or other third-party payor is a time-consuming and costly process that could require us to provide to each payor supporting scientific, clinical and cost-effectiveness data for the use of our products on a payor-by-payor basis, with no assurance that coverage and adequate reimbursement will be obtained. Even if we obtain coverage for a given product, the resulting reimbursement payment rates might not be adequate for us to achieve or sustain profitability or may require co-payments that patients find unacceptably high. Additionally, third-party payors may not cover, or provide adequate reimbursement for, long-term follow-up evaluations required following the use of our products. Patients are unlikely to use our drug product candidates unless coverage is provided and reimbursement is adequate to cover a significant portion of the cost of our drug product candidates. Because our drug product candidates have a higher cost of goods than conventional therapies, and may require long-term follow up evaluations, the risk that coverage and reimbursement rates may be inadequate for us to achieve profitability may be greater.

We intend to seek approval to market our drug product candidates in the United States, European Union, and in selected other foreign jurisdictions. If we obtain approval in one or more foreign jurisdictions for our drug product candidates, we will be subject to rules and regulations in those jurisdictions. For example, in the countries of the European Union, the pricing of biologics is subject to governmental control. In these countries, pricing negotiations with governmental authorities can take considerable time after obtaining marketing approval of a drug product candidate. In addition, market acceptance and sales of our drug product candidates will depend significantly on the availability of adequate coverage and reimbursement from third-party payors for our drug product candidates and may be affected by existing and future health care reform measures.

Healthcare legislative reform measures and constraints on national budget social security systems may have a material adverse effect on our business and results of operations.

14

Third-party payors, whether domestic or foreign, or governmental or private, are developing increasingly sophisticated methods of controlling healthcare costs. In both the United States and certain foreign jurisdictions, there have been a number of legislative and regulatory changes to the health care system that could impact our ability to sell our products profitably. In particular, in 2010, the Patient Protection and Affordable Care Act, as amended by the Health Care and Education Reconciliation Act of 2010, or the ACA, was enacted, which, among other things, subjected biologic products to potential competition by lower-cost biosimilars, addressed a new methodology by which rebates owed by manufacturers under the Medicaid Drug Rebate Program are calculated for drugs that are inhaled, infused, instilled, implanted or injected, increased the minimum Medicaid rebates owed by most manufacturers under the Medicaid Drug Rebate Program, extended the Medicaid Drug Rebate program to utilization of prescriptions of individuals enrolled in Medicaid managed care organizations, subjected manufacturers to new annual fees and taxes for certain branded prescription drugs, and provided incentives to programs that increase the federal government’s comparative effectiveness research. We cannot predict the full impact of the ACA on bio-pharmaceutical companies as many of the ACA reforms require the promulgation of additional detailed regulations implementing the statutory provisions which has not yet completely occurred. Further, new litigation is currently pending before the U.S. Supreme Court seeking to invalidate certain provisions of the ACA.

In addition, other legislative changes have been proposed and adopted in the United States since the ACA was enacted. In August 2011, the Budget Control Act of 2011, among other things, created measures for spending reductions by Congress. A Joint Select Committee on Deficit Reduction, tasked with recommending a targeted deficit reduction of at least $1.2 trillion for the years 2013 through 2021, was unable to reach required goals, thereby triggering the legislation’s automatic reduction to several government programs. This includes aggregate reductions of Medicare payments to providers of 2% per fiscal year, which went into effect in April 2013, and will remain in effect through 2024 unless additional Congressional action is taken. In January 2013, the American Taxpayer Relief Act of 2012, was signed into law, which, among other things, further reduced Medicare payments to several providers, including hospitals and cancer treatment centers, and increased the statute of limitations period for the government to recover overpayments to providers from three to five years.

There have been, and likely will continue to be, legislative and regulatory proposals at the foreign, federal and state levels directed at broadening the availability of healthcare and containing or lowering the cost of healthcare. We cannot predict the initiatives that may be adopted in the future. The continuing efforts of the government, insurance companies, managed care organizations and other payors of healthcare services to contain or reduce costs of healthcare and/or impose price controls may adversely affect:

| | • | | the demand for our drug product candidates, if we obtain regulatory approval; |

| | • | | our ability to set a price that we believe is fair for our products; |

| | • | | our ability to generate revenue and achieve or maintain profitability; |

| | • | | the level of taxes that we are required to pay; and |

| | • | | the availability of capital. |

Any denial in coverage or reduction in reimbursement from Medicare or other government programs may result in a similar denial or reduction in payments from private payors, which may adversely affect our future profitability.

Our drug product candidates are biologics, which are complex to manufacture, and we may encounter difficulties in production, particularly with respect to process development or scaling-out of our manufacturing capabilities. If we or any of our third-party manufacturers encounter such difficulties, our ability to provide supply of our drug product candidates for clinical trials or our products for patients, if approved, could be delayed or stopped, or we may be unable to maintain a commercially viable cost structure.

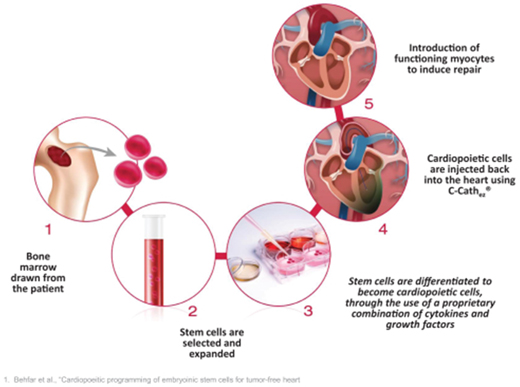

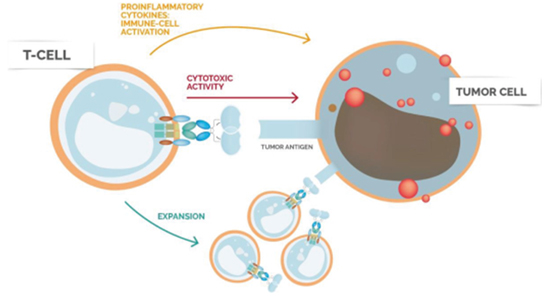

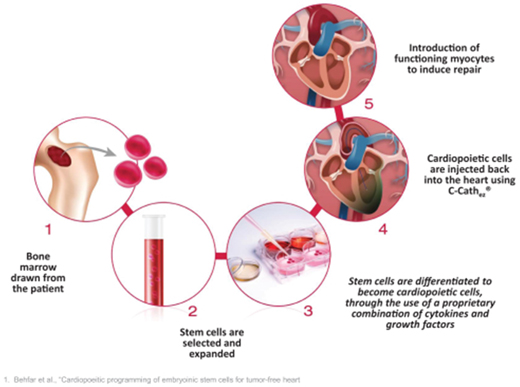

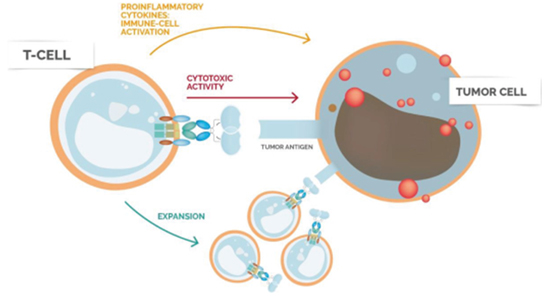

Our drug product candidates are biologics and the process of manufacturing our products is complex, highly-regulated and subject to multiple risks. The manufacture of our drug product candidates involves complex processes, including harvesting cells from patients, selecting and expanding certain cell types, engineering or reprogramming the cells in a certain manner to create either cardiopoietic cells or NKR-T cells, expanding the cell population to obtain the desired dose, and ultimately infusing the cells back into a patient’s body. As a result of the complexities, the cost to manufacture our drug product candidates, is higher than traditional small molecule chemical compounds, and the manufacturing process is less reliable and is more difficult to reproduce. Our manufacturing process is susceptible to product loss or failure due to logistical issues associated with the collection of blood cells, or starting material, from the patient, shipping such material to the manufacturing site, shipping the final product back to the patient, and infusing the patient with the product, manufacturing issues associated with the differences in patient starting materials, interruptions in the manufacturing process, contamination, equipment or reagent failure, improper installation or operation of equipment, vendor or operator error, inconsistency in cell growth, and variability in product characteristics. Even minor deviations from normal manufacturing processes could result in reduced production yields, product defects, and other supply disruptions. For example, we were only able to produce C-Cure for 70% of the patients that we attempted to produce drug product candidate for in our Phase 2 clinical trial. If for any reason we lose a patient’s starting material or later-developed product at any point in the process, the manufacturing process for that patient will

15

need to be restarted and the resulting delay may adversely affect that patient’s outcome. If microbial, viral, or other contaminations are discovered in our drug product candidates or in the manufacturing facilities in which our drug product candidates are made, such manufacturing facilities may need to be closed for an extended period of time to investigate and remedy the contamination. Because our drug product candidates are manufactured for each particular patient, we are required to maintain a chain of identity with respect to materials as they move from the patient to the manufacturing facility, through the manufacturing process, and back to the patient. Maintaining such a chain of identity is difficult and complex, and failure to do so could result in adverse patient outcomes, loss of product, or regulatory action including withdrawal of our products from the market. Further, as drug product candidates are developed through pre-clinical to late stage clinical trials towards approval and commercialization, it is common that various aspects of the development program, such as manufacturing methods, are altered along the way in an effort to optimize processes and results. Such changes carry the risk that they will not achieve these intended objectives, and any of these changes could cause our drug product candidates to perform differently and affect the results of ongoing clinical trials or other future clinical trials.

We manufactured C-Cure for CHART-1 in our pilot manufacturing plant in Belgium and we plan to initially manufacture C-Cure for CHART-2 in the same plant. We are also planning to build a pilot manufacturing facility in the United States to reduce our overall logistical costs for CHART-2 and to allow redundancy between manufacturing sites. The cells for our ongoing Phase 1 clinical trial of NKR-2 are being manufacturing at the Dana Farber Cancer Institute’s cell manufacturing facility. In the future, we plan to operate two commercial manufacturing sites, one in the United States and one in the European Union. We believe this will allow increased flexibility and reduced logistical costs and will allow for the necessary redundancy in case of site or geography-related failure. However, we are very early in the process of locating sites for these commercial manufacturing facilities and may be unsuccessful in our ability to find appropriate sites for such facilities.

Although we are working, or will be working, to develop commercially viable processes for the manufacture of our drug product candidates, doing so is a difficult and uncertain task, and there are risks associated with scaling to the level required for later-stage clinical trials and commercialization, including, among others, cost overruns, potential problems with process scale-out, process reproducibility, stability issues, lot consistency, and timely availability of reagents or raw materials. We may ultimately be unable to reduce the cost of goods for our drug product candidates to levels that will allow for an attractive return on investment if and when those drug product candidates are commercialized.

In addition, the manufacturing process that we develop for our drug product candidates is subject to FDA and foreign regulatory authority approval process, and we will need to make sure that we or our contract manufacturers, or CMOs, if any, are able to meet all FDA and foreign regulatory authority requirements on an ongoing basis. If we or our CMOs are unable to reliably produce drug product candidates to specifications acceptable to the FDA or other regulatory authorities, we may not obtain or maintain the approvals we need to commercialize such drug product candidates. Even if we obtain regulatory approval for any of our drug product candidates, there is no assurance that either we or our CMOs will be able to manufacture the approved product to specifications acceptable to the FDA or other regulatory authorities, to produce it in sufficient quantities to meet the requirements for the potential launch of the product, or to meet potential future demand. Any of these challenges could have an adverse effect on our business, financial condition, results of operations and growth prospects.

We may face competition from biosimilars, which may have a material adverse impact on the future commercial prospects of our drug product candidates.