Exhibit 10.11

EXECUTION VERSION

$100,000,000

LOAN AND SECURITY AGREEMENT

Dated as of December 4, 2012

among

AMERIQUEST BUSINESS SERVICES, INC.,

CORCENTRIC COLLECTIVE BUSINESS SYSTEM CORP.,

AMERIQUEST LEASING & MAINTENANCE, INC., and

AMERIQUEST REMARKETING SERVICES, INC.,

as Borrowers

THE OTHER PARTIES SIGNATORY HERETO AS OBLIGORS,

CERTAIN FINANCIAL INSTITUTIONS,

as Lenders

BANK OF AMERICA, N.A.,

as Agent

UNION BANK, N.A.,

as Documentation Agent

and

MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED,

as Lead Arranger and Book Manager

TABLE OF CONTENTS

| | Page |

SECTION 1. | DEFINITIONS; RULES OF CONSTRUCTION | 1 |

| | |

1.1 | Definitions | 1 |

1.2 | Accounting Terms | 30 |

1.3 | Uniform Commercial Code | 30 |

1.4 | Certain Matters of Construction | 30 |

| | |

SECTION 2. | CREDIT FACILITIES | 31 |

| | |

2.1 | Commitment | 31 |

2.2 | [Reserved] | 33 |

2.3 | Letter of Credit Facility | 33 |

| | |

SECTION 3. | INTEREST, FEES AND CHARGES | 35 |

| | |

3.1 | Interest | 35 |

3.2 | Fees | 37 |

3.3 | Computation of Interest, Fees, Yield Protection | 37 |

3.4 | Reimbursement Obligations | 38 |

3.5 | Illegality | 38 |

3.6 | Inability to Determine Rates | 38 |

3.7 | Increased Costs; Capital Adequacy | 39 |

3.8 | Mitigation | 40 |

3.9 | Funding Losses | 40 |

3.10 | Maximum Interest | 40 |

| | |

SECTION 4. | LOAN ADMINISTRATION | 41 |

| | |

4.1 | Manner of Borrowing and Funding Loans | 41 |

4.2 | Defaulting Lender | 42 |

4.3 | Number and Amount of LIBOR Loans; Determination of Rate | 43 |

4.4 | Borrower Agent | 43 |

4.5 | One Obligation | 43 |

4.6 | Effect of Termination | 44 |

| | |

SECTION 5. | PAYMENTS | 44 |

| | |

5.1 | General Payment Provisions | 44 |

5.2 | Repayment of Loans | 44 |

5.3 | [Reserved] | 44 |

5.4 | Payment of Other Obligations | 44 |

5.5 | Marshaling; Payments Set Aside | 45 |

5.6 | Application and Allocation of Payments | 45 |

5.7 | Dominion Account | 46 |

5.8 | Account Stated | 46 |

5.9 | Taxes | 46 |

5.10 | [Reserved] | 50 |

i

5.11 | Nature and Extent of Each Borrower’s Liability | 50 |

| | |

SECTION 6. | CONDITIONS PRECEDENT | 53 |

| | |

6.1 | Conditions Precedent to Initial Loans | 53 |

6.2 | Conditions Precedent to All Credit Extensions | 55 |

| | |

SECTION 7. | COLLATERAL | 55 |

| | |

7.1 | Grant of Security Interest | 55 |

7.2 | Lien on Deposit Accounts; Cash Collateral | 56 |

7.3 | [Reserved] | 57 |

7.4 | Other Collateral | 57 |

7.5 | No Assumption of Liability | 57 |

7.6 | Further Assurances | 57 |

7.7 | Foreign Subsidiary Stock | 57 |

| | |

SECTION 8. | COLLATERAL ADMINISTRATION | 58 |

| | |

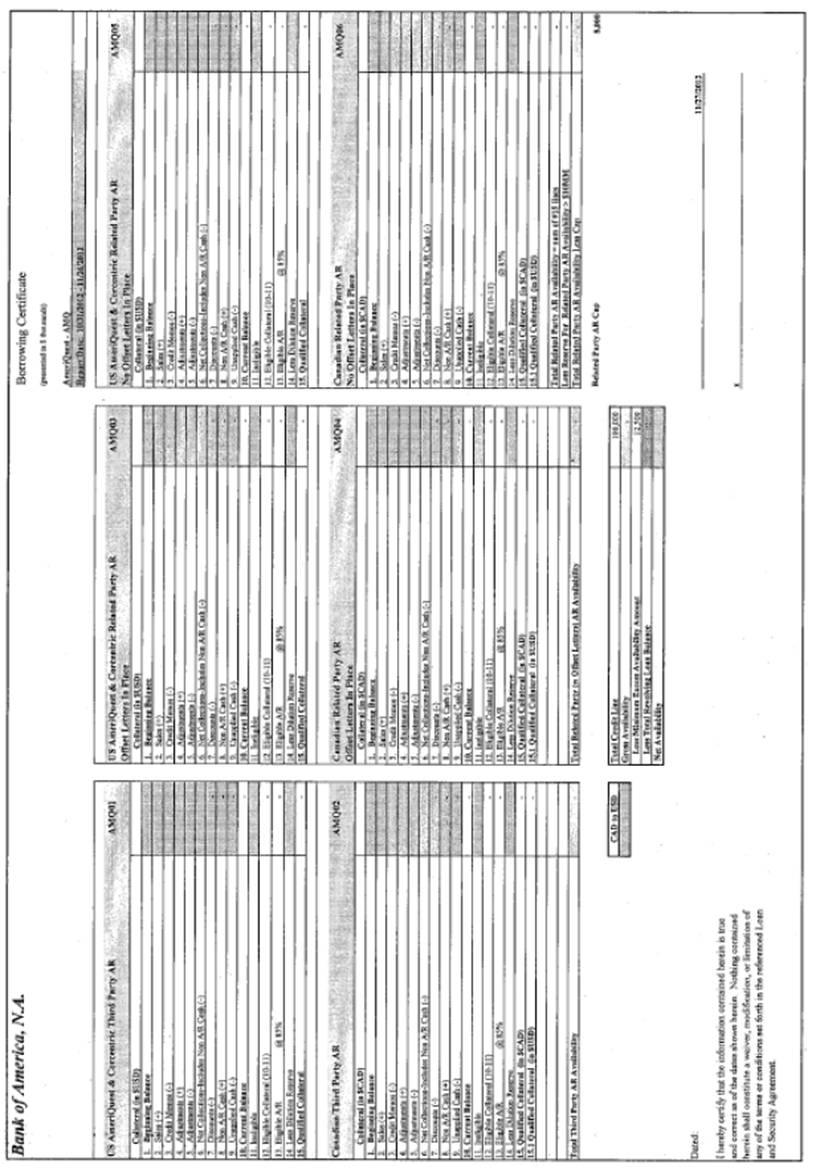

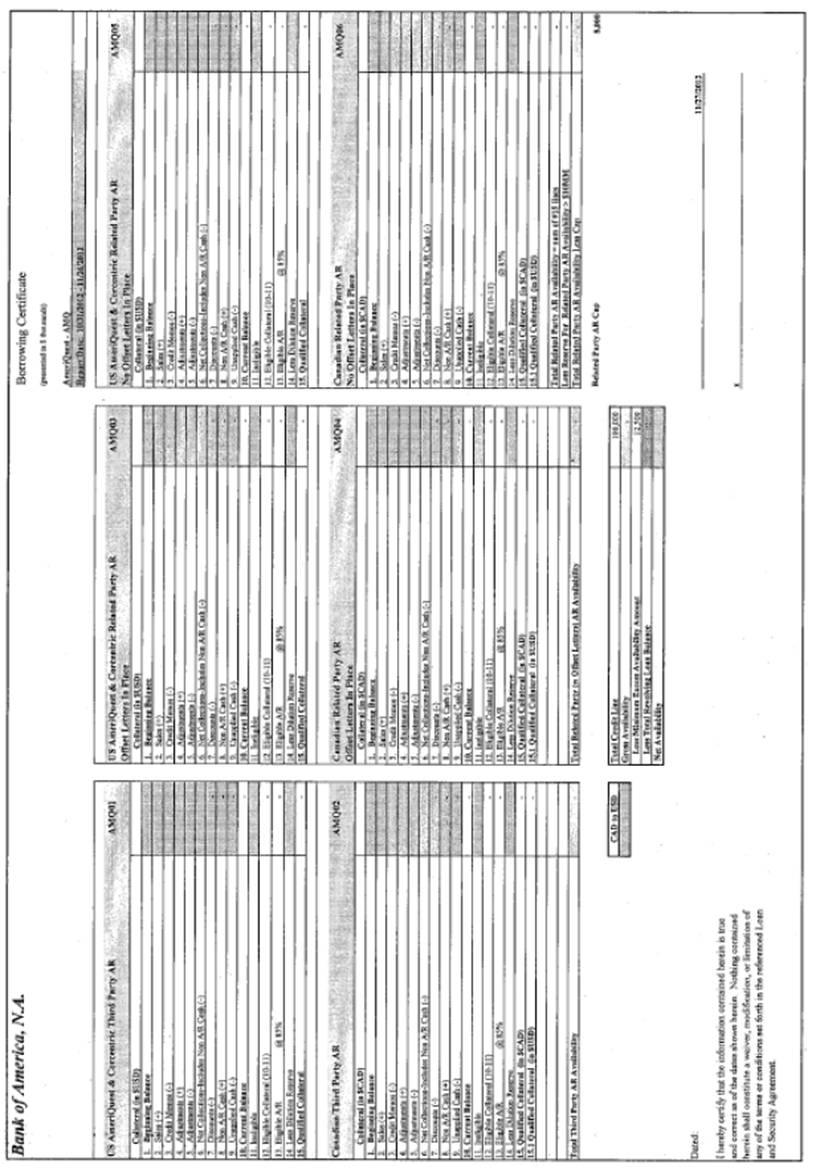

8.1 | Borrowing Base Certificates | 58 |

8.2 | Administration of Accounts | 58 |

8.3 | [Reserved] | 59 |

8.4 | Administration of Equipment | 59 |

8.5 | Administration of Deposit Accounts | 59 |

8.6 | General Provisions | 60 |

8.7 | Power of Attorney | 61 |

| | |

SECTION 9. | REPRESENTATIONS AND WARRANTIES | 62 |

| | |

9.1 | General Representations and Warranties | 62 |

9.2 | Complete Disclosure | 68 |

| | |

SECTION 10. | COVENANTS AND CONTINUING AGREEMENTS | 69 |

| | |

10.1 | Affirmative Covenants | 69 |

10.2 | Negative Covenants | 72 |

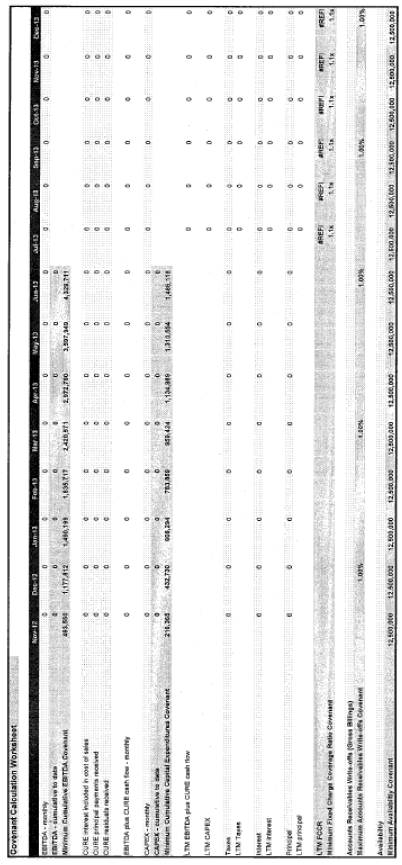

10.3 | Financial Covenants | 76 |

| | |

SECTION 11. | EVENTS OF DEFAULT; REMEDIES ON DEFAULT | 77 |

| | |

11.1 | Events of Default | 77 |

11.2 | Remedies upon Default | 79 |

11.3 | License | 80 |

11.4 | Setoff | 80 |

11.5 | Remedies Cumulative; No Waiver | 80 |

| | |

SECTION 12. | AGENT | 81 |

| | |

12.1 | Appointment, Authority and Duties of Agent | 81 |

12.2 | Agreements Regarding Collateral and Borrower Materials | 82 |

12.3 | Reliance By Agent | 83 |

12.4 | Action Upon Default | 83 |

12.5 | Ratable Sharing | 83 |

12.6 | Indemnification | 83 |

ii

12.7 | Limitation on Responsibilities of Agent | 84 |

12.8 | Successor Agent and Co-Agents | 84 |

12.9 | Due Diligence and Non-Reliance | 85 |

12.10 | Remittance of Payments and Collections | 85 |

12.11 | Individual Capacities | 86 |

12.12 | Titles | 86 |

12.13 | Bank Product Providers | 86 |

12.14 | No Third Party Beneficiaries | 86 |

| | |

SECTION 13. | BENEFIT OF AGREEMENT; ASSIGNMENTS | 86 |

| | |

13.1 | Successors and Assigns | 86 |

13.2 | Participations | 86 |

13.3 | Assignments | 88 |

13.4 | Replacement of Certain Lenders | 89 |

| | |

SECTION 14. | MISCELLANEOUS | 89 |

| | |

14.1 | Consents, Amendments and Waivers | 89 |

14.2 | Indemnity | 90 |

14.3 | Notices and Communications | 90 |

14.4 | Performance of Borrowers’ Obligations | 92 |

14.5 | Credit Inquiries | 93 |

14.6 | Severability | 93 |

14.7 | Cumulative Effect; Conflict of Terms | 93 |

14.8 | Counterparts | 93 |

14.9 | Entire Agreement | 93 |

14.10 | Relationship with Lenders | 93 |

14.11 | No Advisory or Fiduciary Responsibility | 93 |

14.12 | Confidentiality | 94 |

14.13 | [Reserved] | 94 |

14.14 | GOVERNING LAW | 94 |

14.15 | CONSENT TO FORUM | 95 |

14.16 | WAIVERS BY BORROWERS | 95 |

14.17 | Patriot Act Notice | 95 |

iii

LIST OF EXHIBITS AND SCHEDULES

Exhibit A | Form of Note |

Exhibit B | Notice of Borrowing |

Exhibit C | Notice of Conversion/Continuation |

Exhibit D | Assignment and Acceptance |

Exhibit E | Assignment Notice |

Exhibit F-1 | Form of Borrowing Base Case Certificate |

Exhibit F-2 | Form of Compliance Certificate |

Exhibit G-1 | Form of Member Agreement (Membership Program) |

Exhibit G-2 | Form of Supplier Agreement (Membership Program) |

Exhibit H-1 | Form of Participant Agreement (Pinnacle Program) |

Exhibit H-2 | Form of Dealer/Distributor Agreement (Pinnacle Program) |

Exhibit I-1 | Form of Purchasing Participant Agreement (Purchasing Participation Program) |

Exhibit I-2 | Form of Supplier Agreement (Purchasing Participation Program) |

|

Schedule 1.1 | Commitments of Lenders |

Schedule 6.1(s) | No Offset Letters |

Schedule 8.5 | Deposit Accounts |

Schedule 8.6.1 | Business Locations |

Schedule 9.1.4 | Names and Capital Structure |

Schedule 9.1.8 | Surety Obligations |

Schedule 9.1.11 | Patents, Trademarks, Copyrights and Licenses |

Schedule 9.1.14 | Environmental Matters |

Schedule 9.1.15 | Restrictive Agreements |

Schedule 9.1.16 | Litigation |

Schedule 9.1.18 | Pension Plans |

Schedule 9.1.20 | Labor Contracts |

Schedule 10.1.10 | Post-Closing Matters |

Schedule 10.2.2 | Existing Liens |

Schedule 10.2.5 | Restricted Investments |

Schedule 10.2.17 | Existing Affiliate Transactions |

| | |

iv

LOAN AND SECURITY AGREEMENT

THIS LOAN AND SECURITY AGREEMENT is dated as of December 4, 2012, among AMERIQUEST BUSINESS SERVICES, INC., a New Jersey corporation (the “Company”), CORCENTRIC COLLECTIVE BUSINESS SYSTEM CORP., a Virginia corporation (“Corcentric”), AMERIQUEST LEASING & MAINTENANCE, INC., a Delaware corporation d/b/a Cure Leasing & Maintenance (“Cure Leasing”), AMERIQUEST REMARKETING SERVICES, INC., a Florida corporation (“AmeriQuest Remarketing” and together with the Company, Corcentric, Cure Leasing, and AmeriQuest Remarketing, collectively, “Borrowers”), the other parties from time to time signatory hereto as Obligors, the financial institutions party to this Agreement from time to time as lenders (collectively, “Lenders”), BANK OF AMERICA, N.A., a national banking association, as agent for the Lenders (“Agent”), and MERRILL LYNCH, PIERCE, FENNER & SMITH INCORPORATED, as Lead Arranger and Book Manager (“MLPF&S”).

R E C I T A L S:

Borrowers have requested that Lenders provide a credit facility to Borrowers to finance their mutual and collective business enterprise. Lenders are willing to provide the credit facility on the terms and conditions set forth in this Agreement.

NOW, THEREFORE, for valuable consideration hereby acknowledged, the parties agree as follows:

SECTION 1. DEFINITIONS; RULES OF CONSTRUCTION

1.1 Definitions. As used herein, the following terms have the meanings set forth below:

Account: as defined in the UCC, including all rights to payment for goods sold or leased, or for services rendered.

Account Debtor: a Person obligated under an Account, Chattel Paper or General Intangible.

Accounts Formula Amount: 85% of the Value of Eligible Accounts.

Accounts Receivables Write-offs: bad Debt write-downs or write-offs with respect to Accounts created under the Pinnacle Program, the Membership Program or the Purchasing Participation Program or that are otherwise in the Borrowing Base that can no longer be collected or converted to cash.

Acquisition: a transaction or series of transactions resulting in (a) acquisition of a business, division, or substantially all assets of a Person; (b) record or beneficial ownership of 50% or more of the Equity Interests of a Person; or (c) merger, consolidation or combination of a Borrower or Subsidiary with another Person.

Affiliate: with respect to any Person, another Person that directly, or indirectly through one or more intermediaries, Controls or is Controlled by or is under common Control with the Person specified. “Control” means the possession, directly or indirectly, of the power to direct or cause the direction of the management or policies of a Person, whether through the ability to exercise voting power, by contract or otherwise. “Controlling” and “Controlled” have correlative meanings.

Agent: as defined in the preamble to this Agreement.

Agent Indemnitees: Agent and its officers, directors, employees, Affiliates, agents and attorneys.

Agent Professionals: attorneys, accountants, appraisers, auditors, business valuation experts, environmental engineers or consultants, turnaround consultants, and other professionals and experts retained by Agent.

Agreement: as defined in the preamble to this Agreement.

Allocable Amount: as defined in Section 5.11.3.

AmeriQuest Remarketing: as defined in the preamble to this Agreement.

AmeriQuest Remarketing Collateral: all property of AmeriQuest Remarketing (including without limitation vehicles, vehicle leases and vehicle sales and remarketing contracts) in which a security interest now exists or is hereafter granted to secure Permitted AmeriQuest Remarketing Debt.

Anti-Terrorism Law: any law relating to terrorism or money laundering, including the Patriot Act.

Applicable Law: all laws, rules, regulations and governmental guidelines applicable to the Person, conduct, transaction, agreement or matter in question, including all applicable statutory law, common law and equitable principles, and all provisions of constitutions, treaties, statutes, rules, regulations, orders and decrees of Governmental Authorities.

Applicable Margin: with respect to any Type of Loan, the margin set forth below, as determined by the Average Availability for the last Fiscal Quarter:

Level | | Average

Availability | | Base Rate

Loans | | LIBOR Loans | |

I | | > $40,000,000 | | 1.00 | % | 2.00 | % |

II | | > $20,000,000 | | 1.25 | % | 2.25 | % |

| | < $40,000,000 | | | | | |

III | | < $20,000,000 | | 1.50 | % | 2.50 | % |

Until March 31, 2013, margins shall be determined as if Level II were applicable. Thereafter, the margins shall be subject to increase or decrease based on Average Availability for

2

the immediately preceding Fiscal Quarter, which change shall be effective on the first day of each Fiscal Quarter. If, by the first day of a Fiscal Quarter, any Borrowing Base Certificate due in the preceding Fiscal Quarter has not been received, then, at the option of Agent or Required Lenders, the margins shall be determined as if Level III were applicable, from such day until the first Fiscal Quarter following actual receipt.

Approved Fund: any Person (other than a natural person) that is engaged in making, purchasing, holding or otherwise investing in commercial loans and similar extensions of credit in its ordinary course of activities, and is administered or managed by a Lender, an entity that administers or manages a Lender, or an Affiliate of either.

Approved Membership Program Agreement: any membership agreement between a Member and the Company in substantially the form or forms previously delivered to Agent as determined by Agent in its Permitted Discretion with such modifications thereto as will not have an adverse effect on the enforceability or collectability of the Accounts created thereunder as determined by Agent in its Permitted Discretion.

Approved Pinnacle Dealer Agreement: any program agreement between a Dealer/Distributor and Corcentric meeting the requirements to be used in the Pinnacle Program.

Approved Pinnacle Participant Agreement: any program agreement between a Pinnacle Participant and Corcentric meeting the requirements to be used in the Pinnacle Program.

Approved Purchasing Participation Program Agreement: any purchasing participation agreement between a Purchasing Participant and the Company in substantially the form or forms previously delivered to Agent as determined by Agent in its Permitted Discretion with such modifications thereto as will not have an adverse effect on the enforceability or collectability of the Accounts created thereunder as determined by Agent in its Permitted Discretion.

Approved Supplier Agreement: any supplier agreement between a Supplier and the Company meeting the requirements to be used in the Membership Program and/or the Purchasing Participation Program.

Asset Disposition: a sale, lease, license, consignment, transfer or other disposition of Property of an Obligor, including a disposition of Property in connection with a sale-leaseback transaction or synthetic lease.

Asset Review and Approval Conditions: with respect to any Acquisition or merger in respect of which the Accounts acquired therein or thereby are requested to be included in the Borrowing Base, Agent shall have completed its review of such assets, including, without limitation, field examinations, audits, appraisals and other due diligence as Agent shall require; it being acknowledged and agreed that, (1) such additional assets, if any, to be included in the Borrowing Base may be subject to different advance rates or eligibility criteria or may require the imposition of additional reserves with respect thereto and (2) prior to the inclusion of any additional assets in the Borrowing Base, all actions shall have been taken to ensure that Agent has a perfected and continuing first priority security interest in and Lien on such assets.

3

Assignment and Acceptance: an assignment agreement between a Lender and Eligible Assignee, in the form of Exhibit D.

Availability: the Borrowing Base minus the principal balance of all Loans.

Availability Reserve: the sum (without duplication) of (a) the Rent and Charges Reserve; (b) the LC Reserve; (c) the Bank Product Reserve; (d) the Dilution Reserve; (e) the aggregate amount of liabilities secured by Liens upon Collateral that are senior to Agent’s Liens (but imposition of any such reserve shall not waive an Event of Default arising therefrom); and (f) such additional reserves, in such amounts and with respect to such matters, as Agent in its discretion may elect to impose from time to time.

Average Availability: for any period, an amount equal to the sum of the Availability for each day of such period (determined as of the close of business of each such day) divided by the actual number of days in such period, as determined by Agent, which determination shall be conclusive absent manifest error.

Bank of America: Bank of America, N.A., a national banking association, and its · successors and assigns.

Bank of America Indemnitees: Bank of America and its officers, directors, employees, Affiliates, agents and attorneys.

Bank Product: any of the following products, services or facilities extended to any Borrower or Subsidiary by a Lender or any of its Affiliates: (a) Cash Management Services; (b) products under Hedging Agreements; (c) commercial credit card and merchant card services; and (d) leases and other banking products or services as may be requested by any Borrower or Subsidiary, other than Letters of Credit.

Bank Product Reserve: the aggregate amount of reserves established by Agent from time to time in its discretion in respect of Secured Bank Product Obligations.

Bankruptcy Code: Title 11 of the United States Code.

Base Rate: for any day, a per annum rate equal to the greater of (a) the Prime Rate for such day; (b) the Federal Funds Rate for such day, plus 0.50%; or (c) LIBOR for a 30 day interest period as determined on such day, plus 1.0%.

Base Rate Loan: any Loan that bears interest based on the Base Rate.

Board of Governors: the Board of Governors of the Federal Reserve System.

Borrowed Money: with respect to any Obligor, without duplication, its (a) Debt that (i) arises from the lending of money by any Person to such Obligor, (ii) is evidenced by notes, drafts, bonds, debentures, credit documents or similar instruments, (iii) accrues interest or is a type upon which interest charges are customarily paid (excluding trade payables owing in the Ordinary Course of Business), or (iv) was issued or assumed as full or partial payment for

4

Property; (b) Capital Leases; (c) reimbursement obligations with respect to letters of credit; and (d) guaranties of any Debt of the foregoing types owing by another Person.

Borrower Agent: as defined in Section 4.4.

Borrower Materials: Borrowing Base information, reports, financial statements and other materials delivered by Borrowers hereunder, as well as other Reports and information provided by Agent to Lenders.

Borrowers: as defined in the preamble to this Agreement.

Borrowing: a group of Loans of one Type that are made on the same day or are converted into Loans of one Type on the same day.

Borrowing Base: on any date of determination, an amount equal to the lesser of (a) the aggregate amount of Commitments, minus the LC Reserve; or (b) the Accounts Formula Amount minus the Availability Reserve, provided that the total amount of Advances allowed against Accounts owing by Account Debtors that are shareholders of the Company or Affiliates of Borrower that have not executed and delivered No Offset Letters shall not exceed a sublimit of $8,000,000.

Borrowing Base Certificate: a certificate, substantially in the form attached as Exhibit F-1 or otherwise in form and substance satisfactory to Agent, by which Borrowers certify calculation of the Borrowing Base.

Business Day: any day other than a Saturday, Sunday or other day on which commercial banks are authorized to close under the laws of, or are in fact closed in, North Carolina and New York, and if such day relates to a LIBOR Loan, any such day on which dealings in Dollar deposits are conducted between banks in the London interbank Eurodollar market.

Canadian Deposit Account: account no 1004544101 maintained by the Company with JPMorgan Chase Bank, N.A., together with any successor account maintained by the Company with the Agent for purposes of its Canadian operations.

Capital Expenditures: all liabilities incurred or expenditures made by a Borrower or Subsidiary for the acquisition of fixed assets, or any improvements, replacements, substitutions or additions thereto with a useful life of more than one year, including without limitation, capitalized software development costs.

Capital Lease: any lease that is required to be capitalized for financial reporting purposes in accordance with GAAP.

Cash Collateral: cash, and any interest or other income earned thereon, that is delivered to Agent to Cash Collateralize any Obligations.

Cash Collateral Account: a demand deposit, money market or other account established by Agent at such financial institution as Agent may select in its discretion, which account shall be subject to a Lien in favor of Agent.

5

Cash Collateralize: the delivery of cash to Agent, as security for the payment of Obligations, in an amount equal to (a) with respect to LC Obligations, 105% of the aggregate LC Obligations, and (b) with respect to any inchoate, contingent or other Obligations (including Secured Bank Product Obligations), Agent’s good faith estimate of the amount that is due or could become due, including all fees and other amounts relating to such Obligations. “Cash Collateralization” has a correlative meaning.

Cash Equivalents: (a) marketable obligations issued or unconditionally guaranteed by, and backed by the full faith and credit of, the United States government, maturing within 12 months of the date of acquisition; (b) certificates of deposit, time deposits and bankers’ acceptances maturing within 12 months of the date of acquisition, and overnight bank deposits, in each case which are issued by Bank of America or a commercial bank organized under the laws of the United States or any state or district thereof, rated A-1 (or better) by S&P or P-1 (or better) by Moody’s at the time of acquisition, and (unless issued by a Lender) not subject to offset rights; (c) repurchase obligations with a term of not more than 30 days for underlying investments of the types described in clauses (a) and (b) entered into with any bank described in clause (b); (d) commercial paper issued by Bank of America or rated A-1 (or better) by S&P or P-1 (or better) by Moody’s, and maturing within nine months of the date of acquisition; and (e) shares of any money market fund that has substantially all of its assets invested continuously in the types of investments referred to above, has net assets of at least $500,000,000 and has the highest rating obtainable from either Moody’s or S&P.

Cash Management Services: any services provided from time to time by Bank of America or any of its Affiliates to any Borrower or Subsidiary in connection with operating, collections, payroll, trust, or other depository or disbursement accounts, including automated clearinghouse, e-payable, electronic funds transfer, wire transfer, controlled disbursement, overdraft, depository, information reporting, lockbox and stop payment services.

CERCLA: the Comprehensive Environmental Response Compensation and Liability Act (42 U.S.C. § 9601 et seq.).

Change in Law: the occurrence, after the date hereof, of (a) the adoption, taking effect or phasing in of any law, rule, regulation or treaty; (b) any change in any law, rule, regulation or treaty or in the administration, interpretation or application thereof; or (c) the making, issuance or application of any request, guideline, requirement or directive (whether or not having the force of law) by any Governmental Authority; provided, however, that “Change in Law” shall include, regardless of the date enacted, adopted or issued, all requests, guidelines, requirements or directives (i) under or relating to the Dodd-Frank Wall Street Reform and Consumer Protection Act, or (ii) promulgated pursuant to Basel III by the Bank of International Settlements, the Basel Committee on Banking Supervision (or any similar authority) or any other Governmental Authority.

Change of Control: the occurrence of any of the following events:

(a) after an IPO, Douglas W. Clark shall cease to own, directly or indirectly, beneficially and of record, at least 5% of the Equity Interests of the Company;

6

(b) after an IPO, Douglas W. Clark shall cease to own, directly or indirectly, beneficially and of record, at least 5% of the Equity Interests of the Company;

(c) any person or group (within the meaning of Rule 13d-5 of the Securities and Exchange Act of 1934, as in effect on the date hereof) other than the Douglas W. Clark shall own directly or indirectly, beneficially and of record, 35% or more of the Equity Interests of the Company;

(d) the Company shall cease to own and control, beneficially and of record, directly or indirectly, all Equity Interests in all other Obligors;

(e) a change in the majority of directors of the Company during any 24 month period, unless approved by the majority of directors serving at the beginning of such period; or

(f) the sale or transfer of all or substantially all of a Borrower’s assets, except to another Borrower.

Claims: all claims, liabilities, obligations, losses, damages, penalties, judgments, proceedings, interest, costs and expenses of any kind (including remedial response costs, reasonable attorneys’ fees and Extraordinary Expenses) at any time (including after Full Payment of the Obligations or replacement of Agent or any Lender) incurred by any Indemnitee or asserted against any Indemnitee by any Obligor or other Person, in any way relating to (a) any Loans, Letters of Credit, Loan Documents, Borrower Materials, or the use thereof or transactions relating thereto, (b) any action taken or omitted in connection with any Loan Documents, (c) the existence or perfection of any Liens, or realization upon any Collateral, (d) exercise of any rights or remedies under any Loan Documents or Applicable Law, or (e) failure by any Obligor to perform or observe any terms of any Loan Document, in each case including all costs and expenses relating to any investigation, litigation, arbitration or other proceeding (including an Insolvency Proceeding or appellate proceedings), whether or not the applicable Indemnitee is a party thereto.

Closing Date: as defined in Section 6.1.

Code: the Internal Revenue Code of 1986, as amended.

Collateral: all Property described in Section 7.1, all Property described in any Security Documents as security for any Obligations, and all other Property that now or hereafter secures (or is intended to secure) any Obligations.

Commitment: for any Lender, its obligation to make Loans and to participate in LC Obligations up to the maximum principal amount shown on Schedule 1.1, as hereafter modified pursuant to Section 2.1.7 or an Assignment and Acceptance to which it is a party. “Commitments” means the aggregate amount of such commitments of all Lenders. The Commitments as of the Closing Date shall be equal to $100,000,000.

Commitment Termination Date: the earliest to occur of (a) the Termination Date; (b) the date on which Borrowers terminate the Commitments pursuant to Section 2.1.4; or (c) the date on which the Commitments are terminated pursuant to Section 11.2.

7

Company: as defined in the Preamble to this Agreement.

Compliance Certificate: a certificate, in form of Exhibit F-2 or otherwise in form and substance satisfactory to Agent, by which Borrowers certify compliance with Section 10.3.

Connection Income Taxes: Other Connection Taxes that are imposed on or measured by net income (however denominated) or that are franchise Taxes or branch profits Taxes.

Contingent Obligation: any obligation of a Person arising from a guaranty, indemnity or other assurance of payment or performance of any Debt, lease, dividend or other obligation (“primary obligations”) of another obligor (“primary obligor”) in any manner, whether directly or indirectly, including any obligation of such Person under any (a) guaranty, endorsement, co-making or sale with recourse of an obligation of a primary obligor; (b) obligation to make take-or-pay or similar payments regardless of nonperformance by any other party to an agreement; and (c) arrangement (i) to purchase any primary obligation or security therefor, (ii) to supply funds for the purchase or payment of any primary obligation, (iii) to maintain or assure working capital, equity capital, net worth or solvency of the primary obligor, (iv) to purchase Property or services for the purpose of assuring the ability of the primary obligor to perform a primary obligation, or (v) otherwise to assure or hold harmless the holder of any primary obligation against loss in respect thereof. The amount of any Contingent Obligation shall be deemed to be the stated or determinable amount of the primary obligation (or, if less, the maximum amount for which such Person may be liable under the instrument evidencing the Contingent Obligation) or, if not stated or determinable, the maximum reasonably anticipated liability with respect thereto.

Corcentric: as defined in the preamble to this Agreement.

Cumulative Capital Expenditures: the amount of Capital Expenditures made by the Borrowers and/or their Subsidiaries (other than Cure Leasing and AmeriQuest Remarketing) from November 1, 2012 through the end of any month.

Cumulative EBITDA: the amount EBITDA of the Borrowers and their Subsidiaries calculated from November 1, 2012 through the end of any month.

Cure Leasing: as defined in the preamble to this Agreement.

Cure Leasing Collateral: all property of Cure Leasing (including without limitation vehicles and vehicle leases) in which a security interest now exists or is hereafter granted to secure Permitted Cure Leasing Debt.

CWA: the Clean Water Act (33 U.S.C. §§ 1251 et seq.).

Dealer/Distributor: a dealer and/or distributor that has executed an Approved Pinnacle Dealer Agreement and that has been approved for participation in the Pinnacle Program by DTNA.

Debt: as applied to any Person, without duplication, (a) all items that would be included as liabilities on a balance sheet in accordance with GAAP, including Capital Leases, but excluding trade payables and other current liabilities incurred and being paid in the Ordinary

8

Course of Business; (b) all Contingent Obligations; (c) all reimbursement obligations in connection with letters of credit issued for the account of such Person; and (d) in the case of a Borrower, the Obligations. The Debt of a Person shall include any recourse Debt of any partnership in which such Person is a general partner or joint venturer.

Default: an event or condition that, with the lapse of time or giving of notice, would constitute an Event of Default.

Default Rate: for any Obligation (including, to the extent permitted by law, interest not paid when due), 2% per annum plus the interest rate otherwise applicable thereto.

Defaulting Lender: any Lender that, as determined by Agent, (a) has failed to perform any funding obligations hereunder, and such failure is not cured within three Business Days; (b) has notified Agent or any Borrower that such Lender does not intend to comply with its funding obligations hereunder or has made a public statement to the effect that it does not intend to comply with its funding obligations hereunder or under any other credit facility; (c) has failed, within three Business Days following request by Agent, to confirm in a manner satisfactory to Agent that such Lender will comply with its funding obligations hereunder; or (d) has, or has a direct or indirect parent company that has, become the subject of an Insolvency Proceeding or taken any action in furtherance thereof; provided, however, that a Lender shall not be a Defaulting Lender solely by virtue of a Governmental Authority’s ownership of an equity interest in such Lender or parent company.

Deposit Account Control Agreements: the Deposit Account control agreements to be executed by each institution maintaining a Deposit Account for a Borrower, in favor of Agent, as security for the Obligations.

Dilution Reserve: a reserve equal to an amount determined by the Agent (or calculated in a manner proscribed by the Agent) from time to time in its discretion, in respect of bad Debt write-downs or write-offs, discounts, returns, promotions, credits, credit memos and other dilutive items with respect to Accounts for such applicable period.

Distribution: any declaration or payment of a distribution, interest or dividend on any Equity Interest (other than payment-in-kind); any distribution, advance or repayment of Debt to a holder of Equity Interests outside of the ordinary course of business; or any purchase, redemption, or other acquisition or retirement for value of any Equity Interest.

Dollars: lawful money of the United States.

Dominion Account: a special account established by Borrowers at Bank of America or another bank acceptable to Agent, over which Agent has exclusive control for withdrawal purposes.

DTNA: Daimler Trucks North America.

EBITDA: determined on a consolidated basis for Borrowers and Subsidiaries, net income, calculated before interest expense, provision for income taxes, depreciation and amortization expense, gains or losses arising from the sale of capital assets, gains arising from

9

the write-up of assets, any extraordinary gains, any stock-based or other non-cash compensation expense, and any other non-cash expense items (in each case, to the extent included in determining net income). For purposes of the computation of the Fixed Charge Coverage Ratio, EBITDA for any period shall be calculated on a pro forma basis to give effect to (i) any Person or business acquired during such period pursuant to a Permitted Acquisition and not subsequently sold or otherwise disposed of by the Company or any of its Subsidiaries during such period and (ii) any Subsidiary or business disposed of during such period by the Company or any of its Subsidiaries

Eligible Account: an Account owing to a Borrower that arises in the Ordinary Course of Business from the sale of goods or rendition of services, is payable in Dollars (or in the case of Account Debtors located in Canada, Canadian Dollars) and is deemed by Agent, in its discretion, to be an Eligible Account. Without limiting the foregoing, no Account shall be an Eligible Account if (a) it is unpaid for more than 60 days after the original due date, or more than 90 days after the original invoice date; provided that with respect to any Account acquired by a Borrower from another party that originated such Account, such period shall be extended, in each case, by the number of days (not to exceed 10 days) between the invoice date and the date of the related sale of goods and/or services; (b) 50% or more of the Accounts owing by the Account Debtor are not Eligible Accounts under the foregoing clause; (c) to the extent such Account, when aggregated with other Accounts owing by the Account Debtor, it exceeds 20% of the aggregate Eligible Accounts (or such higher percentage as Agent may establish for the Account Debtor from time to time); (d) it does not conform with a covenant or representation herein; (e) it is owing by a creditor or supplier, or is otherwise subject to a potential offset, counterclaim, dispute, deduction, discount, recoupment, reserve, defense, chargeback, credit or allowance (but ineligibility shall be limited to the amount thereof); provided, however, that an Account owing by a Member or Purchasing Participant shall not be disqualified as an Eligible Account solely by reason of the right of such Member or Participant to a rebate from the Company under the Membership Program or the Purchasing Participation Program; (f) an Insolvency Proceeding has been commenced by or against the Account Debtor; or the Account Debtor has failed, has suspended or ceased doing business, is liquidating, dissolving or winding up its affairs, is not Solvent, or is subject to any country sanctions program or specially designated nationals list maintained by the Office of Foreign Assets Control of the U.S. Treasury Department; or the Borrower is not able to bring suit or enforce remedies against the Account Debtor through judicial process; (g) the Account Debtor is organized or has its principal offices or assets outside the United States, unless the Account is supported by a letter of credit (delivered to and directly drawable by Agent) or such Account is originated in the United States and owed by an Account Debtor that is organized or has its principal offices or assets in Canada; (h) it is owing by a Governmental Authority, unless the Account Debtor is the United States or any department, agency or instrumentality thereof and the Account has been assigned to Agent in compliance with the Federal Assignment of Claims Act; (i) it is not subject to a duly perfected, first priority Lien in favor of Agent, or is subject to any other Lien (other than Permitted Liens, which in all cases, are junior to Agent’s Liens thereon); (j) the goods giving rise to it have not been delivered to the Account Debtor, the services giving rise to it have not been accepted by the Account Debtor, or it otherwise does not represent a final sale; (k) it is evidenced by Chattel Paper or an Instrument of any kind, or has been reduced to judgment; (1) its payment has been extended or the Account Debtor has made a partial payment; it arises from a sale on a cash-on-delivery, bill-and-hold, sale or return, sale on approval, consignment, or other repurchase or return basis, or

10

from a sale for personal, family or household purposes; (m) it represents a progress billing or retainage, or relates to services for which a performance, surety or completion bond or similar assurance has been issued; (n) it includes a billing for interest, fees or late charges, but ineligibility shall be limited to the extent thereof; (o) it is a contra account; (p) it is an intercompany account; (q) it is an Account owed by a Pinnacle Participant but which fails to qualify as a Pinnacle Program Account; (r) it is an Account owed by a Member but which fails to qualify as a Member Program Account; (s) it is an Account owed by a Purchasing Participant but which fails to qualify as a Purchasing Participation Program Account; (t) it is an Account subject to potential offset related to rebates that are paid in cash, as determined by the Agent from time to time in its discretion (but ineligibility shall be limited to the amount of such potential offset); or (u) it is an Account of Cure Leasing or AmeriQuest Remarketing. In calculating delinquent portions of Accounts under clauses (a) and (b), credit balances more than 90 days old will be excluded.

Eligible Assignee: a Person that is (a) a Lender, Affiliate of a Lender or Approved Fund; (b) any other financial institution approved by Borrower Agent (which approval shall not be unreasonably withheld or delayed, and shall be deemed given if no objection is made within ten (10) Business Days after notice of the proposed assignment) and Agent, which extends revolving credit facilities of this type in its ordinary course of business; and (c) during any Event of Default, any Person acceptable to Agent in its discretion.

Enforcement Action: any action to enforce any Obligations (other than Secured Bank Product Obligations) or Loan Documents or to exercise any rights or remedies relating to any Collateral (whether by judicial action, self-help, notification of Account Debtors, exercise of setoff or recoupment, exercise of any right to act in an Obligor’s Insolvency Proceeding or to credit bid Obligations, or otherwise).

Environmental Laws: all Applicable Laws (including all programs, permits and guidance promulgated by regulatory agencies), relating to public health (but excluding occupational safety and health, to the extent regulated by OSHA) or the protection or pollution of the environment, including CERCLA, RCRA and CWA.

Environmental Notice: a notice (whether written or oral) from any Governmental Authority or other Person of any possible noncompliance with, investigation of a possible violation of, litigation relating to, or potential fine or liability under any Environmental Law, or with respect to any Environmental Release, environmental pollution or hazardous materials, including any complaint, summons, citation, order, claim, demand or request for correction, remediation or otherwise.

Environmental Release: a release as defined in CERCLA or under any other Environmental Law.

Equity Interest: the interest of any (a) shareholder in a corporation; (b) partner in a partnership (whether general, limited, limited liability or joint venture); (c) member in a limited liability company; or (d) other Person having any other form of equity security or ownership interest.

11

ERISA: the Employee Retirement Income Security Act of 1974.

ERISA Affiliate: any trade or business (whether or not incorporated) under common control with an Obligor within the meaning of Section 414(b) or (c) of the Code (and Sections 414(m) and (o) of the Code for purposes of provisions relating to Section 412 of the Code).

ERISA Event: (a) a Reportable Event with respect to a Pension Plan; (b) a withdrawal by any Obligor or ERISA Affiliate from a Pension Plan subject to Section 4063 of ERISA during a plan year in which it was a substantial employer (as defined in Section 4001(a)(2) of ERISA) or a cessation of operations that is treated as such a withdrawal under Section 4062(e) of ERISA; (c) a complete or partial withdrawal by any Obligor or ERISA Affiliate from a Multiemployer Plan or notification that a Multiemployer Plan is in reorganization; (d) the filing of a notice of intent to terminate, the treatment of a Plan amendment as a termination under Section 4041 or 4041A of ERISA, or the commencement of proceedings by the PBGC to terminate a Pension Plan or Multiemployer Plan; (e) the determination that any Pension Plan or Multiemployer Plan is considered an at risk plan or a plan in critical or endangered status under the Code, ERISA or the Pension Protection Act of 2006; (f) an event or condition which constitutes grounds under Section 4042 of ERISA for the termination of, or the appointment of a trustee to administer, any Pension Plan or Multiemployer Plan; or (g) the imposition of any liability under Title IV of ERISA, other than for PBGC premiums due but not delinquent under Section 4007 of ERISA, upon any Obligor or ERISA Affiliate.

Event of Default: as defined in Section 11.

Excluded Accounts: means any deposit accounts, securities accounts or other similar accounts (i) into which there is deposited no funds other than those intended solely to cover wages for employees of the Obligors for a period of service no longer than one month at any time (other than for periods during which employee bonuses are paid) (and related contributions to be made on behalf of such employees to health and benefit plans) plus balances for outstanding checks for wages from prior periods; (ii) constituting employee withholding accounts and contain only funds deducted from pay otherwise due to employees for services rendered to be applied toward the tax obligations of such employees; (iii) constituting trust accounts; and (iv) accounts containing not more than $10,000 in the aggregate at any time.

Excluded Asset: means, with respect to an Obligor, (a) any “intent-to-use” Trademark applications for which a statement of use has not been filed and accepted with the U.S. Patent and Trademark Office or any Intellectual Property if the grant of a lien on or security interest in such Intellectual Property would result in the cancellation or voiding of such Intellectual Property, (b) any item of General Intangibles that is now or hereafter held by such Obligor but only to the extent that such item of General Intangibles (or any agreement evidencing such item of General Intangibles) contains a term or is subject to a rule of law, statute or regulation that restricts, prohibits, or requires a consent (that has not been obtained) of a Person (other than such Obligor) to, the creation, attachment or perfection of the security interest granted herein, and any such restriction, prohibition and/or requirement of consent is effective and enforceable under applicable law and is not rendered ineffective by applicable law (including, without limitation, pursuant to Sections 9-406, 9-407, 9-408 or 9-409 of the UCC), (c) any property subject to a

12

purchase money Lien or a Capital Lease, in each case as permitted under this Agreement, if the contract or other agreement pursuant to which such Lien is granted (or the document providing for the Capital Lease) prohibits the creation of any other Lien on such property or requires the consent, which has not been obtained, of any Person other than a Obligor as a condition to the creation of any other Lien on such property, (d) more than 65% of the voting stock of any Foreign Subsidiary, (e) any Cure Leasing Collateral or AmeriQuest Remarketing Collateral, (f) Excluded Accounts, and (g) the capital stock and promissory note of Stitzel Leasing, LLC, held by ATS Investment Holdings, Inc.; provided, however, that (x) Excluded Asset shall not include, any Proceeds of any item of General Intangibles (other than any General Intangibles included in Cure Leasing Collateral or AmeriQuest Remarketing Collateral), and (y) any item of General Intangibles that at any time ceases to satisfy the criteria for Excluded Asset (whether as a result of the applicable Grantor obtaining any necessary consent, any change in any rule of law, statute or regulation, or otherwise), shall no longer be Excluded Asset subject to the grant of security contained herein.

Excluded Taxes: any of the following Taxes imposed on or with respect to any Recipient or required to be withheld or deducted from a payment to a Recipient, (a) Taxes imposed on or measured by net income (however denominated), franchise Taxes, and branch profits Taxes, in each case, (i) imposed as a result of such Recipient being organized under the laws of, or having its principal office or, in the case of any Lender, its Lending Office located in, the jurisdiction imposing such Tax (or any political subdivision thereof) or (ii) that are Other Connection Taxes, (b) in the case of a Foreign Lender, U.S. federal withholding Taxes imposed on amounts payable to or for the account of such Lender with respect to an applicable interest in a Loan or Commitment pursuant to a law in effect on the date on which (i) such Lender acquires such interest in the Loan or Commitment (other than pursuant to an assignment request by Borrowers under Section 3.8) or (ii) such Lender changes its Lending Office, except in each case to the extent that, pursuant to Section 5.9, amounts with respect to such Taxes were payable either to such Lender’s assignor immediately before such Lender became a party hereto or to such Lender immediately before it changed its Lending Office, (c) Taxes attributable to such Recipient’s failure to comply with Section 5.9.6 and (d) any U.S. federal withholding Taxes imposed pursuant to FATCA.

Extraordinary Expenses: all costs, expenses or advances that Agent may incur during a Default or Event of Default, or during the pendency of an Insolvency Proceeding of an Obligor, including those relating to (a) any audit, inspection, repossession, storage, repair, appraisal, insurance, manufacture, preparation or advertising for sale, sale, collection, or other preservation of or realization upon any Collateral; (b) any action, arbitration or other proceeding (whether instituted by or against Agent, any Lender, any Obligor, any representative of creditors of an Obligor or any other Person) in any way relating to any Collateral (including the validity, perfection, priority or avoidability of Agent’s Liens with respect to any Collateral), Loan Documents, Letters of Credit or Obligations, including any lender liability or other Claims; (c) the exercise, protection or enforcement of any rights or remedies of Agent in, or the monitoring of, any Insolvency Proceeding; (d) settlement or satisfaction of any taxes, charges or Liens with respect to any Collateral; (e) any Enforcement Action; (f) negotiation and documentation of any modification, waiver, workout, restructuring or forbearance with respect to any Loan Documents or Obligations; and (g) Protective Advances. Such costs, expenses and advances include transfer fees, Other Taxes, storage fees, insurance costs, permit fees, utility

13

reservation and standby fees, legal fees, appraisal fees, brokers’ fees and commissions, auctioneers’ fees and commissions, accountants’ fees, environmental study fees, wages and salaries paid to employees of any Obligor or independent contractors in liquidating any Collateral, and travel expenses.

FATCA: Sections 1471 through 1474 of the Code, as of the date of this Agreement (or any amended or successor version that is substantively comparable and not materially more onerous to comply with), any current or future regulations or official interpretations thereof and any agreements entered into pursuant to Section 1471(b)(1) of the Code.

Federal Funds Rate: (a) the weighted average of interest rates on overnight federal funds transactions with members of the Federal Reserve System arranged by federal funds brokers on the applicable Business Day (or on the preceding Business Day, if the applicable day is not a Business Day), as published by the Federal Reserve Bank of New York on the next Business Day; or (b) if no such rate is published on the next Business Day, the average rate (rounded up, if necessary, to the nearest 1/8 of 1%) charged to Bank of America on the applicable day on such transactions, as determined by Agent.

Fiscal Quarter: each period of three months, commencing on the first day of a Fiscal Year.

Fiscal Year: the fiscal year of Borrowers and Subsidiaries for accounting and tax purposes, ending on December 31 of each year.

Fixed Charge Compliance Date: the first date upon which the Borrowers have demonstrated compliance with a test period for the Fixed Charge Coverage Ratio pursuant to Section 10.3.5.

Fixed Charge Coverage Ratio: the ratio, determined on a consolidated basis for Borrowers and Subsidiaries for the most recent twelve month period (or, if shorter, for the period from November 1, 2012 through any calendar month), of (a) EBITDA plus cash principal payments received by Cure Leasing and AmeriQuest Remarketing from vehicle lessees, plus cash payments received by Cure Leasing and AmeriQuest Remarketing from vehicles sales minus Capital Expenditures (except those financed with Borrowed Money other than Loans), and minus cash taxes paid, to (b) Fixed Charges.

Fixed Charge Coverage Ratio Test Period: with respect to any calendar month, the immediately preceding twelve (12) calendar month period ending on the last day of the prior calendar month.

Fixed Charges: the sum of interest expense (excluding payment-in-kind but including interest expense of Cure Leasing and AmeriQuest Remarketing under vehicle financing Debt), principal payments made on Borrowed Money (including principal payments by Cure Leasing and AmeriQuest Remarketing on vehicle financing Debt), and Distributions made to Persons that are not Obligors.

FLSA: the Fair Labor Standards Act of 1938.

14

Foreign Lender: a Lender that is not a U.S. Person.

Foreign Plan: any employee benefit plan or arrangement (a) maintained or contributed to by any Obligor or Subsidiary that is not subject to the laws of the United States; or (b) mandated by a government other than the United States for employees of any Obligor or Subsidiary.

Foreign Subsidiary: a Subsidiary that is a “controlled foreign corporation” under Section 957 of the Code, such that a guaranty by such Subsidiary of the Obligations or a Lien on the assets of such Subsidiary to secure the Obligations would result in material tax liability to Borrowers.

Fronting Exposure: a Defaulting Lender’s Pro Rata share of LC Obligations or Swingline Loans, as applicable, except to the extent allocated to other Lenders under Section 4.2.

Full Payment: with respect to any Obligations, (a) the full and indefeasible cash payment thereof, including any interest, fees and other charges accruing during an Insolvency Proceeding (whether or not allowed in the proceeding); and (b) if such Obligations are LC Obligations or inchoate or contingent in nature, Cash Collateralization thereof (or delivery of a standby letter of credit acceptable to Agent in its discretion, in the amount of required Cash Collateral). No Loans shall be deemed to have been paid in full until all Commitments related to such Loans have expired or been terminated.

GAAP: generally accepted accounting principles in effect in the United States from time to time.

Governmental Approvals: all authorizations, consents, approvals, licenses and exemptions of, registrations and filings with, and required reports to, all Governmental Authorities.

Governmental Authority: any federal, state, local, foreign or other agency, authority, body, commission, court, instrumentality, political subdivision, or other entity or officer exercising executive, legislative, judicial, regulatory or administrative functions for any governmental, judicial, investigative, regulatory or self-regulatory authority.

Guarantor Payment: as defined in Section 5.11.3.

Guarantors: ATS Investment Holdings, Inc., a Delaware corporation, NationaLease Finance Corporation, an Illinois corporation, AmeriQuest Material Handling Services, Inc., a Florida corporation and each other Person who guarantees payment or performance of any Obligations.

Guaranty: each guaranty agreement executed by a Guarantor in favor of Agent.

Hedging Agreement: any “swap agreement” as defined in Section 101(53B)(A) of the Bankruptcy Code.

15

Indemnified Taxes: (a) Taxes, other than Excluded Taxes, imposed on or with respect to any payment made by or on account of any obligation of any Obligor under any Loan Document and (b) to the extent not otherwise described in (a), Other Taxes.

Indemnitees: Agent Indemnitees, Lender Indemnitees, Issuing Bank Indemnitees and Bank of America Indemnitees.

Insolvency Proceeding: any case or proceeding commenced by or against a Person under any state, federal or foreign law for, or any agreement of such Person to, (a) the entry of an order for relief under the Bankruptcy Code, or any other insolvency, debtor relief or debt adjustment law; (b) the appointment of a receiver, trustee, liquidator, administrator, conservator or other custodian for such Person or any part of its Property; or (c) an assignment or trust mortgage for the benefit of creditors.

Intellectual Property: all intellectual and similar Property of a Person, including inventions, designs, patents, copyrights, trademarks, service marks, trade names, trade secrets, confidential or proprietary information, customer lists, know-how, software and databases; all embodiments or fixations thereof and all related documentation, applications, registrations and franchises; all licenses or other rights to use any of the foregoing; and all books and records relating to the foregoing.

Intellectual Property Claim: any claim or assertion (whether in writing, by suit or otherwise) that a Borrower’s or Subsidiary’s ownership, use, marketing, sale or distribution of any Inventory, Equipment, Intellectual Property or other Property violates another Person’s Intellectual Property.

Interest Period: as defined in Section 3.1.3.

Inventory: as defined in the UCC, including all goods intended for sale, lease, display or demonstration; all work in process; and all raw materials, and other materials and supplies of any kind that are or could be used in connection with the manufacture, printing, packing, shipping, advertising, sale, lease or furnishing of such goods, or otherwise used or consumed in a Borrower’s business (but excluding Equipment).

Investment: an Acquisition; an acquisition of record or beneficial ownership of any Equity Interests of a Person; or an advance or capital contribution to or other investment in a Person.

IPO: the issuance by the Company or any direct or indirect parent of the Company of its common Equity Interests in an initial underwritten primary public offering (other than a public offering pursuant to a registration statement on form S-8) pursuant to an effective registration statement filed with the SEC in accordance with the Securities Act (which generates gross cash proceeds of at least $50,000,000).

IRS: the United States Internal Revenue Service.

Issuing Bank: Bank of America or any Affiliate of Bank of America, or any replacement issuer appointed pursuant to Section 2.3.4.

16

Issuing Bank Indemnitees: Issuing Bank and its officers, directors, employees, Affiliates, agents and attorneys.

LC Application: an application by Borrower Agent to Issuing Bank for issuance of a Letter of Credit, in form and substance satisfactory to Issuing Bank.

LC Conditions: the following conditions necessary for issuance of a Letter of Credit: (a) each of the conditions set forth in Section 6; (b) after giving effect to such issuance, total LC Obligations do not exceed the Letter of Credit Subline, no Overadvance exists and, if no Loans are outstanding, the LC Obligations do not exceed the Borrowing Base (without giving effect to the LC Reserve for purposes of this calculation); (c) the expiration date of such Letter of Credit is (i) no more than 365 days from issuance, in the case of standby Letters of Credit, and (ii) no more than 120 days from issuance, in the case of documentary Letters of Credit; (d) the Letter of Credit and payments thereunder are denominated in Dollars; and (e) the purpose and form of the proposed Letter of Credit is satisfactory to Agent and Issuing Bank in their discretion.

LC Documents: all documents, instruments and agreements (including LC Requests and LC Applications) delivered by Borrowers or any other Person to Issuing Bank or Agent in connection with any Letter of Credit.

LC Obligations: the sum (without duplication) of (a) all amounts owing by Borrowers for any drawings under Letters of Credit; and (b) the stated amount of all outstanding Letters of Credit.

LC Request: a request for issuance of a Letter of Credit, to be provided by Borrower Agent to Issuing Bank, in form satisfactory to Agent and Issuing Bank.

LC Reserve: the aggregate of all LC Obligations, other than those that have been Cash Collateralized by Borrowers.

Lender Indemnitees: Lenders and their officers, directors, employees, Affiliates, agents and attorneys.

Lenders: as defined in the preamble to this Agreement, including Agent in its capacity as a provider of Swingline Loans and any other Person who hereafter becomes a “Lender” pursuant to an Assignment and Acceptance.

Lending Office: the office designated as such by the applicable Lender at the time it becomes party to this Agreement or thereafter by notice to Agent and Borrower Agent.

Letter of Credit: any standby or documentary letter of credit issued by Issuing Bank for the account of a Borrower, or any indemnity, guarantee, exposure transmittal memorandum or similar form of credit support issued by Agent or Issuing Bank for the benefit of a Borrower.

Letter of Credit Subline: $10,000,000.

LIBOR: for any Interest Period for a LIBOR Loan, the per annum rate of interest (rounded up, if necessary, to the nearest 1/8th of 1%) determined by Agent at approximately

17

11:00 a.m. (London time) two Business Days prior to commencement of such Interest Period, for a term comparable to such Interest Period, equal to (a) the British Bankers Association LIBOR Rate (“BBA LIBOR”), as published by Reuters (or other commercially available source designated by Agent); or (b) if BBA LIBOR is unavailable for any reason, the interest rate at which Dollar deposits in the approximate amount of the LIBOR Loan would be offered by Agent’s London branch to major banks in the London interbank Eurodollar market. If the Board of Governors imposes a Reserve Percentage with respect to LIBOR deposits, then LIBOR shall be the foregoing rate, divided by 1 minus the Reserve Percentage.

LIBOR Loan: a Loan that bears interest based on LIBOR.

License: any license or agreement under which an Obligor is authorized to use Intellectual Property in connection with any manufacture, marketing, distribution or disposition of Collateral, any use of Property or any other conduct of its business.

Licensor: any Person from whom an Obligor obtains the right to use any Intellectual Property.

Lien: any Person’s interest in Property securing an obligation owed to, or a claim by, such Person, including any lien, security interest, pledge, hypothecation, trust, reservation, encroachment, easement, right-of-way, covenant, condition, restriction, leases, or other title exception or encumbrance.

Lien Waiver: an agreement, in form and substance satisfactory to Agent, by which (a) for any material Collateral located on leased premises, the lessor waives or subordinates any Lien it may have on the Collateral, and agrees to permit Agent to enter upon the premises and remove the Collateral or to use the premises to store or dispose of the Collateral; (b) for any Collateral held by a warehouseman, processor, shipper, customs broker or freight forwarder, such Person waives or subordinates any Lien it may have on the Collateral, agrees to hold any Documents in its possession relating to the Collateral as agent for Agent, and agrees to deliver the Collateral to Agent upon request; (c) for any Collateral held by a repairman, mechanic or bailee, such Person acknowledges Agent’s Lien, waives or subordinates any Lien it may have on the Collateral, and agrees to deliver the Collateral to Agent upon request; and (d) for any Collateral subject to a Licensor’s Intellectual Property rights, the Licensor grants to Agent the right, vis-à-vis such Licensor, to enforce Agent’s Liens with respect to the Collateral, including the right to dispose of it with the benefit of the Intellectual Property, whether or not a default exists under any applicable License.

Loan: a loan made pursuant to Section 2.1, and any Swingline Loan, Overadvance Loan or Protective Advance.

Loan Documents: this Agreement, Other Agreements and Security Documents.

Loan Year: each 12 month period commencing on the Closing Date and on each anniversary of the Closing Date.

Margin Stock: as defined in Regulation U of the Board of Governors.

18

Material Adverse Effect: the effect of any event or circumstance that, taken alone or in conjunction with other events or circumstances, (a) has or could be reasonably expected to have a material adverse effect on the business, operations, Properties, prospects or condition (financial or otherwise) of any Obligor, on the value of any material Collateral, on the enforceability of any Loan Documents, or on the validity or priority of Agent’s Liens on any Collateral; (b) impairs the ability of an Obligor to perform its obligations under the Loan Documents, including repayment of any Obligations; or (c) otherwise impairs the ability of Agent or any Lender to enforce or collect any Obligations or to realize upon any Collateral.

Material Contract: any agreement or arrangement to which a Borrower or Subsidiary is party (other than the Loan Documents) (a) that is deemed to be a material contract under any securities law applicable to such Person, including the Securities Act of 1933; (b) for which breach, termination, nonperformance or failure to renew could reasonably be expected to have a Material Adverse Effect; or (c) that relates to Subordinated Debt, or to Debt in an aggregate amount of $500,000 or more.

Member: a customer of the Company that has executed an Approved Membership Program Agreement.

Membership Program: the program pursuant to which (a) Suppliers agree to provide pre-approved parts and/or services to Members, (b) Suppliers are entitled to seek payment from the Company on account of the provision of such parts and/or services, (c) the Company agrees to make payment to such Suppliers on account of the provision of such parts and/or services, and (d) Members agree to make payment to the Company on account of the provision of such parts and/or services.

Membership Program Account: an Account that is owed by a Member to the Company pursuant to the Membership Program.

MLPF&S: as defined in the preamble to this Agreement.

Moody’s: Moody’s Investors Service, Inc., and its successors.

Multiemployer Plan: any employee benefit plan of the type described in Section 4001(a)(3) of ERISA, to which any Obligor or ERISA Affiliate makes or is obligated to make contributions, or during the preceding five plan years, has made or been obligated to make contributions.

Net Availability: the amount of Availability that may be utilized by the Borrowers to request Loans and Letters of Credit under this Agreement after giving effect to the restrictions imposed by Section 10.3.4.

Net Proceeds: with respect to an Asset Disposition, proceeds (including, when received, any deferred or escrowed payments) received by a Borrower or Subsidiary in cash from such disposition, net of (a) reasonable and customary costs and expenses actually incurred in connection therewith, including legal fees and sales commissions; (b) amounts applied to repayment of Debt secured by a Permitted Lien senior to Agent’s Liens on Collateral sold;

19

(c) transfer or similar taxes; and (d) reserves for indemnities, until such reserves are no longer needed.

No Offset Letter: a no off-set letter from the Company to an Affiliate, in form and substance satisfactory to Agent, as the same may be amended, restated, supplemented and otherwise modified from time to time.

Notice of Borrowing: a Notice of Borrowing to be provided by Borrower Agent to request a Borrowing of Loans, in the form attached hereto as Exhibit B.

Notice of Conversion/Continuation: a Notice of Conversion/Continuation to be provided by Borrower Agent to request a conversion or continuation of any Loans as LIBOR Loans, in the form attached hereto as Exhibit C.

Obligations: all (a) principal of and premium, if any, on the Loans, (b) LC Obligations and other obligations of Obligors with respect to Letters of Credit, (c) interest, expenses, fees, indemnification obligations, Extraordinary Expenses and other amounts payable by Obligors under Loan Documents, (d) Secured Bank Product Obligations, and (e) other Debts, obligations and liabilities of any kind owing by Obligors pursuant to the Loan Documents, whether now existing or hereafter arising, whether evidenced by a note or other writing, whether allowed in any Insolvency Proceeding, whether arising from an extension of credit, issuance of a letter of credit, acceptance, loan, guaranty, indemnification or otherwise, and whether direct or indirect, absolute or contingent, due or to become due, primary or secondary, or joint or several.

Obligor: each Borrower, Guarantor, or other Person that is liable for payment of any Obligations or that has granted a Lien in favor of Agent on its assets to secure any Obligations.

Ordinary Course of Business: the ordinary course of business of any Borrower or Subsidiary, consistent with past practices and undertaken in good faith.

Organic Documents: with respect to any Person, its charter, certificate or articles of incorporation, bylaws, articles of organization, limited liability agreement, operating agreement, members agreement, shareholders agreement, partnership agreement, certificate of partnership, certificate of formation, voting trust agreement, or similar agreement or instrument governing the formation or operation of such Person.

OSHA: the Occupational Safety and Hazard Act of 1970.

Other Agreement: each LC Document, fee letter, Lien Waiver, No Offset Letter, Borrowing Base Certificate, Compliance Certificate, Borrower Materials, or other note, document, instrument or agreement (other than this Agreement or a Security Document) now or hereafter delivered by an Obligor or other Person to Agent or a Lender in connection with any transactions relating hereto.

Other Connection Taxes: with respect to any Recipient, Taxes imposed as a result of a present or former connection between such Recipient and the jurisdiction imposing such Tax (other than connections arising from such Recipient having executed, delivered, become a party to, performed its obligations under, received payments under, received or perfected a security

20

interest under, engaged in any other transaction pursuant to or enforced any Loan Document, or sold or assigned an interest in any Loan or Loan Document).

Other Taxes: all present or future stamp, court, documentary, excise, property, intangible, recording, filing or similar Taxes that arise from any payment made under, from the execution, delivery, performance, enforcement or registration of, from the receipt or perfection of a security interest under, or otherwise with respect to, any Loan Document.

Overadvance: as defined in Section 2.1.5.

Overadvance Loan: a Base Rate Loan made when an Overadvance exists or is caused by the funding thereof.

Participant: as defined in Section 13.2.

Patent Security Agreement: each patent security agreement pursuant to which an Obligor grants (or purports to grant) to Agent, for the benefit of Secured Parties, a Lien on and security interest in such Obligor’s interests in its patents and patent applications, as security for the Obligations.

Patriot Act: the Uniting and Strengthening America by Providing Appropriate Tools Required to Intercept and Obstruct Terrorism Act of 2001, Pub. L. No. 107-56, 115 Stat. 272 (2001).

Payment Item: each check, draft or other item of payment payable to a Borrower, including those constituting proceeds of any Collateral.

PBGC: the Pension Benefit Guaranty Corporation.

Pension Plan: any employee pension benefit plan (as defined in Section 3(2) of ERISA), other than a Multiemployer Plan, that is subject to Title IV of ERISA and is sponsored or maintained by any Obligor or ERISA Affiliate or to which the Obligor or ERISA Affiliate contributes or has an obligation to contribute, or in the case of a multiple employer or other plan described in Section 4064(a) of ERISA, has made contributions at any time during the preceding five plan years.

Permitted Acquisition: any Acquisition by a Borrower which is consented to by Agent and Required Lenders or where:

(i) the business, division or operating units acquired are for use, or the Person acquired is engaged, in the businesses engaged in by such Borrower on such date;

(ii) immediately before and after giving effect to such Acquisition, no Default or Event of Default shall exist;

(iii) the Specified Transaction Conditions shall have been satisfied in connection therewith;

21

(iv) in the case of the Acquisition of any Person, the board of directors or similar governing body of such Person has approved such Acquisition and such Person shall not have announced that it will oppose such Acquisition or shall not have commenced any action which alleges that such Acquisition will violate any Applicable Law;

(v) reasonably prior to such Acquisition, Agent shall have received complete executed or conformed copies of each material document, instrument and agreement to be executed in connection with such Acquisition together with all lien search reports and lien release letters and other documents as Agent may require to evidence the termination of Liens (other than Permitted Liens of the type described in clauses (d) and (i) of Section 10.2.2) on the assets or business to be acquired;

(vi) not less than fifteen (15) days prior to such Acquisition, Agent shall have (x) received an acquisition summary with respect to the Person and/or business or division to be acquired, such summary to include a reasonably detailed description thereof (including financial information) and operating results (including financial statements for the most recent twelve (12) month period for which they are available and as otherwise available), the terms and conditions, including economic terms, of the proposed Acquisition, and (y) received and approved the Borrower Agent’s certification (including calculations thereof in reasonable detail) of the Loan Parties’ compliance on a Pro Forma Basis with the requirements set forth in clauses (iii) and (iv) above (which certification shall be recertified as of the closing date of such Acquisition);

(vii) consents have been obtained in favor of Agent and Lenders to the collateral assignment of rights and indemnities under the related acquisition documents or the related acquisition documents shall contain the right of the purchaser to collaterally assign the rights and indemnities thereunder to a third party, and, in either case, such rights and indemnities shall have been assigned to Agent and Lenders and all consents related thereto shall have been obtained;

(viii) opinions of counsel for the Loan Parties and (if delivered to the Loan Party) the selling party allowing reliance thereon by Agent and Lenders have been delivered;

(ix) if such Acquisition is of the Equity Interests of a Person (including via merger or consolidation), such Person (and the surviving Person in such merger or amalgamation) shall be organized under the laws of Canada or any province or territory thereof or the laws of the United States or any state or district hereof, such Acquisition shall be of one hundred percent (100%) of the outstanding Equity Interests of such Person (other than director’s qualifying shares) and such Person (and any Wholly-Owned Subsidiary of such Borrower through which such Acquisition was effected) shall constitute a Subsidiary of such Borrower and the provisions of Section 10.1.9 shall have been fully satisfied with respect to all such Persons and its Subsidiaries or such newly-formed Subsidiaries and, in each case, their Property concurrently with or prior to such Acquisition;

(x) if the assets acquired in such Acquisition are intended to be included in the Borrowing Base, prior to such Acquisition, (1) Agent and the Lenders shall have been provided with such information as they shall reasonably request to complete their evaluation of any such Collateral and (2) the Asset Review and Approval Conditions shall have been satisfied; and

22

(xi) prior to consummating such Acquisition, all actions shall have been taken to ensure that Agent has a perfected and continuing first priority security interest in and Lien on all assets that are the subject of such Acquisition.

Permitted AmeriQuest Remarketing Debt: Debt of AmeriQuest Remarketing, whether now existing or hereafter incurred, to finance or refinance vehicle acquisitions, leases and remarketing transactions in the ordinary course of business, provided that such Debt, when combined with all outstanding Permitted Cure Leasing Debt, shall not exceed $40,000,000, in the aggregate at any time.

Permitted Asset Disposition: as long as no Default or Event of Default exists and all Net Proceeds are remitted to Agent, an Asset Disposition that is (a) a sale of Inventory in the Ordinary Course of Business; (b) a disposition of Equipment that, in the aggregate during any 12 month period, has a fair market or book value (whichever is more) of $500,000 or less; (c) a disposition of Inventory that is obsolete, unmerchantable or otherwise unsalable in the Ordinary Course of Business; (d) termination of a lease of real or personal Property that is not necessary for the Ordinary Course of Business, could not reasonably be expected to have a Material Adverse Effect and does not result from an Obligor’s default; (e) leases and sales of vehicles by Cure Leasing and AmeriQuest Remarketing in the ordinary course of business or (f) approved in writing by Agent and Required Lenders.

Permitted Contingent Obligations: Contingent Obligations (a) arising from endorsements of Payment Items for collection or deposit in the Ordinary Course of Business; (b) arising from Hedging Agreements permitted hereunder; (c) existing on the Closing Date, and any extension or renewal thereof that does not increase the amount of such Contingent Obligation when extended or renewed; (d) incurred in the Ordinary Course of Business with respect to surety, appeal or performance bonds, or other similar obligations; (e) arising from customary indemnification obligations in favor of purchasers in connection with dispositions of Equipment permitted hereunder; (f) arising under the Loan Documents; (g) in an aggregate amount of $500,000 or less at any time; (h) arising from the Company’s guaranty of the obligations of Corcentric to the Dealer/Distributors under the Pinnacle Program; or (i) arising from the Company’s guaranty of Permitted Cure Leasing Debt and/or Permitted AmeriQuest Remarketing Debt not to exceed $30,000,000, in the aggregate at any time.

Permitted Cure Leasing Debt: Debt of Cure Leasing, whether now existing or hereafter incurred, to finance or refinance vehicle acquisitions, leases and remarketing transactions in the ordinary course of business, provided that such Debt, when combined with all outstanding Permitted AmeriQuest Remarketing Debt, shall not exceed $40,000,000, in the aggregate at any time.

Permitted Discretion: a determination made in the exercise, in good faith, of reasonable business judgment (from the perspective of a secured, asset-based lender).

Permitted Lien: as defined in Section 10.2.2.

23

Permitted Purchase Money Debt: Purchase Money Debt of Borrowers and Subsidiaries that is unsecured or secured only by a Purchase Money Lien, as long as the aggregate amount does not exceed $1,000,000 at any time.

Person: any individual, corporation, limited liability company, partnership, joint venture, association, trust, unincorporated organization, Governmental Authority or other entity.

Pinnacle Participant: a customer of Corcentric that has executed an Approved Pinnacle Participant Agreement and that has been approved for participation in the Pinnacle Program by DTNA.