USCA All Terrain Fund

Semi-Annual Report

September 30, 2024

USCA All Terrain Fund

Table of Contents

USCA All Terrain Fund

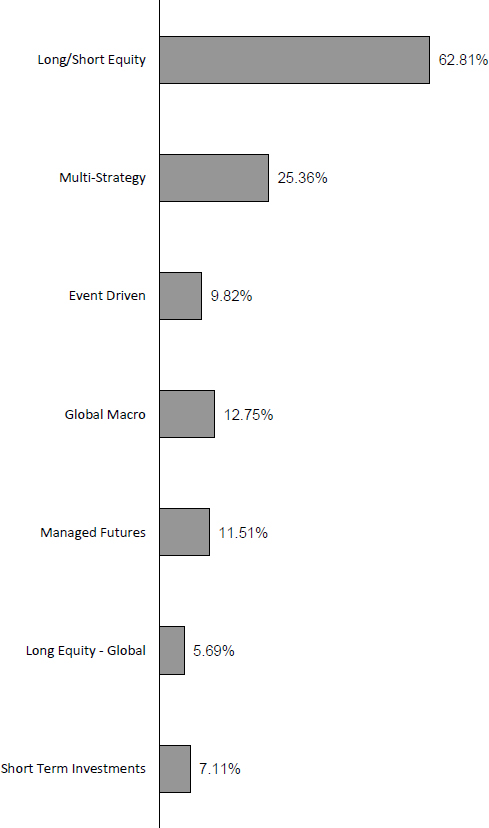

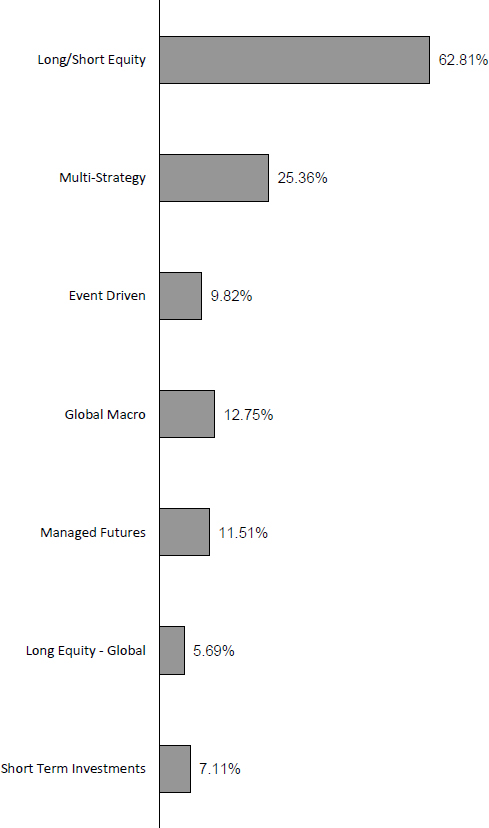

Investment Strategy Allocation

September 30, 2024 (Unaudited)

(expressed as a percentage of net assets)

USCA All Terrain Fund

Schedule of Investments

September 30, 2024 (Unaudited)

| | | Cost | | | Value | | | Frequency of

Redemptions b | | Redemption

Notification

Period (Days) b | |

| INVESTMENTS IN PRIVATE INVESTMENT COMPANIES c - 127.94% a | | | | | | | | | | | | | |

| Event Driven - 9.82% | | | | | | | | | | | | | |

| ECF Value Fund II, L.P. - Class A (Initially Acquired on 7/1/2020) g | | | 2,800,000 | | | | 3,985,789 | | | Annually | | 60 | |

| | | | | | | | 3,985,789 | | | | | | |

| Long Equity - Global - 5.69% | | | | | | | | | | | | | |

| WMQS Global Equity Active Extension Onshore Fund L.P. - Class F-2 (Initially Acquired on 5/1/2018) g | | | 56,014 | | | | 2,313,915 | | | Monthly | | 30 | |

| | | | | | | | | | | | | | |

| Global Macro - 12.75% | | | | | | | | | | | | | |

| Brevan Howard L.P. - Series B (Initially Acquired on 6/26/2015) f, g | | | 1,186,088 | | | | 2,721,939 | | | Monthly | | 90 | |

| Brevan Howard L.P. - Series M (Initially Acquired on 8/1/2021) f, g | | | 375,000 | | | | 461,444 | | | Monthly | | 90 | |

| Mission Crest Macro Fund, L.P. - Series A (Initally Acquired on 10/1/2022 ) g | | | 2,000,000 | | | | 1,984,999 | | | Monthly | | 60 | |

| | | | | | | | 5,168,382 | | | | | | |

| Long/Short Equity - 62.81% | | | | | | | | | | | | | |

| 4D Capital Partners, L.P. (Initially Acquired on 2/1/2024) g | | | 1,550,000 | | | | 1,743,345 | | | Quarterly | | 45 | |

| Cooper Creek Partners LLC - Class B (Initially Acquired on 3/1/2023) g | | | 2,800,000 | | | | 3,381,977 | | | Monthly | | 45 | |

| Greenlight Domestic Holding L.P. (Initially Acquired on 7/31/2023) d, g | | | 228,251 | | | | 238,978 | | | Illiquid | | N/A | |

| Greenlight Masters Qualified, L.P. - Series C (Initially Acquired on 6/24/2015) g | | | 1,923,771 | | | | 4,074,723 | | | Semi-Annually | | 90 | |

| Greenlight Capital, L.P. - Gold Interests (Initially Acquired on 3/1/2023) f, g | | | 1,771,749 | | | | 2,727,630 | | | Quarterly | | 45 | |

| SIO Partners, L.P. (Initially Acquired on 6/1/2020) f, g | | | 1,850,000 | | | | 3,089,956 | | | Monthly | | 60 | |

| Southpoint Qualified Fund L.P. - Class A (Initially Acquired on 10/1/2020) f, g | | | 1,462,500 | | | | 1,873,284 | | | Quarterly | | 60 | |

| Spruce Point Research Activism Partners L.P. - Class I (Initially Acquired on 5/1/2021) g | | | 1,000,000 | | | | 2,030,037 | | | Monthly | | 45 | |

| Stanley Partners Fund, L.P. (Initially Acquired on 7/1/2020) g | | | 250,000 | | | | 2,895,802 | | | Monthly | | 30 | |

| Teton Capital Partners, L.P. (Initially Acquired on 2/1/2022) g | | | 1,000,000 | | | | 1,154,148 | | | Quarterly | | 45 | |

| Voss Value Fund, L.P. (Initially Acquired on 3/1/2020) g | | | 650,000 | | | | 2,271,355 | | | Quarterly | | 45 | |

| | | | | | | | 25,481,235 | | | | | | |

The accompanying Notes to Financial Statements are an integral part of these statements.

USCA All Terrain Fund

Schedule of Investments (continued)

September 30, 2024 (Unaudited)

| | | | | | | | | | | Redemption | |

| | | | | | | | | Frequency of | | Notification | |

| | | Cost | | | Value | | | Redemptions b | | Period (Days) b | |

| Managed Futures - 11.51% | | | | | | | | | | | | | |

| The Winton Fund (US) L.P. - Tranche A (Initially Acquired on 8/1/2015) g | | | 1,846,000 | | | | 2,376,178 | | | Monthly | | 30 | |

| Winton Trend Fund (US), L.P. (Initially Acquired on 1/1/2019) g | | | 1,650,000 | | | | 2,296,436 | | | Weekly | | 2 | |

| | | | | | | | 4,672,614 | | | | | | |

| Multi-Strategy - 25.36% | | | | | | | | | | | | | |

| North Rock Fund, L.P. - Series E (Initially Acquired on 11/1/2021) g | | | 3,400,000 | | | | 4,460,673 | | | Monthly | | 90 | |

| Riverview Omni Fund L.P. (Initially Acquired on 1/1/2023) f, g | | | 5,000,000 | | | | 5,830,417 | | | Quarterly | | 60 | |

| | | | | | | | 10,291,090 | | | | | | |

| | | | | | | | | | | | | | |

| TOTAL INVESTMENTS IN PRIVATE INVESTMENT COMPANIES | | | | | | | | | | | | | |

| (Cost $32,799,373) | | | | | | $ | 51,913,025 | | | | | | |

| | | | | | | | | | | | | | |

| | | | Shares | | | | Value | | | | | | |

| Short Term Investments -7.11% a | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| First AM Treasury OB FD CL X - 4.79% e | | $ | 2,887,151 | | | $ | 2,887,151 | | | | | | |

| | | | | | | | | | | | | | |

| TOTAL SHORT TERM INVESTMENT (Cost $2,887,151) | | | | | | $ | 2,887,151 | | | | | | |

| | | | | | | | | | | | | | |

| | | | | | | | Value | | | | | | |

| Total Investments (Cost $37,415,165) - 135.05% a | | | | | | $ | 54,800,176 | | | | | | |

| Liabilities in Excess of Other Assets (35.05)% a | | | | | | | (14,221,127 | ) | | | | | |

| TOTAL NET ASSETS - 100.00%a | | | | | | $ | 40,579,049 | | | | | | |

Footnotes

| a | Percentages are stated as a percent of net assets. |

| b | Redemption frequency and redemption notice period reflect general redemption terms and exclude liquidity restrictions. Further, the private investment company’s advisor may place additional redemption restrictions without notice based on the aggregate redemption requests received at a given time. |

| c | There are no unfunded capital commitments for private investments. |

| d | Currently in liquidation. Receiving proceeds as liquidated. |

| e | Rate reported is the 7-day current yield as of September 30, 2024. |

| f | Investment has an investor level or fund level redemption gate that limits the investor from redeeming more than a specified percentage of its investment in a specified period or the fund from redeeming more than a specified percentage of its net asset value in a specified period, respectively. |

| g | Securities exempt from registration under the Securities Act of 1933 (as defined below), and may be deemed to be “restricted securities”. As of September 30, 2024, the aggregate fair value of these securities is $51.9 million or 127.94% of the Fund’s net assets. The initial acquisition dates have been included for such securities. |

The accompanying Notes to Financial Statements are an integral part of these statements.

USCA All Terrain Fund

Statement of Assets & Liabilities

September 30, 2024 (Unaudited)

| Assets | | | |

| Investments, at fair value (cost $35,686,524) | | $ | 54,800,176 | |

| Dividend and interest receivable | | | 9,986 | |

| Receivable for investments sold | | | 5,622,208 | |

| Prepaid expenses | | | 7,616 | |

| Total Assets | | | 60,439,986 | |

| | | | | |

| Liabilities | | | | |

| Investment advisory fee payable (Note 4) | | | 75,095 | |

| Payable to Trustees | | | 833 | |

| Redemptions payable | | | 19,683,329 | |

| Accrued expenses and other liabilities | | | 101,680 | |

| Total Liabilities | | | 19,860,937 | |

| | | | | |

| Commitments and Contingencies (Note 4) | | | | |

| | | | | |

| Net Assets | | $ | 40,579,049 | |

| | | | | |

| Net Assets Consist of: | | | | |

| Paid in capital | | $ | 7,861,601 | |

| Total Distributable Earnings/(Accumulated Loss) | | | 32,717,448 | |

| Net Assets | | $ | 40,579,049 | |

| 25,093.14 Shares of beneficial interests outstanding | | | | |

| Net Asset Value per Share | | $ | 1,617.14 | |

The accompanying Notes to Financial Statements are an integral part of these statements.

USCA All Terrain Fund

Statement of Operations

For the Period Ended September 30, 2024 (Unaudited)

| Investment Income | | | |

| Dividend income | | $ | 175,635 | |

| Other income | | | 77 | |

| Total Investment Income | | | 175,712 | |

| | | | | |

| Expenses | | | | |

| Investment advisory fees (Note 4) | | | 259,150 | |

| Portfolio accounting and administration fees | | | 58,818 | |

| Legal fees | | | 64,265 | |

| Compliance fees | | | 18,000 | |

| Transfer agent fees and expenses | | | 19,410 | |

| Audit fees | | | 17,500 | |

| Tax return fees | | | 14,250 | |

| Trustees’ fees | | | 14,333 | |

| Registration fees | | | 10,000 | |

| Custody fees | | | 8,006 | |

| Insurance expense | | | 4,870 | |

| Total Expenses | | | 488,602 | |

| Net Expenses | | | 488,602 | |

| Net Investment Income/(Loss) | | | (312,890 | ) |

| Realized and Unrealized Gain/(Loss) on Investments | | | | |

| Net realized gain/(loss) on sale of investments | | | 8,010,732 | |

| Net realized gain/(loss) | | | 8,010,732 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (6,463,136 | ) |

| Net change in unrealized appreciation/(depreciation) on foreign currency transactions | | | — | |

| Net change in unrealized appreciation/(depreciation) | | | (6,463,136 | ) |

| Net gain/(loss) from Investments | | | 1,547,596 | |

| Net Increase/(Decrease) in Net Assets Resulting from Operations | | $ | 1,234,706 | |

| | | | | |

The accompanying Notes to Financial Statements are an integral part of these statements.

USCA All Terrain Fund

Statements of Changes in Net Assets

| | | For the Period | | | | |

| | | Ended September | | | For the Year | |

| | | 30, 2024 | | | Ended March 31, | |

| | | (Unaudited) | | | 2024 | |

| Change in Net Assets Resulting from Operations | | | | | | | | |

| Net investment income/(loss) | | $ | (312,890 | ) | | $ | (771,123 | ) |

| Net realized gain/(loss) | | | 8,010,732 | | | | 1,505,301 | |

| Net change in unrealized appreciation/(depreciation) on investments | | | (6,463,136 | ) | | | 9,155,851 | |

| Net Increase/(Decrease) in Net Assets Resulting from Operations | | | 1,234,706 | | | | 9,890,029 | |

| | | | | | | | | |

| Change in Net Assets Resulting from Capital Transactions | | | | | | | | |

| Proceeds from shares sold | | | — | | | | 895,000 | |

| Payments for shares redeemed | | | (39,388,976 | ) | | | (7,136,148 | ) |

| Net Increase/(Decrease) in Net Assets Resulting from Capital Transactions | | | (39,388,976 | ) | | | (6,241,148 | ) |

| | | | | | | | | |

| Net Increase/(Decrease) in Net Assets | | | (38,154,270 | ) | | | 3,648,881 | |

| Net Assets, Beginning of Year | | | 78,733,319 | | | | 75,084,438 | |

| Net Assets, End of Year | | $ | 40,579,049 | | | $ | 78,733,319 | |

The accompanying Notes to Financial Statements are an integral part of these statements.

USCA All Terrain Fund

Statement of Cash Flows

For the Period Ended September 30, 2024 (Unaudited)

| Cash Flows from Operating Activities | | | |

| Net increase/(decrease) in net assets resulting from operations | | $ | 1,234,706 | |

| Net realized (gain)/loss on sale of investments | | | (8,010,732 | ) |

| Capital gain distributions from registered investment companies | | | — | |

| Net change in unrealized (appreciation)/depreciation on investments | | | 6,463,136 | |

| Net (increase)/decrease in dividend and interest receivable | | | 16,097 | |

| Net (increase)/decrease in prepaid expenses | | | (4,997 | ) |

| Net increase/(decrease) in investment advisory fee payable | | | (27,610 | ) |

| Net increase/(decrease) in payable to Trustees | | | (4,167 | ) |

| Net increase/(decrease) in accrued expenses and other liabilities | | | (30,287 | ) |

| Purchases of investment securities | | | (153,477 | ) |

| Sales of investment securities | | | 20,217,154 | |

| Net (purchases)/sales of short term investments | | | 4,501,629 | |

| Net cash provided/(used) by operating activities | | | 24,201,452 | |

| | | | | |

| Cash Flows from Financing Activities | | | | |

| Proceeds from shares sold | | | — | |

| Payments for shares redeemed, net of redemptions payable | | | (24,201,452 | ) |

| Net cash provided/(used) in financing activities | | | (24,201,452 | ) |

| | | | | |

| Net Change in Cash | | | — | |

| Cash - Beginning of Year | | | — | |

| Cash - End of Year | | $ | — | |

| | | | | |

| Non-cash operating activities not included herein consist of reinvestment of long term capital gain distributions from registered investment companies of $0,000. | |

The accompanying Notes to Financial Statements are an integral part of these statements.

USCA All Terrain Fund

Financial Highlights

| | | For the Period | | | | | | | | | | | | | |

| | | Ended | | | For the Year Ended | |

| | | September 30, | | | | | | | | | | | | | |

| | | 2024 | | | | | | | | | | | | | |

| | | (Unaudited) | | | March 31, 2024 | | | March 31, 2023 | | | March 31, 2022 | | | March 31, 2021 | |

| | | | | | | | | | | | | | | | |

| Per Share Operating Performance | | | | | | | | | | | | | | | | | | | | |

| Beginning net asset value | | $ | 1,580.47 | | | $ | 1,394.24 | | | $ | 1,358.91 | | | $ | 1,261.98 | | | $ | 953.08 | |

| | | | | | | | | | | | | | | | | | | | | |

| Loss From Investment Operations | | | | | | | | | | | | | | | | | | | | |

| Net investment income/(loss) (1) | | | (7.92 | ) | | | (14.58 | ) | | | (14.62 | ) | | | (15.83 | ) | | | (12.05 | ) |

| Net gain/(loss) from investments | | | 44.59 | | | | 200.81 | | | | 49.95 | | | | 112.76 | | | | 320.95 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total from Investment Operations | | | 36.67 | | | | 186.23 | | | | 35.33 | | | | 96.93 | | | | 308.90 | |

| | | | | | | | | | | | | | | | | | | | | |

| Ending Net Asset Value | | $ | 1,617.14 | | | $ | 1,580.47 | | | $ | 1,394.24 | | | $ | 1,358.91 | | | $ | 1,261.98 | |

| | | | | | | | | | | | | | | | | | | | | |

| Total return | | | 2.32 | % | | | 13.36 | % | | | 2.60 | % | | | 7.68 | % | | | 32.41 | % |

| | | | | | | | | | | | | | | | | | | | | |

| Supplemental Data and Ratios | | | | | | | | | | | | | | | | | | | | |

| Net assets, end of year | | $ | 40,579,049 | | | $ | 78,733,319 | | | $ | 75,084,438 | | | $ | 72,232,227 | | | $ | 63,887,733 | |

| Ratio of expenses to weighted average net assets before (waiver) recoupment (2) | | | 1.56 | % | | | 1.27 | % | | | 1.28 | % | | | 1.24 | % | | | 1.25 | % |

| Ratio of expenses to weighted average net assets after (waiver) recoupment (2) | | | 1.56 | % | | | 1.27 | % | | | 1.28 | % | | | 1.24 | % | | | 1.25 | % |

| Ratio of net investment income/(loss) to weighted average net assets before (waiver) recoupment (2) | | | (1.00 | )% | | | (1.00 | )% | | | (1.08 | )% | | | (1.19 | )% | | | (1.08 | )% |

| Ratio of net investment income/(loss) to weighted average net assets after (waiver) recoupment (2) | | | (1.00 | )% | | | (1.00 | )% | | | (1.08 | )% | | | (1.19 | )% | | | (1.08 | )% |

| Portfolio turnover rate | | | 0.24 | % | | | 8.07 | % | | | 17.89 | % | | | 16.90 | % | | | 26.15 | % |

| (1) | Calculated using average shares outstanding method. |

| (2) | Ratios do not reflect the Fund’s proportionate share of the income and expenses including performance fees/allocations, of the Underlying Funds. |

The accompanying Notes to Financial Statements are an integral part of these statements.

USCA All Terrain Fund

Notes to Financial Statements

September 30, 2024 (Unaudited)

USCA All Terrain Fund (the “Fund”) was organized as a statutory trust under the laws of the state of Delaware on January 13, 2015, and commenced operations on July 1, 2015. The Fund is registered under the Investment Company Act of 1940, as amended (the “1940 Act”), as a closed-end, tender-offer, management investment company. Shares are sold only to eligible investors, that is those that represent that they are “accredited investors” within the meaning of Rule 501(a) of Regulation D promulgated under the Securities Act of 1933, as amended. The Fund’s investment objective is to seek long-term risk-adjusted returns that are attractive as compared to those of traditional public equity and fixed income markets. The Fund is non-diversified and pursues its investment objective using a multi-manager, fund-of-funds approach by investing predominantly in non-affiliated collective investment vehicles, including privately-offered investment funds commonly known as “hedge funds” and publicly traded funds, including exchange-traded funds and mutual funds (collectively, the “Underlying Funds”).

The Fund is managed by USCA Asset Management LLC (the “Advisor” or “USCA”). The Advisor is an investment adviser registered with the Securities and Exchange Commission (“SEC”).

The Underlying Funds are managed by other advisors (the “Underlying Fund Managers”) that invest or trade in a range of investments that may include without limitation, equities and fixed income securities, currencies, derivative instruments, and commodities. The Underlying Funds may employ leverage and hedging strategies as well as pay their Underlying Fund Managers performance fees.

The Fund’s Board of Trustees (the “Board” or “Trustees”) has overall responsibility for monitoring and overseeing the Fund’s investment program, management and operations.

| 2. | Significant Accounting Policies |

The Fund prepares its financial statements in accordance with accounting principles generally accepted in the United States of America (“GAAP”). The Fund is an investment company and applies the specialized accounting and reporting guidance in the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 946 Financial Services – Investment Companies, including Accounting Standards Update (“ASU”) No. 2013-08. The functional and reporting currency of the Fund is the U.S. dollar. Following are the significant accounting policies adopted by the Fund:

A. Use of Estimates

The preparation of financial statements in conformity with GAAP requires management to make estimates and assumptions that affect the reported amount of assets and liabilities, recognition of income, and disclosure of contingent assets and liabilities at the date of the financial statements. Actual results could differ from those estimates.

B. Fund Expenses

The Fund bears its own operating expenses subject to an expense limitation and reimbursement agreement discussed in Note 4. These operating expenses include, but are not limited to: the compensation and expenses of any employees of the Trust and of any other persons rendering any services to the Fund (including any sub-adviser); clerical and shareholder service staff salaries; office space and other office expenses; fees and expenses incurred by the Fund in connection with membership in investment company organizations; legal, auditing and accounting expenses; expenses of registering shares under federal and state securities laws, including expenses incurred by the Fund in connection with the organization and initial registration of shares of the Fund; insurance expenses; fees and expenses of the custodian, transfer agent, dividend disbursing agent, shareholder service agent, plan agent, administrator, accounting and pricing services agent and underwriter of the Fund; expenses, including clerical expenses, of issue, sale, redemption or repurchase of shares of the Fund; the cost of preparing and distributing reports and notices to shareholders, the cost of printing or preparing prospectuses and statements of additional information for delivery to shareholders; the cost of printing or preparing stock certificates or any other documents, statements or reports to shareholders; expenses of shareholders’ meetings and proxy solicitations; advertising, promotion and other expenses incurred directly or indirectly in connection with the sale or distribution of the Fund’s shares that the Fund is authorized to pay. The Fund indirectly bears its portion of the expenses of the Underlying Funds. Therefore, the Underlying Funds’ expenses are not included in the Fund’s Statement of Operations or Financial Highlights.

USCA All Terrain Fund

Notes to Financial Statements (continued)

September 30, 2024 (Unaudited)

C. Investment Transactions and Investment Income

Securities transactions are recorded on the trade date. Realized gains and losses from securities transactions are calculated on an average cost basis. Realized gains and losses on Underlying Funds are recognized at the time of full redemption of the position, with the exception of realized gains and losses from “Private Investment Companies” which are allocated pro rata at the time that the Underlying Fund realizes such profits or losses. Capital gain distributions received are recorded as capital gains as soon as information is available to the Fund. Interest income is recorded on an accrual basis. Dividend income is recorded on the ex-dividend date.

D. Investments in Underlying Funds

In accordance with the terms of the Fund’s Private Offering Memorandum, investments in the Private Investment Companies are valued at their fair value as determined by the Underlying Funds’ management.

The Fund has the ability to liquidate its investments periodically, ranging from weekly to annually, depending on the provisions of the respective Underlying Fund agreements. Generally, the Underlying Fund Managers have the ability to suspend redemptions. Unless otherwise noted on the Schedule of Investments, the Fund expects to be able to redeem its investments in the Underlying Funds at their respective net asset value (“NAV”), based on the applicable redemption schedule.

Underlying Funds receive fees for their services. The fees include management and incentive fees or allocations based upon the NAV of the Fund’s investment in the Underlying Fund. Generally, fees payable to an Underlying Fund are estimated to range from 0% to 2.00% (annualized) of the average NAV of the Fund’s investment in that Underlying Fund. In addition, certain Underlying Funds charge an incentive allocation or fee which can range up to 30% of an Underlying Fund’s net profits. The impact of these fees are reflected in the Fund’s performance, but are not operational expenses of the Fund. Incentive fees may be subject to certain threshold rates.

The Underlying Funds in which the Fund invests utilize a variety of financial instruments in their trading strategies, including equity and debt securities, currencies, options, futures, and swap contracts. Several of these financial instruments contain varying degrees of off-balance sheet risk, whereby changes in fair value of the securities underlying the financial instruments may be in excess of the amounts recorded on each of the Underlying Fund’s balance sheets. In addition, the Underlying Funds may sell securities short whereby a liability is created to repurchase the security at prevailing prices. Such Underlying Funds’ ultimate obligations to satisfy the sale of securities sold short may exceed the amount recognized on their balance sheets. However, due to the nature of the Fund’s interest in the Underlying Funds, such risks are limited to the Fund’s invested amount in each Underlying Fund. Below is a description of each Underlying Fund’s investment strategies (for a more detailed description, please see the Fund’s offering memorandum) by class.

Event Driven. Event-driven strategies are designed to profit from changes in the prices of securities of companies facing a major corporate event. The goal of an event-driven strategy is to identify securities, which may include common or preferred stock as well as many types of fixed income, with a favorable risk-reward ratio based on the probability that a particular event will occur. Such events include mergers and acquisitions as well as restructurings, spin-offs and significant litigation (e.g., tobacco or patent litigation).

Global Macro. Global macro strategies typically seek to generate income and/or capital appreciation through a portfolio of investments focused on macro-economic opportunities across numerous markets and instruments. These strategies rely on the use of, among other things, cash and derivative markets, each of which bear their own risks, as well as certain assumptions about global macro-economic trends. There can be no assurance that such macro-economic assumptions will prove to be correct. Global macro managers may employ relative value, event driven, long/short and other strategies or trading approaches. Trading positions are generally held both long and/or short in both U.S. and non-U.S. markets. Global macro strategies are generally categorized as either discretionary or systematic in nature and may assume aggressive investment postures with respect to position concentrations, use of leverage, portfolio turnover, and the various investment instruments used.

USCA All Terrain Fund

Notes to Financial Statements (continued)

September 30, 2024 (Unaudited)

Long Equity (Domestic and Global). Similar to long/short equity described below, managers employing this strategy invest in equities but generally do not engage in short selling or hedging of the market risks associated with their investments. Inherent in these strategies is the risk associated with the equity markets as a whole. In certain instances, a manager may raise cash as a means of taking a negative view on the market in an attempt to mitigate a portion of the market risk associated with this strategy.

Long/Short Equity and Long/Short Fixed Income. Long/short equity/fixed income strategies generally seek to produce returns from investments in the global equity and/or fixed income markets. These strategies are generally focused on absolute returns and the trades implemented in the strategy generally capitalize on a manager’s views and outlooks for specific markets, regions, sectors, or securities. While these strategies involve both long and short positions in various equity and/or fixed income securities, a manager’s positions will generally reflect a specific view about the direction of a market. Unlike traditional equity or fixed income funds, the directional view relates less to the absolute direction of the market and more toward the specific positions (longs versus shorts) held within a portfolio (nonetheless, a manager may take a directional position that relates to the absolute direction of the market). In addition to making shifts in markets, regions, sectors or securities, managers have the flexibility to shift from a net long to a net short position.

Managed Futures. Managed futures strategies involve speculative trading in futures, forwards and options thereon. Managers may trade portfolios of instruments in U.S. and non-U.S. markets in an effort to capture passive risk premiums, and attempt to profit from anticipated trends in market prices. These managers generally rely on either technical or fundamental analysis or a combination thereof in making trading decisions and attempting to identify price trends. They may attempt to structure a diversified portfolio of liquid futures contracts, including, but not limited to, stock index, interest rate, metals, energy and agricultural futures markets.

Relative Value. Relative value strategies attempt to take advantage of relative pricing discrepancies between various instruments, including equities, fixed income, options and futures. Managers may use mathematical, fundamental or technical analysis to determine misevaluations. Securities may be misprices relative to an underlying security, related securities, groups of securities, or the overall market. Relative value investments may be available only cyclically or not at all. Furthermore, if assumptions used in the research and analysis of relative investments are incorrect or if the model used to evaluate such investments is flawed relative value strategies may be unsuccessful.

Multi Strategy. Multi-strategy managers employ two or more of the strategies described above.

E. Investment Valuation

In computing NAV, portfolio securities of the Fund are valued at their current market values determined on the basis of market quotations, if available. Because market quotations are not typically readily available for the majority of the Fund’s securities, including the Fund’s investment in “private investment funds,” they are valued at fair value as determined by the Fund’s Advisor, in its capacity as Valuation Designee (the “Valuation Designee”). The Board has delegated the day-to-day responsibility for determining these fair values in accordance with the policies it has approved for each period end. Fair valuation involves subjective judgments, and it is possible that the fair value determined for a security may differ materially from the value that could be realized upon the sale of the security. There is no exact approach for determining fair value of a security. Rather, in determining the fair value of a security for which there are no readily available market quotations, the Valuation Designee may consider several factors, including fundamental analytical data relating to the investment in the security, the nature and duration of any restriction on the disposition of the security, the cost of the security at the date of purchase, the liquidity of the market for the security, and the recommendation of an Underlying Fund Manager. The valuation of the Fund’s investments in Underlying Funds is ordinarily determined based upon valuations provided by the Underlying Fund Managers. The Valuation Designee has implemented valuation policies and procedures to assess the reasonableness of valuations provided by the Underlying Fund Managers. The Valuation Designee may also enlist third-party consultants, such as an audit firm or financial officer of a security issuer, on an as-needed basis to assist in determining a security-specific fair value.

USCA All Terrain Fund

Notes to Financial Statements (continued)

September 30, 2024 (Unaudited)

Non-dollar-denominated securities, if any, are valued as of the close of the New York Stock Exchange (”NYSE”) at the closing price of such securities in their principal trading market, but may be valued at fair value if subsequent events occurring before the computation of NAV have materially affected the value of the securities. Trading may take place in foreign issues held by the Fund, if any, at times when the Fund is not open for business. As a result, the Fund’s NAV may change at times when it is not possible to purchase or sell shares of the Fund. The Fund may use a third-party pricing service to assist it in determining the market value of securities in the Fund’s portfolio. The Fund’s NAV per share is calculated by dividing the value of the Fund’s total assets (the value of the securities the Fund holds plus cash and other assets, including dividends and interest accrued but not yet received), less accrued expenses of the Fund, less the Fund’s other liabilities by the total number of shares outstanding.

For purposes of determining the NAV of the Fund, readily marketable portfolio securities listed on a national securities exchange, except those listed on the NASDAQ Global Market®, NASDAQ Global Select Market® and the NASDAQ Capital Market® exchanges (collectively, “NASDAQ”), are valued at the last reported sale price on the exchange on which the security is principally traded. Securities traded on NASDAQ will be valued at the NASDAQ Official Closing Price. If, on a particular day, an exchange-traded or NASDAQ security does not trade, then the mean between the most recent quoted bid and asked prices will be used. If no bid or asked prices are quoted on such day or if market prices may be unreliable because of events occurring after the close of trading, then the security is valued by such method as the Valuation Designee shall determine in good faith to reflect its fair market value.

All equity securities that are not traded on a listed national exchange are valued at the last sale price in the over-the-counter market. If a non-exchange traded security does not trade on a particular day, then the mean between the last quoted closing bid and asked price will be used. In the event such market quotations are not readily available, then the security is valued by such method as the Valuation Designee shall determine in good faith to reflect its fair market value.

The valuation of the Fund’s investments in Underlying Funds is ordinarily determined based upon valuations provided by the Underlying Fund Managers. The Valuation Designee values interests in the Underlying Funds at fair value, using the NAV or pro rata interest in the members’ capital of the Underlying Funds as a practical expedient, as provided by the investment managers of such Underlying Funds. Certain securities in which the Underlying Funds invest may not have a readily ascertainable market price and will be valued by the Underlying Fund Managers at fair value in accordance with procedures adopted by the Underlying Funds. Valuations of Underlying Funds are gross of any redemption fees or penalties and net of management and incentive fees. In this regard, an Underlying Fund Manager may face a conflict of interest in valuing the securities, as their value will affect the Underlying Fund Manager’s compensation. Although the Valuation Designee will review the valuation procedures used by all Underlying Fund Managers, the Valuation Designee will not be able to confirm the accuracy of valuations provided by the Underlying Fund Manager and valuations provided by the Underlying Fund Manager generally will be conclusive with respect to the Fund. In addition, the NAVs or other valuation information received by the Fund from an Underlying Fund and used in calculating the Fund’s NAV may include estimates that may be subject to later adjustment or revision by the Underlying Fund Manager. Any such adjustment or revision will either increase or decrease the NAV of the Fund at the time that the Fund is provided with information regarding the adjustment. The Fund does not expect to restate its previous NAVs to reflect an adjustment or revision by an Underlying Fund. In the unlikely event that an Underlying Fund does not report a fiscal period end value to the Valuation Designee on a timely basis, the Fund would determine the fair value of the Underlying Fund based on the most recent value reported by the Underlying Fund, as well as any other relevant information available at the time the Fund values its portfolio.

USCA All Terrain Fund

Notes to Financial Statements (continued)

September 30, 2024 (Unaudited)

With respect to any portion of the Fund’s assets that are invested in one or more open-end management investment companies registered under the 1940 Act, those companies’ NAVs are calculated based on the NAV as published, and the prospectuses for those companies explain the circumstances under which those companies will use fair value pricing and the effects of using fair value pricing.

F. Cash and Cash Equivalents

Cash and cash equivalents include liquid investments of sufficient credit quality with original maturities of three months or less from the date of purchase.

G. Income Taxes

The Fund’s tax year end is December 31. The Fund is treated as a partnership for federal income tax purposes. The Fund has no present intention of making periodic distributions of net income or gains, if any, to investors. Each shareholder is responsible for the tax liability or benefit relating to such member’s distributive share of taxable income or loss. Accordingly, no provision for federal income taxes is reflected in the accompanying financial statements. The Fund is subject to authoritative guidance related to the accounting and disclosure of uncertain tax positions under GAAP. This guidance sets forth a minimum threshold for the financial statement recognition of tax positions taken based on the technical merits of such positions when the positions are more likely than not to be sustained. Management is not aware of any exposure to uncertain tax positions that could require accrual.

As of September 30, 2024, the Fund did not have a liability for any unrecognized tax benefits. The Fund recognizes interest and penalties, if any, related to unrecognized tax benefits as income tax expense in the Statement of Operations. During the period ended September 30, 2024, the Fund did not incur any interest or penalties.

H. Indemnifications

Under the Fund’s organizational documents, its officers and Trustees are indemnified against certain liabilities arising out of the performance of their duties to the Fund. In addition, in the normal course of business, the Fund may enter into contracts that provide general indemnification to other parties. The Fund’s maximum exposure under these arrangements is unknown, as this would involve future claims that may be made against the Fund that have not yet occurred and may not occur. However, the Fund has not had prior claims or losses pursuant to these contracts and expects the risk of loss to be remote.

| 3. | Investment Transactions |

For the period ended September 30, 2024, the Fund purchased (at cost) and sold interests (proceeds) in investment securities in the amount of $153,477 and $20,217,154 (excluding short-term securities), respectively.

| 4. | Management and Performance Fees, Administration Fees and Custodian Fees |

The Fund has entered into an investment advisory agreement with the Advisor. Under the investment advisory agreement, the Fund pays the Advisor a monthly fee, which is calculated and accrued monthly (the “Advisory Fee”), at the annual rate of 0.75% of the Fund’s average monthly net assets. For the period ended September 30, 2024, the Fund incurred $259,150 in advisory fees under the agreement.

The Advisor and the Fund have entered into an expense limitation and reimbursement agreement under which the Advisor has agreed contractually to waive its fees and to pay or absorb the ordinary operating expenses of the Fund (including all expenses incurred in the business of the Fund (including organizational and offering expenses), but excluding the Fund’s proportional share of (i) fees, expenses, allocations, carried interests, etc. of the underlying investment funds in which the Fund invests (including all acquired fund fees and expenses), (ii) transaction costs, including legal costs and brokerage commissions, of the Fund associated with the acquisition and disposition of primary interests, secondary interests, co-investments, ETF investments, and other investments, (iii) interest payments incurred by the Fund, (iv) fees and expenses incurred in connection with a credit facility, if any, obtained by the Fund, (v) taxes of the Fund, (vi) the fees and expenses of any sub-advisor to the Fund, and (vii) extraordinary expenses of the Fund, which may include non-recurring expenses such as, for example, litigation expenses and shareholder meeting expenses to the extent that they exceed 1.75% per annum of the Fund’s average monthly net assets. In consideration of the Advisor’s agreement to limit the Fund’s expenses, the Fund has agreed to repay the Advisor in the amount of any fees waived and Fund expenses paid or absorbed, subject to the limitations that: (1) waiver or reimbursement by the Advisor is subject to repayment by the Fund within three years from the date the Advisor waived any payment or reimbursed any expense; and (2) the reimbursement may not be made if it would cause the expense limitation to be exceeded. The expense limitation agreement will remain in effect at least until July 31, 2025, unless the Board approves its modification or termination. After July 31, 2025, the expense limitation agreement may be renewed upon the mutual agreement of the Advisor and the Board, in their sole discretion.

USCA All Terrain Fund

Notes to Financial Statements (continued)

September 30, 2024 (Unaudited)

There are no outstanding waivers or recoupments as of September 30, 2024.

The Fund has engaged U.S. Bancorp Fund Services, LLC d/b/a U.S. Bank Global Fund Services, to serve as the Fund’s administrator, fund accountant, and transfer agent.

The Fund has engaged U.S. Bank, N.A. to serve as the Fund’s custodian.

The Fund has engaged ACA Group (“ACA”) to provide compliance services including the appointment of the Funds’ Chief Compliance Officer. ACA is paid a monthly fee for services provided. For the period ended September 30, 2024, the Fund paid ACA a total of $18,000 for services provided.

The Board has overall responsibility for monitoring and overseeing the investment program of the Fund and its management and operations. The Board exercises the same powers, authority and responsibilities on behalf of the Fund as are customarily exercised by the board of trustees of a registered investment company organized as a corporation. For the period ended September 30, 2024, the Trustees were paid $14,333. All Trustees are reimbursed by the Fund for their reasonable out-of-pocket expenses. One of the Trustees is an employee of the Advisor and receives no compensation from the Fund for serving as a Trustee.

With the exception of the Fund’s Chief Compliance Officer, the officers of the Fund are affiliated with the Advisor. All such affiliated officers receive no compensation from the Fund for serving in their respective roles. The Board appointed an external Chief Compliance Officer to the Fund in accordance with federal securities regulations.

| 6. | Shareholder Transactions |

The Fund sells shares on a continual, monthly basis. Shares sold will be priced at the NAV of the Fund determined on the last business day of each month. The Fund may from time to time repurchase shares from shareholders in accordance with written tenders by shareholders at those times, in those amounts, and on those terms and conditions as the Board may determine in its sole discretion. Each such repurchase offer will generally be limited to up to 25% of the net assets of the Fund. In determining whether the Fund should offer to repurchase shares from shareholders, the Board will consider the recommendations of the Advisor. The Advisor expects that, generally, it will recommend to the Board that the Fund offer to repurchase shares from shareholders quarterly, with such repurchases to occur on the first business day following each March 31, June 30, September 30 and December 31. Each repurchase offer will generally commence approximately 130 days prior to the applicable repurchase date.

USCA All Terrain Fund

Notes to Financial Statements (continued)

September 30, 2024 (Unaudited)

The Fund had 25,141.71 shares outstanding at September 30, 2024. The Fund issued 0 shares through shareholder subscriptions and repurchased 24,746.82 shares through shareholder redemptions during the period ended September 30, 2024. The Fund issued 638.05 shares through shareholder subscriptions and repurchased 4674.87 shares through shareholder redemptions during the year ended March 31, 2024.

Because shares may only be repurchased pursuant to tender offers at such time and on such terms as the Board may determine, in its complete and exclusive discretion, and the fact that the shares will not be traded on any securities exchange or other market and will be subject to substantial restrictions on transfer, and because of the fact that the Advisor may invest the Fund’s assets in Underlying Funds that do not permit frequent withdrawals and may invest in illiquid securities, an investment in the Fund is highly illiquid and involves a substantial degree of risk. Underlying Funds are riskier than liquid securities because the Underlying Funds may not be able to dispose of the illiquid securities if their investment performance deteriorates, or may be able to dispose of the illiquid securities only at a greatly reduced price. Similarly, the illiquidity of the Underlying Funds may cause investors to incur losses because of an inability to withdraw their investments from the Fund during or following periods of negative performance. Although the Fund may offer to repurchase shares from time to time, there can be no assurance such offers will be made with any regularity. The Fund invests primarily in Underlying Funds that are not registered under the 1940 Act and invest in and actively trade securities and other financial instruments using different strategies and investment techniques, including leverage, that may involve significant risks. These Underlying Funds may invest a higher percentage of their assets in specific sectors of the market in order to achieve a potentially greater investment return. As a result, the Underlying Funds may be more susceptible to economic, political and regulatory developments in a particular sector of the market, positive or negative, which may increase the volatility of the Fund’s NAV. Various risks are also associated with an investment in the Fund, including risks relating to the multi-manager structure of the Fund, risks relating to compensation arrangements and risks related to limited liquidity of the shares. The Underlying Funds provide for periodic redemptions ranging from daily to annually with lock-up provisions which can be one year or longer.

The increasing interconnectivity between global economies and financial markets increases the likelihood that events or conditions in one region or financial market may adversely impact issuers in a different country, region or financial market. Securities in the Fund may underperform due to inflation (or expectations for inflation), interest rates, global demand for particular products or resources, natural disasters, climate-change or climate-related events, pandemics, epidemics, terrorism, international conflicts, regulatory events and governmental or quasi -governmental actions. The occurrence of global events similar to those in recent years, such as terrorist attacks around the world, natural disasters, social and political discord or debt crises and downgrades, among others, may result in market volatility and may have long term effects on both the U.S. and global financial markets. It is difficult to predict when similar events affecting the U.S. or global financial markets may occur, the effects that such events may have and the duration of those effects. Any such event(s) could have a significant adverse impact on the value and risk profile of the Fund.

| 8. | Fair Value of Financial Instruments |

The Fund has adopted the authoritative fair valuation accounting standards of ASC 820, Fair Value Measurements and Disclosures, which establish an authoritative definition of fair value and set out a hierarchy for measuring fair value. These standards require additional disclosures about the various inputs and valuation techniques used to develop the measurements of fair value and a discussion in changes in valuation techniques and related inputs during the period. These inputs are summarized in the three broad levels listed below.

Level 1 - Quoted prices in active markets for identical securities.

Level 2 - Other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds, credit risk, etc.).

Level 3 - Valuations based primarily on inputs that are unobservable and significant.

USCA All Terrain Fund

Notes to Financial Statements (continued)

September 30, 2024 (Unaudited)

The inputs or methodology used for valuing securities are not an indication of the risk associated with investing in those securities.

In certain cases, the inputs used to measure fair value may fall into different levels of the fair value hierarchy. In such cases, an investment’s level within the fair value hierarchy is based on the lowest level of input that is significant to the fair value measurement. The Valuation Designee’s assessment of the significance of a particular input to the fair value measurement in its entirety requires judgment, and considers factors specific to the investment. The following section describes the valuation techniques used by the Valuation Designee to measure different financial instruments at fair value and includes the level within the fair value hierarchy in which the financial instrument is categorized.

Investments whose values are based on quoted market prices in active markets are classified within Level 1. These investments generally include equity securities traded on a national securities exchange, registered investment companies, certain U.S. government securities and certain money market securities. The Valuation Designee does not adjust the quoted price for such instruments, even in situations where the Fund holds a large position and a sale could reasonably be expected to impact the quoted price.

Investments that trade in markets that are not considered to be active, but are valued based on quoted market prices, dealer quotations or alternative pricing sources supported by observable inputs, are classified within Level 2. These investments generally include certain U.S. government and sovereign obligations, most government agency securities, and investment grade corporate bonds.

Investments classified within Level 3 have significant unobservable inputs, as they trade infrequently or not at all. These investments generally include private equity investments and less liquid corporate debt securities. When observable prices are not available for these investments, the Valuation Designee uses one or more valuation techniques (e.g., the market approach or income approach) for which sufficient data is available. The selection of appropriate valuation techniques may be affected by the availability of relevant inputs as well as the relative reliability of inputs. In some cases, one valuation technique may provide the best indication of fair value while in other circumstances, multiple valuation techniques may be appropriate. The results of the application of the various techniques may not be equally representative of fair value, due to factors such as assumptions made in the valuation. In some situations, the Valuation Designee may determine it appropriate to evaluate and weigh the results, as appropriate, to develop a range of possible values, with the fair value based on the Valuation Designee’s assessment of the most representative point within the range.

USCA All Terrain Fund

Notes to Financial Statements (continued)

September 30, 2024 (Unaudited)

The following is a summary of the inputs used to value the Fund’s investments as of September 30, 2024:

Fair Value Measurements at Reporting Date Using

| Description | | Quoted Prices

in Active markets

for

Identical Assets

(Level 1) | | Significant Other

Observable Inputs

(Level 2) | | Significant

Unobservable

Inputs

(Level 3) | | Total |

| Investments | | | | | | | | |

| Investments in Private Investment | | | | | | | | | | | | | | | | |

| Companies (a) | | $ | — | | | $ | — | | | $ | — | | | $ | 51,913,025 | |

| Short Term Investment | | | 2,887,151 | | | | — | | | | — | | | | 2,887,151 | |

| | | $ | 2,887,151 | | | $ | — | | | $ | — | | | $ | 54,800,176 | |

| (a) | Certain investments that are measured at fair value using the net asset value per share (or its equivalent) practical expedient have not been categorized in the fair value hierarchy. The fair value amounts presented in the table are intended to permit reconciliation of the fair value hierarchy to the amounts presented in the Statement of Assets and Liabilities. |

The Fund has an ongoing tender offer that was filed on August 23, 2024 with a cutoff date for tender requests as of September 23, 2024 and prices on December 31, 2024. There were tender requests of 8,324.43 shares, approximately $13,461,760 received during the tender offer period.

The Fund has not identified any other subsequent events requiring financial statement disclosure as of September 30, 2024, through the date the financial statements were issued.

USCA All Terrain Fund

Additional Information

September 30, 2024 (Unaudited)

N-PORT

The Fund will file its complete schedule of portfolio holdings for the first and third quarters of each fiscal year with the SEC on Form N-PORT. The Fund’s Form N-PORT will be available without charge by visiting the SEC’s Web site at www.sec.gov.

Proxy Voting

A description of the policies and procedures that the Fund uses to determine how to vote proxies relating to portfolio securities owned by the Fund and information regarding how the Fund voted proxies relating to the portfolio of securities for the most recent 12-month period ended June 30th are available to shareholders without charge, upon request by calling the Advisor toll free at (888) 601-8722 or on the SEC’s web site at www.sec.gov.

Board of Trustees

The Fund’s Statement of Additional Information includes additional information about the Fund’s Trustees and is available upon request without charge by calling the Advisor toll free at (888) 601-8722 or by visiting the SEC’s web site at www.sec.gov.

Forward-Looking Statements

This report contains “forward-looking statements,'' which are based on current management expectations. Actual future results, however, may prove to be different from expectations. You can identify forward-looking statements by words such as "may'', "will'', "believe'', "attempt'', "seem'', "think'', "ought'', "try'' and other similar terms. The Fund cannot promise future returns. Management’s opinions are a reflection of its best judgment at the time this report is compiled, and it disclaims any obligation to update or alter forward-looking statements as a result of new information, future events, or otherwise.

USCA All Terrain Fund

Trustees and Officers

September 30, 2024 (Unaudited)

Independent Trustees

Name, Address and Birth

Year | | Position/Term of Office and

Length Served a | | Principal Occupation(s) During

the Past Five Years | | Number of

Portfolios in

Fund Complex

Overseen

by Trustee | | Other Directorships Held

by Trustee During the Past

Five Years |

| | | | | | | | | |

Barry Knight

(Born 1961) | | Trustee, Indefinite since September 2021 | | President of Next Financial Group, Inc. (investment adviser) (September 2006-present); CEO at Next Financial Group, Inc. (September 2006-present). | | 1 | | n/a |

| | | | | | | | | |

Paul Wigdor

(Born 1968) | | Trustee, Indefinite since May 2016 and Chairman since March 2021 | | Managing Partner at Overlook 4 Holdings (venture investing) (February 2011-present), Managing Director at Ascendant Advisors (February 2011- present), Principal, AWM Services (brokerage services), LLC (February 2011-present), Chief Compliance Officer/Chief Operating Officer of Qapital Invest, LLC (January 2017-present). | | 1 | | Global Restaurant Systems (January 2013-present), Private Communications Corp. (November 2010- present), ChartIQ (January 2014-present), USCA Fund Trust (July 2016 – August 2021), Uma Temakeria (August 2014 – November 2017). |

USCA All Terrain Fund

Trustees and Officers (continued)

September 30, 2024 (Unaudited)

Interested Trustees and Officers

| Name, Address and Birth Year | | Position/Term of Office and

Length Served a | | Principal Occupation(s) During

the Past Five Years | | Number of

Portfolios in

Fund Complex

Overseen

by Trustee | | Other Directorships Held

by Officer During the Past

Five Years |

| | | | | | | | | |

Phil Pilibosian

(Born 1968)b | | President and Trustee since April 2015 | | Managing Director at US Capital Advisors LLC (October 2013-present) | | 1 | | Trustee, USCA Fund Trust (July 2016-August 2021) |

| | | | | | | | | |

Bryan Prihoda

(Born 1987) | | Secretary since April 2015 and Anti-Money Laundering Officer since November 2021 | | Executive Director at US Capital Advisors LLC (October 2013-present) | | n/a | | n/a |

| | | | | | | | | |

Kasey de Jonckheere

(Born 1979) | | Treasurer since October 2022 | | Chief Financial Officer, US Capital Advisors LLC(August 2022-present); Director of Accounting (January 2021-August 2022); and Controller (January 2018-December 2020) | | n/a | | n/a |

| | | | | | | | | |

Kevin Hourihan

(Born 1978) | | Chief Compliance Officer since 2022 | | Senior Principal Consultant, Fund Chief Compliance Officer, ACA Global, LLC, a governance, risk and compliance adviser to financial services companies (September 2022-present); Chief Compliance Officer, Ashmore Funds (September 2017-September 2022) | | n/a | | n/a |

| a | The term of office for each Trustee and officer listed above will continue indefinitely. |

| b | Phil Pilibosian is an "Interested Trustee" of the Trust, as that term is defined under the 1940 Act, because of his affiliation with the Advisor. |

USCA All Terrain Fund

Privacy Policy

| PRIVACY NOTICE Rev. July 2019 |

| FACTS | WHAT DOES USCA ALL TERRAIN FUND DO WITH YOUR PERSONAL INFORMATION? |

| | |

| Why? | Financial companies choose how they share your personal information. Federal law gives consumers the right to limit some but not all sharing. Federal law also requires us to tell you how we collect, share, and protect your personal information. Please read this notice carefully to understand what we do. |

| | |

| What? | The types of personal information we collect and share depend on the product or service you have with us. This information can include: |

| ▪ Social Security number and wire transfer instructions |

| | ▪ account transactions and transaction history |

| | ▪ investment experience and purchase history |

| When you are no longer our customer, we continue to share your information as described in this notice. |

| | |

| How? | All financial companies need to share customers’ personal information to run their everyday business. In the section below, we list the reasons financial companies can share their customers’ personal information; the reasons the USCA All Terrain Fund chooses to share; and whether you can limit this sharing. |

| | | | |

| Reasons we can share your personal information | Does USCA All

Terrain Fund

share? | Can you limit this sharing? |

| For our everyday business purposes – such as to process your transactions, maintain your account(s), respond to court orders and legal investigations, or report to credit bureaus | Yes | No |

| For our marketing purposes – to offer our products and services to you | Yes | No |

| For joint marketing with other financial companies | No | We don’t share |

For our affiliates’ everyday business purposes –

information about your transactions and experiences | Yes | No |

For our affiliates’ everyday business purposes –

information about your creditworthiness | No | We don’t share |

| For our affiliates to market to you | No | We don’t share |

| For nonaffiliates to market to you | No | We don’t share |

| Questions? | Call 1-877-259-8722 |

| | | | | | |

USCA All Terrain Fund

Privacy Policy

| Who we are | |

Who is providing this notice? | USCA All Terrain Fund |

| What we do | |

How does USCA All Terrain Fund protect my personal information? | To protect your personal information from unauthorized access and use, we use security measures that comply with federal law. These measures include computer safeguards and secured files and buildings. Our service providers are held accountable for adhering to strict policies and procedures to prevent any misuse of your nonpublic personal information. |

How does USCA All Terrain Fund collect my personal information? | We collect your personal information, for example, when you ● Open an account or give us your contact information ● Make a wire transfer ● Make deposits or withdrawals from your account ● Tell us where to send the money We also collect your personal information from other companies. |

Why can’t I limit all sharing? | Federal law gives you the right to limit only ● Sharing for affiliates’ everyday business purposes – information about your creditworthiness ● Affiliates from using your information to market to you ● Sharing for nonaffiliates to market to you ● State laws and individual companies may give you additional rights to limit sharing. |

| Definitions | |

| Affiliates | Companies related by common ownership or control. They can be financial and nonfinancial companies. ● Our affiliates include financial companies such as USCA LLC (f/k/a US Capital Advisors LLC), USCA Asset Management LLC, USCA Securities LLC, U.S. Capital Wealth Advisors LLC, and USCA Municipal Advisors LLC. |

| Nonaffiliates | Companies not related by common ownership or control. They can be financial and nonfinancial companies ● USCA All Terrain Fund does not share with nonaffiliates so they can market to you. |

| Joint marketing | A formal agreement between nonaffiliated financial companies that together market financial products or services to you. ● USCA All Terrain Fund doesn’t jointly market. |

USCA All Terrain Fund

Fund Service Providers

Trustees and Officers

Phil Pilibosian, President and Trustee

Barry Knight, Trustee

Paul Wigdor, Trustee

Kasey de Jonckheere, Treasurer

Bryan Prihoda, Secretary and Anti-Money Laundering Officer

Kevin Hourihan, Chief Compliance Officer

Investment Advisor

USCA Asset Management LLC

4444 Westheimer Road, Suite G500, Houston, TX 77027

Custodian

U.S. Bank, N.A.

1555 N. River Center Drive, Suite 302, Milwaukee, WI 53212

Transfer Agent

U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 3rd Floor, Milwaukee, WI 53212

Administrator

U.S. Bancorp Fund Services, LLC

777 East Wisconsin Avenue, 4th Floor, Milwaukee, WI 53212

Legal Counsel

Thompson Hine LLP

41 South High Street, Suite 1700, Columbus, OH 43215

Independent Registered Public Accounting Firm

Cohen & Company, Ltd.

1835 Market St., Suite 310, Philadelphia, PA 19103

23

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not applicable to closed-end investment companies.

Not applicable to closed-end investment companies.

Not applicable to closed-end investment companies.

Not applicable to closed-end investment companies.

Not applicable for semi-annual reports.

Not applicable for semi-annual reports.

Not Applicable.

Not Applicable.

The registrant did not engage in securities lending activities during the fiscal period reported on this Form N-CSR.

(2) Not Applicable.

(4) Not Applicable.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Pursuant to the requirements of the Securities Exchange Act of 1934 and the Investment Company Act of 1940, this report has been signed below by the following persons on behalf of the registrant and in the capacities and on the dates indicated.