UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | |

| ☐ | | Preliminary Proxy Statement |

| |

| ☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| |

| ☒ | | Definitive Proxy Statement |

| |

| ☐ | | Definitive Additional Materials |

| |

| ☐ | | Soliciting Material Pursuant to § 240.14a-12 |

AMPLIFY SNACK BRANDS, INC.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| | | | |

| |

| ☒ | | No fee required. |

| |

| ☐ | | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

| | (1) | | Title of each class of securities to which transaction applies: |

| | (2) | | Aggregate number of securities to which transaction applies: |

| | (3) | | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| | (4) | | Proposed maximum aggregate value of transaction: |

| | (5) | | Total fee paid: |

| |

| ☐ | | Fee paid previously with preliminary materials. |

| |

| ☐ | | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| | |

| | (1) | | Amount Previously Paid: |

| | (2) | | Form, Schedule or Registration Statement No.: |

| | (3) | | Filing Party: |

| | (4) | | Date Filed: |

500 West 5th Street, Suite 1350

Austin, Texas 78701

Dear Amplify Snack Brands Stockholder:

I am pleased to invite you to attend the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) of Amplify Snack Brands, Inc. (“Amplify Snack Brands”) to be held on Thursday, May 11, 2017 at 8:00 a.m. Central Time at the JW Marriott Austin located at 110 E 2nd Street, Austin, Texas 78701.

Details regarding the meeting and the business to be conducted are more fully described in the accompanying Notice of 2017 Annual Meeting of Stockholders and Proxy Statement.

Thank you for your ongoing support of and continued interest in Amplify Snack Brands. We look forward to seeing you at our Annual Meeting.

Sincerely,

Thomas Ennis

Chief Executive Officer

YOUR VOTE IS IMPORTANT

On or about March 31, 2017, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”) containing instructions on how to access our proxy statement for our 2017 Annual Meeting of Stockholders (the “Proxy Statement”) and our 2016 Annual Report to Shareholders (“2016 Annual Report”). The Notice provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of proxy materials by mail. This Proxy Statement and our 2016 Annual Report can be accessed directly at the Internet address http://www.astproxyportal.com/ast/20266 using the control number located on your proxy card.

In order to ensure your representation at the meeting, whether or not you plan to attend the meeting, please vote your shares as promptly as possible. Your participation will help to ensure the presence of a quorum at the meeting and save Amplify Snack Brands the extra expense associated with additional solicitation. If you hold your shares through a broker, your broker is not permitted to vote on your behalf in the election of directors unless you provide specific instructions to the broker by completing and returning any voting instruction form that the broker provides (or following any instructions that allow you to vote your broker-held shares via telephone or the Internet). For your vote to be counted, you will need to communicate your voting decision before the date of the Annual Meeting. Voting your shares in advance will not prevent you from attending the Annual Meeting, revoking your earlier submitted proxy or voting your stock in person.

500 West 5th Street, Suite 1350

Austin, Texas 78701

NOTICE OF 2017 ANNUAL MEETING OF STOCKHOLDERS

Notice is hereby given that Amplify Snack Brands, Inc. will hold its 2017 Annual Meeting of Stockholders (the “Annual Meeting”) on Thursday, May 11, 2017 at 8:00 a.m. Central Time at the JW Marriott Austin located at 110 E 2nd Street, Austin, Texas 78701for the following purposes:

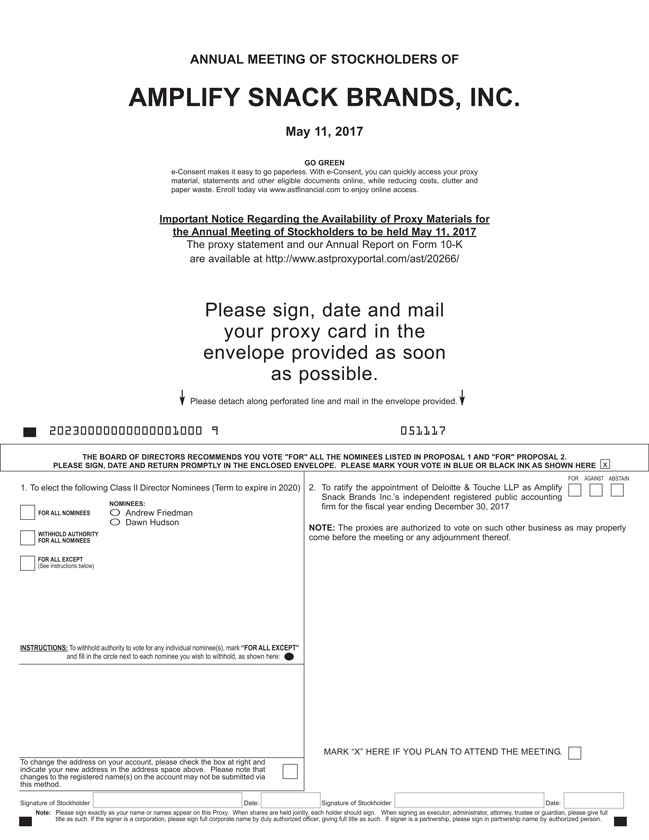

| | • | | To elect two Class II directors, Andrew Friedman and Dawn Hudson to hold office until the 2020 annual meeting of stockholders or until their successors are duly elected and qualified, subject to their earlier resignation or removal; |

| | • | | To ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 30, 2017; and |

| | • | | To transact any other business that properly comes before the Annual Meeting (including adjournments, continuations and postponements thereof). |

On or about March 31, 2017, we expect to mail to our stockholders a Notice of Internet Availability of Proxy Materials (the “Notice”), containing instructions on how to access our proxy statement for our 2017 Annual Meeting of Stockholders (the “Proxy Statement”) and our 2016 Annual Report to Shareholders (“2016 Annual Report”). The Notice provides instructions on how to vote online or by telephone and includes instructions on how to receive a paper copy of proxy materials by mail. This Proxy Statement and our 2016 Annual Report can be accessed directly at the Internet address http://www.astproxyportal.com/ast/20266 using the control number located on your proxy card.

Only stockholders of record at the close of business on March 15, 2017 (the “Record Date”) are entitled to notice of and to vote at the Annual Meeting as set forth in the Proxy Statement. If you plan to attend the Annual Meeting in person, you should be prepared to present photo identification such as a valid driver’s license and verification of stock ownership for admittance. You are entitled to attend the Annual Meeting only if you were a stockholder as of the close of business on the Record Date or hold a valid proxy for the Annual Meeting. If you are a stockholder of record, your ownership as of the Record Date will be verified prior to admittance into the meeting. If you are not a stockholder of record but hold shares through a broker, trustee or nominee, you must provide proof of beneficial ownership as of the Record Date, such as an account statement or similar evidence of ownership. Please allow ample time for the admittance process.

If you have any questions regarding this information or the proxy materials, please contact our investor relations department at http://investors.amplifysnackbrands.com.

By Order of the Board of Directors,

Thomas Ennis

Chief Executive Officer

Austin, Texas

March 31, 2017

AMPLIFY SNACK BRANDS, INC.

2017 ANNUAL MEETING OF STOCKHOLDERS

PROXY STATEMENT

TABLE OF CONTENTS

i

500 West 5th Street, Suite 1350

Austin, Texas 78701

PROXY STATEMENT

FOR THE 2017 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD MAY 11, 2017

GENERAL INFORMATION

Our Board of Directors (the “Board”) solicits your proxy on our behalf for the 2017 Annual Meeting of Stockholders (the “Annual Meeting”) and at any adjournment, continuation or postponement of the Annual Meeting for the purposes set forth in this proxy statement for our 2017 Annual Meeting of Stockholders (the “Proxy Statement”) and the accompanying Notice of 2017 Annual Meeting of Stockholders. The Annual Meeting will be held at 8:00 a.m. Central Time on Thursday, May 11, 2017 at the JW Marriott Austin located at 110 E 2nd Street, Austin, Texas 78701. On or about March 31, 2017, we mailed our stockholders a Notice of Internet Availability of Proxy Materials containing instructions on how to access our Proxy Statement and our 2016 Annual Report to Shareholders (“2016 Annual Report”).

In this Proxy Statement the terms “Amplify Snack Brands,” “the company,” “we,” “us,” and “our” refer to Amplify Snack Brands, Inc. and its subsidiaries. The mailing address of our principal executive offices is Amplify Snack Brands, Inc., 500 West 5th Street, Suite 1350, Austin, Texas 78701.

| | | | |

| Record Date | | March 15, 2017. |

| |

| Quorum | | A majority of the shares of all issued and outstanding stock entitled to vote on the Record Date must be present in person or represented by proxy to constitute a quorum. |

| |

| Shares Outstanding | | 76,770,629 shares of common stock outstanding as of March 15, 2017. |

| |

| Voting | | There are four ways a stockholder of record can vote: |

| | |

| | (1) | | by Internet at http://www.voteproxy.com 24 hours a day, seven days a week, until 11:59 p.m. Eastern Time on May 10, 2017 (have your proxy card in hand when you visit the website); |

| | |

| | | | We encourage you to vote this way as it is the most cost-effective method; |

| | |

| | (2) | | by toll-free telephone at 1-800-PROXIES (1-800-776-9437) or 1-718-921-8500 from outside the United States, until 11:59 p.m. Eastern Time on May 10, 2017 (have your proxy card in hand when you call); |

| | |

| | (3) | | by completing and mailing your proxy card; or |

| | |

| | (4) | | by written ballot at the Annual Meeting. |

| |

| | To be counted, proxies submitted by telephone or Internet must be received by 11:59 p.m. Eastern Time on May 10, 2017. Proxies submitted by U.S. mail must be received before the start of the Annual Meeting. |

| | | | |

| | |

| | | | If you hold your shares through a bank or broker, please follow their instructions. |

| | |

| Revoking Your Proxy | | | | Stockholders of record may revoke their proxies by attending the Annual Meeting and voting in person, by filing an instrument in writing revoking the proxy or by filing another duly executed proxy bearing a later date with our Secretary before the vote is counted or by voting again using the telephone or Internet before the cutoff time (your latest telephone or Internet proxy is the one that will be counted). If you hold shares through a bank or broker, you may revoke any prior voting instructions by contacting that firm. |

| | |

| Votes Required to Adopt Proposals | | | | Each share of our common stock outstanding on the Record Date is entitled to one vote on any proposal presented at the Annual Meeting: For Proposal One, the election of directors, the two nominees receiving the greatest number of votes will be elected as directors. For Proposal Two, a majority of the votes properly cast is required to ratify the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 30, 2017. |

| | |

| Effect of Abstentions and Broker Non-Votes | | | | Votes withheld from any nominee, abstentions and “broker nonvotes” (i.e., where a broker has not received voting instructions from the beneficial owner and for which the broker does not have discretionary power to vote on a particular matter) are counted as present for purposes of determining the presence of a quorum. Shares voting “withheld” have no effect on the election of directors. Abstentions have no effect on the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm for the fiscal year ending December 30, 2017. Under the rules that govern brokers holding shares for their customers, brokers who do not receive voting instructions from their customers have the discretion to vote uninstructed shares on routine matters, but do not have discretion to vote such uninstructed shares on non-routine matters. Only Proposal Two, the ratification of the appointment of Deloitte & Touche LLP, is considered a routine matter where brokers are permitted to vote shares held by them without instruction. If your shares are held through a broker, those shares will not be voted in the election of directors unless you affirmatively provide the broker instructions on how to vote. Proposal One is not considered a routine matter and brokers are not permitted to vote shares held by them and broker nonvotes will have no effect. |

| | |

| Voting Instructions | | | | If you complete and submit your proxy voting instructions, the persons named as proxies will follow your instructions. If you submit proxy voting instructions but do not direct how your shares should be voted on each item, the persons named as proxies will vote “FOR” the election of the nominees for director and “FOR” the ratification of the appointment of Deloitte & Touche LLP as our independent registered public accounting firm. The persons named as proxies will vote on any other matters properly presented at the Annual Meeting in accordance with their best judgment, although we have not received timely notice of any other matters that may be properly presented for voting at the Annual Meeting. |

| | |

| Voting Results | | | | We will announce preliminary results at the Annual Meeting. We will report final results by filing a Form 8-K within four business days after the Annual Meeting. If final results are not available at that time, we will provide preliminary voting results in the Form 8-K and will provide the final results in an amendment to the Form 8-K as soon as they become available. |

2

| | | | |

| | |

| Notice of Internet Availability of Proxy Materials | | | | In accordance with the rules of the Securities and Exchange Commission (the “SEC”), we have elected to furnish our proxy materials, including this Proxy Statement and our 2016 Annual Report, primarily via the Internet. On or about March 31, 2017, we mailed to our stockholders a “Notice of Internet Availability of Proxy Materials” (the “Notice”) that contains instructions on how to access our proxy materials on the Internet, how to vote at the meeting, and how to request printed copies of the proxy materials and 2016 Annual Report. Stockholders may request to receive all future proxy materials in printed form by mail or electronically by e-mail by following the instructions contained in the Notice. We encourage stockholders to take advantage of the availability of the proxy materials on the Internet to help reduce the environmental impact of our annual meetings. |

| | |

| Householding | | | | We have adopted a procedure approved by the SEC called “householding.” Under this procedure, stockholders of record who have the same address and last name and receive hard copies of the Annual Meeting materials will receive only one copy of the Notice, Proxy Statement and 2016 Annual Report, unless we are notified that one or more of these stockholders wishes to receive individual copies. If you and other stockholders living in your household do not have the same last name, you may also request to receive only one copy of future proxy materials. Householding conserves natural resources and reduces our printing and mailing costs. Stockholders who participate in householding will continue to receive separate proxy cards. If you are eligible for householding, but you and other stockholders of record with whom you share an address currently receive multiple copies of our proxy materials, or if you hold Amplify Snack Brands stock in more than one account, and in either case you wish to receive only a single copy of each document for your household, please contact our investor relations department via e-mail at investor@amplifysnackbrands.com, via postal mail at Broadridge Financial Solutions, Inc., ATN: House Holding Department, 51 Mercedes Way, Edgewood, New York 11717, or by telephone at 866-540-7095. Alternatively, if you participate in householding and wish to receive separate copies of our proxy materials or prefer to discontinue your participation in householding, please contact our investor relations department as indicated above, and separate copies of each document will be sent to you promptly. If you are a beneficial owner, you can request information about householding from your broker, bank or other holder of record. |

| | |

| Additional Solicitation/Costs | | | | We are paying for the distribution of the proxy materials and solicitation of the proxies. As part of this process, we reimburse brokerage houses and other custodians, nominees and fiduciaries for their reasonable out-of-pocket expenses for forwarding proxy and solicitation materials to our stockholders. Proxy solicitation expenses that we will pay include those for preparation, mailing, returning and tabulating the Notice and proxies. Our directors, officers and employees may also solicit proxies on our behalf in person, by telephone, email or facsimile, but they do not receive additional compensation for providing those services. |

| | |

| Emerging Growth Company | | | | As a company with less than $1.0 billion in revenue during our last fiscal year, we qualify as an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012, or the JOBS Act. An emerging growth company may take advantage of specified reduced reporting requirements that are otherwise applicable generally to public companies. These provisions include: |

3

| | | | |

| | |

| | (1) | | an exemption from compliance with the auditor attestation requirement on the effectiveness of our internal control over financial reporting; |

| | |

| | (2) | | an exemption from compliance with any requirement that the Public Company Accounting Oversight Board may adopt regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements; |

| | |

| | (3) | | reduced disclosure about our executive compensation arrangements; and |

| | |

| | (4) | | exemptions from the requirements to obtain a non-binding advisory vote on executive compensation or a stockholder approval of any golden parachute arrangements. |

| |

| | We will remain an emerging growth company until the earliest to occur of: the last day of the fiscal year in which we have more than $1.0 billion in annual revenue; the end of the fiscal year in which the market value of our common stock that is held by non-affiliates exceeds $700 million as of the end of the second quarter of that fiscal year; the issuance, in any three-year period, by us of more than $1.0 billion in non-convertible debt securities; and the last day of the fiscal year ending after the fifth anniversary of our initial public offering. We may choose to take advantage of some, but not all, of the available benefits under the JOBS Act. We have chosen to irrevocably “opt out” of the extended transition periods available under the JOBS Act for complying with new or revised accounting standards, but we intend to take advantage of certain of the other exemptions discussed above. Accordingly, the information contained herein may be different than the information you receive from other public companies in which you hold stock. |

4

PROPOSAL ONE:

ELECTION OF DIRECTORS

Number of Directors; Board Structure

Our Board is divided into three staggered classes of directors. One class is elected each year at the annual meeting of stockholders for a term of three years. The term of the Class II directors expires at the Annual Meeting. The term of the Class III directors expires at the 2018 annual meeting and the term of the Class I directors expires at the 2019 annual meeting. After the initial terms expire, directors are expected to be elected to hold office for a three-year term or until the election and qualification of their successors in office.

Nominees

Our Board has nominated Andrew Friedman and Dawn Hudson for election as Class II directors to hold office until the 2020 annual meeting of stockholders or until their successors are duly elected and qualified, subject to their earlier resignation or removal. Each of the nominees is a current member of our Board and has consented to serve if elected.

Unless you direct otherwise through your proxy voting instructions, the persons named as proxies will vote all proxies received “FOR” the election of each nominee. If any nominee is unable or unwilling to serve at the time of the Annual Meeting, the persons named as proxies may vote for a substitute nominee chosen by the present Board. In the alternative, the proxies may vote only for the remaining nominees, leaving a vacancy on the Board. The Board may fill such vacancy at a later date or reduce the size of the Board. We have no reason to believe that any of the nominees will be unwilling or unable to serve if elected as a director.

Recommendation of the Board

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” THE ELECTION OF EACH OF THE NOMINEES.

The biographies of each of the nominees, continuing directors and executive officers below contain information regarding each such person’s service as a director, business experience, director positions held currently or at any time during the last five years and the experiences, qualifications, attributes or skills that caused our Board to determine that the person should serve as a director of the company. In addition to the information presented below regarding each nominee’s and continuing director’s specific experience, qualifications, attributes and skills that led the Board to the conclusion that he or she should serve as a director, we also believe that each of our directors has a reputation for integrity, honesty and adherence to high ethical standards. Each of our directors has demonstrated business acumen and an ability to exercise sound judgment, as well as a commitment of service to our company and our Board. Finally, we value our directors’ experience in relevant areas of business management and on other boards of directors and board committees.

Our corporate governance guidelines also dictate that a majority of the Board be comprised of independent directors whom the Board has determined have no material relationship with the company and who are otherwise “independent” directors under the published listing requirements of the New York Stock Exchange (the “NYSE”).

5

Executive Officers and Directors

The following table sets forth information regarding our directors and executive officers, including their ages, as of February 28, 2017:

| | | | |

Name | | Age | | Position |

Executive Officers: | | | | |

Thomas C. Ennis | | 50 | | Chief Executive Officer, President and Director |

Brian Goldberg | | 43 | | Chief Financial Officer, Treasurer and Secretary |

David Milner | | 54 | | International President, Executive Vice President |

Jason Shiver | | 44 | | North America President, Executive Vice President* |

| | |

Non-Employee Directors: | | | | |

Jeffrey S. Barber(2)(3) | | 44 | | Chairman of the Board |

William David Christ II(3) | | 37 | | Director |

Chris Elshaw(1)(2)(3) | | 56 | | Director |

John K. Haley(1)(3) | | 65 | | Director |

Dawn Hudson(1)(2)(3) | | 59 | | Director |

| | |

Founders and Directors: | | | | |

Andrew S. Friedman | | 48 | | Director |

Pamela L. Netzky | | 42 | | Director |

| (1) | Member of our audit committee. |

| (2) | Member of our compensation committee. |

| (3) | Member of our nominating and corporate governance committee. |

| * | Mr. Shiver will transition into an executive advisory role at Amplify, effective beginning April 1, 2017. |

Information Concerning Nominees for Election for a Three-Year Term Ending at the 2020 Annual Meeting

Dawn Hudson. Ms. Hudson has served on our Board since October 2014. Since September 2014, Ms. Hudson has been the Chief Marketing Officer of the National Football League, a professional sports league. From March 2009 to September 2014, Ms. Hudson was a Vice-Chairman at The Parthenon Group, a global boutique consulting firm, serving as head of its consumer practice. Between 2002 and 2007, Ms. Hudson held several roles at Pepsi-Cola North America, a multi-national beverage company and division of PepsiCo, Inc., including President and Chief Executive Officer of Pepsi-Cola North America and PepsiCo Food Service from 2005 to 2007. Ms. Hudson also served as Executive Vice President of Sales and Marketing at Frito-Lay North America, Inc., an international snack food company, from 1996 to 1998. Ms. Hudson currently serves as a member of the board of directors, audit committee, and compensation committee of Nvidia Corp., a visual computing company; and as a member of the board of directors and compensation committee of Interpublic Group of Companies, Inc., a marketing solutions company. Ms. Hudson served on the board of directors of Lowes Companies, Inc., a retail home improvement company from 2001 to May 2015. Ms. Hudson served on the board of directors of Allergan Inc., a pharmaceutical company from May 2008 to March 2014; served on the board of directors of PF Chang’s China Bistro, Inc. a restaurant chain from 2010 to 2012; and served as Chairman of the board of directors of the Ladies Professional Golf Association, a professional golfing organization, from 2008 to 2010. Ms. Hudson holds a Bachelor of Arts from Dartmouth College.

Ms. Hudson was selected to serve on our Board because of her extensive experience as a current and former director of many companies, including public companies, her experience as a chief executive officer and her knowledge of the snack food industry.

Andrew S. Friedman. Mr. Friedman is our founder and has served on our Board since July 2014. From July 2014 to December 2015, Mr. Friedman also served as our Senior Advisor. From August 2010 to July 2014, Mr. Friedman served as the Chief Executive Officer of SkinnyPop Popcorn LLC, the predecessor to our Company, (“SkinnyPop”). From 2008 to 2010, Mr. Friedman co-founded and served as Chief Executive Officer of Wells Street Popcorn, LLC, a retail popcorn company. Mr. Friedman holds a Bachelor of Arts in Organizational Management from the University of Michigan and a Master of Business Administration with a major in Finance from The Wharton School of the University of Pennsylvania.

Mr. Friedman was selected to serve on our Board because of his experience and perspective as our founder and former Chief Executive Officer of the predecessor to our Company.

6

Information Concerning Directors Continuing in Office Until the 2018 Annual Meeting

Thomas C. Ennis. Mr. Ennis has served as our Chief Executive Officer, President, and has been a member of our Board since July 2014. From June 2009 to July 2014, Mr. Ennis served as the President and Chief Executive Officer of Oberto Sausage Co., Inc., a company manufacturing meat snacks, doing business as Oberto Brands. From August 2007 to June 2009, Mr. Ennis served as the Vice President of Marketing at Oberto Brands. From 2005 to 2007, Mr. Ennis served as the Vice President of Marketing at Maggiano’s, a Brinker International, Inc. national restaurant chain. From 2003 to 2005, Mr. Ennis was Marketing Director at The Dial Corporation, a personal care and household cleaning product company. From July 1996 to August 1997 and from April 1998 to 2003, Mr. Ennis served in various brand management roles at Unilever United States, Inc. From August 1997 to April 1998, Mr. Ennis worked at Nestle S.A., a food and beverage company. From 2012 to 2014, Mr. Ennis served as a member of the board of directors of Toosum Healthy Foods LLC, a private company manufacturing BFY, all-natural snack bars. Mr. Ennis holds a Bachelor of Arts in History and minor in English from Fordham University and a Master of Business Administration with a concentration in marketing from the University of Texas at Austin.

Mr. Ennis was selected to serve on our Board because of his previous experience as Chief Executive Officer of a major snack food company and his deep experience and knowledge of the snack food industry.

Jeffrey S. Barber. Mr. Barber has served as a member of our Board since July 2014, and chairman of the Board since April 2015. Mr. Barber joined TA Associates, a leading growth private equity firm, in 2001 and has served as a Managing Director since 2007. Currently, Mr. Barber co-heads TA Associates’ North American Consumer and Healthcare Group and serves or has served on the boards of several public and private companies including, Marc Anthony Cosmetics, Inc., a haircare and bodycare company, since 2016; Paula’s Choice, LLC, a health and wellness company, since 2016; Truck Hero, Inc., a vehicle products company, since 2014; the Los Angeles Film School, since 2011; Vatterott College, an educational services company, since 2009; Full Sail University, from 2011 to 2017; Cath Kidston Ltd, a fashion company, from 2010 to 2015; Dymatize Enterprises LLC, a nutritional supplements company, from December 2010 to February 2014 and Tempur Sealy International, Inc., a publicly-traded mattress company, from 2002 to 2009. Mr. Barber also serves as a Trustee of The Johns Hopkins University, The Buckingham, Brown and Nichols School and the US Lacrosse Foundation. Mr. Barber holds a Bachelor of Arts from Johns Hopkins University and a Masters of Business Administration from Columbia School of Business.

Mr. Barber was selected to serve on our Board because of his experience as a seasoned investor, a current and former director of many companies, including a public company, and his financial expertise.

John K. Haley. Mr. Haley has served on our Board since April 2015. Mr. Haley currently serves as a member of the board of directors, a member of the compensation committee and chair of the audit committee at GGP, Inc., a publicly-traded real estate investment trust, and a member of the board of directors at Truck Hero, Inc., a vehicle products company. Mr. Haley also acts as a consultant, assisting with financial due diligence for private equity firms. From October 2010 to February 2014, Mr. Haley served as a member of the board of directors and chair of the audit committee at Body Central, Corp., a fashion apparel and accessories retailer. From November 2010 to September 2012, Mr. Haley served as a member of the board of directors at JW Childs Acquisition Corporation, a special purpose acquisition company. From 1978 to 2009, Mr. Haley held various positions, including Partner, at Ernst & Young LLP. Mr. Haley has a Bachelor of Science in Business Administration with a concentration in Accounting from Northeastern University.

Mr. Haley was selected to serve on our Board because of his experience as a current and former director of many companies and his accounting expertise including significant experience in SEC registrations, restructurings, special investigations, forensic investigations, and public company requirements which allow him to provide key contributions to the Board on financial, accounting and corporate governance.

7

Information Concerning Directors Continuing in Office Until the 2019 Annual Meeting

William David Christ II. Mr. Christ has served as a member of our Board since July 2014. Mr. Christ joined TA Associates in 2003, where he now serves as a Director, and is primarily focused on investments in the consumer products, retail and restaurant industries. Mr. Christ currently serves or has served on the boards of several private companies including PepperJax Development, Inc. a restaurant chain, since 2016; Towne Park, LLC, a hospitality services company from December 2013 to December 2014; Dymatize Enterprises LLC, a nutritional supplements company, from December 2010 to February 2014; Vatterott College, an educational services company, from November 2009 to June 2014; and Microban International Ltd., a branded ingredient company, from October 2008 to December 2011. Mr. Christ holds a Bachelor of Science in Business Administration from Washington and Lee University and a Master of Business Administration from the Tuck School of Business at Dartmouth College.

Mr. Christ was selected to serve on our Board because of his experience as a current and former director of many companies and his financial expertise.

Chris Elshaw. Mr. Elshaw has served on our Board since May 2015. Mr. Elshaw has acted as a business advisor to private companies as well as assisting with due diligence for private equity firms since March 2014. Between July 2002 and February 2014, Mr. Elshaw held several roles at Revlon Inc. and its affiliates, a global cosmetics company, including serving as Executive Vice President and Chief Operating Officer from May 2009 to February 2014; serving as Revlon’s Executive Vice President and General Manager, U.S. Region, from October 2007 to April 2009; and holding other leadership roles within Revlon, including Senior Vice President and Managing Director, Europe, Middle East and Canada, from July 2002 to September 2007. Mr. Elshaw served as a board member of the Personal Care Products Council, a cosmetic and personal care products industry association, from November 2007 to February 2014 and also served as its Vice Chairman from February 2012 to February 2014. From 1996 to 2002, Mr. Elshaw held several senior general management positions at Bristol-Myers Squibb Company (Clairol Division), a global pharmaceuticals company with a consumer goods business, including serving as General Manager of the U.K. and Ireland division. Mr. Elshaw is a National Association of Corporate Directors Board Leadership Fellow.

Mr. Elshaw was selected to serve on our Board because of his experience serving in leadership roles at various public companies.

Pamela L. Netzky. Ms. Netzky is our founder and served on our Board since July 2014. From July 2014 to December 2015, Ms. Netzky also served as our Senior Advisor. From August 2010 to July 2014, Mr. Netzky also served as the President of SkinnyPop. From 2008 to 2010, Ms. Netzky co-founded and served as the Chief Operating Officer of Wells Street Popcorn, LLC, a retail popcorn company. Ms. Netzky holds a Bachelor of Arts in Communications from DePaul University.

Ms. Netzky was selected to serve on our Board because of her experience and perspective as our founder and former President of the predecessor to our Company.

Information Concerning Executive Officers

In addition to Mr. Thomas Ennis, our Chief Executive Officer who also serves as a director, our executive officers as of March 31, 2017 consisted of the following:

Brian Goldberg. Mr. Goldberg has served as our Chief Financial Officer, Secretary and Treasurer since September 2014. From January 2013 to September 2014, Mr. Goldberg served as the Chief Financial Officer at Enersciences Holdings, LLC, a company focused on developing technology solutions for the energy industry, and Mr. Goldberg continue to serve on its board of directors since 2016. From January 2012 until December 2012, Mr. Goldberg served as the Chief Financial Officer at Badlands Power Fuels, LLC, an environmental services provider. From 2005 to December 2011, Mr. Goldberg served as the Chief Financial Officer and Chief Operating Officer at Sweet Leaf Tea Company, a beverage company. After Sweet Leaf Tea Company was sold to Nestle S.A., Mr. Goldberg was retained by Nestle to manage the integration. From 2004 to 2005, Mr. Goldberg served as Vice President of New Capital Partners, a private equity firm. Mr. Goldberg also serves, and has served on the boards of several private companies, including Rumble Drinks, a company manufacturing pre-packaged shakes, since September 2013; Runa LLC, a beverage company, from October 2012 to September 2014; and Freed Foods, Inc., an organic baby foods company doing business as NurtureMe since June 2011. Mr. Goldberg holds a Bachelor of Science in Management with a major in accounting from Tulane University, a Master of Accountancy with an emphasis in taxation from the University of Georgia, and a Master of Business Administration from The Darden School at The University of Virginia.

David Milner.Mr. Milner has served as our International President, Executive Vice President since August 2016, in connection with the Company’s acquisition of Crisps Topco Limited, where he was Chief Executive Officer. Mr. Milner served as Chief Executive Officer of Crisps Topco Limited from March 2010 to August 2016. From September 2008 to September 2010, he served as Group Commercial Director for Baxters Food Group Ltd, a manufacturer of soup and other non-perishable foods. From June 2005 to August 2008, Mr. Milner served as Strategic Business Development Director for Young’s Seafood Ltd, a seafood production and distribution company. Mr. Milner holds a Bachelor of Arts in Law with Honors from Nottingham University.

8

Jason Shiver. Mr. Shiver has served as our North American President, Executive Vice President, from October 2016 to April 1, 2017. Effective April 1, 2017, and continuing through December 31, 2017, Mr. Shiver will serve in an executive advisory role. Mr. Shiver served as our Senior Vice President of Sales from July 2014 to October 2016. From May 2013 until July 2014, Mr. Shiver was employed by Precision Capital Group, LLC and served as Vice President of Sales at SkinnyPop. From April 2012 to December 2013, Mr. Shiver served as the General Manager and Senior Vice President of Sales for Rickland Orchards, LLC, a yogurt snack company. From February 2008 to March 2012, Mr. Shiver served as the Senior Vice President of Sales and Marketing at Glutino USA, Inc., a gluten-free snack food company, which was acquired by Boulder Brands, Inc., a diversified food company. From May 2003 to January 2008, Mr. Shiver held several roles at Atkins Nutritionals, Inc., the leader in low-carb foods and beverages, including Vice President of Sales. From September 2001 to May 2003, Mr. Shiver was a Southeast Regional Sales Manager at Acirca, Inc., an organic foods and beverages company. From August 2000 to September 2001, Mr. Shiver was a National Account Manager at Arizona Beverages USA LLC. Mr. Shiver holds a Bachelor of Science in Marketing from University of South Florida.

CORPORATE GOVERNANCE

Our Board, which is elected by our stockholders, is responsible for directing and overseeing our business and affairs. In carrying out its responsibilities, the Board selects and monitors our top management, provides oversight of our financial reporting processes and determines and implements our corporate governance policies. A copy of our corporate governance guidelines can be found on our website at http://investors.amplifysnackbrands.com.

Our Board and management are committed to good corporate governance to ensure that we are managed for the long-term benefit of our stockholders, and we have a variety of policies and procedures to promote such goals. To that end, during the past year, our management periodically reviewed our corporate governance policies and practices to ensure that they remain consistent with the requirements of the Sarbanes-Oxley Act of 2002 (the “Sarbanes-Oxley Act”), SEC rules and the listing standards of NYSE.

Besides verifying the independence of the members of our Board and committees (which is discussed in the section titled “Independence of the Board of Directors” below), at the direction of our Board, we also:

| | • | | Periodically review and make necessary changes to the charters for our audit, compensation and nominating and corporate governance committees; |

| | • | | Have established disclosures control policies and procedures in accordance with the requirements of the Sarbanes-Oxley Act and the rules and regulations of the SEC; |

| | • | | Have a procedure for receipt and treatment of anonymous and confidential complaints or concerns regarding audit or accounting matters in place; and |

| | • | | Have a code of business conduct and ethics that applies to our officers, directors and employees. |

In addition, we have adopted a set of corporate governance guidelines. The nominating and corporate governance committee is responsible for reviewing our corporate governance guidelines from time to time and reporting and making recommendations to the Board concerning corporate governance matters. Our corporate governance guidelines address such matters as:

| | • | | Director Independence—Independent directors must constitute at least a majority of our Board; |

| | • | | Monitoring Board Effectiveness—The Board must conduct an annual self-evaluation of the Board and its committees; |

| | • | | Board Access to Independent Advisors—Our Board as a whole, and each of its committees separately, have authority to retain independent experts, advisors or professionals as each deems necessary or appropriate; and |

9

| | • | | Board Committees—All members of the audit, compensation and nominating and corporate governance committees are independent in accordance with applicable SEC and NYSE criteria. |

Meetings of the Board of Directors

Our Board held sixteen meetings in fiscal year 2016. Each director attended at least 75% of all meetings of the Board and the committees on which they served that were held during fiscal year 2016. Under our corporate governance guidelines, directors are expected to spend the time needed and meet as frequently as our Board deems necessary or appropriate to discharge their responsibilities. Directors are also expected to make efforts to attend our annual meeting of stockholders, all meetings of the Board and all meetings of the committees on which they serve.

Code of Business Conduct and Ethics

Our Board has adopted a code of business conduct and ethics that applies to all of our employees, officers and directors, including our Chief Executive Officer, Chief Financial Officer, and other executive and senior financial officers. A copy of our code of business conduct and ethics is available on our Internet website at http://investors.amplifysnackbrands.com and may also be obtained without charge by contacting our Secretary at Amplify Snack Brands, Inc., 500 West 5th Street, Suite 1350, Austin, Texas 78701. We intend to disclose any amendments to our code of business conduct and ethics, or waivers of its requirements, on our website or in filings under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as required by the applicable rules and exchange requirements. During fiscal year 2016, no waivers were granted from any provision of the code of business conduct and ethics.

Independence of the Board of Directors

Our Board has undertaken a review of the independence of each director. Based on information provided by each director concerning his or her background, employment, and affiliations, our Board has determined that Ms. Hudson and Messrs. Christ, Barber, Elshaw and Haley do not have a relationship that would interfere with the exercise of independent judgment in carrying out the responsibilities of a director and that each of these directors is “independent” as that term is defined under the applicable rules and regulations of the SEC, and the listing standards of the NYSE. In making these determinations, our Board considered the current and prior relationships that each non-employee director has with our company and all other facts and circumstances our Board deemed relevant in determining their independence, including the beneficial ownership of our capital stock by each non-employee director, and the transactions involving them described in the section titled “Related Party Transactions.”

In our Company, the Chief Executive Officer and Chairman are not the same person. Mr. Barber serves as our Chairman, and as such may be deemed to be a lead independent director for purposes of NYSE regulations. Mr. Barber presides over periodic executive sessions of the independent directors.

Board’s Role in Risk Oversight

Our Board’s role in overseeing the management of our risks is conducted primarily through committees of our Board, as disclosed in the descriptions of each of the committees below and in the charters of each of the committees. Our full Board (or the appropriate board committee in the case of risks that are under the purview of a particular committee) discusses with management our major risk exposures, their potential impact on our company, and the steps we take to manage them. When a board committee is responsible for evaluating and overseeing the management of a particular risk or risks, the chairperson of the relevant committee reports on the discussion to the full Board during the committee reports portion of the next Board meeting. This enables the Board and its committees to coordinate the risk oversight role, particularly with respect to risk interrelationships.

Risks Related to Compensation Policies and Practices

As part of its oversight function, our Board, and our compensation committee in particular, along with our management team, considers potential risks when reviewing and approving various compensation plans, including executive compensation. Based on this review, our Board has concluded that such compensation plans, including executive compensation, do not encourage risk taking to a degree that is reasonably likely to have a materially adverse impact on us or our operations.

10

Board Leadership Structure

We believe that the structure of our Board and its committees provides strong overall management of our company. Our Chairman of our Board and our Chief Executive Officer roles are separate. This structure enables each person to focus on different aspects of company leadership. Our Chief Executive Officer is responsible for setting the strategic direction of our company, the general management and operation of the business and the guidance and oversight of senior management. The Chairman of our Board monitors the content, quality and timeliness of information sent to our Board and is available for consultation with our Board regarding the oversight of our business affairs.

We believe this structure of a separate Chairman of our Board and Chief Executive Officer, reinforces the independence of our Board as a whole and results in an effective balancing of responsibilities, experience and independent perspective that meets the current corporate governance needs and oversight responsibilities of our Board.

Committees of the Board of Directors

Our Board has established an audit committee, a compensation committee, and a nominating and corporate governance committee. The composition and responsibilities of each committee are described below. Members serve on these committees until their resignation or until otherwise determined by our Board. Each of the audit, compensation, and nominating and corporate governance committees operates pursuant to a separate written charter adopted by our Board that is available to stockholders on our Internet website at http://investors.amplifysnackbrands.com.

Audit Committee

Our audit committee consists of Ms. Hudson and Messrs. Elshaw, and Haley, with Mr. Haley serving as Chair. Our audit committee held twelve meetings during fiscal year 2016. Under the NYSE listing standards and applicable SEC rules, we are required to have three members of the audit committee. Subject to phase-in rules, the NYSE and Rule 10A-3 of the Exchange Act requires that the audit committee of a listed company be comprised solely of independent directors. Each of members named in this committee are independent. Each member of our audit committee meets the financial literacy requirements of the listing standards of the NYSE. Mr. Haley is an audit committee financial expert within the meaning of Item 407(d) of Regulation S-K under the 1933 Securities Act, as amended, (the “Securities Act”). Our audit committee, among other things:

| | • | | selects a qualified firm to serve as the independent registered public accounting firm to audit our consolidated financial statements; |

| | • | | helps to ensure the independence and performance of the independent registered public accounting firm; |

| | • | | discusses the scope and results of the audit with the independent registered public accounting firm, and reviews, with management and the independent registered public accounting firm, our interim and year-end results of operations; |

| | • | | develops procedures for employees to submit concerns anonymously about questionable accounting or audit matters; |

| | • | | reviews our policies on risk assessment and risk management; |

| | • | | reviews related party transactions; |

11

| | • | | obtains and reviews a report by our internal audit team at least annually, that describes our internal control procedures, any material issues with such procedures and any steps taken to deal with such issues; and |

| | • | | approves (or, as permitted, pre-approves) all audit and all permissible non-audit services to be performed by the independent registered public accounting firm. |

Our audit committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE.

Compensation Committee

Our compensation committee consists of Messrs. Barber, Elshaw, and Ms. Hudson, with Ms. Hudson serving as Chairperson. Our compensation committee held five meetings during fiscal year 2016. The composition of our compensation committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations. Each member of the compensation committee is also a non-employee director, as defined pursuant to Rule 16b-3 promulgated under the Exchange Act, and an outside director, as defined pursuant to Section 162(m) of the Code. The purpose of our compensation committee is to discharge the responsibilities of our Board relating to compensation of our executive officers. Our compensation committee, among other things:

| | • | | reviews, approves and determines, or make recommendations to our Board regarding, the compensation of our executive officers; |

| | • | | administers our stock and equity incentive plans, including approval of all equity grants; |

| | • | | reviews and approves and makes recommendations to our Board regarding incentive compensation and equity plans; and |

| | • | | establishes and reviews general policies relating to compensation and benefits of our employees. |

Our compensation committee operates under a written charter that satisfies the applicable rules of the SEC and the listing standards of the NYSE.

Nominating and Corporate Governance Committee

Our nominating and corporate governance committee consists of Messrs. Barber, Christ, Elshaw and Haley and Ms. Hudson, with Mr. Christ serving as Chairman. Our nominating and corporate governance committee held four meetings during fiscal year 2016. The composition of our nominating and corporate governance committee meets the requirements for independence under the listing standards of the NYSE and SEC rules and regulations. Our nominating and corporate governance committee, among other things:

| | • | | identifies, evaluates and selects, or makes recommendations to our Board regarding, nominees for election to our Board and its committees; |

| | • | | evaluates the performance of our Board and of individual directors; |

| | • | | considers and makes recommendations to our Board regarding the composition of our Board and its committees; |

| | • | | reviews developments in corporate governance practices; |

| | • | | evaluates the adequacy of our corporate governance practices and reporting; and |

| | • | | develops and makes recommendations to our Board regarding corporate governance guidelines and governance matters. |

12

The nominating and corporate governance committee operates under a written charter that satisfies the applicable listing requirements and rules of the NYSE.

Identifying and Evaluating Director Nominees

The Board has delegated to the nominating and corporate governance committee the responsibility of identifying suitable candidates for nomination to the Board (including candidates to fill any vacancies that may occur) and assessing their qualifications in light of the policies and principles in these corporate governance guidelines and the committee’s charter. The nominating and corporate governance committee may gather information about the candidates through interviews, detailed questionnaires, comprehensive background checks or any other means that the nominating and corporate governance committee deems to be appropriate in the evaluation process. The nominating and corporate governance committee then meets as a group to discuss and evaluate the qualities and skills of each candidate, both on an individual basis and taking into account the overall composition and needs of the Board. Based on the results of the evaluation process, the nominating and corporate governance committee recommends candidates for the Board’s approval as director nominees for election to the Board.

Minimum Qualifications

Our nominating and corporate governance committee uses a variety of methods for identifying and evaluating director nominees and will consider all facts and circumstances that it deems appropriate or advisable. In its identification and evaluation of director candidates, our nominating and corporate governance committee will consider the current size and composition of our Board and the needs of our Board and the respective committees of our Board. Some of the qualifications that our nominating and corporate governance committee considers include, without limitation, issues of character, ethics, integrity, judgment, diversity of experience, independence, skills, education, expertise, business acumen, length of service, understanding of our business and industry, potential conflicts of interest and other commitments. Nominees must also have proven achievement and competence in their field, the ability to offer advice and guidance to our management team, the ability to make significant contributions to our success, and an understanding of the fiduciary responsibilities that are required of a director. Director candidates must have sufficient time available in the judgment of our nominating and corporate governance committee to perform all board of director and committee responsibilities. Members of our Board are expected to prepare for, attend, and participate in all board of director and applicable committee meetings. Other than the foregoing, there are no stated minimum criteria for director nominees, although our nominating and corporate governance committee may also consider such other factors as it may deem, from time to time, are in our and our stockholders’ best interests.

Although our Board does not maintain a specific policy with respect to board diversity, our Board believes that our Board should be a diverse body, and our nominating and corporate governance committee considers a broad range of backgrounds and experiences. In making determinations regarding nominations of directors, our nominating and corporate governance committee may take into account the benefits of diverse viewpoints. Our nominating and corporate governance committee also considers these and other factors as it oversees the annual Board and committee evaluations. After completing its review and evaluation of director candidates, our nominating and corporate governance committee recommends to our full Board the director nominees for selection.

The Board does not believe that arbitrary limits on the number of consecutive terms a director may serve or on the directors’ ages are appropriate in light of the substantial benefits resulting from sustained focus on the Company’s business, strategy and industry over a significant period of time.

Stockholder Recommendations

Stockholders may submit recommendations for director candidates to the nominating and corporate governance committee by sending the individual’s name and qualifications to our Secretary at Amplify Snack Brands, Inc., 500 West 5th Street, Suite 1350, Austin, Texas 78701, who will forward all recommendations to the nominating and corporate governance committee. The nominating and corporate governance committee will evaluate any candidates recommended by stockholders against the same criteria and pursuant to the same policies and procedures applicable to the evaluation of candidates proposed by directors or management.

13

Stockholder Communications

The Board provides to every stockholder the ability to communicate with the Board as a whole, the non-employee directors as a group and with individual directors on the Board through an established process for stockholder communication. For a stockholder communication directed to the Board as a whole, stockholders and other interested parties may send such communication to our Secretary at secretary@amplifysnackbrands.com or via U.S. Mail or Expedited Delivery Service to: Amplify Snack Brands, Inc., 500 West 5th Street, Suite 1350, Austin, Texas 78701, Attn: Board of Directors c/o Secretary.

For a stockholder communication directed to an individual director in his or her capacity as a member of the Board, stockholders and other interested parties may send such communication to the attention of the individual director at secretary@amplifysnackbrands.com or via U.S. Mail or Expedited Delivery Service to: Amplify Snack Brands, Inc., 500 West 5th Street, Suite 1350, Austin, Texas 78701, Attn: [Name of Individual Director].

The Secretary shall review all incoming communications and forward such communications to the appropriate member(s) of the Board. The Secretary will generally not forward communications that are unrelated to the duties and responsibilities of the Board, including communications that the Secretary determines to be primarily commercial in nature, product complaints or inquires, and materials that are patently offensive or otherwise inappropriate.

Compensation Committee Interlocks and Insider Participation

During 2016, there were no compensation committee interlocks and no insider participation in compensation committee decisions that were required to be reported under the rules and regulations of the Exchange Act.

PROPOSAL TWO:

RATIFICATION OF THE APPOINTMENT OF

OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM

We have appointed Deloitte & Touche LLP as our independent registered public accounting firm to perform the audit of our consolidated financial statements for the fiscal year ending December 30, 2017, and we are asking you and other stockholders to ratify this appointment. During our fiscal year ended December 31, 2016, Deloitte & Touche LLP served as our independent registered public accounting firm.

The audit committee annually reviews the independent registered public accounting firm’s independence, including reviewing all relationships between the independent registered public accounting firm and us and any disclosed relationships or services that may impact the objectivity and independence of the independent registered public accounting firm, and the independent registered public accounting firm’s performance. As a matter of good corporate governance, the Board is submitting the appointment of Deloitte & Touche LLP to stockholders for ratification. A majority of the votes properly cast is required to ratify the appointment of Deloitte & Touche LLP. In the event that a majority of the votes properly cast do not ratify this appointment of Deloitte & Touche LLP, we will review our future appointment of Deloitte & Touche LLP.

We expect that a representative of Deloitte & Touche LLP will attend the Annual Meeting and the representative will have an opportunity to make a statement if he or she so chooses. The representative will also be available to respond to appropriate questions from stockholders.

Policy on Audit Committee Pre-Approval of Audit and Permissible Non-Audit Services of Independent Registered Public Accounting Firm

We have adopted a policy under which the audit committee must pre-approve all audit and permissible non-audit services to be provided by the independent registered public accounting firm. As part of its review, the audit committee also considers whether the categories of pre-approved services are consistent with the rules on accountant independence of the SEC and the Public Company Accounting Oversight Board. The audit committee pre-approved all services performed since the pre-approval policy was adopted. This policy is set forth in our audit committee’s charter, which is available at http://investors.amplifysnackbrands.com/govdocs.

14

Audit Fees

The following table sets forth the fees billed or expected to be billed by Deloitte & Touche LLP for audit, audit-related, tax and all other services rendered for 2015 and 2016 (in thousands):

| | | | | | | | |

Fee Category | | 2015 | | | 2016 | |

Audit Fees | | $ | 1,855 | | | $ | 1,144 | |

Audit-Related Fees | | | 18 | | | | 708 | |

Tax Fees | | | 205 | | | | 410 | |

All Other Fees | | | — | | | | — | |

| | | | | | | | |

Total Fees | | $ | 2,078 | | | $ | 2,262 | |

| | | | | | | | |

Audit Fees. Consist of professional services rendered in connection with the audit of our annual consolidated financial statements, including audited financial statements presented in our 2016 Annual Report and services that are normally provided by the independent registered public accountants in connection with statutory and regulatory filings or engagements for those fiscal years.

Audit-Related Fees.Consist of aggregate fees for accounting consultations and other services that were reasonably related to the performance of audits or reviews of our consolidated financial statements and were not reported above under “Audit Fees.” These services include accounting consultations concerning financial accounting and reporting standards.

Tax Fees. Consist of aggregate fees for tax compliance, tax advice and tax planning services including the review and preparation of our federal and state income tax returns.

All Other Fees. Consist of aggregate fees billed for products and services provided by the independent registered public accounting firm other than those disclosed above, which include subscription fees paid for access to online accounting research software applications and data.

Recommendation of the Board

THE BOARD RECOMMENDS THAT YOU VOTE “FOR” RATIFICATION OF THE APPOINTMENT OF DELOITTE & TOUCHE LLP AS OUR INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR THE FISCAL YEAR ENDING DECEMBER 30, 2017.

Report of the Audit Committee of the Board of Directors

The information contained in this audit committee report shall not be deemed to be (1) “soliciting material,” (2) “filed” with the SEC, (3) subject to Regulations 14A or 14C of the Exchange Act, or (4) subject to the liabilities of Section 18 of the Exchange Act. No portion of this audit committee report shall be deemed to be incorporated by reference into any filing under the Securities Act, or the Exchange Act, through any general statement incorporating by reference in its entirety the proxy statement in which this report appears, except to the extent that Amplify Snack Brands specifically incorporates this report or a portion of it by reference. In addition, this report shall not be deemed filed under either the Securities Act or the Exchange Act.

This report is submitted by the audit committee of the Board. The audit committee consists of the three directors whose names appear below. None of the members of the audit committee is an officer or employee of Amplify Snack Brands, and the Board has determined that each of Messrs. Elshaw and Haley and Ms. Hudson are “independent” for audit committee purposes as that term is defined under Rule 10A-3 of the Exchange Act and the applicable NYSE rules. Each member of the audit committee meets the requirements for financial literacy under the applicable rules and regulations of the SEC and NYSE.

15

The audit committee’s general role is to assist the Board in monitoring our financial reporting process and related matters. Its specific responsibilities are set forth in its charter.

The audit committee has reviewed the company’s consolidated financial statements for 2016 and met with management, as well as with representatives of Deloitte & Touche LLP, the company’s independent registered public accounting firm, to discuss the consolidated financial statements. The audit committee also discussed with members of Deloitte & Touche LLP the matters required to be discussed by the Statement on Auditing Standards No. 61, as amended (AICPA Performance Standards Vol. 1. AU Section 380), as adopted by the Public Company Accounting Oversight Board in Rule 3200T.

In addition, the audit committee received the written disclosures and the letter from Deloitte & Touche LLP required by applicable requirements of the Public Company Accounting Oversight Board regarding the independent accountant’s communications with the audit committee concerning independence, and discussed with members of Deloitte & Touche LLP its independence.

Based on these discussions, the financial statement review and other matters it deemed relevant, the audit committee recommended to the Board that the company’s audited consolidated financial statements for 2016 be included in its Annual Report on Form 10-K for 2016.

Audit Committee

Dawn Hudson

Chris Elshaw

John K. Haley

EXECUTIVE COMPENSATION

Overview

Our compensation programs are designed to:

| | • | | attract, motivate and retain employees at the executive level who contribute to our long-term success; |

| | • | | provide compensation packages to our executives that are competitive, reward the achievement of our business objectives and effectively align their interests with those of our stockholders; and |

| | • | | increase the incentive to achieve key strategic performance measures by linking incentive award opportunities to the achievement of performance objectives and by providing a portion of total compensation for executive officers in the form of ownership in the company. |

Our compensation committee is primarily responsible for developing and implementing our compensation policies and establishing and approving the compensation for all of our executive officers. The compensation committee oversees our compensation and benefit plans and policies, administers our equity incentive plans and reviews and approves annually all compensation decisions relating to all of our executive officers, including our Chief Executive Officer. The compensation committee considers recommendations from our Chief Executive Officer regarding the compensation of our executive officers other than himself. Pursuant to our 2015 Stock Option and Incentive Plan, our compensation committee may delegate to our Chief Executive Officer the authority to approve grants of equity awards to certain individuals, subject to certain limitations including the amount of awards that can be granted pursuant to such delegated authority. To date, our compensation committee has not delegated such authority. Our compensation committee also has the authority under its charter to engage the services of a consulting firm or other outside advisor to assist it in designing our compensation programs and in making compensation decisions. In 2016, the compensation committee retained Aon Hewitt as its independent compensation consultant. We do not believe the retention of, and the work performed by, Aon Hewitt creates any conflict of interest.

16

Executive Compensation Components

Our executive compensation consists of base salary, cash incentive bonuses, long-term incentive compensation, and broad-based benefits programs. We have not adopted any formal guidelines for allocating total compensation between long-term and short-term compensation, cash compensation and non-cash compensation, or among different forms of non-cash compensation. The compensation committee considers a number of factors in setting compensation for our executive officers, including Company performance, as well as the executive’s performance, experience, responsibilities and the compensation of executive officers in similar positions at comparable companies.

Summary Compensation Table

The following table presents information regarding the compensation awarded to, earned by, and paid to each individual who served as our principal executive officer and the two most highly-compensated executive officers (other than the principal executive officer) as of the last day of the fiscal year ended December 31, 2016 (such individuals collectively referred to as our “Named Executive Officers”). The following table also presents information regarding the compensation awarded to, earned by, and paid to each of our Named Executive Officer during the fiscal year ended December 31, 2015.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

Name and Principal Position | | Year | | | Salary

($) | | | Bonus

($) | | | Stock

Awards

($)(1) | | | Option

Awards

($)(1) | | | Non-Equity

Incentive Plan

Compensation

($)(2) | | | All Other

Compensation

($)(3) | | | Total

($) | |

Current Named Executive Officers: | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Thomas Ennis | | | 2016 | | | | 500,000 | | | | — | | | | — | | | | — | | | | 331,500 | | | | 13,800 | | | | 845,300 | |

Chief Executive Officer | | | 2015 | | | | 500,000 | | | | 915,000 | (7) | | | — | | | | — | | | | 378,294 | | | | 13,200 | | | | 1,806,494 | |

| | | | | | | | |

David Milner(4)(5) | | | 2016 | | | | 112,204 | (6) | | | — | | | | 7,729,200 | | | | — | | | | — | | | | 4,356 | | | | 7,845,760 | |

Executive Vice President, President International | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

Jason Shiver | | | 2016 | | | | 300,000 | | | | — | | | | — | | | | 536,510 | | | | 140,400 | | | | 13,800 | | | | 990,710 | |

Executive Vice President, President North America | | | 2015 | | | | 250,000 | | | | 300,000 | (7) | | | — | | | | — | | | | 189,147 | | | | 13,200 | | | | 752,347 | |

| (1) | The amounts reported in the Stock Awards column represent the aggregate grant date fair value of the equity-based compensation granted to the Named Executive Officers as computed in accordance with FASB ASC Topic 718. Pursuant to SEC rules, these amounts exclude the impact of estimated forfeitures related to service-based vesting conditions. The assumptions used in calculating the aggregate grant date fair value of the shares reported in the Stock Awards column are set forth in our financial statements included in our 2016 Annual Report for the fiscal year ended December 31, 2016. The amounts reported in this column reflect the accounting cost for these shares and do not correspond to the actual economic value that may be received by the Named Executive Officers for the shares. |

| (2) | Represents the annual performance bonus earned by Messrs. Ennis and Shiver under the Company’s bonus plan, based on the Company’s achievement of net revenue and EBITDA targets. Mr. Milner joined the Company on September 2, 2016, in connection with the Company’s acquisition of Crisps Topco Limited, and did not receive a performance bonus from the Company. |

| (3) | Amounts include reimbursements for automobile-related expenses and mobile telephone charges. In addition, amounts for Mr. Milner include payments by the Company for private medical insurance, group income protection and life assurance premiums. |

| (4) | Mr. Milner was not a Named Executive Officer for the fiscal year ended December 31, 2015, but is a Named Executive Officer for the fiscal year ended December 31, 2016. |

17

| (5) | The amounts for Mr. Milner have been converted from GBP to USD based on an exchange rate of 1 GBP: 1.23363 USD, which was the rate in effect on December 31, 2016. |

| (6) | Mr. Milner joined the Company on September 2, 2016, in connection with the Company’s acquisition of Crisps Topco Limited, and his annual salary is pro-rated accordingly. |

| (7) | Messrs. Ennis and Shiver each received a one-time lump sum performance bonus equal to $500,000 and $300,000, respectively, for exceptional performance during the fiscal year ended December 31, 2015. In addition, in July 2015, Mr. Ennis received a one-time retention bonus equal to $415,000 for completing one year of employment with the Company. |

Bonuses

With respect to the fiscal year ended December 31, 2016, Messrs. Ennis and Shiver each earned an annual performance bonus under the Company’s bonus plan, based on the Company’s achievement of net revenue and EBITDA targets. Based on the Company’s achievement of the relevant performance goals for fiscal year 2016, our Board determined that the bonuses would be paid at 78% of target for each of Messrs. Ennis and Shiver. Since Mr. Milner joined the Company on September 2, 2016, in connection with the Company’s acquisition of Crisps Topco Limited, he did not receive a performance bonus from the Company for the fiscal year ended December 31, 2016.

Employment Agreements and Termination of Employment and Change in Control Arrangements

In July 2015, we entered into an employment agreement with Mr. Ennis (the “Ennis Agreement”) and Mr. Shiver (the “Shiver Agreement”), our current Chief Executive Officer and Executive Vice President, President North America, respectively. The terms of the Ennis Agreement and Shiver Agreement are substantially similar to each other and both provide for at-will employment. The agreements also set forth each applicable Named Executive Officer’s initial annual base salary and initial annual target bonus, as well as each applicable Named Executive Officer’s eligibility to participate in benefit plans generally and reimbursements of up to $1,100 per month for automobile-related expenses and mobile telephone charges. The annual base salaries for Messrs. Ennis and Shiver in fiscal year 2016 were $500,000 and $300,000, respectively, and the annual target bonuses for Messrs. Ennis and Shiver in fiscal year 2016 were equal to 85% and 60% of base salary, respectively. Effective as of January 1, 2017, Mr. Ennis’ annual base salary was increased to $665,000 and his annual target bonus was increased to 90% of his base salary.

In connection with the Company’s acquisition of Crisps Topco Limited, we amended Mr. Milner’s then-existing employment agreement with Crisps Topco Limited, dated June 24, 2010 and as amended August 1, 2013 (as amended, the “Milner Agreement”). Mr. Milner is currently our Executive Vice President, President International. The Milner Agreement, effective September 2, 2016, provides for (i) an initial annual base salary, (ii) eligibility for Mr. Milner to participate in an annual discretionary bonus plan with an initial target bonus, (iii) reimbursement for certain relocation expenses associated with any change of office location, (iv) allowance for the use of a car, (v) eligibility to participate in Crisps Topco Limited’s group personal pension scheme, and (vi) life assurance coverage for Mr. Milner equal to two times his salary and private medical insurance for Mr. Milner, his spouse and dependent children up to the age of 18. Mr. Milner’s current annual base salary is £276,000 and his current annual target bonus is equal to 65% of his base salary.

Involuntary Termination of Employment Not in Connection with a Change in Control

Pursuant to the Ennis Agreement and the Shiver Agreement, in the event Mr. Ennis or Mr. Shiver is terminated by us without “cause” (as defined in the Ennis Agreement or Shiver Agreement, as applicable) or he resigns for “good reason” (as defined in the Ennis Agreement or Shiver Agreement, as applicable), subject to the delivery of a fully effective release of claims and continued compliance with applicable restrictive covenants, the applicable Named Executive Officer will be entitled to (i) a cash severance equal to 100% of his annual base salary (payable in 12 equal installments) and (ii) up to 12 monthly cash payments equal to our monthly contribution for health insurance for the Named Executive Officer.

18

Pursuant to the Milner Agreement, Mr. Milner’s employment will continue until either party to such agreement gives the other not less than 12 months’ written notice of termination. Crisps Topco Limited has the right to pay in lieu of providing notice in a lump sum payment or, alternatively, can make payments in monthly instalments until the expiration of the notice period. In the event that Mr. Milner obtains alternative employment, the monthly instalments will be reduced by the amount of salary received from the new employer. The notice payments are subject to Mr. Milner’s duty to mitigate his losses by attempting to find new employment. In addition, the Milner Agreement provides for the ability to place Mr. Milner on garden leave for the duration of the notice period. If Mr. Milner becomes physically or mentally unable to perform his duties due to ill health or injury, he shall be entitled to salary continuation for any period of incapacity of up to 90 days (whether consecutive or not) in any period of 52 consecutive weeks.

Involuntary Termination of Employment in Connection with a Change in Control