As confidentially submitted to the Securities and Exchange Commission on December 6, 2017.

This draft registration statement has not been publicly filed with the Securities and Exchange Commission

and all information herein remains strictly confidential.

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

Amendment No. 1 to

FORM F-1

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

Bioceres S.A.

(Exact name of Registrant as Specified in its Charter)

Not Applicable

(Translation of Registrant’s name into English)

Republic of Argentina | 2870 | Not Applicable |

(State or other jurisdiction of incorporation or organization) | (Primary Standard Industrial Classification Code Number) | (I.R.S. Employer Identification No.) |

Bioceres S.A.

Ocampo 210 bis

Predio CCT, Rosario, Santa Fe, Argentina

Tel: +54 (341) 486-1100

(Address, including zip code, and telephone number, including area code, of registrant’s principal executive offices)

Cogency Global Inc.

10 E. 40th Street, 10th Floor

New York, NY 10016

Tel.: +1 (212) 947-7200

(Name, address, including zip code, and telephone number, including area code, of agent for service)

Copies to:

Conrado Tenaglia, Esq. Matthew S. Poulter, Esq. Linklaters LLP 1345 Avenue of the Americas New York, New York 10105 Phone: +1 (212) 903-9000 Fax: +1 (212) 903-9100 | John R. Vetterli, Esq. White & Case LLP 1221 Avenue of the Americas New York, New York 10020 Phone: +1 (212) 819-8200 Fax: +1 (212) 354-8113 |

Approximate date of commencement of proposed sale to the public: As soon as practicable after this registration statement becomes effective.

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933, check the following box: o

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

If this Form is a post-effective amendment filed pursuant to Rule 462(d) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. o

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933. Emerging growth company. ☒

If an emerging growth company that prepares its financial statements in accordance with U.S. GAAP, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. o

CALCULATION OF REGISTRATION FEE

Title of each Class of Securities to be Registered | Proposed Maximum Aggregate Offering Price(1)(2)(3) | Amount of Registration Fee | ||||

Ordinary Shares, nominal value Ps.1 per share(4) | US$ | US$ | ||||

| (1) | Estimated solely for purposes of computing the amount of the registration fee pursuant to Rule 457(o) under the Securities Act of 1933, as amended. |

| (2) | Includes the aggregate offering price of additional ordinary shares the international underwriters have the option to purchase, if any. |

| (3) | Translated into dollars based on the exchange rate of Ps.17.32 per US$1.00 reported by the Central Bank of Argentina on September 30, 2017. |

| (4) | A separate registration statement on Form F-6 will be filed for the registration of American depositary shares issuable upon deposit of the ordinary shares registered hereby. |

The registrant hereby amends this registration statement on such date or dates as may be necessary to delay its effective date until the registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in accordance with Section 8(a) of the Securities Act of 1933 or until this registration statement shall become effective on such date as the Securities and Exchange Commission, acting pursuant to said Section 8(a), may determine.

The information in this preliminary prospectus is not complete and may be changed. We may not sell these securities until the Securities and Exchange Commission declares our registration statement effective. This preliminary prospectus is not an offer to sell these securities and is not soliciting an offer to buy these securities in any jurisdiction where the offer or sale is not permitted.

SUBJECT TO COMPLETION, DATED DECEMBER 6, 2017

PRELIMINARY PROSPECTUS

American Depositary Shares

Bioceres S.A.

Representing Ordinary Shares

We are offering American Depositary Shares, or ADSs. Each ADS represents ordinary shares. We refer to this offering of ADSs as the “international offering.” The ADSs may be evidenced by American Depositary Receipts, or ADRs. This is our initial public offering of our ADSs. We are concurrently offering ordinary shares in Argentina, which we refer to as the “Argentine offering,” through the Argentine placement agents under a Spanish-language offering document. We refer to the international offering and the Argentine offering together as the “global offering.” The closings of the international offering and the Argentine offering are conditioned upon each other. No public market has previously existed for our ADSs or ordinary shares. All of the ADSs and ordinary shares to be sold in the global offering are being sold by us.

Under Argentine law, all of our existing shareholders are entitled to preemptive and accretion rights to subscribe to our capital increase underlying the global offering and will have the opportunity to subscribe for newly issued ordinary shares at the same price as the shares offered and sold pursuant to the Argentine offering. Existing shareholders may assign their preferential subscription rights subject to applicable law. In order to facilitate the execution of the global offering, certain of our shareholders, representing % of our outstanding share capital, have assigned to AR Partners S.A., as exercise agent, their preemptive and accretion rights with respect to % of the shares to be issued pursuant to the rights. Concurrently with the global offering, we will conduct a preemptive and accretion rights offering in Argentina, or the Argentine Rights Offering. See “Rights Offering in Argentina.”

The estimated initial public offering price per ADS is between US$ and US$ . The estimated initial public offering price per ordinary share is between US$ and US$ .

We have applied to list our ADSs in the United States on the New York Stock Exchange, or NYSE, under the symbol “BIOX.” We have applied to list our ordinary shares in Argentina on the Bolsas y Mercados Argentinos S.A., or BYMA, under the symbol “BIOX.”

Investing in our ADSs involves a high degree of risk. Before buying any ADSs, you should carefully read the discussion of material risks of investing in our ADSs in “Risk Factors” beginning on page 29 of this prospectus.

We are an “emerging growth company” as defined under the federal securities laws and, as such, will be subject to reduced public company reporting requirements. See “Prospectus Summary—Implications of Being an Emerging Growth Company and a Foreign Private Issuer” for additional information.

Neither the U.S. Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of this prospectus. Any representation to the contrary is a criminal offense.

Per ADS | Total | |||||

Public offering price | US$ | US$ | ||||

Underwriting discounts and commissions(1) | US$ | US$ | ||||

Proceeds to Bioceres S.A., before expenses | US$ | US$ | ||||

| (1) | We have agreed to reimburse the underwriters for certain expenses. See “Underwriting.” |

Delivery of the ADSs is expected to be made on or about , 2017. We have granted the international underwriters an option for a period of 30 days to purchase an additional ADSs. If the international underwriters exercise the option in full, the total underwriting discounts and commissions payable by us will be US$ , and the total proceeds to us, before expenses, will be US$ .

Sole Global Coordinator | |||

Jefferies | |||

Joint book-running managers | |||

Jefferies | Piper Jaffray | ||

Prospectus dated , 2017.

TABLE OF CONTENTS

Page | |||

This prospectus has been prepared by us solely for use in connection with the proposed offering of ADSs in the United States and elsewhere outside Argentina. Neither we nor the international underwriters have authorized anyone to provide information different from that contained in this prospectus, any amendment or supplement to this prospectus or in any free writing prospectus prepared by us or on our behalf. When you make a decision about whether to invest in our ADSs, you should not rely upon any information other than the information in this prospectus and any free writing prospectus prepared by us or on our behalf. Neither the delivery of this prospectus nor the sale of our ADSs means that information contained in this prospectus is correct after the date of this prospectus. This prospectus is not an offer to sell or the solicitation of an offer to buy our ordinary shares or ADSs in any circumstances under which such offer or solicitation is unlawful. The information in this prospectus is accurate only as of the date of this prospectus, regardless of the time of delivery of this prospectus or when any sale of ADSs occurs.

This prospectus includes statistical, market and industry data and forecasts which we have obtained from publicly available information and independent industry publications and reports that we believe to be reliable sources. These publicly available industry publications and reports generally state that they obtain their information from sources that they believe to be reliable, but they do not guarantee the accuracy or completeness of the information. Although we believe that these sources are reliable, we have not independently verified the information contained in such

i

publications. Certain estimates and forecasts involve uncertainties and risks and are subject to change based on various factors, including those discussed under the headings “Special Note Regarding Forward-Looking Statements” and “Risk Factors” in this prospectus.

Certain figures included in this prospectus have been subject to rounding adjustments. Accordingly, figures shown as totals in certain tables may not be an arithmetic aggregation of the figures that precede them.

This offering is being made in the United States and elsewhere outside of Argentina solely on the basis of the information contained in this prospectus. The concurrent offering of our ordinary shares is being made in Argentina by a prospectus in Spanish that will be submitted to the CNV. The prospectus for the Argentine offering, although in a different format in accordance with CNV regulations, contains substantially the same information as contained in this prospectus. The public offering of the ordinary shares in Argentina was authorized by the CNV pursuant to Resolution No. 17919, on December 4, 2015, subject to the fulfillment of certain requirements. The authorization by the CNV means only that the information requirements of the CNV have been satisfied. The CNV has not rendered an opinion with respect to the accuracy of the information contained in this prospectus. No offer or sale of ADSs may be made to the public in Argentina except in circumstances that do not constitute a public offer or distribution under Argentine laws and regulations.

IMPORTANT INFORMATION ABOUT FINANCIAL PRESENTATION

We present financial statements in accordance with IFRS as issued by the IASB and all financial information included in this prospectus is presented in accordance with IFRS as issued by the IASB, except as otherwise indicated. In particular, this prospectus contains certain non-IFRS financial measures which are described under “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-IFRS Financial Measures.”

The financial statements we have included in this prospectus consist of:

| ■ | the audited consolidated financial statements of Bioceres and its subsidiaries as of and for the six-month transition period ended June 30, 2017, or the Transition Period, and as of and for the fiscal years ended December 31, 2016 and 2015 and for the unaudited six-month period ended June 30, 2016, and the notes thereto; |

| ■ | the audited consolidated financial statements of Rizobacter as of and for the fiscal years ended June 30, 2017, 2016 and 2015, and the notes thereto; |

| ■ | the unaudited interim condensed consolidated financial statements of Bioceres and its subsidiaries as of September 30, 2017 and June 30, 2017 and for the three-month periods ended September 30, 2017 and 2016, and the notes thereto; and |

| ■ | the unaudited interim condensed consolidated financial statements of Rizobacter as of September 30, 2017 and June 30, 2017 and for the three-month periods ended September 30, 2017 and 2016, and the notes thereto. |

The financial information of Rizobacter: (i) is prepared on a standalone basis; (ii) does not reflect the purchase accounting adjustments recorded at the consolidated level of Bioceres after the acquisition; (iii) does not include any corporate and other expenses that should be allocated to Rizobacter; (iv) uses different segments than the Bioceres consolidated financial statements; (v) is for information purposes only and (vi) should not be viewed as a substitute for the consolidated financial statements of Bioceres.

On December 15, 2016, our shareholders approved a change in our fiscal year end from December 31 to June 30. As a result of this change, the Transition Period figures presented in our consolidated financial statements are not entirely comparable to the years ended December 31, 2016 and 2015 and we do not present financial statements for a separate historical period that is comparable to the Transition Period. Following the Transition Period, we will prepare annual financial statements for the fiscal years ending June 30, beginning with the fiscal year ended June 30, 2018.

Furthermore, the comparability of our results of operations is affected by the completion of our acquisition of Rizobacter, which was consummated on October 19, 2016. Our results of operations for periods prior to this date do not include the

ii

results of Rizobacter and therefore are not comparable to our results for periods after this date. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Note Regarding Comparability of Our Results of Operations.”

We have also included certain unaudited pro forma consolidated financial information derived by the application of pro forma adjustments with respect to our acquisition of Rizobacter to the historical consolidated financial information of Bioceres. See “Unaudited Pro Forma Consolidated Financial Information” and “Unaudited Pro Forma Condensed Combined Financial Information.”

The consolidated historical financial information of Rizobacter for the year ended June 30, 2017 is provided as additional information to permit readers to compare the more recent results of Rizobacter on a stand-alone basis.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

We make forward-looking statements in this prospectus that are subject to risks and uncertainties. These forward-looking statements include information about possible or assumed future results of our business, financial condition, results of operations, liquidity, anticipated growth strategies, anticipated trends in our industry, our potential growth opportunities, plans and objectives. In some cases, you can identify forward-looking statements by terminology such as “believe,” “may,” “might,” “will,” “consider,” “estimate,” “continue,” “anticipate,” “intend,” “target,” “project,” “contemplate,” “should,” “plan,” “expect,” “predict,” “potential,” or the negative of these terms or other similar terms or expressions. The statements we make regarding the following matters are forward-looking by their nature:

| ■ | our ability to develop and commercialize biotechnology products; |

| ■ | our ability to maintain our joint venture agreements with our current partners; |

| ■ | our ability to enter into new joint ventures and expand our technology sourcing and product development to new seed traits and crops; |

| ■ | our or our collaborators’ ability to develop commercial products that incorporate our seed traits and complete the regulatory approval process for such products; |

| ■ | our expectations regarding the commercial value of our key products in yield and abiotic stress and biotic stress; |

| ■ | our expectations regarding regulatory approval of products developed by us, our joint ventures and third-party collaborators; |

| ■ | our ability to adapt to continuous technological change in our industry; |

| ■ | our expectations that products containing our seed traits will be commercialized and we will earn royalties from the sales of such products; |

| ■ | our ability to maintain and recruit knowledgeable or specialized personnel and collaborators to perform our R&D work; |

| ■ | our expectations regarding the future growth of the global agricultural, agricultural biotechnology, biological-based chemical and agro-industrial biotechnology markets; |

| ■ | our ability to develop and exploit a proprietary channel for the sale of our biotechnology products; |

| ■ | our compliance with laws and regulations that impact our business and changes to such laws and regulations; |

| ■ | our ability to assemble, store, integrate and analyze significant amounts of public and proprietary data; and |

| ■ | our ability to protect our intellectual property through patents, PVP, trademarks, trade secret laws, confidentiality provisions, and licensing arrangements for the genes that we identify. |

The preceding list is not intended to be an exhaustive list of all of our forward-looking statements. The forward-looking statements are based on our beliefs, assumptions and expectations of future performance, taking into account the information currently available to us. These statements are only predictions based upon our current expectations and projections about future events. There are important factors that could cause our actual results, levels of activity,

iii

performance or achievements to differ materially from the results, levels of activity, performance or achievements expressed or implied by the forward-looking statements. In particular, you should consider the risks provided under “Risk Factors” in this prospectus.

You should not rely upon forward-looking statements as predictions of future events. Although we believe that the expectations reflected in the forward-looking statements are reasonable, we cannot guarantee that future results, levels of activity, performance and events and circumstances reflected in the forward-looking statements will be achieved or will occur. Except as required by law, we undertake no obligation to update publicly any forward-looking statements for any reason after the date of this prospectus or to conform these statements to actual results or to changes in our expectations.

iv

Unless otherwise specified or the context requires otherwise in this prospectus:

| ■ | references to “we,” “us,” the “Company” and “our” refer to Bioceres S.A., together with our subsidiaries; |

| ■ | references to “US$” and “Dollars” are to U.S. Dollars, and references to “Ps.” and “Argentine pesos” are to Argentine pesos; |

| ■ | “AACREA” refers to the Argentine Association of Regional Consortiums for Agricultural Experimentation (Asociación Argentina de Consorcios Regionales de Experimentación Agrícola), an organization representing certain large farm operations in Latin America; |

| ■ | “AAPRESID” refers to the Argentine Association of No-Till Producers (La Asociación Argentina de Productores en Siembra Directa), an Argentine farmers’ organization with an international leadership position in the adoption of new agricultural technologies; |

| ■ | “ADRs” refers to American Depositary Receipts, which are certificates evidencing a specific number of ADSs, registered in the name of the holder of such ADSs; |

| ■ | “ADSs” refers to American Depositary Shares representing our ordinary shares; |

| ■ | “ADS Depositary” refers to Deutsche Bank Trust Company Americas; |

| ■ | “AFIP” refers to the Argentine Federal Administration of Public Revenue (Administración Federal de Ingresos Públicos); |

| ■ | “AGBM” refers to AGBM S.A., an industrial company that produces and commercializes chymosin from modified safflower seeds; |

| ■ | “amaranth” refers to a family of plants that includes species cultivated for a highly nutritious grain; |

| ■ | “APHIS” refers to the Animal and Plant Health Inspection Service of the USDA; |

| ■ | “Arcadia Biosciences” refers to Arcadia Biosciences, Inc., a U.S. company that commercializes agriculture-based technologies; |

| ■ | “Argentine Capital Markets Law” refers to Law No. 26,831, as amended and supplemented; |

| ■ | “Argentine Corporate Law” refers to Law No. 19,550, as amended and supplemented; |

| ■ | “Argentine PVP Law” refers to Law No. 20,247 of the Seeds and Phytogenetic Creations Law; |

| ■ | “BAF” refers to BAF Latam Trade Finance Fund B.V.; |

| ■ | “Bioceres Semillas” refers to our proprietary commercial channel for seeds, Bioceres Semillas S.A.; |

| ■ | “biopolymers” refer to polymers produced by living organisms; |

| ■ | “BRS” refers to Biotechnology Regulatory Services; |

| ■ | “BYMA” refers to the Argentine Stock Exchange (Bolsas y Mercados Argentinos S.A.); |

| ■ | “Central Bank” refers to the Central Bank of Argentina (Banco Central de la República de Argentina); |

| ■ | “Certified Public Accountant” means a member of an officially accredited professional body of accountants; |

| ■ | “chymosin” refers to an enzyme used in the production of cheese; |

| ■ | “CIBIC” refers to Cibic Centro de Diagnóstico Médico de Alta Complejidad S.A.; |

| ■ | “CNBS” refers to the Brazilian National Biosafety Council (Conselho Nacional de Biossegurança); |

| ■ | “CNV” refers to the Argentine Securities Commission (Comisión Nacional de Valores); |

| ■ | “CONABIA” refers to the Argentine National Advisory Commission of Agricultural Biotechnology (Comisión Nacional Asesora de Biotecnología Agropecuaria); |

v

| ■ | “CONICET” refers to the National Scientific and Technical Research Council of Argentina (Consejo Nacional de Investigaciones Científicas y Técnicas), the main organization in charge of the promotion of science and technology in Argentina and an entity run by the Argentine federal government; |

| ■ | “Convention” refers to the Convention on Biological Diversity, an international treaty that was adopted at the Earth Summit in Rio de Janeiro, Brazil in 1992; |

| ■ | “CPI” refers to consumer price index; |

| ■ | “crop protection technologies” refers to our technologies that are designed to control weeds, insects or diseases; |

| ■ | “CTNBio” refers to the Brazilian National Technical Commission on Biosafety (Comissão Técnica Nacional de Biossegurança); |

| ■ | “De Sangosse” refers to De Sangosse Argentina S.A.; |

| ■ | “Ditta Calza Clemente” refers to Ditta Calza Clemente S.R.L.; |

| ■ | “Don Mario” refers to Asociados Don Mario S.A.; |

| ■ | “Dow AgroSciences” refers to Dow AgroSciences LLC; |

| ■ | “DRS” refers to the Direct Registration System, a system administered by DTC, pursuant to which the depositary may register the ownership of uncertificated ADSs; |

| ■ | “DTC” refers to The Depositary Trust Company; |

| ■ | “EcoSeed” refers to our customized seed treatments that complement our seed traits and germplasms; |

| ■ | “Exchange Act” refers to the U.S. Securities Exchange Act of 1934, as amended; |

| ■ | “FAO” refers to the Food and Agriculture Organization of the UN; |

| ■ | “Florimond Desprez” refers to FD Admiral SAS, a French company specializing in wheat breeding, among other crops; |

| ■ | “FSA” refers to the U.S. Federal Seed Act; |

| ■ | “GAAP” means generally accepted accounting principles; |

| ■ | “GDP” means gross domestic product; |

| ■ | “germplasm” refers to the genetic resources of a particular species and contains the information for a species’ genetic makeup; |

| ■ | “glyphosate” refers to a non-selective herbicide used to kill weeds; |

| ■ | “GM” refers to genetically modified; |

| ■ | “GMO” refers to genetically modified organism; |

| ■ | “GMPO” refers to genetically modified plant organism; |

| ■ | “growers” refers to farmers, plantation owners, breeders and cultivators of different types of crops; |

| ■ | “HB4” refers to the yield improvement technology we co-own with CONICET and the National University of the Litoral (La Universidad Nacional del Litoral), including our modified HB4 gene traits in our 2012 HB4 patents (see “Business—Intellectual Property” for a description of our 2012 HB4 patents); |

| ■ | “Hahb 4” refers to a sunflower gene that confers drought tolerance in crops and to an element which activates that gene, which are the subjects of 2003 patents co-owned by CONICET and National University of the Litoral from whom we have an exclusive license to commercially exploit their rights in the 2003 Hahb 4 patents (see “Business—Intellectual Property” for a description of the 2003 Hahb 4 patents); |

| ■ | “Héritas” refers to Héritas S.A., a company formed in partnership with CIBIC to provide translational medicine services to the regional community, mainly in Argentina; |

vi

| ■ | “IAS 34” refers to International Accounting Standard 34, Interim Financial Reporting; |

| ■ | “IASB” refers to International Accounting Standards Board; |

| ■ | “ICSID” refers to the International Centre for Settlement of Investment Disputes; |

| ■ | “IFRS” refers to International Financial Reporting Standards as issued by the IASB; |

| ■ | “IMF” refers to the International Monetary Fund; |

| ■ | “INDEAR” refers to our technology sourcing and product development subsidiary, Instituto de Agrobiotecnologia Rosario S.A.; |

| ■ | “INDEC” refers to the Argentine National Institute of Statistics and Census (Instituto Nacional de Estadística y Censos); |

| ■ | “industrial enzymes” refers to enzymes that have industrial applications, such as chymosin; |

| ■ | “INMET” refers to our technology sourcing and product development subsidiary specialized in bacterial fermentation solutions, Ingenieria Metabolica S.A.; |

| ■ | “INTA” refers to the Argentine National Agricultural Technological Institute (Instituto Nacional de Tecnología Agropecuaria); |

| ■ | “ISAAA” refers to the International Service for the Acquisition of Agri-biotech Applications; |

| ■ | “JOBS Act” refers to the U.S. Jumpstart Our Business Startups Act of 2012; |

| ■ | “MG” refers to maturity group; |

| ■ | “microbial fermentation solutions” refers to genetically engineered Bacillus subtilis modified for the conversion of low-value organic carbon sources into higher value molecules, such as biofuels, biopolymers and ectoine; |

| ■ | “Momentive” refers to Momentive Performance Materials Inc.; |

| ■ | “Monsanto” refers to Monsanto Argentina, S.R.L.; |

| ■ | “MULC” refers to the Argentine Exchange Currency Market (Mercado Único y Libre de Cambio); |

| ■ | “NUE” refers to nutrient use efficiency; |

| ■ | “OECD” refers to the Organization for Economic Co-operation and Development; |

| ■ | “PCAOB” refers to the Public Company Accounting Oversight Board; |

| ■ | “PCT” refers to the Patent Cooperation Treaty of 1970, as amended and modified; |

| ■ | “PFIC” refers to a passive foreign investment company within the meaning of Section 1297 of the Internal Revenue Code of 1986, as amended; |

| ■ | “polyhydroxyalkanoates” refer to completely biodegradable biopolymers with plastic properties (similar to polypropylene); |

| ■ | “Porta” refers to Porta Hermanos S.A.; |

| ■ | “PVP” refers to plant variety protection; |

| ■ | “quality traits” refer to technologies designed to increase or decrease the content of a particular grain or forage component, thus improving its nutritional value or generating a downstream benefit; |

| ■ | “RASA Holding” refers to RASA Holding LLC, a Delaware limited liability company and our wholly owned holding company used to acquire the stake in Rizobacter; |

| ■ | “R&D” refers to research and development; |

| ■ | “reduced lignin trait” refers to a technology that provides higher than average quality forage; |

vii

| ■ | “Rizobacter” refers to Rizobacter Argentina S.A., an Argentine company that focuses on research, development, production and commercialization of biological agents used in agriculture; |

| ■ | “RNC” refers to the National Registry of Seed Varieties (Registro Nacional de Cultivares); |

| ■ | “RNCFS” refers to the National Registry of Trade and Control of Seeds (Registro Nacional del Comercio y Fiscalización de Semillas); |

| ■ | “S&W Seed” refers to S&W Seed Company, a U.S.-based producer of warm climate, high-yield alfalfa seed varieties, including varieties that can thrive in poor, saline soils, which recently announced the acquisition of DuPont Pioneer’s alfalfa business, expanding its operation to include dormant materials; |

| ■ | “SAMSA” refers to Servicios de Aguas de Misiones S.A. which focuses on grain production, processing and exports; |

| ■ | “San Cristóbal” refers to San Cristóbal Seguro de Retiro S.A.; |

| ■ | “Sarbanes-Oxley Act” refers to the U.S. Sarbanes-Oxley Act of 2002, as amended; |

| ■ | “SAV” refers to Argentina’s Secretariat of Value Added (Secretaría de Valor Agregado); |

| ■ | “Semya” refers to Semya S.A., our Argentina-based, intra-company joint venture with Rizobacter that conducts technology sourcing and product development to commercialize seed treatments and agricultural biological inputs for soybean, wheat, corn and alfalfa; |

| ■ | “SENASA” refers to Argentina’s National Food Safety and Quality Service (Servicio Nacional de Sanidad y Calidad Agroalimentaria); |

| ■ | “senescence” refers to the condition or process of deterioration with age; |

| ■ | “SIMI” refers to the Import Monitoring System (Sistema Integral de Monitoreo de Importaciones) imposed by the Argentine government in December 2015; |

| ■ | “soy glycerin” refers to raw glycerin extracted from soy oil in the biodiesel production process; |

| ■ | “SPC” refers to our technology for the production of bovine chymosin; |

| ■ | “Synertech” refers to Synertech Industrias S.A., Rizobacter’s Argentine-based joint venture with De Sangosse that produces and commercializes fertilizers based on microgranules that promote efficiency and accuracy; |

| ■ | “Syngenta” refers to Syngenta AG; |

| ■ | “TMG” refers to Tropical Melhoramento e Genética Ltda; |

| ■ | “transgenic products” refer to plants or other products that have had traits artificially introduced into them; |

| ■ | “Transition Period” means the six-month transition period ended June 30, 2017; |

| ■ | “TREF” refers to resistance to low temperature stress (Tolerancia/Resistencia a Estrés por Frío); |

| ■ | “Trigall Genetics” refers to Trigall Genetics S.A., our Uruguay-based joint venture with Florimond Desprez to develop and commercialize conventional wheat varieties as well as varieties with next-generation biotechnologies in South America; |

| ■ | “UN” refers to the United Nations; |

| ■ | “USDA” refers to the United States Department of Agriculture; |

| ■ | “U.S. EPA” refers to the United States Environmental Protection Agency; |

| ■ | “U.S. FDA” refers to the United States Food and Drug Administration; |

| ■ | “Valent Biosciences” refers to Valent Biosciences LLC; |

| ■ | “Verdeca” refers to Verdeca LLC, our U.S.-based joint venture with Arcadia Biosciences that develops and deregulates soybean varieties with next-generation agricultural technologies; |

viii

| ■ | “we” or “us” refer to Bioceres S.A. and its consolidated subsidiaries; |

| ■ | “WPI” refers to Wholesale Price Index (Índice de Precios Internos al por Mayor); |

| ■ | “WUE” refers to water use efficiency; |

| ■ | “yield improvement” refers to the increase in the production of a given crop; and |

| ■ | “YPF” refers to YPF Sociedad Anónima, the main Argentine oil company, including YPF Tecnología S.A., its R&D subsidiary. |

ix

This summary highlights selected information contained elsewhere in this prospectus. This summary does not contain all of the information you should consider before investing in our ADSs. Before investing in our ADSs, you should read carefully this entire prospectus for a more complete understanding of our business and this offering, including the sections entitled “Risk Factors,” “Management’s Discussion and Analysis of Financial Condition and Results of Operations” and our consolidated financial statements included elsewhere in this prospectus.

Overview

We are a fully-integrated provider of crop productivity solutions, including seeds, seed traits, seed treatments, biologicals, high-value adjuvants and fertilizers. Unlike most industry participants that specialize in a single technology, chemistry, product, condition or stage of plant development, we have developed a multi-discipline and multi-product platform capable of providing solutions throughout the entire crop cycle, from pre-planting to transportation and storage. Our platform is designed to cost-effectively bring high-value technologies to market through an open-architecture approach. See “—Our Business Model”. Our headquarters and primary operations are based in Argentina, which is our key end-market as well as one of the largest markets globally for GM crops. We leverage our relationship with our 308 shareholders, many of whom are industry leaders and key participants in our end-markets, to increase adoption of our products and technologies. More recently, we raised capital through financing from Monsanto and BAF, which we believe represents strategic validation of our business model as well as endorsement of our products.

As of September 30, 2017, we owned or licensed approximately 300 registered products and we owned or licensed, either exclusively or non-exclusively, approximately 200 patents and patent applications. In some instances, our licenses are limited in terms of duration, geography and/or field of use. For the three-month period ended September 30, 2017, we distributed over 3.4 million doses of inoculants, 1.8 million liters of adjuvants, 1.2 thousand tons of high value fertilizers as well as other agricultural inputs across Argentina, Brazil, Paraguay, China, India, the United States and Uruguay, among others. For the twelve-month period ended June 30, 2017, we distributed over 12.3 million doses of inoculants, seven million liters of adjuvants, three thousand tons of high value fertilizers as well as other agricultural inputs across 25 countries, including Argentina, Brazil, Paraguay, China, India, the United States and Uruguay, among others. Our pipeline of products includes fertilizers, inoculants, adjuvants, baits, crop protection solutions and seeds. Our pro forma net revenue, net loss and Adjusted EBITDA for the nine-month period ended September 30, 2017 were US$83.3 million, US$14.1 million and US$7.9 million, respectively. Our pro forma net revenue, net loss and Adjusted EBITDA (including that of Rizobacter) for the nine-month period ended September 30, 2016 were US$59.1 million, US$14.8 million and US$5.4 million, respectively. Our pro forma net revenue, net loss and Adjusted EBITDA (including that of Rizobacter) for the year ended December 31, 2016 were US$104.1 million, US$15.0 million and US$15.5 million, respectively. Our net revenue, net loss and Adjusted EBITDA for the year ended December 31, 2016 were US$44.3 million, US$5.2 million and US$6.4 million, respectively. Our net revenue, net loss and Adjusted EBITDA for the three-month period ended September 30, 2017 were US$35.0 million, US$2.9 million and US$5.6 million, respectively. Our pro forma net revenue, net loss and Adjusted EBITDA (including that of Rizobacter) for the three-month period ended September 30, 2016 were US$28.0 million, US$0.8 million and US$6.6 million, respectively. Our net revenue, net loss and Adjusted EBITDA for the Transition Period were US$48.3 million, US$11.2 million and US$2.3 million respectively. Our pro forma net revenue, net loss and Adjusted EBITDA (including that of Rizobacter) for the six-month period ended June 30, 2016 were US$31.1 million, US$14 million and US$1.2 million, respectively. Adjusted EBITDA is a non-IFRS financial measure. Net loss is the most directly comparable measure calculated in accordance with IFRS. See “Management’s Discussion and Analysis of Financial Condition and Results of Operations—Non-IFRS Financial Measures” and “Risk Factors” for information regarding our use of Adjusted EBITDA and a reconciliation of net loss to Adjusted EBITDA.

Over the past 40 years, we have established a leadership position in sourcing, development, production and sales of biological products for some of the most globally prolific crops, including soy, corn, wheat and alfalfa. We sell

1

our products through a 90-person sales and marketing team and enjoy exceptional access to the end-user grower as a result of: (i) our strategic alliances with global leaders, such as Syngenta, Valent Biosciences, Dow AgroSciences, Don Mario and TMG; (ii) our shareholders, who collectively control significant agricultural land; and (iii) our longstanding relationships with dealers and distributors. Our customers include global blue-chip companies and industry leaders, large distributors, co-ops and dealers, as well as growers. Our leading infrastructure, the success of our platform and commanding presence in our key markets have made us the effective flagship agricultural solutions provider, as well as the natural partner for global conglomerates, in South America.

Our History

Bioceres was founded in 2001 by a leading group of growers in Argentina to address the demand for higher crop yield and productivity in a sustainable and environmentally conscious way. Since our founding, we have developed one of the leading fully integrated biotechnology platforms of its kind to source, validate, develop and commercialize agricultural technologies and products. We have strategically targeted some of the most globally prolific crops, namely, soy, wheat, alfalfa and corn, in one of the largest geographies for GM plants on a global scale.

In order to bring our products to market in an efficient and cost-effective manner, we have established multiple joint ventures, formed non-joint venture collaborations, as well as created and acquired multiple companies. Our joint ventures include partnerships with important industry participants, such as Florimond Desprez, De Sangosse and Arcadia Biosciences. Some of our non-joint venture collaborations include those with Dow AgroSciences, Momentive, Syngenta and Forage Genetics, among others. Of the companies we have acquired, the most significant was our 2016 acquisition of the controlling stake in Rizobacter S.A., a global leader in biological products and a pioneer in liquid inoculants. We expect to exercise a mandatory call option for 9.99% of Rizobacter upon the successful completion of this offering. In addition, we intend to incrementally increase our participation in Rizobacter as and when possible. In addition to its market leading position in biological and non-biological products, Rizobacter offers fertilizers, professional seed treatment services, and tolling or formulation services.

The graph below sets forth our history and track record of innovation through joint ventures and acquisitions:

| (1) | Patents include issued and pending patents, both licensed and proprietary. |

| (2) | INMET was formed in 2011 and officially launched in 2013. |

2

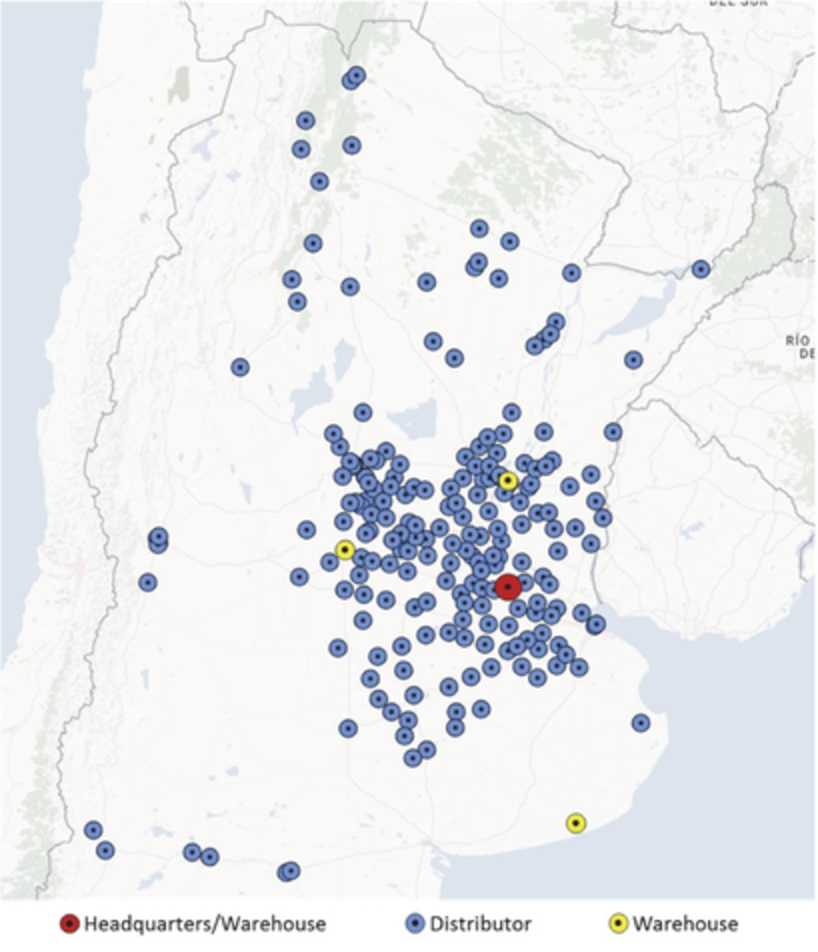

Our Operational and Organizational Structure

Bioceres is headquartered in Rosario, Argentina, where we operate our INDEAR facility. INDEAR houses a state-of-the-art R&D laboratory spanning over 40,000 square feet. Our main manufacturing and distribution facilities are located in Pergamino, Argentina. Our manufacturing facilities include an approximately 1.05 million gallon formulation plant, an approximately 24,000 gallon fermentation plant as well as packaging and logistics operations with over 375,000 square feet of warehouse space. We also recently inaugurated our new 250,000-square foot fertilizer facility and as part of our joint venture with De Sangosse.

We test and conduct trial runs of our key technologies at our main field station located in Pergamino, which also has processing capabilities for foundation seed. We also operate facilities in Cordoba, Argentina as well as international facilities in Brazil and Paraguay and have sales offices or representatives in nine countries. We believe we will continue to grow our dominant position in Argentina and that our leadership position will continue to attract interest in partnerships from global industry leaders seeking to develop and commercialize high-value crop productivity solutions in the large and attractive Argentine and South American markets. As of September 30, 2017, we had 500 full-time employees in the companies in which we have a majority ownership interest.

The following graphic provides a simplified chart of our structure:

Our Structure

| (1) | Reflects our minority investment in Chemotecnica. See “Business—Significant Transactions—Chemotecnica Investment.” |

| (2) | Reflects our syndicated ownership of Rizobacter, of which we currently control 50.01% and expect to increase to 60% upon the exercise of a mandatory call option for an additional 9.99% of Rizobacter. |

Our Business Model

Our business model is driven by three key pillars: technology sourcing, product development partnering, and production and market access:

Technology Sourcing. This pillar is focused on identifying and validating leading scientific research and developing technologies for multiple applications and/or global end-markets. We source and validate promising early stage technologies, which are usually financed through public grants and/or other capital efficient sources, and thereby

3

mitigate the associated high financial risks associated with such early stage discoveries. We currently have 30 products in the proof of concept phase and 11 products in the early development phase. The following subsidiaries support this pillar:

| ■ | INDEAR represents our R&D services arm and was formed through a strategic alliance with CONICET. |

| ■ | INMET was formed to develop and commercialize fermentation solutions based on bacterial metabolic engineering. |

Product Development Partnering. This pillar is focused on collaborating with strategic partners and creating joint ventures to develop validated technologies and products, and to bring these to market. We currently have four products in the advanced development and regulation phase and three products in the pre-launch phase. By co-funding projects, we further reduce our financial burden and risk from product development activities while also increasing our ability to develop multiple products. The following joint ventures support this pillar:

| ■ | Verdeca, our U.S.-based joint venture, was created to develop and bring soybean varieties with next-generation agricultural technologies to market. |

| ■ | Trigall Genetics, our Uruguay-based joint venture, that focuses on developing and commercializing conventional and next-generation biotechnology wheat varieties for the South American market. |

| ■ | Semya, an intra-company joint venture with Rizobacter, is dedicated to the EcoSeed initiative and focuses on researching and developing seed treatments, as well as agricultural biological input applications for soybean, wheat and alfalfa markets. |

| ■ | S&W Semillas is a joint venture that was formed to pursue development of alfalfa traits and varieties. |

Production and Market Access. This pillar is focused on leveraging our shareholder base of leading South American growers as well as proprietary sales channels for direct access to end consumers. By establishing multiple pathways to markets, we maximize our market reach and rate of technology adoption. The following subsidiaries support this pillar:

| ■ | Rizobacter, a global leader in soybean biological products and Argentina’s leading provider of bio-based solutions for the agricultural sector with a strong focus on crop nutrition and protection solutions. |

| ■ | Bioceres Semillas, our sales channel for seeds, with a primary crop focus on wheat and soybean. |

| ■ | Synertech, which was formed in partnership with De Sangosse with the goal of producing and commercializing micro-beaded fertilizers. |

| ■ | AGBM, which is our industrial enzymes company working to produce and commercialize chymosin and safflower industrial by-products from modified safflower seeds using our leading molecular farming technology. |

| ■ | Héritas, which was formed in partnership with CIBIC to provide translational medicine services to the regional community, predominantly in Argentina. |

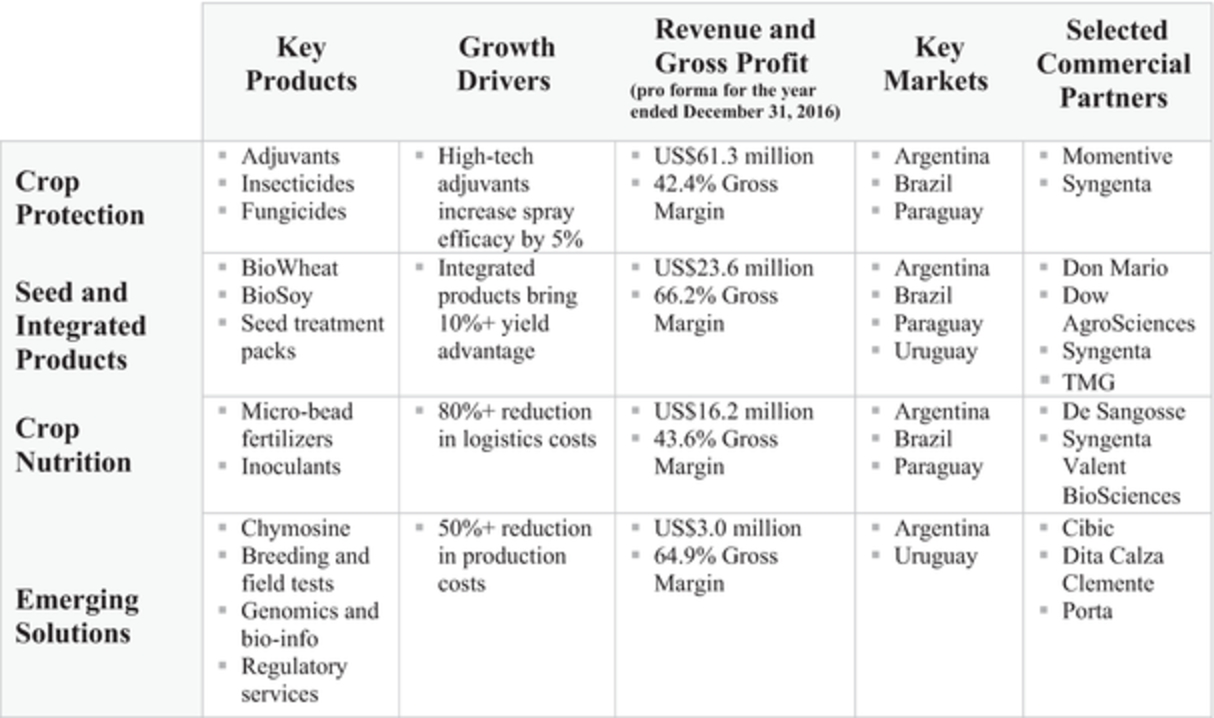

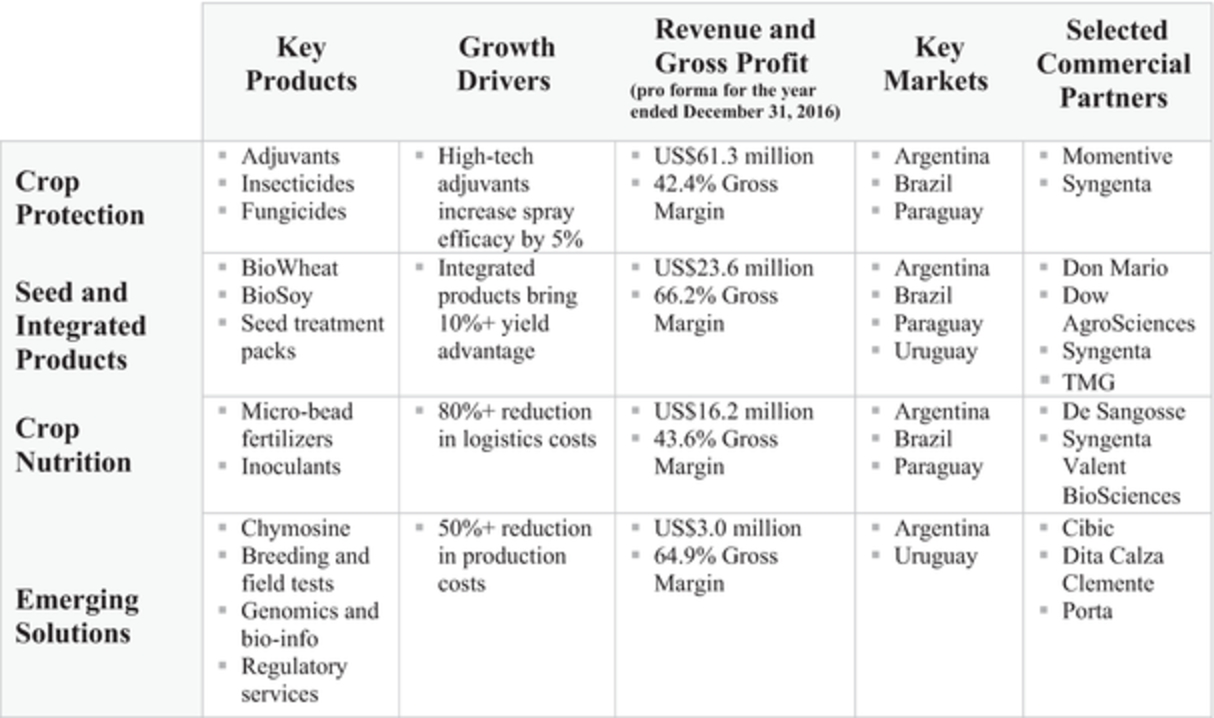

Our Segments and Key Products

We divide our business into the following four principal segments: crop protection, seed and integrated products, crop nutrition and emerging solutions.

Crop Protection. Our key crop protection products include adjuvants as well as seed-applied insecticides and fungicides.

| ■ | Adjuvants. Adjuvants are used in tank mixes to facilitate application and effectiveness of crop protection products. We produce the market leading silicone-based adjuvant, Silwet, and are currently developing microbially-enhanced adjuvants in partnership with other companies. |

| ■ | Insecticides and Fungicides. We offer a full range of chemical seed treatments tailored for specific crop and pest combinations. We are in the process of formulating and commercializing standalone chemical seed treatments, including fungicides and insecticides, in partnership with Syngenta, to reduce disease |

4

and pest pressure during crop establishment. Also, in partnership with De Sangosse, we offer a range of pest baits to effectively and safely control pests that are particularly harmful for harvested and stored grains or seeds. We hold a leading market position for such products, with an estimated 50% current market share. Furthermore, we are pursuing commercialization of biological fungicides formulated as seed treatments that control and restrict the growth of pathogenic agents in wheat and barley, as well as developing a microbial-based insecticide.

Seed and Integrated Products. The key products of this segment include seed traits, germplasms and seed treatments for healthier and higher yielding crops.

| ■ | Seed Traits. Our seed trait effort is primarily focused on improving plant yields by increasing plant tolerance to abiotic stress, such as drought or salinity. We also have a secondary focus on crop protection and quality traits. We gain access to these technologies by collaborating with the original developers or by co-developing new events with our partners. Our most advanced technology in the seed trait area, HB4, helps increase yield by an average 13% to 19% for multiple crops under various growing seasons and conditions, including sporadic drought episodes. HB4 is also able to provide this higher yield without adversely impacting yields in optimal growing conditions, which is a distinctive and important factor compared to other stress tolerance technologies. HB4 has been approved for use in soybean in Argentina and by the U.S. FDA. Submissions for approval for use of HB4 in wheat have been initiated in Argentina, Brazil, Uruguay and Paraguay, and we have also filed for approval of HB4 in soybean in China. |

| ■ | Germplasms. We currently breed germplasms for soybean and wheat and plan to advance our elite germplasms by delivering these technologies using our proprietary channels. Our soybean breeding program produces varieties that are registered or are in process of being registered in Argentina, Uruguay, Paraguay and South Africa. Our wheat breeding program is operated through our joint venture, Trigall Genetics, which has exclusive rights to the wheat breeding program of Florimond Desprez. In addition, we hold exclusive rights to all wheat varieties developed between 2003 and 2013 by the Argentine national breeding program at INTA. |

| ■ | Seed Treatments. Seed treatments comprise one of our core products and include Rizopacks, produced by our subsidiary Rizobacter in partnership with Syngenta Seedcare, which are the flagship soybean product with proprietary inoculants and fungicides. We also offer certain variations customized for peanut, beans and chickpea. In addition, we are pursuing the development of next-generation biologicals, particularly for seed treatments tailored for specific germplasms, seed traits and environment combinations. |

Crop Nutrition. Our main crop nutrition products include inoculants, biofertilizers and chemical-based fertilizers:

| ■ | Inoculants. Inoculants are broadly used nitrogen-fixing bacteria that promote growth of leguminous crops such as soybean and alfalfa. We hold a global leadership position in sales of soybean inoculants with approximately 21% market share per our internal projections. We are currently developing the next-generation of inoculants, including Bioinductor 2.0 and Extended-Shelf-Life products for professional seed treatment businesses. |

| ■ | Biofertilizers. Biofertilizers contain living microorganisms that colonize the interior of a plant and promote growth by increasing supply or availability of primary nutrients through the natural processes of nitrogen fixation, solubilizing phosphorus and stimulating plant growth through synthesis of growth-promoting substances. The combination of biologicals and chemical fertilizers can maximize crop yields while reducing environmental impact as a result of reduced use of chemicals. We are also in early stages of development for microbially-enhanced fertilizers for soybean, wheat, corn and chickpeas. |

| ■ | Chemical-Based Micro-Granulated Fertilizers. We produce and commercialize fertilizers based on chemically formulated microgranules. As these fertilizers can be applied next to the seed at planting, lower doses are needed than standard fertilizers, resulting in logistical efficiency and environmental benefits. Currently, our production is focused on Microstar PZ, a starter fertilizer that provides nitrogen, phosphorus, sulfur and zinc to different crops. |

5

Emerging Solutions. Our emerging solutions segment provides high value R&D, technical and advisory services to strategic partners and third parties. We also commercialize specialized products for a variety of end markets, including enzymes, such as chymosin, microbial fermentation solutions and translational medicine services.

| ■ | R&D Services. Our R&D services provide advanced biotechnology capabilities and specialized knowledge and expertise to facilitate validated technology sourcing and product development efforts from our industry collaborations. We also enter early-stage research collaboration arrangements with external research groups, most of which are funded through government grants. Our R&D services are provided through our two subsidiaries: INDEAR, which provides R&D services across a broad range of platforms, and INMET, which focuses on fermentation solutions using synthetic biology and metabolic engineering for application in agro-industrial solutions. |

| ■ | Agro-Industrial Biotechnology. We have developed a safflower-based molecular farming platform for industrial enzymes, which allows us to use harvested grains as an efficient way of storing enzymes prior to processing. Our most advanced molecular farming technology is SPC®, which is used to produce bovine chymosin, an enzyme used in the manufacturing of cheese. We are also developing solutions for producing biopolymers, such as PHA/PHB, biodiesel and ectoine from soybean glycerin based on bacillus fermentation, which we also use for cost-effective production of biological pest control agents. |

The following graphic sets forth the key products, growth drivers, revenue and gross profit, key markets and selected commercial partners for each of our segments:

Our Competitive Strengths

Our diversified platform generates revenues through multiple technologies, customers, distribution channels and end-markets, providing us with a profitable growth trajectory. Our key competitive strengths include:

Premier Agricultural Solutions Provider with the Flagship Position in Latin America. As the first non-governmental Latin America-based entity with a GMO event approved in a major global crop, we consider ourselves to be the pioneer in the agricultural biotechnology industry in Latin America. Our experience over the last 40 years has allowed us to become and maintain our position not only as a reference entity for governmental agencies and policy-makers, but

6

also as a leading choice for partnerships with global conglomerates. We have helped define regulations for gene editing and new breeding technologies as well as formulate intellectual property guidelines and legislation for our industry. We are a founding member of the Argentine Chamber of Biotechnology and one of a handful of selected companies collaborating with the Argentine Ministry of Science, Technology and Productive Innovation in the design of research grants aimed at our sector. We are a frequent and leading participant in all major forums dedicated to our industry and a prominent representative of our sector.

Proven Platform with a Successful Track-Record in Sourcing, Developing and Commercializing Key Biotechnologies. Over the last 40 years, we and our subsidiaries have created our proprietary platform for sourcing, validating, developing and bringing key technologies and products to commercialization.

We manage our sourcing efforts through our two key business divisions: INDEAR, which focuses on our technology and product development efforts and third party initiatives, and INMET, which focuses on metabolic engineering solutions for the conversion of agricultural feedstock into higher value molecules.

We source our technologies and products through various partnerships, collaborations and long standing relationships with research institutions and scientists. We are the strategic partner of various institutions including CONICET for the development of multiple GM trait leads, Danziger Innovations for the development of modified gene lines in soybeans as well as quality and protection traits and the University of Illinois for the development of herbicide tolerance technology for alfalfa and soybeans, among others. We have also entered into various collaborative product development agreements, including with: (a) Forage Genetics for enhanced alfalfa with herbicide resistance technology; (b) Dow AgroSciences for the development of new seed traits in soybeans; (c) Momentive for adjuvants; (d) Syngenta for new seed treatments; and (e) Valent BioSciences for microbials in the United States, among others.

We manage our product development via various joint ventures and partnerships with leading participants in the global agriculture sector. We focus our efforts on developing products and technologies that address the specific requirements and demands of our global customer base and for some of the highest demanded crops, such as soy, wheat and alfalfa, among others.

We operate a commercialization platform for agricultural biotechnology products in South America as well as other select global agricultural markets. We have access not only to the largest distributors, co-ops and dealers, but also to end customers through our well-established subsidiaries, divisions and partnerships. By selling our proven genetics, seed and seed treatments on a branded basis, we believe we are able to further strengthen our brand and grow our position in Latin America.

Capital-Efficient, Risk Mitigated Development Model. Development and regulatory approval for our products and technologies requires a highly evolved and complicated process that can last between 12 to 14 years. Furthermore, capital allocation requirements can be onerous due to the expensive research activities usually associated with life sciences research and the strict requirements for regulatory approval that are imposed on GM crops and technologies.

We believe that we have created a highly-competitive independent platform for developing such products and technologies in South America. We consider ourselves to be the go-to partner for advanced validation of promising research leads developed by local research institutions, most of which do not have the necessary capabilities for this purpose. As advanced validation initiatives are funded often by existing government programs, we are able to reduce our capital exposure at this high-risk stage of the R&D process.

Upon technology validation, we enter into joint ventures, partnerships and collaborative agreements with industry participants that agree on the merits of a new technology and pursue the business opportunity jointly with us. Partnering with others in this stage of the R&D process allows us to reduce our capital exposure while retaining a controlling interest in the product or technology under development.

7

We enjoy a competitive advantage in commercializing our products as we are able to leverage our strong industry relationships to bring our products to market faster than our competitors. We also facilitate the use of our technologies through licensing agreements and partnerships with global industry leaders, particularly in new markets with expanded regulatory requirements.

Patented and Well-Established High Impact Technologies and Products as well as a Robust Pipeline of New Products and Technologies at or Close to Commercialization Phase. Our patent and trademark portfolio for biologicals is amongst the most competitive in South America. As of the date of this prospectus, we have identified and sought patent protection in our capacity as either title holder or licensee, either as exclusive or non-exclusive licensee, to approximately 200 patents or patent applications. In some instances, our licenses are limited in terms of duration, geography and/or field of use. We usually seek patent protection in the largest global markets for our products and technologies, including, the United States, Brazil, Argentina, China, India, Mexico, Australia and certain other European and South American countries.

We have registrations in Argentina for 27 wheat, 18 soybean, 5 alfalfa, 4 corn and 2 safflower varieties and are also seeking registration for an additional 13 soybean, 2 wheat, 2 amaranth and 17 alfalfa varieties. Our portfolio also includes 42 trademarks and 4 trademark applications in Argentina, Brazil, the United States, and Uruguay for Bioceres, while our subsidiary Rizobacter has more than 355 trademarks and applications in Argentina and over 300 trademarks and applications globally.

We also have a robust and innovative portfolio of products and technologies for all stages of crop development across various chemistries, many of which are at or close to the commercialization phase, such as EcoSoy, EcoWheat and HarvXtra™ Alfalfa products.

Unique Ownership by Key Industry Influencers Leading to Early and Broad Adoption of Technologies and Products. Our current ownership structure is composed of 308 shareholders, including some of the largest farm operators, processors, distributors and commercial participants in the South American agricultural sector. Our shareholder structure also includes founding members of AAPRESID and leading members of AACREA. These unique relationships not only allow us to quickly bring our products to market and integrate our technologies into the broad market by creating a proprietary distribution and commercialization channel, but also provides us with a much desired early stage testing platform which allows us to receive direct market feedback early on in the testing process to vet and facilitate faster market penetration.

Highly Accomplished Management Team with a Unique Blend of Technical and Commercialization Experience as well as the Ability to Identify and Integrate Key Acquisitions. We believe we have a strong management team with a unique blend of executive, managerial, technical, commercialization and acquisition experience. We are able to leverage the experience of our management team not only to efficiently source and develop our technologies and products, but also to leverage their vast experience in commercial production, distribution, navigation of intellectual property requirements and inorganic acquisitions to strategically grow our company.

Our Growth Strategy

Our long-term growth strategy is based on an open-architecture approach to technology origination, identifying and accessing promising technologies from third parties, as well as forming strategic and capital-efficient partnerships that leverage each party’s strategic strengths and capabilities to more quickly bring innovations to market. Our near-term growth strategy includes the following:

Continue to Lead Development and Commercialization of New Agricultural Biotechnology Products in Existing and New Markets. We intend to build upon our diverse portfolio of crop productivity solutions by consolidating our position on biological assets, including microbial, seed traits and germplasm assets, and continuing to pursue an integrated approach in the development of superior yielding products. We intend to expand upon our direct reach to customers by offering additional high demand technologies, including digital farming solutions and direct-to-consumer retail, which we believe will facilitate the adoption and subsequent sales of our products as well as achieve efficiencies creating additional value opportunities.

8

Scale-up Production of Rizobacter Products to Accelerate Penetration in Local and Regional Crop Nutrition Markets. We have invested significant capital in future developments of specialty fertilizers and have recently completed the construction of our micro-beaded fertilizer facility in Pergamino, Argentina. The facility began operations in January 2017 and is expected to supply high-demand specialty fertilizers in Argentina and neighboring countries. Micro-beaded fertilizers place non-toxic formulations of macro- and micro-nutrients next to the planted seed allowing growers to significantly reduce application rates by as much as 75% to 80% on a weight basis and resulting in significant logistical as well as operational savings. Through our recent acquisition of Rizobacter, we also own Microstar, the leading brand in micro-granulated fertilizers.

Commercial Launch of Seed Traits and EcoSeed Products to Drive Penetration in Local and Regional Integrated Seed Market. Given the near-term commercialization opportunity that HB4 and other seed technologies represent, we plan to integrate these solutions into customized seed products that represent a superior value proposition in the current market, with an initial focus on Latin America. EcoWheat and EcoSoy seeds integrate the uniqueness of HB4 stress tolerance into locally-adapted germplasms, customized with a seed treatment solution prescribed for specific environments. We believe that the product differentiation provided by our unique and varied technologies increase the value of our products for EcoSeed customers and will drive significant growth in this segment of our business. In the medium-term, we expect royalties from HB4 licensees to represent a significant component of our revenues as this landmark technology is more broadly adopted through strategic partnerships and third-party channels. We also expect to obtain regulatory approval for the commercialization of the HarvXtra™ Alfalfa with Roundup Ready® technology developed by Forage Genetics International.

Expand our International Business by Accelerating Registration and Sales of Products Through Multiple Subsidiaries. We consider ourselves to be a global leader in the soybean biological market and have used this position to establish subsidiaries in Brazil, Paraguay, Bolivia, Uruguay, the United States, South Africa, and more recently, India, Colombia and France. We believe we can use our international footprint and sales force to continue to define our key brands by bringing our broader portfolio of crop productivity solutions to these markets. We expect international growth to be driven initially by continued growth in our historical biological business, as well as by incorporating high-value adjuvants and crop nutrition solutions in the future. In the medium-term, we expect to leverage our leading distribution network to bring our integrated seed products and other crop protection and nutrition solutions to all of our current and target markets.

Pursue Strategic Collaborations and Acquisitions in Key Markets. We intend to continue working with our collaboration partners to bring our products to customers in key markets. We also plan to continue pursuing acquisitions and in-licensing opportunities to gain access to validated and important later stage products and technologies that we believe to be a strategic fit for our business.

Further Develop Emerging Agro-Industrial Biotechnology Solutions. Through our investment in AGBM, we plan to scale-up our molecular farming business, by initially producing and commercializing chymosin, an enzyme used in cheese manufacturing. We intend to accelerate the cost-efficient development of commercial technologies that rely on metabolic engineering for bio-conversions of soy glycerin to produce biofuels, bio-chemicals and bioplastics as well as technologies for the production of new industrial enzymes through our safflower molecular farming platform. We believe that the ability to combine our capabilities in genomic and bio-informatics, synthetic biology, metabolic engineering and fermentation as well as unique relationships with some of the largest participants in the agricultural sector allows commercialization of technologies more quickly and efficiently and with lower risk than our competitors.

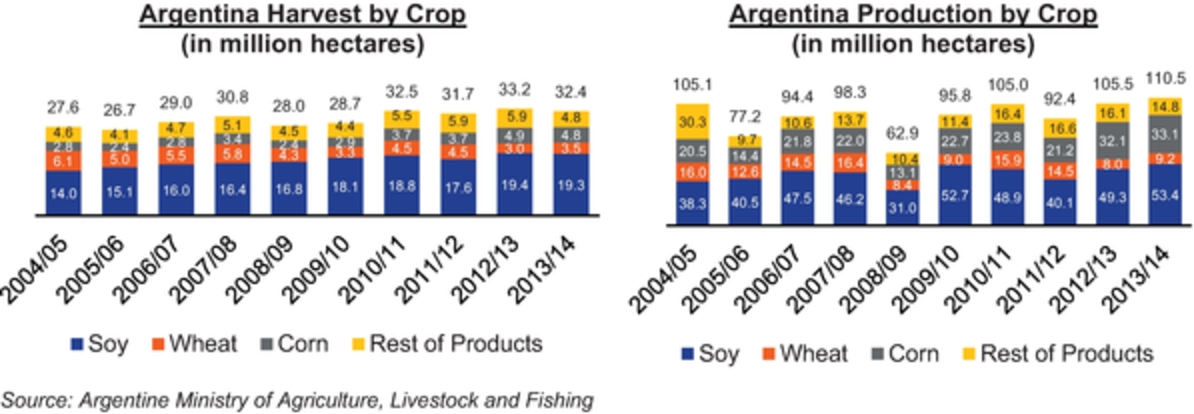

Global Industry Overview

We develop, produce and/or formulate: germplasm, seed traits, seed treatments, biological and micro-granulated fertilizers, specialty insecticides and fungicides, adjuvants and specialty enzymes. Our key geographical end-markets include Argentina, which is the third largest market for agricultural biotechnology products, Brazil and the rest of Latin America, the United States, China and India. We sell our products in more than 25 countries

9

globally. Our products and technologies have applicability across a wide variety of crops, including some of the most globally farmed crops such as corn, soy, alfalfa and wheat.

Demand for crop yields from agricultural lands are seeing a dramatic increase as a result of increasing global population, an expanding middle class, trend towards urbanization, decrease in agricultural land per capita, demand for reduced use of environmentally harmful chemicals and an increase in unfavorable weather patterns for farming. This demand cannot be met by conventional farming alone. Agricultural biotechnology products are the only current viable avenue available to meet this expected high demand in crop yields.

According to the USDA, global demand for grains increased by more than 57% from 1.4 billion metric tons in 1980 to 2.2 billion metric tons in 2010. Furthermore, according to the OECD and the FAO, this demand is expected to increase another 20% by 2020 reaching 2.6 billion metric tons. The increase in demand is primarily driven by population growth in developing countries and an expanding middle class. Also, according to the OECD and the FAO, global population is projected to increase from 7.3 billion in 2016 to 8.2 billion in 2026, with almost all of this increase occurring in developing countries. Furthermore, the OECD estimates that global middle-class population is expected to grow from 1.8 billion people in 2009 to 3.2 billion people by 2020 and 4.9 billion people by 2030. As household incomes rise, demand for protein-rich diets often increases and this drives additional demand for grains. The trend toward urbanization is also causing a large drop in arable land available per capita. The FAO estimates that ratio of arable land to population has declined by over 50% from 1962 to 2010. As a result of this, according to a report from Statista, the number of people fed per hectare is expected to increase by more than 100% from 2.3 to 5.6 people fed per hectare from 1960 to 2020.

The U.S. EPA has validated that more extreme temperature and precipitation can prevent crops from growing. Dealing with drought could become a challenge in areas, and although increased irrigation might be possible in some places, in other places water supplies may also be reduced, leaving less water available for irrigation when more is needed. According to the U.S. Global Change Research Program, climate disruptions to agricultural production have increased in the past 40 years and are projected to increase over the next 25 years. By mid-century and beyond, these impacts will be increasingly negative on most crops and livestock.

According to the ISAAA, conventional crop technology alone cannot address this immense demand or feed the increase in population. Sustainable approaches using the best of conventional crop technology, such as use of the best adapted germplasms, as well as the best of biotechnology are required in order to increase crop productivity enough to meet the growing demands associated with the increase in population. The last 20 years of commercialization of biotech crops has confirmed that biotech crops have and can deliver substantial agronomic, environmental, health, economic and social benefits. The rapid adoption of biotech crops reflects the multiple substantial benefits realized globally and in the last 20 years, with an accumulated 2 billion hectares of biotech crops grown commercially. Furthermore, in most countries, the adoption rate for biotech crops has reached over 90% for major products in principal markets in both developing and industrial companies.

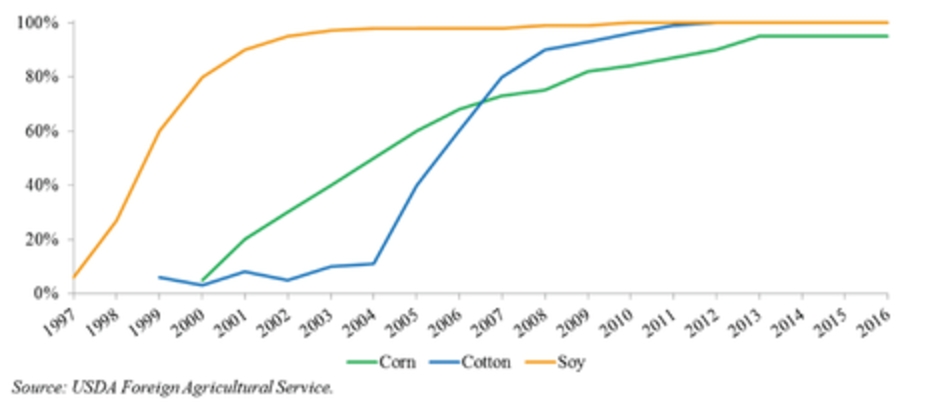

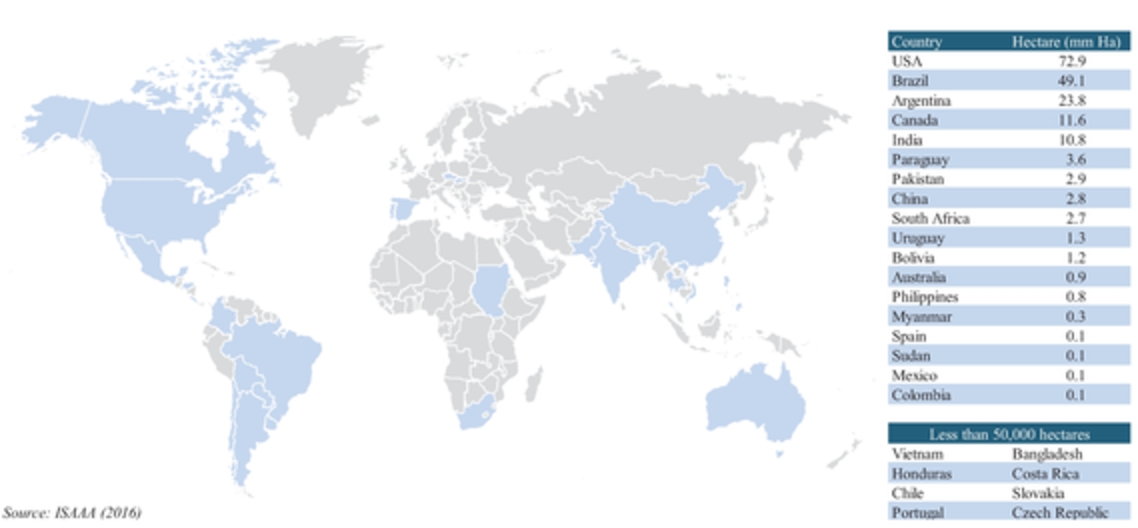

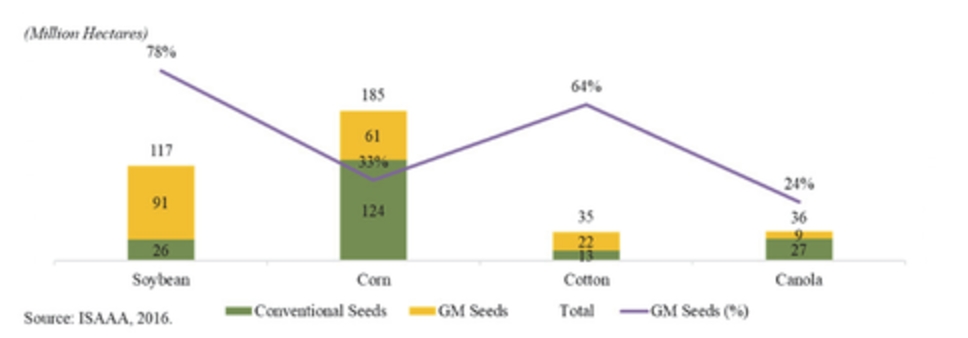

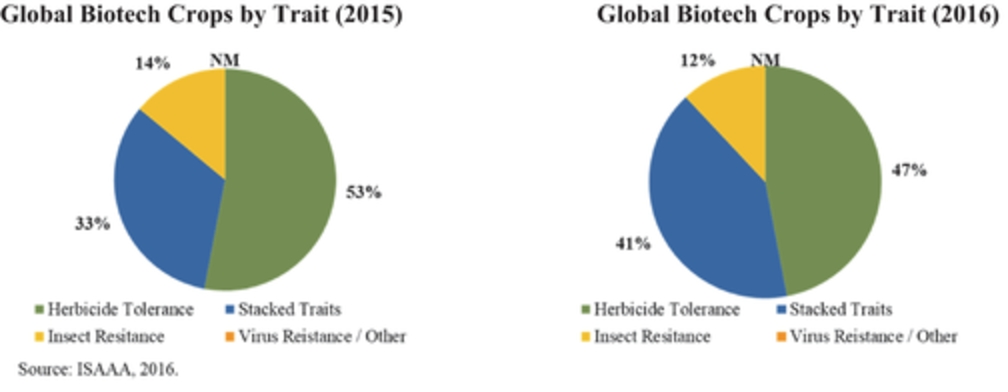

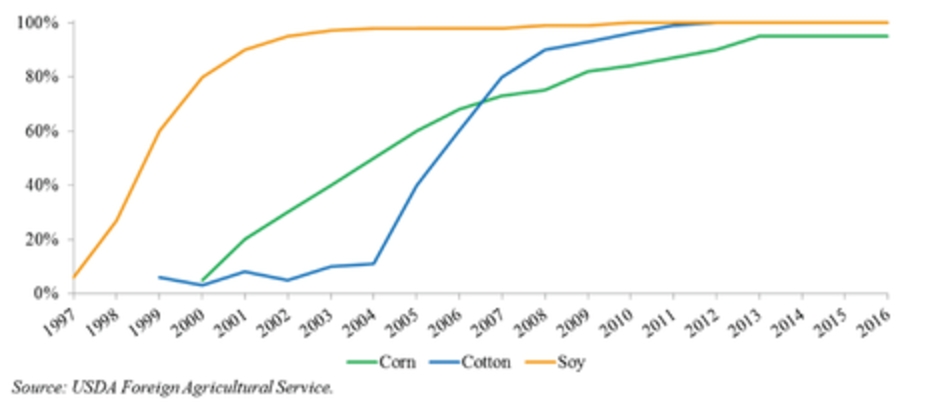

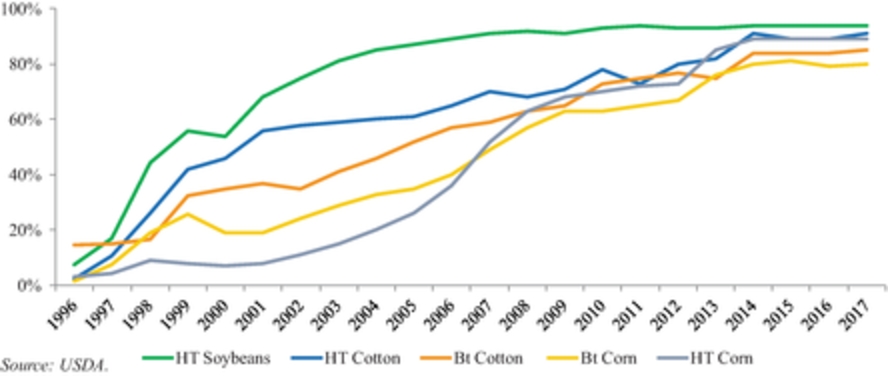

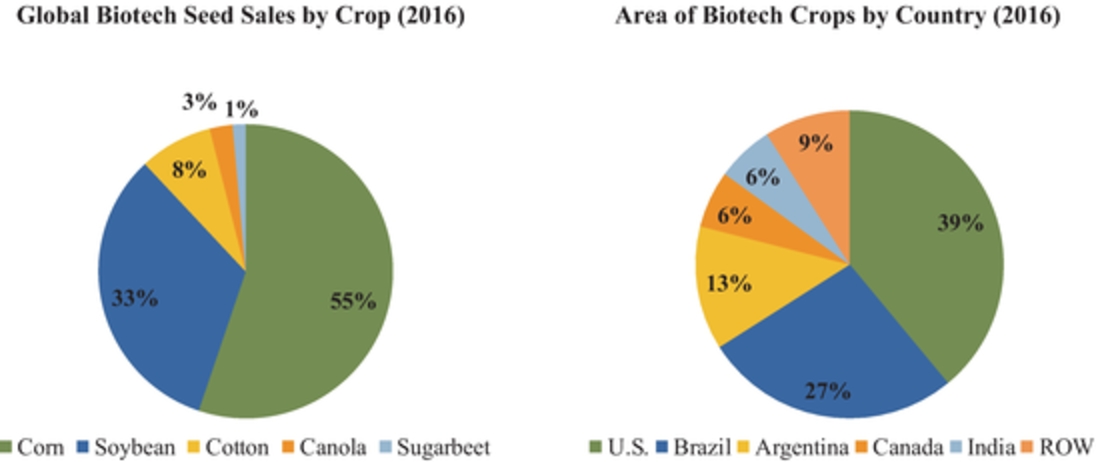

In 2016, according to the ISAAA, corn and soybeans represented a majority of the seed biotechnology market, making up approximately 87% of the global biotech seed market. The United States, Brazil and Argentina were the top planters of biotech seeds with more than 145 million hectares under production of biotech crops. Current adoption of GM varieties is above 90% for soybean, above 80% for corn and above 65% for cotton. In Argentina, approximately 24 million hectares of biotech crops were planted in 2016 with virtually 100% of soybean, 97% of corn and 95% of cotton hectares utilizing biotech varieties. Historically, the Argentine market has been quick to adopt biotechnology as a result of concentrated nature of farm groups as well as comfort with fast commercialization of new GM varieties. In the United States, which is the top producer of biotech seeds, 73 million hectares were planted using biotech crops. The United States has an established history of rapid adoption rates of GM crops, typically reaching 65% to 90% peak penetration in ten years driven by overall yield and productivity improvements of specific seed traits as well on-going consumer education and resulting acceptance.

10

The graph below reflects the adoption of rates of GM crops in Argentina for the periods indicated:

Adoption Rates of GM Crops in Argentina

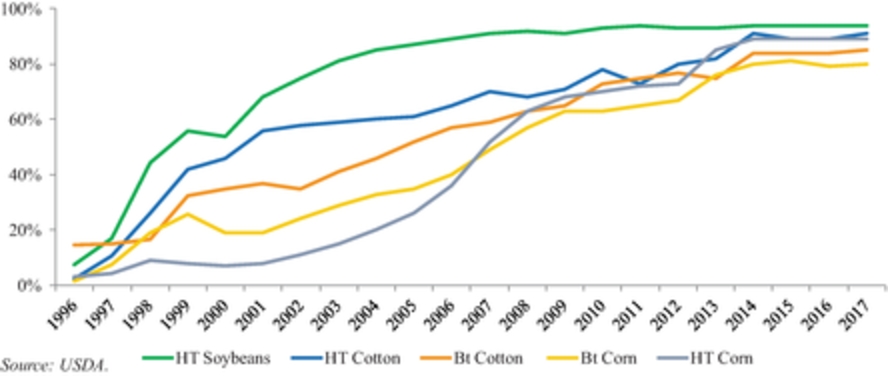

In the United States, which is the top producer of biotech seeds, 73 million hectares were planted using biotech crops. The United States has an established history of rapid adoption rates of GM crops, typically reaching 65% to 90% peak penetration in ten years driven by overall yield and productivity improvements of specific seed traits as well on-going consumer education and resulting acceptance.

The graph below reflects the adoption rates of GM crops in the United States for the periods indicated:

Adoption Rates of GM Crops in the U.S.

The global seed market has grown an 85% in ten years up to US$37 billion in 2016 from US$20 billion in 2006 per a 2017 report by Phillips McDougall. Also, GM seeds have grown in prominence, representing only 29% (US$6 billion) of the global market in 2006 up to 55% (US$20 billion) in 2016. This increase of more than 330% in the market size of GM seeds underlines the increasing significance and need for agricultural biotechnology.

11

The graph below reflects the increase in the global seed market and the penetration of biotechnology crops for the periods indicated:

Global Seed Market & Penetration of Biotech Crops

Source: Phillips McDougall, 2017.

Syngenta, our joint venture partner and a global leader in crop protection, estimates that the global market for agrochemical products, including crop protection products doubled from 2000 to 2014, reaching an estimated size of US$63 billion. The Company, based on its research and market sources, also estimates this unprecedented growth to continue driven by introduction of new chemistries, which addressed many unmet agronomic challenges faced by growers, as well as need to address significant losses from abiotic stresses that could potentially be more than US$100 billion.

We believe that agricultural biotechnology and biologicals will continue to grow as the benefits of these technologies and products become more widely known and consumers appreciate the similar efficacy to conventional chemicals while also addressing other issues such as pest resistance and environmental safety.

Implications of Being an Emerging Growth Company and a Foreign Private Issuer

As a company with less than US$1.07 billion in revenue during our last fiscal year, we qualify as an “emerging growth company,” as defined in the JOBS Act. Section 107 of the JOBS Act provides that an emerging growth company may take advantage of the extended transition period provided in Section 7(a)(2)(B) of the Securities Act of 1933, as amended, or the Securities Act, for complying with new or revised accounting standards. Thus, an emerging growth company can delay the adoption of certain accounting standards until those standards would otherwise apply to private companies. However, we are choosing to “opt out” of such extended transition period, and as a result, we will comply with new or revised accounting standards on the relevant dates on which adoption of such standards is required for non-emerging growth companies. Section 107 of the JOBS Act provides that our decision to opt out of the extended transition period for complying with new or revised accounting standards is irrevocable.

An emerging growth company may also take advantage of reduced reporting requirements that are otherwise applicable to public companies. If we choose to take advantage of any of these reduced reporting burdens, the information we provide to shareholders may be different from that which you may receive from other public companies. These provisions include:

| ■ | a requirement to have only two years of audited financial statements in addition to any required interim financial statements and correspondingly reduced Management’s Discussion and Analysis of Financial Condition and Results of Operations disclosure; and |

12

| ■ | an exemption from the auditor attestation requirement under Section 404(b) of the Sarbanes-Oxley Act in the assessment of our internal control over financial reporting. |

We may take advantage of these provisions for up to five years or such earlier time that we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earlier to occur of:

| ■ | the last day of our fiscal year during which we have total annual gross revenue of at least US$1.07 billion; |

| ■ | the date on which we have, during the previous three-year period, issued more than US$1.0 billion in non-convertible debt; or |

| ■ | the date on which we are deemed to be a “large accelerated filer” under the Securities Exchange Act of 1934, as amended, or the Exchange Act, which would occur if the market value of our shares that are held by non-affiliates exceeds US$700 million as of the last business day of our most recently completed second fiscal quarter. |

Once we cease to be an emerging growth company, we will not be entitled to the exemptions provided in the JOBS Act.

We are also considered a “foreign private issuer.” Even after we no longer qualify as an emerging growth company, as long as we qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

| ■ | the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations with respect to a security registered under the Exchange Act; |

| ■ | the requirement to comply with Regulation FD, which requires selective disclosure of material information; |