Investor Presentation November 2019 Exhibit 99.1

This presentation contains forward-looking statements. All statements other than statements of historical facts contained in this presentation, including statements regarding possible or assumed future results of operations, business strategies, development plans, regulatory activities, competitive position, potential growth opportunities, & the effects of competition are forward-looking statements. These statements involve known & unknown risks, uncertainties & other important factors that may cause actual results, performance or achievements of EverQuote, Inc. (“the Company”) to be materially different from any future results, performance or achievements expressed or implied by the forward-looking statements. In some cases, you can identify forward-looking statements by terms such as “may,” “should,” “expect,” “plan,” “project,” “estimate,” or “potential” or the negative of these terms or other similar expressions. The forward-looking statements in this presentation are only predictions. The Company has based these forward-looking statements largely on its current expectations & projections about future events & financial trends that it believes may affect the Company’s business, financial condition & results of operations. These forward-looking statements speak only as of the date of this presentation & are subject to a number of risks, uncertainties & assumptions, some of which cannot be predicted or quantified & some of which are beyond the Company’s control. The events & circumstances reflected in the Company’s forward-looking statements may not be achieved or occur, & actual results could differ materially from those projected in the forward-looking statements, including as a result of the risks described in the “Risk Factors” section of the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q & the other filings that the Company makes with the Securities & Exchange Commission from time to time. Moreover, new risk factors & uncertainties may emerge from time to time, & it is not possible for management to predict all risk factors & uncertainties that the Company may face. Except as required by applicable law, the Company does not plan to publicly update or revise any forward-looking statements contained herein, whether as a result of any new information, future events, changed circumstances or otherwise. The Company’s presentation also contains estimates, projections, & other information concerning the Company’s industry, the Company’s business & the markets for certain of the Company’s products & services, including data regarding the estimated size of those markets. Information that is based on estimates, forecasts, projections, market research, or similar methodologies is inherently subject to uncertainties & actual events or circumstances may differ materially from events & circumstances reflected in this information. Unless otherwise expressly stated, the Company obtained this industry, business, market & other data from reports, research surveys, studies & similar data prepared by market research firms & other third parties, from industry, general publications, & from government data & similar sources. We present adjusted EBITDA as a non-GAAP measure, which is not a substitute for or superior to, other measures of financial performance prepared in accordance with U.S. GAAP. A reconciliation of adjusted EBITDA to the most directly comparable GAAP measure is included in the Appendix to these slides. Disclaimer

Our mission Be the largest online source of insurance policies by using data & technology to make insurance decisions simpler, more affordable & personalized

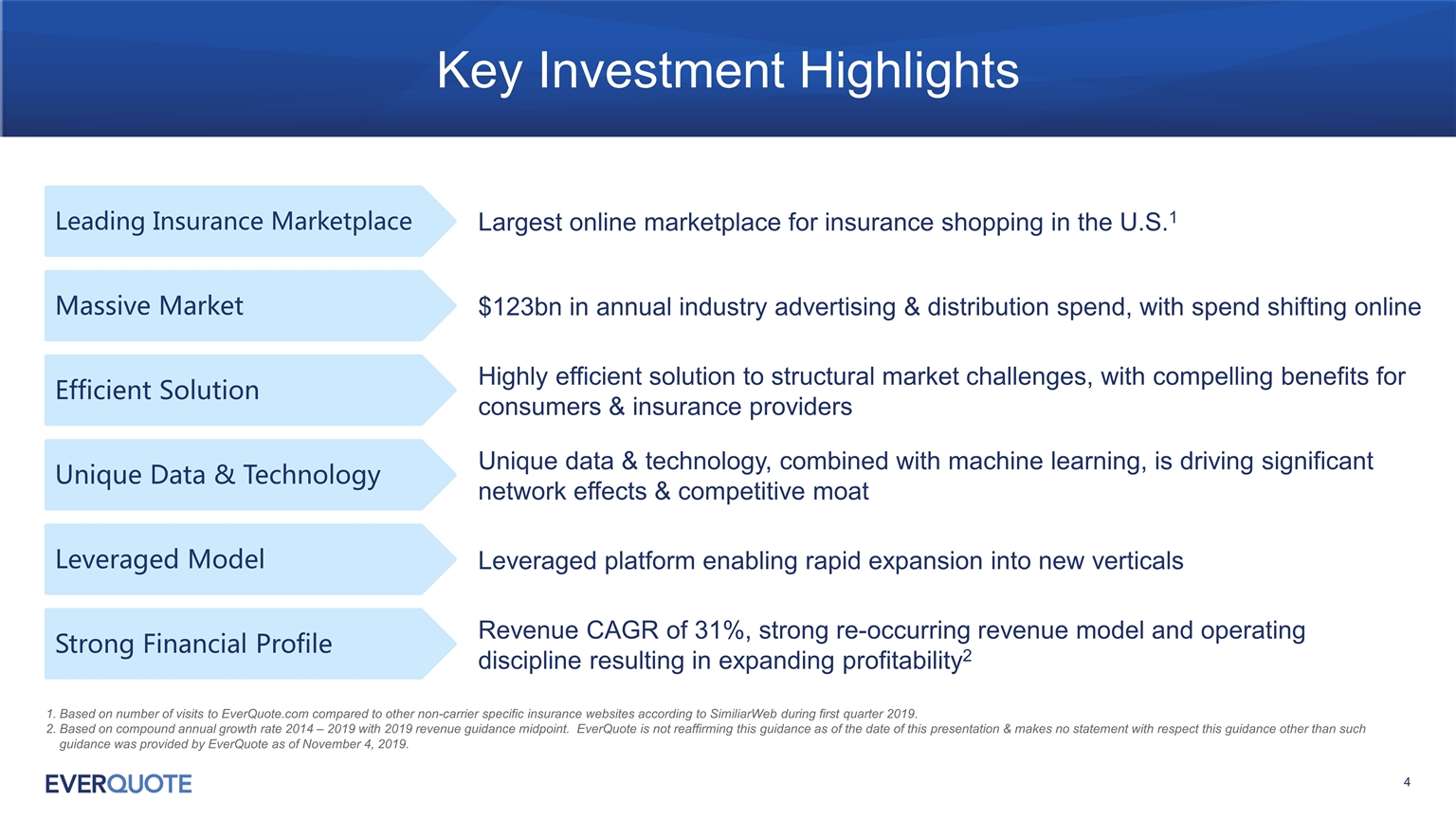

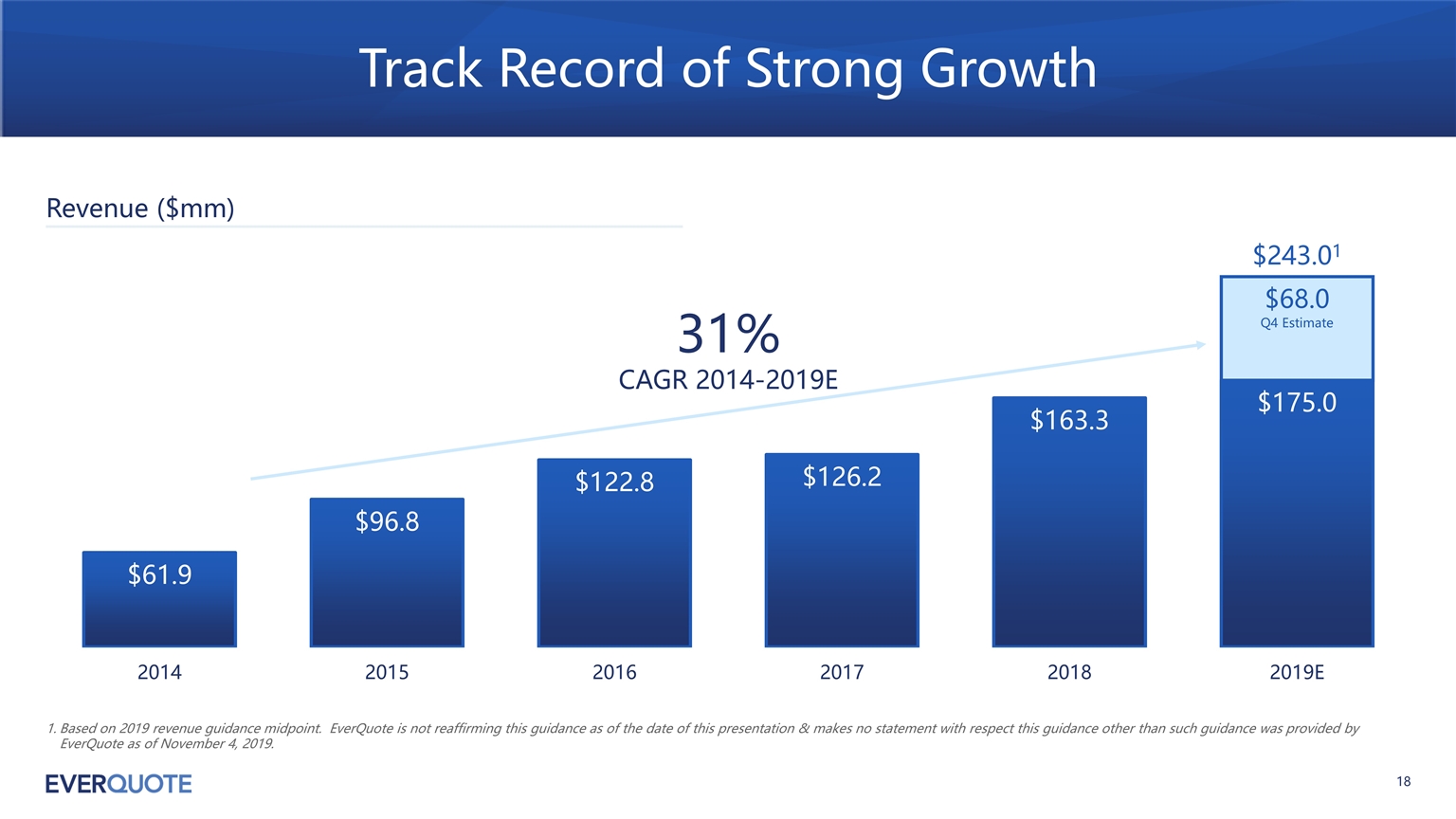

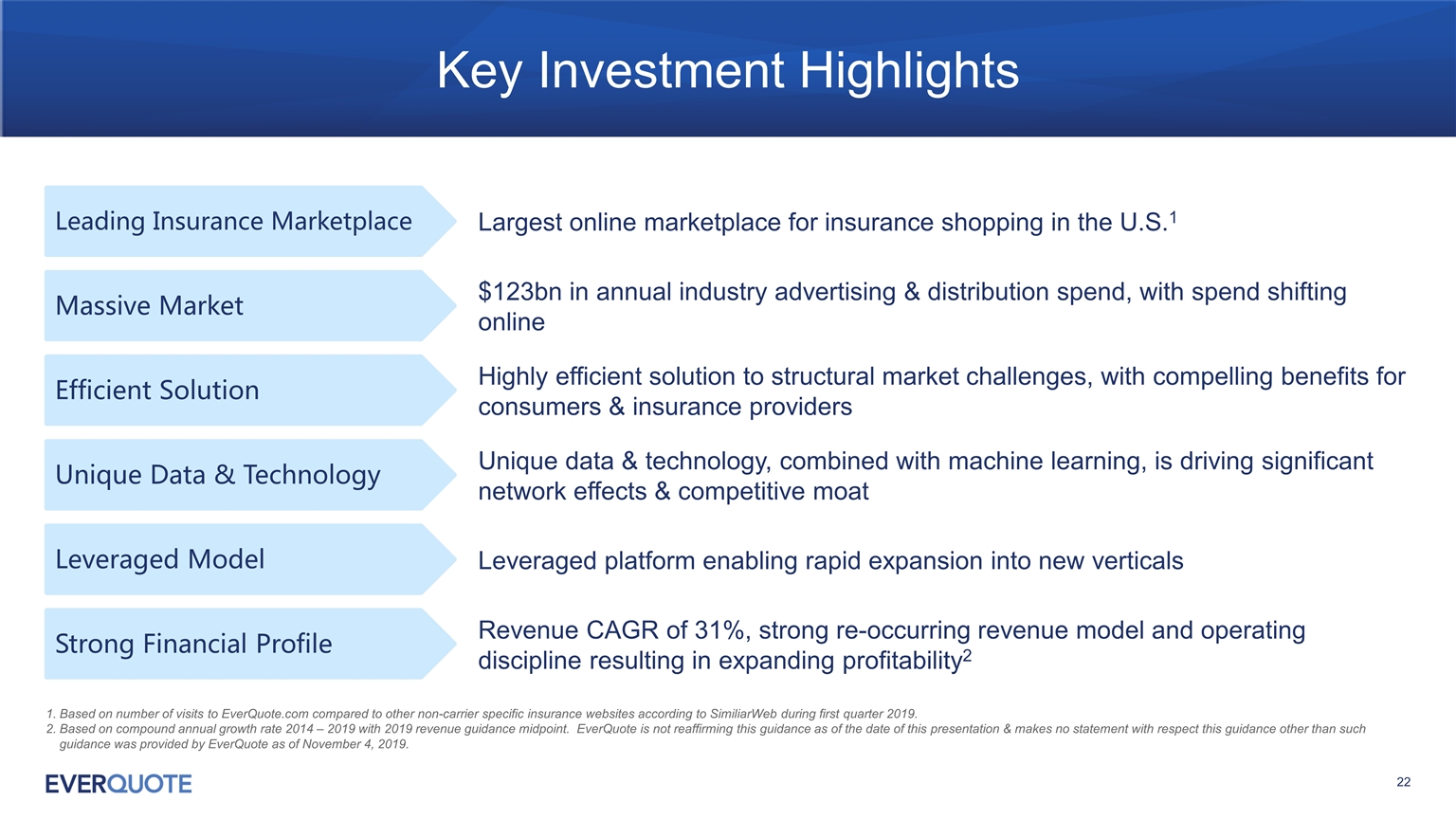

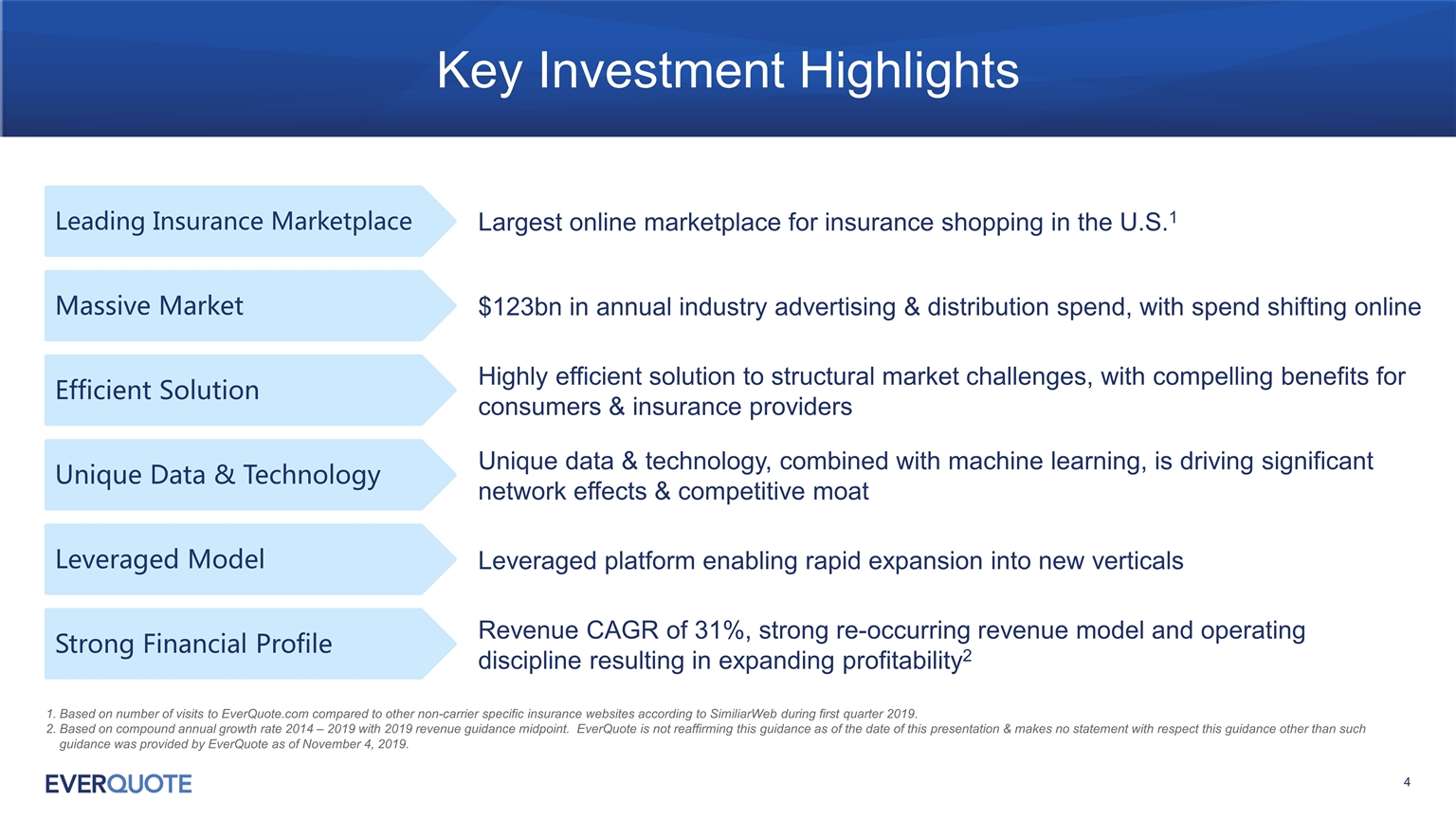

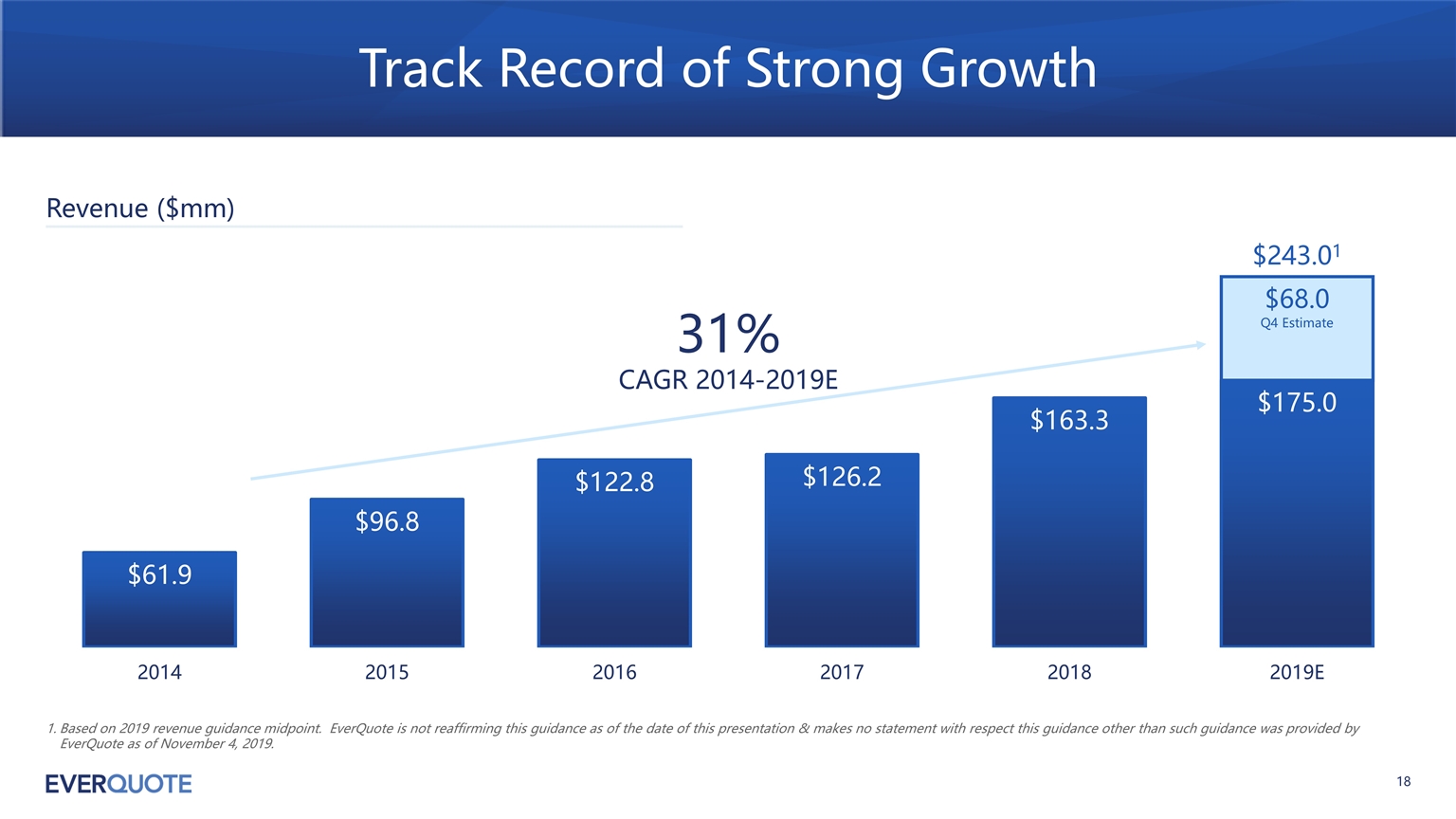

Key Investment Highlights Largest online marketplace for insurance shopping in the U.S.1 $123bn in annual industry advertising & distribution spend, with spend shifting online Highly efficient solution to structural market challenges, with compelling benefits for consumers & insurance providers Leveraged platform enabling rapid expansion into new verticals Revenue CAGR of 31%, strong re-occurring revenue model and operating discipline resulting in expanding profitability2 Unique data & technology, combined with machine learning, is driving significant network effects & competitive moat Based on number of visits to EverQuote.com compared to other non-carrier specific insurance websites according to SimiliarWeb during first quarter 2019. Based on compound annual growth rate 2014 – 2019 with 2019 revenue guidance midpoint. EverQuote is not reaffirming this guidance as of the date of this presentation & makes no statement with respect this guidance other than such guidance was provided by EverQuote as of November 4, 2019. Leading Insurance Marketplace Massive Market Efficient Solution Unique Data & Technology Leveraged Model Strong Financial Profile

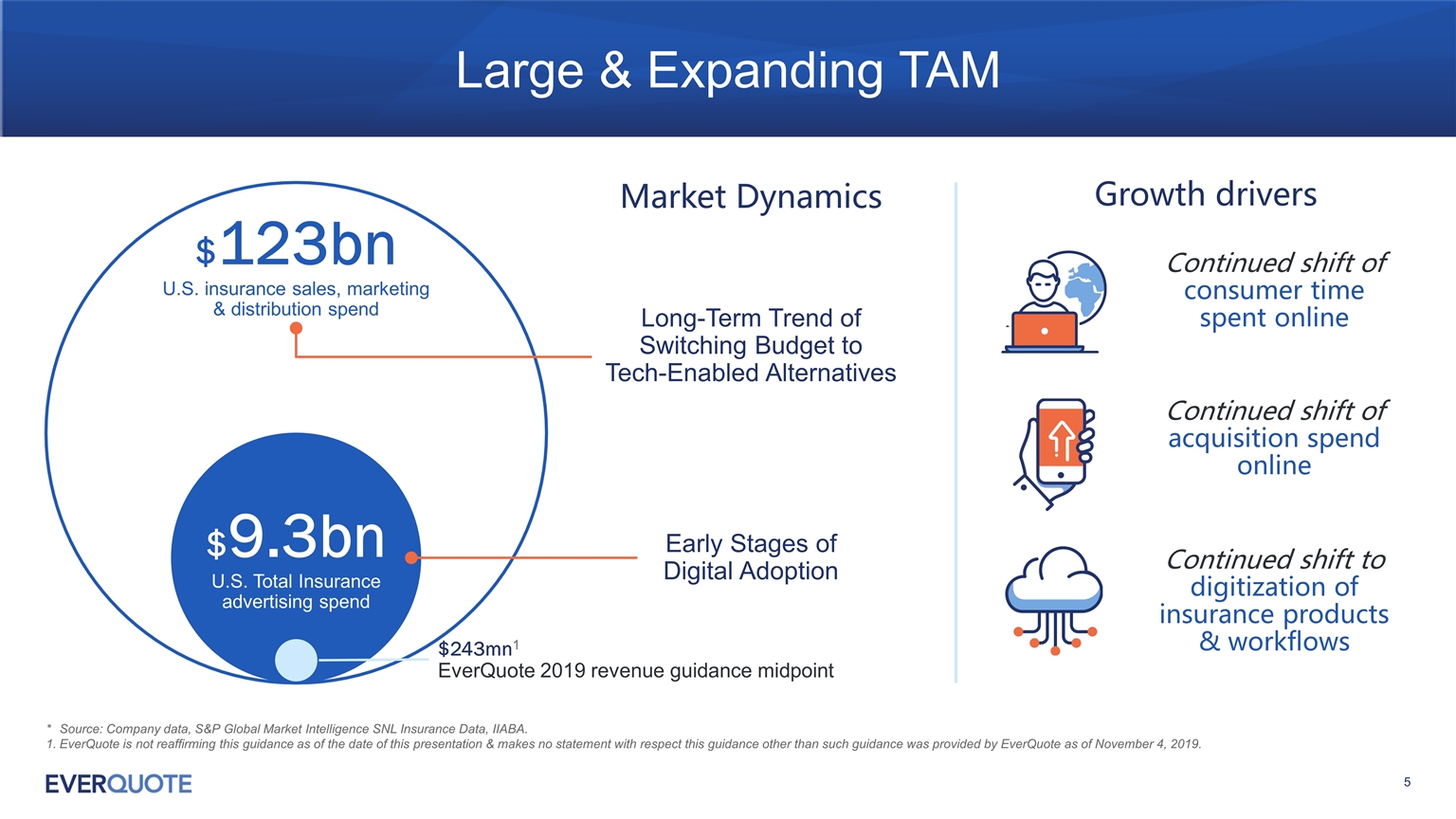

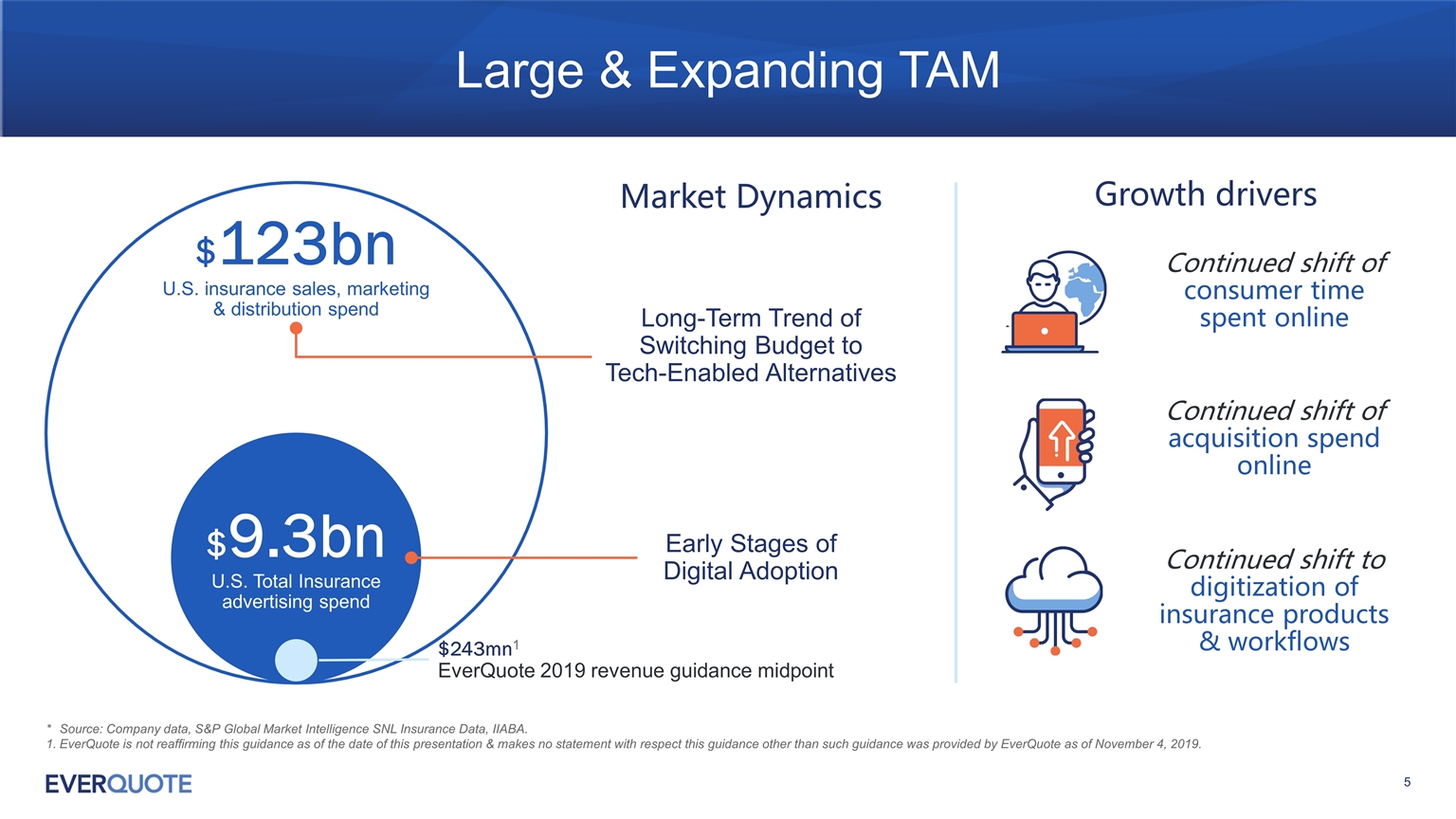

Large & Expanding TAM * Source: Company data, S&P Global Market Intelligence SNL Insurance Data, IIABA. EverQuote is not reaffirming this guidance as of the date of this presentation & makes no statement with respect this guidance other than such guidance was provided by EverQuote as of November 4, 2019. $243mn1 EverQuote 2019 revenue guidance midpoint $123bn U.S. insurance sales, marketing & distribution spend $9.3bn U.S. Total Insurance advertising spend Long-Term Trend of Switching Budget to Tech-Enabled Alternatives Early Stages of Digital Adoption Market Dynamics Continued shift of consumer time spent online Continued shift of acquisition spend online Continued shift to digitization of insurance products & workflows Growth drivers

70% of insurance consumers shop online But, 80% of policies still closed offline Online to Offline Sales Journey Consumers cite the desire to speak to an agent as top reason for not buying online Source: 2015 comScore survey.

Estimated average annual premium savings of $610 based on a countrywide survey between November 2018 & April 2019 of EverQuote users that reported old & new premiums. More Efficient Acquisition for Providers Consumers Save Time & Money Business Model: Benefits Large volume of high intent consumers Target based consumer attributes Consistent new acquisition ROI Single starting point Match & connect for multiple quotes Average Savings $610 per year1 Consumers Insurance Providers

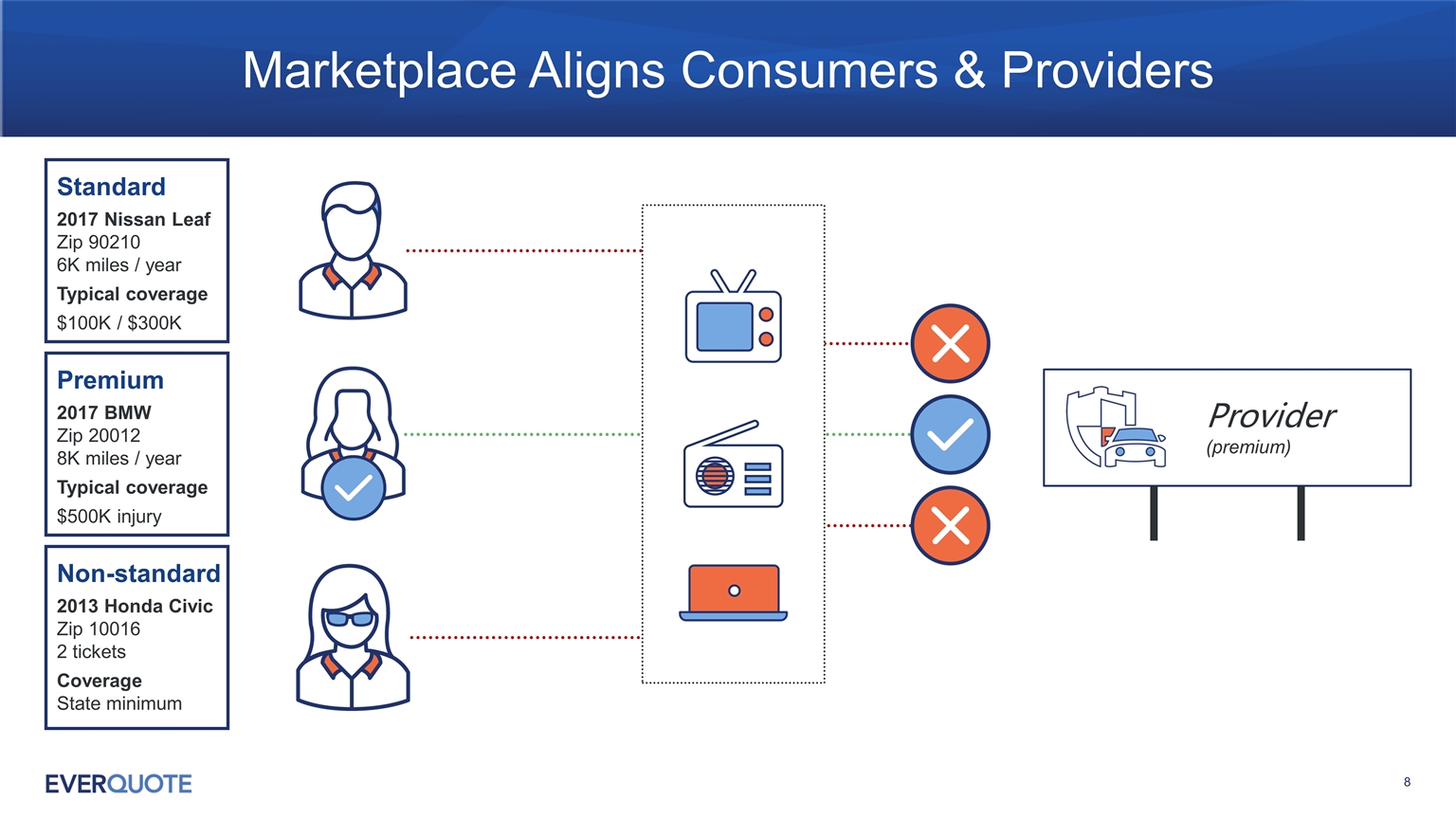

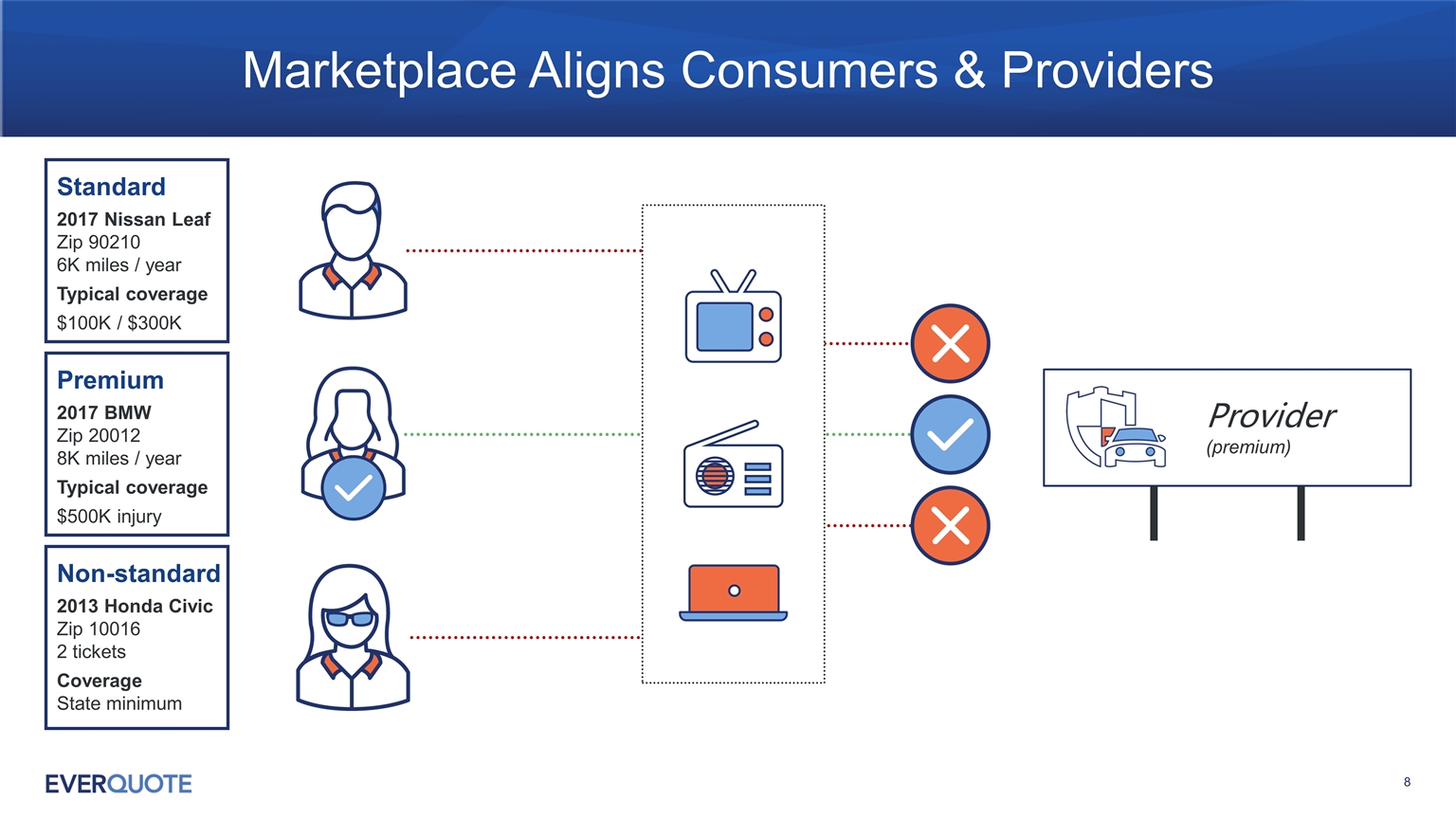

Marketplace Aligns Consumers & Providers Premium 2017 BMW Zip 20012 8K miles / year Typical coverage $500K injury Standard 2017 Nissan Leaf Zip 90210 6K miles / year Typical coverage $100K / $300K Non-standard 2013 Honda Civic Zip 10016 2 tickets Coverage State minimum Provider (premium)

Consumer Journey from Ad to Provider Matching Targeted, bid-informed, dynamic creatives attract consumers Adaptive workflow minimizes steps & increases conversion rates Alignment algorithms match optimal referral partners from our network of providers Representative Partners Verticals Auction Alignment Bidding * Potential new verticals. *

Market Opportunity & Business Model

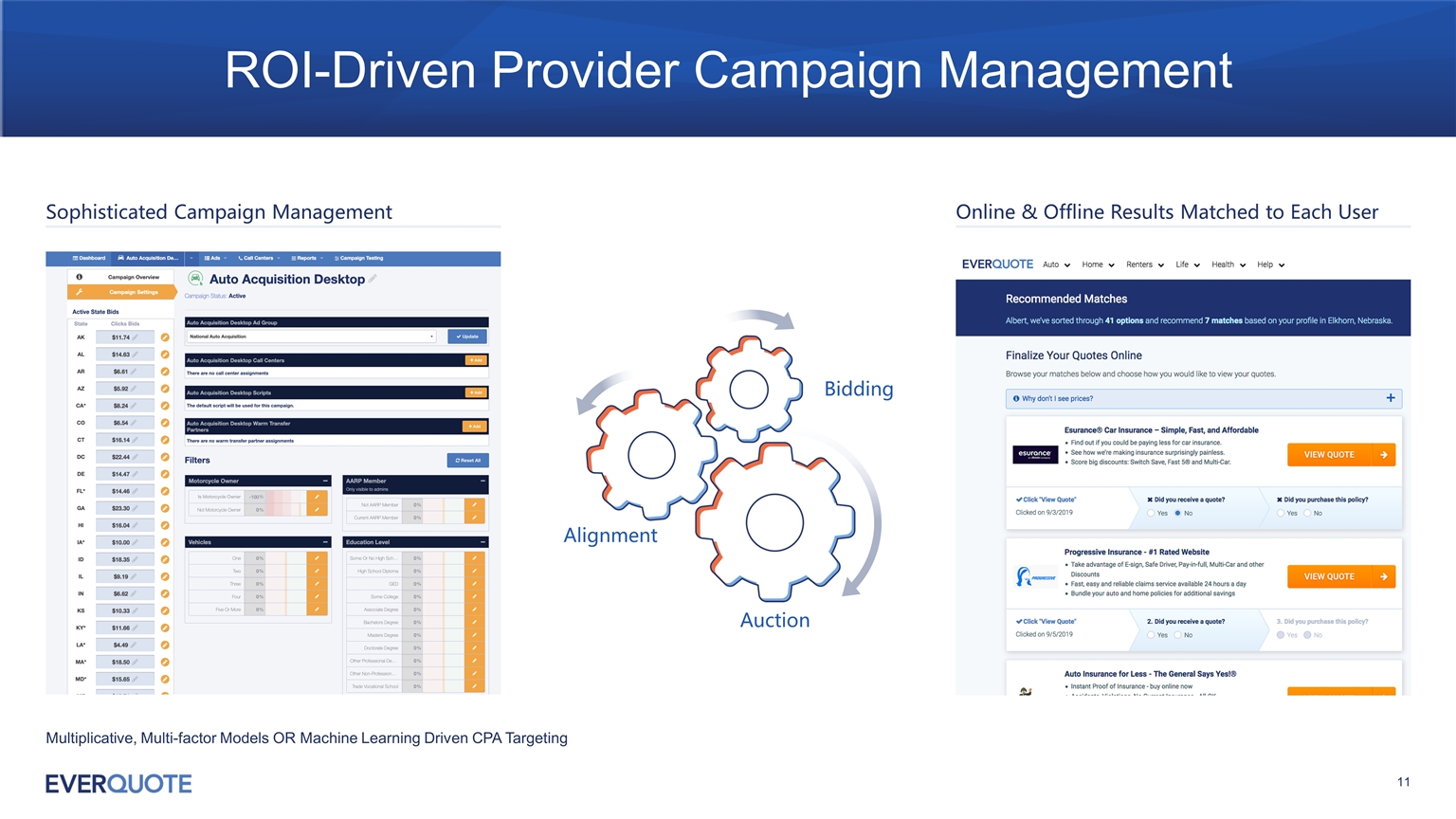

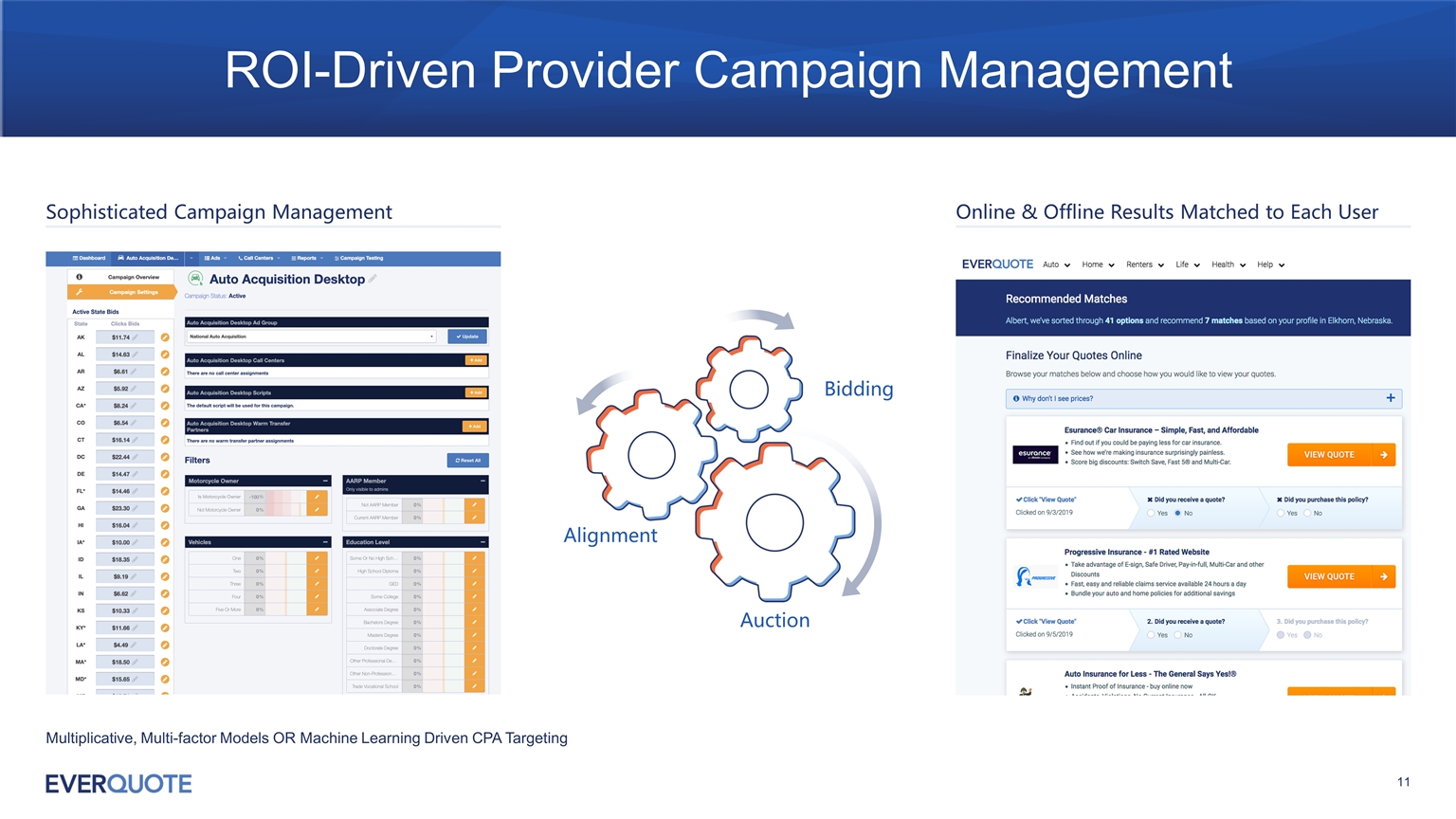

ROI-Driven Provider Campaign Management Auction Alignment Bidding Multiplicative, Multi-factor Models OR Machine Learning Driven CPA Targeting Sophisticated Campaign Management Online & Offline Results Matched to Each User

Powerful Data Driven AI-Platform & Growth Opportunities

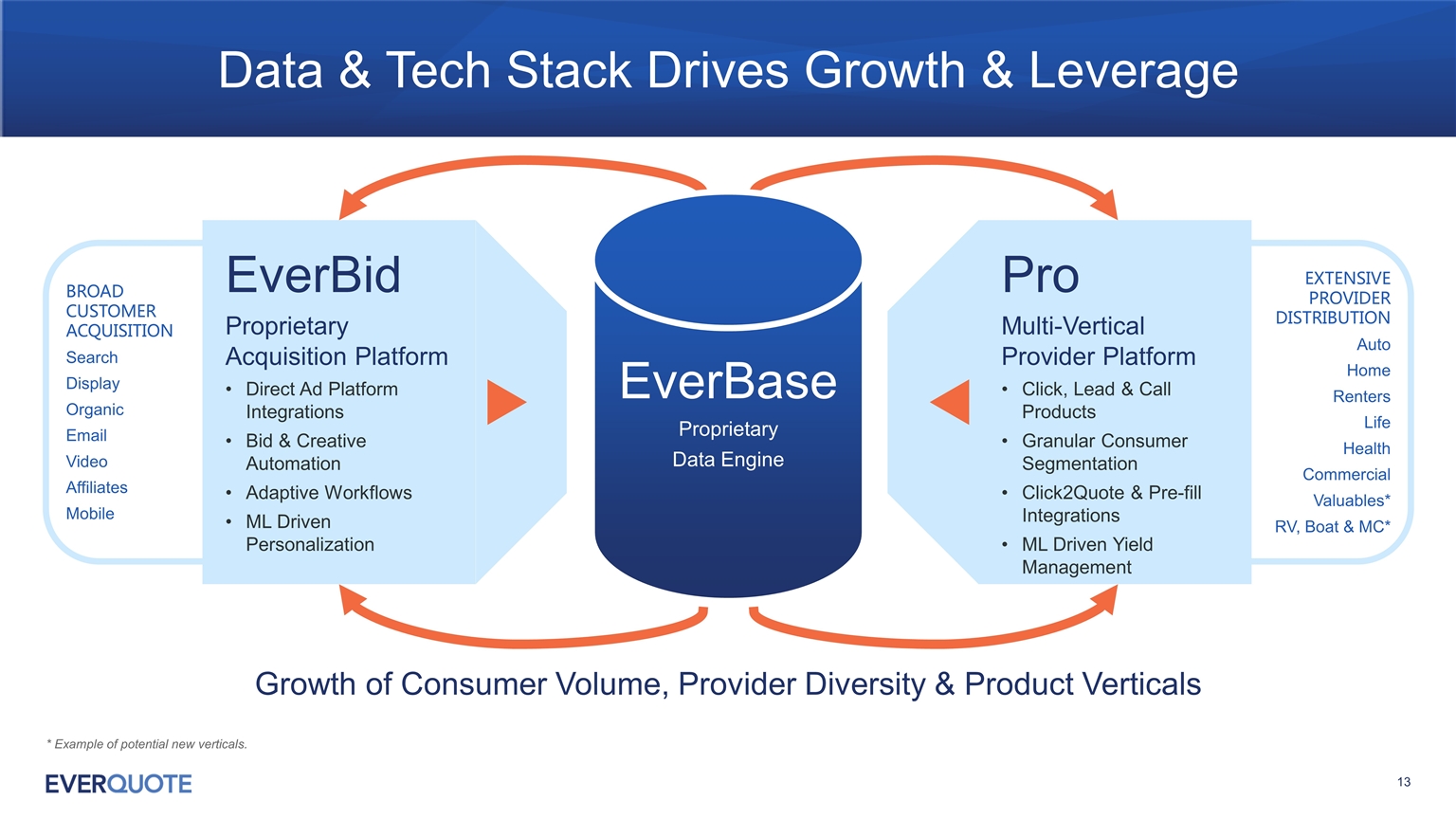

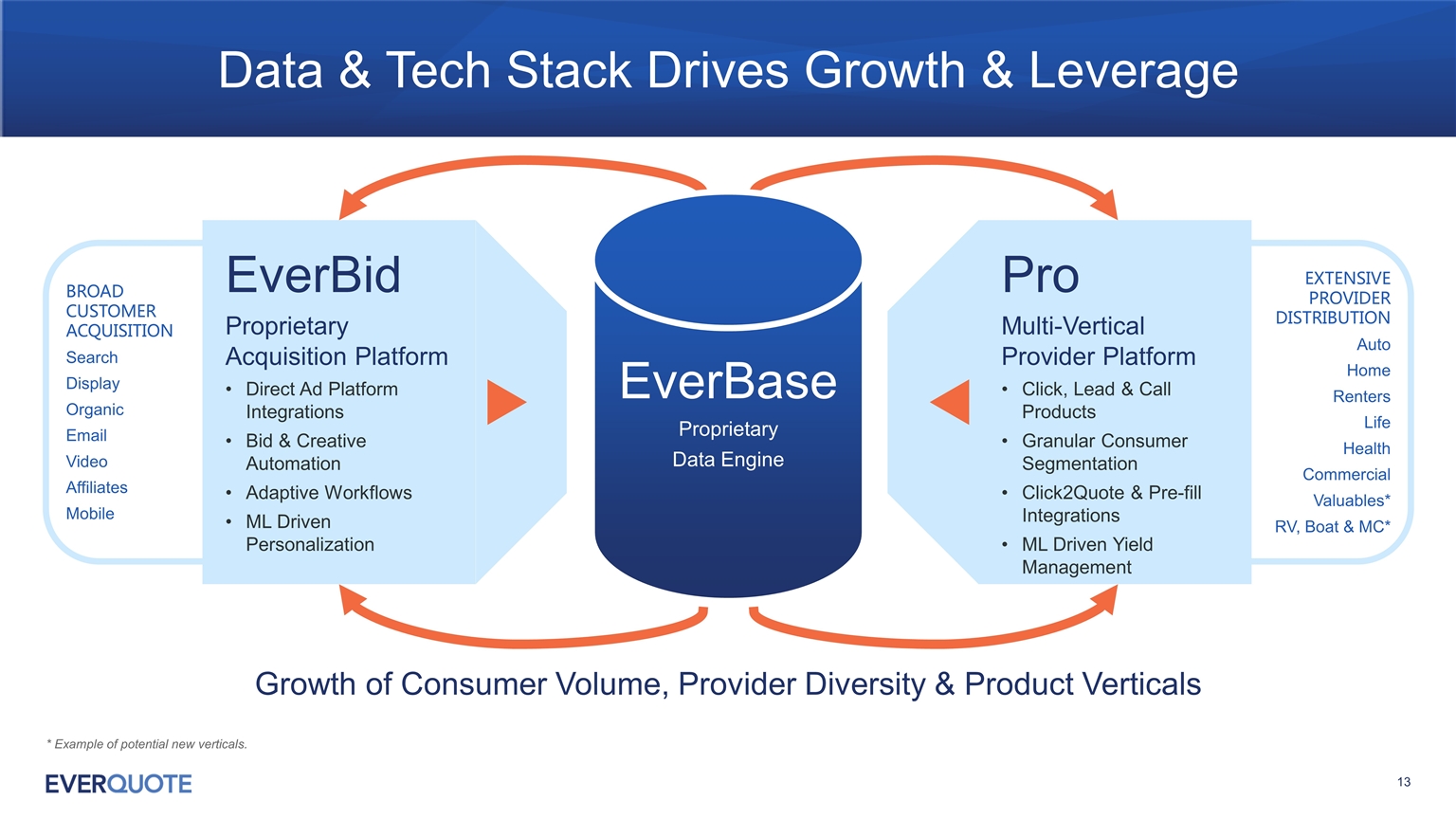

Data & Tech Stack Drives Growth & Leverage * Example of potential new verticals. Growth of Consumer Volume, Provider Diversity & Product Verticals BROAD CUSTOMER ACQUISITION Search Display Organic Email Video Affiliates Mobile EXTENSIVE PROVIDER DISTRIBUTION Auto Home Renters Life Health Commercial Valuables* RV, Boat & MC* EverBid Proprietary Acquisition Platform Direct Ad Platform Integrations Bid & Creative Automation Adaptive Workflows ML Driven Personalization Pro Multi-Vertical Provider Platform Click, Lead & Call Products Granular Consumer Segmentation Click2Quote & Pre-fill Integrations ML Driven Yield Management EverBase Proprietary Data Engine

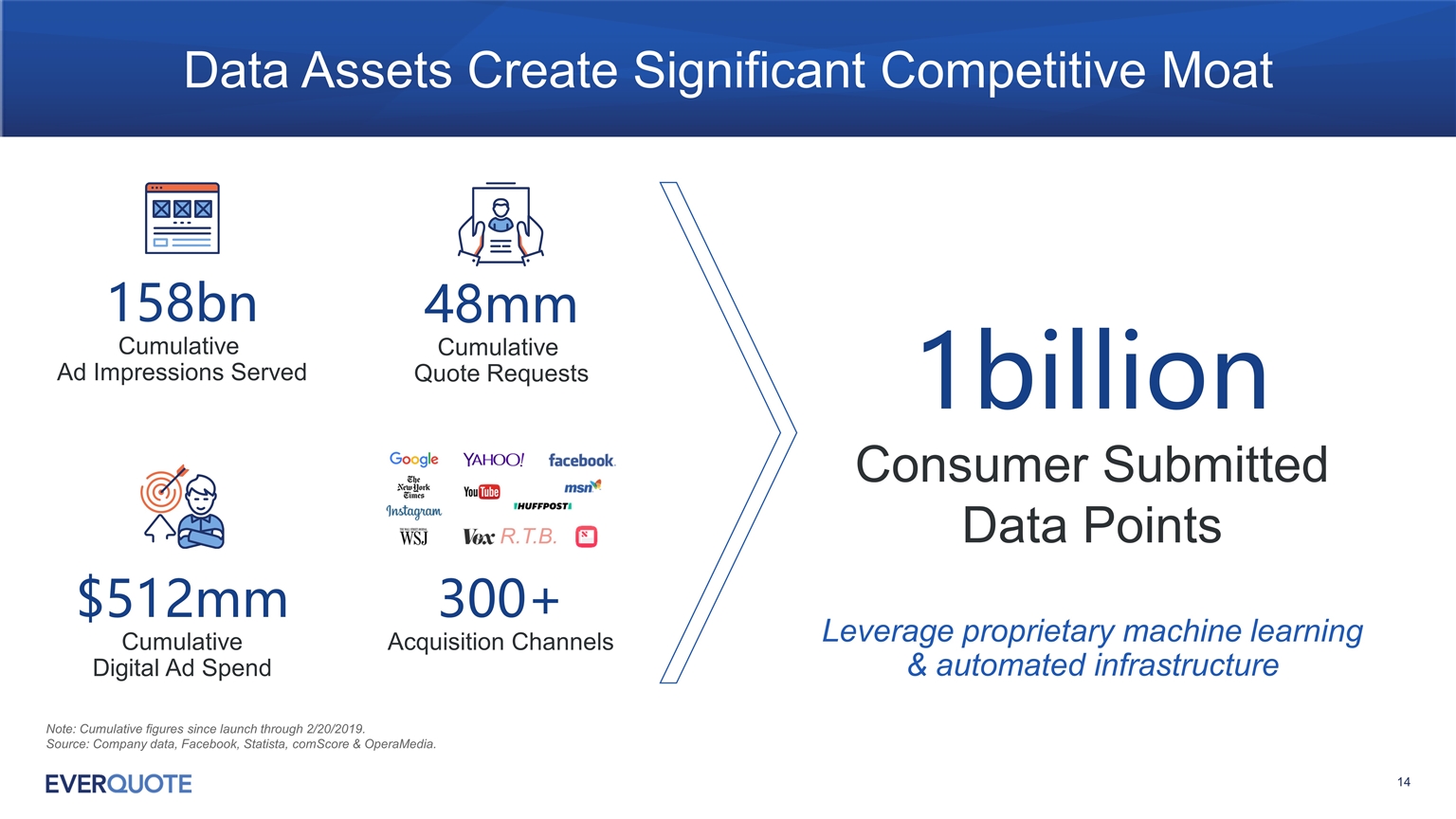

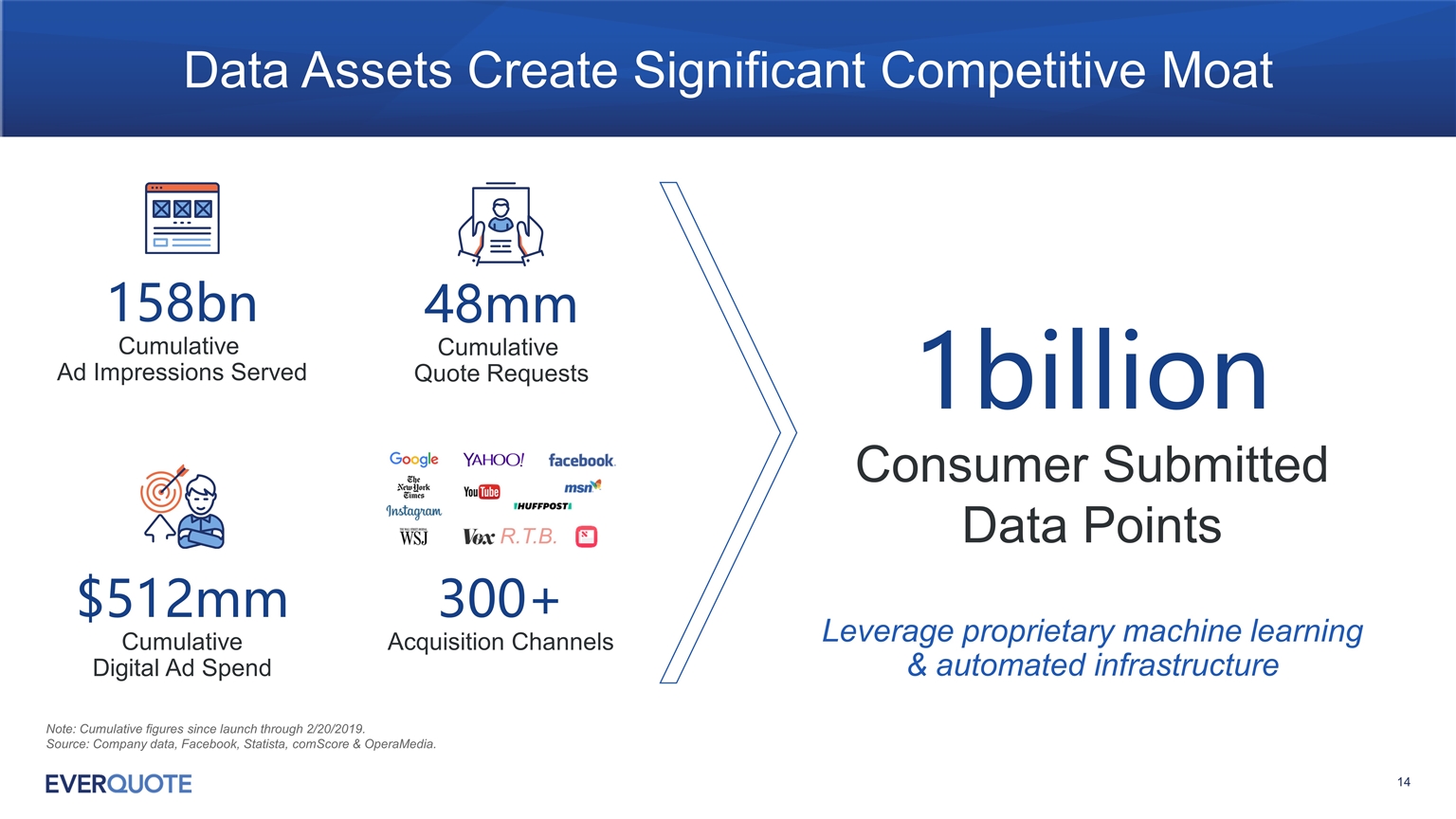

Data Assets Create Significant Competitive Moat R.T.B. 300+ Acquisition Channels 158bn Cumulative Ad Impressions Served $512mm Cumulative Digital Ad Spend 48mm Cumulative Quote Requests 1billion Consumer Submitted Data Points Note: Cumulative figures since launch through 2/20/2019. Source: Company data, Facebook, Statista, comScore & OperaMedia. Leverage proprietary machine learning & automated infrastructure

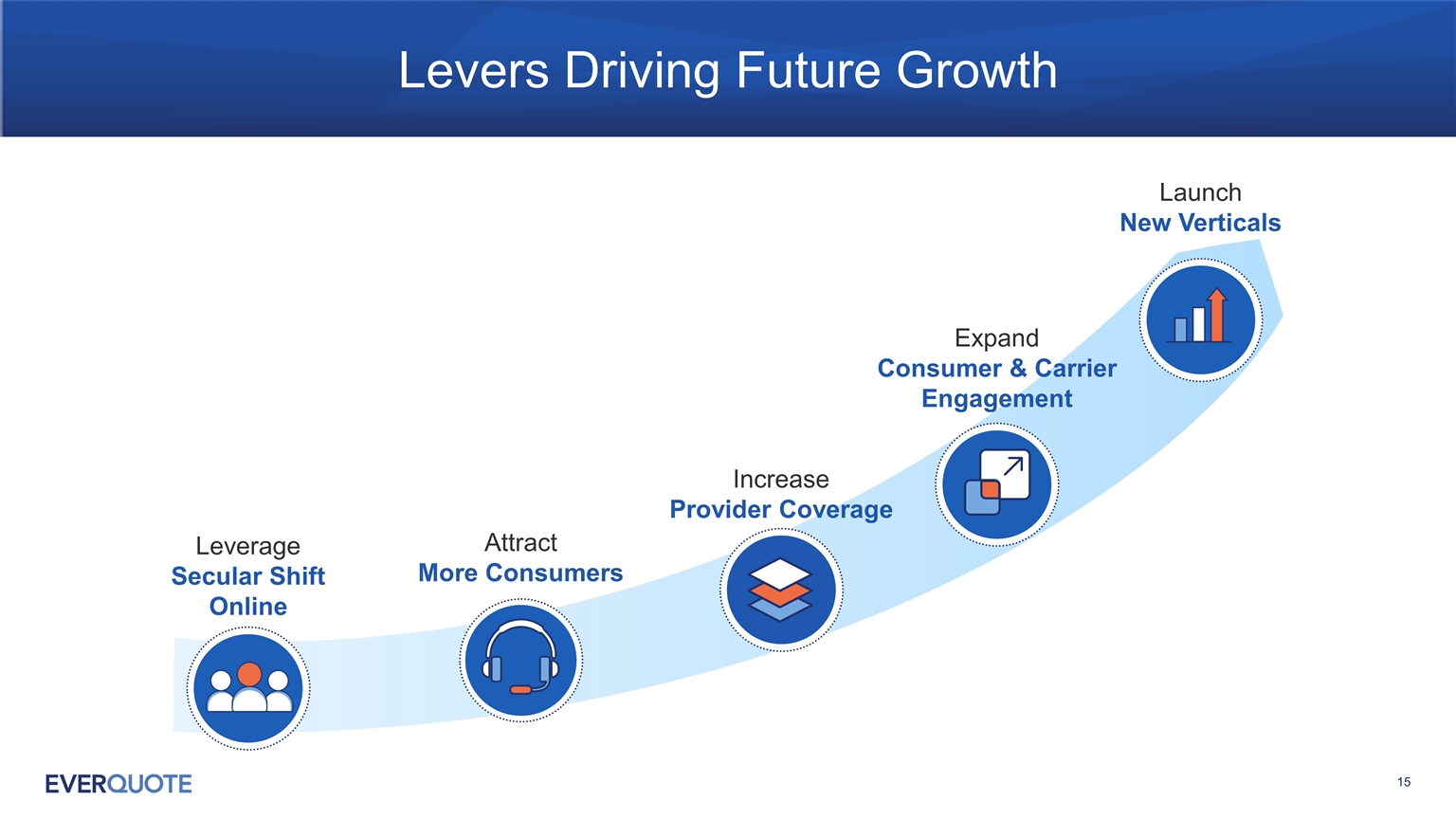

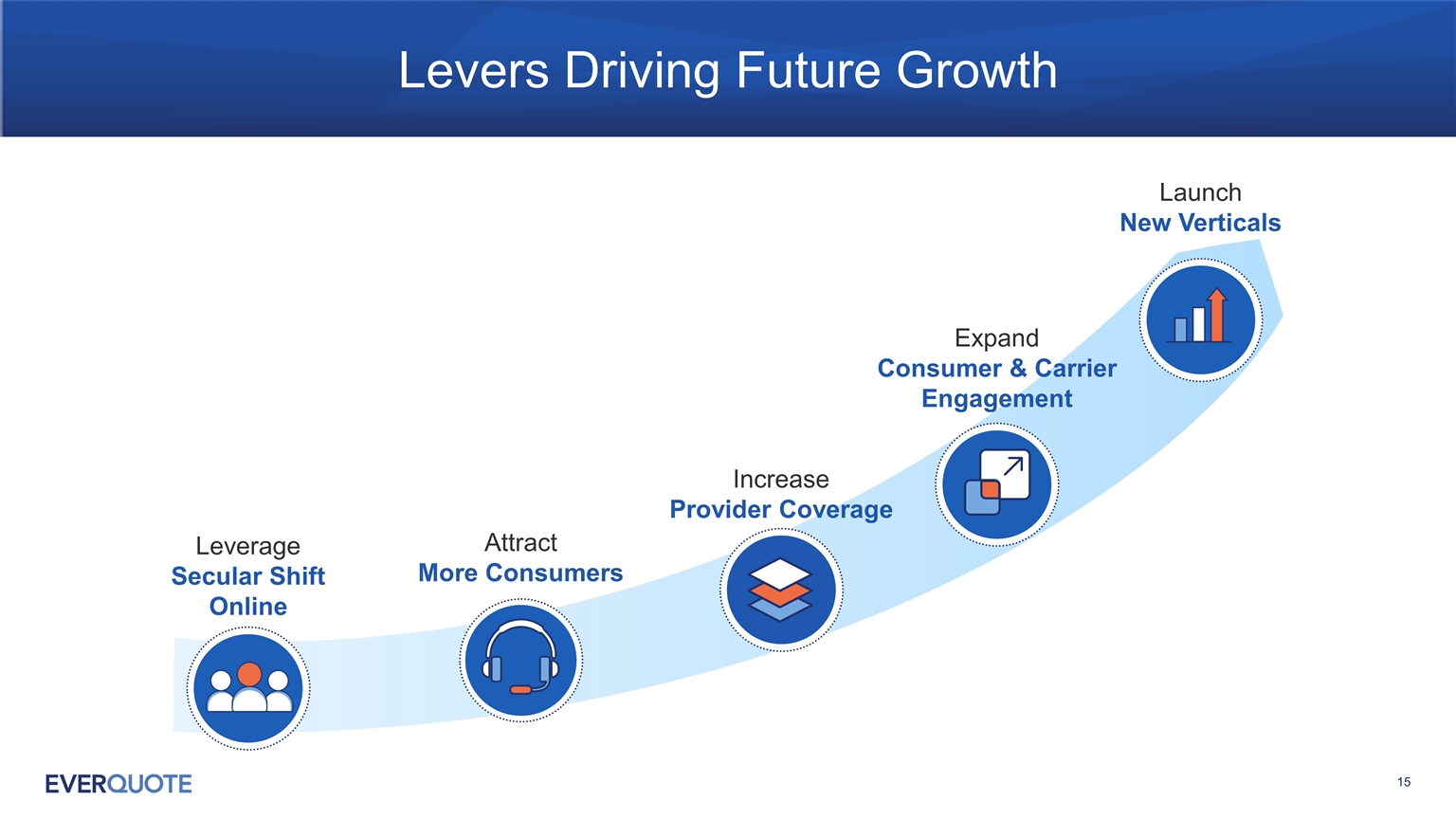

Levers Driving Future Growth Attract More Consumers Leverage Secular Shift Online Increase Provider Coverage Expand Consumer & Carrier Engagement Launch New Verticals

Financial Overview

Third Quarter 2019 Highlights Note: Adjusted EBITDA is a non-GAAP metrics, refer to financial reconciliation for additional detail. Revenue increased 61% YoY to $67.1 Million +61% Quote requests increased 81% YoY +81% Variable Marketing Margin (VMM) increased 67% YoY to $20.9 Million +67% Adjusted EBITDA of $3.9 Million $3.9mm Added 24 new technology integrations with providers +24 Achieve Milestone of GAAP Profitability Launched commercial vertical Increased Full Year 2019 Revenue, VMM & Adjusted EBITDA Guidance Welcomed several significant senior leaders to our team

Revenue ($mm) 31% CAGR 2014-2019E Track Record of Strong Growth Based on 2019 revenue guidance midpoint. EverQuote is not reaffirming this guidance as of the date of this presentation & makes no statement with respect this guidance other than such guidance was provided by EverQuote as of November 4, 2019.

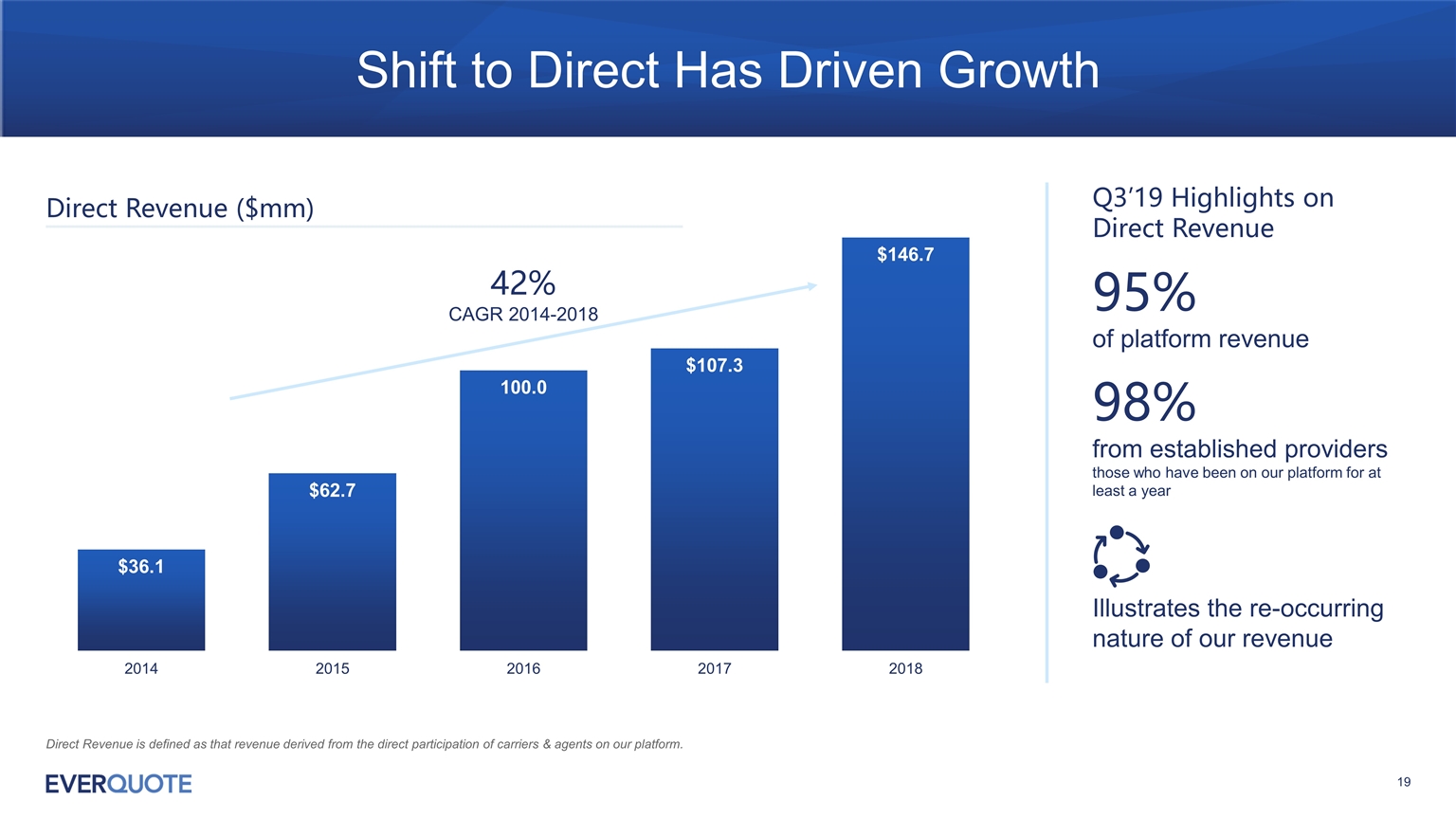

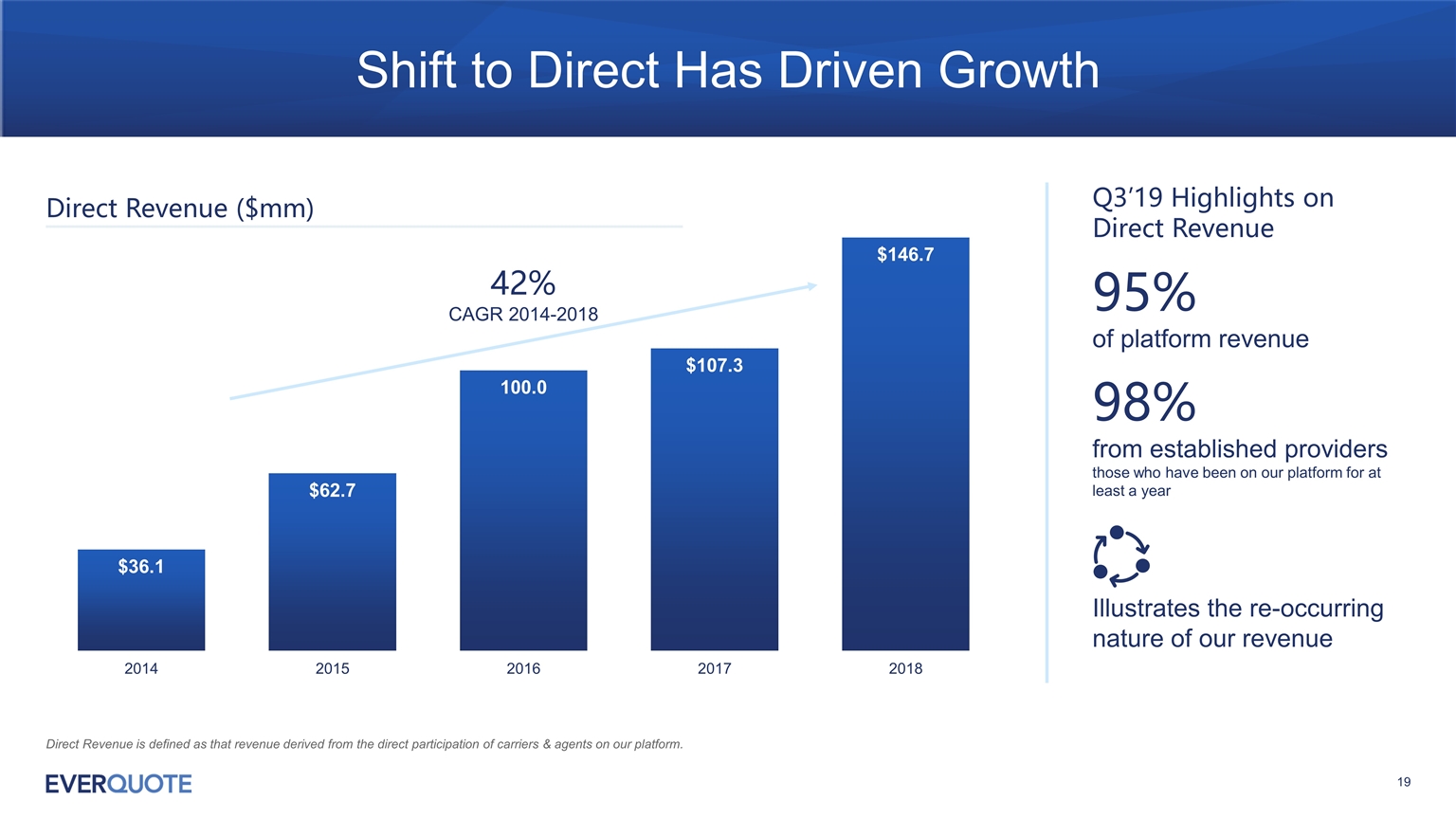

Shift to Direct Has Driven Growth Direct Revenue ($mm) 42% CAGR 2014-2018 Q3’19 Highlights on Direct Revenue 95% of platform revenue 98% from established providers those who have been on our platform for at least a year Illustrates the re-occurring nature of our revenue Direct Revenue is defined as that revenue derived from the direct participation of carriers & agents on our platform.

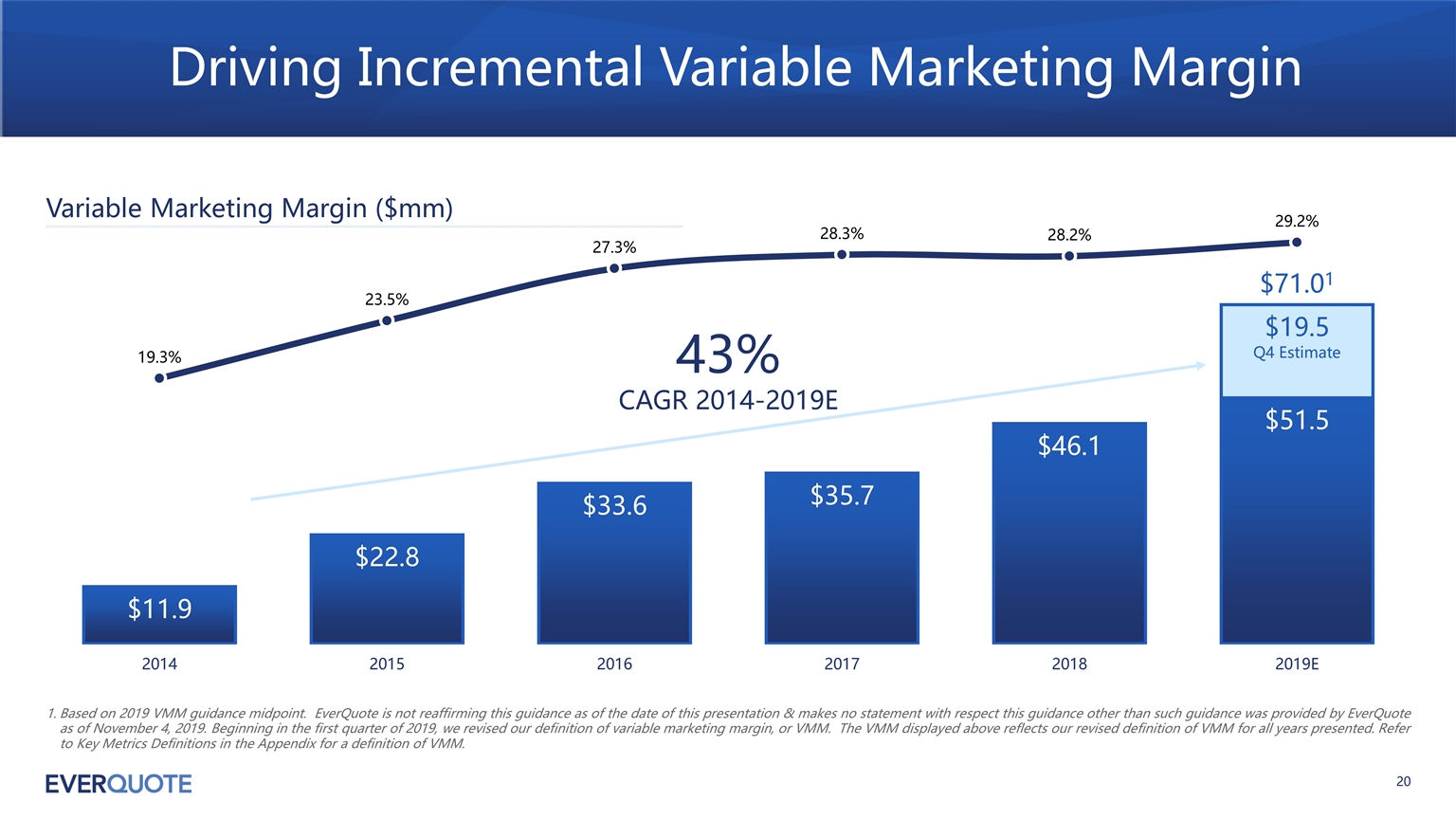

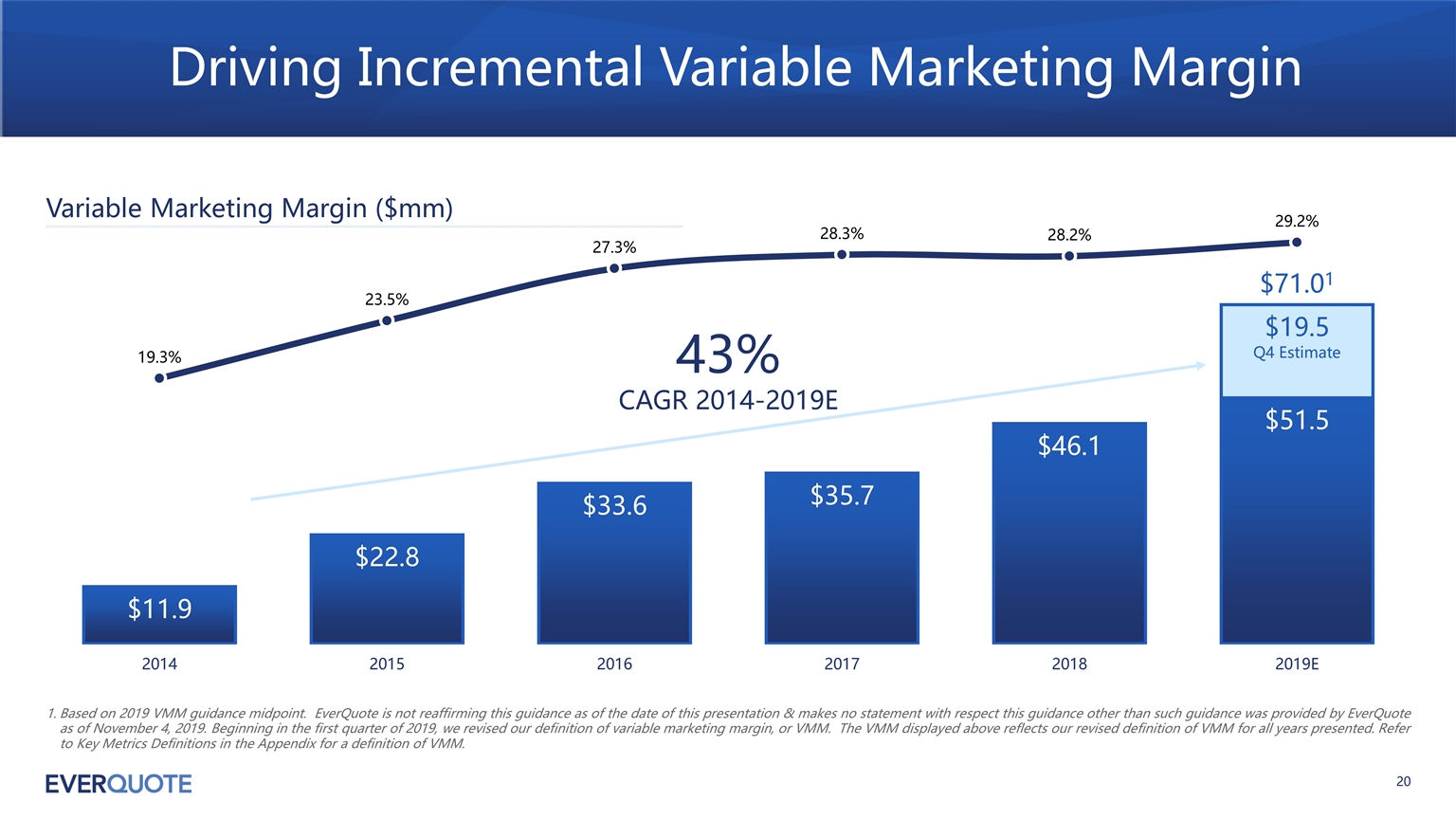

Driving Incremental Variable Marketing Margin 43% CAGR 2014-2019E Based on 2019 VMM guidance midpoint. EverQuote is not reaffirming this guidance as of the date of this presentation & makes no statement with respect this guidance other than such guidance was provided by EverQuote as of November 4, 2019. Beginning in the first quarter of 2019, we revised our definition of variable marketing margin, or VMM. The VMM displayed above reflects our revised definition of VMM for all years presented. Refer to Key Metrics Definitions in the Appendix for a definition of VMM. Variable Marketing Margin ($mm)

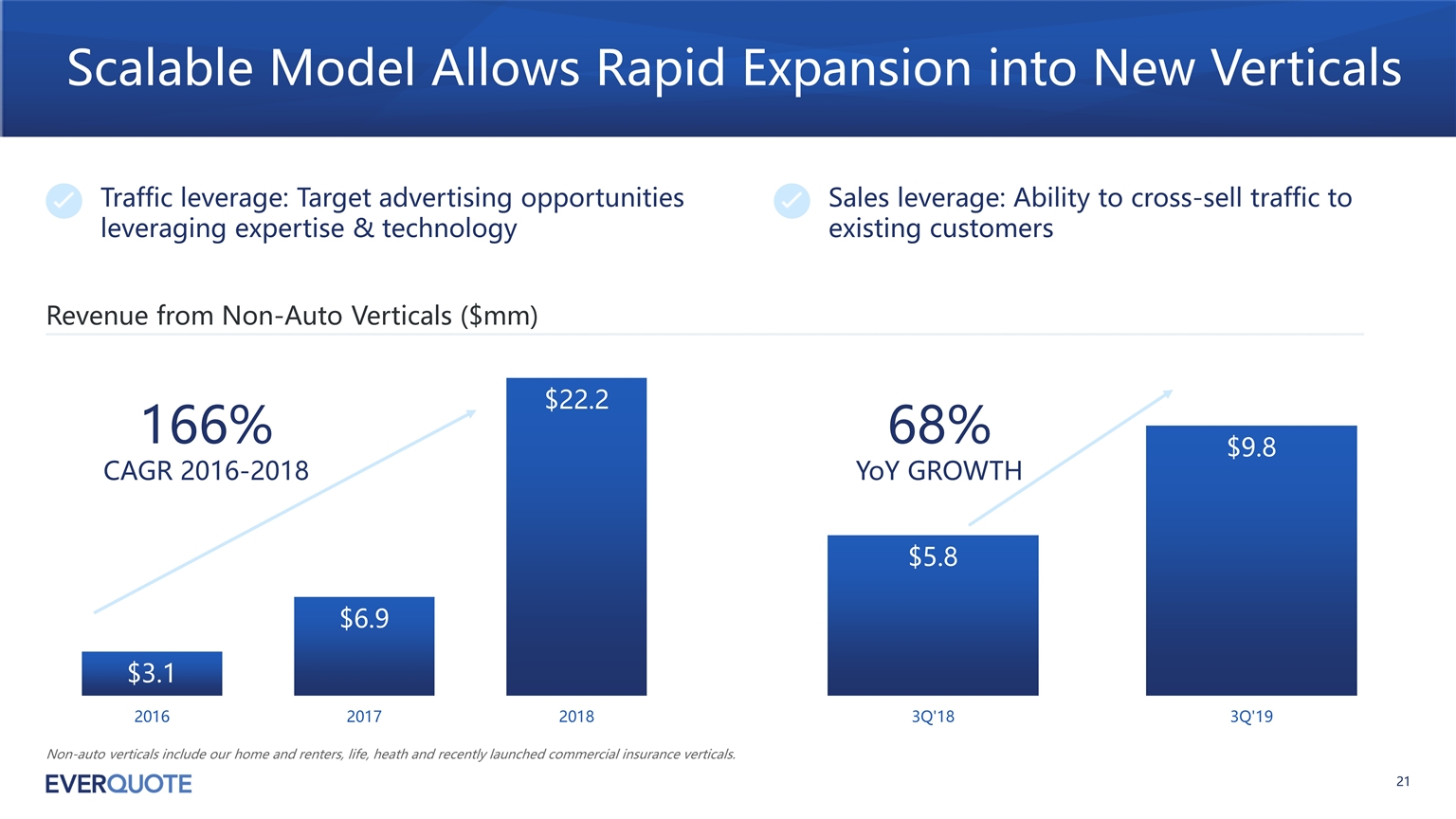

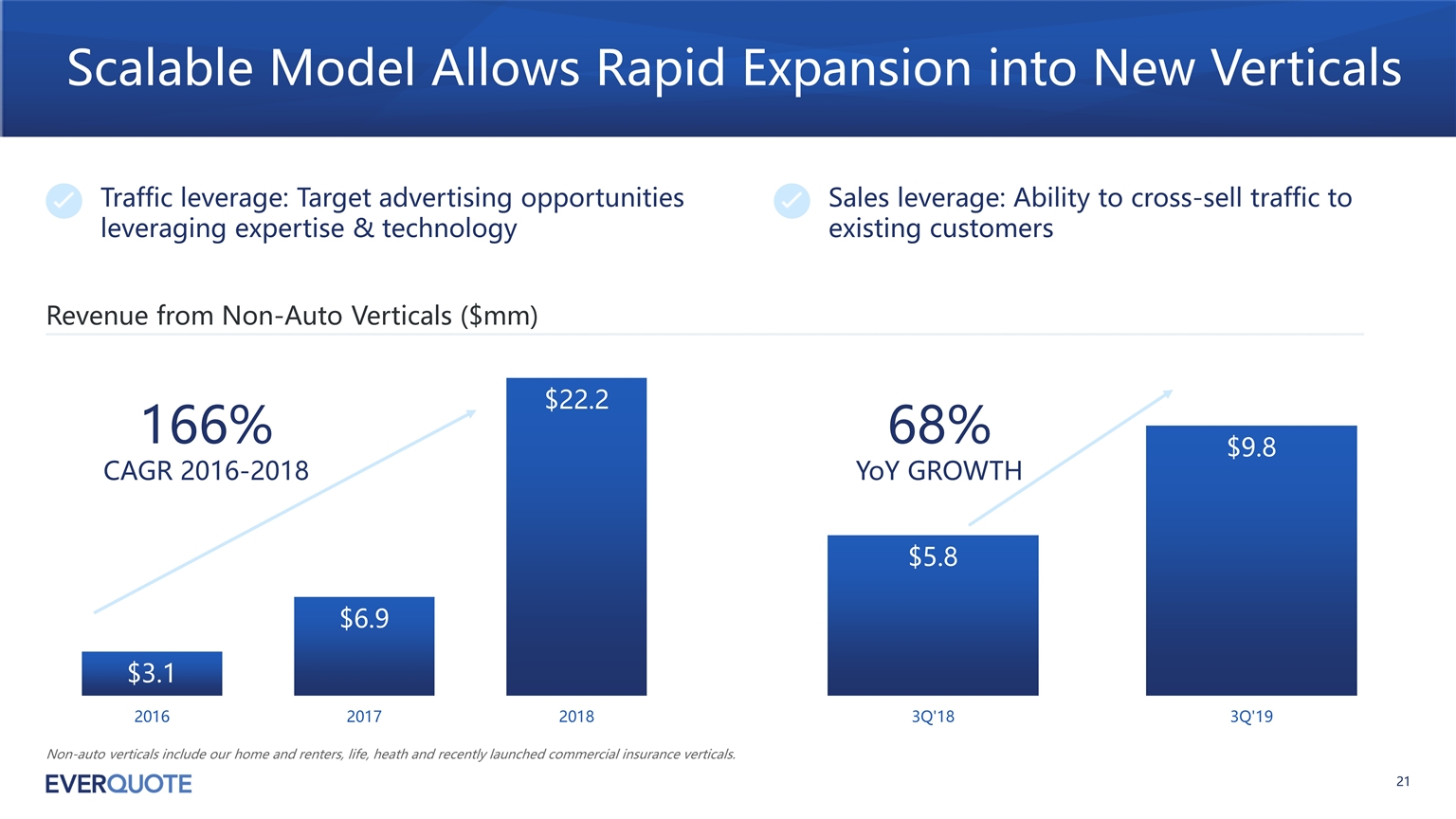

Non-auto verticals include our home and renters, life, heath and recently launched commercial insurance verticals. Scalable Model Allows Rapid Expansion into New Verticals Revenue from Non-Auto Verticals ($mm) Traffic leverage: Target advertising opportunities leveraging expertise & technology Sales leverage: Ability to cross-sell traffic to existing customers 166% CAGR 2016-2018 68% YoY GROWTH

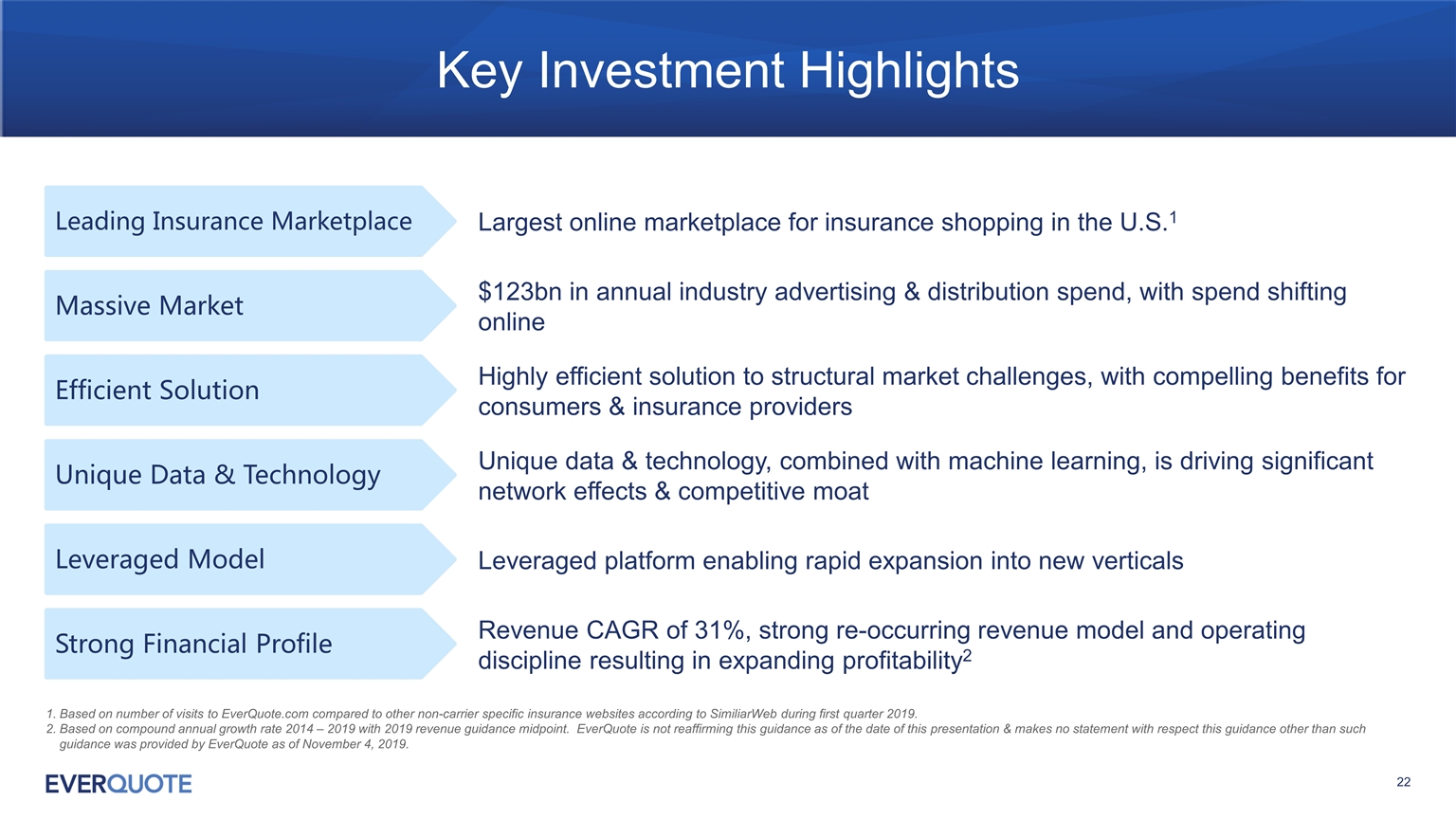

Key Investment Highlights Largest online marketplace for insurance shopping in the U.S.1 $123bn in annual industry advertising & distribution spend, with spend shifting online Highly efficient solution to structural market challenges, with compelling benefits for consumers & insurance providers Leveraged platform enabling rapid expansion into new verticals Revenue CAGR of 31%, strong re-occurring revenue model and operating discipline resulting in expanding profitability2 Unique data & technology, combined with machine learning, is driving significant network effects & competitive moat Leading Insurance Marketplace Massive Market Efficient Solution Unique Data & Technology Leveraged Model Strong Financial Profile Based on number of visits to EverQuote.com compared to other non-carrier specific insurance websites according to SimiliarWeb during first quarter 2019. Based on compound annual growth rate 2014 – 2019 with 2019 revenue guidance midpoint. EverQuote is not reaffirming this guidance as of the date of this presentation & makes no statement with respect this guidance other than such guidance was provided by EverQuote as of November 4, 2019.

NASDAQ: EVER

Appendix

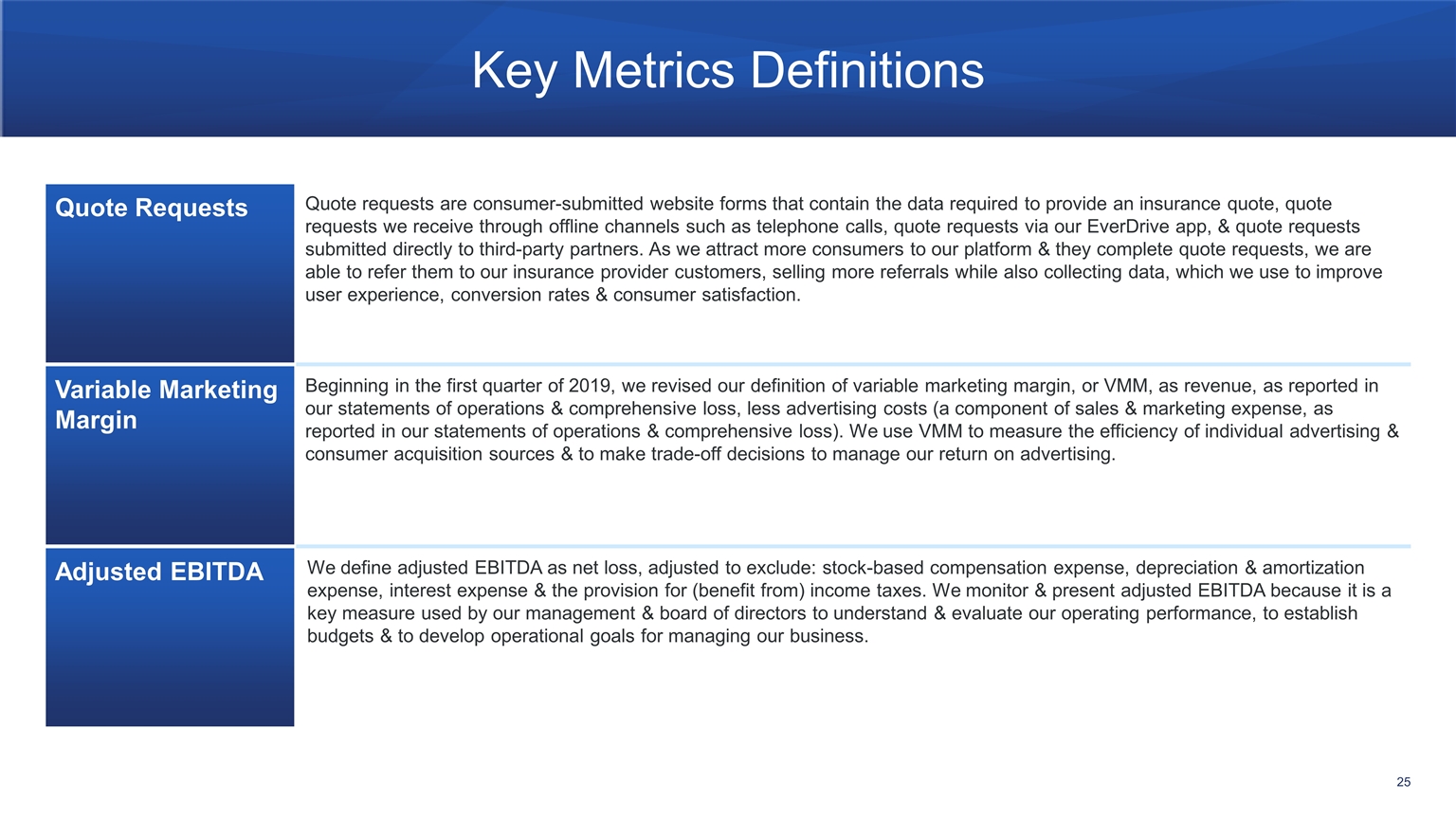

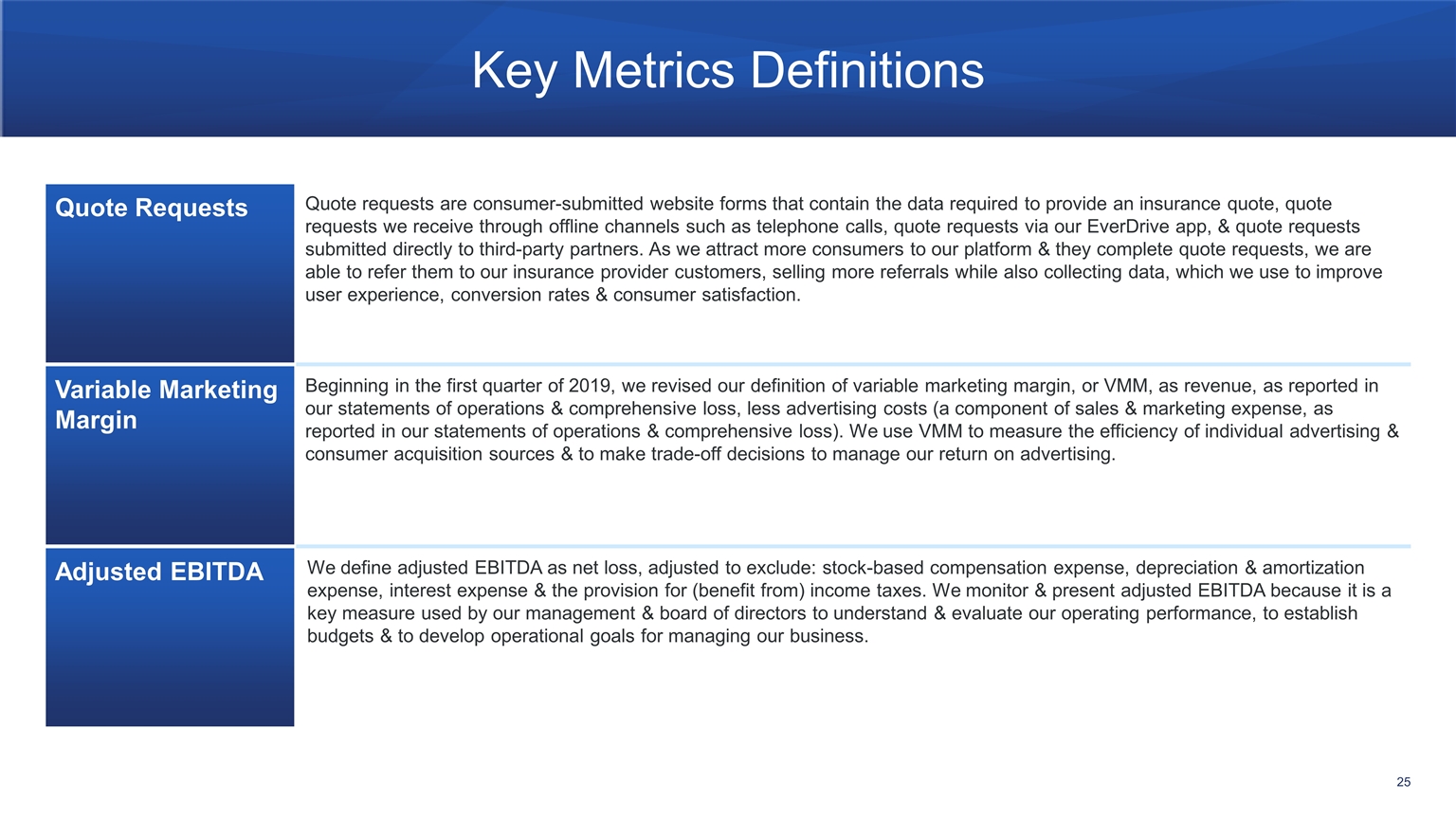

Key Metrics Definitions Quote Requests Quote requests are consumer-submitted website forms that contain the data required to provide an insurance quote, quote requests we receive through offline channels such as telephone calls, quote requests via our EverDrive app, & quote requests submitted directly to third-party partners. As we attract more consumers to our platform & they complete quote requests, we are able to refer them to our insurance provider customers, selling more referrals while also collecting data, which we use to improve user experience, conversion rates & consumer satisfaction. Variable Marketing Margin Beginning in the first quarter of 2019, we revised our definition of variable marketing margin, or VMM, as revenue, as reported in our statements of operations & comprehensive loss, less advertising costs (a component of sales & marketing expense, as reported in our statements of operations & comprehensive loss). We use VMM to measure the efficiency of individual advertising & consumer acquisition sources & to make trade-off decisions to manage our return on advertising. Adjusted EBITDA We define adjusted EBITDA as net loss, adjusted to exclude: stock-based compensation expense, depreciation & amortization expense, interest expense & the provision for (benefit from) income taxes. We monitor & present adjusted EBITDA because it is a key measure used by our management & board of directors to understand & evaluate our operating performance, to establish budgets & to develop operational goals for managing our business.

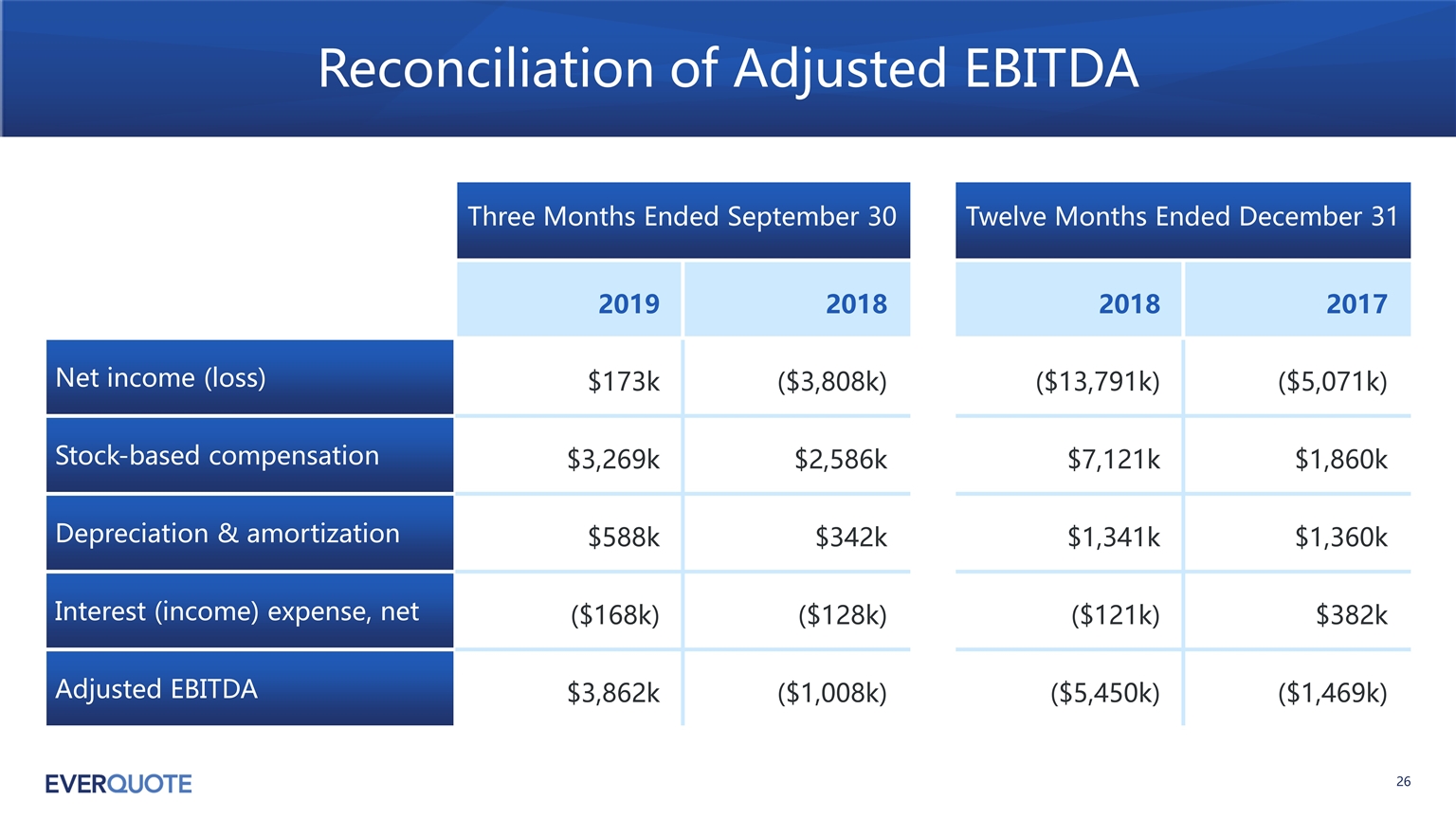

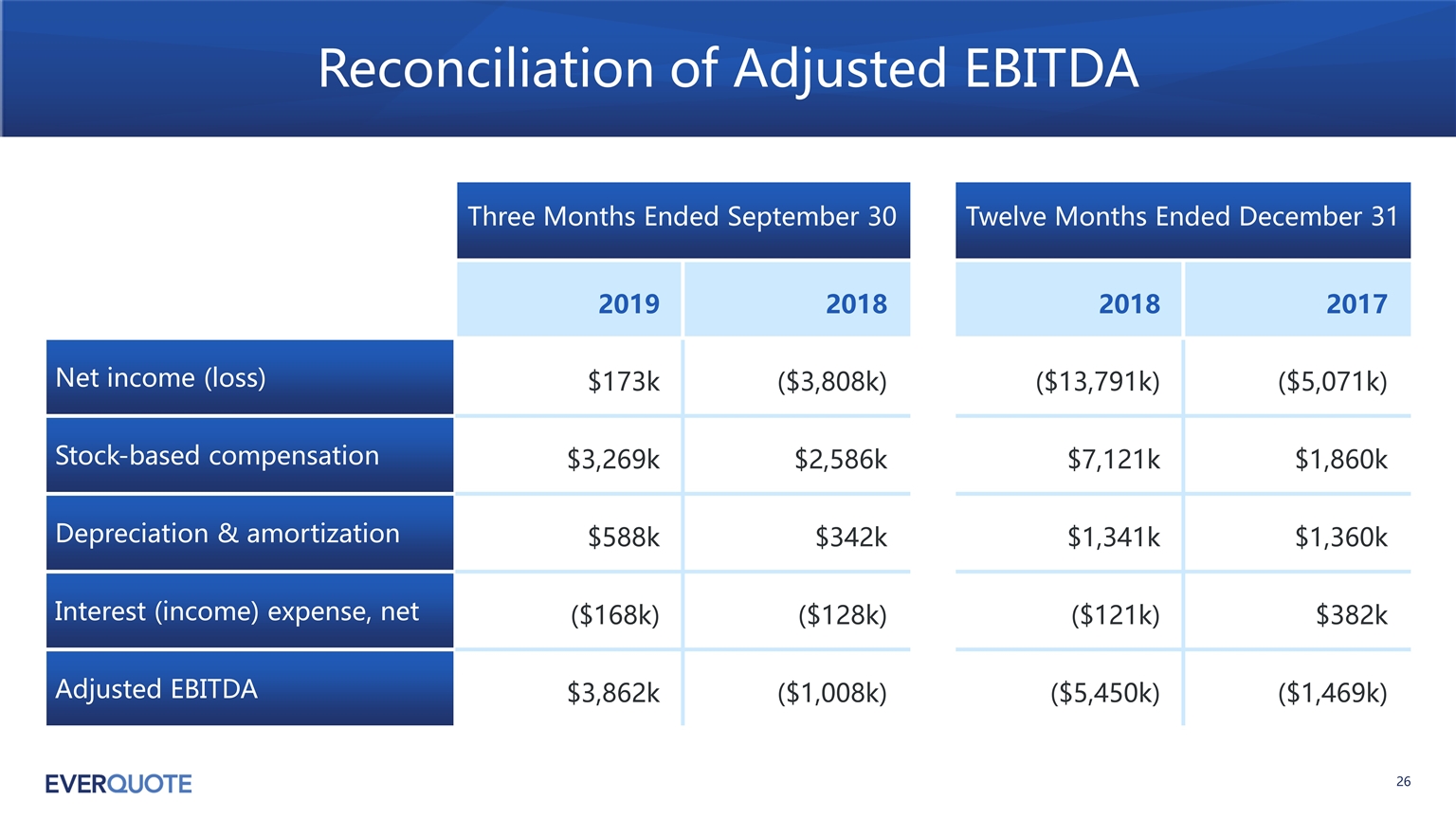

Reconciliation of Adjusted EBITDA Three Months Ended September 30 Twelve Months Ended December 31 2019 2018 2018 2017 Net income (loss) $173k ($3,808k) ($13,791k) ($5,071k) Stock-based compensation $3,269k $2,586k $7,121k $1,860k Depreciation & amortization $588k $342k $1,341k $1,360k Interest (income) expense, net ($168k) ($128k) ($121k) $382k Adjusted EBITDA $3,862k ($1,008k) ($5,450k) ($1,469k)