| ● | refuse to approve a pending BLA or comparable foreign marketing application, or any supplements thereto, submitted by us or our collaboration partners; |

| ● | restrict the marketing or manufacturing of the product; |

| ● | seize or detain the product or otherwise require the withdrawal of the product from the market; |

| ● | refuse to permit the import or export of products; or |

| ● | refuse to allow us to enter into supply contracts, including government contracts. |

Any government investigation of alleged violations of law could require us to expend significant time and resources in response and could generate negative publicity. The occurrence of any event or penalty described above may inhibit our ability to commercialize our product candidates and adversely affect our business, financial condition, results of operations and prospects.

In addition, FDA policies, and those of equivalent foreign regulatory agencies, may change and additional government regulations may be enacted that could prevent, limit or delay regulatory approval of our product candidates. We cannot predict the likelihood, nature or extent of government regulation that may arise from future legislation or administrative action, either in the United States or abroad. If we are slow or unable to adapt to changes in existing requirements or the adoption of new requirements or policies, or if we are not able to maintain regulatory compliance, we may lose any marketing approval that we may have obtained and we may not achieve or sustain profitability, which would harm our business, financial condition, results of operations and prospects.

We face significant competition in an environment of rapid technological change and the possibility that our competitors may achieve regulatory approval before us or develop therapies that are more advanced or effective than ours, which may harm our business and financial condition, and our ability to successfully market or commercialize our product candidates.

The biopharmaceutical industry is characterized by intense and dynamic competition to develop new technologies and proprietary therapies. Any product candidates that we successfully develop into products and commercialize may compete with existing therapies and new therapies that may become available in the future. While we believe that our gene therapy platform, product programs, product candidates and scientific expertise in the fields of gene therapy and neuroscience provide us with competitive advantages, we face potential competition from various sources, including larger and better-funded pharmaceutical, specialty pharmaceutical and biotechnology companies, as well as from academic institutions, governmental agencies and public and private research institutions.

We are aware of several companies focused on developing AAV gene therapies in various indications, including AAVANTIBio, Inc., Abeona Therapeutics, Inc., Adverum Biotechnologies, Inc., Aevitas Therapeutics, Inc., Apic Bio, Inc., Applied Genetic Technologies Corporation, Asklepios BioPharmaceutical, Inc., Audentes Therapeutics, Inc., AveXis, Inc. (acquired by Novartis AG in 2018), or AveXis, Axovant Sciences Ltd., or Axovant, Biogen, Inc., or Biogen, Brain Neurotherapy Bio, Inc., GenSight Biologics SA, Homology Medicines, Inc., LogicBio Therapeutics, Inc., Lysogene SA, MeiraGTx Ltd., or MeiraGTx, Neurogene, Inc., Passage Bio, Inc., Pfizer, Inc., Prevail Therapeutics, Inc., PTC Therapeutics, Inc., REGENXBio Inc., Sarepta Therapeutics, Inc., Solid Biosciences, Inc., Spark Therapeutics, Inc. (acquired by F. Hoffmann-La Roche Ltd., or Roche, in 2019), or Spark, StrideBio, Inc., and uniQure NV, or uniQure, as well as several companies addressing other methods for modifying genes and regulating gene expression. Any advances in gene therapy technology made by a competitor may be used to develop therapies that could compete against any of our product candidates.

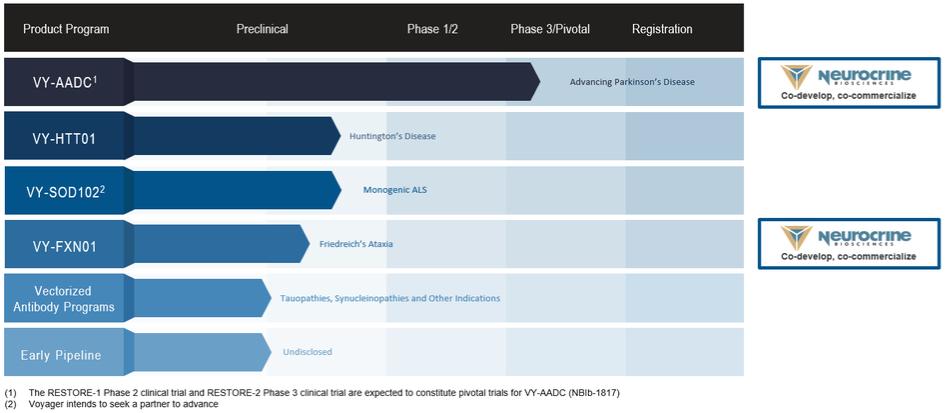

We expect that VY-AADC (NBIb-1817) will compete with a variety of therapies currently marketed and in development for Parkinson’s disease, including DBS marketed by Medtronic plc, Abbott Laboratories (acquired from St. Jude Medical in 2017), and other medical device companies, DUOPA/Duodopa marketed by AbbVie, as well as other novel, non-oral forms of levodopa in development, including Mitsubishi Tanabe Pharma’s ND0612 (acquired from