- MTVA Dashboard

- Financials

- Filings

-

Holdings

-

Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

MetaVia (MTVA) DEF 14ADefinitive proxy

Filed: 30 Apr 24, 8:41am

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material under §240.14a-12 |

| ☒ | No fee required |

☐ | Fee paid previously with preliminary materials |

☐ | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11 |

| • | Proposal 1 - to elect three Class II directors, each to serve a three-year term until the 2027 annual meeting of stockholders and until the election and qualification of his or her successor, or such director’s earlier death, resignation, or removal; |

| • | Proposal 2 - to ratify the appointment of BDO USA, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| • | Proposal 3 - to approve an amendment to the NeuroBo Pharmaceuticals, Inc. 2022 Equity Incentive Plan. |

| • | Proposal 1 - to elect three Class II directors, each to serve a three-year term until the 2027 annual meeting of stockholders and until the election and qualification of his or her successor, or such director’s earlier death, resignation, or removal; |

| • | Proposal 2 - to ratify the appointment of BDO USA, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2024; and |

| • | Proposal 3 - to approve an amendment to the NeuroBo Pharmaceuticals, Inc. 2022 Equity Incentive Plan. |

| | | | | | | How Votes Impact Approval of Proposal | ||||||||||||

| Proposal | | | Required Approval | | | For | | | Withhold/ Against | | | Abstention | | | Broker Non- Votes(1) | |||

| 1 | | | Election of Directors | | | Plurality of votes | | | For the director nominee(s) | | | No impact(2) | | | — | | | No effect. |

| | | | | | | | | | | | ||||||||

| 2 | | | Ratification of the Appointment of BDO USA, P.C. as our independent registered public accounting firm for the fiscal year ending December 31, 2024 | | | Majority of the voting power present in person or represented by proxy and entitled to vote | | | For the proposal | | | Against the proposal | | | Against the proposal | | | Not applicable (brokers have discretionary authority) |

| | | | | | | | | | | | ||||||||

| | | | | | | How Votes Impact Approval of Proposal | ||||||||||||

| Proposal | | | Required Approval | | | For | | | Withhold/ Against | | | Abstention | | | Broker Non- Votes(1) | |||

| 3 | | | Approval of an amendment to the NeuroBo Pharmaceuticals, Inc. 2022 Equity Incentive Plan | | | Majority of the voting power present in person or represented by proxy and entitled to vote | | | For the proposal | | | Against the proposal | | | Against the proposal | | | No effect |

| (1) | A broker non-vote occurs when a broker or other nominee submits a proxy card with respect to shares of Common Stock held in a fiduciary capacity (typically referred to as being held in “street name”), but declines to vote on a particular matter because the broker or nominee has not received voting instructions from the beneficial owner or the persons entitled to vote those shares and for which the broker or nominee does not have discretionary voting power under rules applicable to broker-dealers. |

| (2) | Withhold votes, if any, will have no effect on the outcome of the election of directors. If a nominee gets at least one vote For then the Withhold votes will have no effect. |

| • | Vote at the Annual Meeting - to participate in the Annual Meeting, you will need the 16-digit control number included on the instructions that accompanied your proxy materials. Submitting a proxy will not prevent a stockholder from attending the Annual Meeting, revoking their earlier submitted proxy, and voting in person. |

| • | Vote through the Internet - you may vote through the Internet. To vote by Internet, you will need to use a control number provided to you in the materials with this Proxy Statement and follow the additional steps when prompted. The steps have been designed to authenticate your identity, allow you to give voting instructions, and confirm that those instructions have been recorded properly. |

| • | Vote by mail - complete, sign and date the accompanying proxy card and return it as soon as possible before the Annual Meeting in the envelope provided. If the postage-paid envelope is missing, please mail your completed proxy card to the attention of our Secretary, NeuroBo Pharmaceuticals, Inc., 545 Concord Avenue, Suite 210, Cambridge, Massachusetts 02138. |

| • | delivering to our Secretary (by any means, including facsimile) a written notice stating that the proxy is revoked; |

| • | signing and delivering a proxy bearing a later date; |

| • | voting again through the Internet; or |

| • | attending and voting at the Annual Meeting (although attendance at the meeting will not, by itself, revoke a proxy). |

| • | review of financial statements and SEC reports, including the adequacy of our internal control over financial reporting, disclosure controls and procedures, including any specific cybersecurity issues that could affect the adequacy of the Company’s internal controls and internal controls related to sustainability information in public disclosures, and any mitigating activities adopted in response to material weaknesses or significant control deficiencies; |

| • | our compliance with legal and regulatory requirements; |

| • | the qualifications, independence and performance of our independent auditors; and |

| • | the preparation of the audit committee report to be included in our annual proxy statement. |

| • | evaluating, recommending, approving and reviewing executive officer and director compensation arrangements, plans, policies and programs; |

| • | evaluating and approving the Company’s performance against corporate goals and objectives; |

| • | reviewing the Company’s practices and policies of employee compensation as they relate to risk management; |

| • | administering our cash-based and equity-based compensation plans; and |

| • | making recommendations to the Board regarding any other Board responsibilities relating to executive compensation. |

| • | identifying, considering and recommending candidates for membership on the Board; |

| • | overseeing the process of evaluating the performance of the Board; |

| • | developing a set of corporate governance guidelines and principles to be applicable to the Company and periodically reviewing and assessing the Company’s Corporate Governance Guidelines and the Company’s Code of Business Conduct and Ethics; and |

| • | advising the Board on other corporate governance matters. |

| Total Number of Directors | | | 7 | |||||||||

| | | Female | | | Male | | | Non- Binary | | | Did Not Disclose Gender | |

| Part I: Gender Identity | | | | | | | | | ||||

Directors | | | — | | | 7 | | | — | | | — |

| Part II: Demographic Background | | | | | | | | | ||||

African American or Black | | | — | | | 1 | | | — | | | — |

Asian | | | — | | | 1 | | | — | | | |

White | | | — | | | 5 | | | — | | | — |

| Name | | | Age | | | Title | | | Class |

Jason L. Groves(1) | | | 53 | | | Director | | | Class II |

Hyung Heon Kim | | | 48 | | | Chief Executive Officer, President, Director | | | Class II |

Andrew Koven(2) | | | 66 | | | Chair of the Board of Directors | | | Class II |

| (1) | Member of the nominating and corporate governance committee. |

| (2) | Chair of the Board, member of the audit committee and chair of the nominating and corporate governance committee. |

| Name | | | Age | | | Title | | | Class |

Mark A. Glickman | | | 58 | | | Director | | | Class III |

Michael Salsbury(1) | | | 74 | | | Director | | | Class III |

D. Gordon Strickland(2) | | | 77 | | | Director | | | Class I |

James P. Tursi | | | 59 | | | Director | | | Class I |

| (1) | Chair of the compensation committee. |

| (2) | Chair of the audit committee. |

| Name | | | Fees Earned or Paid in Cash ($) | | | Stock Awards(1) ($) | | | Total ($) |

Mark A. Glickman(2) | | | 31,481 | | | 18,988 | | | 50,469 |

Jason L. Groves(3) | | | 49,988 | | | 50,363 | | | 100,351 |

Richard Kang(4) | | | 10,000 | | | — | | | 10,000 |

Hyung Heon Kim(5) | | | 33,000 | | | — | | | 33,000 |

Na Yeon (Irene) Kim(6) | | | 34,757 | | | 50,363 | | | 85,120 |

Andrew Koven(7) | | | 90,473 | | | 50,363 | | | 140,836 |

Michael Salsbury(8) | | | 52,000 | | | 50,363 | | | 102,363 |

D. Gordon Strickland(9) | | | 60,351 | | | 50,363 | | | 110,714 |

James P. Tursi(10) | | | 7,459 | | | 14,467 | | | 21,926 |

| (1) | Amounts reported reflect the aggregate grant date fair value of restricted stock units (“RSUs”), whose grant date fair value was determined based on the closing sales price of our Common Stock as reported on Nasdaq on the date of grant. The amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. |

| (2) | Mr. Glickman was appointed to the Board in May 2023. As of December 31, 2023, Mr. Glickman had 3,126 outstanding unvested RSUs. |

| (3) | As of December 31, 2023, Mr. Groves had 333 outstanding exercisable options and 7,032 outstanding unvested RSUs. |

| (4) | Dr. Kang resigned from the Board in March 2023. |

| (5) | Mr. Kim earned $33,000 in fees as a director prior to Mr. Kim’s appointment as president and as an executive officer in August 2023. |

| (6) | Ms. Kim resigned from the Board in September 2023. |

| (7) | As of December 31, 2023, Mr. Koven had 333 outstanding options, of which 271 options were exercisable, and 12,501 outstanding RSUs, of which 5,469 RSUs were vested with Common Stock issuance deferred under the terms of the RSU award, and the remaining 7,032 RSUs were unvested. |

| (8) | As of December 31, 2023, Mr. Salsbury had 333 outstanding exercisable options and 7,032 outstanding unvested RSUs. |

| (9) | As of December 31, 2023, Mr. Strickland had 250 outstanding options, of which 189 options were exercisable, and 7,032 outstanding unvested RSUs. |

| (10) | Dr. Tursi was appointed to the Board in November 2023. As of December 31, 2023, Dr. Tursi had 2,458 outstanding unvested RSUs. |

| | | Audit Committee | | | Compensation Committee | | | Nominating and Corporate Governance Committee | |

Committee Chair | | | $18,000 | | | $12,000 | | | $10,000 |

Committee Member (other than the Chair) | | | 9,000 | | | 6,000 | | | 5,000 |

| • | each person, or group of affiliated persons, known by us to beneficially own more than 5% of the Common Stock; |

| • | each of our named executive officers; |

| • | each of our directors and nominees for director; and |

| • | all of our current executive officers and directors as a group. |

| | | Shares Beneficially Owned | | | ||

| Name Of Beneficial Owner | | | Number(1) | | | Percent(2) |

| Greater than 5% stockholders | | | | | ||

Dong-A ST Co., Ltd.(3) | | | 2,803,699 | | | 57.15% |

| Directors and Named Executive Officers | | | | | ||

Mark A. Glickman, Director | | | 1,562 | | | * |

Jason L. Groves, Director(4) | | | 5,801 | | | * |

Andrew Koven, Chair of the Board of Directors(5) | | | 5,797 | | | * |

Hyung Heon Kim, Chief Executive Officer, President, Director(6) | | | 83 | | | * |

Michael Salsbury, Director(4) | | | 5,801 | | | * |

D. Gordon Strickland, Director(7) | | | 5,685 | | | * |

James P. Tursi, Director | | | 1,563 | | | * |

Marshall Woodworth, Chief Financial Officer | | | — | | | * |

Joseph Hooker, Former Interim Chief Executive Officer and President(8) | | | — | | | * |

Gil Price, Former President and Chief Executive Officer(9) | | | — | | | * |

All current executive officers and directors as a group (8 persons) | | | 26,292 | | | * |

| * | Represents beneficial ownership of less than one percent. |

| (1) | Includes shares underlying (i) options that are exercisable and (ii) RSUs that are vested or will become vested within 60 days of April 24, 2024. |

| (2) | Applicable percentage of ownership is based on 4,906,002 shares of Common Stock outstanding as of the Record Date, as adjusted for each stockholder. |

| (3) | Represents shares of Common Stock owned by Dong-A, a South Korean corporation, with an address of Dong-A is 64, Cheonho-daero, Dongdaemun-gu, Seoul, Republic of Korea. |

| (4) | Includes 333 shares of Common Stock issuable upon exercise of outstanding options within 60 days of April 24, 2024. |

| (5) | Includes 328 shares of Common Stock issuable upon exercise of outstanding options within 60 days of April 24, 2024 and 5,469 of vested RSUs whose Common Stock issuance was deferred under the terms of the RSU award. |

| (6) | Includes 83 shares of Common Stock issuable upon exercise of outstanding options within 60 days of April 24, 2024. |

| (7) | Includes 217 shares of Common Stock issuable upon exercise of outstanding options within 60 days of April 24, 2024. |

| (8) | Mr. Hooker served as our Interim President and Chief Executive Officer from January 2023 to August 2023. |

| (9) | Dr. Price resigned as our President and Chief Executive Officer in January 2023. |

| Name | | | Age | | | Position(s) |

Hyung Heon Kim | | | 47 | | | Chief Executive Officer and President |

Marshall H. Woodworth | | | 66 | | | Chief Financial Officer |

| Name and Principal Position | | | Year | | | Salary ($) | | | Bonus ($) | | | Stock Awards(1) ($) | | | Option Awards(1) | | | All Other Compensation ($) | | | Total ($) |

Hyung Heon Kim, President and Chief Executive Officer(2) | | | 2023 | | | 174,009 | | | 55,000 | | | 386,915 | | | — | | | 48,131(3) | | | 664,055 |

| | 2022 | | | — | | | — | | | — | | | 6,663 | | | 54,217(3) | | | 60,880 | ||

Marshall Woodworth, Chief Financial Officer(4) | | | 2023 | | | — | | | — | | | — | | | — | | | 154,500(5) | | | 154,500 |

| | 2022 | | | — | | | — | | | — | | | — | | | — | | | — | ||

Gil Price, Former President and Chief Executive Officer(6) | | | 2023 | | | 16,667 | | | — | | | — | | | — | | | 100,140(7) | | | 116,807 |

| | 2022 | | | 400,000 | | | 100,000 | | | — | | | — | | | 1,579(7) | | | 501,579 | ||

Joseph Hooker, Former Interim President and Chief Executive Officer(8) | | | 2023 | | | — | | | — | | | — | | | — | | | 432,000(9) | | | 432,000 |

| | 2022 | | | — | | | — | | | — | | | — | | | — | | | — |

| (1) | Amounts for fiscal year ended December 31, 2023 reflect the aggregate grant date fair value of RSUs, whose grant date fair value was determined based on the closing sales price of our Common Stock as reported on Nasdaq on the date of grant. The amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. Amounts for fiscal year ended December 31, 2022 reflect the aggregate grant date fair value of options, whose grant date fair value was estimated using the Black Scholes valuation model and the assumptions used for valuation can be found in Note 8 Stock-based compensation of the Notes to Consolidated Financial Statements, included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023. The amounts shown exclude the impact of estimated forfeitures related to service-based vesting conditions. |

| (2) | Mr. Kim was appointed as our President and Chief Executive Officer in August 2023. |

| (3) | Other compensation paid to Mr. Kim was related to (i) $33,000 fees earned in 2023 as a director prior to Mr. Kim’s appointment as an executive officer in August 2023, (ii) $15,131 for health and welfare benefits paid by NeuroBo in 2023, and (iii) $54,217 fees earned in 2022 as a director. |

| (4) | Mr. Woodworth was appointed as our Acting Chief Financial Officer in October 2023 and was appointed as Chief Financial Officer in March 2024. |

| (5) | While serving as our Acting Chief Financial Officer, Mr. Woodworth was employed by WhiteCap Search Holdings, LLC (“WhiteCap”) and was contracted to us from October 2023 until March 2024. We paid $154,500 in consulting fees to WhiteCap for Mr. Woodworth’s services for 2023. |

| (6) | Dr. Price was appointed as our President and Chief Executive Officer in November 2021. Dr. Price resigned as our President and Chief Executive Officer in January 2023. |

| (7) | Other compensation paid to Dr. Price was related to (i) a severance payment of $100,000 in 2023 and (ii) health and welfare benefits paid by NeuroBo in 2023 and 2022. |

| (8) | Mr. Hooker was appointed as our interim President and Chief Executive Officer in January 2023. Mr. Hooker stepped down as the Interim President and Chief Executive Officer in August 2023. |

| (9) | While serving as our Interim President and Chief Executive Officer, Mr. Hooker was employed by Korn Ferry US (“Korn Ferry”) and was contracted to us from January 2023 until August 2023. We paid $432,000 in consulting fees to Korn Ferry for Mr. Hooker’s services for 2023. |

| | | Option Awards | | | Stock Awards | |||||||||||||

| Name | | | Grant Date | | | Number Of Securities Underlying Unexercised Options Exercisable (#) | | | Option Exercise Price ($) | | | Option Expiration Date | | | Number Of Shares Of Stock That Have Not Vested (#) | | | Market Value Of Shares Of Stock That Have Not Vested ($) |

Hyung Heon Kim | | | June 9, 2022 | | | 83 | | | 14.18 | | | June 9, 2032 | | | — | | | — |

Hyung Heon Kim | | | August 10, 2023 | | | — | | | — | | | — | | | 78,133(1) | | | 288,858 |

| (1) | 50% of the RSUs will vest on August 11, 2024, and the remainder will vest in equal monthly installments on the last day of each full month over the subsequent 12 months, subject to continuing service. |

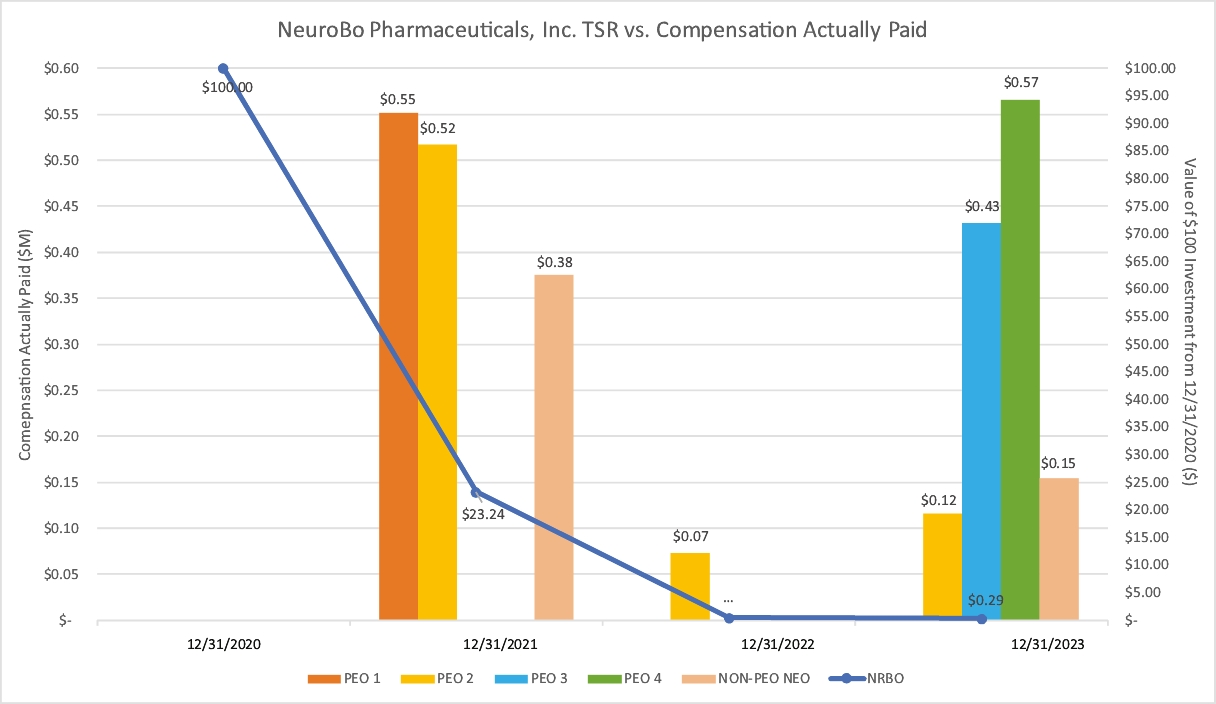

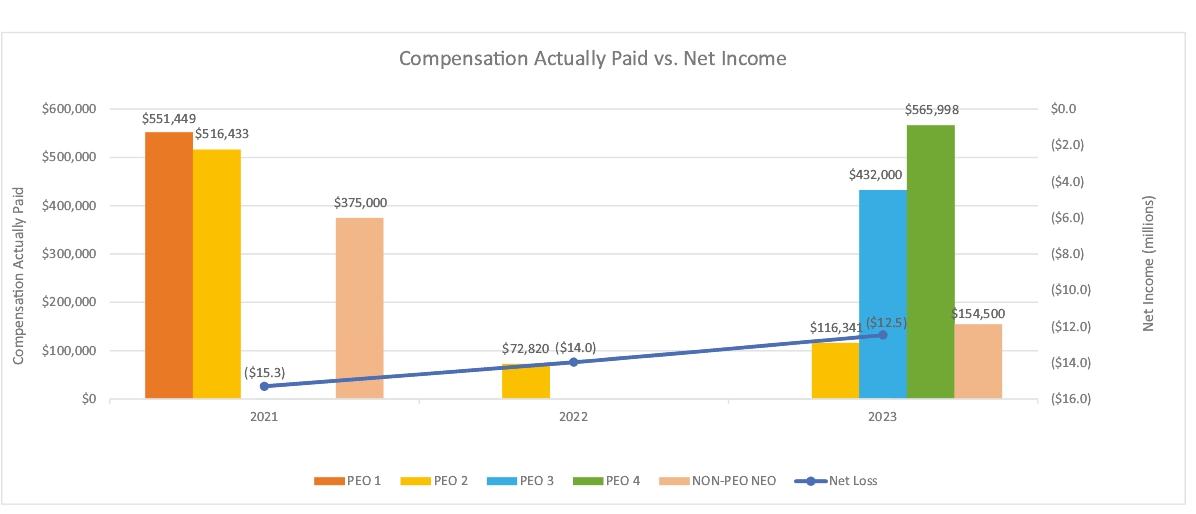

| Year | | | Summary Compen- sation Table Total for PEO 1(1) | | | Compen- sation Actually Paid to PEO 1(2)(3) | | | Summary Compen- sation Table Total for PEO 2(1) | | | Compen- sation Actually Paid to PEO 2(2)(4) | | | Summary Compen- sation Table Total for PEO 3(1) | | | Compen- sation Actually Paid to PEO 3(2)(3) | | | Summary Compen- sation Table Total for PEO 4(1) | | | Compen- sation Actually Paid to PEO 4(2)(5) | | | Average Summary Compen- sation Table Totals for non-PEO NEOs(1) | | | Average Compen- sation Actually Paid to non-PEO NEOs(2)(3) | | | Average Summary Compen- sation Table Totals for non-PEO NEOs(1) | | | Average Compen- sation Actually Paid to non-PEO NEOs(2)(3) | | | Value of Initial Fixed $100 Investment Based On: | | | Net Income (thousands) |

| | Total Shareholder Return | | ||||||||||||||||||||||||||||||||||||||||

| 2023 | | | — | | | — | | | $116,807 | | | $116,341 | | | $432,000 | | | $432,000 | | | $664,055 | | | $565,998 | | | — | | | — | | | $154,500 | | | $154,500 | | | $0.23 | | | $(12,470) |

| 2022 | | | — | | | — | | | $501,579 | | | $72,820 | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | — | | | $0.46 | | | $(13,967) |

| 2021 | | | $551,449 | | | $551,449 | | | $920,276 | | | $516,433 | | | — | | | — | | | — | | | — | | | $375,000 | | | $375,000 | | | — | | | — | | | $23.24 | | | $(15,284) |

| (1) | Dr. Richard Kang (PEO 1) served as our PEO through November 3, 2021. Dr. Gil Price (PEO 2) was appointed as our President and Chief Executive Officer and became our PEO as of November 3, 2021 and through January 2023. Joseph Hooker (PEO 3) served as our Interim President and Chief Executive Officer from January 2023 to August 2023 and was contracted to us from Korn Ferry. Hyung Heon Kim (PEO 4) was appointed as our Chief Executive Officer and President in August 2023. The non-PEO NEO for whom the average compensation is presented in this table for 2021 is Akash Bakshi, who served as our Chief Operating Officer until December 31, 2021. The non-PEO NEO for whom the average compensation is presented in this table for 2023 is Marshall Woodworth, who served as our Acting Chief Financial Officer from October 25, 2023 until his appointment as our Chief Financial Officer on March 1, 2024. |

| (2) | The amounts shown as Compensation Actually Paid have been calculated in accordance with Item 402(v) of Regulation S-K and do not reflect compensation actually realized or received by the applicable PEO or non-PEO NEOs. These amounts reflect total compensation as set forth in the Summary Compensation Table for each year, adjusted with respect to Dr. Price as described in footnote 4 below and with respect to Mr. Kim as set forth in footnote 5 below. |

| (3) | Compensation Actually Paid was equal to the total compensation set forth in the Summary Compensation Table as none of the exclusions and inclusions to determine Compensation Actually Paid were applicable. |

| (4) | Compensation Actually Paid reflects the exclusions and inclusions of certain amounts for Dr. Price (PEO 2) as set forth below. Equity values are calculated in accordance with FASB ASC Topic 718. |

| PEO 2 | | | | | | | |||

Prior FYE Current FYE Fiscal Year | | | 12/31/2020 12/31/2021 2021 | | | 12/31/2021 12/31/2022 2022 | | | 12/31/2022 12/31/2023 2023 |

SCT Total | | | $920,276 | | | $501,579 | | | 116,807 |

Minus Grant Date Fair Value of Options Awards and Stock Awards Granted in Fiscal Year | | | $(854,122) | | | — | | | — |

Plus Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year | | | $450,279 | | | — | | | — |

Plus Change in Fair Value of Outstanding and Unvested Options Awards and Stock Awards Granted in Prior Fiscal Years | | | — | | | $(255,112) | | | — |

Plus Fair Value at Vesting of Option Awards and Stock Awards Granted in Fiscal Year That Vested During Fiscal Year | | | — | | | $10,527 | | | — |

Plus Changes in Fair Values as of Vesting Date of Option Awards and Stock Awards Granted in Prior Fiscal Years For Which Applicable Vesting Conditions Were Satisfied During Fiscal Year | | | — | | | $(184,174) | | | — |

Minus Fair Value as of Prior Fiscal Year-End of Option Awards and Stock Awards Granted in Prior Fiscal Years That Failed to Meet Applicable Vesting Conditions During Fiscal Year | | | — | | | — | | | $(466) |

Compensation Actually Paid | | | $516,433 | | | $72,820 | | | $116,341 |

| (5) | Compensation Actually Paid reflects the exclusions and inclusions of certain amounts for Hyung Heon Kim (PEO 4) as set forth below. Equity values are calculated in accordance with FASB ASC Topic 718. |

| PEO 4 | | | | | | | |||

Prior FYE Current FYE Fiscal Year | | | 12/31/2020 12/31/2021 2021 | | | 12/31/2021 12/31/2022 2022 | | | 12/31/2022 12/31/2023 2023 |

SCT Total | | | — | | | — | | | $664,055 |

Minus Grant Date Fair Value of Options Awards and Stock Awards Granted in Fiscal Year | | | — | | | — | | | $(386,915) |

Plus Fair Value at Fiscal Year-End of Outstanding and Unvested Option Awards and Stock Awards Granted in Fiscal Year | | | — | | | — | | | $288,858 |

Compensation Actually Paid | | | — | | | — | | | $565,998 |

| Fee Category | | | Fiscal Year 2023 | | | Fiscal Year 2022 |

Audit fees | | | $450,704 | | | $677,037 |

Audit-related fees | | | — | | | — |

Tax fees | | | $42,400 | | | — |

All other fees | | | — | | | — |

Total fees | | | $493,104 | | | $677,037 |

| • | automatically increase on January 1st of each year for a period of eight years commencing on January 1, 2025 and ending on (and including) January 1, 2032, the aggregate number of shares of Common Stock that may be issued pursuant to Awards (as defined in the 2022 Equity Incentive Plan) to an amount equal to 10% of the Fully Diluted Shares (as defined in the 2022 Equity Incentive Plan) as of the last day of the preceding calendar year, provided, however that the Board may act prior to the effective date of any such annual increase to provide that the increase for such year will be a lesser number of shares of Common Stock; and |

| • | increase the aggregate maximum number of shares of Common Stock that may be issued pursuant to the exercise of Incentive Stock Options (as defined in the 2022 Equity Incentive Plan) to 1,000,000 shares of the Common Stock plus the amount of any increase in the number of shares that may be available for issuance pursuant to the annual increase described above, but in no event more than 15,000,000 shares of the Common Stock issued as Incentive Stock Options. |

| Plan Category | | | Number of securities to be issued upon exercise of outstanding options, warrants and rights (#) (a) | | | Weighted average exercise price of outstanding options, warrants and rights ($) (b) | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) (#) (c) |

Equity compensation plans approved by security holders | | | 171,063 | | | 398.80 | | | 469,654(1)(2) |

Equity compensation plans not approved by security holders | | | — | | | — | | | 4,166(3) |

Total | | | 171,063 | | | 398.80 | | | 469,820 |

| (1) | The number of shares of Common Stock remaining available for future issuance represents shares available for issuance under the 2022 Equity Incentive Plan. |

| (2) | The 2022 Equity Incentive Plan (not including the Amendment) provides that the number of shares that may be issued under the 2022 Equity Incentive Plan shall be increased on the first day of each fiscal year by an amount equal to the lesser of (i) 5% of the number of outstanding shares of Common Stock on such date and (ii) an amount determined by the plan administrator. |

| (3) | Our only equity compensation plan not approved by our security holders is our 2021 Inducement Plan. A total of 4,166 shares of our common stock have been reserved for issuance under the Inducement Plan, subject to adjustment for stock dividends, stock splits, or other changes in our common stock or capital structure. The Inducement Plan was approved by the Compensation Committee without stockholder approval pursuant to Nasdaq Stock Market Listing Rule 5635(c)(4), and is to be utilized exclusively for the grant of stock awards to individuals who were not previously an employee or non-employee director of NeuroBo (or following a bona fide period of non-employment with NeuroBo) as an inducement material to such individual’s entry into employment with NeuroBo, within the meaning of Nasdaq Listing Rule 5635(c)(4). The 2021 Inducement Plan is administered by the Board. Stock awards under the Inducement Plan may only be granted by: (i) the Compensation Committee or (ii) another committee of the Board composed solely of at least two members of the Board who meet the requirements for independence under the Nasdaq Stock Market Listing Rules (the foregoing subsections (i) and (ii) are collectively referred to as the “Committee”). Under the 2021 Inducement Plan, the Committee may choose to grant (i) non-statutory stock options, (ii) stock appreciation rights, (iii) restricted stock awards, (iv) restricted stock unit awards, (v) performance stock awards, (vi) performance cash awards, and (vii) other stock awards to eligible recipients, with each grant to be evidenced by an award agreement setting forth the terms and conditions of the grant as determined by the Committee in accordance with the terms of the Inducement Plan. |

NEUROBO PHARMACEUTICALS, INC. | ||||||

| | | | | |||

| By: | | | | | ||

| Name: | | | | | ||

| Title: | | | | | ||