QuickLinks -- Click here to rapidly navigate through this document

FERROGLOBE PLC

(a public limited company having its registered office at 5 Fleet Place, London, EC4M 7RD, United

Kingdom and incorporated in England and Wales with company number 9425113)

3 June 2019

Dear Shareholder

2019 Annual General Meeting of Shareholders of Ferroglobe Plc ("Ferroglobe" or the "Company")

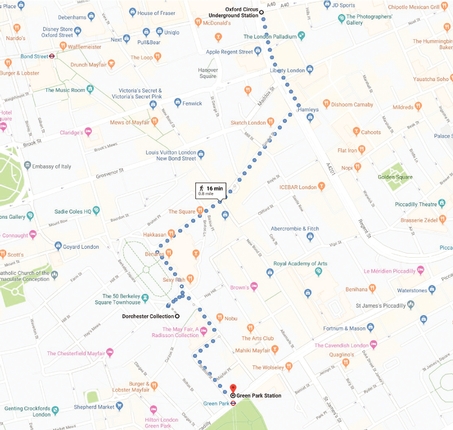

I am pleased to invite you to attend Ferroglobe's annual general meeting of its shareholders (the "Annual General Meeting" or "AGM"), to be held at 10:00 a.m. (British Summer Time) on Friday, 28 June 2019 at the Dorchester Collection Academy, Ground Floor, Lansdowne House, Berkeley Square, London, W1J 6ER, United Kingdom. The accompanying notice of Annual General Meeting describes the meeting, the resolutions you will be asked to consider and vote upon and related matters.

Your vote is important, regardless of the number of shares you own. Whether or not you intend to attend the Annual General Meeting, please vote as soon as possible to make sure that your shares are represented. You may vote via the internet, by phone or by mail by signing, dating and returning your proxy card in the envelope provided.

Recommendation

We consider all resolutions proposed to shareholders at the Annual General Meeting to be standard business. You will find an explanation of each resolution within the Explanatory Notes on pages 3 to 7 of this pack. The Company's board of directors (the "Board") considers that all the resolutions to be put to the Annual General Meeting are in the best interests of the Company and its shareholders as a whole and are most likely to promote the success of the Company. The Board unanimously recommends that you vote in favour of each of the proposed resolutions, as the members of the Board intend to do in respect of their beneficial holdings.

Thank you for your continued support of Ferroglobe.

Yours sincerely,

Javier López Madrid

Executive Chairman

FERROGLOBE PLC

(a public limited company having its registered office at 5 Fleet Place, London, EC4M 7RD, United

Kingdom and incorporated in England and Wales with company number 9425113)

NOTICE OF 2019 ANNUAL GENERAL MEETING OF SHAREHOLDERS

To the holders of ordinary shares of Ferroglobe Plc ("Ferroglobe" or the "Company"):

Notice is hereby given that Ferroglobe's Annual General Meeting of shareholders will be held on Friday, 28 June 2019 at 10:00 a.m. (British Summer Time), at the Dorchester Collection Academy, Ground Floor, Lansdowne House, Berkeley Square, London, W1J 6ER, United Kingdom ("U.K.").

The business of the Annual General Meeting will be to consider and, if thought fit, pass the resolutions below. All resolutions will be proposed as ordinary resolutions. Explanations of the resolutions are given in the explanatory notes on pages 3 to 7 of this Annual General Meeting notice and additional information for those entitled to attend the Annual General Meeting can be found on pages 8 to 11. All resolutions will be put to vote on a poll, where each shareholder has one vote for each share held.

Certain of the resolutions that shareholders of the Company will be asked to consider may not be familiar to them because, unlike many companies with shares traded on the NASDAQ Global Select Market ("NASDAQ"), the Company is incorporated under the laws of England and Wales and is therefore subject to the U.K. Companies Act 2006 (the "Companies Act"). The Companies Act obliges the Company to propose certain matters to shareholders for approval that would generally not be subject to periodic approval by shareholders of companies incorporated in the United States but would be considered routine items for approval by shareholders of companies incorporated in England and Wales.

ORDINARY RESOLUTIONS:

U.K. annual report and accounts 2018

- 1.

- THAT the directors' and auditor's reports and the accounts of the Company for the financial year ended 31 December 2018 (the "U.K. Annual Report and Accounts") be received.

Directors' Remuneration

- 2.

- THAT the directors' remuneration policy (the "Remuneration Policy"), as set out on pages 25 to 38 of the U.K. Annual Report and Accounts be approved.

1

- 3.

- THAT the directors' annual report on remuneration for the year ended 31 December 2018 (excluding the Remuneration Policy), as set out on pages 23 and 24 and 39 to 53 of the U.K. Annual Report and Accounts be approved.

Directors' re-election

- 4.

- THAT Javier López Madrid be re-elected as a director.

- 5.

- THAT José María Alapont be re-elected as a director.

- 6.

- THAT Donald G. Barger, Jr. be re-elected as a director.

- 7.

- THAT Bruce L. Crockett be re-elected as a director.

- 8.

- THAT Stuart E. Eizenstat be re-elected as a director.

- 9.

- THAT Manuel Garrido y Ruano be re-elected as a director.

- 10.

- THAT Greger Hamilton be re-elected as a director.

- 11.

- THAT Pedro Larrea Paguaga be re-elected as a director.

- 12.

- THAT Juan Villar-Mir de Fuentes be re-elected as a director.

Appointment of Auditor

- 13.

- THAT Deloitte LLP be appointed as auditor of the Company to hold office from the conclusion of the Annual General Meeting until the conclusion of the next general meeting at which accounts are laid before the Company.

Remuneration of auditor

- 14.

- THAT the Audit Committee of the Board be authorised to determine the auditor's remuneration.

Dorcas Murray

Company Secretary

3 June 2019

2

Explanatory notes to the resolutions

Resolution 1 (U.K. Annual Report and Accounts 2018)

The Board is required to present at the Annual General Meeting the U.K. Annual Report and Accounts for the financial year ended 31 December 2018, including the Directors' Report, the Auditor's Report on the U.K. Annual Report and Accounts and those parts of the Directors' Remuneration Report which have been audited.

Resolution 1 is an advisory vote and in accordance with its obligations under English law, the Company will provide shareholders at the Annual General Meeting with the opportunity to receive the U.K. Annual Report and Accounts and ask any relevant and appropriate questions of the Board and/or any representative of Deloitte LLP in attendance at the Annual General Meeting.

Resolutions 2 and 3 (directors' remuneration)

These resolutions deal with the remuneration of the directors and seek approval of the Remuneration Policy and of the remuneration of the Directors during the year under review.

Resolution 2 is a binding vote to approve the Company's proposed Remuneration Policy. Under English law, a company's directors' remuneration policy must be put to its shareholders for approval at least once every three years. The Company's current directors' remuneration policy was last approved by shareholders in 2016 and was subject to extensive review by the Company's Compensation Committee in 2018. As a result of this review, a new Remuneration Policy, largely unchanged from that approved in 2016, is now put to the shareholders for approval. If approved, it will take effect from immediately following the conclusion of the Annual General Meeting. There is more information on the Remuneration Policy, including on the minor changes it proposes to the policy approved in 2016, on pages 25 to 38 of the UK Annual Report and Accounts.

Resolution 3 is an advisory vote to approve the directors' annual remuneration report for the year ended December 31, 2018. The directors' remuneration report is set out on pages 23 and 24 and 39 to 53 of the U.K. Annual Report and Accounts. It provides information on the remuneration of the directors for 2018 and that proposed for 2019; it includes a statement by the Chairman of the Compensation Committee but excludes the Remuneration Policy proposed for approval in resolution 2.

Resolutions 4 to 12 (directors seeking re-election)

In line with best practice in corporate governance, all our directors retire annually and, if agreed with them that they will continue in office, they offer themselves for re-election by the shareholders.

The biographies of the directors standing for re-election at the Annual General Meeting are set out below to enable shareholders to make an informed decision on their re-election. The biographies give the date of appointment of each director to the Board or Committees of Ferroglobe, as appropriate. Several of our directors have also held roles at Grupo FerroAtlántica S.A.U. ("FerroAtlántica") or Globe Speciality Metals, Inc. ("Globe"). On 23 December 2015 FerroAtlántica merged with Globe through corporate transactions (the "Business Combination") to form the Ferroglobe group of companies under Ferroglobe's ownership.

3

Javier López Madrid has been Executive Chairman of the Company since 31 December 2016 and Chairman of our Nominations Committee since 1 January 2018. He was first appointed to the Board on 5 February 2015 and was the Company's Executive Vice-Chairman from 23 December 2015 until 31 December 2016.

He has been Chief Executive Officer of Grupo Villar Mir S.A.U., our principal shareholder, since 2008, is a member of the World Economic Forum, Group of Fifty and a member of the board of several non profit organizations. He is the founder and largest shareholder of Financiera Siacapital and founded Tressis, Spain's largest independent private bank.

Mr. López Madrid holds a Master in Law and Business from ICADE University.

José María Alapont was appointed to our Board as a Non-Executive Director on 24 January 2018 and to our Audit and Compensation Committees on 16 May 2018. Mr. Alapont was appointed on 16 January 2019 as our Senior Independent Director and Chairman of our Corporate Governance Committee.

Mr. Alapont holds a number of other board appointments. He has been a member of the board of directors of Ashok Leyland and of its investment and technology committee since 2017 and a member of its nomination and remuneration committee since 2018. Mr Alapont has also been a board director of Navistar Inc. and a member of its finance committee since 2016 and Chair of its nomination and governance committee since 2018. He has been a member of the board of directors of Hinduja Investments and Project Services Ltd since 2016 and of Hinduja Automotive Ltd since 2014.

Mr. Alapont was formerly President and Chief Executive Officer of Federal-Mogul Corporation, the automotive powertrain and safety components supplier, from March 2005 to 2012, Chairman of its board from 2005 to 2007 and board director from 2005 to 2013. Prior to that, he was Chief Executive and a board director of Fiat Iveco, S.p.A., a leading global manufacturer of commercial trucks, buses, defence and other specialized vehicles from 2003 to 2005. Prior to 2003, he held executive, vice presidential and presidential positions for more than 30 years at other leading global vehicle manufacturers and suppliers, such as Ford Motor Company, Delphi Corporation and Valeo S.A. His non-executive experience includes being member of the board of directors of the Manitowoc Company Inc. from 2016 to 2018 and a board director of Mentor Graphics Corp. from 2011 to 2012. He was a member of the Davos World Economic Forum from 2000 to 2011.

Mr. Alapont holds an Industrial Engineering degree from the Technical School of Valencia and a Philology degree from the University of Valencia in Spain.

Donald G. Barger, Jr, was appointed to our Board as a Non-Executive Director on 23 December 2015. He has served as the Chairman of our Compensation Committee and a member of our Nominations Committee since 1 January 2018. From 23 December 2015 to 31 December 2017, he was the Chair of our Nominating and Corporate Governance Committee and a member of our Compensation Committee.

Mr Barger was a member of the board of directors of Globe from December 2008 until the closing of the Business Combination and Chairman of Globe's audit and compensation committees. He had a successful 36-year business career in manufacturing and services companies, including as Vice President and Chief Financial Officer of YRC Worldwide Inc. (formerly Yellow Roadway Corporation)

4

from 2000 to 2007 and as advisor to the CEO from 2007 until his retirement in 2008. He was Vice President and Chief Financial Officer of Hillenbrand Industries, a provider of services and products for the health care and funeral services industries, from 1998 to 2000. He was Vice President of Finance and Chief Financial Officer of Worthington Industries, Inc., a diversified steel processor, from 1993 to 1998 and a member of the board of directors of Gardner Denver, Inc. and a member of its audit committee for his entire 19-year tenure until the company's sale in July 2013, serving as chair of the audit committee for 17 of those years. He served on the board of directors of Quanex Building Products Corporation for sixteen years, retiring in February 2012. He served on its audit committee for 14 years and was its Chair for most of that time.

Mr. Barger has a Bachelor of Science degree from the U.S. Naval Academy and an MBA from the University of Pennsylvania.

Bruce L. Crockett was appointed to our Board as a Non-Executive Director on 23 December 2015. He has been a member of our Audit Committee from that date and has served on our Compensation Committee since 1 January 2018.

Mr. Crockett holds a number of other board and governance roles. He has been Chairman of the Invesco Mutual Funds Group board of directors and a member of its audit, investment and governance committees, serving on the board since 1991, as Chair since 2003 and on the board of predecessor companies from 1978. Since 2013, he has been a member of the board of directors and, since 2014, Chair of the audit committee of ALPS Property & Casualty Insurance Company. He has been Chairman of, and a private investor in, Crockett Technologies Associates since 1996. He is a life trustee of the University of Rochester.

Mr. Crockett was a member of the board of directors of Globe from April 2014 until the closing of the Business Combination, as well as a member of Globe's audit committee. He was formerly President and Chief Executive Officer of COMSAT Corporation from 1992 until 1996 and its President and Chief Operating Officer from 1991 to 1992, holding a number of other operational and financial positions at COMSAT from 1980, including that of Vice President and Chief Financial Officer. He was a member of the board of directors of Ace Limited from 1995 until 2012 and of Captaris, Inc. from 2001 until its acquisition in 2008 and its Chairman from 2003 to 2008.

Mr. Crockett holds an A.B. degree from the University of Rochester, B.S. degree from the University of Maryland, an MBA from Columbia University and an Honorary Doctor of Law degree from the University of Maryland.

Stuart E. Eizenstat was appointed to our Board as a Non-Executive Director on 23 December 2015. He has been a member of the Company's Corporate Governance Committee since 1 January 2018 and was appointed to our Nominations Committee on 16 May 2018.

Mr. Eizenstat is Senior Counsel at Covington & Burling LLP in Washington, D.C. and has co-headed its international practice since 2001. He has served as a member of the advisory boards of GML Ltd. since 2003 and of the Office of Cherifien de Phosphates since 2010. He was a trustee of BlackRock Funds from 2001 until 2018.

Mr. Eizenstat was a member of board of directors of Globe from 2008 until the closing of the Business Combination and Chair of its nominating committee. He was a member of the board of directors of

5

Alcatel-Lucent from 2008 to 2016 and of United Parcel Service from 2005 to 2015. He has had an illustrious political, legal and advisory career, including serving as Special Adviser to Secretary of State, Hillary Clinton, and Secretary of State, John Kerry, on Holocaust-Era Issues from 2009 to 2017 and Special Representative of the President and Secretary of State on Holocaust Issues during the Clinton administration from 1993 to 2001. He was Deputy Secretary of the United States Department of the Treasury from July 1999 to January 2001, Under Secretary of State for Economic, Business and Agricultural Affairs from 1997 to 1999, Under Secretary of Commerce for International Trade from 1996 to 1997, U.S. Ambassador to the European Union from 1993 to 1996 and Chief Domestic Policy Advisor in the White House to President Carter from 1977 to 1981. He is the author of "Imperfect Justice: Looted Assets, Slave Labor, and the Unfinished Business of World War II"; "The Future of the Jews: How Global Forces are Impacting the Jewish People, Israel, and its Relationship with the United States" and "President Carter: The White House Years". He has published articles on economic, trade, and foreign policy issues for a wide-range of publications, including among many others, The New York Times, Washington Post, Financial Times, Foreign Affairs Magazine, Foreign Policy Magazine, The Hill and Politico.

Mr. Eizenstat holds a B.A. in Political Science, cum laude and Phi Beta Kappa, from the University of North Carolina at Chapel Hill, a J.D. from Harvard Law School and nine honorary doctorate degrees and awards from the United States, French, German, Austrian, Belgian and Israeli governments.

Manuel Garrido y Ruano was appointed to our Board as a Non-Executive Director on 30 May 2017. He was a member of our Nominating and Corporate Governance Committee from 30 May 2017 until 31 December 2017, when he was appointed to our Corporate Governance Committee.

Mr. Garrido y Ruano has been Chief Financial Officer of Grupo Villar Mir S.A.U. since 2003 and a member of the board or on the steering committee of a number of its subsidiaries in the energy, financial, construction and real estate sectors. He is Professor of Communication and Leadership of the Graduate Management Program at CUNEF in Spain. Mr. Garrido y Ruano was a member of the steering committee of FerroAtlántica until 2015, having previously served as its Chief Financial Officer from 1996 to 2003. He worked with McKinsey & Company from 1991 to 1996, specializing in restructuring, business development and turnaround and cost efficiency projects globally.

Mr. Garrido y Ruano holds a Masters in Civil Engineering with honors from the Universidad Politecnica de Madrid and an MBA from INSEAD.

Greger Hamilton was appointed to our Board as a Non-Executive Director on 23 December 2015. He was a member of our Compensation Committee from that date until 31 December 2017. He has been Chairman of our Audit Committee since 23 December 2015 and a member of our Corporate Governance Committee since 1 January 2018.

Mr. Hamilton has been Managing Partner of Ovington Financial Partners Ltd since 2009. He is cofounder of the BrainHealth Club and has been a member of its board of directors since 2016. From 2009 to 2014, Mr. Hamilton was a partner at European Resolution Capital Partners, where he assisted in the restructuring of international banks in 16 countries and managing director at Goldman Sachs International from 1997 to 2008. He began his career at McKinsey and Company, where he worked from 1990 to 1997.

Mr. Hamilton holds a B.A. in Business Economics and International Commerce from Brown University.

6

Pedro Larrea Paguaga has been Chief Executive Officer of the Company since 23 December 2015 and a member of our Board of Directors since 28 June 2017.

Mr. Larrea was Chairman of FerroAtlántica from 2012 to 2015, and Chief Executive Officer of FerroAtlántica from 2011 to 2015. From 1996 to 2009, he held various executive roles at Endesa, the biggest power company in Spain and Latin America, including as Chairman and CEO of Endesa Latinoamérica. He was a board director of Enersis from 2007 to 2009 and of Endesa Chile from 1999 to 2002 and from 2006 to 2007, both being Chilean companies listed on the NYSE. In 2010 and 2011, he held management consulting roles with PwC, where he led the energy sector practice in Spain, and from 1989 to 1995 he worked for McKinsey & Company in Spain, Latin America and the United States.

Mr. Larrea holds a Mining Engineering degree (MSc equivalent) from Universidad Politécnica de Madrid, from where he graduated with honors and an MBA from INSEAD, where he was awarded the Henry Ford II award for academic excellence.

Juan Villar-Mir de Fuentes was appointed to our Board as a Non-Executive Director on 23 December 2015.

Mr. Villar-Mir de Fuentes has been Vice Chairman of Inmobiliaria Espacio, S.A since 1996 and Vice Chairman of Grupo Villar Mir, S.A.U. since 1999. He has been a member of the board of directors of Obrascon Huarte Lain, S.A. since 1996, a member of the audit committee and, later, its compensation committee and its Chairman since 2016. He was a board director and member of the compensation committee of Inmobiliaria Colonial, S.A from June 2014 to May 2017. He also was a member of the board of directors and of the compensation committee of Abertis Infraestructuras, S.A. between 2013 and 2016.

Mr. Villar-Mir de Fuentes is Patron and member of the Patronage Council of Fundación Nantik Lum and Fundación Princesa de Gerona

Mr. Villar-Mir holds a Bachelor's Degree in Business Administration and Economics and Business Management.

Resolution 13 (appointment of auditor)

At each general meeting at which accounts are laid before the shareholders, the Company is required to appoint an auditor to serve until the next such meeting. Deloitte LLP has served as the Company's U.K. statutory auditor since 3 February 2016.

If this resolution does not receive the affirmative vote of a majority of the shares entitled to vote and present in person or represented by proxy at the Annual General Meeting, the Board may appoint an auditor to fill the vacancy.

Resolution 14 (remuneration of auditor)

Under the Companies Act, the remuneration of the Company's U.K. statutory auditor must be fixed in a general meeting or in such manner as may be determined in a general meeting. The Company asks its shareholders to authorise the Audit Committee to determine the remuneration of Deloitte LLP in its capacity as the Company's U.K. statutory auditor under the Companies Act.

7

Further notes:

- 1.

- Some of the resolutions are items that are required to be approved by shareholders periodically under the Companies Act and generally do not have an analogous requirement under United States laws and regulations. As such, while these resolutions may be familiar and routine to shareholders accustomed to being shareholders of companies incorporated in England and Wales, other shareholders may be less familiar with these routine resolutions and should review and consider each resolution carefully.

- 2.

- In accordance with the Articles, all resolutions will be taken on a poll. Voting on a poll will mean that each Ordinary Share represented in person or by proxy will be counted in the vote.

- 3.

- All resolutions will be proposed as ordinary resolutions, which means that such resolutions must be passed by a simple majority of the total voting rights of shareholders who vote on such resolutions, whether in person or by proxy. The results of the shareholders' vote on resolutions 1 and 3 regarding receipt of the U.K. Annual Report and Accounts and approval of the Directors' Remuneration Report will not require the Board or any Committee thereof to take (or refrain from taking) any action. The Board values the opinion of shareholders as expressed through such resolutions and will carefully consider the outcome of the votes on resolutions 1 and 3.

- 4.

- "Shareholders of record" are those persons registered in the register of members of the Company in respect of Ordinary Shares at 10:00 a.m. (British Summer Time) on 3 May 2019. If, however, Ordinary Shares are held for you in a stock brokerage account or by a broker, bank or other nominee, you are considered the "beneficial owner" of those Ordinary Shares.

- 5.

- Beneficial owners of Ordinary Shares as at 10:00 a.m. (British Summer Time) on 3 May 2019 have the right to direct their broker or other agent on how to vote the Ordinary Shares in their account and are also invited to attend the Annual General Meeting. However, as beneficial owners are not Shareholders of record of the relevant Ordinary Shares, they may not vote their Ordinary Shares at the Annual General Meeting unless they request and obtain a legal proxy from their broker or agent.

- 6.

- Any Shareholder of record attending the Annual General Meeting has the right to ask questions. The Company must cause to be answered any questions put by a Shareholder of record attending the meeting relating to the business being dealt with at the Annual General Meeting unless to do so would interfere unduly with the business of the meeting, be undesirable in the interests of the Company or the good order of the meeting, involve the disclosure of confidential information or if the information has already been given on the Company's website.

- 7.

- In accordance with the provisions of the Companies Act, and in accordance with the Articles, a Shareholder of record who is entitled to attend and vote at the Annual General Meeting is entitled to appoint another person as his or her proxy to exercise all or any of his or her rights to attend and to speak and vote at the Annual General Meeting and to appoint more than one proxy in relation to the Annual General Meeting (provided that each proxy is appointed to exercise the rights attached to different Ordinary Shares). Such proxies need not be Shareholders of record, but must attend the Annual General Meeting and vote as the

8

Shareholder of record instructs. Further details regarding the process to appoint a proxy, voting and the deadlines therefor are set out in the "Voting Process and Revocation of Proxies" section below.

- 8.

- Pursuant to section 527 of the Companies Act 2006, shareholders meeting the threshold requirements set out in that section have the right to require the Company to publish on a website a statement setting out any matter relating to:

- (a)

- the audit of the Company's accounts (including the auditor's report and the conduct of the audit) that are to be laid before the AGM; or

- (b)

- any circumstance connected with an auditor of the Company ceasing to hold office since the previous meeting at which annual accounts and reports were laid in accordance with section 437 of the Companies Act 2006.

The Company may not require the shareholders requesting any such website publication to pay its expenses in complying with sections 527 or 528 of the Companies Act 2006. Where the Company is required to place a statement on a website under section 527 of the Companies Act 2006, it must forward the statement to the Company's auditor no later than the time when it makes the statement available on the website. The business which may be dealt with at the AGM includes any statement that the Company has been required under section 527 of the Companies Act 2006 to publish on a website.

- 9.

- The results of the polls taken on the resolutions at the Annual General Meeting and any other information required by the Companies Act will be made available on the Company's website as soon as reasonably practicable following the AGM and for a period of two years thereafter.

- 10.

- A copy of this Annual General Meeting notice can be found at the Company's website, www.ferroglobe.com.

- 11.

- Recipients of this notice and the accompanying materials may not use any electronic address provided in this notice or such materials to communicate with the Company for any purposes other than those expressly stated.

- 12.

- To be admitted to the Annual General Meeting, please bring the Admission Ticket that you will have received through the post. You will need to be able to provide your photo identification at the registration desk.

- 13.

- On arrival at the Annual General Meeting venue, all those entitled to vote will be required to register and collect a poll card. In order to facilitate these arrangements, please arrive at the Annual General Meeting venue in good time. You will be given instructions on how to complete your poll card at the Annual General Meeting.

9

VOTING PROCESS AND REVOCATION OF PROXIES

If you are a Shareholder of record, there are three ways to vote by proxy:

- •

- By Internet – You can vote over the Internet at www.envisionreports.com/FGLO by following the instructions at such web address. You will need to enter your control number, which is a 15-digit number located in a box on your proxy card. We encourage you to vote by Internet even if you received this Annual General Meeting notice in the mail.

- •

- By Telephone – You may vote and submit your proxy by calling toll-free 1-800-652-8683 in the United States and providing your control number, which is a 15-digit number located in a box on your proxy card.

- •

- By Mail – If you received this Annual General Meeting notice by mail or if you requested paper copies of the Annual General Meeting notice, you can vote by mail by marking, dating, signing and returning the proxy card in the postage-paid envelope.

Telephone and Internet voting facilities for Shareholders of record will be available 24 hours a day and will close at 10:01 a.m. (British Summer Time) on Wednesday, 26 June 2019. Submitting your proxy by any of these methods will not affect your ability to attend the Annual General Meeting in-person and vote at the Annual General Meeting.

If your shares are held in "street name", meaning you are a beneficial owner with your shares held through a bank or brokerage firm, you will receive instructions from your bank or brokerage firm, which is the Shareholder of record of your shares. You must follow the instructions of the Shareholder of record in order for your shares to be voted. Telephone and Internet voting may also be offered to shareholders owning shares through certain banks and brokers, according to their individual policies.

The Company has retained Computershare to receive and tabulate the proxies.

If you submit proxy voting instructions and direct how your shares will be voted, the individuals named as proxies must vote your shares in the manner you indicate.

A shareholder who has given a proxy may revoke it at any time before it is exercised at the Annual General Meeting by:

- •

- attending the Annual General Meeting and voting in person;

- •

- voting again by Internet or Telephone (only the last vote cast by each Shareholder of record will be counted), provided that the shareholder does so before 10:01 a.m. (British Summer Time) on Wednesday, 26 June 2019.

- •

- delivering a written notice, at the address given below, bearing a date later than that indicated on the proxy card or the date you voted by Internet or Telephone, but prior to the date of the Annual General Meeting, stating that the proxy is revoked; or

- •

- signing and delivering a subsequently dated proxy card prior to the vote at the Annual General Meeting.

10

You should send any written notice or new proxy card to Proxy Services, c/o Computershare Investor Services, PO Box 30202 College Station, TX 77842-9909, USA.

If you are a registered shareholder you may request a new proxy card by calling Computershare at 1-866-490-6057 if calling from the United States, or +1-781-575-2780 from outside the United States, or you may also send a request via email toweb.queries@computershare.com.

ANY SHAREHOLDER OWNING SHARES IN STREET NAME MAY CHANGE OR REVOKE PREVIOUSLY GIVEN VOTING INSTRUCTIONS BY CONTACTING THE BANK OR BROKERAGE FIRM HOLDING THE SHARES OR BY OBTAINING A LEGAL PROXY FROM SUCH BANK OR BROKERAGE FIRM AND VOTING IN PERSON AT THE ANNUAL GENERAL MEETING. YOUR LAST VOTE, PRIOR TO OR AT THE ANNUAL GENERAL MEETING, IS THE VOTE THAT WILL BE COUNTED.

Location of Annual General Meeting:

DOCUMENTS AVAILABLE FOR INSPECTION

Forms of appointment of the non-executive directors, as well as a memorandum setting out the terms of the executive director's contracts, will be available for inspection at the Company's registered office during normal business hours and at the place of the Annual General Meeting from at least 15 minutes prior to the start of the meeting until the end of the Annual General Meeting.

By order of the Board,

Dorcas Murray

Company Secretary

3 June 2019

11

Location of Annual General Meeting