- OLLI Dashboard

- Financials

- Filings

-

Holdings

- Transcripts

- ETFs

- Insider

- Institutional

- Shorts

-

DEF 14A Filing

Ollie's Bargain Outlet (OLLI) DEF 14ADefinitive proxy

Filed: 5 May 23, 4:14pm

☐ | Preliminary Proxy Statement |

☐ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ | Definitive Proxy Statement |

☐ | Definitive Additional Materials |

☐ | Soliciting Material Pursuant to §240.14a-12 |

OLLIE’S BARGAIN OUTLET HOLDINGS, INC. |

(Name of Registrant as Specified in its Charter) |

☒ | | | No fee required. |

☐ | | | Fee paid previously with preliminary materials. |

☐ | | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| 1. | Elect eight directors to serve on the Board of Directors until the 2024 annual meeting of stockholders; |

| 2. | Approve a non-binding proposal regarding named executive officer compensation; and |

| 3. | Ratify the appointment of KPMG LLP as the Company’s independent registered public accounting firm for the fiscal year ending February 3, 2024. |

BY ORDER OF THE BOARD OF DIRECTORS | | | |

| | | |

James J. Comitale | | | |

Senior Vice President, General Counsel and Corporate Secretary | | | |

May 5, 2023 | | |

| • | This Proxy Statement; |

| • | A Notice of our Annual Meeting (which is attached to this Proxy Statement); and |

| • | Our 2022 Annual Report to Stockholders. |

| • | By telephone - Use the toll-free telephone number shown on the Notice of Internet Availability or any proxy card you receive; |

| • | By internet - Visit the internet website indicated on the Notice of Internet Availability or any proxy card you receive and follow the on-screen instructions; or |

| • | By mail - If you request a paper proxy card by telephone or internet, you may elect to vote by mail. If you elect to do so, you should date, sign, and promptly return your proxy card by mail in the postage prepaid envelope which accompanied that proxy card. |

| • | In person - You can deliver a completed proxy card at the Annual Meeting or vote in person. |

| • | As of the end of Fiscal 2022, we are in compliance with Nasdaq’s Board Diversity Rule. We publicly disclose board-level diversity statistics using a standardized template and have at least two (2) diverse board members, including at least one (1) female board member. |

| • | On November 29, 2022, our Board fixed the number of directors at eight and appointed Abid Rizvi as a member of the Board. |

| • | Our Board consists of all independent, non-employee directors other than our Chief Executive Officer. |

| • | Our Board is fully declassified, and all our directors are up for election annually. |

| • | Our Board has adopted the so-called “Rooney Rule,” requiring that we or search firms we engage to recruit directors must include qualified candidates with a diversity of race/ethnicity and gender in the initial pool from which the Committee selects director candidates. Accordingly, our Nominating and Corporate Governance Committee Charter requires that the Committee include and require that any search firm that it engages includes qualified candidates with a diversity of race/ethnicity and gender in the initial pool from which the Committee selects director candidates. |

| • | The Company’s Corporate Governance Guidelines and Principles reflect the Board’s commitment to consider diversity of race, ethnicity, gender, age, nationality, education, cultural background, and professional experiences in evaluating candidates. |

| • | Our Nominating and Corporate Governance Committee Charter requires that the Committee periodically review our environmental, social and governance (“ESG”) strategy, initiatives, and policies. |

| • | We have a majority voting standard for directors in uncontested elections with a resignation policy for directors who do not receive the support of a majority of our stockholders. |

| • | Our Nominating and Corporate Governance Committee is comprised entirely of independent directors, including an independent Chair of the Committee. |

| • | Our Certificate of Incorporation does not contain any supermajority vote provisions. |

| • | All employees and directors are prohibited from hedging and pledging shares of Company stock. |

| • | Directors are required to notify the Board when the director’s principal occupation or business association changes substantially from the position held when the director originally joined the Board. |

| • | None of our directors currently serves on more than three other public company boards. |

| • | The Board and each of its committees conduct annual self-evaluations, during which Board refreshment is considered. |

| | Director | | | Age | | | Tenure | | | Committee Service | |

| | Alissa Ahlman | | | 51 | | | 2020 - present | | | Compensation Committee, Nominating and Corporate Governance Committee | |

| | Robert Fisch | | | 73 | | | 2015 - present | | | Compensation Committee, Nominating and Corporate Governance Committee | |

| | Stanley Fleishman | | | 71 | | | 2013 - present | | | Audit Committee, Nominating and Corporate Governance Committee (Chair) | |

| | Thomas Hendrickson | | | 68 | | | 2015 - present | | | Audit Committee (Chair), Nominating and Corporate Governance Committee | |

| | Abid Rizvi | | | 47 | | | 2022 - present | | | Audit Committee, Nominating and Corporate Governance Committee | |

| | John Swygert | | | 54 | | | 2019 - present | | | None | |

| | Stephen White | | | 68 | | | 2016 - present | | | Audit Committee, Nominating and Corporate Governance Committee | |

| | Richard Zannino | | | 64 | | | 2012 - present | | | Compensation Committee (Chair), Nominating and Corporate Governance Committee | |

Name | | | Age | | | Position(s) |

John Swygert | | | 54 | | | President and Chief Executive Officer |

Robert Helm | | | 43 | | | Senior Vice President and Chief Financial Officer |

Eric van der Valk | | | 53 | | | Executive Vice President and Chief Operating Officer |

Kevin McLain | | | 57 | | | Senior Vice President, General Merchandise Manager |

Larry Kraus | | | 52 | | | Vice President, Chief Information Officer |

James Comitale | | | 58 | | | Senior Vice President, General Counsel and Secretary |

| | Board Diversity Matrix (as of May 5, 2023) | | ||||||||||||

| | Total Number of Directors | | | 8 | | |||||||||

| | | | Female | | | Male | | | Non-Binary | | | Did not Disclose Gender | | |

| | Directors | | | 1 | | | 7 | | | — | | | — | |

| | Number of Directors Who Self-Identify in Any of the Categories Below: | | ||||||||||||

| | African American or Black | | | — | | | — | | | — | | | — | |

| | Alaskan Native or Native American | | | — | | | — | | | — | | | — | |

| | Asian | | | — | | | 1 | | | — | | | — | |

| | Hispanic or Latinx | | | — | | | 1 | | | — | | | — | |

| | Native Hawaiian or Pacific Islander | | | — | | | — | | | — | | | — | |

| | White | | | 1 | | | 6 | | | — | | | — | |

| | Two or More Races or Ethnicities | | | — | | | 1 | | | — | | | — | |

| | LGBTQ+ | | | — | | | — | | | — | | | — | |

| | Did not Disclose Demographic Background | | | — | | | — | | | — | | | — | |

| • | Presiding at all meetings of the Board, including executive sessions of the independent directors; |

| • | Serving as liaison between the Chief Executive Officer and the independent directors; |

| • | Together with management, approving information sent to the Board; |

| • | Together with management, approving meeting schedules to assure that there is sufficient time for discussion of all agenda items; |

| • | Calling meetings of the independent directors; and |

| • | If requested by major stockholders, ensuring that he is available for consultation and direct communication. |

BE A TEAM PLAYER: Support all teammates across the company and work together in the best interests of Ollie’s, our customers, and communities we serve. ACT: Respect other points of view, remember the common goal, build each other up, no “meetings after the meeting.” THINK: “There’s no ‘I’ in team.” “Leave your cape in the closet” #1Team1Jersey | | | BE CARING: Care for our Ollie’s team first, then care for our customers, communities, business partners, and investors. ACT: Encourage, show understanding, give to local communities, create a fun and inclusive work environment, respect work/life balance. THINK: “How do I treat others with courtesy, dignity and respect” #YesICareYesICan | | | BE VALUE OBSESSED: Have a “Good Stuff Cheap” mindset across all areas of our business to provide customers with the lowest prices possible. ACT: Be resourceful, frugal, and negotiate the best price. THINK: “Invest like it’s your own money” #GoodStuffCheap |

| | | | | |||

BE COMMITTED: Honor our legacy by operating with grit, passion, tenacity, and action. ACT: Own the business, do whatever it takes, share your point of view. THINK: “Why not today?” #WeAreOllies | | | BE GROWING: We evolve through continuous improvement with a practical and scalable approach. ACT: Engage in learning, measure success, share results, be accountable, attain simplicity, be an agent of change, strategically approach improvement, promote from within, be devoted to development, keep an open mind. THINK: “How do we get better every day?” #HereWeGrowAgain | | | BE REAL: “No politics, no hidden agendas, no nonsense.” ACT: Be honest and transparent, provide candid feedback, be genuine and trustworthy. THINK: “Sincere and straightforward.” #BeReal |

Ollie’s helps the communities where it does business thrive because our employees and customers live, work, and raise families there. Ollie’s endeavors to maximize its community support. Ollie’s makes every effort to support a variety of groups, with an emphasis on organizations that better the lives of children and provide the best opportunities for our next generation. Through its “Ollie’s Cares” initiative, Ollie’s supports the following national organizations in significant ways: | | |  |

| • | Cal Ripken, Sr. Foundation: During our 14-year partnership with the Cal Ripken Sr. Foundation, we have donated approximately $13.0 million in support of the organization’s mission to strengthen America’s most underserved and distressed communities by supporting and advocating for children, building parks, partnering with law enforcement and youth service agencies, and addressing community needs. |

| • | Kevin Harvick Foundation: During our 11-year partnership with the Kevin Harvick Foundation, we have donated approximately $3.6 million in support of the organization’s mission to support programs that positively enrich the lives of children throughout the United States. |

| • | Children’s Miracle Network: During our 14-year partnership with the Children’s Miracle Network, we have donated approximately $3.4 million in support of the organization’s mission to increase funding and awareness for local children’s hospitals. |

| • | Toys for Tots: During our 4-year partnership with Toys for Tots, we have donated approximately $2.8 million in support of the organization’s mission to collect new, unwrapped toys and distribute those toys to less fortunate children during the holidays. |

| • | Feeding America: During our 4-year partnership with Feeding America, we have donated approximately $2.2 million in support of the organization’s mission to advance change by ensuring equitable access to nutritious food for all. |

| (a) | reporting to a member of management or a human resources representative; |

| (b) | calling the Company’s Tipline at 1 (888) 655-4371, a voicemail system where reporters can explain the situation to achieve a resolution, and through which all complaints are investigated; |

| (c) | calling the Company’s Whistleblower Hotline at 1 (844) 373-2029, operated by NASDAQ (an outside, independent service provider), in which reporters receive a PIN designed to protect their identity and confidentiality, and through which NASDAQ provides reporting to the Company’s general counsel and human resource department for review and for quarterly Audit Committee review; |

| (d) | using the internet page http://www.openboard.info/OLLI/, also operated by NASDAQ, in which case reporters receive a PIN designed to protect the identity and confidentiality, and through which NASDAQ provides reporting to the Company’s general counsel for preliminary review; |

| (e) | reporting directly to the Company’s General Counsel through telephone, email, or regular mail; or |

| (f) | reporting directly to the Lead Independent Director of the Board or, for accounting concerns, directly to the Audit Committee, which reports may then be delivered to the general counsel of the Company for review. |

Plan Category | | | Number of securities to be issued upon exercise of outstanding options, warrants and rights | | | Weighted-average exercise price of outstanding options, warrants and rights | | | Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (a)) |

| | | (a) | | | (b) | | | ||

Equity compensation plans approved by security holders | | | 1,485,529(1) | | | $53.92(2) | | | 2,225,974(3) |

Equity compensation plans not approved by security holders | | | — | | | — | | | — |

Total | | | 1,485,529 | | | $53.92 | | | 2,225,974 |

| (1) | Includes 15,250 outstanding options granted pursuant to our 2012 Equity Incentive Plan (the “2012 Plan”) and 1,194,001 outstanding options and 276,278 non-vested Restricted Stock Units (“RSUs”) granted pursuant to our 2015 Equity Incentive Plan (the “2015 Plan” and together with the 2012 Plan, the “Equity Plans”). See Note 9 to our audited financial statements for Fiscal 2022 included in our Annual Report on Form 10-K for additional information regarding our Equity Plans. |

| (2) | Represents the weighted average price of outstanding stock options and does not take into account RSUs granted under the 2015 Plan. |

| (3) | All shares of common stock reserved for future issuance are reserved for issuance under the 2015 Plan. |

Director Compensation | |||||||||

Name(1) | | | Fees earned or paid in cash | | | Stock awards(2) | | | Total |

Alissa Ahlman | | | $87,500 | | | $125,007 | | | $212,507 |

Robert Fisch | | | $87,500 | | | $125,007 | | | $212,507 |

Stanley Fleishman | | | $90,000 | | | $125,007 | | | $215,007 |

Thomas Hendrickson | | | $100,000 | | | $125,007 | | | $225,007 |

Abid Rizvi(3) | | | $22,500 | | | $20,633 | | | $43,133 |

Stephen White | | | $90,000 | | | $125,007 | | | $215,007 |

Richard Zannino | | | $95,000 | | | $125,007 | | | $220,007 |

| (1) | Although John Swygert, the Company’s Chief Executive Officer, is a member of the Board, he does not receive any additional compensation for his service as a Board member. |

| (2) | Represents the aggregate grant date fair value for equity awards granted in Fiscal 2022, determined in accordance with the Financial Accounting Standards Board (“FASB”) Accounting Standards Codification (“ASC”) Topic 718 Compensation - Stock Compensation excluding the effect of estimated forfeitures. As of January 28, 2023, our directors held the following number of options and RSUs, respectively: Ms. Ahlman – 0 and 2,893; Mr. Fisch – 6,250 and 2,893; Mr. Fleishman – 6,250 and 2,893; Mr. Hendrickson – 15,750 and 2,893; Mr. Rizvi – 0 and 342; Mr. White – 0 and 2,893; and Mr. Zannino – 0 and 2,893. Each equity award was granted in connection with the director’s Board service. |

| (3) | On November 29, 2022, the Board increased the number of directors from seven to eight and appointed Mr. Rizvi as a member of the Board, as an independent director, and also appointed Mr. Rizvi to serve on the Audit Committee, both appointments effective immediately. Amounts reported for Mr. Rizvi reflect his prorated director fees from November 29, 2022 (date of appointment) through January 28, 2023. |

Name | | | Position |

John Swygert | | | President and Chief Executive Officer Interim Chief Financial Officer(1) |

Robert Helm | | | Senior Vice President and Chief Financial Officer |

Jay Stasz | | | Former Senior Vice President, Chief Financial Officer and Secretary |

Eric van der Valk | | | Executive Vice President, Chief Operating Officer |

Kevin McLain | | | Senior Vice President, General Merchandise Manager |

Larry Kraus | | | Vice President, Chief Information Officer |

| (1) | Effective June 30, 2022, Mr. Stasz resigned as the Company’s Senior Vice President and Chief Financial Officer. In connection with Mr. Stasz’s resignation, Mr. Swygert assumed the role of Interim Chief Financial Officer in addition to his role as the Chief Executive Officer, with no additional compensation for such additional role. Mr. Swygert had previously served as the Company’s Chief Financial Officer. On October 17, 2022, Mr. Helm began serving as the Company’s Chief Financial Officer. |

| • | Total net sales were $1.827 billion, an increase of 4.2% compared to the prior year; |

| • | Comparable store sales decreased 3.0% from the prior year; |

| • | We opened 40 new stores, growing our store base 8.6% and ended the year with 468 stores in 29 states; |

| • | Net income totaled $102.8 million, a decrease of 34.7% as compared with net income of $157.5 million, in the prior year; |

| • | Earnings per diluted share were $1.64, a decrease of 32.5% as compared with earnings per diluted share of $2.43 in the prior year; and |

| • | Adjusted EBITDA totaled $168.9 million a decrease of 28.8% compared to the prior year. |

| | What we do | | | What we don’t do | | ||||||

| | ☑ | | | Majority of compensation is incentive-based and at risk tied to company performance | | | X | | | No guaranteed incentive payments | |

| | ☑ | | | Engage independent compensation consultants | | | X | | | No 280G excise tax gross-ups | |

| | ☑ | | | Engage in peer group benchmarking | | | X | | | No pension or retirement plans | |

| | ☑ | | | Due diligence in setting compensation targets and goals | | | X | | | No option repricing | |

| | ☑ | | | Periodically assess the compensation programs to ensure that they are not reasonably likely to incentivize employee behavior that would result in any material adverse risks to the company | | | X | | | Perquisites are not a substantial portion of our NEO pay packages | |

| | ☑ | | | Provide reasonable severance protection in our employment agreements with double trigger protections upon a change in control | | | X | | | No hedging or pledging of company stock permitted by directors or any company employees | |

| | ☑ | | | Double trigger change-in-control payments | | | X | | | No single trigger change in control arrangement | |

| | ☑ | | | Clawbacks of equity compensation in the event of a restatement | | | | | | ||

| | ☑ | | | Stock Ownership Policy | | | | | | ||

| • | align with and support the strategic direction of our business; |

| • | to link pay with overall company performance and reward executives for behaviors which drive shareholder value creation; and |

| • | to be financially efficient and affordable. |

| | Aaron’s | | | Five Below, Inc. | |

| | At Home Group, Inc. | | | Floor & Décor Holdings, Inc. | |

| | Big Lots, Inc. | | | Grocery Outlet, Inc. | |

| | Boot Barn Holdings, Inc. | | | Lumber Liquidators Holdings, Inc. | |

| | Burlington Stores, Inc. | | | The Michaels Companies, Inc. | |

| | Conn’s, Inc. | | | RH (formerly, Restoration Hardware) | |

| | Decker’s Outdoor Corp. | | | Sleep Number Corporation | |

| | Dollarama Inc. | | | Urban Outfitters | |

| | Big Lots, Inc. | | | Floor & Décor Holdings, Inc. | |

| | Boot Barn Holdings, Inc. | | | Grocery Outlet, Inc. | |

| | Burlington Stores, Inc. | | | Haverty Furniture Companies, Inc. | |

| | Conn’s, Inc. | | | Leslie’s, Inc. | |

| | Decker’s Outdoor Corp. | | | LL Flooring, Inc. | |

| | Designer Brands Inc. | | | Sleep Number Corporation | |

| | Dollarama Inc. | | | Sportsman’s Warehouse | |

| | Five Below, Inc. | | | Weis Markets, Inc. | |

Executive | | | Base Salary (1/29/2022) ($) | | | Base Salary (1/28/2023) ($) |

John Swygert | | | 900,000 | | | 900,000 |

Robert Helm | | | — | | | 450,000 |

Eric van der Valk | | | 400,000 | | | 525,000 |

Kevin McLain | | | 290,000 | | | 335,000 |

Larry Kraus | | | 252,000 | | | 325,000 |

Executive | | | Threshold Payout (% of Base) | | | Target Payout (% of Base) | | | Maximum Payout (% of Base) | | | Resulting Payout |

John Swygert | | | 0% | | | 100% | | | 200% | | | $0 |

Robert Helm | | | 0% | | | 50% | | | 100% | | | $0 |

Eric van der Valk | | | 0% | | | 75% | | | 150% | | | $0 |

Kevin McLain | | | 0% | | | 50% | | | 100% | | | $0 |

Larry Kraus | | | 0% | | | 40% | | | 80% | | | $0 |

| | Executive Level | | | Stock Value as a Multiple of Salary | |

| | Chief Executive Officer | | | 5x Salary | |

| | Section 16 Officers | | | 2x Salary | |

| | Other Corporate Officers | | | 1x Salary | |

| | Board of Directors | | | 4x Annual Cash Retainer | |

| • | Actual stock owned; |

| • | Vested in-the-money stock options, net of an assumed 40% tax rate; |

| • | Unvested restricted stock units; |

| • | Outside purchases or holdings of stock; and |

| • | Stock beneficially owned by the family members of the officer or director. |

Name and Principal Position | | | Year | | | Salary ($) | | | Bonus ($) | | | Stock Awards ($)(1) | | | Option Awards ($)(1) | | | Non-Equity Incentive Plan Compensation ($)(2) | | | All Other Compensation ($)(4) | | | Total ($) |

John Swygert(6) President and Chief Executive Officer | | | 2022 | | | 900,000 | | | — | | | 1,599,980 | | | 1,599,991 | | | — | | | 17,466 | | | 4,117,437 |

| | 2021 | | | 865,385 | | | — | | | 1,599,986 | | | 1,600,011 | | | 173,270 | | | 14,474 | | | 4,253,126 | ||

| | 2020 | | | 750,000 | | | — | | | —(3) | | | —(3) | | | 1,501,392 | | | 14,391 | | | 2,265,783 | ||

| | | | | | | | | | | | | | | | | |||||||||

Robert Helm(7) Senior Vice President, Chief Financial Officer | | | 2022 | | | 121,154 | | | — | | | 324,978 | | | 325,007 | | | — | | | 9,062 | | | 780,201 |

| | | | | | | | | | | | | | | | | |||||||||

Jay Stasz Former Senior Vice President, Chief Financial Officer | | | 2022 | | | 162,692 | | | — | | | 315,001 | | | 315,005 | | | — | | | 7,061 | | | 799,759 |

| | 2021 | | | 341,538 | | | — | | | 258,778 | | | 258,766 | | | 34,257 | | | 15,215 | | | 908,554 | ||

| | 2020 | | | 327,308 | | | — | | | 247,488 | | | 247,499 | | | 328,273 | | | 15,109 | | | 1,165,677 | ||

| | | | | | | | | | | | | | | | | |||||||||

Eric van der Valk Executive Vice President, Chief Operating Officer | | | 2022 | | | 480,769 | | | — | | | 871,931 | | | 371,909 | | | — | | | 16,668 | | | 1,741,277 |

| | 2021 | | | 284,615 | | | 75,000(5) | | | 299,996 | | | 299,999 | | | 28,532 | | | 10,398 | | | 998,540 | ||

| | | | | | | | | | | | | | | | | |||||||||

Kevin McLain Senior Vice President, General Merchandise Manager | | | 2022 | | | 304,423 | | | — | | | 262,501 | | | 262,494 | | | — | | | 16,372 | | | 845,790 |

| | 2021 | | | 284,808 | | | — | | | 217,484 | | | 217,502 | | | 28,661 | | | 16,078 | | | 764,533 | ||

| | 2020 | | | 265,481 | | | — | | | 200,646 | | | 200,646 | | | 213,829 | | | 15,588 | | | 896,189 | ||

| | | | | | | | | | | | | | | | | |||||||||

Larry Kraus Vice President, Chief Information Officer | | | 2022 | | | 279,308 | | | — | | | 206,241 | | | 206,255 | | | — | | | 10,208 | | | 702,012 |

| | 2021 | | | 245,769 | | | — | | | 157,521 | | | 157,510 | | | 19,739 | | | 4,017 | | | 584,556 | ||

| | 2020 | | | 222,308 | | | — | | | 140,651 | | | 140,649 | | | 133,964 | | | 3,168 | | | 640,740 |

| (1) | Represents the aggregate grant date fair value of the RSUs and option awards, computed in accordance with ASC Topic 718 excluding the effect of estimated forfeitures. These values have been determined based on the assumptions set forth in Note 9 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended January 28, 2023. The actual value, if any, which may be realized will depend on the excess of the stock price over the exercise price on the date any such options are exercised. |

| (2) | None of our NEOs received annual incentive payments with respect to Fiscal 2022. The amounts reported in this column for prior years represents amounts paid pursuant to the achievement of the Target Adjusted EBITDA in 2021 and 2020. See ‘‘Elements of Our Executive Compensation and Benefits Programs — Annual Incentive Compensation,” above. |

| (3) | On December 10, 2019, Mr. Swygert was appointed by the Board to the position of President and Chief Executive Officer. In conjunction with this promotion, Mr. Swygert was granted a long-term incentive equity award valued at $2,000,000 consisting of both stock options and RSUs. Therefore, in fiscal 2020, Mr. Swygert did not receive any additional stock compensation. |

| (4) | All other compensation consists of automobile allowances, group term life insurance, 401(k) matching contributions, and other compensation as set forth in the table below. |

| (5) | Represents a $25,000 sign-on bonus and an additional $50,000 discretionary performance bonus for Mr. van der Valk. |

| (6) | In addition to his role as the Chief Executive Officer, Mr. Swygert assumed the role of Interim Chief Financial Officer upon Mr. Stasz’s resignation, until Mr. Helm began serving as Chief Financial Officer on October 17, 2022. Mr. Swygert received no additional compensation for his service as the Interim Chief Financial Officer. |

| (7) | Mr. Helm began serving as Chief Financial Officer on October 17, 2022. |

| | | Automobile Allowance ($) | | | Group Term Life insurance ($) | | | 401(k) Matching Contributions ($) | | | All Other Compensation ($) | | | Total ($) | |

John Swygert | | | 12,000 | | | 966 | | | 4,500 | | | — | | | 17,466 |

Robert Helm | | | 3,231 | | | 81 | | | — | | | 5,750(1) | | | 9,062 |

Jay Stasz | | | 5,077 | | | 764 | | | 1,220 | | | — | | | 7,061 |

Eric van der Valk | | | 12,000 | | | 966 | | | 3,702 | | | — | | | 16,668 |

Kevin McLain | | | 10,000 | | | 1,806 | | | 4,566 | | | — | | | 16,372 |

Larry Kraus | | | 5,077 | | | 966 | | | 4,165 | | | — | | | 10,208 |

| (1) | Amount represents temporary housing allowance paid to Robert Helm. |

| | | | | | | Estimated Possible Payouts Under Non-Equity Incentive Plans(1) | | | All Other Stock Awards: Number of Shares of Stock or units (#) | | | All Other Option Awards: Number of Securities Underlying options (#)(3) | | | Exercise or Base Price of Option Awards ($)(4) | | | Grant Date Fair Value of Stock and Option Awards ($)(5) | |||||||||

Name | | | Approval Date | | | Grant Date | | | Threshold ($) | | | Target ($) | | | Maximum ($) | | |||||||||||

John Swygert | | | 3/15/2022 | | | 3/25/2022 | | | — | | | 900,000 | | | 1,800,000 | | | 37,028(2) | | | 79,404 | | | 43.21 | | | $3,199,970 |

Robert Helm | | | 9/18/2022 | | | 10/17/2022 | | | — | | | — | | | — | | | 6,017(2) | | | 11,940 | | | 54.01 | | | 649,985 |

Jay Stasz(6) | | | 3/15/2022 | | | 3/25/2022 | | | — | | | 81,346 | | | 162,692 | | | 7,290(2) | | | 15,633 | | | 43.21 | | | 630,006 |

Eric van der Valk | | | 3/15/2022 | | | 3/25/2022 | | | — | | | 152,212 | | | 304,423 | | | 8,607(2) | | | 18,457 | | | 43.21 | | | 743,817 |

| | 6/5/2022 | | | 6/6/2022 | | | — | | | — | | | — | | | 10,314(7) | | | — | | | — | | | 500,023 | ||

Kevin McLain | | | 3/15/2022 | | | 3/25/2022 | | | — | | | 240,385 | | | 480,769 | | | 6,075(2) | | | 13,027 | | | 43.21 | | | 524,995 |

Larry Kraus | | | 3/15/2022 | | | 3/25/2022 | | | — | | | 111,723 | | | 223,446 | | | 4,773(2) | | | 10,236 | | | 43.21 | | | 412,497 |

| (1) | The amounts reflect the threshold, target, and maximum amounts payable under the Incentive Bonus Plan. See “Elements of Our Executive Compensation and Benefits Programs — Annual Incentive Compensation” above. The actual amount paid under the Incentive Bonus Plan is reflected in the Summary Compensation Table under “Non-Equity Incentive Plan Compensation.” |

| (2) | Represents RSUs granted to our NEOs in Fiscal 2022. These RSUs will vest ratably at a rate of twenty-five percent (25%) per year on each annual anniversary date of the grant until fully vested, subject to the NEO providing continued services through the applicable vesting date. Any unvested RSUs are forfeited upon a termination of employment for any reason, but note that vesting acceleration may occur in connection with a termination of employment under certain circumstances. See, for example, “Potential Payments Upon Termination of Employment or Change in Control” below. |

| (3) | Represents stock options granted to our NEOs in Fiscal 2022. These options will vest ratably at a rate of twenty-five percent (25%) per year on each annual anniversary date of the grant until fully vested, subject to the NEO providing continued services through the applicable vesting date. Any unvested options are forfeited upon any termination of employment for any reason, but note that vesting acceleration may occur in connection with a termination of employment under certain circumstances. See, for example, “Potential Payments Upon Termination of Employment or Change in Control” below. |

| (4) | The exercise price of the Options is equal to the closing price of a share of the Company’s common stock on the grant date (or, if no closing price is reported on that date, the closing price on the immediately preceding date on which a closing price was reported). |

| (5) | Amounts represent the fair value of the equity awards calculated on the grant date in accordance with ASC Topic 718 excluding the effect of estimated forfeitures. These values have been determined based on the assumptions set forth in Note 9 to our audited consolidated financial statements included in our Annual Report on Form 10-K for the year ended January 28, 2023. |

| (6) | As Mr. Stasz terminated his employment with the Company effective on June 30, 2022, he became ineligible to receive a bonus under the Incentive Bonus Plan for Fiscal 2022, and he forfeited his equity awards granted in Fiscal 2022, upon his termination of employment as each equity award granted in Fiscal 2022 was unvested as of his termination date. |

| (7) | Represents RSUs granted to Mr. van der Valk in Fiscal 2022. These RSUs vest as to fifty percent (50%) on the first anniversary of the date of grant and will vest ratably at a rate of twenty-five percent (25%) per year on each of the second and third anniversaries of the date of grant until fully vested, subject to Mr. van der Valk providing continued services through the applicable vesting date. Any unvested RSUs are forfeited upon a termination of employment for any reason, but note that vesting acceleration may occur in connection with a termination of employment under certain circumstances. See, for example, “Potential Payments Upon Termination of Employment or Change in Control” below. |

| | | Option Awards | | | Stock Awards | ||||||||||||||||

Name(1) | | | Option Grant Date(2) | | | Number of Securities Underlying Unexercised Options (#) Exercisable | | | Number of Securities Underlying Unexercised Options (#) Unexercisable | | | Option Exercise Price ($)(5) | | | Option Expiration Date ($) | | | Number of Shares or Units of Stock That Have Not Vested (#) | | | Market Value of Shares or Units of Stock That Have Not Vested ($)(7) |

John Swygert | | | 3/7/2016 | | | 54,736 | | | — | | | 20.26 | | | 3/7/2026 | | | — | | | — |

| | | 3/22/2017 | | | 35,866 | | | — | | | 32.20 | | | 3/22/2027 | | | — | | | — | |

| | | 1/5/2018 | | | 3,032 | | | — | | | 53.50 | | | 1/5/2028 | | | — | | | — | |

| | | 3/28/2018 | | | 26,652 | | | — | | | 58.90 | | | 3/28/2028 | | | — | | | — | |

| | | 3/20/2019 | | | 18,802 | | | 6,268 | | | 79.89 | | | 3/20/2029 | | | 1,956(4) | | | 105,565 | |

| | | 12/10/2019 | | | 41,186 | | | 13,729 | | | 60.30 | | | 12/10/2029 | | | 4,146(4) | | | 223,760 | |

| | | 3/22/2021 | | | 11,768 | | | 35,305 | | | 86.03 | | | 3/22/2031 | | | 13,948(4) | | | 752,774 | |

| | | 3/25/2022 | | | — | | | 79,404 | | | 43.21 | | | 3/25/2032 | | | 37,028(4) | | | 1,998,401 | |

Robert Helm | | | 10/17/2022 | | | — | | | 11,940 | | | 54.01 | | | 10/17/2032 | | | 6,017(4) | | | 324,737 |

Eric van der Valk | | | 5/3/2021 | | | 2,161 | | | 6,482 | | | 88.26 | | | 5/3/2031 | | | 2,549(4) | | | 137,570 |

| | | 3/25/2022 | | | — | | | 18,457 | | | 43.21 | | | 3/25/2032 | | | 8,607(4) | | | 464,520 | |

| | | 6/6/2022 | | | — | | | — | | | — | | | 6/6/2032 | | | 10,314(6) | | | 556,647 | |

Kevin McLain | | | 3/22/2017 | | | 2,841 | | | — | | | 32.20 | | | 3/22/2027 | | | — | | | — |

| | | 3/28/2018 | | | 4,123 | | | — | | | 58.90 | | | 3/28/2028 | | | — | | | — | |

| | | 3/20/2019 | | | 5,866 | | | 1,956 | | | 79.89 | | | 3/20/2029 | | | 2,441(3) | | | 131,741 | |

| | | 3/24/2020 | | | 7,694 | | | 7,693 | | | 41.49 | | | 3/24/2030 | | | 2,418(4) | | | 130,499 | |

| | | 3/22/2021 | | | 1,600 | | | 4,799 | | | 86.03 | | | 3/22/2031 | | | 1,896(4) | | | 102,327 | |

| | | 3/25/2022 | | | — | | | 13,027 | | | 43.21 | | | 3/25/2032 | | | 6,075(4) | | | 327,868 | |

Larry Kraus | | | 2/6/2017 | | | 428 | | | — | | | 31.15 | | | 2/6/2027 | | | — | | | — |

| | | 3/28/2018 | | | 2,752 | | | — | | | 58.90 | | | 3/28/2028 | | | — | | | — | |

| | | 3/20/2019 | | | 4,043 | | | 1,348 | | | 79.89 | | | 3/20/2029 | | | 1,682(3) | | | 90,778 | |

| | | 3/24/2020 | | | 5,393 | | | 5,393 | | | 41.49 | | | 3/24/2030 | | | 1,695(4) | | | 91,479 | |

| | | 3/22/2021 | | | 1,159 | | | 3,475 | | | 86.03 | | | 3/22/2031 | | | 1,373(4) | | | 74,101 | |

| | | 3/25/2022 | | | — | | | 10,236 | | | 43.21 | | | 3/25/2032 | | | 4,773(4) | | | 257,599 | |

| (1) | Mr. Stasz had no equity awards outstanding as of January 28, 2023. |

| (2) | Options vest at a rate of twenty-five percent (25%) per year on each annual anniversary date of the grant until fully vested, subject to the NEO providing continued services through the applicable vesting date and otherwise in accordance with the applicable Equity Plan and award agreement. |

| (3) | RSUs vest in their entirety four years from the date of grant, subject to the NEO providing continued services through the vesting date and otherwise in accordance with the applicable Equity Plan and award agreement. |

| (4) | RSUs vest at a rate of twenty-five percent (25%) per year on each annual anniversary date of the grant until fully vested, subject to the NEO providing continued services through each applicable vesting date and otherwise in accordance with the applicable Equity Plan and award agreement. |

| (5) | The exercise price of the Options is equal to the closing price of a share of the Company’s common stock on the grant date (or, if no closing price is reported on that date, the closing price on the immediately preceding date on which a closing price was reported). |

| (6) | RSUs vest as to fifty percent (50%) on the first anniversary of the date of grant and will vest ratably at a rate of twenty-five percent (25%) per year on each of the second and third anniversaries of the date of grant until fully vested, subject to Mr. van der Valk providing continued services through each applicable vesting date and otherwise in accordance with the applicable Equity Plan and award agreement. |

| (7) | Calculated based on $53.97, the closing price of the Company’s common stock on January 27, 2023, the last trading day of Fiscal 2022. |

| | | Option Awards | | | Stock Awards | |||||||

Name | | | Number of Shares Acquired on Exrcise (#) | | | Value Realized Upon Exercise ($) | | | Number of Shares Acquired on Vesting (#) | | | Value Realized on Vesting ($) |

John Swygert | | | — | | | — | | | 12,875 | | | 585,820 |

Robert Helm | | | — | | | — | | | — | | | — |

Jay Stasz | | | 56,488 | | | 1,951,004 | | | 5,427 | | | 230,764 |

Eric van der Valk | | | — | | | — | | | 850 | | | 41,370 |

Kevin McLain | | | — | | | — | | | 4,467 | | | 189,936 |

Larry Kraus | | | — | | | — | | | 3,058 | | | 130,062 |

| • | established with reference to an executive’s position and current cash compensation opportunities, not with reference to his or her tenure; |

| • | conditioned upon execution of a release of claims against the Company and its affiliates; and |

| • | conditioned on the executive’s commitment not to compete with the Company for a reasonable period following any cessation of his or her employment. |

| | | “Good Reason” or Termination without “Cause” Termination Following a Change in Control(3) | ||||||||||

| | | Severance Payments ($)(1) | | | Annual Incentive ($)(2) | | | Equity Compensation ($)(3) | | | Total ($) | |

John Swygert | | | 1,800,000 | | | 900,000 | | | 6,562,265 | | | 9,262,265 |

Robert Helm | | | 450,000 | | | — | | | 324,737 | | | 774,737 |

Eric van der Valk | | | 525,000 | | | — | | | 1,357,333 | | | 1,882,333 |

Kevin McLain | | | 335,000 | | | — | | | 1,086,484 | | | 1,421,484 |

Larry Kraus | | | 325,000 | | | — | | | 768,472 | | | 1,093,472 |

| (1) | Each of our NEOs is eligible to receive separation payments in the event the NEO resigns from the Company for “Good Reason” or is terminated by the Company without “Cause”, subject to certain conditions. These conditions are more fully described in “Employment Agreements.” |

| (2) | In the event Mr. Swygert resigns for “Good Reason” or is terminated without “Cause,” then the Company will pay Mr. Swygert a pro-rated portion of the bonus for the fiscal year in which such termination occurred, together with health, life, and disability payments during the severance period. |

| (3) | We do not maintain separate change in control agreements with any NEOs, but the 2015 Plan provides that equity awards granted to our NEOs will be accelerated to the extent that the NEO experiences a termination without Cause or with Good Reason (as defined in their employment agreements, if at all) within 12 months of the change in control. Amounts for all NEOs represent stock options and RSUs outstanding as of January 28, 2023. |

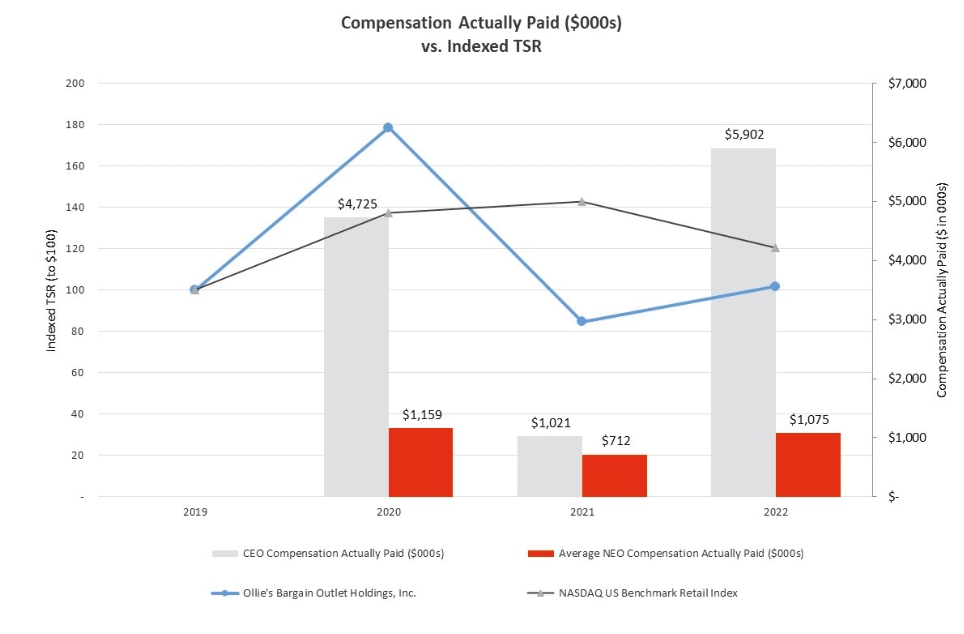

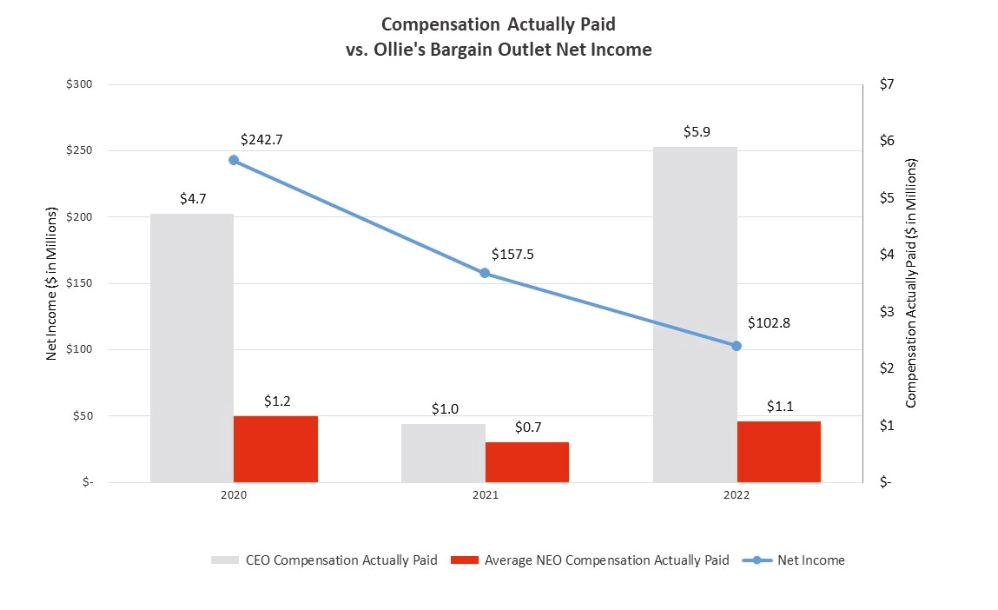

Fiscal Year | | | Summary Compensation Table Total for PEO ($)(1) | | | Compensation Actually Paid to PEO ($)(2) | | | Average Summary Compensation Table Total for Non-PEO NEOs ($)(3) | | | Average Compensation Actually Paid to Non-PEO NEOs ($)(4) | | | Value of Initial Fixed $100 Investment Based On: | | | Net Income ($)(7) | | | Adjusted EBITDA ($)(8) | |||

| | Total Shareholder Return ($)(5) | | | Peer Group Total Shareholder Return ($)(6) | | |||||||||||||||||||

(a) | | | (b) | | | (c) | | | (d) | | | (e) | | | (f) | | | (g) | | | (h) | | | (i) |

2022 | | | 4,117,437 | | | 5,902,431 | | | 973,808 | | | 1,075,052 | | | 101.75 | | | 120.56 | | | 102,790 | | | 168,875 |

2021 | | | 4,253,126 | | | 1,021,150 | | | 814,046 | | | 712,250 | | | 84.71 | | | 142.67 | | | 157,455 | | | 237,332 |

2020 | | | 2,265,783 | | | 4,725,192 | | | 839,257 | | | 1,158,624 | | | 178.60 | | | 137.26 | | | 242,696 | | | 306,500 |

| (1) | The dollar amounts reported in column (b) are the amounts of total compensation reported for Mr. Swygert for each corresponding year in the “Total” column of the “Summary Compensation Table.” |

| (2) | The dollar amounts reported in column (c) represent the amount of “compensation actually paid” to Mr. Swygert, as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual amount of compensation earned by or paid to Mr. Swygert during the applicable year and were not considered by the Compensation Committee at the time it made decisions with respect to Mr. Swygert’s compensation. In accordance with the requirements of Item 402(v) of Regulation S-K, the following adjustments were made to Mr. Swygert’s total compensation for each year to determine the compensation actually paid to him for the relevant year: |

Year | | | Reported Summary Compensation Table Total for PEO ($) | | | Reported Value of Equity Awards ($)(a) | | | Equity Award Adjustments ($)(b) | | | Compensation Actually Paid to PEO ($) |

2022 | | | 4,117,437 | | | (3,199,971) | | | 4,984,965 | | | 5,902,431 |

2021 | | | 4,253,126 | | | (3,199,997) | | | (31,979) | | | 1,021,150 |

2020 | | | 2,265,783 | | | — | | | 2,459,409 | | | 4,725,192 |

| (a) | The grant date fair value of equity awards represents the total amounts reported in the “Stock Awards” and “Option Awards” column of the “Summary Compensation Table” for the applicable year. |

| (b) | The equity award adjustments for each applicable year include the addition (or subtraction, as applicable) of the following: (i) the year-end fair value of any equity awards granted in the applicable year that are outstanding and unvested as of the end of the year; (ii) the amount of change as of the end of the applicable year (from the end of the prior fiscal year) in fair value of any equity awards granted in prior years that are outstanding and unvested as of the end of the applicable year; and (iii) for equity awards granted in prior years that vest in the applicable year, the amount equal to the change as of the vesting date (from the end of the prior fiscal year) in fair value. The Company did not (i) grant any equity awards that were granted and vested in the same year, (ii) grant any performance-based vesting equity awards, or (iii) pay any dividends or other earnings on equity awards that are not otherwise reflected in the fair value of the equity award. The amounts deducted or added in calculating the equity award adjustments are as follows: |

Fiscal Year | | | 2022 | | | 2021 | | | 2020 |

Year End Fair Value of Equity Awards Granted During the Year ($) | | | 4,162,954 | | | 1,698,456 | | | — |

Year over Year Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years ($) | | | 675,099 | | | (1,362,003) | | | 2,455,150 |

Year over Year Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year ($) | | | 146,912 | | | (368,432) | | | 4,259 |

Subtract: Forfeitures During Current Year Equal to Prior Year-end Fair Value ($) | | | — | | | — | | | — |

Total Equity Award Adjustments ($) | | | 4,984,965 | | | (31,979) | | | 2,459,409 |

| (3) | The dollar amounts reported in column (d) represent the average of the amounts reported for the Company’s NEOs as a group (excluding Mr. Swygert) in the “Total” column of the “Summary Compensation Table” in each applicable year. The names of the NEOs (excluding Mr. Swygert) included for purposes of calculating the average amounts for each applicable year are as follows: (i) for 2022, Messrs. Helm, Stasz, van der Valk, McLain, and Kraus; (ii) for 2021, Messrs. Stasz, van der Valk, McLain and Kraus; and for 2020, Messrs. Stasz, McLain, Kraus, and Daugherty, Jr. |

| (4) | The dollar amounts reported in column (e) represent the average amount of “compensation actually paid” to the NEOs as a group (excluding Mr. Swygert), as computed in accordance with Item 402(v) of Regulation S-K. The dollar amounts do not reflect the actual average amount of compensation earned by or paid to the NEOs as a group (excluding Mr. Swygert) during the applicable year and |

Year | | | Average Reported Summary Compensation Table Total for Non-PEO NEOs ($) | | | Average Reported Value of Equity Awards ($) | | | Average Equity Award Adjustments ($)(a) | | | Average Compensation Actually Paid to Non-PEO NEOs ($) |

2022 | | | 973,808 | | | (346,132) | | | 447,376 | | | $1,075,052 |

2021 | | | 814,046 | | | (233,445) | | | 131,649 | | | 712,250 |

2020 | | | 839,257 | | | (182,360) | | | 501,727 | | | 1,158,624 |

| (a) | The amounts deducted or added in calculating the total average equity award adjustments are as follows: |

Fiscal Year | | | 2022 | | | 2021 | | | 2020 |

Average Year End Fair Value of Equity Awards Granted During the Year ($) | | | 678,828 | | | 245,981 | | | 433,545 |

Year over Year Average Change in Fair Value of Outstanding and Unvested Equity Awards Granted in Prior Years ($) | | | 28,942 | | | (109,640) | | | 75,332 |

Year over Year Average Change in Fair Value of Equity Awards Granted in Prior Years that Vested in the Year ($) | | | 1,034 | | | (4,692) | | | (7,150) |

Subtract: Forfeitures During Current Year Equal to Prior Year-end Fair Value ($) | | | (261,428) | | | — | | | — |

Total Average Equity Award Adjustments ($) | | | 447,376 | | | 131,649 | | | 501,727 |

| (5) | Cumulative TSR is calculated by dividing the sum of the cumulative amount of dividends for the measurement period, assuming dividend reinvestment, and the difference between the Company’s share price at the end and the beginning of the measurement period by the Company’s share price at the beginning of the measurement period. |

| (6) | Represents the weighted peer group TSR, weighted according to the respective companies’ stock market capitalization at the beginning of each period for which a return is indicated. The peer group used for this purpose is the following published industry index: the NASDAQ US Benchmark Retail Index over the same period. |

| (7) | The dollar amounts reported represent the amount of net income reflected in the Company’s audited financial statements for the applicable year. |

| (8) | Adjusted EBITDA is defined as net income before net interest income or expense, depreciation and amortization expenses, and income taxes, further adjusted for non-cash stock-based compensation expense and gains on insurance settlements. While the Company uses various financial and non-financial performance measures for the purpose of evaluating performance for the Company’s compensation programs, the Company has determined that Adjusted EBITDA is the financial performance measure that, in the Company’s and the Compensation Committee’s assessment, represents the most important performance measure (that is not otherwise required to be disclosed in the table) used by the Company to link compensation actually paid to the company’s NEOs, for the most recently completed fiscal year, to company performance. Reconciliation and further information for Adjusted EBITDA can be found on page 39 of our Annual Report on Form 10-K, filed with the SEC on March 24, 2023. |

| • | each person or group who is known by us to own beneficially more than 5% of our common stock; |

| • | each member of our Board, each nominee for election as a director, and each of our NEOs; and |

| • | all members of our Board and our executive officers as a group. |

| | | Beneficial Ownership of Common Stock | ||||

Name and Address of Beneficial Owner | | | Number of shares | | | Percentage of Class |

5% Stockholder Not Listed Below: | | | | | ||

FMR LLC | | | 9,335,851(1) | | | 15.08% |

The Vanguard Group, Inc. | | | 5,421,296(2) | | | 8.76% |

BlackRock, Inc. | | | 5,006,831(3) | | | 8.09% |

Wasatch Advisors, Inc. | | | 4,947,509(4) | | | 7.99% |

T. Rowe Price Investment Management, Inc. | | | 3,630,597(5) | | | 5.87% |

The Bank of New York Mellon Corporation | | | 3,105,122(6) | | | 5.02% |

Named Executive Officers and Directors: | | | | | ||

John Swygert | | | 278,130(7) | | | * |

Robert Helm | | | — | | | — |

Jay Stasz | | | 38,805(8) | | | * |

Eric van der Valk | | | 17,059(9) | | | * |

Kevin McLain | | | 40,338(10) | | | * |

Larry Kraus | | | 27,465(11) | | | * |

Alissa Ahlman | | | 5,172(12) | | | * |

Robert Fisch | | | 26,253(13) | | | * |

Stanley Fleishman | | | 58,753(14) | | | * |

Thomas Hendrickson | | | 21,203(15) | | | * |

Abid Rizvi | | | — | | | — |

Stephen White | | | 13,639(16) | | | * |

Richard Zannino | | | 7,358(17) | | | * |

All Board members and executive officers as a group (13 persons) | | | 534,175 | | | 0.86% |

Outstanding Shares | | | 61,897,333 | | | |

| * | Represents beneficial ownership of less than 1% of our outstanding common stock. |

| (1) | In its Schedule 13G/A filed on February 9, 2023, FMR LLC, 245 Summer Street, Boston, MA 02210, stated that it beneficially owned the number of shares reported in the table as of December 31, 2022, had sole voting power over 9,330,346 of the shares, had sole dispositive power over 9,335,851 shares, and had no shared voting power or shared dispositive power over any of the shares. |

| (2) | In its Schedule 13G/A filed on February 9, 2023, The Vanguard Group, 100 Vanguard Blvd., Malvern, PA 19355, stated that it beneficially owned the number of common shares reported in the table as of December 30, 2022, had no sole voting power over any of the shares, had shared voting power over 20,836 shares, had sole dispositive power over 5,344,622 of the shares, and had shared dispositive power over 76,674 shares. |

| (3) | In its Schedule 13G/A filed on February 3, 2023, BlackRock, Inc., 55 East 52nd Street, New York, NY 10055, stated that it beneficially owned the number of shares reported in the table as of December 31, 2022, had sole voting power over 4,861,017 of the shares, had sole dispositive power over 5,006,831 shares, and had no shared voting power or shared dispositive power over any of the shares. |

| (4) | In its Schedule 13G/A filed on February 8, 2023, Wasatch Advisors, Inc., 505 Wakara Way, Salt Lake City, UT 84108, stated that it beneficially owned the number of common shares reported in the table as of December 31, 2022, had sole voting power over 4,947,509 shares, had no shared voting power over any of the shares, had sole dispositive power over 4,947,509 shares, and had no shared dispositive power over any of the shares. |

| (5) | In its Schedule 13G filed on February 14, 2023, T. Rowe Price Investment Management, Inc., 100 E. Pratt Street, Baltimore, MD 21202, stated that it beneficially owned the number of shares reported in the table as of December 31, 2022, had sole voting power over 1,025,104 of the shares, had sole dispositive power over 3,630,597 of the shares, and had no shared voting power or shared dispositive power over any of the shares. |

| (6) | In its Schedule 13G/A filed on February 10, 2023, The Bank of New York Mellon Corporation, 240 Greenwich Street, New York, NY 10286, stated that it beneficially owned the number of common shares reported in the table as of December 31, 2022, had sole voting power over 2,909,501 of the shares, had shared voting power over 360 of the shares, had sole dispositive power over 1,049,499 of the shares, and had shared dispositive power over 2,032,846 of the shares. |

| (7) | Includes 48,200 shares held directly by Mr. Swygert and 229,930 shares underlying vested options or options vesting within 60 days. |

| (8) | Includes 38,805 shares held directly by Mr. Stasz. |

| (9) | Includes 2,116 shares held directly by Mr. van der Valk and 14,943 shares underlying vested options or options vesting within 60 days. |

| (10) | Includes 7,555 shares held directly by Mr. McLain and 32,783 shares underlying vested options or options vesting within 60 days. |

| (11) | Includes 5,928 shares held directly by Mr. Kraus and 21,537 shares underlying vested options or options vesting within 60 days. |

| (12) | Represents 5,172 shares held directly by Ms. Ahlman. |

| (13) | Includes 20,003 shares held directly by Mr. Fisch and 6,250 shares underlying vested options or options vesting within 60 days. |

| (14) | Includes 52,503 shares held directly by Mr. Fleishman and 6,250 shares underlying vested options or options vesting within 60 days. |

| (15) | Includes 3,503 shares held directly and 1,950 shares held indirectly by Mr. Hendrickson and 15,750 shares underlying vested options or options vesting within 60 days. |

| (16) | Represents 13,639 shares held directly by Mr. White. |

| (17) | Represents 7,358 shares held directly by Mr. Zannino. |

| • | The quality and efficiency of KPMG’s historical and recent performance on the Company’s audit; |

| • | KPMG’s capability and expertise; |

| • | The quality and candor of communications and discussions with KPMG; |

| • | The ability of KPMG to remain independent; |

| • | The appropriateness of fees charged; and |

| • | KPMG’s tenure as the Company’s independent registered public accounting firm and their familiarity with our operations, businesses, accounting practices, and internal controls over financial reporting. |

| | | For the Fiscal Year Ended January 28, 2023 | | | For the Fiscal Year Ended January 29, 2022 | |

Audit Fees(1) | | | $1,129,000 | | | $1,103,500 |

Audit-Related Fees(2) | | | — | | | — |

Tax Fees(2) | | | — | | | — |

| | | | | |||

All Other Fees(3) | | | $1,780 | | | $1,780 |

| (1) | Audit fees for the fiscal years ended January 28, 2023 and January 29, 2022 include fees for professional services rendered for the audit and quarterly reviews of our consolidated financial statements filed with the SEC on Forms 10-K and 10-Q and the audit of internal control over financial reporting. |

| (2) | There were no amounts billed for audit-related or tax fees for the fiscal years ended January 28, 2023 or January 29, 2022. |

| (3) | Other fees for the fiscal years ended January 28, 2023 and January 29, 2022 are for our use of KPMG’s online accounting research software. |

| • | reviewed and discussed our audited financial statements for Fiscal 2022, with management; |

| • | discussed with KPMG, our independent registered public accounting firm, the matters required to be discussed by the Public Company Accounting Oversight Board (“PCAOB”) Auditing Standard No. 1301 (Communications with Audit Committees); and |

| • | received from KPMG the written disclosures and the letter from KPMG required by the applicable requirements of the PCAOB regarding KPMG’s communications with the Audit Committee concerning independence and has discussed with KPMG its independence. |

| | | By Order of the Board, | |

| | |  | |

| | | ||

| | | JOHN SWYGERT | |

| | | President and Chief Executive Officer |